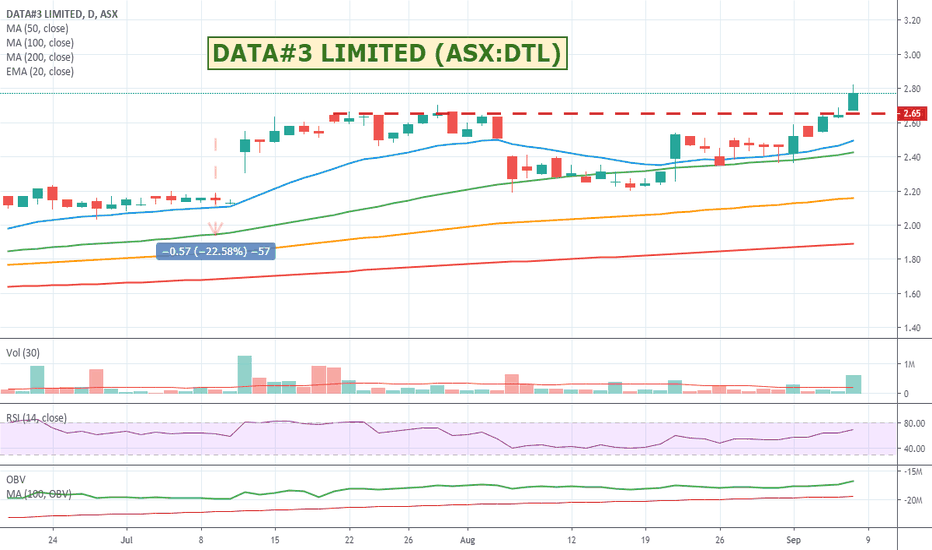

DATA#3 LIMITED (ASX:$DTL)Breakout of resistance area on good volume. Could be worth a watch on Monday if it heads the right way.

Got hammered pretty badly with the market downturn at the start of August so I'd probably suggest tighter stops if you take the trade.

Data#3 Limited is engaged in providing information technology solutions. The Company operates through two segments: Product, which is engaged in providing hardware and software licenses for its customers' desktop, network and data center infrastructure, and Services, which is engaged in providing consulting, project, managed and maintenance contracts, as well as workforce recruitment and contracting services, in relation to the design, implementation, operation, and support of information and communication technologies (ICT) solutions. Its technology offerings cover various areas, including consulting; which offers solutions to align people, processes and technology; data and analytics for business decisions; hybrid Information technology (IT)/cloud, which offers secure data center solutions; IT lifecycle management, which offers solutions to optimize customers' IT landscape; mobility, which connects to business networks and information, and security to manage cyber security.

Search in ideas for "zAngus"

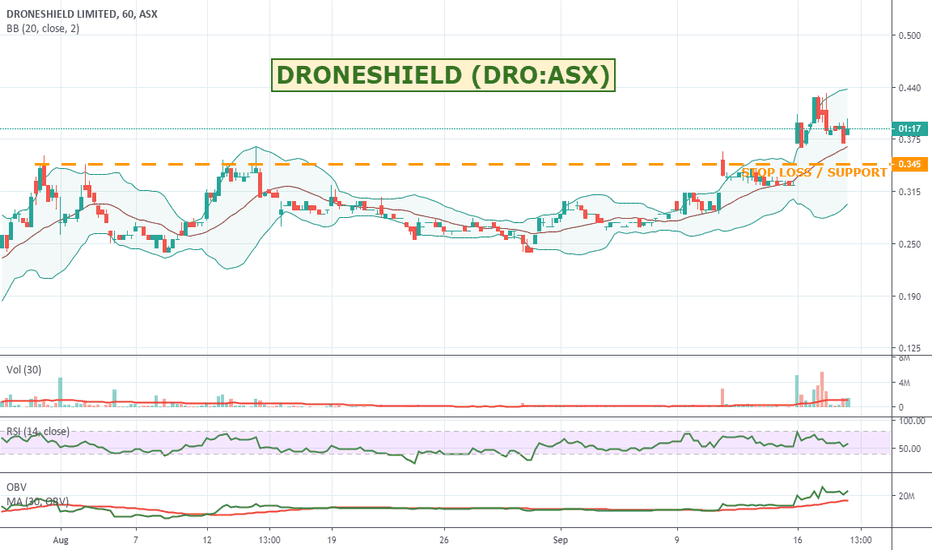

$DRO:ASX - DRONESHIELD - Anti Drone Player Have been watching DRO for a couple of days after the destruction of the oil fields by "drones". Figured the whole thing will get the conversation around anti-drone type technology a bit more forward in peoples minds with the budgets so figured it might be worth a look. Basically one big ad for them whether it was actually drones or not. It has had a bit of a pull back off the previous high after the news and the RSI and OBV both look good moving up. Worth a watch.

Current demand: 214 buyers for 3,696,752 units vs 76 sellers for 1,829,863 units

DroneShield Limited is a drone security technology company. The Company is engaged in the development and commercialization of hardware and software acoustic technology for drone detection. It has developed drone detection solution that protects people, organizations and infrastructure from intrusion from drones. The Company's products include Widealert Sensor, Faralert Sensor, Dronegun, Droneshield Baseprocessor, Droneshield User Interface and Dronesentry. The Company helps security force to identify unauthorized drones using real-time alerts and digital evidence collection. The Company's technology uses software and hardware, to detect drones of one kilometer away and alert users in real-time through multiple channels. The Company utilizes audio/acoustic signatures to detect drones. The Company offers solutions for airports, prisons, government, commercial venues, critical infrastructure and executive protection.

$CDA:ASX - CODAN - Breakout through resistance with volumeCodan looks to have pushed through that resistance area with a retest and new volume behind it. Moving averages spreading apart nicely. Global operator with government clients who don't tend to curb their spend i downturns. Might be worth a watch.

Current demand is 61 buyers for 106,346 units with 29 sellers for 47,241 units

Codan Limited develops electronics solutions for government, corporate, non-governmental organization (NGO) and consumer markets across the globe. The Company's segments include communications equipment, metal detection and tracking solution. The communications equipment segment includes the design, development, manufacture and marketing of communications equipment. The metal detection segment includes the design, development, manufacture and marketing of metal detection equipment. The tracking solutions segment includes the design, manufacture, maintenance and support of a range of electronic products and associated software for the mining sector. The Company's technologies include radio communications, metal detection and tracking solutions. It also serves aid and humanitarian organizations, mining companies, security and military groups, and artisanal miners. The Company operates in Australia, Canada, the United States, China, the United Arab Emirates, South Africa and Ireland.

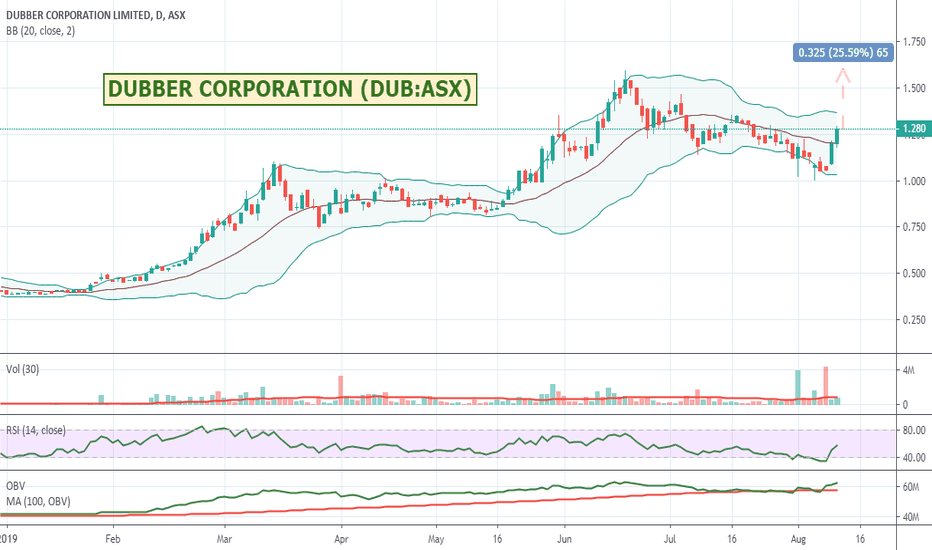

$DUB:ASX - DUBBER - Up almost 300% YTD and recoveringDubber has had some pretty good price momentum this year and looks to be recovering after the dip. Looks like there could be 25% or so in it to get back to old highs. Might be worth a watch.

Dubber is the world’s most scalable call recording service which has been adopted as core network infrastructure by multiple global leading telecommunications carriers in North America, Europe and Asia Pacific. Dubber is a disruptive innovator in the multibillion dollar call recording industry, its Software as a Service offering removes the need for hardware, productisation or capital expenditure. As the telecommunications sector moves towards Cloud services, Dubber has also been chosen by BroadSoft, Inc., a Cisco Systems Company, for its global leading Cloud telecommunications platform, BroadCloud, as the recording and voice data capture service for its network of telecommunication Service Provider Customers. Dubber provides the opportunity for the capture of voice data across these networks enabling further monetising opportunities, in addition to regulatory compliance, in the areas of analytics, artificial intelligence and ‘Big Data’ - expanding the potential market for call recording to every phone.

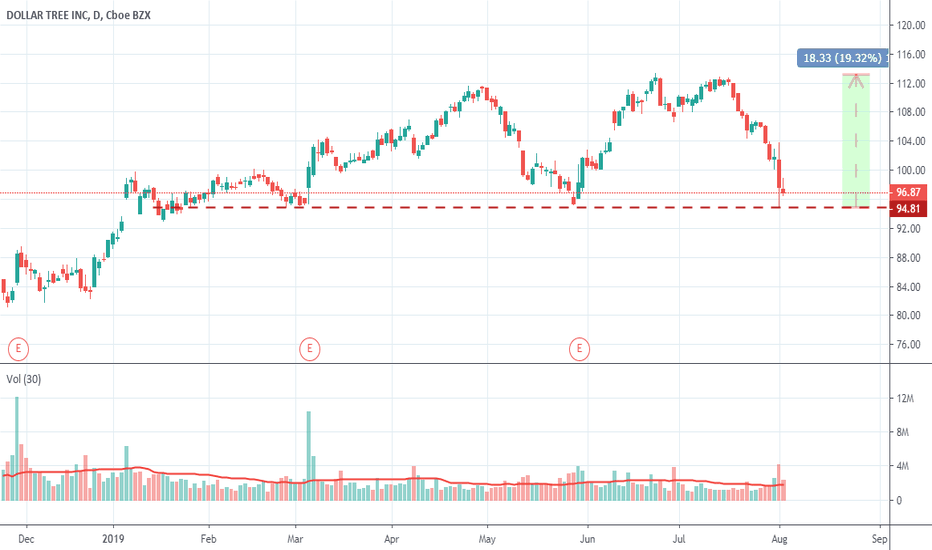

$DLTR:NASDAQ - DOLLAR TREE - Will it bounce on earnings?Dollar Tree is at a pretty strong support area at the moment and it has in the past bounced on top of its earnings the last few times so might be one to watch.

Could be 20% opportunity to get back up to its previous highs if it returns to range.

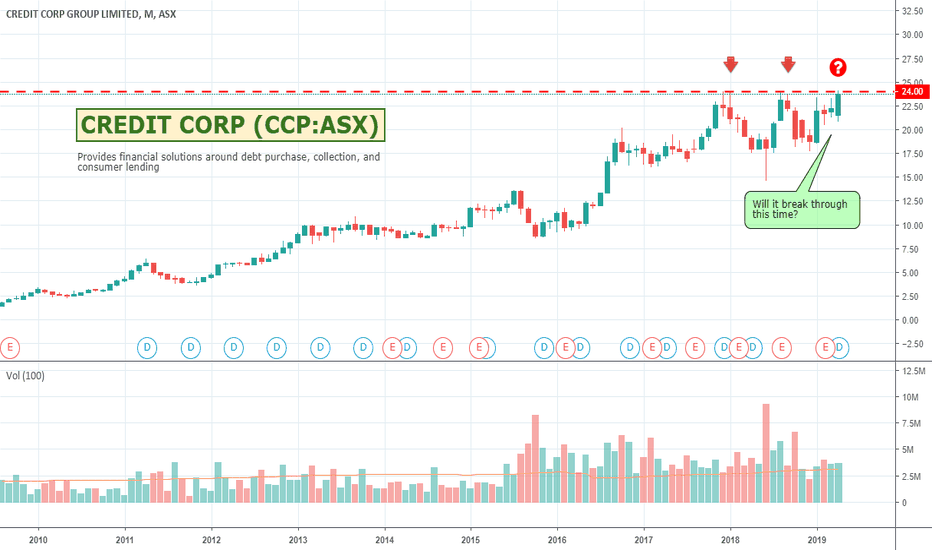

$CCP - CREDIT CORP - Retesting Resistance$CCP - CREDIT CORP - Retesting Resistance

Having a third crack at the $24 mark. Could be worth a look if it breaks.

About Credit Corp

Credit Corp Group Limited is an Australia-based company engaged in providing financial solutions. The Company is engaged in debt purchase, collection, as well as consumer lending. The Company's segments include Debt ledger purchasing and consumer lending. Its Debt ledger purchasing segment is engaged in purchasing consumer debts at discount to their face value from credit providers with the objective of recovering amounts in excess of the purchase price over the collection life cycle of the receivables. The Consumer lending business offers various financial products to credit-impaired consumers. In its debt purchasing business, it acquires past due consumer debts from the Australian and New Zealand banks, financial services utility and telecommunication providers. The Company's products include Wallet Wizard, CarStart Finance, ClearCash, Credit 2U and Trove Capital. CarStart Finance is a specialist financial service provider for the consumers seeking to purchase and finance a car.

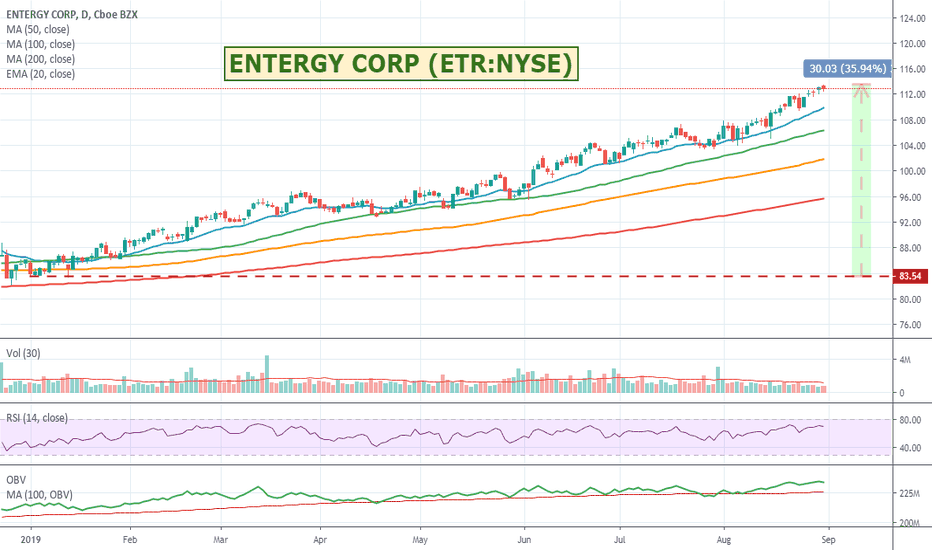

$ETR:NYSE - ENTERGY - Up 30% YTD and trending nicelyGood looking stock with a beautifully trending chart. Up 30% YTD and doesn't look to be slowing down. Possibly defensive. Worth a watch.

Entergy Corporation is a holding company. The Company is an integrated energy company engaged in electric power production and retail electric distribution operations. The Company operates through two business segments: Utility and Entergy Wholesale Commodities. The Utility segment includes the generation, transmission, distribution and sale of electric power to retail and wholesale customers in areas of Arkansas, Mississippi, Texas and Louisiana, including the City of New Orleans and operates a natural gas distribution business. The Entergy Wholesale Commodities segment includes the ownership, operation and decommissioning of nuclear power plants located in the northern United States and the sale of the electric power produced by its operating plants to wholesale customers. As of December 31, 2016, the Company owned and operated power plants with over 30,000 megawatts of aggregate electric generating capacity, including approximately 10,000 megawatts of nuclear-fueled capacity.

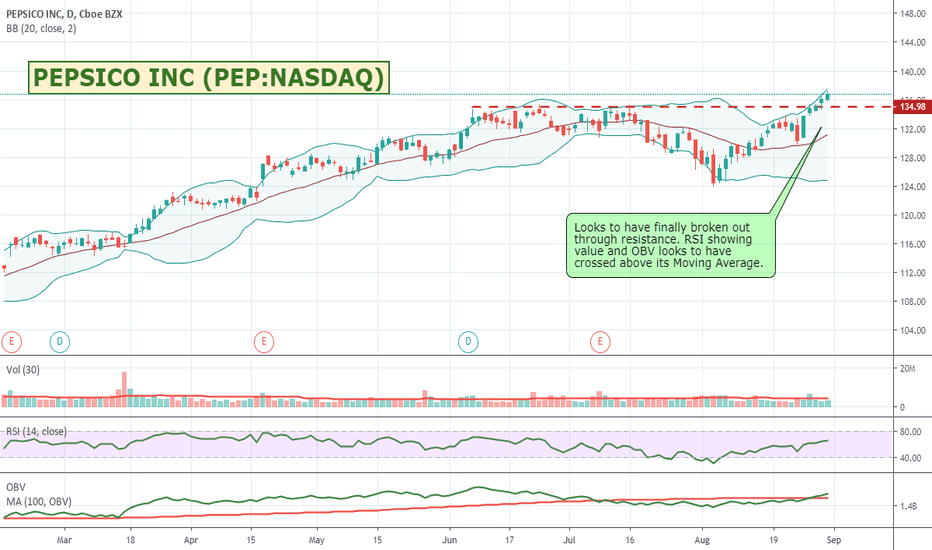

PEPSICO INC ($PEP:NASDAQ) - Breaking out through resistancePepsi and Coke are probably both companies that might do well in a market downturn as well and continuing their current upward run. Looks to have broken through its current resistance area and RSI still looks like there is still some upside available.

PepsiCo, Inc. is a global food and beverage company. The Company's portfolio of brands includes Frito-Lay, Gatorade, Pepsi-Cola, Quaker and Tropicana. The Company operates through six segments: Frito-Lay North America (FLNA), Quaker Foods North America (QFNA), North America Beverages (NAB), Latin America, Europe Sub-Saharan Africa (ESSA), and Asia, Middle East and North Africa (AMENA). The FLNA segment includes its branded food and snack businesses in the United States and Canada. The QFNA segment includes its cereal, rice, pasta and other branded food businesses in the United States and Canada. The NAB segment includes its beverage businesses in the United States and Canada. The Latin America segment includes its beverage, food and snack businesses in Latin America. The ESSA segment includes its beverage, food and snack businesses in Europe and Sub-Saharan Africa. The AMENA segment includes its beverage, food and snack businesses in Asia, Middle East and North Africa.

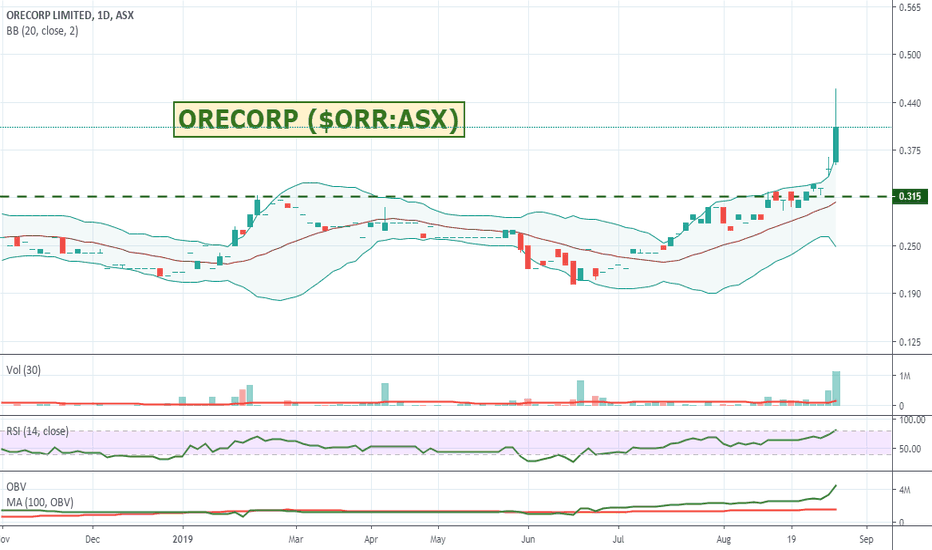

$ORR:ASX - ORECORP - Breakout on good volume with no newsOrecorp has taken off on no news that I could see. Be interesting to see if it pulls back tomorrow or keeps running. Current demand has 37 buyers for 1,108,618 units with only 12 sellers for 231,254 units so might be worth a watch.

OreCorp Limited is a development company. The Company is engaged in mineral exploration for gold and precious metals in Africa, including the completion of a scoping study (Scoping Study) and commencement of a pre-feasibility study (PFS) on the Nyanzaga Gold Project Joint Venture (Nyanzaga) in Tanzania. The Company's Nyanzaga Gold Project is located at northwest Tanzania and the Akjoujt South Nickel-Copper Project in Mauritania. The Nyanzaga Project consists of over 30 contiguous Prospecting licenses and renewal applications covering a combined area of over 270 square kilometers. The Akjoujt South Project consists of over two licenses (1415 and 1416) and covers over 460 square kilometers. The Cheriton's East Project (E77/1223) is located over 50 kilometers southeast of Marvel Loch in the Eastern Goldfields of Western Australia. The Cheriton's East Project covers an area of approximately 14.6 square kilometers.

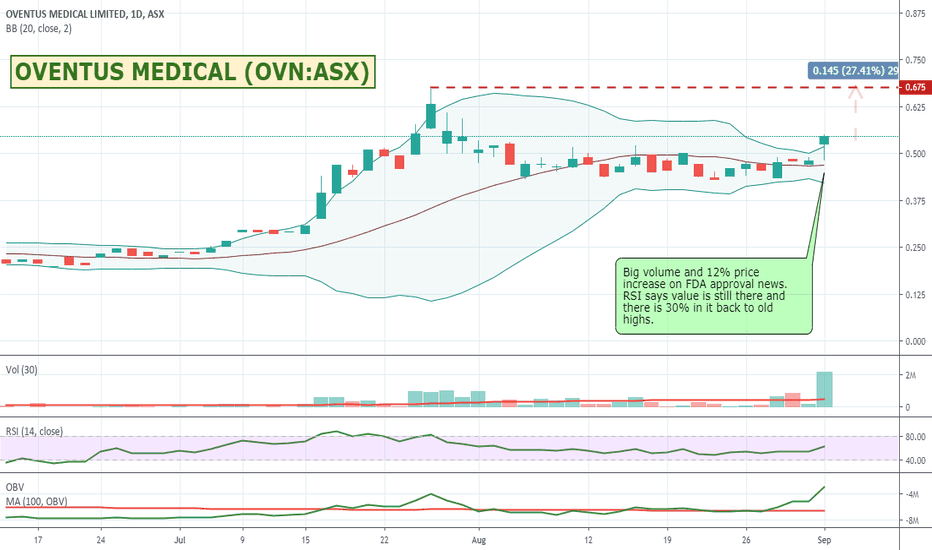

$OVN:ASX - OVENTUS MEDICAL - Breakout on FDA approval grantedI'm quite late to the party on this one as it is already up 12% on the news of FDA approval being granted. My thinking is that it has been around 30% higher previously so there could still be more upside to this stock as more news services pick up and distribute the announcement. From a business perspective as things like obesity rates increase there will be more and more people with interrupted sleep as well as snorers with partners willing to smother them in their sleep. Morningstar Quant valuations put it above 55 cents which is somewhat reassuring as well. Could be worth a watch...

Oventus Medical Limited is an Australia-based medical device company that is commercializing a suite of oral appliances for the treatment of sleep apnea and snoring. The principal activities of the Company consist of the commercialization and distribution of the O2Vent Mono in Australia, as well as development of a pipeline or products to treat segments of the snoring and sleep and apnea market. These segments include those that do not comply or adhere to existing treatment options due to nasal obstruction and/or inability to utilize the continuous positive airway pressure (CPAP) mask. Its devices have an airway within the device that delivers air to the back of the mouth bypassing multiple obstructions from the nose, soft palate and tongue. The O2Vent is designed to allow nasal breathing when the nose is unobstructed. It uses three-dimensional (3D) metal printing technologies to manufacture medical devices for the treatment of sleep apnea.

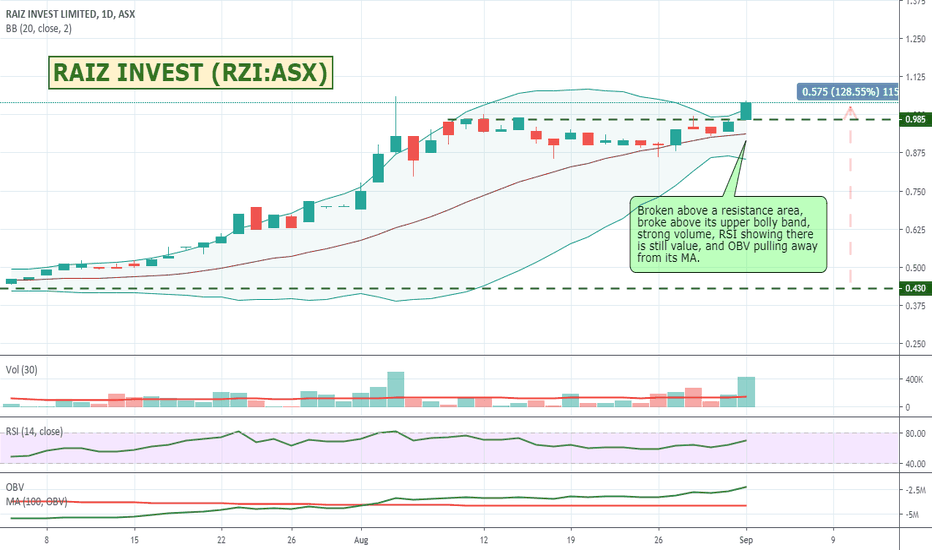

$RZI:ASX - RAIZ INVEST - Breakout with volumeI like the business premise of this fintech of seamlessly investing spare change into stocks to help build a position you would barely notice over time. The whole passive investing approach is quite clever. The stock has broken above a resistance area, broke above its upper bolly band, strong volume, RSI showing there is still value, and OBV pulling away from its MA. I also like that it has broken above that $1 psychological ceiling. All good signs that this could be well worth a watch.

Note however it is a pretty niche type solution so not sure how much upside, but it is up almost 140% or so this financial year and the chart looks like there is still some strength there. Again, I like the business concept.

Raiz Invest Limited (RZI) provides financial services through its mobile first microinvesting platform which offers its customers an easy way to regularly invest either small or large amounts of money using the Raiz application or through the Raiz website. Raiz operates in the Australian retail financial services industry which provides investing and financial services and wealth products to Australian retail customers.

Demand: 51 buyers for 287,924 units 16 sellers for 216,812 units

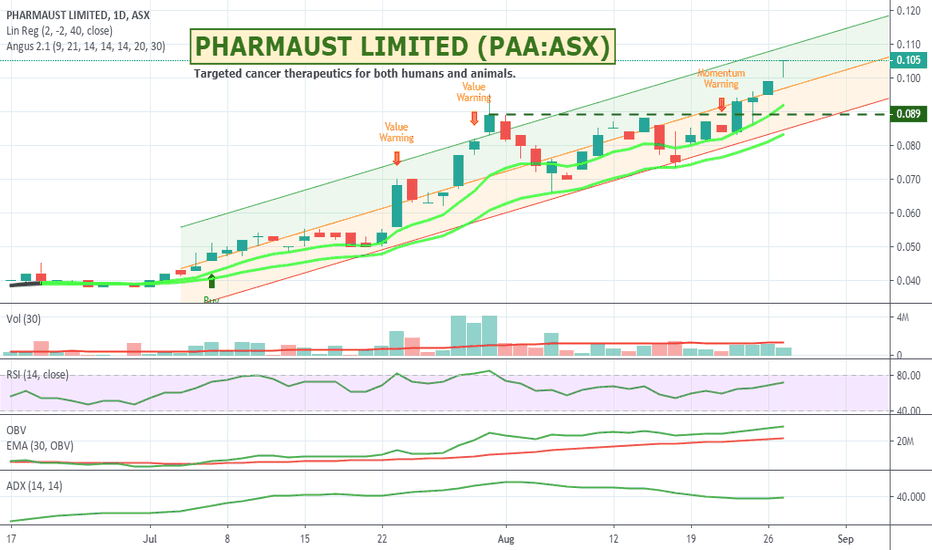

$PAA:ASX - PHARMAUST - Up 170% over the last 3 monthsPharmAust is a clinical-stage company developing targeted cancer therapeutics for both humans and animals through re-purposing marketed drugs lowering the risks and costs of development. They look to have broken through a previous resistance area and could be worth a watch.

Current demand shows 76 buyers for 3,015,228 units with only 19 sellers for 2,181,188 units.

The principal activities of the Company are to develop its own drug discovery intellectual property, namely approximately three platforms for the treatment of different types of cancers in humans and animals, as well as providing specialized medicinal and synthetic chemistry services on a contract basis to clients. The Company's segments are Corporate and Pharmaceutical. The Pharmaceutical segment provides products and services in synthetic and medicinal chemistry to the drug discovery and pharmaceutical industries. The Corporate segment covers all the corporate overhead expenses. Its subsidiaries include Pitney Pharmaceuticals Pty Ltd, which is engaged in business of developing therapeutic cancer products, and Epichem Pty Ltd, which offers a range of rare and hard to find pharmaceutical impurities, degradants and metabolites of active ingredients and excipients, particularly for over-the-counter and generic drugs.

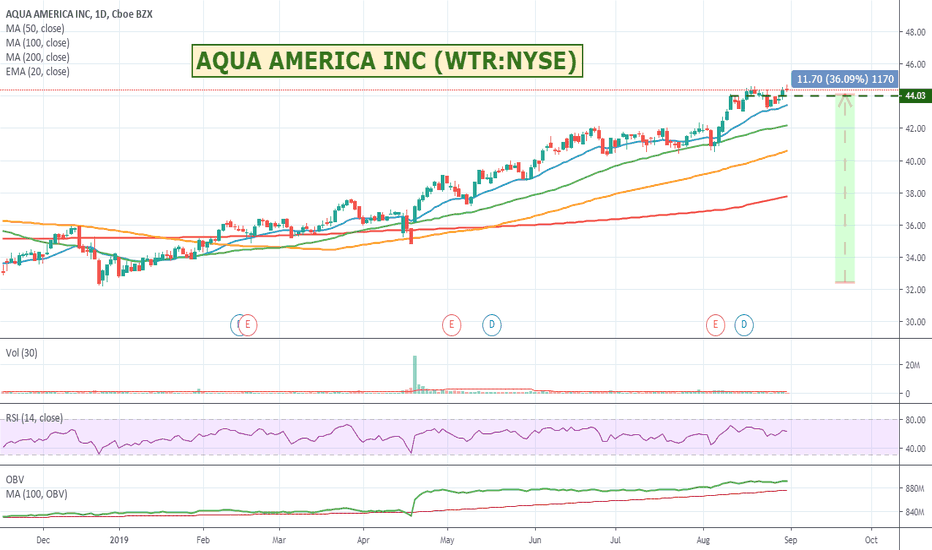

$WTR:NYSE - AQUA AMERICA INC - Potential defensive play?Could be a good play if the market heads the wrong way. Trending nicely at a minor breakout area. Worth a watch.

Aqua America, Inc. is a holding company. The Company is engaged in providing water or wastewater services concentrated in Pennsylvania, Ohio, Texas, Illinois, North Carolina, New Jersey, Indiana and Virginia. The Company is the holding company for its primary subsidiary, Aqua Pennsylvania, Inc. Its market-based activities are conducted through Aqua Resources, Inc. (Aqua Resources) and Aqua Infrastructure, LLC (Aqua Infrastructure). Aqua Resources, Inc. provides water and wastewater service through operating and maintenance contracts with municipal authorities and other parties close to its utility companies' service territories, and offers, through a third party, water and sewer line repair service and protection solutions to households. Aqua Infrastructure provides non-utility raw water supply services for firms in the natural gas drilling industry. The Company owns several wastewater collection systems that convey the wastewater to a municipally-owned facility for treatment.

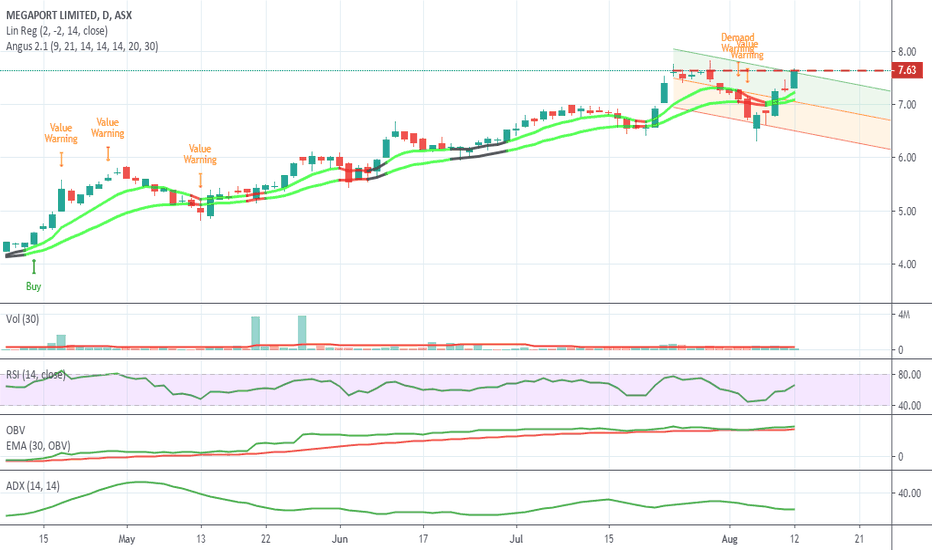

$MP1:ASX - MEGAPORT - Will it break resistance?Megaport has had a pretty good run this year and is back up at its resistance area after a pull back. All the indicators look good. Volume perhaps a little light. Could be worth a watch.

Megaport Limited (MP1) is provider of elasticity connectivity and network services interconnection across any location, to any services by SDN based, ubiquitous Ethernet fabric allowing our customers wider coverage, speed to market while reducing costs and enabling real-time provisioning across one platform.

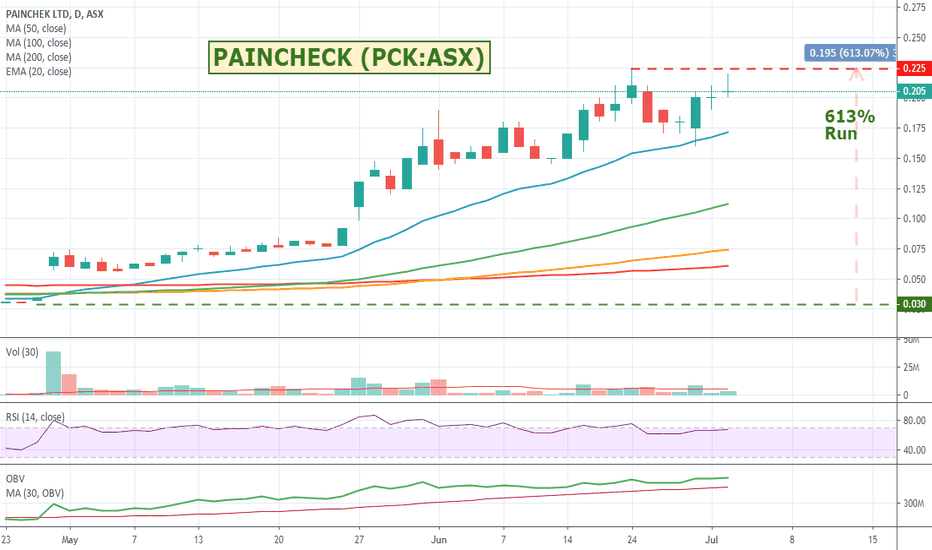

$PCK - PAINCHECK - 600% run since the end of AprilPaincheck is a company I probably trade more emotively than technically as I find their combination of smart phones and AI based pain detection one of those great and obvious innovative matches made in technology heaven. You only have to watch as Apple adds more and more health monitoring hardware and software to their portable and wearable devices. They are both gradually working their way up to becoming an early Star Trek Medical Tricorder and I keep waiting for someone like an Apple to simply turn around and buy Paincheck and integrate their technology into all of their devices.

Paincheck announced today that they are going to try and apply their technology to detecting pain in infants partnering with Melbourne's Murdoch Children’s Research Institute (MCRI)which is the largest child health research institute in Australia and one of the top three worldwide.

About the existing PainChek Adult App

The PainChek Adult App is a clinically validated and regulatory cleared technology that uses automated facial recognition and analysis to identify, quantify and monitor pain in adults that are unable to verbalise their pain. The PainChek Adult is under annual contracts covering more than 80 aged care facilities which are in the process of being implemented across Australia helping to better assess pain severity levels for residents living with dementia and cognitive impairment.

In the past few months the Australian Federal Government announced it will invest $5M to facilitate the implementation of the company’s pain recognition app in Australian Aged Care Facilities.

The Company has also entered the UK market through a distribution agreement with leading Aged Care software provider Person Centred Software.

It is a small company and pretty volatile stock so I tend to run it with very wide / or no stops. One of those buy it and forget it and hope someone buys it type stocks.

Do your own research of course, but could be worth a watch.

$WAF - WEST AFRICAN RESOURCES - Running on market weaknessCurrently has a bit of interest with 172 buyers for 2,205,452 units vs 58 sellers for 1,504,738 units. Looks to have broken above an old resistance area on the daily and weekly charts with the current run on gold. Good chunky bit of volume behind it but might be a bit extended on the RSI. Could pull back but I like the look of the moving averages starting to cross back over. Worth a watch.

West African Resources Limited is a gold exploration company. The Company's principal activity is mineral exploration and feasibility study work focusing primarily on the Boulsa Gold project within Burkina Faso and Niger. The Company has approximately 100% interest in the Tanlouka gold exploration permit in Burkina Faso. The Company is targeting gold production at its Mankarga 5 project in Burkina Faso. The project includes M1 South Prospect and M1 North Prospect. The Company also has over 100% interest in the Sartenga Permit. The Sartenga copper-gold-molybdenum project is a porphyry system. The inferred mineral resources contain approximately 174,000 tons of copper and over 651,000 ounces of gold. The Moktedu prospect is located in the southwestern part of the Boulsa Project. The prospect covers approximately 10 kilometers of strike and it is confined within a northeast trending regional shear. The Company's subsidiaries include Wura Resources Pty Ltd SARL and Swan Resources SARL.

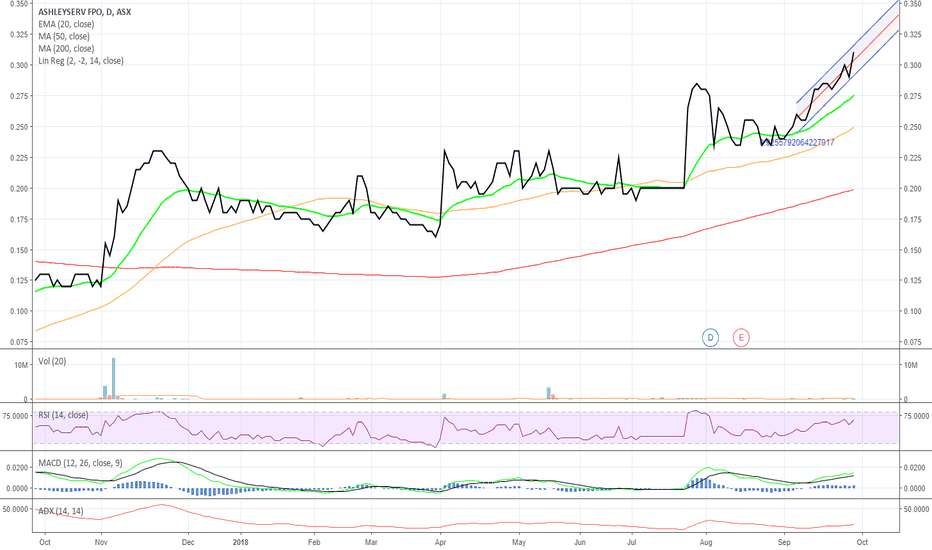

$ASH ASX - Ashley Services Group Might have a bit of momentum coming through. Check your charts. DYOR. Stops in.

Ashley Services Group Limited is engaged in the provision of labor hire (including retirement) and training services. The Company's segments include Labour Hire and Training. The Company offers recruitment services, such as permanent, temporary and contract placements. It offers various courses for a range of industry sectors from aged care, children's services, food/meat processing to transport and logistics. The Company provides technical training to the telecommunications and electronic security industries. The Company also provides work-based training and classroom programs in hospitality, business, leadership and management, food processing and retail sectors. The Company serves warehouse, logistics, fast-moving consumer goods (FMCG), food, pharmaceutical, manufacturing and trades industries. Its labor hire brands include Action Workforce and Concept Engineering. The Company's training brands include Ashley Institute of Training, Integracom and Tracmin, among others.

$S2R:ASX - S2 RESOURCES - Nice momentum run. Up 144% YTD.S2R if it wiggles the right way when trading opens could be worth a look.

Currently 43 buyers for 2,195,705 units vs 18 sellers for 576,671 units.

S2 Resources Limited is engaged in mineral exploration. The Company operates through three segments: Scandinavian exploration activities, Australian exploration activities and Unallocated. The Scandinavian exploration activities segment includes exploration and evaluation of mineral tenements in Finland and Sweden. The Australian exploration activities segment includes exploration and evaluation of mineral tenements in Australia. The Company's projects include Polar Bear Project and Norcott Project. The Polar Bear project spans an area of approximately 150 square kilometers, located between Higginsville and Norseman. It has over 360 square kilometers of ground under application adjacent to the Polar Bear project. It holds an interest in over six exploration licenses, covering approximately 100 square kilometers of ground adjacent to the Polar Bear project (the Eundynie Joint Venture).

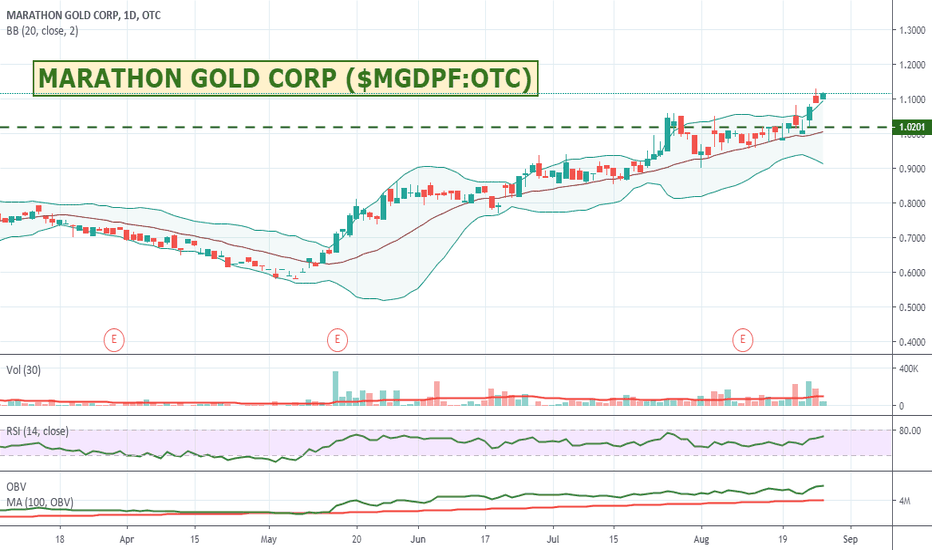

$MGDPF:OTC - MARATHON GOLD - Momentum runner up almost 100% YTDMarathon Gold Corp (Marathon) is a Canada-based company engaged in the acquisition, exploration and development of natural resource properties located in North America. The Company's projects include Valentine gold Camp, Baie Verte gold property, The Bonanza Mine and The Gold Reef property. The Valentine Gold Camp is in west central Newfoundland and includes over four zones with existing mineral resources, the Leprechaun, Marathon, Sprite and Victory Deposits. The Bonanza Mine is located in Baker County in northeastern Oregon, the United States. The Gold Reef property is an exploration property consisting of approximately 10 hectares of claims located near Stewart, British Columbia. The Company has royalty interest in the Golden Chest property.

Broken above an old resistance area. Indicators look good and currently rated a STRONG BUY by the Trading View bots. Worth a watch.

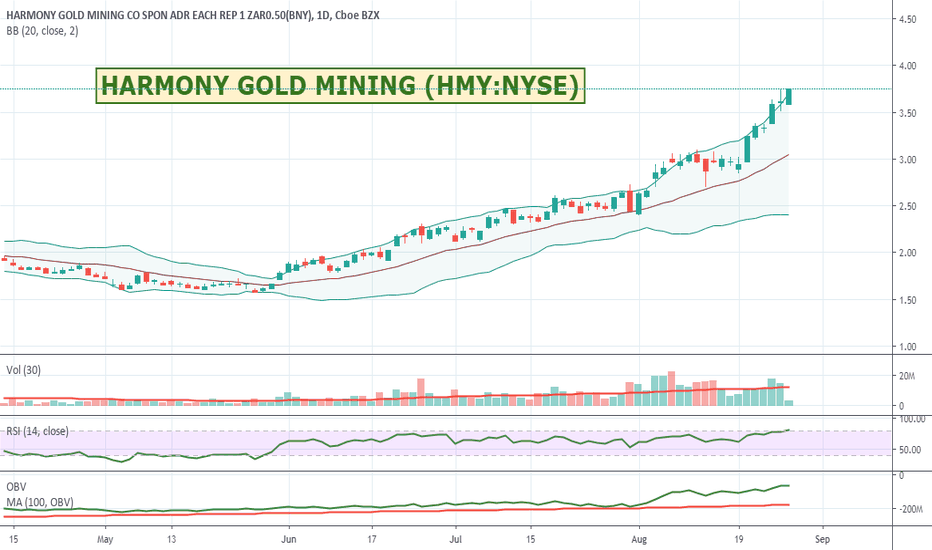

$HMY:NYSE - HARMONY GOLD MINING - Running nicelyHarmony has been having a great run and looks good on all the indicators except the RSI which at 80 is pretty hot. Would be better to look for an entry when the RSI comes back to around 70 or so, but certainly worth adding to your watch lists if you are interested in Gold stocks.

Harmony Gold Mining Company Limited, through its subsidiaries, is engaged in gold mining and related activities, including exploration, extraction and processing. The Company's segments include South Africa Underground, Surface, and International. The South Africa Underground segment includes Kusasalethu, Doornkop, Phakisa, Tshepong, Masimong, Target 1, Bambanani, Joel, Unisel and Target 3. The Surface segment comprises the Company's other surface operations. The Company's International segment comprises Hidden Valley Project. The Company has operations in South Africa and Papua New Guinea (PNG). The Company's principal product is the Gold bullion. The Company's exploration projects include Golpu project and Kili Teke prospect. The Company has approximately nine underground mines, one open pit operation and several surface sources in South Africa. The Company's subsidiaries include Lydenburg Exploration Limited, Tswelopele Beneficiation Operation (TBO) and Harmony Copper Limited.

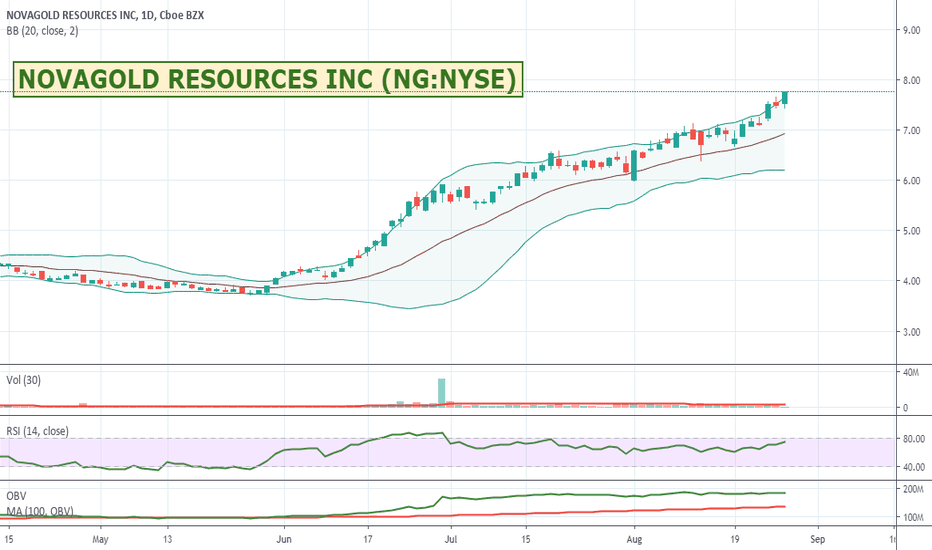

$NG:NYSE - NOVAGOLD RESOURCES - Good run with positive volumeNovagold Resources Inc. is a mineral exploration company. The Company is engaged in the exploration and development of mineral properties. The Company's segments include the Donlin Gold project in Alaska, the United States and the Galore Creek project in British Columbia, Canada. The Company operates in the gold mining industry, primarily focused on advancing permitting of the Donlin Gold project in Alaska. The Company has its interest in the Copper Canyon copper-gold-silver property that is adjacent to the Galore Creek project. The Donlin Gold property is located in the Kuskokwim region of southwestern Alaska on private, Alaska Native-owned mineral and surface land, and Alaska state mining claims. The Galore Creek project is a copper-gold-silver project located in northwestern British Columbia. The Company's subsidiaries include NOVAGOLD Canada Inc., Copper Canyon Resources Inc., NOVAGOLD U.S. Holdings Inc., NOVAGOLD Resources Alaska Inc. and AGC Resources Inc.

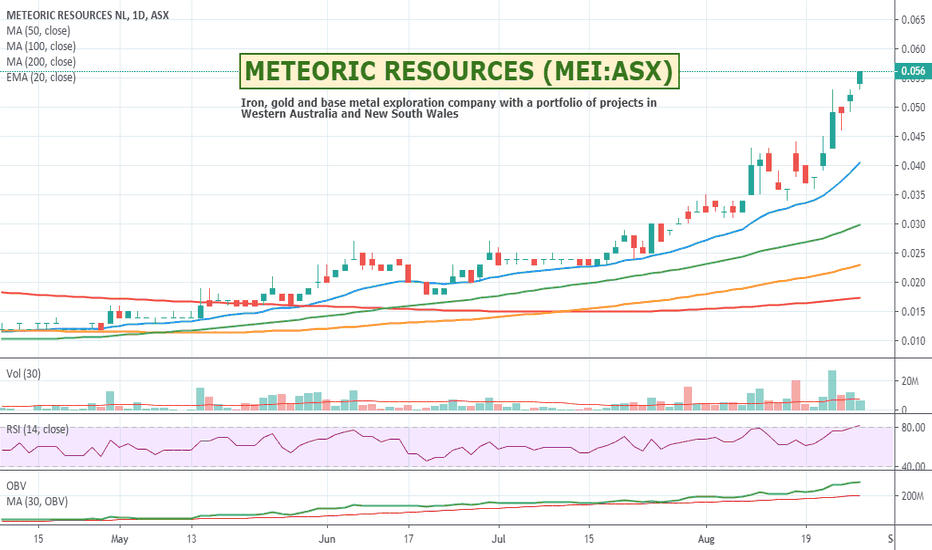

$MEI:ASX - METEORIC RESOURCES - 230% gain in 3 monthsMeteoric Resources is an iron, gold and base metal exploration company with a portfolio of projects in Western Australia and New South Wales. They have been having a nice steady run over the last 3 months and could well be worth a watch. RSI might be a little over extended so watch for a pull back.

Current demand looks strong with 156 buyers for 21,536,802 units vs 59 sellers for 11,541,884 units

Meteoric Resources NL is a mineral explorer. The Company is engaged in exploration of mineral tenements in Western Australia, Northern Territory and Spain. It holds copper-gold, iron and diamond projects in Australia, and a graphite project under application in Spain. Its projects include Webb, Barkly, Warrego North, Perseverance and Cortegana. It is engaged in exploring the kimberlite field in the Webb Diamond Joint Venture. It holds a granted exploration license (EL23764) over magnetic and gravity anomalies near the old Warrego copper-gold mine in the Tennant Creek mineral field. Its Barkly Copper-Gold Project is located approximately 30 kilometers east of the town of Tennant Creek in the Northern Territory. It holds interest in approximately nine granted mineral leases in the Perseverance Project. It has lodged an Investigation Permit application over several crystalline flake graphite occurrences in the Aracena Metamorphic Belt, Huelva province in the Cortegana Graphite Project.

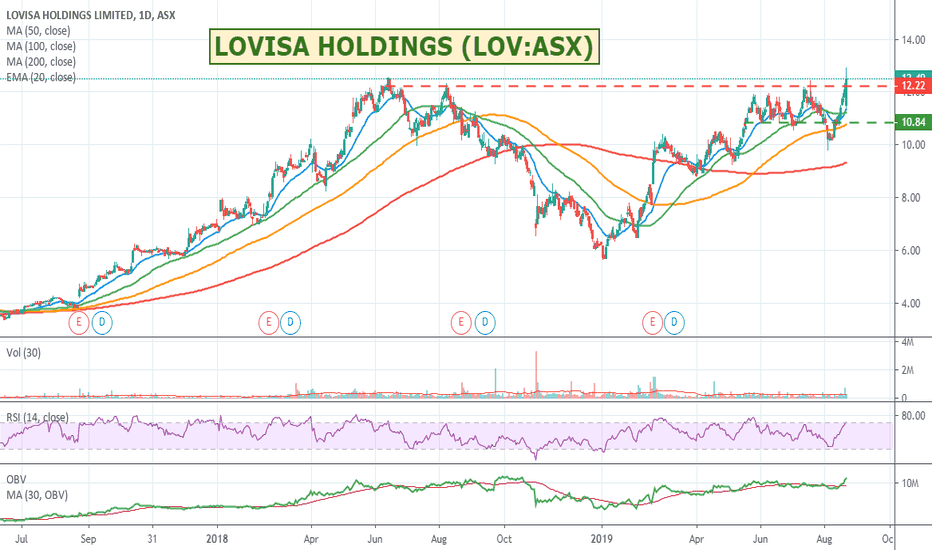

$LOV:ASX - LOVISA - Because every portfolio needs a little lovNot the kind of stock I would normally trade, but I know that Angie Ellis an Aussie trader with a pretty good comp track record is bullish on it. Earnings came out today and the market has been supportive. It is at an interesting resistance area and with a break above it could potentially run for a bit. Worth a watch.

Market Capitalization $1.275B

EBITDA (TTM) $61.188M

Gross Profit (FY) $138.924M

Total Revenue (FY) 217.01M

Lovisa Holdings Limited is engaged in the retail sale of fashion jewelry and accessories. The Company's segments include Australia & New Zealand, which is engaged in the retail sale of women's jewelry and accessories in Australia and New Zealand, and Rest of the World, which is engaged in the retail sale of women's jewelry and accessories in Singapore, South Africa, Malaysia and the United Kingdom. The Rest of the World segment also includes the Company's franchise stores in the Middle East. The Company utilizes daily inventory monitoring software and airfreight to move product to store locations within approximately 48 hours from its centrally located warehouses in Melbourne and Hong Kong. The Company has over 230 retail stores. Its each store contains an average of over 2,500 product lines. It operates in Australia, New Zealand, Singapore, Malaysia, South Africa and the United Kingdom, and franchised stores in the Middle East (Kuwait, the United Arab Emirates and Saudi Arabia).