Search in ideas for "zAngus"

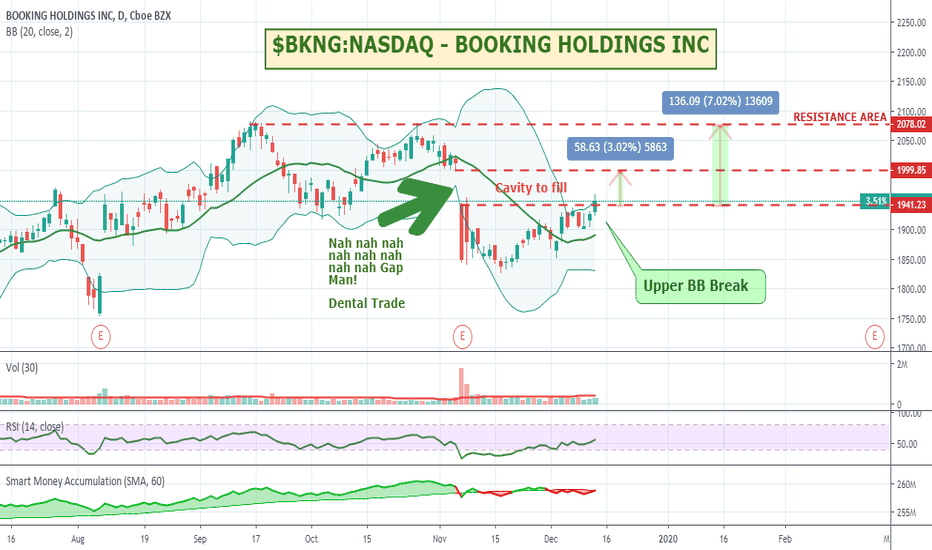

$BKNG:NASDAQ - BOOKING HOLDINGS - Dental Trade!Have a few trading friends who are Dentists and this is a good looking gap fill if I have ever seen one. Which of course means it will probably all go terribly wrong and head downwards. Momentum looks good, the market post Trump signing with China (until he didnt) all looks like good signs for a reasonable return. Well worth a watch - but keep an eye out (ie stops at the ready) when it gets closer to that secondary resistance area.

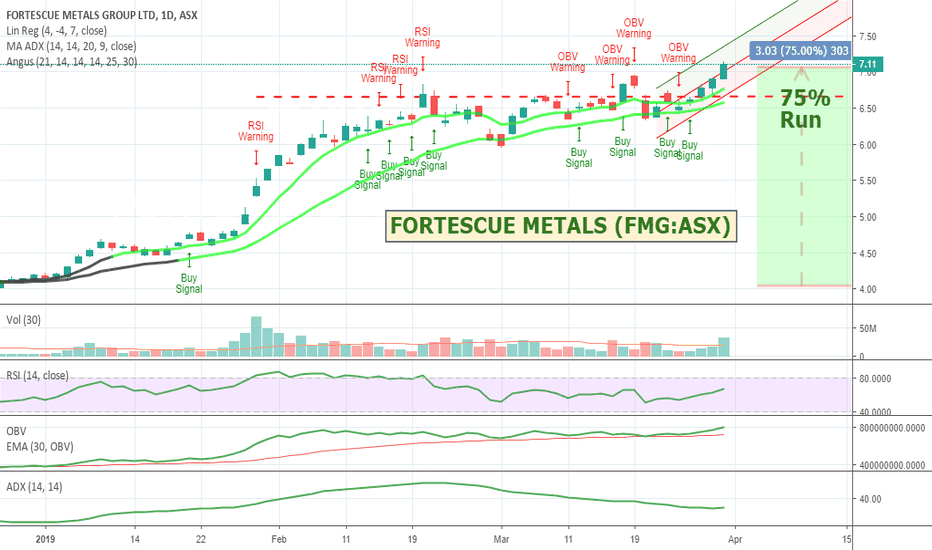

$FMG - FORTESCUE METALS - New all time high on breakoutFORTESCUE METALS - New all time high on breakout

Fortescue has been a strong performer this year with Australia’s iron ore export earnings also forecast to soar to the second highest level on record this financial year bolstered by supply disruptions in Brazil after the tailings dam collapse. Fortescue rallied up hard before momentum fell away at the end of February and most of March. Some interesting volume has come through and indicators have started to turn up again so might be a good time to enter or top up if it opens up on Monday. Added bonus is it has also pushed through the $7.00 psychological barrier so will hopefully start to build a base there and continue its run.

About Fortescue Metals Group

Fortescue Metals Group Limited is engaged in the exploration, development, production, processing and sale of iron ore. It owns and operates an integrated supply chain, including its approximately five berth Herb Elliott Port in Port Hedland and the heavy haul railway with approximately 42 ton axle load capacity over 620 kilometers of track. Its operations span over four mine sites in the Pilbara. The Chichester Hub, which includes the Cloudbreak and Christmas Creek mines, is located in the Chichester Ranges, and produces over 90 million tons per annum (mtpa) from three ore processing facilities. The Solomon Hub is located in the Hamersley Ranges, and includes the Firetail and Kings Valley mines, which produce in excess of 70 mtpa. The Company owns and operates its purpose designed rail and port facilities, constructed to deliver iron ore from its mines to Port Hedland and onto its customers. Its Iron Bridge Magnetite project is located over 100 kilometers south of Port Hedland.

My Indicator Entry Rules (needs to meet all):

Price > EMA(9) (Trending up short term)

EMA(9) > EMA(21) (Trending up short to medium term)

Volume > Volume(30) (Others have become more interested in the stock)

RSI(14) > 50 but < 80 (Has momentum but not overbought yet)

OBV > EMA (30, OBV) (Volume is accelerating)

ADX(14) > 25 (Strong momentum in the trend direction)

My Just Before I Buy Rules:

Check all or most indicators are pointing up to confirm their direction

Wait for price to move up > 2% (Headed in the right direction today)

I'll check market depth to ensure lots of buyers and sellers at close price points to ensure demand and liquidity (ie I can get out quickly if I need to)

I'll check for any company announcements to see whats driving the volume

My Indicator Warnings:

RSI(14) < 40 (Interest falling)

RSI(14) > 80 (Very overbought territory - may reverse)

OBV < EMA (30, OBV) (Volume falling away, people losing interest at this price)

My Sell Rules:

Trailing Stop at 1.5 to 2 x ATR (Depends how aggressive I want to be - means trend has ended for now)

OR if

EMA(9) < EMA (21) (Trend has failed for now)

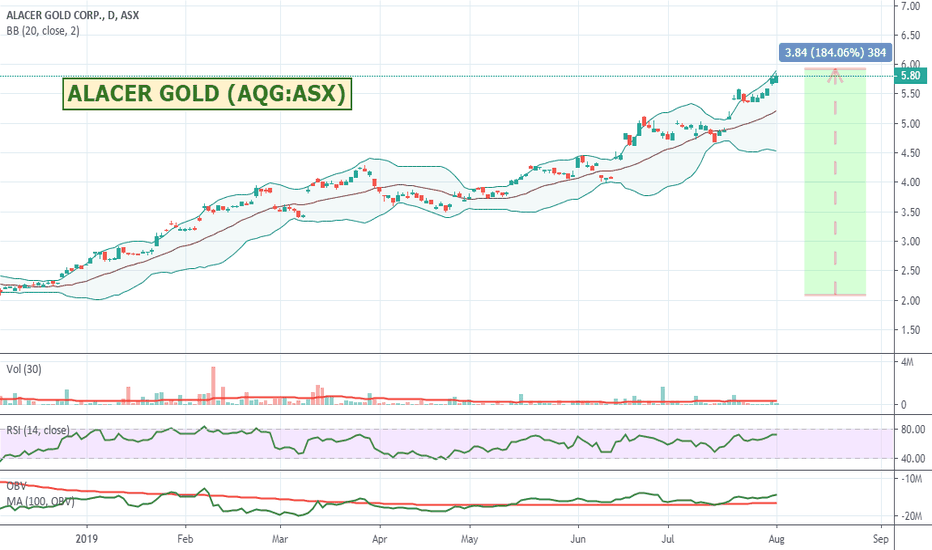

$AQG:ASX - ALACER GOLD - Good momentumI've been looking for more exposure to Gold with some of the economic uncertainty about and Alacer has been having a good run since the start of the year. It's a billion dollar company with a good EBITDA and turning a profit so hoping it will continue its run. Indicators look good for now. Might be worth a watch.

Alacer Gold Corp (AQG) is low-cost gold producer, with an 80% interest in the Copler Gold Mine in Turkey operated by Anagold Madencilik Sanayi ve Ticaret A.S, and the remaining 20% owned by Lidya Madencilik Sanayi ve Ticaret A.S.

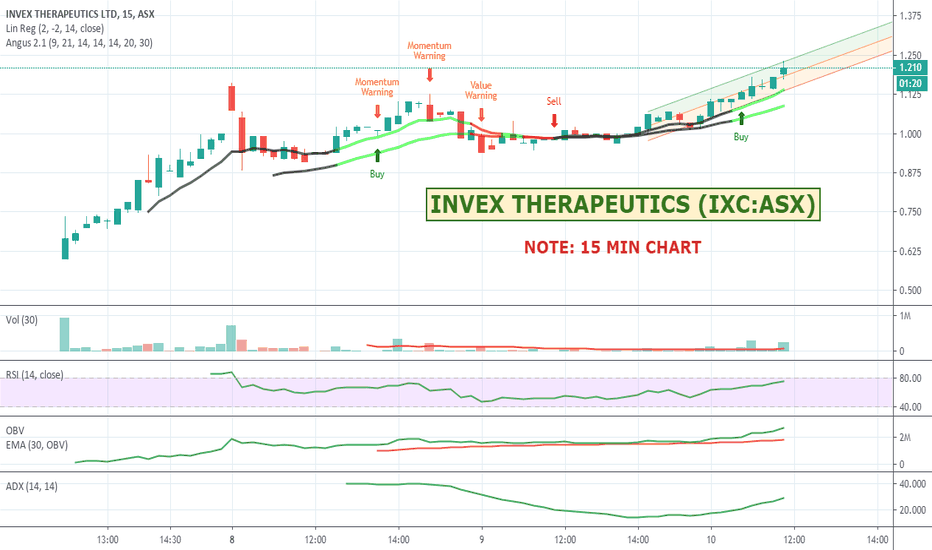

$IXC - INVEX THERAPEUTICS - New ASX listingInvex Therapeutics aims to re-purpose a diabetic drug for brain disorders such as idiopathic intracranial hypertension, traumatic brain injury and acute stroke.

It only just listed but seems to be headed the right way price wise. It is already up another 16% today with 99 buyers for 659,825 units vs 30 sellers for 233,020 units. Pity I didn't see it sooner.

Looks good on the 15 min chart. Might be worth a watch.

Invex Therapeutics Ltd (IXC) is a biopharmaceutical company, focused on the research and development of Exenatide as an efficacious treatment for neurological conditions derived from or involving raised intracranial pressure, such as Idiopathic Intracranial Hypertension (IIH), acute stroke, hydrocephalus, venous sinus thrombosis, brain tumours, meningitis, secondary pseudo tumour cerebri and traumatic brain injury.

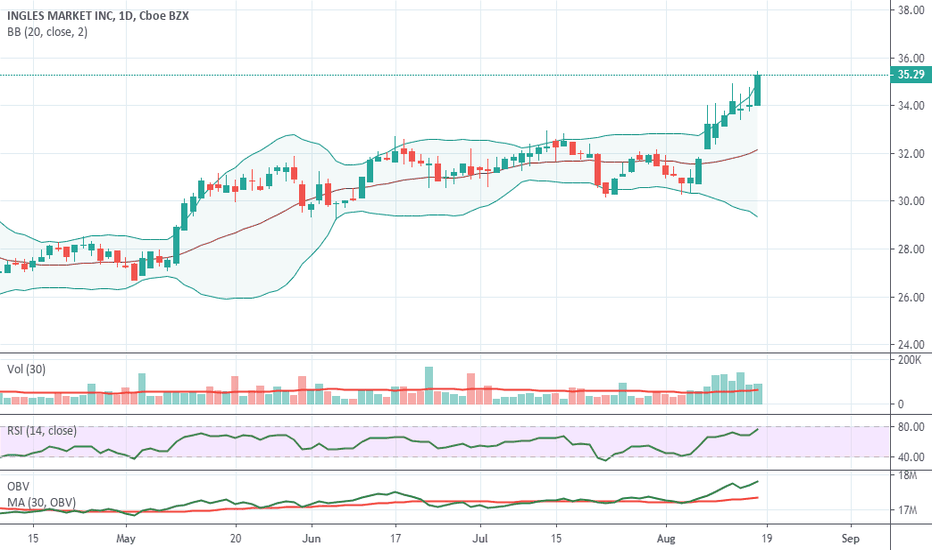

$IMKTA:NYSE - INGLES MARKET - Walmart alternative running wellIngles is a good mid-sized supermarket in the consumer-noncyclicals space that has been having a good run. Doing a bit of an upper bollinger band walk at the moment with god supporting volume. Could be worth a watch.

Ingles Markets, Incorporated (Ingles) is a supermarket chain in the southeast United States. The Company's segments include retail grocery and other. Its other segment consists of fluid dairy operations and shopping center rentals. As of September 24, 2016, the Company operated 201 supermarkets in Georgia, North Carolina, South Carolina, Tennessee, Virginia and Alabama. The Company locates its supermarkets primarily in suburban areas, small towns and rural communities. Ingles supermarkets offer customers a range of food products, including grocery, meat and dairy products, produce, frozen foods and other perishables and non-food products. Its non-food products include fuel centers, pharmacies, health and beauty care products and general merchandise. The Company focuses on selling products to its customers through the development of organic products, bakery departments and prepared foods, including delicatessen sections.

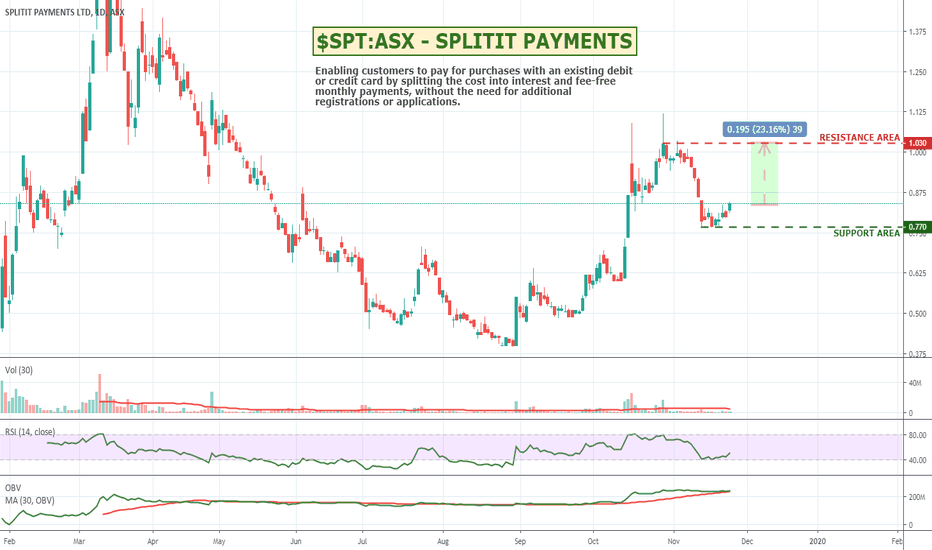

$SPT:ASX - SPLITIT PAYMENTS - Good upside on APT newsWith some of the pressure possibly coming off ATP, SPT and other payment processors might get a bit of an association bump. SPT is up 5% today and looks like it has quite a bit of upside if it can rally. Could be worth a watch especially with the gifting season right upon us.

Splitit Ltd is an Israel-based company that offers payment solutions. It offers Splitit, a payment method solution enabling customers to pay for purchases with an existing debit or credit card by splitting the cost into interest-free monthly payments, without the need for additional registrations or applications. Splitit enables online retailers to offer their customers a way to pay for purchases in installments with instant approval, decreasing cart abandonment rates. The Company serves approximately 800 merchants in more than 20 countries.

$AMC:ASX - AMCOR PLC - Half way through 20% swingAMCOR bounced off its old support area quite well and is now coming up to its first resistance test area. Indicators look good for now and demand is there for a push through with 547 buyers for 453,396 units vs 295 sellers for 200,714 units. Might be worth a watch.

Amcor Limited is a packaging company. The Company's segments include Amcor Rigid Plastics, Amcor Flexibles and Other/Investments. The Company offers a range of packaging related products and services, including packaging for beverages, food, healthcare, and personal and homecare, tobacco and industrial applications. Its products include packaging for fresh foods, such as meat, fish, bread, produce and dairy, and processed foods, such as confectionery, snack foods, coffee and ready meals, as well as resin and aluminum based medical applications, hospital supplies, pharmaceuticals, personal and home care products, and specialty packaging.

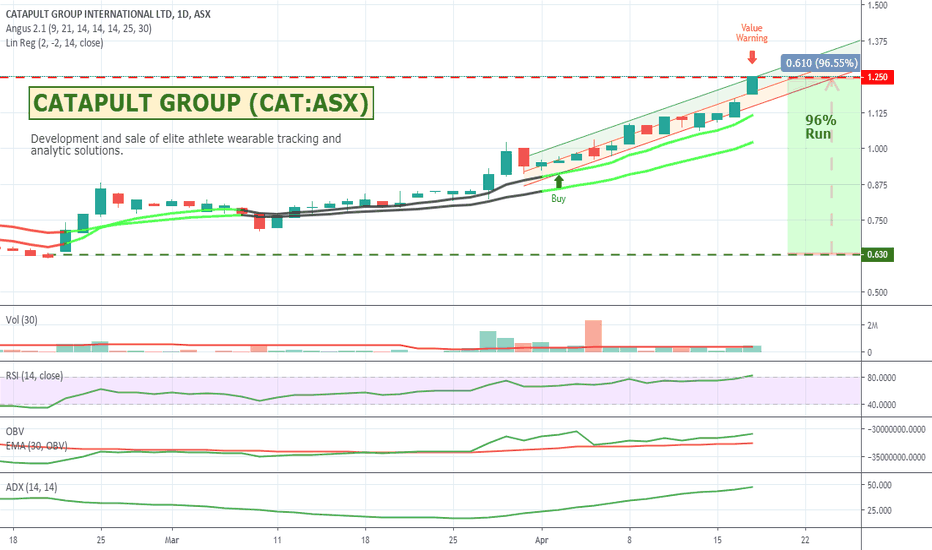

$CAT - CATAPULT GROUP - Up 100% in the last 2 months$CAT - CATAPULT GROUP - Up almost 100% in the last 2 months

CAT has been having a pretty good run. Up almost 100% over the last 2 months and looking to challenge and old resistance point. It's still a long way down from its old $4 highs so potentially some room to move if it keeps running. The precedent is there.

About Catapult

Catapult Group International Limited is an Australia-based company, which offers wearable elite athlete tracking technology and corresponding sporting analytics. The Company is engaged in the ongoing development and sale of elite athlete wearable tracking solutions, and the ongoing development and sale of analytics for athlete tracking. It has a diverse customer base across sports regions and leagues. It offers ClearSky, a local positioning system that combines pinpoint player movement traces with micro-movement analysis to enable an end-to-end solution for measuring performance and tactical output. Its OptimEye S5 is an athlete monitoring device in elite sport. The OptimEye has both a Global Positioning System (GPS) and Global Navigation Satellite System (GLONASS) antenna, allowing the device to access twice the satellites to increase accuracy and decrease drop outs. Its Inertial Movement Analysis (IMA) is a scientific algorithm that removes the inherent errors of inertial sensors.

$ALQ:ASX - ALS LIMITED - CompressingALS is at a very strong resistance type area but showing quite a bit of compression. Could break and run either way but Im guessing towards the upside. Too early to tell and with results out on the 20th November will just add to my watch list and wait and see. Could be worth a watch.

ALS Limited is a testing services provider. The principal activities of the Company are the provision of professional technical services in the areas of testing, measurement, inspection and monitoring; food and pharmaceutical quality assurance; mining and mineral exploration; commodity certification; equipment maintenance, and asset care operations. The Company's segments include: ALS Life Sciences, which provides testing data to assist consulting and engineering firms, industry and governments; ALS Industrial, which provides the energy, resources and infrastructure sectors with asset care and tribology testing services; Commodities, which provides assaying and metallurgical services for mining and mineral exploration companies and provides specialist services to the coal industry such as coal sampling, analysis and certification and formation evaluation services.

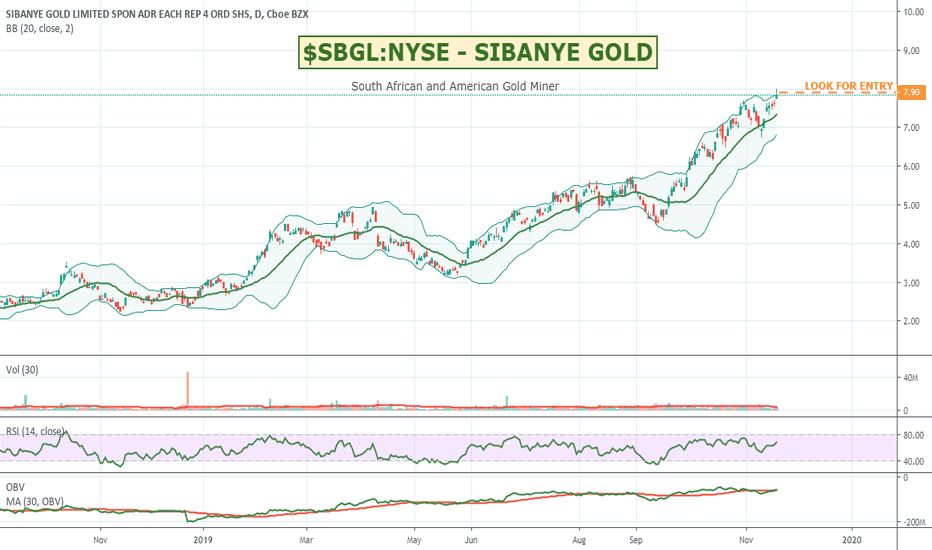

$SBGL:NYSE - SIBANYE GOLD - Up 175% year to dateSibayne has been having a stellar run - up 175% YTD and up 50% over the last 3 months. I'd probably wait until it gets in the $7.90's to confirm direction. If you are a gold stock lover this could be worth a watch.

Sibanye Gold Limited is an independent, global precious metal mining company. The Company is engaged in producing a mix of metals that includes gold and the platinum group metals (PGMs). Its projects are grouped by two regions: the Southern Africa region and the Americas region. Its products include gold, platinum group metals and by-products. The Company’s gold project in the Southern Africa region includes Beatrix, Cooke, Driefontein, and Kloof. Its PGM projects include Kroondal, Rustenburg operations, Mimosa, and Platinum Mile. Its other projects in the Southern Africa region include Burnstone, Kloof Decline, Driefontein decline, The West Rand Tailings Retreatment Project (WRTRP) and The Southern Free State (SOFS) project. The Company’s PGM project in the Americas region includes East Boulder, Stillwater, and Columbus Metallurgical Complex. Its other projects in the Americas region include Blitz, Altar and Marathon.

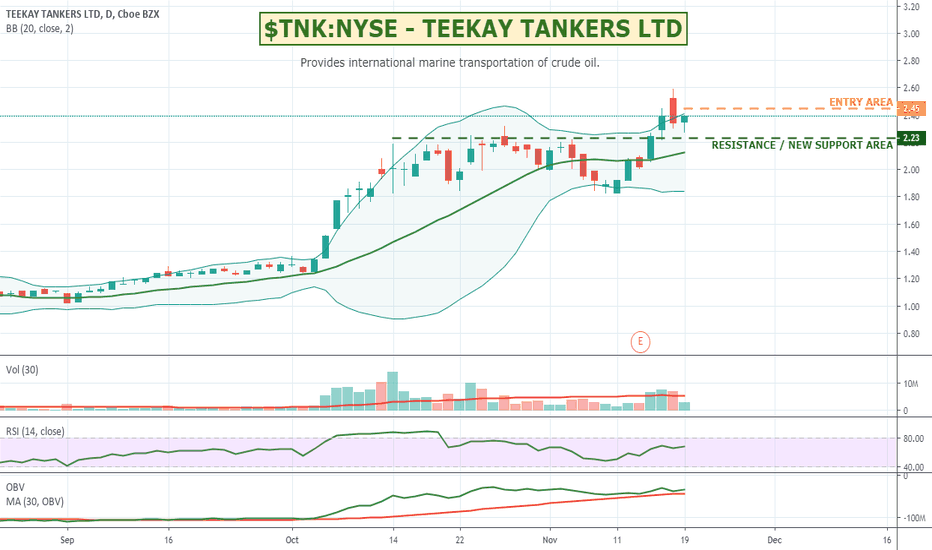

$TNK:NYSE - TEEKAY TANKERS LTD - About to bounce?TNK has had a great run over the last 3 months up some 116%. Looks like after a bit of a pullback it might bounce and run again. I will wait until it hits $2.45 for confirmation of direction and look for an entry around there. Could be worth a watch.

Teekay Tankers Ltd. is an international provider of marine transportation to the oil industries. The Company's business is to own crude oil and product tankers. The Company has two segments: conventional tanker and ship-to-ship transfer. Its conventional tanker segment consists of the operation of all of its tankers, including those employed on full service lightering contracts. Its ship-to-ship transfer segment consists of its lightering support services, including those provided to the Company's conventional tanker segment as part of full service lightering operations and other related services. Its operations are managed by Teekay Tankers Management Services Ltd., which provides the Company with commercial, technical, administrative and strategic services. Its fleet consists of approximately 60 conventional vessels (including over 10 in-chartered vessels and an approximately 50%-owned very large crude carrier (VLCC)) and approximately six ship-to-ship (STS) support vessels.

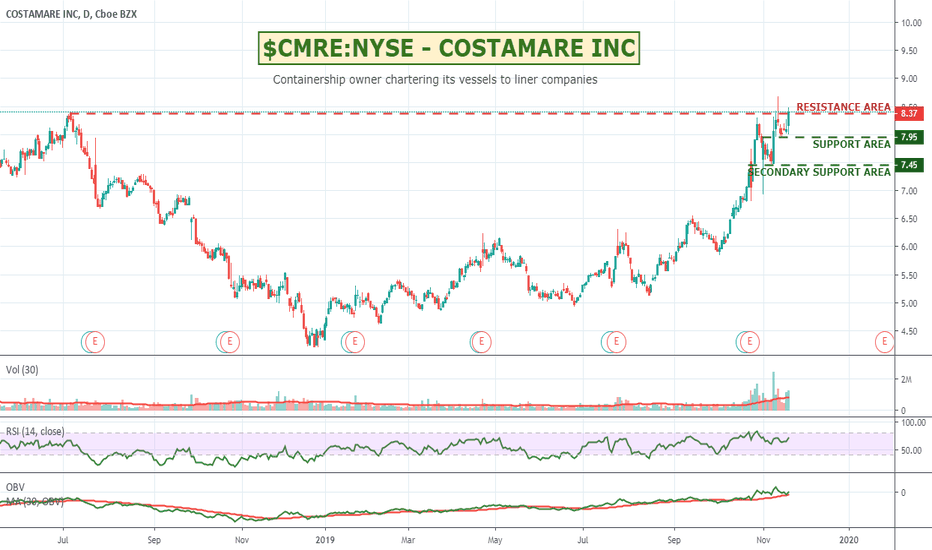

$CMRE:NYSE - COSTAMARE INC - Containership CharterCOSTAMARE has had a good run over the last 3 months and is back at a previous resistance area with a couple of levels of support below. Currently trading at $8.40. If it pushed $8.50 I'd be quite interested. Could be worth a look.

Costamare Inc. (Costamare) is a holding company. The Company is an international owner of containerships. The Company is engaged in chartering its vessels to various liner companies. The Company provides marine transportation services around the world by chartering its container vessels to liner operators under long, medium and short-term time charters. As of March 10, 2017, the Company had a fleet of 69 containerships with a total capacity of approximately 456,000 TEU, including five newbuilds on order. The Company's fleet of vessels includes Cosco Guangzhou, Titan, Cosco Yantian, Valor, Valiant and Maersk Kobe. Its subsidiaries include Adele Shipping Co., Bastian Shipping Co., Cadence Shipping Co., Jodie Shipping Co. and Kayley Shipping Co.

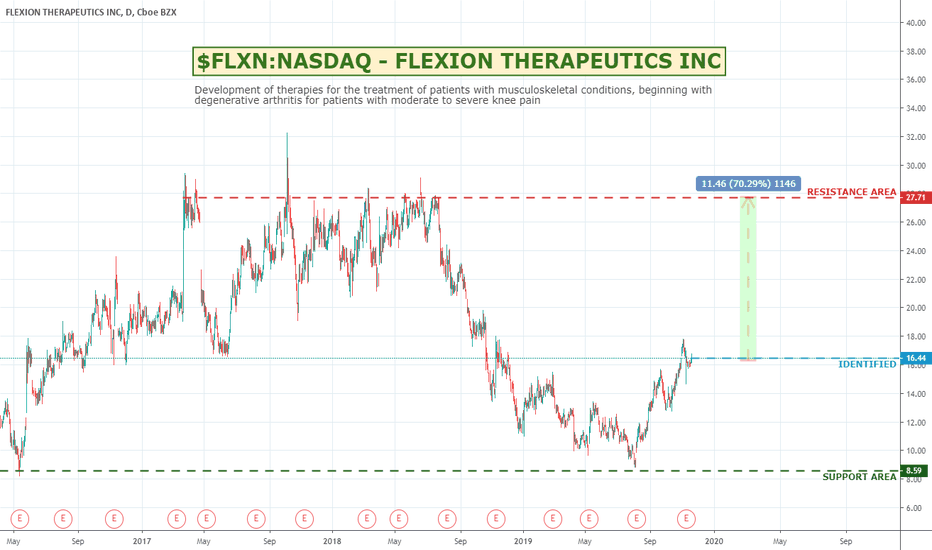

$FLXN:NASDAQ - FLEXION THERAPEUTICS INC - Got Knees?I like the look of the Flexion chart - especially long term. It has had a good 3 month run and looks to be resuming after a pull back. Quite a bit of upside if it continues to run like it did in the past off that bottom support back up to resistance. Knee pain treatment would seem to be a good space based on all the people who seem to have it. Might be worth a watch in your speccies list.

Flexion Therapeutics, Inc. is a United States-based specialty pharmaceutical company. The Company is focused on the development and commercialization of local therapies for the treatment of patients with musculoskeletal conditions, beginning with osteoarthritis (OA), a type of degenerative arthritis. The Company's lead product candidate, Zilretta, is a late-stage, injectable, extended-release, intra-articular (IA) investigational steroid. The Company is developing Zilretta as a treatment for patients with moderate to severe OA knee pain. The Company has specifically designed Zilretta to combine a steroid, triamcinolone acetonide (TCA) with poly lactic-co-glycolic acid (PLGA), for providing sustained therapeutic concentrations in the joint and persistent analgesic effect. The Company's other product candidates include FX007 for post-operative pain and FX005 for the treatment of end-stage OA patients. The Company is engaged in conducting a Phase IIb clinical trial of Zilretta.

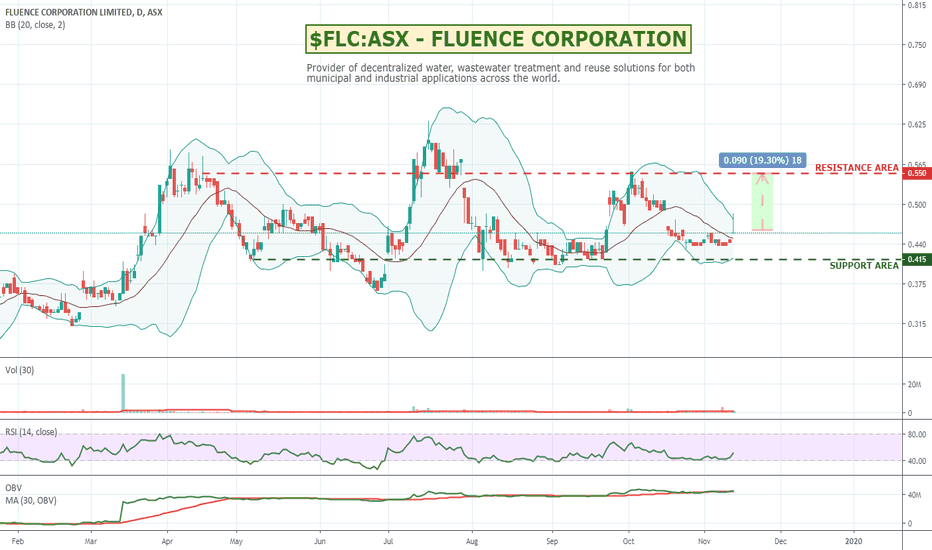

$FLC:ASX - FLUENCE CORPORATION - Water treatment businessFluence is a provider of decentralized water, wastewater treatment and reuse solutions for both municipal and industrial applications across the world. There seems to be some recent interest in this industry sector with some spectacular past performance of companies like Phoslock and SDV as examples. With droughts and pollution hot topics cleaning up of water ways and assisting desalination type plants as well as cleaning waters used by miners will all become more and more regulated with higher standards of quality being required to be met. It seems to trade within a bit of a range at the moment so could be worth a watch with tighter stops as it gets to the top of that range where resistance starts to kick in.

Fluence Corporation Ltd, formerly Emefcy Group Ltd, is an Israel-based company that is engaged in providing water treatment solutions. It offers decentralized, packaged water and wastewater treatment solutions. Its solutions include decentralized treatment, desalination, reuse, waste-to-energy, water treatment, wastewater treatment, food and beverage processing. It provides services and support for project financing and after-sale support. The Company offers water treatment products and wastewater treatment products. Water treatment products include NIROBOX SW, NIROBOX BW, ultrafiltration and reverse osmosis. Wastewater treatment includes MABR, NIRBOX WW, packaged plants, aeration equipment and dissolved air flotation. The Company operates in approximately 70 countries.

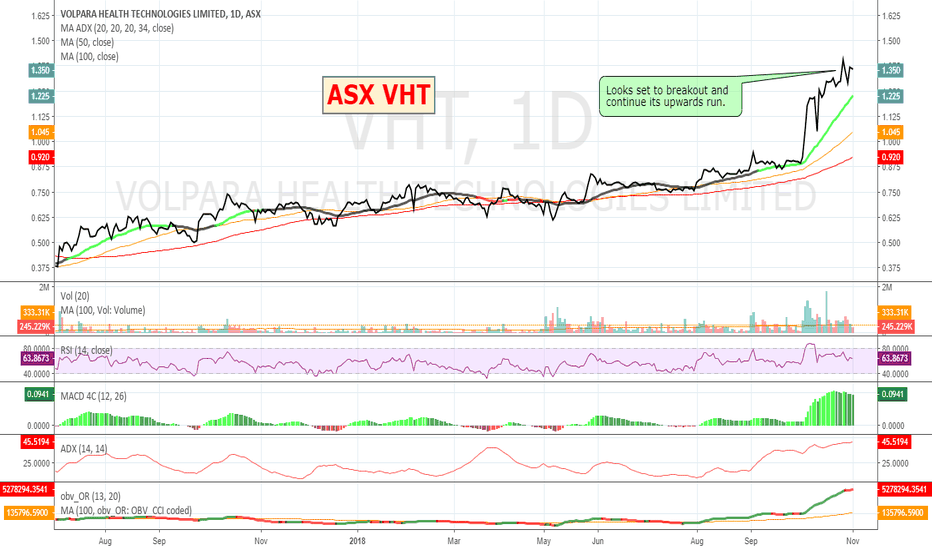

$VHT #ASX - Volpara Health Technologies - About to breakout?Volpara Health Technologies Limited is a New Zealand-based research, development and manufacturing company. The Company operates through the sale of a single suite of medical device software products segment. Its geographic segments include America and South America, Europe, Asia and Middle East, and Australia and New Zealand. The Company provides breast imaging analytics and analysis products that help in clinical decision-making and the early detection of breast cancer. Its offerings include VolparaEnterprise, which enables breast imaging providers to perform control checks; VolparaDensity, which provides objective assessment of a woman's breast density; VolparaAnalytics, which includes a reporting dashboard for breast imaging centers, and VolparaDoseRT, which provides clinicians with patient-specific x-ray dose and applied compression pressure based on a woman's breast composition. Its subsidiaries include Volpara Solutions Limited, Volpara Solutions Inc and Matakina UK Limited.

Came up on todays scans as a strong buy. Looks like it might breakout and continue its upward climb. Just needs a bit more volume to give it a push.

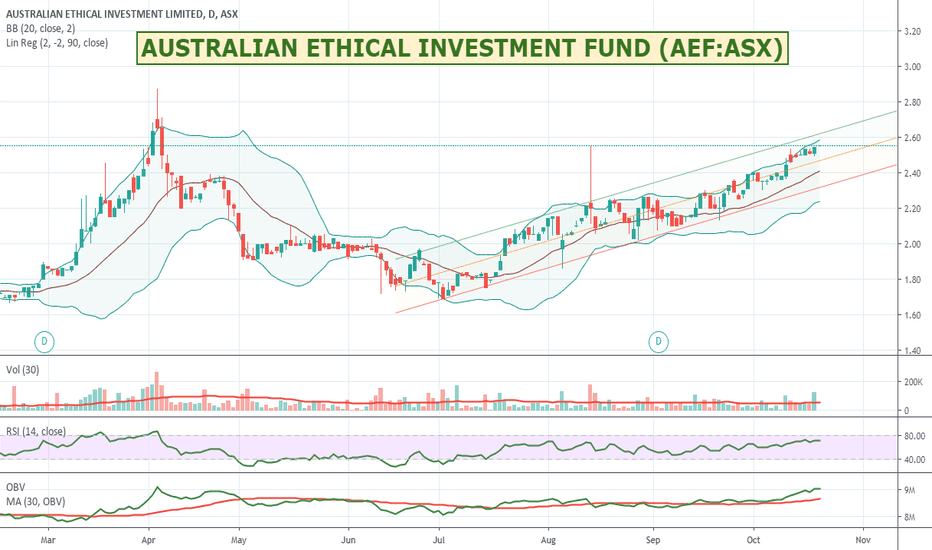

$AEF:ASX - AUSTRALIAN ETHICAL INVESTMENT FUND - Up 61%Ethical stocks and funds seem to be getting more and more popular and AEF popped up on one of my scans today. Up 61% over the last year. Might be worth a watch.

Australian Ethical Investment Limited is engaged in acting as the responsible entity for a range of ethically managed investment schemes. The Company also acts as the Trustee of the Australian Ethical Retail Superannuation Fund. It operates through fund management segment. The Company's products include Super, Managed Funds and Pensions. The Company invests in clean energy solutions, such as solar and wind; energy efficiency, such as light emitting diode (LED) lighting, motors and smart energy management technologies; Other products and activities, such as recycling, insulation and battery storage; healthcare; medical research; communication; education; information technology; Responsible Banking; Aged Care, and sustainable products. Its managed fund is a managed investment portfolio and can include investments in shares, property and fixed interest. Its subsidiaries are Australian Ethical Superannuation Pty Limited and Australian Ethical Investment Limited Employee Share Plan Trust.

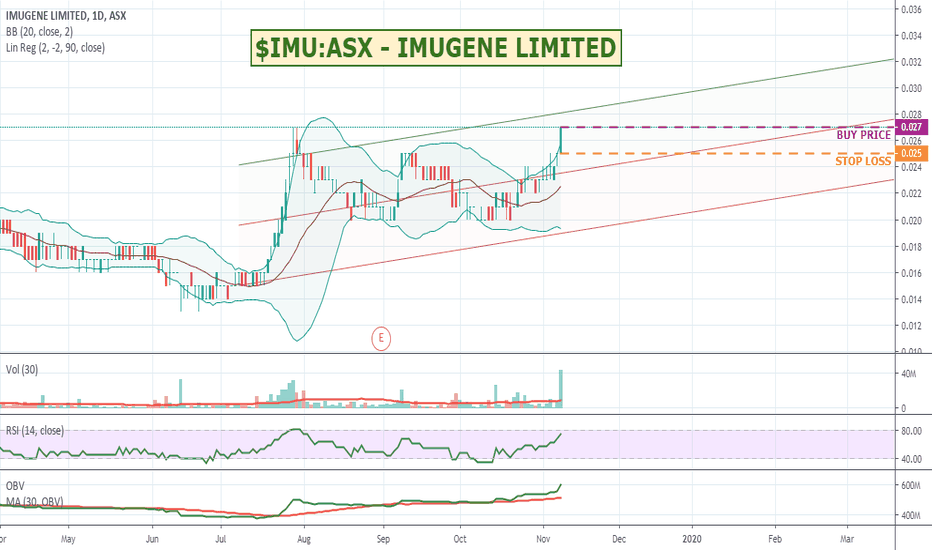

$IMU:ASX - IMUGENE LIMITED - Big buy side before conferenceWill be interesting to see if IMU gets more of a bump during and after its conference today. MASSIVE buy side demand with 220 buyers for 107,568,372 units vs 61 sellers for 26,085,482 units.

Imugene Limited is an immuno-oncology focused biopharmaceutical company. The Company is engaged in the research and development of human epidermal growth factor receptor 2 positive (HER2 +ve), and gastric and breast cancer vaccines. The Company is also engaged in the research, development and commercialization of health technologies. HER-Vaxx is a cancer immunotherapy designed to treat tumors that over-express the HER-2/neu receptor, such as gastric, breast, ovarian, lung and pancreatic cancers. HER-Vaxx has completed a Phase I clinical trial with over 10 HER-2 positive patients with metastatic breast cancer. It was shown in pre-clinical studies and in one Phase 1 study to stimulate a potent polyclonal antibody response to HER-2/neu. HER-Vaxx has stimulated the production of HER-2 antibodies in early-stage cancer patients enrolled in the initial clinical trial. The Company is also developing mimotope-based immunotherapies against validated and oncology targets.

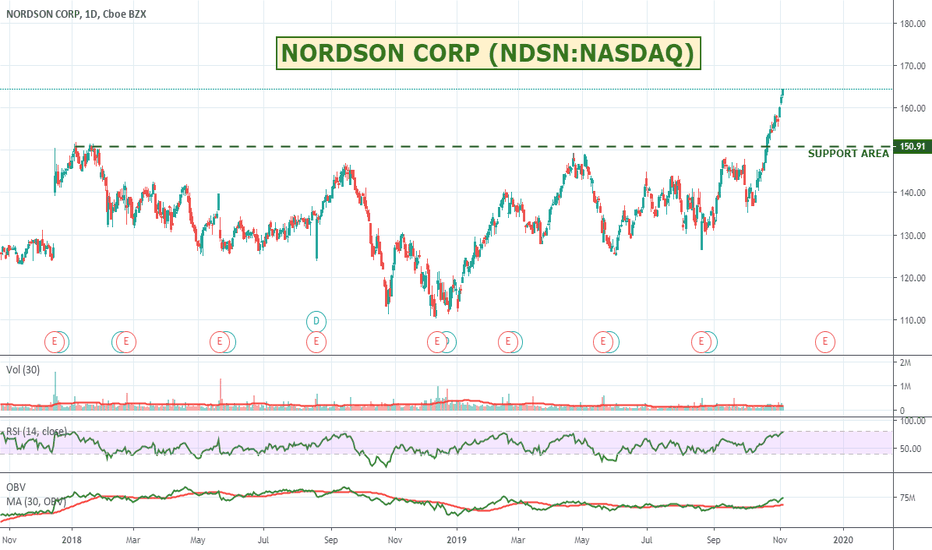

$NDSN:NASDAQ - NORDSON CORP- Nice run after breakout.NORDSON is continuing its nice run post its earlier breakout through that traditional resistance area. Trade / manufacturing fears lessening has been in its favour. Might be worth a look.

Nordson Corporation engineers, manufactures and markets differentiated products and systems used to dispense, apply and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids, to test and inspect for quality, and to treat and cure surfaces. The Company's segments include Adhesive Dispensing Systems, Advanced Technology Systems and Industrial Coating Systems. The Adhesive Dispensing Systems segment delivers its precision dispensing and processing technology to various markets. The Advanced Technology Systems segment integrates its product technologies found in progressive stages of a customer's production process, such as surface treatment, precisely controlled automated, and post-dispense bond testing, optical inspection and X-ray inspection. The Industrial Coating Systems segment provides equipment used primarily for applying coatings, paint, finishes, sealants and other materials, and for curing and drying of dispensed material.

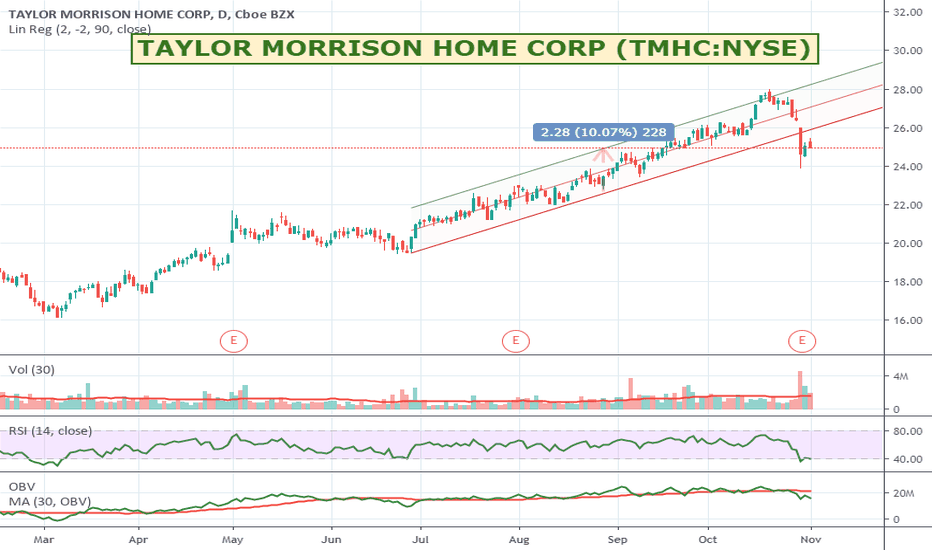

$TMHC:NYSE - TAYOR MORRISSON - Possibly oversold.Might be a value opportunity for those who like this kind of trade where it has probably oversold on earnings announcement.

Taylor Morrison Home Corporation (Taylor Morrison) is a home building and land developing company. It builds and sells single-family detached and attached homes. It operates under the Taylor Morrison and Darling Homes brand names. It also provides financial services to customers through its mortgage subsidiary, Taylor Morrison Home Funding, LLC (TMHF), and title insurance and closing settlement services through its title company, Inspired Title Services, LLC. Its business is organized into multiple homebuilding operating divisions and a mortgage and title services division, which are managed as multiple reportable segments like: East Central and West Mortgage Operation. Its East Central segment includes Atlanta, Charlotte, Chicago, Orlando, Raleigh, Southwest Florida and Tampa Austin, Dallas, Houston and Denver. Its West Mortgage Operation includes Bay Area, Phoenix, Sacramento and Southern California, Taylor Morrison Home Funding (TMHF) and Inspired Title Services