1727:HKEX - HEBEI CONSTRUCTION - 350% run since March lowsHebei Construction is a Chinese company heavily involved in building construction and infrastructure projects across residential, public, industrial, and commercial buildings; as well as in specialised construction areas such as electrical and mechanical installation and steel structure. The company operates through two segments: Construction Contracting and Others. The Construction Contracting segment provides general contractor services for building construction projects and infrastructure construction projects. The Others segment provides property development, property management, and other services. Nice and steady progress. I'm trying to be a bit more disciplined and buy at better value areas so I have set an alert for when the RSI crosses back through 70. Im also greedy, so have an alert if it goes up another couple of percent and might rethink about an entry. Either way, worth a look.

(Description source: Trading View)

Search in ideas for "zAngus"

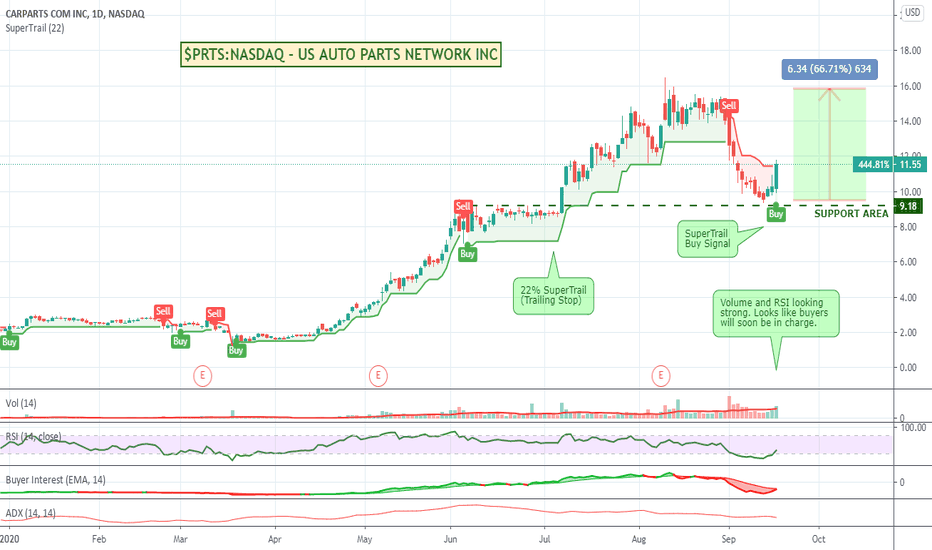

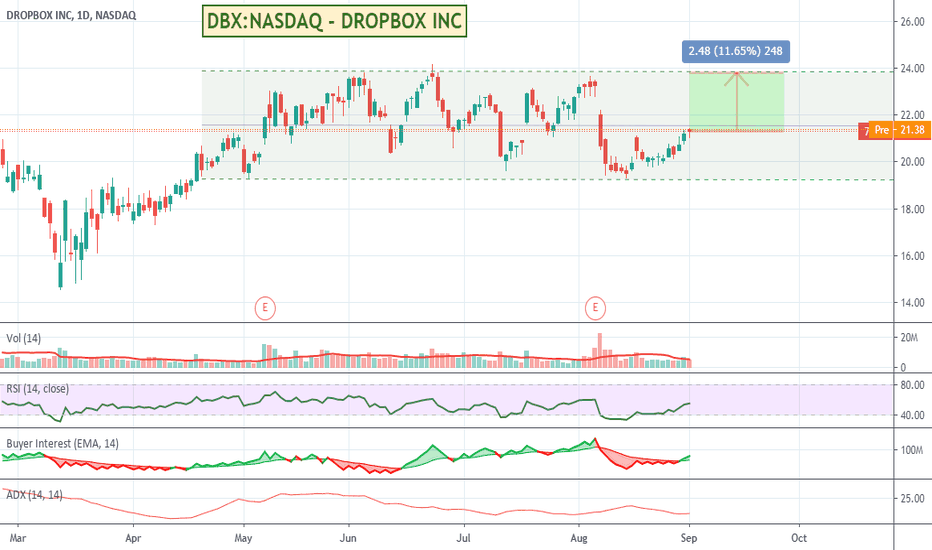

$PRTS:NASDAQ - US AUTO PARTS - Comeback buy signal ?US Auto Parts was one of the best runners up around 800% since its lows in March before its big pullback. It has had a good last couple of days and the volume and RSI look encouraging. After yesterdays 12% run it might pull back a little, but either way well worth a look again.

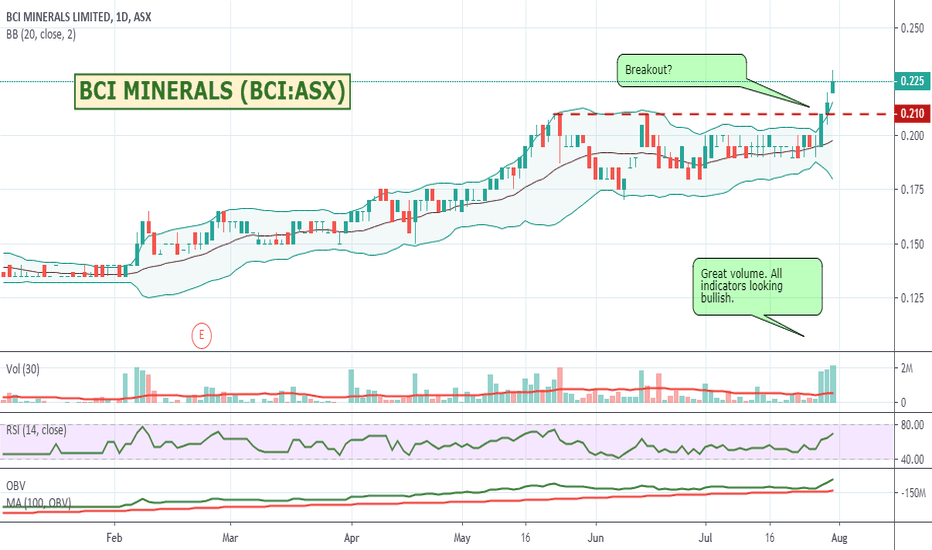

$ASX:BCI - BCI MINERALS - Breakout from resistance on volumeBCI seems to be running well at the moment having broken out of a resistance area after several tests on strong volume. Bit overextended on the Bollinger Bands but all other indicators look like it could still have more in it. Might pull back for a bit after such a hard run so buyer beware. Worth a watch.

BCI Minerals Limited (BCI, formerly BC Iron Limited) is an iron ore development and mining company with key project in the Pilbara region of Western Australia. BCI's projects include Iron Valley Mine, Buckland Project, Mardie Salt Project and Carnegie Potash Project.

Demand: 154 buyers for 4,475,492 units vs 83 sellers for 2,860,271 units

TradingView TA Opinion: tradingview.sweetlogin.com

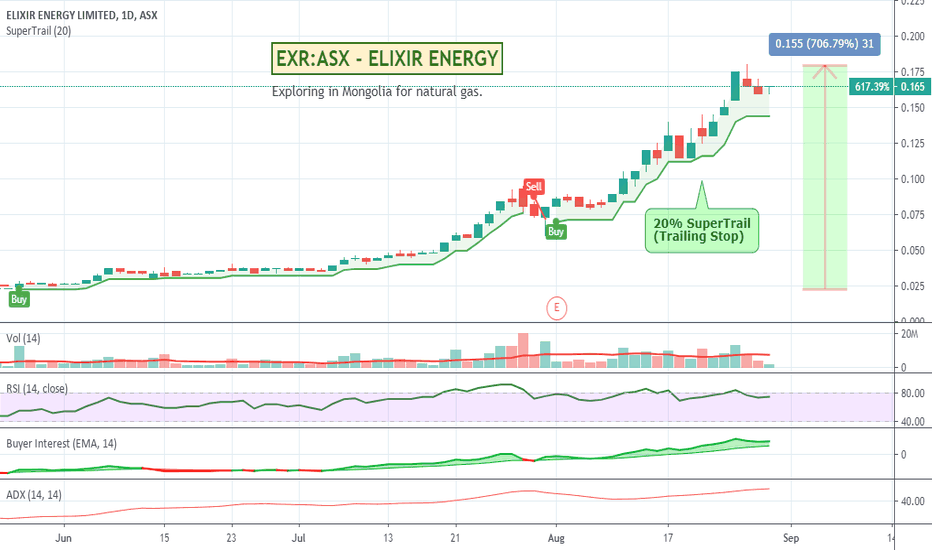

EXR:ASX - ELIXIR ENERGY - 600%+ runnerElixir is an interesting stock. The company is exploring in Mongolia for natural gas with the goal of finding large gas reserves on the Chinese border. It has had a bit of a pull back from its 18 cent recent high. Could be worth a watch.

About Elixir (source: www.elixirenergy.net.au)

Elixir Energy Limited (ASX: EXR) is an Australian Securities Exchange listed oil and gas exploration and development company. It is focused on exploring in Mongolia for natural gas in the form of coal-bed methane (CBM). In Australia CBM is also known as coal seam gas (CSG). EXR’s Corporate Vision is simply “to find large gas reserves on the Chinese border”. In Mongolia, EXR holds 100% of a CBM production sharing contract (PSC), located just to the North of the Mongolian/Chinese border. The PSC was signed in September 2018 with the Mineral Resources and Petroleum Authority of Mongolia (MRPAM). The licence area covered is ~30,000 square kilometers (~7 million acres). This very large area has been independently certified to contain a giant CBM risked recoverable prospective resource of 7.6 Tcf (best case). EXR acquired the PSC through the back-door listing of unlisted Australian public company Golden Horde Ltd, which was set up in 2011 solely to acquire CBM rights in Mongolia. The company’s founders accordingly have strong networks in, and experience of, Mongolia. Australia is the global leader in CBM production and exports the gas extracted from Queensland coal seams to various Asian countries, including China, Japan and South Korea. EXR is taking Australia’s leading CBM expertise to Mongolia. The company successfully ended its 2019 exploration program, which comprised shooting 2D seismic and drilling a number of wells. The last well in the first year’s program - Nomgon-1 - made a coal seam gas discovery. The plans for 2020 are to undertake further delineation work around Nomgon-1 and pursue further exploration work (seismic and drilling) across the vast PSC.

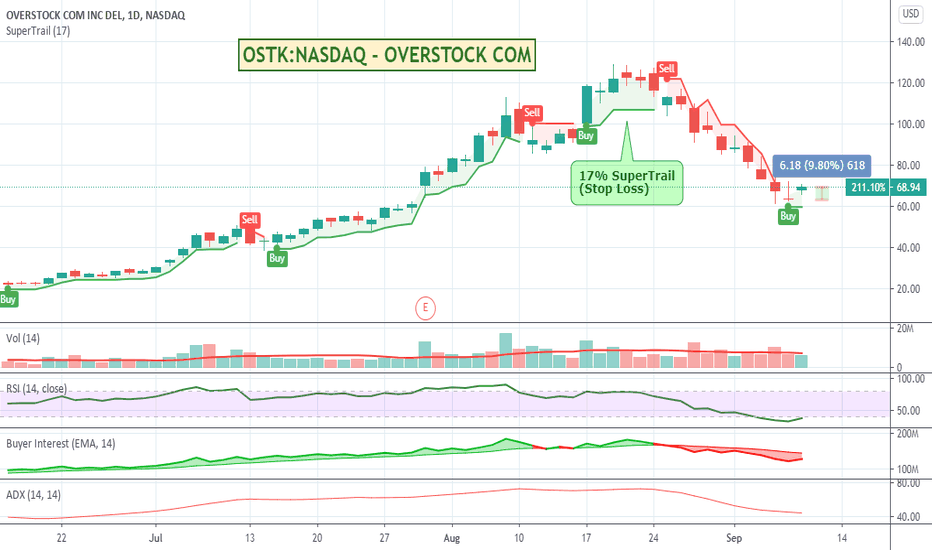

OSTK:NASDAQ - OVERSTOCK COM - Got a buy signal. Got a buy signal yesterday on Overstock so back in the trade again. RSI was well and truly in oversold territory and with the big gains on the DOW and NASDAQ last night the buying will hopefully continue. Ran REALLY well before its decline, so hopefully now that its back to a better value area might resume an upward trend. Worth a watch.

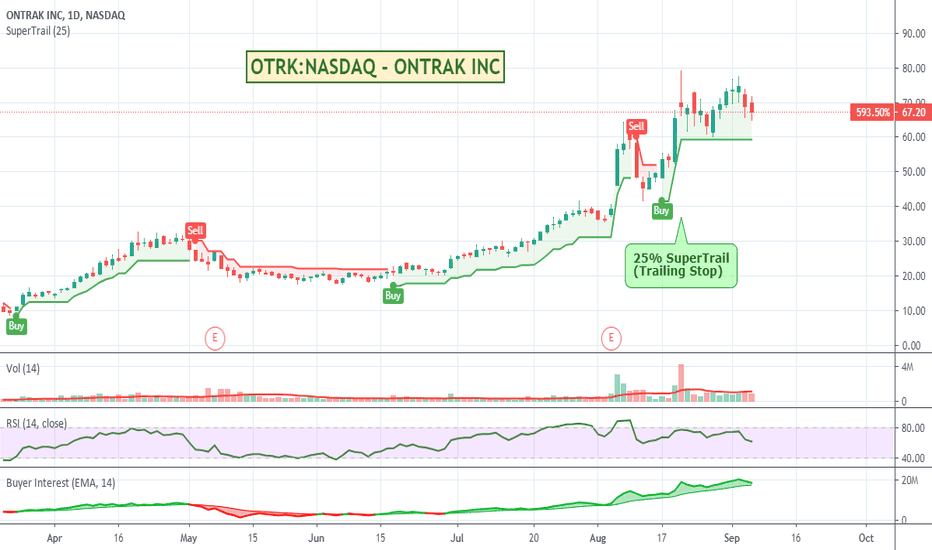

OTRK:NASDAQ - ONTRAK INC - AI powered healthcare up 500%Ontrak, Inc. is a leading AI and technology-enabled healthcare company. They operate in the telehealth space as well. Quite a volatile pricing chart, but with recent pullbacks could be worth a look.

More about what they do here on their home page. Looks interesting: catasys.com

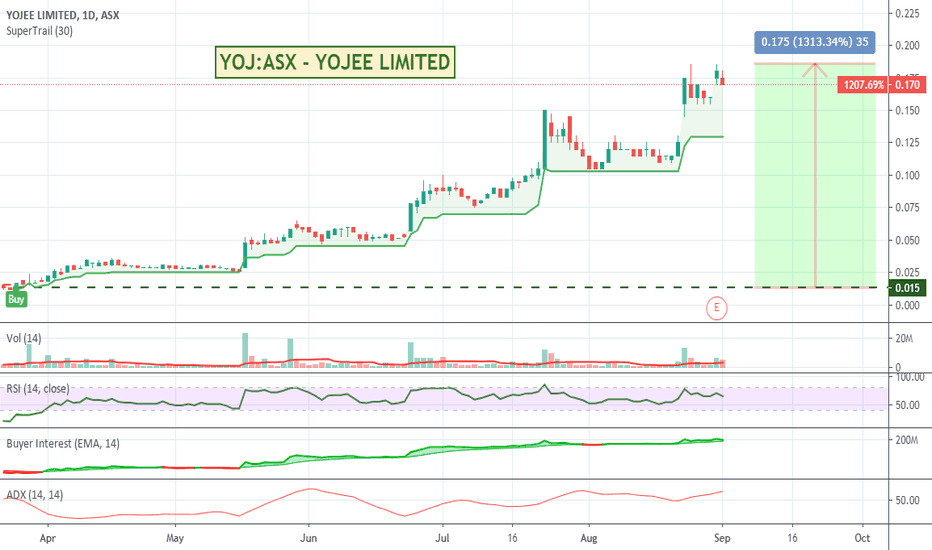

YOJ:ASX - YOJEE LIMITED - 1500% logistics runnerHmmm. Surprised YOJ hasn't been on my radar much earlier. Had to go and have a better read of what they do, and from their about us it looks like they use AI and machine learning to solve more complex logistics type issues. They are past earning and the price didn't collapse. Looking at level 2 type data on Commsec buyers and sellers are pretty equal and there arent really any gaps in price so might keep these price levels. Worth a look.

Yojee (YOJ:ASX) is an ASX publicly listed technology company which has introduced new ways of working, communicating, and collaborating within the logistics industry. Yojee’s best-in-class logistics software utilises Artificial Intelligence (AI) and Machine Learning to optimise and manage delivery operations. Yojee can add value to logistics companies of all sizes at an affordable rate, on a transaction based fee model. We are here to empower small and medium enterprises with the ability to achieve cost efficiencies only the industry giants have enjoyed before, as well as to help large multinationals transition into the digital age seamlessly. (Source: yojee.com)

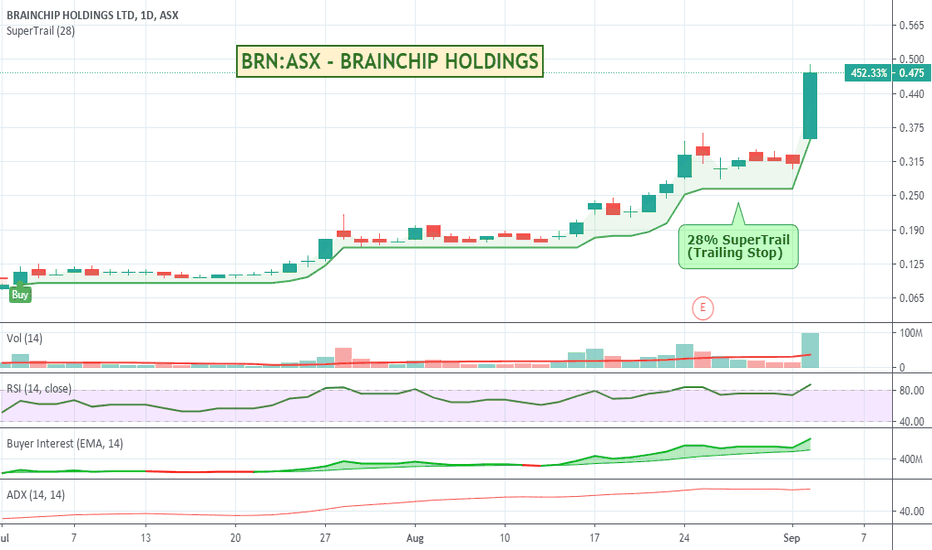

BRN:ASX - BRAINCHIP - AI / Machine Learning stock running hardBig up day today on news of a collaboration agreement with Vorago Tech (privately listed). It is a stock I have been in and out of a few times over the last month as I didnt want to keep my stops so wide. Caught most of todays move thankfully. I like the sound of what they do. The whole BRN is "a leading provider of ultra-low power high performance AI technology" sounds good to me long term. One to watch perhaps after a more significant pullback.

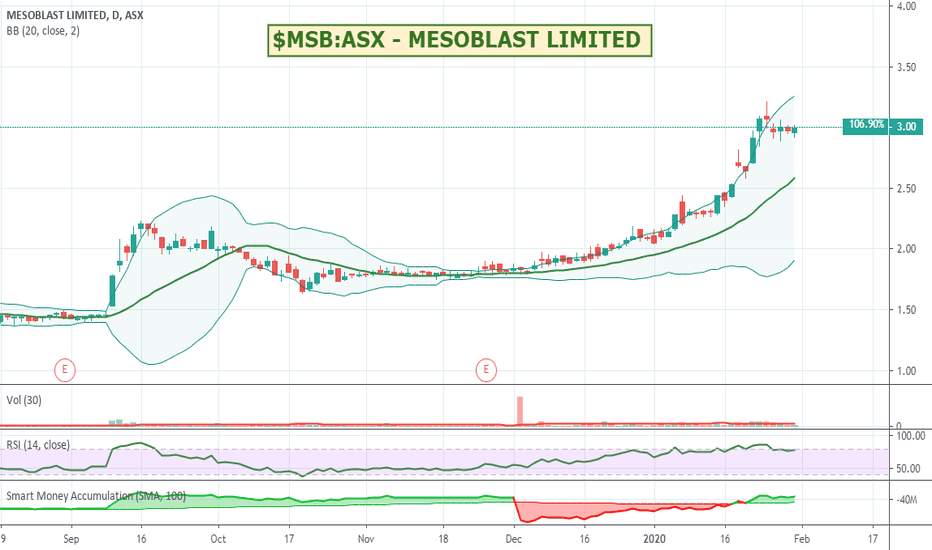

$MSB:ASX - MESOBLAST LIMITED - Up 150% over 12 monthsMesoblast has had a strong run especially over the last couple of months. Has had a bit of a pullback off its highs so could be well worth a watch to see if it continues back on its upward march. I've set an alert at $3.05 to see what happens.

Mesoblast Ltd. is a biopharmaceutical company, which engages in the research, development, and market of mesenchymal lineage adult stem cell technology platform. Its medicines target the cardiovascular diseases, spine orthopedic disorders, oncology and hematology, immune-mediated, and inflammatory diseases. The company was founded by Itescu Silviu on June 8, 2004 and is headquartered in Melbourne, Australia.

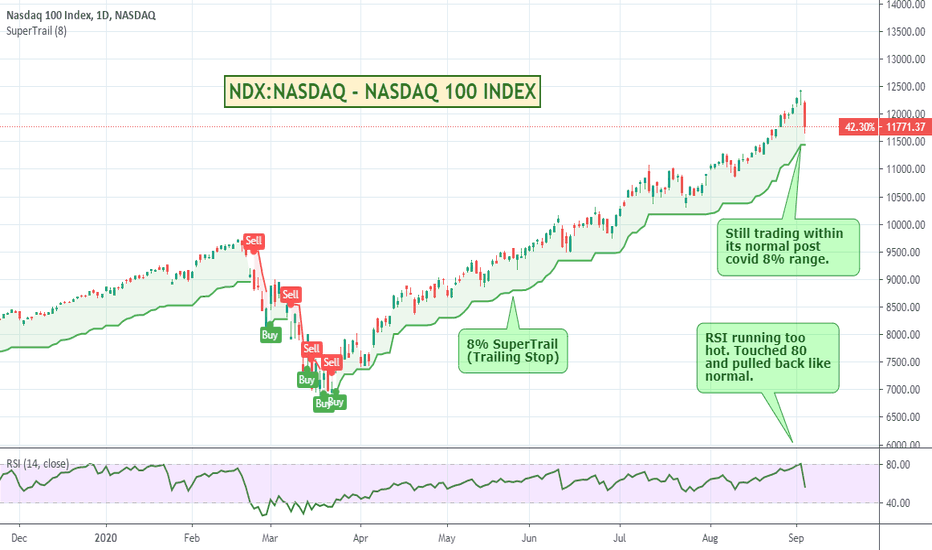

NASDAQ - Normal pull back or trouble ahead?You can see that despite a fairly large correction, the NASDAQ is still trading within its normal 8% type range. If it breaks out below than we might be in for a bit of pain. Will need to wait and watch for the next few days. Could be a good buying opportunity if it does bounce and move back up.

HUB:ASX - HUB24 LIMITED - 140% runHUB24 runs an investment and superannuation platform that has been having a nice steady run since the March lows. Its just past its earning so looking to see if it builds a base here and continues its run. Not a lot of available stocks, so pick your entry carefully. Worth a look.

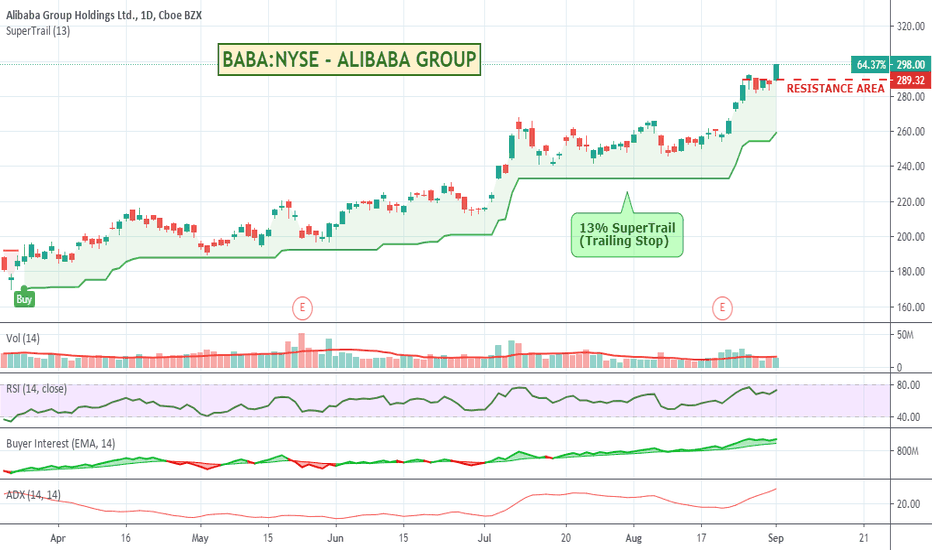

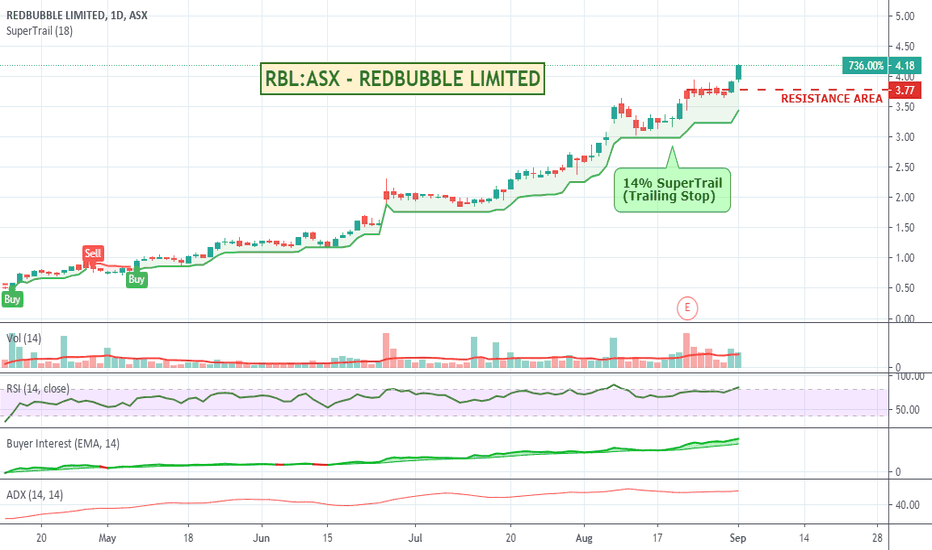

RBL:ASX - REDBUBBLE LIMITED - 700% run.RedBubble is looking good doubling down on both the ecommerce, and work from home side hustle industries post covid. It looks like it has built a bit of a base post earnings and then broken out above a recent resistance area. RSI might be a bit overcooked, so perhaps wait for a pullback and test to confirm support. Worth a watch.

$HD:NYSE - HOME DEPOT INC - Breaking out over old highsHome Depot is running well at the moment registering as a strong buy on the Trading View TA signals. Another one breaking out over old highs. Worth a watch.

The Home Depot, Inc. (The Home Depot) is a home improvement retailer. The Company sells an assortment of building materials, home improvement products, and lawn and garden products, and provides various services. The Home Depot stores serves three primary customer groups: do-it-yourself (DIY) customers, do-it-for-me (DIFM) customers and professional customers. Its DIY customers are home owners purchasing products and completing their own projects and installations. The Company assists these customers with specific product and installation questions both in its stores and through online resources and other media designed to provide product and project knowledge. Its DIFM customers are home owners purchasing materials themselves and hiring third parties to complete the project or installation. Professional Customers are primarily professional renovators/remodelers, general contractors, repairmen, installers, small business owners and tradesmen.

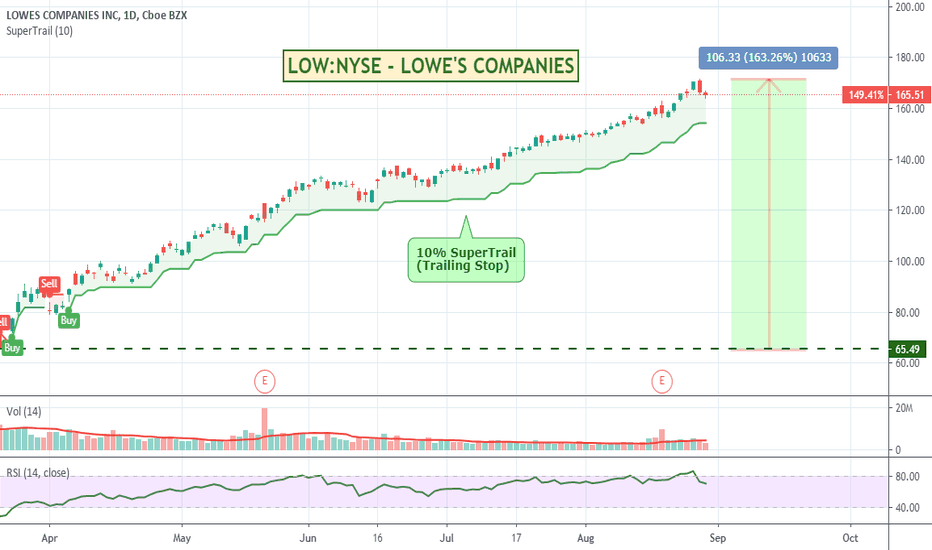

LOW:NYSE - LOWE'S COMPANIES - 150% home improvements runWas reading an article this morning on the "nesting economy" and they were saying that companies like Lowes and Home Depot have been doing particularly well lately. Lowes has had a 30% jump in revenue for their second quarter which includes a whopping 135% surge in online sales. Chart looks pretty good and not too much volatility. Nice and smooth. Has had a small pullback so might be back in a value area. Could be worth a look.

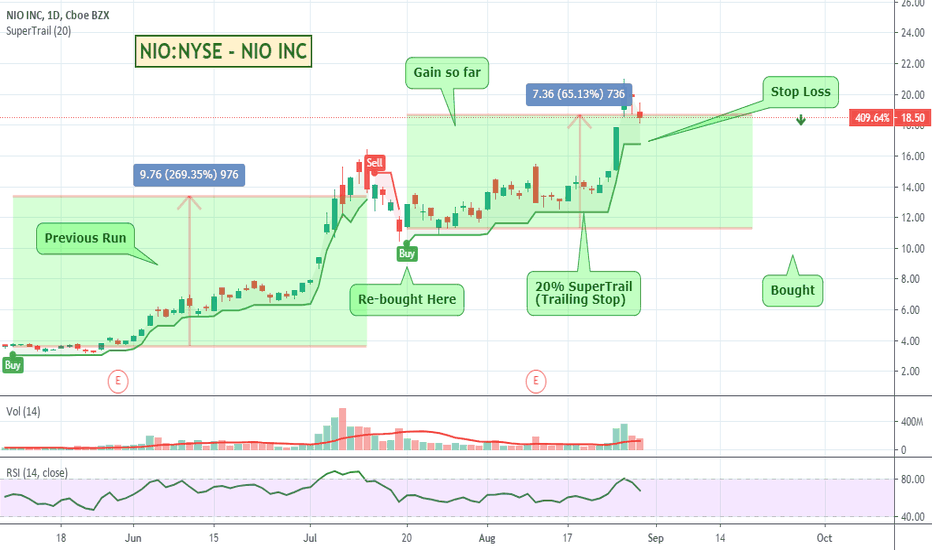

NIO:NYSE - SuperTrail and Trade Station working togetherLot happening in this chart of NIO, but thought I'd just show you how a live trade looks in TradingView using Trade Station.

You can see on the right hand side where I bought the stock (added automatically by TradingView and doesn't move), and where my current stop loss is set (this one I can adjust and move up and down to change my stop). I could also add a take profit (also adjustable) if I wanted to try and take advantage of spikes - like in this case where it spiked just short of $21 before pulling back.

You can see at a value of 20% for a SuperTrail / Trailing Stop Loss where I have entered and exited the trade (as confirmed by the Trade Station buy line). You can also see the approximate gains made if you had trusted and followed the trail. I think its interesting how before and after the buy and sell the 20% signal remained true for this period.

Best thing I like about the trading integration with Trading View is how easy it is to visualise where your entry and exits are, and you can literally just drag the line up and down to change your position. Its cool. I like it.