$SUI:NYSE - SUN COMMUNITIES - Manufactured communitiesSun Communities popped up on one of my momentum scans and as well as an outstanding chart and year on year price growth, I really like the concept. Housing prices here in Australia have gone crazy with $1M+ needed to own a property in most major cities in Australia. I really like the idea of as alternative to apartments or tiny homes a happy medium using modern prefabricated materials to create comparatively inexpensive but comfortable housing. I can imagine this will be a more and more a desirable option. Well worth a watch.

$13B USD company :)

EBITDA (TTM) $591.087M

Gross Profit (FY) $650.935M

Last Year Revenue (FY) $1.127B

Sun Communities, Inc. is a self-administered and self-managed real estate investment trust (REIT). The Company is a fully integrated real estate company, which, together with its affiliates and predecessors, has been in the business of acquiring, operating, developing, and expanding manufactured housing (MH) and recreational vehicle (RV). As of December 31, 2016, it owned and operated or had an interest in a portfolio of properties located throughout the United States and Ontario, Canada, including 226 MH communities, 87 RV communities, and 28 properties containing both MH and RV sites. The Company operates through two segments: Real Property Operations and Home Sales and Rentals. The Real Property Operations segment owns, operates, or has an interest in a portfolio, and develops MH communities and RV communities throughout the United States and is in the business of acquiring, operating, and expanding MH and RV communities.

Search in ideas for "zAngus"

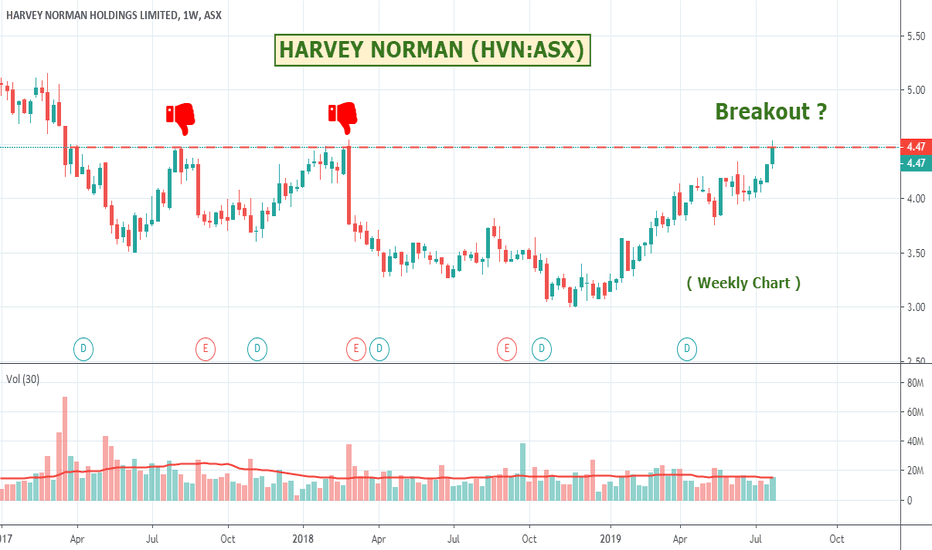

$HVN:ASX - HARVEY NORMAN - Breakout?Harveys has been running well in the absence of any real competition from Amazon having arisen. It's a long way off old historic highs and looks like it might be able to breakout. There was a minor pull back the previous day so if its up today and volume appears it could be worth a look. Might get rejected as before so buyer beware :)

Harvey Norman Holdings Limited (HVN) engages in franchising operation, integrated retail business, property development and digital system. HVN operates under a franchise system in Australia and operates wholly-owned or controlled stores in overseas markets.

Market Depth: 82 buyers for 336,250 units vs 74 sellers for 202,752 units

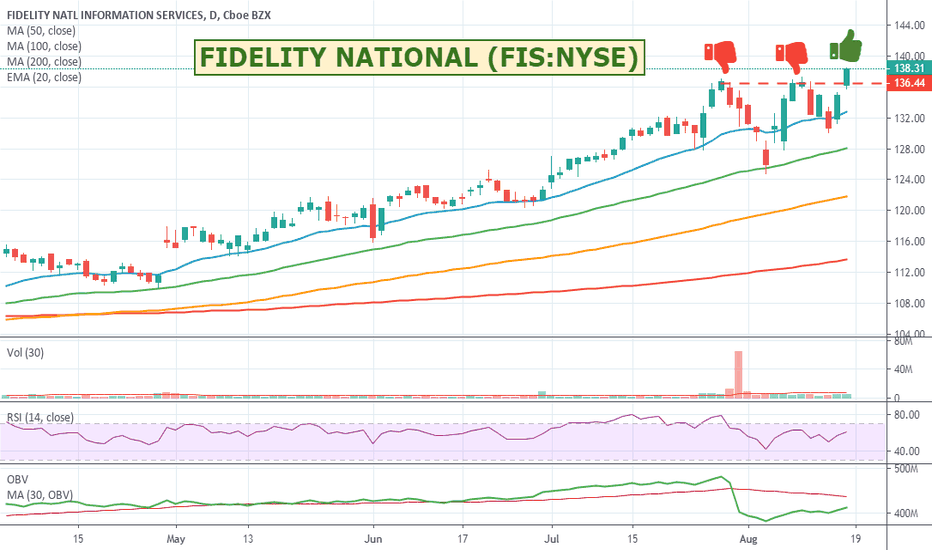

$FIS:NYSE - FIDELITY NATIONAL - Momentum stock at resistanceI picked up some Fidelity stocks when they bought out World Pay and so far they have been performing reasonably well up around 35% since the start of the year. Might be worth a watch if they can break above the current resistance area and resume their march.

Fidelity National Information Services, Inc. (FIS) is a financial services technology company. The Company operates through three segments: Integrated Financial Solutions (IFS), Global Financial Solutions (GFS), and Corporate and Other. The IFS segment is focused on serving the North American regional and community bank and savings institutions market for transaction and account processing, payment solutions, channel solutions, digital channels, risk and compliance solutions, and services. The GFS segment is focused on serving the financial institutions and/or international financial institutions with a range of capital markets and asset management and insurance solutions, as well as banking and payments solutions and consulting and transformation services. Its business solutions in Corporate and Other segment include Public Sector and Education, Global Commercial Services and Retail Check Processing.

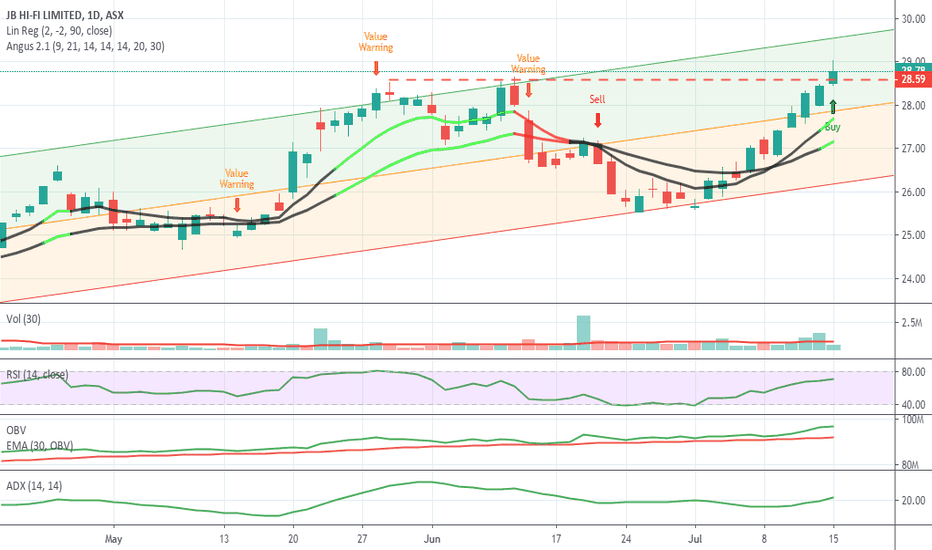

$JBH:ASX - JB HIFI - 3rd Test of Resistance. Breakout?This is its 3rd time that it has tested that $27.60 resistance area and looks to have finally broken through. Looks like the momentum is there finally and with 93 buyers for 72,442 units vs 36 sellers for 18,791 units hopefully it will hold and continue its run. Might be worth a watch.

JB Hi-Fi Limited (JB Hi-Fi) is engaged in the retailing of home consumer products. The Company has two segments: Australia and New Zealand. It is involved in the sale of consumer electronics products and services, including televisions, audio equipment, computers and cameras; software, including Compact Discs (CDs), Digital Versatile Discs (DVDs), Blu-ray discs and game; whitegoods, cooking products and small appliances; telecommunication products and services; musical instruments, and digital video content. The Company also offers information technology and consulting services. The Company has approximately 60 JB Hi-Fi Home branded stores, including over four in New Zealand. The Company operates approximately 190 physical stores. The Company offers various solutions, such as corporate, government and education sales of products and services, and insurance replacements. The Company also offers JB Hi-Fi Home roll-out. The Company has approximately 40 stores with small appliances.

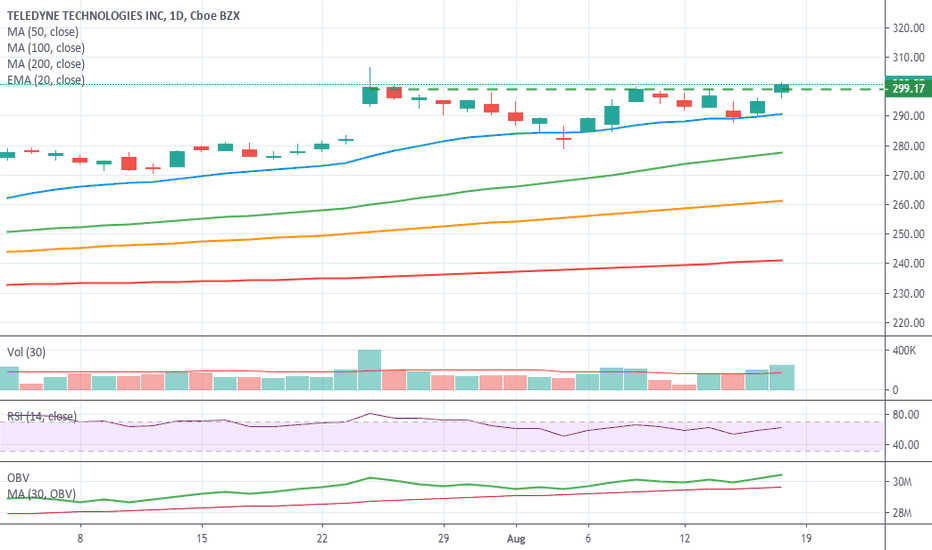

$TDY:NYSE - TELEDYNE TECHNOLOGIES - Zacks Pick of the DayTeledyne has been having a great run year-to-date. It appeared on the Zacks Pick of the Day list and according to their site the average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +24.80% per year since 1988 so thought I'd have a quick look. I think that I'd want to see another up day to get confirmation of the break but good looking stock performing well so far. Worth a watch.

Teledyne Technologies Incorporated provides enabling technologies for industrial growth markets. The Company's segments include Instrumentation, Digital Imaging, Aerospace and Defense Electronics, and Engineered Systems. Instrumentation segment provides monitoring and control instruments for marine, environmental, industrial and other applications, as well as electronic test and measurement equipment. Digital Imaging segment includes sensors, cameras and systems, within the visible, infrared, ultraviolet and X-ray spectra. Aerospace and Defense Electronics segment provides electronic components and subsystems and communications products, including defense electronics. Engineered Systems segment provides systems engineering and integration and technology development, as well as manufacturing solutions.

$SAM:NYSE - BOSTON BEER COMPANY - Good momentumBoston Beer company has been running well and continuing to set new highs. Broken out of a pretty strong resistance area. Might be worth a watch.

The Boston Beer Company, Inc. is a craft brewer in the United States. The Company is engaged in the business of producing and selling alcohol beverages primarily in the domestic market and in selected international markets. The Company operates through two segments: Boston Beer Company segment, and A&S Brewing Collaborative segment. The Boston Beer Company segment comprises of the Company's Samuel Adams, Twisted Tea, Angry Orchard and Truly Spiked & Sparkling brands. The A&S Brewing Collaborative segment comprises of The Traveler Beer Company, Coney Island Brewing Company, Angel City Brewing Company and Concrete Beach Brewing Company. Both segments sell low alcohol beverages. The Company produces malt beverages and hard cider at the Company-owned breweries and under contract arrangements at other brewery locations. As of December 31, 2016, the Company sold its products to a network of approximately 350 wholesalers in the United States and to a network of distributors.

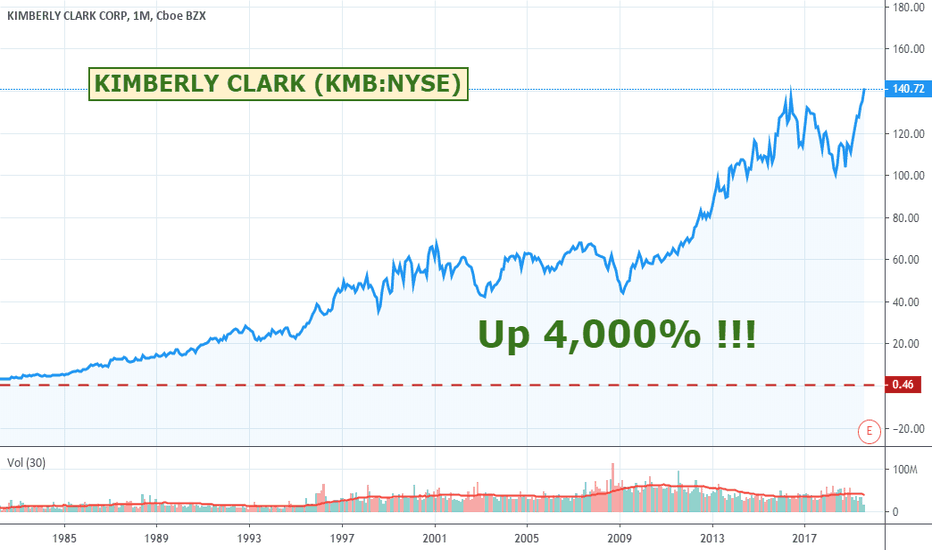

$KMB - KIMBERLY CLARK - Up 4,000% !Kimberly Clark is another mega stock that has been having a good consistent run for years. Looks set to make new highs with a recent breakout. Volume is a bit light at this level so might need to wait another day for confirmation of continuation and not a pull back. Earnings arent too far around the corner either but it seems to have rallied well off earnings in the past. Could be worth a watch for more conservative buy and hold defensive style portfolios especially in uncertain times.

Closer daily view showing the possible break out zone being breached.

Kimberly-Clark Corporation is engaged in the manufacturing and marketing of a range of products made from natural or synthetic fibers. The Company's segments include Personal Care, Consumer Tissue, K-C Professional and Corporate & Other. The Company's Personal Care segment offers various solutions and products, such as disposable diapers, training and youth pants, swimpants, baby wipes, feminine and incontinence care products, and other related products. The Company's Consumer Tissue segment offers products, such as facial and bathroom tissue, paper towels, napkins and related products. The Company's K-C Professional segment offers solutions and supporting products, such as wipers, tissue, towels, apparel, soaps and sanitizers. The Company's business outside North America includes Developing and Emerging Markets (D&E) and Developed Markets. It sells its products to supermarkets, mass merchandisers, drugstores, warehouse clubs and other retail outlets.

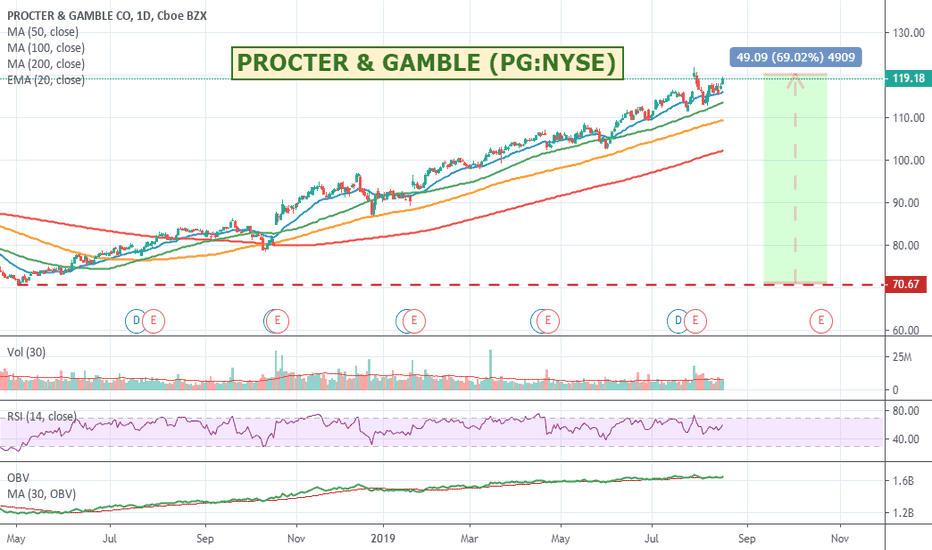

$PG:NYSE - PROCTER & GAMBLE - Whale having a good run.Another mega brand having a nice consistent run. Up around 40% over the last year and looks to be in a reasonable value area looking at the indicators. Again a large stock that might not be a quick mover but will probably continue to grind away especially in a weaker economy. Might be a good counter-cyclical / defensive stock to look at. Worth a watch.

The Procter & Gamble Company is focused on providing branded consumer packaged goods to the consumers across the world. The Company operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care, and Baby, Feminine & Family Care. The Company sells its products in approximately 180 countries and territories primarily through mass merchandisers, grocery stores, membership club stores, drug stores, department stores, distributors, baby stores, specialty beauty stores, e-commerce, high-frequency stores and pharmacies. It offers products under the brands, such as Olay, Old Spice, Safeguard, Head & Shoulders, Pantene, Rejoice, Mach3, Prestobarba, Venus, Cascade, Dawn, Febreze, Mr. Clean, Bounty and Charmin.

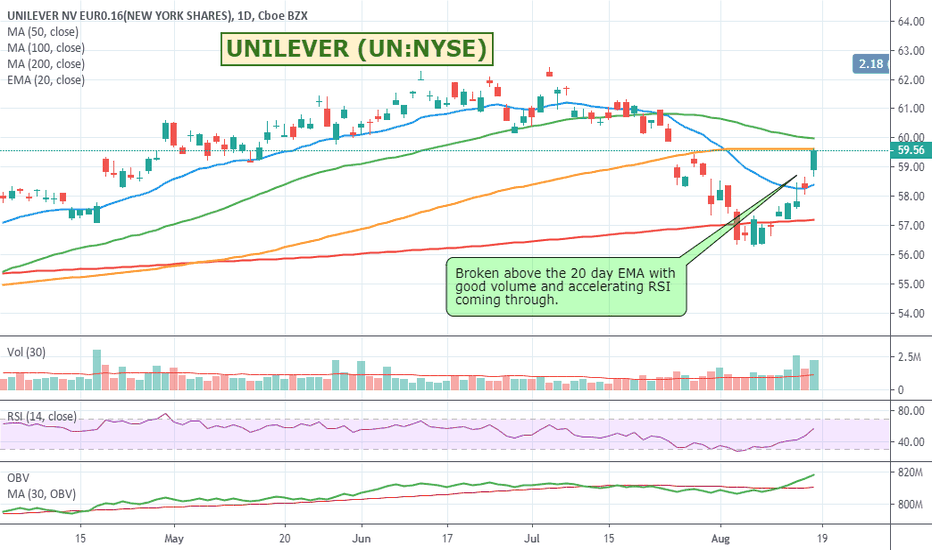

$UN:NYSE - UNILEVER - Broken above 20 Day EMAAnother mega whale stock that is moving back up in the right direction. It wont be a quick gainer but good solid stock potentially for more conservative / defensive portfolios. Could be worth a watch.

Unilever N.V. is a fast-moving consumer goods (FMCG) company. The Company's segments include Personal Care, which primarily includes sales of skin care and hair care products, deodorants and oral care products; Foods, which primarily includes sales of soups, bouillons, sauces, snacks, mayonnaise, salad dressings, margarines and spreads; Home Care, which primarily includes sales of home care products, such as powders, liquids and capsules, soap bars and a range of cleaning products, and Refreshment, which primarily includes sales of ice cream and tea-based beverages. The Company's geographical segments include Asia/AMET/RUB, The Americas and Europe. Its brands include Axe, Dirt is Good (Omo), Dove, Family Goodness (Rama), Heartbrand (Wall's), Hellmann's, Knorr, Lipton, Lux, Magnum, Rexona, Sunsilk and Surf. The Company operates in more than 100 countries, selling its products in more than 190 countries. The Company operates approximately 310 factories in over 70 countries.

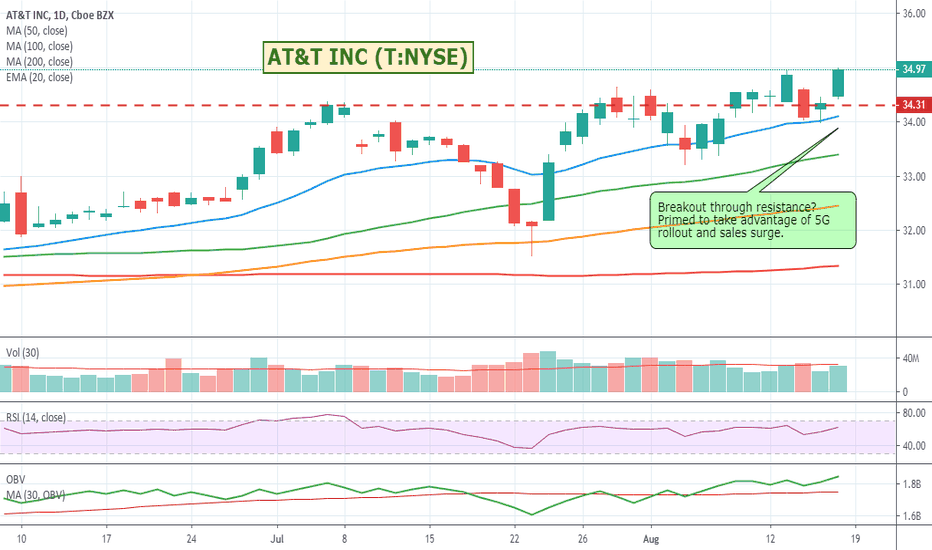

$T:NYSE - AT&T INC - Breakout through resistance?Global telco whale looks to have broken through resistance for the second time. I feel that AT&T is primed to take advantage of the 5G rollout and sales surge.

Trading View technical indicators are showing it as a strong buy as well. Might be one to watch.

AT&T Inc. is a holding company that provides communications and digital entertainment services in the United States and the world. The Company operates through four segments: Business Solutions, Entertainment Group, Consumer Mobility and International. The Company offers its services and products to consumers in the United States, Mexico and Latin America and to businesses and other providers of telecommunications services worldwide. It also owns and operates three regional TV sports networks, and retains non-controlling interests in another regional sports network and a network dedicated to game-related programming, as well as Internet interactive game playing. Its services and products include wireless communications, data/broadband and Internet services, digital video services, local and long-distance telephone services, telecommunications equipment, managed networking, and wholesale services. Its subsidiaries include AT&T Mobility and SKY Brasil Servicos Ltda.

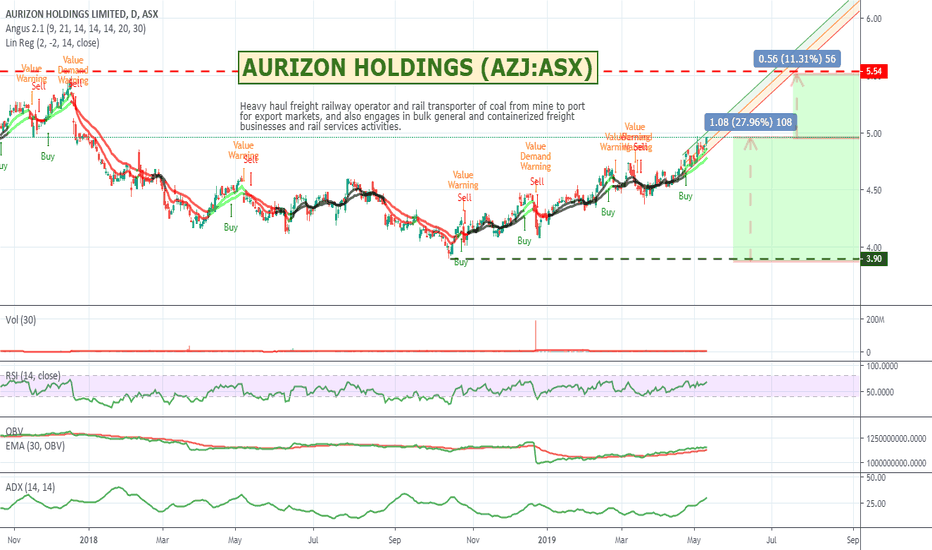

$AJZ - AURIZON HOLDINGS - Having a good run and Directors Buying$AJZ - AURIZON HOLDINGS - Having a good run and Directors Buying

Aurizon has been having a good run over the last few months and is 30% off its lows with around 10-15% more before it regains its previous highs. I picked it up when looking for Directors who were buying on market parcels greater than $100k - often a good indication of internal bullishness.

Directors Purchase:

AURIZON HOLDINGS LIMITED (AZJ) Director Michael Fraser on 06 May 19 purchased 30,000 shares @ $4.855 = $145,650

Financials

Aurizon isn't a stock I had looked at before but it has pretty solid looking financials to go along with a good looking chart. Might be worth a watch.

Market Capitalization 9.732B

Price to Earnings Ratio (TTM) 19.2778

EBITDA (TTM) 1.473B

Gross Profit (MRQ) 1.079B

Gross Profit (FY) 2.321B

Last Year Revenue (FY) 3.113B

Total Revenue (FY) 3.113B

Free Cash Flow (TTM) 268.7M

About Aurizon

Aurizon Holdings Limited is engaged in rail-based transport business. The Company acts as a heavy haul freight railway operator and rail transporter of coal from mine to port for export markets, and also engages in bulk general and containerized freight businesses and rail services activities. Its segments include Network, Commercial & Marketing, Operations and Other. The Network segment provides access to, operation and management of the Central Queensland Coal Rail Network. The Network segment is also engaged in the provision of overhaul and maintenance of rail network assets. The Commercial & Marketing segment is responsible for commercial negotiation of sales contracts and customer relationship management. The Operations segment is responsible for the national delivery of coal, iron ore, bulk and intermodal haulage services. It also includes yard operations, fleet maintenance, operations, engineering and technology, engineering program delivery and safety, health and environment.

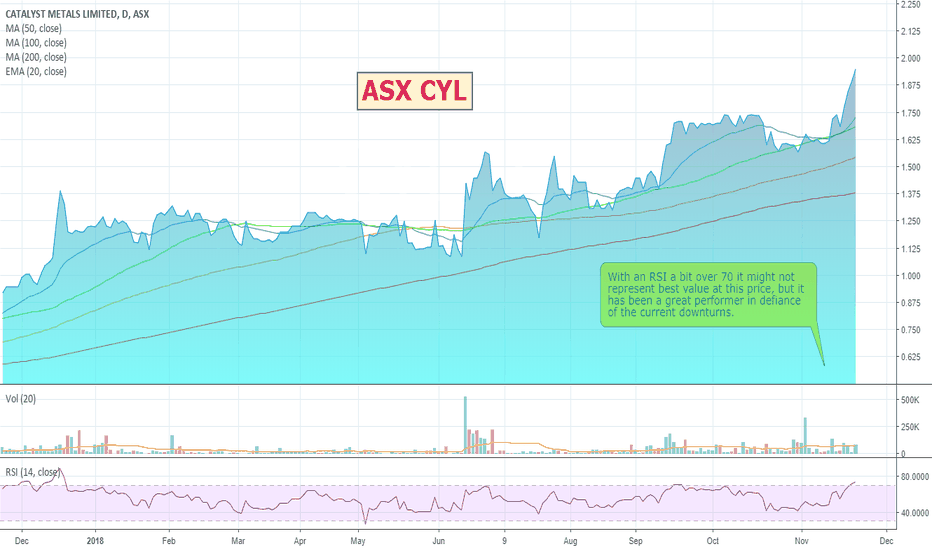

#ASX $CYL - Catalyst MetalsGetting close to that magical $2 resistance mark. Be nice to see it break through and continue its run. Has held up well despite the overall market turbulence.

Catalyst Metals Limited is engaged in mineral exploration and evaluation. The Company holds interests in advanced gold projects located in Victoria. Its tenements are situated along the 100-kilometer long Whitelaw Fault. The Company's projects include Tandarra Gold Project, Raydarra Project, Four Eagles Project, Macorna Bore Project and Sebastian Project. The Company's Four Eagles Gold Project is a joint venture between the Company, Providence Gold and Minerals Pty Ltd (Providence) and Gold Exploration Victoria Pty Ltd (GEV). The Raydarra Project lies immediately south of the Tandarra Project and covers a strike length of approximately 10 kilometers on the southern extension of the Whitelaw and Tandarra Faults. Its Four Eagles Project consists of three prospects: Discovery, Hayanmi and Boyd's Dam. The Macorna Bore Project lies north of the town of Pyramid Hill and straddles the interpreted northern corridor of the Whitelaw and Sebastian Faults.

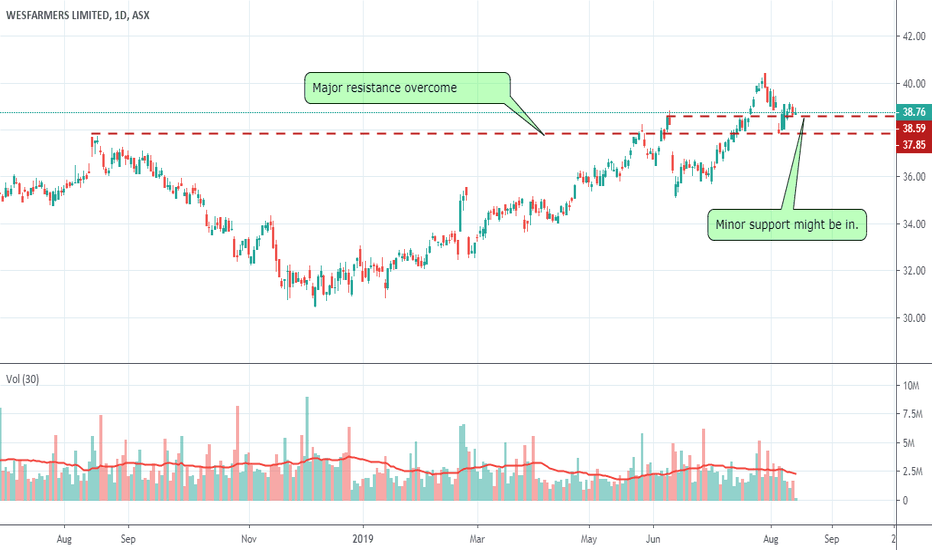

$WES - WESFARMERS - Interesting TA area. Might be an interesting conservative play. My feeling is whenever I walk into a Bunnings, Officeworks and KMart they are always busy...

Might be at a good area TA wise, missing volume confirmation though.

Demand bias is there with 691 buyers for 307,733 units vs 441 sellers for 244,803 units.

Wesfarmers Limited is engaged in various business operations, such as supermarkets, liquor, hotels and convenience stores; home improvement; office supplies, and an industrials division with businesses in chemicals, energy and fertilizers, industrial and safety products and coal. The Company's segments include Home Improvement; Department Stores; Office Works; Industrials, which includes Resources, WIS and WesCEF, and Other. Bunnings is a retailer of home improvement and outdoor living products in Australia and New Zealand. Kmart is a retailer with approximately 210 stores throughout Australia and New Zealand. Target operates a network of over 300 stores and sells a range of products for the contemporary family, including apparel, homewares and general merchandise. Officeworks is a retailer and supplier of office products and solutions for home, business and education.

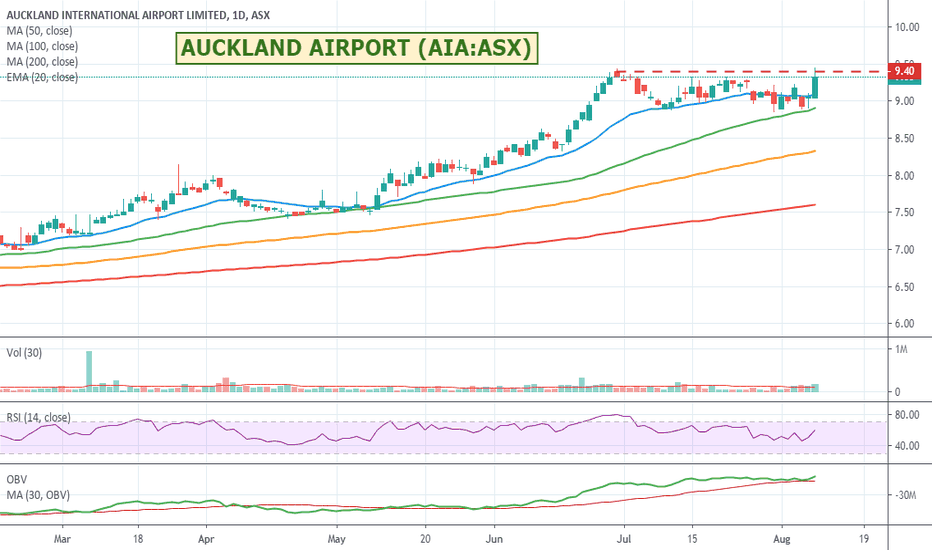

$AIA:ASX - AUCKLAND AIRPORT - Will it break resistanceAuckland Airport has been a great runner and is also a reasonably defensive stock through periods of market volatility. It is pushing up against a previous resistance point and I think this time volume and indicators are on its side.

Liquidity is the big problem with this one. If you get an opportunity to get in it might be a buy and hold for a while.

$MML:ASX - MEDUSA MINING - Chugging alongProbably be harder to find a miner not doing well at the moment. Nice chart. Indicators look good. Might get some consolidation but steady chart that could be worth a watch.

Added it primarily because of its presence in the Philippines just for something a bit different. Be interesting to see how Gold mining in that company pans out - pun intended.

Medusa Mining Limited (Medusa) is a gold producer, focused solely in the Philippines. The Company is engaged in mineral exploration, evaluation, development and mining/production of gold. The Company's segments include mine, exploration and other. The Co-O mine infrastructure projects include E15 Service Shaft, Mine Ventilation Project and Level eight exploration development and drill stations. The Company's other projects include saugon gold-silver project, Tambis Project: bananghilig (b1) gold deposit, Barobo Gold Corridor, Lingig (Das-Agan) Copper Prospect, Kamarangan Copper Prospect and Narrow Vein Mining. The Philippines project includes the tenements comprising the Apical and Corplex Projects. Within the Company's tenement holding, covering approximately 590 square kilometers, work is progressing on various other gold prospects, as well as various copper prospects. Its subsidiaries include Phsamed Mining Corporation and Medusa Overseas Holding Corporation.

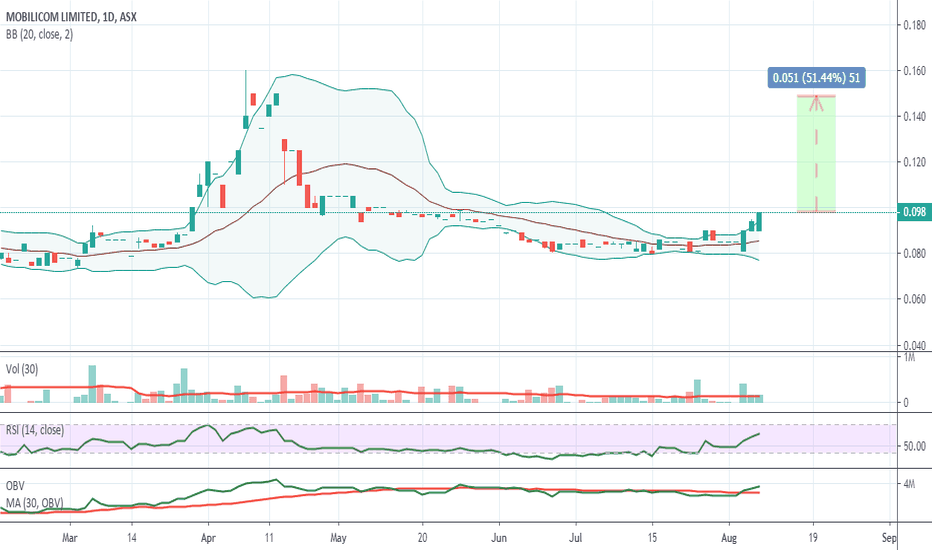

$MOB:ASX - MOBILICOM - Interesting speccyI don't like the gaps in the market depth but I think the company and its tech looks pretty interesting. Feel like there might be some upside to this if you can buy in at the right price. Worth a watch.

Mobilicom Limited (MOB) develops and delivers Bound-Free Mobile Private Network technology and solutions without the need for any infrastructure. By leveraging 4G technology combined with Mobile MESH network topology, Mobilicom assures optimal secured wireless communications. With versatile network topologies and large product portfolio, Mobilicom caters to every deployment and project scope from small to large scale with the highest flexibility, reliability and mobility in the market.

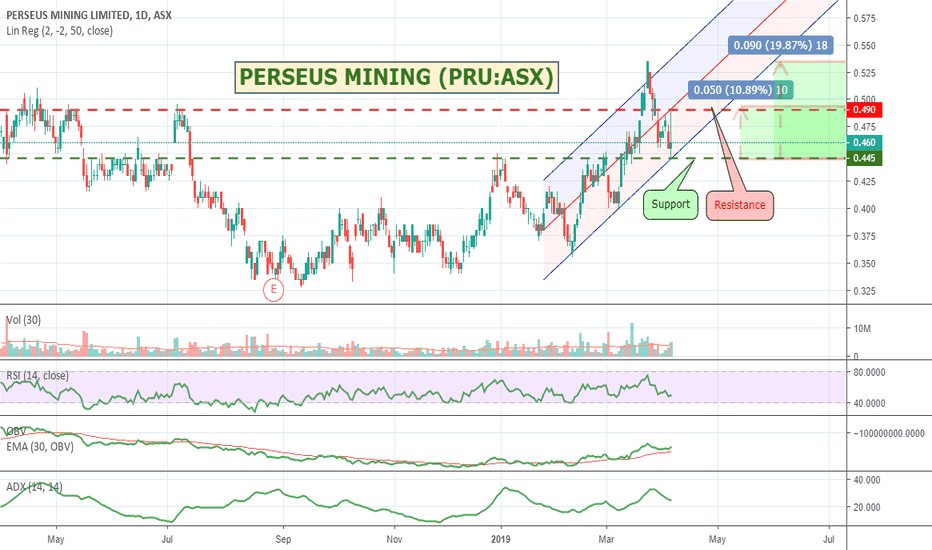

$PRU - PERSEUS MINING - Short term opportunity?$PRU - PERSEUS MINING - Short term opportunity?

Might be worth a look on Monday. It traded the whole range on Friday with seller depth eventually overwhelming and exhausting the buyers. There is still some volume there and it's pretty close to the bottom end of the resistance area so if it heads up on the open there are a few points there for the quick win. If it breaks out there is more opportunity as well. I'd like to see my ADX stronger though to confirm momentum but worth a watch.

About Perseus Mining

Perseus Mining Limited is engaged in mining operations and sale of gold, mineral exploration and gold project evaluation and development in the Republics of Ghana, Cote d'Ivoire and Burkina Faso, in West Africa. The Company's segments include Australia, Ghana and Cote d'Ivoire. The Australia segment is engaged in investing activities and corporate management. The Ghana segment is engaged in mining, mineral exploration, evaluation and development activities. The Cote d'Ivoire segment is engaged in mineral exploration, evaluation and development activities. The Company holds over 90% of Edikan Gold Mine (EGM), approximately 90% of Grumesa Gold Project, over 90% of Yaoure Gold Project and approximately 86% of Sissingue Gold Mine. It has commenced exploration at various near-mine prospects, including Bokitsi, Mampong, Pokukrom and the Agyakusu prospecting license. It has also commenced exploration at other prospects in Cote d'Ivoire, including the Mbengue, Mahale and Napie licenses.

Disclaimer

I am guessing and the market lies.

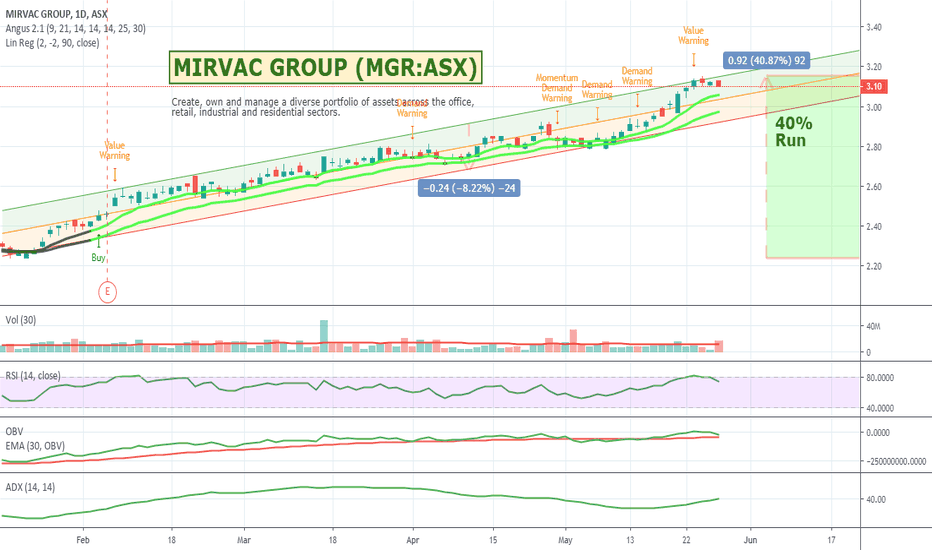

$MGR - MIRVAC GROUP (MGR:ASX) - Consistent performer$MGR - MIRVAC GROUP (MGR:ASX) - Consistent performer

Mirvac has been having a pretty good run recently. Now that the elections are over and less uncertainty it will be interesting to see if the run will continue. Buyers and demand heavily outweigh sellers and shares on offer in the trading queue but volume is weak at the moment so I'll hold off on any entry until I see more momentum come back into the stock. One to watch.

About Mirvac

Mirvac Group (MGR) is involved in the Australian development and construction industry. It has a stapled security structure, comprising Mirvac Property Trust (MPT) and Mirvac Limited. They create, own and manage a diverse portfolio of assets across the office, retail, industrial and residential sectors.

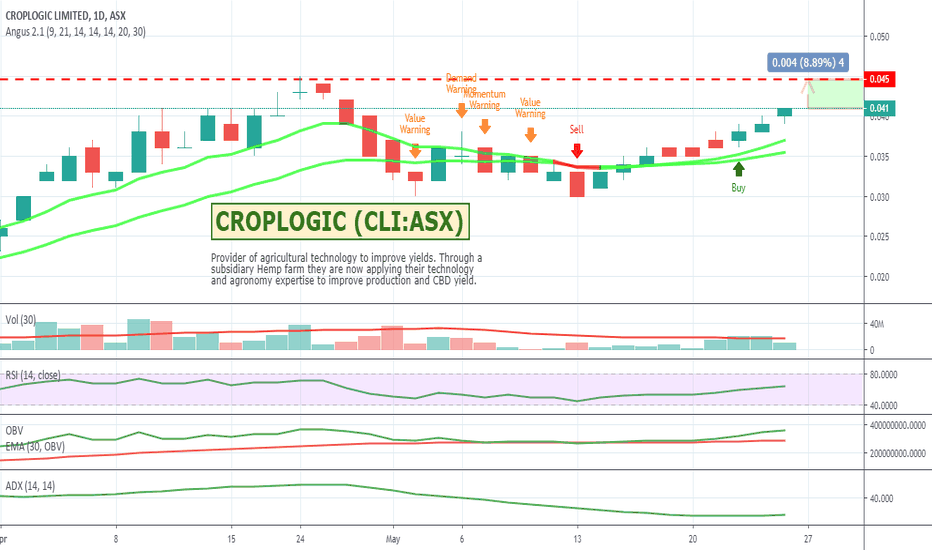

$CLI - CROPLOGIC (CLI:ASX) - Making another run at resistance$CLI - CROPLOGIC (CLI:ASX) - Making another run at resistance

Could be interesting. Company with significant agricultural expertise and technology applying this to their own product. In this case hemp and the CBD yield. Chart looks like there "might" be a quick 8-10% in it at least until resistance. Never know though, so make sure you run your stops :)

From a recent announcement:

CropLogic Limited (ASX: CLI) (CropLogic or Company), the award-winning global agricultural technology company providing cutting-edge technology to growers for decision support, is pleased to provide an update on the Company’s Industrial Hemp Trial Farm in Oregon, USA (Trial Hemp Farm). The Hemp Trial Farm project is operated by CropLogic’s wholly owned subsidiary, LogicalCropping, and is designed to apply CropLogic’s technology and agronomy expertise to improve production and CBD yield. As hemp biomass is sold based on CBD content, any increase in CBD yield increases CropLogic’s clients bottom line.

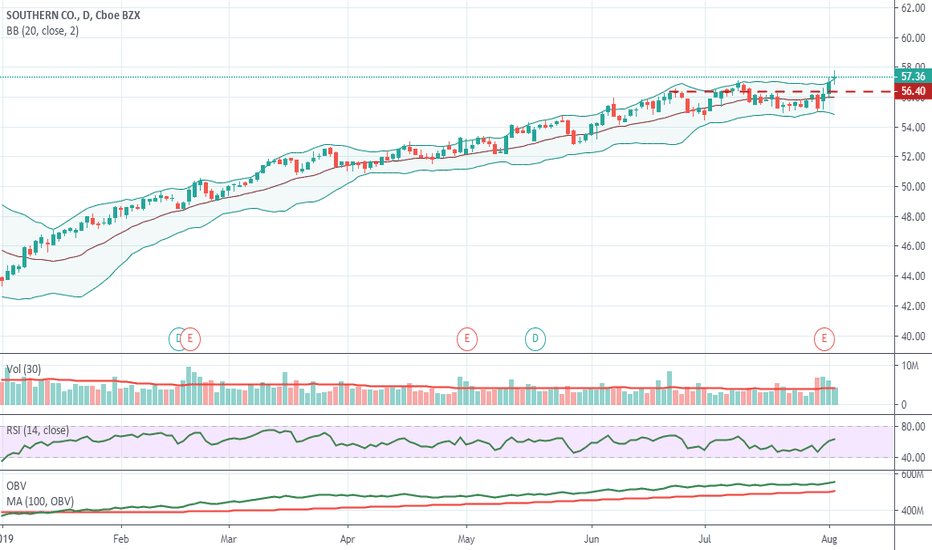

$SO:NYSE - SOUTHERN - Defensive stock running nicelyHave been having a look around for sticky revenue stocks and Southern looks quite good. Its had a 30% gain since the start of the year and popped up as a STRONG BUY here on Trading View based on the existing indicator patterns. It seems to have broken resistance and the RSI gives some hints it will continue to run. Worth a watch.

The Southern Company (Southern Company) is a holding company. The Company owns all of the stock of the traditional electric operating companies and the parent entities of Southern Power Company (Southern Power) and Southern Company Gas, and owns other direct and indirect subsidiaries. The Company's segments include Gas distribution operations, Gas marketing services, Wholesale gas services, Gas midstream operations and All other. The Gas distribution operations segment includes natural gas local distribution utilities that construct, manage, and maintain intrastate natural gas pipelines and gas distribution facilities in seven states. The Gas marketing services segment provides natural gas commodity and related services to customers markets that provide for customer choice. The Wholesale gas services segment engages in natural gas storage and gas pipeline arbitrage. The Gas midstream operations consist primarily of gas pipeline investments, with storage and fuels.

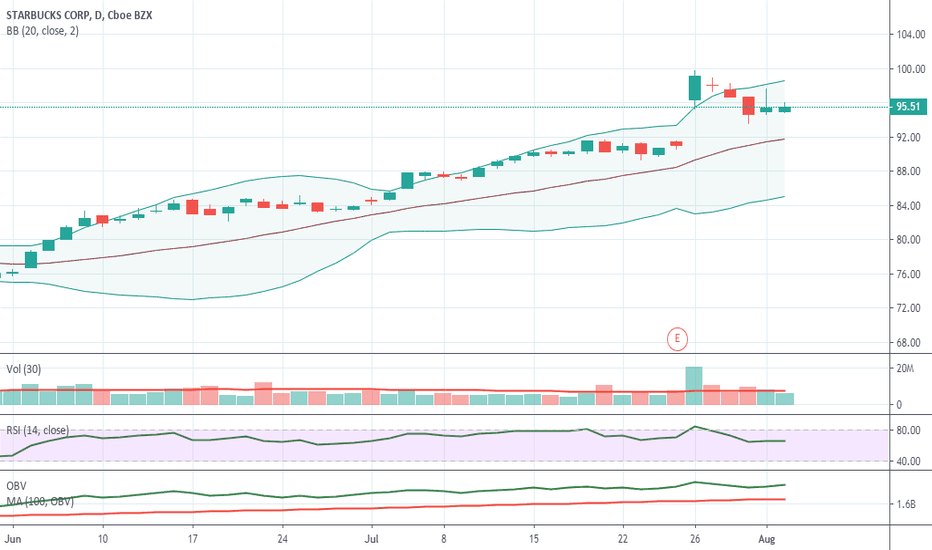

$SBUX:NYSE - STARBUCKS - Will it crack $100?Starbucks came through its earnings quite well and has had such a resilient run up around 80% over the last 12 months. Small pullback on earnings will give it a 5% gain back up to the $100 mark. Signals are a bit neutral at the moment so would like to see where it goes over the next couple of days. Trade war with China might slow down some of its upside growth, but in the event of a market downturn / recession I can't see too many people giving up their daily coffees. Worth a watch.

Starbucks Corporation (Starbucks) is a roaster, marketer and retailer of coffee. As of October 2, 2016, the Company operated in 75 countries. The Company operates through four segments: Americas, which is inclusive of the United States, Canada, and Latin America; China/Asia Pacific (CAP); Europe, Middle East, and Africa (EMEA), and Channel Development. The Company's Americas, CAP, and EMEA segments include both company-operated and licensed stores. Its Channel Development segment includes roasted whole bean and ground coffees, Tazo teas, Starbucks- and Tazo-branded single-serve products, a range of ready-to-drink beverages, such as Frappuccino, Starbucks Doubleshot and Starbucks Refreshers beverages and other branded products sold across the world through channels, such as grocery stores, warehouse clubs, specialty retailers, convenience stores and the United States foodservice accounts.

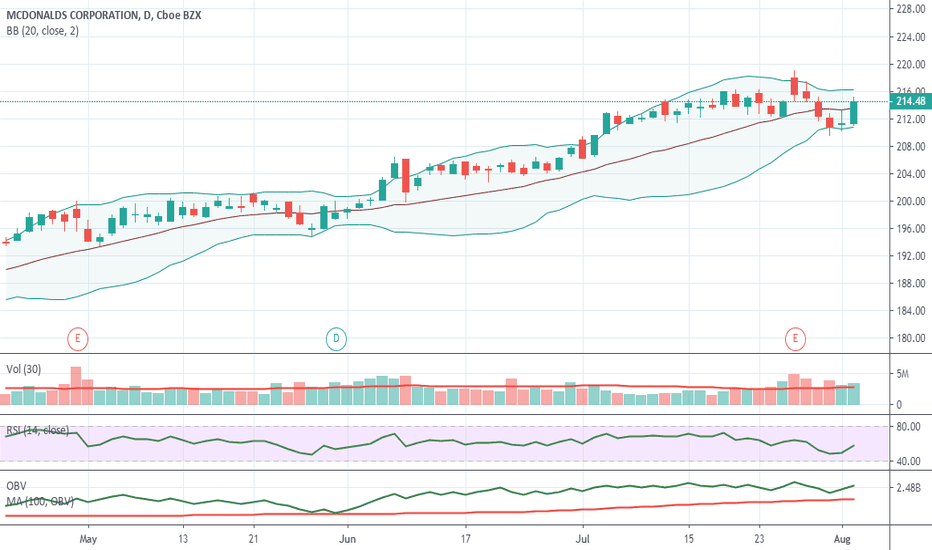

$MCD:NYSE - McDONALDS - Resuming after minor pull backMcDonald's has had a nice steady 30% increase over the last 12 months and seems to have a tradition of dropping for a few days after earnings before recovering and we do now seem to be in that recovery mode. Could be a good stock to hold through a recession / downturn in consumer confidence. One to watch.

McDonald's Corporation (McDonald's) operates and franchises McDonald's restaurants. The Company's restaurants serve a locally relevant menu of food and drinks sold at various price points in over 100 countries. The Company's segments include U.S., International Lead Markets, High Growth Markets, and Foundational Markets and Corporate. The U.S. segment focuses on offering a platform for authentic ingredients that allows customers to customize their sandwiches. Its High Growth Markets segment includes its operations in markets, such as China, Italy, Korea, Poland, Russia, Spain, Switzerland, the Netherlands and related markets. The International Lead markets segment includes the Company's operations in various markets, such as Australia, Canada, France, Germany, the United Kingdom and related markets. The Foundational markets and Corporate segment is engaged in operating restaurants and increasing convenience to customers, including through drive-thru and delivery.

$EBR:NYSE - ELETROBRAS - Shares running on privatisation rumoursELETROBRAS is a big fat profitable electricity provider with a Market Capitalization of $15.042B and an EBITDA of $2.461B.

It has had a good run recently and has broken through a $10.50 resistance area. It might need to retest this and confirm its run, but looking good at the moment and might be worth a watch.

Brazil's state-controlled Centrais Eletricas Brasileiras SA, known as Eletrobras, said in a securities filing on Thursday that President Jair Bolsonaro had authorized studies into privatising the power company via a share offering. The company, which is responsible for almost one third of the generational capacity and half of Brazil's power transmission grid, said the privatisation would need to be approved by Congress. Bolsonaro, who was elected last year on an economic platform that included aggressive pro-market reforms and privatisations, met with Eletrobras' Chief Executive Officer Wilson Ferreira Jr on Thursday, sending the company's share price to a record high on hopes it might be privatised.

Centrais Eletricas Brasileiras S.A. (Eletrobras) is a power generation company. The Company operates in the generation, transmission, distribution and trading segments. The Company operates through various companies, including Eletrobras holding, CGTEE, Chesf, Eletronorte, Eletronuclear, Eletrosul, Furnas, Amazonas Energia, Distribuicao Acre, Distribuicao Alagoas, Distribuicao Piaui, Distribuicao Rondonia, Distribuicao Roraima and half the capital of Itaipu Binacional. The Company has a total installed capacity for generation of over 44,150 megawatts. It has a nationwide network of transmission lines of approximately 60,500 kilometers in length. The Eletrobras Eletrosul's Megawatt Solar Plant has over 4,000 photovoltaic panels, totaling an area of approximately 8,300 square meters. The Eletrobras Eletrosul's Megawatt Solar Plant has an installed capacity of approximately one megawatt-peak (MWp), and the Megawatt Solar Plant can produce approximately 1.2 gigawatt hour (GWh).