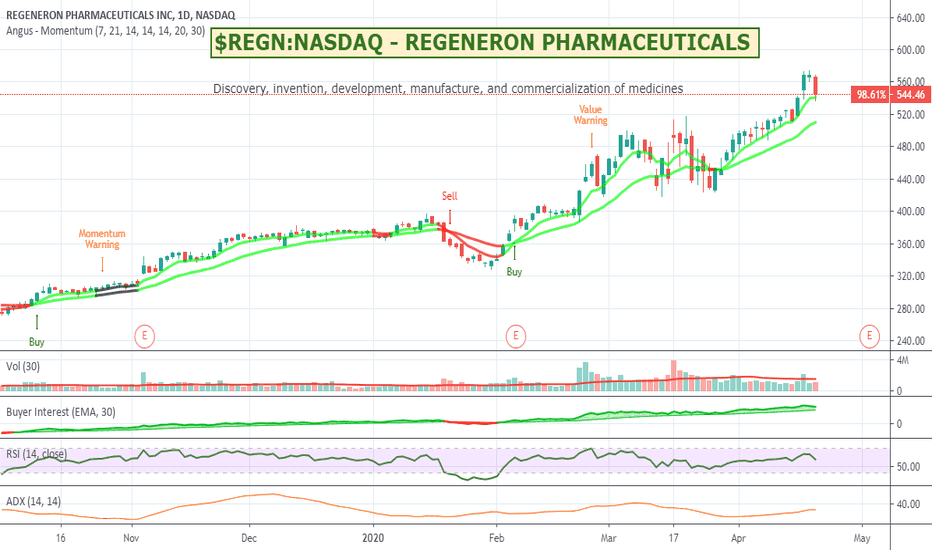

$REGN:NASDAQ - REGENERON PHARMACEUTICALSRegeneron has been having a nice run since the end of last year and is up around 100%. Financials look pretty strong. Could be worth a watch.

Regeneron Pharmaceuticals, Inc. is a biotechnology company, which engages in the discovery, invention, development, manufacture, and commercialization of medicines. It product portfolio includes the following brands: EYLEA, Dupixent, Praluent, Kevzara, Libtayo, ARCALYST, and ZALTRAP.

Search in ideas for "zAngus"

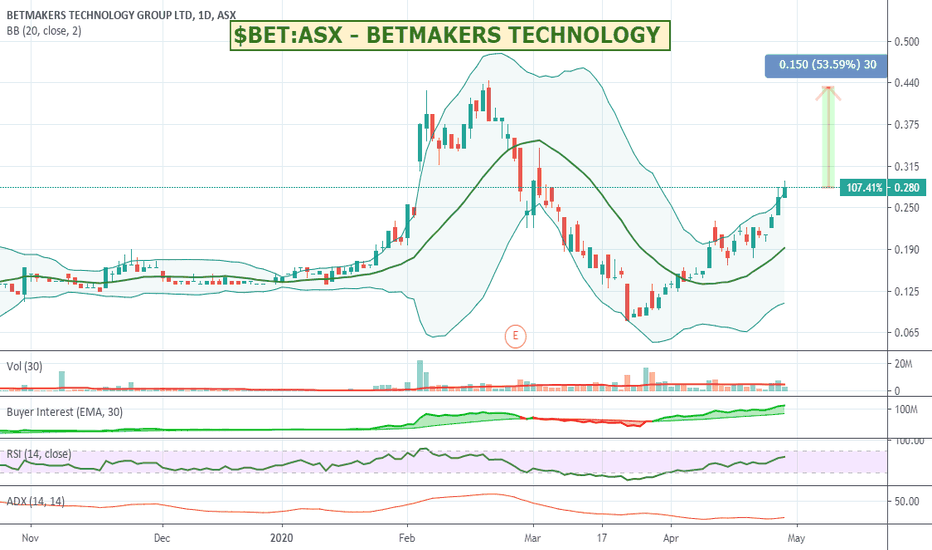

$BET:ASX - BETMAKERS TECHNOLOGY - Up 800% over 12 months.BET has been having quite a nice run and is back up around 140% over the last month. With real world sporting events being mostly shut down, looks like BET is benefiting from the fantasy wagering space. Worth a watch.

Betmakers Technology Group Ltd. engages in online gaming and wagering services. It operates through the following segments: Fantasy Wagering and Wagering, Content Services, and Corporation. The Fantasy Wagering and Wagering segment refers to an online wagering platform which utilizes proprietary technology across risk management systems, odds management, content delivery, and consumer facing platforms. The Content Services segment deals with a free and premium content platform, which enables customers to seamlessly access a range of sporting, and racing content. The Corporate segment includes head office costs. The company was founded by Todd Buckingham on June 27, 2013 and is headquartered in Newcastle, Australia.

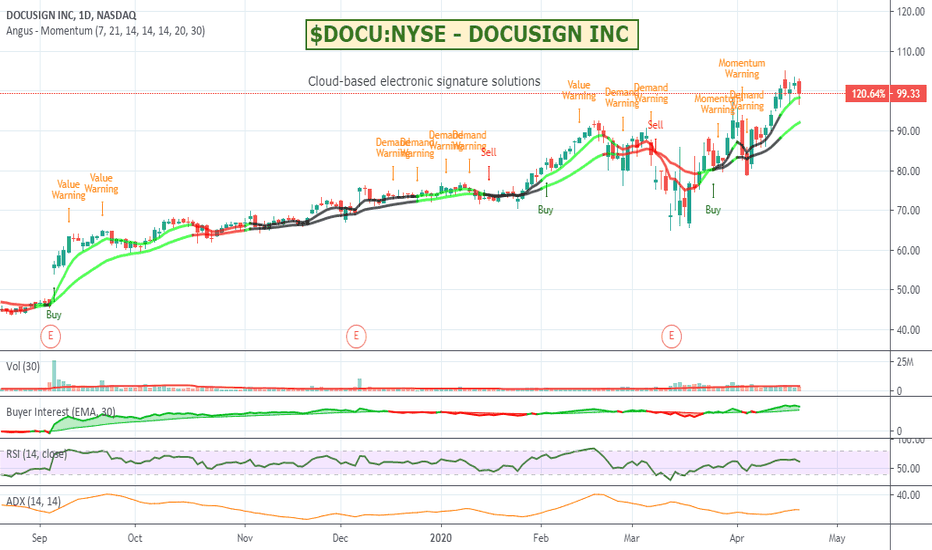

$DOCU:NYSE - DOCUSIGN INC - Electronic document signaturesDocusign has been having a reasonably good run in the current environment. Up a bit over 100% since the end of last year it could be worth a watch.

DocuSign, Inc. provides cloud-based electronic signature solutions. Its cloud based electronic signature platform helps companies and individuals securely collect information, automate data workflows and sign anything. The firm automates manual, paper-based processes allowing users to manage all aspects of documented business transactions include identity management, authentication, digital signature, forms and data collection, collaboration, workflow automation and storage.

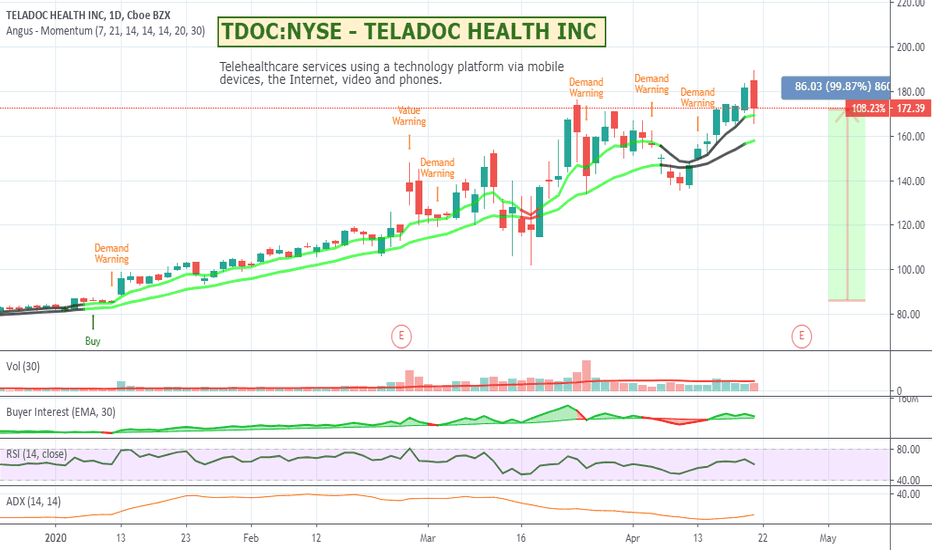

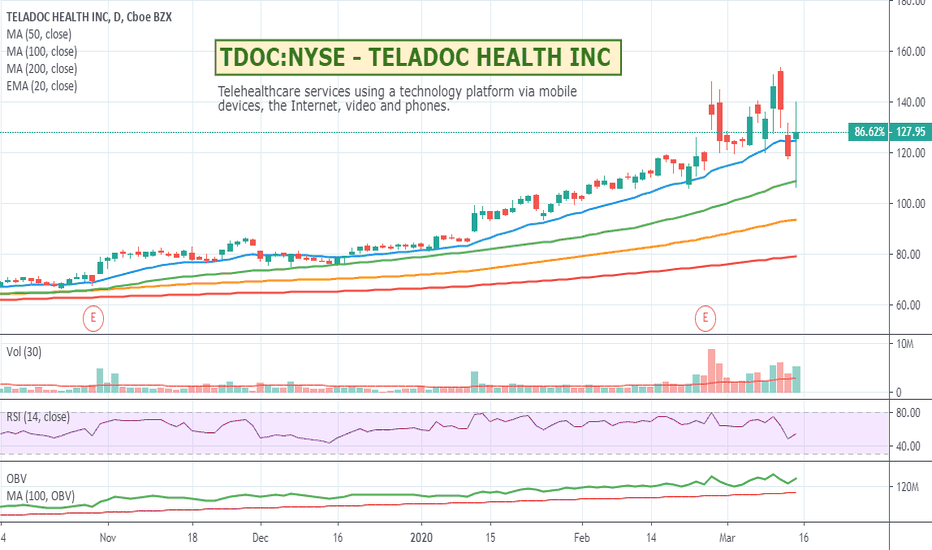

$TDOC:NYSE - TELADOC HEALTH INC - Telehealth up 100%Teladoc is 7 days away from earnings and with a pullback last night of 5%, if it heads back up over the next couple of days could be worth a look. Hard to imagine they wont have some great earnings to report - but much of that could already be over inflated in the current share price. Worth a watch.

Teladoc Health, Inc. engages in the provision of telehealthcare services using a technology platform via mobile devices, the Internet, video and phone. Its portfolio of services and solutions covers medical subspecialties from non-urgent, episodic needs like flu and upper respiratory infections, to chronic, complicated medical conditions like cancer and congestive heart failure.

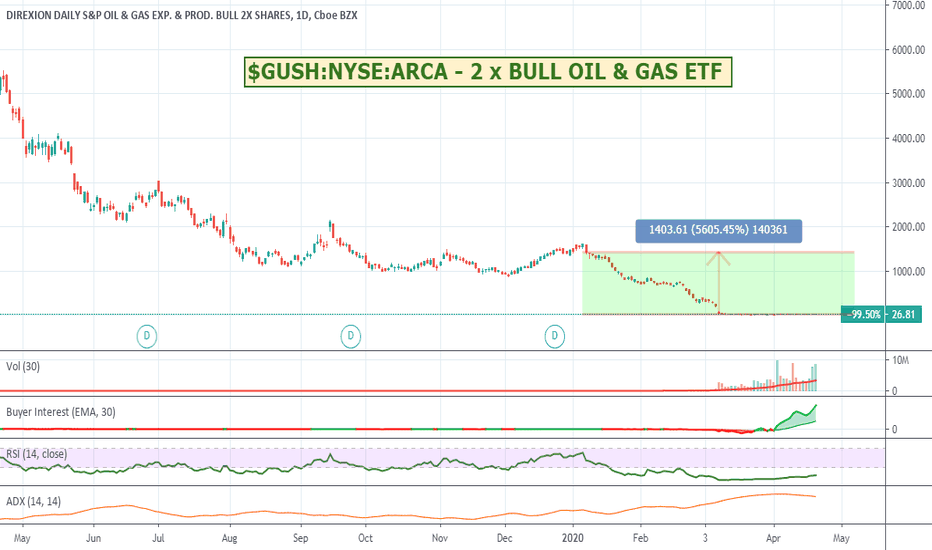

$GUSH:NYSE:ARCA - 2 x BULL OIL & GAS ETFGUSH is the bull version of DRIP (the inverse Oil & Gas) ETF. With Oil prices and energy stocks in general taking SUCH a beating this could be worth a look if you think they will go back up at some stage. There might still be some turbulence ahead, but worth a watch. Definitely worth Googling or talking to your broker first as leveraged ETFs can be a bit trickier for a longer term buy and hold just because of how they work. Could be fun to buy a small amount and then put them in a drawer and forget about them for a while. USO is potentially another to look at.

The Direxion Daily S&P Oil & Gas Exp. & Prod. Bull and Bear 2X Shares seek daily investment results, before fees and expenses, of 200%, or 200% of the inverse (or opposite - ie DRIP), of the performance of the S&P Oil & Gas Exploration & Production Select Industry Index

$MMM:ASX - MARLEY SPOON - Foodie up 450% over the last monthMarley Spoon has been having a crazy run over the last month. Being a food delivery service in these current times is obviously a good business to be in. It will be interesting to see how sticky their business is when restaurants start opening up again. Worth a watch at any rate.

Marley Spoon engages in the provision of food delivery services. It offers boxes with recipes, ingredients, and tips on cooking created by the chefs of the company, and then delivers them to its customers.

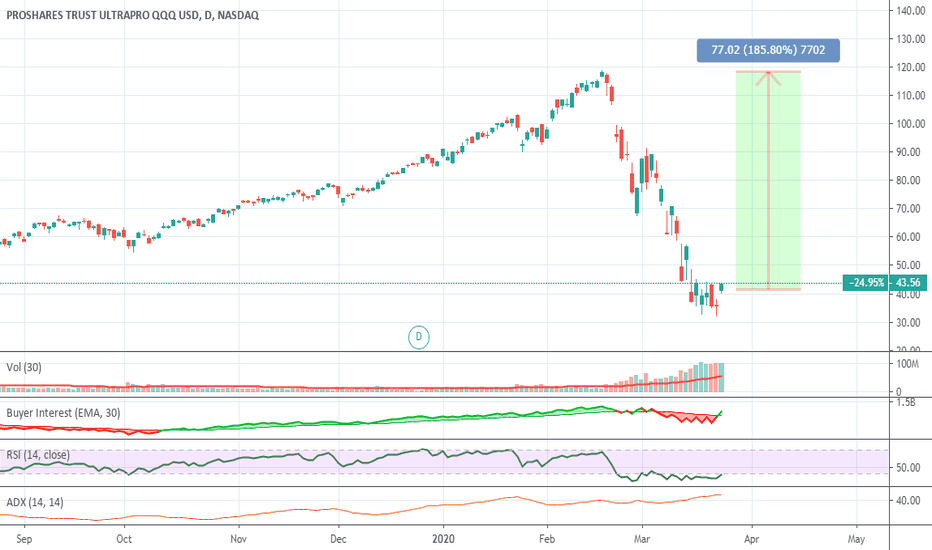

TQQQ - Leveraged Bull NASDAQ TQQQ provides 3x leveraged exposure to a modified market-cap-weighted index tracking 100 of the largest nonfinancial firms listed on NASDAQ. Could be worth a watch over the next few weeks especially if market starts to recover. Not a buy and hold trade. I was long on it today which created some nice gains.

$TDOC:NYSE - TELADOC HEALTH INC - Remote healthcare up 120%Teladoc provides telehealthcare services using a technology platform via mobile devices, the Internet, video and phone. Think healthcare over the phone. With the increasing volumes of potential patients flooding into hospitals to be checked out eventually these kinds of services will become overwhelmed - and of course who want to queue up in a line with other sick people. If you aren't sick already, you probably will be by the time you leave. Remote healthcare services like Teladoc could start to benefit. It is still very turbulent but a close above say $130 could give us a clearer signal of whether its investable or not. Could be worth a watch.

Teladoc Health, Inc. engages in the provision of telehealthcare services using a technology platform via mobile devices, the Internet, video and phone. Its portfolio of services and solutions covers medical subspecialties from non-urgent, episodic needs like flu and upper respiratory infections, to chronic, complicated medical conditions like cancer and congestive heart failure.

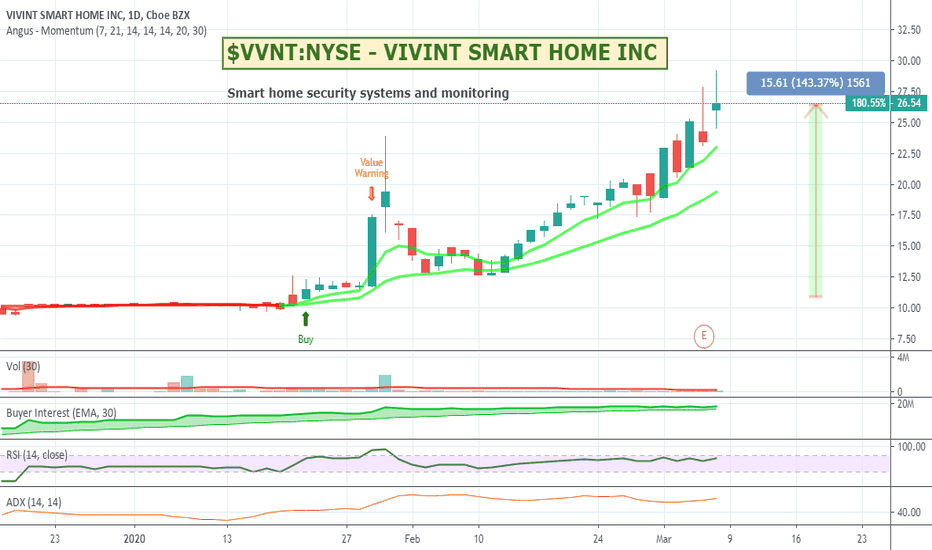

$VVNT:NYSE - VIVINT SMART HOME INC - Speccy with promiseBit more speculative, but I could imagine how security combined with automation could become an increasingly bigger deal over time and especially with the US. I like the idea of the solutions they offer such as a front door package that comes with professional installation and lets you control a doorbell camera, smart lock, and garage door from anywhere using their app. Useful for letting friends and family have access, deliveries to be dropped off, and even AirBnB type guests to get access.

The stock is up 160% over the last month and a bit, so could be worth a watch.

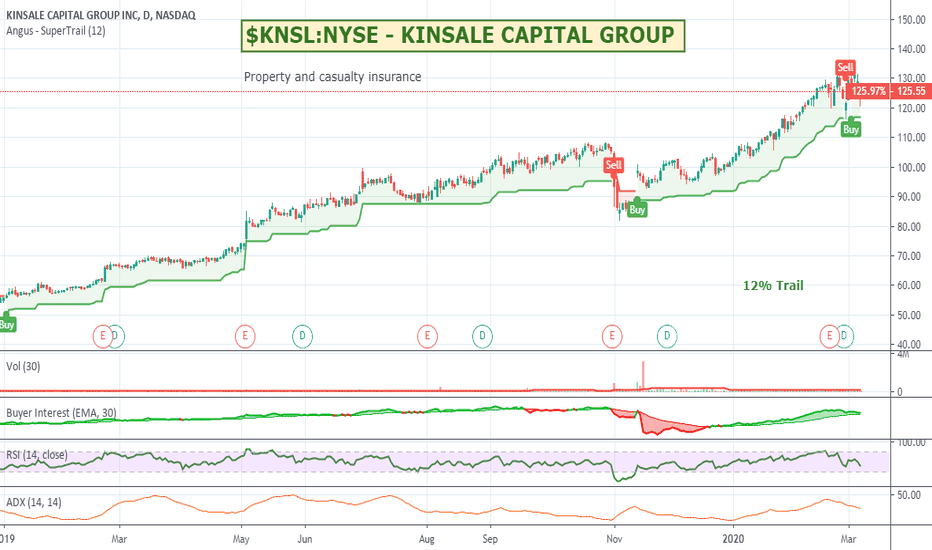

$KNSL:NYSE - KINSALE CAPITAL - 125% run so farKNSL has had a great 12 month run and seems to be holding up well. Could be worth a look.

Kinsale Capital Group, Inc. is a holding company, which engages in the provision of property and casualty insurance. It focuses on the excess and surplus lines market. The company was founded by Michael P. Kehoe on June 3, 2009 and is headquartered in Richmond, VA.

$CDLX:NASDAQ - CARDLYTICS INC - Will it break and run?Cardlytics was one of last years better performers with a 500% run pre covid. They have struggled to recover, but the bollingers are getting squishy which often indicates a break one way or other. Earnings are close by which adds a level of risk given current economic conditions. Could be worth a watch.

About Cardlytics

Cardlytics (CDLX) uses purchase intelligence to make marketing more relevant and measurable. We partner with financial institutions to run their banking rewards programs that promote customer loyalty and deepen banking relationships. In turn, we have a secure view into where and when consumers are spending their money. We use these insights to help marketers identify, reach, and influence likely buyers at scale, as well as measure the true sales impact of marketing campaigns. Headquartered in Atlanta, Cardlytics has offices in London, New York, San Francisco and Visakhapatnam

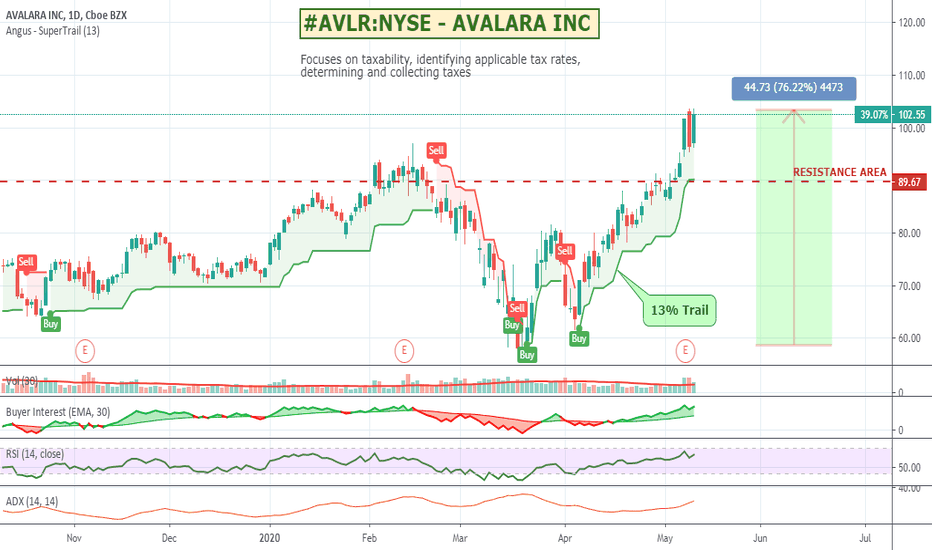

#AVLR:NYSE - AVALARA INC - Tax ComplianceAvalar has been having a good run with the uptick in businesses opening online stores and needing to come up to code quickly around tax compliance. Definitely a bit more of a speculative stock but having looked at their website I really like all the integration points they have with major online vendors - especially those in the ecommerce space. Would seem to be one of those must have tools / plugins if you run any kind of serious online business - even more so where you ship globally. Could be worth a watch.

Avalar provides simplified tax compliance through automation technology to help businesses manage sales and use, excise, GST, VAT, and other tax types, across the U.S and abroad.

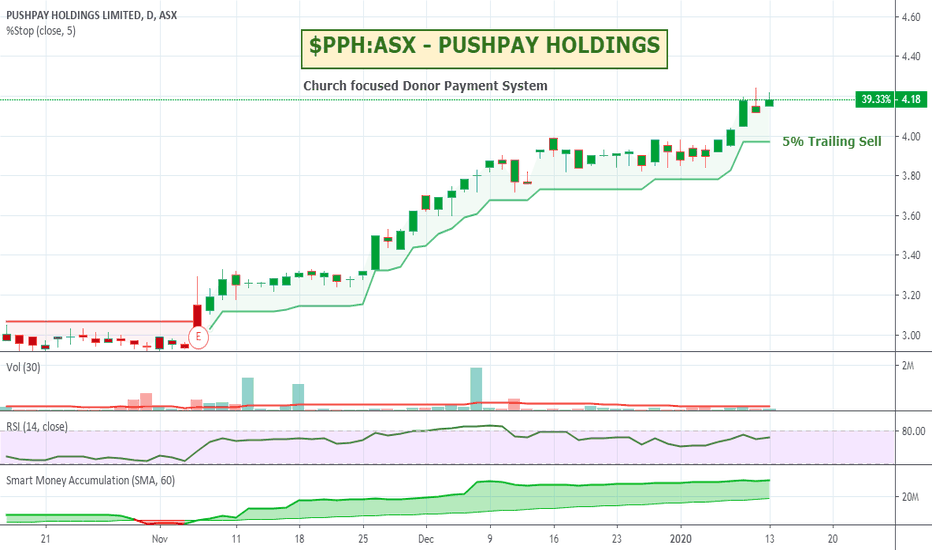

$PPH:ASX - PUSHPAY HOLDINGS - Up 40% over last 3 monthsPushpay is a Churches focused donation management / payment system allowing Churchgoers to donate in the absence of having cash or cheques on them. It has had a nice and steady 40% gain over the last 3 months - one in which a 5% trailing sell would have kept you in the trade. Could be worth a watch.

Pushpay Holdings Ltd. engages in the development of platform for mobile commerce and electronic payments and tools for merchants to engage with consumer. It focuses on the provision of donor management system, including donor tools, finance tools, and a custom community app, to the faith sector, non-profit organizations, and education providers. The company was founded by Christopher Heaslip and Eliot Barry Crowther on July 25, 2011 and is headquartered in Auckland, New Zealand.

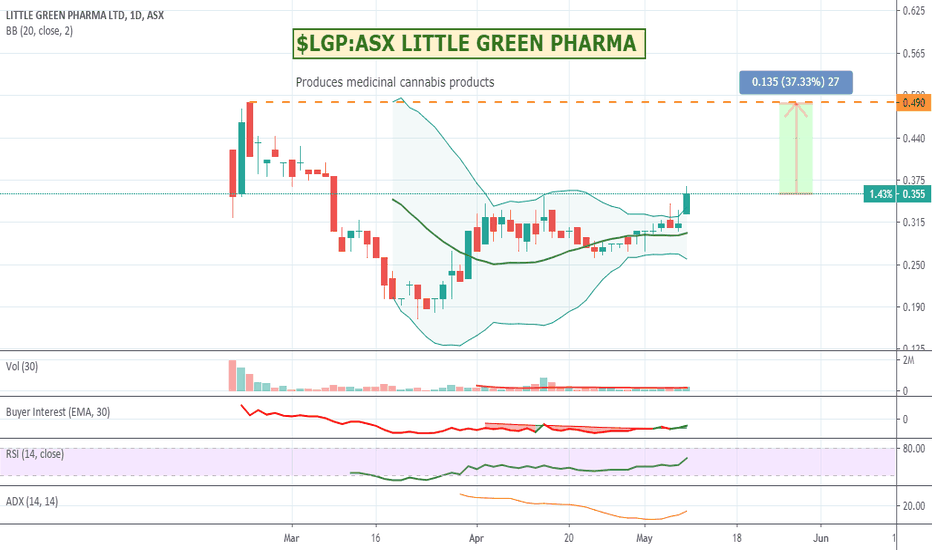

$LGP:ASX - LITTLE GREEN PHARMA - New Pot StockWas just having a wander through recent listings and spotted this one having a bit of a breakout moment. Not really into pot stocks, but their recent presentation looked interesting. Could be worth a watch.

About Little Green Pharma

Little Green Pharma is a vertically integrated medicinal cannabis business with operations from cultivation and production through to manufacturing and distribution. The Company has an indoor cultivation facility in Western Australia and an exclusive partnership with a GMP licensed pharmaceutical manufacturer for the production of its own-branded range of medicinal cannabis products. Little Green Pharma products comply with all required Therapeutic Goods Administration regulations and testing requirements. With a growing range of products containing differing ratios of active ingredients, Little Green Pharma supplies medical-grade cannabis products to Australian and overseas markets. The Company has a strong focus on patient access in the emerging global medicinal cannabis market and is actively engaged in promoting education and outreach programs, as well as participating in clinical investigations and research projects to develop innovative new delivery systems.

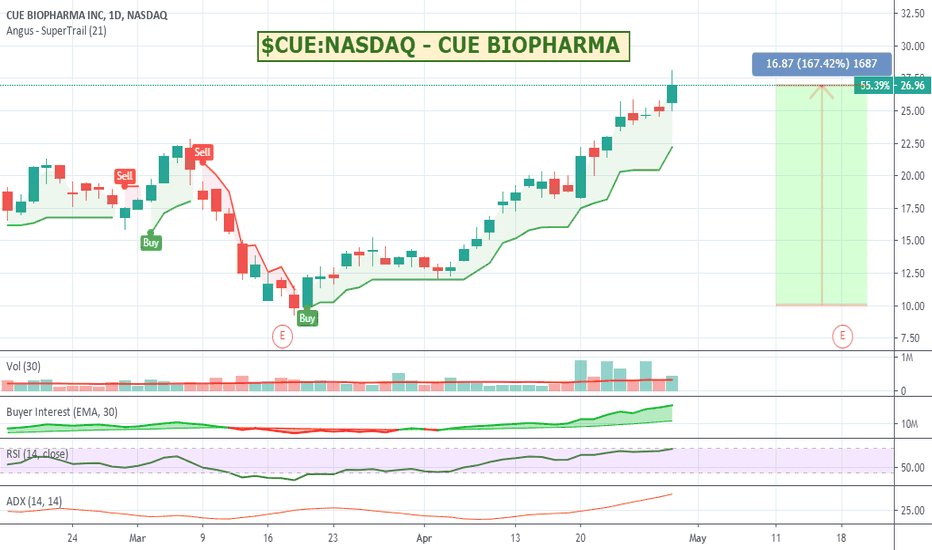

$CUE:NASDA - CUE BIOPHARMA - 100% run over the last month.Cue has been having a great run of late - up 100% over the last month and up a bit over 200% over the last 6 months. Its been running pretty hard for a while so might be overextended, but I like what they do and could be worth a watch. Be careful of pullbacks.

Cue Biopharma, a clinical-stage biopharmaceutical company, is engineering a novel class of injectable biologics to selectively engage and modulate targeted T cells within the body to transform the treatment of cancer and autoimmune diseases. The company’s proprietary platform, Immuno-STAT™ (Selective Targeting and Alteration of T cells), is designed to harness the body’s intrinsic immune system without the need for ex vivo manipulation.

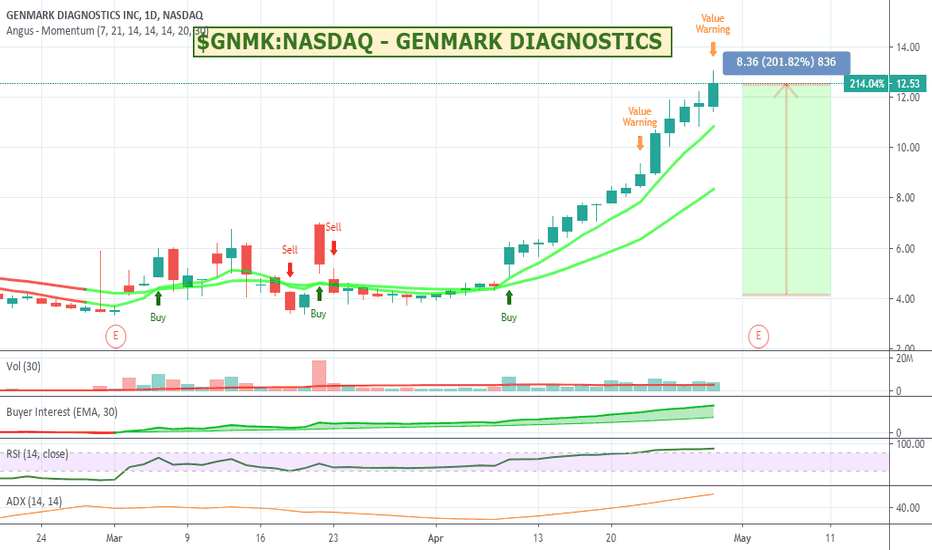

$GNMK:NASDAQ - GENMARK DIAGNOSTICS - Nice 200% run in AprilGenmark has been having a great run throughout April on the back of the Food and Drug Administration (FDA) issuing their Emergency Use Authorization (EUA) for the company’s ePlex Covid Test. It's been a nice and steady run but looking at the RSI has probably been overpriced for a while, but volume is still there. Might be worth a watch with a tighter stop in place for this one.

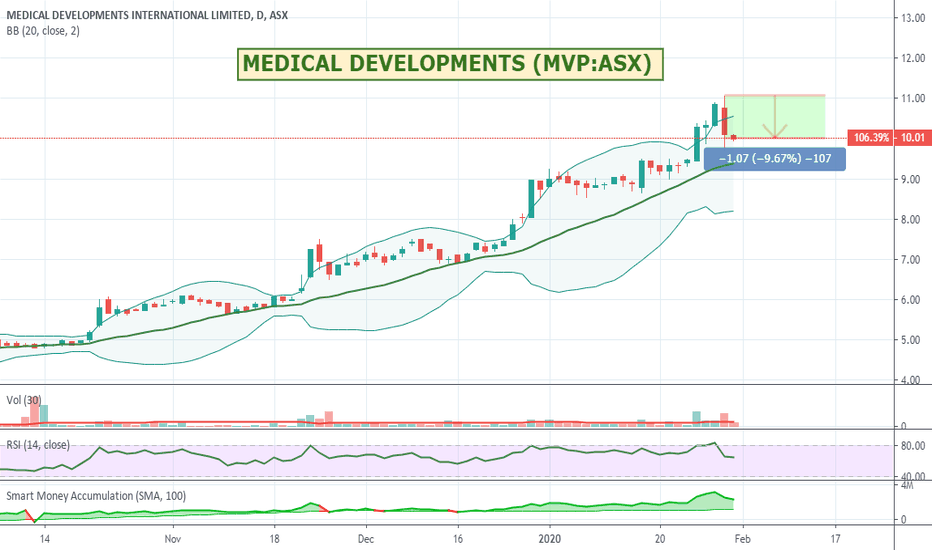

$MVP:ASX - MEDICAL DEVELOPMENTS - Up 170% and 10% PullbackMVP has had a good run over the last 12 months up around 170% and with the recent turbulence has had a 10% pullback. If it climbed back up to around $10.20 or so to reconfirm direction it could be worth a look.

Medical Developments International Ltd. engages in the manufacture and distribution of pharmaceutical drugs, medical, and veterinary equipment. It operates through the following segments: Pharmaceuticals, Medical Equipment, and Veterinary Equipment. The Pharmaceuticals segment involves the selling of Penthrox drugs. The Medical Equipment segment includes the sale of medical devices. The Veterinary Equipment segment relates to the sale of veterinary products within Australia, Europe, and Asia. The company was founded in 1971 and is headquartered in Scoresby, Australia.

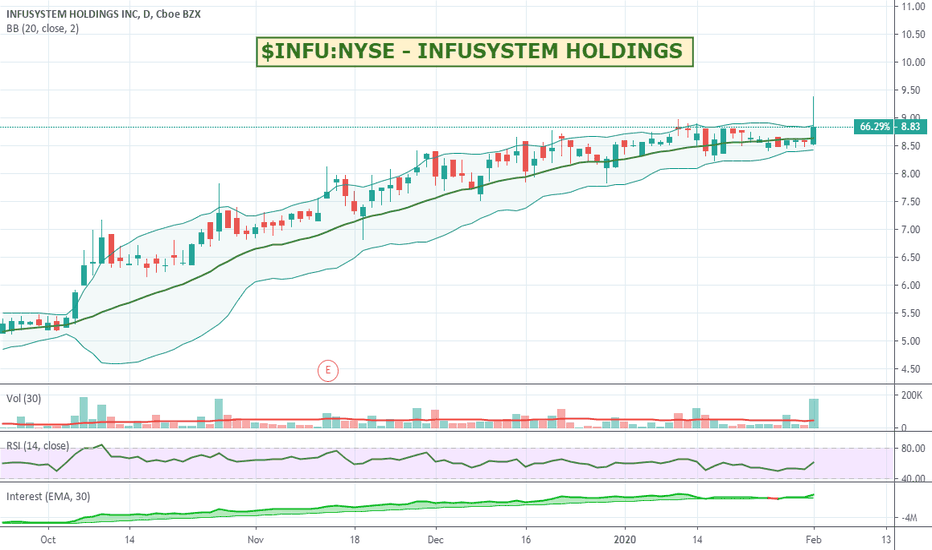

$INFU:NYSE - INFUSYSTEM HOLDINGS - Breakout Ahead?INFU has been having a nice steady run - up over 130% over the last 12 months, but momentum has been falling forming a bit of a hill top. The Bollinger Bands have been compressing and yesterday we saw an attempt at a breakout with quite big volume. It didn't succeed but could be worth a watch over the next day or so to see if it will indeed run. It did this once before in October with a very similar candle which saw the price fall away before resuming its run. Worth keeping an eye on it.

InfuSystem Holdings, Inc. engages in the provision of infusion pumps and related products and services for patients in the home, oncology clinics, ambulatory surgery centers, and other sites. The firm also provides its products and services to hospitals, oncology practices and facilities and other alternate site health care providers. The company was founded in August 2005 and headquartered in Madison Heights, MI.

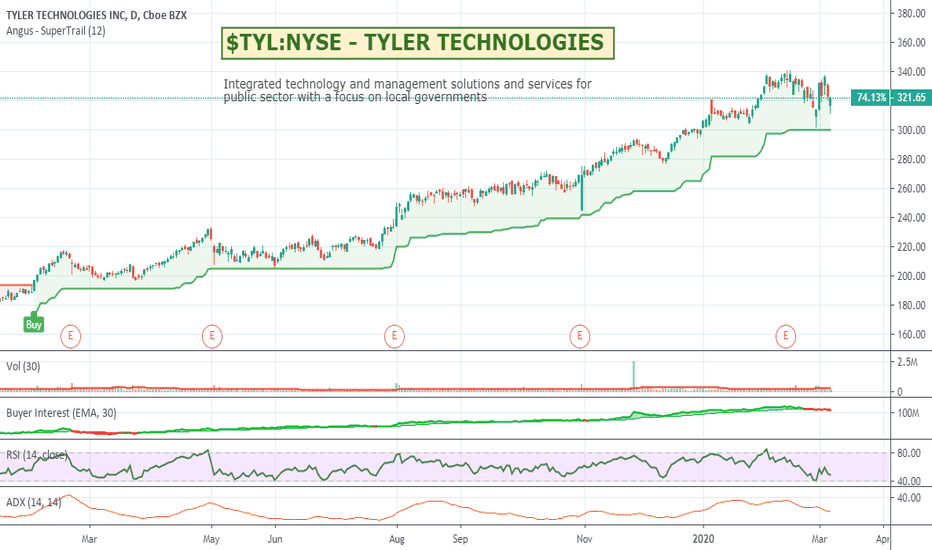

$TYL:NYSE - TYLER TECHNOLOGIES - Holding up well.Tyler is another stock that has been holding up pretty well so far throughout the current downturn. A 12% Trail would have kept you in for the year for a 74%+ gain. Could be worth a watch.

Tyler Technologies, Inc. engages in the provision of integrated technology and management solutions and services for public sector with a focus on local governments. It operates through the Enterprise Software, and Appraisal and Tax segments. The Enterprise Software segment provides municipal and county governments and schools with software systems to meet their information technology and automation needs for mission-critical back-office functions such as financial management, courts, and justice processes. The Appraisal and Tax segment provides systems and software that automate the appraisal and assessment of real and personal property, as well as property appraisal outsourcing services for local governments and taxing authorities. The company was founded in 1966 and is headquartered in Plano, TX.

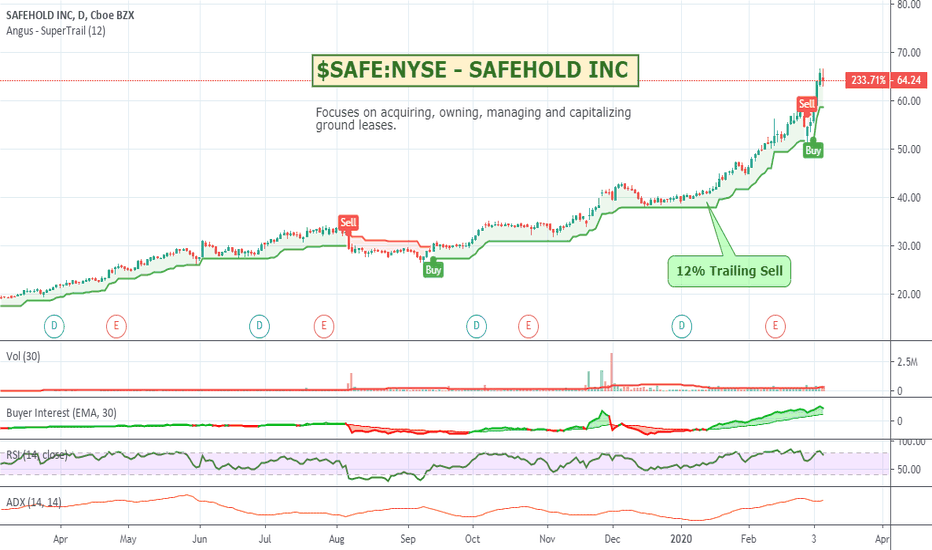

$SAFE:NYSE - SAFEHOLD INC- Up 200%+ in 12 monthsSAFEHOLD has continued to trend upwards throughout the current market turmoil. A 12% trailing sell would have netted you around a 233% gain with only 2 re-buys which is pretty good considering how turbulent the market has been. Could be worth a watch.

Safehold Inc. operates as a real estate investment trust, which focuses on acquiring, owning, managing and capitalizing ground leases. It seeks to provide safe & growing income, as well as capital appreciation to shareholders by building a diversified portfolio of ground leases. The company's property is generally leased on a triple net basis with the tenant responsible for taxes, maintenance and insurance, as well as all operating costs and capital expenditures.

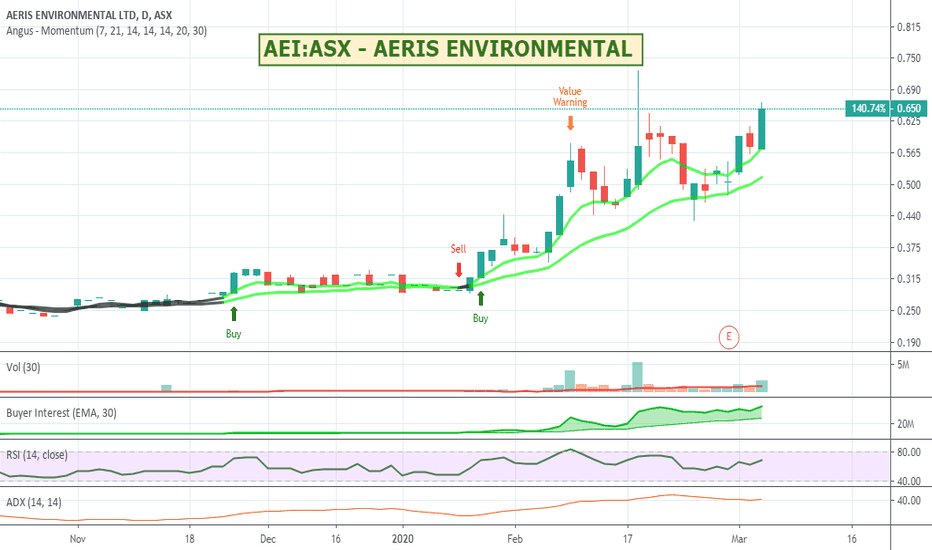

AEI:ASX - AERIS ENVIRONMENTAL - Effective for CoronavirusSingapore NEA lists Aeris Active as effective for #Coronavirus and other independent testing has shown that in 60 seconds Aeris Active kills 99.999% of the Influenza virus; and also the Norovirus, which causes Gastroenteritis.

Aeris Environmental Ltd (Aeris or the Company) has been notified by Eurofins AMS Laboratories, a provider of world-class analytical and consulting services in microbiology, that Aeris Active has achieved an over five log kill (i.e. 99.999%), after just 60 second contact time, against two significant causes of death globally. The World Health Organisation has stated that seasonal influenza kills up to 650,000 people every year. The US Centre for Disease Control and Prevention – a leading national public health institute in the USA – calculates that Norovirus is responsible for 18% of diarrheal disease globally and is estimated to cause approximately 200,000 deaths annually, worldwide, with 70,000 or more deaths being children in developing countries.

Up over 400% in the last 12 months, AEI could be worth a watch.

Aeris manufactures and markets proprietary, environmentally-friendly technology, which drives measurable improvements in asset performance and sustainability. The Company’s whole-of-system approach ensures that systems perform better, are safer, last longer and cost less to run. Aeris’ products solve real-world problems more effectively than conventional toxic chemicals. Uniquely based on validated, green formulations, the Company’s enzymes and treatments, with residual protection provide long-term remediation, and prevention of mould, bacteria growth, corrosion and improved hygiene. AerisVIEW, the Company’s cloud-based visualisation network, is uniquely scalable across all climatecontrolled environments, including buildings of all sizes, and vehicles. Aeris’ solution delivers dramatic and proven energy savings, alongside documented benefits to system efficiency, and independently-validated indoor air quality with proven immediate improvements in sustainability and cash flow savings.

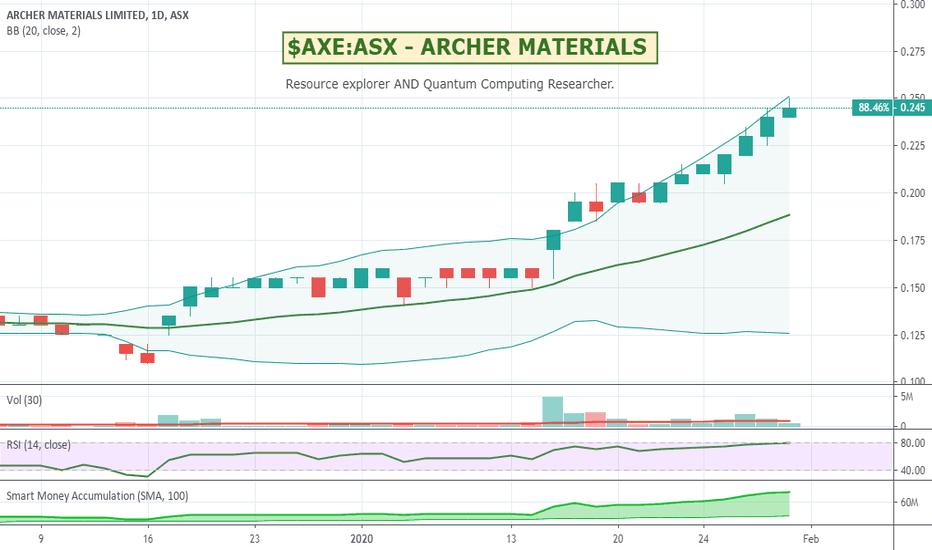

$AXE:ASX - ARCHER MATERIALS - 230% gain over 12 monthsArcher is an interesting company. I thought it was just a resource explorer but looking at their website they are heavily engaged in Quantum computing research. Everything from materials to building the chips. With a sharp price increase over the last couple of months, could be overextended, but also well worth a watch.

ARCHER IS A MATERIALS TECHNOLOGY COMPANY: Materials are the tangible physical basis of all technology. We’re developing and integrating materials to address complex global challenges in quantum technology, human health, and reliable energy.

ADVANCED MATERIALS TO UNDERPIN TECHNOLOGY: We’re developing advanced materials to build disruptive technology. Our innovative materials include carbon-based qubits for quantum computing, graphene enhanced biosensors, graphitic battery anodes and more.

MINERAL EXPLORATION TO SECURE FUTURE ECONOMIES: We’re exploring Australia’s natural resources to source the building blocks of modern technology. Our projects span critical minerals like graphite, copper, tungsten, cobalt and more.

INTEGRATION TO ACCELERATE GLOBAL IMPACT: Our approach to materials development and exploration is enabling a new wave of converging technologies, each with the potential to positively impact global industries spanning electronics, medicine, and energy.

TECHNOLOGY: Materials that enable quantum information processing could transform all industries dependent on computational power. The development of our 12CQ qubit processor chip could provide a potential solution to room-temperature quantum computing and enable direct consumer ownership of quantum computing powered technology.

HEALTH: Materials in complex biosensing devices provide the means to identify disease and infection. We are developing a potential solution to rapid multiplexing that involves printable graphene-based biosensors that could simplify medical diagnosis and aid point of care disease management.

ENERGY: Materials that have the ability to control the accumulation of heat, light and electricity reversibly and efficiently have wide-reaching applications in energy storage and use. We are developing mineral commodities for downstream use in battery technologies that could address trade-offs between cost and performance.