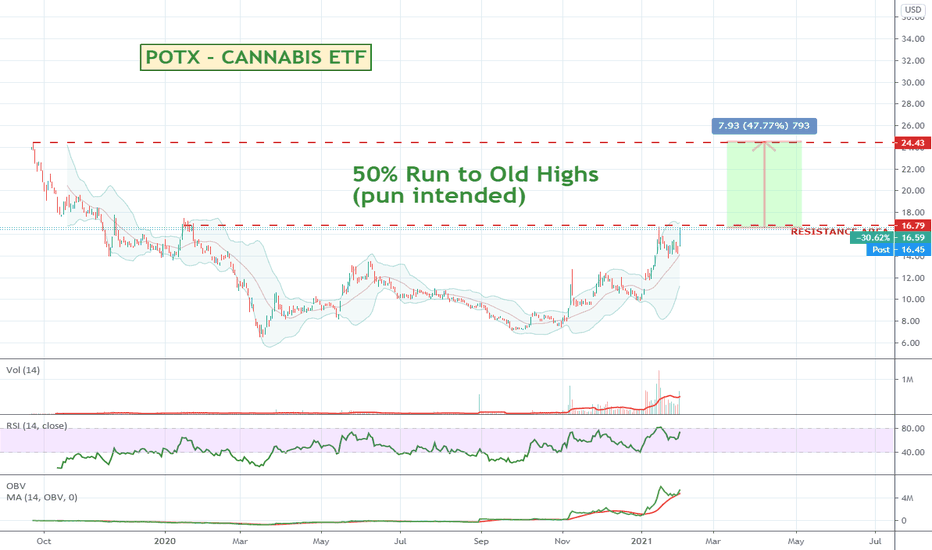

POTX - CANNABIS ETF - Running again after pullbackPotX is looking like it is back on track again with a strong 12% gain today. RSI heading back up, and OBV shows buyers are pushing the volume at the moment. It is one of the best performing ETFs at the moment so if you are looking for safer trades by picking an industry sector as opposed to an individual stock this could be worth a look at. I also like that is price is still sub $20 which always makes it attractive to the mass market retail investors - more bang for their buck so to speak.

AMEX:CNBS would also be worth a look. Much of a muchness between them, I just think POTX has more confirmed upside and has the momentum at the moment.

Search in ideas for "zAngus"

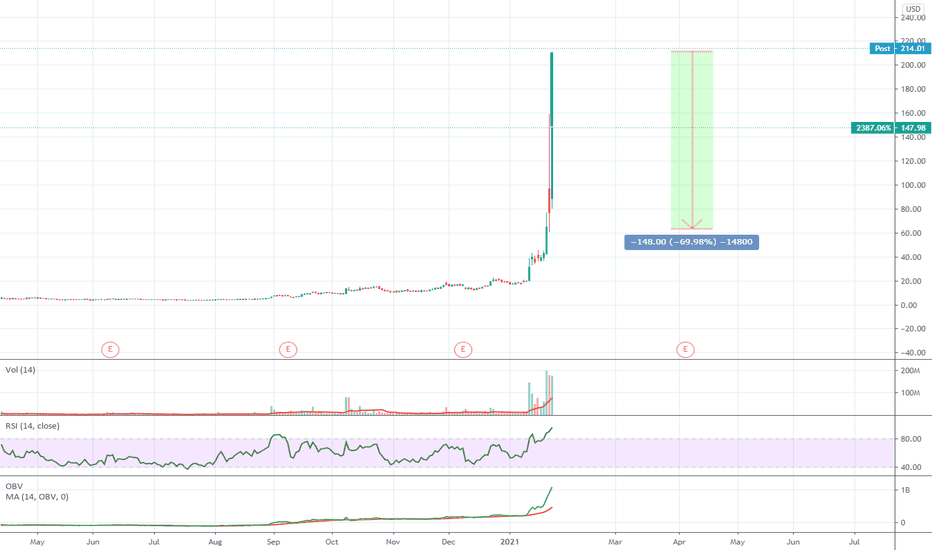

Gamestop mega pump will end badly :)User FOMO is strong with this one. Hit $220+ in the after market after a strong couple of days of wallstreetbets pumping made even sillier by Elon tweeting about it.

Going to be interesting to see what happens next and could be a good lesson in how to potentially trade these. I'd be mega short.

Elon Musk @elonmusk 1h

Gamestonk!!

wallstreetbets • r/wallstreetbets

Like 4chan found a Bloomberg Terminal

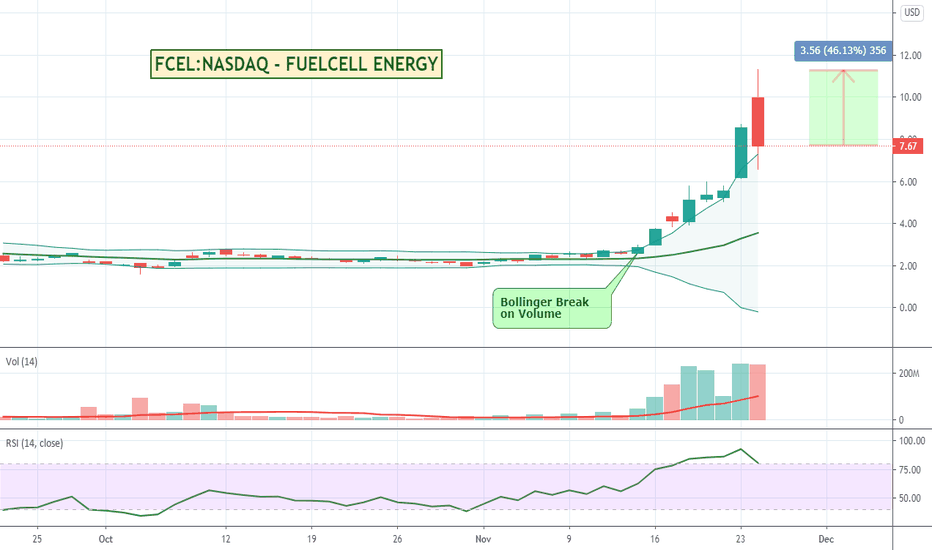

FCEL:NASDAQ - FUELCELL ENERGY - Hype stock running hardFCEL is one of the stocks with a lot of "enthusiasm" behind it at the moment. Had a big pull back after a strong rally so worth seeing if it runs again after the drop. Being under $10 will give it some attention. I'd suggest set a stop order at $8 in case it rallies through there and keep a tight stop on it if it runs. Worth keeping an eye on as a speculative short-term trade just for the fun of it.

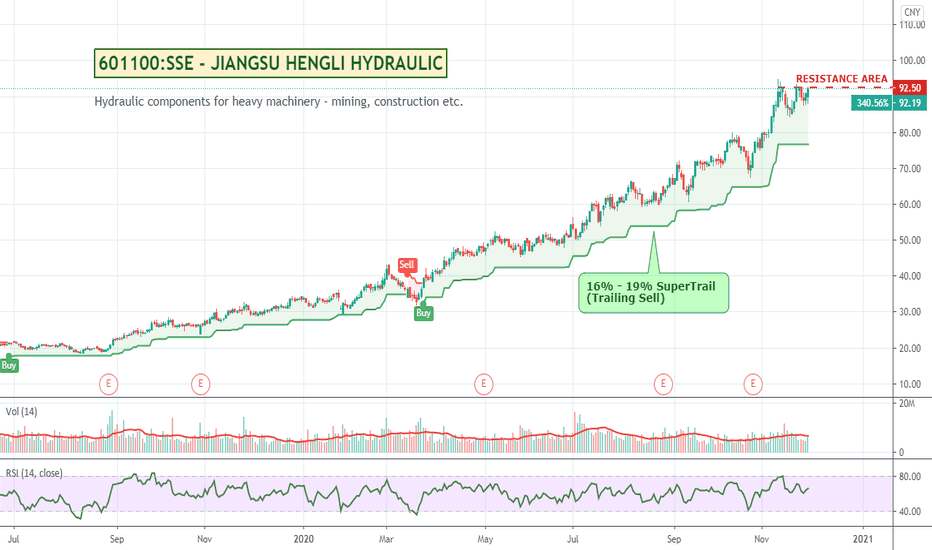

601100:SSE - JIANGSU - Hydraulic parts for mining & constructionJiangsu Hengli Hydraulic Co. Ltd. is a China-based company, principally engaged in the manufacture and sales of professional hydraulic components and hydraulic systems for heavy engineering and construction vehicles, port vessels, mining machinery, tunnel machinery, metallurgy machinery and industrial manufacturing industries. Figure with the boom in building and mining their components will be in demand. The chart has in a solid upward trend up over 300% so far. Could be worth a watch.

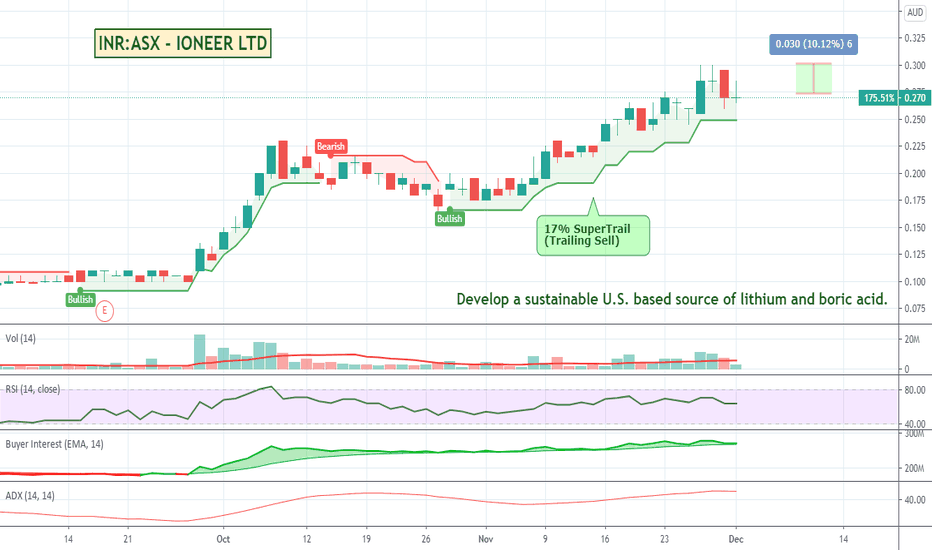

INR:ASX - IONEER LTD - Low Cost US Lithium PlayIoneer has a Nevada US based Lithium and Boron project. A core mission of ioneer is to develop a sustainable U.S. based source of lithium and boric acid that can be efficiently produced and delivered to customers domestically and internationally. Lithium production at Rhyolite Ridge equates to supplying batteries for approximately 400,000 electric vehicles annually. Could be worth a look.

ZIP:ASX - ZIP CO - Could be at a support / value areaZip has been pretty volatile of late hovering up and down around that $6 mark. Seems to be back at a support area and with the RSI pointing up and below 40 it might be about to head back up from its oversold area. Stops are in tight, but could be worth a look at these levels.

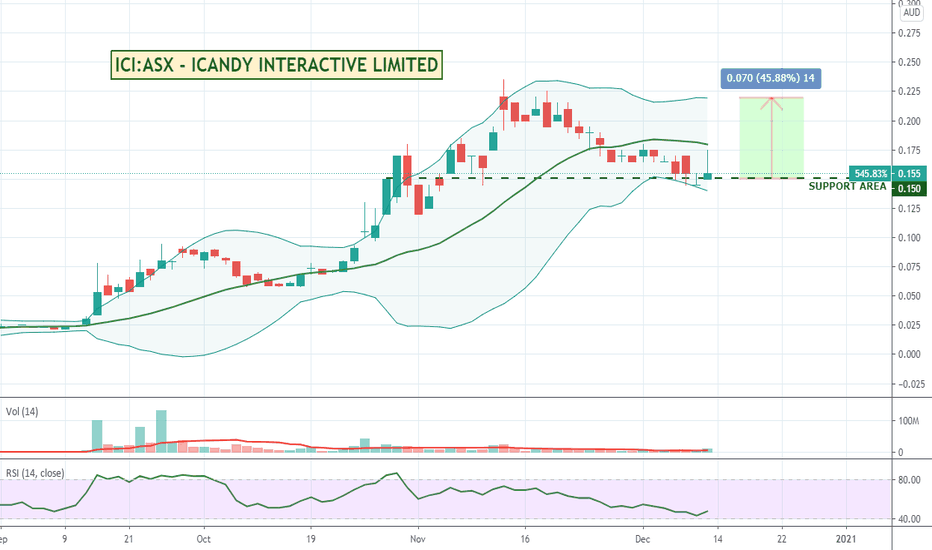

ICI:ASX - ICANDY INTERACTIVE LIMITED - Value area?ICI tried to push higher on Friday with news that their game Masketeers: Idle of Fallen has reached a record revenue milestone of A$1,000,000 in just over 60 days, the fastest ever for an iCandy game. RSI is at a pretty good value area. Could be worth keeping an eye on to see if its recovery continues.

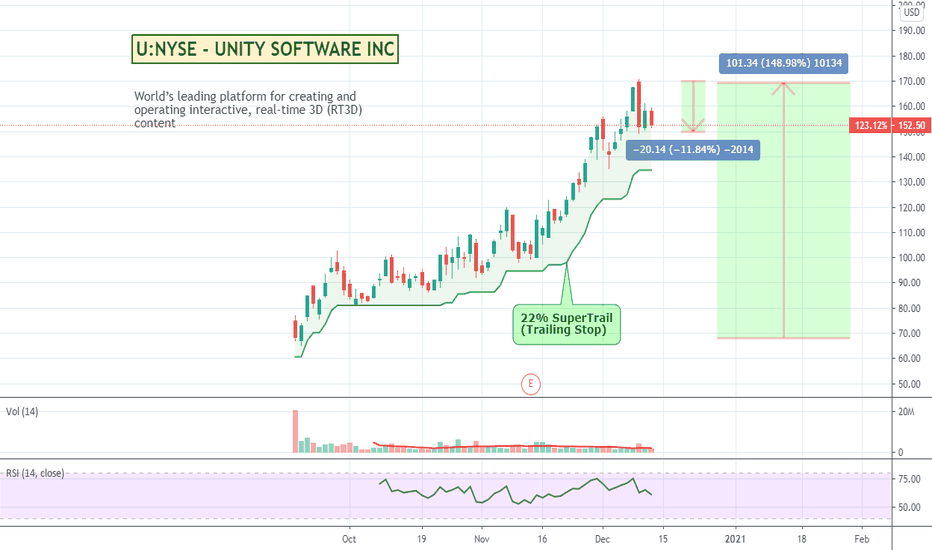

U:NYSE - UNITY SOFTWARE INC - Gaming development platformA relatively new stock that seems to be performing pretty well. Has had a 10% pullback so will be interesting to see if they have more upside.

Unity describes themselves as the world’s leading platform for creating and operating interactive real-time 3D (RT3D) content empowering creators across industries and around the world.

Could be a good gaming company to keep an eye on.

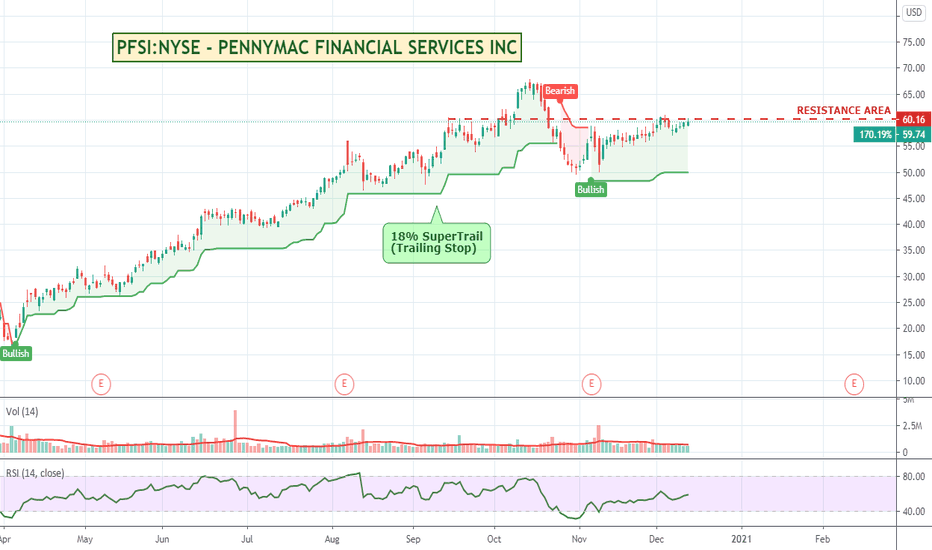

PFSI:NYSE - PENNYMAC - Benefiting from US housing boom.As mortgage brokers PennyMac has been benefiting from the strong USA housing resurgence. Existing home sales rose by 10.5% y-o-y to a seasonally adjusted annual rate of 6 million units in August 2020, according to the National Association of Realtors (NAR). Likewise, new homes sold soared 43.2% y-o-y to a seasonally-adjusted annual rate of 1,011,000 units in August 2020, according to the US Census Bureau. Worth a look.

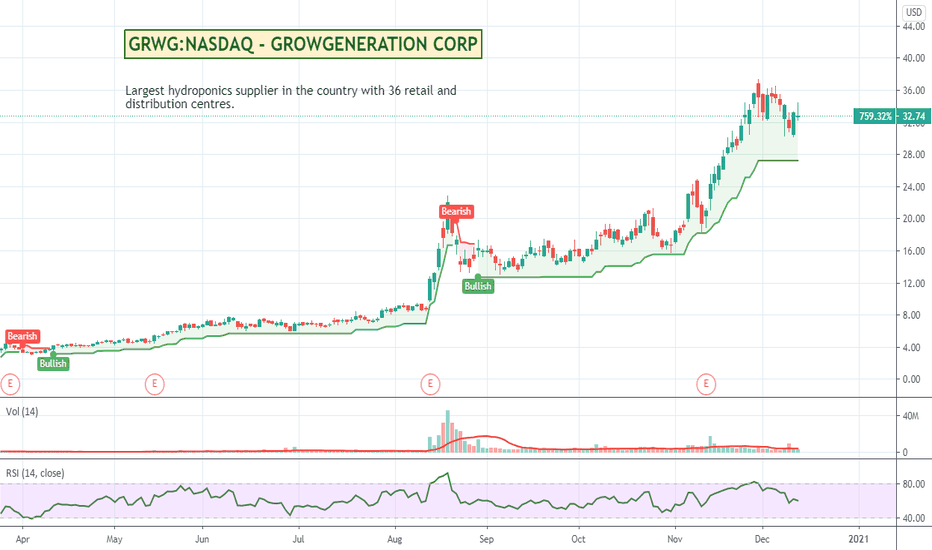

GRWG:NASDAQ - GROWGENERATION - Shovels to the minersWith the increasing decriminalisation / legalisation / re-classification of pot in the US and potentially around the world with the World Health Organisation and the United Nations both onboard, pot stocks might enjoy a resurgence beyond just medical use. As consumer at home type recreational use grows (pun intended) GRWG as the largest hydroponics supplier in the USA with 36 retail and distribution centres could continue to benefit for quite a while yet. Worth a watch.

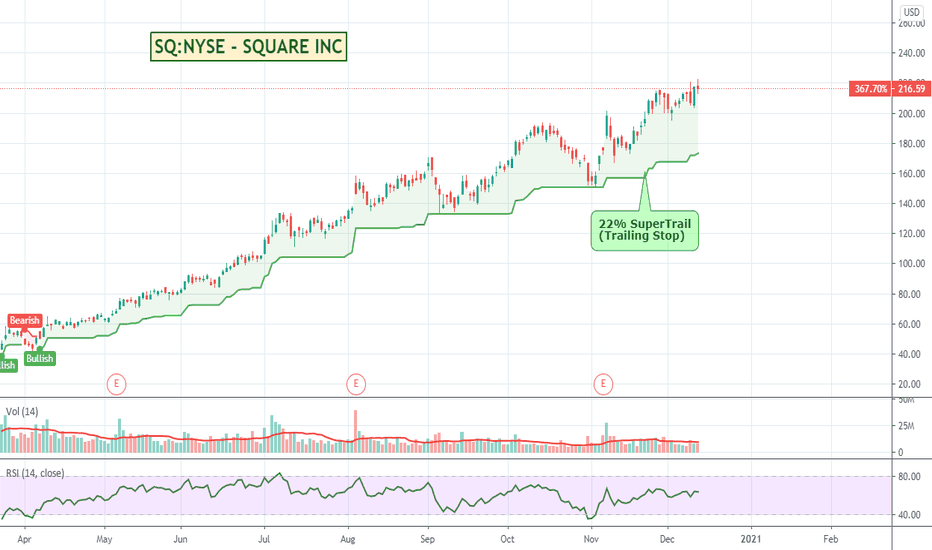

SQ:NYSE - SQUARE INC - Trending nicely. Might be good for 2021. Square has been having a great run post covid up around 400% or just over 230% for the last 12 months. Good chance they will be one of the better performers through 2021 especially if retail and other consumer oriented services begin to recover. Worth a watch.

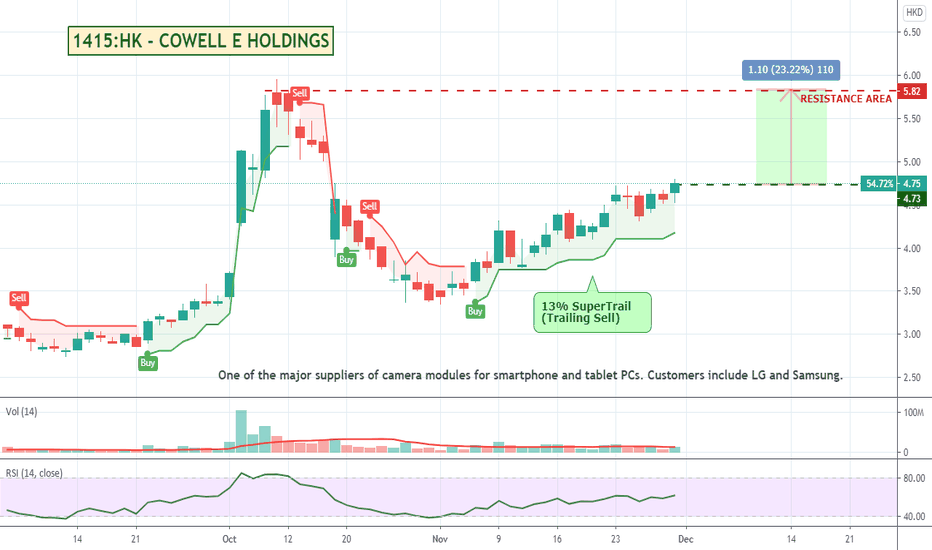

1415:HK - COWELL - Camera parts supplier for phones & tabletsCowell could be an interesting one. Their website indicates that they are one of the worlds major suppliers of camera modules for smartphone and tablet PCs with customers including ABC (who I haven't heard of) as well as LG and Samsung (who I certainly have). Stock chart looks to be bullish at the moment. Bit of upside to potentially fill. Could be worth a watch.

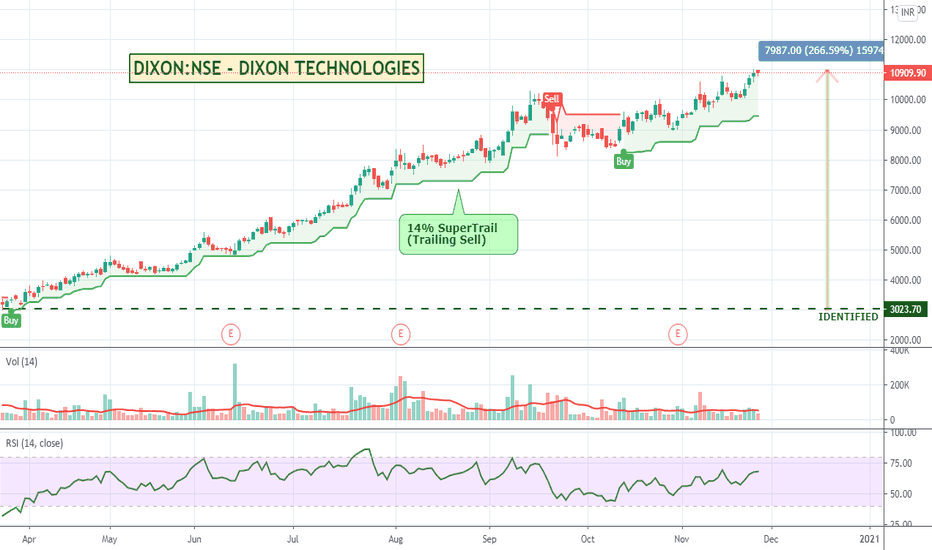

DIXON:NSE - DIXON TECHNOLOGIES - Smooth 200% run so far.From their website - Dixon Technologies provides design focused solutions in consumer durables, home appliances, lighting, mobile phones and security devices to customers across the globe, along with repairing and refurbishment services of a wide range of products including set top boxes, mobile phones and LED TV panels.

Super smooth consistent run. Could be worth a look.

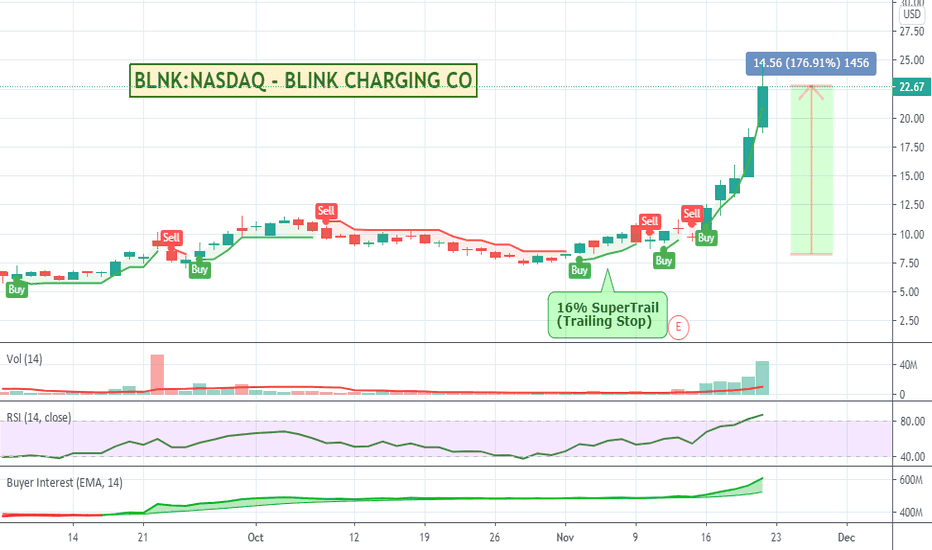

BLNK:NASDAQ - BLINK CHARGING CO - Running hardWith the massive investor interest in electric vehicles (and it seems like there is a new one every week) I thought I would have a look around and see what complimentary businesses are doing well. Blink is one company that popped up as running really well over the last month - up 150% this month alone. Blink is in the design, manufacturing, owning and operating of EV charging stations. Probably over priced right now looking at its RSI but its still a relatively affordable and attractive stock for smaller retail investors in that $20 range. I've set an alert to have a better look when the RSI drops back below 70 on a pull back. Will keep an eye on it.