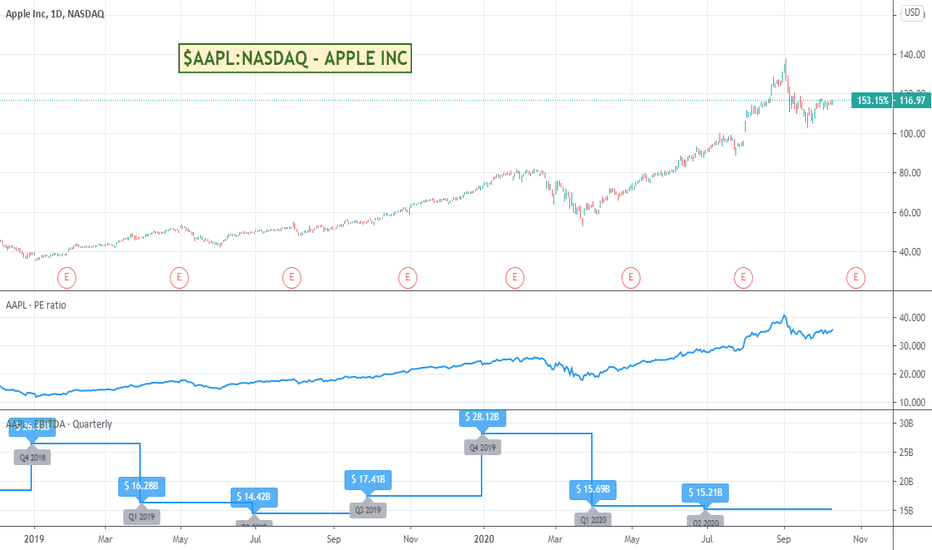

Apple Chart with PE and EBITDA ChartedSaw a post by one of the mods on here @scheplick (tradingview.sweetlogin.com) where he posted a stocks market cap below its price chart. I've known that you can chart fundamentals on here for a while, but haven't seen anyone really using it. As a technical trader I dont pay much attention to fundamentals BUT for my superfunds and longer term buy and holds I do like to pick companies where they have a positive EBITDA. Thought it was interesting to see how PEs also can grow over time as stocks become increasingly popular with investors future expectations of the growth of a company. Figured I'd share it just in case of interest to anyone else.

If you use and chart fundamentals in your trading style - love you to post some of your charts in the comments section below. Am always looking to learn new tricks :)

Search in ideas for "zAngus"

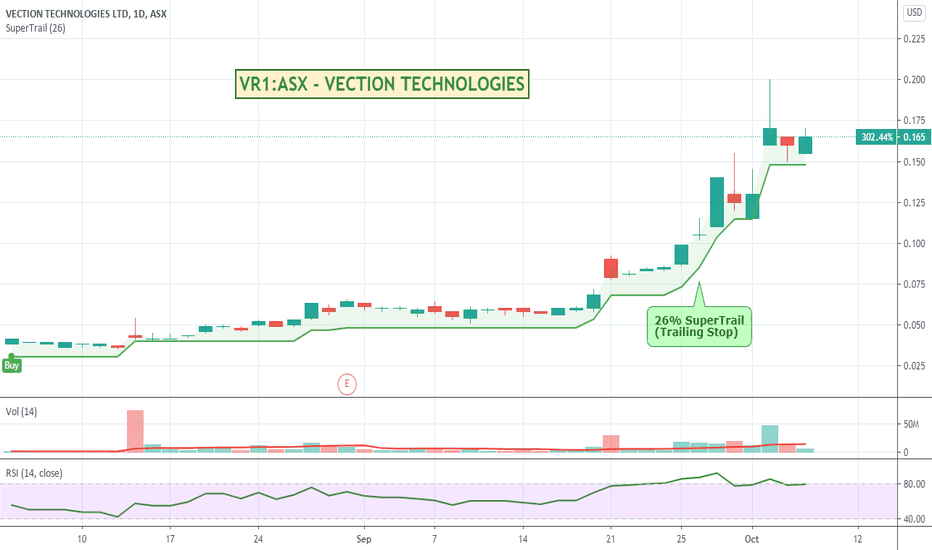

VR1:ASX - VECTION TECHNOLOGIES - Running on Facebook entry.Vection is having a nice run further enhanced by its recent entry into the Facebook Oculus Independent Software Vendor (ISV) program and the launch of their Mindesk 2020 product. Current demand for the stock seems to be there with 414 buyers for 19,664,418 units vs 113 sellers for 6,663,548 units. Could be worth a watch.

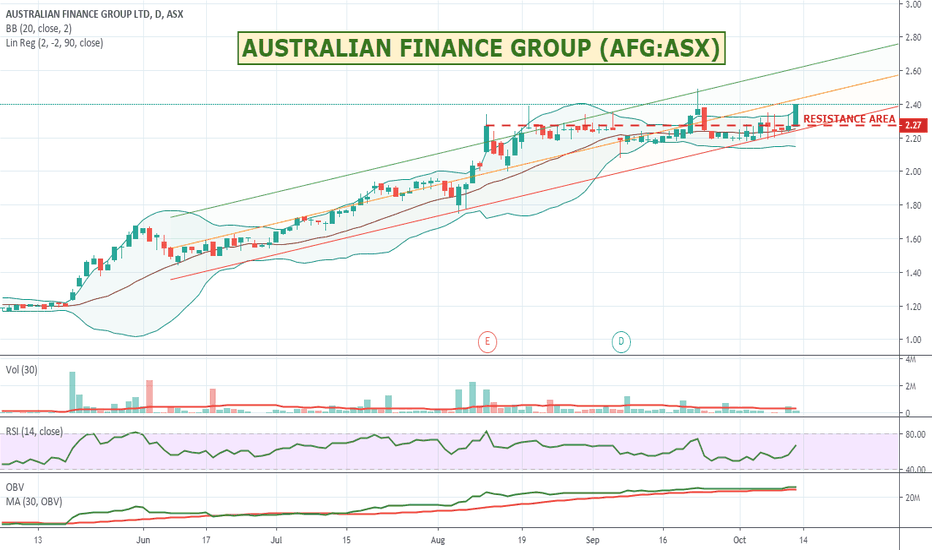

$AFG:ASX - AUSTRALIAN FINANCE GROUP - Popped resistance areaVolume indicators are a bit weak for my liking, but it has been having a good run (up almost 100% over 6 months) and if it is up Monday it could be worth a closer watch.

Australian Finance Group Limited (AFG) is a mortgage broking company. The Company's principal activities are mortgage origination and management of home loans and commercial loans, and distribution of own branded home loan products, be they funded through traditional mortgage management products, while label or its residential mortgage backed securities program. Its segments include AFG Wholesale Mortgage Broking, AFG Home Loans and Other. The AFG Wholesale Mortgage Broking segment includes operating activities in which the Company acts as a wholesale mortgage broker that provides its broker members with administrative and infrastructure support, as well as access to a panel of lenders. The AFG Home Loans segment offers its branded mortgage products. It offers commercial finance, insurance products, and AFG-branded and securitized products. Its subsidiaries include Australian Finance Group (Commercial) Pty Ltd and Australian Finance Group Securities Pty Ltd, among others.

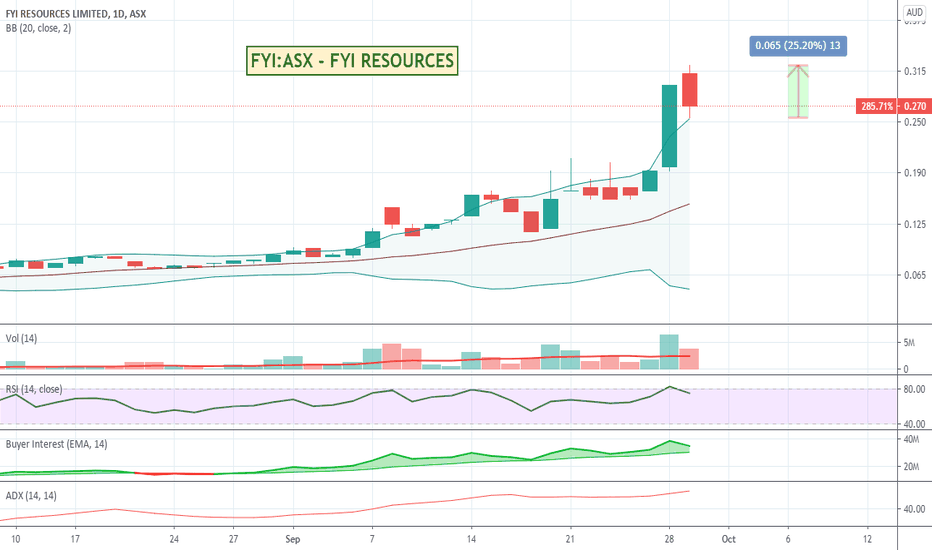

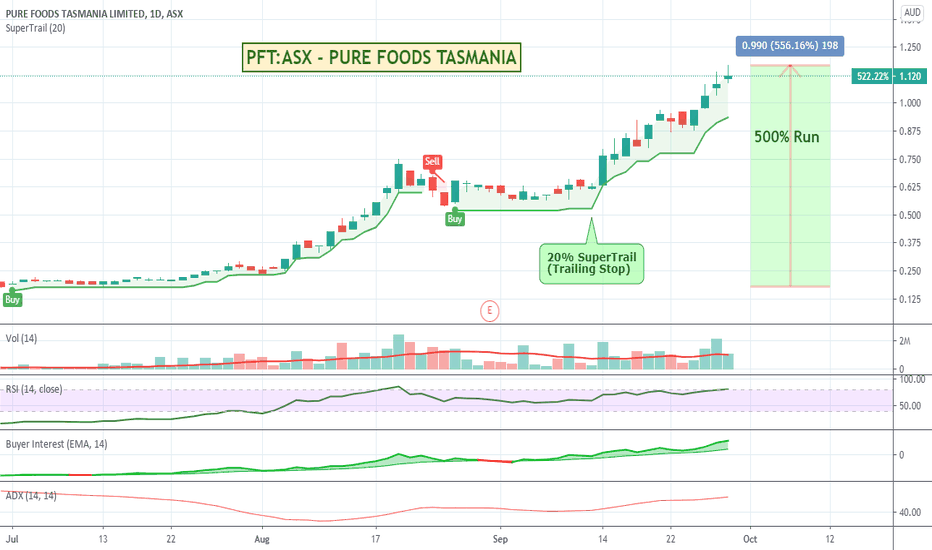

FYI:ASX - FYI RESOURCES - 500% 3 month runFYI has been having a strong run. Had a fairly volatile second day off a previous massive day so will be interesting to see which way it heads tomorrow. Will keep an eye on it.

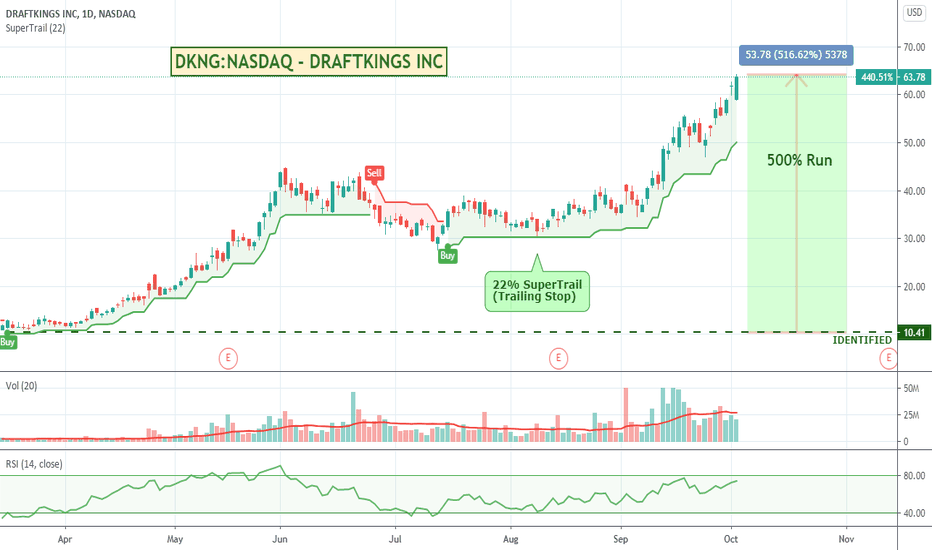

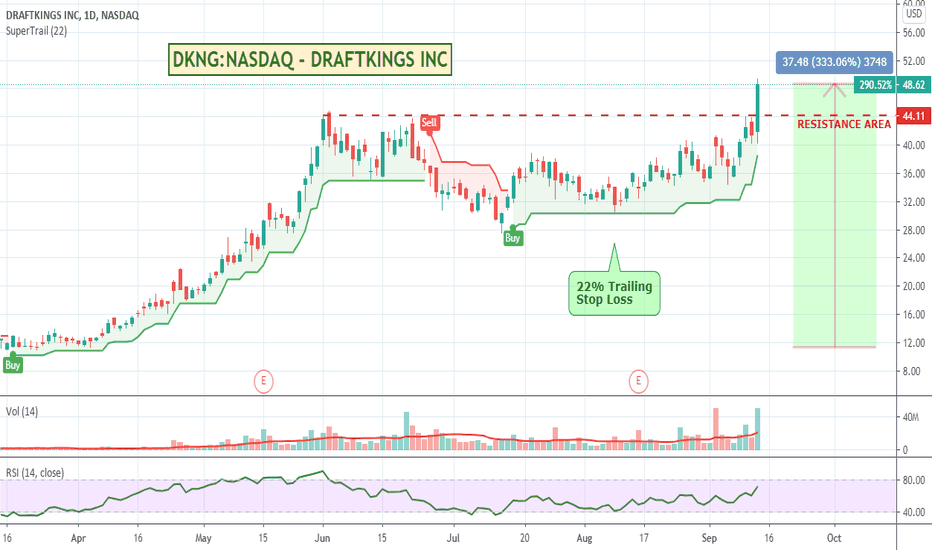

DKNG:NASDAQ - DRAFTKINGS INC - 500% run since March lowsDKNG is in the online and retail sports wagering space as well as operating daily fantasy contests and online casino games. Seems to be a pretty hot space at the moment with similar stocks around it also doing well as sports in the US start to open up. Could be worth a watch.

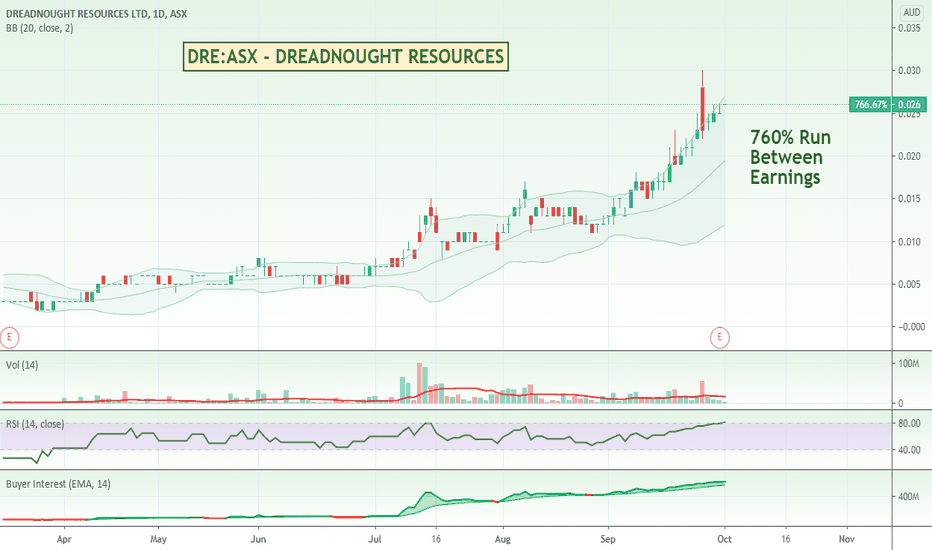

DRE:ASX - DREADNOUGHT RESOURCES - 760% run for nickel minerDreadnought Resources is a gold, copper and nickel miner in Western Australia. It has been having a great run on its gold finds but feels very overextended at the moment. Will look for a pullback to below 70 on the RSI, but worth keeping an eye on with the Tesla battery day showing demand for nickel could be high in the future.

CLV:ASX - CLEARVUE TECHNOLOGIES - Glass into Solar PanelsI like the idea that ClearVue Technologies produces clear glass that generates electricity as well as that they are happy to grow their business through licencing and royalty payments (I've been watching too much of Kevin O'Leary aka Mr Wonderful on Shark Tank). Looking at all the sky scrapers and buildings in modern cities you know at some stage they will all become giant solar arrays. Up just under 500% since their March lows, but still a long way way from their previous all time highs I like the idea. They just need some more sales on the board. Could be worth a watch.

RUN:NASDAQ - SUNRUN - Residential Solar with a 700% run so farSunRun is one of the leading residential solar, battery storage, and energy services company in the United States and their stock has been on a nice and steady run since the March lows up around some 700%. I will probably wait for a bit of a pullback before an entry, but certainly worth a watch.

YNDX:NASDAQ - YANDEX - Russian Search Engine up 130%Yandex is a Russian search engine also catering to users in the Ukraine, Belarus, Kazakhstan, Uzbekistan and Turkey. The stock has been moving up steadily since the March market lows and looks to continue. Could be worth a look.

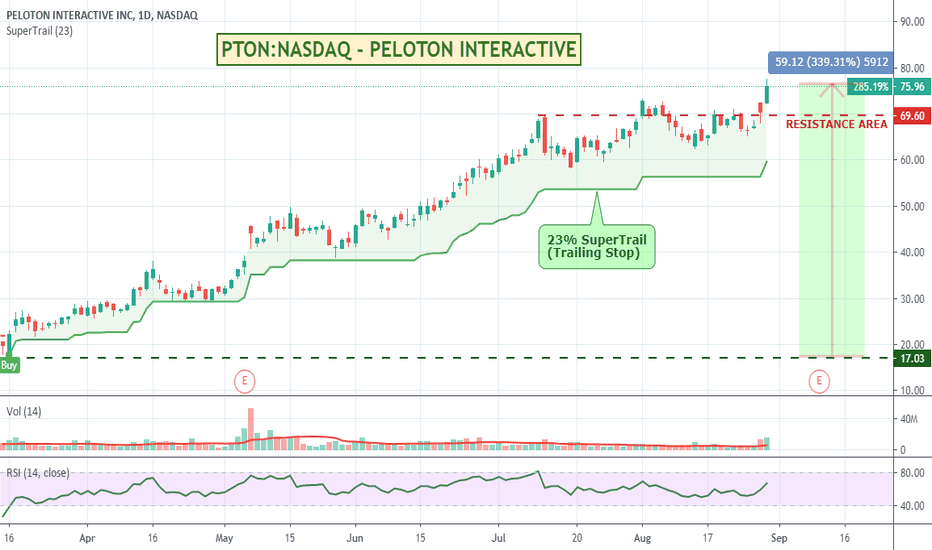

PTON:NASDAQ - PELOTON INTERACTIVE - 300% run since March lowsPeloton is another business benefiting from the stay-at-home economy with people increasingly looking for home-gym exercise type solutions. RSI looking good, but getting close to earnings which are probably likely to be up - but are they up as much as shareholders expect. Watch up for a pullback to retest that resistance area, but a stock worth keeping an eye on the longer the stay home environment runs.

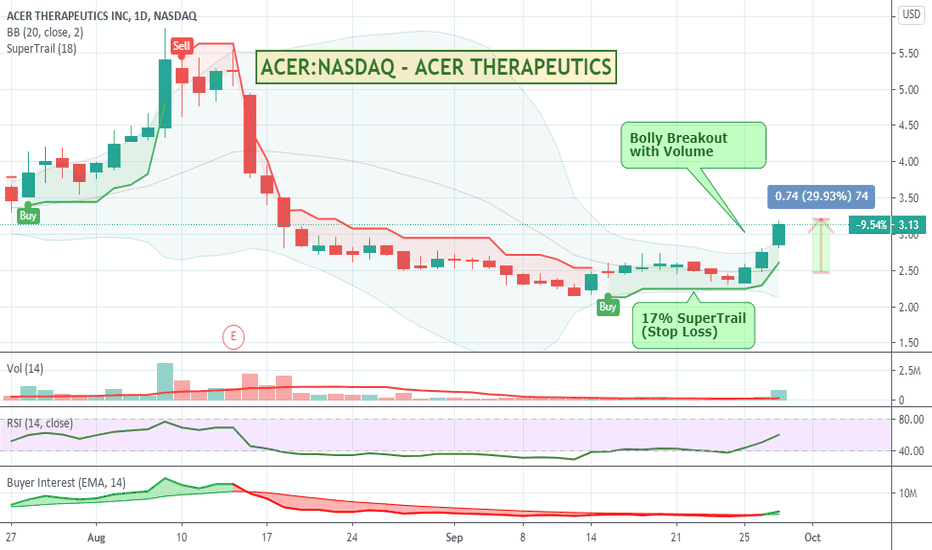

ACER:NASDAQ - ACER THERAPEUTICS - Bolly Breakout.ACER had a nice move overnight on the back of a few days of rallying. Still around 70% to get back to old highs so has some good wiggle room above current levels. Could be worth a look.

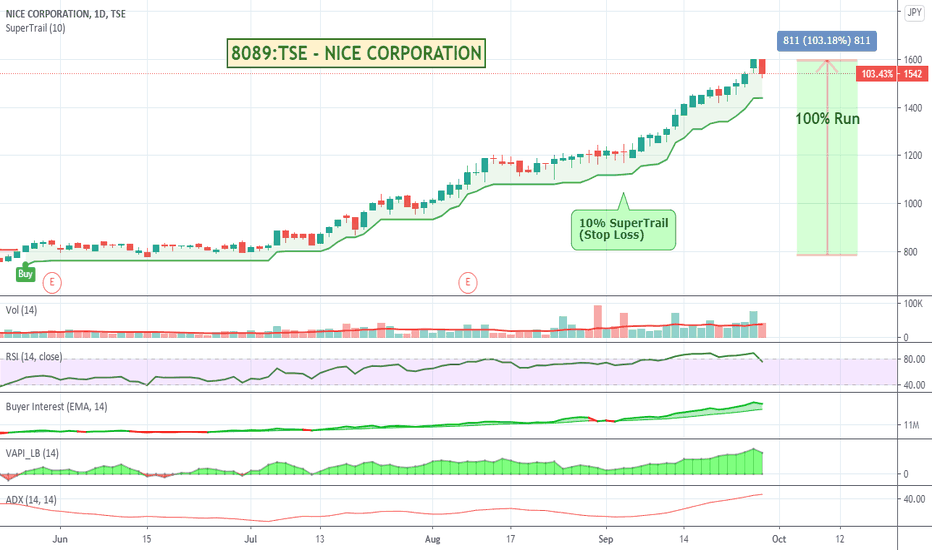

8089:TSE - NICE CORPORATION - 100% run on a 10% trail.Nice Corporation imports, distributes, and sells building materials for housing in Japan and internationally. Super smooth chart and a consistent gainer. Has finally had another pull back into a slightly better value area. One to watch if it resumes its run.

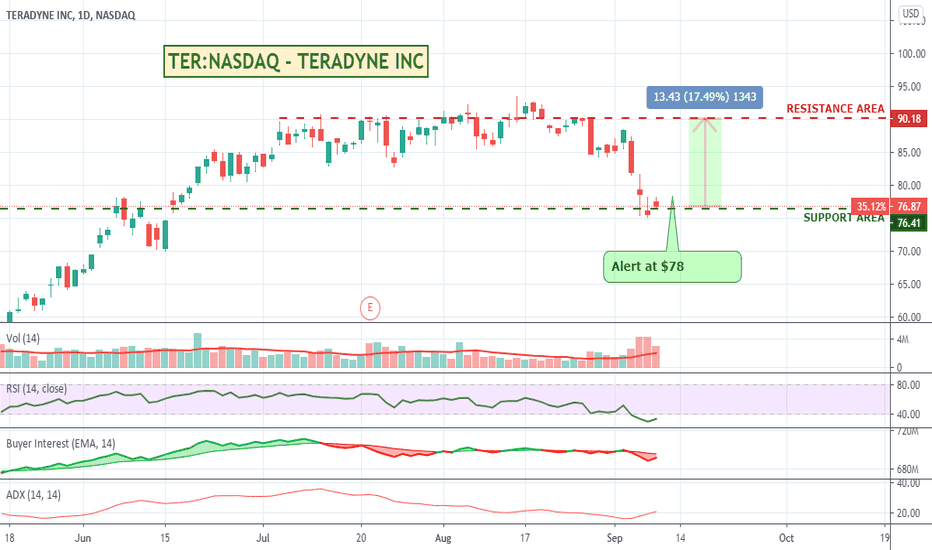

TER:NASDAQ - TERADYNE INC - S&P 500 and 20% swing trade?Teradyne along with Etsy and Catalent was added to the S&P 500 index by the committee effective Sept. 21. Just looking at the chart it looks like it was comfortably pushing the $90 mark before the big tech stock correction. Entry into the S&P 500 will mean a bunch of ETFs and funds will be looking to add it to their collections so could further help its chances of a move up. Ive put an alert in at $78, but could equally place a stop-limit order to take a position if it heads in the right direction. Might get shaky up around that $90 mark. Be interesting if the index addition can push it through that level or not. Need to take into account the wider market volatility too of course and hope we dont correct again after this recent bounce. Worth a look.

DKNG:NASDAQ - DRAFTKINGS INC - Nice run on double newsDraftKings, Penn, and Caesars all ran strongly last night with news of sports in the US beginning to open back up and the big ESPN deal helped propel Draftkings further. Quite a lot of volatility in DKNG, but looks promising after breaking through that previous resistance area with some news propelled momentum behind it. Worth a watch.

CRWD:NASDAQ - CROWDSTRIKE - Data security up 300% since MarchCrowdstrike basically helps businesses defend against hacking, viruses, and other data incursions - a pretty hot space at the moment. Looks like it is through its recent resistance areas powered by earnings and after a pullback with the wider market. Could be worth a watch.

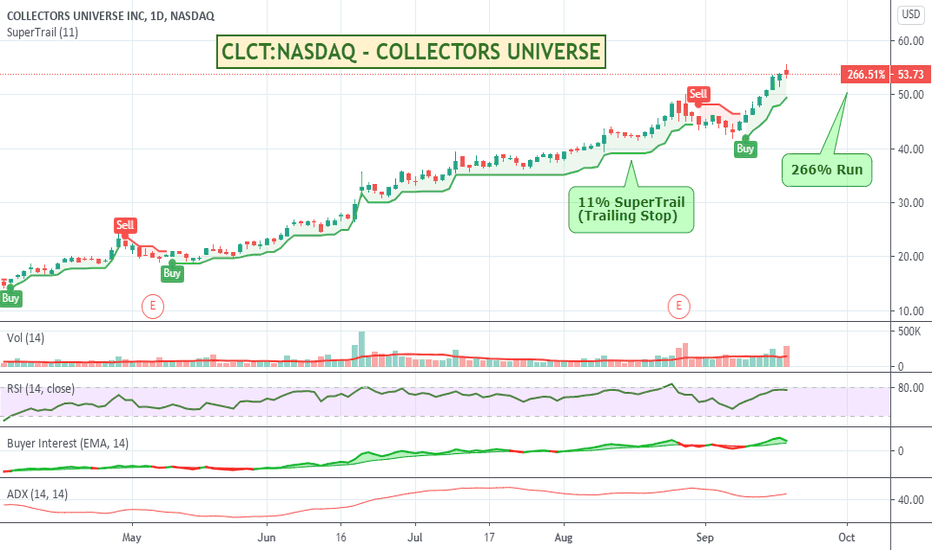

CLCT:NASDAQ - COLLECTORS UNIVERSE - 250% RunCollector Universe is a really weird one that I wouldn't have expected to run as strong as it is. How many people have collections they want to authenticate and track. Seems a lot must do. Might need a pullback to get back into value, but worth a watch.

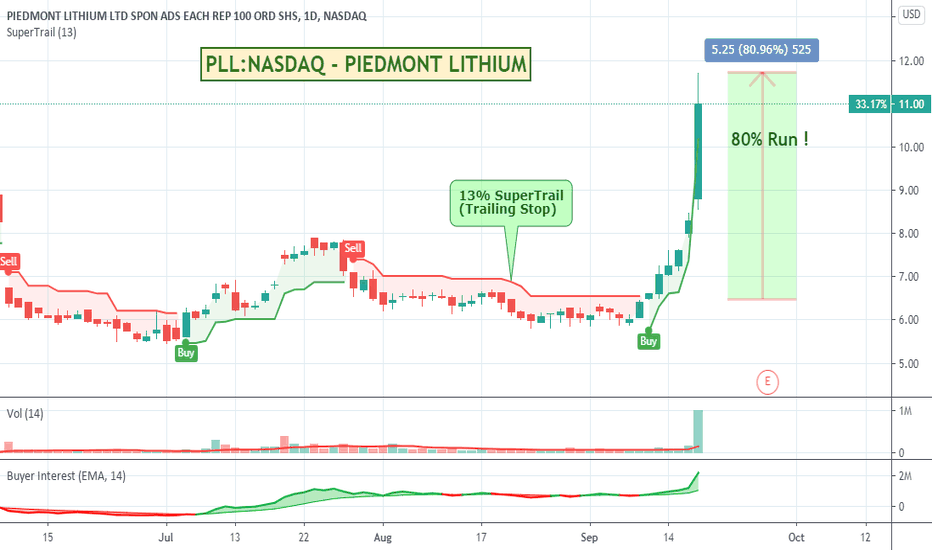

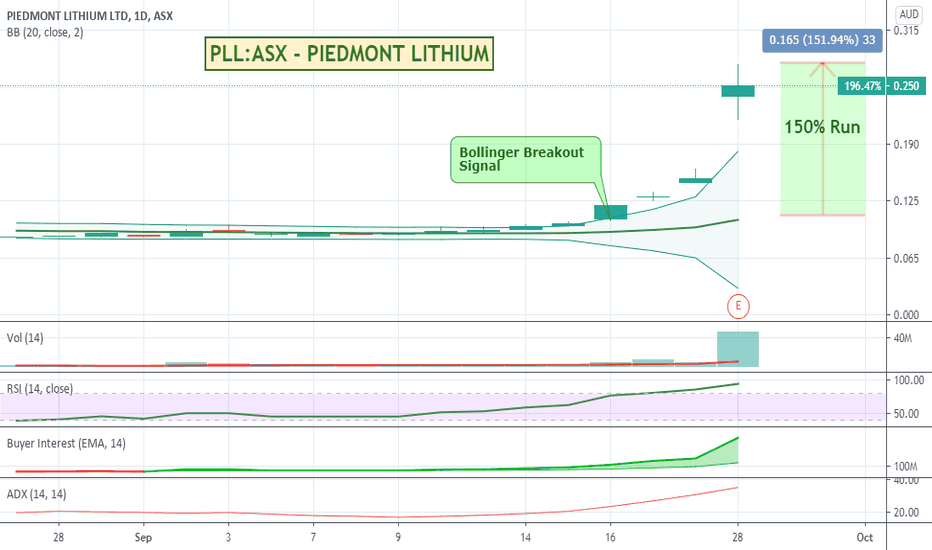

PLL:NASDAQ - PIEDMONT LITHIUM - Deal with Tesla announced.PLL announced a deal with Tesla after going into a trading halt back on the 17th of September. The Australian holding is up 80% today. Will be interesting to see what this US version does tonight or when it re-opens. Article on Yahoo News, Reuters etc. Worth a watch.

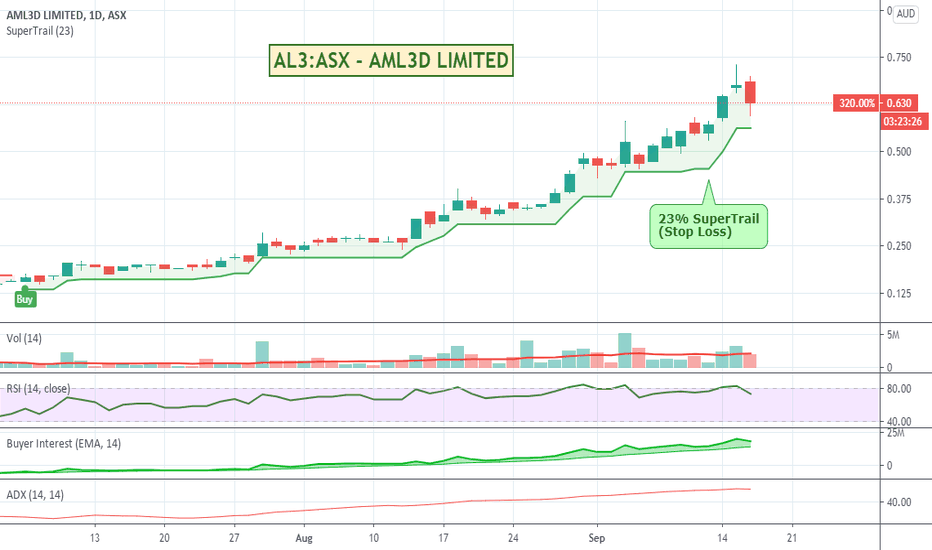

AL3:ASX - AML3D - 3D Metal Printer - Up 320% since debutAL3 was pointed out to me by @zbfairlane here on TV. Company looks interesting. I would imagine the ability to be able to 3D print metal is definitely something we are going to see more and more of as opposed to the traditional making a cast and pouring, welding and shaping. If its anything like household 3D printing it should allow for some complex shapes and approaches in industrial design and manufacturing we perhaps haven't seen before. Had a big 10% pullback today on no news so could be a good entry area if interested. Worth a watch.

DEG:ASX - DE GREY MINING - 3000% run!De Greys has been having a brilliant run. Up 3000% over a year, up 600% since March lows. Worth keeping an eye on.