Chalice continuing to run strongly with green metals mining.ASX listed stock Chalice continues to head on up.

From their recent announcements:

Julimar – a new high-grade PGE-Ni-Cu-Co-Au discovery in WA

• Australia’s first major palladium discovery

• Emerging as a very large, strategic deposit of critical, ‘green metals’ in a world-class jurisdiction

• Highly leveraged to battery (Ni-Cu-Co) and hydrogen (PGEs-Ni) technology adoption

Unrivalled pipeline of greenfield discovery opportunities in Australia

• ‘First mover’ advantage in the new West Yilgarn Ni-CuPGE Province

• Large exploration holdings in Victoria and the Kimberley

Search in ideas for "zAngus"

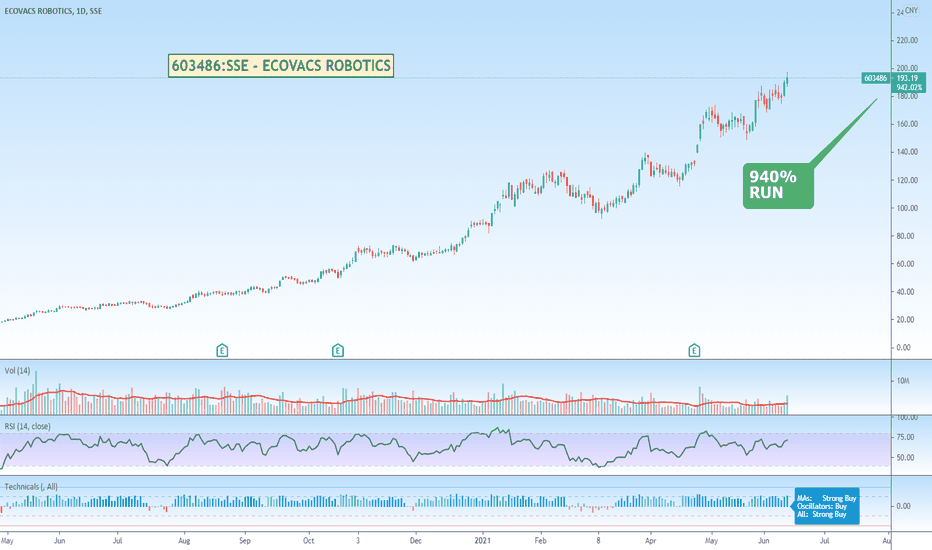

Robot Vacuum Cleaners Don't Suck. Making The Big Bucks.I bought one of these Ecovac robot vacuums and have had it bumping around my place for the last year or so. It works really well and I'm always amazed how much it picks up.

I was more amazed to see how its share price has been going over the last 12 months.

Worth a look.

Chinese Mega Ride-Hailing Giant DIDI Just ListedSuper early days in terms of seeing how any price action will play out, but think of DIDI as the Chinese version of UBER and all its related businesses.

Well worth keeping an eye on.

About DIDI- www.didiglobal.com

Didi Chuxing (“DiDi”) is the world's leading mobility technology platform. It offers a wide range of app-based services across Asia Pacific, Latin America, Africa and Russia, including taxi-hailing, private car-hailing, ridesharing, bus, bikes & e-bikes, designated driving, automobile solutions, delivery, freight and logistics, and financial services.

DiDi provides car owners, drivers and delivery partners with flexible work and income opportunities. It is committed to collaborating with policymakers, the taxi industry, the automobile industry and the communities to solve the world's transportation, environmental and employment challenges through the use of AI technology and localized smart transportation innovations. DiDi strives to create better life experiences and greater social value, by building a safe, inclusive and sustainable transportation and local services ecosystem for cities of the future.

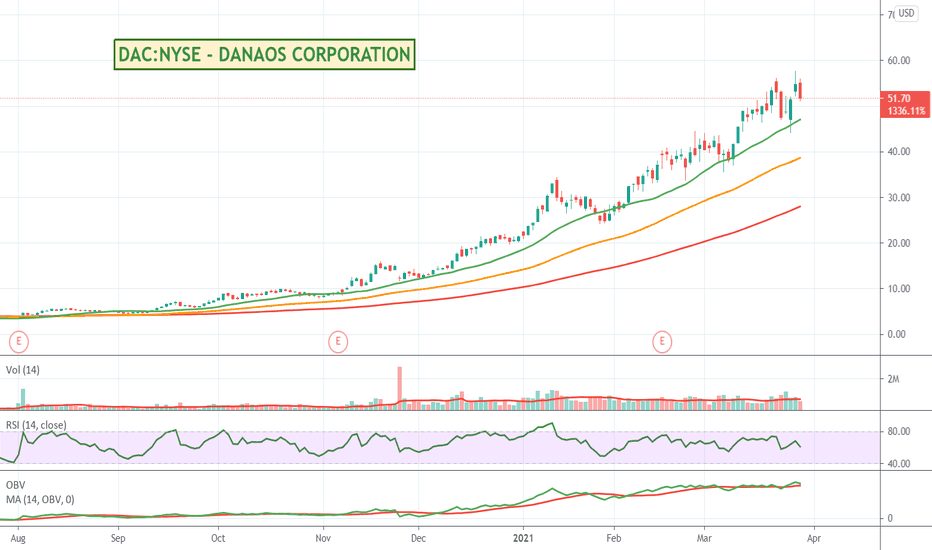

DANAOS Still In Beast Mode. Just Cracked 2000% Gain For The YearDAC is in the business of operating containerships around the globe and has been one of the best performers stock price wise over the last 12 months. They are sill a sub $100 stock which is in the sweet psychological spot for retail traders still.

Could be worth a look.

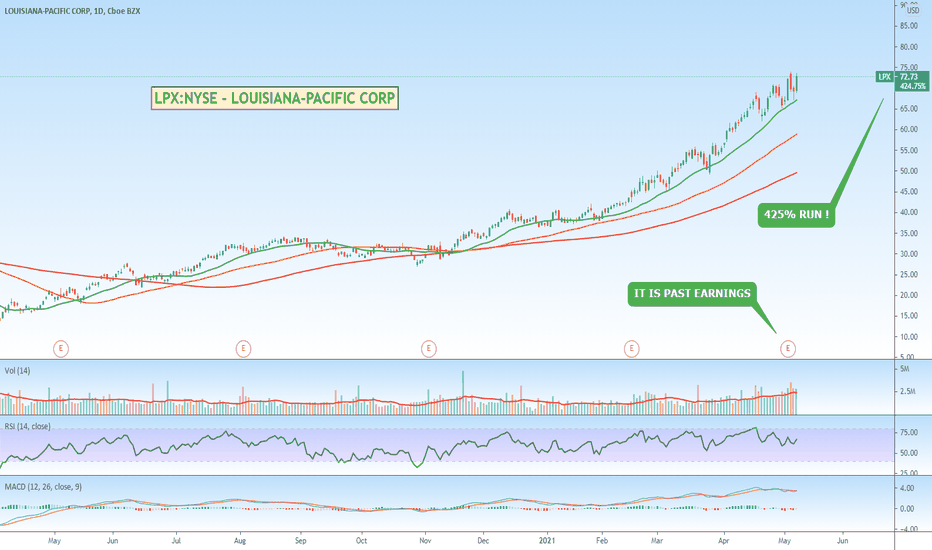

Got Wood ? Louisiana Pacific does.Louisiana is a STRONG BUY on the TradingView Technical Analysis Dial and given it has just passed its earnings period with flying colours the trend might be set to continue.

Check out this link if you have not seen it before. It's one of those super cool TradingView features that not everyone knows about:

tradingview.sweetlogin.com

Stocks on the watch list.

VIRX - Bollinger Breakout with VolumeViracta (VIRX) is a clinical stage biotech firm focused on the treatment of Epstein-Barr related cancers which is one of the most common virus infections found in humans. Had a good run last week, and one of those stocks that can really move with some good news. Might be worth a look.

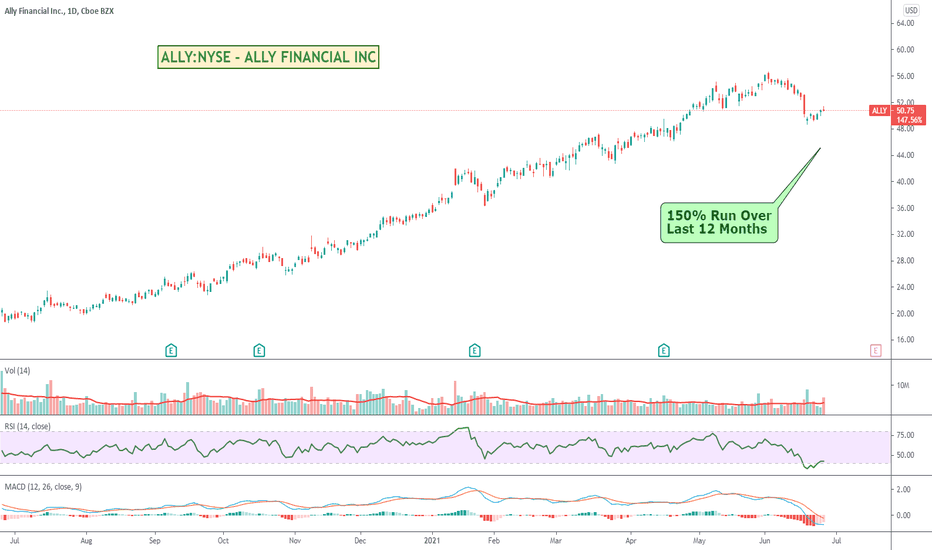

ALLY Finance recovering after nice 14% pullback.ALLY is another stock that has been consistently making higher highs over the last 12 months, but recently had a nice deep pullback to value of around 14%.

RSI shows it is at a better value area and MACD looks like bearish pressure on the price is reducing and buyers are coming back in helping the price recover.

Earnings aren't too far away so buyer beware. The deal they did with Sezzle last month gives us an indication that they could be open to more innovative fintech type deals.

Worth keeping an eye on.

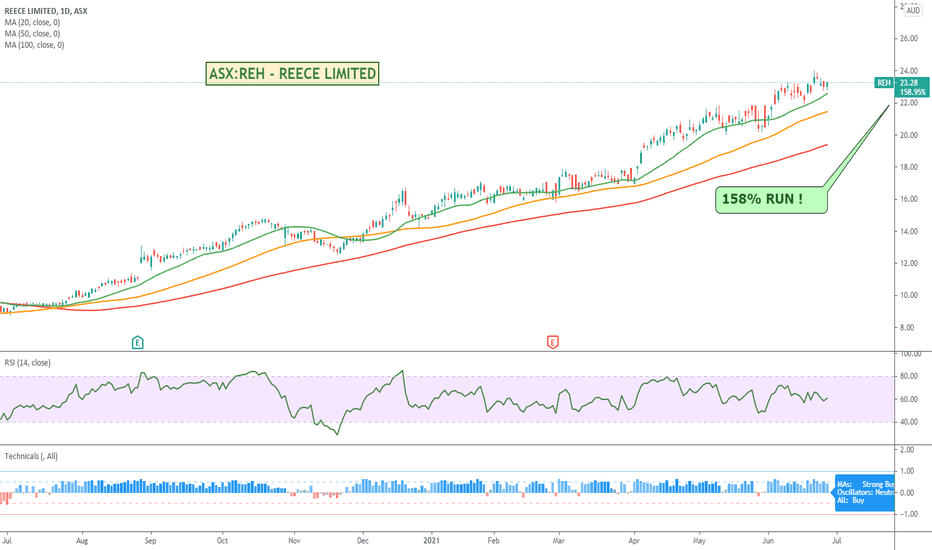

Making Higher Highs: ASX Stock Reece Having a Great Run Aussie company Reece has been having a great run over the last 12 months continually making higher highs through the year to be up just under 150% in price - while still a low $20 stock.

The Australian building boom doesn't look like it will slow down any time soon, so Reece could be well worth a watch for a while to come.

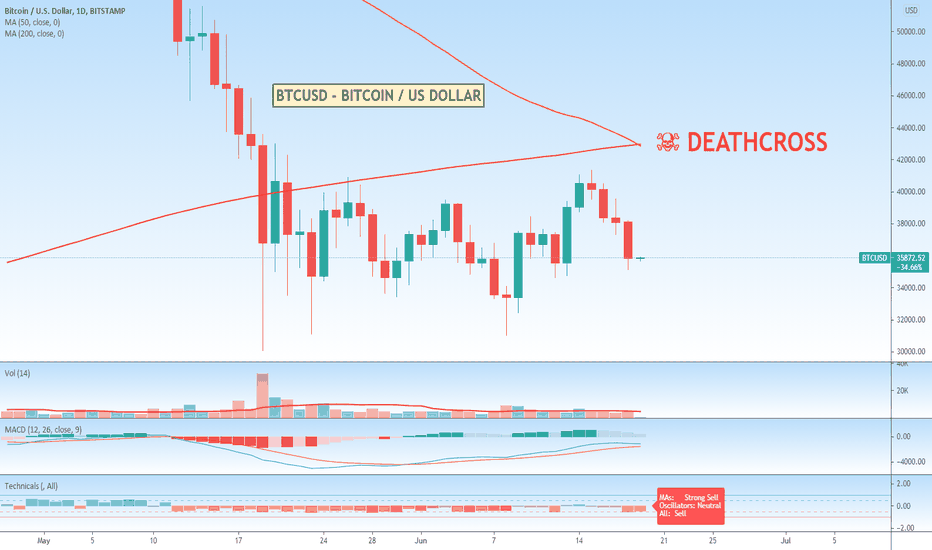

Bitcoin just triggered a DeathCross :)☠☠☠ Doom And Gloom Ahead For Bitcoin ? ☠☠☠

A Death Cross is an old trading superstition indicated by the 50 Day Moving Average crossing below the 200 Day Moving Average.

In the past it has often been a good indicator for a significant sell-off in the stock (or in this case Bitcoin). Whether or not it will happen who knows, but good for a bit of drama.

Youtubers everywhere will be squealing in delight with all the new DeathCross videos they can make for views :)

What do you think will happen ?

$20k on its way - or a bounce off $30k and back to all time highs?

Also, did you know that on TradingView we have chat rooms where you can discuss all things trading?

Come and check out the Crypto chat room if you haven't seen it yet. Better bring your sense of humour though. Bit of the wild wild trading west in some of these rooms.

Crypto chat: tradingview.sweetlogin.com

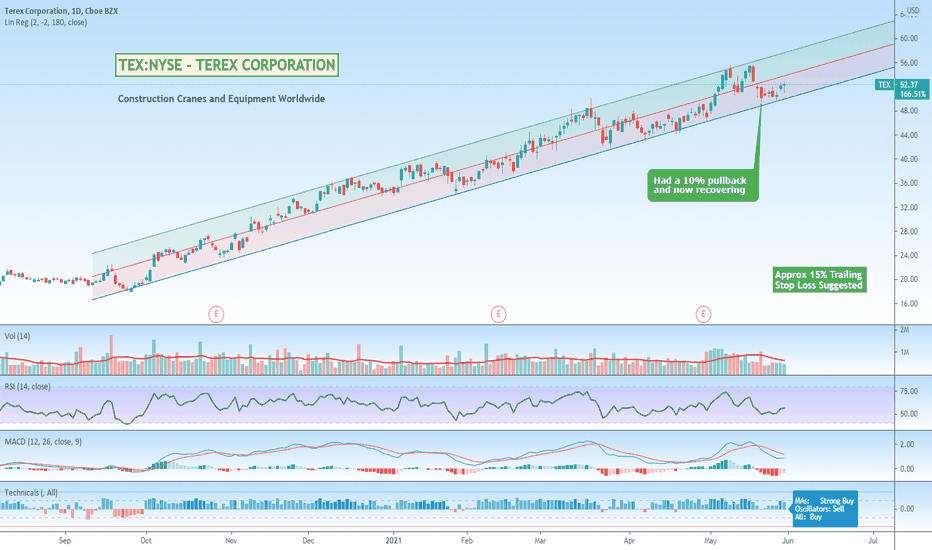

Construction Cranes and Materials Processing Equipment BoomingWith governments around the world releasing various stimulus packages focused heavily around infrastructure and construction type projects to help boost the economy, equipment suppliers like TEREX have been benefiting.

Terex has been showing strong momentum and after a nice 10% pullback to value might be about to continue its run.

Worth a watch.

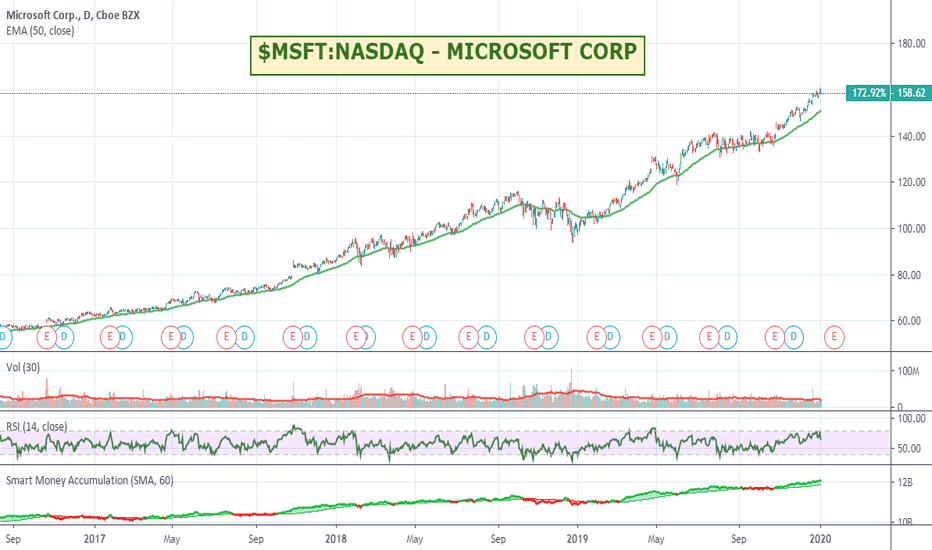

$MSFT:NSDAQ - MICROSOFT CORP - Continues to impressUp 55% over the last 12 months, Microsoft continues to climb. In the trillion dollar market cap club it will be interesting to see what areas Microsoft excels in (pun intended) over the next decade. They still own the desktop software market - certainly in the commercial space - and I think that AI might be their next big frontier that they will want to try and dominate. Certainly a stock well worth a watch.

Microsoft Corporation is a technology company. The Company develops, licenses, and supports a range of software products, services and devices. The Company's segments include Productivity and Business Processes, Intelligent Cloud and More Personal Computing. The Company's products include operating systems; cross-device productivity applications; server applications; business solution applications; desktop and server management tools; software development tools; video games, and training and certification of computer system integrators and developers. It also designs, manufactures, and sells devices, including personal computers (PCs), tablets, gaming and entertainment consoles, phones, other intelligent devices, and related accessories, that integrate with its cloud-based offerings. It offers an array of services, including cloud-based solutions that provide customers with software, services, platforms, and content, and it provides solution support and consulting services.

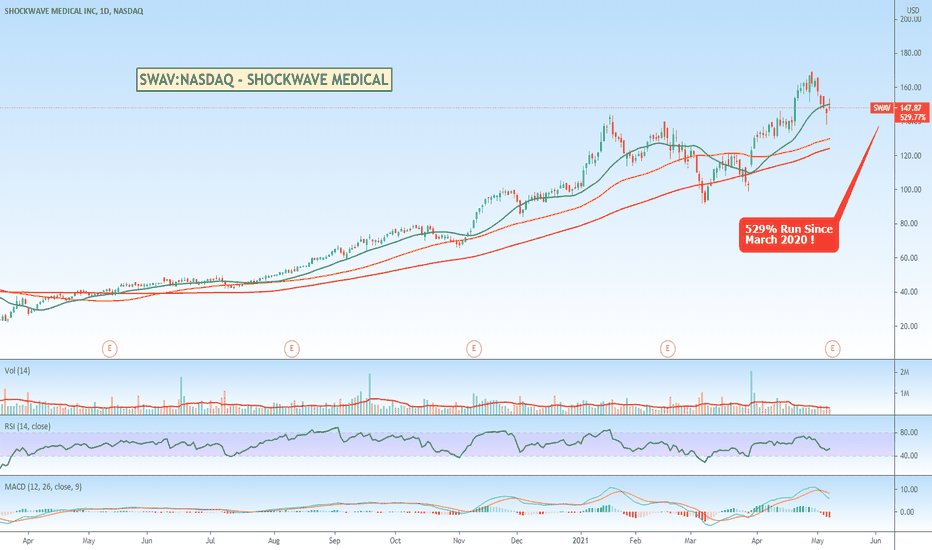

Will Shockwave Medical bounce on Earnings tonight?Shockwave is a medical device company focused around catheters as implantable medical devices to help assist in treating cardiovascular disease.

It has had a strong run trending nicely since March last year and is up around 500%+ since then or up over 250% over just the last 12 months - both numbers including the big pullback.

It will be interesting to see if todays numbers come in well. One way to trade it might be to set a stop order a few percent above its current price to capture it if it heads in the right direction.

Worth a look.

It was at $86 when I started to look at it last year.

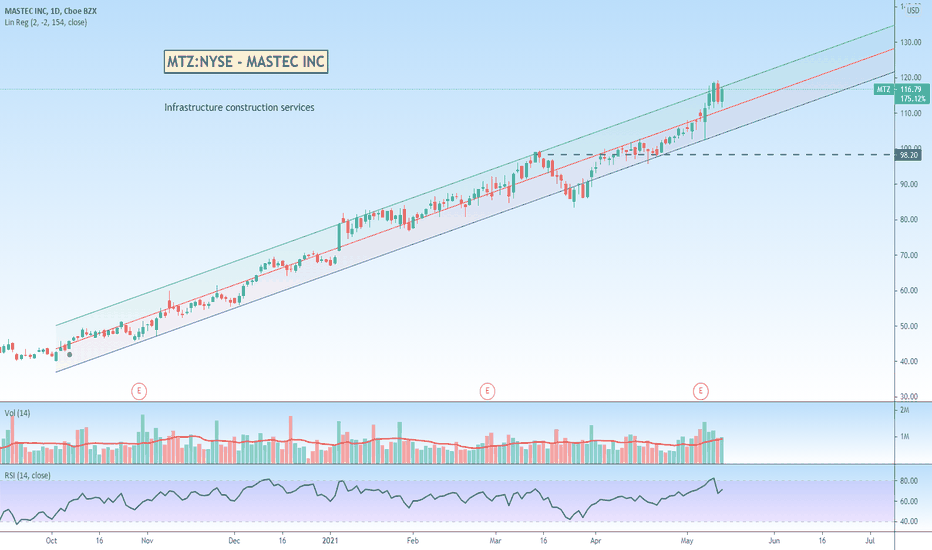

Mastec - Power Plant and Renewable Energy Construction CompanyMastec has been having a RIPPER run over the last 12 months with the boom in infrastructure development but the thing that caught my eye (after the chart of course) was their strong presence in building power plants and especially renewable energy projects.

Price might be a little expensive at the moment so keep an eye out for a pullback and recovery if you want to get in at better value.

A trailing stop loss around 10 to 13% will keep you in most of the trend with only a few stops.

From their about us:

Mastec is one of the nation's top power plant and renewable energy construction companies.

Capitalizing on our expertise in electric transmission, MasTec is one of the nation's top power plant construction companies, specializing in engineering, procurement and construction of thermal power plants, alternative fuel power plants, wind farms, and solar energy facilities . Whether we're designing, building, expanding or maintaining a power plant or renewable energy facility, we have the experience and resources to maximize efficiencies during construction and throughout the facility's operation. We help clients determine the optimal site, size, materials, construction methods and design features to meet their needs for power plants and renewable energy facilities, and we continually work to increase their ROI. By keeping a focus on safety and innovation, we're able to provide the most effective and socially responsible solutions to the world's changing energy needs.

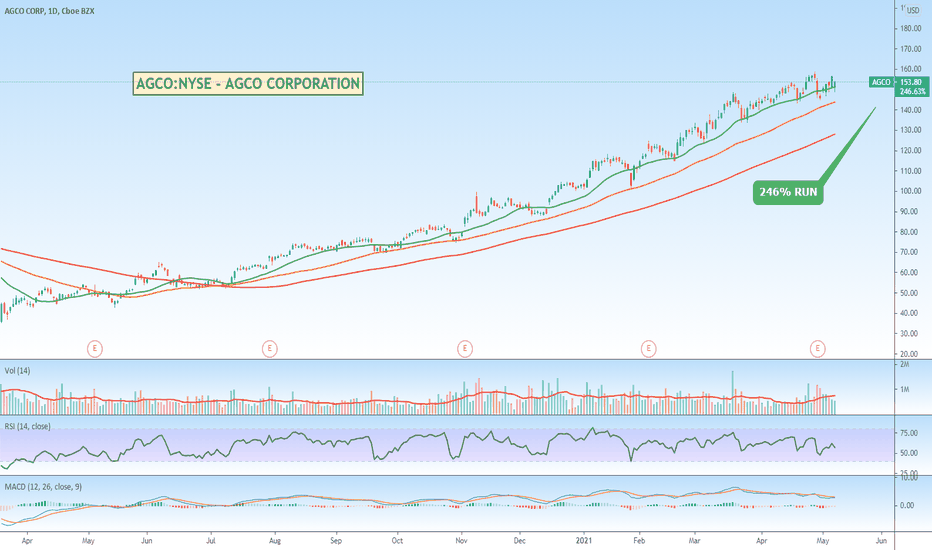

Want to buy a Tractor -> Try AGCO. Everyone else apparently is.AGCO is another beautifully tending stock. Consistently making higher highs it is now up well over the 200% mark over the last 12 months. Worth a watch.

From the TradingView description: AGCO Corp. engages in the manufacture and distribution of agricultural equipment and related replacement parts. It operates through the following geographic segments: North America; South America; Europe and Middle East; and Asia, Pacific, and Africa. The Asia/Pacific/Africa segment includes the regions of Australia and New Zealand. The firm's products include tractors, combines, self-propelled sprayers, hay tools, forage equipment, seeding and tillage equipment, implements, and grain storage and protein production systems. Its brands include Challenger, Fendt, GSI, Massey Ferguson, Valtra, and Fella.

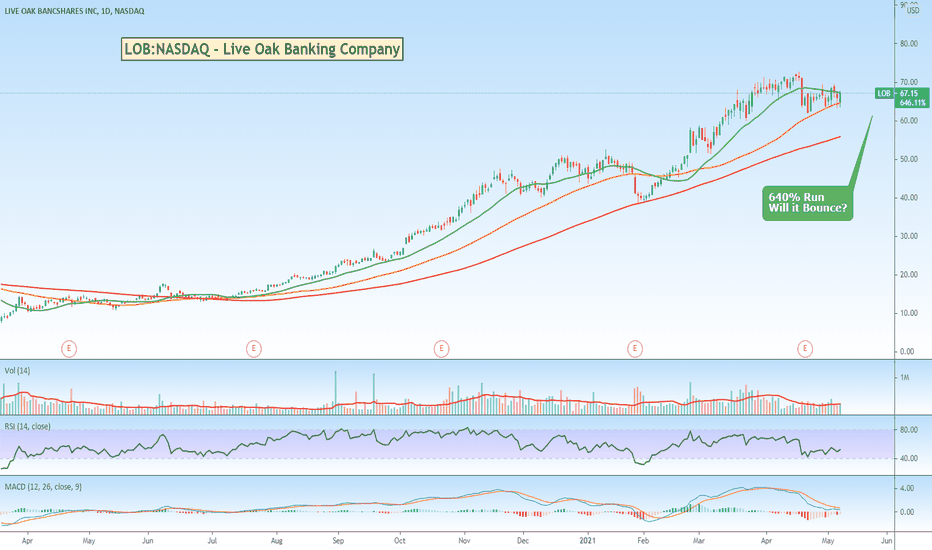

646% Run. Will it bounce of its 50 day!Live Oak Banking is a national online lending platform for small businesses and is up around over 640% since its March lows.

Super steady run without too much volatility.

Stock price looks like it has been consolidating. RSI is back at a pretty good value area in the low 50s. MACD looks like it might be starting to turn up. Hoping it will bounce of its 50day and resume its run.

My last post on this was when it was in the low $40's so a nice run to date.

DANAOS Shipping is Up 1500% Over 12 months.Was just having a bit of a look around to see what has been running smoothly and avoiding all the turmoil that the tech stocks are currently going through and spotted Danaos.

From their website, Danaos Corporation is one of the largest independent owners of modern, large-size containerships and charter their containerships on long-term contracts at fixed rates to many of the world's largest liner companies.

With the bit of a blip caused by the EverGreen ship stuck and now freed in the Suez Canal, it will be interesting to see if this continues its run.

Could be worth a look.

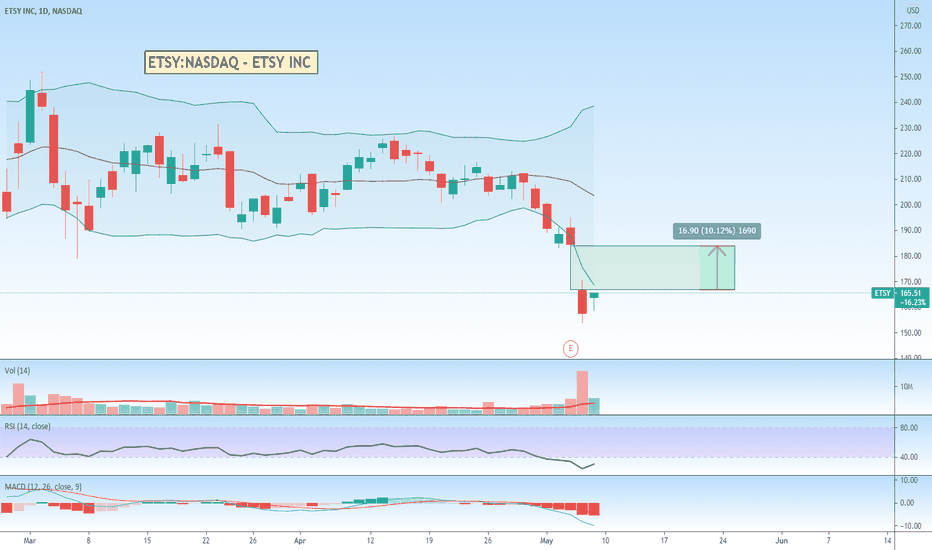

Big pullback on Twitter post earnings. Was it oversold though?Twitter got punished at the end of last week on reporting a slower start to the year. Looks like it could have been an over reaction. I'd probably have a look at it if the price moved back up a dollar or so. Could be worth a look if you like oversold type plays.

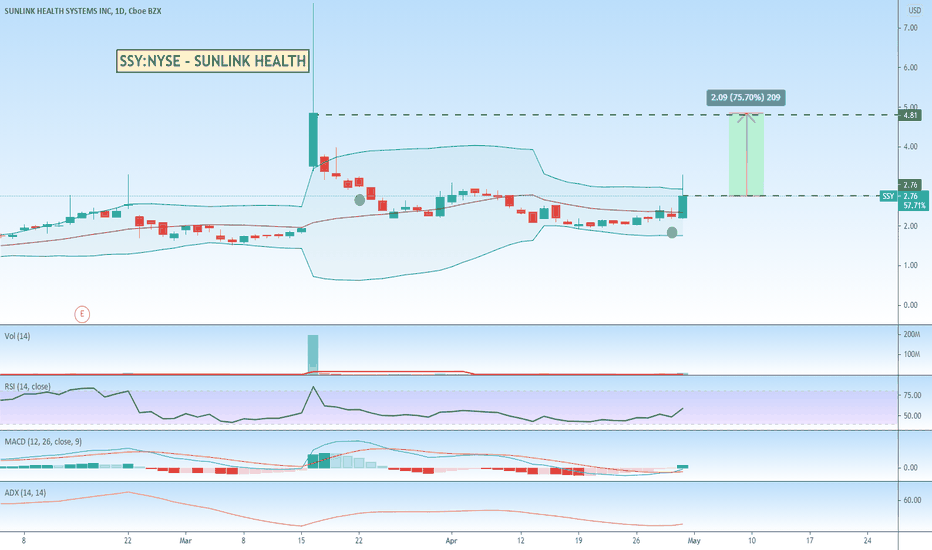

Sunlink Health looking Bullish. MACD turning green :)Found Sunlink on an unusual volume scan with a price increase of 2% or more. Had a nice move up on Friday but has been headily steadily up prior to that after a big pullback. Supporting indicators all look pretty reasonable. Might be worth keeping an eye on it.

Vaxart COVID-19 Tablet Potentially Effective Against New StrainsBought Vaxart last week on the bollinger breakout and big volume surge and was nicely surprised by this headline that the Vaxart COVID-19 Tablet is potentially effective against new strains.

It has had the ability to pop big in the past, so will be interesting to see if it runs for a bit.

POTX back at support again.POTX is a Cannabis ETF that invests in pot stocks and companies across the cannabis industry. It is back at support again so might see a bit of a bounce, but overall we haven't seen much activity in this industry sector.

HOW TO: Trade Vale Iron Ore with a Trailing Stop Loss. VALE struggling to keep up with Chinese Iron Ore Demand

Was having a bit of a read through Yahoo News and spotted this article showing that the two biggest Iron Ore suppliers globally are having trouble keeping up with demand out of China. Vale has had a couple of set backs operationally, but looking at the chart looks like the share price might start moving higher again and most of the supporting indicators looking reasonably bullish.

Article: au.finance.yahoo.com

A 16% trailing stop loss as shown on the chart would have kept you through most of the gains made over the last 12 months, whereas you can see in the chart below a 15% trail would have stopped you out early.