Search in ideas for "zAngus"

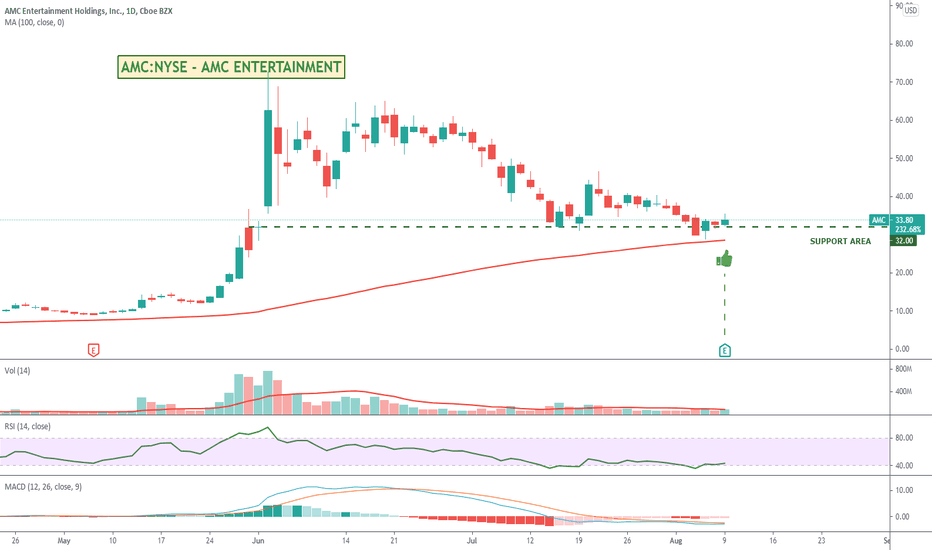

AMC Entertainment 'Crushed' Second-Quarter SalesAMC sales came in much higher than expected and the stock price held up well, supported by both the 100 day moving average and at a solid support area.

Might be some upside ahead for WallStreetBets favourite pumper :)

Keep your stops close if you like the trade.

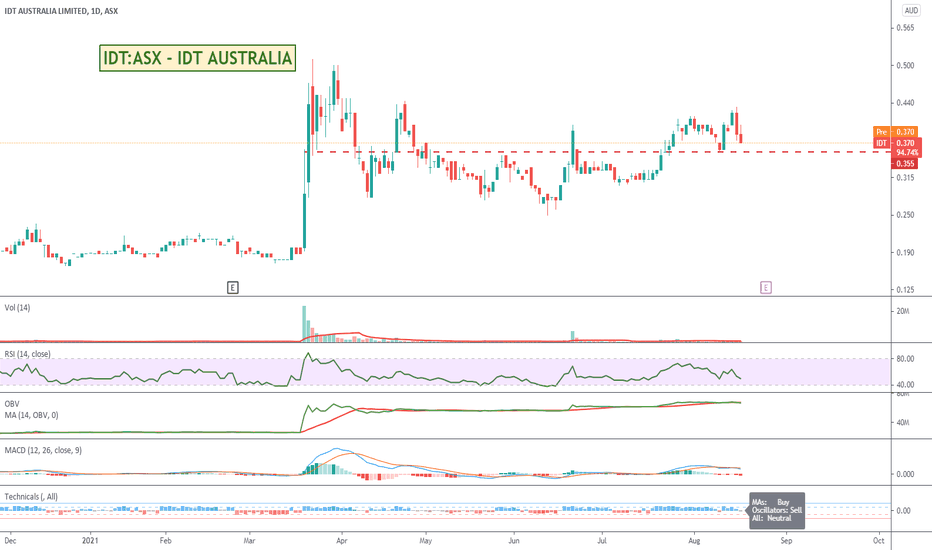

Australian IDT offers bid to produce mRNA vaccines from 2023Saw this on the Sydney Morning Herald this morning that IDT has offered to put in a rival bid to help produce Covid vaccines and boosters domestically to the Australian market.

Article: www.smh.com.au

Might give the share price a bit of a pop today.

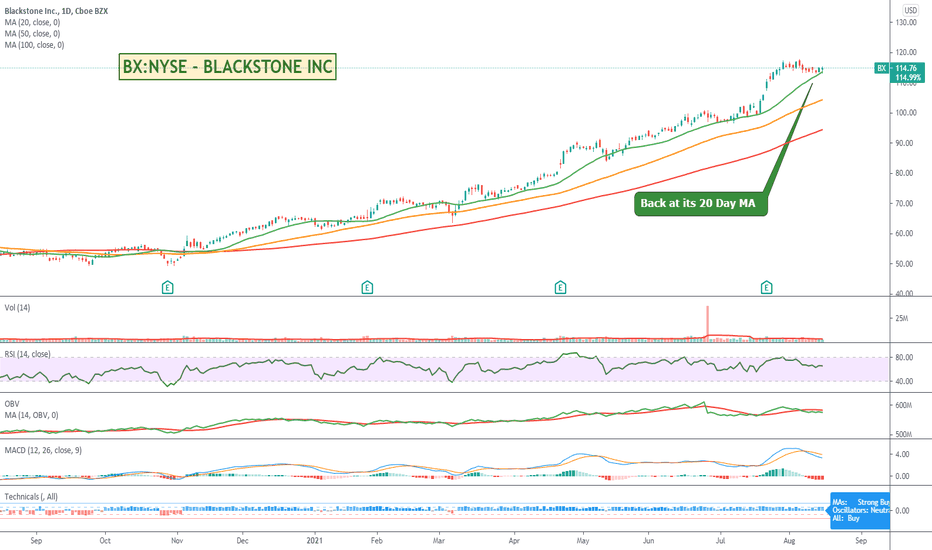

Blackstone back at its 20 Day MA. Bounce O'Clock?The Blackstone Group Inc. is an alternative asset management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

It has been trending beautifully over the last 12 months and has typically bounced back off its 20 day moving average so might be a good time to look at an entry if it does.

Worth a watch.

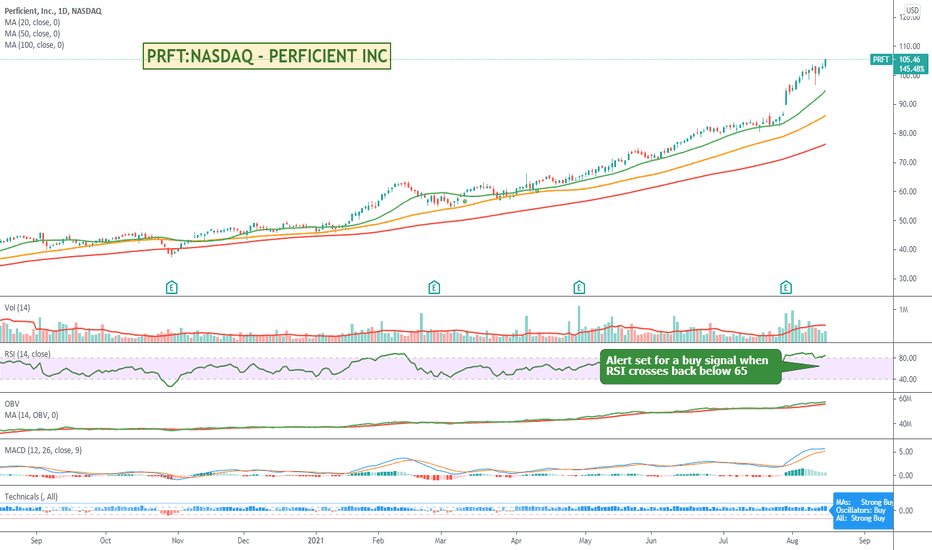

Perficient trending nicely, but needs a pullbackPerficient, Inc. provides digital consultancy services and solutions in the United States and has been one of the steadier gainers over the last 12 months.

RSI says too expensive at the moment, so I have set an alert for when it crosses back below 65 to start looking for a potential entry.

One for the watch list.

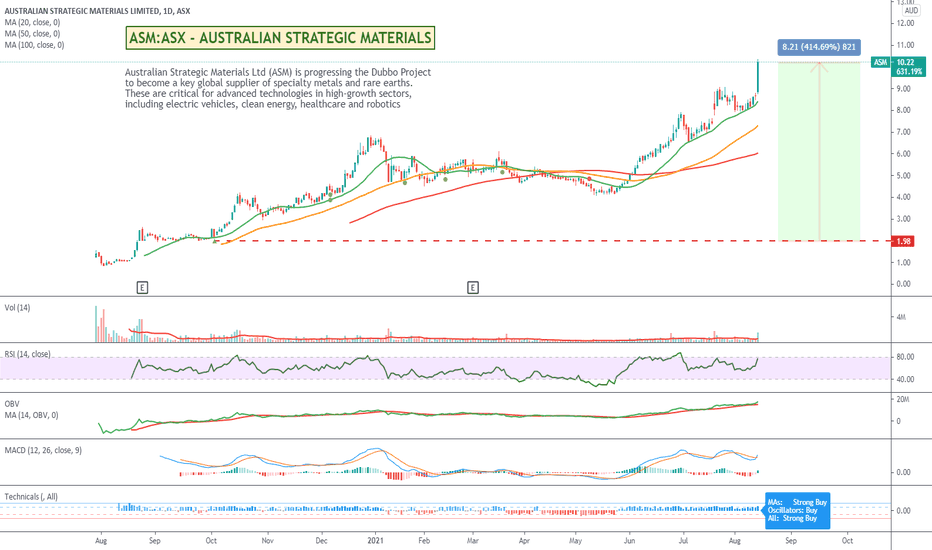

Big Move Today On ASM - An Australian Rare Earth MinerI bought and held this late last year but got shaken out of the trade and so it has been off my radar for a while.

Big move today and has been steadily making ground but still a sub $10 stock.

If it pulls back or consolidates I'll have another look. Could be a good one to put in a drawer and forget about for a couple of years.

My previous post on it:

DieCast Manufacturer has 5,180% stock price gain over 12 months.Hong Kong listed LK is in the business of designing, manufacturing and selling Die Casting Services and Machines, Plastic Injection Moulding Machines & CNC Machining Centres world wide.

Their stock price has seen massive gains over the last 12 months and with a bit of a pullback could be worth keeping an eye on.

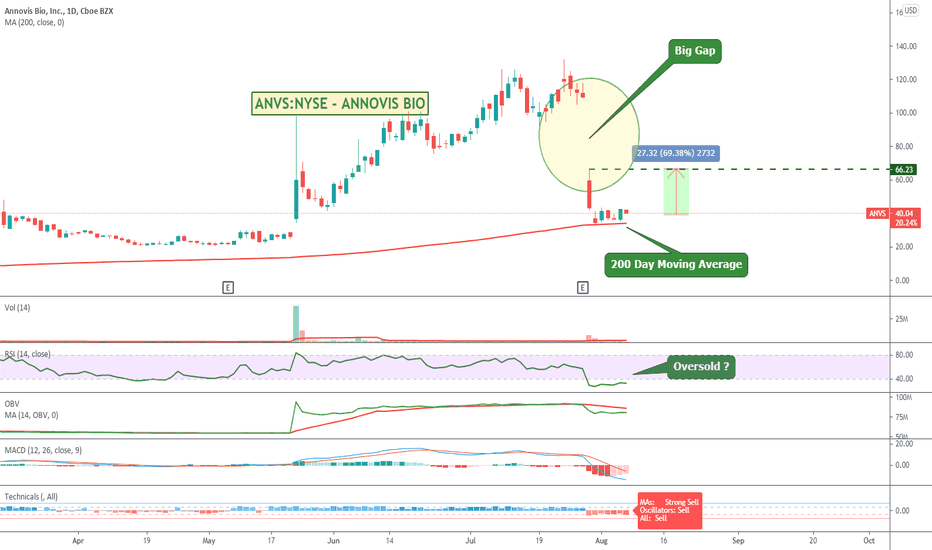

ANVS Big Gap Down On EarningsOne of those "I should know better" kind of trades, but has gapped down significantly and seems to be close to a pretty good support area at its 200 Day Moving Average.

One of those close your eyes, hit and hopes. Not recommended :)

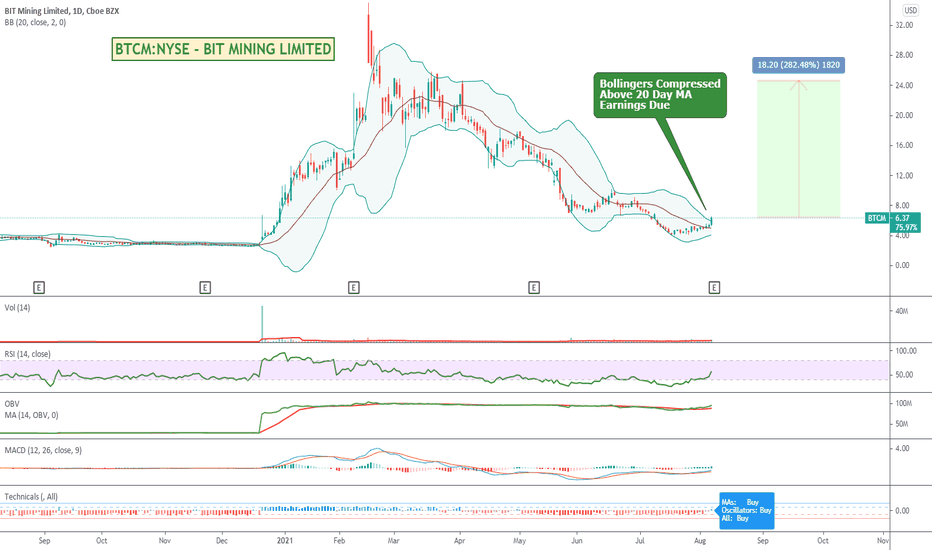

Bitcoin Miner Could Move On Earnings TodayBTCM is looking bullish with the Bollingers starting to really squeeze and a good rise in price last trading day pushing it back over its 20 day moving average.

With Bitcoins price rise a lot of these kinds of stocks will hopefully get a flown on benefit.

NASDAQ:BITF is a similar stock I bought last week. Will be keeping an eye on this one as well.

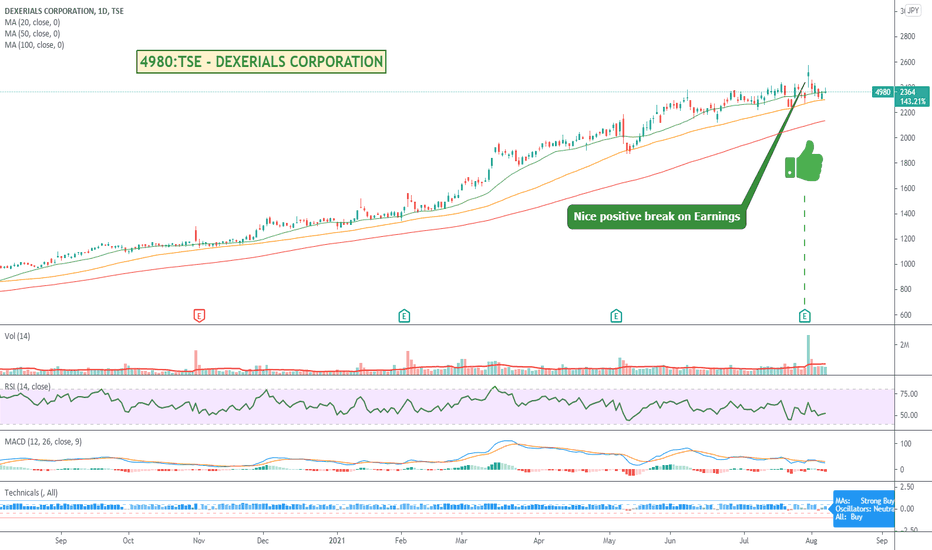

Japans Dexerials Safely Through EarningsTokyo Exchange listed Dexerials Corporation manufactures and sells electronic components, bonding materials, optics materials, and other products in Japan.

It has had a nice steady run over the last 12 months and has risen around 140%. I would probably wait for a little bit until the MACD moves back up over its signal line and the RSI starts to point back up a bit more just for confirmation.

Nice steady stock that has been consistently making new highs over the last 12 months.

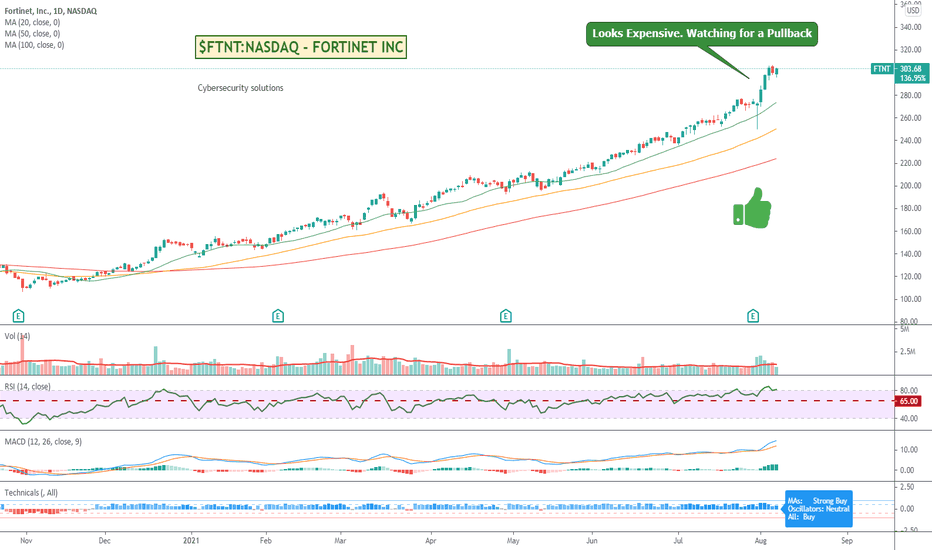

Fortinet Up Nicely On Earnings. Looks A Bit Too Expensive.Fortinet, Inc. provides broad, integrated, and automated cybersecurity solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

It is one of those hot IT spots in demand by Governments and Businesses alike and will probably only increase in importance over the years.

Fortinet had a good pump on earnings, but I'd like to see it come back down closer to its 20 day moving average, or under 65 on its RSI before I'd start looking at entries.

Might be a good long term buy and hold in theory if you like the idea of the business and the space that it is in.

Worth keeping an eye on and doing your own due diligence if you like it.

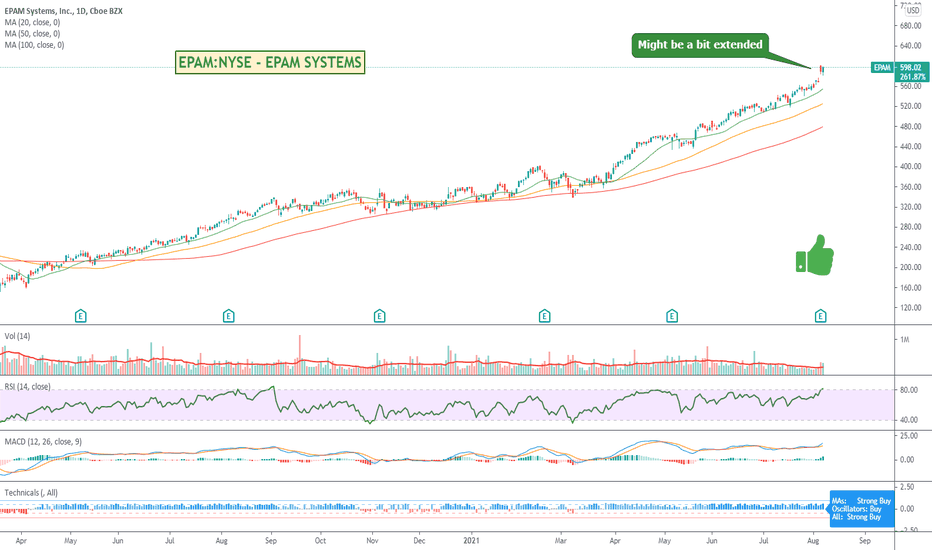

EPAM Having A Great Run. Popped Higher On Earning. EPAM Systems, Inc. provides digital platform engineering and software development services in North America, Europe, Russia, Belarus, Kazakhstan, Ukraine, Georgia, East Asia, Southeast Asia, and Australia.

It has been having a great run over the last year, and on my stocks to watch list, but I feel it is a bit too far away from its 20 Day Moving Average and RSI is in the overbought area so its probably better to wait for a pull back closer to that 20 Day MA if you like the stock. Look how closely it hugs it :)

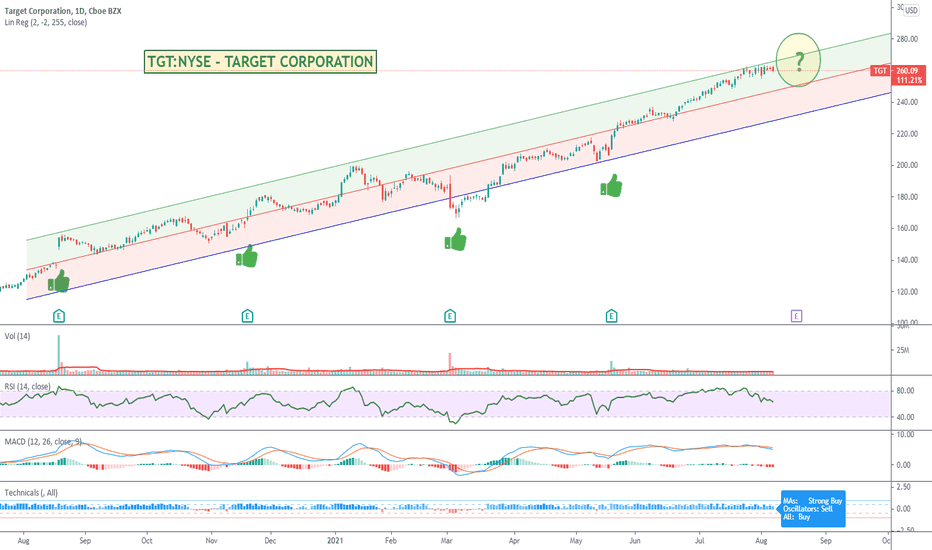

Target Is Approaching Earnings. Boom or Doom ?Target has had a pretty good record recently of continuing its upward move on earnings or shortly after. Its just topped a 100% return for the year.

Will be interesting to see what happens this next earnings period. My vote would be on the boom side. I think it will keep going up regardless of pandemic or not.

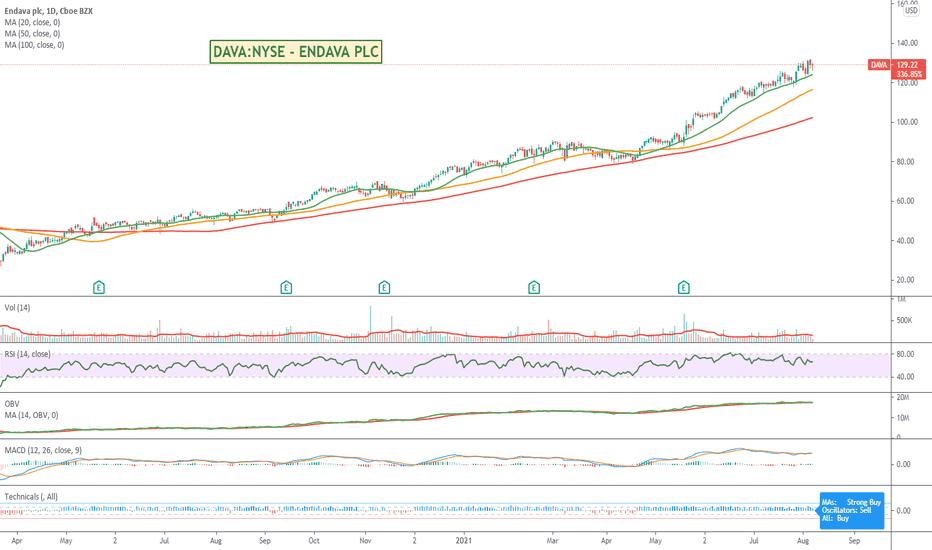

Super Steady Runner Up 300%Endava provides technology services for clients in the consumer products, healthcare, logistics, and retail verticals in Europe, Latin America, and North America.

It has had a nice steady run a bit over 300% since its last dip, and up over 140% for the last year.

Never know when the trend will end, but it's had a pretty good run so far.

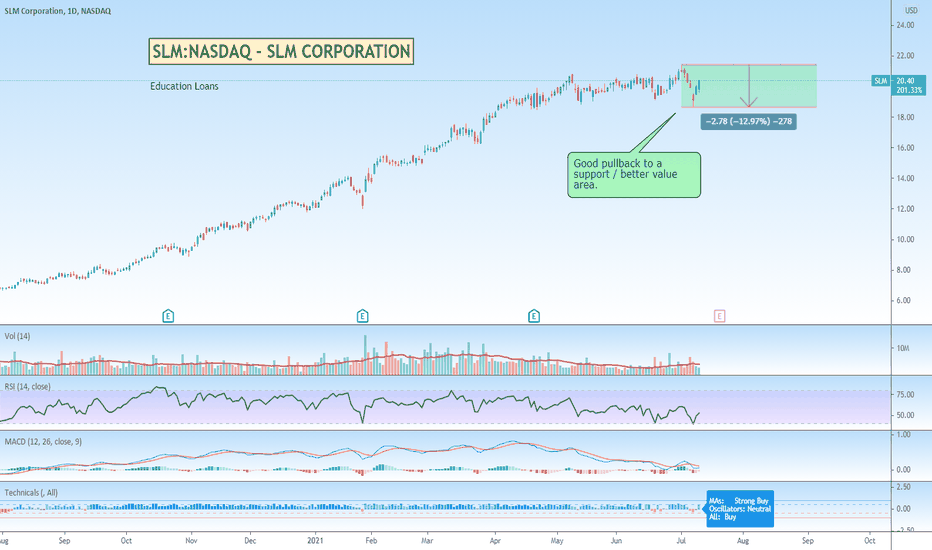

Student Loans Business a WinnerSallie Mae specialises in providing private loans to students and seems to be doing very well out of it. The stock price is up 200% over the last 12 months and with a recent pullback could be a good time to have a look around for an entry if the business appeals to you.