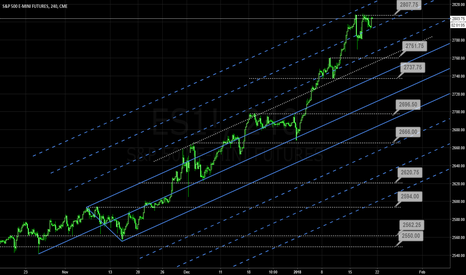

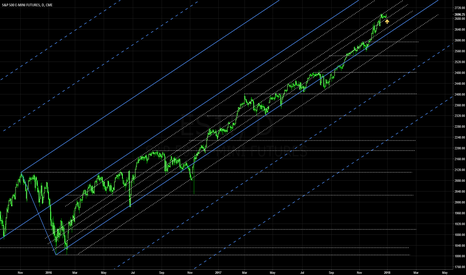

S&P 500 Index SPX Next Buy Points From HereS&P 500 Index - Update Next Buy Points

A fantastic clean break gave an entry at 2635 and showing

about a 60 point profit so far to add to the massive short on

this index right down to the lows on Monday. So far this has

been the most profitable week for shorts and then longs on

the major indexes for over 2 years. We've had the easy part,

now it gets a little more difficult again...

It's now probing resistance at 2700 and can come back to 2668

before rallying again. So can close down the long or

alternatively place a stop close under it to trap in profits if it

does come off more from here first before the next rally kicks in.

On the upside there is resistance potential stretching from

2700 up to 2715 - it has to penetrate and hold 2715 to trigger

the next long which should take it to 2732 to begin with and

then after consolidating to 2762 and close to the upper rising

parallel where will look to take profits again if touched.

On downside, if it comes off from here back to 2669-2660

line will look to buy here with stops below 2260.

Any break below 2260 will signal a retest of the lows - and if

we see this will look to buy again from there.

Otherwise can run this long but with stop quite tight under

price from here to trap in profit if it does fall away to 2669 first.

Sandp500

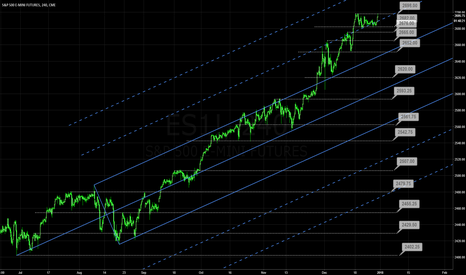

S&P STANDARD AND POOR'S LONG RANGE VIEW, by DANIEL BRUNO, CMTDANIEL BRUNO, CHARTERED MARKET TECHNICIAN. LOOK ME UP ON LINKEDIN

LONG RANGE VIEW FROM 2008

WOW, THE S AND Ps REDISCOVERED GRAVITY.

MY FIRST LOOK IN A LONG TIME. NOTE THAT CRYPTOS ARE CRASHING TOO, AND THE USD AS WELL

FIRST TARGET IS 2/1 ANGLE AROUND 2500 ZONE

THEN 2100 ZONE

WILL HAVE MORE TO SAY LATER, THIS WILL TAKE SOME TIME.

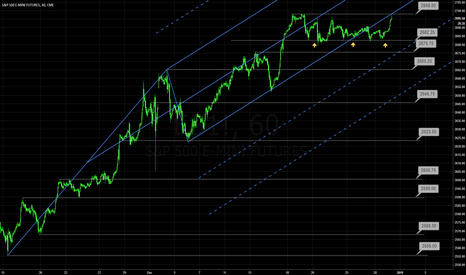

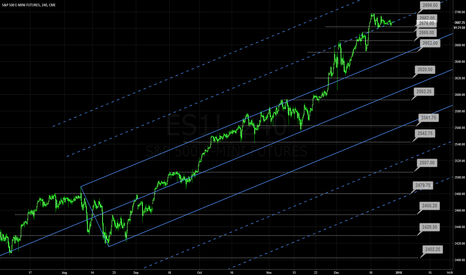

S&P 500 Index Further Downside YetS&P 500 Index: SPX

Same problem as as the Dow - risen to fill the gap and now

retesting near term lows at 27330 - The first real support lies

at 27130 and it looks likely it will be tested soon. Failure to

hold here will signal further near term weakness back to

26687 and potentially, if this level fails, back to 26007

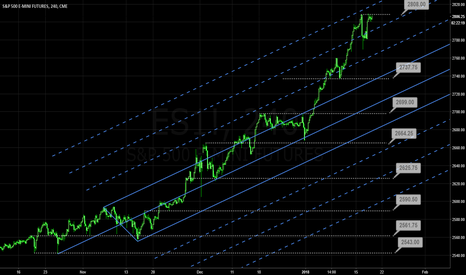

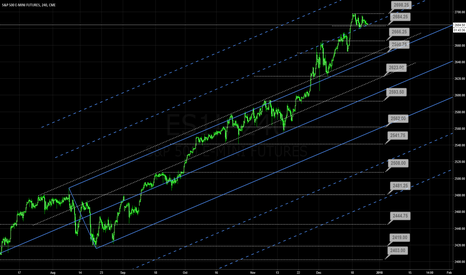

S&P 500As per the long term chart of S&P 500

tradingview.sweetlogin.com

Below are my review points

1. MACD shows overbought character , which also reflects in price and volume

2. From last two years there was a steady uptrend with few corrections

3. As per my Analysis s&p will hit 3000 mark end of march

4. We can still rely on technical analysis , as there are no fundamental news coming in .

5. In the last few days price dropped more than 100 dollars , which i see a major correction , as price was increasing exponentially in last few weeks and people made shit load of money

6. Those who are still betting on their long positions might do panic sell and bear losses

7. Price might drop further more and can hit support level 2600 in another week's time

8. Good entry would be 2600 or earlier if we see any uptrend move

9. I am relying on MACD to become neutral

Please invest on your own risk

Idea : Sell( short term )

: Buy ( Long term )

Opportunity to short S&P 500Every one on the Street talks about incoming crisis and 5%+ downtrend for main US indexes. I suppose every trader should use such opportunities and open corresponding short positions.

What we have for S&P today? 2017 and January 2018 made it extremely overbought - RSI was on 86, the last time we saw these levels during 1980 rise, and it was followed by 21% correction. Bad news from Apple (3.5% of the whole S&P) and unjustified tax expectations made the trend line breakout, with a wide gap. RSI has approved the signal by breaking through 70 (the most reliable RSI signal). Combing these factors all together I see a safe trade opportunity and open a short position.

The best tactic for TPs is to close step by step. I am going to do it in three steps, as I show on the graph. I also put my SL very closely, because we still have a bull market, and I don't want to take additional, very possible risks.

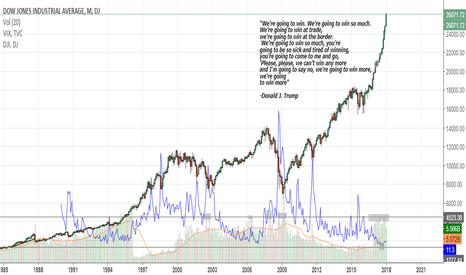

Dow 30 000The VIX has never been this low, ever.

The Dow's daily trading volume has never had so many massive monthly volume bars in such a short time period, unless it was a big sell off, or dip buying after a massive recession.

The only risks are war, disease, or Trump getting impeached. This shutdown will cause a little pull back, but the trend will continue