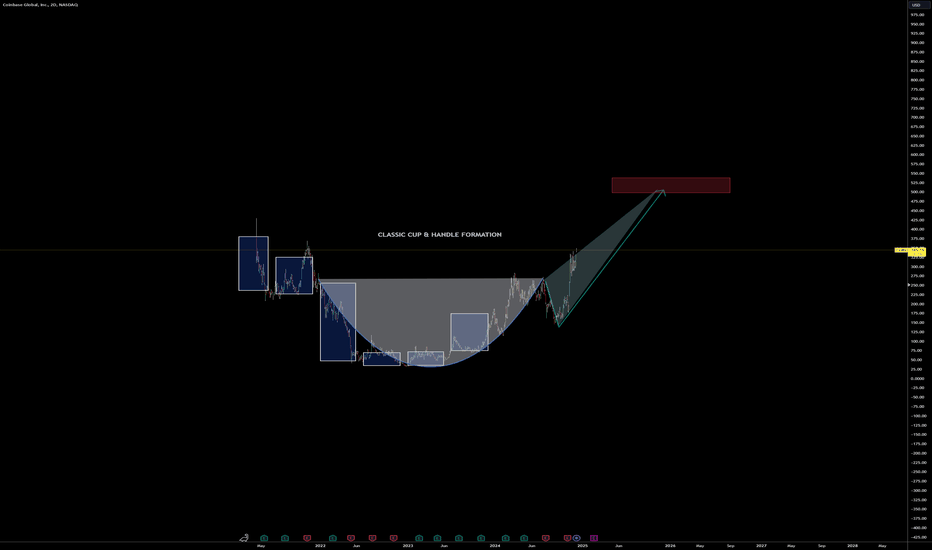

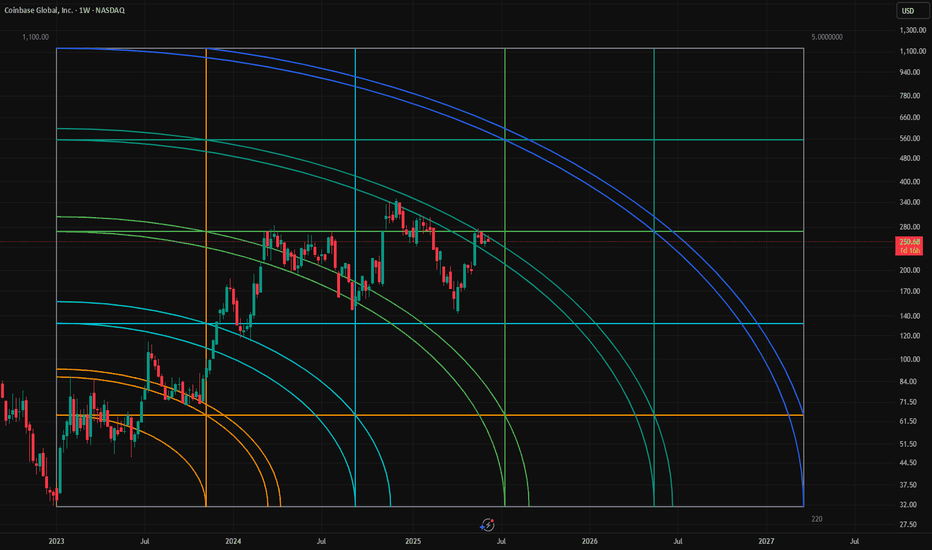

COIN- Cup and Handle FormationThere is more to this, but the basic formation is here. Other systems seem to also support the formation (such as Gann, and Harmonics).

There are a few 6 month candles overlaid in the entry to this that I was creating- illustrating the 6 month gains to form the cup. The handle portion did catch me off guard as we are typically use to seeing a cup form at the initial correction, but this one seems to have formed inside of the down move (very interesting).

Lets see how it works out. If true- its 50% gain on the bone here.

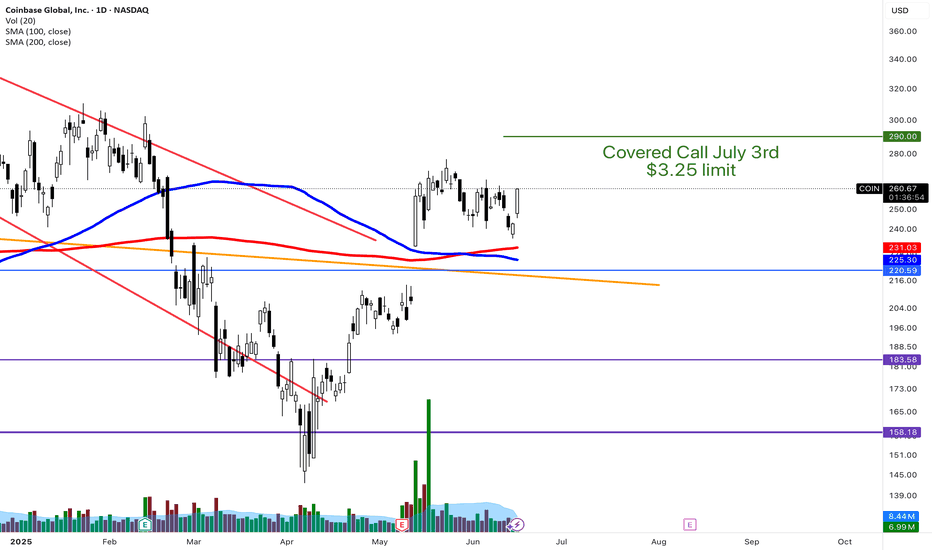

S-COIN

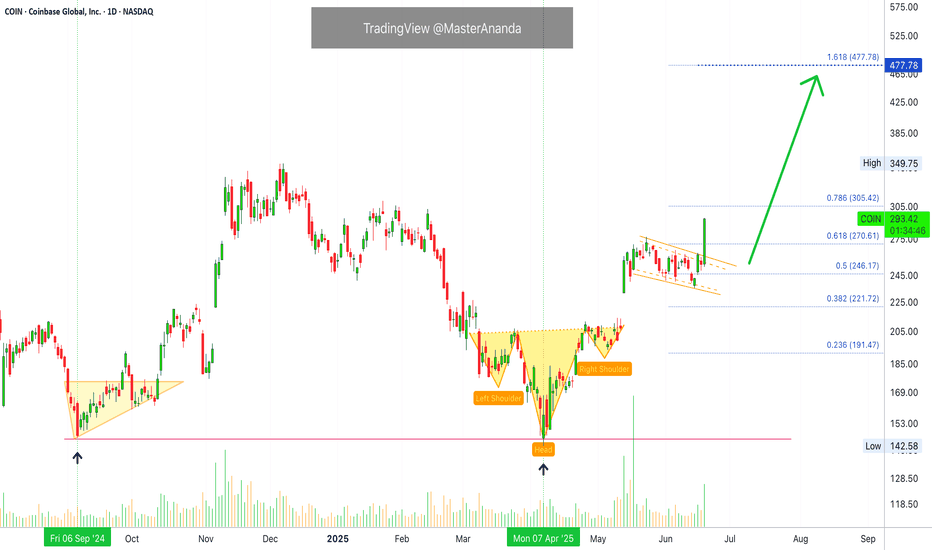

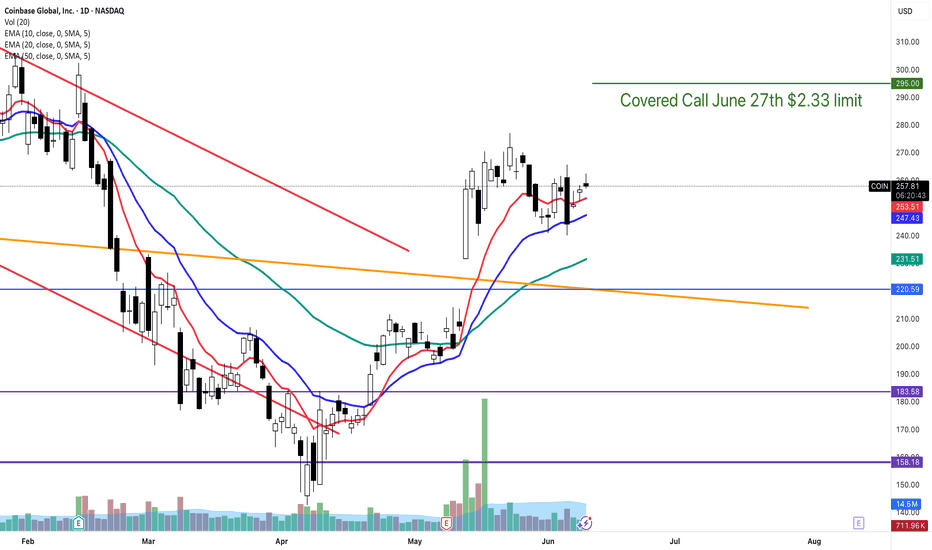

Coinbase Global Inc. Bullish Confirmed Confirms Bullish BitcoinCOIN's chart looks very similar to Ethereum. Today's action reveals something great; bullish confirmed.

Always, since this stock started trading, it has been moving as a unit together with Bitcoin and the entire Cryptocurrency market.

When Bitcoin is bullish, Coinbase is bullish.

When Bitcoin is bearish, Coinbase is bearish and vice versa.

Here we have a very strong, high volume bullish breakout on COIN. This means that Bitcoin, Cardano, Ethereum, XRP, Dogecoin, Avalanche and the rest of the Cryptocurrency market is about to break bullish really strong.

There was a low point 7-April 2025. The same with the projects I just mentioned above.

Here this 7-April low marks a double-bottom compared to September 2024. After this low, the recovery starts and we have a strong rise.

In late May, there is a price peak and we enter a consolidation phase, in this case a small retrace. The chart is identical to ETHUSDT.

After a strong higher low, some minor bearish action with no bearish pressure, Coinbase is going up. You can expect the exact same dynamic happening to Bitcoin and all the Altcoins. Bullish confirmed. The market will resolve green.

Today Coinbase hits the highest price since February 2025.

Namaste.

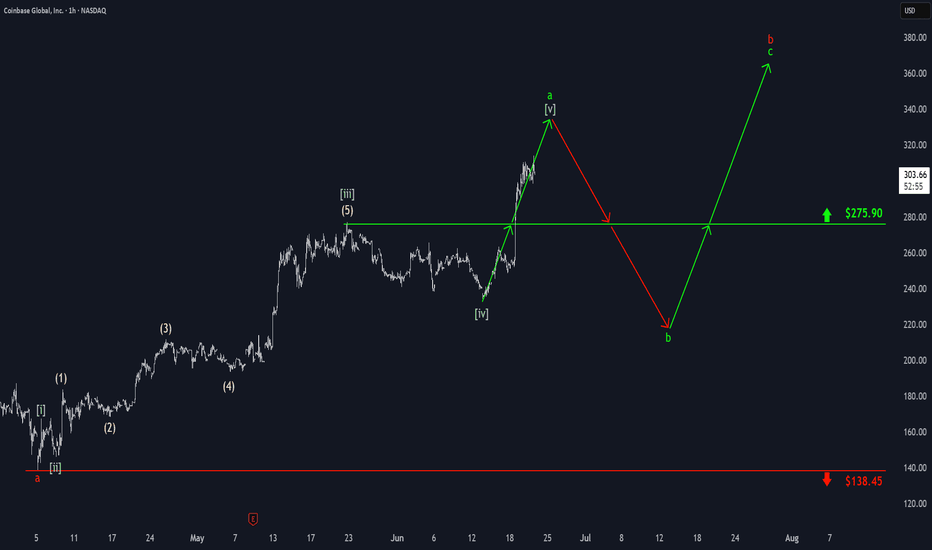

Coinbase: Surging HigherCoinbase has surged sharply above the $275.90 level, prompting us to consider green wave finished. Now, we see the stock advancing in wave , which still has more upside potential to finalize light green wave a. Afterward, we expect a corrective pullback in wave b, which may dip below $275.90, before green wave c resumes the advance, thus completing orange wave b distinctly above $275.90.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

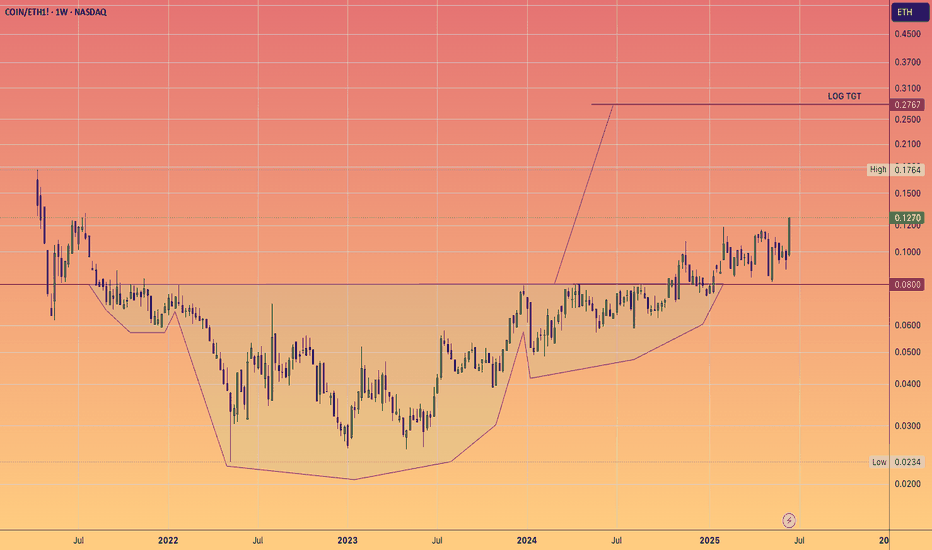

The Chart you don't want to see: Coinbase Vampire attacked ETHBrian Armstrong is a significant influencer in both Silicon Valley and now Washington, D.C., where he is instrumental in shaping legislation and attracting investments that benefit Coinbase and its shareholders.

Vitalik writes blogs and appoints EF directors who appear to have ambiguous gender identities and are quite out there on the spectrum.

Jesse Pollak is yet another astute player who has leveraged ETH's technology to transform BASE into a powerhouse integrating neatly into Coinbase platform for payments and now DEX trading within app.

ETH will thrive.

However, as we've observed, Joe Lubin's return as a public figure to advocate for and steer the future of Ethereum has never been more crucial.

But will it be sufficient to compete with Brian and Jesse? They seem to be operating on a significantly higher plane.

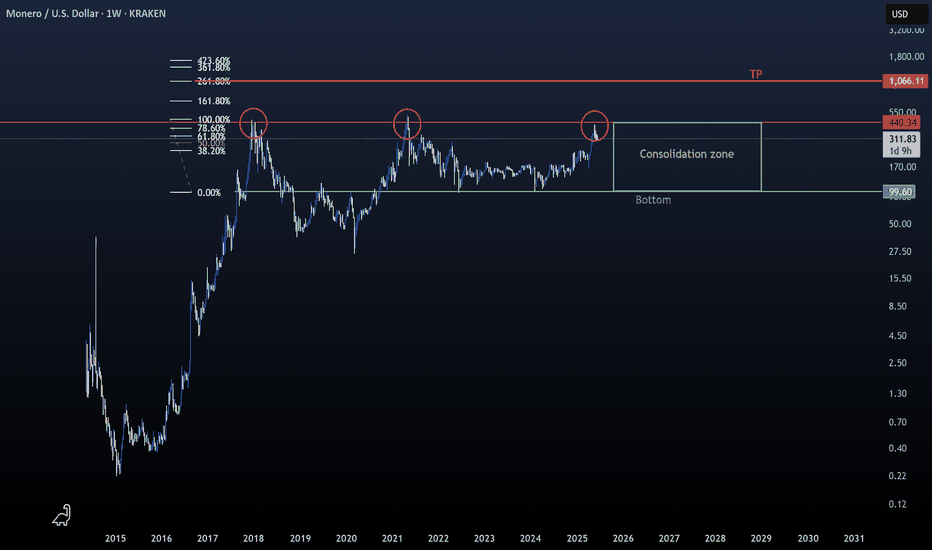

His name is Monero- Despite numerous attempts by various projects to create private coins or tokens, none have succeeded meaningfully.

- Monero is the Bitcoin of the darknet. They can delist it or try to kill it, but Monero is here to stay.

- With rising concerns over privacy and the inevitable push toward CBDCs, the next bullish cycle could drive XMR to a new ATH, $1,000 is a realistic target, not a fantasy.

- Everything you need is in the chart. This is not financial advice, buy only when you believe the time is right.

Happy Tr4Ding !

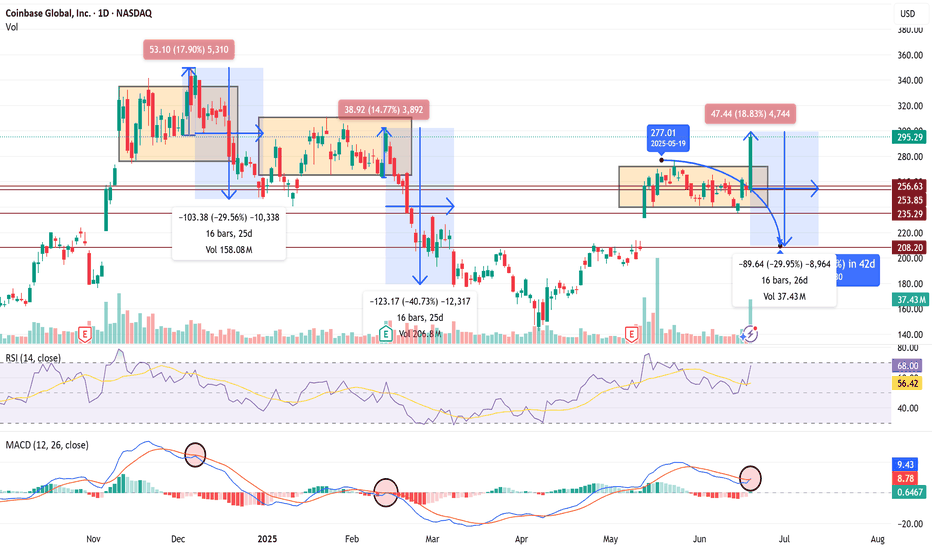

$COIN 30% Pullback Confirms if we Fakeout Recent 15%+ Rally 🧨 COIN SHORT TRADE IDEA — FAKEOUT TRAP IN PLAY

Ticker: NASDAQ:COIN

Date: June 20, 2025

Thesis: Breakout trap setup — expecting a rug pull / red reversal tomorrow to confirm.

🔍 Context

Price broke above range today with a big +18.8% candle to $295 — but...

Volume spike may signal exhaustion, not strength.

RSI = 68 → near overbought

MACD curling into a bearish cross — same signal preceded the last -30% and -40% drawdowns.

History: Same range-break setups in Dec and Feb collapsed hard (-30 to -40%) over 16–25 days.

💣 Trade Plan (Short Setup)

Entry Trigger:

🔻 Enter short if price closes below $277 tomorrow — confirms breakout trap.

Targets:

🎯 Target 1: $253 (top of old range)

🎯 Target 2: $235 (mid-range support)

🎯 Target 3: $208 (full breakdown move, matches last 2 cycles)

Stop Loss:

🛑 Above $297 (breakout highs)

Timeframe:

1–3 weeks (16–26 bars historically)

🧠 Bias

Bearish unless bulls hold $280+. If we get a big red daily candle tomorrow, fakeout confirmed — high-probability follow-through expected.

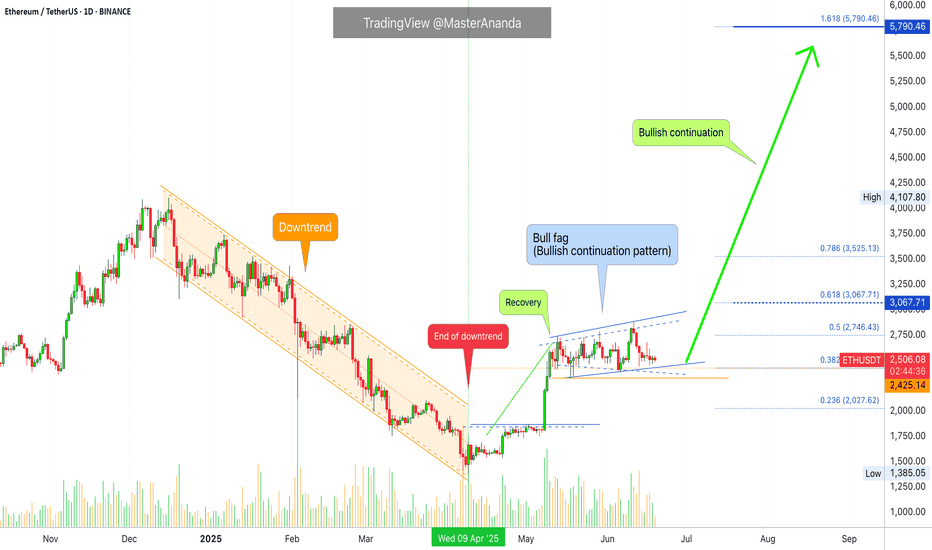

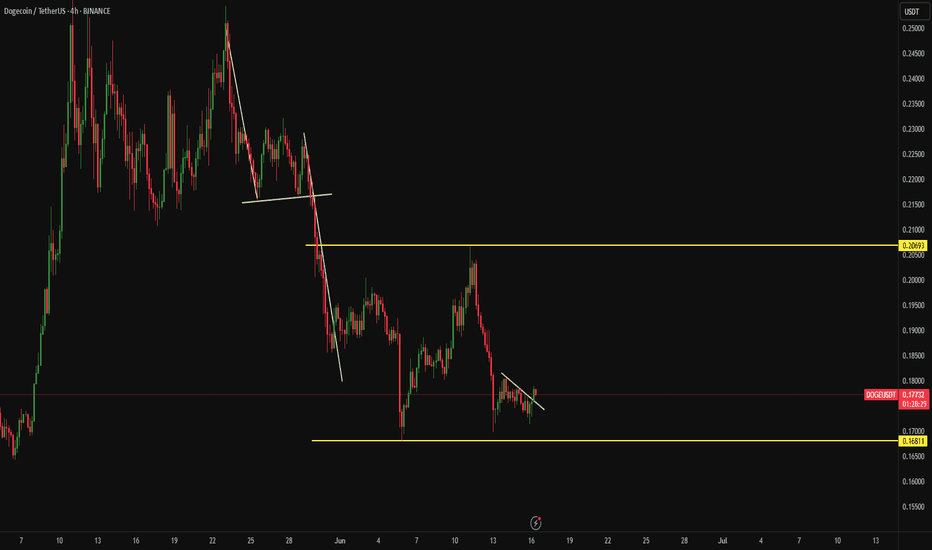

Ethereum, Bullish Breakout Expected Any Moment Now!Look at this, the first peak for Ethereum happened 13-May after the start of the recovery and the end of the downtrend. The lowest point happened five days later on 18-May and there has been no new lows since. Ethereum has been in a bullish consolidation pattern, a classic bullish flag.

This kind of dynamic clearly reveals a bullish bias and certainly, Ethereum is already trading pretty low compared to its last high.

A new and most interesting signal comes from the stock COIN, for Coinbase. This stock went ahead and produced a very strong bullish breakout yesterday with a green candle reaching +16%. COIN's chart and ETH are almost identical, exactly the same. Since these two move together, we can expect Ethereum to follow suit and do the same. We can expect a bullish breakout to happen any day now. Consolidation has been going long enough. It is time for the market to grow.

Some of the smaller altcoins continue to move forward, this is a signal that should not be ignored.

Namaste.

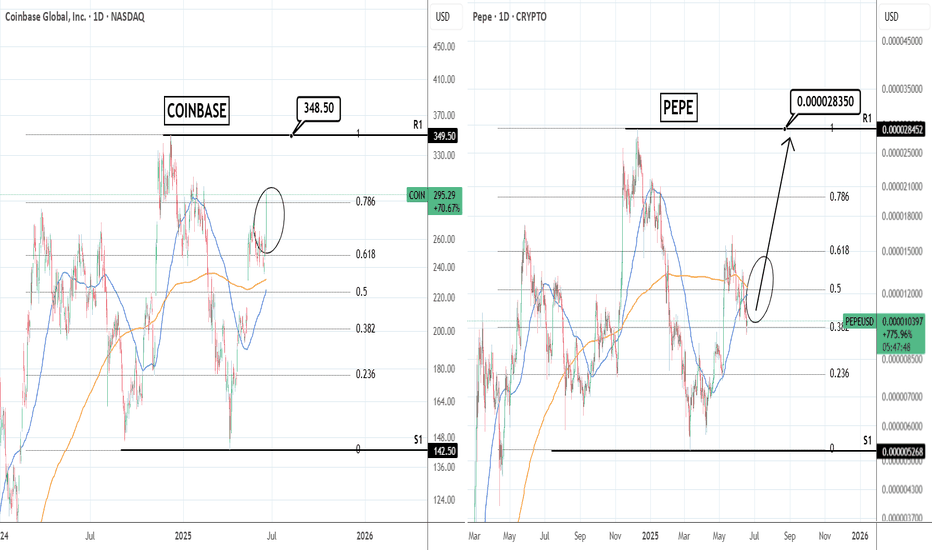

COINBASE: Is it a guide on how to trade PEPE??Coinbase saw a massive surge yesterday as the Senate cleared the path for stablecoin regulation. This turned its 1D technical outlook almost overbought (RSI = 68.001, MACD = 11.870, ADX = 26.090). Our TP = 348.50 on COIN remains but oddly enough, we see a stronger than expected correlation with PEPE. Since it is now lagging after the Senate decision, this may be a great time to buy PEPE as this pattern shows that soon it will follow Coinbase upwards anf they will converge.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Coinbase Shares Rise Following Stablecoin Legislation ApprovalCoinbase (COIN) Shares Rise Following Stablecoin Legislation Approval

Shares in Coinbase Global (COIN) surged by 11% yesterday, making the company the top performer in the S&P 500 index (US SPX 500 mini on FXOpen).

The sharp rise was driven by news that the US Senate has approved the GENIUS stablecoin bill, which sets out a regulatory framework for the use of stablecoins — crypto assets whose value is pegged to another currency or financial instrument, such as the US dollar.

The bill (which still requires approval from the House of Representatives) would pave the way for banks, fintech companies, and other financial market participants to use stablecoins. This development acted as a strong bullish catalyst for COIN shares.

Technical Analysis of Coinbase (COIN) Share Price Chart

In our previous analysis of the COIN share price chart, we:

→ identified an ascending channel (shown in blue);

→ suggested that the COIN share price could rise towards the psychological level of $300.

That projection has played out — the price is now very close to the $300 mark. So, what comes next?

In a bold, optimistic scenario, buyers may hope for a continuation of the rally, with the share price pushing towards the upper boundary of the long-term ascending channel, especially following the recent news. In the medium term, the blue ascending channel may remain relevant, given the strong signal of improved cryptocurrency regulation in the US legislative framework.

However, we also note some vulnerability to a pullback, as:

→ the $300 level may act as significant resistance;

→ the price is approaching the upper boundary of the blue channel, which also shows resistance characteristics;

→ once the initial wave of positive sentiment fades, some investors may look to take profits, especially given the more than 20% rise in Coinbase (COIN) shares since the beginning of the month.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

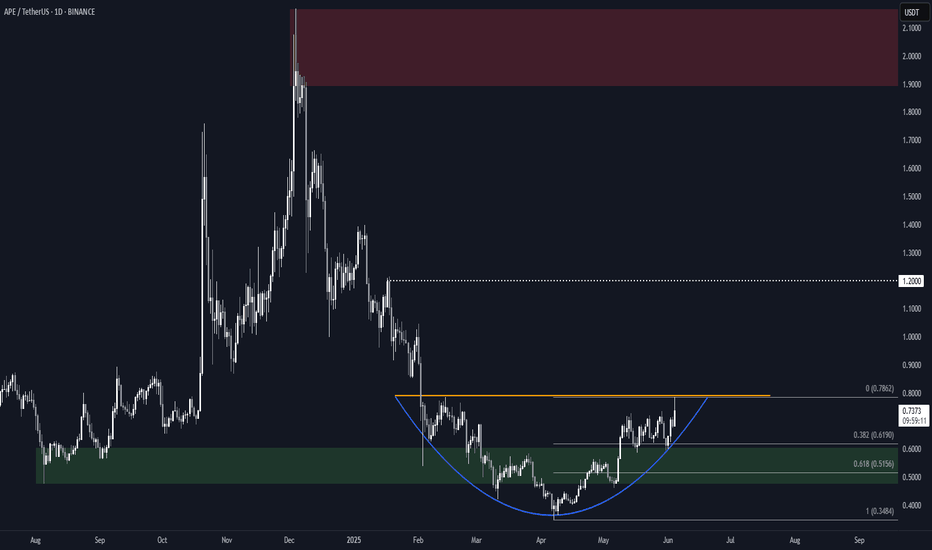

ApeCoin (APE) Cup Pattern (1D)After a deviation below demand, BINANCE:APEUSDT formed a clean rounded bottom, reclaimed the zone, briefly consolidated, and it's now attempting to break above resistance.

Key Levels

• $0.79: Current resistance

• ~$0.65: Current support, breaking it might lead to the formation of a handle

• $0.50-$0.60: Main demand zone and logical pullback target in case of a handle

• $1.20: Measured breakout target, and previous swing high

Worth watching it closely for a daily close above $0.79 with good volume to activate the target.

Alternatively, look at the $0.50-$0.60 area for a reversal in case of a rejection here.

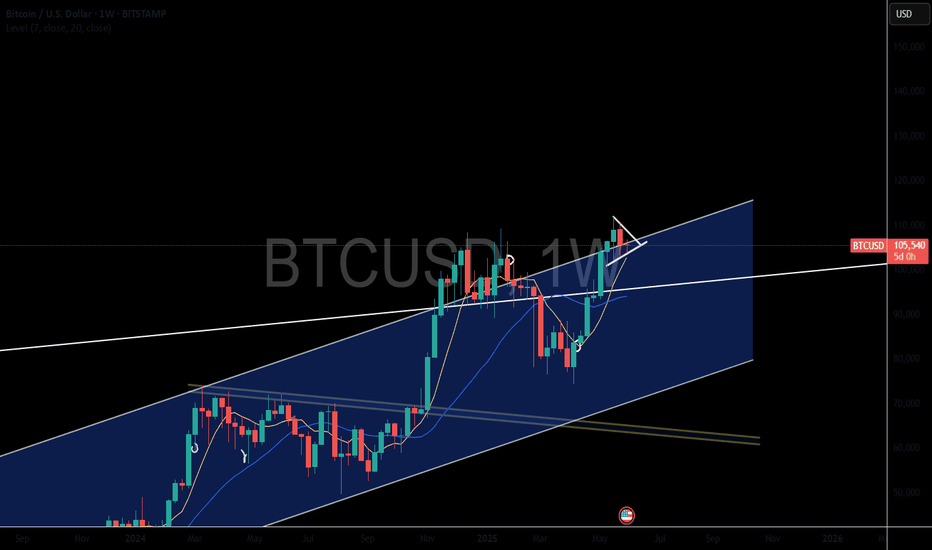

Bitcoin Brewing - A large move is coming!Bitcoin has been under pressure over the last few trading sessions.

Despite the equity markets going higher this asset is stuck in a holding pattern.

We are currently forming a wedge pattern that has given us a directional bias to trade.

Price action is at a 50/50 in terms of falling lower or rallying higher.

Being the fact that the bulls have been forming higher lows & higher highs, we have to give them due respect.

However understand this BTC is showing some distribution signs and is likely going to have a decent selloff within the next 15-45days. We may have 1 more spike higher but we may not.

1 note of interest is the 7day & 20 day moving average just signaled a bearish crossover which is something you need to monitor closely.

I do think the upside is limited to about 115K if we have 1 more move higher.

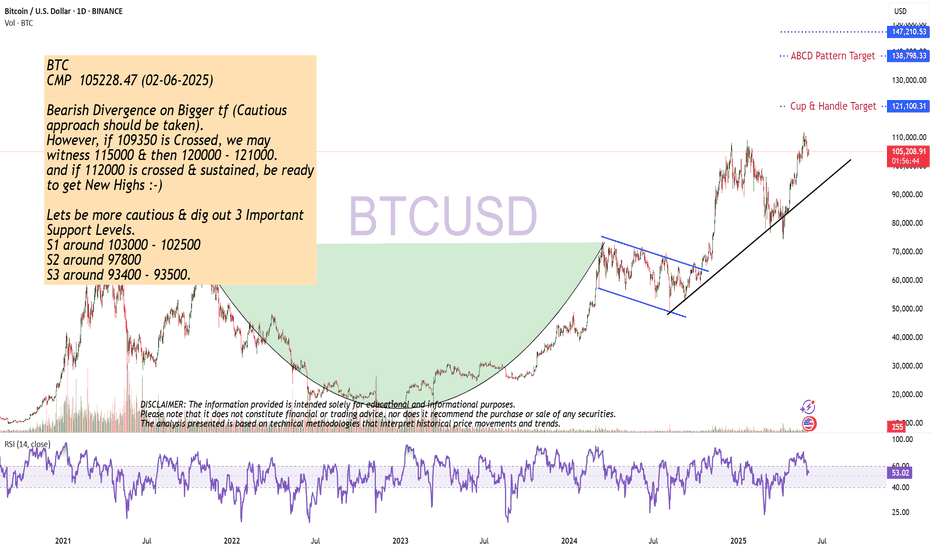

Bearish Divergence on Bigger tf

CMP 105228.47 (02-06-2025)

Bearish Divergence on Bigger tf (Cautious

approach should be taken).

However, if 109350 is Crossed, we may

witness 115000 & then 120000 - 121000.

and if 112000 is crossed & sustained, be ready

to get New Highs :-)

Lets be more cautious & dig out 3 Important

Support Levels.

S1 around 103000 - 102500

S2 around 97800

S3 around 93400 - 93500.

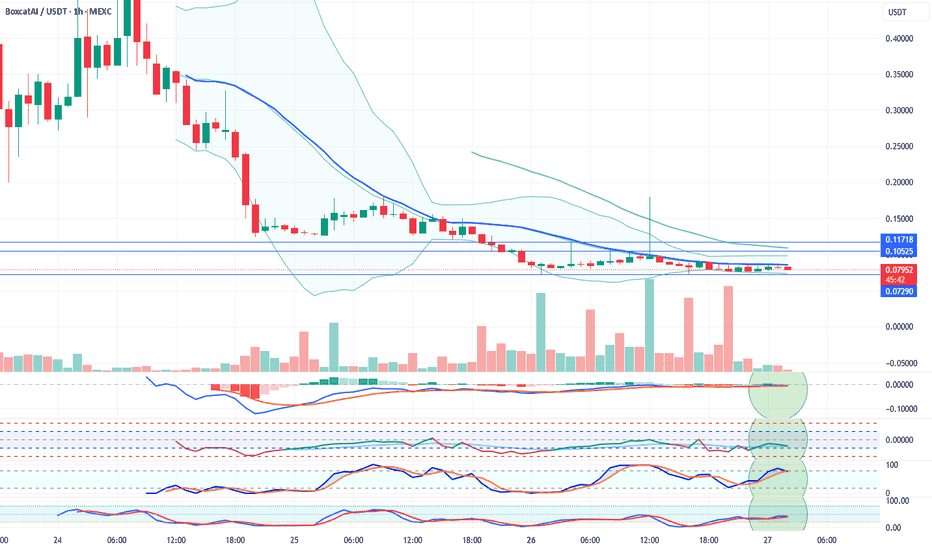

BOXCATUSDT Hourly Technical AnalysisBOXCATUSDT Hourly Technical Analysis

Boxcat, one of the newly listed coins, has moved sideways after the initial listing drop. Currently, it is pricing above the 0.0729 support level. In case of a possible reversal, Boxcat coin may present a high profit potential. With indicators also showing a positive outlook, we expect a possible upward movement in the near future. If a rise occurs and the price reaches the 0.10525 resistance level, there could be a profit potential of around 44%.

Resistances: 0.10525 - 0.11718

Support: 0.07290

THIS IS NOT INVESTMENT ADVICE.

The information, comments, and recommendations provided here do not constitute investment advice. Investment advisory services are provided under a contract between the investor and authorized institutions such as brokerage firms, portfolio management companies, and non-deposit banks. The content on this page reflects personal opinions only. These views may not be suitable for your financial situation or your risk and return preferences. Therefore, no investment decisions should be made based solely on the information and commentary provided here.

We’d greatly appreciate it if you follow and like us to avoid missing our analyses with positive or risky technical indicators.

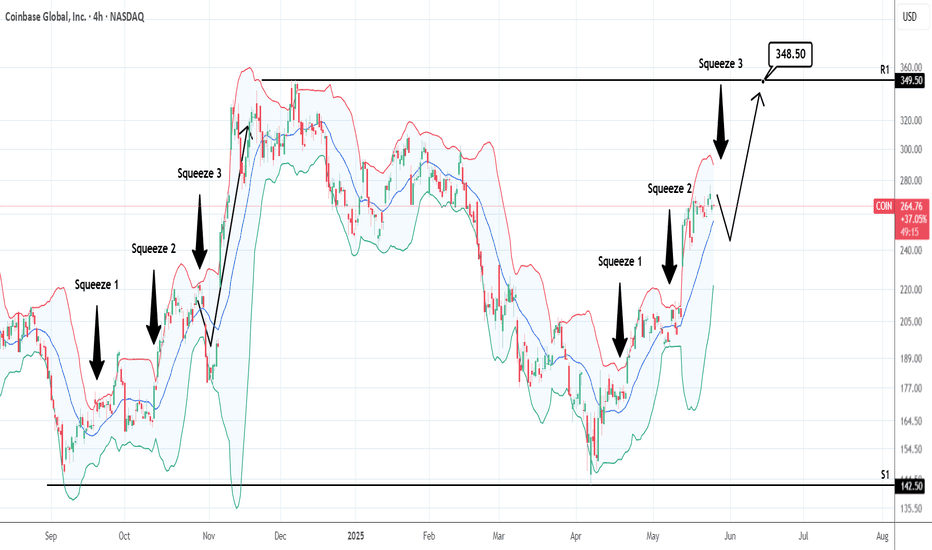

COINBASE: 3rd Bollinger Squeeze is a pullback buy signalCoinbase is bullish on its 1D technical outlook (RSI = 65.834, MACD = 21.140, ADX = 19.909) as it is extending the bullish wave following the S1 rebound. The Bollindger Bands are now expriencing a squeeze, which is the 3rd since the bottom. The 2024 bullish wave also had three Bollinger Squeezes with the 3rd being the last that made the 349.50 High but not before a pullback to the Bollinger bottom. If that takes place, it will be a signal to go even stronger on the bullish side and target the R1 level (TP = 348.50).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

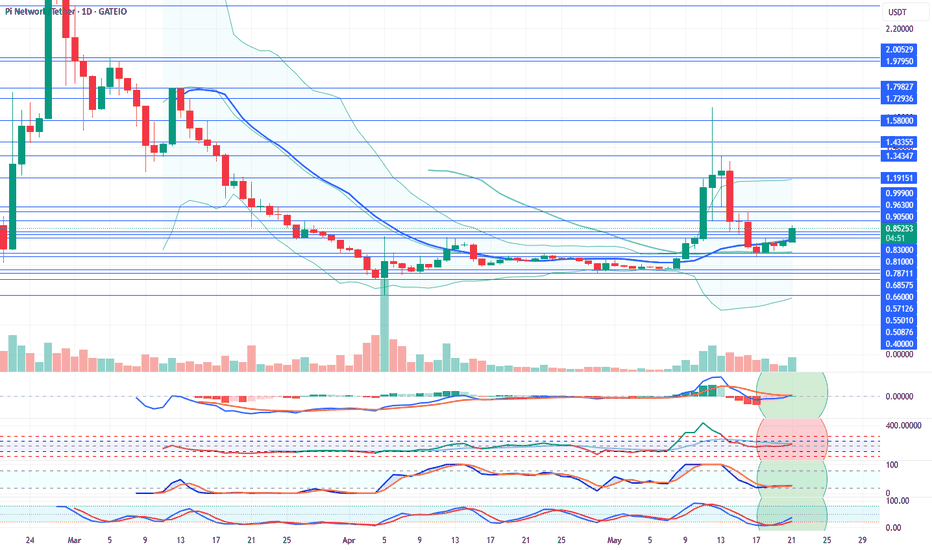

PIUSDT Daily Technical AnalysisPIUSDT Daily Technical Analysis

Pi Network Coin Indicators Are POSITIVE.

The price has broken above the 21-day moving average and successfully held above it. Currently, Pi Network appears to be targeting the $0.905 resistance level. After a wave of profit-taking, its recovery has increased the likelihood of continued positive price action. Resistance levels will be monitored closely. Indicators have turned positive from lower levels and are now pointing upward.

Resistance Levels: 0.900 – 0.963 – 0.999

Support Levels: 0.830 – 0.810 – 0.787

Positive news from the Pi Network team could support further upward price movement. Accumulating Pi Network Coin at these price levels for long-term investment might be considered potentially profitable. However, the decision is entirely yours. This is not financial advice. In the long run, Pi Network Coin may test the $3 levels again — or it might remain at a lower price range.

NOT FINANCIAL ADVICE

The information, commentary, and suggestions provided here do not constitute investment advice. Investment advisory services are offered only through a formal agreement with authorized institutions such as brokerage firms, portfolio management companies, or non-deposit banks.

The content on this page reflects personal opinions only. These views may not align with your financial situation or your risk and return preferences. Therefore, investment decisions should not be made solely based on the information provided here.

If you’d like to stay updated on our technical analyses — whether positive or risky — please follow and like us. We’d really appreciate your support!

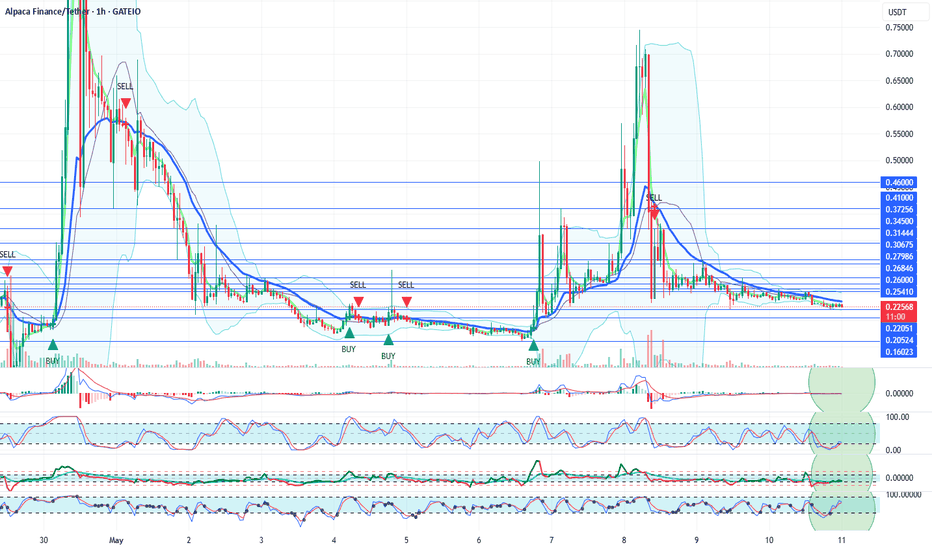

ALPACAUSDT HourlyTechnical AnalysisALPACAUSDT HourlyTechnical Analysis

Alpaca Finance Coin indicators are POSITIVE.

The coin saw a strong upward movement following the news of its delisting from Binance. High returns continue in this cryptocurrency. Alpaca Coin, which experiences periodic price surges, is currently priced near its 21-day moving average. Due to low liquidity, it exhibits sharp price movements, making it a favorite among short-term traders.

While it appears calm at the moment, we believe Alpaca Finance may resume its upward trend over time.

If it breaks above the 21-day moving average, the 0.254 resistance level will be the next target.

In the case of sharp sell-offs, the 0.160 support level will be monitored.

Based on 2-week price movements, Alpaca has shown returns of 558% - 285% - 93% - 110% - 106% - 61% at various points.

This is a high-risk cryptocurrency. This is not investment advice.

Resistances: 0.254 - 0.260 - 0.268 - 0.279 - 0.306 - 0.314 - 0.345 - 0.372 - 0.410

Supports: 0.220 - 0.205 - 0.160

THIS IS NOT INVESTMENT ADVICE.

The information, comments, and suggestions here do not constitute investment advisory services. Investment advisory services are provided under a formal agreement between clients and licensed institutions such as brokerage firms, portfolio management companies, and non-deposit banks.

The content on this page reflects only personal opinions. These opinions may not be suitable for your financial situation or your risk and return preferences. Therefore, investment decisions should not be made solely based on the information and commentary provided on this page.

We’d appreciate it if you follow and like us so you don’t miss our analyses with positive or risky technical indicators.

PIUSDT Daily Technical AnalysisPIUSDT Daily Technical Analysis

Pi Network Coin indicators are POSITIVE.

It has broken above the 21-day moving average and managed to stay above it.

The announcement that the Pi Network team will make about its ecosystem on May 14th could significantly benefit the project and increase activity around the cryptocurrency.

Resistance: 0.79028 - 0.90433 - 1.05080

Support: 0.68164 - 0.57126 - 0.55010

New and positive news from the Pi Network team could support a price increase.

At these levels, accumulating Pi Network Coin for long-term investment could be considered potentially profitable. The decision is yours. This is not investment advice.

In the long run, there is a possibility that Pi Network Coin could retest the $3 levels.

For users who use the Pi app and hold locked Pi Network Coins, if there is no urgent need, they may consider re-locking their coins for another 2 weeks. They can continue this strategy by monitoring the price every two weeks.

In the long term, the probability of the price reaching much better levels remains high.

THIS IS NOT INVESTMENT ADVICE.

The information, comments, and suggestions here do not fall under investment advisory services. Investment advisory services are provided under an agreement between clients and authorized institutions such as brokerage firms, portfolio management companies, and non-deposit banks.

The content of this page reflects only personal opinions.

These views may not be suitable for your financial situation or your risk and return preferences. Therefore, investment decisions should not be made based solely on the information and content on this page.

We’d appreciate it if you could follow and like us so you don’t miss our analyses with positive or risky technical indicators.

Coinbase (COIN) Shares to Be Added to the S&P 500Coinbase (COIN) Shares to Be Added to the S&P 500

According to media reports, shares of the cryptocurrency exchange Coinbase Global (COIN) are scheduled to be added to the S&P 500 index (US SPX 500 mini on FXOpen) on 19 May, replacing Discover Financial Services (DFS), which is in the final stages of being acquired by Capital One Financial (COF). The deal, having received all necessary approvals from regulators and shareholders of both companies, is expected to be completed on 18 May 2025.

As a result, Coinbase Global will become the first cryptocurrency-related company to be included in the S&P 500 index — a development that sent COIN shares surging to their highest level since late February. Inclusion in the S&P 500 is considered a bullish catalyst, as it suggests increased demand for the stock from index funds and signals improved prospects. Analysts have taken note; Rosenblatt Securities raised their price target for Coinbase Global Inc. (COIN) from $260 to $300.

Technical Analysis of COIN Stock Chart

In previous analyses of the COIN stock chart, we:

→ drew a descending channel;

→ identified a resistance zone in the $225–240 range (highlighted in purple).

However, the surge in demand triggered by the news of COIN’s inclusion in the S&P 500 has led to:

→ the descending channel appearing to lose relevance entirely;

→ the price gapping above the purple resistance zone;

→ increasing grounds to draw a potential upward trend trajectory (shown with blue lines).

Given the current momentum, it is possible that the COIN share price could rise towards the psychological $300 level, which acted as resistance earlier in 2025.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.