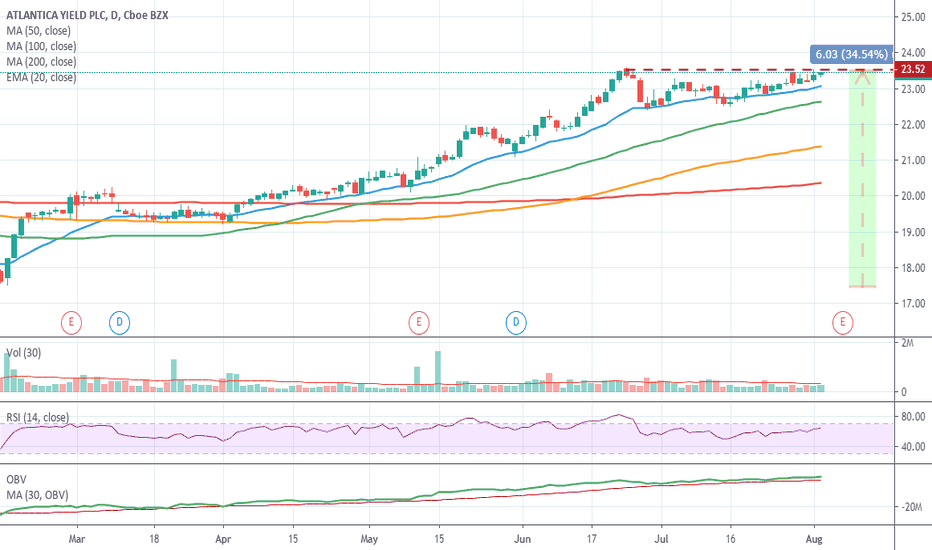

$AY:NASDAQ - ATLANTICA YIELD PLC - Running well up to earningsAtlantica has been having a good run up roughly 35% since the start of the year. It is at a bit of a resistance area so needs to break above and test it but the various signals and current track record look good. Could be one to watch as a bit of a defensive stock.

Atlantica Yield plc, formerly Abengoa Yield plc, is a total return company. The Company owns, manages, and acquires renewable energy, conventional power, electric transmission lines and water assets, focused on North America (the United States and Mexico), South America (Peru, Chile, Brazil and Uruguay) and Europe, Middle East and Africa (Spain, Algeria and South Africa). Its segments include North America, South America and EMEA. It operates in business sectors, including renewable energy, conventional power, electric transmission lines and water. As of December 31, 2016, it owned or had interests in 21 assets, comprising 1,442 megawatt (MW) of renewable energy generation, 300 MW of conventional power generation, 1,099 miles of electric transmission lines, as well as an exchangeable preferred equity investment in Abengoa Concessoes Brasil Holding S.A., (ACBH). The renewable energy sector includes its activities related to the production electricity from solar power and wind plants.

Search in ideas for "zAngus"

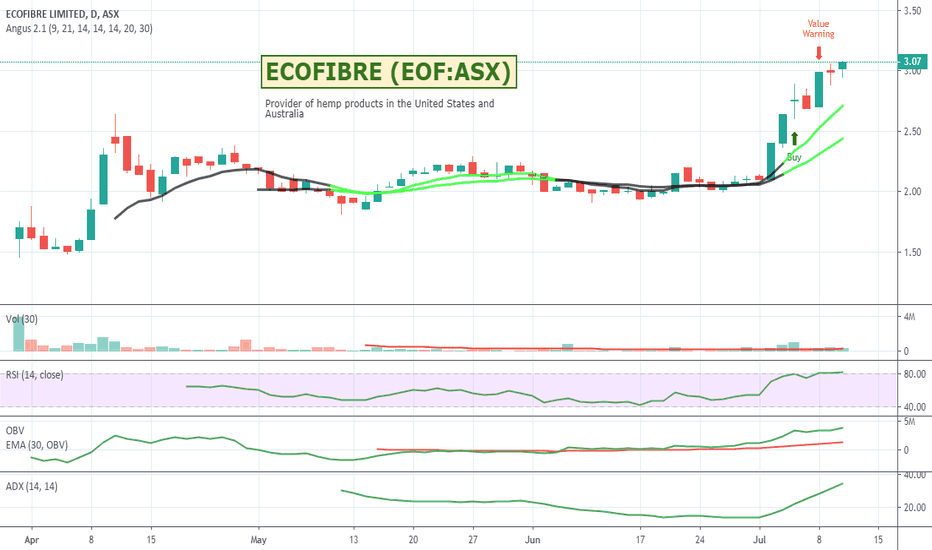

$EOF:ASX - ECOFIBRE - New ASX listingEcofibre is a provider of hemp products in the United States and Australia.

The whole vegetarian / Beyond Meat / sustainable / natural products space has quite a bit of mainstream momentum at the moment and companies like Ecofibre will look to benefit from this interest as well as potentially get added to the various "eco-friendly / responsible investing" ETFs and funds that seem to be popping up. It's their early forays into hemp-based textiles and materials that interests me more so than their food lines. Be interesting to follow them for a bit. Might be worth a watch.

In the United States, the Company produces nutraceutical products for human and pet consumption, as well as topical creams and salves. In Australia, the Company grows and produces hemp food products including protein powders, de-hulled hemp seed and hemp oil.

The Company is also developing innovative hemp-based products in textiles and composite materials in partnership with Thomas Jefferson University (TJU) in the United States. The Company owns or controls key parts of the value chain in each business, from breeding, growing and production to sales and marketing.

Ecofibre Limited (EOF) is focused on selectively owning or controlling specific parts of the hemp value chain, in targeted geographies. EOF sells hemp-based products to consumers, wholesalers and manufacturers and owns diverse collections of genetics with over 300 land races of cannabis from over 25 countries.

They are however about to release results so be careful with your timing and see how the market reacts. The Company will release its Appendix 4C Quarterly Report on 11 July, and the full year results on 29 July.

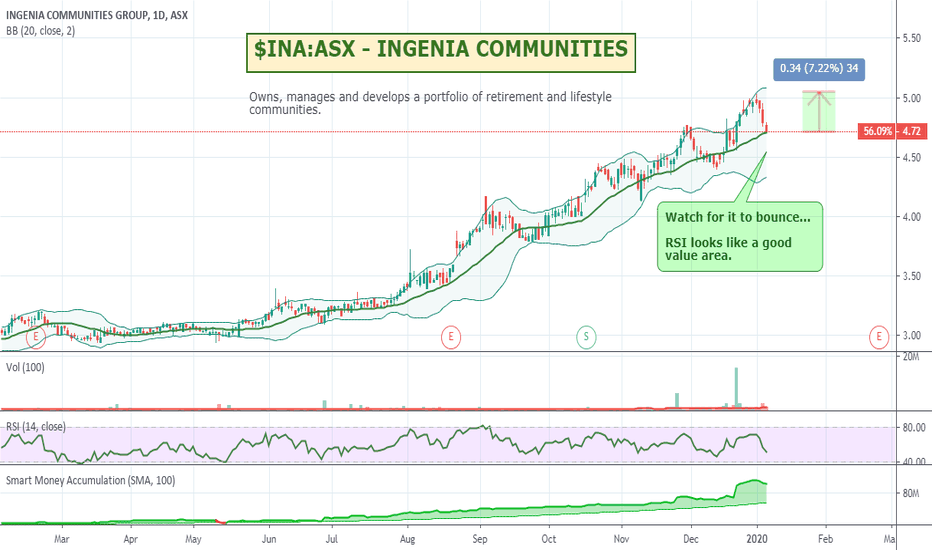

$INA:ASX - INGENIA COMMUNITIES - Will it bounce off support?INA looks like it is back at its 20 D MA (Bollinger mid line) an area where it has typically bounced off in the past. INA owns, manages and develops a portfolio of retirement and lifestyle communities which would seem to be a strong growth market over the next several decades as baby boomers start to increasingly downsize and move into lifestyle type villages with their friends. Wait for confirmation of the bounce, but could be worth a watch.

Ingenia Communities Group owns, manages and develops a portfolio of retirement and lifestyle communities. It operates through four segments: Gardens, Fuel, Food and Beverage Services, Lifestyle & Holidays, Corporate and Other and Lifestyle Development. The Gardens segment provides rental villages. The Settlers segment provides deferred management fee villages. The Lifestyle & Holidays segment comprises of long-term and tourism within lifestyle parks. The Lifestyle Development segment comprises development and sale of manufactured homes. The , Fuel, Food and Beverage Services segment consists of investment in service station operations and food & beverage activities attached to Ingenia Lifestyle and Holiday communities. The Corporate and Other segment comprises investment in development joint venture, deferred management fee village and corporate overheads. The company was founded on January 11, 2007 and is headquartered in Sydney, Australia.

$PPK:ASX - PPK GROUP - Up 800% over 12 months.PPK is involved in the manufacturing and leasing of mining equipment and is still up close to 800% over 12 months and that is after a significant pull back. Its price has been travelling sideways now for a little while and compressing quite nicely with buyers and sellers stalemated. I have an alert set a bit above the current price to watch for a breakout. Might be worth keeping an eye on.

PPK Group Ltd. engages in the manufacture of load haul dump machines for the underground coal mining industry. It operates through the Investing and Mining Equipment segments. The Investing segment includes the management of debt and equity investments. The Mining Equipment segment comprises of design, manufacture, service, support, and distribution of CoalTram; and other underground coal mining vehicles, alternators, electrical equipment, drilling and bolting equipment and mining consumables, and hire of underground coal mining equipment. The company was founded by Glenn Robert Molloy in 1979 and is headquartered in Brisbane, Australia.

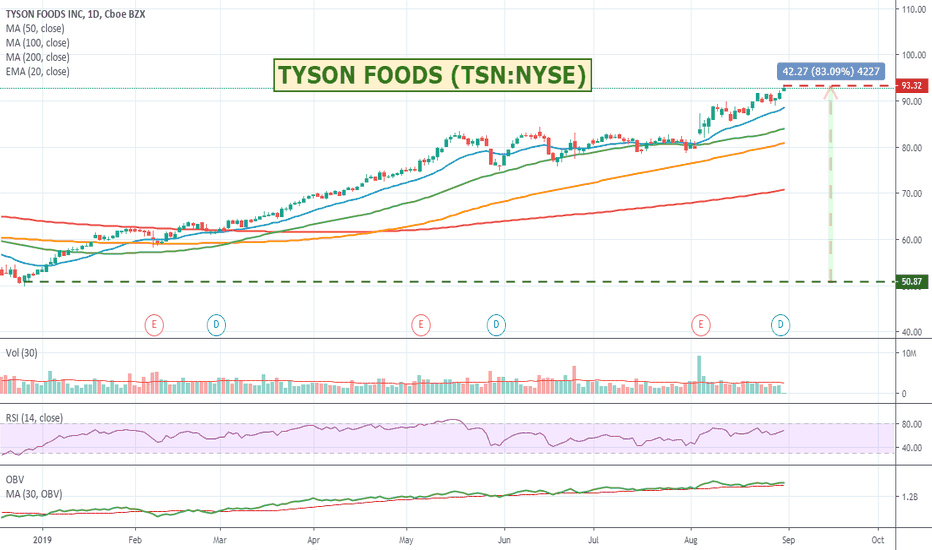

$TSN:NYSE - TYSON FOODS - Diversified food supplier up 75% YTDGood steady momentum. Might be worth a watch especially in uncertain times.

Tyson Foods, Inc. is a food company, which is engaged in offering chicken, beef and pork, as well as prepared foods. The Company offers food products under Tyson, Jimmy Dean, Hillshire Farm, Sara Lee, Ball Park, Wright, Aidells and State Fair brands. The Company operates through four segments: Chicken, Beef, Pork and Prepared Foods. It operates a vertically integrated chicken production process, which consists of breeding stock, contract growers, feed production, processing, further-processing, marketing and transportation of chicken and related allied products, including animal and pet food ingredients. Through its subsidiary, Cobb-Vantress, Inc. (Cobb), the Company is engaged in supplying poultry breeding stock across the world. It produces a range of fresh, frozen and refrigerated food products. Its products are marketed and sold by its sales staff to grocery retailers, grocery wholesalers, meat distributors, warehouse club stores and military commissaries, among others.

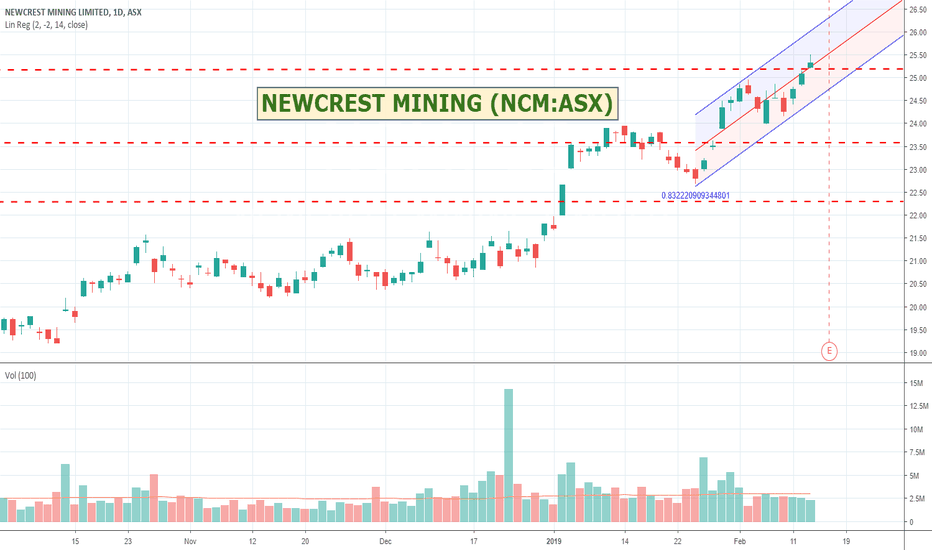

$NCM - NEWCREST MINING - Punching through resistanceNewcrest is performing well and has defeated 3 large resistance points. Needs to consolidate above this latest 3rd one for a while though to be sure.

Too close to earnings to buy in now and lack of volume isnt overly encouraging. One to watch for sure though.

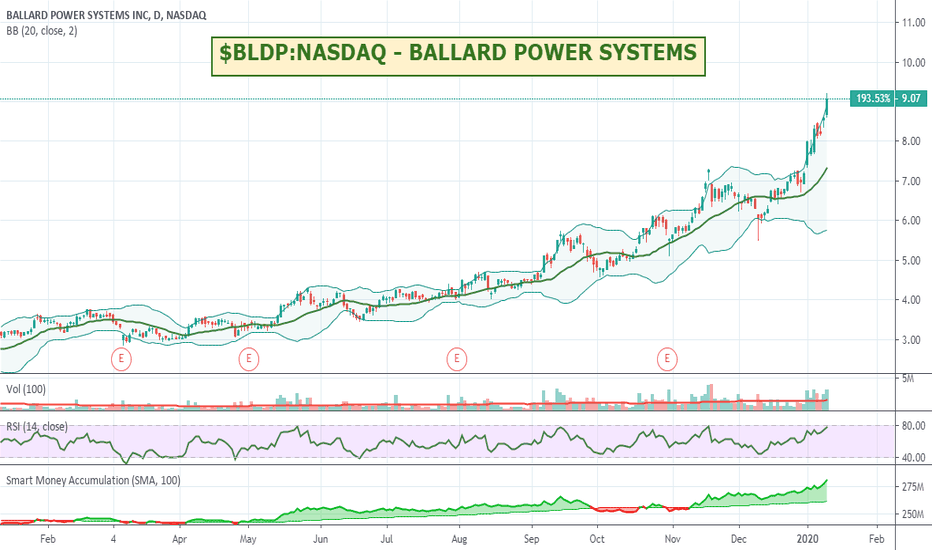

$BLDP:NASDAQ - BALLARD POWER SYSTEMS - Up almost 200%Ballard has been having a great run, but might be a bit overbought at this point. Good one to keep an eye on for a pullback. Could be worth a watch.

Ballard Power Systems, Inc. engages in the design, development, manufacture, sale, and service of fuel cell products for a variety of applications. It focuses on power product markets of heavy duty motive, portable power, material handling, and backup power, as well as the delivery of technology solutions. The company was founded on November 12, 2008 and is headquartered in Burnaby, Canada.

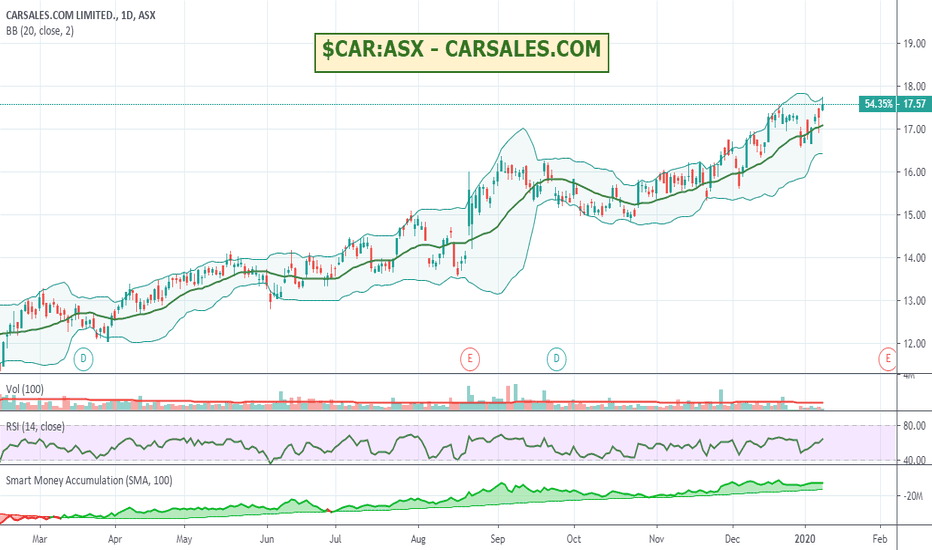

$CAR:ASX - CARSALES.COM - Running nicelyCarsales has been having a nice steady run, up 55% over the last 12 months. Could be worth a watch.

Carsales.com Ltd. engages in the operation of online automotive, motorcycle and marine classifieds business. It provides car buying and selling services in Australia. The company also provides provide online advertising solutions to media agencies and its clients, dealers, industry organizations and many other businesses. It operates through following segments: Online Advertising, Data, Research and Services, International, Finance and Related Services. The Online Advertising Services segment comprises of classified advertising, which allows customers to advertise automotive and non-automotive goods and services for sale across the carsales network; and display advertising, which displays the product or service offerings of the corporate advertiser. The Data and Research and Services segment offers software, analysis, research and reporting, valuation services, website development and hosting as well as photography services. The International segment operates in overseas countries through subsidiaries and equity accounted associate investments. The Finance and Related Services segment provides innovative vehicle finance arrangements, vehicle procurement and other related services to customers. The company was founded by Gregory Paul Roebuck on June 18, 1996 and is headquartered in Richmond, Australia.

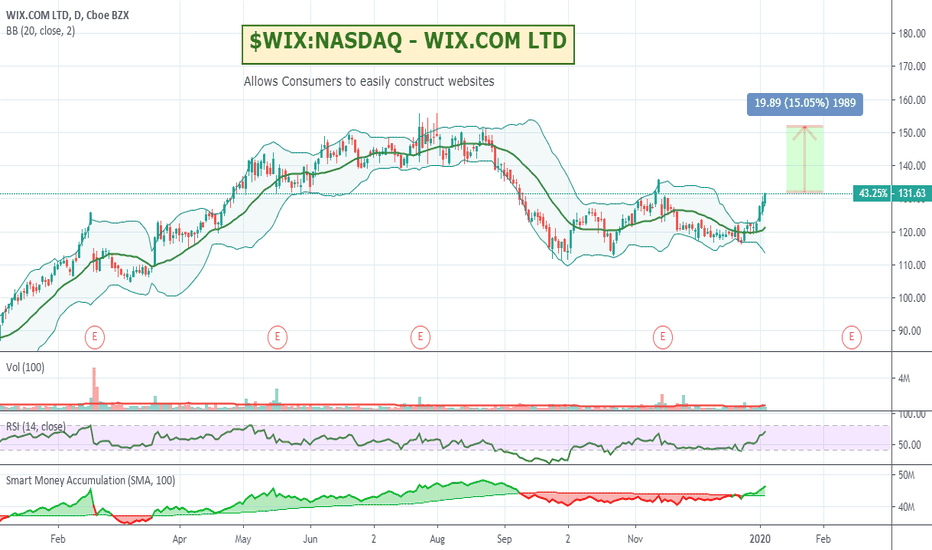

$WIX:NASDAQ - WIX.COM LTD - Up 550% over 5 years.Spotted Wix via a Facebook ad and thought I would come and have a look at how the shareprice was going and found it has been going well up some 550% over the last 5 years or so since it listed. It has had a bit of a pullback recently so could be at a reasonable value area. I feel like Wix is increasingly becoming the goto for those who feel the WordPress learning curve is too steep. Feels like Wix is becoming to web publishing what Shopify is to ecommerce. Might be worth a watch.

Wix.com Ltd. engages in the provision of web development, design, and management solutions and applications. It provides free design templates for personal and business use, web design and layout tools, web hosting through the Wix domain, applications from the App Market, blog and social network page support, other marketing and work flow management applications and services. The company also offers eCommerce and appointment applications, and marketing tools such as Google Analytics and mailing lists. Wix.com was founded by Avishai Abrahami, Nadav Abrahami and Giora Kaplan on October 5, 2006 and is headquartered in Tel Aviv, Israel.

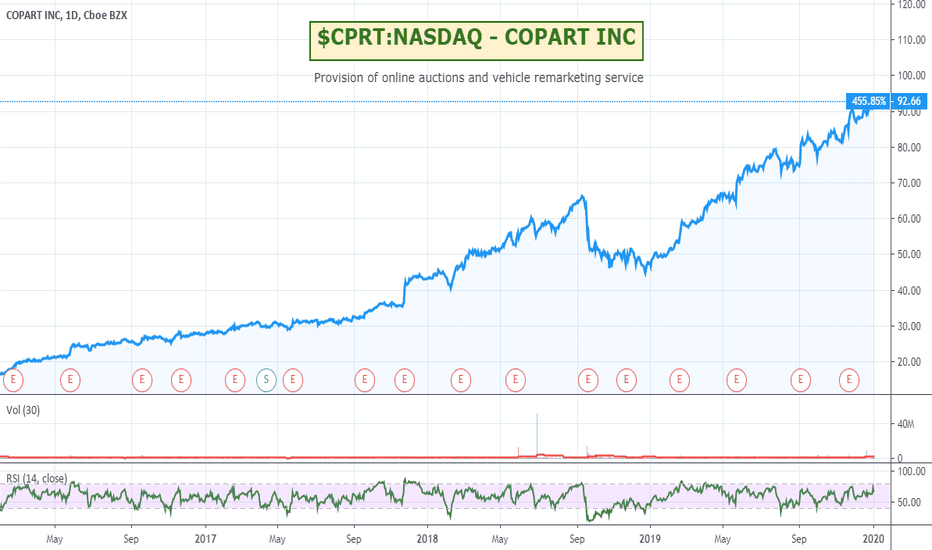

$CPRT:NASDAQ - COPART INC - 450% gain over last 4 yearsCopart is one of the most consistent gainers around with a nice steady year on year increase. Certainly worth a watch.

Copart, Inc. engages in the provision of online auctions and vehicle remarketing services. It provides vehicle sellers with a full range of services to process and sell vehicles primarily over the internet through Virtual Bidding Third Generation Internet auction-style sales technology. The company sells the vehicles principally to licensed vehicle dismantlers, rebuilders, repair licensees, used vehicle dealers, and exporters and at certain locations, as well as to general public. Its services include online seller access, salvage estimation services, estimating services, end-of-life vehicle processing, virtual insured exchange, transportation services, vehicle inspection stations, on-demand reporting, DMV processing, and vehicle processing programs. It operates through the United States and International segments. The company was founded by Willis J. Johnson in 1982 and is headquartered in Dallas, TX.

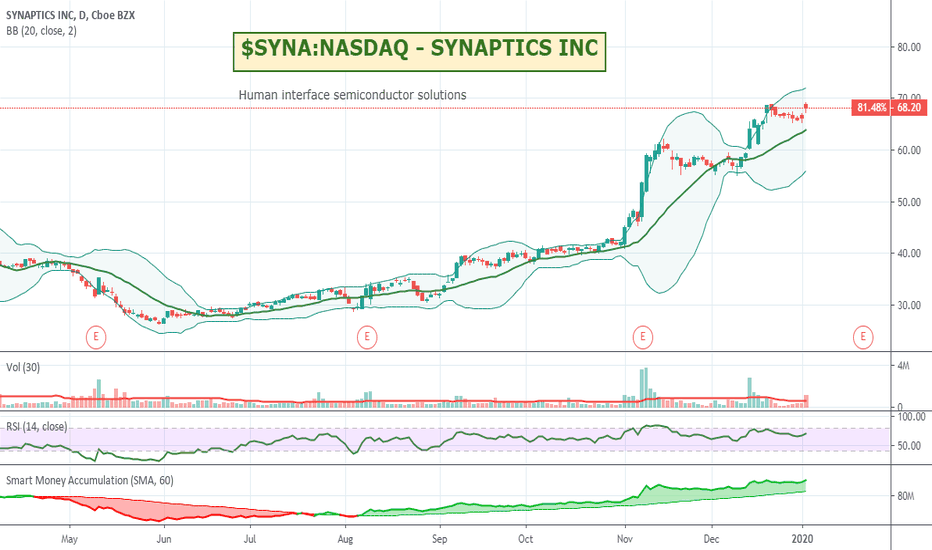

$SYNA:NASDAQ - SYNAPTICS INC - Human Interface SemiconductorsFound this one while digging through semiconductor stocks and liked the look of the chart and the business. More and more devices around us will rely on some kind of touch or facial or voice recognition. It has appeared on several analysts list for stocks to watch for 2020 and there are rumours they might be involved with technology in the next generation of Apple iphones and other devices. Could be worth a watch.

Synaptics, Inc. engages in the development, marketing, and sale of human interface semiconductor solutions for electronic devices and products. It specializes in custom-designed human interface that enable people to interact with mobile computing, communications, entertainment, and other electronic devices. It operates through the following geographical segments: China, Japan, United States, South Korea, Taiwan, and Other. The company was founded by Federico Faggin and Carver A. Mead in March 1986 and is headquartered in San Jose, CA.

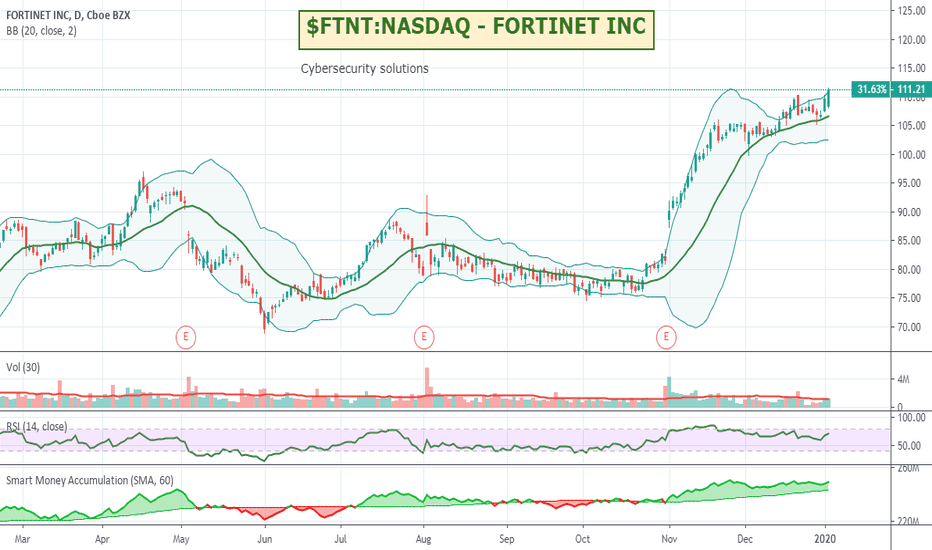

$FTNT:NASDAQ - FORTINET INC - Cybersecurity will be hot in 2020I've been looking for some Cybersecurity stocks for my portfolios and think that Fortinet might be worth a look. The wars of the future will increasingly be economic and with things like AI and Quantum Computing its going to be really interesting to see how defensive technologies evolve to try and combat them. Fortinet seems to have had some good price momentum lately up 66% over the last 12 months so will look for a possible entry - especially with the increased awareness the US / Iran dispute is bringing to the digital warfare space.

Fortinet, Inc. provides cybersecurity solutions to variety of business, such as enterprises, communication service providers and small businesses. It operates through the following segments Network Security, Fortinet Security Fabric, Cloud Security and Internet of Things and Operational Technology. The Network Security segment include majority of product sales from it FortiGate network security appliances. The Fortniet Security Fabric segment provide platform which is an architectural approach that protects the entire digital attack surface, including network core, endpoints, applications, data centers and private and public cloud. Together with it network of Fabric-Ready Partners, the Fortinet Security Fabric platform enables disparate security devices to work together as an integrated, automated and collaborative solution. The Cloud Security segment provides help to the customers connect securely to and across their cloud environments by offering security through it virtual firewall and other software products in public and private cloud environments. The Internet of Things and Operational Technology segment include the proliferation of Internet of Things ("IoT") and an Operational Technology ("OT") device has generated new opportunities for it to grow it business. IoT and OT have created an environment where data move freely between devices across locations, network environments, remote offices, mobile workers and public cloud environments, making the data difficult to consistently track and secure. The company was founded by Ken Xie and Michael Xie in October 2000 and is headquartered in Sunnyvale, CA.

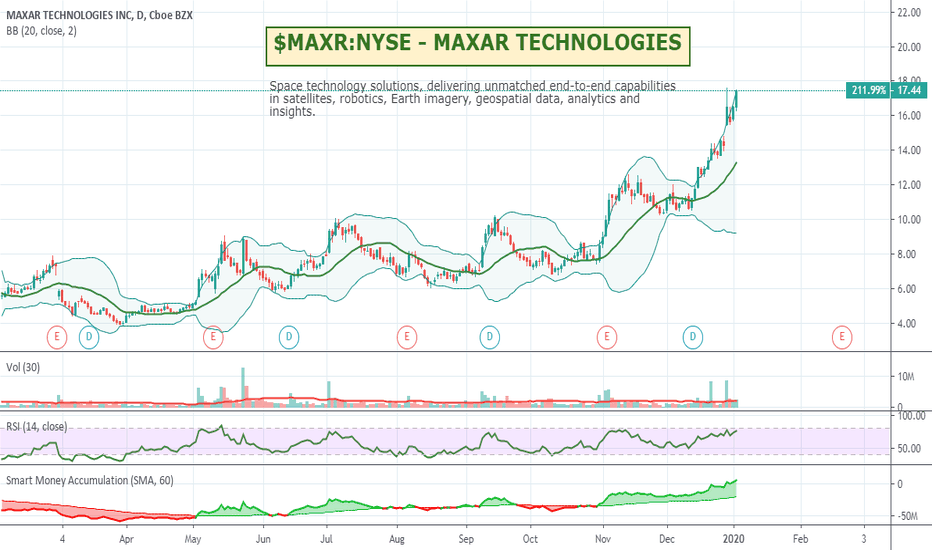

$MAXR:NYSE - MAXAR TECHNOLOGIES - Up 135% over 3 monthsMAXAR is one of the military defence stocks on my watch list for tonight. They have had a very good run over the last year and the last 3 months especially. What caught my interest was I saw an article titled "Maxar announces defense, intelligence contracts worth $95 million for imagery and analytics" where it looks like they are starting to focus more of their technology in military operations applying things like AI and Machine Learning to their mapping data. In the world of drone strikes and Trumps Space Force high quality imagery will be king. Could be worth a watch.

Maxar Technologies, Inc. provides space technology solutions, delivering unmatched end-to-end capabilities in satellites, robotics, Earth imagery, geospatial data, analytics and insights. Its segments include Space Systems, Imagery and Services. The company was founded on February 3, 1969 and is headquartered in Westminster, Co.

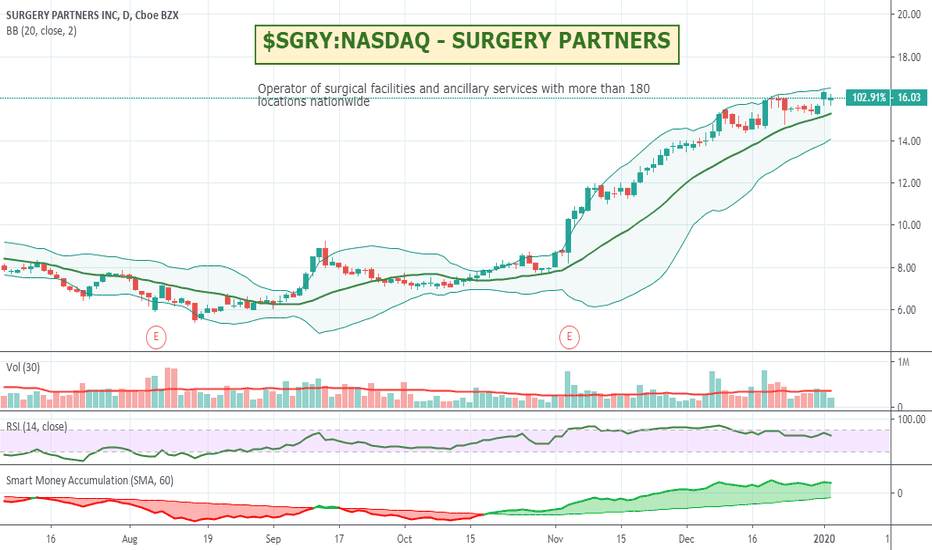

$SGRY:NASDAQ - SURGERY PARTNERS - Has some potentialSurgery Partners is an interesting looking business that has enjoyed a steady run up 120% over the last 3 months and well down on older historical highs. They describe themselves as operators of surgical facilities and ancillary services with more than 180 locations nationwide. They seem to provide a more integrated end-to-end approach offering greater flexibility depending on location and need. I liked what I read about them. Could be worth a watch.

Surgery Partners, Inc. is healthcare services holding company, which engages in the provision of solutions for surgical and related ancillary care in support of its patients and physicians. It operates through the following business segments: Surgical Facility Services, Ancillary Services, and Optical Services. The Surgical Facility Services segment consists of the operation of ambulatory surgery centers and surgical hospitals, including anesthesia services of the company. The Ancillary Services segment operates a diagnostic laboratory and multi-specialty physician practices. The Optical Services segment involves an optical laboratory and an optical products group purchasing organization. The company was founded in 2004 and is headquartered in Brentwood, TN.

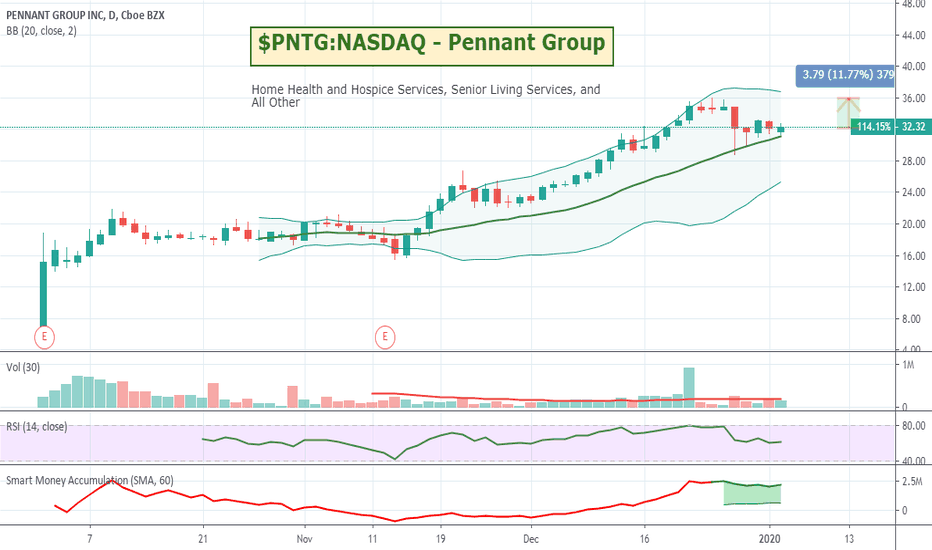

$PNTG:NASDAQ - Pennant Group - New Aged Care listingPennant Group could be interesting. Up 115% since its listing at the start of October it looks like a new company but operating in the home health and senior living space which I think will accelerate over this coming decade. It has had a bit of a pullback so would like to see it move back up to confirm direction. Could be worth a watch.

The Pennant Group, Inc. engages in the provision of healthcare services. It operates through the following segments: Home Health and Hospice Services, Senior Living Services, and All Other. The Home Health and Hospice Services segment provides combination of clinical care services such as nursing, speech, occupational and physical therapy, medical social work, and home health aide services. The Senior Living Services segment deals with assisted and independent living and memory care businesses. The All Other segment includes mobile diagnostic and laboratory services. The company was founded on January 24, 2019 and is headquartered in Eagle, ID.

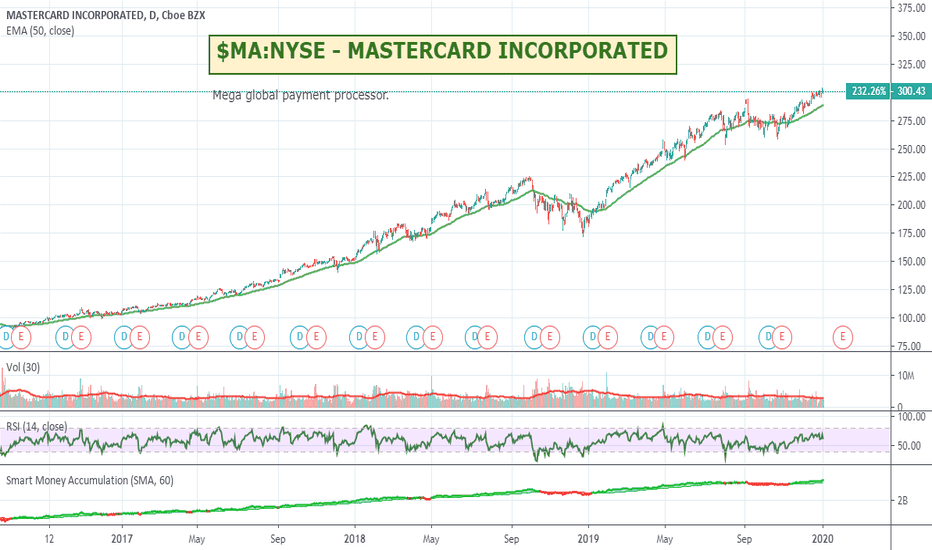

$MA:NYSE - MASTERCARD INCORPORATED - up 60% over 12 monthsMastercard continues its upwards climb now up 60% over the last 12 months. As a mega global payment processor it is certainly well worth a watch.

Mastercard, Inc. operates as a technology company, which engages in the payments industry that connects consumers, financial institutions, merchants, governments, and business. It operates through United States and Other countries geographical segments. It offers payment solutions that enables the development and implementation of credit, debit, prepaid, commercial, and payment programs and solutions. The company was founded in 1966 and is headquartered in Purchase, NY.

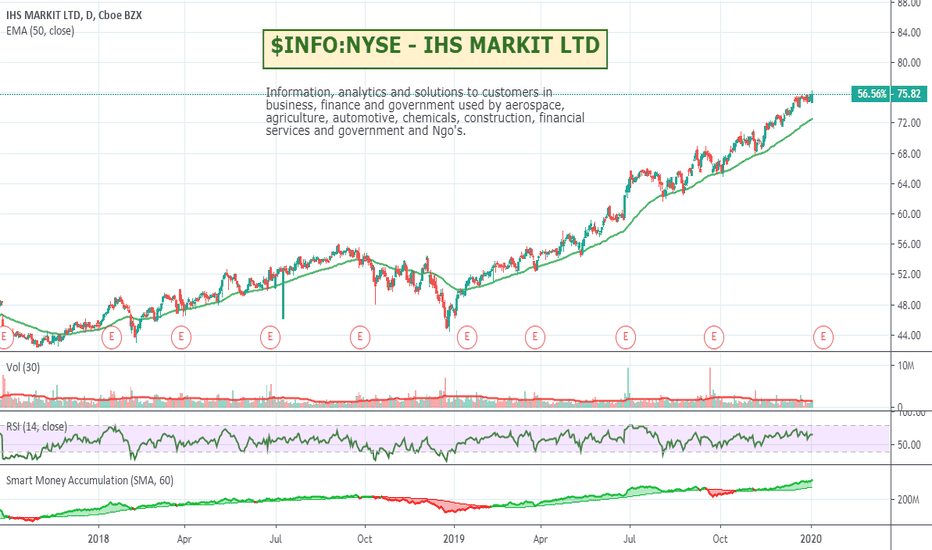

$INFO:NYSE - IHS MARKIT LTD - Smooth runner.Great looking chart without any significant wobbles and up 55% over the last 12 months. Could be worth a watch.

IHS Markit Ltd. delivers information, analytics and solutions to customers in business, finance and government. Its products are used by aerospace, agriculture, automotive, chemicals, construction, financial services and government and Ngo's. It operates through the following business segments: Resources, Transportation, Consolidated Markets & Solutions and Financial Services. The Resources segment includes energy and chemicals product offerings. The Transportation segment includes automotive; maritime & trade; and aerospace, defense & security product offerings. The Consolidated Markets & Solutions segment includes product design; technology, media & telecom; and economics & country risk product offerings. The Financial Services segment includes financial information, processing and solutions product offerings. The company was founded in 1959 and is headquartered in London, the United Kingdom.

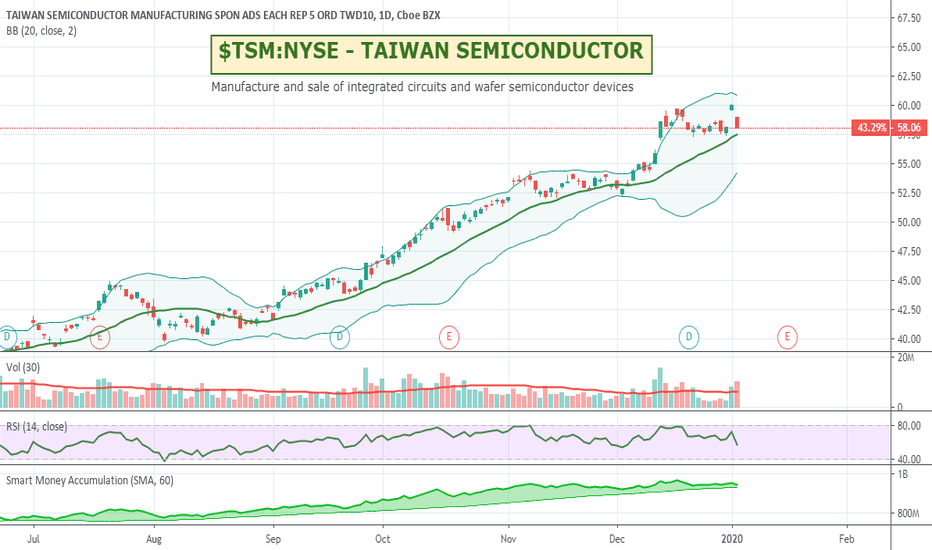

$TSM:NYSE - TAIWAN SEMICONDUCTOR - Will it bounce?Has been having a great run up around 60% over the last 12 months.$300 BILLION market cap and a $20 BILLION EBITDA it is a mega whale and hopefully over the next year the trade tensions between the US and China will continue to ease giving it more upside. It has been having a great run, but a bit of a recent pullback means it needs watching to make sure it rallies and continues its upward move. Could be worth a watch.

Taiwan Semiconductor Manufacturing Co., Ltd. engages in the manufacture and sale of integrated circuits and wafer semiconductor devices. Its chips are used in personal computers and peripheral products; information applications; wired and wireless communications systems products; automotive and industrial equipment including consumer electronics such as digital video compact disc player, digital television, game consoles, and digital cameras. The company was founded by Chung Mou Chang on February 21, 1987 and is headquartered in Hsinchu, Taiwan.

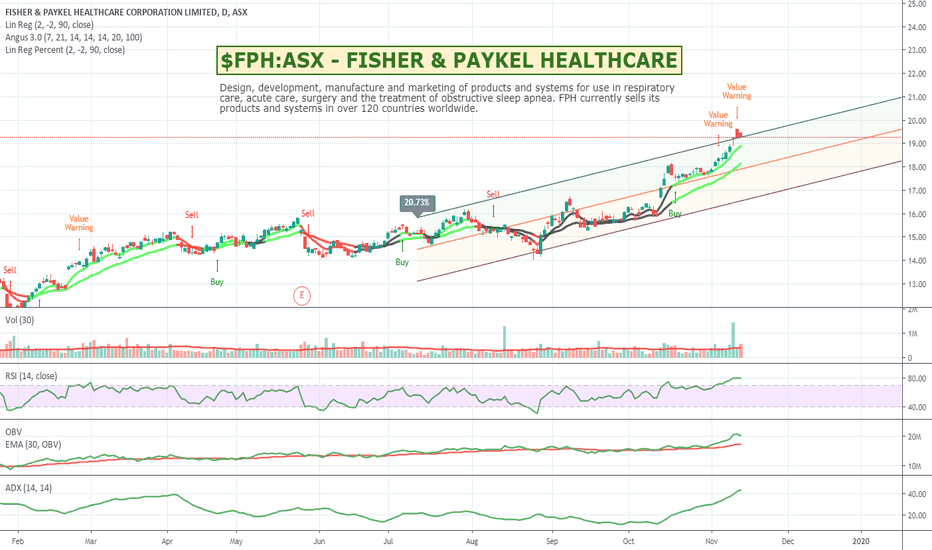

$FPH:ASX - FISHER & PAYKEL HEALTHCARE - Entry on pullback?Fisher and Paykel have been having a great run so far this year up around 60% since the start of the year and not much sign of slowing down. The RSI is WAY overextended so I'm hoping that there might be a bit of a pullback / consolidation period allowing us to buy at better value before it continues so I have set an alert for when the RSI gets back to under 70 and see what happens then. Could be worth a watch.

Fisher & Paykel Healthcare Corporation Limited designs, manufactures and markets medical device products and systems for use in respiratory care, acute care and the treatment of obstructive sleep apnea. The Company's segments include New Zealand, which includes all activities controlled by entities or employees based in New Zealand; North America, which includes all activities controlled by entities or employees based in the United States and Canada; Europe, which includes all activities controlled by entities or employees based in the United Kingdom, France, Germany, Sweden, Turkey and Russia, and Asia-Pacific, which includes all activities controlled by entities or employees based in Australia, Japan, India, China, South Korea, Taiwan and Hong Kong. Its products include respiratory humidifiers, single-use and reusable chambers and breathing circuits, infant resuscitators, infant warmers and accessories. In addition, the Company offers hardware and consumables.

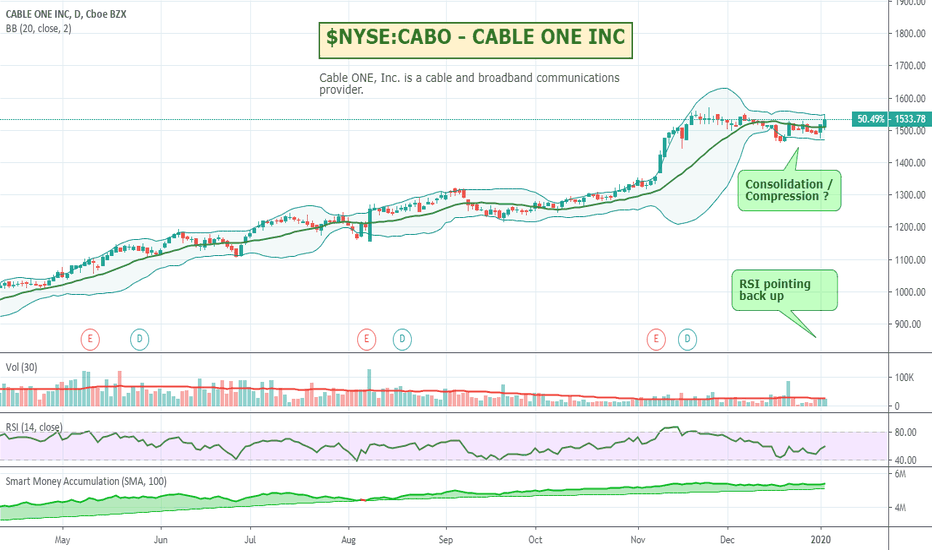

$NYSE:CABO - CABLE ONE INC - About to run again?CABLE ONE has had a good run over the last 12 months, up some 80% and well and truly out performing the market. It has been consolidating since mid November and with the RSI starting to show some upward movement might be giving some indication it might be ready to move up again. Might be worth a watch if it heads up.

Cable ONE, Inc. is a cable and broadband communications provider. It provides consumers with an array of communications and entertainment services, including Internet and wireless fiber solutions, cable television and phone service. The company was founded in 1977 and is headquartered in Phoenix, AZ.

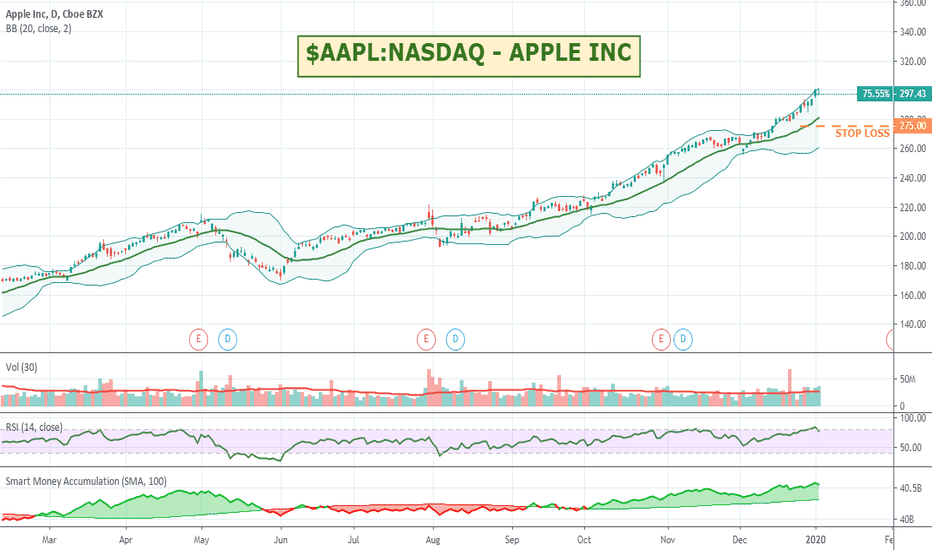

$AAPL:NASDAQ - APPLE INC - Mega Whale Continuing to Trend.Apple has been having a stellar run over the last 12 months. I think that once they move to 5G within their phones it will be a BIG incentive for everyone hanging onto older devices to upgrade. Up 100% over the last 12 months. Well worth a watch.

Apple Inc. designs, manufactures and markets mobile communication and media devices, personal computers and portable digital music players. The Company sells a range of related software, services, accessories, networking solutions, and third-party digital content and applications. The Company's segments include the Americas, Europe, Greater China, Japan and Rest of Asia Pacific. The Americas segment includes both North and South America. The Europe segment includes European countries, India, the Middle East and Africa. The Greater China segment includes China, Hong Kong and Taiwan. The Rest of Asia Pacific segment includes Australia and the Asian countries not included in the Company's other operating segments. Its products and services include iPhone, iPad, Mac, iPod, Apple Watch, Apple TV, a portfolio of consumer and professional software applications, iPhone OS (iOS), OS X and watchOS operating systems, iCloud, Apple Pay and a range of accessory, service and support offerings.

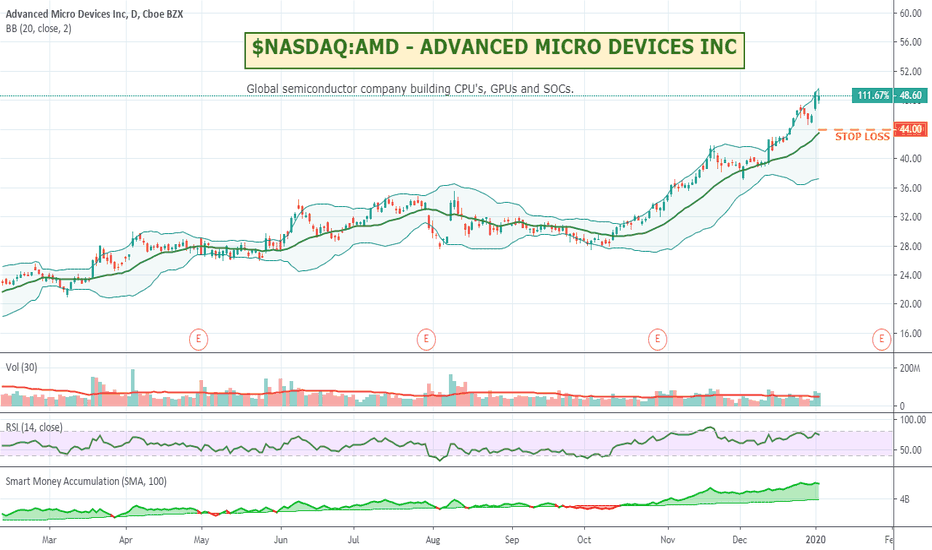

$NASDAQ:AMD - ADVANCED MICRO DEVICES - Up 150% over 12 month.Trending nicely, AMD will hopefully have an even better year this year once some of the trade disputes settle down. Up 150% over the last 12 months, might be a good one to watch.

Advanced Micro Devices, Inc. is a global semiconductor company. The Company is engaged in offering x86 microprocessors, as standalone devices or as incorporated into an accelerated processing unit (APU), chipsets, discrete graphics processing units (GPUs) and professional graphics, and server and embedded processors and semi-custom System-on-Chip (SoC) products and technology for game consoles. The Company's segments include the Computing and Graphics segment, and the Enterprise, Embedded and Semi-Custom segment. The Computing and Graphics segment primarily includes desktop and notebook processors and chipsets, discrete GPUs and professional graphics. The Enterprise, Embedded and Semi-Custom segment primarily includes server and embedded processors, semi-custom SoC products, development services, technology for game consoles and licensing portions of its intellectual property portfolio.

$NYSE:DORIAN LPG LIMITEDDorian LPG has been one of my better performers over the last year. The stock is now up 150% over the last 12 months and no real sign of slowing down at this stage. It has held up well under some of the political turmoil in the markets / threats of trade wars etc. RSI hasn't blown out so still looks like it is at a reasonable price value. Might be worth a watch.

Dorian LPG Ltd. is a holding company which engages in the transportation of liquefied petroleum gas. It focus on managing gas carriers and developing customer services. It also offers in-house commercial and technical management services to vessels in their fleet and vessels deployed in the Helios Pool. The company was founded on July 1, 2013 and is headquartered in Stamford, CT.