Australias Galan Lithium is back to support. Will it bounce ?Galan has had a great run over the last 12 months up almost 200% in price - including a 25% drop from its recent highs with the overall market pullback.

It is at the bottom of one of its trading ranges and a bounce could possibly see a 15% run before it hits resistance again. Would like to see its RSI turn around and point up to get better confirmation and will need some support from the overall market - especially the TESLA share price to get some strength back into it. I think Lithium demand will be here to stay though for quite some time though which will always help stocks like these longer term hopefully. If it breaks and closes below this level and puts in some new lower lows, then buyer beware. Best to wait for confirmation of an uptrend.

Worth a watch.

-------------------

Speaking of watching, here are some videos I have made with tips and tricks in them on how to use TradingView where you might find something useful.

tradingview.sweetlogin.com

Search in ideas for "zAngus"

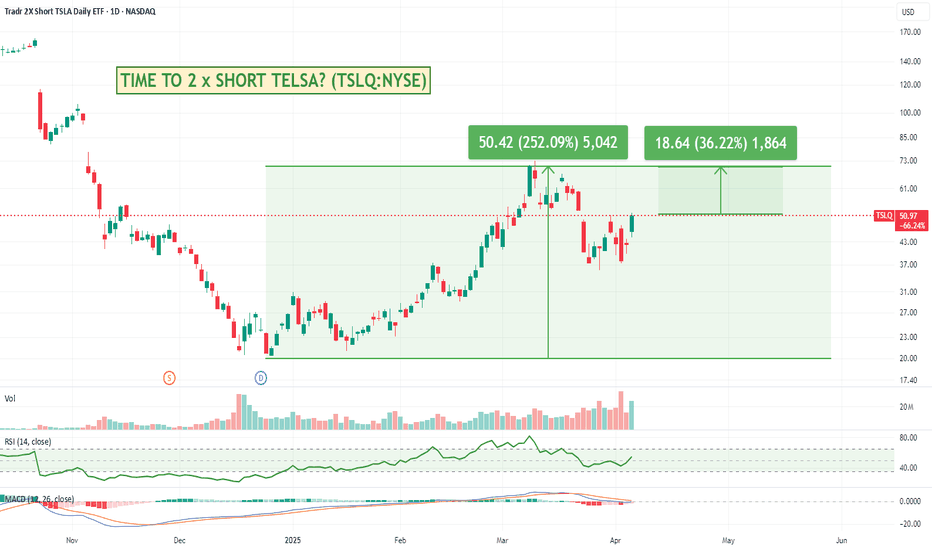

Is it time to short Tesla? If so TSLQ might be of interest.Tesla's ongoing turbulence is getting harder and harder to ignore even amongst some of the permabulls. Notably, Wedbush Securities' Dan Ives, a long-time Tesla bull, recently slashed his 12-month price target by a whopping 43% reduction noting concerns over CEO Elon Musk's political entanglements and the impact of new tariffs under President Trump's administration.

If you think TESLA is likely to keep going down, you might want to consider NASDAQ:TSLQ a leveraged short position. TSLQ aims to deliver twice the inverse (-200%) of Tesla's daily performance.

Its important though to understand that these types of leveraged trades are really only meant to be shorter term and if the stock starts to go up, then you will be losing at 2x the rate as well. Overtime, any wiggle up and down tends to work against you - even if the stock continues to go down.

Definitely not trading advice, but something I was asked about today, and the current climate doesn't look overly positive for Tesla or Elon.

TSLA article: finance.yahoo.com

TSLQ info: www.tradretfs.com

Short-Term Gamble on a NASDAQ Bounce Using TQQQIn this quick update, I’m taking a speculative short-term trade on a possible NASDAQ recovery after a steep sell-off. Was the market oversold—at least for a day? Maybe. Do I think the pain is over for the longer term? Probably not.

I’m using NASDAQ:TQQQ , a 3x leveraged ETF that tracks the NASDAQ-100 (the top 100 non-financial stocks in the NASDAQ). This means if the index moves up 2%, TQQQ should theoretically gain roughly 6%, and vice versa on the downside. Leveraged ETFs like this are high-risk, time-sensitive instruments—they’re designed for short-term trades, not buy-and-hold investing.

The idea here is that after a sharp drop, institutions might step in to scoop up oversold tech stocks, creating a brief rebound. If that happens, TQQQ could give me amplified upside. But this is purely a gamble—I’m under no illusion that the market has bottomed. In fact, I expect more downside ahead.

I entered in the after-hours session once some of the heavy bearish volume faded, and I’ve set a tight 5% stop-loss to manage risk. Yes, I could get shaken out by an early dip before any rebound, but the stop is there to protect me if the sell-off continues.

This is a high-risk, short-term trade—buyer beware. If you’re considering TQQQ, understand the risks: decay from daily resetting leverage, extreme volatility, and the potential for rapid losses.

I’ll update on how this plays out. Wish me luck in the comments below 😁

Real question is where to take profit...

Drill Baby Drill PlayThought I would have a look around for stocks that have been running well over the last couple of months around the Trump campaign and win cycle that are in Oil and Gas in the US.

I like the idea that this stock has been having a pretty aggressive but steady run and is still sub $10. Revenue figures looked okay as well.

Indicators would show it might be on the more expensive side based on its technicals, but its still pretty cheap to perhaps be a relatively low risk play.

Set your stop loss around the SuperTrend or pick a moving average and see if you can ride it until the trend ends.

Buyer beware :)

Kolibri Global Energy - Benefiting from Trump PumpSpeculative small play United States energy company focused on the exploration, development, and production of oil and natural gas with seemingly good financials. Almost a unicorn :)

Certainly has good momentum over the last few months. Could be worth a watch.

Buyer beware ;)

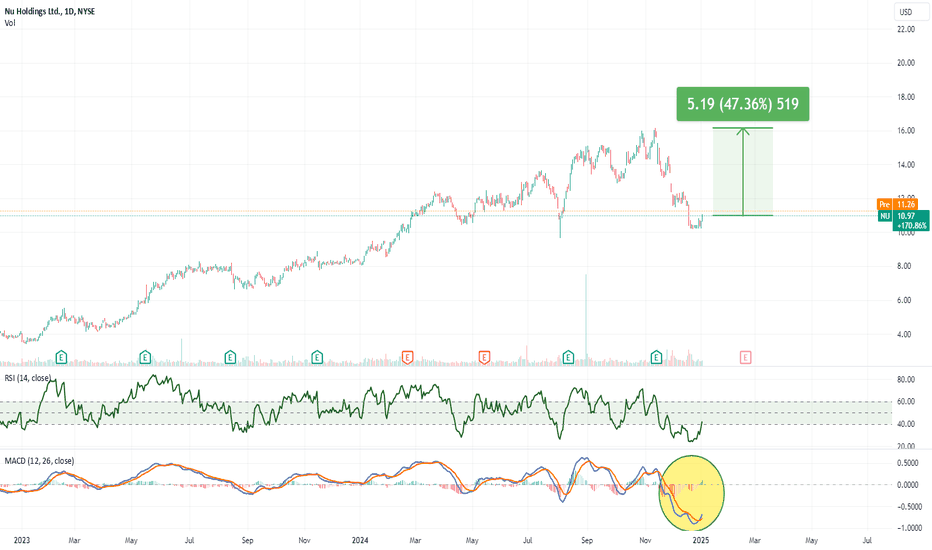

Palantir Due for a Pullback?Back at its original all time high back in 2021 but looking over extended with earnings not too far away. Both MACD and RSI looking expensive.

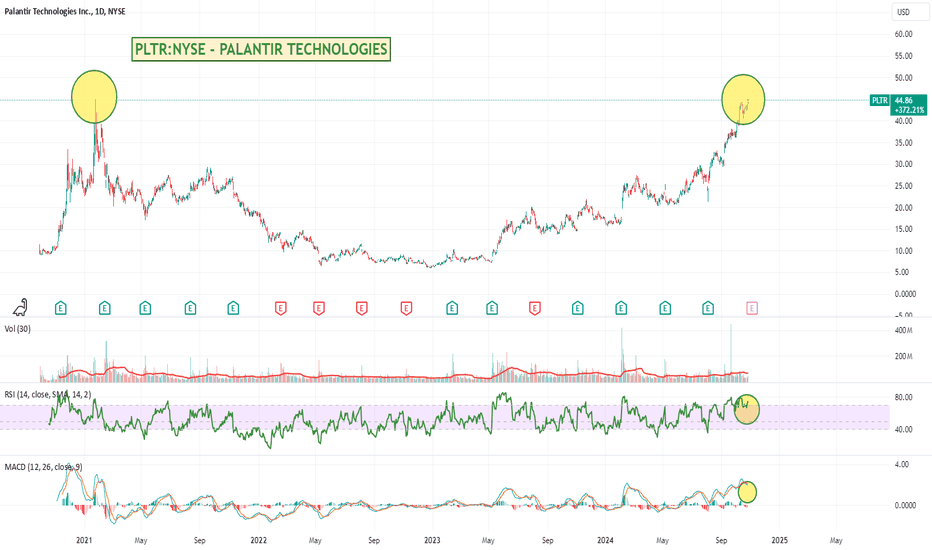

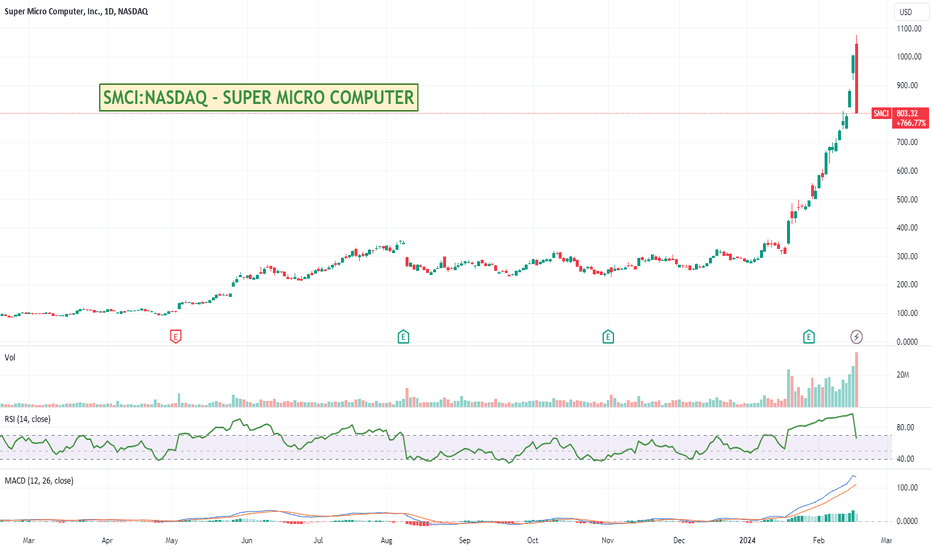

SMCI due for a run?With earnings roughly 24 hours away, SMCI could be worth a watch.

They will often drop around earnings and then put on a nice run, but with the RSI and MACD both looking like they are at a reasonable area as well as the crazy ongoing demand for chips SMCI might be worth a watch.

I'll probably take a punt on it, but with a super tight stop loss in case it heads downwards. Could use a conditional buy order to enter on a turn-around trail. eg if it goes up x% then buy.

Either way, looks like some upside if they can sort out their issues.

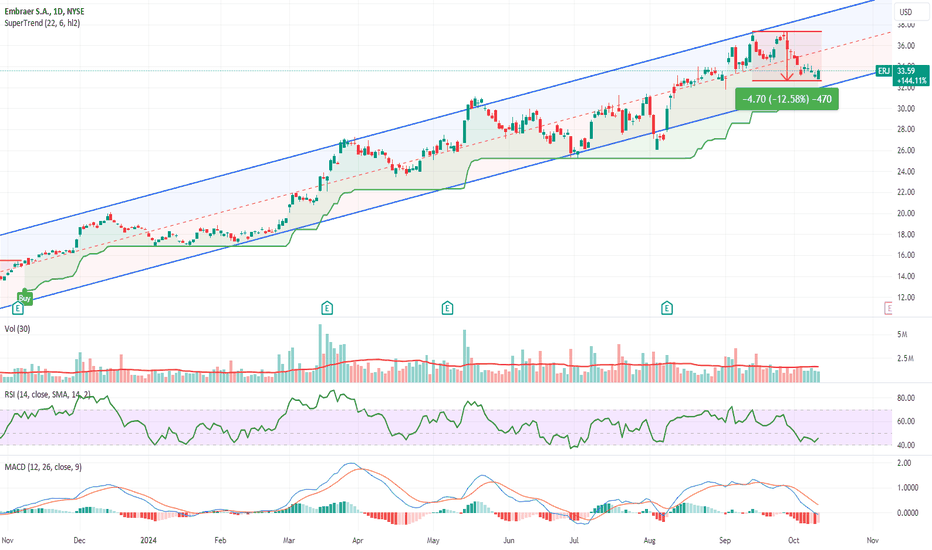

ERJ has been having a nice run.Just been having a bit of a look around for some lesser know and potentially more speculative stocks that meet the following criteria:

Price is still below $100

Up 100% over the last 12 months

Sales up year on year

Sales up quarter on quarter

In a nice consistent uptrend steadily making higher highs

Has recently made a new period high

Has had a 10%+ recent pullback

Is starting to regain ground

I only found 3 stocks meeting those criteria and ERJ was one I thought was interesting.

Might be worth a watch to see if it keeps going.

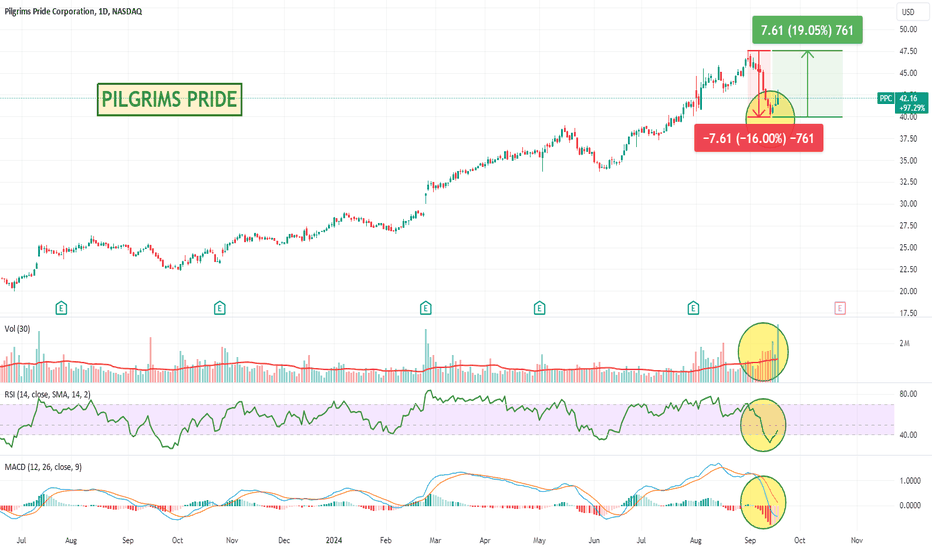

Pilgrims Pride Might Be Worth A LookWith some overall market momentum from the interest rate change by the Fed I thought this stock might be worth a look.

Pure technical play only.

Sub $100 stock

Has had a strong 100% run

Has had a recent 15% pullback

Looks like it is heading back up

Strong volume

RSI at a value area and heading back up

MACD at a value area and looking like its heading back up

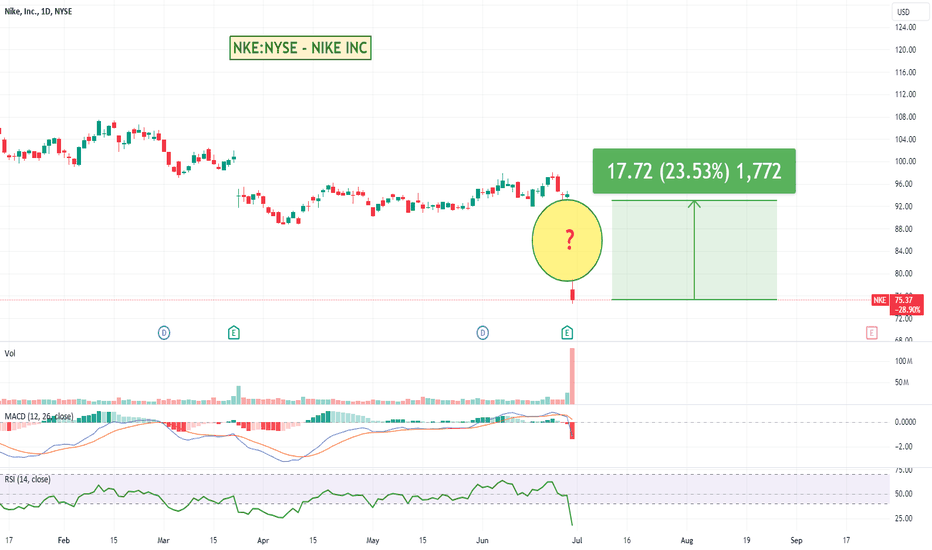

BIG drop for NIKE. 20% dump. Will it get a bounce?Close to a 20% drop for Nike on Friday which was its worst drop in the companies history.

Might be one to watch for a short term recovery. Companies sales showing weakness so I wouldn't expect a bigger long term recovery. More an in and out type play or one with a close stop for the bargain hunters if they think it is oversold.

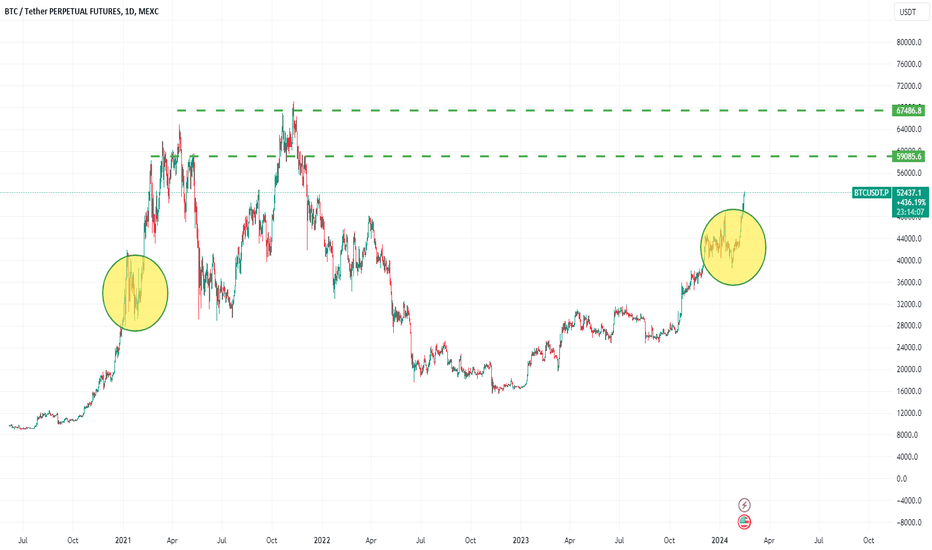

BTC - Moon or Doom? Where do you think we are?Might be the start of something great, or time for a pullback.

Be interesting to know what impact the newer ETFs are having on it but either way some good momentum out there for now.

You short term bullish or bearish?

If bearish where do you think the pull back will be to?

If bullish, feel free to apply smug mode :)

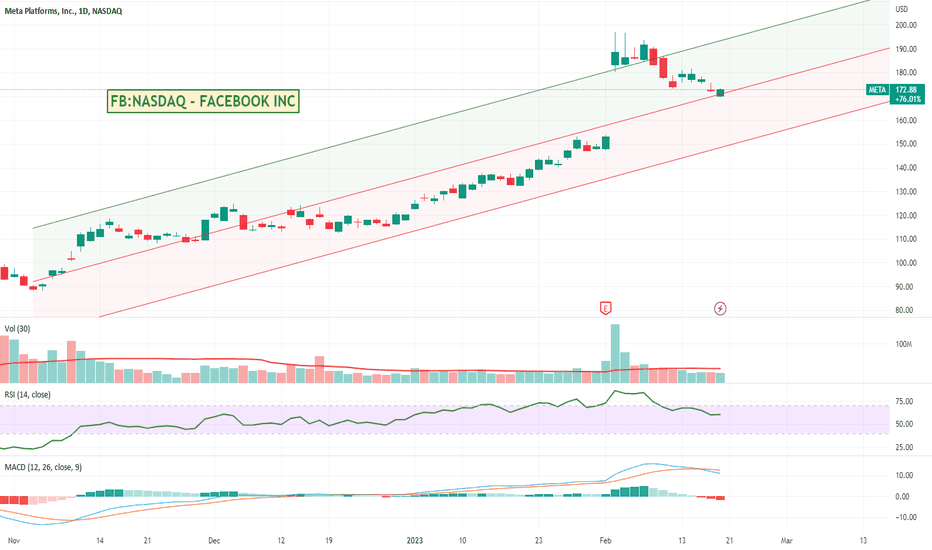

The Zucks just announced paid subscriptions for FB and Instagram"Meta CEO Mark Zuckerberg announced a new paid subscription service for Facebook and Instagram on Sunday, granting users a hallowed blue check for a monthly fee. Meta Verified will cost $11.99 a month on web and $14.99 a month on iOS. It's launching in Australia and New Zealand this week ahead of a wider rollout. The subscription "lets you verify your account with a government ID, get a blue badge, get extra impersonation protection against accounts claiming to be you, and get direct access to customer support," Zuckerberg said."

Be interesting to see if this gives FB price a bit of a bump with the potential new revenue that could be generated by this.

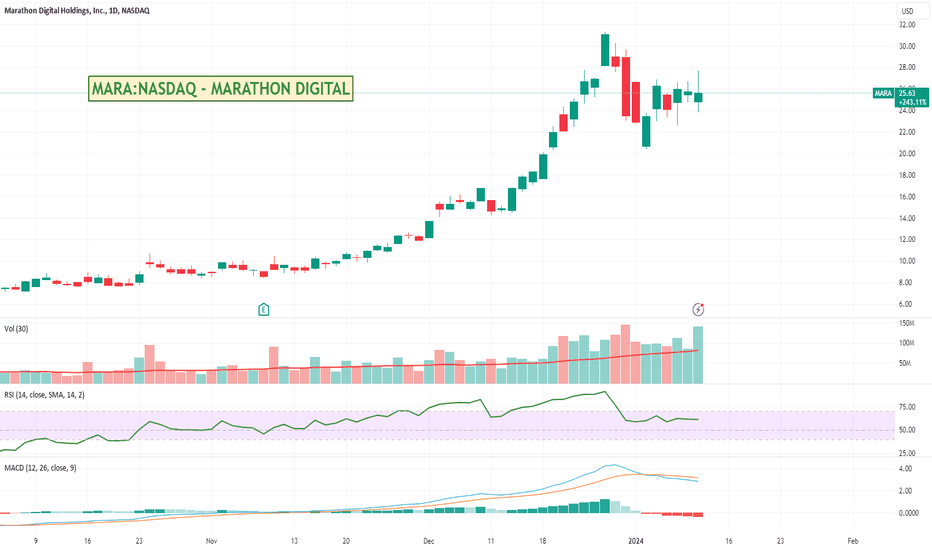

Will MARA get a Crypto ETF pump?I've held MARA for quite a while now and it has been one of the best performers in my portfolio. For me it was to be able to buy into the Bitcoin speculation without having to directly buy Bitcoin. Whenever BTC went up, Mara behaved like an leveraged stock and would rise more significantly. When BTC went down, Mara of course would follow.

It will be interesting to see how the market digests news of the new Crypto ETFs being approved into the mainstream by the SEC today.

Might be one to watch.

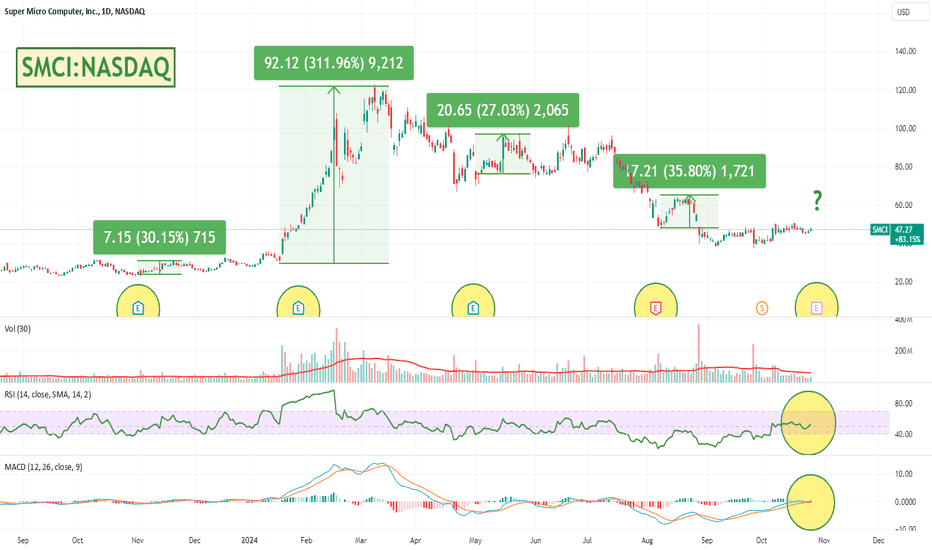

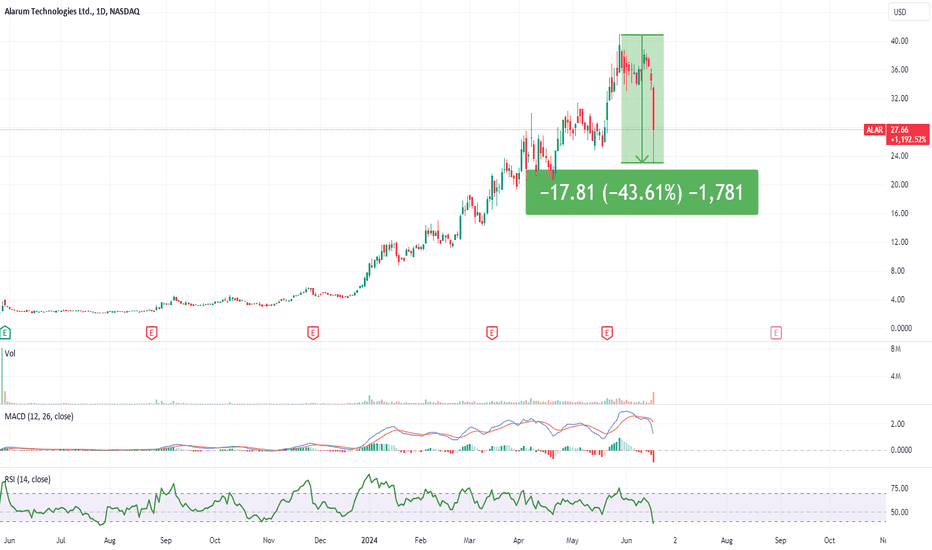

Big Pullback On SMCI - Super Micro ComputerSMCI is another company whose share price is strongly benefiting from the bubble in AI stocks and looked WAY over bought for the last few weeks. It is still up 776% over the last 12 months and that is after Fridays 20% pullback!

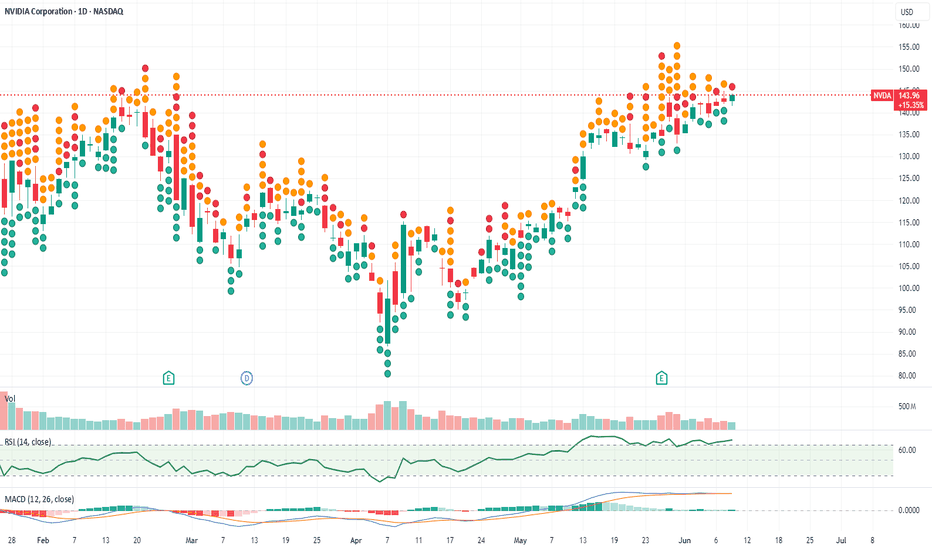

NVIDIA who is leading the AI charge has earnings on Wednesday and depending on how that goes we might see a bounce on SMCI or a bigger drop. Buyer and holders beware. Post NVIDIA earnings should see more certainty.

Secondary indicators such as the RSI and the MACD both show weakening momentum as well as the price is probably still too high unless it starts to consolidate or pull back further.

Big reaction on Friday with profit takers probably sensibly jumping ship. Will be interesting to see how it goes in the next few weeks.

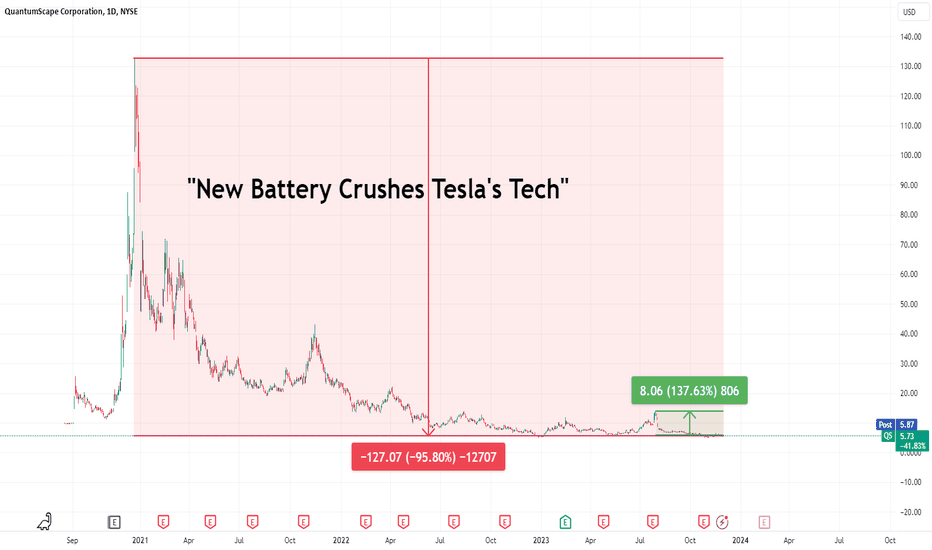

New Battery Crushes Tesla's Tech"New Battery Crushes Tesla's Tech" is the heading I read on Yahoo Finance this morning.

- finance.yahoo.com

The article is originally from Benzinga and talks about how QuantumScape has a solid state battery that is significantly better than Teslas.

What caught my interest with this one though is how far the stock has fallen from its bubbly launch highs as well as having Volkswagen mentioned in the article as an investor.

This is SUPER speculative but my dumb way of looking at it is that it wouldn't take much of a move to get a reasonable gain in its overall share price. The price can of course always go lower, but thought it might be worth having a look at to see how it fares in the future.

Definitely not trading advice by any means, but might be one to keep an eye on.

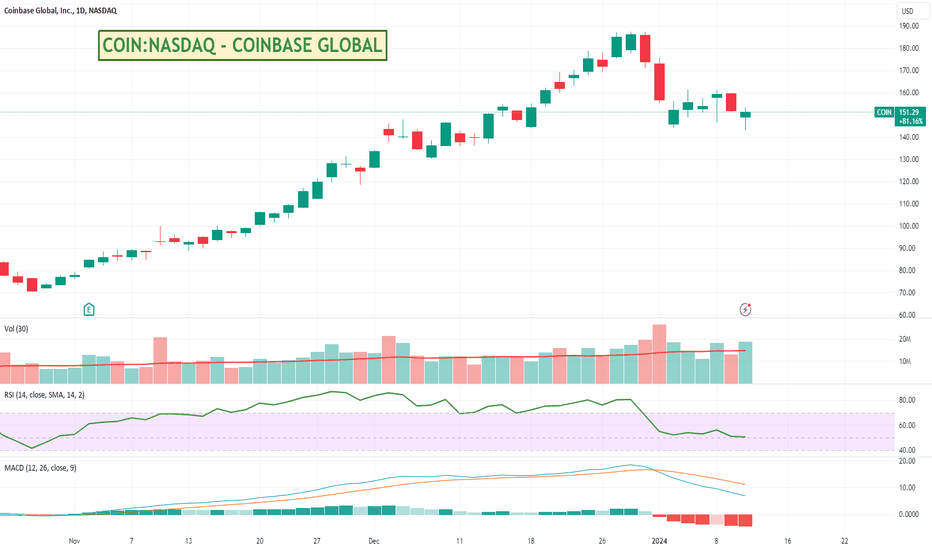

SEC ENDS CRYPTO DRAMA BY GREEN LIGHTING 11 BITCOIN ETF'SThis has been in the pipeline for quite a while but there was still an uncertainty around whether or not the SEC could continue to delay what most feel was inevitable.

The bit that caught my interest though was mentions of Coinbases heavy involvment around helping "to address the SEC's manipulation concerns, Nasdaq and CBOE have created a market surveillance mechanism with Coinbase, the largest U.S. cryptocurrency exchange".

I feel like it further "legitimises" Coinbase as an exchange that previously concerned consumers and the SEC itself might now embrace.

Coinbases price has risen nicely over the year and with its recent pullback it could be interesting to see what happens next. Might be a good entry area if you have done your research and decide to buy.

ARM Holdings - Got a strong mention in Elons AI interview.Elon mentioned ARM in his AI discussion on Twitter last night as one of the leaders when he was discussing robotics.

twitter.com (39:30 min mark)

"Tesla uses a lot of ARM technology. Almost everyone does actually". ~Elon Musk

Might be worth a look.

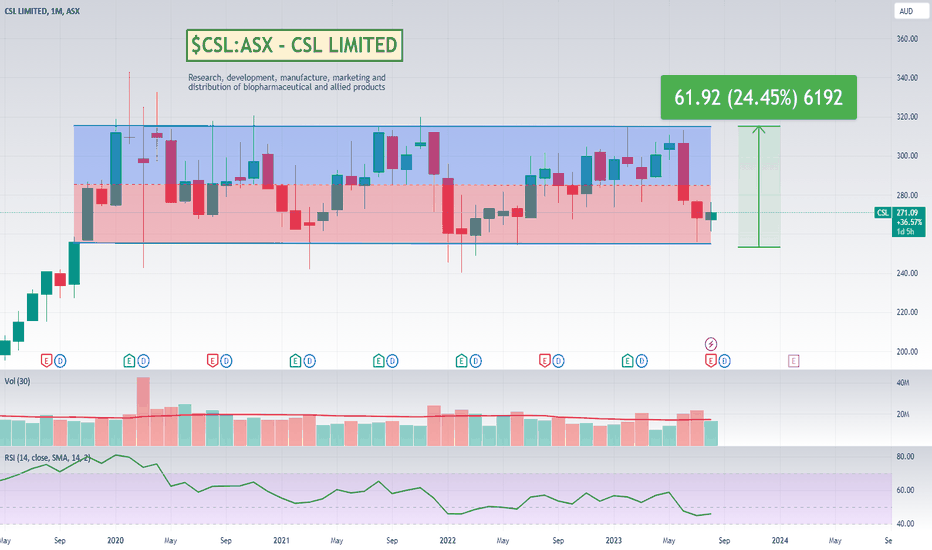

Australias CSL Trading in a range on the monthly.Not one I am personally trading at the moment, but CSL was one of the most reliable stocks on the Australian market for years. Since 2020 though it has been stuck in this sideways range that could be good for the worlds slowest swing trade :)

Being towards the bottom of the range might mean there is some upside on the table if the ASX is a market you trade.