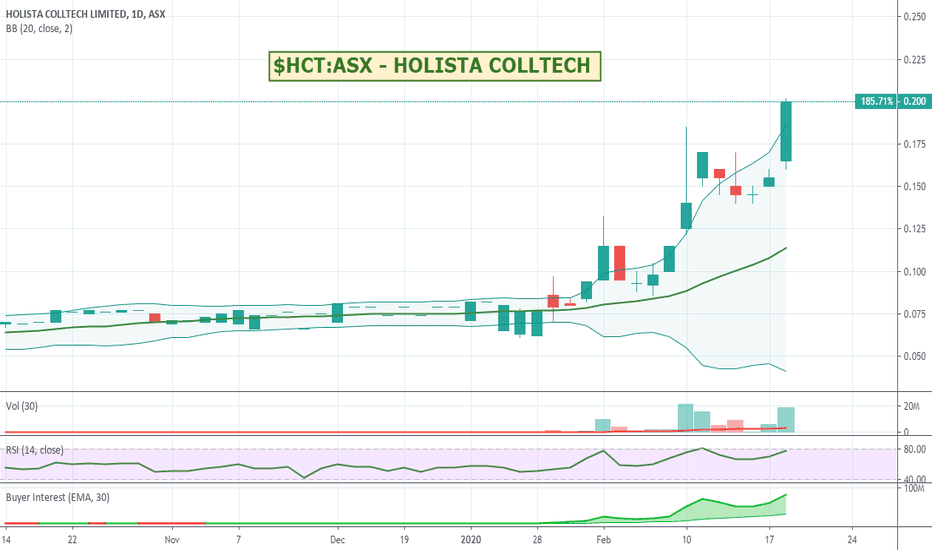

$HCT:ASX - HOLISTA COLLTECH - Is this the next $ZNO ?Hollista has been running hard on news of the Coronavirus and seems to be building momentum if anything. Their The nasal balm is an all-natural sanitizer to reduce the risk of viral infection via the nose, either through inhaled or via touch (hand to nose). It is a plant-based formula proven in world renowned laboratories, including laboratories working with World Health Organization, to kill over 170 deadly pathogens including previously tested forms of the coronavirus. Up 200% over the last couple of months it could be worth a look.

Holista is a research-driven biotech company, the result of a merger between Holista Biotech Sdn Bhd and CollTech Australia Ltd. Headquartered in Perth and with extensive operations in Malaysia, the company is dedicated to delivering first-class natural ingredients and wellness products globally. Holista is a leader in the research of herbs and ingredients for the making of healthier food. Listed on the Australian Securities Exchange (ASX), Holista researches, develops, manufactures and markets “health-style” products to address the unmet and evolving needs of natural medicine. Holista’s suite of ingredients, among other things, includes low-GI baked products, reduced-sodium salts, low-fat fried foods and low calories sugar without compromising taste, odour and mouthfeel. Holista remains the only company to produce sheep (ovine) collagen using patented extraction methods.

Search in ideas for "zAngus"

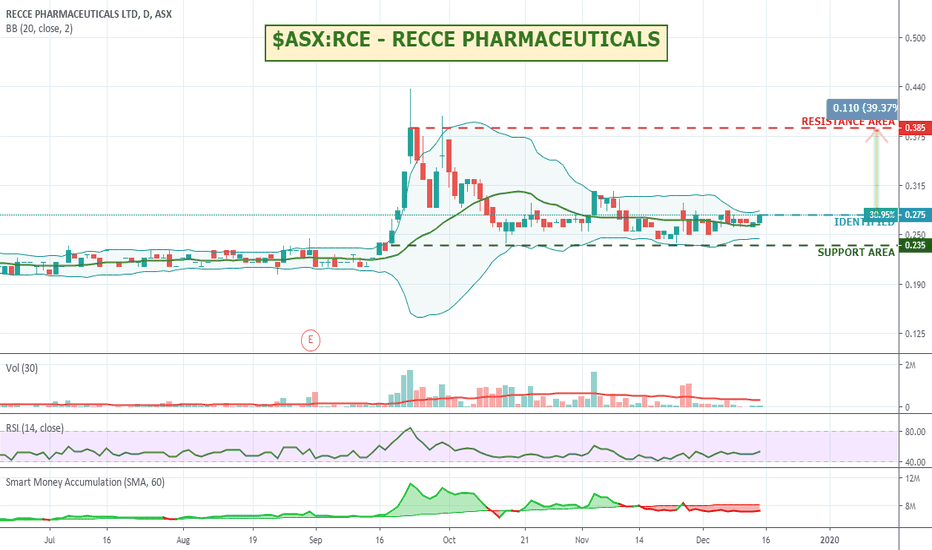

$ASX:RCE - RECCE PHARMACEUTICALS - Bolly Compression to BreakoutRECCE might be worth a watch. Seems to be going through a bit of a compression cycle after making some big highs. Quite a lot of potential upside and support not too far away. I'd like to see more volume but could be work adding to your watch lists.

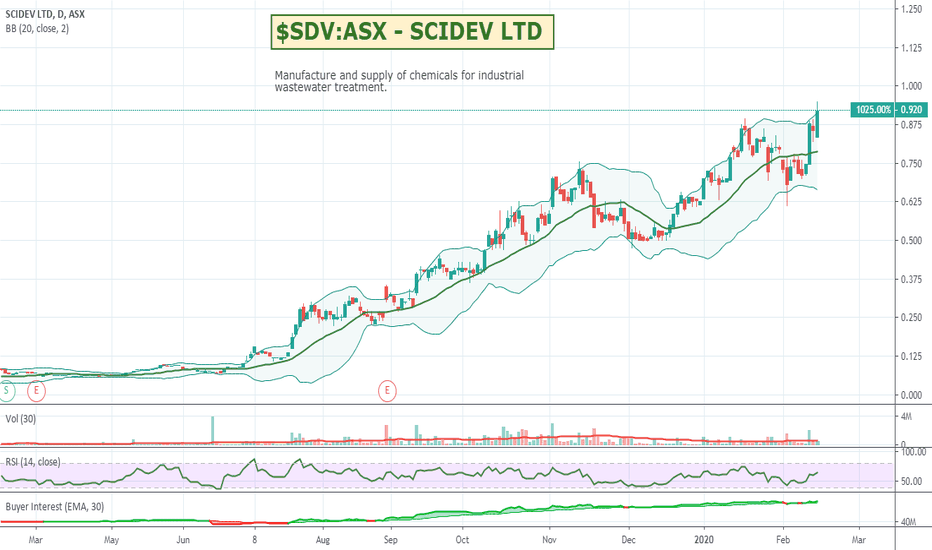

$SDV:ASX - SCIDEV LTD - Up 1000% for the yearSDV is one of my favourite stocks and has just pushed through a 1000% gain over the last 12 months. Could still be some value there and worth a look.

SciDev is a leader in the development and application of both chemistry and process control for solids-liquid separation. SciDev brings together world-class technology, chemistry, management and manufacturing capabilities to solve pressing operational and environmental issues for the minerals processing, tailings, water treatment and Oil & Gas markets.

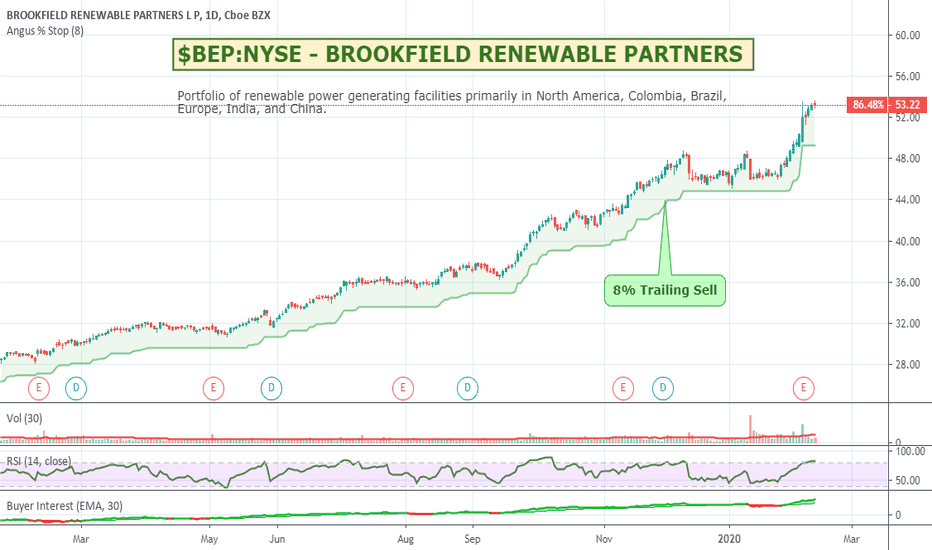

$BEP:NYSE - BROOKFIELD RENEWABLE PARTNERS - Up 85% over 1 yearBEP is a longer term buy and hold for me that I like with its push into the renewable energy segment. $16B market cap and $1.9B EBITDA its a whale of a company that can hopefully carve out a leadership position in this space. Nice and steady trending stock. Could be worth a look.

Brookfield Renewable Partners LP engages in owning a portfolio of renewable power generating facilities primarily in North America, Colombia, Brazil, Europe, India, and China.. It operates through following segments: Hydroelectric; Wind; Solar; Storage and Other; and Corporate. The company was founded on June 27, 2011 and is headquartered in Hamilton, Bermuda.

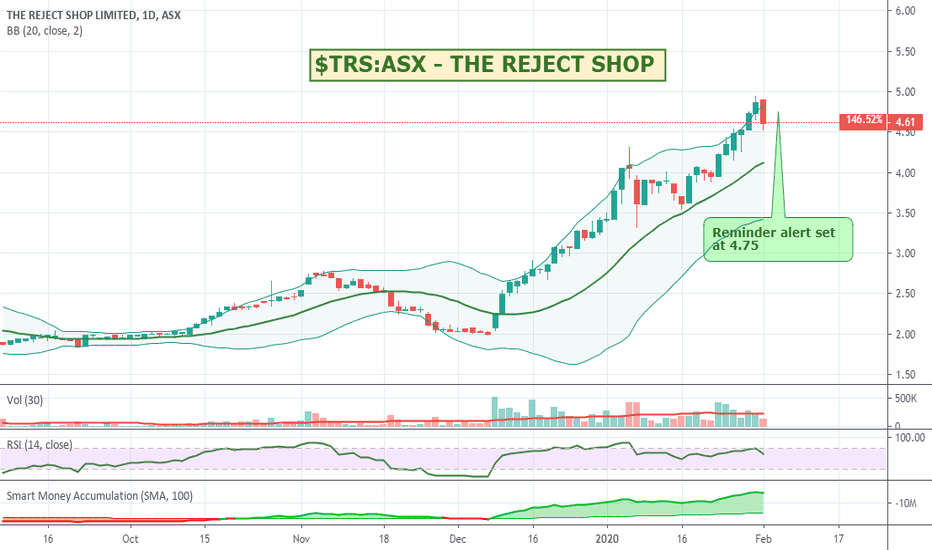

$TRS:ASX - THE REJECT SHOP - Up 130% over the last 2 months. The Reject Shop has been on a bit of a run over the last few weeks and with todays overall market down time, might have put it back in a bit of a value area again. I've noticed my younger niece and her friends all seem to like shopping at the Reject Shop and I do tend to go into them as well. Lot of Youtubers also regularly shoot videos in and around them. Might have become a thing. I have set an alert at $4.75 to remind me to have another look when it starts to head back up.

The Reject Shop Ltd. engages in retailing of discount variety merchandise. It offers general consumer merchandise such as toiletries, cosmetics, homewares, personal care products, hardware, basic furniture, household cleaning products, kitchenware, confectionery, snack food, lifestyle and seasonal merchandise, such as seasonal gifts, cards and wrapping, toys, leisure items, and home decorations. The company was founded by Ron Hall and John Shuster in 1981 and is headquartered in Kensington, Australia.

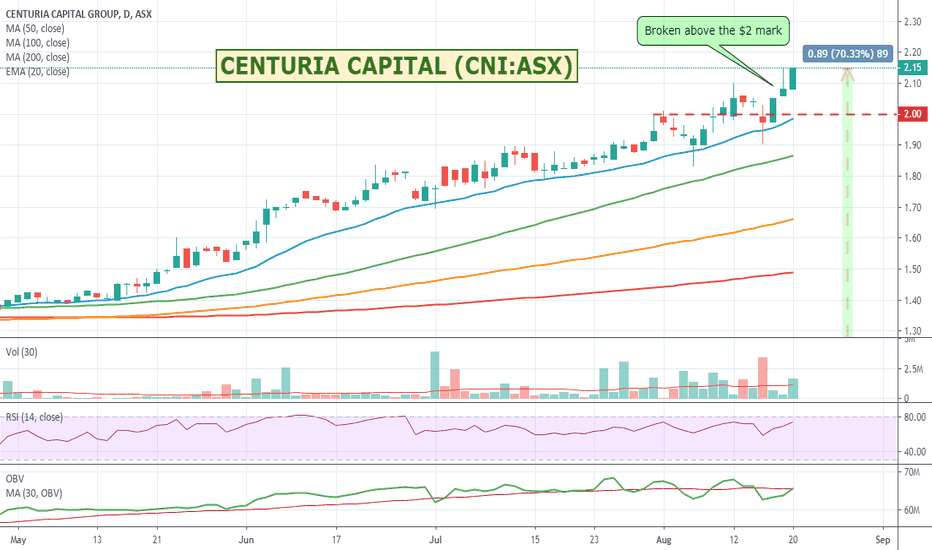

$CNI:ASX - CENTURIA CAPITAL - Broken above the magic $2 mark.Centuria has been having a good run so far this year - up around 70% from the start of the year. It looks like it will be able to hold itself above that $2 psychological level now. Not a lot of buyers and sellers but if you think you can get in at the right price it could be worth a watch.

Centuria Capital Group is an Australia-based specialist investment manager. The Companies core business is the management of listed property funds (AREITS) together with a range of unlisted property funds. It operates through four segments: Property Funds Management, Investment Bonds Management, Co-Investments and Corporate. Property Funds Management segment is engaged in management of listed and unlisted property funds. Investment Bonds Management is focused on Management of the Benefit Funds of Centuria Life Limited and management of the Over Fifty Guardian Friendly Society Limited. The Benefit Funds include a range of financial products, including single and multi-premium investments. Co-Investments segment is focused on direct interest in property funds and other liquid investments. The Company buys, manages and sells commercial and industrial property.

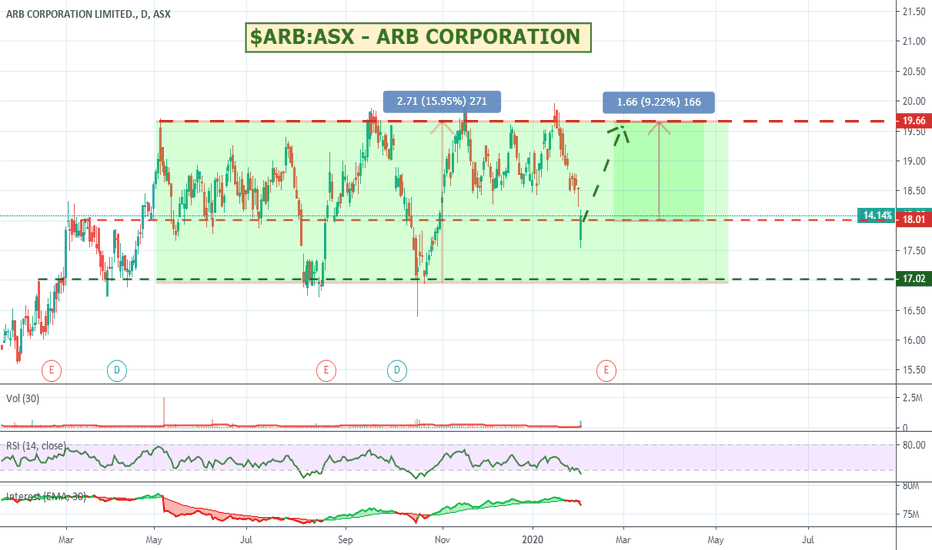

$ARB:ASX - ARB CORPORATION - Swing Trade In Play?Another pattern trade. There is a possible longer 15% swing, but based on todays rally, it might be reversing and going for the shorter 10% swing. Check for confirmation of course, but could be worth a watch... again I'd probably use a bracket order.

ARB Corp. Ltd. designs, manufactures, distributes and sells of motor vehicle accessories and light metal engineering works. It operates through the following geographical segments: Australia, USA, Thailand; and Middle East and Europe. Its products include protection equipment, old man emu suspension, air lockers and accessories, ARB compressors. roof racks and roof bars, canopies and ute lids, drawers and cargo barriers, vehicles lighting and rear vision, fridges and camping accessories, battery, power and solar solutions, safari snorkels, general accessories and recovery equipment. The company was founded by Anthony Ronald Brown in 1975 and is headquartered in Kilsyth, Australia.

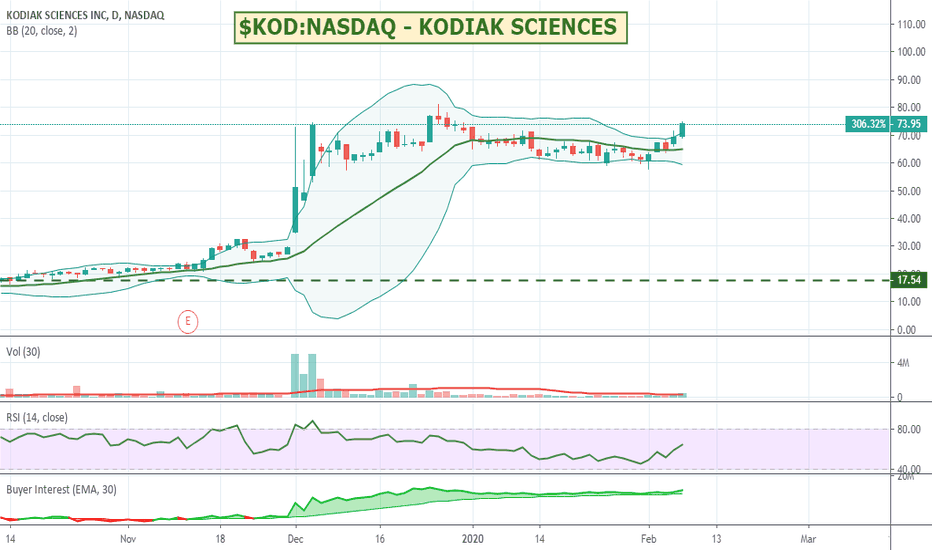

$KOD:NASDAQ - KODIAK SCIENCES - Up 950% over 12 monthsKodiak has had an amazing run over the last year but has been ranging sideways for the last couple of months. With a Bollinger breakout to the upside it could be worth a look.

Kodiak Sciences, Inc. is a a clinical-stage biopharmaceutical company, which engages in the development of novel therapies for the treatment of retinal diseases. Its product pipeline include KSI-301 for wet AMD; KSI-301 for diabetic eye disease; KSI-501 for DME and uveitis; KSI-201 for resistant wet AMD; and KSI-401 for dry AMD.

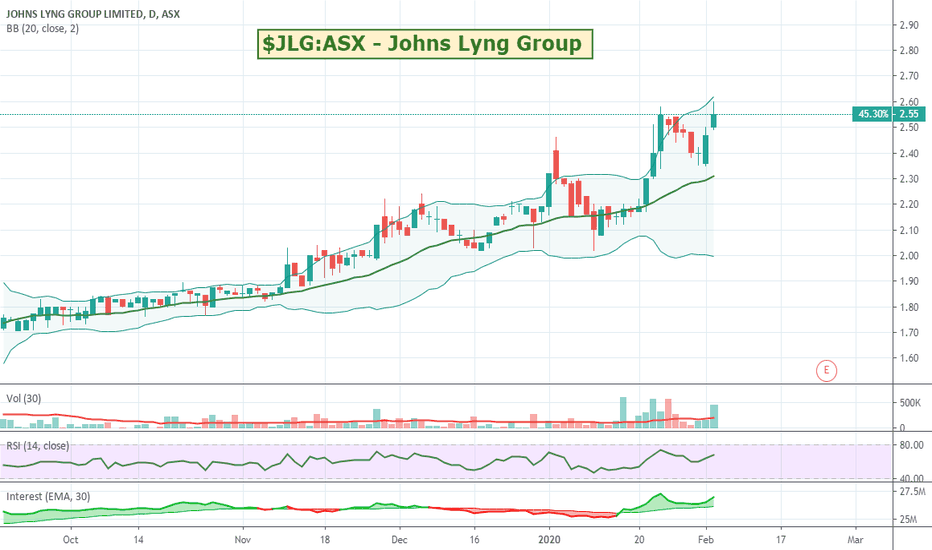

$JLG:ASX - Johns Lyng Group - Up 120% and resuming its run.JLG provides building and restoration services in Australia and has been having a great run since late 2018 where its price has risen steadily by around 200%. It has had a couple of recent pullbacks but looks like it could be resuming its run with good volume, an RSI showing value, and we can see interest in the stock is higher than normal. Could be worth a watch.

It operates through following segments: Insurance & Building Restoration Services, Commercial Building Services, Commercial Construction Services and Other. The Insurance & Building Restoration Services segment engages in building and restoration jobs. The Commercial Building Services segment offers commercial glazing, commercial flooring, shop fitting, hazardous waste removal and emergency domestic services. The Commercial Construction Services segment includes traditional commercial building activities in Victoria. The Other segment includes unallocated corporate overhead costs and a start-up recruitment and labour hire business which undertakes jobs on behalf of the Group and external clients. The company was founded in 1953 and is headquartered in Doncaster, Australia.

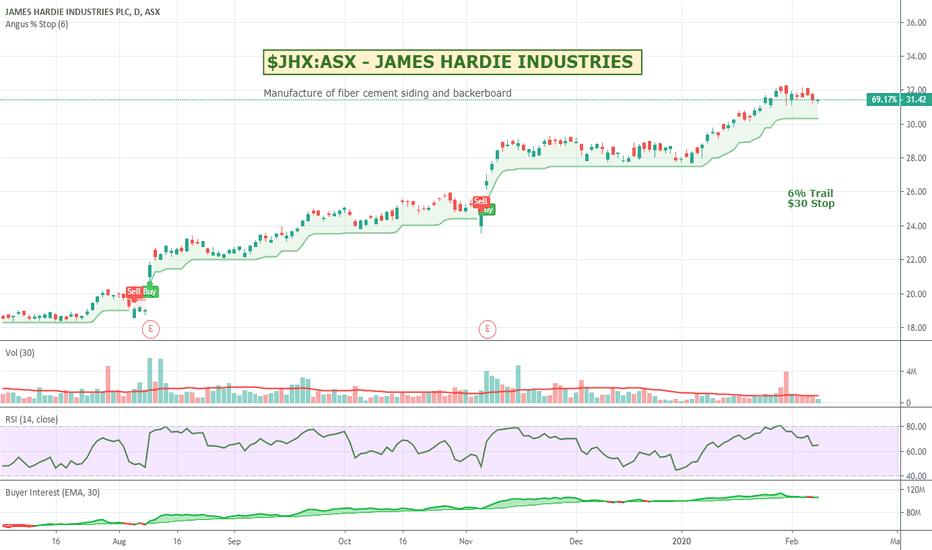

$JHX:ASX - JAMES HARDIE INDUSTRIES - Trending nicely up 90%James Hardie has been having a nice run. Small pullback back under 32 but showing better value. Trades in a nice and tight range with about a 6% trailing sell keeping you in the stock most of the time. Could be worth a watch.

James Hardie Industries Plc engages in the manufacture of fiber cement siding and backerboard. It operates through the following segments: North America Fiber Cement, International Fiber Cement, Other Businesses and Research and Development. The North America Fiber Cement segment manufactures fiber cement interior linings, exterior siding products, and related accessories in the United States. The International Fiber Cement segment comprises of all fiber cement products manufactured in Australia, New Zealand, and the Philippines, and sold in Australia, New Zealand, Asia, the Middle East, and various Pacific Islands. The Other Businesses segment focuses in the certain non-fiber cement manufacturing and sales activities in North America, including fiberglass windows. The Research and Development segment represents the cost incurred by the research and development centers. The company was founded in 1888 and is headquartered in Dublin, Ireland.

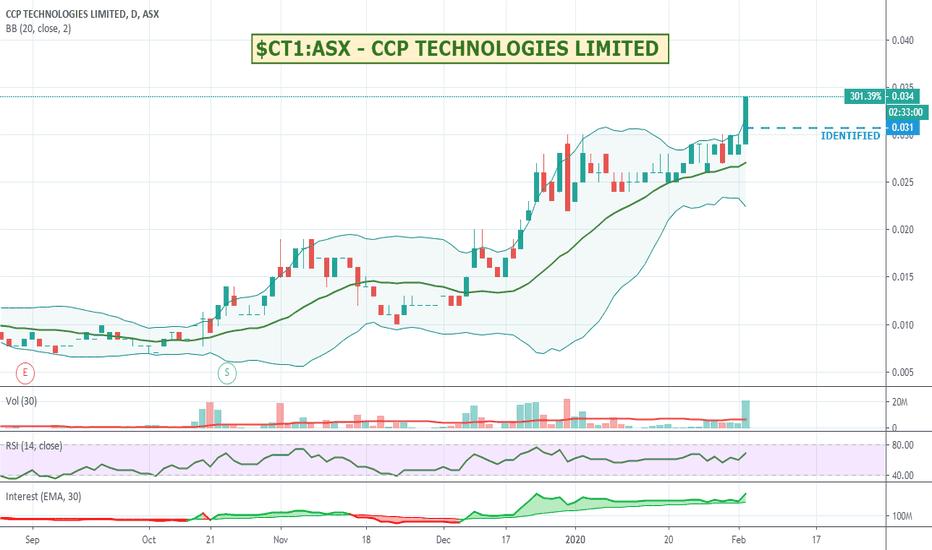

$CT1:ASX - CCP TECHNOLOGIES - IoT player up 435% over 12 monthsNot to be confused with $CCP, CT1 or CCP Technologies designs and supports innovative IoT solutions for industry and government focusing on creating and monetising sensory and cloud platform technologies that contribute to the improvement of humanity including in the areas of health, industrial productivity, environmental preservation, education, safety and general efficiency.

Think things like smart tags that perform 24/7 wireless monitoring of temperature, humidity and other critical control points with a stack of analytics behind each one with real time alerts in case of any problems. In the food industry their smart tags are placed in temperature-controlled environments (e.g. fridges, display cabinets, freezers and cool-rooms) to comply with food safety regulations and HACCP programs. CCP tags can also be used in other industries; for example, in the health industry, our solution is being used to monitor vaccine and temperature-sensitive research material storage environments.

Share price has shown strong growth over the last 12 months and it is still a sub 10 (ie its 3) cent stock so could be worth a watch.

The Company is Australian based with wholly-owned subsidiaries in India and China.

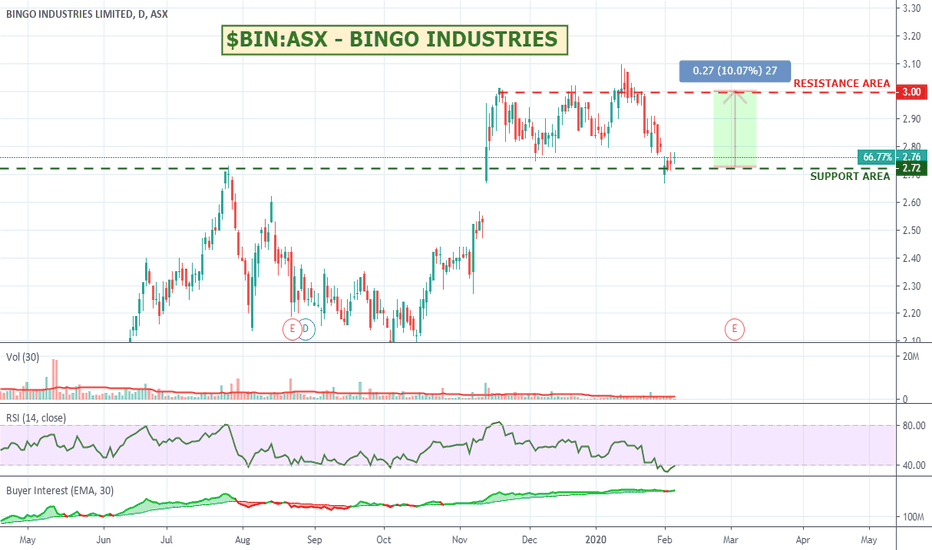

$BIN:ASX - BINGO INDUSTRIES - Swing off value?Could be an interesting swing trade. At a pretty solid support / resistance area. RSI showing oversold and starting to point up so momentum might be coming back into the stock. Plenty of buyers and sellers in the queue. I have a bracket order on it. Sell if drops 5% or if it hits $2.95. Could be worth a look for a shorter term trade.

Longer view showing support / resistance to the left.

Bingo Industries Ltd. engages in the provision of waste management for domestic and commercial business. It offers skip bins, commercial waste, liquid waste, recycling centres, contaminated soils, and sand and soil supplies. The company was founded on March 03, 2017 is headquartered in Auburn, Australia.

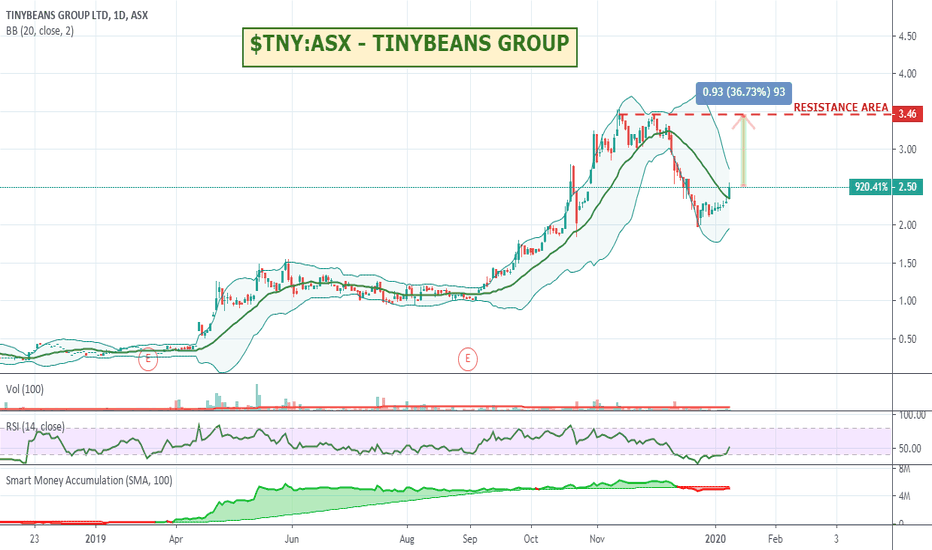

$TNY:ASX - TINYBEANS GROUP - Recovering?Tiny Beans was one of the top runners on the ASX over the last year - up a staggering 1,000+% before their pullback. Looks like they might be starting to recover, so could be worth a watch.

Tinybeans Group Pty Ltd. provides mobile and web-based social media platform that allows parents to record and share moments and milestones with family and friends privately and securely. The company was founded by Stephen O'Young, Sarah-Jane Kurtini and Eddie Geller in March 2012 and is headquartered in Surry Hills, Australia.

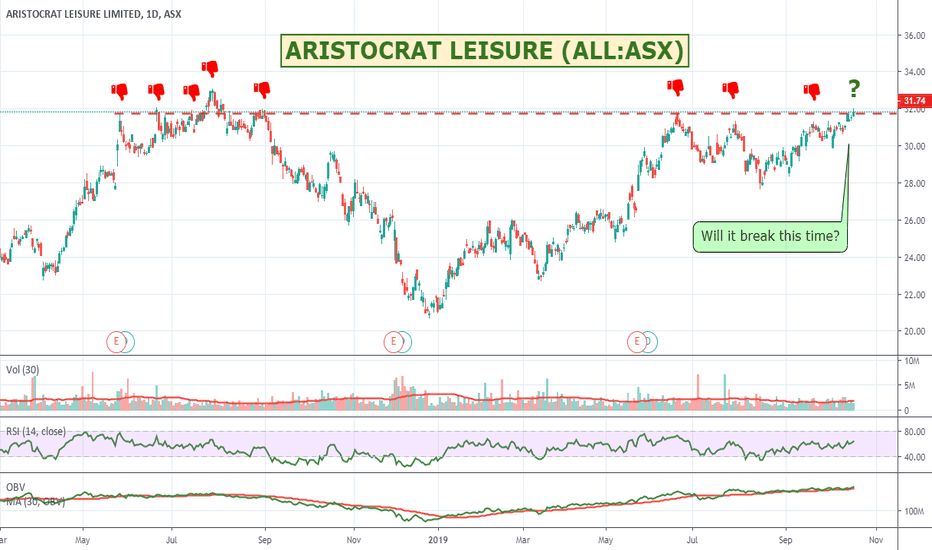

$ALL:ASX - ARISTOCRAT - Will it break and run this time?Interesting breakout point especially looking at the long term chart below. With an EBITDA of $1.465B (yes billion) might be worth a watch.

Aristocrat Leisure Limited provides gaming solutions. The Company's principal activities include design, development and distribution of gaming content, platforms and systems. The Company's segments include The Americas; Australia and New Zealand, Digital, and International Class III. The Company offers a range of products and services, including electronic gaming machines and casino management systems. The Company also operates within the online social gaming and real money wager markets. The Company, through Video Gaming Technologies, Inc. (VGT), develops, manufactures and distributes casino games for the Class II and emerging markets. It offers Oasis 360, which is a casino management system and contains a portfolio of open-platform technologies. It also offers System 7000 casino management system. The System 7000 family includes System 7000 PRIME, System 7000 eCo and System 7000 Atom. Its ARC cabinets offer a cinematic experience with sweeping, curved and touch-screen technology.

$IGO:ASX - IGO LIMITED - Easy Swing Trade?IGO is more of a pattern trade than anything else. I would want to make sure that it does indeed start to go back up, but you can see that in the past it has had a fairly consistent 15% or so range. Could be a good bracket order. Wait for confirmation, but worth a watch.

IGO Ltd. is a development stage company, which engages in the exploration and mining of gold and nickel. It operates through the following business segments: Tropicana Operation; Long Operation; Jaguar Operation; Nova Project; and New Business and Regional Exploration Activities. The Tropicana Operation segment represents the joint venture interest in the Tropicana Gold Mine. The Long Operation segment offers nickel and copper. The Jaguar Operation segment produces copper and zinc concentrates. The Nova Project segment involves the construction and development of the Nova nickel, copper, and cobalt mine located east of Norseman in Western Australia. The New Business and Regional Exploration Activities segment covers the Stockman Project. IGO was founded in May 2000 and is headquartered in South Perth, Australia.

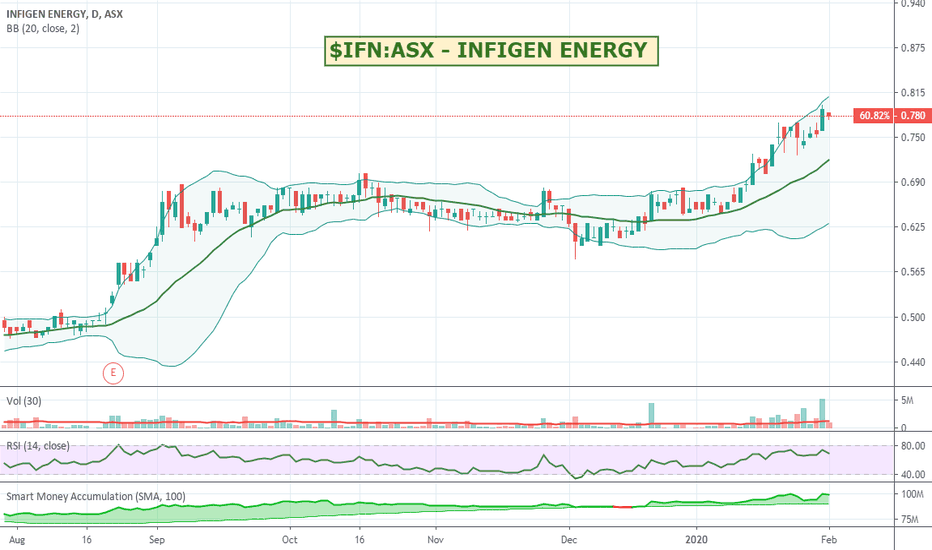

$IFN:ASX - INFIGEN ENERGY - Clean Energy CompanyInfigen is a developer, owner and operator of renewable energy generation assets delivering energy solutions to Australian businesses and large retailers with a development pipeline comprising equity interests in approximately 1,100 mw of large-scale wind and solar in Australia. I think there will be a steadily increasing demand to move away from fossil fuel and mining type resources to sustainable / renewable energy by the bigger portfolio managers and super funds over the next few years. Up 70% over the last year and still priced under $1, IFN could be worth a look.

Infigen invests in renewable generation and is developing firming capabilities to deliver reliable energy to Australian businesses. As the Australian energy market transitions to lower emission energy, Infigen meets this transformation through its geographically diverse clean renewable generation portfolio of assets, proven operating expertise and focus on energy firming technology. Infigen is a licenced energy retailer in the National Electricity Market (NEM) regions of Queensland, New South Wales (including the Australian Capital Territory), Victoria and South Australia. The company has wind generation assets in New South Wales, South Australia and Western Australia. Infigen is also developing options for firming in the NEM to support its business strategy. Infigen is proudly Australia’s largest listed owner of wind power generators by installed capacity of 557MW, with a further 113.2MW under construction in New South Wales, and actively supports the communities in which it operates.

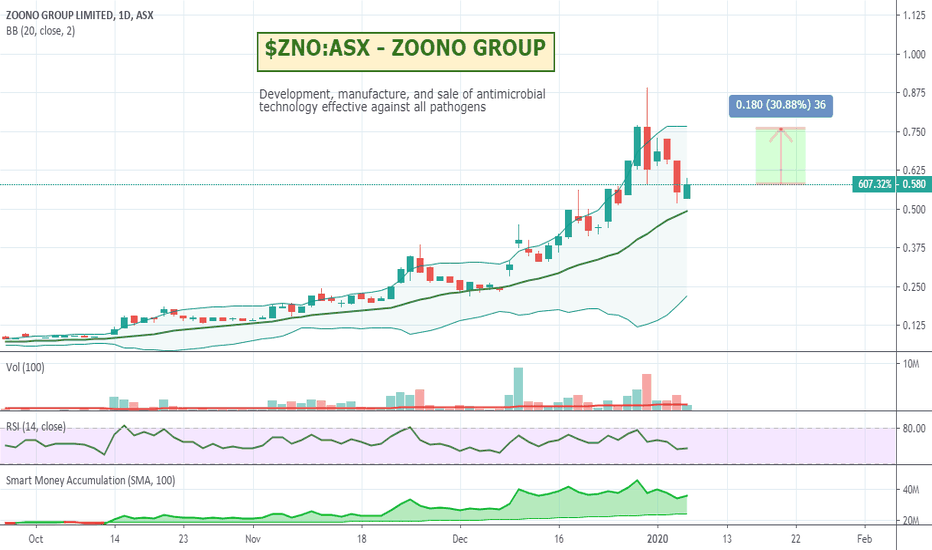

$ZNO:ASX - ZOONO GROUP - Helping reduce the pig virus in ChinaZoono sounds like an interesting business with both consumer and commercial product offerings. The thing I thought that was most interesting was the deal they did with China as their product has significant impacts on reducing the African Swine Fever virus in the pig population in China. As a result they had a meteoric rise over the last couple of months and might be recovering after a strong pullback. Quite a lot of upside to older highs if it does re-run. Could be worth a watch.

Zoono Group Ltd. is a pharmaceutical and biotechnology company. The firm is engaged in the development, manufacture, and sale of antimicrobial technology effective against all pathogens including bacteria, viruses, mould, algae, and fungi. Its products include aerosol-based sprays, surface sanitizers, treatment of acne, and mould remediation. The company was founded on November 26, 2009 and is headquartered in Auckland, New Zealand.

$ALK - ALKANE RESOURCES - Broken through resistance on newsALKANE RESOURCES - Broken through resistance on news

On Friday it had a good run and closed up near its daily high after breaking through a previous resistance area. Has some good market depth in the order queue and looks like some additional volume (ie interest) coming through as well. Gold stocks could also become more interesting depending on how the economy keeps going. Looks like it could be worth a watch.

Company Announcement 29th March 2019

Significant Gold Intercepts Confirm Potential for Tomingley Extension - 50,000 metres of Drilling Initiated

Broad, shallow high grade gold intercepts 3 to 4 kilometres south of Tomingley Gold Operations demonstrate potential for material project life extension and flag potential return to open pit mining.

RC and diamond core drilling results received for the San Antonio prospect demonstrated significant high grade gold zones.

Results compare favourably with those that became part of the Tomingley Gold Operations open pits.

RC drilling has confirmed significant gold mineralisation at San Antonio over a strike length of 800 metres and Roswell of 350 metres. The prospects are open along strike and down dip and an additional 3,000 metres of drilling is in progress to test the 300 metre untested strike between them.

Resource definition drilling at the San Antonio and Roswell prospects will commence as soon as practical and is expected to comprise of ~50,000 metres of predominantly RC drilling.

About Alkane Resources

Alkane Resources Limited is involved in mineral exploration and evaluation, development and extraction. The Company focuses on its projects at Tomingley and Dubbo in New South Wales (NSW). It operates through two segments: gold operations and rare metals. Its Dubbo Zirconia Project is based on a resource of zirconium, hafnium, niobium, tantalum, yttrium and rare earth elements, located at Toongi, approximately 30 kilometers south of the regional center of Duddo. Its Tomingley Gold Operations are located over 50 kilometers south-west of Dubbo in the Central West of NSW. Its Northern Molong Belt Porphyry Project consists of three exploration licenses, such as EL4022-Bodangora, EL6209-Kaiser and EL8261-Finns Crossing. Its Finns Crossing is located immediately to the north-west of the Bodangora exploration license. Its Kaiser covers approximately 127 hectors and is enclosed by the Bodangora license. Its Orange East Project is located approximately 15 kilometers east-south-east of Orange.

My Indicator Entry Rules (needs to meet all):

- Price > EMA(9) (Trending up short term)

- EMA(9) > EMA(21) (Trending up short to medium term)

- Volume > Volume(30) (Others have become more interested in the stock)

- RSI(14) > 50 but < 80 (Has momentum but not overbought yet)

- OBV > EMA (30, OBV) (Volume is accelerating)

- ADX(14) > 25 (Strong momentum in the trend direction)

My Just Before I Buy Rules:

- Check all or most indicators are pointing up to confirm their direction

- Wait for price to move up > 2% (Headed in the right direction today)

- I'll check market depth to ensure lots of buyers and sellers at close price points to ensure demand and liquidity (ie I can get out quickly if I need to)

- I'll check for any company announcements to see whats driving the volume

My Indicator Warnings:

- RSI(14) < 40 (Interest falling)

- RSI(14) > 80 (Very overbought territory - may reverse)

- OBV < EMA (30, OBV) (Volume falling away, people losing interest at this price)

My Sell Rules:

- Trailing Stop at 1.5 to 2 x ATR (Depends how aggressive I want to be - means trend has ended for now)

OR if

- EMA(9) < EMA (21) (Trend has failed for now)

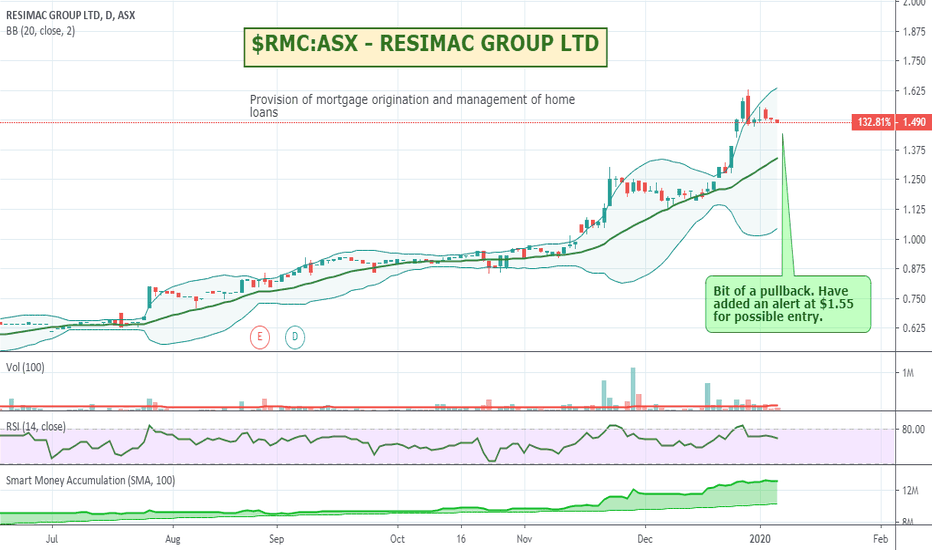

$RMC:ASX - RESIMAC GROUP - Up 200% in 12 months.RMC has been having a great run over the last 12 months and with a bit of a pullback could be worth a watch if it resumes its run.

Resimac Group Ltd. engages in the provision of mortgage origination and management of home loans. It also engages in the securitization of mortgages through residential mortgage trust, a special purpose vehicle used to residential mortgage backed securities. The firm operates through three segments: Australian Lending Business, New Zealand Lending Business and Paywise Business. The company was founded by Timothy Alastair Holmes and Robert Peter Salmon in 1985 and is headquartered in Sydney, Australia.

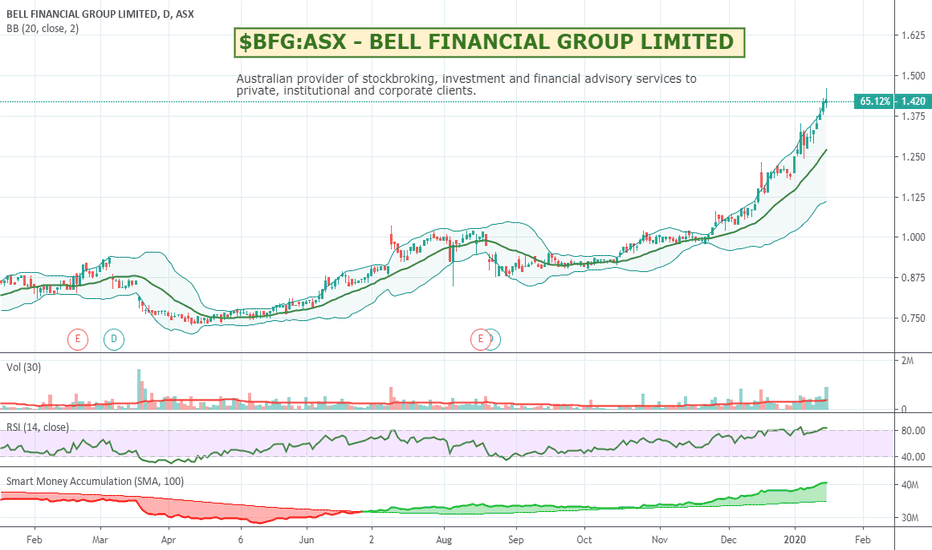

$BFG:ASX - BELL FINANCIAL GROUP - Nice Upper BB Walk.Bell Financial Group is up roughly 65% over the last 12 months and has been having a very steady upper Bollinger Band walk. Looking at the RSI it is due for a pullback as it is so overextended but there has been some very good volume over the last few days which is interesting. Current demand has 40 buyers for 411,573 units vs 17 sellers for 149,834 units. Could be worth a watch after a pullback.

Most recent announcement on Monday, 6 January 2020 – "Bell Financial Group Ltd (ASX:BFG) today announced that it expects to report a full year profit before tax of around $46 million, an increase of 30% on its 2018 result. Full details will be provided when audited results are released in February".

Bell Financial Group Ltd. engages in the provision of stock broking, investment and advisory services to private, institutional and corporate clients. It operates its business through the Retail and Wholesale segments. The Retail segment consists of equities, futures, foreign exchange, corporate fee income, and portfolio administration services. The Wholesale segment comprises of equities and corporate fee income. The company was founded on June 30, 1998 and is headquartered in Melbourne, Australia.

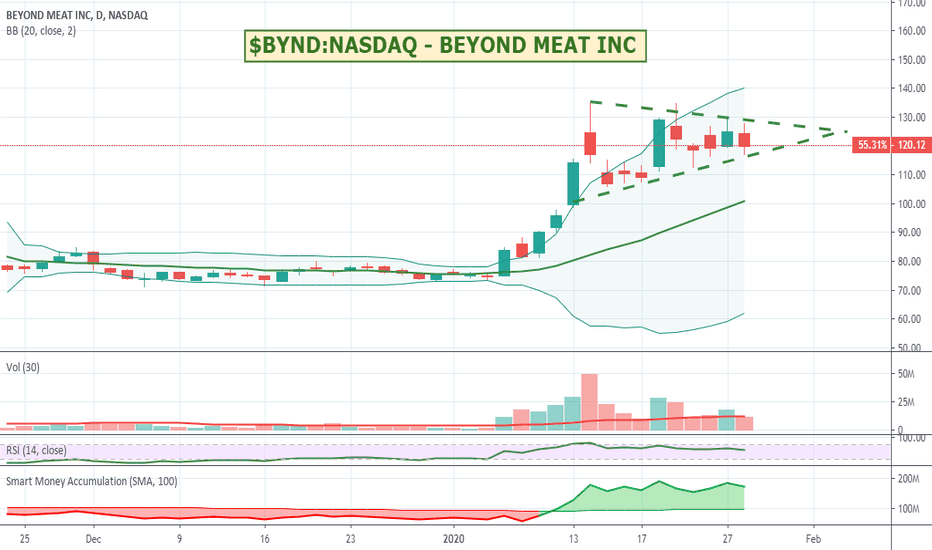

$BYND:NASDAQ - BEYOND MEAT INC - Some big deals aheadRumour on Yahoo Finance is that KFC and McDonalds who have both had successful trials could be looking at bigger national roll outs in the near future. Might be worth a watch.

Beyond Meat, Inc. engages in the provision of plant-based meats. Its products include ready-to-cook meat under the brands The Beyond Burger and Beyond Sausage; and frozen meat namely Beyond Chicken Strips and Beyond Beef Crumbles. The company was founded by Ethan Walden Brown and Brent Taylor in 2009 and is headquartered in El Segundo, CA.

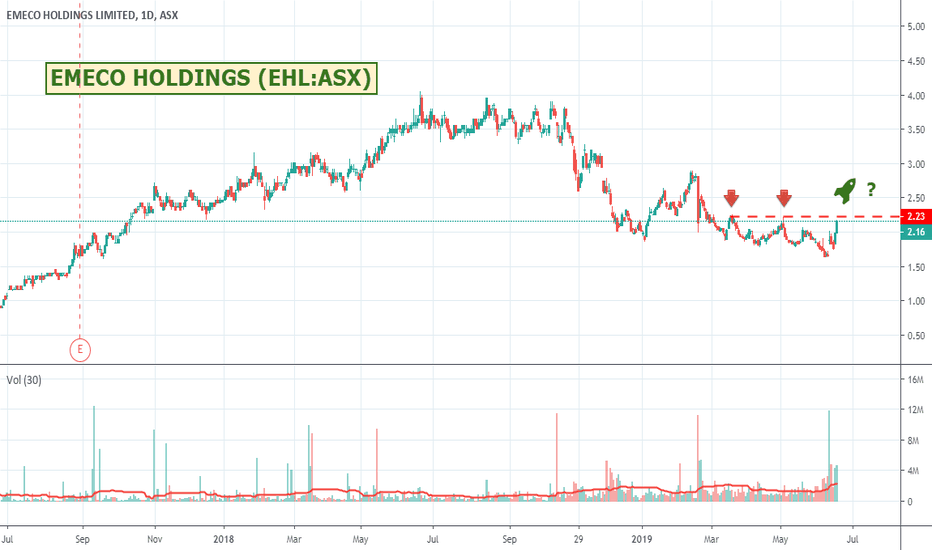

$EHL - EMECO - Will it break and run?Not the sort of stock pattern I would buy or hold but might be of interest for others. It's having a 3rd crack at resistance and had a good run earlier (which I would have bought in to) so it might be finding its feet again. Paradice have bought in and increased their position to around 9% so that could be a good sign. Might be worth a watch as plenty of upside to historical levels if it breaks and runs.

About Emeco

Emeco Holdings Limited (Emeco) provides heavy earthmoving equipment rental solutions to mining companies and contractors. The Company's segments include Australia, Canada and Chile. The Australia segment provides a range of earthmoving equipment and maintenance services to customers in Australia. The Canada segment provides a range of earthmoving equipment and maintenance services to customers primarily in Canada. The Chile segment provides a range of earthmoving equipment and maintenance services to customers in Chile. Its rental fleet includes Caterpillar and Komatsu rear dump trucks of 50 to 240 tons; Komatsu, Hitachi, Liebherr and Caterpillar excavators of 40 to 400 tons; Caterpillar articulated trucks of 30 to 40 tons; Caterpillar dozers of D8 to D11; Caterpillar and Komatsu loaders of 966 to 994H; Caterpillar graders of 14H to 24M, and ancillary equipment, including water carts, service trucks, compactors, integrated tool carriers and tire handlers.