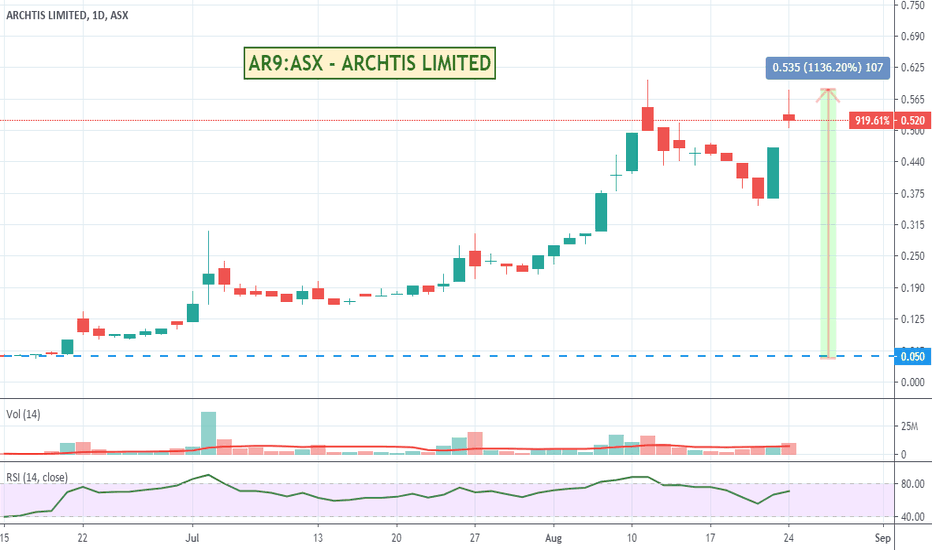

AR9:ASX - ARCHTIS LIMITED - Secure docs space up 1,000%+AR9 is in the secure document sharing space with defence level accreditation and took off running mind June and after a recent pullback looks like it might keep going. Worth a look.

archTIS was established to resolve a critical global problem – The need to share information securely. archTIS is a Canberra-based firm that specialises in the design and development of products, solutions and services for secure information sharing and collaboration. Our products and solutions have the ability to apply and enforce dynamic, policy-driven access controls at the user and information level. Established in 2006, archTIS has over 10 years’ experience delivering secure information and identity management services and solutions within the highest security levels of the Australian Government. archTIS’ experience working with Defence at TOP SECRET has led to a deep understanding of cyber security, information sharing and collaboration challenges. Here are some of our highlights. (Source: www.archtis.com)

Search in ideas for "zAngus"

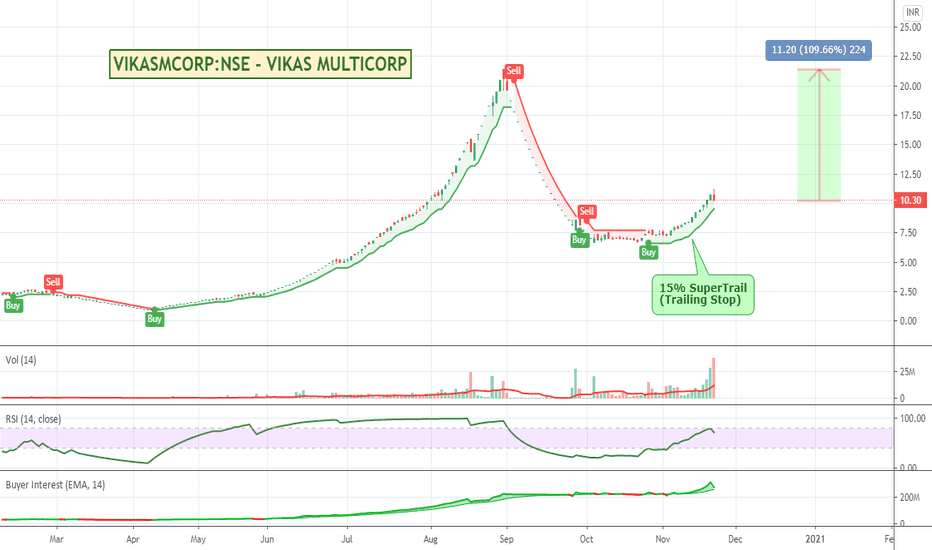

VIKASMCORP:NSE - VIKAS MULTICORPI don't know enough about the Indian market (other than they have 2 main exchanges) but I liked the smooth look of this pattern. Be interesting to see if it will continue to roll up like last time or if its going to consolidate and pull back for a bit.

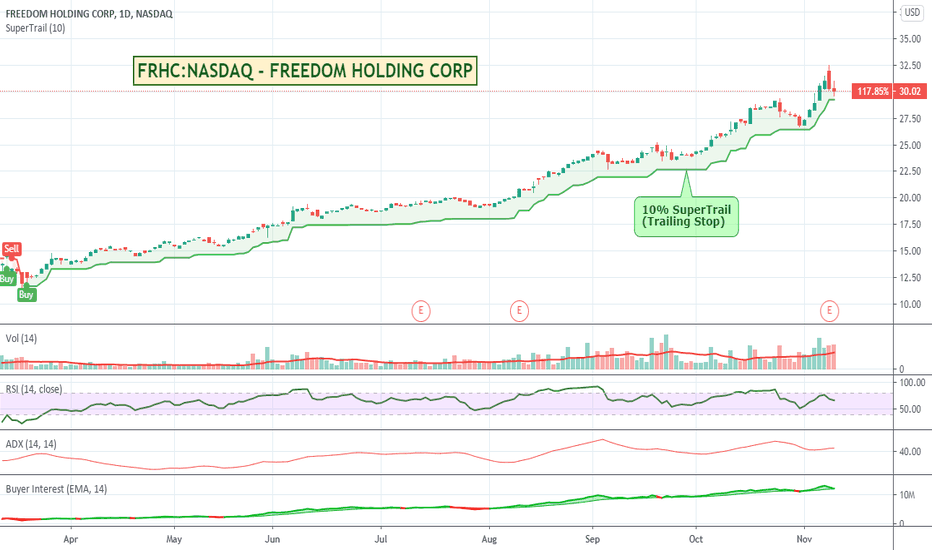

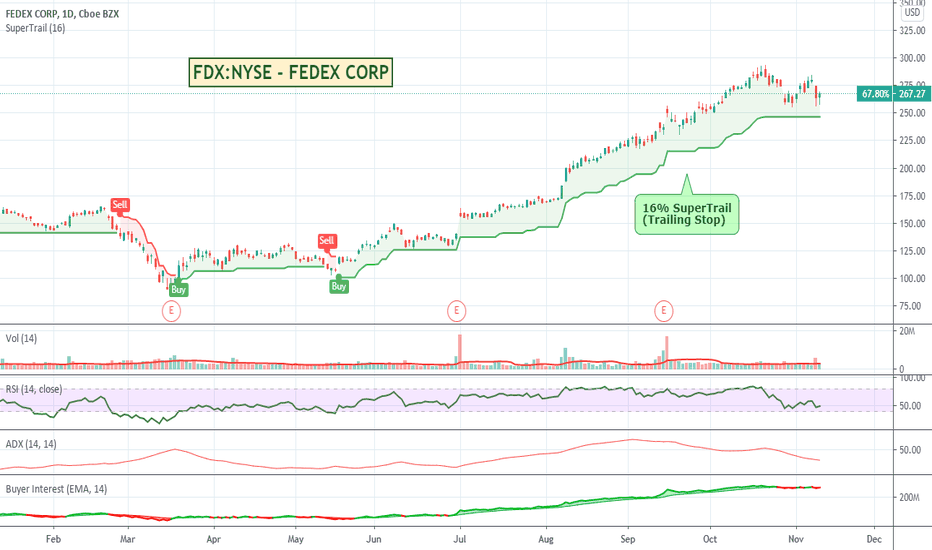

FRHC:NASDAQ - FREEDOM HOLDING - Steady low volatility gainer.Freedom Holding Corp provides brokerage and financial services and has just been ticking along nice and steadily with quite low volatility. Up 150% from its March lows. It has had a small 7-8% pullback with the current market volatility so if it starts to recover and head back up it could be worth a look.

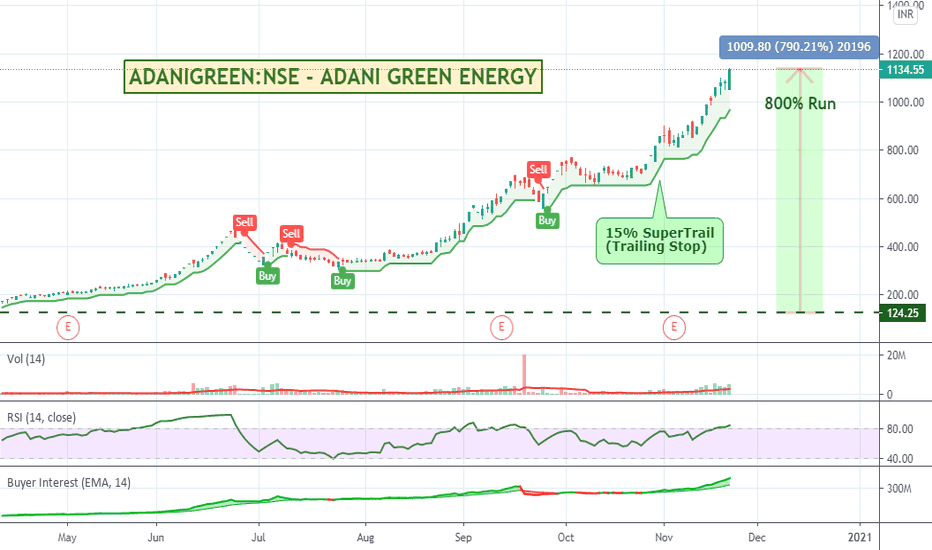

ADANIGREEN:NSE - ADANI GREEN ENERGY - Solar Energy StockAdanai Green Energy Ltd is an Indian based company operating solar power plants and developing wind power projects has been having a great run, up over 800% since March lows. Solar and green energy related stocks will probably be the main growth area over the next few years. Worth a look.

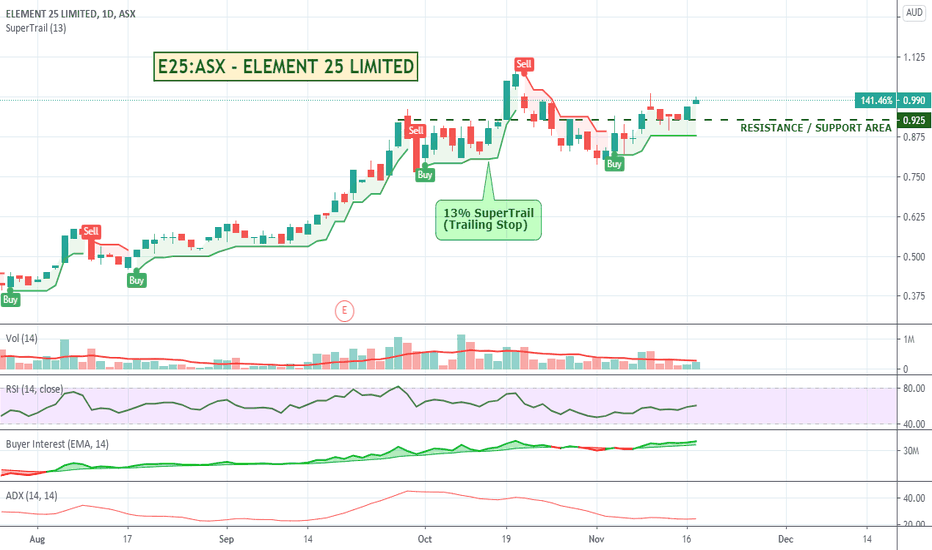

E25:ASX - ELEMENT 25 - Manganese producer for car batteries.Element 25 is up over 800% since its March lows, buoyed by Teslas announcement of moving its battery technologies to a new innovative type of lithium-ion battery with a cathode that contains around 33% manganese, made directly from manganese metal. Could be worth a look - especially being a "green" producer of Manganese.

From their website:

Element 25’s wholly owned Butcherbird Project hosts a very large manganese resource containing over 260 million tonnes of resources. This world class resource underpins the Company’s core strategy of entering the manganese market with a low capital cost manganese concentrate export start up operation following by a downstream processing pathway to produce high purity manganese products powered with renewable energy. A cleaner, lower carbon flowsheet coupled with high penetration renewable energy place Butcherbird at the forefront of sustainable metal production.

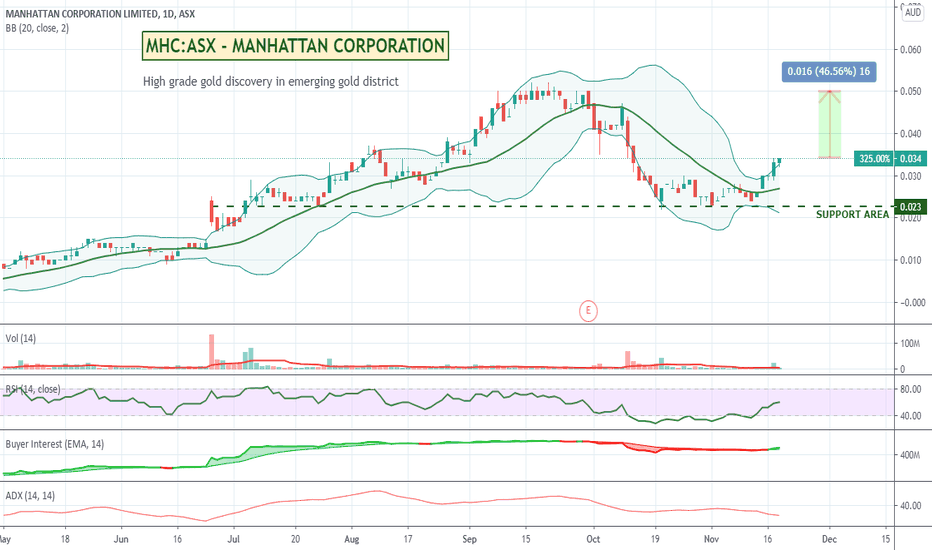

MHC:ASX - MANHATTAN CORPORATION - Bullish Gold ExplorerManhattan believes they have early-mover advantage in an emerging high-grade gold district in northern NSW that holds a multi-million-ounce gold discovery potential similar to those of the Victorian goldfields. Price seems to be heading back up in the right direction. Could be worth a look.

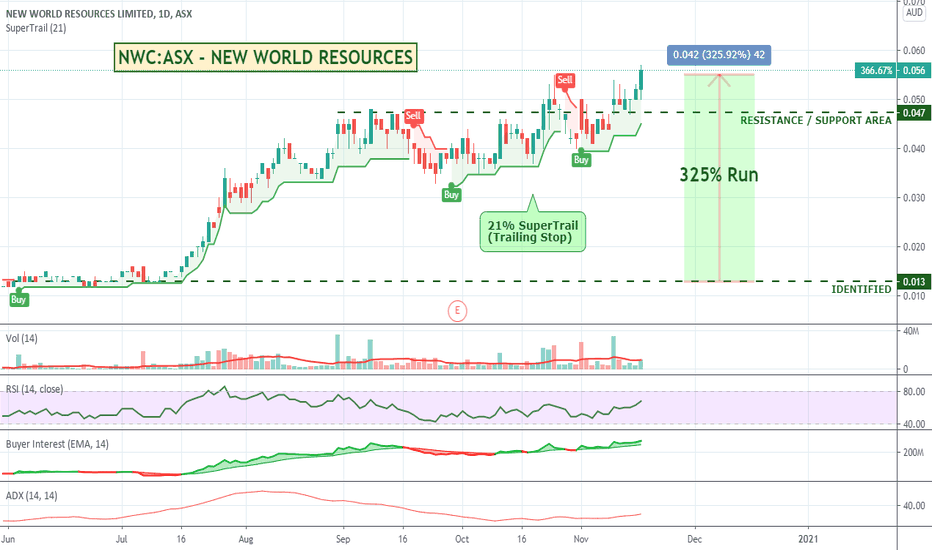

NWC:ASX - NEW WORLD RESOURCES - 300% run since JuneNew World Resources has been having a pretty good run over the last 6 months. Looks to have finally broken out through a bit of a resistance area. With the USA looking more and more to self-reliance and domestic sourcing of mineral deposits, this could be worth a watch.

From their about us at newworldres.com

New World Resources has been assembling a portfolio of highly prospective mineral resources projects in North America. These assets currently comprise: the Antler Copper Project in Arizona, USA; the Tererro Copper-Gold-Zinc VMS Project in New Mexico, USA; the Colson Cobalt-Copper Project in Idaho, USA; the Goodsprings Copper-Cobalt Project in Nevada, USA.

Collectively these projects comprise a highly prospective portfolio of high-grade projects all located in stable, pro-mining jurisdictions. Small-scale production has been recorded, historically, at all three projects, yet very little modern exploration has been undertaken at any of the projects. Accordingly, there is considerable potential for exploration success at all of the projects, which provides the Company the opportunity to realise considerable value for shareholders.

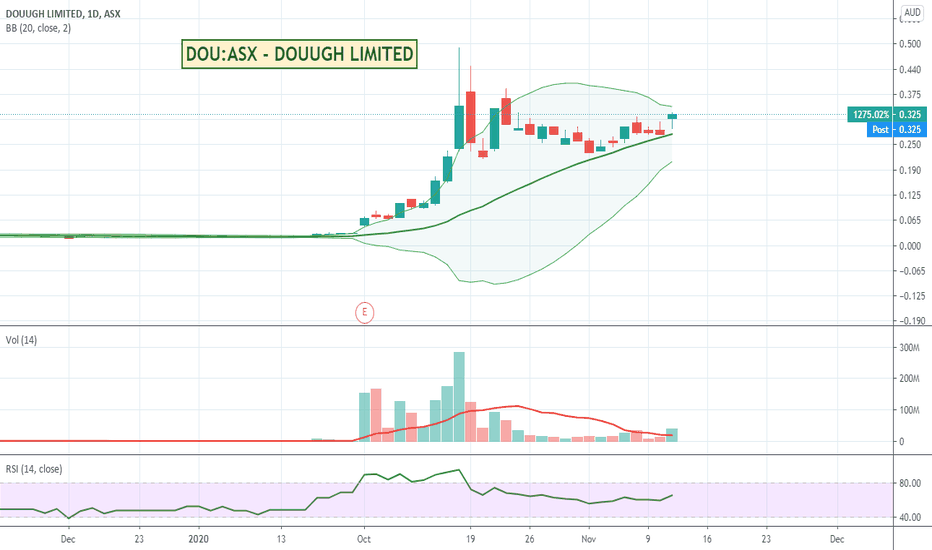

DOU:ASX - DOUUGH LIMITED - Ready for USA launchA variety of good news in todays announcement from DOU. They have completed their beta program ahead of their US launch, as well as they have obtained all necessary compliance and regulatory approvals required for the launch. and are on schedule for final submission to Apples App Store. Nice bit of volume today and RSI pointing up. Looks like bollingers might be starting their expansion again. More speculative, but could be worth a look.

SWAV:NASDAQ - SHOCKWAVE MEDICAL - Trending nicely.Shockwave is another medical devices company that has been having a good run for a while now. 16% is a nice level without too much volatility, while an 18% stop loss would have kept you in the trade through recent volatility. Still a bit of room on the RSI, so could be worth a watch.

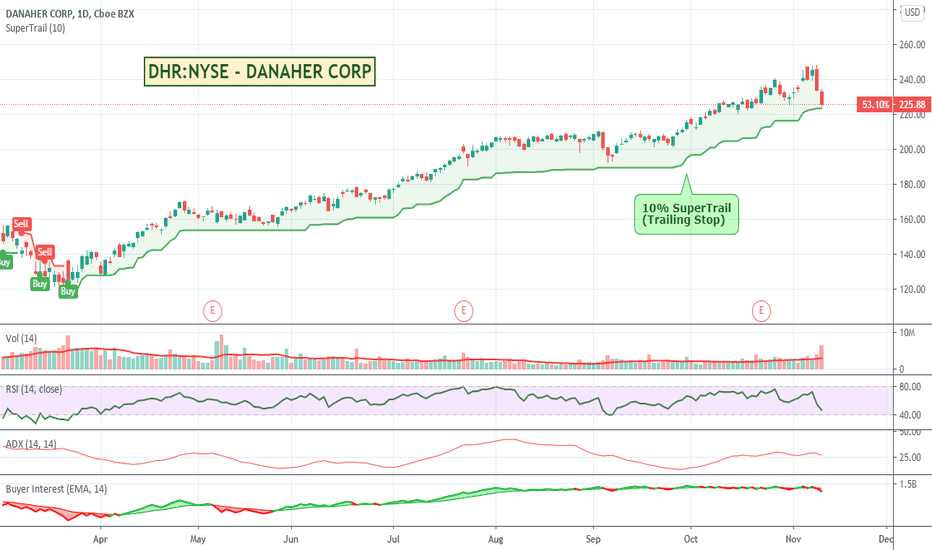

DHR:NYSE - DANAHER CORP - Medical equipment and research toolsDanaher is another nice steady runner. Up around 85% since its March lows, it is currently going through a pullback and almost back at the bottom of its normal trading range. Could be at a reasonable value area. Worth a watch if it heads back up.

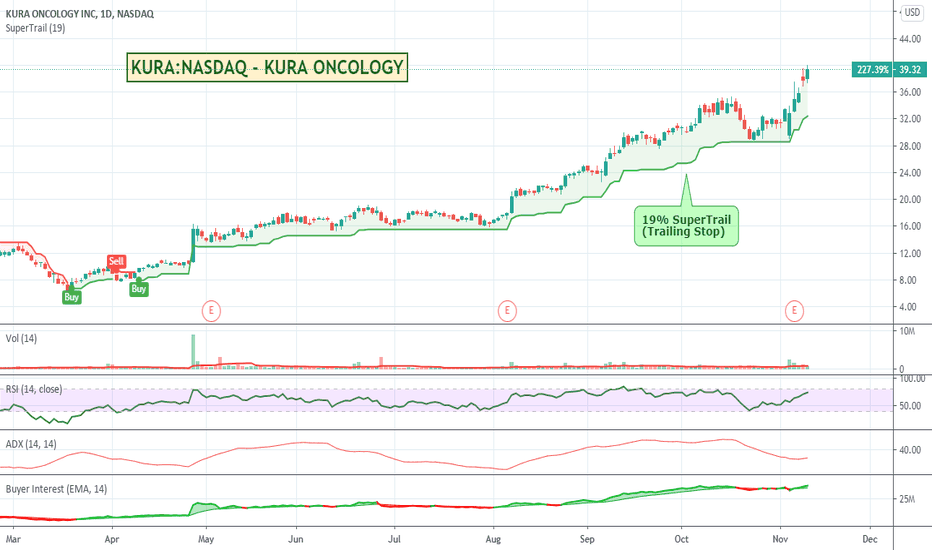

Covid Cure Runners - Where the Smart Money is moving.Well, Pfizers news yesterday of a Corona vaccine with 90% efficiency was received well by the market sending the Dow through the roof and heavily punishing the stay-at-home / work-from-home stocks that have been keeping us all entertained for the last 6-8 months. As per the video, it all feels a bit too soon, but there does seem to have been a big sell off of the tech stocks, and you can see the smart (and retail) money moving into the heavily beaten up areas like airlines, cruises, casinos, and complimentary businesses like hotels and resorts where a lot more value and potential upside remains.

I thought I'd cover examples of some of the stocks in each of these areas and suggest possible ways outside of the TradingView Screener for you to find additional stocks in these spaces that might also be running, as well as how to look at what an ETF is made up of. You could choose to trade the ETF which is a container of like-themed stocks, or pick the best individual stocks and seek to outperform the ETF.

The video includes examples of some US as well as Australian stocks, but the idea will work for any markets. As always do your own research. None of these should be considered any kind of recommendation, they were just names I pulled out of my memory without having done any research. The whole market could turn upside down and inside out again tomorrow on different news :)

What do you think. Was the timing of the news just lucky coincidence or delayed conspiracy ;)

Hope it's useful. Enjoy.

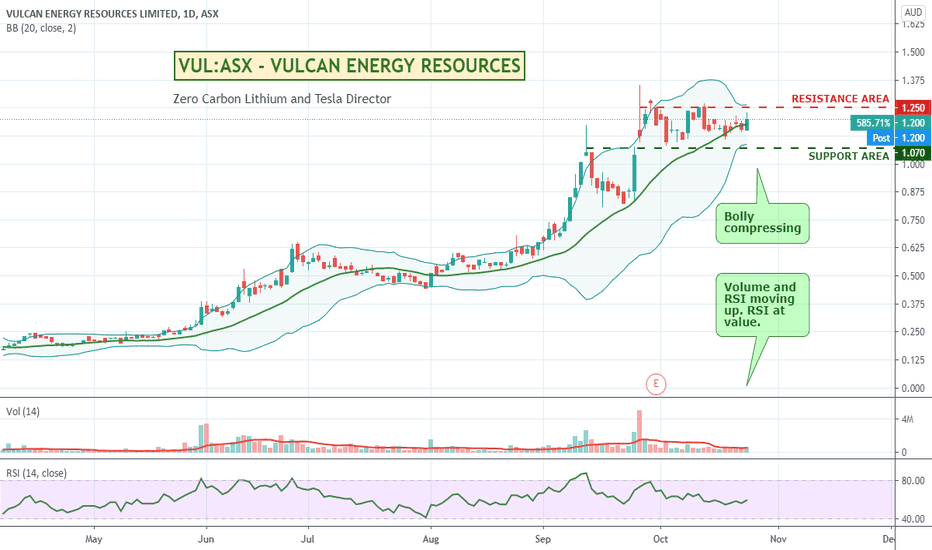

VUL:ASX - VULCAN ENERGY - Zero Carbon Lithium and Tesla DirectorLate play in the day. VUL popped up on a higher than normal volume and price scan. I had a bit of a read of their latest announcement and looked interesting. They are making a strong play for the battery metals market in Europe with zero carbon lithium as their differentiator. Have an ex Tesla director in their employ to help broker deals. Bolly looks to have compressed after a period of price consolidation building a base. RSI and Volume both look like they might be ready to head up. Could be worth a look.

From their release: 20/10/2020

About Vulcan

Vulcan Energy Resources is aiming to become the world’s first Zero Carbon Lithium™ producer, by

producing a battery-quality lithium hydroxide chemical product with net zero carbon footprint from its

combined geothermal and lithium resource, which is Europe’s largest lithium resource, in the Upper

Rhine Valley of Germany. Vulcan will use its unique Zero Carbon Lithium™ process to produce both

renewable geothermal energy, and lithium hydroxide, from the same deep brine source. In doing so, it

will fix lithium’s current problems for the EU market: a very high carbon and water footprint of

production, and total reliance on imports, mostly from China. Vulcan aims to supply the lithium-ion

battery and electric vehicle market in Europe, which is the fastest growing in the world. Vulcan has a

resource which can satisfy Europe’s needs for the electric vehicle transition, from a zero-carbon source,

for many years to come.

Recent activities by the Company (v-er.com):

• Appointment of former Tesla director Jochen Rudat to Business Development team.

• Taro license grant and increased global Mineral Resource Estimate.

• Appointment of lithium industry expert Vincent Pedailles to Business Development team.

• Appointment of lithium chemistry expert Dr. Katharina Gerber to the Executive team.

• Excellent recoveries of over 90% from lithium extraction test work on Upper Rhine Valley brine.

• Securing EU backing support package, and EU-backed investment agreement into the Vulcan

Zero Carbon Lithium™ project.

• $4.8m institutional and ESG investor equity placement.

• Agreement to acquire 3D seismic package to accelerate project development. Commencement

of lithium test work for Pre-Feasibility Study. Completion of positive Scoping Study

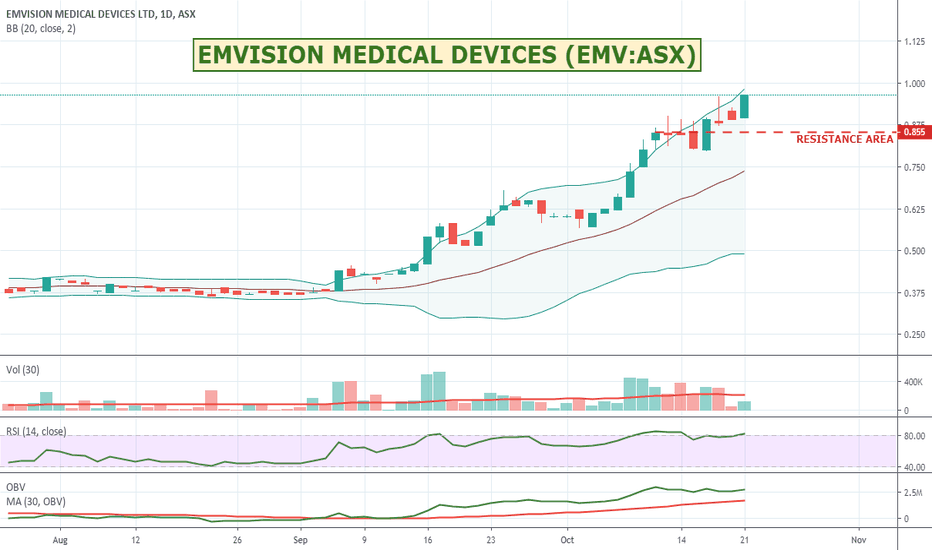

$EMV:ASX - EMVISION MEDICAL DEVICES - Awaiting announcementDespite no real news Emvision has been having a bit of a run of late and looks to have cleared a small resistance area. Good chance it is running on people anticipating that the trial mention in early September might be about to begin. See announcement "03/09/2019 8:28 am AEST On Target For Trial To Commence Q4 Calendar 2019 ". Worth a watch.

Blame or praise to @StanH2443 on Twitter for pointing it out as it wasn't yet on my radar.

EMvision Medical Devices Limited is an Australia-based medical device company. The Company is primarily focused on the development and commercialization of medical imaging technology. It is developing a medical imaging device using electromagnetic microwave imaging for diagnosis of brain stroke, and other organs and other medical applications.

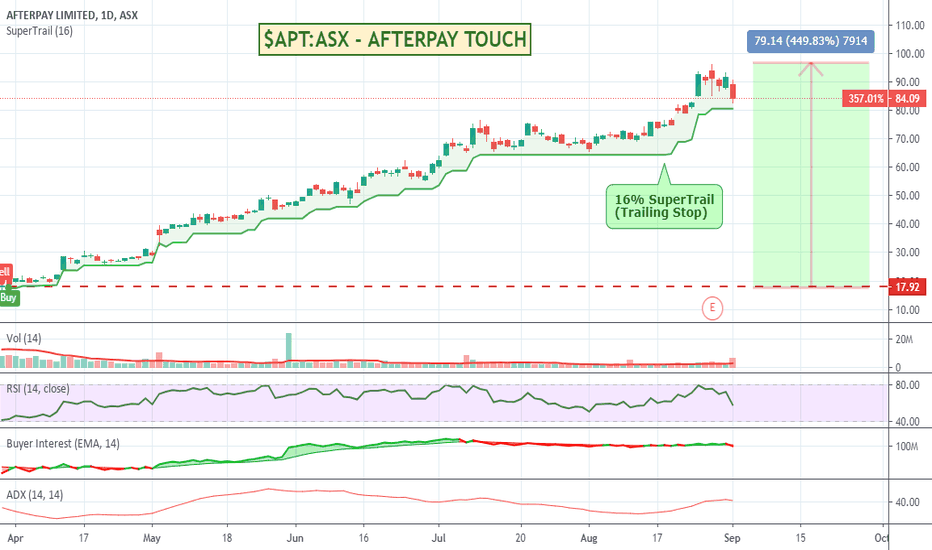

$APT:ASX - AFTERPAY TOUCH - Big pullback with the market.Afterpay has been having an amazing run, and with an 8%+ pullback today with the rest of the ASX down up to 2% it could well be an over reaction. Could be worth a watch for an entry on resumption of trend.

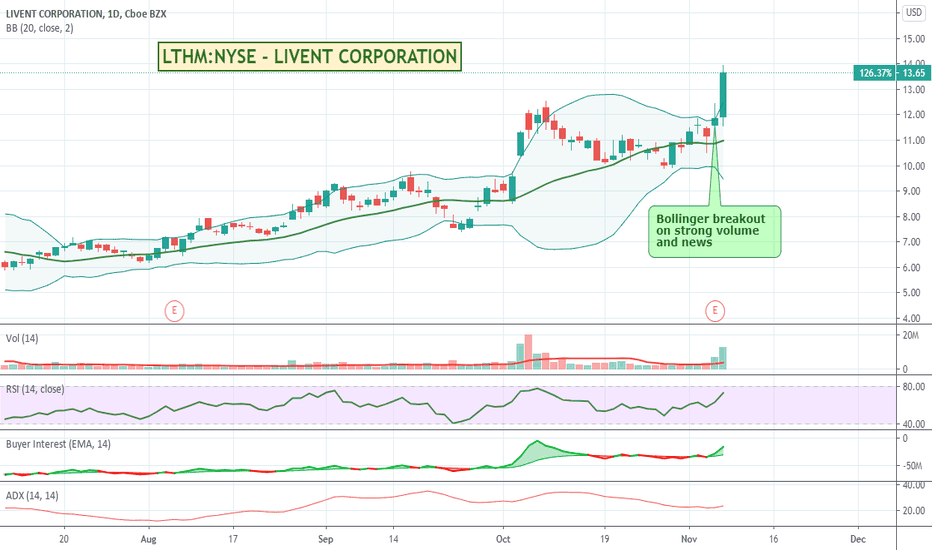

LTHM:NYSE - LIVENT CORPORATION - Tesla DealCould be another NASDAQ:PLL / ASX:PLL on news of Tesla adding to an existing lithium supply agreement, providing Tesla with additional access to high-quality battery material supplies. Could be worth a watch.

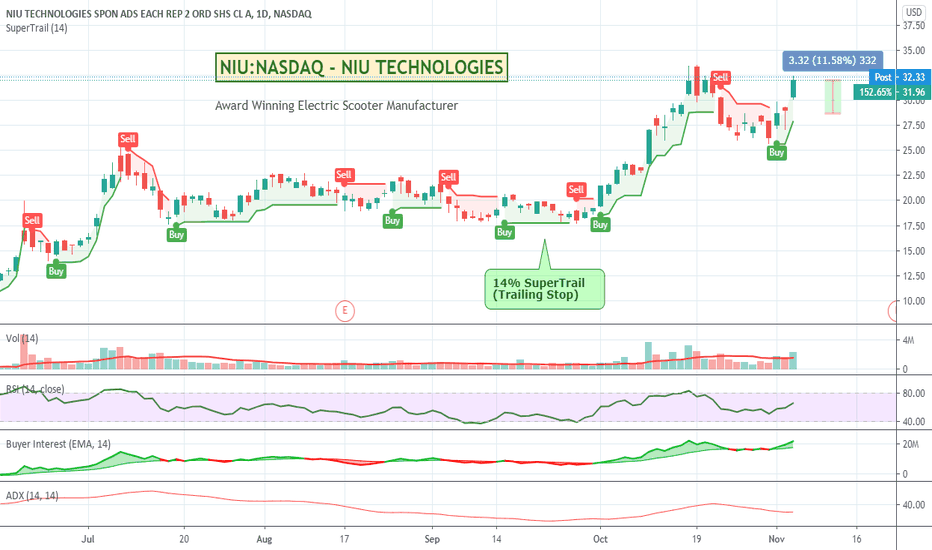

NIU:NASDAQ - NIU - Award Winning Electric Scooter ManufacturerNice pop on NIU yesterday rising 11% with the strength of the wider market. If you have ever travelled through Europe or Asia, scooters are EVERYWHERE and much more practical in those inner city type areas than cars which are slowly being forced out of CBDs world wide due to congestion. Could be worth a watch.