SandP 500 E-Mini Futures 60 CME Updated 11/6/2017Price has come up and passed through the middle median line and is using it as support multiple times. Look to see if price will hold as support, break through 2585, and go to the upper median line. We are starting to coil up into energy, so there should be a move soon.

Sandp500

Megaphone Top On S&P 500This is the daily chart of SPY that is displaying, in my opinion, a megaphone pattern that will likely resolve to the downside. As evidence of this being a megaphone pattern is the disjointed trend lines as well as the relatively large volumes that correspond to the "higher highs" and "lower lows." My reasoning for expecting this to be a reversal pattern stems from seeing bearish divergence in a number of indicators- the daily chart displays a bearish cross in the True Strength Indicator and the picture that I've included also shows a bearish trend in the TSI.

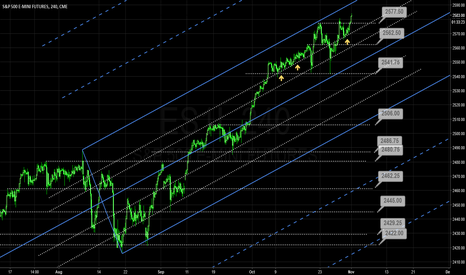

SandP 500 E-Mini Futures 240 CME Updated 10/31/2017Price has hit the sliding parallel and is moving up nicely to try to touch 2577 again. Look to see if price will break that level and retest as support to possible break out of the upper blue median line that is currently resistance. Notice how price bounced on the line that I had marked yesterday, so this was expected support.

SandP 500 E-Mini Futures 240 CME Updated 10/30/2017Price has continued on bouncing from 2542 and has hit the upper median line again near 2577. Look to see if price will break to the upside and retest the blue line as support. Price is currently near resistance so see what it will do. We may also come down to test 2562 before as support.

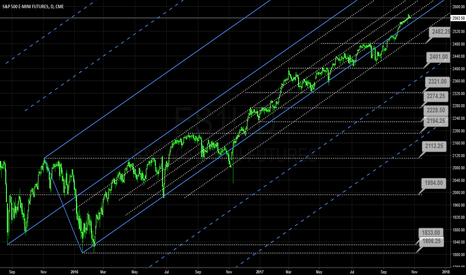

DOW and S&P 500: DOWI SPX500 Super-Long-Term AnalysisDow and S&P 500 Super-long-term: How much longer longer, how much farther? Let the past be your guide. Apart from your dog it's the best friend you've got. The trick is to realise it. Chart is a bit of a mess so will upload a second without the BS