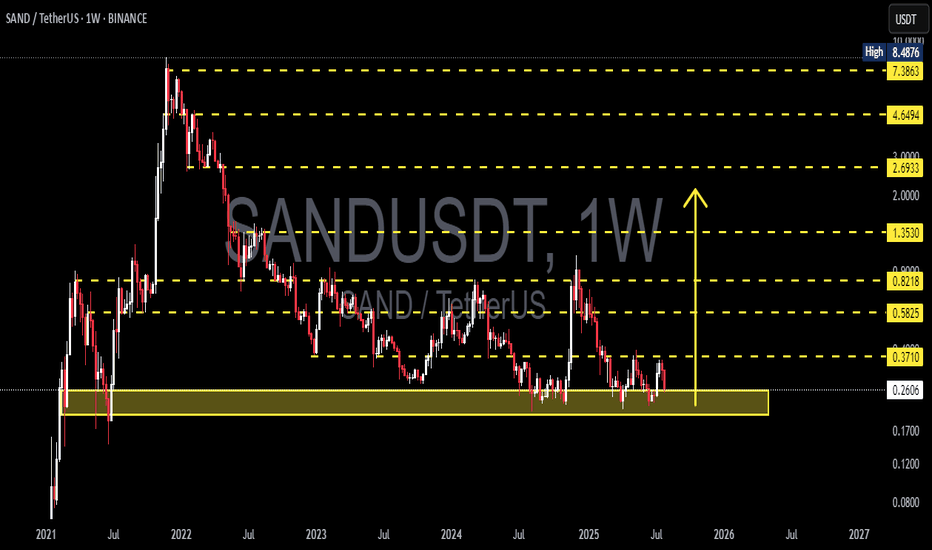

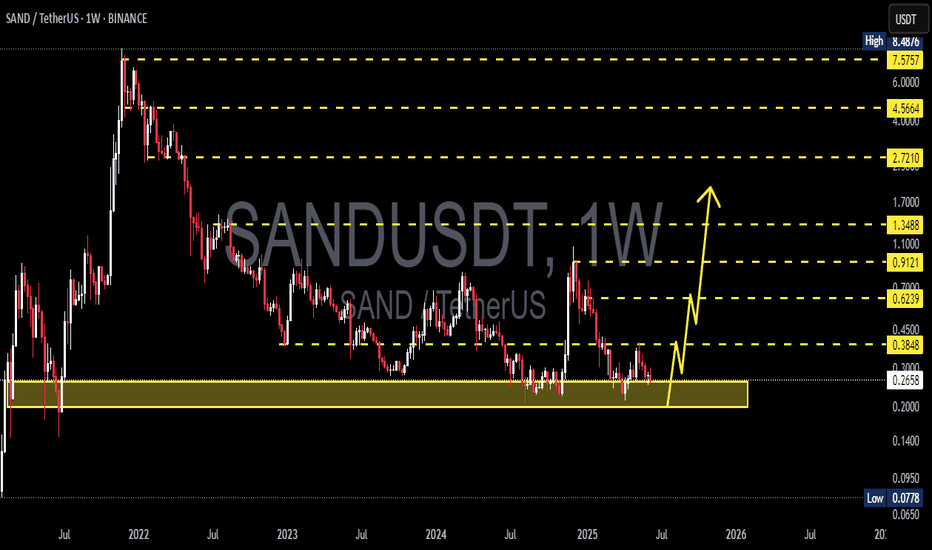

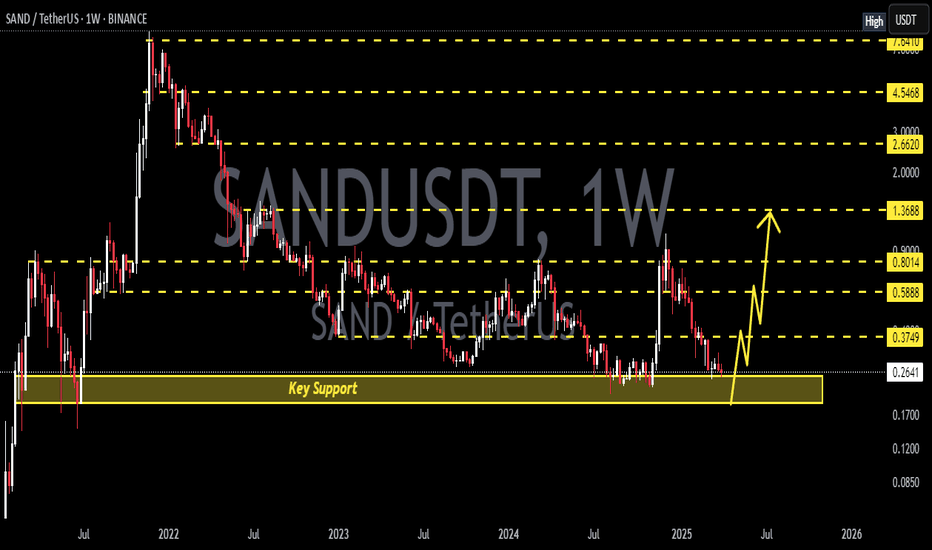

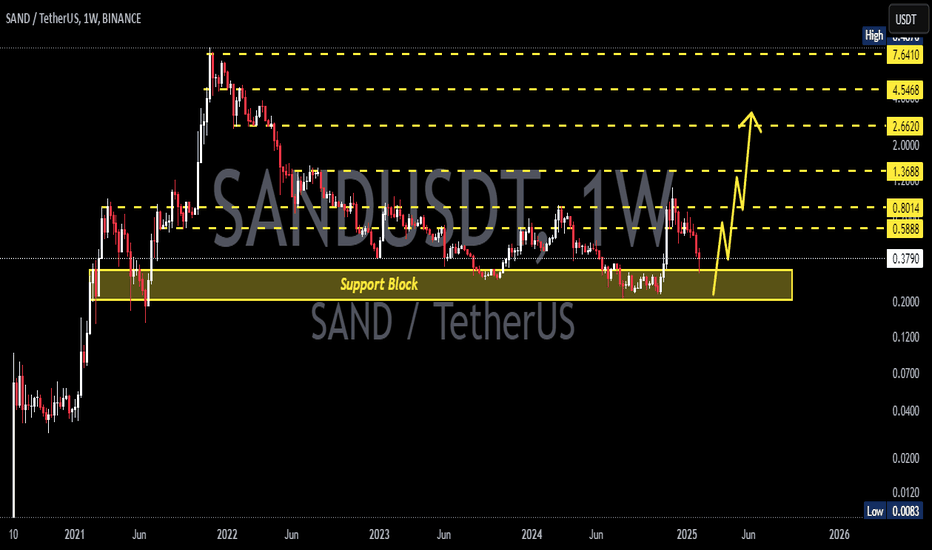

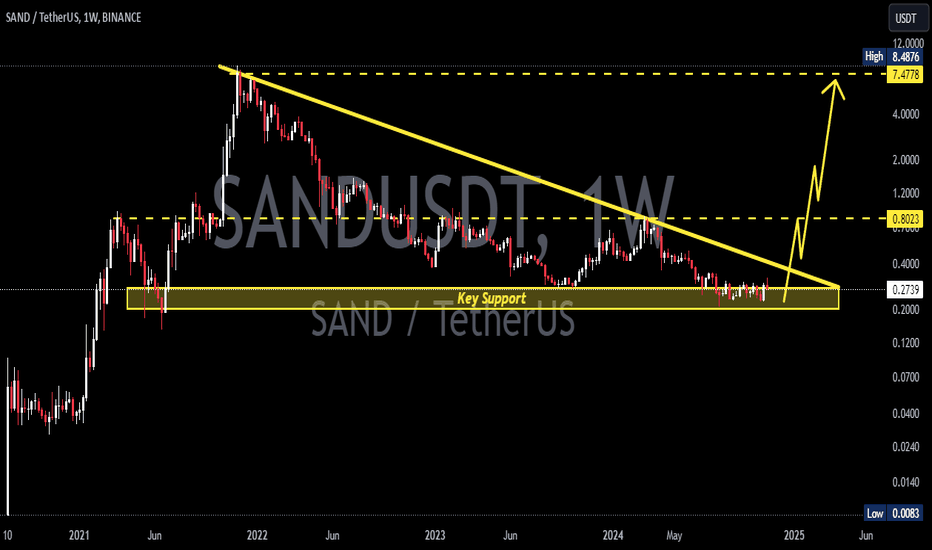

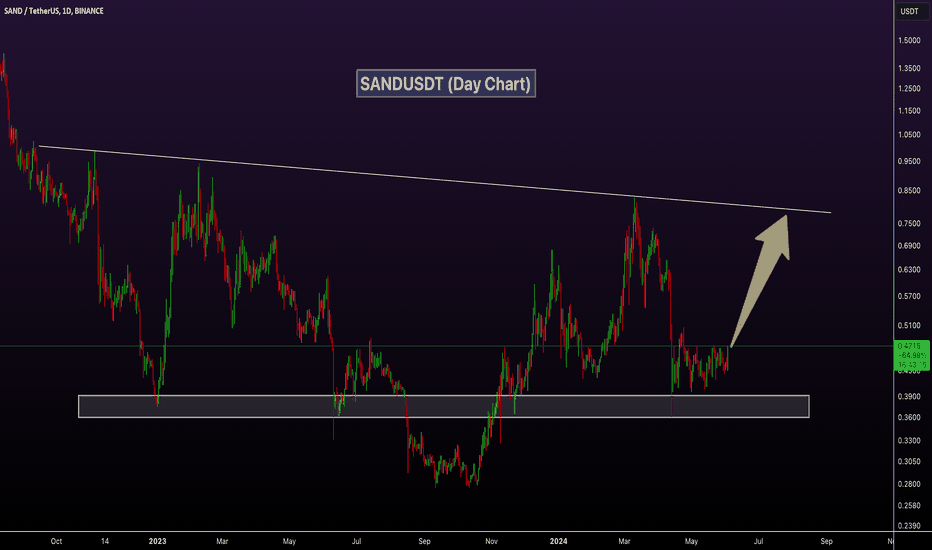

SAND/USDT Analysis – Major Accumulation or Imminent Breakdown?🔍 Overview:

SAND is currently trading at a crucial historical support zone, which has held firm multiple times since mid-2022. The chart shows a prolonged accumulation phase, offering significant potential for a major breakout or a decisive breakdown depending on market reaction.

---

🧠 Price Structure & Price Action:

After reaching an all-time high at $8.4876 in late 2021, SAND has been in a long-term downtrend.

However, over the past year, it has formed a wide base around the $0.26–$0.37 range — a clear sign of potential accumulation.

Price is currently moving sideways in a compression structure, signaling the build-up of energy for the next explosive move.

---

🧱 Key Levels:

Level Function Status

$0.2613 Primary Historical Support Currently being tested

$0.3710 Local Resistance Needs to be reclaimed

$0.5825 Major Resistance Bullish confirmation level

$0.8218 Weekly S/R Flip Mid-range target

$1.3530 Psychological Resistance Potential medium-term target

$2.6933 / $4.6494 Expansion Phase Targets Long-term upside potential

$7.3863 Pre-ATH Resistance Late-cycle target

---

🟢 Bullish Scenario:

1. If price holds and bounces off the $0.26–$0.37 demand zone, a bullish reversal may unfold.

2. A weekly close above $0.3710 would be the first sign of strength.

3. Breaking $0.5825 with solid volume would confirm trend reversal and open the path toward $0.82 – $1.35.

📌 Additional Bullish Confirmation:

Bullish divergence on RSI (if present)

Increasing volume during upward moves

---

🔴 Bearish Scenario:

1. A clear breakdown below $0.2613 on the weekly timeframe would signal a loss of major support.

2. This opens downside risk toward:

$0.17

$0.12

Possibly even $0.08 if the market seeks a deeper revaluation.

3. Such a move would likely represent a full structure reset.

📌 Additional Bearish Confirmation:

Strong bearish candles with high volume

Weak or no bullish reaction within the demand zone

---

🔁 Formations in Play:

Accumulation Rectangle: A sideways range often found at market bottoms before new bull cycles.

Multi-year Base Formation: Can serve as a launchpad for major parabolic moves if resistance is broken.

---

📚 Conclusion:

SAND is at a make-or-break zone. The market is coiled like a spring — preparing either for a new bullish expansion or for further downside pain. Smart traders and investors will:

Wait for breakout confirmation

Or exit positions on breakdown signals

This is a golden zone for preparation, not reaction.

---

📌 Suggested Trading Plan:

✅ Bullish Bias: Scale in within support zone; tight stop below $0.26

❌ Bearish Bias: Short only after weekly close below $0.26

🧠 Neutral/Waiting: Let the market prove itself

#SANDUSDT #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #MetaverseToken #SupportZone #BullishScenario #BearishOutlook #SmartMoneyAccumulation #CryptoTA #AccumulationPhase

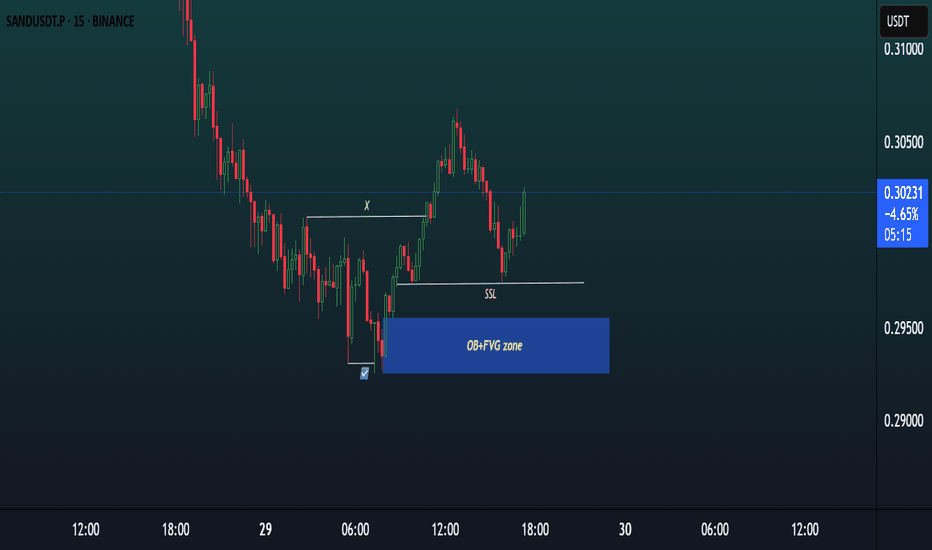

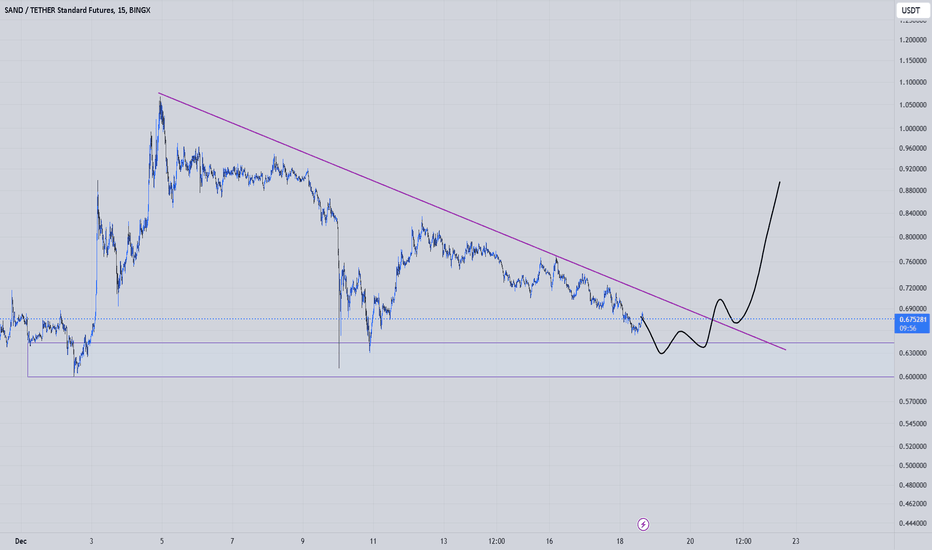

SANDUSDTPERP

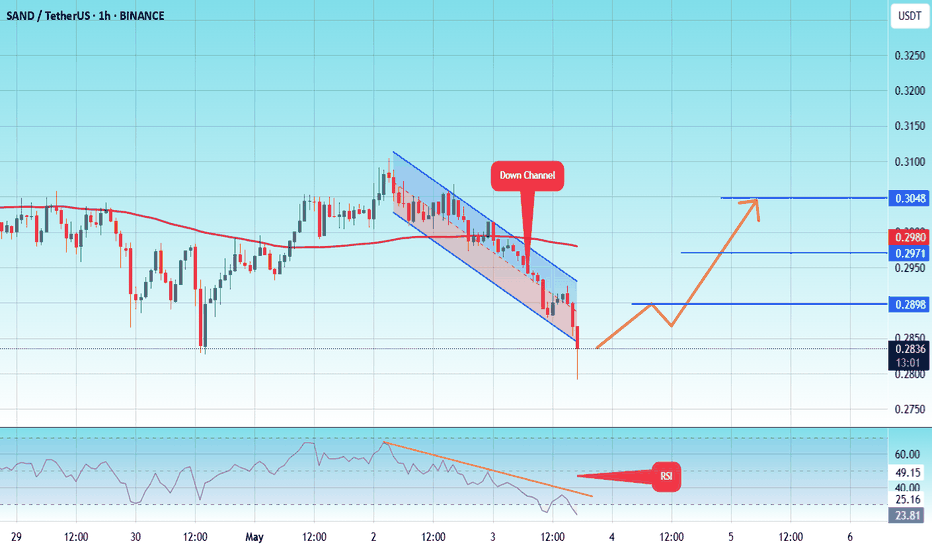

SAND SCALP TRADE IDEA.1. Market Structure:

The chart shows a bullish market structure with a clear Break of Structure (BoS) to the upside (marked by “X”).

After this impulsive move, the price has entered a retracement phase, forming lower highs and lower lows within this short-term correction.

2. Liquidity Engineering:

Sell-Side Liquidity (SSL) is visible just below the 0.2980 level, formed by equal lows and previous swing lows.

This liquidity has not yet been swept, meaning the market may still target this area to grab liquidity before any strong bullish move.

3. Key Demand Zone – OB + FVG:

Below the SSL lies a strong demand zone, marked by a Bullish Order Block (OB) overlapping with a Fair Value Gap (FVG) in the 0.2940–0.2960 range.

This confluence increases the probability of a strong bullish reaction when price enters this zone.

4. Current Price Action:

Price is currently reacting around 0.3000, showing a minor bounce, but no key zone has been tapped yet.

As SSL is still intact and unmitigated, there is a high likelihood that price will first move lower to sweep the liquidity and tap into the OB + FVG zone.

5. Trade Expectation:

Ideal setup: Wait for price to sweep SSL, enter the OB + FVG zone, and then look for bullish confirmation (such as a bullish engulfing, change of character, or lower timeframe BOS) to consider a long position.

Stop Loss: Below the OB zone (~0.2930).

Take Profit: 1.5x to 2x RR, or targeting the recent high around 0.3060–0.3080.

6. Summary:

SAND/USDT is showing bullish intent, but is likely to first sweep sell-side liquidity and tap into the OB + FVG demand zone before resuming the uptrend. Patience is key — await a clean reaction and confirmation before entering long.

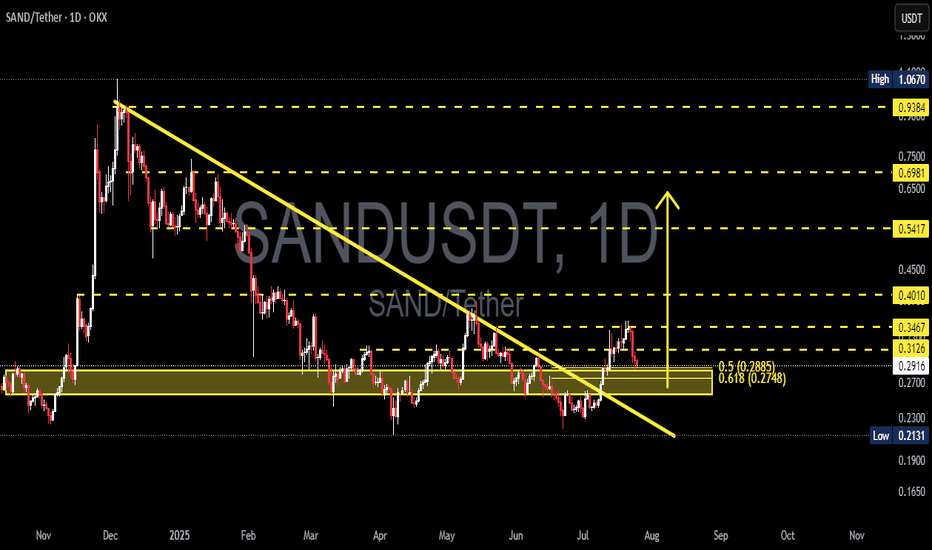

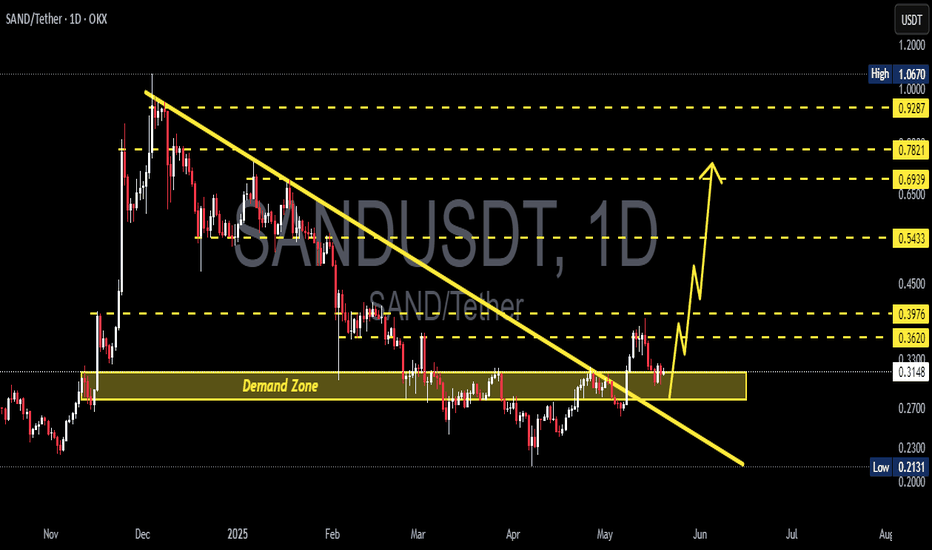

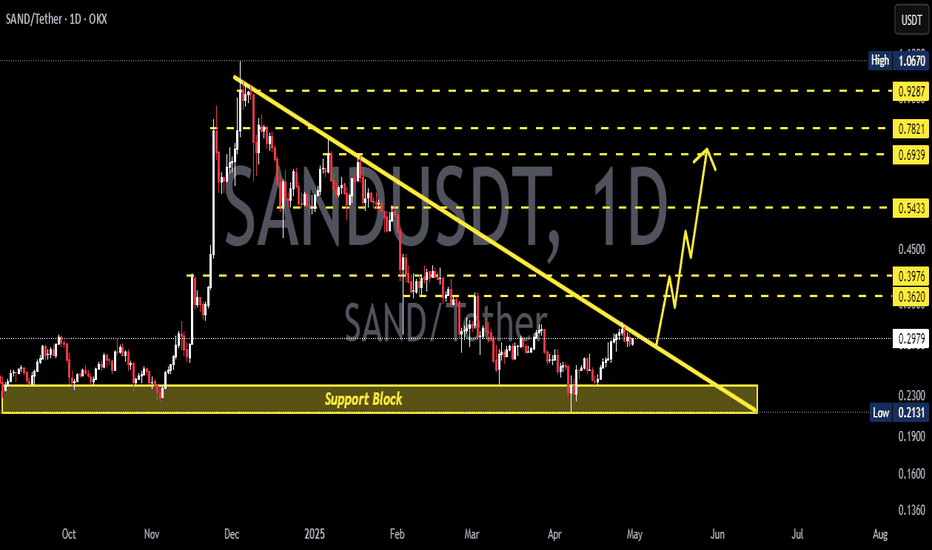

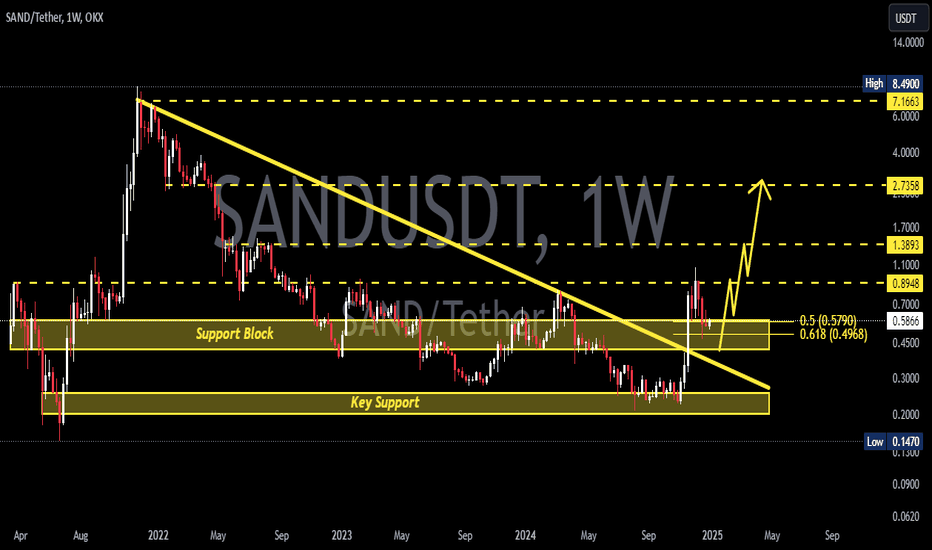

SANDUSDT Breaks Major Downtrend – Golden Pocket Retest!

Technical Analysis:

SAND/USDT has successfully broken out of a descending trendline that had been capping the price since late 2024. The breakout occurred with increased volume, signaling strong buyer interest.

Following the breakout, price rallied and is now retesting a key support zone, which includes:

A demand zone (yellow box) between 0.2748 - 0.2885, aligning with the Fibonacci Golden Pocket (0.618 - 0.5)

A solid horizontal support around 0.2913

Fibonacci retracement levels are clearly defined:

0.3126

0.3467

0.4010

0.5417

Up to major resistance near 0.9384

---

Bullish Scenario 🟢:

If the price holds above the Golden Pocket zone and prints bullish confirmation (such as a bullish engulfing or hammer candlestick), then further upside potential is likely:

1. Initial targets: 0.3126 and 0.3467

2. Mid-range targets: 0.4010 and 0.5417

3. Long-term potential: 0.6981 and possibly the major resistance at 0.9384

Stronger confirmation would come from a daily candle closing above 0.3126.

---

Bearish Scenario 🔴:

If price breaks below the 0.2748 zone, it could indicate a failed breakout, potentially leading to:

1. Initial support: 0.2700

2. Deeper pullback zone: 0.2131 (previous low)

3. Potential fakeout of the trendline breakout

A daily close below 0.2748 would strongly validate the bearish setup.

---

Chart Pattern Overview:

Descending Triangle Breakout already confirmed

Price is now in the retest phase of the breakout

The Golden Pocket Fibonacci zone is the crucial point of trend continuation or reversal

---

Conclusion:

The breakout from the long-standing downtrend marks a strong shift in structure. However, a successful retest at the Golden Pocket will be key to confirming further bullish continuation. If buyers defend this zone, SAND is likely to print a higher low and resume its upward move.

#SANDUSDT #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #FibonacciLevels #TrendlineBreakout #GoldenPocket #BullishSetup #BearishSetup

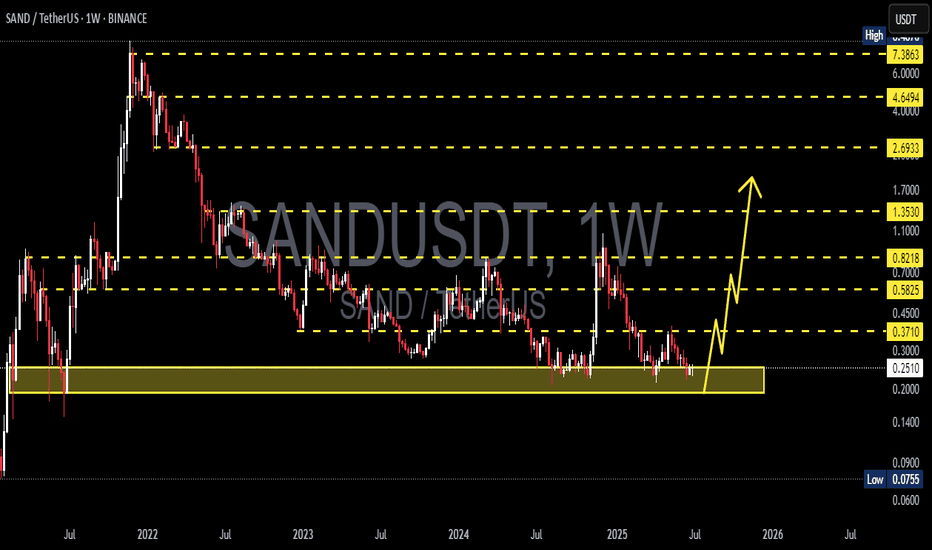

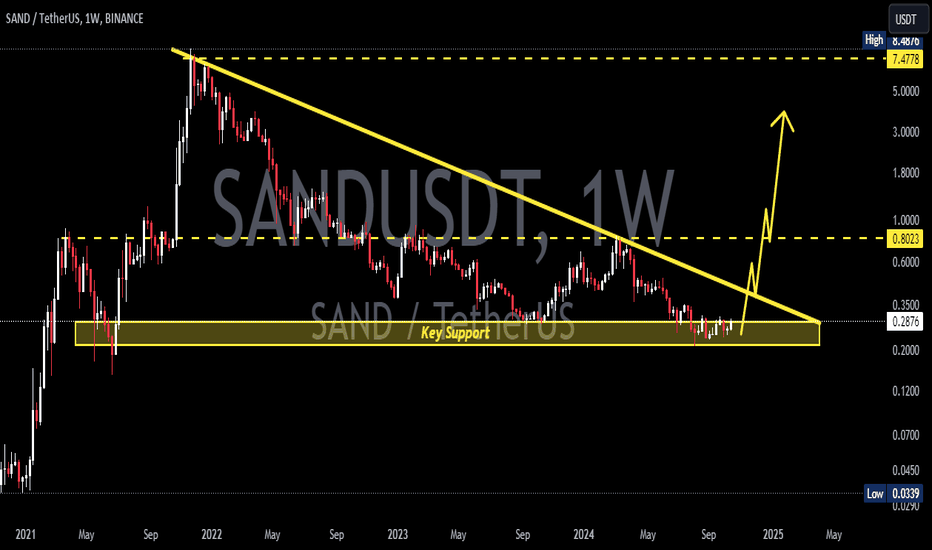

SAND/USDT at Critical Support Zone – Rebound Potential?Detailed Technical Analysis:

The SAND/USDT weekly chart shows the price currently hovering around a historically strong support zone between $0.20 – $0.25. This yellow-marked demand area has been tested multiple times since 2021 and has consistently prevented further downside, making it a crucial decision point for both bulls and bears.

🟢 Bullish Scenario:

If the price manages to hold this key support and prints bullish price action (e.g., a bullish engulfing or hammer candlestick), a reversal is likely. The projected upward path on the chart outlines the next key resistance levels:

1. $0.3710 – Initial resistance.

2. $0.4500 – First major breakout confirmation.

3. $0.5825 - $0.7000 – Mid-term resistance cluster.

4. $0.8218 - $1.3530 – Longer-term targets if bullish momentum sustains.

Bullish Confirmation:

Weekly candle close above $0.37

Breakout with strong volume beyond $0.45

🔴 Bearish Scenario:

If the price breaks below and closes under the $0.20 support zone, it would signal a bearish continuation, with possible downside targets at:

1. $0.14 – Minor historical support.

2. $0.09 - $0.075 – Extreme low support region and historical bottom.

Bearish Confirmation:

Weekly close below $0.20

Strong breakdown volume without immediate bullish rejection

📊 Chart Pattern Overview:

✅ Triple Bottom / Accumulation Zone:

The current support area resembles a potential triple bottom structure or long-term accumulation phase. If confirmed, this pattern could mark the beginning of a new bullish cycle.

🧠 Conclusion:

SAND is at a make-or-break level. As long as the price holds above the $0.20 - $0.25 support zone, bullish recovery remains a valid possibility. However, a breakdown below this level could trigger a significant bearish move.

#SANDUSDT #CryptoAnalysis #AltcoinSeason #TechnicalAnalysis #BullishScenario #BearishScenario #CryptoTrading #PriceAction #SupportResistance #TripleBottom

#SAND/USDT#SAND

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.2790, which acts as strong support from which the price can rebound.

Entry price: 0.2828

First target: 0.2890

Second target: 0.2971

Third target: 0.3048

#SAND #SANDUSDT #SANDBOX #LONG #SWING #AMD #Eddy#SAND #SANDUSDT #SANDBOX #LONG #SWING #AMD #Eddy

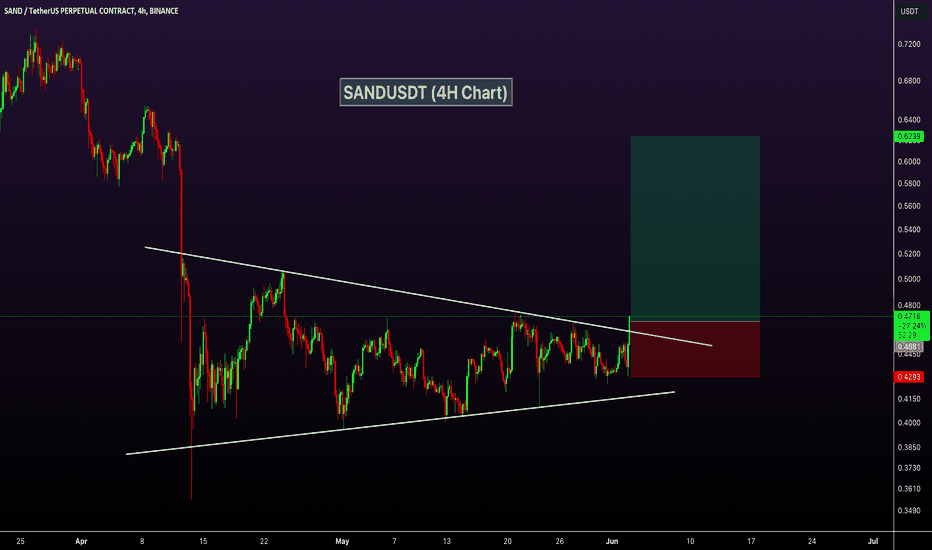

SANDUSDT.P SWING Long AMD Setup

Important areas of the upper time frame for scalping are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style. (( AMD SETUP ))

Based on your strategy and style, get the necessary confirmations for this Swing Setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

By scratching the price and time bar, you can see the big picture and targets.

Note: The price can go much higher than the second target, and there is a possibility of a 50%-100% pump on this currency. By observing risk and capital management, obtaining the necessary approvals, and saving profits in the targets, you can keep it for the pump.

Be successful and profitable.

sand idea"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

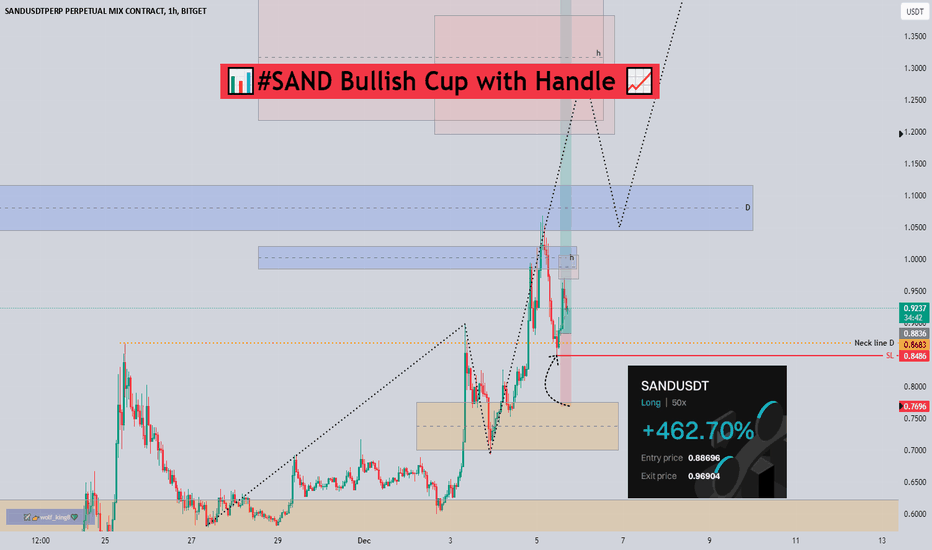

#SAND Bullish Cup with Handle📊#SAND Bullish Cup with Handle 📈

🧠From a structural point of view, we reached the staged resistance zone at the daily level and then fell back, which is very reasonable. However, the ideal target zone at the daily level has not been achieved, so it is still a bullish trend.

➡️In addition, a bullish cup with handle structure is also constructed on the 1h chart, so the probability of us continuing to rise from here is high. At present, we have locked in major profits and will expect more with the remaining positions.

🤜If you like my analysis, please like 💖and share it💬

💕 Follow me so you don't miss out on any signals and analyze 💯

BITGET:SANDUSDT.P

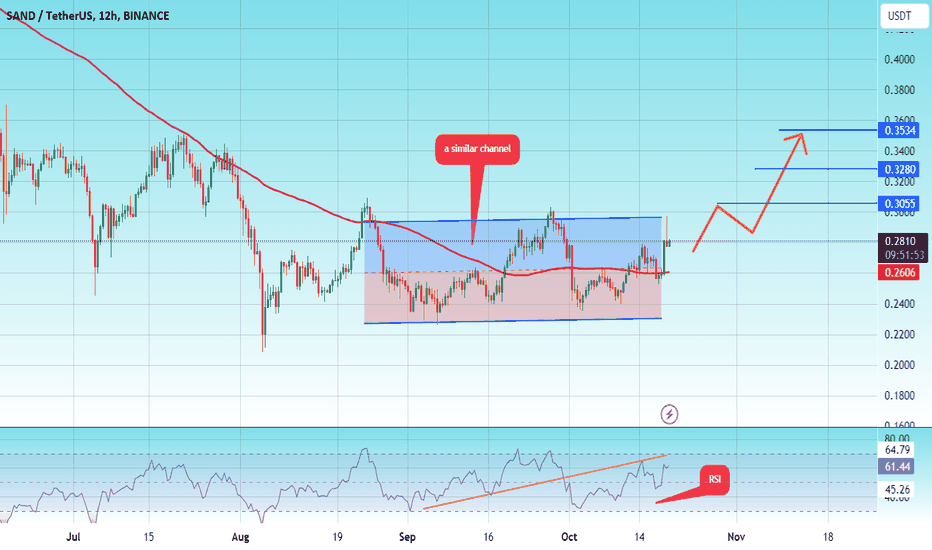

#SAND/USDT#SAND

The price is moving in a bearish channel on the 12-hour frame, and it adheres to it well, and the price rebounded from the green zone

After rebounding from a significant decline, it is expected that the downward gap will be filled

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that is expected to break higher to support the rise

Entry price is 0.4430

The first target is 0.5300

The second target is 0.6094

The third goal is 0.7113

#SAND/USDT#SAND

The price is moving in a similar channel on the 12-hour frame upwards and is expected to continue.

We have a trend to stabilize above the moving average 100 again.

We have an upward trend on the RSI indicator that supports the rise by breaking it upwards.

We have a support area at the lower limit of the channel at a price of 0.2380.

Entry price 0.2800.

First target 0.3055.

Second target 0.3280.

Third target 0.3533

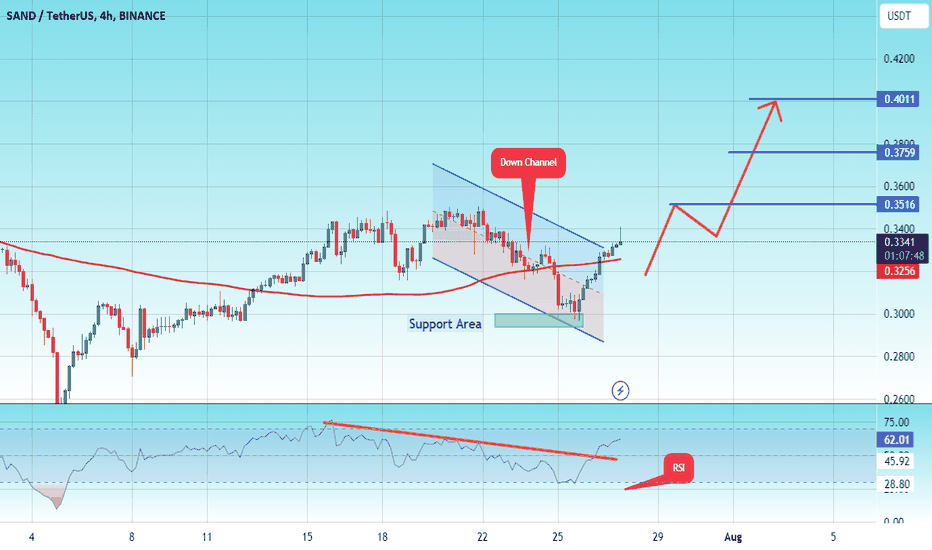

#SAND/USDT#SAND

The price is moving in a descending channel on the 4-hour frame and we are about to break it

We have a bounce from a major support area in green at 0.3000

We have a downtrend on the RSI indicator that has been broken upwards

We have a trend to stabilize above the moving average 100 which supports the rise

Entry price 0.3300

First target 0.3516

Second target 0.3759

Third target 0.4011

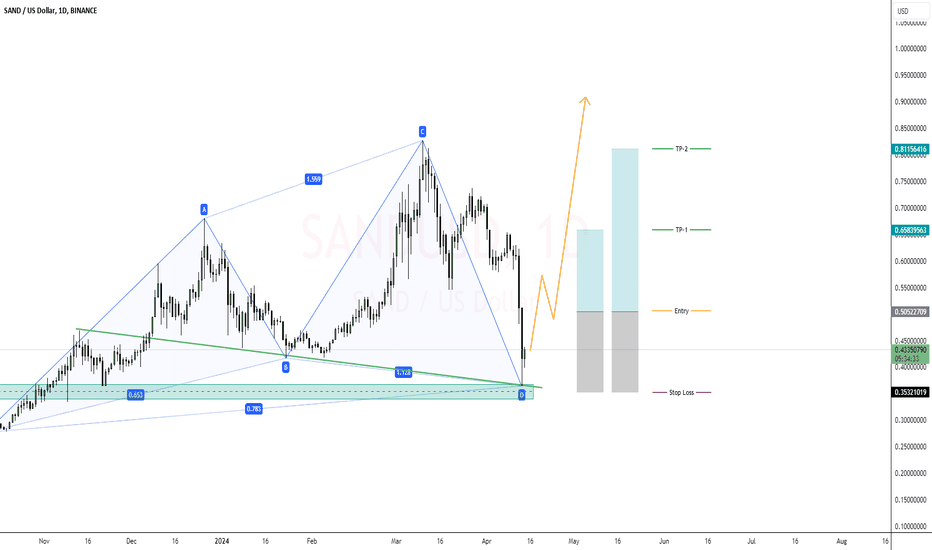

SAND/USDT Technical Analysis - Potential Bullish OpportunitySAND/USDT has exhibited a notable XABCD harmonic pattern formation, coinciding with a pivotal support level. This suggests a potential bullish reversal from point D, indicating favorable trading opportunities for discerning investors.

Harmonic Pattern Analysis:

The XABCD harmonic pattern observed in SAND/USDT signals a systematic price structure characterized by precise Fibonacci relationships. The completion of this pattern at point D suggests a high probability of trend reversal, presenting an optimal entry point for bullish positions.

Key Support Area:

The convergence of the XABCD pattern with a key support area strengthens the bullish bias, reinforcing the significance of the anticipated price movement. This confluence enhances the reliability of our analysis and underscores the importance of the identified entry level.

Entry Strategy:

We recommend initiating long positions near the price level of 0.5053, strategically aligning with the completion of the harmonic pattern and the established support region. This entry point offers favorable risk-reward dynamics and positions traders advantageously for potential upside movements.

Risk Management:

To mitigate downside risks, it is prudent to implement a stop-loss order near 0.3532. This predefined exit point safeguards capital and preserves trading discipline, ensuring minimal losses in the event of adverse price fluctuations.

Profit Targets:

Our profit-taking strategy encompasses two distinct targets to capitalize on the anticipated bullish momentum. The initial profit target (TP-1) is set at 0.6584, representing a conservative approach to securing gains. Subsequently, the secondary profit target (TP-2) is identified at 0.8115, offering the potential for extended profitability as the uptrend unfolds.

Conclusion:

In conclusion, the technical analysis of SAND/USDT reveals a compelling bullish outlook, characterized by the formation of a XABCD harmonic pattern and the confluence with a key support area. By adhering to the suggested entry, stop-loss, and profit-taking levels, traders can optimize their trading strategy and capitalize on the anticipated price appreciation.

Disclaimer:

This analysis is based solely on technical indicators and historical price data. It is imperative to conduct thorough risk assessments and exercise prudent risk management practices when executing trades in the financial markets.*

#SAND/USDT #SAND

The price is moving in a descending triangle on the 4-hour frame

We are now at the lower border of the channel from which the price has rebounded more than once, and this is also the support area

A rebound is expected to the upside

We also have support from the RSI indicator

Current price is 0.4300

First target 0.4400

Second target 0.04535

Third goal 0.4673