NIFTY FINANCIAL SERVICES DETAILED ANALYSIS. FUTURE TREND!!I have drawn many things in this idea, stay with me till the end, and I will clear you.

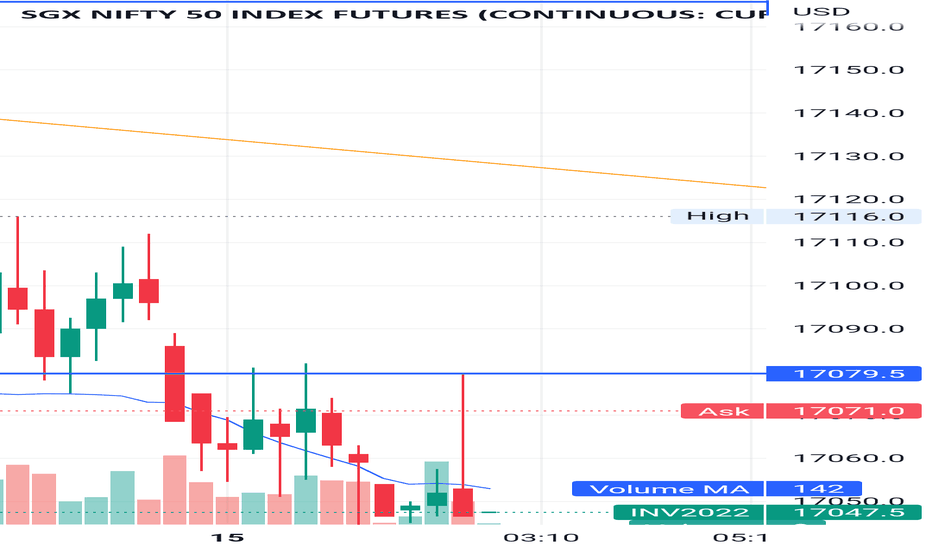

first, let me talk about the future trend(because based on that and my prediction I have drawn the rest drawings), the future trend is the dark black line(drawn both support and resistance). the trend is based on the markets getting consolidated and its reaction shown by nifty finserv components.

now how is that trend came to surety says the pullbacks drawn by arcs circle and arrows.

i have drawn many of them, have a good good at those, those are majorly pullbacks and pullouts. its just that the market was very volatile at that time, like FII SELLING, DII BUYING, interest rates, money incoming etc..

so that made to disturb the trend, but we get to know it by the pull back strategy.

now if you looked very carefull you could observe that the last arc drawn is in black, because nifty finserv, did not supported my trend, that actually because major FII selling had come on.

like in major stocks like hdfc, icici, bajaj finance. banking stocks and bajaj finance(one to give high returns), sum the nifty finserv about 85%. thats a lot, so mostly nifty finserv is very closely related to bank nifty chart.

since bank nifty chart has almost reached its top and making new ATH, this says that nifty fin serv, is at a very discounted, and at any time rally could come in. but this rally could be defined when US markets react positive and FII selling starts coming. and which is already started.

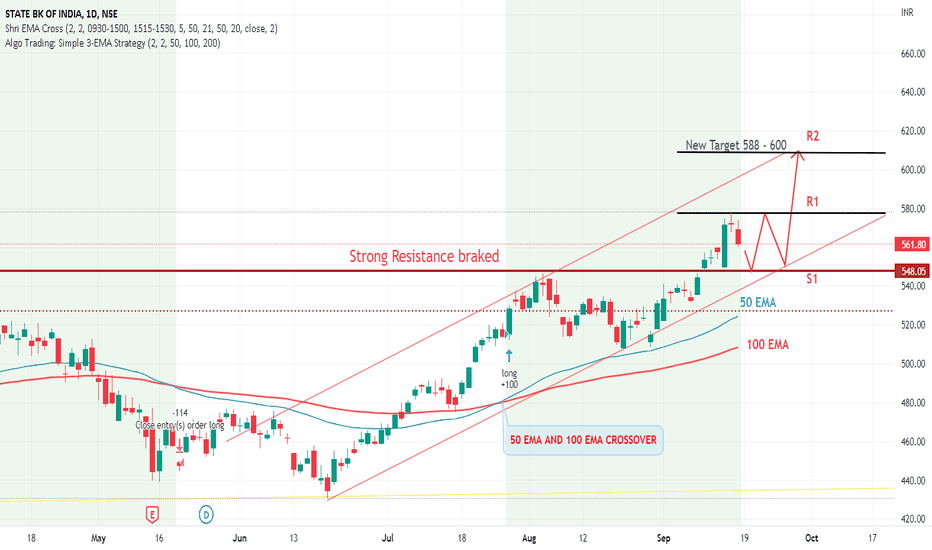

DISCOUNTED STOCKS are meant by those which has a good possibility to go up. stocks such as hdfc, kotak, bajaj finance are much in discounted. icici bank has given a good rally, and same acts for SBI.

the next part is the brush drawing: i feel that market could be volatile for several days/weeks because nifty50 is a bit overvalued so this could afraid the market to go in a buy side. there could be a clash of buying and selling, mostly giving some doji candles. if such happens, then January of next year, could be a great possibility to give a bull rally, in nifty finserv components. although this volatile theory could go wrong if market directly sees an upmove, instead of waiting much. to add on as a final point, markets where volatile at the time from AUG- OCT, after a bull rally came in. such case could be possible but this volatile market could be a small one, since many things have been formulated, and bad things(like global conditions, no need to mention it) are coming to an end.

the price action and following trends is the best thing. mark some good levels in your chart, and check the trend, based on that start taking positions.

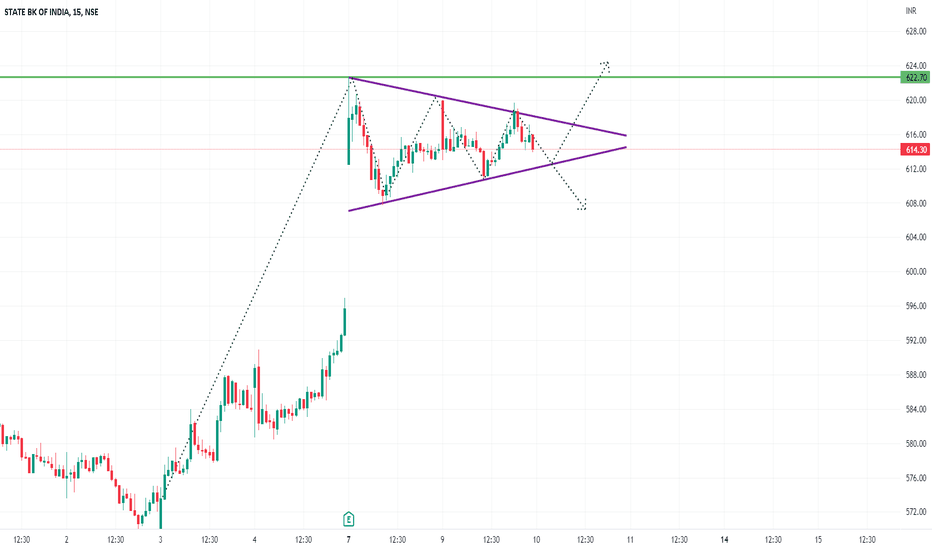

Sbin

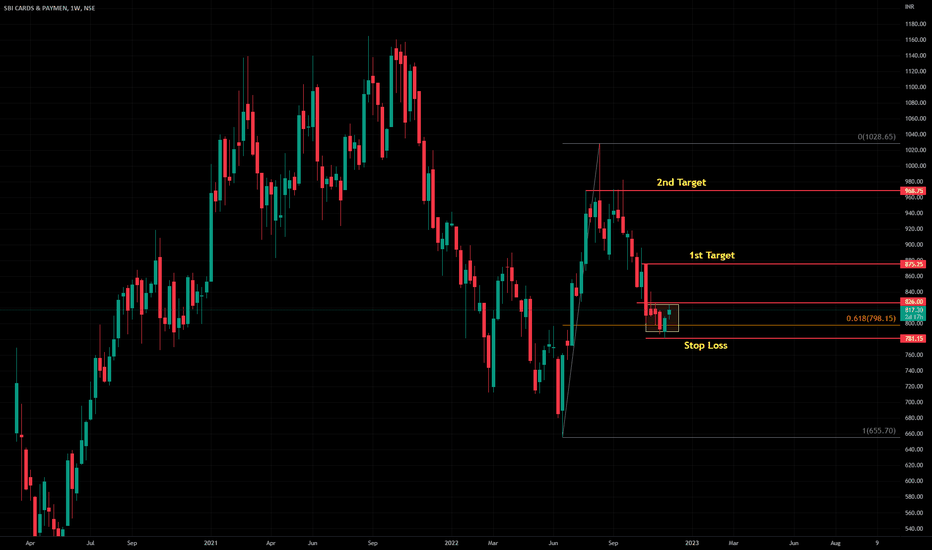

Muhurat Trading picks - 2022What's your Diwali picks ?🤔 comment down below.

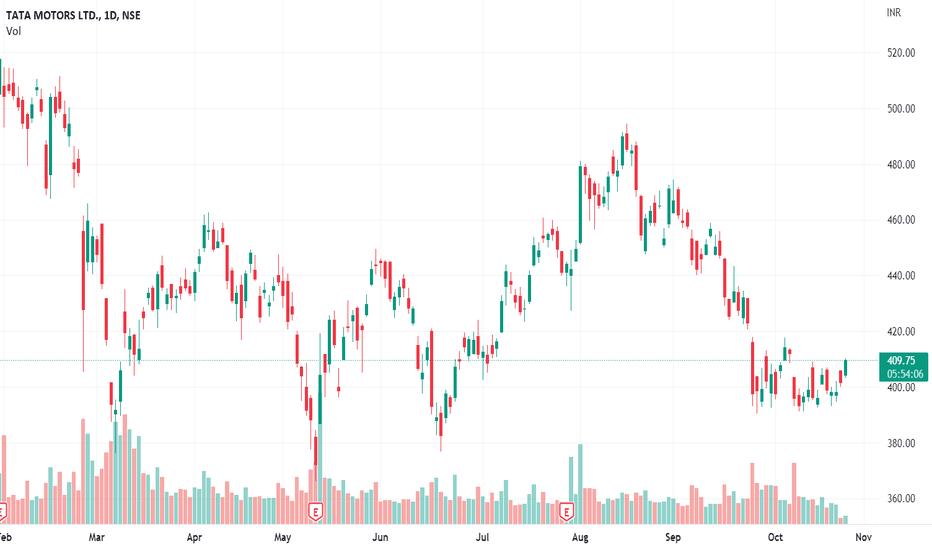

1. TATAMOTORS

C.M.P - 398.2

TARGET - 447

Potential Upside % +12.26 %

2. M_M

C.M.P - 1257

TARGET - 1425

Potential Upside % +13.37 %

3. FEDERALBNK

C.M.P - 132.85

TARGET - 150

Potential Upside % +12.91 %

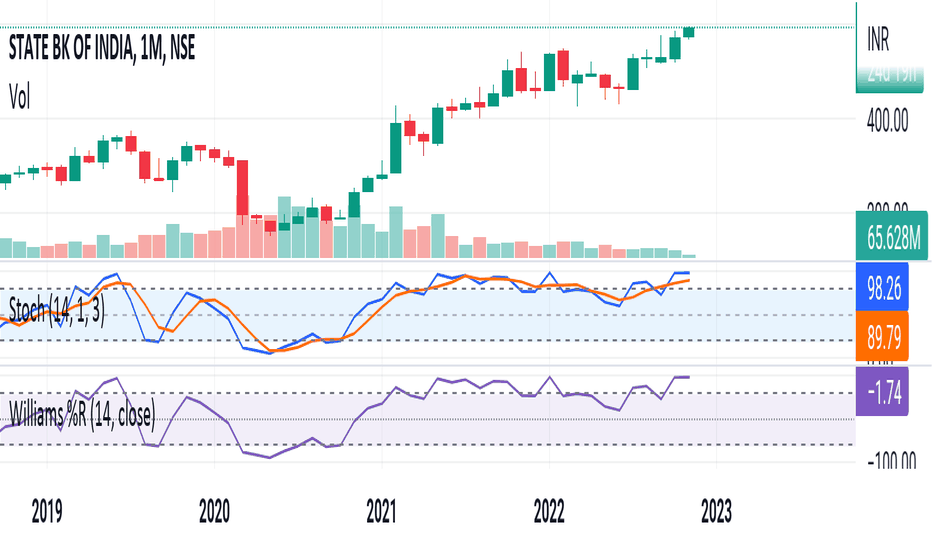

4. SBIN

C.M.P - 561.65

TARGET - 640

Potential Upside % +13.95 %

5. BDL

C.M.P - 954.85

TARGET - 1078

Potential Upside % +12.90 %

6. PARAS

C.M.P - 643.45

TARGET - 740

Potential Upside % +15.01 %

7. ONGC

C.M.P - 131.45

TARGET - 148

Potential Upside % +12.59 %

8. POWERGRID

C.M.P - 216.6

TARGET - 248

Potential Upside % +14.50 %

9. RECLTD

C.M.P - 93.55

TARGET - 105

Potential Upside % +12.24 %

10. BAJAJFINSV

C.M.P - 1681.95

TARGET - 1932

Potential Upside % +14.87 %

11. ITC

C.M.P - 344.85

TARGET - 389

Potential Upside % +12.80 %

12. VBL

C.M.P - 1011.25

TARGET - 1145

Potential Upside % +13.23 %

13. LEMONTREE

C.M.P - 84

TARGET - 96

Potential Upside % +14.29 %

14. INDHOTEL

C.M.P - 313.55

TARGET - 360

Potential Upside % +14.81 %

15. KPITTECH

C.M.P - 711.8

TARGET - 801

Potential Upside % +12.53 %

16. HCLTECH

C.M.P - 1025

TARGET - 1175

Potential Upside % +14.63 %

17. VEDL

C.M.P - 279.95

TARGET - 323

Potential Upside % +15.38 %

18. HINDALCO

C.M.P - 392.1

TARGET - 433

Potential Upside % +10.43 %

19. LAURUSLABS

C.M.P - 477

TARGET - 540

Potential Upside % +13.21 %

20. SUNPHARMA

C.M.P - 978.95

TARGET - 1144

Potential Upside % +16.86 %

21. IOC

C.M.P - 67.5

TARGET - 77

Potential Upside % +14.07 %

⚠️ Important: Always maintain your Risk & Reward Ratio.

⚠️ Purely technical based pick.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat🔁

Happy Diwali 🪔🎉✨

Happy learning with trading. Cheers!🥂

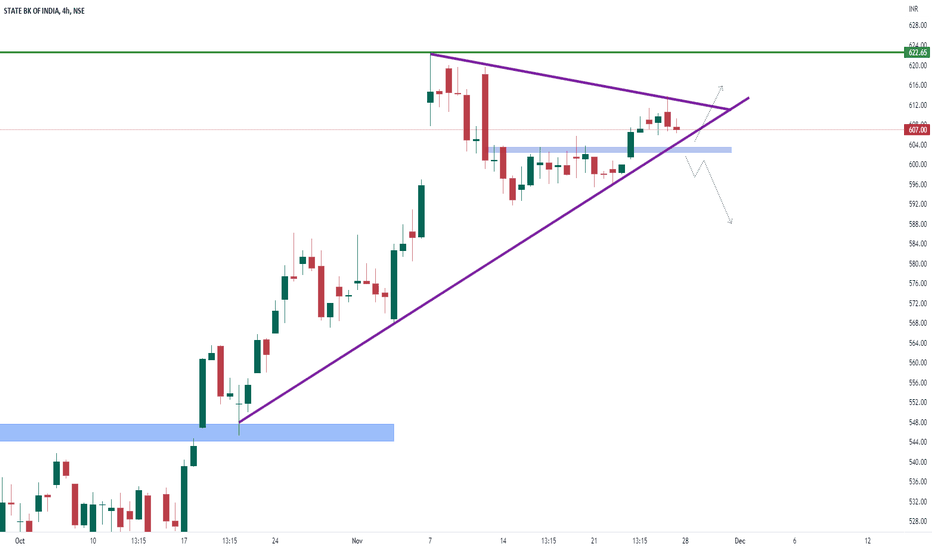

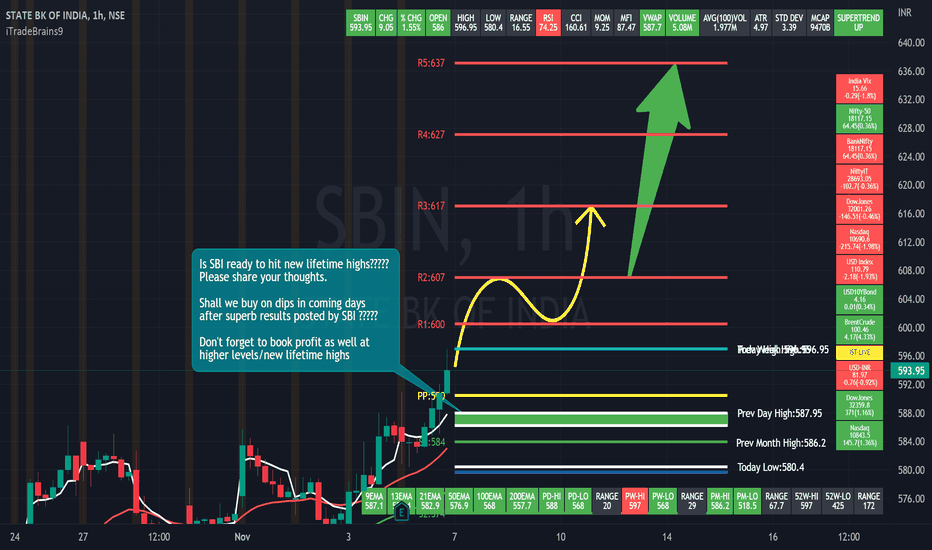

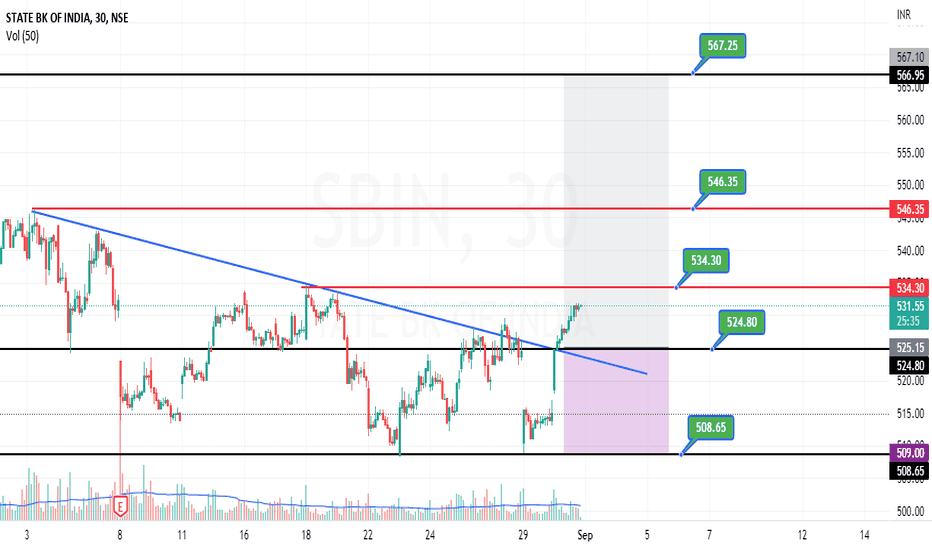

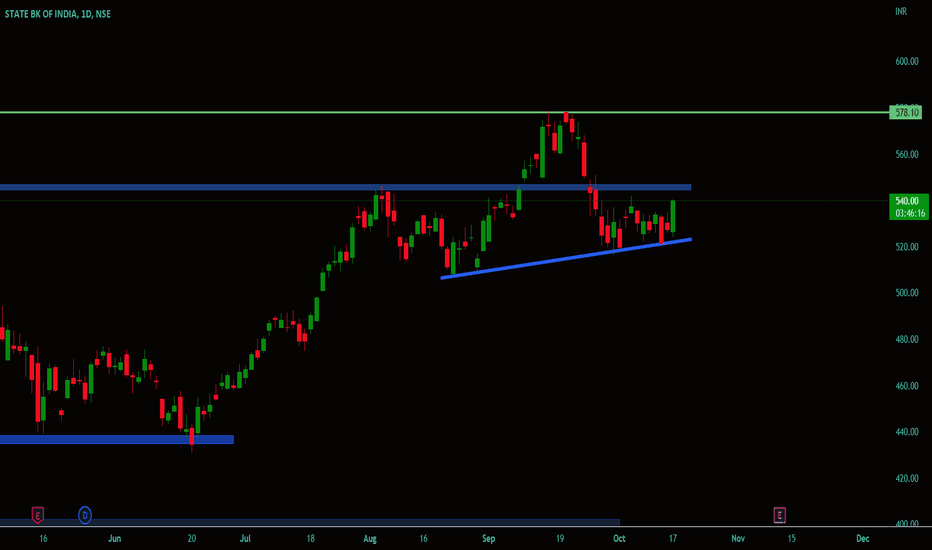

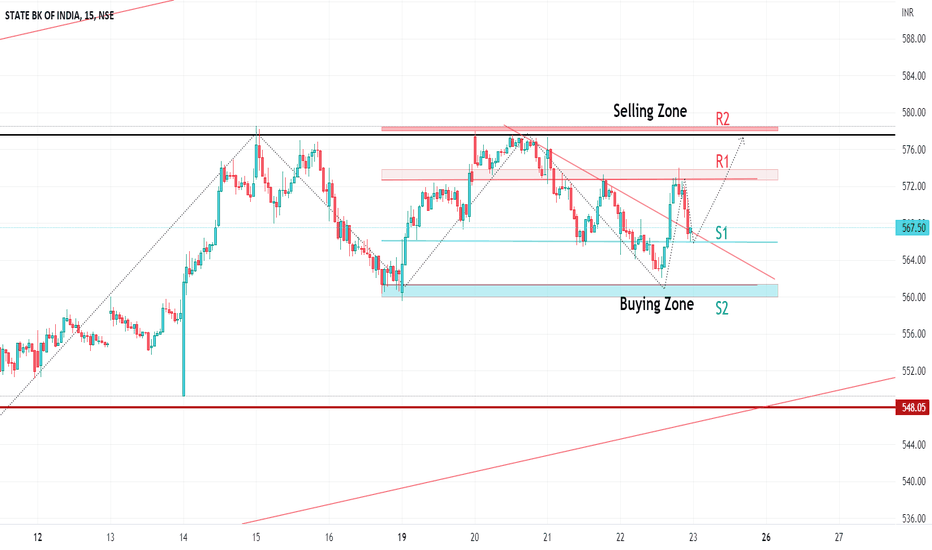

SBI Levels & Strategy for next few daysDear traders, I have identified chart levels based on my analysis, major support & resistance levels. Please note that I am not a SEBI registered member. Information shared by me here for educational purpose only. Please don’t trust me or anyone for trading/investment purpose as it may lead to financial losses. Focus on learning, how to fish, trust on your own trading skills and please do consult your financial advisor before trading.

SBI has posted excellent results and clearly beat the market expectations. I am feeling quite happy for long term investors who are consistently getting rewarded. SBI is trend is positive & momentum on buying side is strong. Buy on dips strategy is working well in SBI, however traders must be careful near new lifetime highs and work level by level with strict stoploss and maximize the profit using trailing stop loss.

Shall we wait & look for buy on dips opportunity in SBI in coming days?????

Yes, I think so.

Shall we book profits near major resistance levels/near new lifetime high?????

Yes, I think so.

Shall we short SBI near new lifetime high?????

We should avoid to short.

Is correction in coming days due to imported weakness in Indian market/RBI rate hike to curb inflation, likely to be buying opportunity for traders & long term investors????

Yes, I think so.

Please share your thoughts as well. Good luck to traders & investors for profitable trading in SBI.

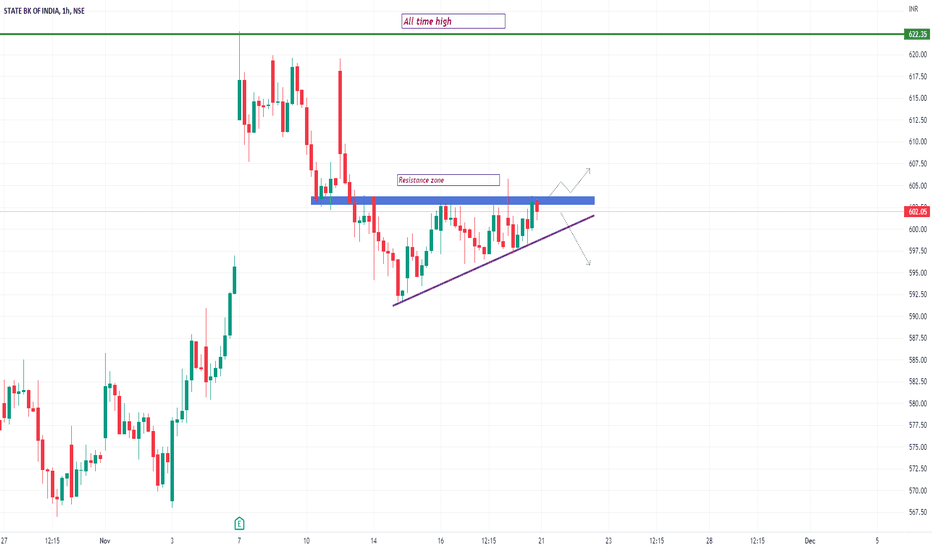

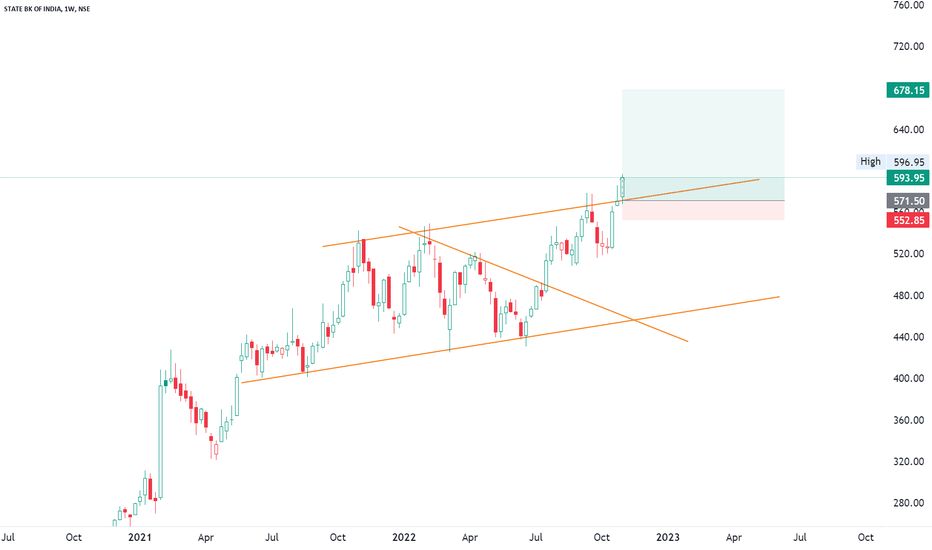

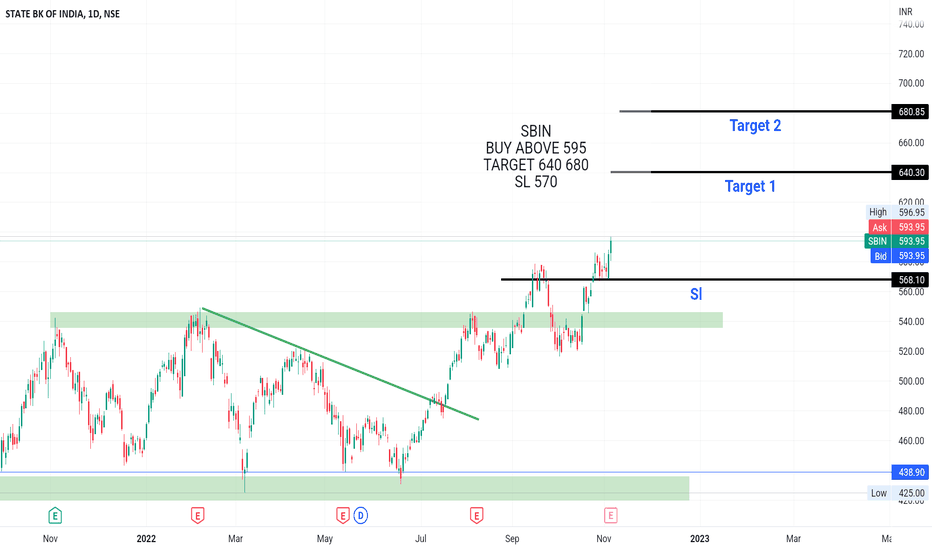

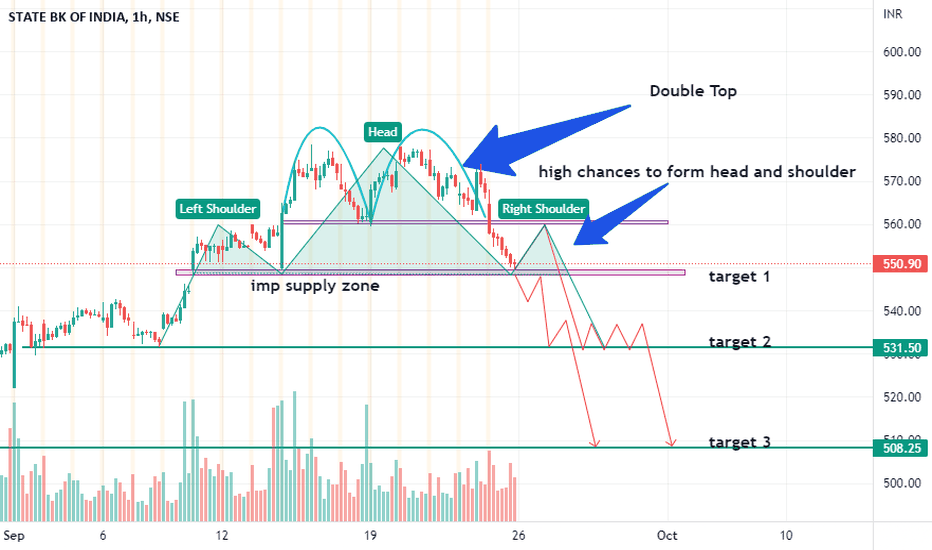

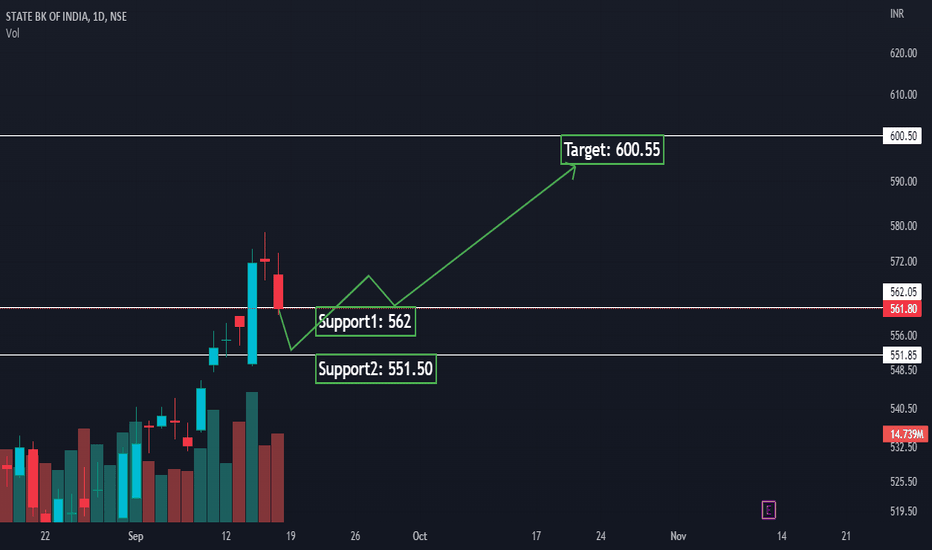

SBINNSE:SBIN

> One can enter Now or wait for an Retest !

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low of Daily Candle.

2. Close, should be good and Clean.

3. R:R ratio should be 1 :2 minimum

4. Plan as per your RISK appetite

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose!

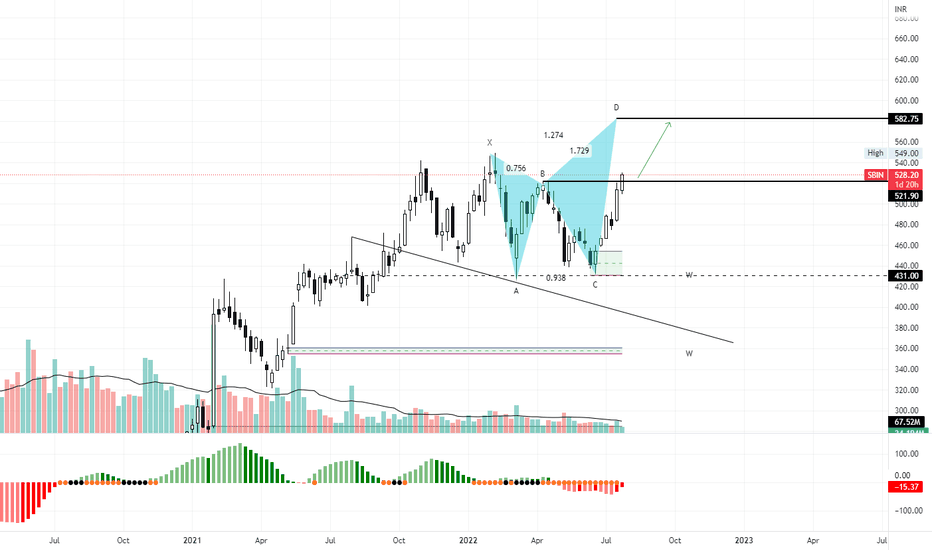

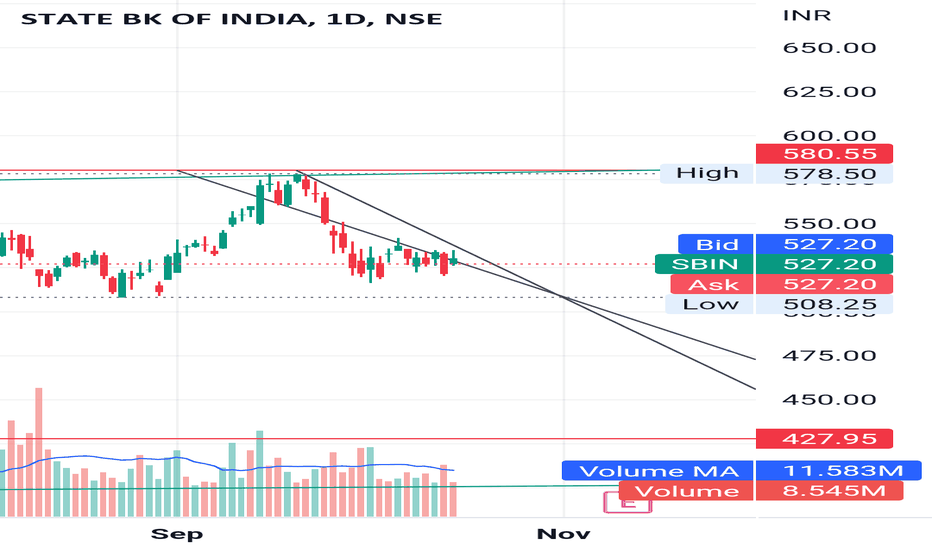

SBIN - Bullish Price Action Analysis NSE:SBIN has already activated Harmonic PRZ 1.272 level in weekly timeframe of the target price 583.

BUY:

if price sustains above 520-522.

SELL:

if it not sustains above 520. you may get some profit booking up to 475.

Chances are more in favor of buyers to make new All time high so do accordingly.

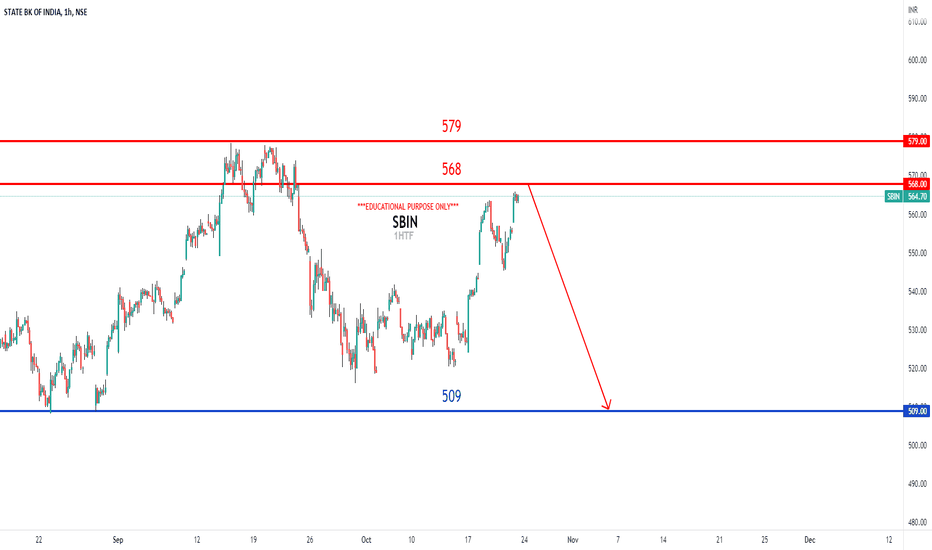

SBINAs SBIN has gave the entry for double top and the target one is almost achieved but if it makes an head and shoulder there is still a chance to enter this trade and SBI is on all time highs so it has to retrace to go up. Enter on given levels and I'm sure you will make good money ,

FOLLOW ME FOR MORE

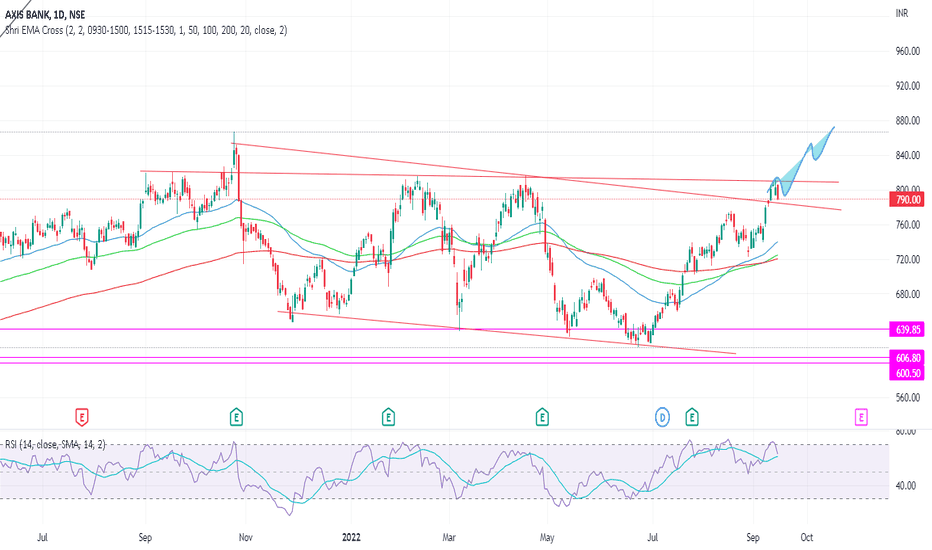

AXISBANK Retracement AXISBANK as per 50 ema crossed above 100 ema and 100 ema crossed above 200 ema so as per technical indicators axisbank in uptrend and as per priceaction it is giving only retracement and it will fly in upcoming days like #icicibank #sbin my opinion to hold the position and stay tuned

if you found helpful so please like

thank you

study purpose only