American Battery Metals Back Above Its 20 Day Moving AverageABML is a long term favourite of mine conceptually but has been beaten up with the rest of the EV stocks.

Good to see it back above its 20 Day Moving Average.

Back on the watch list.

Search in ideas for "zAngus"

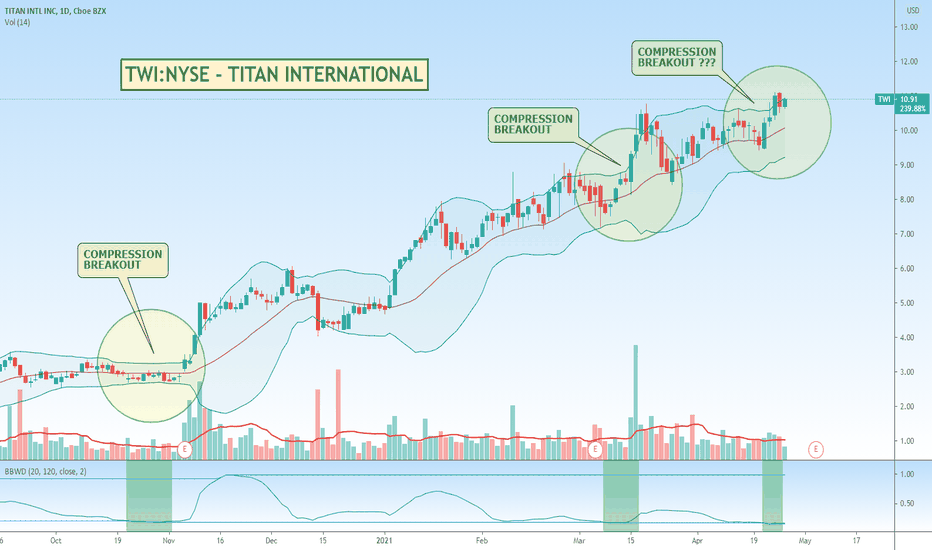

Will This New Script Help Find and Confirm Bollinger Breakouts?Bollinger breakouts are one of my favourite ways to play short term trades. I spotted this script from @norok earlier today and thought I would have a bit of a look to see how well it might work. It makes sense to me and the few times I have looked at stocks that have broken out, it seems to often call them so will see how it goes with this one. Normally for Bollinger breakouts I would like to see a big surge in accompanying volume which you can see the earlier breakout candles had, but not this latest one so much. Here's hoping I'm early to the party :)

You can find the script and much more information about it here:

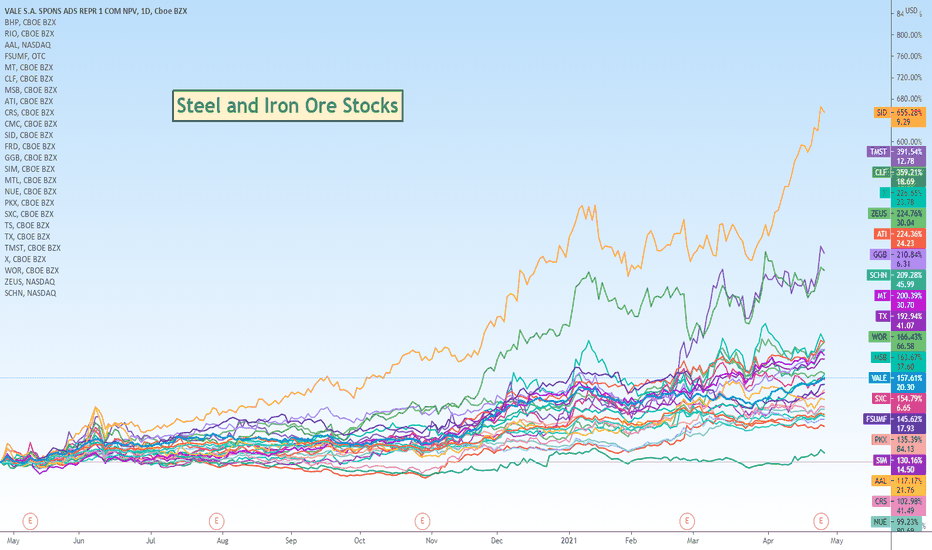

Steel Hits Fresh Highs in China. Iron Ore Miners Struggle.I keep reading articles about the massive demand for steel in China and its growing scarcity as iron ore miners and steel manufacturers struggle to keep up so for fun I thought I would plot a whole heap of them together and see which ones were performing the best. Gives us a nice looking chart.

You can easily find and go through these via an often overlooked, but AWESOME part of the site here:

tradingview.sweetlogin.com

Hint: Click on the PERFORMANCE tab and sort by whichever time period you like.

Top U.S. trade negotiator discusses vaccine ramp-up with NovavaxGovernments around the world are desperate to ramp up inoculations in fear of a second or third wave of Corona coming through and potentially decimating their economies if they are forced to shut down again.

Novavax going through a Bolly Breakout with significant volume. Will it be another bull run?

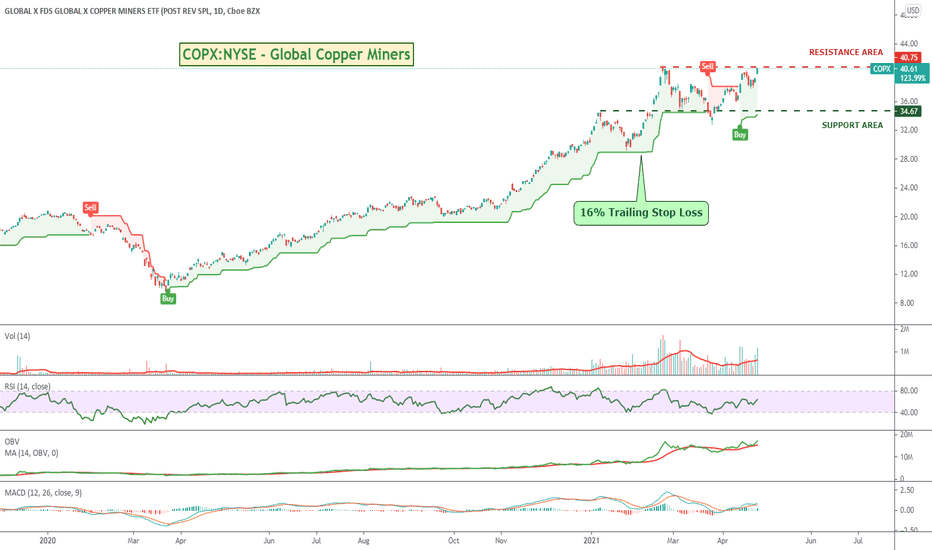

How To: Ride the Copper Boom while Protecting Your Downside. I have been seeing articles about Copper shortages but hadn't really paid much attention to them. My interest was sparked looking at one of the latest TradingView Editors Picks which was a chart of Copper pricing and how it has been in a nice steady uptrend for the last year.

What's driving the demand in Copper and why do I think it might continue upwards - well apparently copper is critical for solar panels, wind turbines, electric vehicles and battery storage - and there has been a massive surge in demand, but the miners haven't been expanding rapidly enough or finding enough new sites to keep up with the volume.

I thought I would go looking for a Copper Mining ETF so I can invest in the industry overall as opposed to individual companies and liked the look of COPX which is now up close to 300% since March last year. The advantage of the ETF is I want to hold it for a longer period than an individual company so I am looking for gains - but with less volatility. Makes it more suitable for some of my long term holdings. With COPX I get a basket of miners across Canada, the United Kingdom, Hong Kong, United States, India, Australia, Mexico, Poland, Sweden, and Japan so in theory might reduce some of my risk as they will be able to supply companies globally without so much political interference or local issues out of their control such as natural disasters. That's the theory anyway.

The chart looks nice and steady so I want to stay in the trade as long as possible - potentially years, until enough new mines have opened - or perhaps another battery mineral replaces copper.

So once I have picked my entry I will look to set a trailing stop loss to protect any reversals - but at the same time I want it wide enough to keep me in while there is any volatility. I don't want to get stop hunted along the way. Based on the last 12 months of price volatility a stop around 16% or so looks like it will meet this criteria. Things can of course change. If some new comes out about replacing copper as a key ingredient in these devices I may tighten my trail and look to exit earlier, but for now it seems about right.

COPX could be worth a look - OR - you could look to invest in some of the individual miners that make up the ETF and try and outperform it.

Have a look at either of these two ETF sites for more information with a breakdown of what's in the ETF. ETFs are fun :)

www.etf.com

etfdb.com

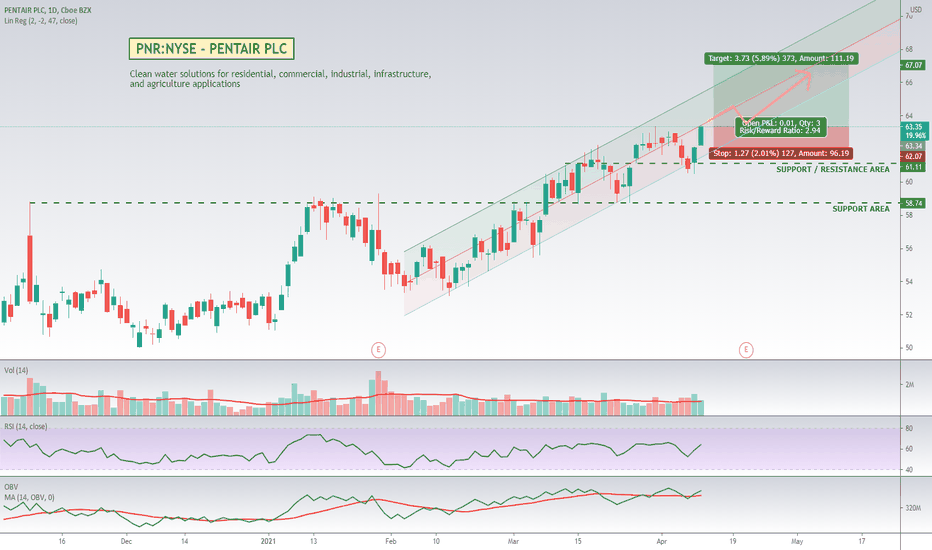

Pentair continuing to make Higher Highs. Just having a play around with some of the charting functionality and thought I would put this one of Pentair up. Stock looks interesting. It has been having a great run this year up over 100% gains and has bounced off support to new highs after a recent pull back so hopefully the trend will continue. Earnings aren't too far away so exercise caution.

About: Pentair provides clean water solutions for residential, commercial, industrial, infrastructure, and agriculture applications.

Facebook back at highs.I haven't looked at many of the bigger technology stocks for a while, but it looks like some of the bigger names have been enjoying a resurgence of late.

Facebook is finally back at all time highs after having pushed through multiple layers of price resistance.

I would expect a pullback here - possibly back down to $300 just to confirm and set that base, but any kind of positive price action will certainly be worth a look.

Good to see a couple of the FANGS making comebacks. Microsoft worth a look as well. The others still a bit messy.

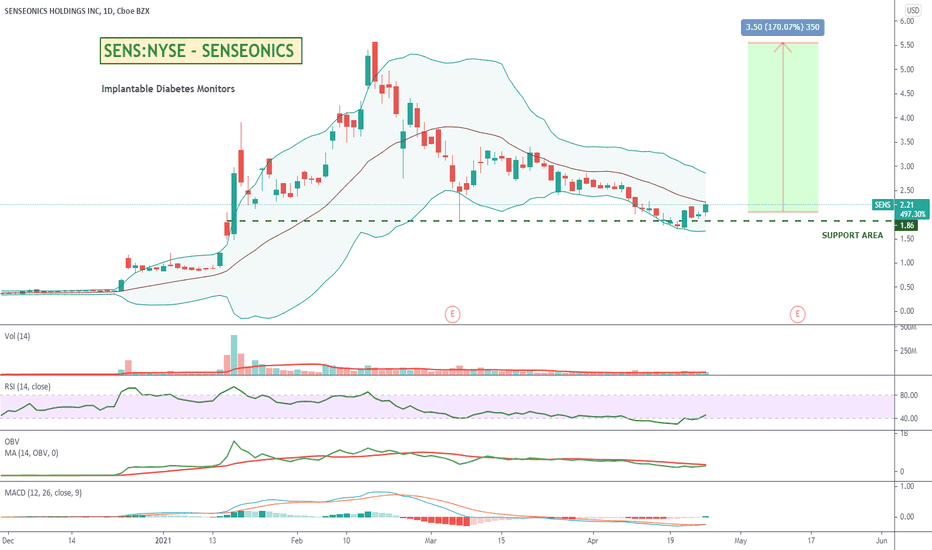

Senseonics - Implantable Glucose Monitoring SystemsFrom their website, Senseonics are the creators of the first and only Long-term Implantable CGM (Continuous Glucose Monitoring device).

Bought this in the pre-market - only catch is I cant remember how I found it. I normally look for stocks that have unusual volume and have broken above their upper Bollinger on the daily or hourly, but in this case it doesn't seem to meet either of those criteria so really not sure how I found it - but hey I got lucky. I bought it in the premarket and it ended up climbing a bit over 10% of which I caught a bit over 8% of the move, so happy with that.

I think a lot of us as we age and obesity levels rocket will sadly end up with a similar type device. Will this one be the long term winner, who knows, but what I liked was that there is plenty of upside on the chart and these medical type electronic devices can often run up hard on any kind of positive news.

Pretty speculative, but might be work a look.

Volcano Trade - Sorrento has a history of big explosions.Again, just for something different, I thought this looked interesting. Has a habit of quite big runs on positive news. Looks like we might be due sooner or later for the next big one.

Super duper speculative. 100% guessing on this for the fun of it. MACD turned positive, RSI heading up, so never know. Perhaps a rising buy with a trailing sell.

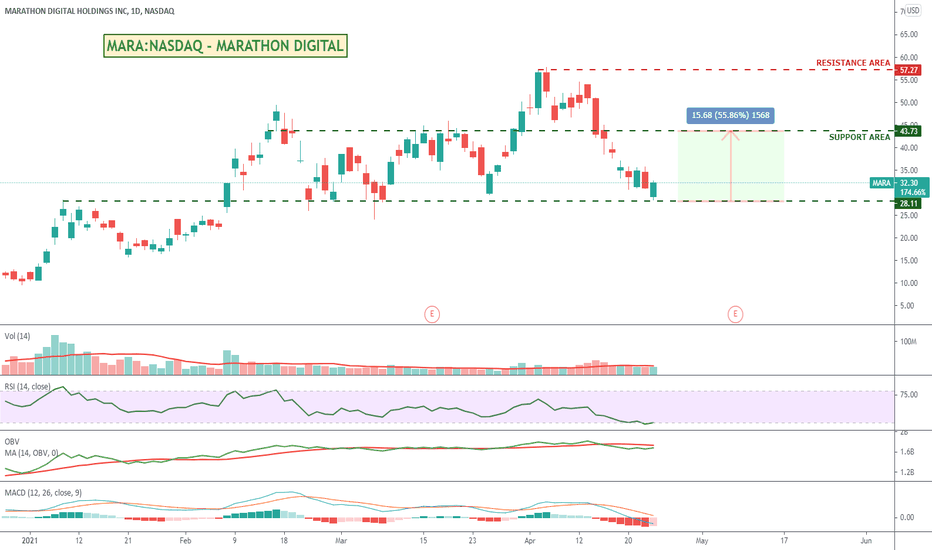

MARA trading in a range. Might be a quick win.Mara has been trading in a range and looks to have bounced back off its support area. If it is up today could be worth a close look. Supporting indicators look like an uptrend is forming.

Bit of potential upside there if it runs. Certainly a fairly popular pump stock by social media posters.

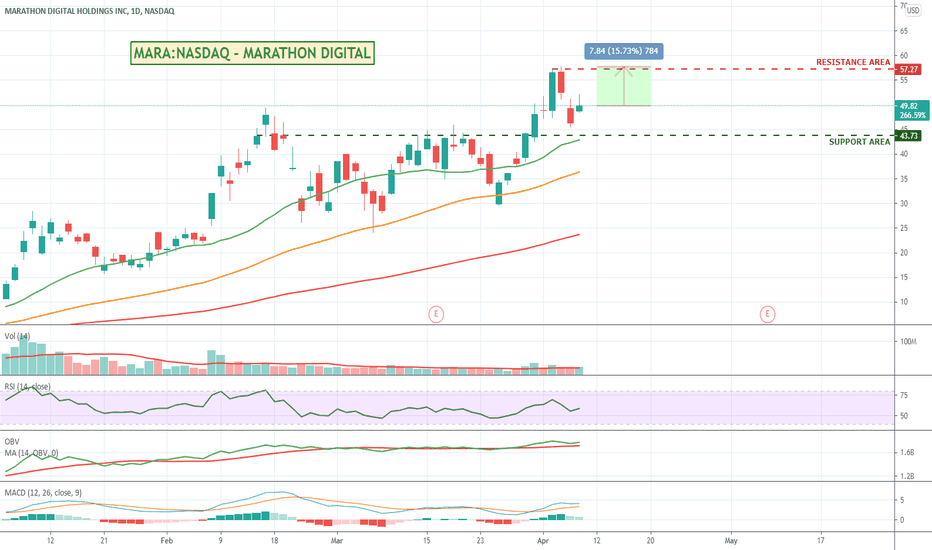

MARA looking like recovering after a pullback.MARA has been an absolute beast of a stock this year up and incredible 11,500% !!! over the last 12 months.

Had a bit of a well deserved pullback, but looks like it will resume its run.

I suspect though that if Bitcoin crashed Mara will come down just as quickly so keep a close watch if you decide to buy.

ASX based XERO on a European Acquisition TrailXero has been recovering nicely and managed to move up through a couple of fairly solid resistance points.

It is starting to approach old time highs again, so might be a bit of a short term pullback in the next couple of days, but it is looking good in the medium to long term, and there really doesn't seem to be much in the way of competition these days - certainly not in the Australian landscape.

With their recent purchases of Swedens Tickstar (e-invoicing specialist) and Workforce Management Platform Planday it looks like they will be expanding their service offerings and hopefully in turn attracting more revenue and any businesses who have resisted switching across while awaiting those functionality changes.

Any stock market recovery will likely be led by tech stocks, so Xero is certainly worth keeping an eye on.

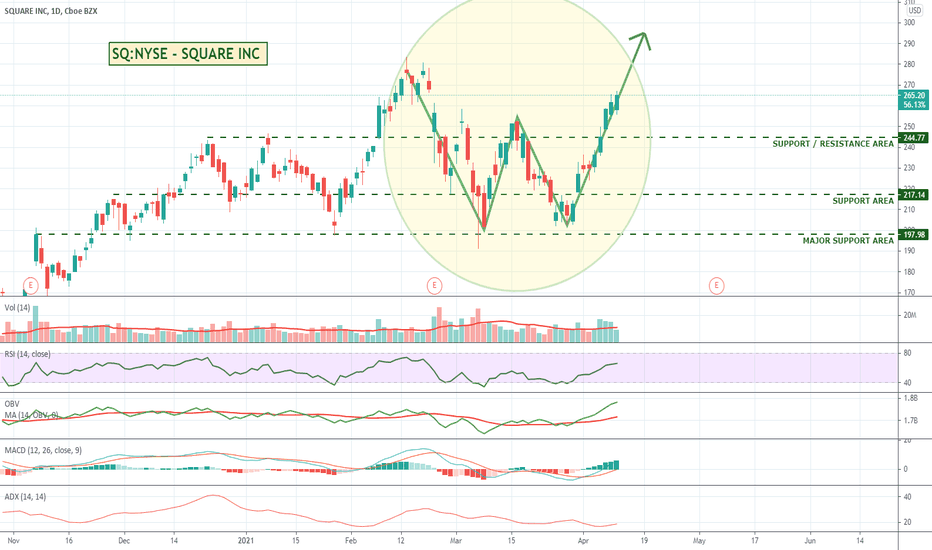

Square put in a double bottom which is often a bullish signal.Square has been looking good lately after having spent some time building a bit of a base from which to potentially move higher.

Double bottoms are often seen by technical traders as a good signal that the stock is likely to continue to move higher. You can always expect a bit of a pullback, but overall it is a pretty bullish signal.

Worth watching.

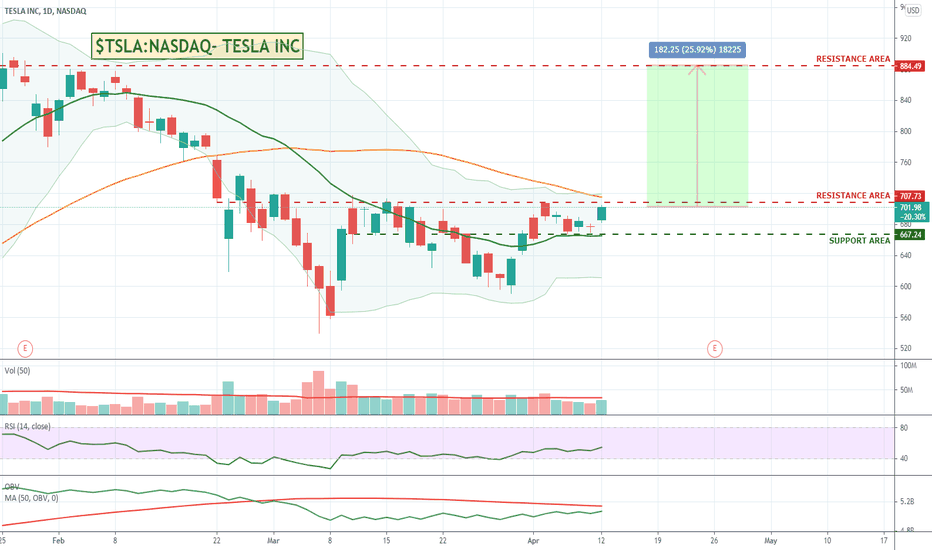

Tesla getting closer to crossing its 50 Day Moving AverageTesla has been struggling sideways for a while now which has been holding back the rest of the EV market, but it looks to have found a base and is getting closer to re-crossing its 50D MA which is normally a good bullish sign for investors.

There have been a few more analysists looking more closely at Tesla this week and re-rating its target price above the $1,000 mark with a lot of interest in their energy generation and storage business more so than their car business. Solar and battery technology and storage is what is driving these higher analyst re-ratings.

It will be interesting to see what happens coming up to earnings especially with the global chip shortages and what impact that has short term on Tesla pricing. Fingers crossed China sales provides the needed bump.

I am REALLY interested in the idea that Tesla could one day become one of the worlds largest decentralised (and that is the key word) energy providers with Tesla Solar Tiles and a Powerwall in more and more homes and office buildings. They could majorly disrupt some of the biggest energy markets around the world.

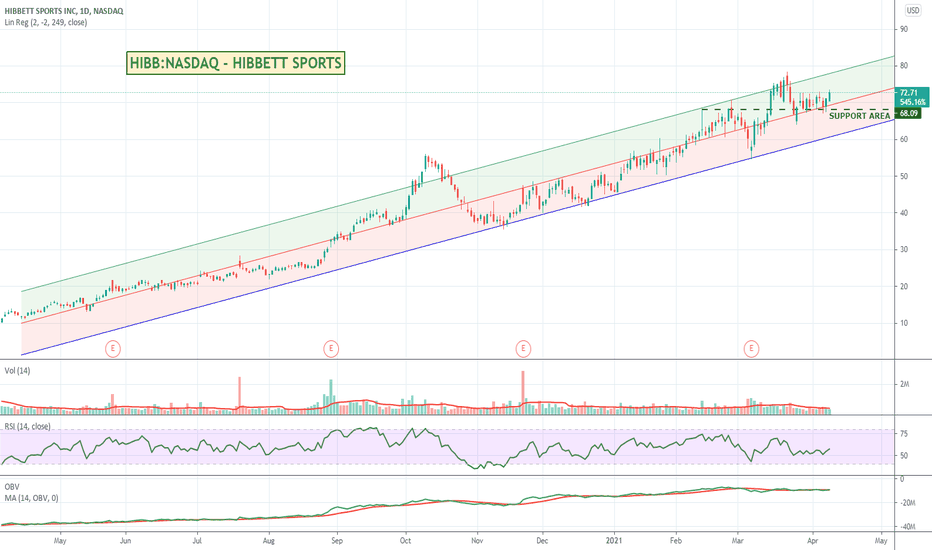

HIBBETT SPORTS - 1,000+ stores selling sporting goodsHibbett has had a great 500%+ run over the last 12 months and announced that they are expecting their revenues and customer retention to continue to build in the post-Corona lockdown environment.

Great run so far. Worth a watch.

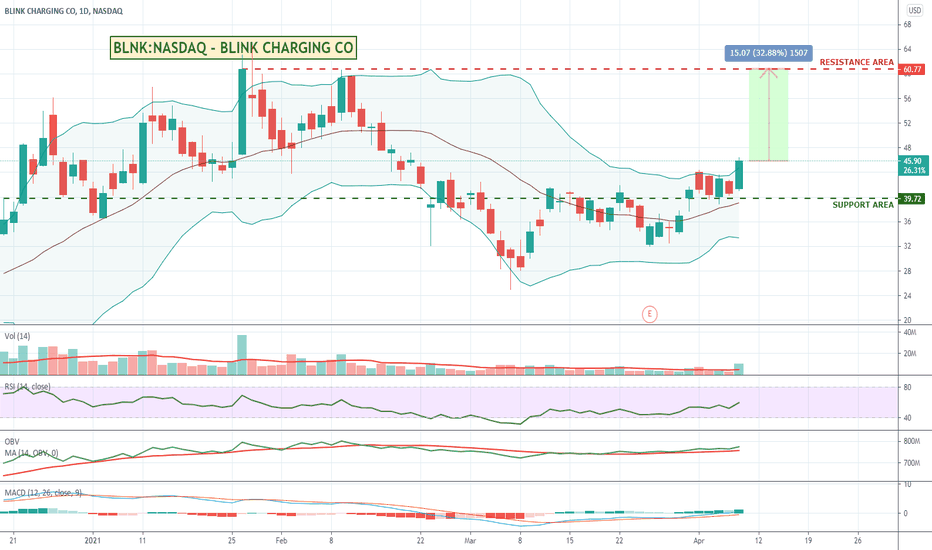

Blink Charging - Bollinger Breakout with Higher VolumeAnother potential breakout with Blink. Sometimes with these they will pullback the next day before running so I would put my buy price a little higher than yesterdays close probably around $46.50 or so. I like that the OBV is showing steady buying pressure coming back into the stock after EVs and associated technologies have been struggling lately.

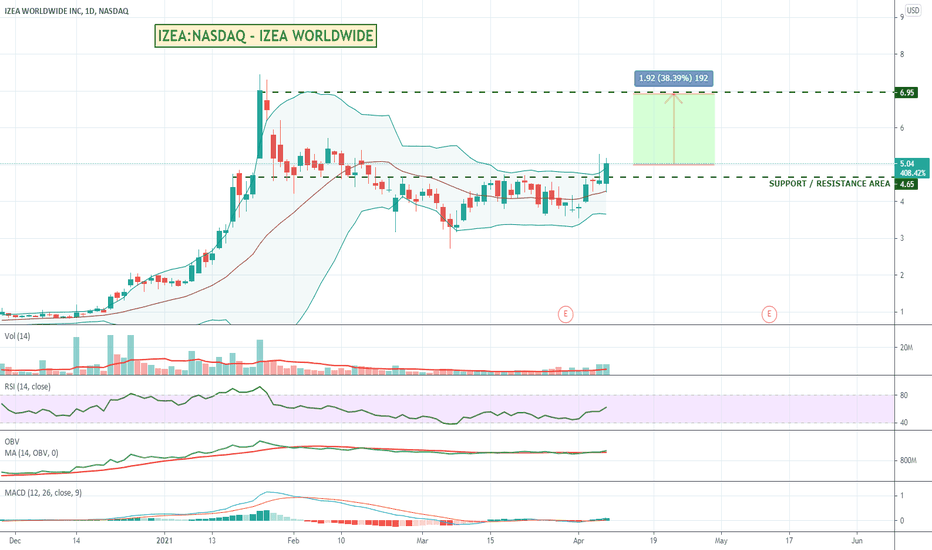

IZEA - Bullish on Bollinger Breakout with Unusual Volume.Just having a bit of a look around for possible breakout and quite like the look of this. Super speculative but has had some pretty good gains this year so far. Izea connects social media influencers with money (ie advertisers) which I think is quite an interesting business. Might be worth keeping an eye on just for something a bit different.

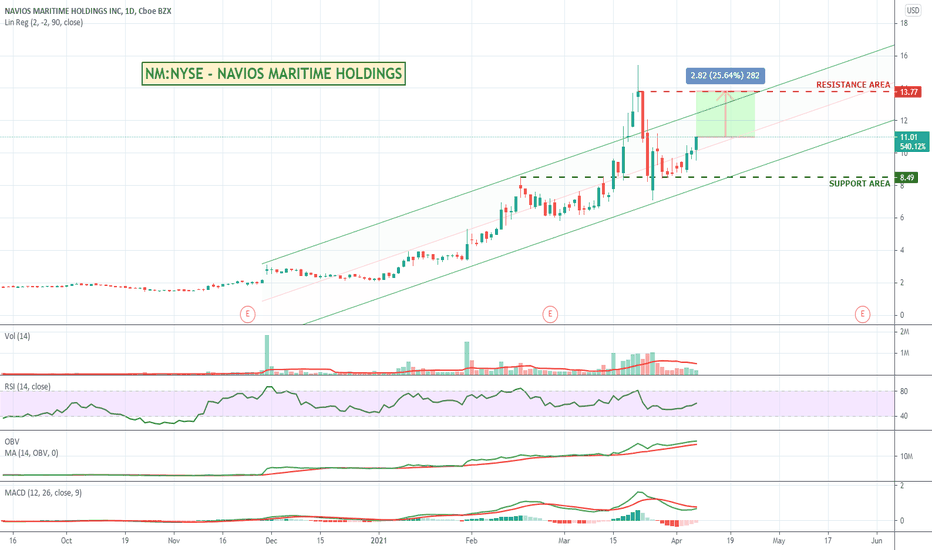

Navios Maritime recovering nicely after the Suez Canal blockage.Navios looks like it is recovering nicely after its pullback with the Suez Canal incident that occurred over the last couple of weeks. It is back up above its 20 day moving average, but Id like to give it another day or so just for confirmation and to see some of the other indicators turn positive. Perhaps a stop buy order 2% or 3% above its current price. Worth a look.

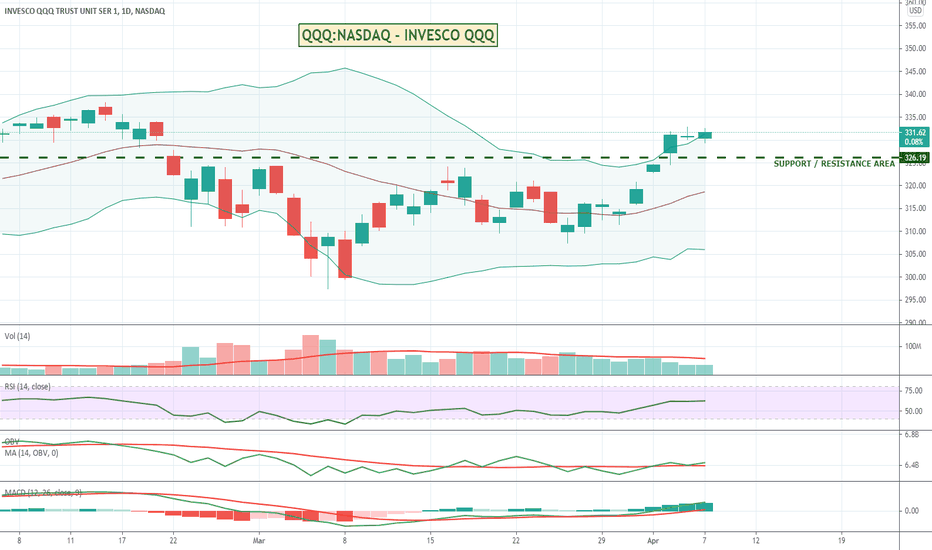

Will the NASDAQ continue to recover or are we in for a pullback?I like to trade the more speculative tech and future energy type stocks so its been an ugly ride on these on the NASDAQ lately. ARK type ETFs getting punished and the stocks they contain.

Nice to see that the NASDAQ / QQQ is back up above its 20 day and through a resistance area, but Volume is still looking weak.

OBV and MACD hopefully hinting at an upward move over the coming days.

Might be a bit of short term weakness still until it can consolidate a bit better at this level and stay above the resistance area. Time will tell.

I've deliberately left this chart as a NEUTRAL opinion to see what others think.

What is your view? LONG or SHORT and over what period?

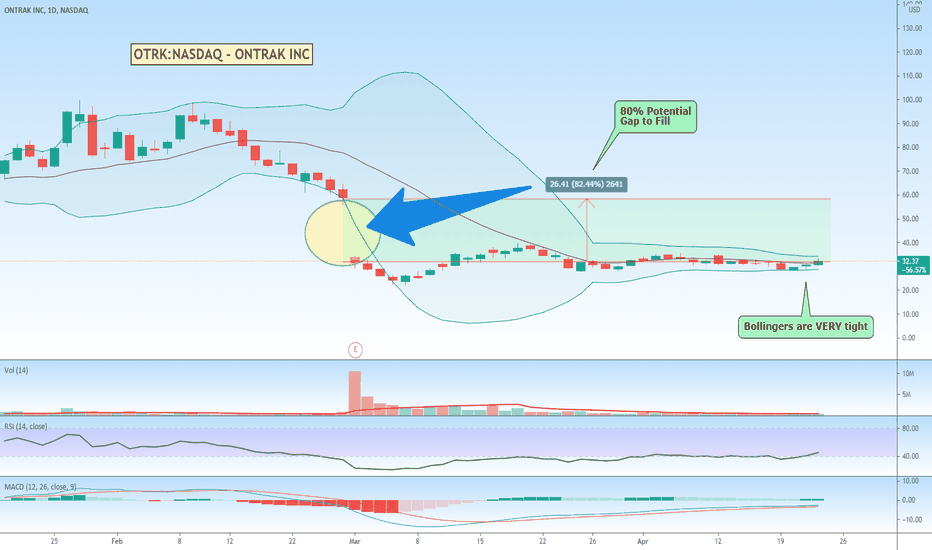

Ontrak looking very compressed with a big gap to fill.Just one for interest. I found it on a site that lists the top most shorted stocks and OTRK sites at around 40% short interest.

I'm wondering if there might be a short squeeze about to play out.

Bollingers are crazy compressed and there is a big 80% gap so even a small rise could be interesting.

A stop order perhaps around the $35 to $36 mark could be an interesting way to keep an eye on it.

I haven't tried to play one like this before, so keen to see what happens.