Alibaba Rising from the Ashes after $2.8 Billion fineAlibaba was fined $2.75 Billion by Chinese regulators and so of course immediately shot up 9%.

Now that there is some certainty again, if the stock manages to continue to move up through the next resistance area it might keep going to close that gap and put on another 10% or so.

Could be a good swing trade, just need to see if it can get to the $246 mark.

Search in ideas for "zAngus"

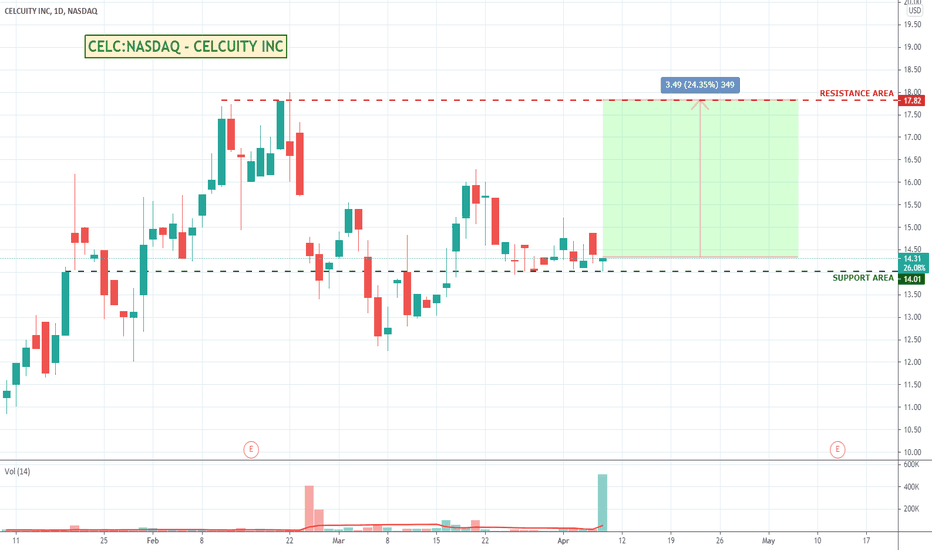

Celcuity's Breast Cancer Drug Trial Shows Encouraging ResultsLook at that big fat volume bar off the back of the successful trial news. The company's stock price has been growing steadily up some 164% over the last 12 months, and this news could help propel it back up to previous highs so there might be a bit in it. Worth a watch.

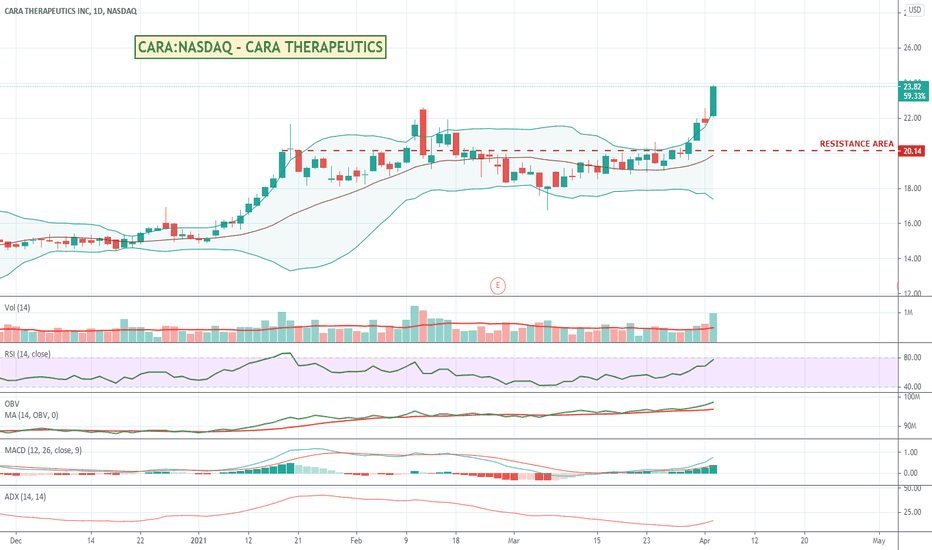

Cara Therapeutics to Join S&P SmallCap 600 - Bullish NewsCara joining the SmallCap 600 is normally a pretty bullish signal as it means more of the larger brokers and market makers will start to keep an eye on it, as well as various funds and etfs might look to buy as well. Worth keeping an eye on it.

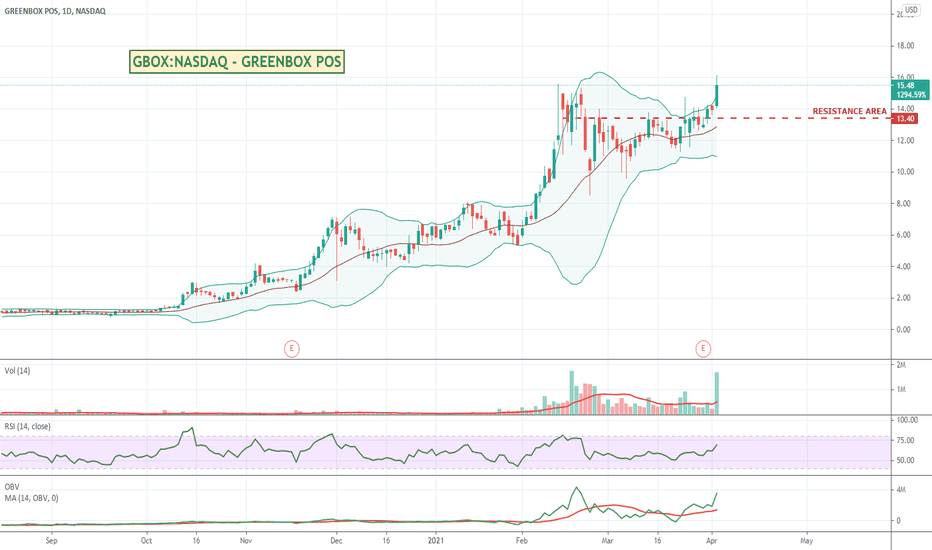

Greenbox POS up 1200% leveraging Block Chain TechnologyGreenbox looks interesting, leveraging block chain technology to drive point of sale transactions and business payments. I would have thought too niche, but has made massive gains over the last 12 months and had a big volume break on earnings. Bollinger Breakout bullish.

Worth keeping an eye on.

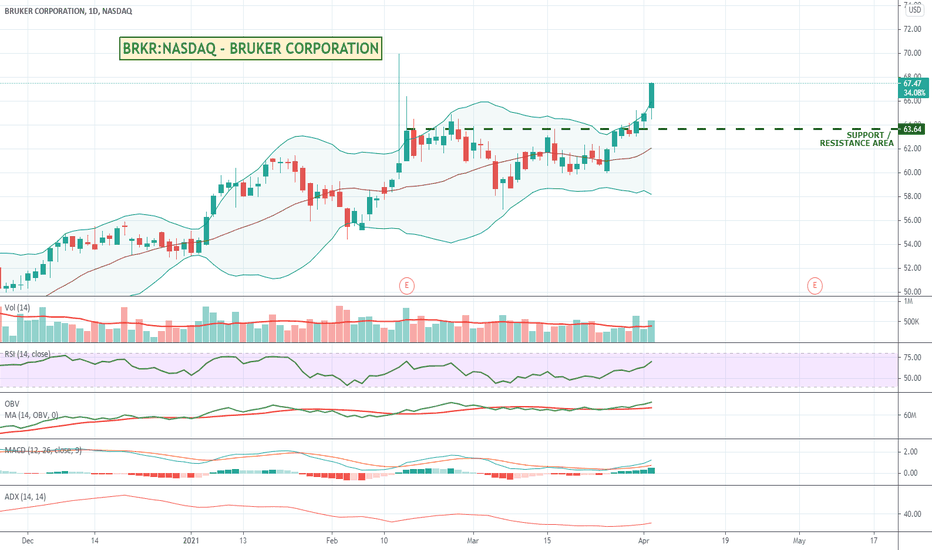

Bruker looking bullish.Again just another trade idea where for the fun of it I used the TradingView Stock Screener to look for stocks showing bullish signals from a wide variety of indicators. Might be a little extended so could pull back, but looks strong across most of the more popular indicators I have added.

From their website: Bruker is enabling scientists to make breakthrough discoveries and develop new applications that improve the quality of human life. Bruker’s high-performance scientific instruments and high-value analytical and diagnostic solutions enable scientists to explore life and materials at molecular, cellular and microscopic levels. In close cooperation with our customers, Bruker is enabling innovation, improved productivity and customer success in life science molecular research, in applied and pharma applications, in microscopy and nanoanalysis, and in industrial applications, as well as in cell biology, preclinical imaging, clinical phenomics and proteomics research and clinical microbiology.

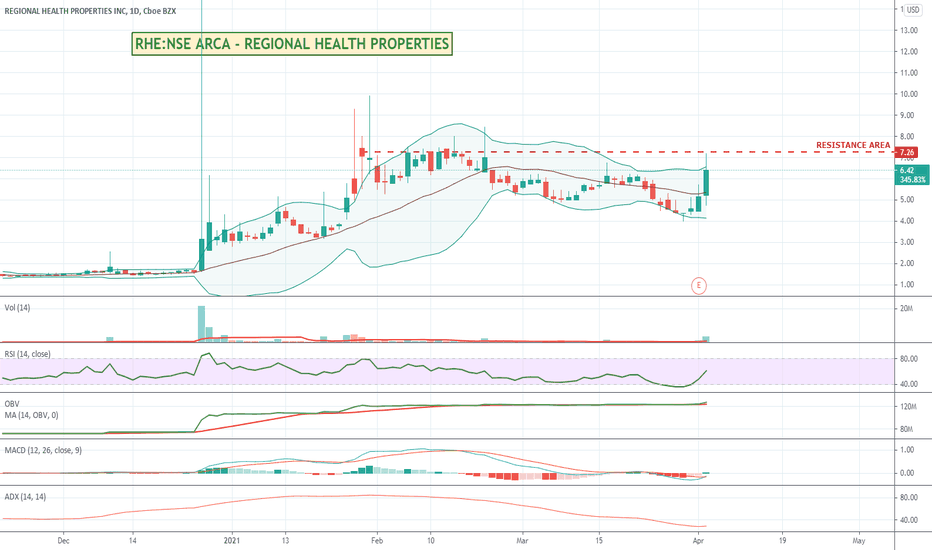

Regional Health Properties running on earnings.Just having a play around looking at stocks that tick some of the stronger indicators bullish signals. I'd like to see it break above its resistance area before I would take a trade, but I do like the business itself. With a rapidly aging population increasingly needing care facilities, this could be a good longer term play. Up 470% over the last 12 months and still a sub $10 stock which often makes the more attractive.

From their website: Founded in 1991, Regional Health Properties, Inc. (the successor to AdCare Health Systems, Inc. | NYSE American: RHE) is a self-managed healthcare real estate investment company that invests primarily in real estate purposed for senior living and long-term healthcare through facility lease and sub-lease transactions. The company currently owns, leases or manages for third parties, 30 facilities.

Interesting.

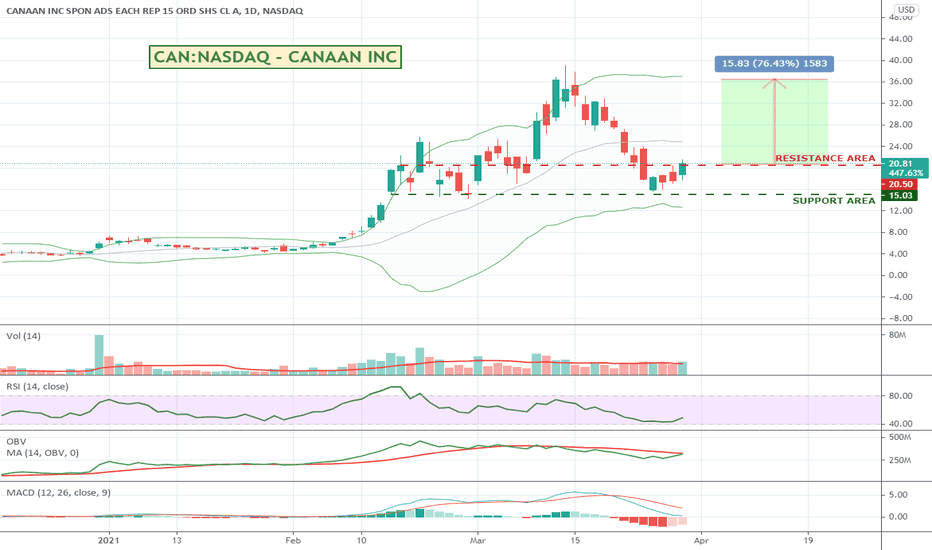

Canaan - Bitcoin Mining Hardware Solutions and AI Chip MakerLeveraging off the surge in Bitcoin popularity, Canaan is an interesting company that focuses on pure horsepower for CPUs processing Bitcoin and more importantly AI.

Big recovery today after getting back to a good support area, with quite a bit of upside to old highs. At $20 a share could be a good target for retail investors particularly to push.

From their website: Canaan Creative, known simply as Canaan, is a China-based computer hardware manufacturer. Established in 2013 by N.G. Zhang, Canaan specializes in Blockchain servers and ASIC microprocessor solutions for use in bitcoin mining. Initially, Canaan mainly developed FPGA products based on the SHA-256 algorithm

TradingView Description: "Canaan, Inc. provides high-performance computing solutions to efficiently solve complex problems. Currently, the company is focused on the research and development of advanced technology, including such areas as AI chips, AI algorithms, AI architectures, system on a chip (SoC) integration and chip integration. Using the AI chip as its base, Canaan has established an intellectual value chain. The company also provides a suite of AI service solutions and is able to tailor these solutions to the needs of its partners."

Worth keeping an eye on.

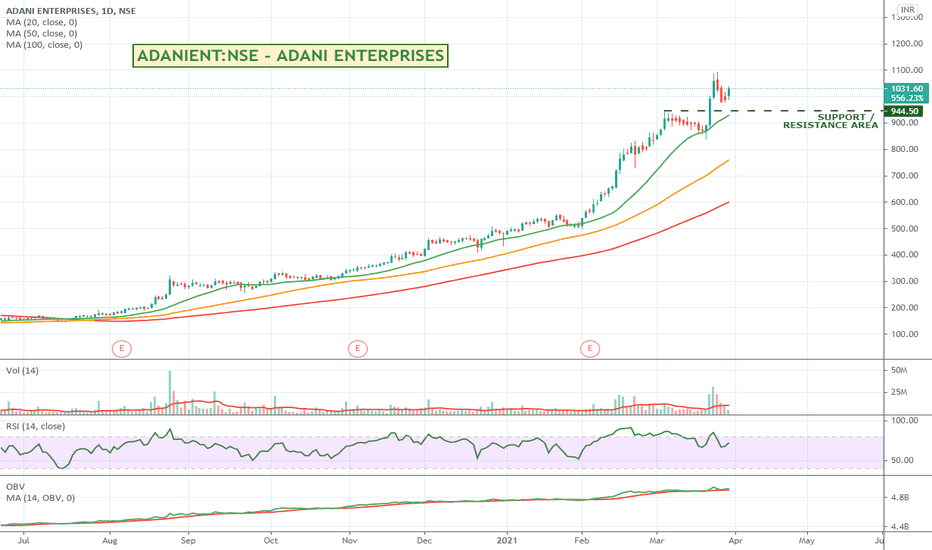

Adani Enterprises - Fuelling the Growth of the Indian Economy.Just having a look at what stocks are running well on the global market and Adani has been consistently putting in higher highs over the last 12 months. Up over 700% and just breaking through that $1,000 INR price point after a pull back as a business firmly entrenched in the infrastructure and energy sectors they are well worth keeping an eye on.

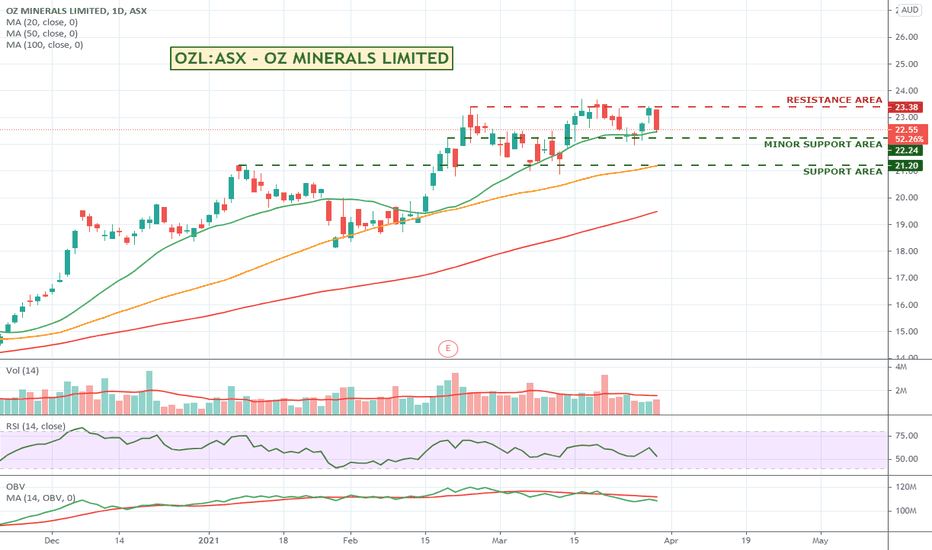

Aussie OZ Minerals trading sideways. Needs to push resistance. Oz Minerals has had a great 12 months up a bit over 200% with a pretty consistent run. It is currently having a hard time getting through that $23.50 barrier and was rejected again today with the overall ASX being down around 1% so I wouldn't read too much into it. Hopefully it will bounce off its 20 day moving average and have another run at it, but if it drops below its minor support area then I'd stay away. Worth keeping an eye on it but there are more sellers than buyers in the queue looking at Commsec (94 buyers for 139,436 units vs 133 sellers for 206,960 units) so I'd want to see it break above that resistance area before being too excited about it.

Plug Power, Brookfield Renewable to build green hydrogen plantPlug finally having a good day up 10% as I'm posting this. I have a strong belief in Hydrogen as a future energy source so have been holding onto Plug despite being down 10% from my buy price. Its one of those more emotional type trades for stocks that I just like having in my portfolio. I have a stop at $30 which was a pretty strong support area in the past, and with so much upside back to old highs, I'll keep hanging on :)

Chewy Pet Supplies looking interesting after earnings.The pet supplies space was particularly bullish last year with everyone staying home because of Covid and pampering their pets so I have a few of them on some of my watch lists.

Chewy has had quite a big pullback, but yesterday their earnings (or rather how much they were losing) came in better than expected and saw buyers move back in.

OBV has broken up through its MA 14, and RSI has crossed back above 40. Both signs that a bit of a recovery might be underway. Its been hovering around its support area for a while without falling back through it, so would seem a lower level of risk if you wanted to take a punt.

Might be worth a look.

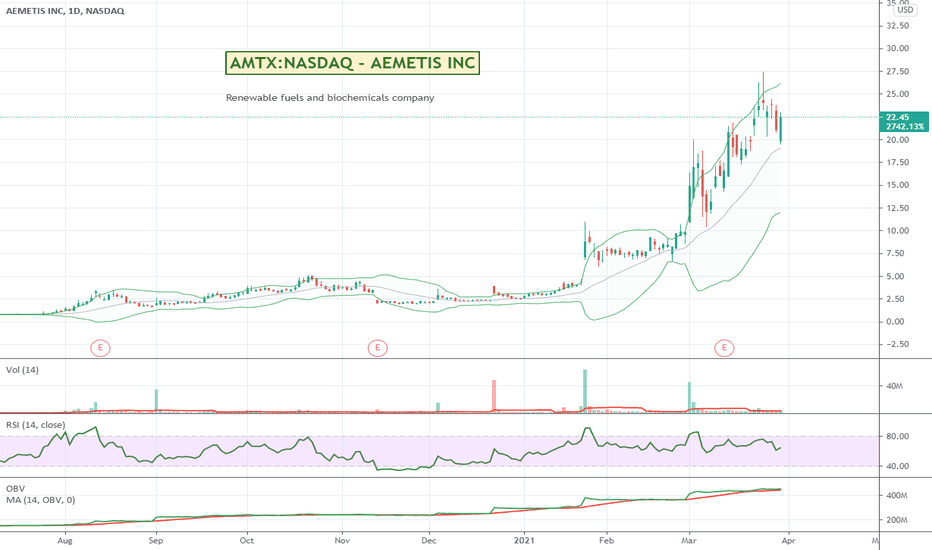

AEMETIS alternative fuels has gained 4200% over 12 months I first posted about Aemetis when it was $1.95 and it looked interesting then. Of course I didn't buy in and it is now sitting at $22.45.

RSI is looking at a reasonably bullish area at 65 and pointing up. Looks like on past history you can ride the RSI into mid 80s before expecting a pullback. I like that it is still a low $20's stock so the retail buyers should find it attractive still.

From their website: Aemetis is an advanced renewable fuels and biochemicals company focused on the production of advanced fuels and chemicals through the acquisition, development and commercialization of innovative technologies that replace traditional petroleum-based products by conversion of first-generation ethanol and biodiesel plants into advanced biorefineries.

Could be worth a look.

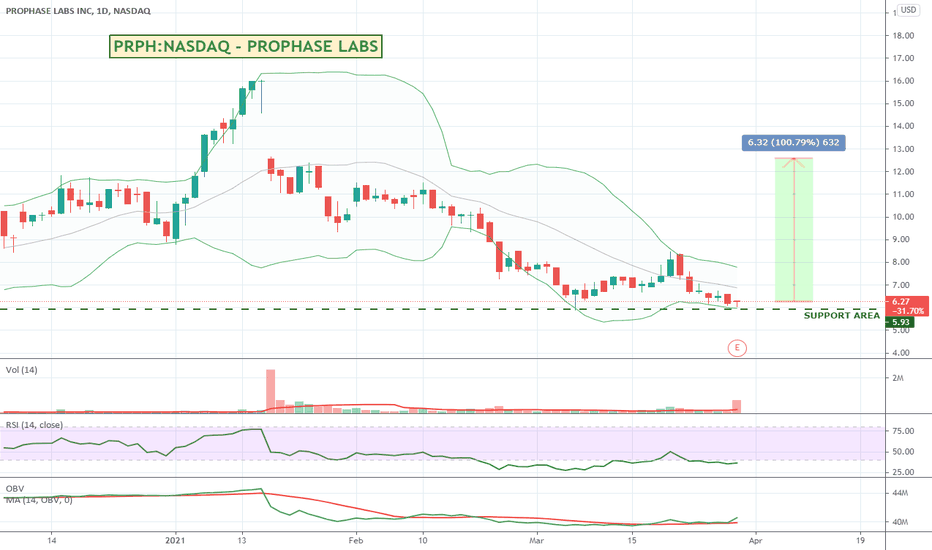

Prophase buys Covid Vaccination & Testing “Passport” SolutionWith increasing news chatter around countries requiring people to have proof of Covid vaccinations before allowing travel, this headline caught my eye.

The stock has been on a bit of a downwards run, but this might be interesting enough to turn it around. Its got a pretty good support are close by prior to the news which should reduce some of the risk if you decide to take the trade.

Lot of upside to old highs if it does run.

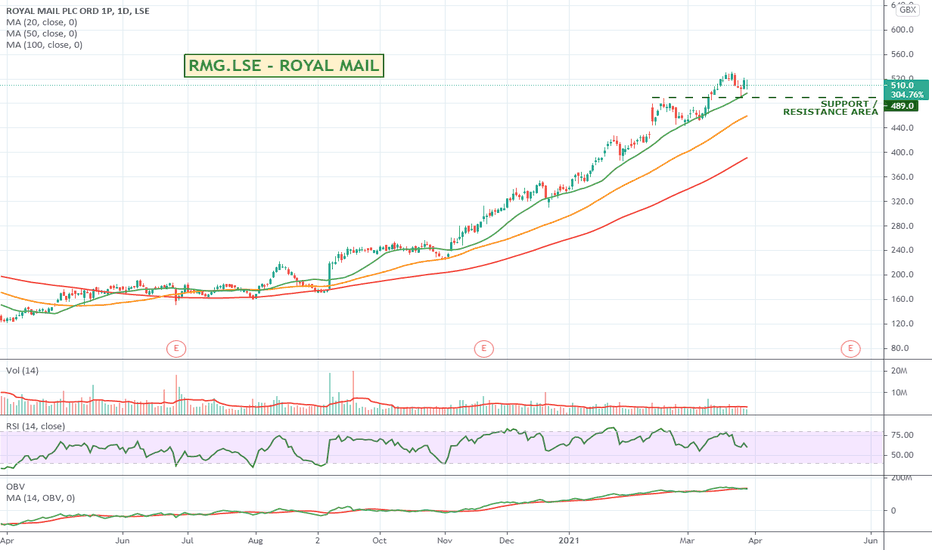

Hooray for the Royal Mail - Up 300% and still room to growAnother international stock on the London Exchange, Royal Mail has been taking great advantage of the boom in ecommerce deliveries over the Covid lock down. Up some 300% over the last 12 months, they are still down from some of their historical highs.

Describing themselves as an international business, focused on developing a modern, optimised and efficient network to deliver letters, parcels and new products they operate across 40 countries and nation states worldwide, 36 in Europe and, following recent acquisitions, eight states in the Western US and Canada. With some 160,000 employees their "about us" is well worth a quick skim read to appreciate how big they really are: www.royalmailgroup.com

Looking at their Monthly Chart going back to 2014 you can see the share price was up around $620 so roughly another $100 (or around 20%) from where they are now if they continue their current run.

Could be worth a look.

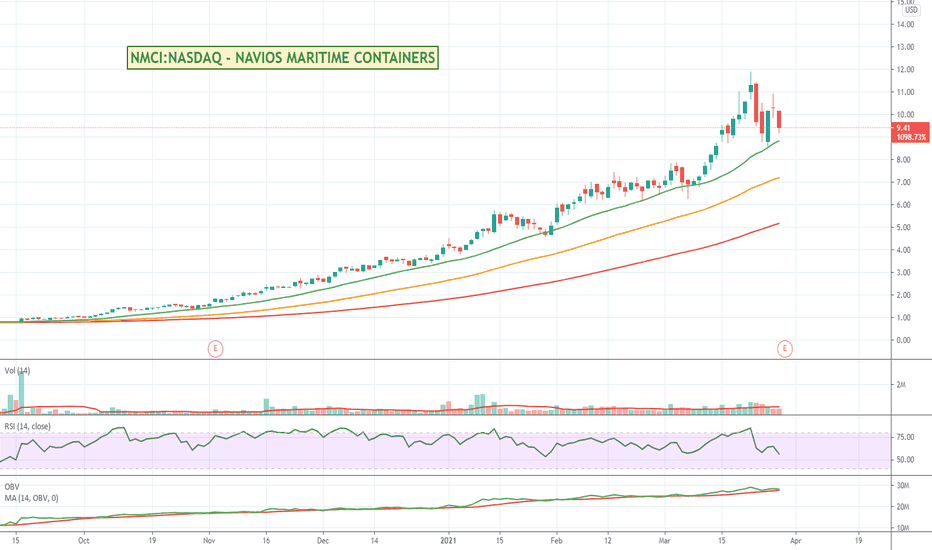

Navios Maritime is up 1000% over the last 12 months.Another strong containership runner that has enjoyed extraordinary growth over the last 12 months. It will be interesting to see if they will recover after the pullback caused by the stuck containership in the Suez Canal now that is has been freed.

From their website: Navios Maritime Containers L.P. (“Navios Containers”) is a growth-oriented international owner and operator of containerships. Navios Containers was formed in April 2017 to take advantage of opportunities in the container shipping sector.

I also like that it is still a sub $10 share which might encourage some of the more speculative market traders drive some of its price action.

Worth keeping an eye on - but be careful of how it reacts to earnings which are due.

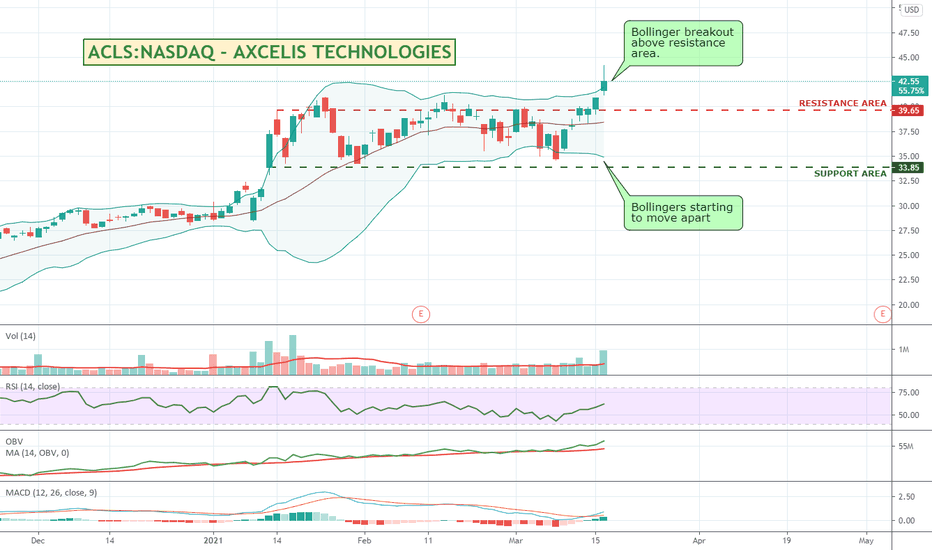

AXCELIS TECHNOLOGIES - Bollinger Breakout Above Resistance AreaWith the global semi conductor shortage I thought I would have a bit of a look around at some of the equipment suppliers and see if any of them were looking interesting.

From their website: At Axcelis, we have a single goal: to help semiconductor manufacturers achieve the highest quality and yield, with the lowest cost of ownership. We deliver on that goal with ion implant platforms based on unique enabling technologies that provide unmatched purity, precision and productivity. The result: competitive advantage for our customers—and rapid growth for Axcelis. (Source: www.axcelis.com)

So why do I like Axcelis.

I thought for the fun of it I would give a bit more insight into what I look at. I can do all of the below in one quick glance at the chart and don't need to use most of the indicators, but they are nice for confirmation.

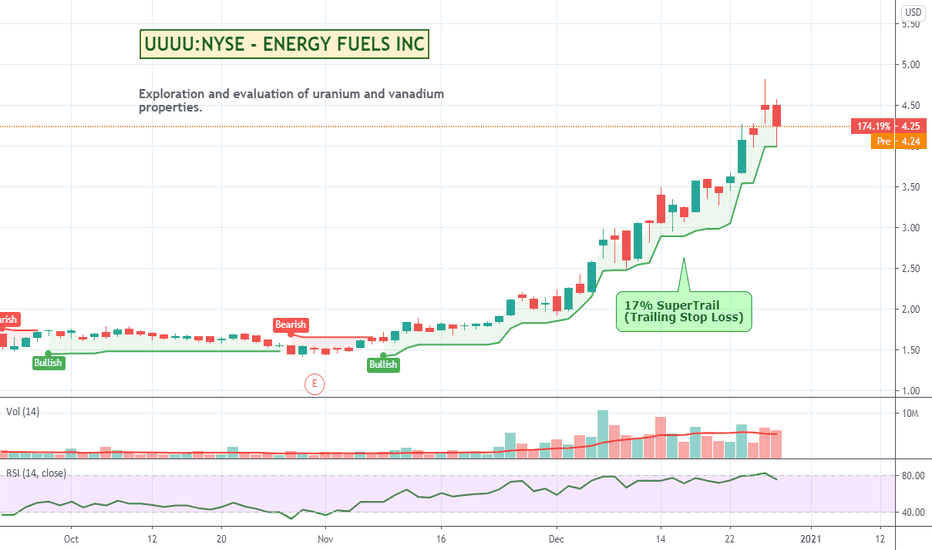

I found Axcelis by using the TradingView Screener to look for Bollinger breakouts with higher than normal volume.

The upper and lower Bollingers are starting to move apart indicating growing momentum.

They are up 217% year to date showing positive momentum and investor belief in the business.

They have broken out above a previous significant resistance area.

The middle Bollinger line (20 period moving average) is horizontal, showing price has been stable moving sideways for a while consolidating and building a good base.

The RSI is moving up through 60 showing momentum and still at a good value area.

The recent volume is significantly higher than its 14 day moving average - so much higher than normal.

The On Balance Volume is moving away from its 14 day moving average showing buyers are currently in control and building.

The MACD has crossed up and is accelerating away from its signal line - and the histogram is building a darker green hill also showing momentum.

It is past earnings so I don't have to worry about earnings surprises.

I have read their about us on their website twice and I still don't know what they do - so must be high tech :)

Craaaazy people might look at the chart and call it a double-bottom or a W pattern which is often bullish.

Best of all it is up 1.7% in the pre-market confirming most of the above.

On the downside, there is always a chance that the price will pull back to re-test the former resistance line and perhaps re-run from there.

As such I would put a stop loss a bit below that and see how it all goes. If it ran for a while I would move to a 17% Trailing Stop Loss to it to hang onto it for a while.

Fingers crossed.

Hope the above was useful. Comment like if so :)

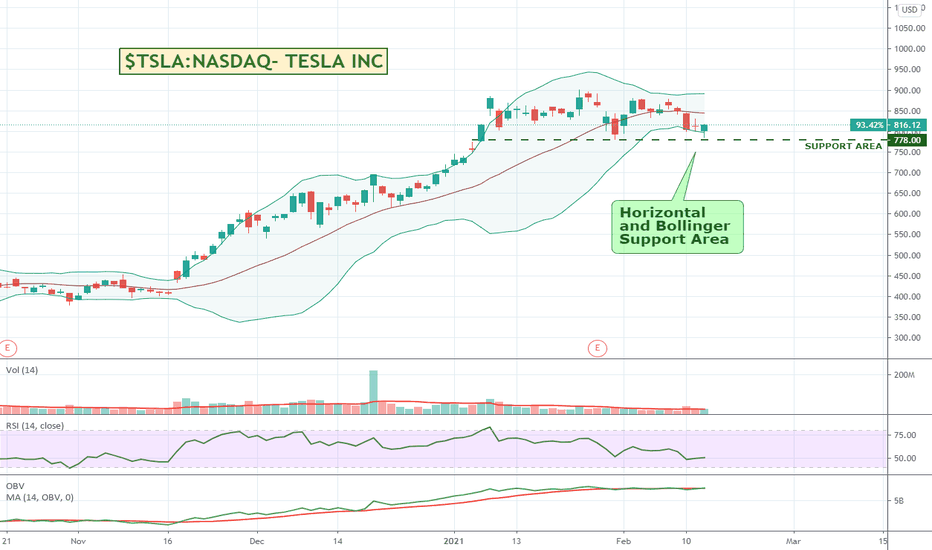

Has Tesla turned the Corner? Time to go long again?Tesla had a big 20% night last night with a strong overall market recovery.

It is still 30% down from previous highs.

RSI is pointing up again.

OBV is pointing up

MACD is pointing up.

Positive volume.

Risk of any earnings news to upset things still a way off.

I'm not expecting a pullback depending on what the wider market does, but will look to buy using a Trailing Buy order that will trigger a market order around a tight $675 with a 5% trail in case it does head back down. Post market bids look like they are already sitting around the high $680's.

Fingers crossed we are through this corrective phase.

Might be a short term 10% swing trade in it. Was just having a look at LHC Group which provides post-acute health care services to patients through its home nursing agencies, hospices and long-term acute care hospitals. Seems to be trading in a bit of a channel, so if it was to push above the current resistance area, there could be a quick 8% to 10% trade in it. Pretty strong support area just below, but I'd still run a fairly tight stop - especially the close it go to the upper resistance and as it approaches earnings. RSI and OBV both look good in terms of confirmation. I'd wait for the break above though. Might be worth a look.

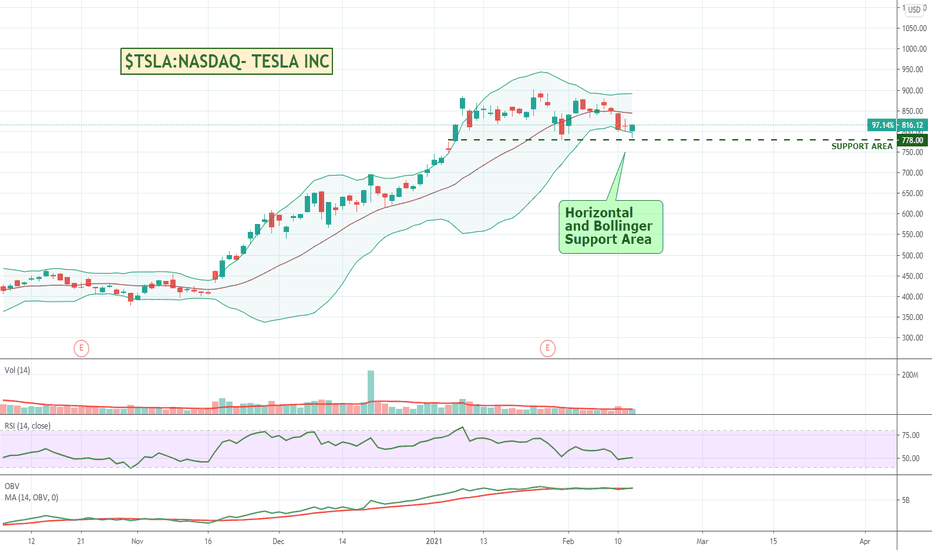

Tesla to Start Making Cars in India, Targeting Vast MarketTesla could be at a good technical buy area, and bolstered by the news of potentially beginning production in India - a MASSIVE market - could bode well for the stock.

RSI also at a good value area. If it starts moving up - especially through the RSI (14) 55 level it would be a good indication of bullishness returning to the stock now that it has spent some time consolidating.

Well worth a watch.

Tesla to Start Making Cars in India, Targeting Vast MarketTesla could be at a good technical buy area, and bolstered by the news of potentially beginning production in India - a MASSIVE market - could bode well for the stock.

RSI also at a good value area. If it starts moving up - especially through the RSI(14) 55 level it would be a good indication of bullishness returning to the stock now that it has spent some time consolidating.

Well worth a watch.

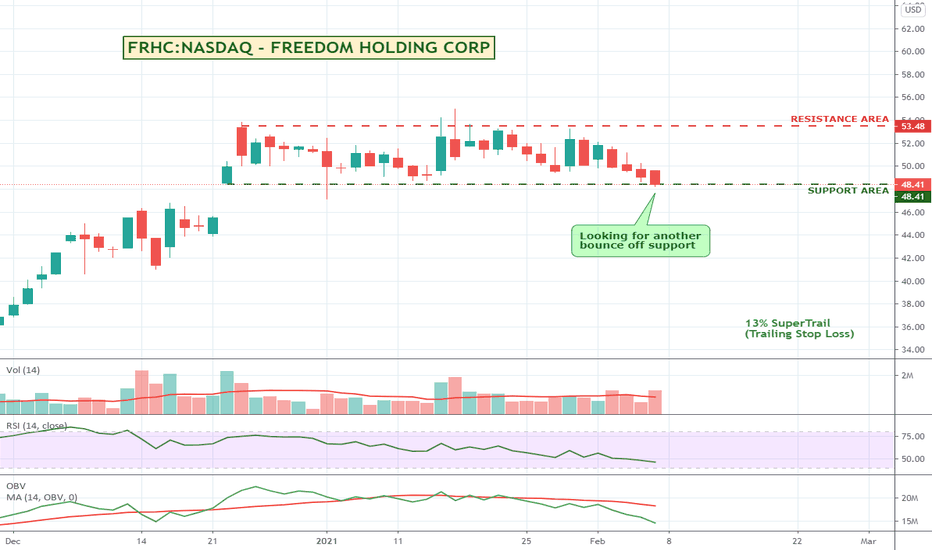

Looking for a bounce off support.Freedom Holding has had a monster 280%+ run over the last 12 months and has been taking a breather to consolidate its most recent gains. I've held for a while so am hoping for another bounce off support here. Hoping it will ricochet off the 50 day MA that's coming up to meet it as well.

12 Month View

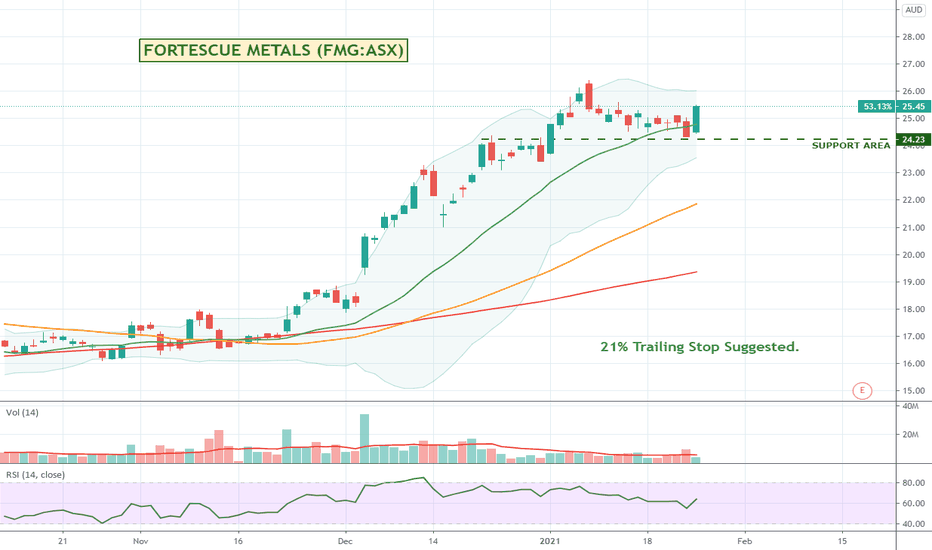

Fortescue getting into the Hydrogen businessI've been reading about Fortescue and hydrogen for a while now, and on the back of their already amazing Iron Ore run I think this will be yet another possibly even more important catalyst that should keep the FMG engine running even harder. It has had a nice pullback to support after its last run and with the RSI beginning its rise again, I think anything around the $25 mark is probably good value again. Worth a good look at any rate.

Not convinced about Hydrogen? Have a look at these two purer hydrogen plays for fun.

HZR:ASX

PLUG:NASDAQ