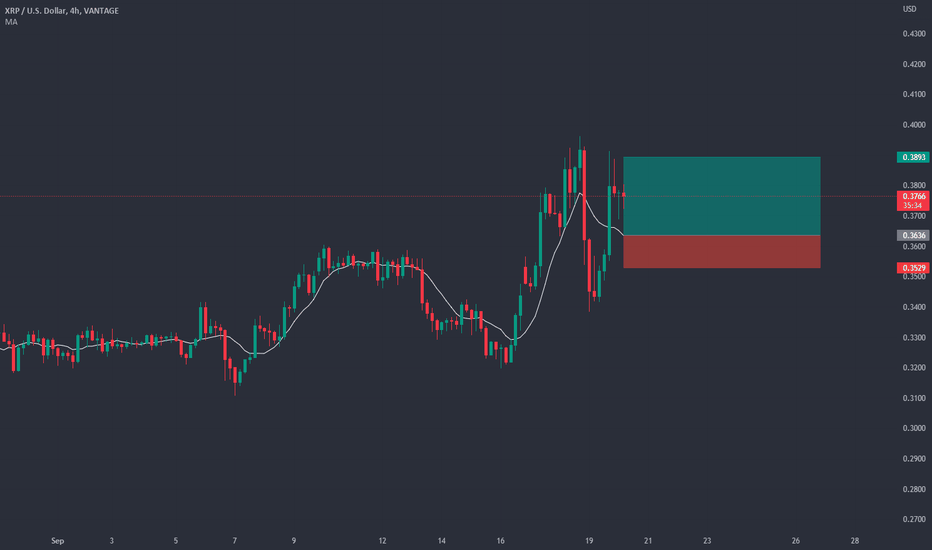

XRP: Buying dips!XRP

Intraday - We look to Buy at 0.3636 (stop at 0.3529)

Expect trading to remain mixed and volatile. We look to buy dips. 20 4hour EMA is at 0.3633. 0.3630 has been pivotal.

Our profit targets will be 0.3893 and 0.3993

Resistance: 0.3800 / 0.3900 / 0.4000

Support: 0.3700 / 0.3600 / 0.3500

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

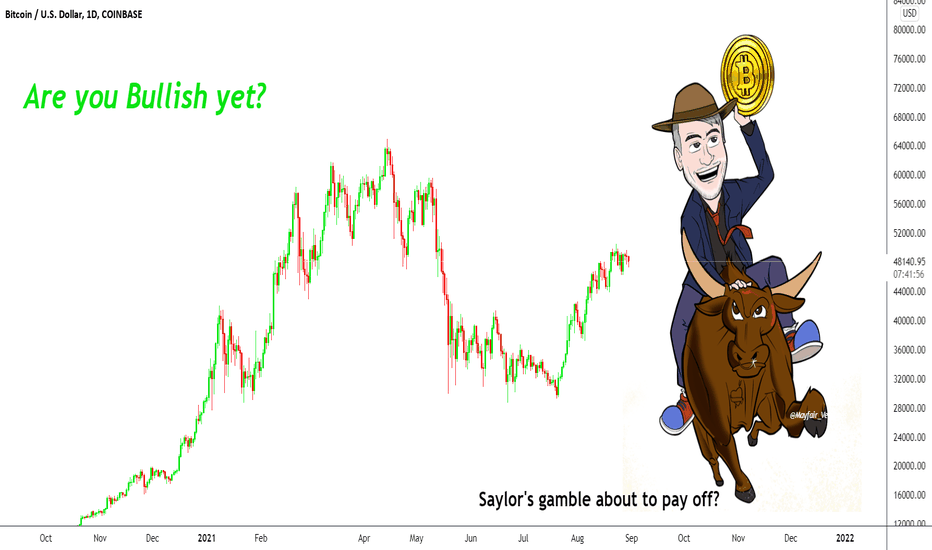

Saylor

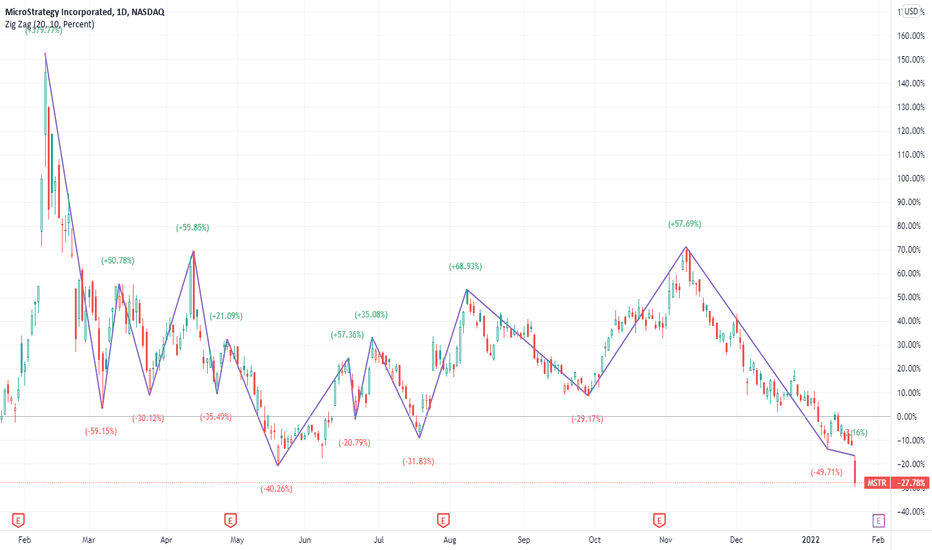

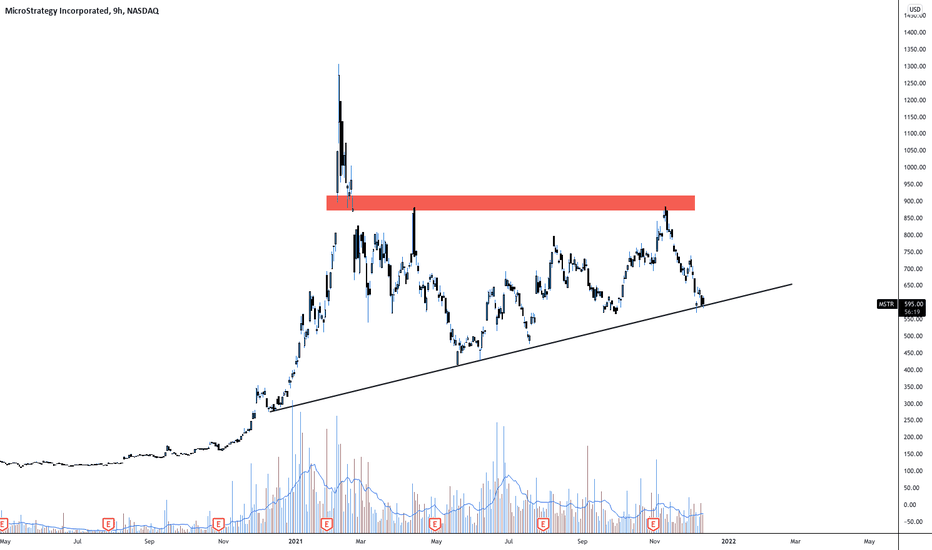

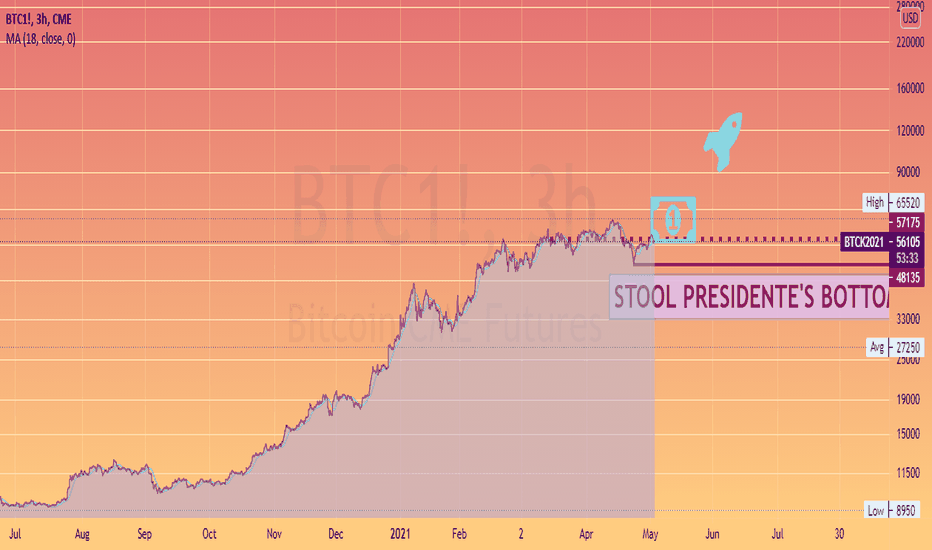

Microstrategy to sub $100 per stockGive me one good reason as to why $MSTR should not visit the lows of this fibonacci retracement .

Right now you can't.

Will it see ATH again? "Absolutely". But it will continue to bleed along $SPX and other stocks.

Good to hear Michael Taylor assure everyone that they will be fine no matter have bad $BTC will dump.

AKA MicroBrain StrategyThese guys have 122,500 Bitcoin (BTC) and have a total average purchase price of 30k with an average buy in of $3.66 Billion. Watch out if Bitcoin breaks below 30k.... who knows when the banks are gonna start calling and asking for their billions back... at the time of this article in December 2021, Microstrategy's BTC was valued at $6.13 Billion which is now as of this date worth about $4.25 Billion. At what point does Mr. Saylor sell???

www.nasdaq.com

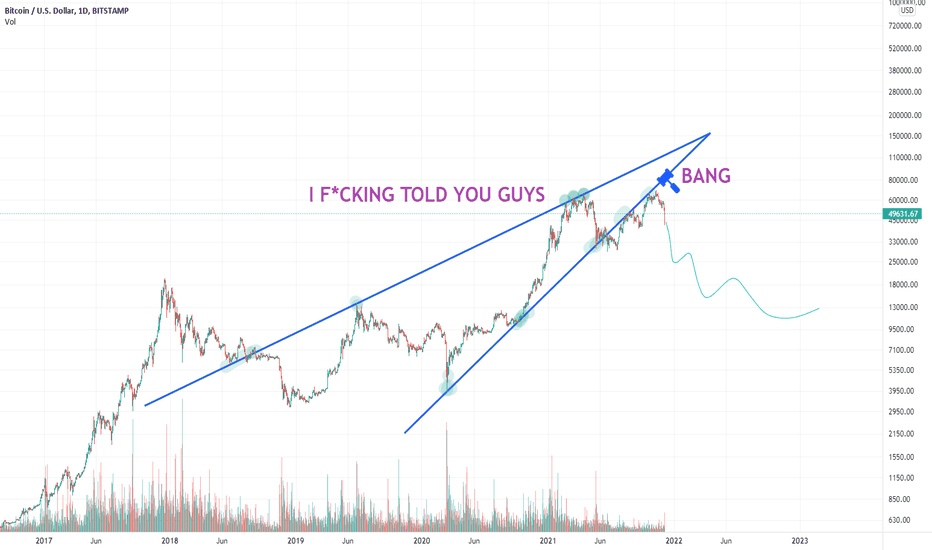

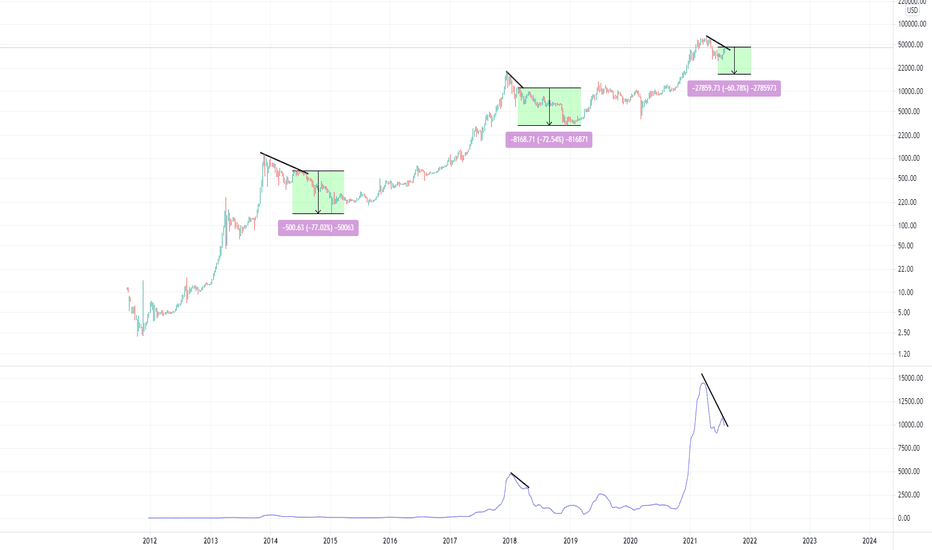

That higher volume you see on the wave C is indicative of a wave C pullback and a blowoff top which is exactly what occured in 2021.

We might get a really good bounce to the upside before this red arrow takes effect but it's going to happen. Bitcoin is the riskiest of risk assets and these guys have $3.66 Billion worth of Bitcoin

Saylor vs. The SEC ...no winners here $MSTR #BTCInstitutional investors get hyper when they hear #SEC. Saylor and company told the SEC it used non-GAAP measures to give investors a fuller picture of its finances. If the company only showed declines in value, it would give “an incomplete assessment” of its Bitcoin holdings that would be “less meaningful to management or investors” in light of the company’s strategy to acquire and hold Bitcoin.

“We further believe that the inclusion of bitcoin non-cash impairment losses may otherwise distract from our investors’ analysis of the operating results of our enterprise software analytics business,” the company wrote.

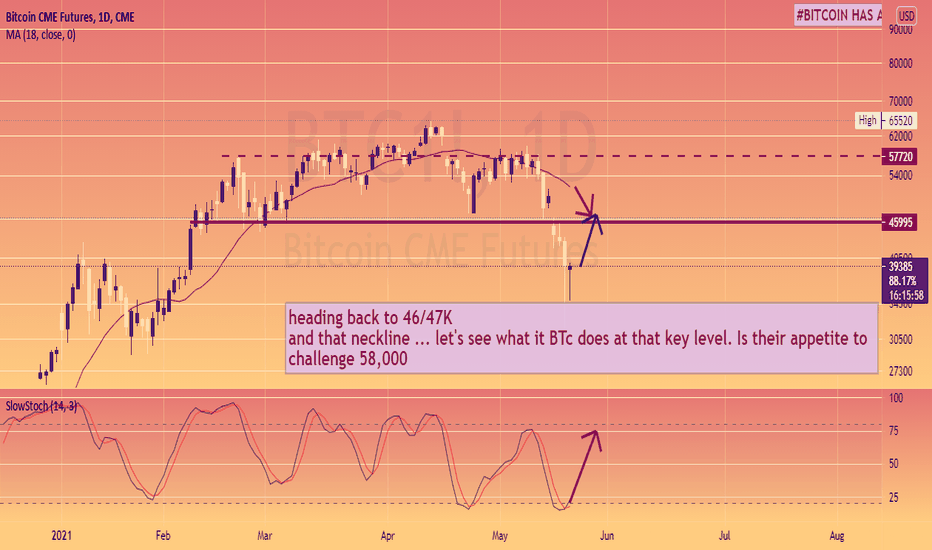

Tweeter whoooo ah twitter ah Some brilliant moves today in Bitcoin. Fun and games as to be expected.

Microstrategy new purchase and Walmart well accepting or maybe not? Either way it's played the charts both ways.

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

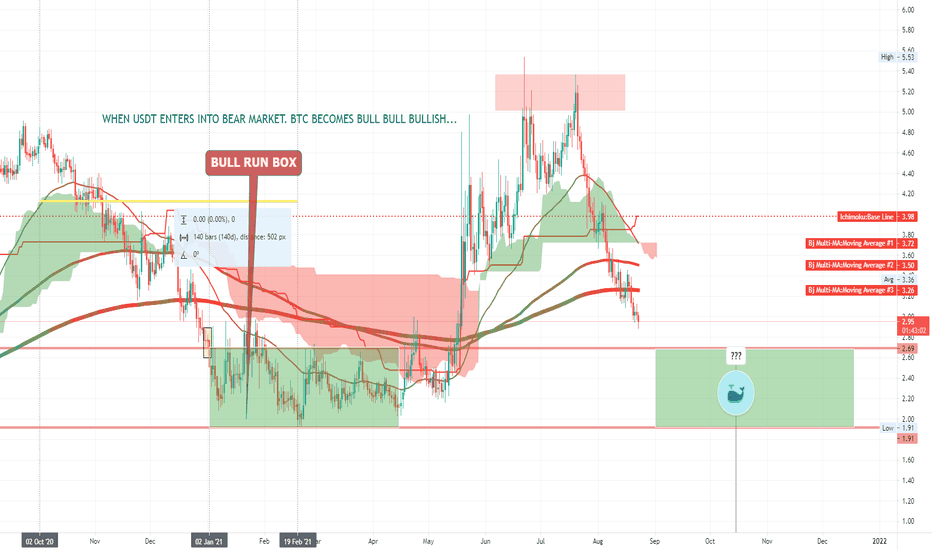

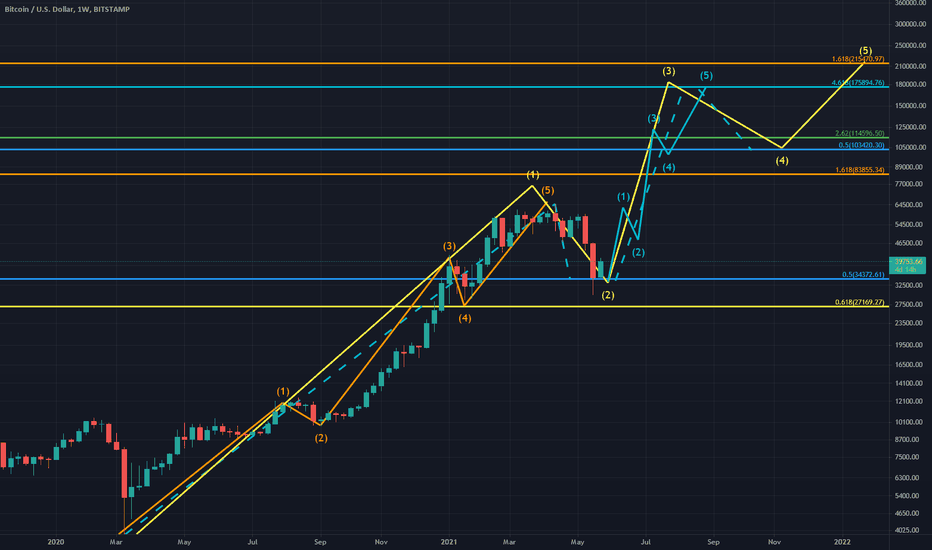

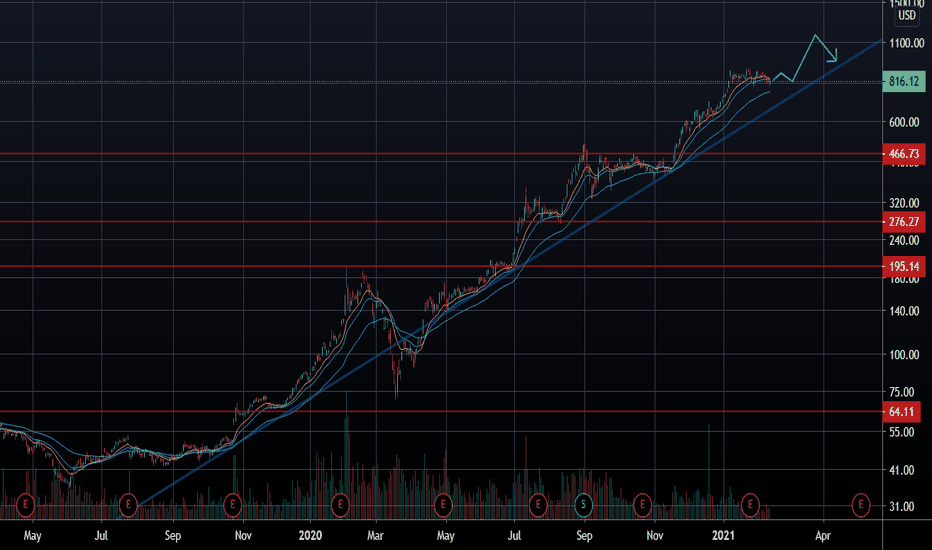

Bullish on BitcoinBeen spending more and more time looking at all possible scenario's.

Although there is still logic for both Bullish and Bearish, I am a reactive trader - currently waiting for my confirmation on the long term entry.

I have shared several video's lately on the two types of scenario's and here's some additional info;

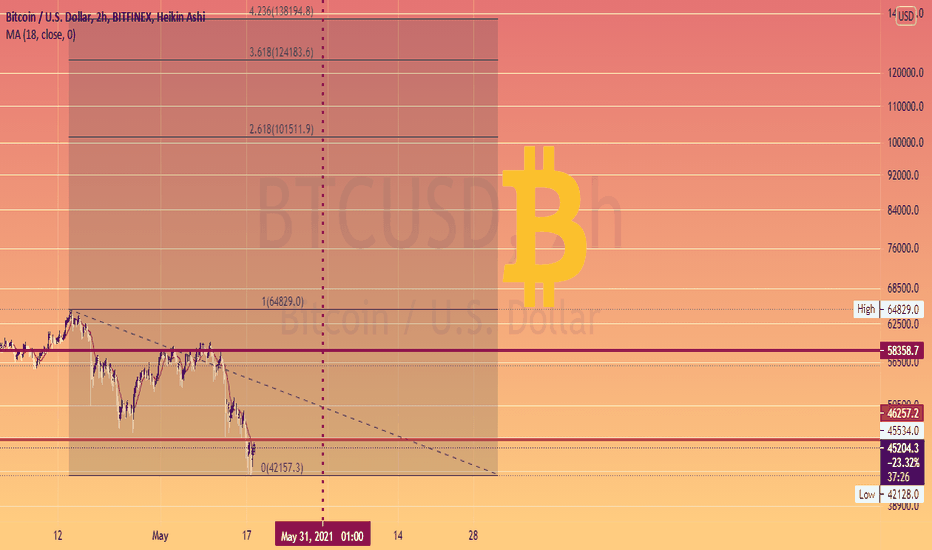

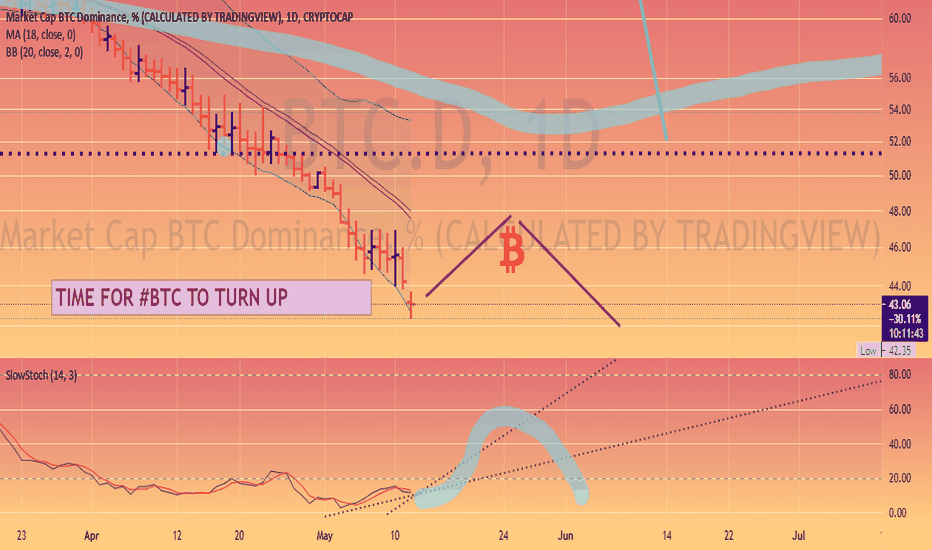

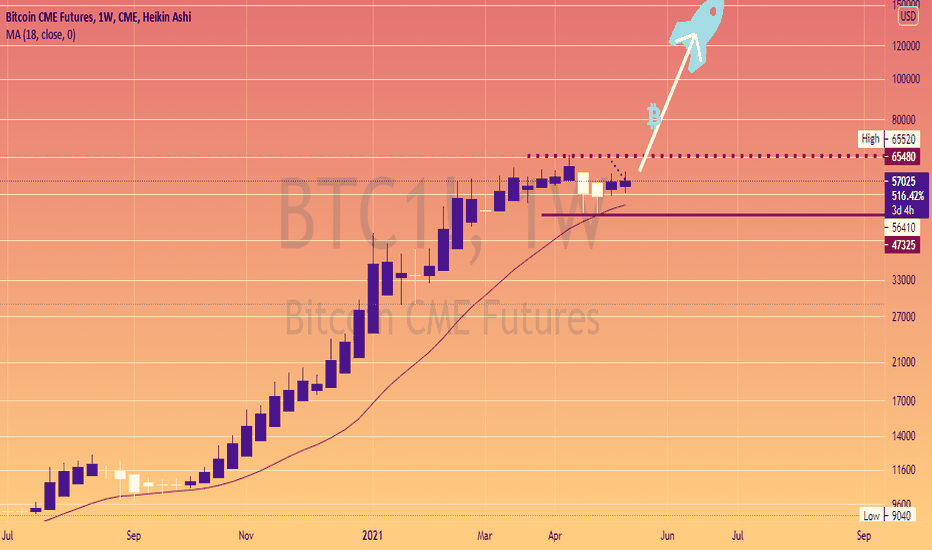

Here we have a weekly view (software generated Elliott count.

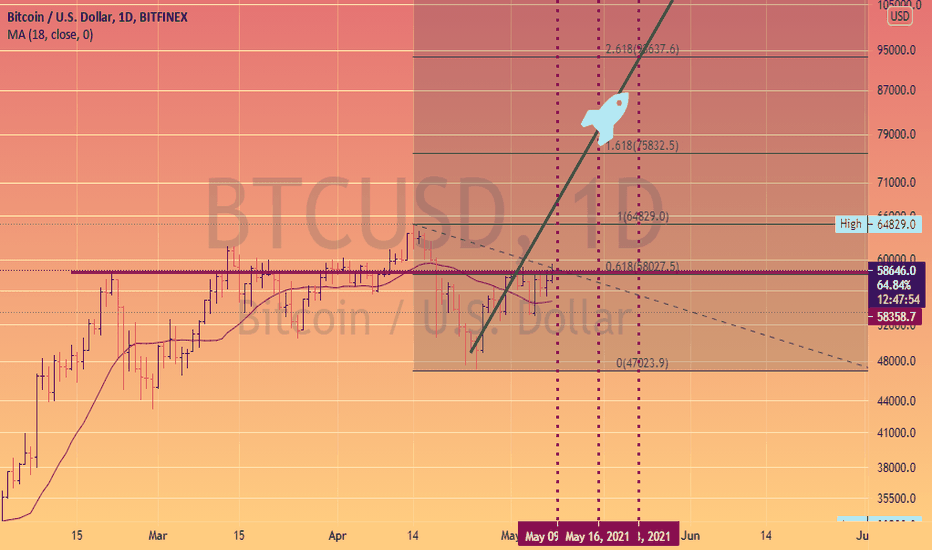

Here's the daily;

If the Daily proves correct - this is what the cycle wave should look like;

Fibonacci levels kinda make sense;

A 38% Pullback would be inline with the previous resistance;

Look at this all the way back from the 26th of March (see the date)

The image above was from this post:

And this is the current view;

Same goes for the rocket post (going back to the 18th of March) - what is interesting here, is the key levels are now Support & Resistance.

Play this scenario forward;

========================================================================================================================

So what is your take? are we going to the moon or just another high before the bigger drop?

Comments below.

Have a Great Week!!!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

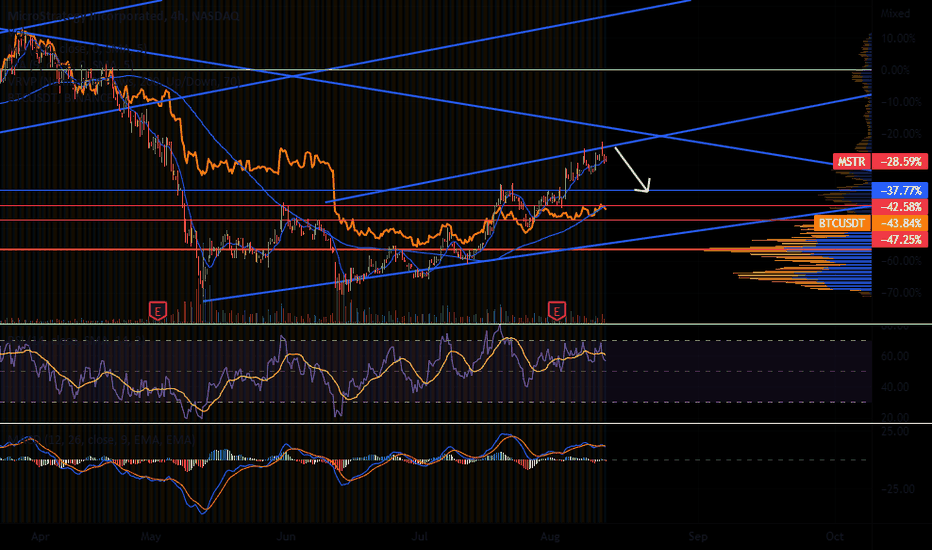

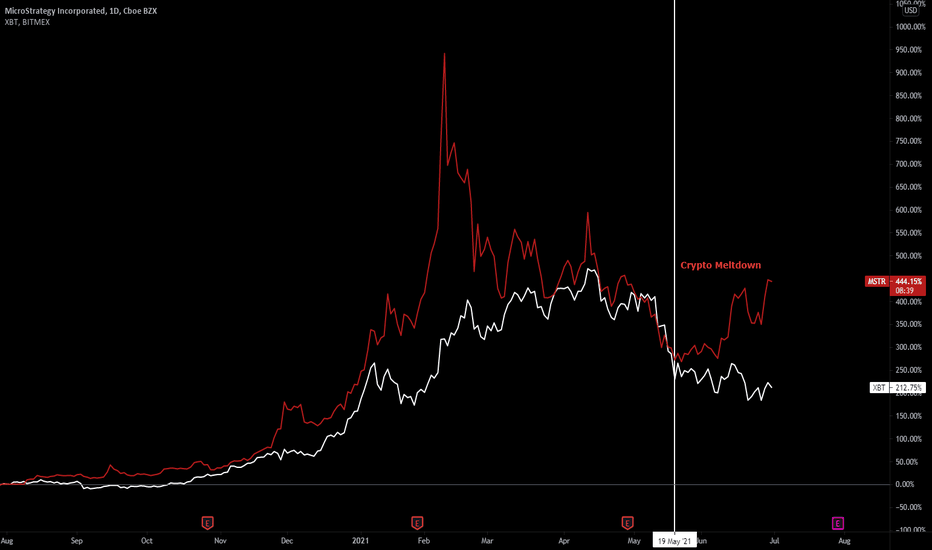

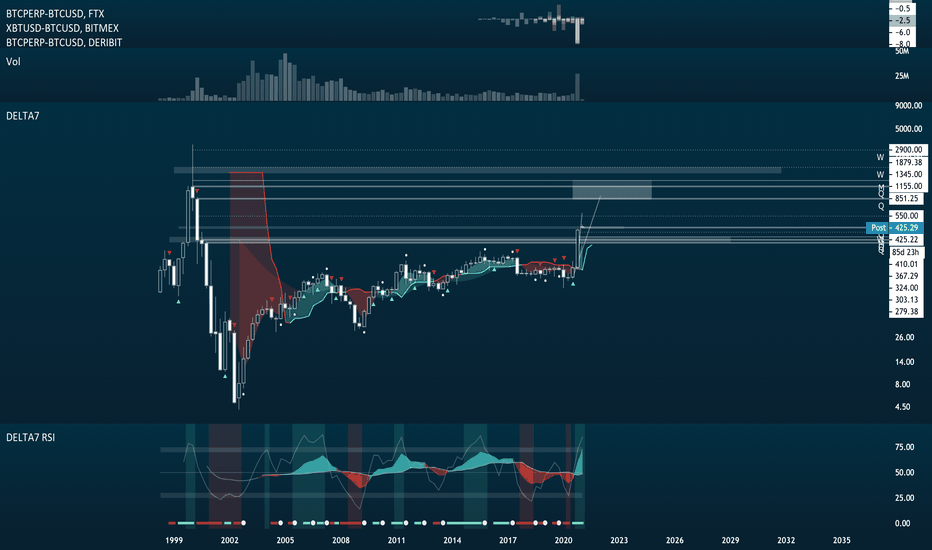

Bitcoin is Bullish. BITMEX:XBT Since the complete Crypto meltdown MSTR has outperformed Bitcoin off the lows.

Saylor announced that MSTR has bought another $500 million worth of Bitcoin and also filed to sell up to $1 billion worth of MSTR to fund more Bitcoin purchases. MSTR now holds around 110,000 Bitcoins. Many institutions have expressed interest in Bitcoin exposure which carries great risk for them to custody the Bitcoin themselves.

Being that MSTR is basically a Bitcoin holding company it seems that institutions are buying the Bitcoin dip.

To keep it simple..... Number go up.