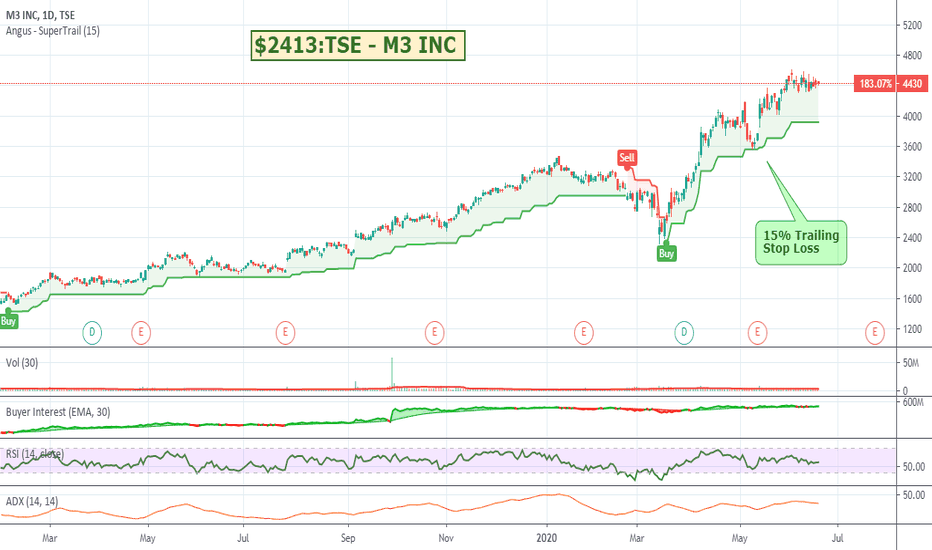

$2413:TSE - M3 INC - Up 125% over the last 12 monthsM3 Has been having a good run but momentum has slowed. Viewing it with a Bollinger Bands overlay shows a bit of compression happening so will be interesting to see which way it breaks.

M3, Inc. engages in the provision of medical related services through the Internet. It operates through the following segments: Medical Portal, Evidence Solutions, Overseas, Clinical Platform, and Others. The Medical Portal segment provides the medical-related marketing support and research services. The Evidence Solutions segment includes clinical research support business, medical clinical trials management, and management support business. The Overseas segment offers marketing support and research services for medical-related firms in the United States, the United Kingdom, and South Korea. The Clinical Platform segment engages in the development, sale and support of electronic medical records. The Others segment offers information services for medical institutions and prescription drug advertising business. The company was founded on September 29, 2000 and is headquartered in Tokyo, Japan.

Search in ideas for "zAngus"

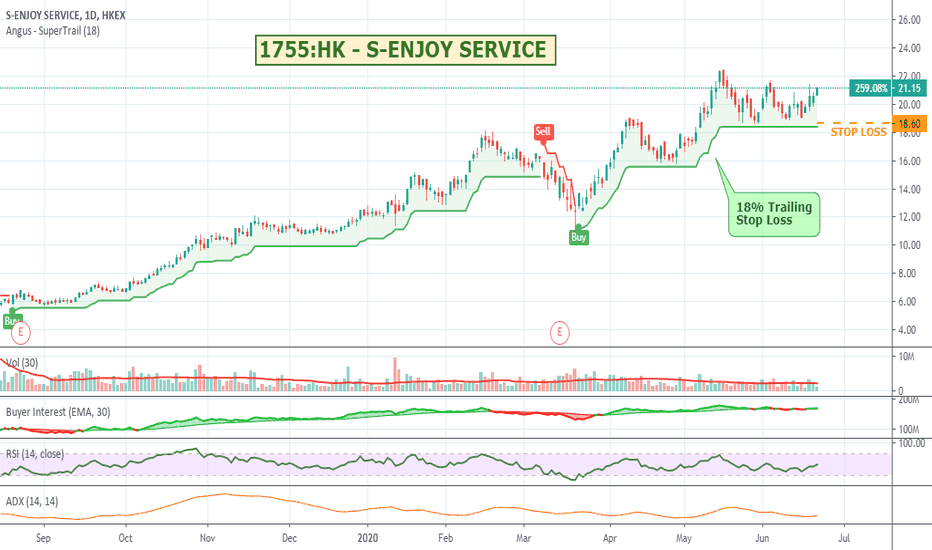

1755:HK - S-ENJOY SERVICE - 260% run to-date. S-ENJOY has been having a nice steady run over the last 9 months. Could be worth a watch.

S-Enjoy Service Group Co., Ltd. is an investment holding company. It engages in the provision of property management and value-added services, including property developer-related, community-related and professional services in the People's Republic of China.

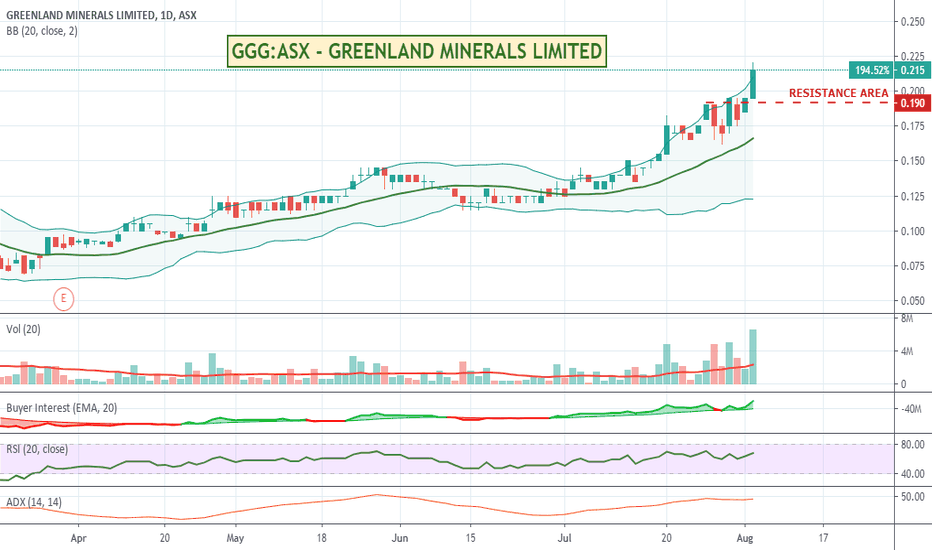

GGG:ASX - GREENLAND MINERALS - Bollinger breakout with volumeBit of a run post their AGM on Friday. Through a resistance area it might need to retest, but could be worth a watch over the next few days.

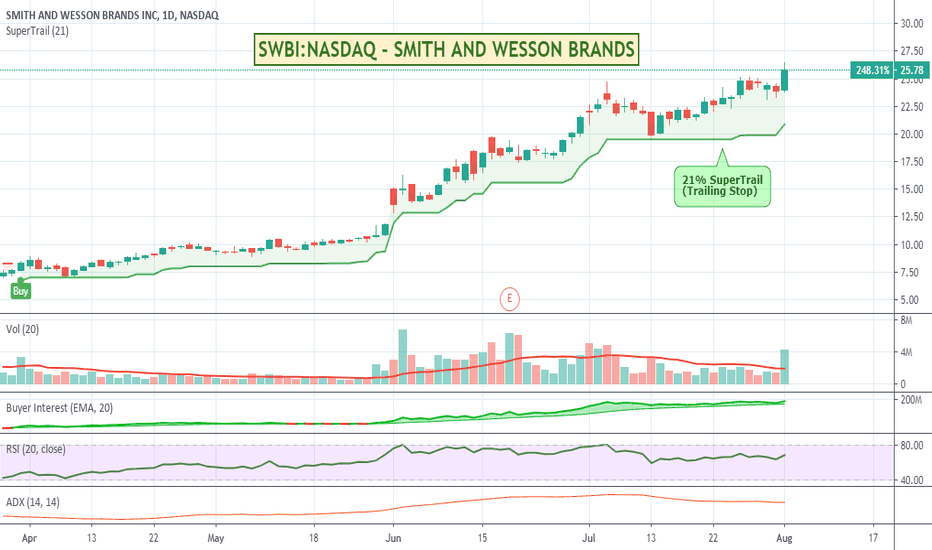

SWBI:NASDAQ - SMITH AND WESSON BRANDS - Up 250%With gun sales in the US going through the roof, it shouldn't be any surprise that Smith and Wesson has been doing particularly well. Big volume yesterday and the RSI shows there is probably still value in it. Could be worth a watch.

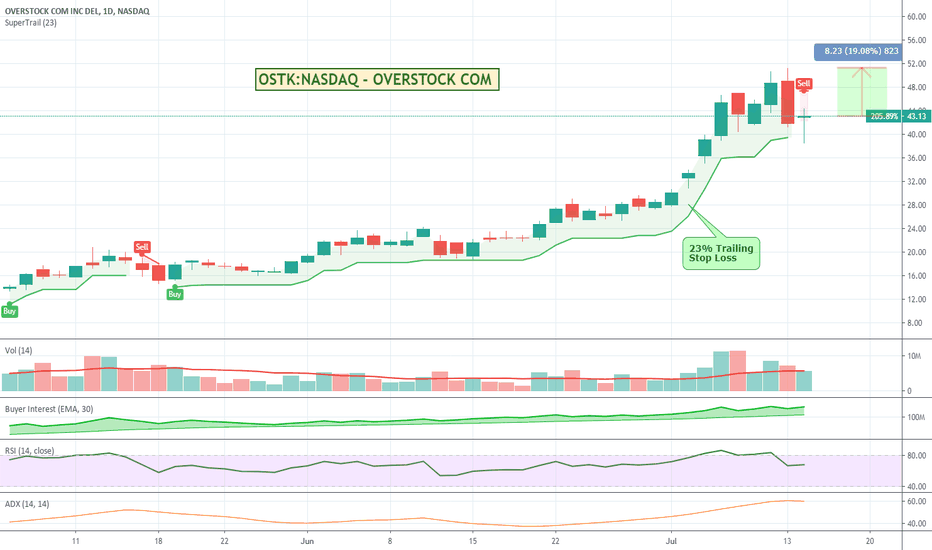

(a 16% trail would keep you in most of the trade if you wanted to run a tighter stop).

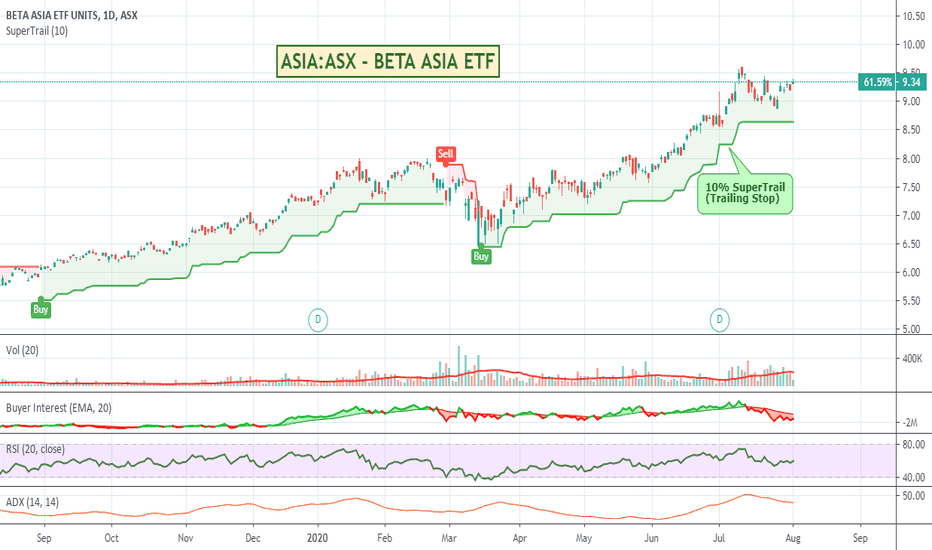

ASIA:ASX - BETA ASIA ETF - Asian tech and online retail exposureGood looking ETF for Aussies. Gain exposure to the 50 largest Asian (ex Japan) technology and online retail stocks such as technology giants such as Alibaba, Tencent, Baidu and JD.com.

More info on the ETF and what it is made up of at www.betashares.com.au

Could be worth a look to get exposure to Asian companies from the ASX.

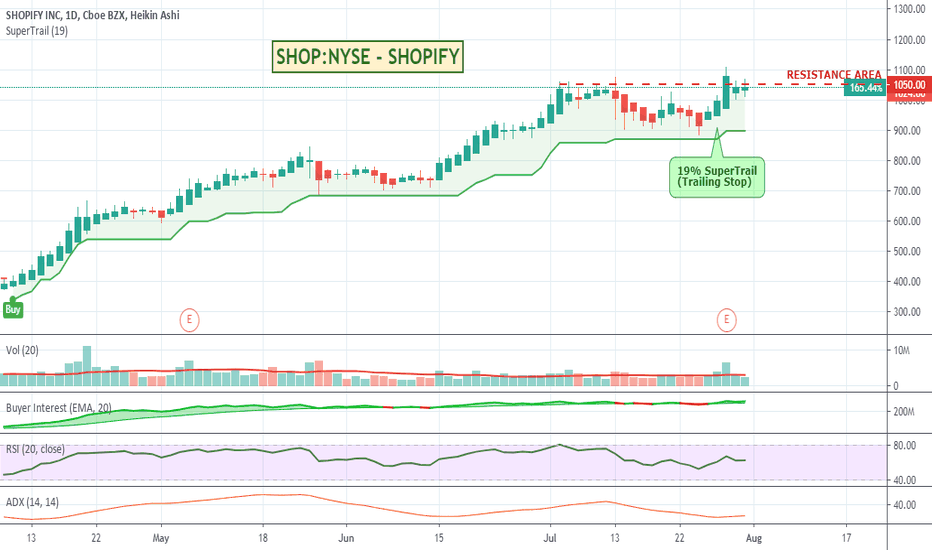

SHOP:NYSE - SHOPIFY - Will it push through resistance?19% SuperTrail trailing sell, stop / support at $900. Stuck at a resistance area while trying to make new highs, but post earnings so could be a buy.

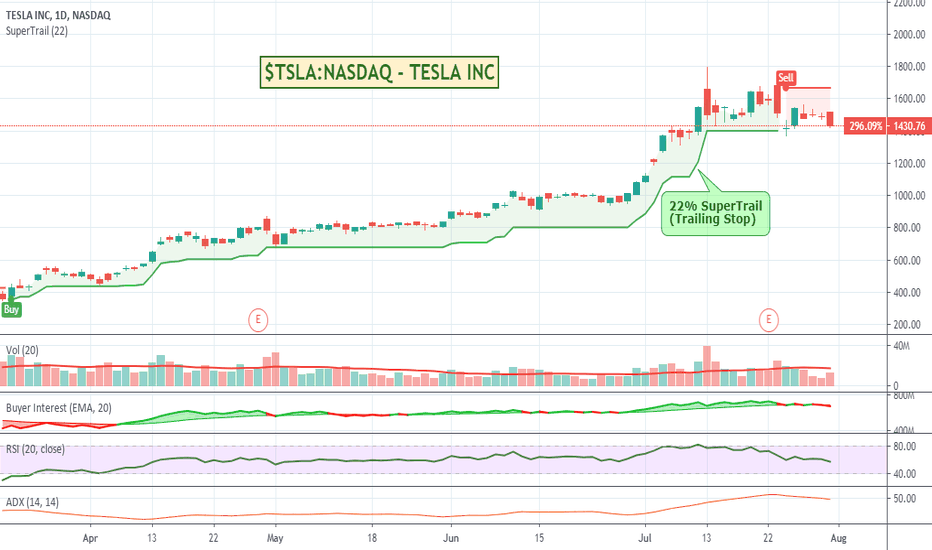

TSLA:NASDAQ - TESLA INC - Are we going to see a bounce :)It has been good to see Tesla have a much needed pullback, but I think there is more upside to come.

Looking at the chart it looks like it might be finding support at the bottom of its normal volatility range so in theory a good place to buy if it starts to recover. RSI also looks like there is more value in it.

From a sentimental point of view, I think the Cybertruck will significantly eat into Ford sales especially in the US; the German Gigafactory will eat into Mercedes and BMW sales; we will start to see more China sales coming through propping up any slow down in other countries; we haven't even seen the "China designed" car yet; the Roadster I think due in 2021 will start to hurt some of your traditional premium performance cars; companies like VW came out last week and said they are around 10 years behind Tesla to which Elon said he is VERY happy to license Tesla tech and components to them, so we might start seeing deals where manufacturers wanting to leapfrog their competitors and reduce some of their build costs will start to use Tesla drivetrain components and their own "shells" on top. Then there is the whole Telsla Truck which fleets around the world will start to transition to. The model Y will of course start to fill in the shopping / soccer mum crossover territory... it goes on and on. Tesla hasn't run out of tricks yet by any means.

Crazy valuation though - 100% :)

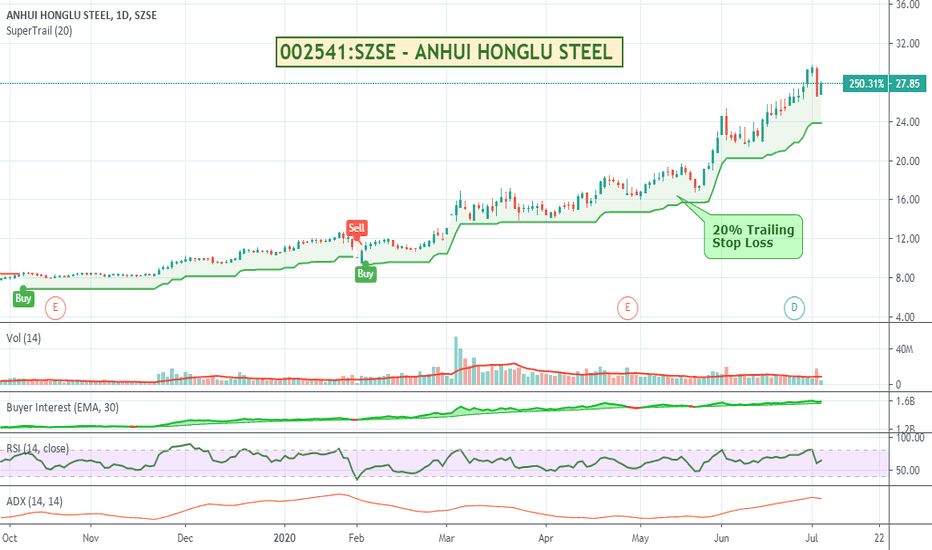

002541:SZSE - ANHUI HONGLU STEEL - Up 250% last 12 monthsTrading on the Shenzhen Stock Exchange, Anhui Honglu Steel engages in the manufacture of steel products. Its business activities include production and sale of new building materials, processing of steel products, steel structure engineering contracting services, production and sale of intelligent three dimensional garage, and steel trading business. Its products consist of high rise steel structure, intelligent three dimensional parking equipment, lifting equipment, rolled steel pipes, welding wires, light steel housing system, container room, and polyvinyl chloride products. The company was founded on September 19, 2002 and is headquartered in Hefei, China. (Source: Trading View)

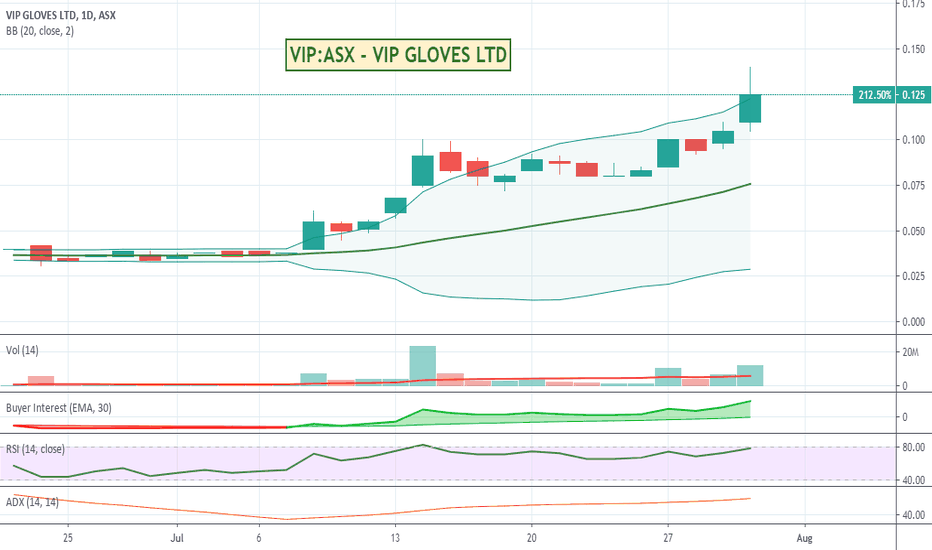

VIP:ASX - VIP GLOVES LTD - Up 200% this monthStock I hadnt seen before, but nice run this month. Produces Nitrile gloves that can be used in the medical, health, dental and numerous other industrial and commercial sectors. Could be worth a watch.

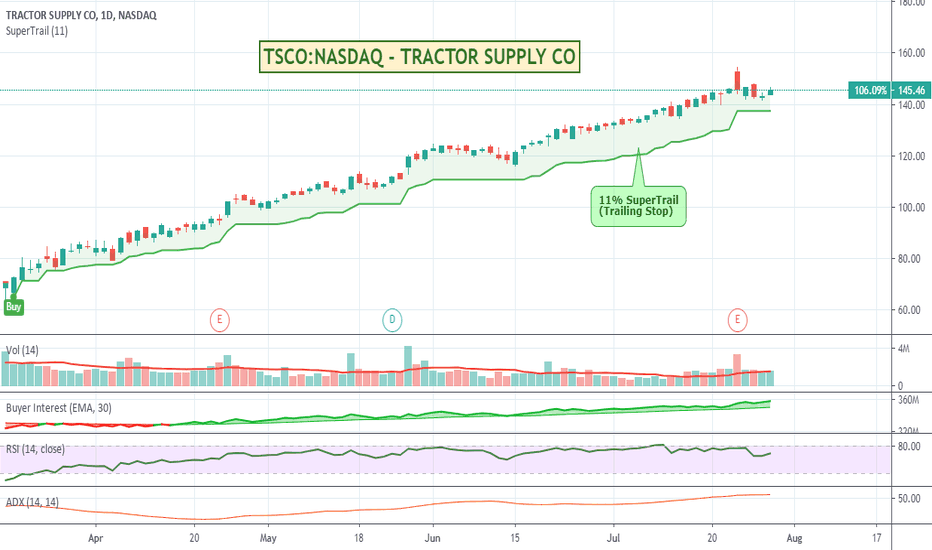

TSCO:NASDAQ - TRACTOR SUPPLY CO - Resume after pullback?Tractor Supply Co is up around 100% since mid March and trending nicely without too much volatility. Could be worth a watch if it continues its run, especially after its recent pullback now it has a bit more value in it looking at the RSI.

Tractor Supply Co. engages in the retail sale of farm and ranch products. It operates retail farm & ranch stores and focuses on supplying the lifestyle needs of recreational farmers and ranchers, as well as tradesmen and small businesses. The firm operates the retail stores under the names: Tractor Supply Company, Del's Feed & Farm Supply, and Petsense. Its product categories includes equine, livestock, pet, and small animal; hardware, truck, towing, and tool; heating, lawn and garden items, power equipment, gifts, and toys; recreational clothing and footwear; and maintenance products for agricultural and rural use. The company was founded by Charles E. Schmidt, Sr. in 1938 and is headquartered in Brentwood, TN. (Source: Trading View)

$OSTK:NASDAQ - OVERSTOCK COM - Big run. Pulled back.Overstock could be interesting to watch over the next couple of days. Down around 20% from its recent highs but up a crazy 1500% since early to mid March. I'd be interested if it made it back up above $45 to see if it will continue its run. Needs a pretty wide trail.

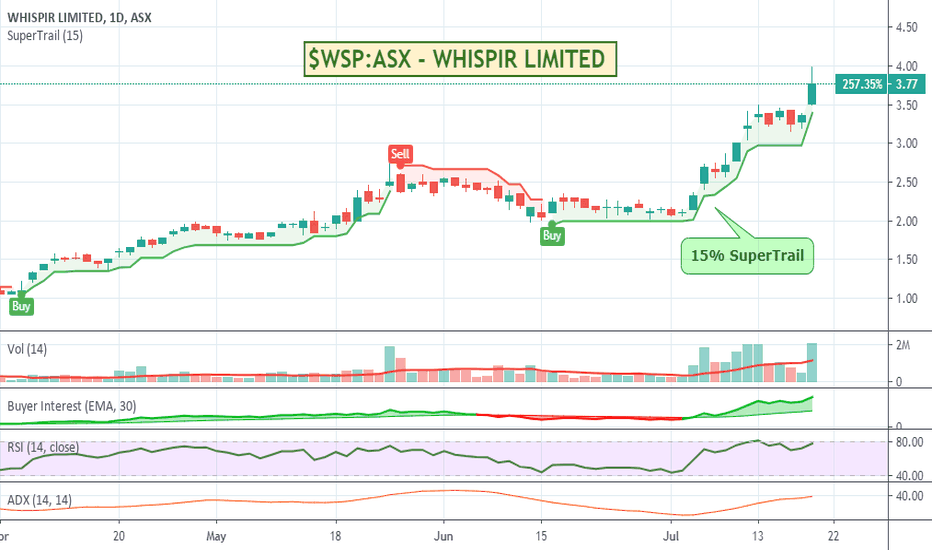

$WSP:ASX - WHISPIR LIMITED - Up 170% over 12 monthsWhispr has been doing very well with their cloud-based communications platform. Might be over extended especially after todays 20% run so will keep an eye on it for a better value entry. Worth a watch.

$SLR - SILVERLAKE - Could be interesting if it bounces$SLR - SILVERLAKE - Could be interesting if it bounces

Silverlake has been pushing past its resistance points and if its up tomorrow could be well worth a watch. Signals I look at are quite bullish so if it runs this time I suspect it will push up to its previous highs which would be a nice gain.

Silver Lake Resources Limited is a gold producing and exploration company. The Company's principal activities include gold mining and processing from the Mount Monger Operation, gold exploration and evaluation projects. Its projects include Mount Monger operation, Murchison operation and Great Southern Gold project. The Mount Monger goldfield is located approximately 50 kilometers southeast of Kalgoorlie, Western Australia. Its operations include Daisy Complex, Cock-eyed Bob, Santa and Imperial/Majestic. The Murchison operation is located southeast of the town of Cue, over 600 kilometers northeast of Perth. Its assets consist of the Tuckabianna, Comet, Moyagee and Eelya projects. The Great Southern Gold Project is a gold exploration project located in the Ravensthorpe region of Western Australia, approximately 200 kilometers west of the Port of Esperance. The Great Southern Project consists of a package of tenements, gold and base metal mineral resources and ore reserves.

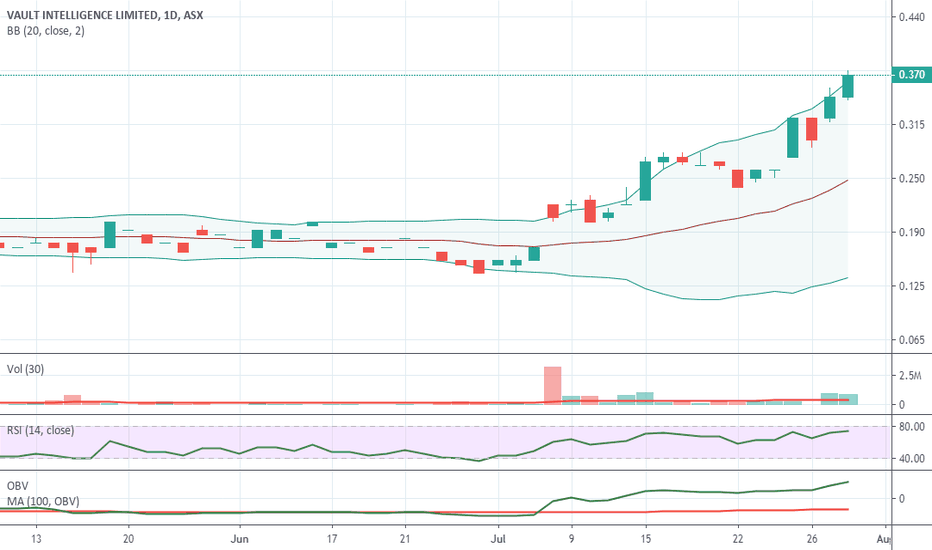

$VLT:ASX - VAULT - On a surgeSmaller company with not too many outstanding shares. Seems to have a reasonably good client list. Might be worth a watch.

Vault Intelligence Limited (Vault), formerly Credo Resources Limited, provides cloud-based and mobile environmental health and safety (EHS) software. The Company's software streamlines a corporation's EHS processes. The Vault software offers features, such as combining all EHS related work in an end-to-end enterprise system; providing access to audit, inspection and incident reporting at any time from any location; asset management and integrating with existing enterprise systems, and mobile applications that can standalone or work with existing systems. The software is available across various devices and is accessible for a range of varied user purposes, including non-desk bound users through its applications. Its software includes components, such as Risk Management, Contractor Management, Incident Management, Mobility, Compliance, Claims Management and Governance. It offers Vault Business EHS solution for smaller companies and Vault EHS Enterprise Solution for larger corporations.

$MGV:ASX - MUSGRAVE MINERALS - Up 620% YTD.Musgrave has been having a particularly good run. Seems to have recovered from recent pullback and broken above previous resistance level. Could be worth a watch.

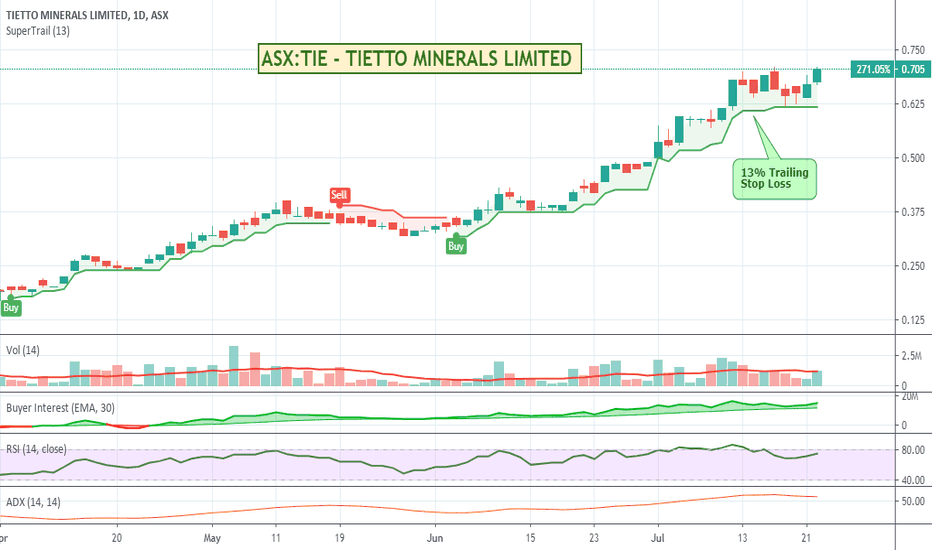

ASX:TIE - TIETTO MINERALS - Up 290% last 12 monthsTietto has been having a pretty good run without too much volatility. Recovering after a bit of a pullback, currently showing 50 buyers for 1,168,356 units vs 12 sellers for 755,079 units could be worth a look.