SBET vs DFDV: Which Crypto Treasury Horse Will Run Fastest?SharpLink Gaming (SBET) and DeFi Development Corp. (DFDV) are prime examples of the MicroStrategy model applied to different digital assets, Ethereum and Solana, respectively.

SharpLink Gaming, formerly an online gaming company, has made a dramatic and public pivot to become one of the world's largest corporate holders of Ether (ETH). Its strategy is to act as a direct and transparent vehicle for investors to gain exposure to the Ethereum ecosystem. The company actively raises significant capital through equity offerings, such as its recent multi-billion dollar ATM program, to fund its ETH acquisitions. It also generates yield by staking its ETH, which is a key part of its business model. The company's stock price and market narrative are now almost exclusively tied to the performance of its growing ETH treasury, making it a high-beta proxy for Ethereum.

DeFi Development Corp. has a similar, dedicated focus on Solana (SOL). The company's business is centered on accumulating, compounding, and providing exposure to SOL. DFDV's core strategy is to grow its "SOL per share" metric, which is its equivalent to MicroStrategy's Bitcoin per share. To achieve this, DFDV also engages in aggressive capital raises. Like SharpLink, it also generates revenue by actively participating in the ecosystem through staking, operating its own validator nodes, and exploring other on-chain opportunities.

In essence, both companies have fundamentally transformed their business models to serve as publicly-traded, regulated treasury vehicles for their respective assets. They both use financial engineering, like capital raises, to grow their holdings and create a leveraged play for investors. The primary difference is the underlying asset—ETH for SBET and SOL for DFDV—and the specific ecosystem activities they engage in to generate additional value beyond simple price appreciation.

Market Cap

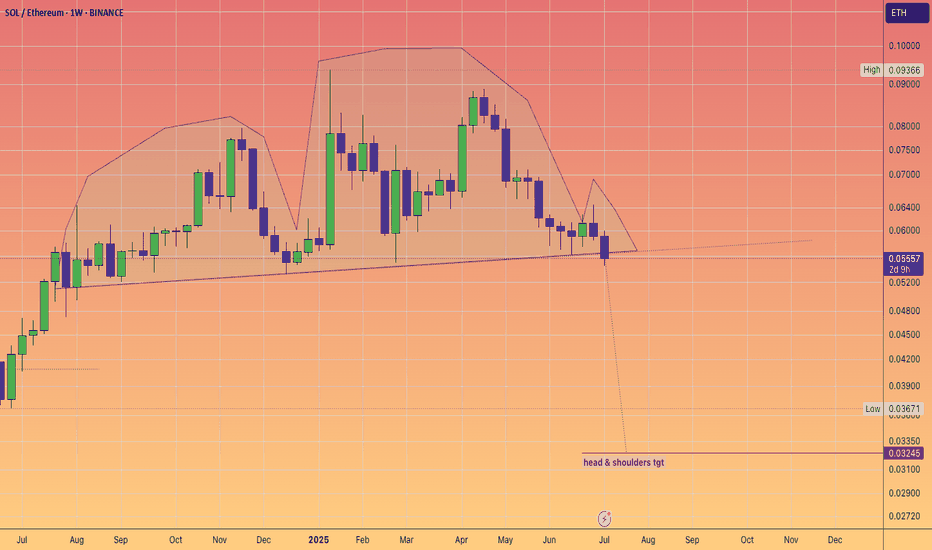

Comparing the market capitalization of Ethereum (ETH) and Solana (SOL) is crucial for understanding the capital flows needed for one to outperform the other. As of late August 2025, ETH's market cap is approximately $429 billion, while SOL's is about $87 billion, meaning ETH is nearly 5 times larger.

For SOL to outperform ETH, it must grow at a much faster rate. Due to its smaller size, SOL requires a proportionally smaller amount of new capital to achieve a significant price increase. For example, to close the market cap gap by 10%, SOL would need an additional $43 billion in inflows, which would cause its price to more than double. In contrast, for ETH to achieve the same proportional gain (e.g., a 10% increase), it would need over $40 billion in new capital inflows.

Essentially, SOL has a higher beta and a lower monetary hurdle to achieve significant percentage gains. A steady inflow of tens of billions of dollars would have a much more dramatic impact on SOL's price than on ETH's. However, with ETH's sheer size and institutional backing, particularly with the recent launch of spot ETFs, it can absorb and channel much larger capital flows, which is a key reason its price is less volatile. Therefore, SOL's smaller size makes it more sensitive to inflows, making it easier for it to outperform ETH on a percentage basis, especially during a retail-driven bull market.

Impact of Spot ETFs

A significant number of spot Ethereum ETFs have already been approved and are trading in the United States. Following the approval of the initial 19b-4 filings in May 2024, the SEC subsequently declared several S-1 registration statements effective in July 2024, allowing the ETFs to begin trading. There are currently nine SEC-approved spot ETH ETFs from major issuers like BlackRock, Fidelity, and Grayscale. There are currently no approved SOL spot ETFs in the United States. However, several applications are under active consideration by the SEC. Filings from major issuers such as Bitwise and 21Shares have been submitted, but the SEC has consistently delayed its decision on them. There is a general expectation that if the SEC continues to follow the precedent set by Bitcoin and Ethereum, a Solana ETF could be the next in line for approval. In summary, a clear distinction exists: ETH spot ETFs are a reality, with multiple products already trading, while SOL spot ETFs are still in the application and review phase, awaiting a decision from the SEC.

Summary

While ETH has had relative outperformance in August 2025 against Bitcoin and most large-cap alts, the approval of Solana spot ETFs will provide a significant tailwind for SOL and SOL treasury companies like DFDV. While Ethereum is the strongest horse among the alts, has experienced no downtime, and gas fee transactions on the main chain have become much cheaper than they were the last cycle, hot money will quickly allocate capital towards the highest-beta alts and crypto treasury companies as ETFs are approved; possibly on a rolling basis if underlying assets are approved at different times in Q4. However, expect ETH and SBET to do exceptional through 2026 as ETH hits mainstream adoption through ERC-20 based tokenized stocks, prediction markets, etc. and as spot ETF inflows accelerate.

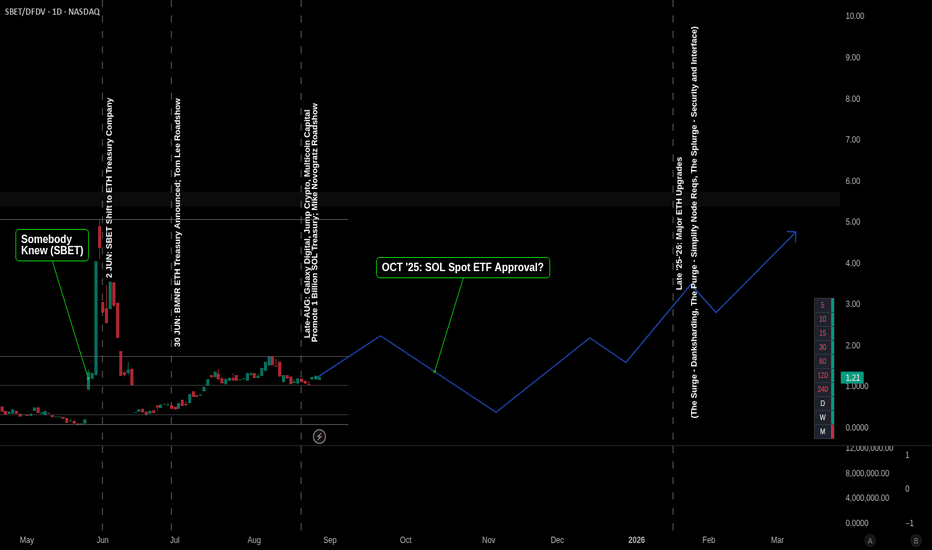

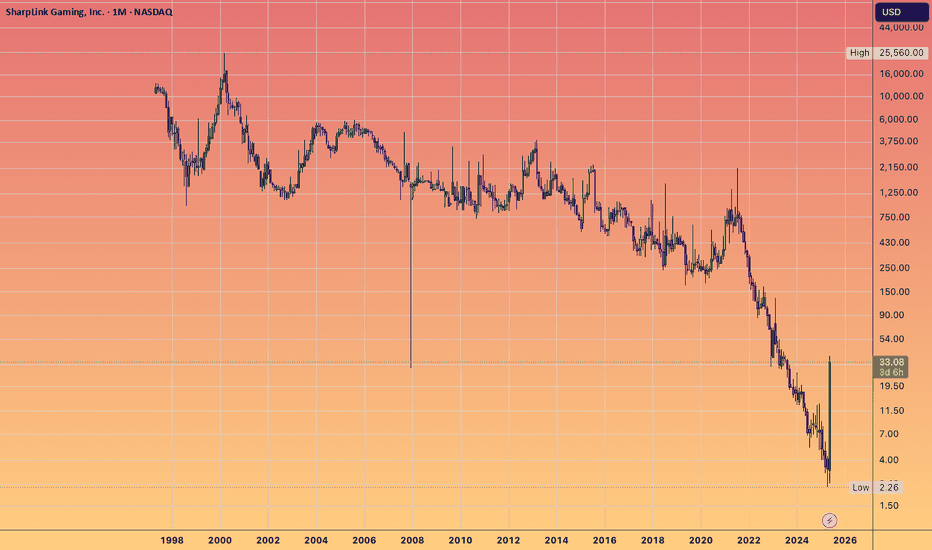

SBET

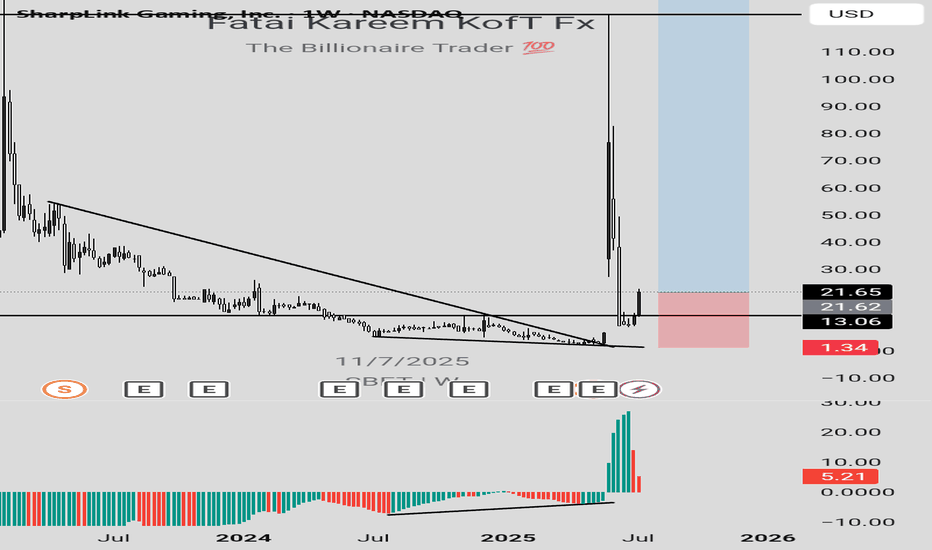

A life-changing SBET long ideaSBET stock presents an amazing long opportunity that has a potential to do over 100x. After the break out of a down trend line, price retraced to the support, with price closing above this support level.

To advantage of this long opportunity, you can buy from the current market price while the exit can be at $1.34 and the targets can be at $123.70, $178.48, $541.22, $1041.90 and the final target at $2155.20.

Confluences for the long opportunity are as follows:

1. Break out of down trendline

2. Retest of the down trendline and support level.

3. Bullish divergence signal from awesome oscillator.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

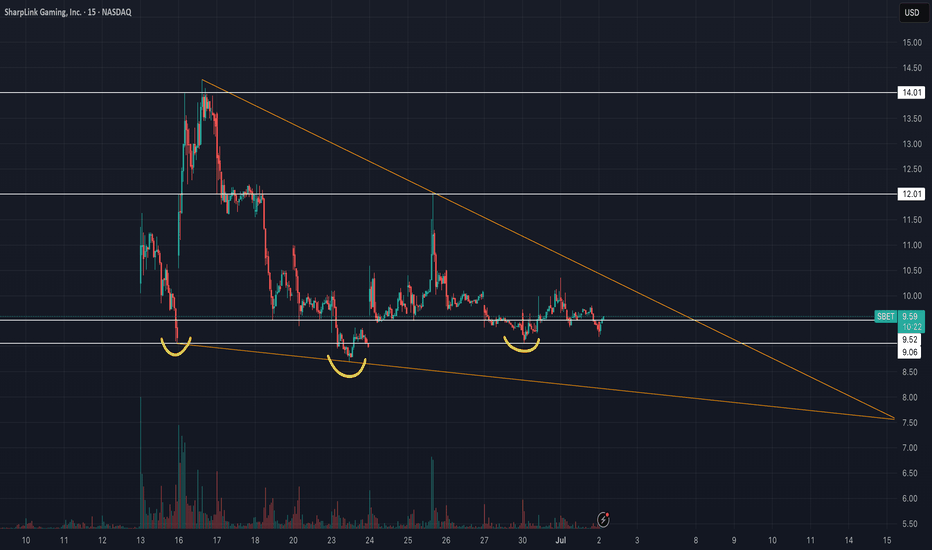

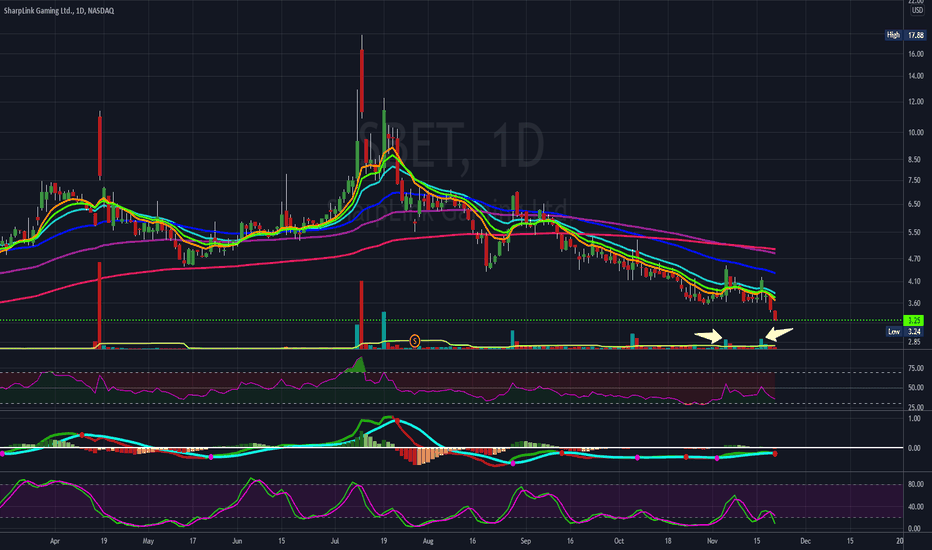

SharpLink Gaming Inc (SBET) - Falling Wedge & Inverse H&S🚀 SharpLink Gaming ( NASDAQ:SBET ) – Ethereum, Joe Lubin & a Bullish Setup

SharpLink Gaming has undergone a bold transformation: the company is now the largest public holder of Ethereum (ETH), with ~198,000 ETH acquired since June 2025. Over 95% of it is staked, already earning 200+ ETH in rewards – turning ETH into a yield-bearing treasury asset.

Driving this shift is Joe Lubin, co-founder of Ethereum and CEO of ConsenSys, who recently became Chairman of SharpLink. Under his leadership, SBET is betting big on Ethereum as “digital capital”, aiming to merge iGaming and Web3.

📊 Technical Setup:

SBET is forming a falling wedge and an inverse head and shoulders – both classic bullish reversal patterns. After a post-announcement retracement, the chart suggests growing potential for a breakout as fundamentals strengthen.

🧠 My thesis: This is MicroStrategy playbook 2.0 – but with ETH instead of BTC. SharpLink gives equity exposure to Ethereum + staking yield + visionary leadership.

🔔 Worth watching closely.

⚠️ Always do your own investment research and make your own decisions before investing.

SBETSharplink Gaming Ltd (NASDAQ:SBET) I really like this stock, although the price sits at lows, I feel it deserves a much higher valuation. Volume looks healthy, and we are seeing up days on heavy volume and down days on very low volume, which is clearly a good sign that the stock is under institutional accumulation.