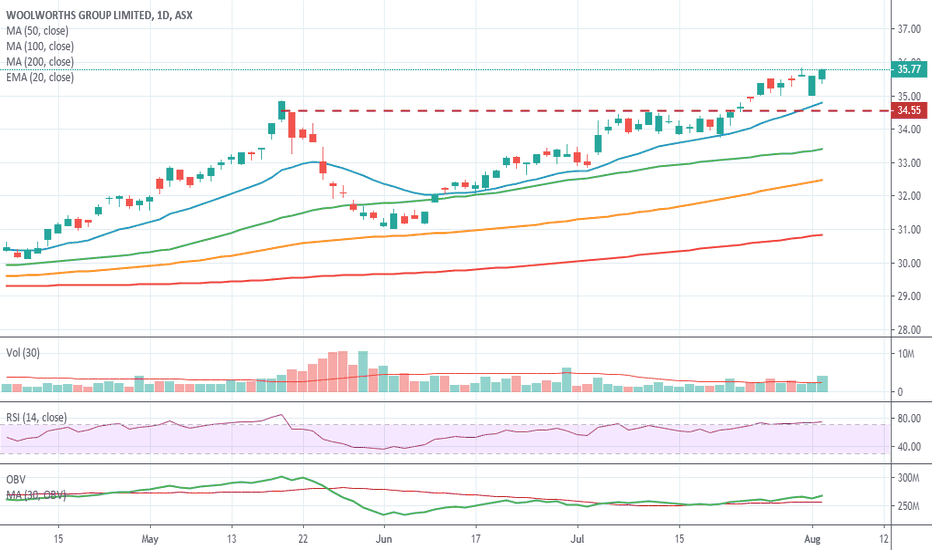

$WOW:ASX - WOOLWORTHS - Through resistanceWoolworths could be worth a watch as consumer spending on dining out decreases. Not a strong runner, but up 30% year to date.

Woolworths (WOW) is a retailer with primary activities in Supermarkets. WOW's other operations include: BIGW discount department stores; Home Improvement; Petrol through the Woolworths/Caltex alliance; and Hotels.

Demand: 199 buyers for 124,493 units vs 207 sellers for 126,697 units

Search in ideas for "zAngus"

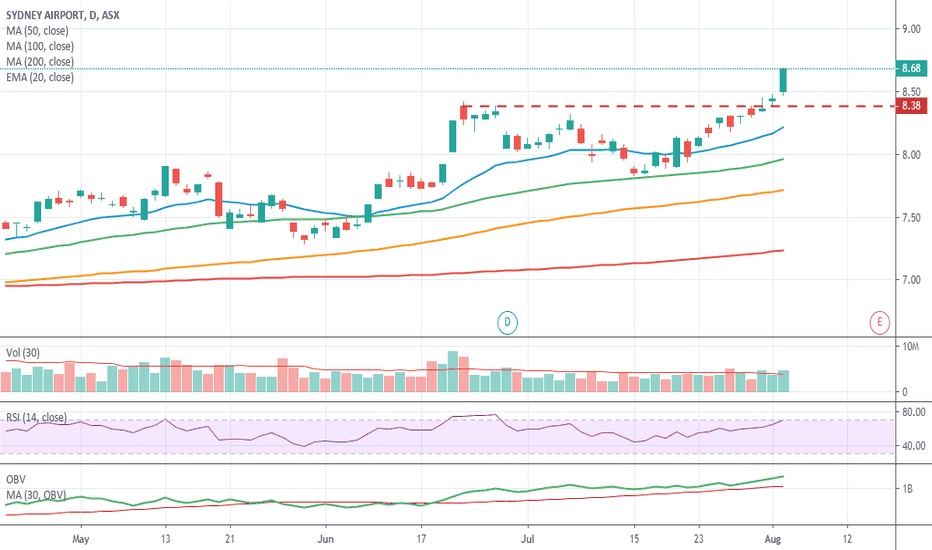

$SYD:ASX - SYDNEY AIRPORT - Through resistanceSydney Airport could be a good defensive stock with some of the market volatility around at the moment. It has broken through a resistance area and has some reasonable volume behind it. With 30% gained this year to date it might be worth a watch.

Earnings are due August 15th so buyer beware around this date.

Sydney Airport (SYD) owns and operates an airport in Sydney, Australia. SYD Provides Aeronautical, retail, property, car rental and parking and ground transport services through their two main business units which are Aviation (Sydney Airport) and Leasing & Advertising Opportunities.Sydney Airport (SYD) owns and operates an airport in Sydney, Australia. SYD Provides Aeronautical, retail, property, car rental and parking and ground transport services through their two main business units which are Aviation (Sydney Airport) and Leasing & Advertising Opportunities.

Demand: 242 buyers for 462,743 units vs 38 sellers for 73,751 units

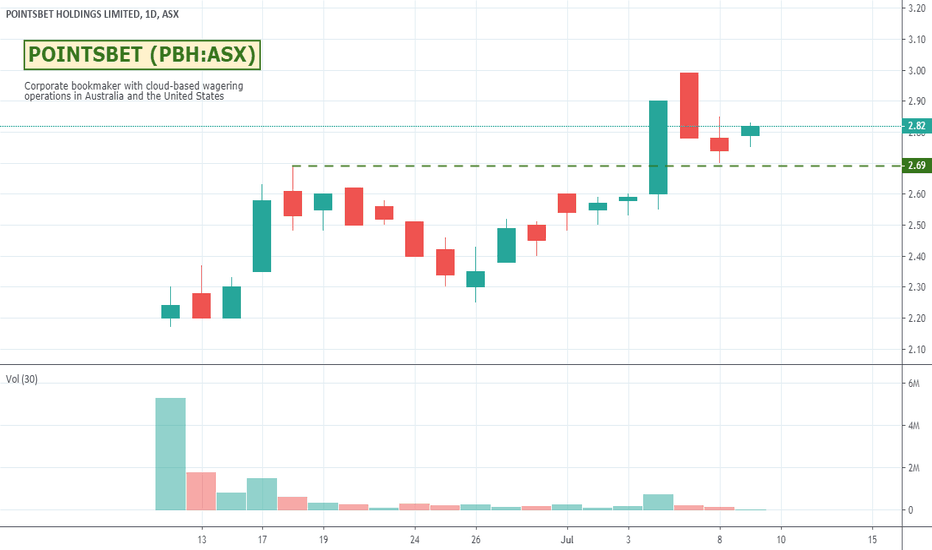

$PBH - POINTSBET - New listing. Might be worth a watch.I was having a look through some of the newly listed stocks on the ASX and thought this might be interesting. JIN has been one of my best performers and I feel this is a little similar in the space it operates in. As I post this, there are 67 buyers for 209,812 units and only 18 sellers for 127,415 units. One to watch to see what it does.

Pointsbet Holdings Limited (PBH) is a corporate bookmaker with operations in Australia and New Jersey (United States). PointsBet has developed a scalable cloud-based wagering Platform through which it offers its Clients innovative sports and racing wagering products. PointsBet's product offering includes Fixed Odds Sports, Fixed Odds Racing and Points Betting. PBH announced Hawthorne Race Course Inc.as their sports betting partner in the State of Illinois.

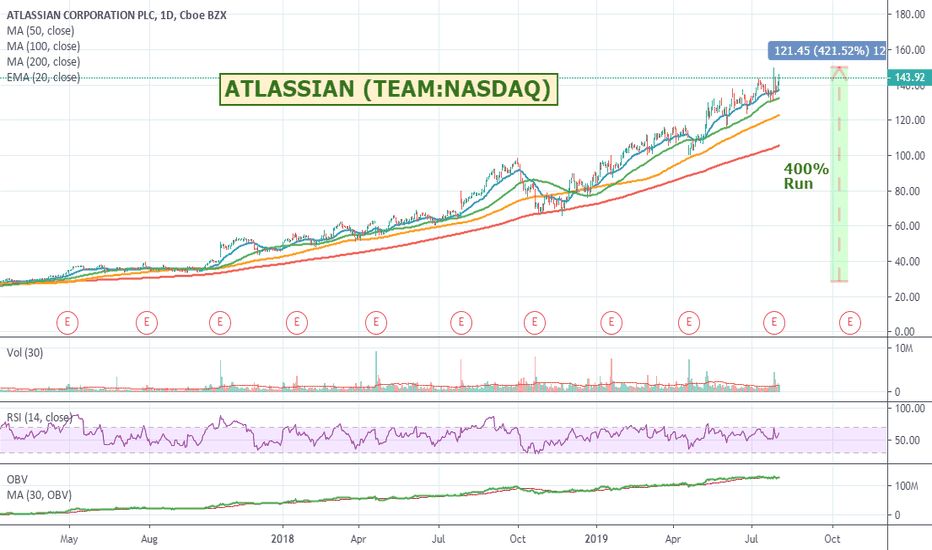

$TEAM:NASDAQ - ATLASSIAN- Strong run. Up 400%Atassian has had a great run since its debut on the stock market and is up now a bit over 400%. They have closed out a record year and are on track to pull in around $1.5B revenue for use of their products. Could be worth a watch.

Atlassian Corporation Plc is a holding company. The Company offers a range of team collaboration products. The Company offers products, including JIRA, Confluence, HipChat, Bitbucket and JIRA Service Desk, for software developers, information technology (IT) managers and knowledge workers. The Company offers JIRA for team planning and project management; Confluence for team content creation and sharing; HipChat for team real-time messaging and communications; Bitbucket for team code sharing and management, and JIRA Service Desk for team service and support applications. JIRA allows teams to organize their work into projects and customize dashboards for those projects to keep their teams aligned and on track. Confluence provides a system for organizing, sharing and securing content in spaces arranged by team, project, department and others. The Company also offers additional tools for software developers, such as FishEye, Clover, Crowd, Crucible, Bamboo and SourceTree.

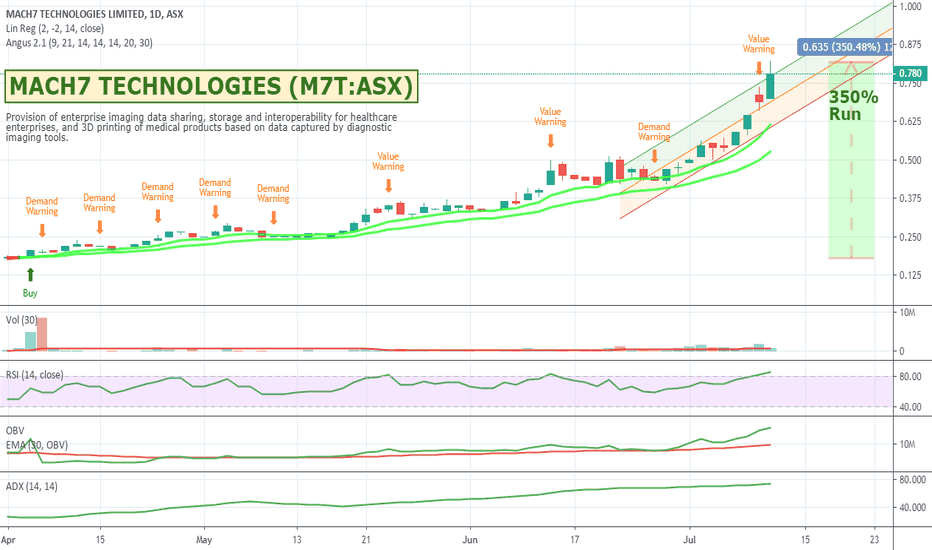

$M7T - MACH7 TECHNOLOGIES - Running well. Up 350% since April.M7T is a company I like the idea of a a software and services provider into the medical space.

They have had a great run up to and post their signing up Advocate Aurora Health (AAH), an integrated healthcare network headquartered in Milwaukee, Wisconsin. The agreement has a minimum total contract value of A$5.7 million across a five-year term. AAH has contracted with Mach7 for its Enterprise Imaging Platform to store and manage images across its healthcare network. Along with the Mach7 Platform, AAH also purchased the migration engine to migrate ~3.5 petabytes of data. This deal is one of Mach7’s largest to date within the US demonstrating that Mach7 has an increasing influence and market share in the US market.

As I post this there are currently 158 buyers for 1,337,235 units vs 33 sellers for 324,960 units and the stock is up around 13%. Demand is there, but some kind of consolidation / pullback can't be too far away either.

About Advocate Aurora Health:

AAH is one of the 10 largest not-for-profit integrated health systems in the United States, encompassing 28 hospitals, 500 outpatient locations, and 68 Walgreen’s clinics across the states of Wisconsin and Illinois.

About Mach7 Technologies:

Mach7 Technologies (ASX:M7T) develops innovative data management solutions that create a clear and complete view of the patient to inform diagnosis, reduce care delivery delays and costs, and improve patient outcomes. Mach7’s award-winning enterprise imaging platform provides a vendor neutral foundation for unstructured data consolidation and communication to power interoperability and enables healthcare enterprises to build their best-of-breed clinical ecosystems. Mach7’s sophisticated workflow tools, advanced clinical viewing and optimized vendor neutral archiving solutions unlock silos of legacy systems empowering healthcare providers to own, access and share patient data without boundaries.

$OPT:ASX - OPTHEA - Broken through resistanceLooks to have finally broken through a previous strong area of resistance with the announcement of moving their trial results forward. I like the biopharmaceutical space and anything to do with eye disease and diabetes would seem to be a good medium to long term opportunity. Might be worth a watch.

Opthea Limited (ASX:OPT), is a clinical stage biopharmaceutical company developing novel biologic therapies to treat eye diseases and is pleased to announce that the timing of the primary analysis from its ongoing Phase 2b trial of OPT-302 for wet age-related macular degeneration (AMD) will occur sooner than expected and be brought forward by one quarter, with the primary data now expected to be reported in the 3rd quarter of calendar year 2019.

$IME:ASX - IMEXHS LIMITED - Running nicelyBit more of a speculative buy, but at 7 cents it seems reasonable value and momentum has been on its side since they announced their US deal with IGMC MEDICAL TECHNOLOGY GROUP (IGMC Med) for a nonexclusive distribution agreement in the US market. Miami-based, IGMC Med is a wholesale medical supply & equipment distributor with market positions in Florida and Texas. IMEXHS and IGMC Med will start reviewing market strategies while IMEXHS is waiting on its 510(k) clearance notice from the US FDA. If they get their FDA clearance it could move quite aggressively. Might be worth a watch.

Currently at 7 cents with 59 buyers for 7,089,371 units vs 34 sellers for 3,722,441 units. I have a trailing sell of 10% set, but will keep an eye on it around the 5% trail type mark.

IMEXHS Limited is a leading imaging Software as a Service (SaaS) and ancillary solutions provider. Founded in 2012, IMEXHS is known for its innovation in the imaging services market, offering flexible and scalable imaging solutions via its Hiruko branded suite of solutions for next generation Picture Archiving and Communications System (PACS) and integrated Radiology Imaging System (RIS). The Hiruko system is completely cloud based, vendor neutral and zero footprint with no need for installed software. Enhanced features such as a fully web-based voice recognition option and a zero footprint DICOM viewer are some of its advanced features. In addition to PACS and RIS, imaging technology and management systems can be provided on a Platform as a Service (PaaS) basis when packaged with equipment. The IMEXHS products are designed to increase productivity and save money for the users, with a scalable platform that is configured for the future, while enhancing patient outcomes.

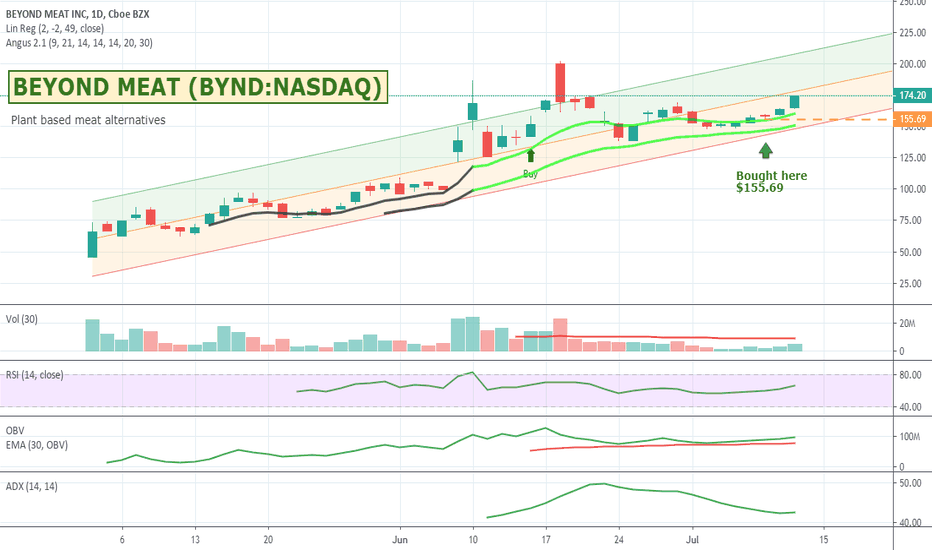

$BYND:NASDAQ - BEYOND MEAT INC - Plant Based Meat AlternativesHave been watching all the vegetarianism / vegan movements building momentum on Youtube for the last couple of years and got a chance to try a Beyond Meat Burger a couple of days ago at a local burger restaurant and I liked it. Beyond Meat has been getting a lot of press attention after its launch and while I don't know if they will be the long term winner, they do seem to have first market mover momentum at the moment on the stock market. I do think there will be more and more meat alternatives coming through especially with all the hype from the various heart associations versus red meat and limiting its consumption. Salads inside McDonalds have never done much, but I could imagine them and others coming out with meat alternative type burgers that could get a good following as way for people to feel better about their consumption habits as well as the whole eat less meat save the planet mantra.

From a TA point of view I don't like buying new listings on the float as you never know which way they are going to go, but now that BYND has had a bit of a pullback of its hyped-highs and some volume seems to be rebuilding I thought I'd take a punt. Up around 9% on my buy already which is nice. As always do your own research. Will be interesting to see how popular this whole industry gets. Stops are in at a 10% trail which will get moved to 15% when I'm up 15% and will stay there until it sells.

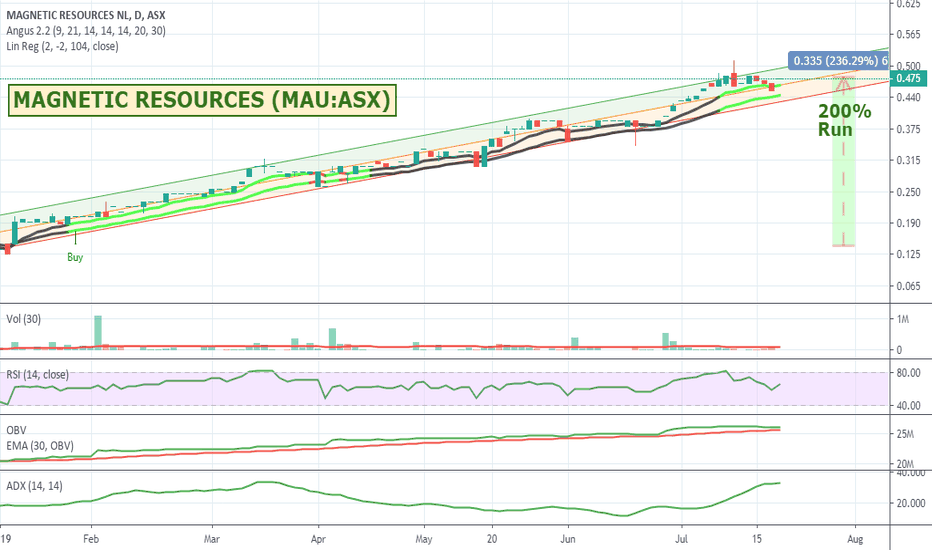

$MAU:ASX - MAGNETIC RESOURCES - 200% YTD Run.Good momentum gold explorer stock going through a bit of a pullback but still looking strong overall. Might be worth a watch.

Currently 20 buyers for 200,878 units vs 12 sellers for 161,574 units

Magnetic Resources NL is an Australia-based mineral exploration company. The Company is engaged in exploring mineral tenements in Western Australia. The gold tenements held by the Company include Mount Jumbo EL38/3100 and P38/4201 (approximately 20 square kilometers (sq.km)), Kowtah P39/8694-8697 and P39/5617 (nine sq.km), Hawks Nest E38/3127 (approximately 150 sq.km), Mertondale E37/1258 (over 80 sq.km) and Christmas Well P37/8687-8694 (approximately 10 sq.km). Its projects also include Nambi E37/1303, Raeside E37/1304, Raeside East P37/8905-08, Braiser P37/8909-12 and Trigg P37/8913-21. The Mount Jumbo gold rich shear straddles EL38/3100 and ELA38/3127, and totals over 1.3 kilometers in length. The Mount Jumbo and Hawks Nest tenements are approximately 10 kilometers and 20 kilometers north of the Wallaby deposit, respectively. The Company holds a retention license over the Jubuk projects. The Company holds a royalty over gold rights at Lake Seabrook E70/2935.

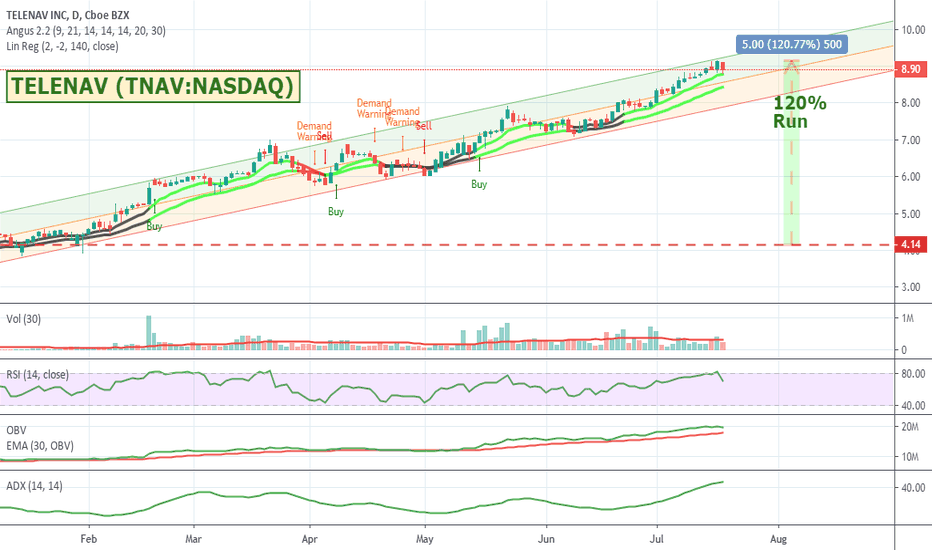

$TNAV:NASDAQ - TELENAV - Up 120% Year-to-dateTelenav has been having a nice consistent run. Has been consistently making higher highs. Might be worth a watch.

TeleNav, Inc. (Telenav) is a provider of location-based platform services. The Company's services consist of its automotive and mobile navigation platform and its advertising delivery platform. The Company operates through three segments: automotive, advertising and mobile navigation. The automotive segment provides its map and navigation platform to auto manufacturers and original equipment manufacturers (OEMs) for distribution with their vehicles. The advertising segment provides interactive mobile advertisements on behalf of its advertising clients to consumers based on the location of the user and other targeting capabilities. The mobile navigation segment provides its map and navigation platform to end users through mobile devices. The Company's auto and mobile navigation platform allows it to deliver location-based services to auto manufacturers, developers and end users through various distribution channels, including wireless carriers.

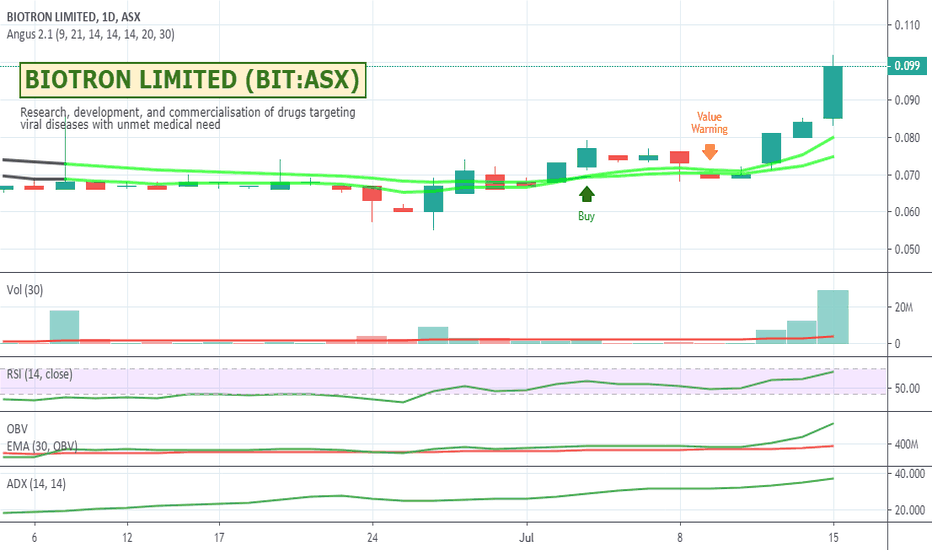

$BIT:ASX - BIOTRON LIMITED - Promising progressTheir letter to shareholders didn't come out with much fanfare, but I like the space they are operating in. Couple of things that caught my eye was their successful trial in 2018 of their HIV product and they have spent the last year analysing the data out of it and they are soon holding a Scientific/Clinical Advisory Meeting with internationally recognised HIV-1 experts. This might give them a bit of a credibility bump and publicity which often comes out of these kinds of things as they release more PR around the meeting and the feedback.

During the second half of 2019, they are planning to consult with the USA Food and Drug Administration (FDA) to ensure the proposed path is in accordance with relevant regulations.

Also, the positive outcomes from the trial also mean that Biotron has been meeting with key potential partners with compelling Phase 2 data in hand. Phase 2 is generally considered the best time to license technology to a major pharmaceutical company as they have the expertise and resources necessary for late stage clinical development and regulatory approvals in major markets such as the USA

Spiked up around 20% today on top of yesterdays run, so I'd want to see what happens tomorrow. Buyers and seller pretty evenly matched. Might be worth a watch.

Biotron Limited (BIT) is a biotechnology company engaged in research, development, and commercialisation of drugs targeting viral diseases with unmet medical need. The Company focuses on the progression of the clinical development of the drug, BIT225, an investigational, orally-administered, novel antiviral compound in development by Biotron for treatment of HCV and HIV infections.

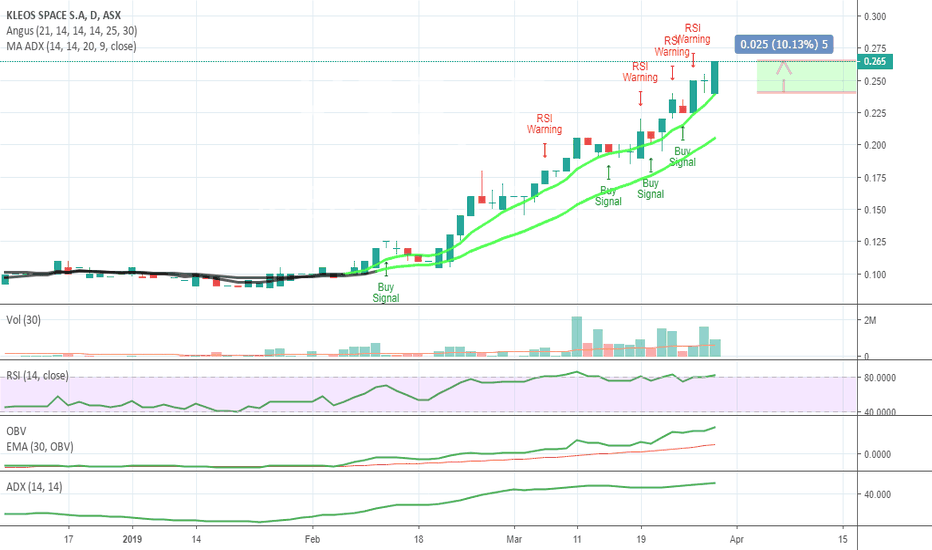

$KSS - KLEOS SPACE - Spy satellites heading to the moon :)Spotted this one on a volume scan this morning and got on board the rocket ship at .240 and it ran to .265 so a nice little 10% gain.

Driven largely by good recent news announcements with another one today. Stop losses are in. I've been playing more with using an ATR range value to set the dollar amount on my trailing sells so have this one at .03

It closed today at its high so hopefully will remain bullish tomorrow and run for a bit. Market depth on the buy side still looks good.

About Kleos Space S.A.

Kleos Space S.A. (ASX: KSS, Frankfurt: KS1) is a space enabled, activity-based intelligence, data as a service

company based in Luxembourg. Kleos Space aims to guard borders, protect assets and save lives by

delivering global activity-based intelligence and geolocation as a service. The first Kleos Space satellite

system, known as Kleos Scouting Mission (KSM), will deliver commercially available data and perform as

a technology demonstration. KSM will be the keystone for a later global high capacity constellation. The

Scouting Mission will deliver targeted daily services with the full constellation delivering near-real-time

global observation. For more information please visit: www.kleos.space.

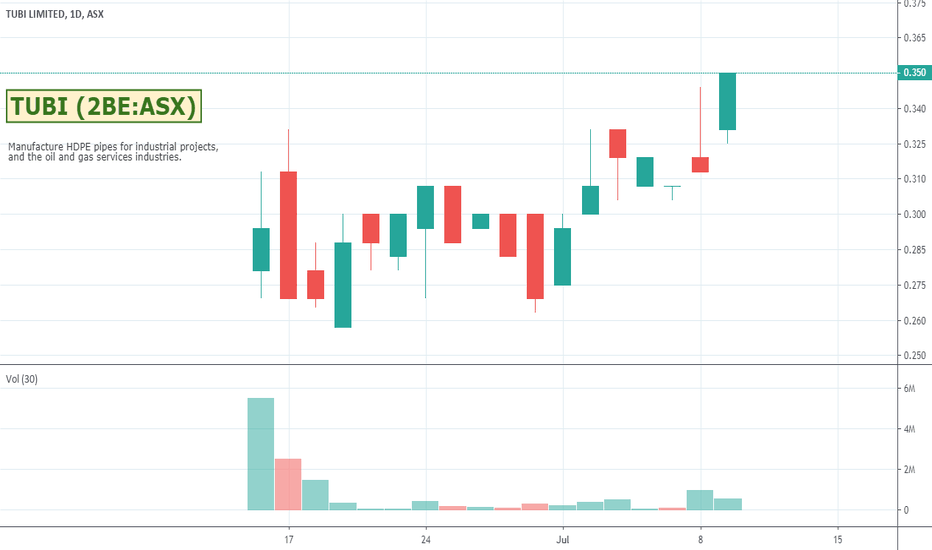

$2BE - TUBI LIMITED - New ASX listing I think is interestingAnother new listing that seems to be headed in the right direction for now. I had a bit of a read of what they do and like the sound of it... the old sell the shovels to the miners ploy. Might be worth a watch.

Currently 53 buyers for 1,429,882 units vs 8 sellers for 242,119 units and up 13% for the day as I write this. Be careful of a pull back but might be an interesting long term buy and hold. Always run stops of course if you do decide to have a play.

Tubi Limited is an Australia-based company that operates in the high-density polyethylene (HDPE) pipe manufacturing market. The Company operates its Mobile Plant to manufacture HDPE pipes for industrial projects, and the oil and gas services industries. The Company operates under one segment: being the manufacturing of HDPE pipe and the sale of technology licenses to manufacture HDPE pipe. The Company targets the oil and gas sector in the United States and Canada, water projects around the world and mine construction projects in the United States, Canada, Australia and South America. The Company’s technology enables it to produce HDPE pipe at lengths of between 300 metres and up to 3 kilometre (km) for 160-millimetre (mm) diameter pipe. The Company’s subsidiaries include Tubi New Zealand Limited and Tubi USA, Inc.

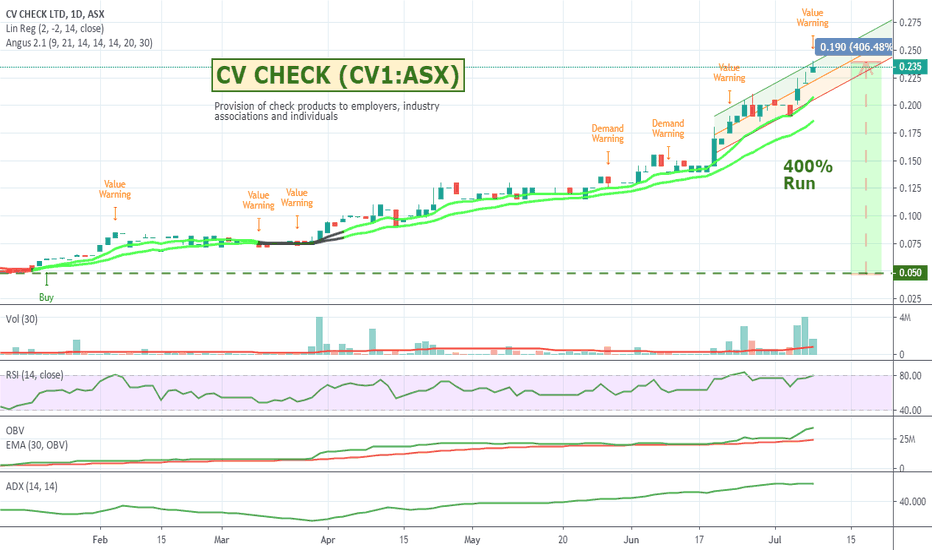

$CV1 - CV CHECK - 400% run since the start of the yearCV Check is having a great run. They have just posted their third consecutive cash flow positive quarter and look set to continue. In the buy vs sell queue there are 207 buyers for 5,323,281 units vs 40 sellers for 1,886,920 units which is always a good bullish sign, but the price is looking over extended so hard to know if an entry right now is the right timing. Might wait for a pull back, but certainly one to watch.

CV Check Ltd (CV1) is an expanding business with growing revenue streams through the provision of its check products to employers, industry associations and individuals via its proprietary online platform www.cvcheck.com. CVCheck has been operating for more than 10 years and in the process has developed a world-class online platform providing a comprehensive range of checks across the globe. The CV1 is organised into two operating segments based on geographical locations consisting of Australia and New Zealand.

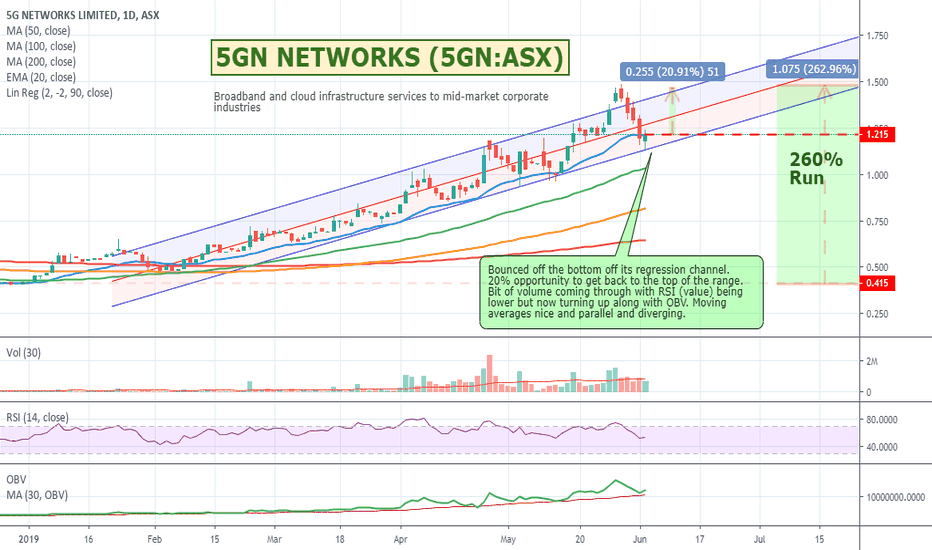

$5GN - 5G NETWORKS - Rebounding off support$5GN - 5G NETWORKS - Rebounding off support

Bounced off the bottom off its regression channel. 20% opportunity to get back to the top of the range. Bit of volume coming through with RSI (value) being lower but now turning up along with OBV. Moving averages nice and parallel and diverging. Might be worth a watch if it heads up again tomorrow.

About 5GN

5G Networks Limited is an Australia-based provider of Internet broadband and cloud infrastructure services to mid-market corporate industries. The Company is principally engaged in providing high speed broadband access to businesses. It also offers cloud-based solutions, managed services, and network infrastructure services. It provides technology solutions and services for integrated fiber and wireless access, cloud infrastructure, high speed Internet access, cloud network, virtual private network, voice over IP, and redundancy.

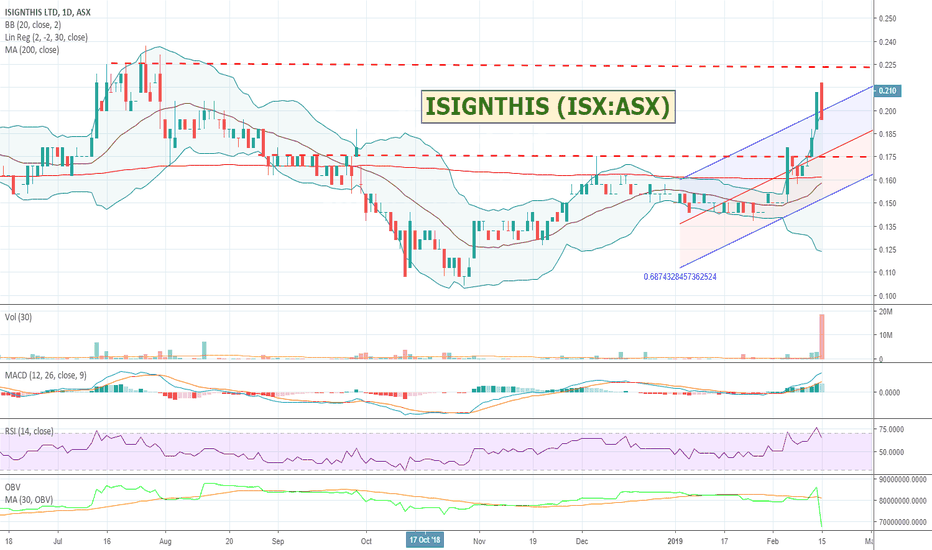

$ISX - ISIGNTHIS - They bought a Russian bank!$ISX - ISIGNTHIS - They bought a Russian bank!

Well not really. They bought a banking service in Lithuania which was part of Russia up until 1918 or so.

I'm actually not sure what to do with this stock which means I will sit out for now. I only like it because it has massive volume and good market depth on the buyers side. Its had a pullback on approaching an old high so will wait to see what it does early next week. I just have this feeling that there is something to this stock that's worth a watch...

iSignthis Ltd provides identification and payment authentication services. The Company is engaged in anti-money laundering (AML)/counter terrorist funding (CTF) know your customer (KYC) identity proofing. It provides online payment security, Internet identity, e-mandates and e-contract validation services to e-Commerce operators, and assists AML and CTF. The Company's solutions include Evidence of Identity (EOI), e-Know Your Customer (eKYC) and Strong Customer Authentication (SCA). Its Paydentity solution incorporates real time electronic verification to converge remote payment authentication and KYC identification. Its eKYC offers a range of online services, including digital banking, card issuers, loan providers, insurance, bitcoin and crypto currency exchange, financial services, and person to person remittance/money service businesses. It also has partnerships with various card schemes and payment processors, as well as direct connect to a number of acquiring institutions.

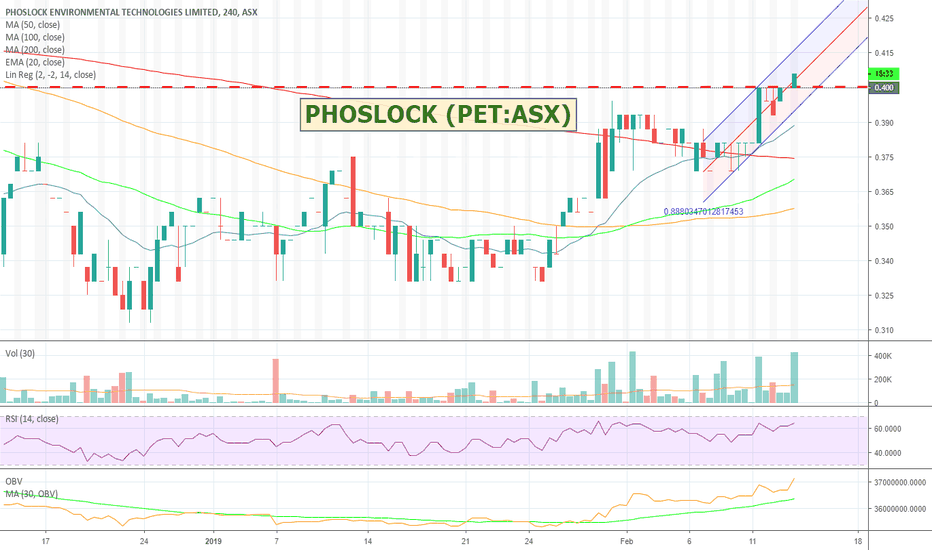

$PET - PHOSLOCK - Back above $4 and climbing! Phoslock has edged back above 40 cents with some nice volume behind it. Need to wait a couple of days to make sure it can hold it and build support from here. Volume and various indicators are looking good though. It was a 48 cent stock not so long ago so has some room to the upside. It's a business I have always liked - cleaning up the water ways of China - but the share price has been annoyingly erratic.

Phoslock Environmental Technologies Limited (ASX: PET) is an international environmental company specialising in engineering solutions and water treatment products to remediate impaired lakes, rivers, canals and drinking water reservoirs.

PET has its headquarters in Sydney, Australia with offices in Brisbane, Beijing & Changxing, China; and Manchester, UK. PWS is represented by licensees, distributors and agents in ten other countries including SePRO Corporation in the United States and HidroScience in Brazil. PWS has a number of marketing and co-operation agreements in China with various environmental companies and government agencies.

With the massive water remediation market in China, in 2017 Phoslock (Beijing) was formed. Our 100% owned subsidiary undertakes design, engineering, and implementation using remediation materials for rivers, canals, reservoirs and lakes along with construction of wetland areas. This is a significant broadening of the historical PET business and enables it to undertake a greater array of projects in China and elsewhere, supplying both services and materials.

PET owns the patent for PHOSLOCK; a unique water treatment product that permanently binds excess phosphorus in the water column and sediments. This in turn inhibits the growth of Harmful Algal Blooms (HAB) that lead to detrimental effects to both aquatic and human life.

Along with PHOSLOCK, PET also supplies:

1) Zeolites - a porous, natural material that can be applied to heavily polluted water to absorb nutrients such as nitrogen. Nitrogen is another important food source for the growth of harmful algae; and

2) Bacteria. - Certain types of bacteria can break down contaminants and organic matter that pollute water and cause human and water borne diseases.

PWS has a large multi-purpose factory in Changxing, Zhejiang province, China, 150km inland from Shanghai, which manufactures its patented technology, PHOSLOCK, along with nutrient binding materials (zeolites) and biological solutions (such as nutrient consuming bacteria).

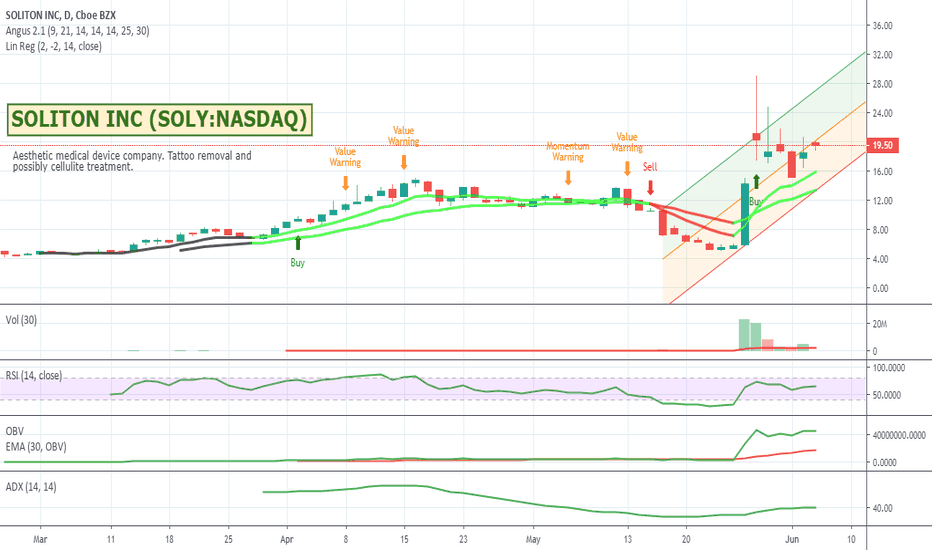

SOLITON INC (SOLY:NASDAQ) - Could be a runner!SOLY is an interesting company with an established tattoo removal treatment, but has recently come out suggesting they might also be able to treat cellulite which has all the pundits excited. One to watch.

About Soliton, Inc.

Soliton, Inc. is a medical device company with a novel and proprietary platform technology licensed from MD Anderson. The Company's first FDA cleared commercial product uses rapid pulses of acoustic shockwaves as an accessory to lasers for the removal of unwanted tattoos. The Company is based in Houston, Texas, and is actively engaged in bringing its Rapid Acoustic Pulse ("RAP") device to the market. The Company believes this "Soliton" method has the potential to lower tattoo removal costs for patients, while increasing profitability to practitioners, compared to current laser removal methods. Soliton is also investigating additional indications for its RAP technology based on early clinical testing indicating the potential for RAP to reduce the appearance of cellulite and the potential to assist existing fat reduction technologies in the reduction of subcutaneous fat, as well as preclinical testing suggesting the potential for additional indications related to abberant fibrotic activity. Although our device is now cleared for sale in the United States for the tattoo removal indication, it remains investigational and not yet cleared for these additional indications.

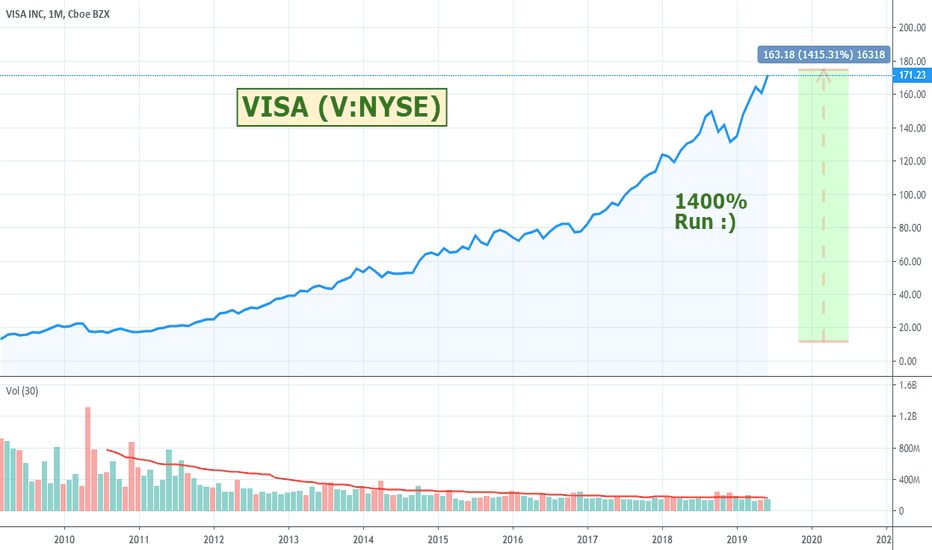

$V - VISA (V:NYSE) - Great multi year run. Up 1400%VISA has had such a good run since inception and after a bit of a pull back in the final quarter of last year it has been having a great run again. It's an absolute beast of a company with a Market Capitalization over 373.832B, EBITDA (TTM) 14.919B and Free Cash Flow (TTM) 9.701B. Crazy numbers. I've ridden it since the start of the year and am looking to top up again with the announcement of their multipayment plans being tested.

Visa Unveils Instalment Payment Capabilities to Give Shoppers Simple and Flexible Way to Pay

Visa (NYSE:V) is making it easier to provide shoppers the ability to choose how they pay before, during or after purchase with the introduction of a suite of Visa’s instalment solutions APIs. Through a pilot program, participating issuers and merchants will be able to offer their customers an instalment payment experience at checkout using a Visa card they already have in their wallet. With Visa’s instalment solutions, Visa cardholders will have the option to divide their total purchase amount…

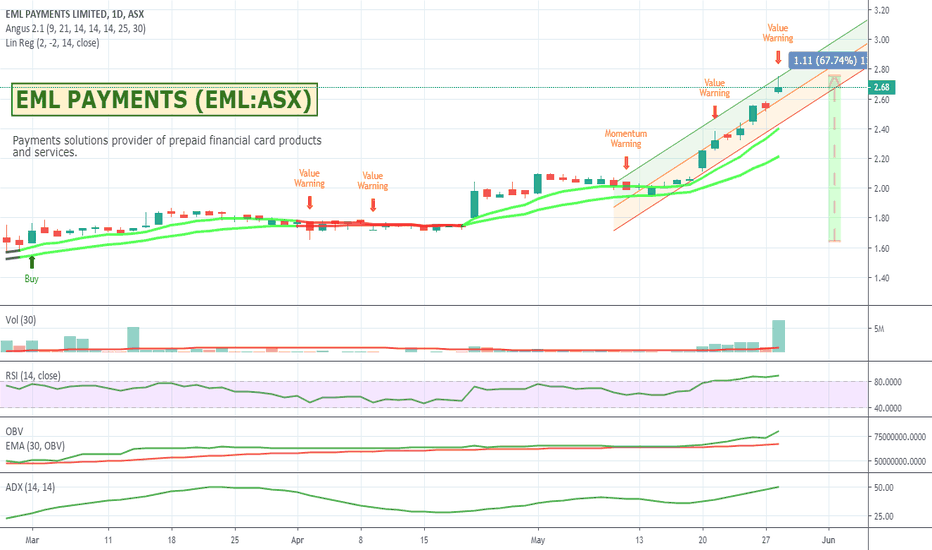

$EML - EML Payments - Good volume bump from conference$EML - EML Payments - Good volume bump from conference

EML has been having a good run as of late and had another nice volume and price bump today. They are doing an investor conference tour and I guess they audience is liking what they are selling. With another conference scheduled for Thursday I'm hoping the run will continue through the weekend.

About EML

EML PAYMENTS LIMITED (ASX: EML) (“EML”) is presenting at a number of investor events on Tuesday 28th May and Thursday 30th May in Sydney and Melbourne.

EML Payments Limited, formerly Emerchants Limited, is a payments solutions provider of prepaid financial card products and services. The Company's segments include Australia Reloadable, Australia Non-Reloadable, Europe and North America. By using its payments software and processing platform, the Company provides its clients with financial service payment solutions for reloadable and non-reloadable prepaid card programs, in Australia, the United Kingdom and Europe, the United States and Canada. It offers various solutions, such as consumer lending, EachWay cash load solution and commercial solutions. It provides prepaid solutions, such as treasury, and compliance and fraud management. EachWay cash load solution allows customers to convert cash to value in their gaming account, and to deposit cash at a retailer for instant value in the gaming account. It delivers general purpose reloadable and non-reloadable prepaid card based solutions for clients across various industries.

$RMS - RAMELIUS - Will it bounce?Hopefully has found support at the 80 cents mark on both the horizontal historical support level as well as the 90 day linear regression support trading range. Possible 20% upside to get back to the top of the channel. Risk of 8% or so if it breaks and heads down to the next support level. I already hold a few so will see where it goes. I have a stop loss at 75 cents but if it breaks below 79 cents I will probably look to sell. Might be worth a watch especially if it heads up tomorrow. Otherwise stay out or for me it's a sell :)

Ramelius Resources Limited is engaged in exploration, mine development, mine operations, the sale of gold and milling services. The Company's segments include Mt Magnet, Burbanks and Exploration. The Company's operational projects include Mt Magnet Mine, Kathleen Valley Mine and Vivien Mine. Its development projects include Blackmans and Water Tank Hill. Its exploration projects include Milkyway, Boorgardie Basin and Tanami Joint Venture Gold Project. The Mt Magnet gold project is located adjacent to the town of Mt Magnet, approximately 500 kilometers north-east of Perth in the Murchison Goldfield of the Western Australian Yilgarn Craton. The Blackmans gold project is located approximately 30 kilometers north of Mt Magnet, in Western Australia. The Water Tank Hill project lies over 1.5 kilometers west of Mt Magnet, in Western Australia. The Milkyway gold project is located approximately 3.6 kilometers southwest of the processing plant at Mt Magnet, Western Australia.