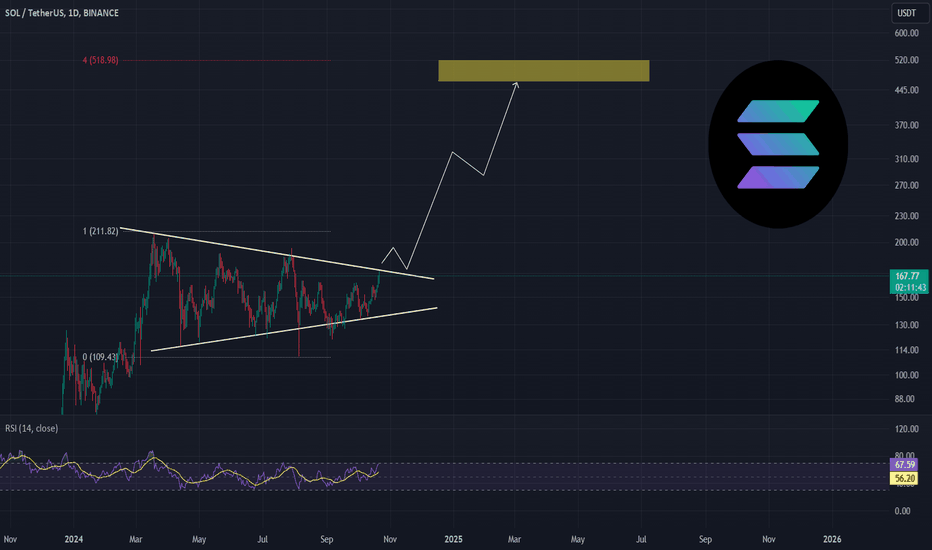

Sypercycle meme is real on SOLANASolana is an integral part of the entire meme community. Many people do not take this sector seriously, but they should. The supercycle is here, it is the memes and RWAs on Solana that will show the best run in this bullish phase of the market. Buckle up! The breakout is just around the corner!

RWA

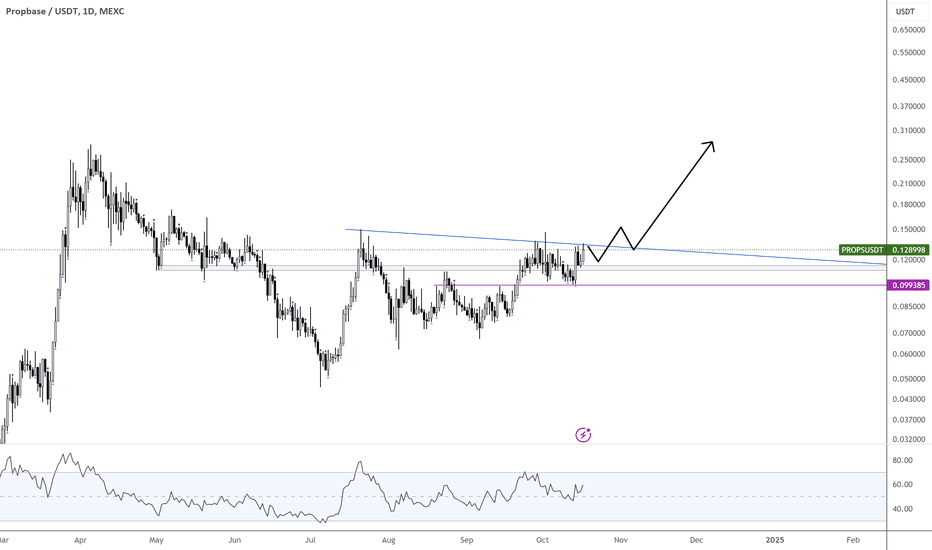

PROPS Primed for Breakout!I believe this one will significantly outperform $ONDO.

I haven’t posted many LSE:RWA projects lately since they’ve been slower compared to #memes and #AI-based coins. However, this one has just printed a daily bullish signal, flipping the August open and showing solid consolidation ahead of a probable breakout from the trendline.

I’d prefer to see a weekly trend confirmed this week; it’s easier to achieve than next week, which would require a massive candle.

-------------------------------------------------

I’ll be looking to buy any retraces closer to 12 cents or on a breakout of the trendline, as the daily trend is already active.

This one has a market cap of only 50 million and hasn't been listed on any major exchanges yet. I like the price action, and it’s significant enough to post here on TradingView.

$PROPS

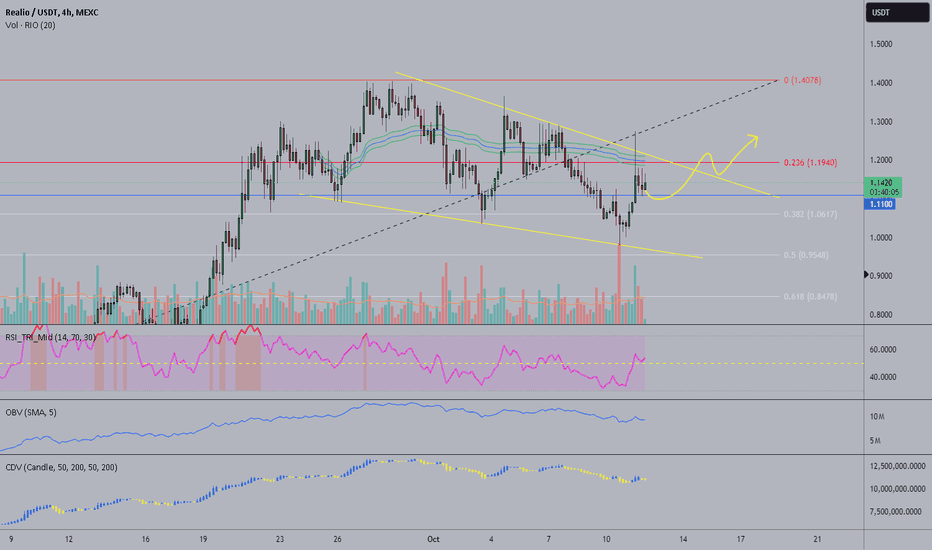

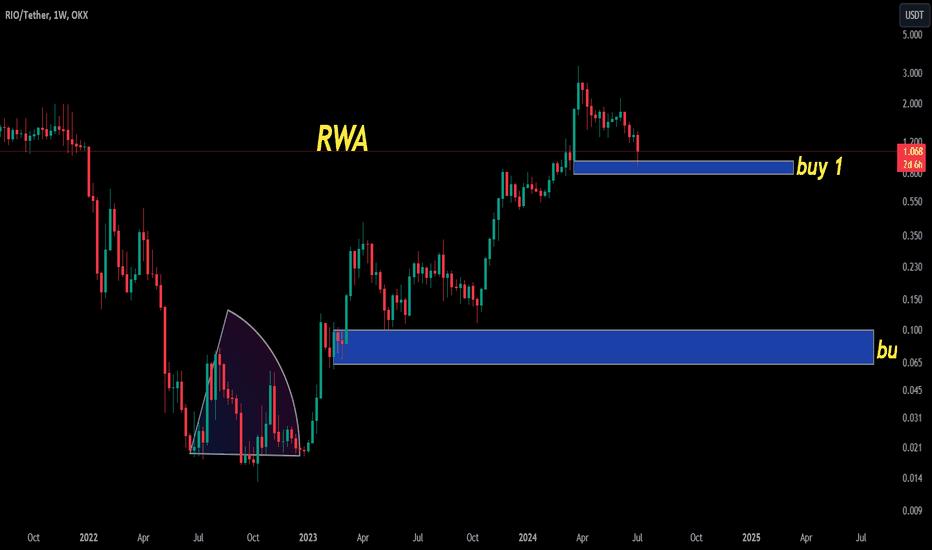

I added RIO for the long termThe major narratives of this cycle are AI, GameFi and RWA but I see too many people talking about the first twos and few about the last one. I'm trying to have a bit of everything in my portfolio although I'm adding small bags because unfortunately I've already spent the majority of my money.

You can see on 4h that price is in a bullish falling wedge and this is more or leass what I'd expect from it.

On Daily the bullish structure is more clear: and the upper wick indicates that price should go up again on daily timeframe.

On weekly the worst I could expect is a drop of a 12% from my entry price (blue line).

RIO has less than 8 mil USDT as market cap, this can easily go 20x during altseason. I think it's worth risk. So far RIO goes with CREDI and SOIL in my RWA bag.

Good luck

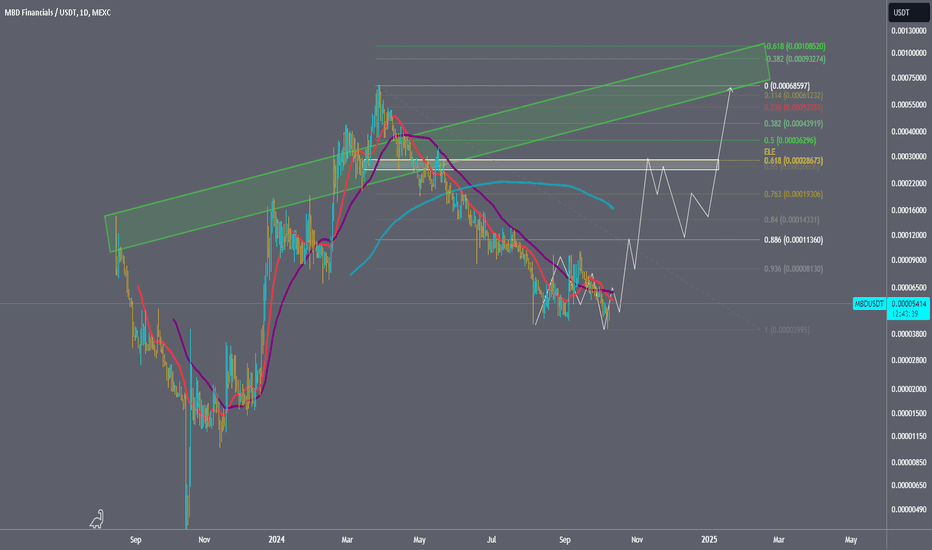

MBD financials or $MBD: Metaverse get's pumped by RWA.Project description:

MBD Financials ($MBD) is a decentralized financial platform focused on providing financial services like lending, staking, and asset management through blockchain technology, targeting both retail and institutional users with transparent and secure DeFi solutions.

Type of project:

Decentralized finance (DeFi) platform offering financial services such as lending, staking, and asset management.

Is it under a block?:

Yes, MBD Financials operates primarily on Ethereum and other compatible blockchains, leveraging smart contracts to facilitate decentralized lending, staking, and asset management services.

Latest update or news:

As of July 2024, MBD Financials launched its Institutional Asset Management Suite, allowing institutions to securely manage and invest digital assets through decentralized protocols, further expanding the utility of the $MBD token.

Narrative:

Decentralized finance (DeFi), institutional asset management, and blockchain-based financial services.

Why is it a good investment?

Institutional Backers and Angel Investors:

Pantera Capital:

Pantera Capital has backed MBD Financials for its potential to bridge traditional financial services and decentralized finance, particularly with its focus on institutional asset management.

Framework Ventures:

Framework Ventures has invested in MBD Financials due to its innovative approach to asset management and DeFi services, seeing the platform as a key player in providing blockchain-based financial solutions for both retail and institutional investors.

Coinbase Ventures:

Coinbase Ventures has also supported MBD Financials, recognizing its ability to integrate decentralized finance with traditional financial services, offering a secure and transparent solution for investors.

Angel Investors:

Chris Dixon (a16z Crypto):

Dixon has expressed interest in DeFi platforms that target both retail and institutional investors, making MBD Financials a potential match for his investment focus, though no direct investment is confirmed.

Michael Novogratz (CEO of Galaxy Digital):

Novogratz has voiced his support for decentralized finance platforms, and while there is no confirmed direct investment in MBD, the platform aligns with his vision for blockchain-based financial services.

Futuristic Use Case:

Decentralized asset management for institutions:

MBD Financials allows institutions to securely manage and invest in digital assets through decentralized protocols, providing a transparent and efficient alternative to traditional asset management services.

Lending and staking services:

MBD Financials offers decentralized lending and staking services, enabling users to earn interest on their digital assets while participating in the DeFi ecosystem, all through secure smart contracts.

Cross-chain financial services:

MBD Financials is exploring cross-chain capabilities, allowing users to access DeFi services across multiple blockchain networks, improving liquidity and expanding the platform's reach to more assets and users.

Integration with traditional finance (TradFi):

MBD Financials aims to bridge the gap between DeFi and TradFi by offering decentralized financial services that integrate with traditional banking systems, allowing for easier onboarding of institutions into the DeFi ecosystem.

Why will it make a significant amount of profits?

Unique competitive edge:

MBD Financials combines decentralized finance with traditional financial services, targeting both retail and institutional investors. Its focus on asset management gives it a competitive edge over other DeFi platforms that primarily focus on lending and staking.

Growing demand for institutional DeFi solutions:

As institutional interest in DeFi grows, MBD Financials is positioned to capture a significant share of this market by providing secure, transparent, and efficient financial services for institutional investors, driving demand for $MBD tokens.

Revenue from lending and staking services:

MBD Financials generates revenue through its decentralized lending and staking platforms, allowing users to earn interest on their assets while driving demand for $MBD tokens as a key utility in the ecosystem.

Integration with traditional finance (TradFi):

By integrating decentralized finance with traditional financial services, MBD Financials attracts both crypto-native users and institutional investors, expanding the platform's user base and increasing the value of $MBD tokens over time.

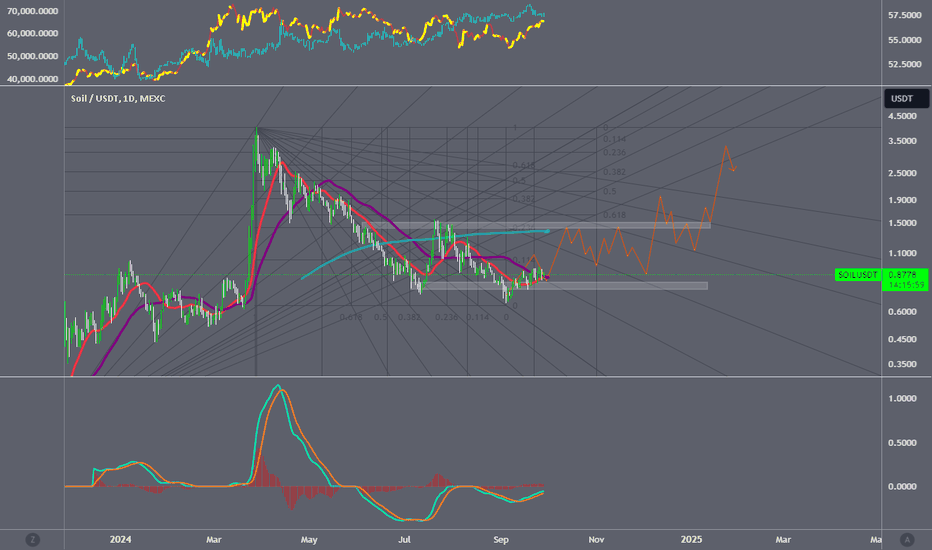

SOIL $SOIL of Blackrock: The BUIDL project.Project description:

SOIL is a decentralized platform focused on regenerative agriculture and sustainability, utilizing blockchain technology to promote transparency, carbon offset trading, and sustainable farming practices through tokenized assets.

Type of project:

Sustainability and regenerative agriculture with blockchain integration.

Is it under a block?:

Yes, SOIL operates on Ethereum and other compatible blockchains, using smart contracts to track carbon credits and facilitate trading in the sustainability sector.

Latest update or news:

As of August 2024, SOIL introduced its Carbon Credit Marketplace, enabling farmers and businesses to tokenize and trade carbon offsets, further driving adoption of sustainable agricultural practices through blockchain.

Narrative:

Sustainability, regenerative agriculture, carbon credits, and blockchain-based environmental solutions.

Why is it a good investment?

Institutional Backers and Angel Investors:

Consensys:

Consensys, a blockchain development firm, has backed SOIL for its innovative approach to integrating blockchain with sustainability and regenerative agriculture, focusing on the carbon credit market.

Vital Capital:

Vital Capital, an impact investment firm, has supported SOIL, recognizing its potential to drive environmental and social impact while creating a tokenized market for carbon credits and sustainable farming.

Parafi Capital:

Parafi Capital has invested in SOIL to further explore how blockchain can disrupt the sustainability and carbon offset markets, especially through decentralized infrastructure.

Angel Investors:

Meltem Demirors (CoinShares):

While not a direct investor, Demirors has spoken in favor of projects like SOIL that focus on blockchain-based sustainability and carbon markets, aligning with the broader ESG movement.

Sandeep Nailwal (Co-founder of Polygon):

Nailwal has expressed interest in blockchain projects that tackle environmental issues, and while no direct investment is confirmed, SOIL’s focus on sustainability resonates with his support for blockchain’s role in environmental solutions.

Futuristic Use Case:

Carbon credit trading on blockchain:

SOIL enables the tokenization of carbon credits, allowing farmers and businesses to trade these credits transparently on the blockchain. This democratizes access to carbon offset markets and drives sustainable practices globally.

Regenerative agriculture incentives:

Through blockchain-based rewards, SOIL incentivizes farmers to adopt regenerative agriculture techniques, offering tokenized rewards for sustainable practices and promoting environmental stewardship.

Blockchain-based supply chain transparency:

SOIL provides a transparent system for tracking the origins of agricultural products, ensuring that they are produced using sustainable methods, which can appeal to environmentally conscious consumers and businesses.

Integration with DeFi and ESG finance:

SOIL is positioned to integrate with decentralized finance (DeFi) to create financial products centered around sustainability, allowing investors to earn returns while supporting environmental projects through tokenized carbon credits and ESG-driven investments.

Why will it make a significant amount of profits?

Unique competitive edge:

SOIL is one of the few blockchain projects focused specifically on regenerative agriculture and carbon credits, giving it a unique position in the sustainability and environmental finance markets.

Growing demand for carbon credits and sustainability solutions:

As global businesses and governments prioritize sustainability and carbon neutrality, the demand for transparent and efficient carbon credit trading solutions will grow. SOIL’s blockchain-based approach offers a more secure and transparent method of trading carbon offsets, which will drive adoption.

Revenue from carbon credit marketplace:

SOIL’s Carbon Credit Marketplace allows users to trade tokenized carbon credits, generating transaction fees and ensuring a consistent revenue stream as businesses and individuals increasingly engage with carbon markets.

Long-term integration with ESG investments:

As environmental, social, and governance (ESG) investments become more prominent, SOIL is well-positioned to integrate its platform into ESG-driven financial products, attracting institutional investors focused on sustainability, thus increasing demand for MIL:SOIL tokens.

Now, follow me for more data and research like this.

If you want my format of research please just ff me here on Tradingview.

I have docs and papers in Google Docs for more aggressive research waiting to be posted.

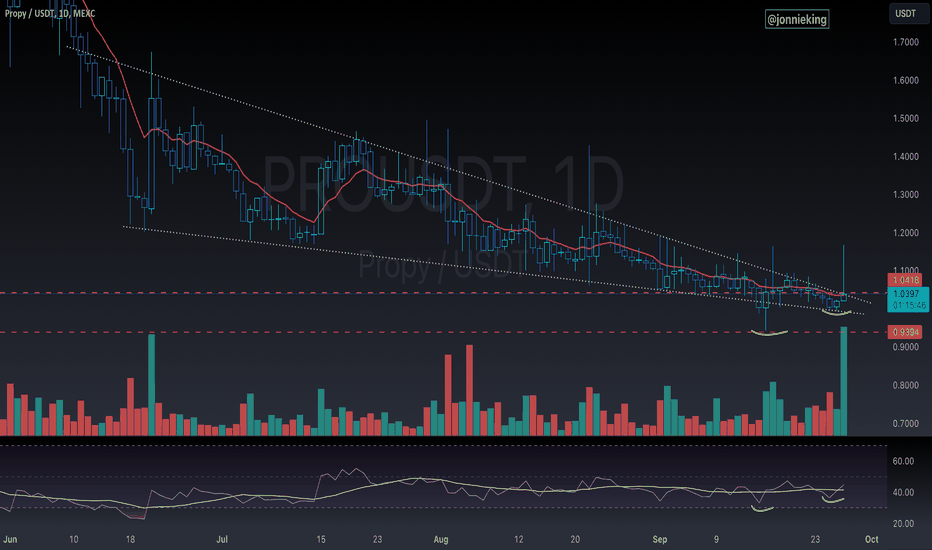

$PRO Massive Breakout Underway From Descending WedgeMassive breakout underway for Propy as it pushes through its descending wedge on the Daily.

Yesterday NYSE:PRO got its biggest influx of buying volume in 6 months, largely in part to this whale typing 😉

Propy has been building the RWA real estate narrative since 2017.

It’s a micro-cap sitting at $60m on BASE.

Kind of a no-brainer to put in your portfolio here.

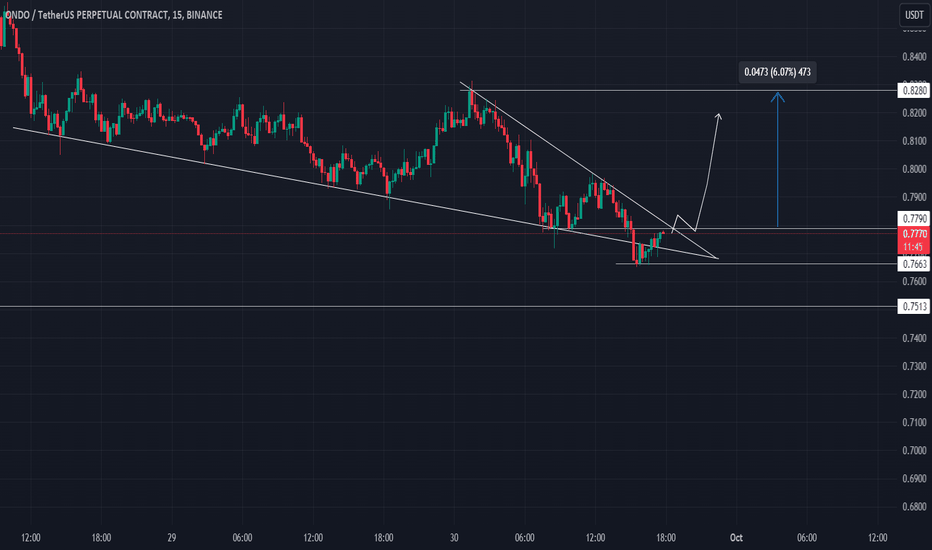

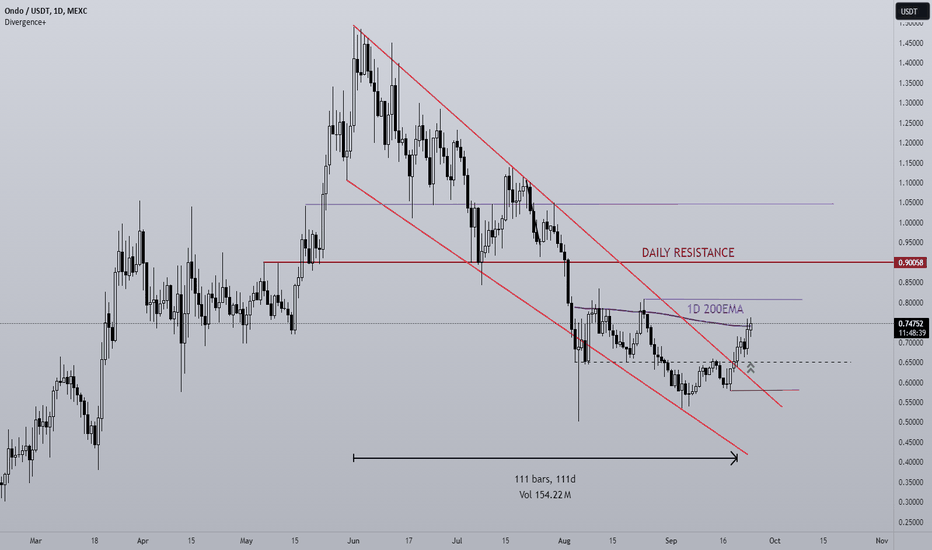

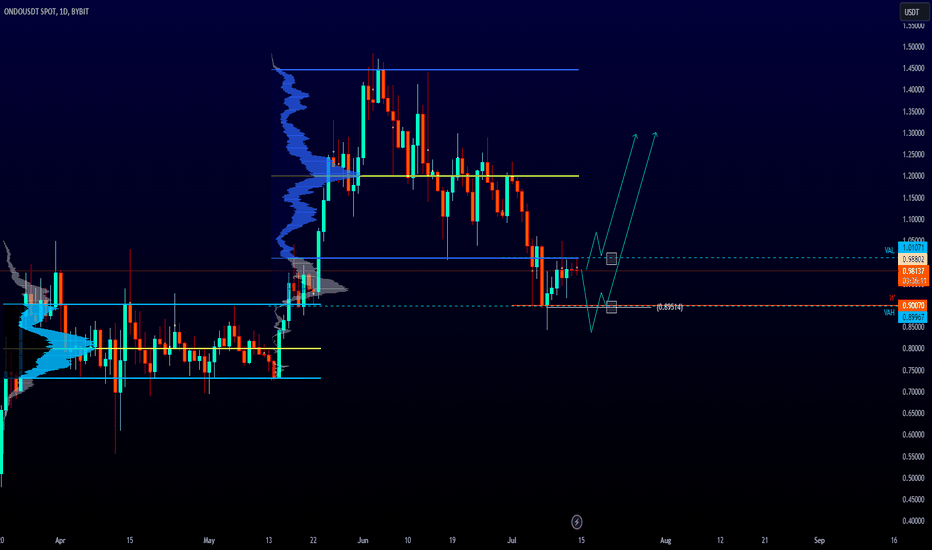

ONDO BREAKOUT Since the beginning of June ONDO has been in a downtrend that saw a -66% move to the downside. Now 111 days later price has broken out of the trend channel, showing a +15% move from the breakout.

The daily candle is currently trying to close above the 1D 200EMA, a convincing close above the MA would be extremely bullish having now cleared the major resistances and the trend is flipping bullish.

Bullish targets would be:

- Local high (LTF) $0.808

- Daily resistance (1D) $0.901

- Key S/R level (1D) $1.048

- ATH $1.50

Stop Loss:

- Local low (downtrend continuation) $0.58

ONDO being one of the standout RWA projects has a great R:R here for the next 6-12 months. Definitely a coin worth keeping an eye on.

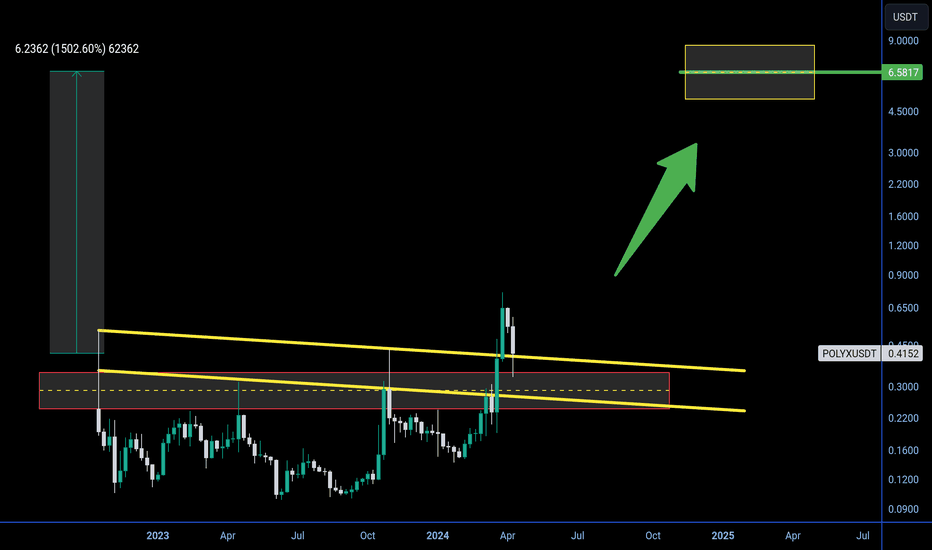

POLYX ( RWA ) project macro analysis ⏰Expecting potential 15x from here 📌+1500%

📌 Not expecting weekend candle close below the red box ☑️

>< Present price $0.48 :-: but :-: anything below $1 is gift 🎁 from God 💟

" No logic ❌ only magic ✨ bcs " RWA " sector hype goon take this more than OKX:RIOUSDT

👉🏾 Follow and save article with boosting 🚀 for future updates 🚨

💰 Returns calculated from present price

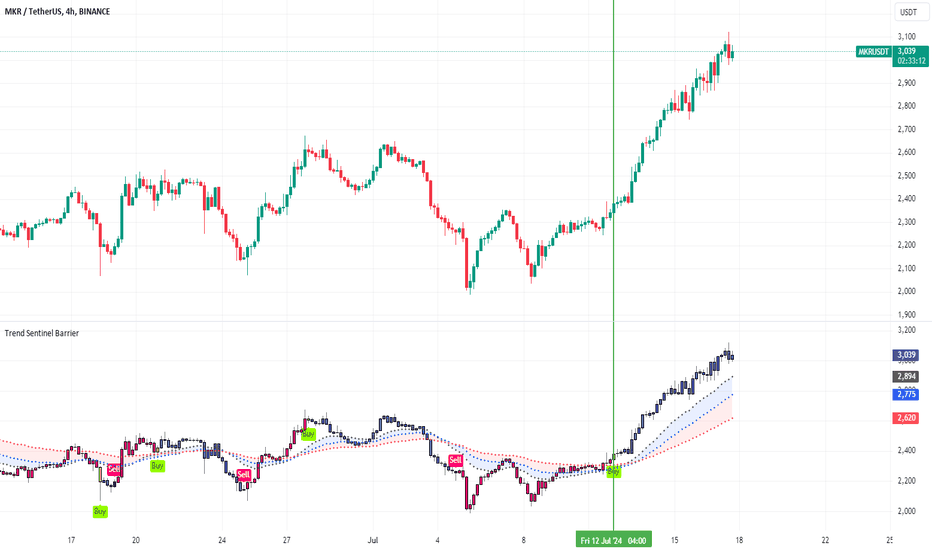

Integration of RWA---- MKRIf you think we're still in a bull market and want to find a track for Alpha, then RWA must be the place with better soil and fertilizer. The near-listing of the ETH ETF and the impending easing of monetary policy will provide a large amount of funds for the crypto. These funds are mainly asset management companies and enterprises. They will look for compliance risk targets to increase their crypto positions. Apart from directly holding BTC and ETH, what I can think of is the RWA track.

Probably in the last few weeks, you can see an increase in the number of news mentions about RWA on social media. Some asset management companies that issue BTC ETFs have begun to get involved with RWA. We mentioned the leading projects in the RWA track a few months ago, such as MKR and ONDO. But unlike at that time when they were fighting separately, today's RWA track is becoming more and more integrated as a whole.

Today, let’s take another look at MKR. As one of the protocols with the highest revenue in the crypto market, MakerDAO received an impact from the challenger ONDO in 2024, and due to miscalculation and increased USDe positions, many DeFi protocols increased their vigilance towards DAI. This has also caused the price of MKR to enter a continuous decline since April. Aging and opposition do not lead to improvement.

Recently, MakerDAO changed its original strategy and expressed its willingness to use US$1 billion in investment and US Treasury bond products from its treasury. The move attracted a number of RWA protocols, including BlackRock and original contender ONDO. The market interpreted this as MakerDAO’s strategy for ONDO changing from confrontation to complementarity. Benefiting from this, MKR prices have rebounded in recent days.

After talking about the changes in fundamentals, let’s take a look at the reaction on the indicators. Earlier than MKR’s policy change, the TSB indicator prompted a BUY signal on July 11. After that, MKR started an upward trend and broke through the 4h-high of 2600. The current column is far away from the wavy area of the TSB indicator, and the bullish trend is healthy.

Introduction to indicators:

Trend Sentinel Barrier (TSB) is a trend indicator, using AI algorithm to calculate the cumulative trading volume of bulls and bears, identify trend direction and opportunities, and calculate short-term average cost in combination with changes of turnover ratio in multi-period trends, so as to grasp the profit from the trend more effectively without being cheated.

KDMM (KD Momentum Matrix) is not only a momentum indicator, but also a short-term indicator. It divides the movement of the candle into long and short term trends, as well as bullish and bearish momentum. It identifies the points where the bullish and bearish momentum increases and weakens, and effectively capture profits.

Disclaimer: Nothing in the script constitutes investment advice. The script objectively expounded the market situation and should not be construed as an offer to sell or an invitation to buy any cryptocurrencies.

Any decisions made based on the information contained in the script are your sole responsibility. Any investments made or to be made shall be with your independent analyses based on your financial situation and objectives.

Perfect Pullback!The areas I am interested in for a long trade would be around $0.90 cents to retest the weekly or flipping $1 into support.

Targets for both would be the Value Area High of the upper range.

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

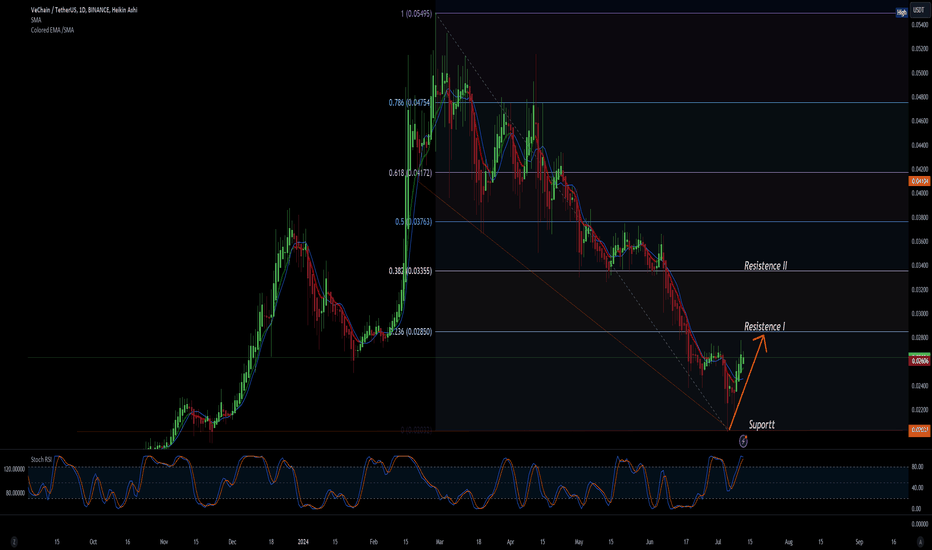

VETUSDT : VeChain Breaks Out of Descending Trendline

VeChain is currently at a critical point, showing signs of potential upward movement and a strong support base. The chart indicates a recent upward trend following a prolonged decline.

Resistances and Support:

Resistance I: Around $0.02850, where the price might face difficulties breaking through.

Resistance II: Near $0.03355.

Support: Located at $0.02037, an important level that could hold the price in case of a decline.

The Stochastic RSI shows that VET is currently in an overbought zone, which could indicate a possible short-term correction.

Fibonacci levels suggest potential areas of support and resistance. The 0.618 level at $0.04772 is particularly important for the continuation of the upward trend.

VeChain has stood out with strategic partnerships including companies like BMW, Walmart China, and major telecommunications operators such as AT&T, T-Mobile, and Verizon. These partnerships are focused on areas such as supply chain tracking, food safety, and preparation for 5G networks (Crypto News Flash).

Recently, analysts predicted significant upside potential for VET, with estimates that the price could reach $1.80 by October 2024, based on detailed Fibonacci analysis and other technical indicators. VeChain has also launched important technological products such as the VeWorld Mobile wallet and the VORJ digital asset platform, promoting the adoption of Web3 technology

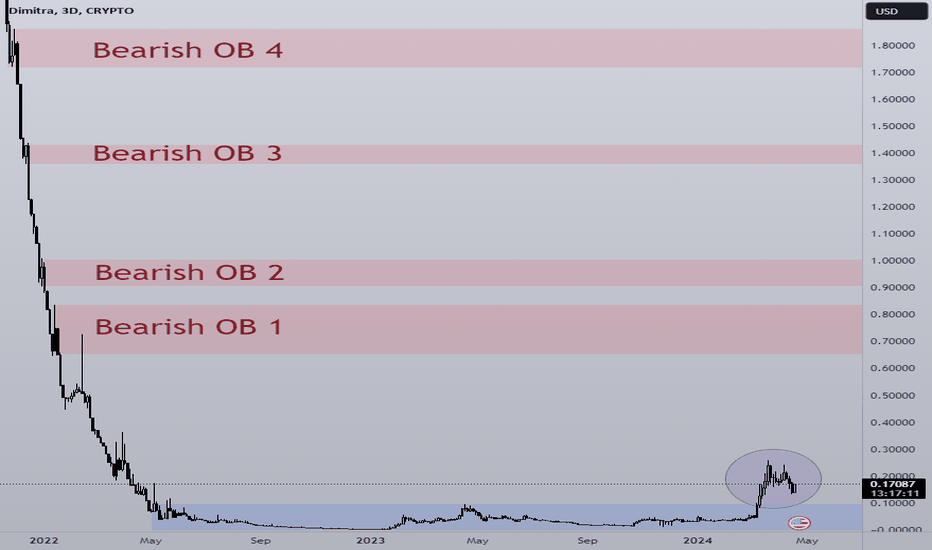

LOW CAP GEMS - DIMITRA (DMTR)In this series I will be breaking down and analysing projects that are <$100m in market capitalisation (at time of post).

- PROJECT OVERVIEW

Dimitra Incorporated is a global Agtech company with a mission to help smallholder farmers across the world. Operating on the Ethereum blockchain, the name derives from Demeter, the Greek Goddess of the harvest and agriculture. Dimitra works with governments, government agencies, NGOs, and for-profit organizations. The Dimitra platform is built on blockchain technology and incorporates mobile technology, machine learning, IoT devices, satellite and drone imagery, genomics, and advanced farming research. Through our data driven approach, Dimitra helps farmers increase yields, reduces expenses, and mitigates risk. Dimitra believes that every smallholder farmer, regardless of economic standing, should benefit from simple, beautiful, and useful technology. With 100K+ users currently and growing it's the largest cryptocurrency to deal with agriculture of it's kind.

- ROADMAP

Dimitra has ambitious and impactful goals. The goal is to grow our platform to 100 million smallholder farmer users within the next 4-years. They already have agreements in place with 8 countries but there is a long way to go to reach their goal.

- TEAM

Dimitra has 123 team members in total including CEO and Founder Jon Trask. He is the winner of the 2023 Government Blockchain Association Annual Achievement Award in the “Social Impact” Category!

- PARTNERSHIPS

Global projects operating in 14+ countries with partners in 68 countries.

In terms of exhange listings they are partnered with one tier-1 exchange in Kucoin, as well as Gate.IO, BitMart, Bittrex, Uniswap and more. However, they are not listed on Binance or Coinbase, once this does happen it will open up the opportunity for a much larger population of potential buyers.

- PRICE TARGETS

It's easy for people to throw outlandish price targets out there in the world of crypto without much reference to how they got to that conclusion. I prefer to compare Market Caps in order to derive token prices.

Looking back at the previous Bullrun, alts hit very high MarketCaps before falling back to 'fair value'. For this I'll use current MCap and Bullrun MCap for a guide, DMTR is currently #484' on MCap:

- Oraichain (ORAI) #343

Price target: $0.35 (2.1x)

- PAAL AI (PAAL) #226

Price target: $0.49 (x2.95)

-Ocean protocol (OCEAN) #135

Price target: $1.05 (x6.24)

- Fetch.ai (FET) #51

Price target: $4.43 (x26.33)

- Cardano (ADA) #10

Price target: $33.74 (x197.65)

I've used other AI projects and a top 10 crypto to show how DMTR could move up the leaderboard and what that would mean for token price.

- SUMMARY

Dimitra is an exciting project with genuine real world value, aiming to tackle a very important problem we have on this planet and that's providing Food to the increasing population of earth. The tokenomics could be better as there is only 41% circulating supply, however with a growing interest by large entities such as BlackRock for RWA's and AI projects we could see a considerable investment in a project like DMTR in the future. Having broken out of a multiyear accumulation phase recently I think DMTR will be a very strong performer

- RATING

8/10

- SOURCES/b]

dimitra.io

coinmarketcap.com

marketcapof.com

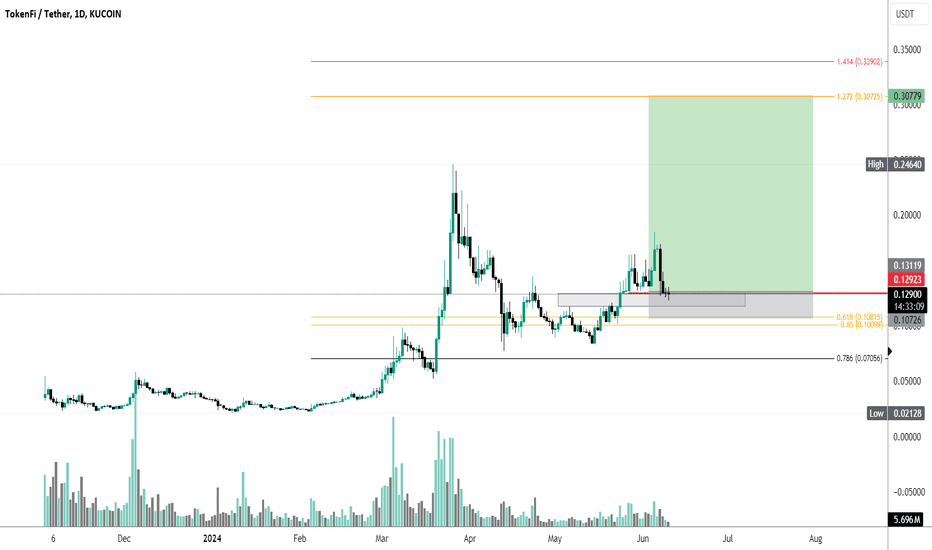

TokenFi: June 10th, 2024Hello dear traders.

Considering that a weekly level (i.e. red) is being defended, I think this is a great longing opportunity. Having swept some lows, the structure at the lows is interesting as well. The FVG is holding the price for now, and I always like to long into fear-inducing candles if the bullish structure is defended.

I hope this idea is useful.

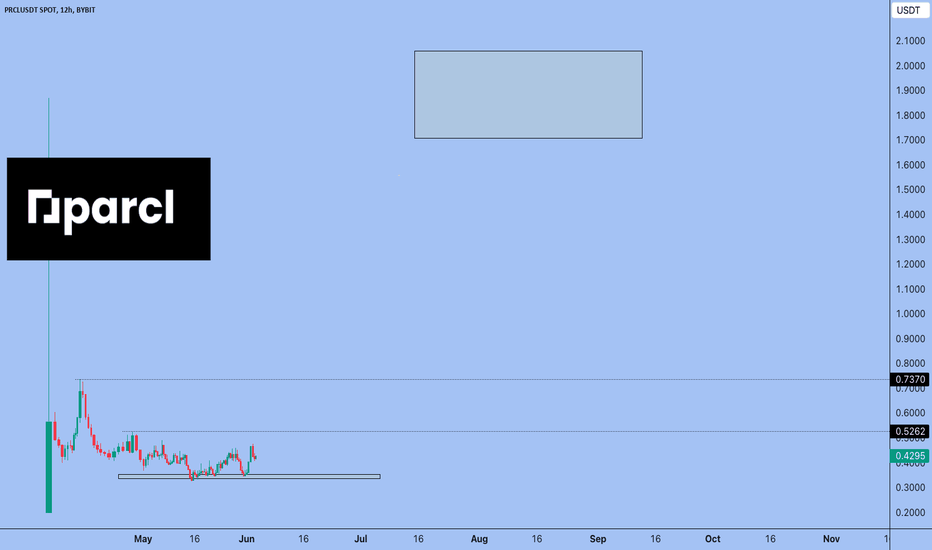

Parcl $PRCL - RWA gem on SOLParcl (PRCL) is a decentralized real estate project built on the Solana blockchain. It allows users to invest in digital square feet of real estate in various cities around the world.

The Parcl project provides tools for speculation and hedging in the real estate market by offering indices for various cities. Users can trade debt or short positions depending on their forecasts for rising or falling real estate prices in selected cities. A key element of the Parcl ecosystem is the PRCL token, which serves to manage the protocol and provides various benefits to holders, such as voting rights in protocol management decisions and access to improved data and trading incentives within the ecosystem. The Parcl project has attracted attention due to its unique concept of allowing users to invest in real estate digitally and the ability to trade in the real estate market using blockchain technology.

Team

The Parcl team is a diverse group of people with experience in a variety of fields including Wall Street, big tech, and PhD-level research. The team consists of 14 talented individuals and plans to expand. Some of the most notable members of the team include:

Trevor Bacon - Founder and CEO of Parcl. Trevor has a background in finance and technology, has worked at several hedge funds and has been involved in blockchain and cryptocurrencies for over five years.

Kellan Grenier is co-founder, COO and head of strategy at Parcl. Kellan has nearly a decade of experience as an investment analyst in traditional finance (TradFi).

Jason Lewris - Co-founder and Chief Data Officer at Parcl, Jason has a background in data science and machine learning, having worked at Microsoft and Deloitte.

Together, the team developed the Parcl protocol, a decentralized real estate trading platform built on the Solana blockchain. The protocol allows users to trade price movements in real estate markets around the world via city indices. Parcl has also received strategic investments from prominent companies and investors including Fifth Wall, JAWS, IA Capital, Eberg Capital and SkyBridge Capital. These investments have helped the team to expand and further develop the Parcl ecosystem. The Parcl team aims to democratize access to global real estate investing and create a culture of continuous growth and collaboration.

Tokenomics

The Parcl token distribution plan is designed to incentivize and reward the community, early supporters and advisors, and to promote the growth and development of the Parcl protocol. The plan includes initial distribution to the community, ongoing distribution to the community, growth and incentives, and allocations to early adopters and advisors.

1. Initial Community Distribution:

8% of the total volume (80,000,000 PRCLs) distributed to community members. 75,000,000 PRCLs (7.5% of total) distributed to early adopters of the Parcl protocol. 5,000,000,000 PRCL (0.5% of total) distributed to core members of the Parcl community.

2. Ongoing Community, Growth, & Incentives: 28% of the total (~280,000,000,000 PRCL) is reserved in the treasury for the protocol's key goals. These goals include infrastructure, growth, partnerships, and continued incentivization of the network.

3. Early Supporters & Advisors:

- 28% of the total supply (~280,000,000 PRCL) is set aside for early supporters and advisors. These tokens are unlocked over a 3 year period with a 1 year break.

4. Core Contributors:

- 21% of the total (~210,000,000,000 PRCL) is distributed to core contributors. These tokens vest and unlock over 3 years, with a 1 year break.

5. Ecosystem Fund:

- 15% of the total proposal (~150,000,000 PRCL) is set aside in a portion dedicated to ecosystem development. This fund is intended to incentivize the long-term growth and development of Parcl's ecosystem. The tokens in this fund will be used to improve the performance of liquidity providers (LPs) and traders, increase the liquidity of protocols, and incentivize developers to create valuable Parcl-based products.

Utility

Governance

The PRCL token will govern some aspects of the protocol and decentralized trading application. Users will use the token to vote on critical changes to risk parameters and protocol architecture. The governance structure is expected to be implemented by the end of 2Q24.

Data functionality

PRCL token holders will have access to best-in-class institutional-quality real estate data through an API developed by Parcl Labs. Over time, users who maintain the required level of PRCL in their connected wallets will continue to access the API.

Network Incentives

Parcl token holders will have the opportunity to participate in perpetual network incentives (e.g., points) shortly after the first distribution event. These incentives are designed to encourage and reward eligible PRCL holders for their participation and contribution to the Parcl ecosystem.

RWA

Real World Assets (RWA) in the context of Parcl refers to the tokenization of real world real estate prices on the Solana blockchain. Parcl is a decentralized perpetual exchange focused on real-world real estate prices and offers real-world index markets for speculation or hedging. The platform allows users to access the world's largest asset class - real estate - through “city indices,” which are the median price per square foot/meter aggregated at the city or neighborhood level.

Parcl's approach to tokenizing real world assets is groundbreaking and aims to democratize access to global real estate investing. The innovative use of decentralized smart contracts with perpetual futures allows users with as little as $1 to access price movements in real estate markets around the world, making the platform accessible to a wide range of investors.

The integration of real-world assets into the blockchain ecosystem represents a significant step towards tokenizing traditional financial assets, offering new opportunities for investment and risk management in the real estate sector. Parcl's focus on real estate RWAs positions the company as a key player in the emerging landscape of decentralized finance and blockchain technology.

Conclusion

Looking forward, Parcl's focus on RWA real estate positions it as a key player in the emerging landscape of decentralized finance and blockchain technology. The platform is committed to its mission of making real estate accessible to all by providing access to the price points of real estate markets with no minimum requirements, high liquidity, and low transaction fees. With continued development and support from the community, Parcl is well-positioned to continue its growth and innovation in real estate tokenization. Overall, the main drawbacks include the large competition in the real estate market and the lack of a license, which is crucial in the RWA sector. However, the team, capitalization and Solana involvement are all positives that make this project undervalued. In addition, there is potential for listing on Binance.

token is now available for purchase on Bybit

Best regards EXCAVO

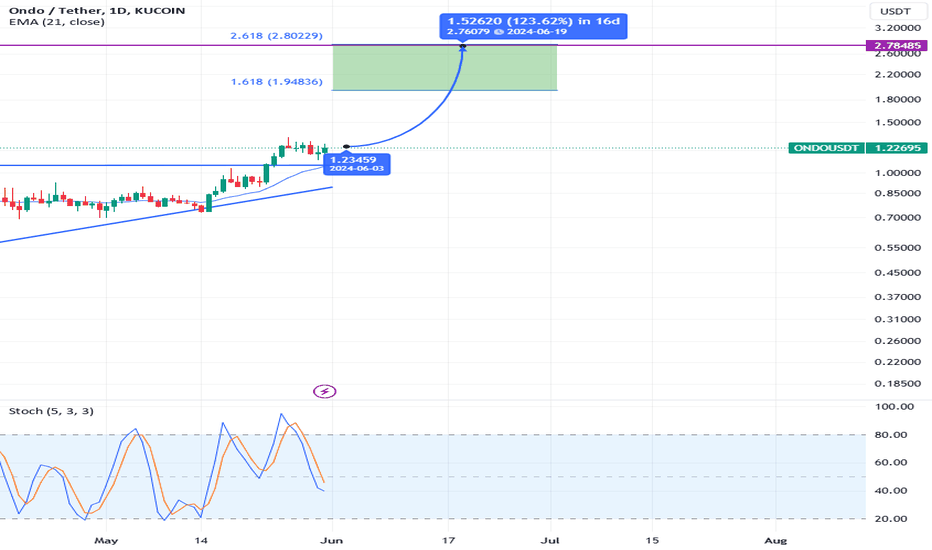

Ondo Ready For $3 Price Action

The main trend shows a significant rise from a low of around $0.35 to reach over $1.20, with the price currently hovering around $1.24. The next major resistance based on the Fibonacci Extension is around $1.95 (1.618) and $2.80 (2.618).

The price formed an ascending triangle pattern before breaking out upwards, indicating bullish strength. The pattern is supported by the dynamic support line of the trendline and breakout at around $1.23.

Indicator

- The price is above the 21 EMA, indicating strong short-term bullish momentum.

The 21 EMA also acts as additional dynamic support, currently located around $1.05.

- Stochastic RSI is at a medium level, neither overbought nor oversold, which indicates that there is still room for further increases before a potential correction.

Price Target

Using Fibonacci Extension, the next upside targets are at level 1,618 (around $1.95) and level 2,618 (around $2.80). These targets are based on previous movements measured from the last breakout of ascending triangle.

Overall market sentiment is bullish with prices consistently making higher highs and higher lows, indicating investor confidence in price moves higher. In conclusion, the Ondo chart shows strong bullish potential.

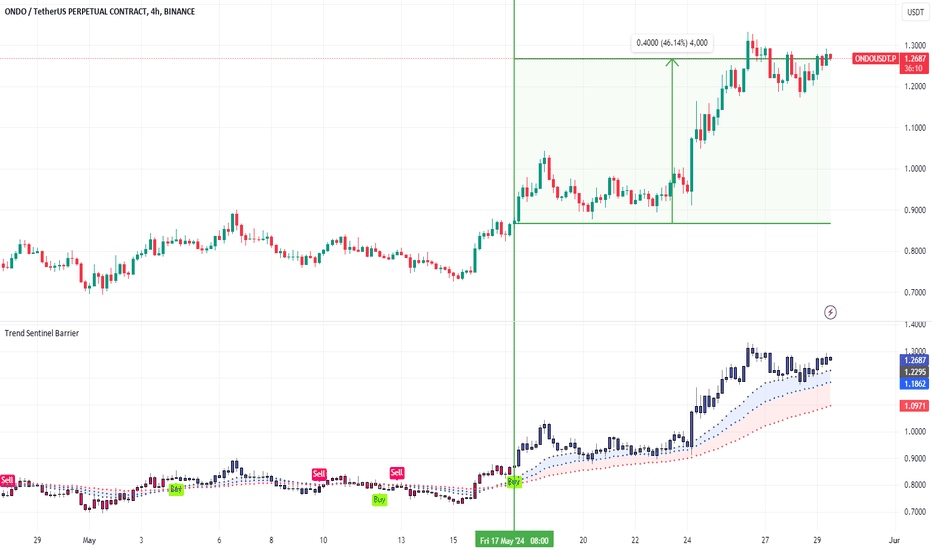

New King of RWA ---- ONDOThe RWA track is one of the most popular tracks in 2024. Especially after Trump expressed support for crypto and the approval of the ETH ETF. Traditional large asset management such as BlackRock and Franklin Templeton will pay more attention to this track. We also talked about token MKR, GFI, etc. in RWA track in our previous analysis. Today we take a look at the head protocol ONDO.

The entire RWA track has been developing slowly due to regulatory restrictions before. Market share is concentrated on MakerDAO. Since the BTC ETF was successfully approved at the beginning of this year, ONDO has quickly occupied mainstream chains such as Ethereum and Solana with its RWA products such as USDY and OUSG. In April, it reached a cooperation with BlackRock's BUIDL fund and holds a large number of BUIDL shares. This has a lot to do with ONDO's team composition. Different from traditional protocols, the core members in ONDO have working experience in traditional institutions such as Goldman Sachs, McKinsey, and BlackRock, which MakerDAO does not have.

Now that ETFs have been approved, more and more institutions are getting involved with crypto. They need an interest-bearing stablecoin with extremely high compliance and security. ONDO’s USDY meets the needs. Although MakerDAO occupies a large market share, ONDO is likely to surpass it and become the new king of RWA.

After a long period of fluctuation, bulls strengthened and ONDO started a new rise. As can be seen from the indicator area, at the 4h level, the TSB indicator prompted a BUY signal on May 21,, and then the pump started. If you used the TSB indicator and opened a long position, you would have made over 40% of unrealized profits. And the current column still remains above the wavy area, and the bullish trend is healthy.

Introduction to indicators:

Trend Sentinel Barrier (TSB) is a trend indicator, using AI algorithm to calculate the cumulative trading volume of bulls and bears, identify trend direction and opportunities, and calculate short-term average cost in combination with changes of turnover ratio in multi-period trends, so as to grasp the profit from the trend more effectively without being cheated.

KDMM (KD Momentum Matrix) is not only a momentum indicator, but also a short-term indicator. It divides the movement of the candle into long and short term trends, as well as bullish and bearish momentum. It identifies the points where the bullish and bearish momentum increases and weakens, and effectively capture profits.

Disclaimer: Nothing in the script constitutes investment advice. The script objectively expounded the market situation and should not be construed as an offer to sell or an invitation to buy any cryptocurrencies.

Any decisions made based on the information contained in the script are your sole responsibility. Any investments made or to be made shall be with your independent analyses based on your financial situation and objectives.

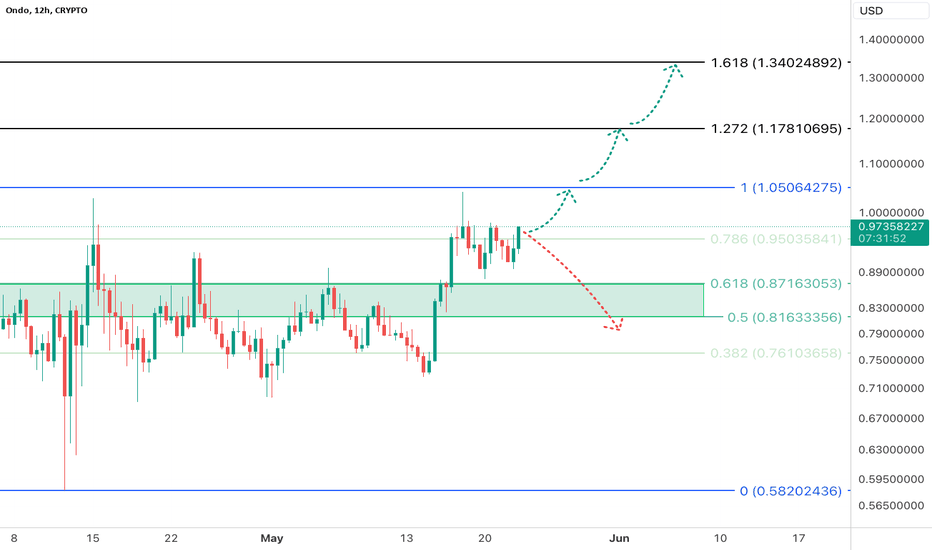

ONDO - Fib ExtensionsOndo - ONDO

Sitting in the real world tokensiations of assets category, ONDO is technically already above this key 0.618 ‘golden-ratio’ area. Below are my bullish and bearish thesis from here.

Bullish scenario

Prices continue to consolidate, accumulate, and move higher to the previous high, the 1.272 ratio and 1.618 ratio from here.

Bearish scenario

Failure to hold above the 0.618 level (green box) would be bearish in my opinion and a failed breakout.

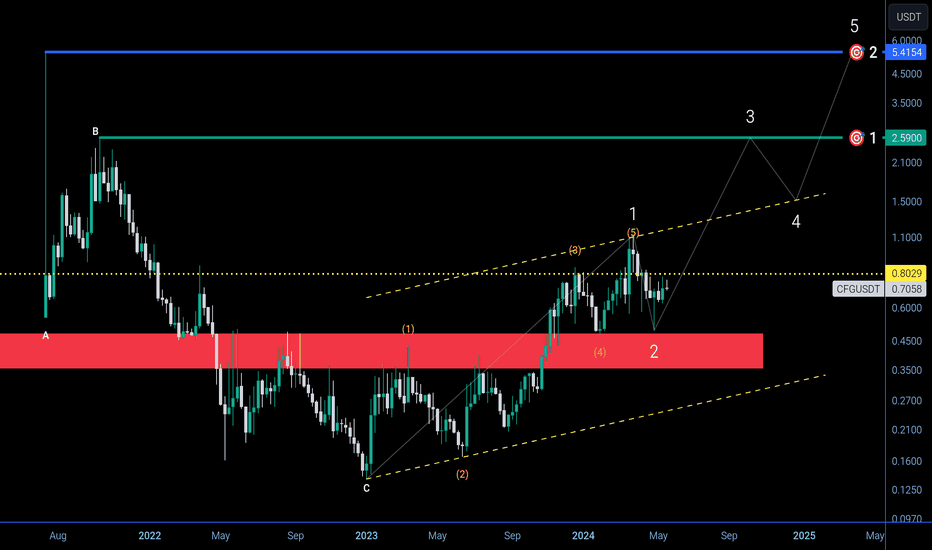

$CFG macro analysis ⏰ RWA project One of my favourite coin 📌 OKX:CFGUSDT

Don't BUY if price goes below red box 📍 which is danger ⚡ to coin 🪙 #cfg

Below $0.8 always BUY / accumulation

Target 1 = $2.6 in short term 📌

Target 2 = $5.4 in macro ( I may be target 1 also )

Pls DYOR , just follow article for future updates 📌 soon i will post many updates on this coin under this article/ analysis 📜

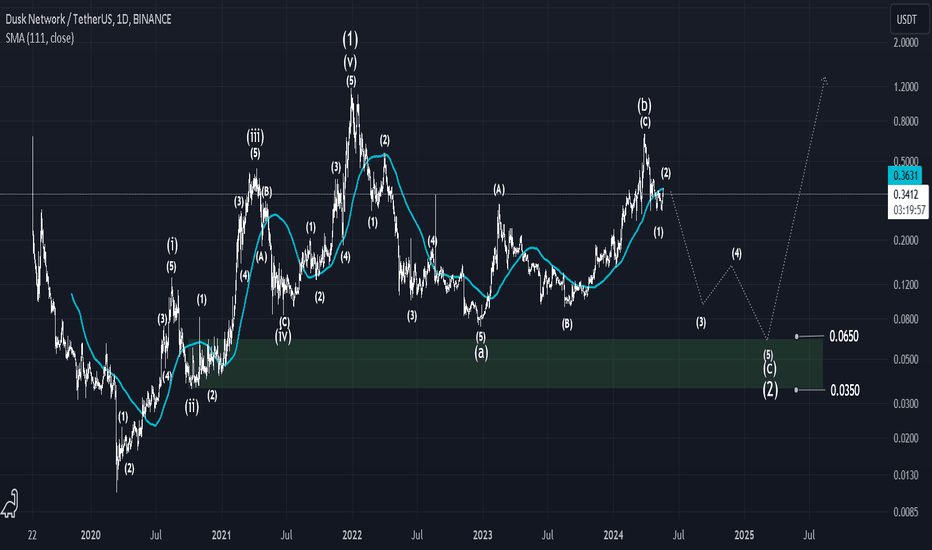

DUSK (THE RWA GEM)Although all the hype going around DUSK at this point, I think it was in a corrective bullish wave since Dec2022.

The best buying range for it would be between $0.065 : $0.035

The invalidation point is crossing $1

The confirmation is breaking $0.27

After this bearish wave competes I think DUSK will be targeting a new ATH from down there.

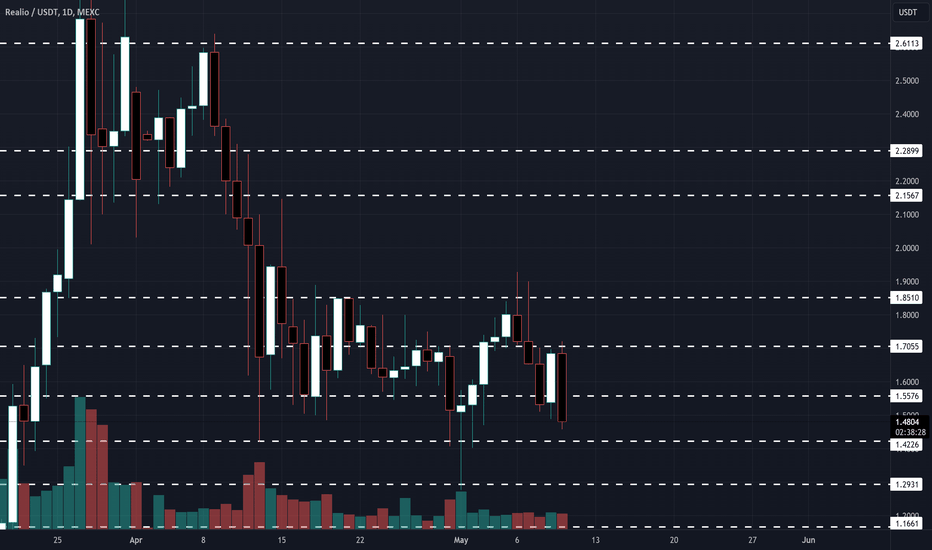

Rio Realio $Rio #Rio #RealioRWA's (Real world assets) Will be and have been a HUGE narrative in this cycle as well as will most likely be even bigger by next cycle and in the next cycle. Quite possibly besides gaming they will also be one of the few sectors that not only will survive the next Bear market AKA. Crypto Winter but may also end up being far less effected by it and or even end up growing and staying upwards during it.

There overall will someday be no real reason for true working projects and ideas to have a winter per say. As they will move with the market they entertain and will grow as the projects deliver real world use and or adoption.

At some point we will see gaming and RWA's that are winning actually hit highs during the Bear/Winter rather than in the peak of cycles. There are many reason for this to become true but i will save that for another post/charting upcoming.

IMO Rio will be one of the shining stars in this upcoming cycle and IMO we will easily see it hit $3-$5 ranges in the next few months followed by a possibly cycle top well beyond that.

IMO the current market cap is relatively small for what is coming for this space as well as the current popularity of this project.

IMO we are currently just in the first major distribution and consolidation phases for this project after having a major run from the start of this cycle.

Depending upon your time horizon and rather or not your looking to just trade this VS invest in it you can use the lines given for areas of key interest to BUY and SELL and or just BUY/DCA and wait for those longer term targets to show up for the real Gains/Profit's etc.