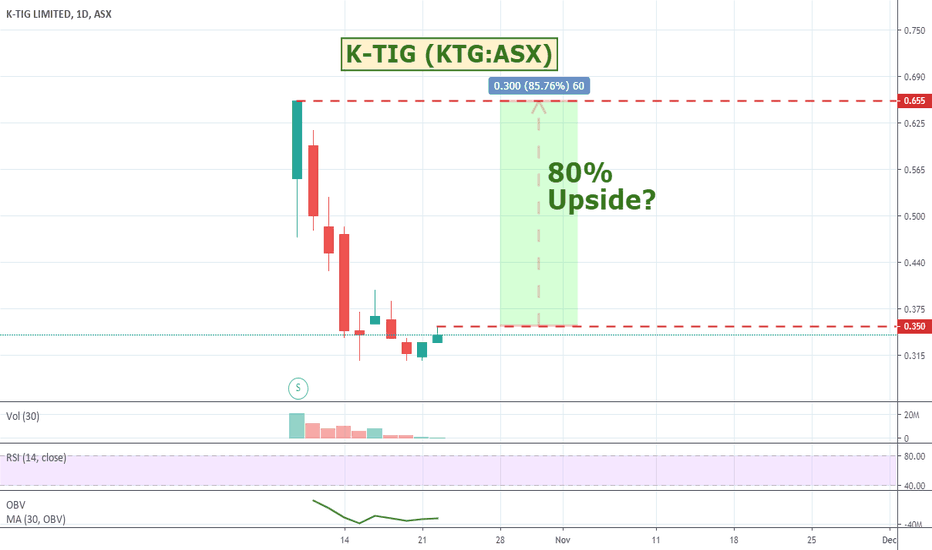

$KTG:ASX - KTIG - CSIRO developed tech welding company.KTIG is not the normal kind of stock that I would buy but their association with Australia's CSIRO combined with claims of super efficient manufacturing tech with massive enterprise cost out caught my attention. I liked that they also cater to a wide range of high growth / high income industries including - Nuclear; Aerospace; Defence; Oil & Gas; Mineral Processing; Pipe Mills & Tube Mills; Power Generation; Filtration & Water Treatment; Process Industry; Pressure Vessels, Suction Vessels & Cryogenic Vessels. Newly listed and down off the open, but might be worth a watch.

What is K-TIG?

K-TIG is the developer and manufacturer of a patented, high productivity welding technology known as Keyhole TIG.

A K-TIG system is able for perform a traditional 6-hour TIG weld in 3 minutes, and to a quality standard which meets the most demanding requirements of the nuclear, aerospace & defence industries.

In addition to 50x to 100x speed advantages over TIG/GTAW, the K-TIG technology reduces power and gas consumption by up to 95% and dramatically reduces labour costs.

Cost Savings

What are the cost savings associated with using K-TIG?

Overall cost savings are routinely in excess of 90%.

Who are K-TIG's customers?

K-TIG’s customers include many of the world’s largest fabricators.

Our customers range from Global 500 companies such as G.E to industry specialists such as Bilfinger and Aibel, to the world’s pre-eminent advanced manufacturing development centres such as:

- The Nuclear Advanced Manufacturing Research Centre (NAMRC) (UK)

- The Defence Materials Technology Centre (DMTC) (AUS)

- The GE Global Research Centre (US)

K-TIG serves and supports its customers worldwide through a combination of direct sales and its international distribution network. K-TIG invests heavily in research and development, and is committed to transforming the welding and fabrication industry.

Unlike traditional welding, K-TIG welding requires no edge bevelling of the materials, and eliminates the need for wire consumables.

How has K-TIG been developed?

Developed by the Australian Government’s Commonwealth Scientific & Industrial Research Organisation (CSIRO), K-TIG is a high speed, single pass, full penetration welding technology that eliminates the need for wire consumables and edge bevelling.

K-TIG produces exceptional quality welds up to 100x faster than conventional TIG/GTAW welding in materials up to 16mm (5/8 inch) in thickness.

The heart of the K-TIG system is a multi-processor controller and communications platform which has been designed from the ground up to reduce complexity to a push-button operation. The system is capable of integrating with virtually all welding automation equipment in use today.

The sustainability dimension of K-TIG is significant. The order-of-magnitude power and gas savings provide an opportunity to significantly reduce the carbon footprint of the industrial welding and fabrication industry.

The result of ten years of research and numerous customer deployments on four continents has resulted in a welding technology of extraordinary productivity and simplicity.

How is K-TIG different?

We thrive on solving customer challenges and embed these solutions into every successive generation of our technology.

K-TIG has world leading expertise in the following areas:

- Keyhole TIG and Keyhole GTAW welding

- Advanced welding physics

- Welding control systems

- Welding automation

- High productivity welding of corrosion resistant metals and exotic materials

- Autogenous welding

- Cloud-enabled welding systems

K-TIG’s customer support, distribution, product development and R&D divisions are structured for a single purpose – to increase the productivity of our customers.

What fabrication sectors can be used with K-TIG?

K-TIG serves all major fabrication sectors where exceptional quality and high productivity are demanded, including:

- Pressure Vessel, Suction Vessel & Cryogenic Vessel

- Nuclear

- Aerospace

- Defence

- Oil & Gas

- Mineral Processing

- Pipe Mills & Tube Mills

- Power Generation

- Filtration & Water Treatment

- Process Industry

Search in ideas for "zAngus"

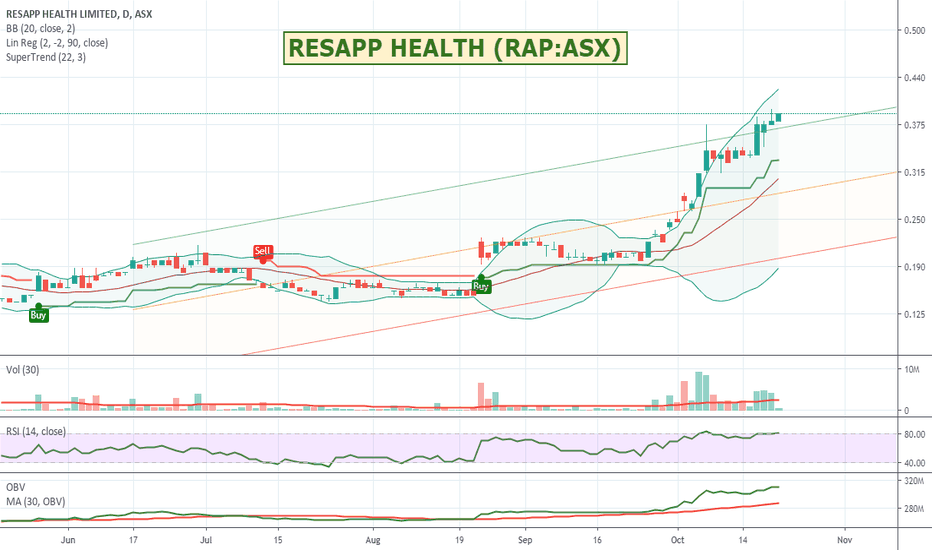

$RAP:ASX - RESAPP HEALTH - Up 250% YTDMight be a bit overbought at the moment looking at the RSI, but it is still trading with the upper bollinger and demand is high with 269 buyers for 12,650,445 units vs 80 sellers for 2,279,491 units. Might be worth a watch.

ResApp Health Limited is engaged in developing digital healthcare solutions to assist doctors and patients to diagnose and manage respiratory disease. The Company offers a range of solutions, such as telehealth, clinical use, direct consumer and big data insights. The Company provides point of care diagnostic solutions for telehealth companies, which is integrated into their platforms. The Company is working on applications to provide clinical quality diagnostic tests and management tools directly to consumers and healthcare providers. The Company is developing smartphone medical applications for the diagnosis and management of respiratory disease. The Company's technology is based on the premise that cough and breathing sounds carry vital information on the state of the respiratory tract. ResApp measures the severity of a range of chronic and acute diseases, such as pneumonia, asthma, bronchiolitis and chronic obstructive pulmonary disease (COPD) using this insight.

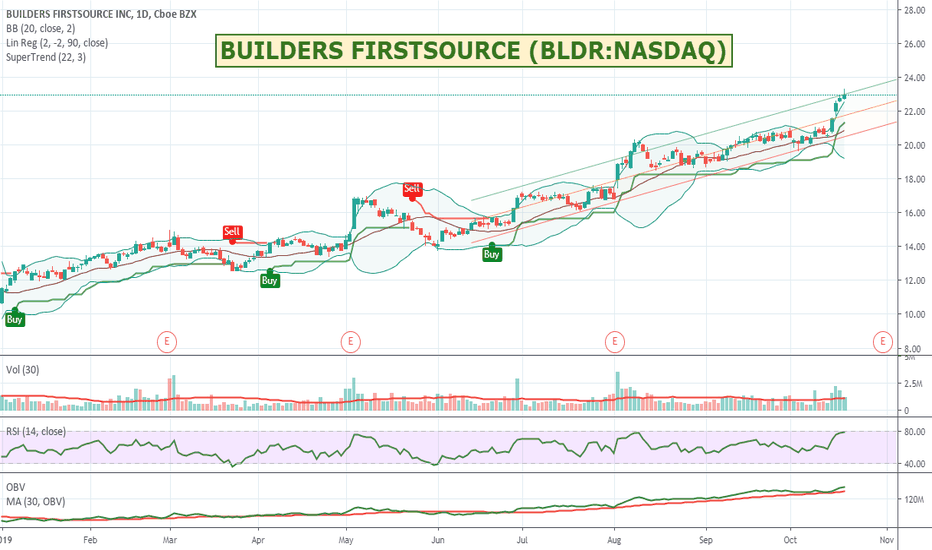

$BLDR:NASDAQ - BUILDERS FIRSTSOURCE - Leveraging the homebuilderI've been on this stock for a couple of weeks now - just didn't get a chance to post about it, but is has been having a great run of late piggy-backing off the whole home builders market being driven by low interest rates. Good to be the company selling shovels to the miners when they are in a boom. Might be a bit overextended at the moment if you are looking for an entry, but wait for a bit of a pull back and it could then be worth a look.

Builders FirstSource, Inc. is a supplier and manufacturer of building materials, manufactured components and construction services to professional contractors, sub-contractors, remodelers and consumers. The Company's operating segments include Northeast, Southeast, South and West. As of December 31, 2016, it operated at 400 locations in 40 states across the United States. It offers an integrated solution to its customers providing manufacturing, supply and installation of a range of structural and related building products. Its manufactured products include factory-built roof and floor trusses, wall panels and stairs, vinyl windows, custom millwork and trim, as well as engineered wood that it designs, cuts and assembles for each home. It assembles interior and exterior doors into pre-hung units. Additionally, it supplies customers with offering of professional grade building products, such as dimensional lumber and lumber sheet goods, and various window, door and millwork lines.

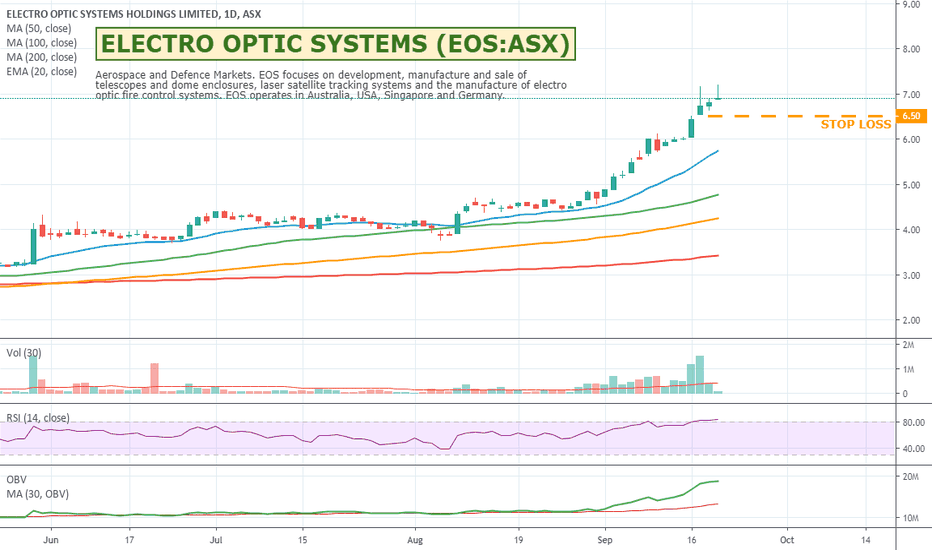

$EOS:ASX - ELECTRO OPTIC SYSTEMS - Space and Defence SystemsEOS has been having a great run over the last several months and uncertainty around Iran and other parts of the globe has been good for the sector as a whole and EOS in particular. Recent volume has been strong and it broke back up above the $7 mark today getting as high as $7.20 before pulling back. Fingers crossed this is a sign it will push past that $7 barrier over the next few days and start to use it as support. Might be worth a watch.

Current demand: 134 buyers for 315,798 units vs 53 sellers for 119,528 units

Electro Optic Systems Holdings Limited is an Australia-based company engaged in the space and defense system business. The Company's segments include Space and Defence Systems. Space segment includes laser-based space surveillance systems and also manufactures and sells telescopes and dome enclosures for space projects. Defence Systems segment develops, manufactures and markets fire control, surveillance and weapon systems military customers. The Company has developed space tracking sensors. The Company, through its subsidiary, offers observatories, telescopes, space surveillance products, detector systems and laser products. The Company's product range includes EOS R-400 and EOS R-600. It offers repair services and sensor units for military and security application.

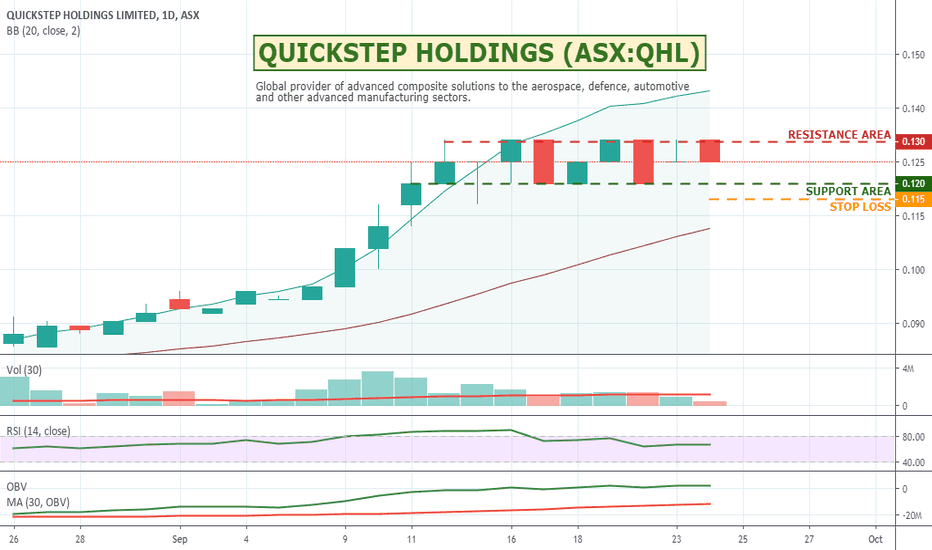

$QHL:ASX - QUICKSTEP HOLDINGS - Aerospace and Defence up 50%Quickstep popped up on a couple of my momentum scans and the whole aerospace and defence sector seems to be pretty hot at the moment so thought I would add this to my watch list. It gained almost 50% over the last month and has since been trading sideways for the last couple of weeks, so I would like to see it break above 13 to confirm direction. The Trading View indicator has switched over to suggesting it is a strong buy on its TA consensus indicator which could also be a good sign. Worth a watch.

Current demand: 92 buyers for 6,144,075 units vs 58 sellers for 4,233,989 units.

Quickstep Holdings Limited is an Australia-based provider of advanced composite components and manufacturing processes for the aerospace, defense, marine, automotive, and other transportation sectors. The Company's segments include Aerospace Manufacturing and New Technology. The Aerospace Manufacturing segment manufactures aerospace composite components, primarily using traditional manufacturing technologies, such as autoclaves, and targeting additional manufacturing contracts. The New Technology segment is engaged in the development and manufacturing of parts utilizing the Company's Qure and Resin Spray Transfer (RST) processes, and licensing and providing Quickstep machines to Original Equipment Manufacturers (OEMs) and their suppliers and further product and technology development.

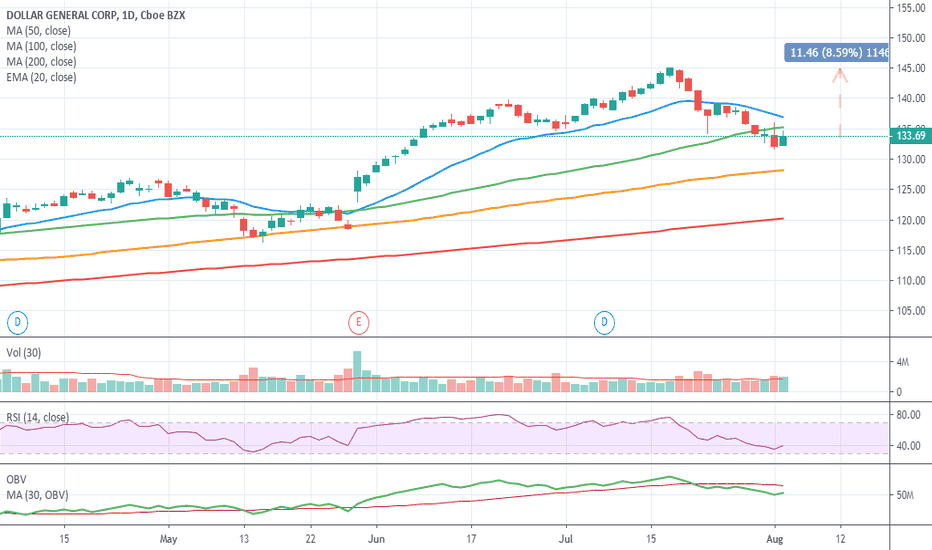

$DG:NYSE - DOLLAR GENERAL - Recovering after pullback?Dollar General is a stock that will probably continue to benefit from any significant downturn in the market and general consumer confidence. It's not too far out from earnings but it does seem to dip into the run into them and bounce out, so buyer beware, but might be one to watch. I'd probably want to see another day of increased pricing and move above its 50 day MA before I would look for an entry. Alert set.

Dollar General Corporation is a discount retailer. The Company offers a selection of merchandise, including consumables, seasonal, home products and apparel. The Company's consumables category includes paper and cleaning products (such as paper towels, bath tissue, and other home cleaning supplies); packaged food (such as cereals, spices, sugar and flour); perishables (such as milk, beer and wine); snacks (such as candy, cookies, and carbonated beverages); health and beauty (such as over-the-counter medicines and personal care products); pet (pet supplies and pet food), and tobacco products. Its seasonal products include decorations, toys, batteries, stationery, prepaid phones and accessories, and home office supplies. Its home products include cookware, craft supplies and kitchen, and bed and bath soft goods. Its apparel products include casual everyday apparel for infants, toddlers, girls, boys, women and men, as well as socks, underwear, disposable diapers, shoes and accessories.

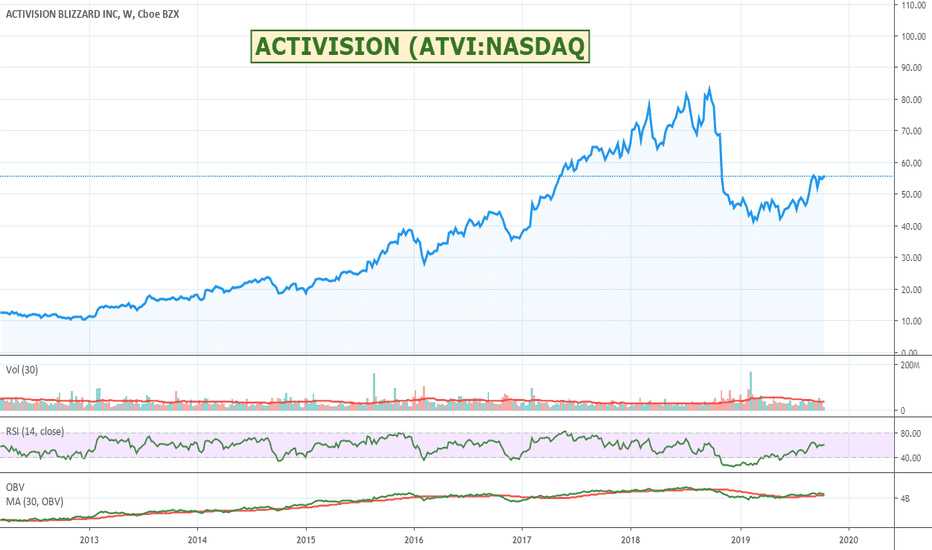

$ATVI:NASDAQ - ACTIVISION - At important breakout with a gapActivision is starting to look interesting again. It has had MASSIVE success with World of Warcraft Classic and Call of Duty: Mobile seems to be gaining momentum as well. If the stock pushes through the $56.55 type mark there is a gap there to fill and the stock could continue to gain with quite a bit of upside to previous levels. Need to wait for confirmation though, but if it does push through then could certainly be worth a watch.

Activision Blizzard, Inc. is a developer and publisher of interactive entertainment content and services. The Company develops and distributes content and services across various gaming platforms, including video game consoles, personal computers (PC) and mobile devices. Its segments include Activision Publishing, Inc. (Activision), Blizzard Entertainment, Inc. (Blizzard), King Digital Entertainment (King) and Other. Activision is a developer and publisher of interactive software products and content. Blizzard is engaged in developing and publishing of interactive software products and entertainment content, particularly in PC gaming. King is a mobile entertainment company. It is engaged in other businesses, including The Major League Gaming (MLG) business; The Activision Blizzard Studios (Studios) business, and The Activision Blizzard Distribution (Distribution) business. It also develops products spanning other genres, including action/adventure, role-playing and simulation.

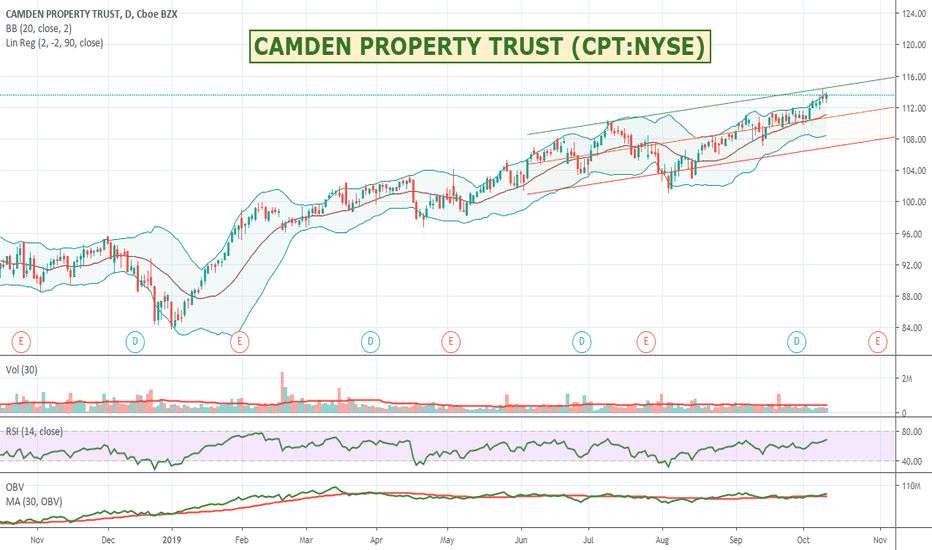

CAMDEN PROPERTY TRUST ($CPT:NYSE) - Residential REIT up 35% YTD Another nice (hopefully) steady stock up 35% so far this year. It is toward the top of its 90 day channel with an RSI just under 70 so might be some pullback, but if it continues to climb over the next couple of days could be worth a watch.

Camden Property Trust is a real estate investment trust (REIT). The Company is engaged in the ownership, management, development, redevelopment, acquisition and construction of multifamily apartment communities. As of December 31, 2016, the Company owned interests in, operated, or were developing 159 multifamily properties, which consisted of 55,366 apartment homes across the United States. The Company also owns land holdings, which it may develop into multifamily communities. The Company's properties consist of mid-rise buildings or two and three story buildings in a landscaped setting and provide residents with a range of amenities common to multifamily rental properties. The 152 operating properties in which the Company owned interests and operated, as of December 31, 2016, averaged 953 square feet of living area per apartment home. As of December 31, 2016, 137 of its operating properties had over 200 apartment homes.

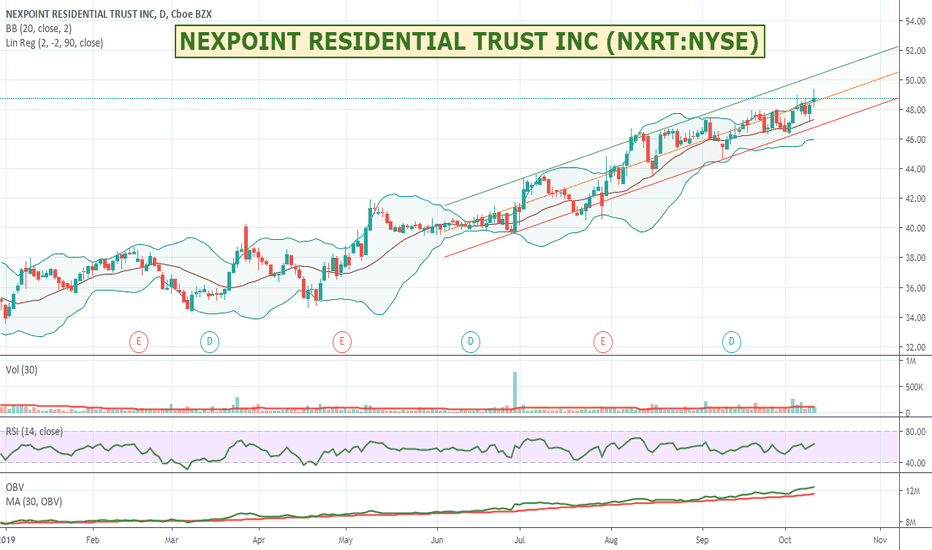

$NXRT:NYSE - NEXPOINT RESIDENTIAL - Residential REIT up 45% YTDAnother REIT trending nicely. Worth a watch in these turbulent economic times. It's at the midpoint on its 90 day linear regression channel with an RSI in the low 60's so could still be some value there. It's trading within an 8% range in the channel so not too volatile and easier to set stops - especially trails.

NexPoint Residential Trust, Inc. is an externally managed real estate investment trust (REIT). The Company's investment objectives are to maximize the cash flow and value of properties owned, acquire properties with cash flow growth potential, provide quarterly cash distributions and achieve long-term capital appreciation for its stockholders through targeted management and a value-add program. The Company is focused on multifamily investments primarily located in the Southeastern and Southwestern United States. All of the Company's business operations are conducted through NexPoint Residential Trust Operating Partnership, L.P. (OP). The sole limited partner of the OP is the Company. Its subsidiary, NexPoint Residential Trust Operating Partnership GP, LLC, is the sole general partner of the OP. As of December 31, 2016, the Company owned 39 properties representing 12,965 units in eight states, including two Parked Assets. The Company's advisor is NexPoint Real Estate Advisors, L.P.

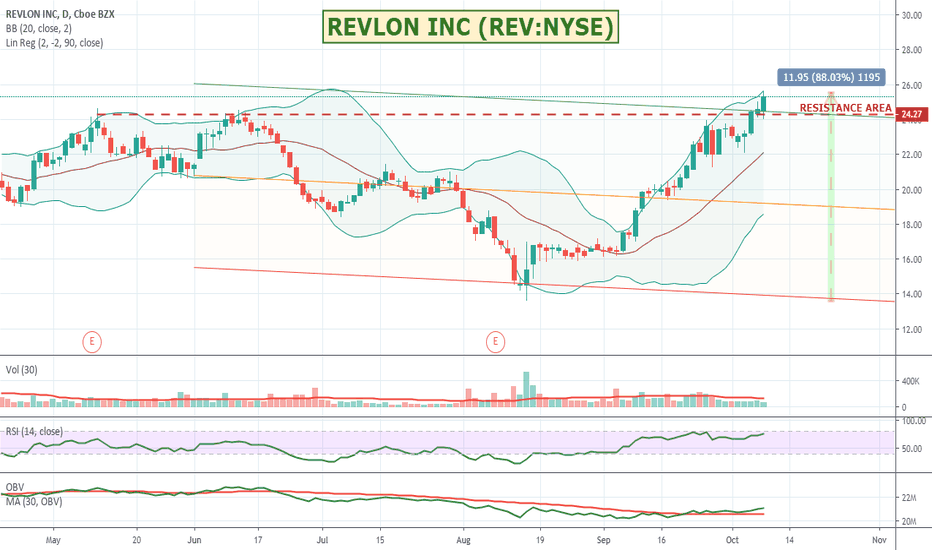

$REV:NYSE - REVLON - Up 90% in the last 2 months.Revlon has been having a great steady run over the last couple of months and has just pushed through and old resistance level. Could be worth a watch.

Revlon, Inc. manufactures, markets and sells around the world a range of beauty and personal care products, including color cosmetics, hair color, hair care and hair treatments, as well as beauty tools, men's grooming products, anti-perspirant deodorants, fragrances, skincare and other beauty care products. The Company operates through four segments: Consumer, which includes cosmetics, hair color and hair care, beauty tools, anti-perspirant deodorants, fragrances and skincare products; Professional, which includes a line of products sold to hair and nail salons, and professional salon distributors, including hair color, shampoos, conditioners, styling products, nail polishes and nail enhancements; Elizabeth Arden, which include Elizabeth Arden, which produces skin care, color cosmetics and fragrances under the Elizabeth Arden brand and Other, which includes the distribution of prestige, designer and celebrity fragrances, cosmetics and skincare products.

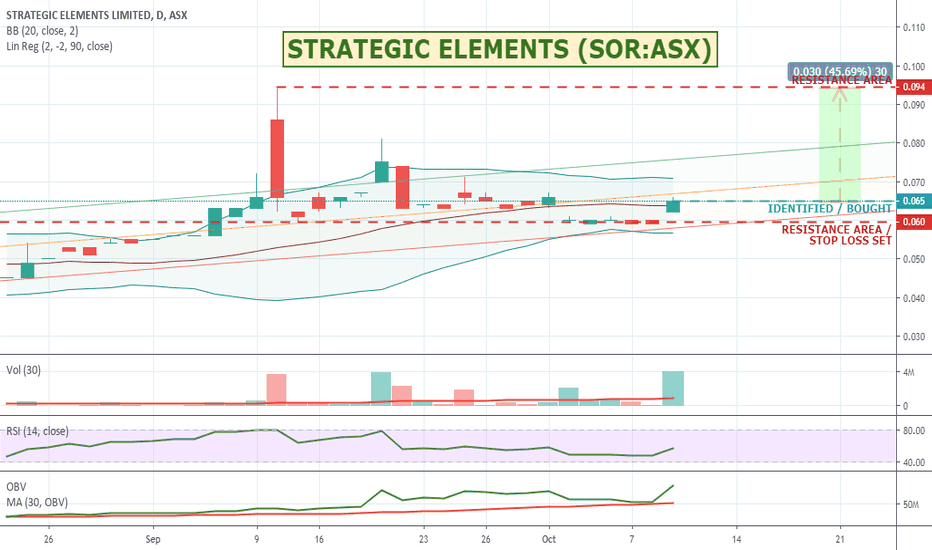

$SOR:ASX - STRATEGIC ELEMENTS - Australian Innovation FundCould be an interesting stock to follow and likely to be spiky on news with some really interesting projects they are backing. Quite a bit of upside on these spikes too. Worth a read of what they do and their recent announcements. Super speccy. Could be worth a watch.

The Australian Federal Government has registered Strategic Elements as a Pooled Development Fund with a mandate to back Australian innovation. Strategic Elements operates as a ‘venture builder’ where it generates ventures and projects from combining teams of leading scientists or innovators in the technology or resources sectors. Due to the Pooled Development Fund program which Strategic Elements operates under, most shareholders pay no tax on capital gains or dividends . The Company is listed on the ASX under the code “SOR”

Strategic Elements Limited is a Pooled Development Fund (PDF). The Company invests into small and medium sized Australian companies to assist in the development or expansion of the company. The Company's segments are Metals and Materials, and Research & Development. The Company owns Australian Advanced Materials Pty Ltd, which is engaged in developing a memory technology. The technology consists of tiny cube-shaped memory cells with potential to enable memory to be printed in an ink onto a range of materials, such as flexible plastic and glass. The Company also holds investments in Maria Resources Pty Ltd (Maria Resources) and Strategic Materials Pty Ltd (Strategic Materials). Maria Resources owns the Officer project. Strategic Materials owns the Golden Blocks Project in New Zealand. The Company also licensed new Ultraviolet (UV) light transistor-memory combination technology (UVTM), which enables a transistor to have non-volatile memory capacity.

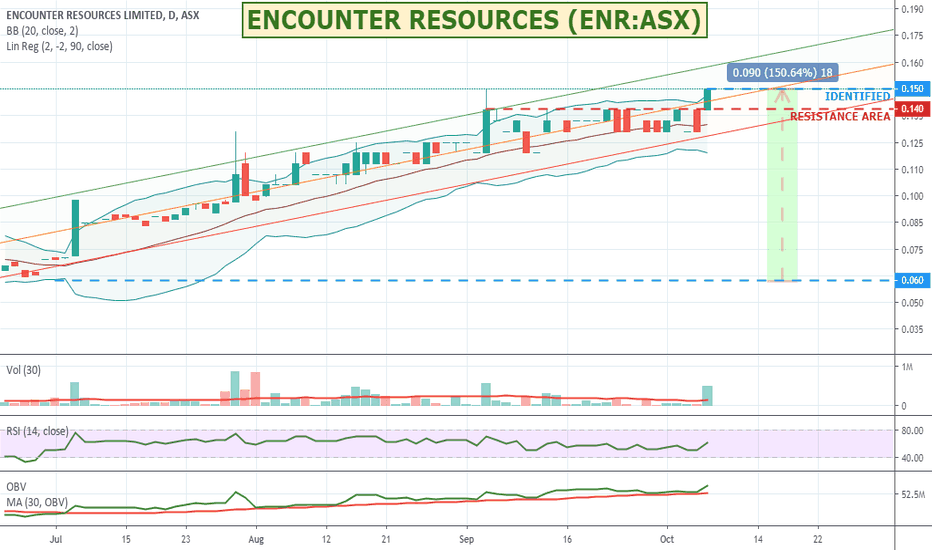

$ENR:ASX - ENCOUNTER RESOURCES - Up 150% FYTD at new breakoutEncounter has been having a good run this year and looks to be about to breakout and run again. Up 15% today on strong volume but still at a reasonable value area based on RSI and 90-Day trading range. Could be worth a watch.

Encounter Resources Limited is an Australia-based exploration and resource development company. The Company's principal activity is mineral exploration. The Company's Yeneena project covers over 1,800 square kilometers tenement package in the Paterson Province of Western Australia located between the Nifty copper mine, the Woodie Woodie manganese mine, the Telfer gold-copper mine and the Kintyre uranium deposit. The Yeneena Project includes the BM1, BM7 and BM8 copper prospects. The Yeneena Project Gold Claw-back relates to various exploration licenses: E45/2500, E45/2501, E45/2502, E45/2503, E45/2561, E45/2657, E45/2658, E45/2805 and E45/2806. Its Millennium zinc project consists of exploration licenses, which include EL45/2501, EL45/2561 and over four blocks of EL45/2500 in the Paterson Province of Western Australia. The Company's subsidiaries include Encounter Operations Pty Ltd, Hamelin Resources Pty Ltd and Encounter Yeneena Pty Ltd.

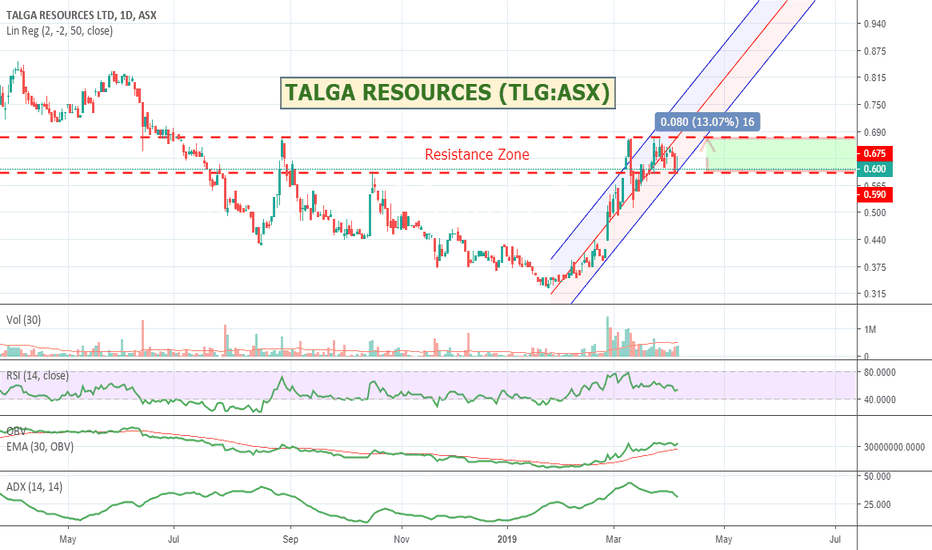

$TLG - TALGA RESOURCES - Short term play?$TLG - TALGA RESOURCES - Short term play?

I like the idea of the company - a vertical graphite miner AND a battery developer with some good tech results.

Has some good market depth on the buy side and if it goes up on Monday you would think there is at least 10% in a short term upside play. It's in a pretty strong area of resistance so might not run for long if it does. Keep your stops close, but I do like what they are doing.

About Talga Resources

Talga Resources Ltd is an advanced materials technology company enabling stronger, lighter and more functional graphene and graphite enhanced products for the multi-billion dollar global battery, coatings, construction and composites markets. Talga has significant commercial advantages owing to its vertically integrated high grade Swedish graphite deposits and in-house process to product technology. Company website: www.talgaresources.com

Disclaimer

I am guessing and the market lies.

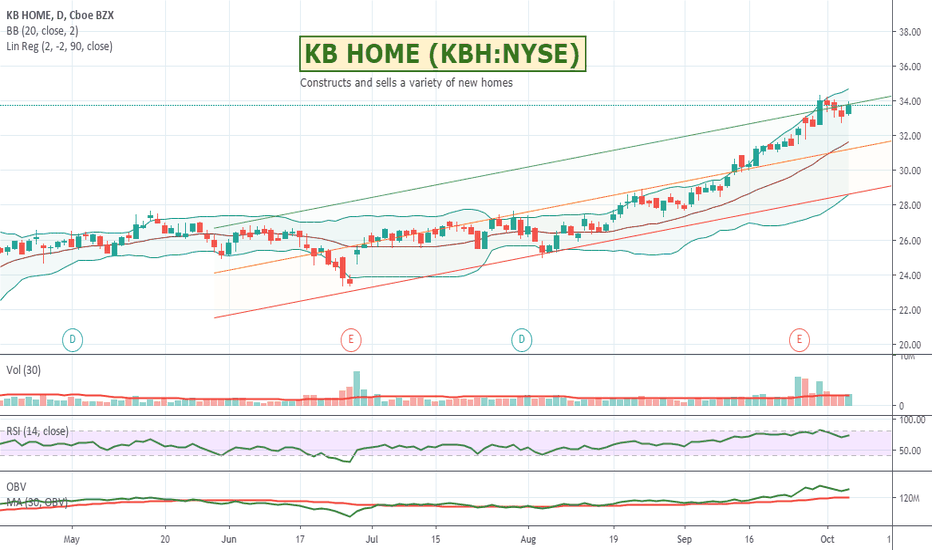

$KBH:NYSE - KB HOMES - Homebuilder up 70% YTDHomebuilders in the US have been having a great run year-to-date and with low interest rates likely to continue for a while then this could be a good stock to watch.

KB HOME is a homebuilding company. The Company is engaged in selling and building a range of new homes designed primarily for first-time, move-up and active adult homebuyers, including attached and detached single-family residential homes. It operates through five segments, which consist of four homebuilding segments and one financial services segment. Its homebuilding segments include West Coast, Southwest, Central and Southeast. The homebuilding segments are engaged in the acquisition and development of land primarily for residential purposes. The financial services segment offers property and casualty insurance and, in certain instances, earthquake, flood and personal property insurance to its homebuyers in the same markets as its homebuilding segments, and provides title services in the majority of markets located within its Central and Southeast homebuilding segments. It offers homes in development communities, at urban in-fill locations and as part of mixed-use projects.

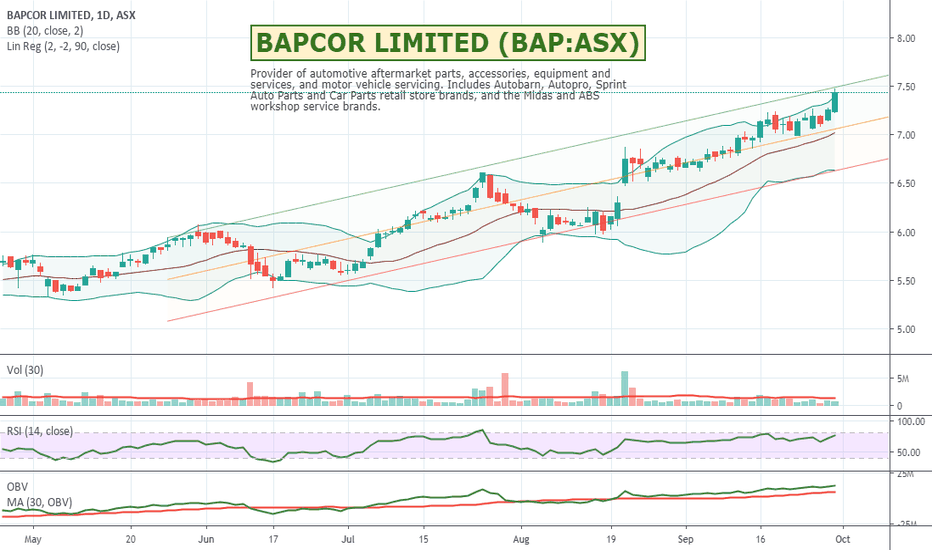

$BAP:ASX - BAPCOR - Automative Parts Provider up 30% in 3 MonthsBAPCOR is another company I haven't heard much about in terms of its parent brand but their Retail brands of Autobarn, Autopro, Sprint Auto Parts and Car Parts retail store brands, and the Midas and ABS workshop service brands I certainly have. I recently had my car serviced and it's always surprising how much it costs. In theory it is everyone's largest asset after their home, and equally amazing is how many vehicles are on the road. As a generalisation, every 12 months whether the car is brand new or older they seem to require a service at a couple hundred dollars a pop and for older vehicles they also need to be checked every 12 months in order to pass their rego check and be re-registered for the next year. It would seem like a good business to be in for now. The share price seems to be going the right way. Might be worth a watch.

Bapcor Limited, formerly Burson Group Limited, is a provider of automotive aftermarket parts, accessories, automotive equipment and services, and motor vehicle servicing. Its segments are Trade, Retail and Specialist Wholesale. The Trade segment consists of the Burson Auto Parts and Precision Automotive Equipment business units. The Trade segment is a distributor of automotive aftermarket parts and consumables to trade workshops for the repair and service of vehicles, and automotive workshop equipment, such as vehicle hoists and scanning equipment, including servicing of the equipment. The Retail segment consists of business units that are retail customer focused, and includes Autobarn, Autopro, Sprint Auto Parts and Car Parts retail store brands, and the Midas and ABS workshop service brands. The Specialist Wholesale segment consists of the operations that specialize in automotive aftermarket wholesale and includes the AAD business, as well as Bearing Wholesalers and Opposite Lock.

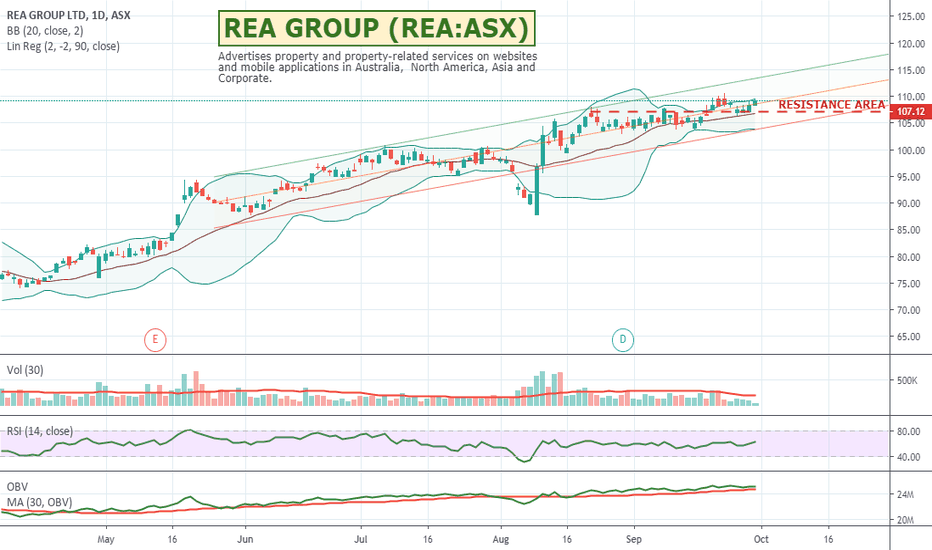

$REA:ASX - REA GROUP - RealEstate.com.au etc up 50% YTDI didn't realise that REA operated across as many countries with as many portals as they do. Well known to Australians for the RealEstate.com.au portal they also have similar sites across Europe and Asia. They have been having a great run so far this year so could be worth a watch.

REA Group Limited advertises property and property-related services on Websites and mobile applications in Australia, Europe and Asia. The Company's segments include Australia, Europe, North America, Asia and Corporate. It operates residential and commercial property sites, realestate.com.au and realcommercial.com.au in Australia. Its European operations consist of Italy, Luxembourg and France. It operates Italian digital property advertising business, casa.it; Luxembourg's residential and commercial property sites, atHome.lu and atOffice.lu, and immoRegion.fr in France. Its Asian operations comprise iProperty, which operates property portals across Malaysia and Hong Kong, and portals in Thailand, Singapore and Indonesia, and its Chinese site, myfun.com, which supports the Asian, Australian and the United States businesses by showcasing residential property listings to Chinese buyers and investors. It has interest in Move, Inc. and PropTiger, which offer online real estate services.

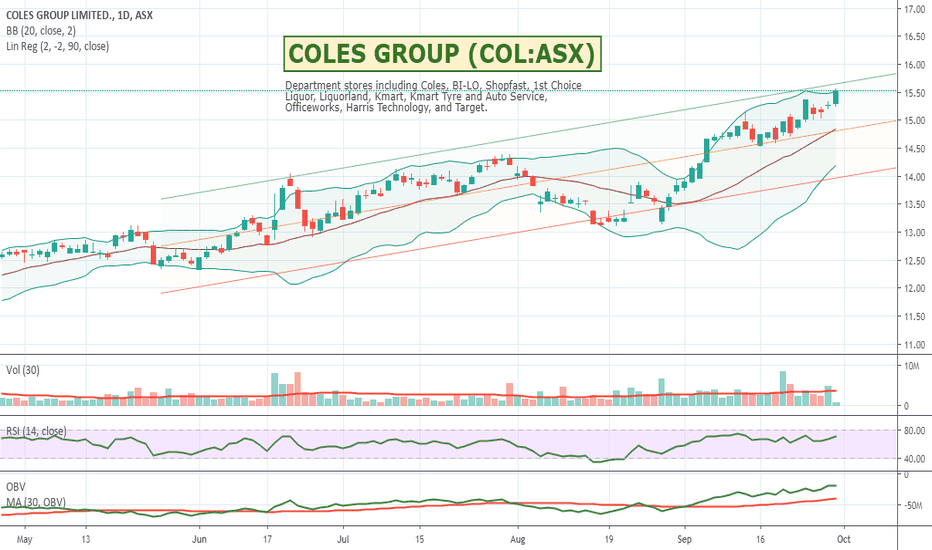

$COL:ASX - COLES GROUP - Running nicely. Up 30% YTD.Coles has been having a nice steady run since its listing / spin off last year. I was thinking it could make a reasonably good defensive stock to hold throughout any downturns but they did suffer a dip in August in line with the rest of the market. With more and more news about Coles expanding their online presence they could continue their upward march for a while. Could be one to watch for the more conservative portfolios out there.

Current demand: 492 buyers for 390,045 units vs 256 sellers for 142,679 units

Coles Group Limited is an Australia-based company that operates predominantly in the retail industry. The Company sells various products, including fresh food, groceries, household goods, liquor, fuel and financial services through its store network and online platforms. The Company operates through three divisions: Coles Supermarkets, Coles Liquor and Coles Convenience. Coles Supermarkets comprises the Coles supermarkets store network, the Coles Online supermarket offering and Coles Financial Services. Coles Liquor operates a range of liquor retailing formats encompassing three brands, such as Liquorland, First Choice Liquor and Vintage Cellars, as well as an online liquor retailing business. Coles Convenience segment sells shell fuels and a range of products, such as groceries, snacks, drinks, gas bottles, firewood, and Shell oils and lubricants. Coles Liquor also operates a network of 88 hotels under the Spirit Hotels brand, predominantly located in Queensland.

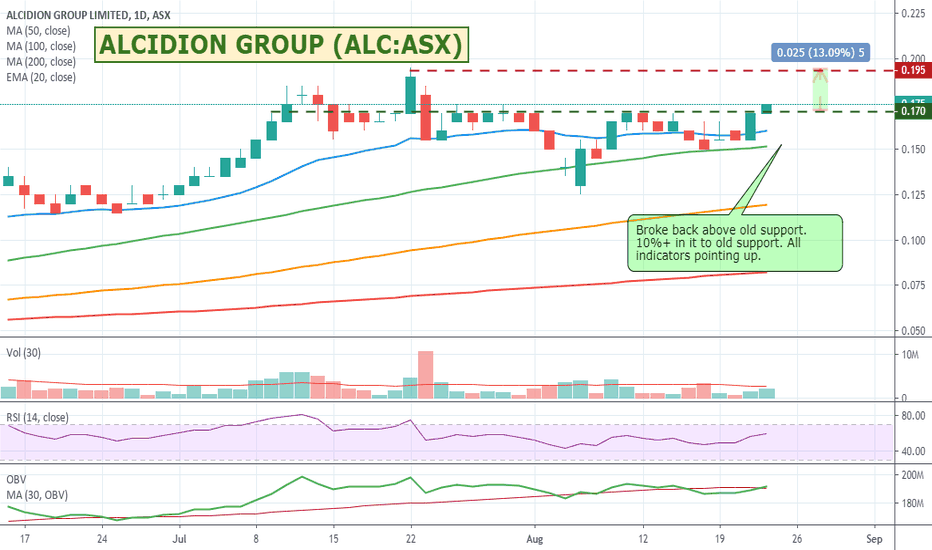

ALC:ASX - ALCIDION GROUP - Broken back above old supportAlcidion has been having a good run before recent pull back. It's now broken back above its old support level and there is around 10-15% back to its previous breakout high. Barchart technical indicator is showing as a strong buy and current demand is 235 buyers for 10,765,654 units vs 71 sellers for 3,797,123 units. All indicators are pointing up so fingers crossed might be worth a watch.

Alcidion Group Limited, formerly Naracoota Resources Limited, is an Australia-based health informatics company. The Company solutions focus on Emergency Rooms, Inpatient Services and Outpatient Departments, and are built upon health informatics platform, which incorporates an electronic medical records (EMR), clinical decision support engine and electronic smartforms. Its solutions include Miya ED, Miya Patient Flow, Miya Clinicals and Miya Clinic. Its Miya ED provides a set of clinical dashboards and emergency-department (ED) whiteboards. Its Miya Patient Flow System is an e-health guidance system, which offers integrating electronic journey boards, mobile EMR data capture, EMR software and a monitoring system. Its Miya Clinicals offers a suite of applications and services to the existing health information technology (IT) infrastructure. Its Miya Clinic Outpatient Software and Referral Management System optimizes the outpatient processes from referral through to discharge.

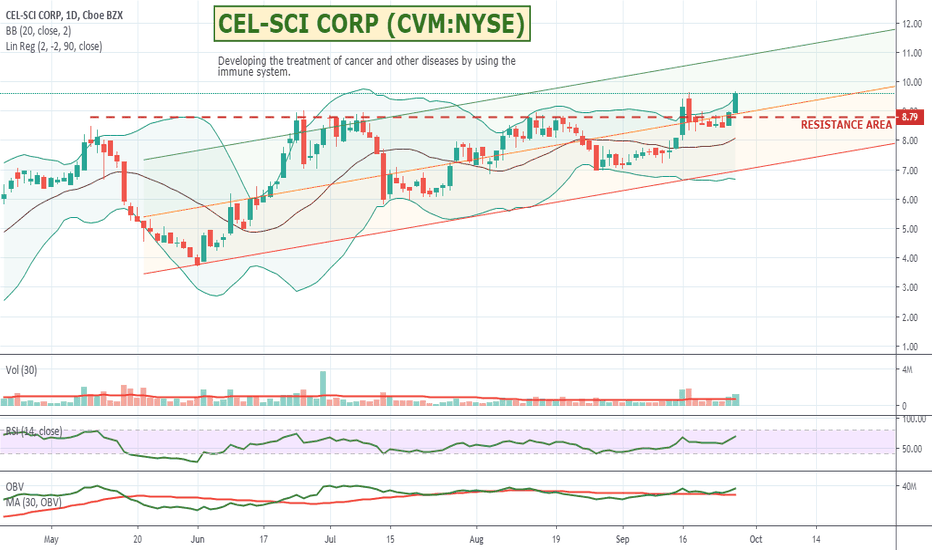

$CVM - CEL-SCI - Using the bodies immune system to fight cancersStill playing around with buying shares directly in Trading View via Trade Station and REALLY liking it so far. Super simple. Took a punt on CVM as it looks to have broken above a multiple resistance area, has broken above its upper bollinger band, has good volume, OBV is up, and the RSI is showing it has demand behind it and is still at fair value.

As for the company itself, I do like the idea of using the bodies own defence systems and turbo boosting them to fight cancers and other diseases. These "discovery" type stocks can however be highly volatile and can rocket or plummet on news.

You can see on the chart in the blue buy box I bought 100 @ $9.09 and they are now at $9.60 - and the green $58.48 in the box is how much I am up for the stock so far. You can also see that I have a sell stop (ie sell at market) if the stock hits $7 or below. This sell stop is easy to drag up and down, so I can have a look each day and very quickly visually check on say the 1 Day and 15 minute charts to see if I want to move it up or down. I can also very quickly flick between my moving averages views and my bollinger band views to see if I want to make it tighter or looser depending one whats happening in the market. Very cool. I like it :)

I don't have a take profit order in but that is also easily set and movable. Sometimes on these speculative type shares I might have a 15% take profit to capture any sudden rises before they pull back. For now I will monitor this one manually and move my stops as it progresses. Note that I will almost never move a stop down. They are there for a reason. Id prefer to take the $5 brokerage hit and get out and buy back in if one of my stops gets taken out.

CVM is also my mothers initials so fingers crossed this one rockets :) (<- Not a buy recommendation by any means :))

CEL-SCI Corporation is engaged in the research and development at developing the treatment of cancer and other diseases by using the immune system. The Company is focused on activating the immune system to fight cancer and infectious diseases. It operates through the segment of research and development of certain drugs and vaccines. It is focused on the development of Multikine (Leukocyte Interleukin, Injection), an investigational immunotherapy under development for treatment of certain head and neck cancers, and anal warts or cervical dysplasia in human immunodeficiency virus and human papillomavirus co-infected patients and Ligand Epitope Antigen Presentation System (L.E.A.P.S.) technology, with over two investigational therapies, LEAPS-H1N1-DC, a product candidate under development for treatment of pandemic influenza in hospitalized patients, and CEL-2000 and CEL-4000, vaccine product candidates under development for treatment of rheumatoid arthritis.

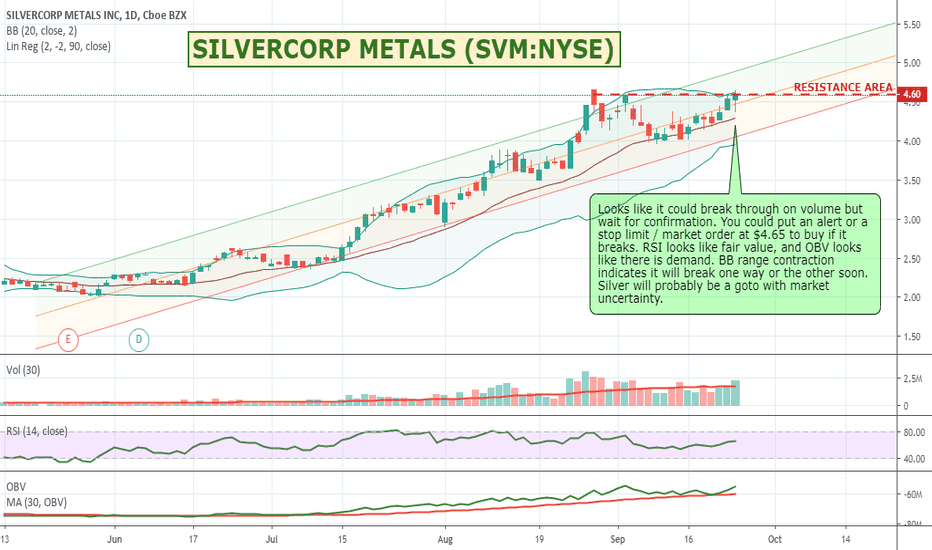

$SVN:NYSE - SILVERCORP METALS - Looking to breakout.Looks like it could break through on volume but wait for confirmation. You could put an alert or a stop limit / market order at $4.65 to buy if it breaks. RSI looks like fair value, and OBV looks like there is demand. BB range contraction indicates it will break one way or the other soon. Silver will probably be a goto with market uncertainty. Up 80% over the last 3 months. Worth adding to your watchlist.

Silvercorp Metals Inc. (Silvercorp) is a silver-producing Canadian mining company. The Company is engaged in the acquisition, exploration, development, and mining of silver-related mineral properties in China. The Company's segments include Mining, including projects, such as Henan Luoning, Hunan, Guangdong and Other, and Administrative, which includes Beijing and Vancouver. The Company is the primary silver producer in China through the operation of over four silver-lead-zinc mines in the Ying Mining District in Henan Province, China, including SGX, HZG, TLP, Haopinggou (HPG) and the LM mines. The Company also has commercial production at its Gaocheng (GC) silver-lead-zinc project in Guangdong Province. Silvercorp's principal products and source of sales are silver-bearing lead and zinc concentrates and some direct smelting ores. The Company sells all its products to local smelters or companies in the mineral products trading business.

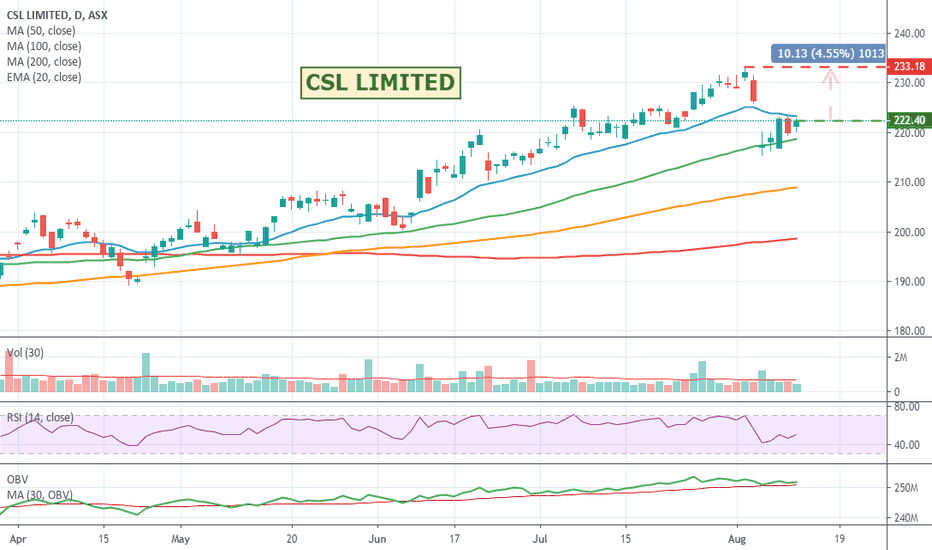

$CSL:ASX - CSL LIMITED - Mega whale showing signs of recoveryCSL is one of those mega stocks everyone used to have in their portfolios which is up something like 28,000% since the mid 90's. After the recent sell off it looks like its showing signs of recovery. Might be a day or two early, but certainly worth a watch.

Currently 739 buyers for 131,397 units vs 415 sellers for 80,974 units

CSL Limited is a biotherapeutics company that develops and delivers biotherapies. The Company's principal activities are research, development, manufacture, marketing and distribution of biopharmaceutical and allied products. Its segments include CSL Behring, Seqirus and CSL Intellectual Property. The CSL Behring segment manufactures, markets and develops plasma therapies (plasma products and recombinants). The Seqirus segment manufactures and distributes non-plasma biotherapeutic products. Seqirus manufactures, sells and distributes a range of vaccines, antivenoms and other pharmaceutical products in Australia and New Zealand. It also manufactures and markets in vitro diagnostic products through Seqirus immunohematology. The CSL Intellectual Property segment is engaged in licensing of intellectual property generated by the Company to unrelated third parties. The Company has facilities in Australia, Germany, Switzerland, the United Kingdom and the United States.

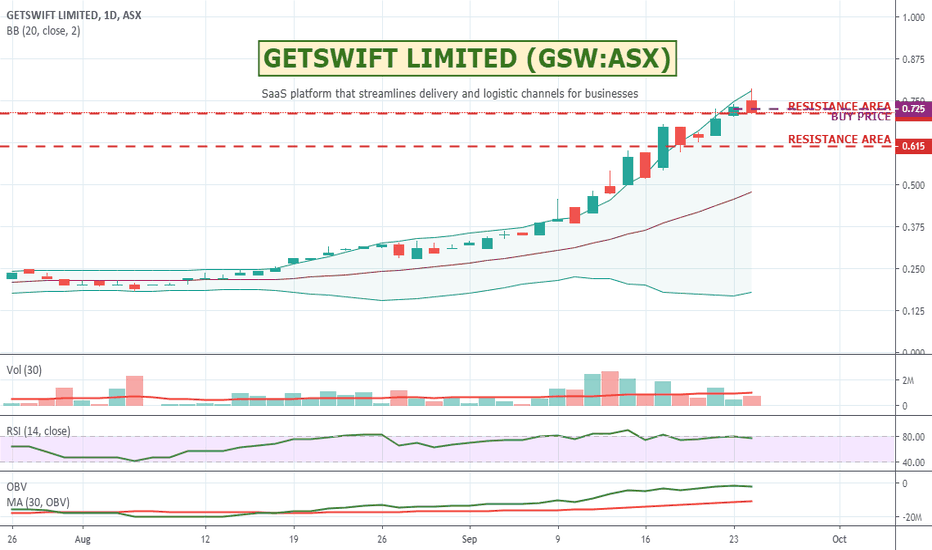

$GSW:ASX - GETSWIFT - SAAS logistics up 300% in 3 monthsGetswift seems to be getting back on its feet after last years downfall and seems to be heading the right way with perhaps more diligence around its reporting of signups. It has broken through two pretty strong resistance areas and seems to be holding its ground. This was a $4 stock at the end of 2017 so might be some upside if it can continue to build. Probably a bit overbought right at the moment but still has 81 buyers for 1,613,616 units vs 43 sellers for 1,081,959 units in the queue. Could be worth a watch.

GetSwift Limited is a logistics management software company. The Company provides a cloud-based software-as-as-service (SaaS) platform that streamlines delivery and logistic channels for businesses. The Company's delivery tracking software platform optimizes routes for businesses to deliver their products to end customers automates the delivery dispatch process. It provides real-time tracking and alerts to both the sender and the receiver via mobile devices. The Company's algorithm chooses the appropriate driver based on the location, mode of transport and distance to drop-off. It increases customer loyalty. It monitors the driver's service and performance. It monitors the customer feedback in real-time. It allows clients to place new delivery bookings via their own white labelled booking form. It captures photos, delivery notes and digital signature as proof of delivery on the driver application.

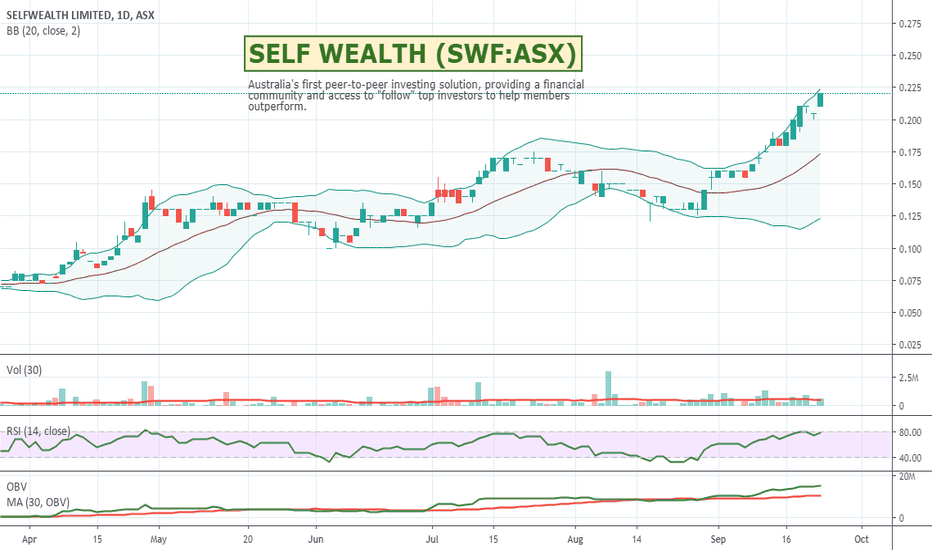

$SWF:ASX - SELF WEALTH - Having a good run. Up 200% YTD.Self Wealth has been having a great run over the last couple of months and is up over 200% year-to-date. Self Wealth is one of Australia's first peer-to-peer investing solution, providing a financial community and access to "follow" top investors to help members outperform. I quite like the idea of the whole gamification of investing and being able to more easily see who is genuinely getting good results. The whole fintech space - especially around different ways of investing is hot at the moment and more and more mobile first type applications are getting a lot of attention. Could be worth a watch.

Current demand has 50 buyers for 1,621,560 units vs 6 sellers for 171,051 units so could be hard to find a good entry, but often tightly held stocks do seem to do well if you can get into and hang onto them.

SelfWealth Ltd is an Australia-based company that provides a flat fee brokerage solution, SelfWealth TRADING. The Company offers various account types, including individuals, companies, trusts, self managed super fund (SMSFs) and joint accounts. SelfWealth provides a suite of benchmarking tools so users can compare their own portfolio to other investors in the Community based on performance, SafetyRating and WealthCheck Scores. Its platform allows users to trade in various securities, including ordinary shares, Australian listen property shares, Australian listed investment company shares, Australian listed debt securities and Australian exchange traded funds. The Company provides its SelfWealth TRADING application for mobile.