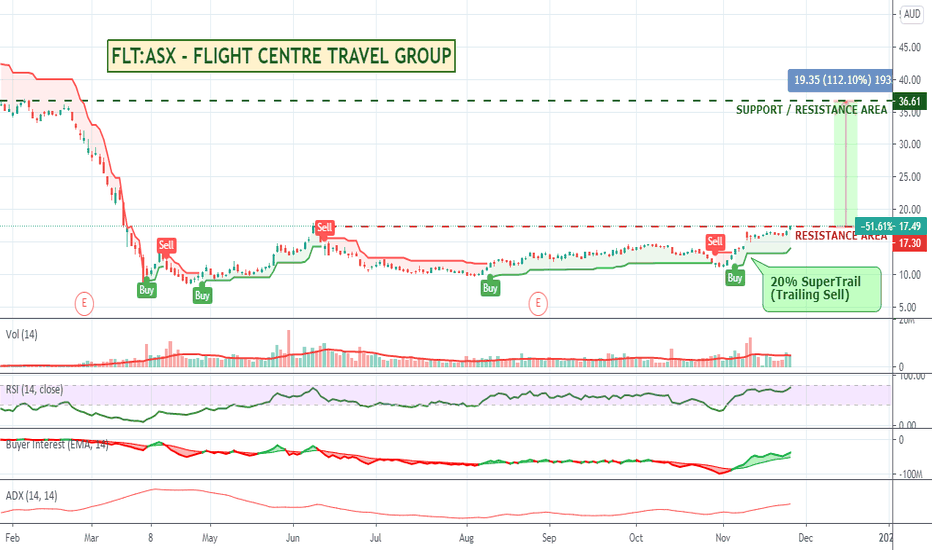

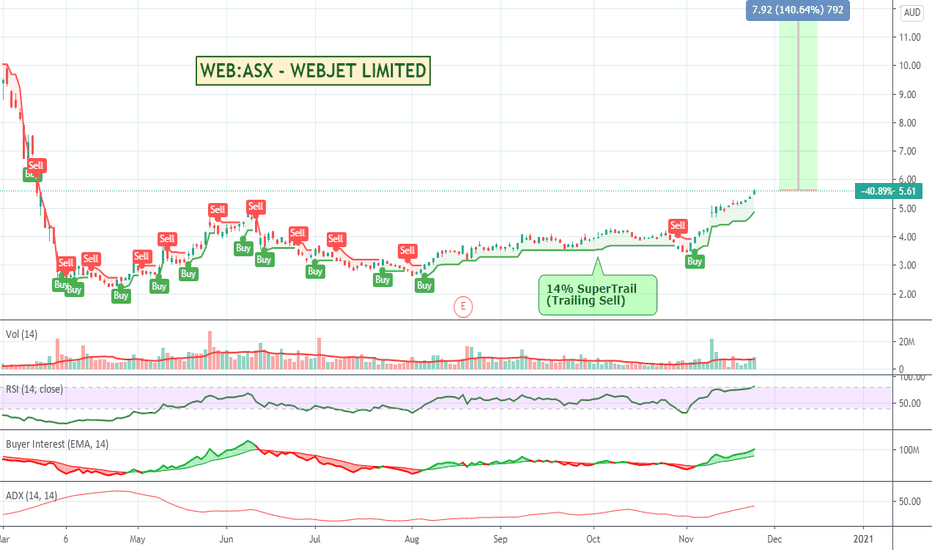

FLT:ASX - FLIGHT CENTRE - Back at resistanceWith all the news of Corona "cures" (aka vaccines) and the holiday season coming up as well as people probably just sick of being stuck at home all year, it looks like some of the Airline and complimentary travel stocks are finally starting to make a comeback. A long way down from old levels there is plenty of upside if people start holidaying and travelling again - domestic or international. Sector could be worth a watch and Flight Centre seems to have a lot of room to move.

Search in ideas for "zAngus"

NEW APPLE ELECTRIC VEHICLE with HYUNDAI PARTNERSHIPWas having a bit of a read around the web on the news of Apple looking to build a car potentially with Hyundai and wondered what the impact on their share price would be. Here's your answer...

It would be interesting to see if Apple just comes out with another electric car concept or whether they can do something truly transformative. Apple is incredibly cashed up and when they do make a run at the car market, they wont be doing it to become second or third...

SSG:ASX - Shaver Shop - 400% run post March lows.Massive run for Shaver Shop during the pandemic and saw an article in todays SMH talking about how that run is likely to continue if more people return to the workplace post vaccines. Just about every bloke I know has taken the opportunity to grow a beard (or just not shave) during the lock down period. I'd want to wait for a pullback after todays big move, but could be worth a watch.

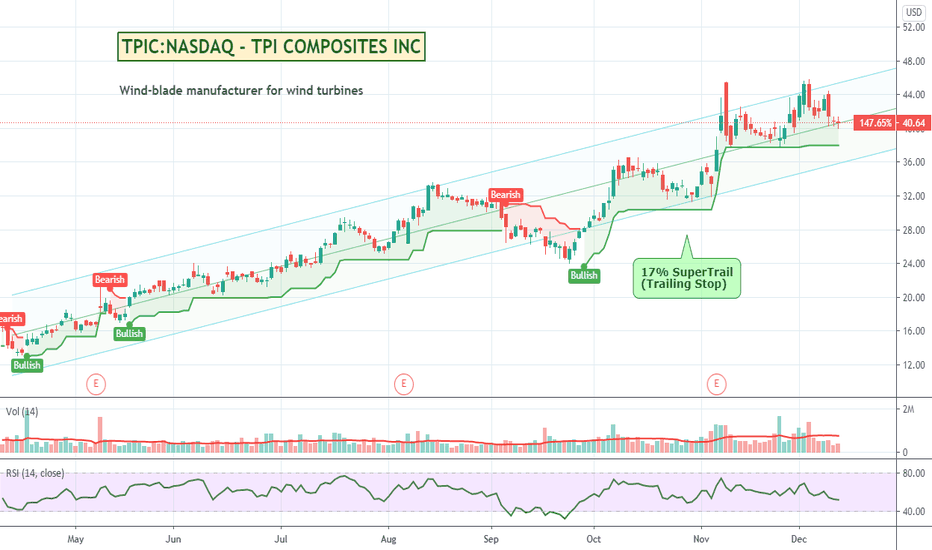

TPIC:NASDAQ - TPI COMPOSITES - Wind-blade ManufacturerI thought TPIC was an interesting one. They are one of the leading wind-blade manufacturers and accounted for approximately 18% of all sold onshore wind blades globally in 2019 with over $1.4 billion in net sales and more than 9,500 wind blades sold. These turbine blades can last up to 20 years, but many are taken down after just 10 so they can be replaced with bigger and more powerful designs. With solar and wind energy increasingly popular this could be a company to watch.

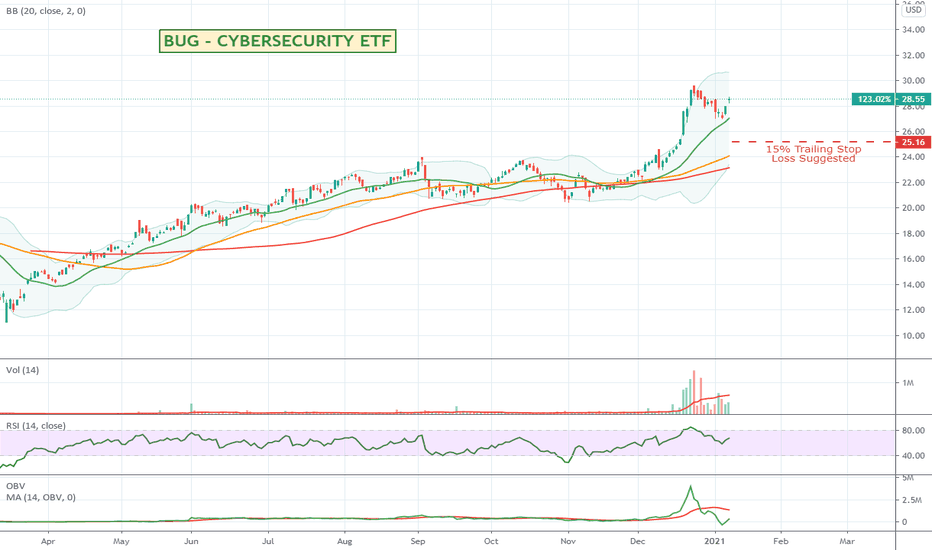

BUG - CYBERSECURITY ETF - Up 140% post MarchA relatively new ETF, BUG provides exposure to companies involved in the development and management of security protocols preventing intrusion and attacks to systems, networks, applications, computers, and mobile devices. Eligible securities are those in the emerging and developed countries and are selected based on the revenue which must be at least 50% generated from cybersecurity activities. (Source and more info at: www.etf.com)

From a TA perspective it has had a nice steady run post March and would seem to be in a pretty hot sector with global reports of state level hacking and company intrusions on the rise. RSI shows there is still some value in it after its most recent pullback and its steep incline would indicate interest is growing. Would be nice to see the OBV in positive territory above its 14 day moving average for confirmation. Could be worth a look for a longer term buy and hold.

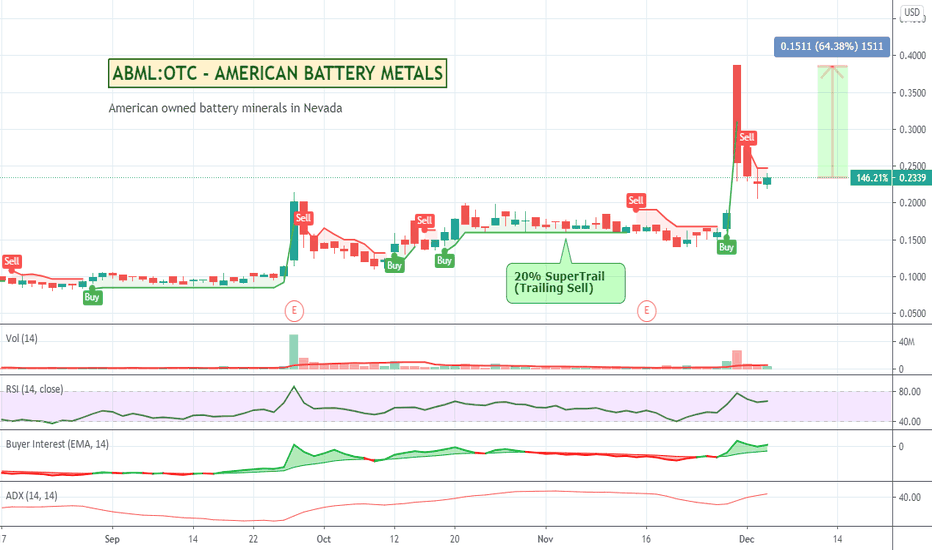

ABML:OTC - AMERICAN BATTERY METALS - Producer and recycler. American owned battery minerals in Nevada that is looking to meet the soaring global demand for lithium-ion battery technology with a USA-made complete lifecycle approach. They perform: 1. Recycling of lithium-ion batteries to recover and reuse battery metals. 2. Extraction of battery metals from primary resources and development of new green technologies that can be deployed at scale. and 3. Exploration and stewardship of new mineral resources globally. With all the new solar, wind, and EV all demanding battery type resources, could be one to keep an eye on. Early days though so beware the volatility.

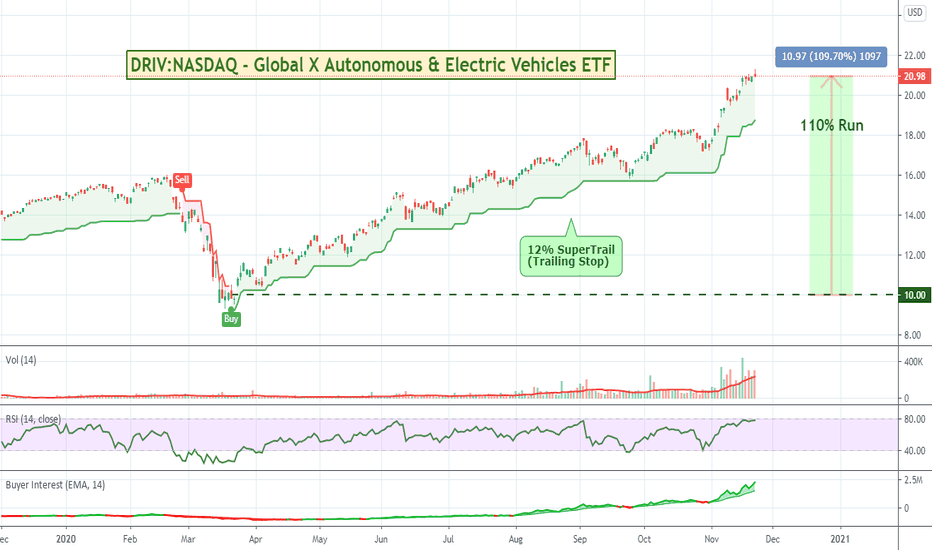

DRIV:NASDAQ - Global X Autonomous & Electric Vehicles ETFIf you're over trying to guess which electric car company is going to be the winner, then this ETF could be for you.

The Global X Autonomous & Electric Vehicles ETF (DRIV) seeks to invest in companies involved in the development of autonomous vehicle technology, electric vehicles (“EVs”), and EV components and materials. This includes companies involved in the development of autonomous vehicle software and hardware, as well as companies that produce EVs, EV components such as lithium batteries, and critical EV materials such as lithium and cobalt.

Top Holdings By Percentage Include:

TSLA Tesla Inc 3.61%, QCOM Qualcomm Inc 3.19%, NVDA NVIDIA Corporation 3.01%, AAPL Apple Inc. 2.78%, NIO NIO Inc. Sponsored ADR Class A 2.75%, GOOGL Alphabet Inc. Class A 2.65%, 7203 Toyota Motor Corp. 2.45%, MSFT Microsoft Corporation 2.33%, AMD Advanced Micro Devices, Inc. 2.18%, CSCO Cisco Systems, Inc. 2.05%, HON Honeywell International Inc. 2.03%, GE General Electric Company 2.00%, 005930 Samsung Electronics Co., Ltd. 1.97%, PLUG Plug Power Inc. 1.82%, GM General Motors Company 1.79%

(Source: www.globalxetfs.com)

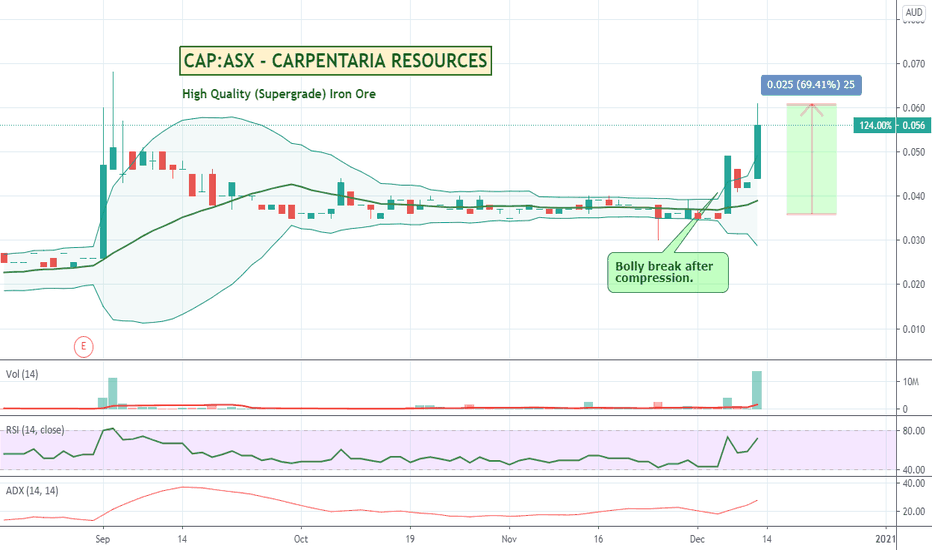

CAP:ASX - CARPENTARIA RESOURCES - Iron Ore runnerCAP has been having a particularly strong run over the last few days off the back of rising iron ore prices. Located near Broken Hill, they have the makings of the world’s leading undeveloped high-quality iron ore concentrate and pellet feed project. Worth a watch.

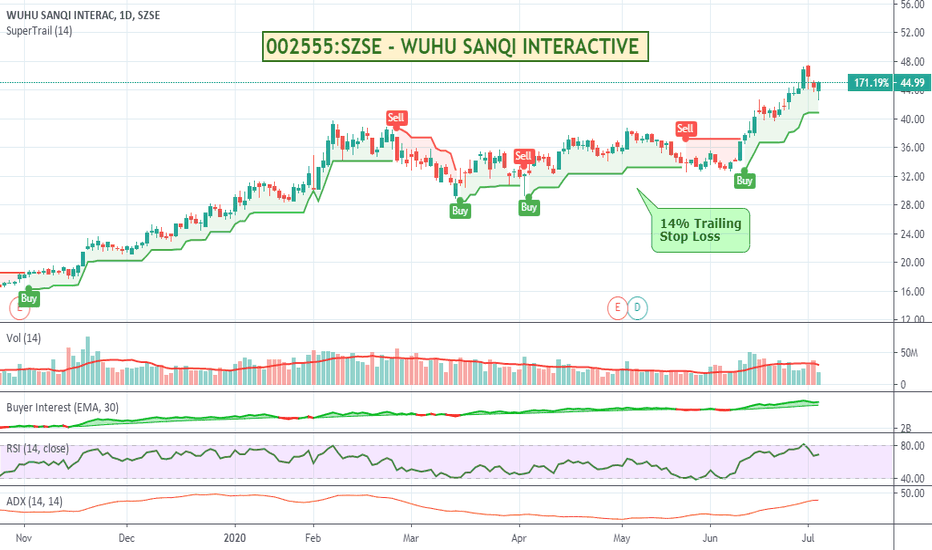

002555:SZSE - WUHU SANQI INTERACTIVE ENTERTAINMENTTraded on the Shenzhen Stock Exchange, Wuhu Sanqi is a top 25 global public game company (No.3 in China) with a focus on the publication and development of mobile, browser and html5 games. Up 220% over the last 12 months, with its recent pullback, might be worth a look.

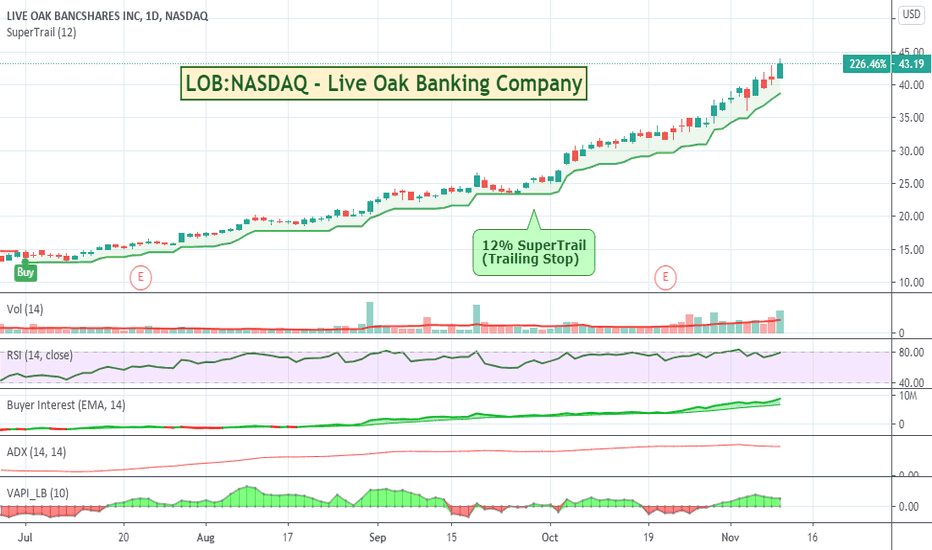

LOB:NYSE - Live Oak Banking Company - Nice run.Live Oak Banking is a national online lending platform for small businesses and is up around 430% since its March lows. Super steady run without too much volatility. RSI is at the high end so will be interesting to see how long the run continues. Worth a watch.

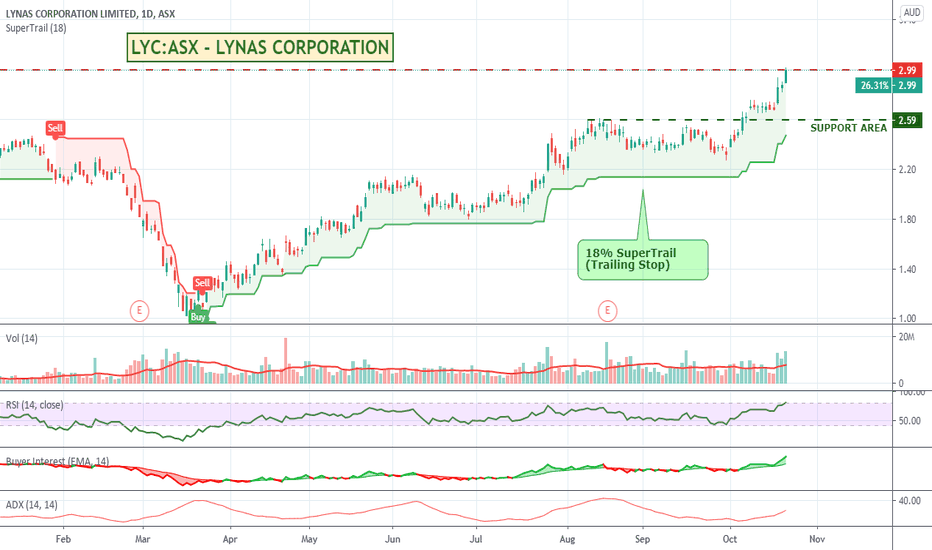

LYC:ASX - LYNAS CORPORATION - Rare Earther back at highsLynas is back at old time highs after a strong bollinger break with growing volume. I like that they announced earlier in the year that they have a contract signed with the US Department of Defense for Phase 1 work on the proposed U.S. based HRE facility. Might be a bit overbought now looking at the RSI, but rare earths does seem to have some interest at the moment so could be worth a watch.

Previous highs:

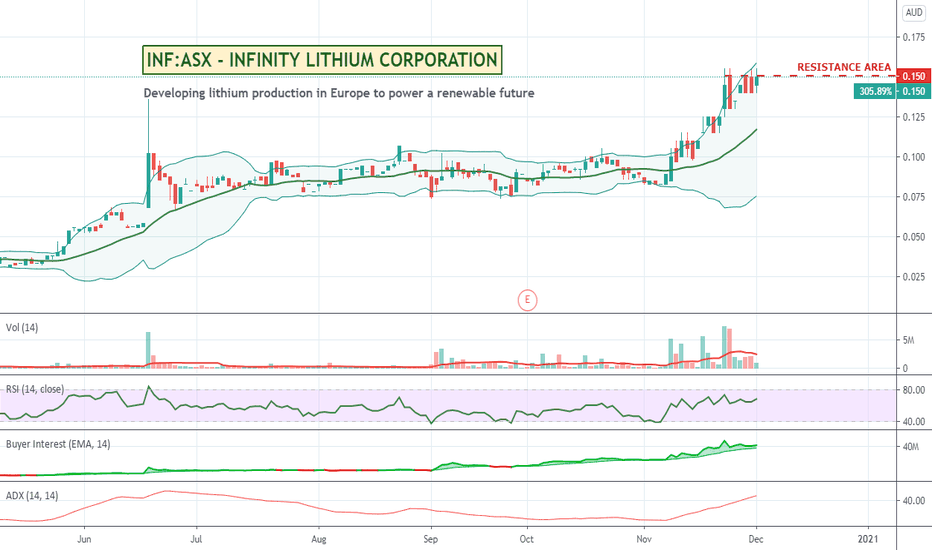

INF:ASX - INFINITY LITHIUM - Lithium production in EuropeI heard about INF on a YouTube video comparing ASX listed battery stocks with an overseas presence and Infinity was one of those mentioned especially as it was a hard rock resource. Might be worth having a look.

From their home page:

Infinity Lithium Corporation is an Australian listed minerals company who is seeking to develop its 75% owned San Jose Lithium Project and produce battery grade lithium hydroxide in Spain. Supply response is needed to satisfy Europe’s burgeoning energy storage needs through feeding the large-scale battery plants currently under construction.

The San Jose deposit is a highly advanced, previously mined brownfield development opportunity representing EU’s second largest lithium deposit. Infinity Lithium will mine the hard rock Mica resource and develop processing facilities to provide a long term, low cost, and sustainable European mine-to-end-product lithium hydroxide operation.

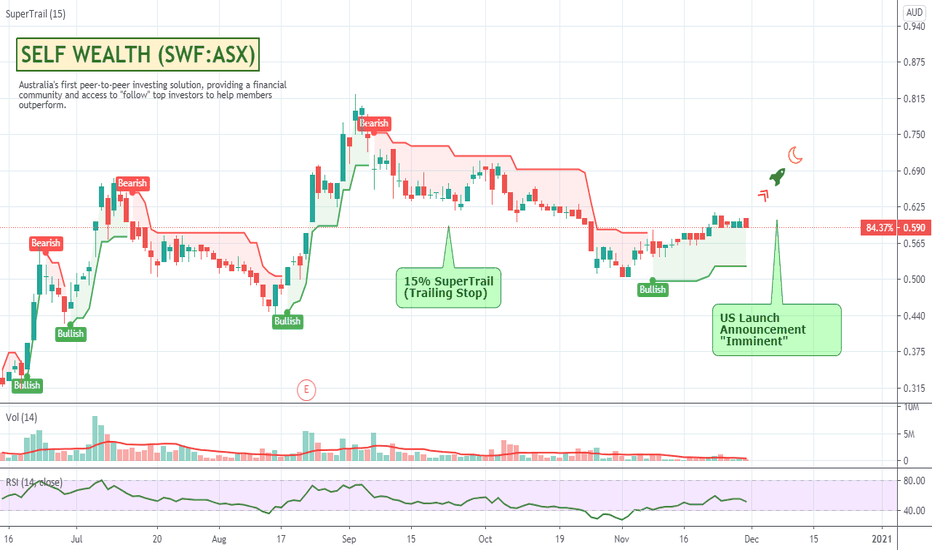

SELF WEALTH (SWF:ASX) - US Stocks "Imminent"Have seen more and more chatter about SelfWealth launching US stocks which could be interesting to see its impact on price. Have an alert set in case it does indeed take off.

They have a limited amount of information on their website at trade.selfwealth.com.au

Not a lot to go off, but worth a watch.

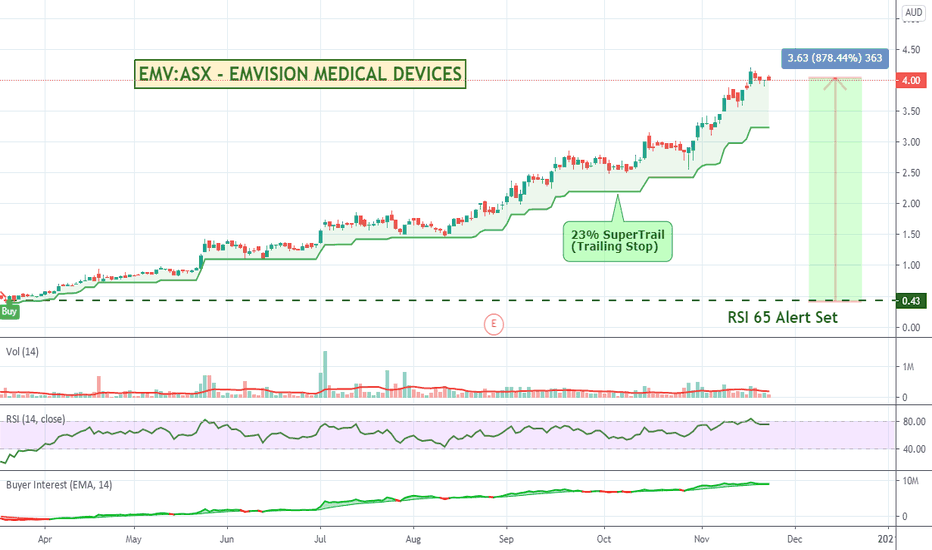

EMV:ASX - EMVISION MEDICAL DEVICES - Monster run since March lowEMV is up over 800% since its March lows this year. EMVision is developing a portable brain scanner for rapid, point of care, stroke diagnosis and monitoring which sounds like a good space to be in. I have had an alert set at RSI(14) < 65 for a while now to try and get back into it at better value, but I'm sill waiting :)

From their about us:

EMVision Medical Devices Limited is focused on the development and commercialisation of medical imaging technology. The Company is developing and seeking to commercialise a potentially cost effective, portable, medical imaging device using electromagnetic microwave imaging for diagnosis and monitoring of stroke and other medical applications. The technology is the result of over 10 years of development by researchers at the University of Queensland. The team of approximately 30 researchers is led by co-inventors Professor Amin Abbosh, who is considered a global leader in electromagnetic microwave imaging, along with Professor Stuart Crozier, who created technology central to most MRI machines manufactured since 1997. EMVision’s CEO, Dr Ron Weinberger, is the Former Executive Director and CEO of Nanosonics' (ASX:NAN), a $1.65 billion market cap healthcare company. Dr Weinberger has over 25-years’ experience developing and commercialising medical devices. During his time at Nanosonics, Dr Weinberger codeveloped the company’s platform technology and launched their breakthrough product ‘Trophon’ globally, which would go on to become the gold standard for infection prevention. Dr Weinberger was instrumental in transforming Nanosonics from a research and development company to one of Australia’s leading medical device commercialisation success stories.

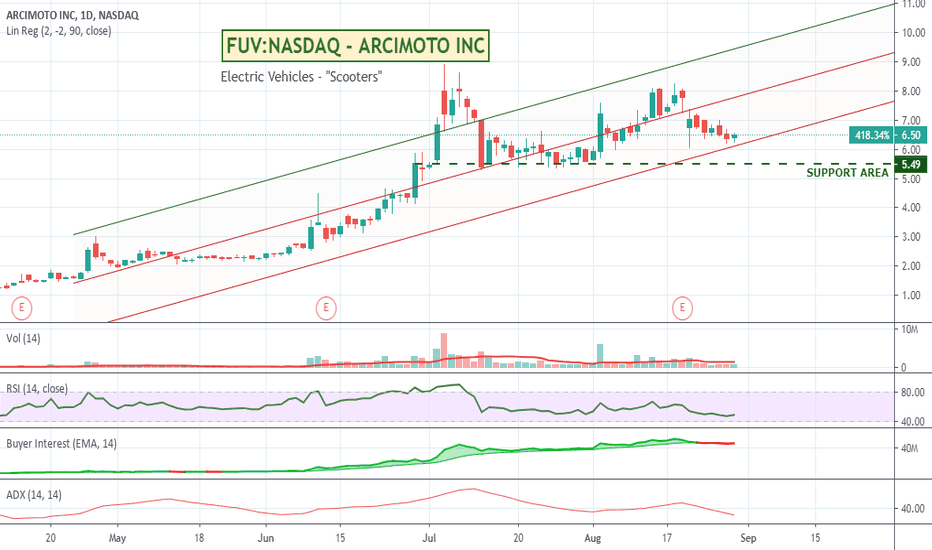

FUV:NASDAQ - ARCIMOTO INC - Electric Vehicle ManufacturerJust been having a look around at some of the Tesla alternatives to see who else might be riding that bubble. FUV or Arcimoto has had around a 500% run since its March lows. Its at the bottom of it linear regression range with some additional support not too far below. The RSI dipped below 50 and could be heading back up. Short version is it could be at a reasonable buy area with some upside if it heads back up. The vehicles though that it produces are more like oversized scooters than cars so not sure if they will be the long term answer. Worth a watch from a trade perspective at any rate.

I've put an alert on it at $6.75 so will have a look if it heads back up early next week.

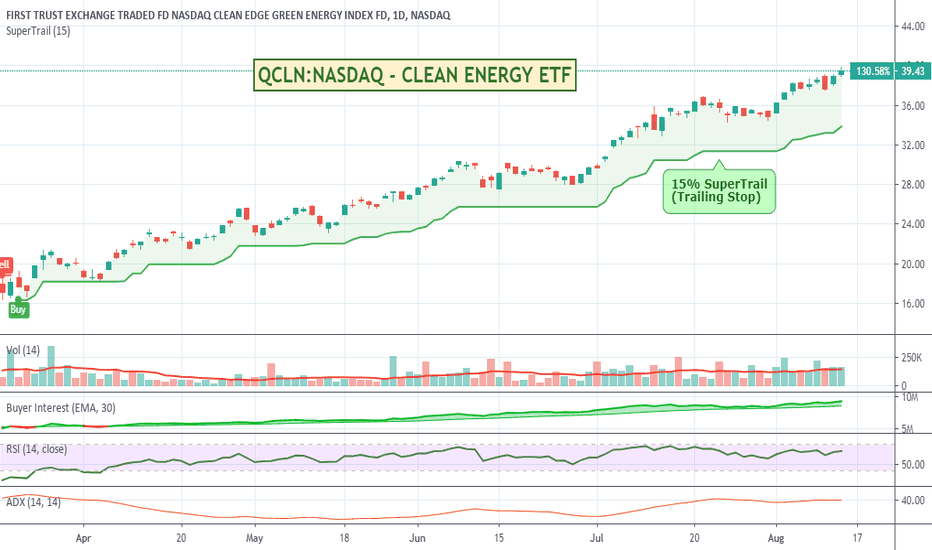

QCLN:NASDAQ - CLEAN ENERGY ETF - Up 130% since March lowsQCLN holds a broad portfolio of US-listed firms in the clean energy industry. Eligible companies must be manufacturers, developers, distributors, or installers of one of the following four sub-sectors: advanced materials (that enable clean-energy or reduce the need for petroleum products), energy intelligence (smart grid), energy storage and conversion (hybrid batteries), or renewable electricity generation (solar, wind, geothermal, etc). Because there is subjectivity in classifying companies as “clean energy”, potential investors would be well-served by reviewing the fund’s portfolio to make sure your definition of “clean energy” matches QCLN’s. This ETF is among the least expensive and most liquid funds in its segment, making it a strong contender for investors considering the space. (Source: www.etf.com)

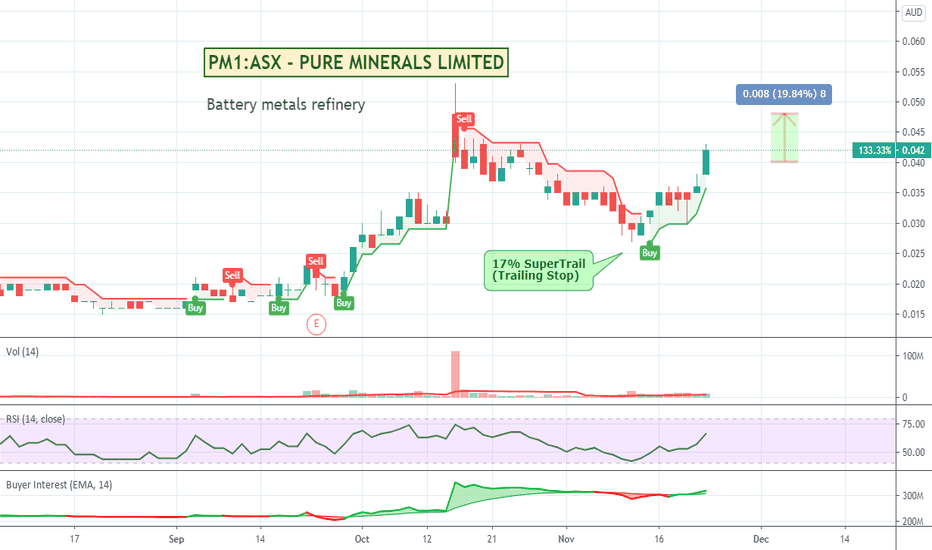

PM1:ASX - PURE MINERALS LIMITED - RecoveringPM1 looking good. Pure Minerals is developing a modern battery metals refinery in northern Queensland. The refinery, dubbed the Townsville Energy Chemicals Hub or TECH, will process imported, high grade Ni-Co laterite ore from New Caledonia to produce nickel sulphate, cobalt sulphate and other valuable co-products. Pure Minerals’ senior management has combined experience of more than 60 years in nickel refinery operations and is well versed in dealing with nickel and cobalt buyers around the world. With established infrastructure, a well-developed labour pool and a long history of processing imported laterite ore, Townsville is the ideal location for the project. (Source: PM1 website)

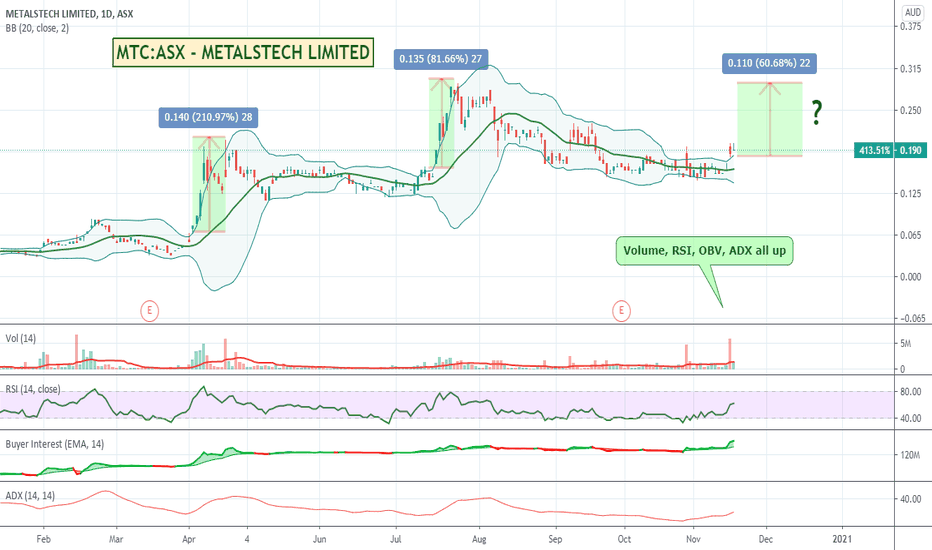

MTC:ASX - METALSTECH LIMITED - Bollinger breakout on news.Metalstech seems to feel based on their last 2 company announcements today and yesterday that there is more gold to come. They have a recent history of running fairly well on these kinds of announcements so will be interesting to see if history repeats itself.

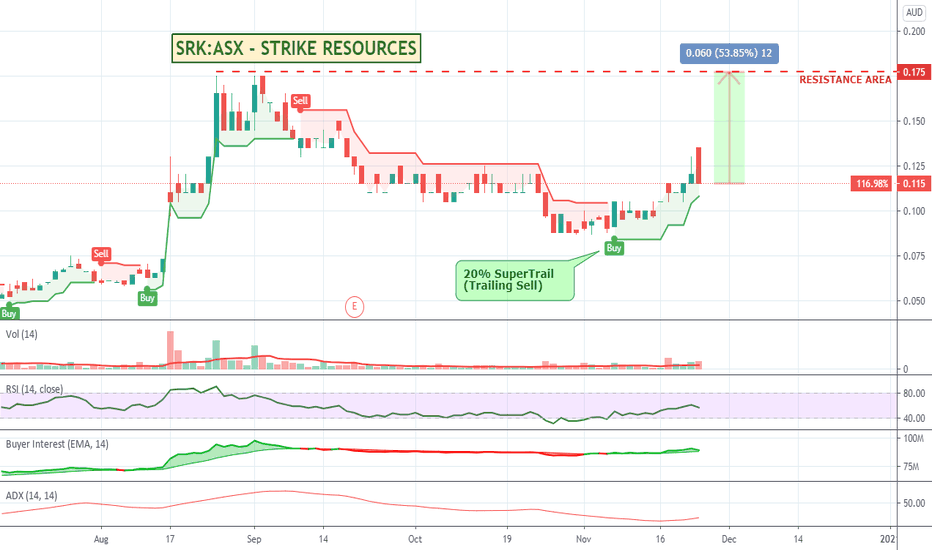

SRK:ASX - STRIKE RESOURCES - Iron Ore with a sneaky battery playStrike chart looked interesting so I thought Id go and have a look at their website to find out more about what they do. They have a strong Iron Ore focus, but they have been increasing their battery minerals portfolio as well buying into Argentina and Australia. I like that the chart is trying to push higher, but can't quite get there. Bit of upside to old highs. Could be worth a watch - especially on battery mineral news.

From their corporate profile at strikeresources.com.au

Strike is an international mineral exploration company, with projects in South America and Australia. Strike has been operating in South America since 2005, where it has been principally focused on developing its Apurimac Iron Ore Project in Peru, recognised as one of the highest grade, large-scale magnetite projects in the world with the potential to support the establishment of a significant 20 Mtpa iron ore operation. In addition, Strike is currently developing the Paulsens East Iron Ore Project in the Pilbara, Western Australia which contains high grade iron ore potentially suitable as direct shipping ore (DSO) for customers in China.

Anticipating the expected massive increase in demand for commodities used for the manufacture of electric vehicle (EV) and grid storage (GS) batteries, Strike has more recently made strategic investments in two battery minerals projects – the Solaroz Lithium Brine project in Argentina (located in the heart of South America’s ‘Lithium Triangle’); and, the Burke Graphite Project in Queensland, Australia.

Both lithium and graphite are critical ingredients for the current generation of EV and GS batteries and both projects offer tremendous upside potential for Strike.

Strike’s portfolio of projects therefore provides investors with exposure to the exciting emerging battery minerals sector, plus a world class established asset in the Apurimac Iron ore Project and near term iron ore production potential in Australia.