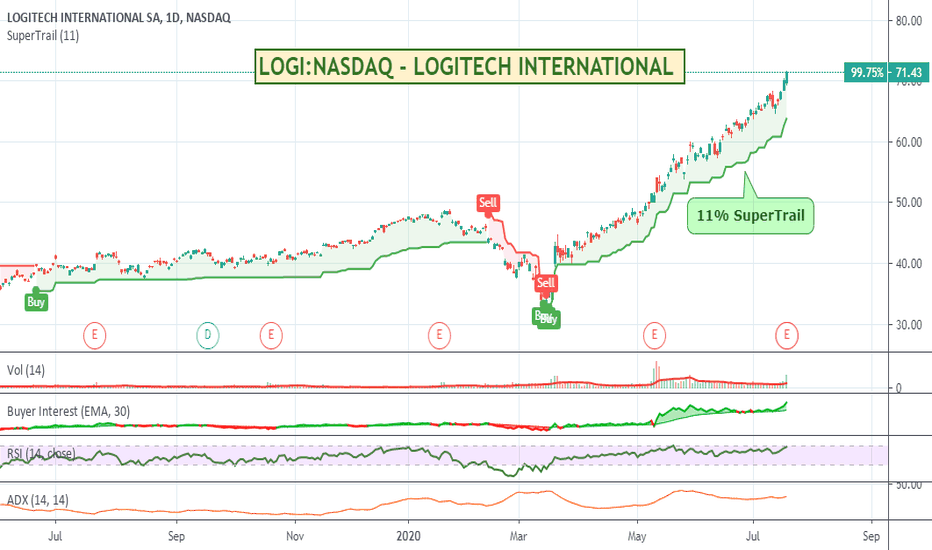

LOGI:NASDAQ - LOGITECH INTERNATIONAL - Operating profit up 75%Logitech is a major manufacturer / seller of computer peripheries and has been benefiting from the work from home, school at home movement. Nice momentum without too much volatility. Worth a look.

Article below from Trading View News / Reuters

July 20 (Reuters) - Logitech International LOGN raised its outlook for the 2021 fiscal year and reported a more than 75% increase in non-GAAP operating income in its first quarter, boosted by demand for its webcams, video conferencing products and headsets as homeworking increased during the coronavirus lockdowns.

The company said demand for video streaming and productivity products remained high as lockdowns introduced around the world to restrict the spread of the coronavirus resulted in an increase in the number of people working from home.

The Swiss-U.S. maker of computer peripherals raised its sales outlook for the 2021 fiscal year to 10% to 13% growth from mid single-digit percentage gain in constant currency.

The company also raised its annual outlook for non-GAAP operating profit in the range of $410 million to $425 million from $380 to $400 million.

Gaming products like computer mice, keyboards and headsets have also done well, as people have played more on their computers at home during the lockdowns.

"Logitech's business was already positioned to grow from these long-term trends, and since early March they have accelerated, making Logitech more relevant to customers than ever before," said Chief Executive Bracken Darrell.

Logitech said its non-GAAP operating income rose to $117.3 million in the quarter ended June 30, up from $67 million a year earlier.

Net income rose 58.9% to $72.1 million, with sales increasing about 22.9% to $791.9 million.

Search in ideas for "zAngus"

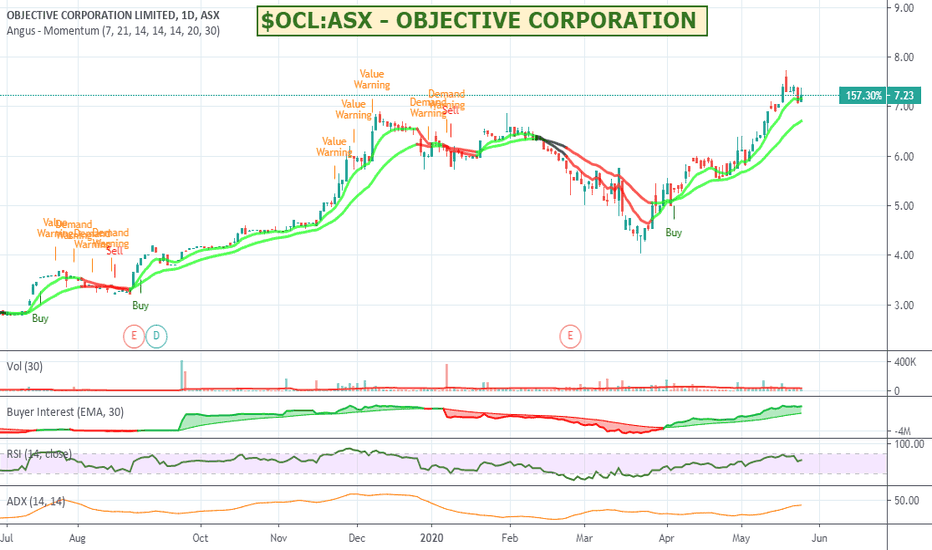

$OCL:ASX - OBJECTIVE CORPORATION - Up 150% over last 12 months.OCL has had a pretty good run over the last 12 months. Bit of a pull back at the moment so could be worth keeping an eye on.

Objective Corp. Ltd. engages in the supply of information technology software and services. It provides content, collaboration and process management solutions. It operates through the following segments:Objective Content Management (ECM), Keystone, Connect, Trapeze, and Corporate. The ECM segment includes result from the sale of ECM related products which allow customers to manage information and process governance across enterprise. The Keystone segmeng is comprised of results of Keystone products that improve efficiency and deliver governance in the process authoring, reviewing, engaging with and publishing documents. The Trapeze segment encompasses the sale of objective Trapeze products which digitally tranform development application plan reviews and assessments. The Corporate segment refers to the head office and central service groups including treasury function.

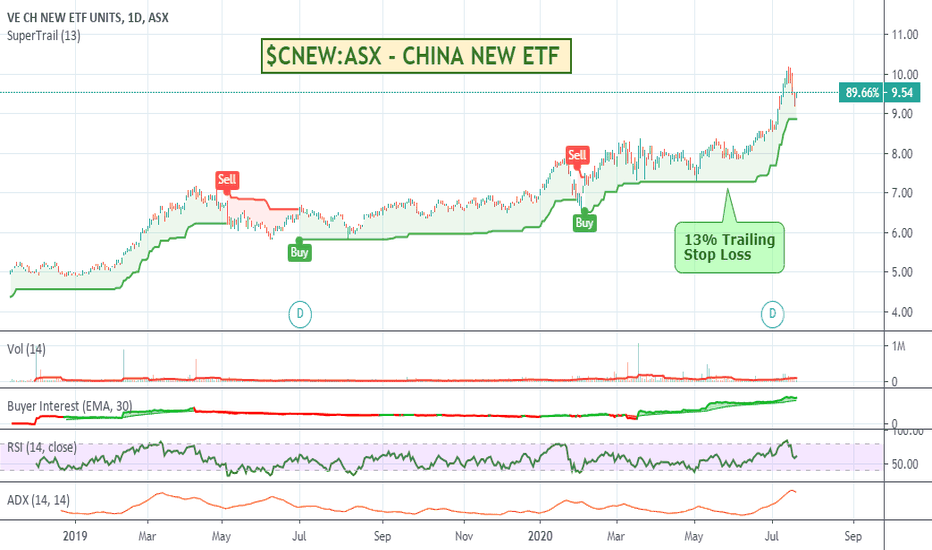

$CNEW:ASX - CHINA NEW ETF - Top China Exposure.CNEW gives investors a portfolio of the most fundamentally sound companies in China having the best growth prospects in sectors making up ‘the New Economy’, namely technology, health care, consumer staples and consumer discretionary. The index aims to select 120 companies in China with the best growth at a reasonable price which are considered the best drivers of long-term capital appreciation. Companies are selected on the basis of the strength of 24 fundamental indicators across four factor categories: growth, value, profitability and cash flow. (Source: www.vaneck.com.au)

Heard about them on the AusBiz daily show and they look like an interesting way to get exposure to Chinese markets.

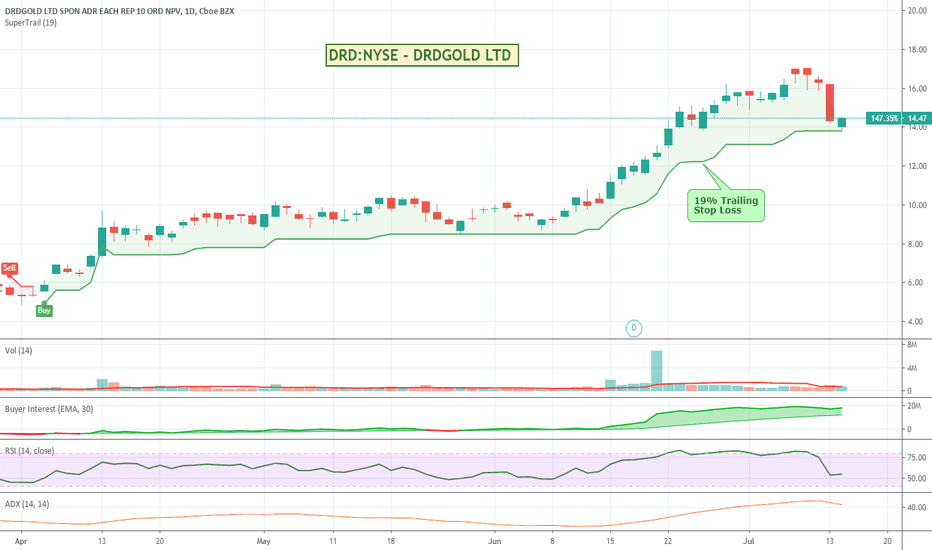

DRD:NYSE - DRDGOLD LTDGood pullback on DRD. If it gets back over $15 could be worth a look.

DRDGOLD is a South African gold producer and a world leader in the recovery of gold from the retreatment of surface tailings. Our network of assets is unrivalled in South Africa and, with our consolidated businesses operating as a single entity, is focused on optimising these assets in order to increase gold production. At the end of FY2018, DRDGOLD provided jobs for 2 304 people, including 878 permanent employees. The remaining 1 426 people worked for the specialist service providers engaged by the company to provide the expertise required for tailings reclamation and tailings dam management. In FY2018, the company produced 150 423oz of gold, generated R2 490.4 million in revenue, spent R1 452.7 million on capital projects (property, plant, equipment, surface) and 191ha of rehabilated land were lodged for clearance for redevelopment. Mineral Resources of 7.3Moz and Mineral Reserves of 3.3Moz were declared. (Source: www.drdgold.com)

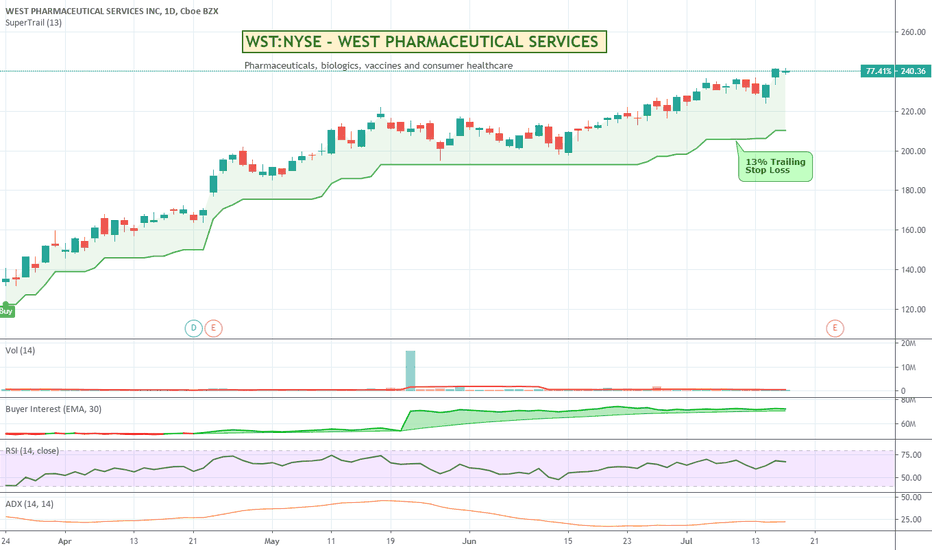

WST:NYSE - WEST PHARMACEUTICAL- Up 100% over last 12 monthsWest Pharmaceutical Services, manufactures and markets pharmaceuticals, biologics, vaccines and other consumer healthcare products. It has had a nice steady run post covid without too much volatility. Seems to have recovered after a recent pullback. Could be worth a watch.

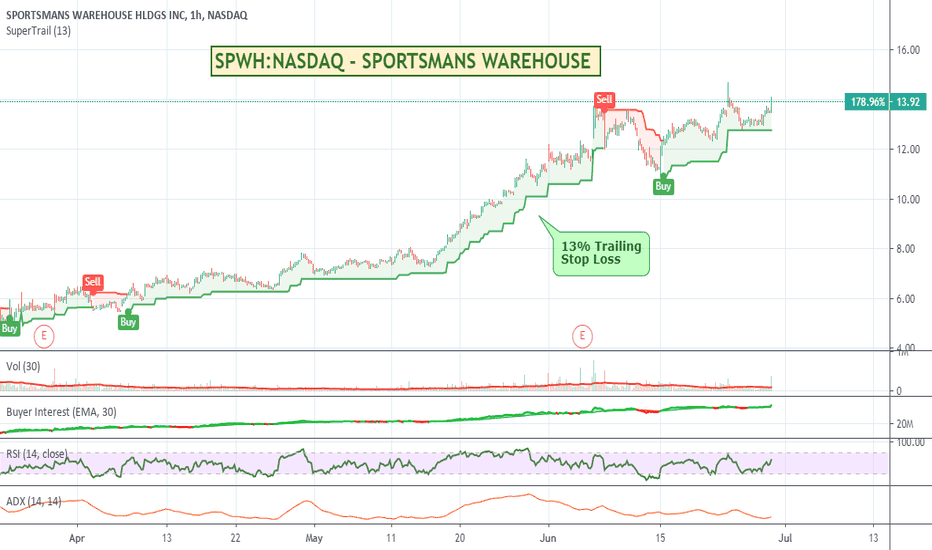

SPWH:NASDAQ - SPORTSMANS WAREHOUSE - Up 270% over 12 months Sportsman's Warehouse Holdings, Inc. engages in the retail of sporting and athletic goods through its wholly owned subsidiaries, Sportsman's Warehouse, Inc., and Minnesota Merchandising Corp. Its products include hunting and shooting; archery; fishing; camping; boating accessories; optics and electronics; knives and tools; and footwear. The company was founded in 1986 and is headquartered in West Jordan, UT.

(Description source: Trading View)

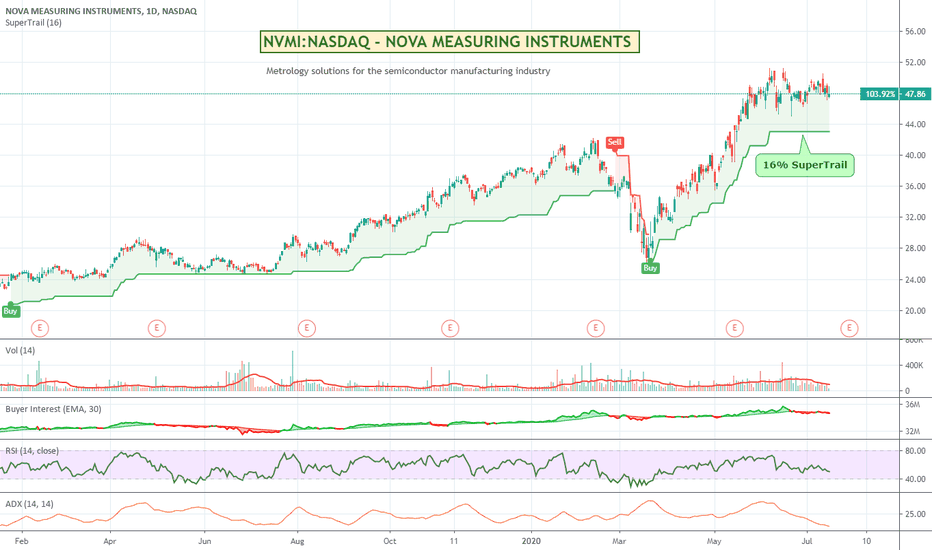

$NVMI:NASDAQ - NOVA MEASURING INSTRUMENTS - Up 90%NVMI has had a good run so far, but price starting to compress. Which way will it break. They provide metrology solutions for the semiconductor manufacturing industry so hopefully to the upside if everything doesn't get shut down again. Worth a watch.

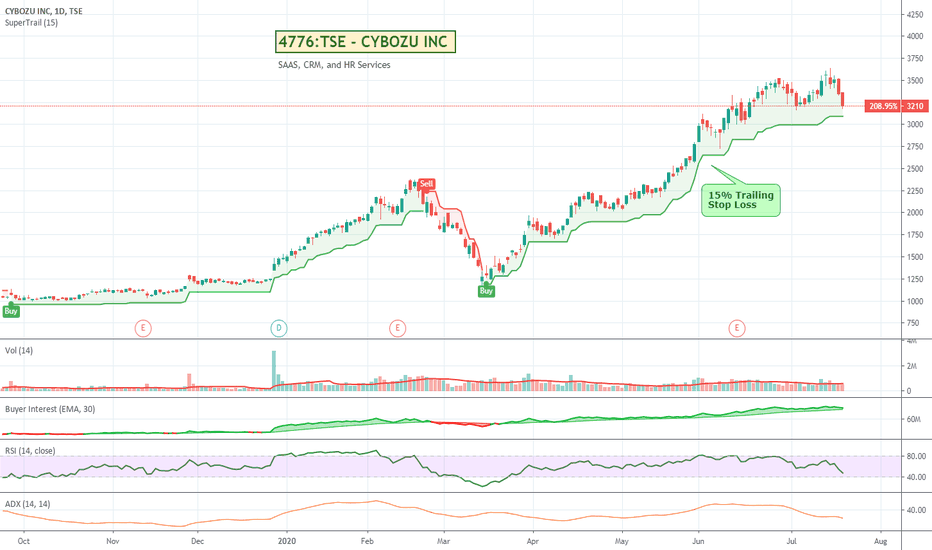

$4776:TSE - CYBOZU INC - Up 135% over 12 monthsCybozu based in Japan is a provider of SAAS, CRM and HR type solutions. Has had a pullback back to a previous support area so might be worth keeping an eye on to see if it heads back up. Would want to wait for confirmation though. Just on the watch list for now.

$PLUG:NASDAQ - PLUG POWER - Hydrogen Fuel CellsPlug is up 190% over the last 12 months and as an alternate energy source to fossil fuels could be worth a look.

Plug Power, Inc. provides alternative energy technology, which focuses on the design, development, commercialization, and manufacture of hydrogen and fuel cell systems used primarily for the material handling and stationary power markets. Its fuel cell system solution is designed to replace lead-acid batteries in electric material handling vehicles and industrial trucks for some distribution and manufacturing businesses. The company was founded by George C. McNamee and Larry G. Garberding on June 27, 1997 and is headquartered in Latham, NY.

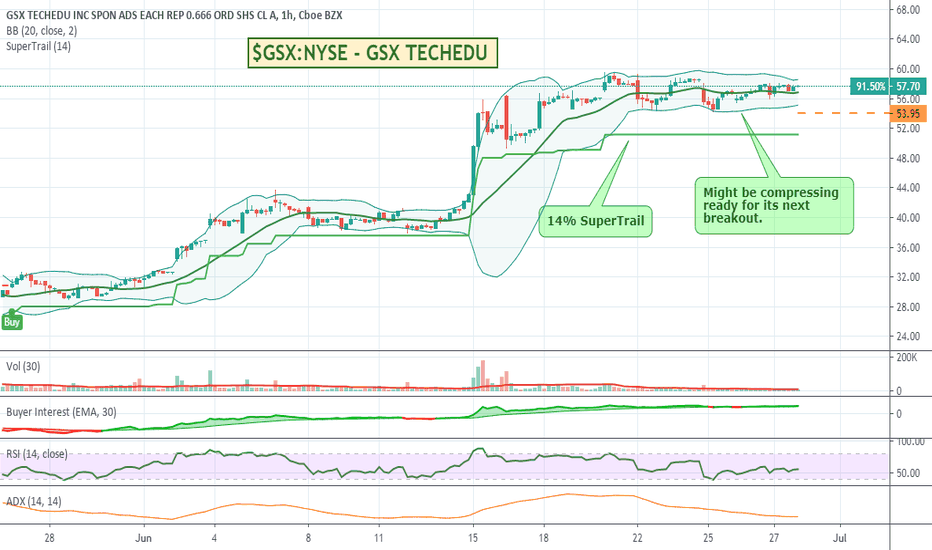

$GSX:NYSE - GSX TECHEDUGSX has had a great run off the back of the Corona virus. Looks like it is in a Bollinger Compression which can be a good sign it will break higher (or lower) so might be worth a watch with some of the "fear" around Covid coming back into the market.

GSX Techedu, Inc. is a technology-driven education company. Its core expertise is in online K-12 courses, and online K-12 large-class after-school tutoring service provider in China. The company's K-12 courses cover all primary and secondary grades. It also offers foreign language, professional and interest courses. The company was founded by Xiang Dong Chen in June 2014 and is headquartered in Beijing, China.

(Description source: Trading View)

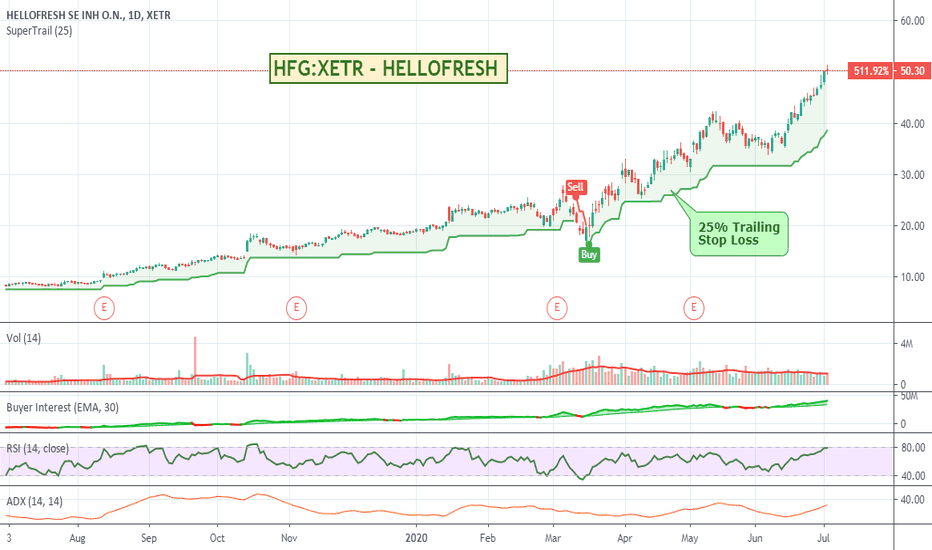

$HFG:XETR - HELLOFRESH - Up 500% over 12 monthsTrade-able on the German Exchange, Hellofresh is one of those brands that I feel like I am seeing advertised everywhere. They were already running nicely pre-covid but the whole no dining out movement gave them a big boost. Be interesting to see how long they will continue to run once the restrictions are lifted, but with Covid cases beginning to accelerate again it could be worth a watch...

HelloFresh SE engages in the provision of personalized meal solutions. It operates through the following segments: United States of America (USA), International, and Holding. The International segment comprises Australia, Austria, Belgium, Canada, Germany, the Netherlands, Switzerland, and the United Kingdom. The Holding segment represents centralized overhead functions, where certain costs are recharged with a markup to the operating entities with the exception of strategic and finance costs. (Source Trading View)

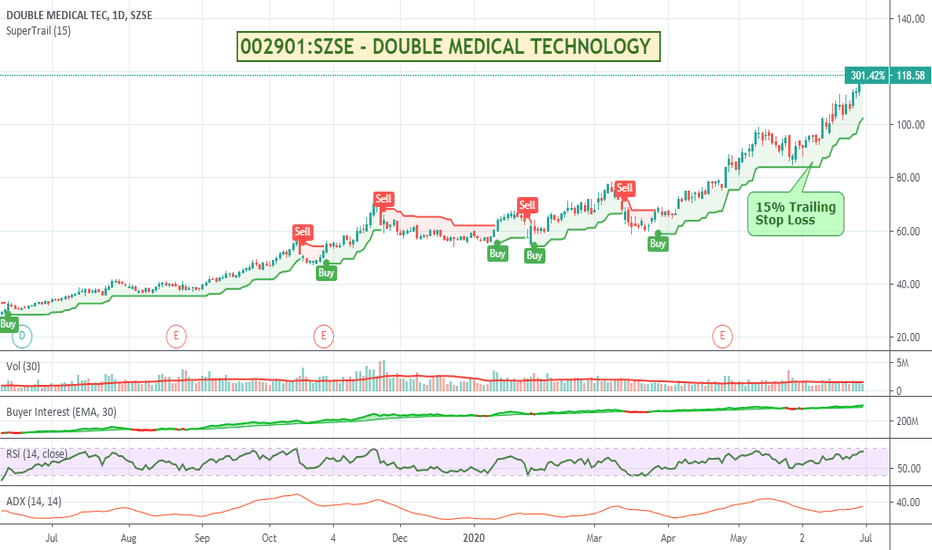

002901:SZSE - DOUBLE MEDICAL TECH - 300% gain over 12 monthsTraded on the Shenzhen exchange, Double Medical Technology engages in the development, manufacture and sale of orthopedic devices, wound management, neurosurgery, and general surgery products. Might be overpriced at the moment so I have set an alert for when the RSI drops back below 70 to see if I can buy at better value. Certainly having a great run to date and could be worth a watch.

Double Medical′s orthopaedic implants are a leader in the domestic market in China. Dedicated to rehabilitation, Double Medical focus on providing high-quality, affordable products, quick logistics and constant doctors' support. The products are CE 0120 certified, approved by FDA 510(K) and Australian TGA. Double Medical has branches in over 30 provinces and cities and is cooperating with more than 3,500 hospitals and nearly 1,000 business enterprises in China; its products have been exported to more than 50 countries and regions that include EU, Russia, South America, Australia, Southeast Asia, Middle East and South Africa.

Source: en.double-medical.com

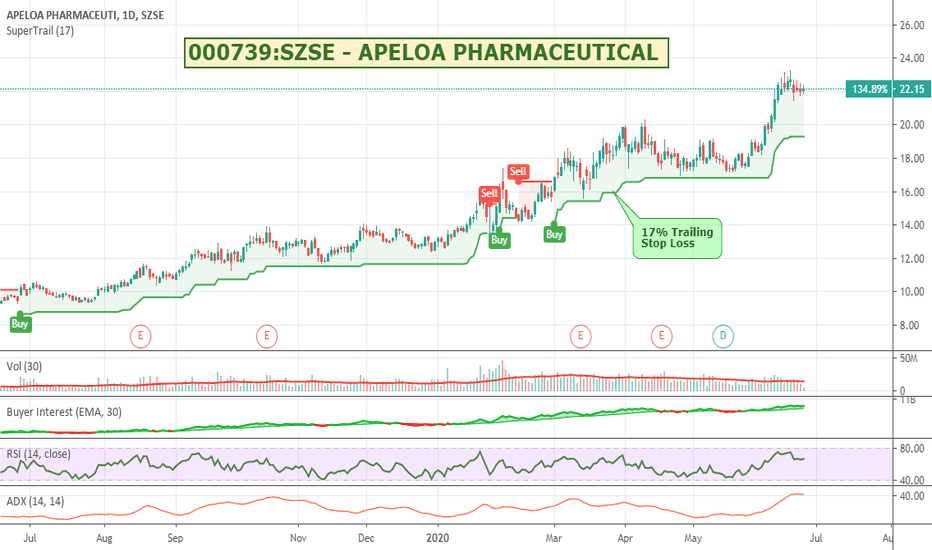

000739:SZSE - APELOA PHARMACEUTICAL - Up 130% over 12 monthsApeloa Pharmaceutical Co., Ltd. engages in the pharmaceutical manufacturing business. Its products include Active Pharmaceutical Ingredient (API) intermediates, Contract Research and Development and Production (CDMO), and Formulation preparation products. The company was founded on May 6, 1997 and is headquartered in Jinhua, China. Might be worth a watch.

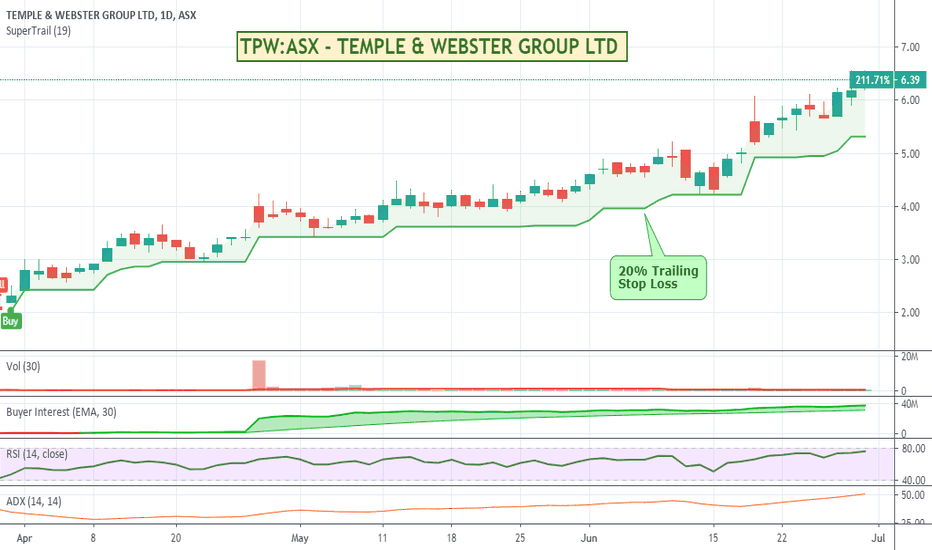

$TPW:ASX - TEMPLE & WEBSTER - Up 200% since AprilAnother Aussie dot com retailer with a share price going through the roof. Up 200% over the last few months, it is still a sub $10 stock so psychologically at least could still have quite a bit of upside. Might be a bit expensive at the moment, but certainly worth a watch. Temple & Webster is Australia's Number 1 online retailer of furniture and home wares that offers more than 180,000 products and a subscriber base of more than 1 million Australians.

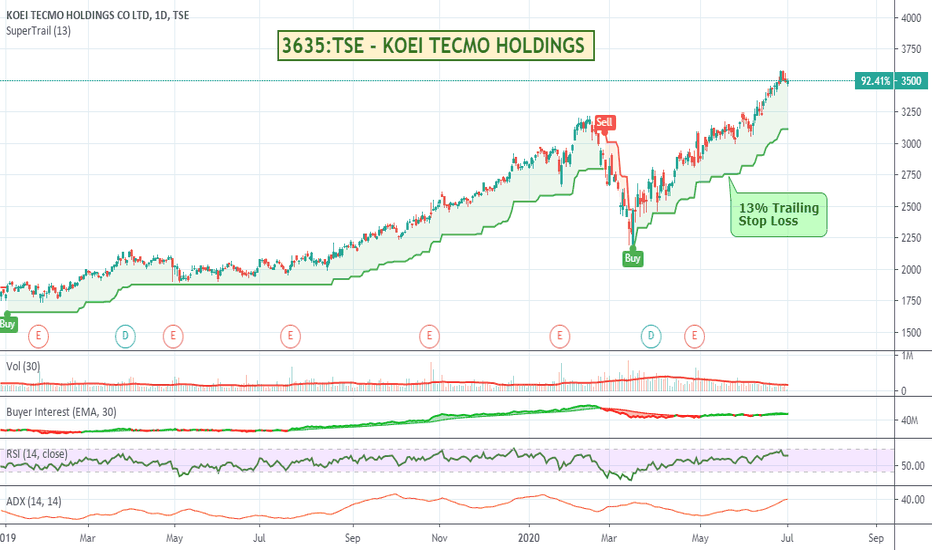

$3635:TSE - KOEI TECMO HOLDINGS - Japanese Gaming CompanyKoei traded on the Tokyo exchange seems to be in a nice steady uptrend with fairly minimal volatility. Could be worth a look.

Koei Tecmo Holdings Co., Ltd. engages in game software development. It operates through the following business segments: Entertainment, SP, Amusement Facility Operations, Real Estate, and Others. The Entertainment segment develops and sells entertainment contents for personal computers, family consoles, online games, and smartphone applications. The SP segment develops the pachinko and pachislots, and royalty income. The Amusement Facility Operations segment manages amusement arcades. The Rea Estate segment covers real estate leases. The Others segment includes the venture capital businesses. (Description via Trading View)

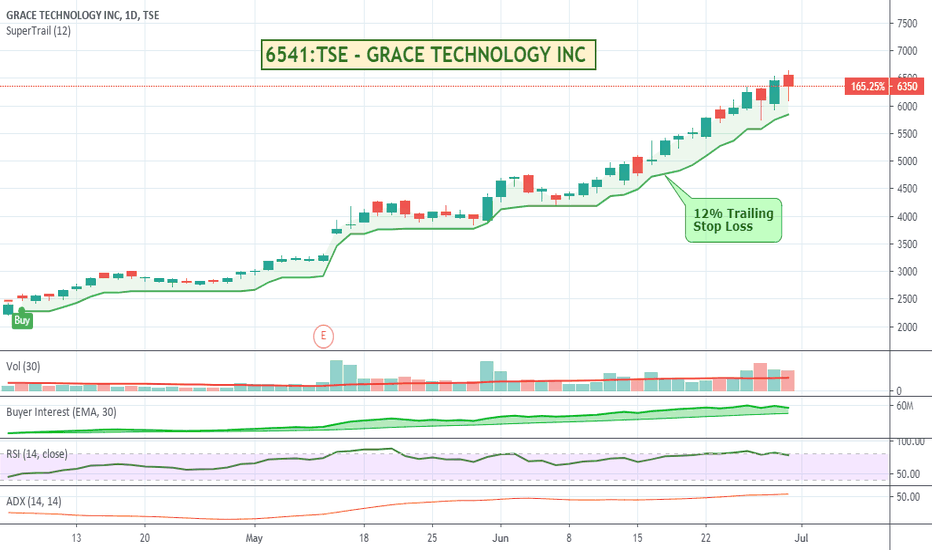

6541:TSE - GRACE TECHNOLOGY - Up 150% over 3 monthsTraded on the Tokyo Stock Exchange, Grace Technology is another company that seems to have strongly benefited from the Covid work from home / work remotely movement. After a pretty flat last few years, it is now up over 150% in the last 3 months. Could be worth a watch.

Grace Technology Inc. develops, maintains and distributes technical e-documents. The firm's business activities include creation and translation of technical documents, including production manuals; planning, construction, and management of e-manual, a portal site that delivers documents; consulting business regarding documents and manuals; and production of internal management manuals. It also maintains and distributes documents for foreign and domestic-affiliated information technology-related companies. The company was founded on August 1, 2000 and is headquartered in Tokyo, Japan.

Source: Trading View