$TLS - TELSTRA - Looking to break 52 week high.$TLS - TELSTRA - Looking to break 52 week high.

Telstra has been showing good signs of recovery and testing some pretty consistent resistance and hopefully soon to become support areas. Has some good additional volume coming through and it will be interesting to see what the eventual roll out of the 5G Network will do to Telstras growth revenue opportunities. Worth a watch.

Closer view

About Telstra

Telstra Corporation Limited (Telstra) is a telecommunications and technology company. Its principal activity is to provide telecommunications and information services for domestic and international customers. The Company operates through four segments. The Telstra Retail segment provides telecommunication products, services and solutions across mobiles, fixed and mobile broadband, telephony and Pay television/Internet Protocol television and digital content. The Global Enterprise and Services segment provides sales and contract management for business and government customers. The Telstra Operations segment offers overall planning, design, engineering and architecture and construction of Telstra networks, technology and information technology solution. The Telstra Wholesale segment provides a range of telecommunication products and services delivered over Telstra networks and associated support systems to other carriers, carriage service providers and Internet service providers.

Search in ideas for "zAngus"

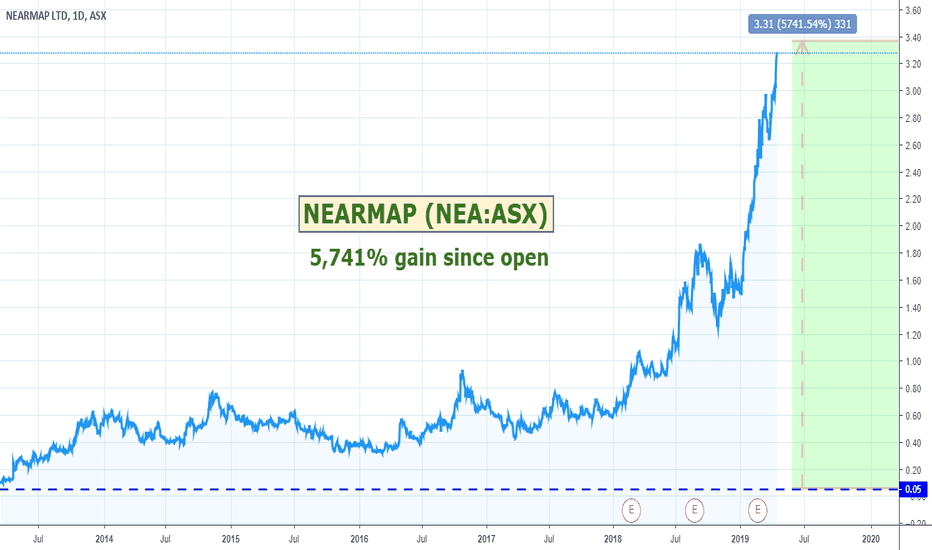

$NEA - NEARMAP - Being admitted to the ASX 200.$NEA - NEARMAP - Being admitted to the ASX 200.

Nearmap has been one of my longest held stocks and just an absolute beast of a performer. News out today has it being admitted Survivor style into the ASX 200 with MYOB being voted out. Should put it on the radar of more of the big boy investors.

MYOB Group Limited to be removed from the S&P/ASX 200 Index

SYDNEY, APRIL 15, 2019: S&P Dow Jones Indices announced today that it will remove MYOB Group Limited (XASX: MYO) from the S&P/ASX 200, subject to shareholder and final court approval of the scheme of arrangement whereby the company will be acquired by KKR & Co Inc (XNYS: KKR).

S&P Dow Jones will remove MYOB Group Limited from the S&P/ASX 200 effective after the close of trading on April 24, 2019. Myob Group Ltd will be replaced by Nearmap Ltd (XASX: NEA) in the S&P/ASX 200 effective after the close of trading on April 24, 2019.

$CHC - CHARTER HALL (CHC:ASX) - The Trend Is Your Friend$CHC - CHARTER HALL - The Trend Is Your Friend

Charter Hall has been having a great run this year, up around 60% since it started its uphill climb. With some of the nervousness out of the way with the election behind us it could be a great one to watch. Bit of weakness in the volume at the moment so time your entry and set your stops.

About Charter Hall

Charter Hall Group (CHC) is a property fund manager and developer managing a suite of institutional, wholesale and retail unlisted property funds in which it holds investments. The funds are diversified across the office, retail, industrial and residential sectors. CHC has offices in Sydney, Melbourne, Brisbane, Adelaide, and Perth. CHC's business comprises two divisions namely property investments, and property funds management.

$WHK - WHITEHAWK (WHK:ASX) - Up 135% since the start of May$WHK - WHITEHAWK (WHK:ASX) - Up 135% since the start of May

Whitehawk has been having a great run since the start of May which looks set to continue especially with all the extra attention to the "hacking / spying" industry the Trump Huawei bans in the news has been generating. Might be worth a watch.

About Whitehawk

WhiteHawk Ltd is an Australia-based company that operates a business to business (B2B) e-commerce cyber security exchange. The Company operates through its subsidiary, WhiteHawk CEC Inc (WhiteHawk US). Its cyber security exchange allows users to match vendor cyber security products and services to their needs and allows them to buy it online or a WhiteHawk cyber advisor underpinning the WhiteHawk exchange. Its services include cyberpath solution engine, vendor exchange, WhiteHawk advisory and WhiteHawk Insights. Cyberpath solution engine is a cyber risk profile that identifies existing cyber security gaps and matches customers to product and solution options for purchase. Vendor Exchange is a living vendor online exchange of products and services and allows small and midsize businesses to assess, shop and buy cyber solutions online. WhiteHawk advisory includes online analysts who can assist all customers with completing the CyberPath Solution Engine questionnaire.

$TNE - TECHNOLOGY ONE - Been having a good runId like to see it break $7.54 to confirm continuation of trend but it has been a great performer.

Technology One Limited is an enterprise software company. The Company is engaged in the development, marketing, sale, implementation and support of enterprise business software solutions. The Company's segments include Sales and Marketing, which includes sales of license fees and customer support to its customers; Consulting, which includes implementation, consulting services and custom software development services for large scale purpose built applications; Research and development, which includes the research, development and support of its products; Cloud, which includes delivery of cloud hosting services to its customers, and Corporate. Its enterprise business software solutions include TechnologyOne Financials, TechnologyOne Enterprise Asset Management, TechnologyOne Supply Chain, TechnologyOne Human Resource and Payroll, TechnologyOne Property and Rating, TechnologyOne Stakeholder Management and TechnologyOne Student Management.

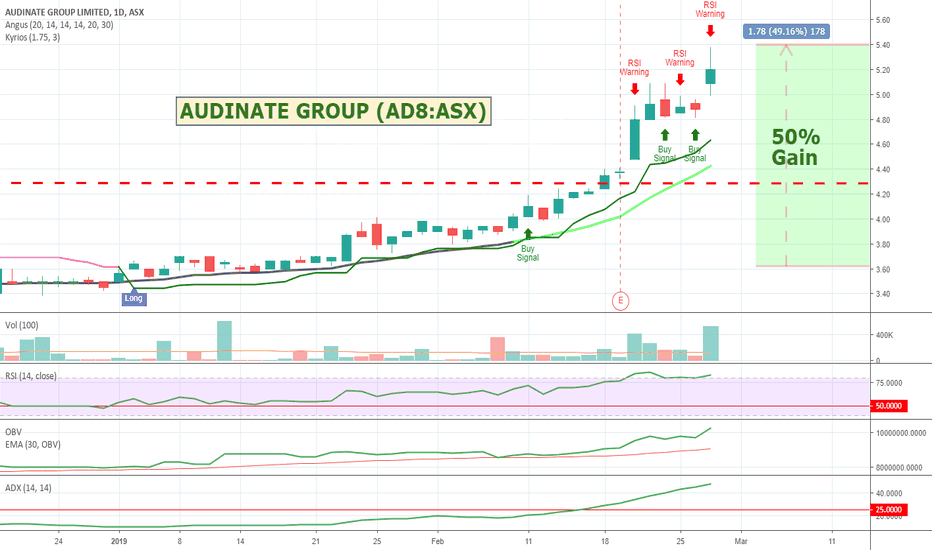

$AD8 - AUDINATE GROUP - Smashing old highsPerforming well with some nice volume behind it. Closed at $5.09. Has some good market depth on the buy side behind it so I think we will see it continue up. Worth a watch.

Audinate Group Limited is an Australia-based provider of professional audio networking technologies globally. The Company is engaged in developing both software and hardware to facilitate the delivery and management of audio over information technology (IT) networks, which improves audio quality, equipment interoperability and system flexibility. Its Dante solution is an uncompressed, multi-channel digital media networking technology, with near-zero latency and synchronization. Its products include Dante Analog Output Module, Dante Broadway, Dante Brooklyn II, Dante Brooklyn II PDK, Dante Controller, Dante Domain Manager, Dante HC, Dante PCIe-R Soundcard, Dante Ultimo, Dante Ultimo Product Development Kit (PDK), Dante Via, Dante Virtual Soundcard and Dante-MY16-AUD2. The Dante Analog Output Module is a Dante audio to analog audio adapter module, supporting one RJ45 Dante input, and one or two balanced analog outputs.

$LNY - LANEWAY RESOURCES - Buyer interest building$LNY - LANEWAY RESOURCES - Buyer interest building

Laneway came up on an average day volume scan with a pullback off a strong rally leading to a high. Catalyst is their announcement around their beginning mining of a new site. Might be worth a watch.

150 buyers for 85,439,709 units; versus

88 sellers for 58,748,682 units

Company News - 11 April 2019 - Mining Begins at Agate Creek Gold Project

Mining operations have commenced at Laneway Resources’ 100% owned Agate Creek Gold Project.

First ore blast took place yesterday afternoon.

Ore is currently being mined and stockpiled at site.

Transportation of ore to Maroon Gold’s Plant at Charters Towers is expected to commence this weekend.

Ore processing will begin shortly thereafter pursuant to the Mining and Processing Agreement Laneway has entered into with Maroon Gold which will allow toll treatment of high grade ore through Maroon’s Gold Processing Black Jack Plant at Charters Towers.

Laneway anticipates material positive cash flow from the mining activities at the Agate Creek high grade project aided by recent high prices for AUD denominated gold.

About Laneway Resources

Laneway Resources Limited is a mineral exploration company, which is engaged in exploration for and evaluation of gold and coal tenements. The Company's projects include Agate Creek Gold Project, LNJV Gold Project and Ashford Coking Coal Project. The Agate Creek Gold Project includes approximately 10 separate exploration permits (EPMs), a mineral development lease (MDL) and a mining lease application (MLA). Its tenement package covers an area of over 620 square kilometers and approximately 180 sub-blocks. The Agate Creek Gold Project has MDL402, EPM17788, EPM17739, EPM17632, EPM17949, EPM17626, EPM17629 and MLA100030. The Agate Creel Gold Project is located approximately 60 kilometers south of Georgetown. The LNJV Gold Project is located on the North Island of New Zealand in the Hauraki goldfield. The Ashford Coking Coal Project comprises a Joint Venture Northern Energy Corporation (NEC). The Joint Venture incorporates the Ashford Mine Area (exploration license (EL) 6234 and EL 6428).

Standard Disclaimer

I am guessing. Do your own research. The market lies.

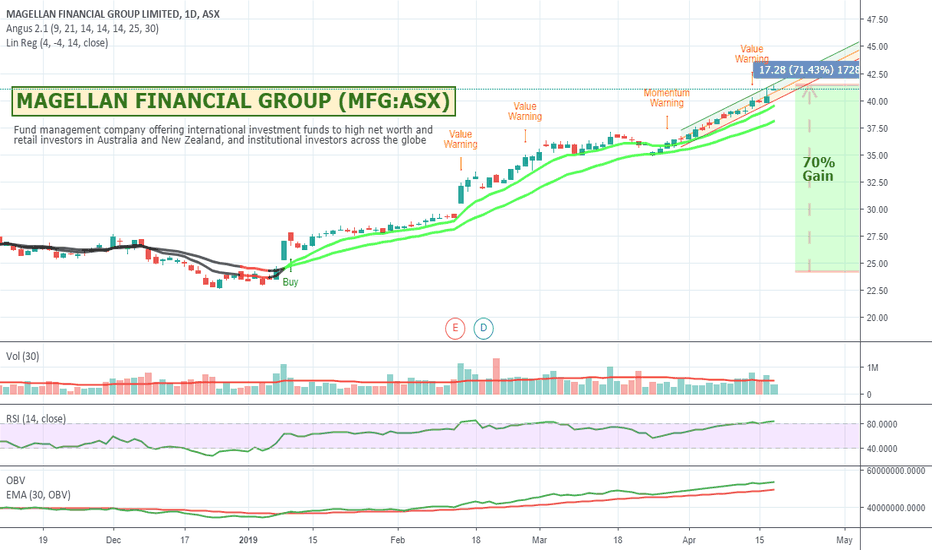

$MFG - MAGELLAN - Performing well$MFG - MAGELLAN - Performing well

Magellan has been having a good run this year. Might be worth a look for those with more conservative portfolios.

About Magellan

Magellan Financial Group Limited is a fund management company. The Company's objective includes offering international investment funds to high net worth and retail investors in Australia and New Zealand, and institutional investors across the globe. Its segments include Funds Management, Principal Investments and Corporate. The funds management activities of the Company are undertaken by the controlled entities, Magellan Asset Management Limited (MAM) and MFG Services LLC (MFGS). MAM's funds management activities comprise acting as trustee, responsible entity and investment manager for the managed investment schemes offered primarily to Australian and New Zealand investors. MFGS acts as a service company providing MAM with services of investment analysts and distribution personnel based in the United States. The principal investment portfolio comprises its investments in the Australian Stock Exchange (ASX) Quoted Funds, the Unlisted Magellan Funds and the Frontier MFG Funds.

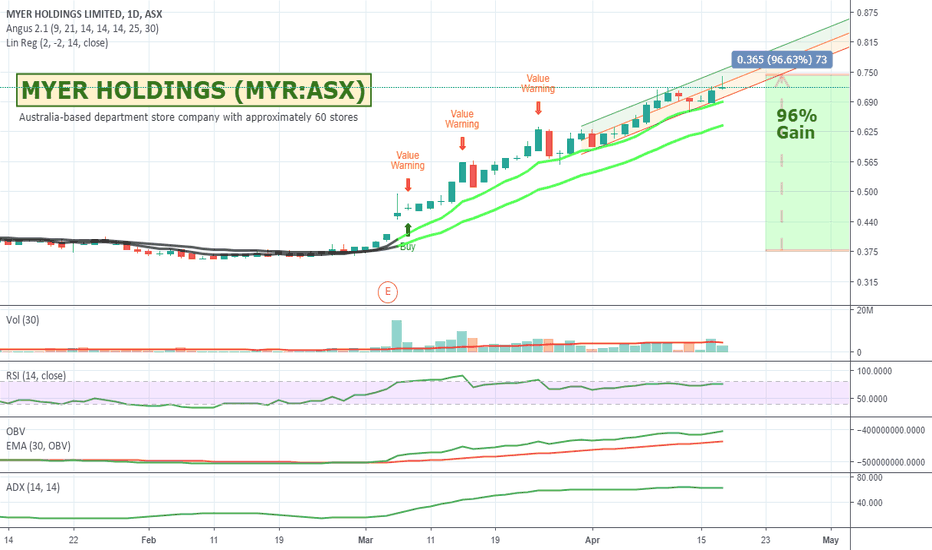

$MYR - MYER HOLDINGS - Amazing retail run$MYR - MYER HOLDINGS - Amazing retail run

Myer is another surprise runner with close to a 100% gain over since the start of March. Might be worth a look.

About Myer

Myer Holdings Limited (Myer) is an Australia-based department store company. The Company's department store network includes a footprint of approximately 60 stores in retail locations across Australia. The Myer merchandise offer includes 11 product categories: Womenswear; Menswear; Miss Shop (Youth); Childrenswear; Intimate apparel; Beauty, fragrance and cosmetics; Homewares; Electrical goods; Toys; Footwear, handbags and accessories, and General merchandise. The Company also owns womenswear designer brand, sass & bide. The Company's brands include TOPSHOP TOPMAN, Seed, French Connection, Mimco, Veronika Maine, Jack & Jones and Industrie. The Company's subsidiaries include Myer Pty Ltd, NB Elizabeth Pty Ltd, NB Russell Pty Ltd, Warehouse Solutions Pty Ltd, Myer Group Finance Limited, Myer Group Pty Ltd and Myer Travel Pty Ltd. The Company also undertakes activities outside the department store retail business through its subsidiaries, sass & bide, and FSS Retail Pty Ltd.

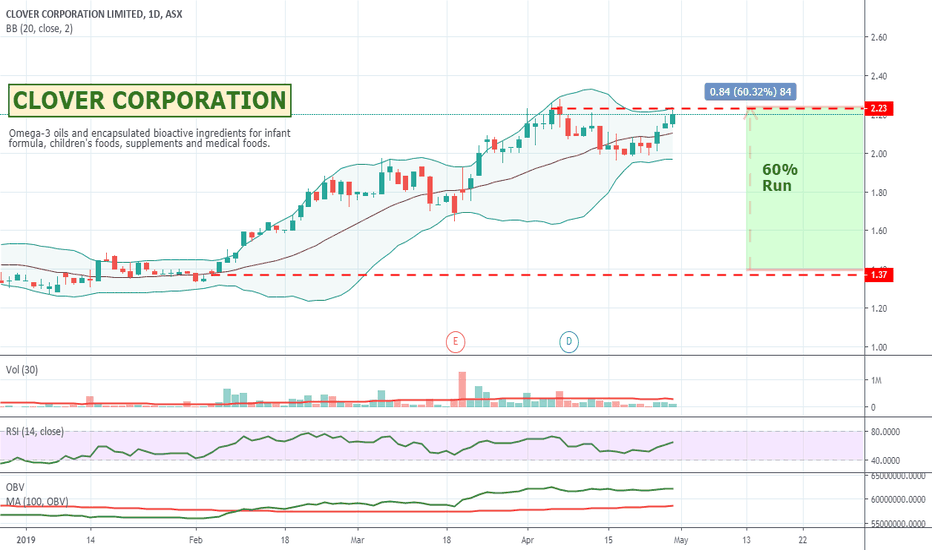

$CLV - CLOVER CORP - Back testing resistanceClover has been having a good run. Back testing resistance. On the lower level timeframes Im getting some volume alerts so might be one to watch.

Clover Corporation Limited (CLV) is involved in the refining and sale of omega-3 oils and encapsulated bioactive ingredients for infant formula, children's foods, supplements and medical foods. CLV operates its businesses from five sites: a headquarter in Sydney; a manufacturing plant for tuna oils and related products in Altona; a product development R&D facility, technical support and marketing in Brisbane; the finance and IT departments in Gladstone Park; and a logistic and customer service office in the UK.

$SMR - STANMORE COAL - Testing resistance again$SMR - STANMORE COAL - Testing resistance again

Looks like it is setting up for another attempt to push through. Has some better volume signals behind it this time. Might be worth a watch.

Stanmore Coal Limited (SMR) is a mineral exploration company, focusing on the exploration and development of export coking, PCI and thermal coal deposits within the prime coal bearing regions of Eastern Australia.

$CGC - COSTA GROUP - Looking to fill the gap?$CGC - COSTA GROUP - Looking to fill the gap?

It got whacked in Jan because of earnings warning. Things seem back on track and big gap up to fill. I like the look of it technically. Commonwealth Bank has bought in. Maybe a stop around 5.75 based on the 15 min chart. Long term could be promising. Worth a watch.

About Costa Group

Costa Group Holdings Limited is a horticulture company. The Company is principally engaged in the growing of mushrooms, blueberries, raspberries, glasshouse grown tomatoes, citrus and other selected fruits within Australia; the packing, marketing and distribution of fruit and vegetables within Australia and to export markets; provision of chilled logistics warehousing and services within Australia, and licensing of blueberry varieties and berry farming in international markets. It operates in three segments: Produce, which operates in four categories: berries, mushrooms, glasshouse grown tomatoes and citrus; Costa Farms and Logistics (CF&L), which incorporates interrelated logistics, wholesale avocado marketing and banana farming and marketing operations within Australia, and International, which consists of royalty income from licensing of the Company's blueberry varietals in Australia, the US and Africa, and international berry farming operations in Morocco and China.

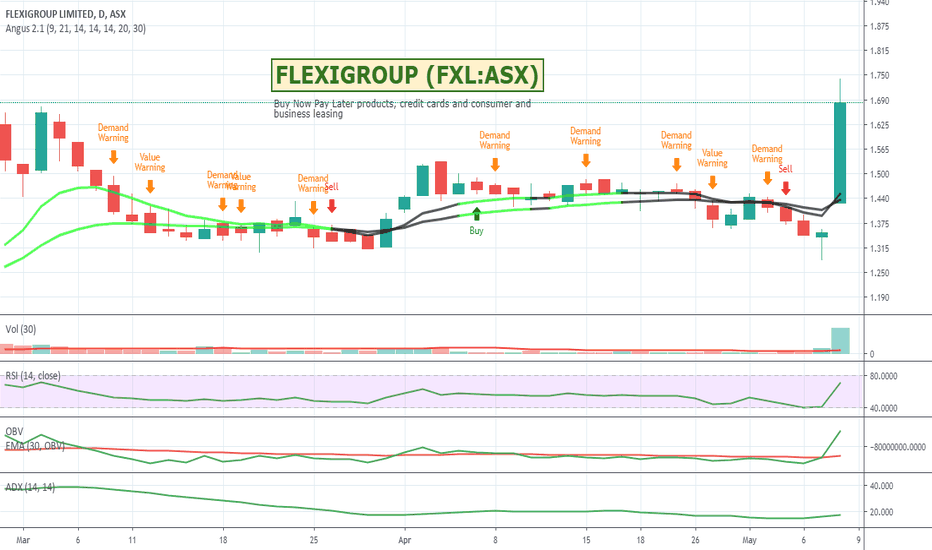

$FXL - FLEXIGROUP - One to watch for the APT halo effect$FXL - FLEXIGROUP - One to watch for the APT halo effect

FLEXIGROUP has been around for a LONG time - I used to sell their products when I worked at Harvey Normans in the very early 2000's and it was ridiculously popular (and profitable for Harveys) even then.

They are having a pretty good run at the moment positioning themselves as the "original" Afterpay play in the Australian market. With such a big push today I'd be cautious about a pullback but definitely a share to keep an eye on.

Today's Announcement

Australia’s original Buy Now Pay Later provider launches newest offer as Myer, IKEA, JB Hifi New Zealand, Solomon’s Carpets, Strandbags, National Hearing, National Dental Plan and City Fertility join the Flexigroup / humm platform to take total humm retailers to over 13,000

FlexiGroup Limited (ASX: FXL) (“flexigroup”) today announces that a number of new high profile retail partners have joined the humm platform. The addition of these tier one retailers in the fashion retail, health and home improvement categories represents continued momentum across humm’s target verticals.

Flexigroup, the inventor of Buy Now Pay Later (“BNPL”) in Australia has successfully consolidated two legacy platforms - Certegy EziPay and OxiPay - into an innovative and differentiated customer offer which enables shoppers to spend from $1 up to $30,000 completely interest free. humm accounts for 17% market share of the BNPL transaction volume in Australia (and 40% of receivables) with over 1 million customers shopping at more than 13,000 seller locations and e-commerce platforms. In New Zealand flexigroup has over 160,000 BNPL customers who can shop at over 1,700 seller locations.

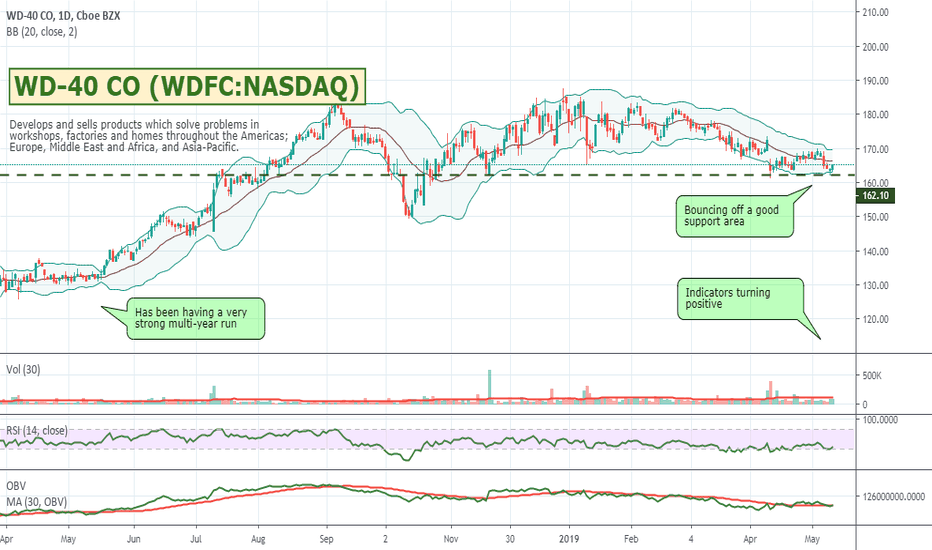

$WDFC:NASDAQ - WD-40 CO - My mums now picking stocks :O$WDFC:NASDAQ - WD-40 CO - My mums now picking stocks :O

My mother who has never expressed *any* interest in the stock market another than being annoyed at hearing my Dad and I who are both highly active / daily traders blab on about it constantly, came up to us on the weekend with an article on WD-40 and simply said I'd like to buy some of this... and she did indeed mean the stock. Who were we to argue - hahaha.

The stock does actually look quite good - long year-on-year price growth and seems to be bouncing off a resistance point at the moment after having ranged sideways for a while. Pretty sure mum just liked the story about the CEO. If you want to Google it, the article is: 'Squeaks in China, rust in Russia': WD-40 Aussie chief's lube plans

About WD-40 CO

WD-40 Company is a global company engaged in developing and selling products, which solve problems in workshops, factories and homes. The Company's segments include the Americas; Europe, Middle East and Africa (EMEA), and Asia-Pacific. The Company's Americas segment includes the United States, Canada and Latin America. The EMEA segment includes countries in Europe, the Middle East, Africa and India. The Asia-Pacific segment includes Australia, China and other countries in the Asia region. The Company has two product groups, which include maintenance products and home care and cleaning products. As of August 31, 2016, the Company marketed and sold its products in more than 176 countries and territories around the world primarily through mass retail and home centre stores, warehouse club stores, grocery stores, hardware stores, automotive parts outlets, sport retailers, independent bike dealers, online retailers and industrial distributors and suppliers.

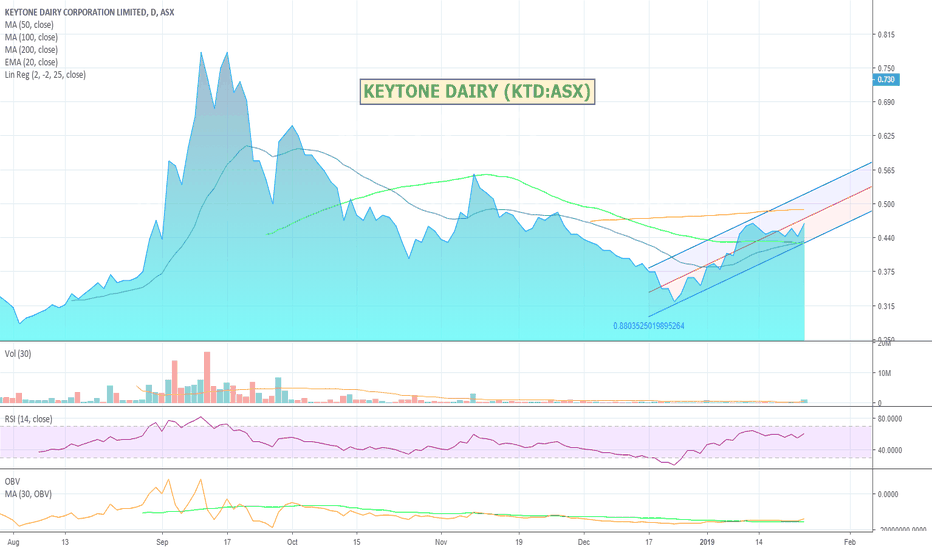

$KTD - KEYTONE DAIRY - Interesting innovative business I like$KTD - KEYTONE DAIRY

I don't love the chart quite yet and their financials even less, but they are starting to make a bit of a consistent recovery again from their old highs, and I do VERY much like the business they are in.

They have just announced 2 new products targeting diabetes which is going to be a MASSIVE future industry (and arguably already is). In 2017, China alone had more than 114 million people with diabetes and spent US$110 billion on diabetes-related healthcare.

They also have products targeting developing children and have LOADS of certifications that will allow their product to trade globally including the Certification & Accreditation Administration of the People’s Republic of China manufacturer registration, which allows it to export a range of dairy and dairy-based products to China, including the new diabetic and junior formulas. Its factory also holds a Halal certification from the Federation of Islamic Associations of New Zealand, an accredited body recognised by Islamic countries worldwide. The Halal certification enables Keytone to export its products to regions such as the Middle East and Southeast Asia.

See if you can find the Australian SmallCaps blog post on it. Quite an interesting and well positioned it would seem company. With a new factory on its way in New Zealand I like them as a longer term buy and hold while they get their production numbers up and sales funnels going.

ABOUT KEYTONE (KTD)

=======================

Keytone Dairy Corporation Limited is an Australia-based diary product manufacturer. The Company manufactures and exports nutritional dairy products with a focus on powdered milk products. It markets its products under the brand names, KeyDiary, KeyHealth, and FaceClear. KeyDiary includes powdered milk nutritional products, such as whole milk powder, skim milk powder, colostrums milk powder, and kiwifruit milk powder. KeyHealth and FaceClear are health supplement capsules for the treatment of acne. The Company is conducting research for developing dairy-based products for sports nutrition, senior dairy nutrition, junior products, pregnancy blends, patient formulas, and yoghurt powders.

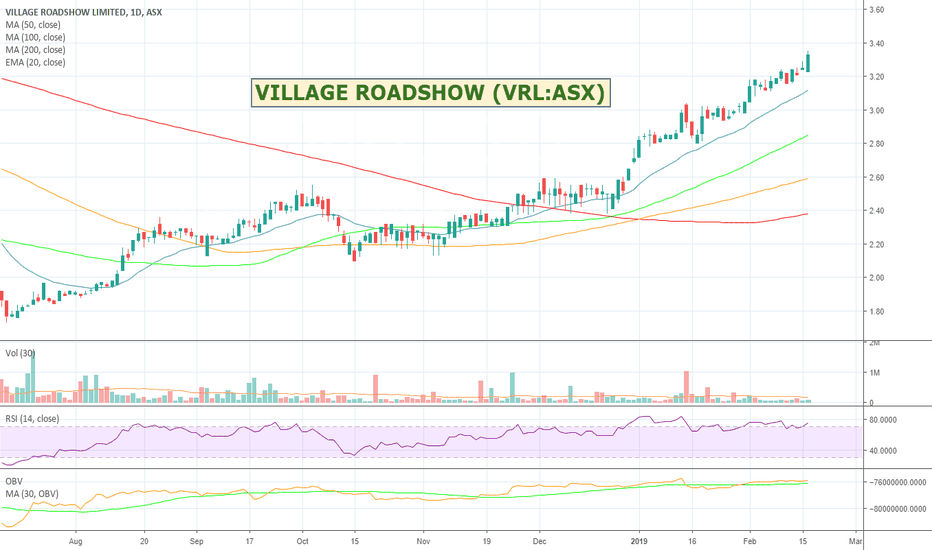

$VRL - VILLAGE ROADSHOW - Making one of its $8 runs again?$VRL - VILLAGE ROADSHOW - Making one of its $8 runs again?

Village isn't one I would normally look at as its not speculative enough for me and for my more conservative portfolios I think its financials are a little flaky - BUT - it has been making a VERY steady recovery and most of its bad news / safety / PR disasters are gradually moving behind it and less in the public's front of mind. I was surprised to learn they are operating theme parks in China which was what made me more interested. Fantastic chart for the recent period and if you have a look at it over the last 5 to 10 years it does have a history of these BIG sell offs and recoveries. Has me interested.

Village Roadshow Limited is engaged in theme park and water park operations, cinema exhibition operations, film and digital versatile disc (DVD) distribution operations, and sales promotion and loyalty program operations. The Company's segments include Theme Parks, Cinema Exhibition, Film Distribution, Marketing Solutions and Other. The Theme Parks segment is engaged in theme park and water park operations. The Cinema Exhibition segment is engaged in cinema exhibition operations. The Film Distribution segment is engaged in film and DVD distribution operations. The Marketing Solutions segment is engaged in sales promotion and loyalty program operations. In addition, the Company has an equity interest in Village Roadshow Entertainment Group Limited, which is engaged in film production activities. The Company's other activities include corporate overheads, financing activities, and digital and information technology development.

$APT - AFTERPAY - New Highs. Will it breakout or plunge?$APT - AFTERPAY - New Highs. Will it breakout or plunge?

A few people on some of the forums are starting to talk about shorting opportunities for Afterpay. I have a pretty good holding with my last top up at $16 and like to trade long only so I'm of course hoping it keeps going up.

Market depth is still good with buyer numbers and buyer volume is still roughly double the sale side so we haven't seen a rush for the exit by any means.

On the 5 minute chart it has tested the old high a couple of times and hasn't dropped back through so will hopefully start to use it for support and continue its run. I think I can also see that the RSI is in oversold territory and headed back up, there looks to be some volume, and the OBV is also heading up so I don't think its run is over yet. Might consolidate and trend sideways for a bit while the market gets used to this new price point. Be interesting to see if it bounces off the MA (200).

The whole market is pretty bullish so that is in our favour as well but my trailing stops are in as always so I'll auto exit if it heads the wrong way.

5 minute chart testing resistance / support

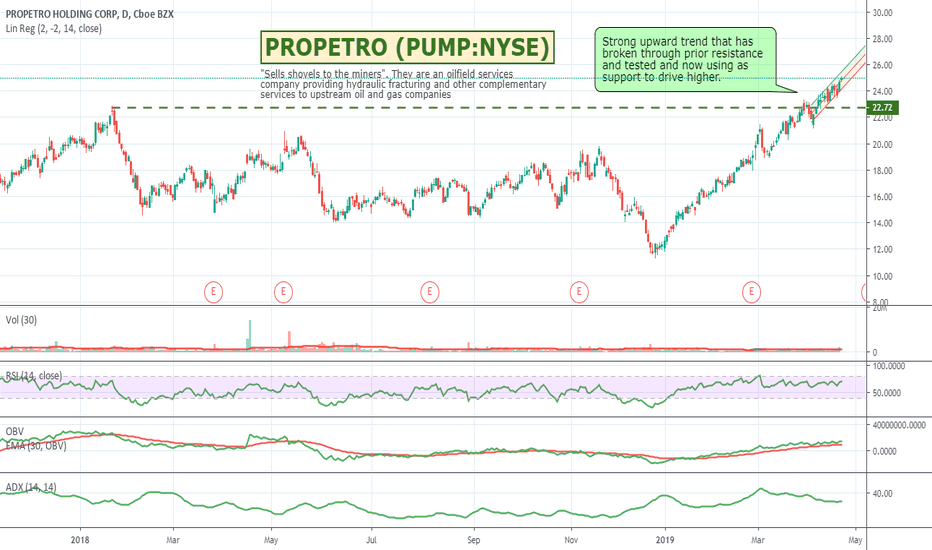

$PUMP - PROPETRO (PUMP:NYSE) - Broken resistance$PUMP - PROPETRO (PUMP:NYSE) - Broken resistance

Has been performing well since the start of the year with a nice consistent uptrend supported by volume that has helped it break through old resistance and continue its run.

Also figured I can't go wrong with a stock with "pump" as its code.

Closer view

About ProPetro

ProPetro Holding Corp. is an oilfield services company. The Company provides hydraulic fracturing and other complementary services to upstream oil and gas companies, which are engaged in the exploration and production (E&P) of North American unconventional oil and natural gas resources. The Company operates through seven segments: hydraulic fracturing, cementing, acidizing, coil tubing, flowback, surface drilling and Permian drilling. Its pressure pumping segment includes cementing and acidizing operations. The Company's operations are focused in the Permian Basin. As of December 31, 2016, the Company's fleet consisted of 10 hydraulic fracturing units with an aggregate of 420,000 hydraulic horsepower (HHP).

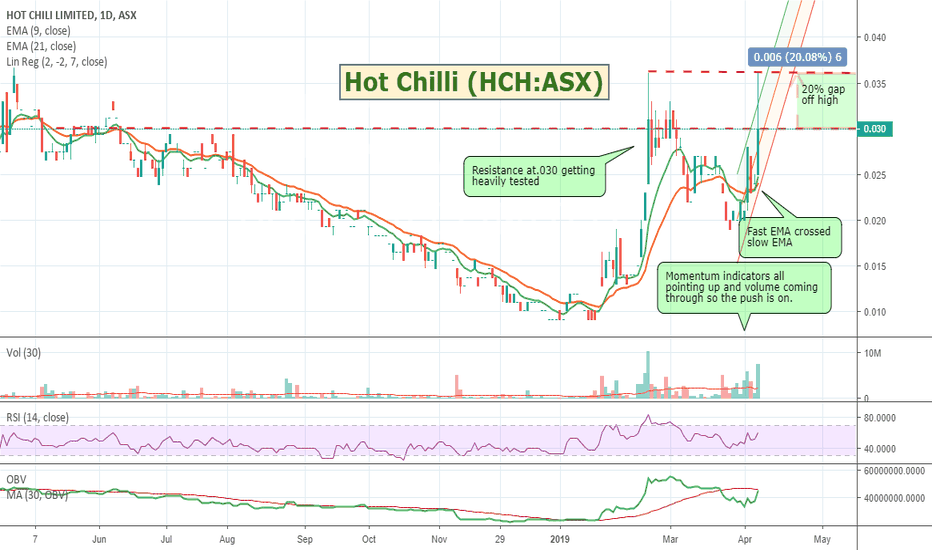

$HCH - Hot Chili - Volume Breakout at Resistance$HCH - Hot Chili - Volume Breakout at Resistance

HCH closed up 25.0 percent on Friday, April 5, 2019, on 3.56 times normal volume and appears to be in a medium-term rally confirmed by multiple indicators.

Most importantly, the faster 9-day exponential moving average is above the slower 21-day exponential moving average and both are strongly rising with previous resistance in the .030 + range having been heavily tested and the long wick shows buyers were prepared to pay significantly more before the rally retreated.

Volume has surged past its 30 day average and our OBV (On Balance Volume) indicator also looks to be about to breakout and push strongly though its 30 day moving average so there is strong buyer interest coming into the stock.

The RSI is above 50 and moving up which is also a great sign of strength. Importantly the RSI is at 60 so well below the 70 to 80 traditional reversal range which indicates the stock is probably considered fairly valued by the market at this price point and nor is it likely to trigger profit taking as it's not in that overbought range. With these signals it would seem less likely for it to reverse significantly without a strong catalyst like bad news.

Other bullish signals from the days trade that will help support our break out include:

- MACD Bullish Signal Line Cross

- New Uptrend

- Pocket Pivot Swing Setup

- Volume Surge

- Wide Range Bar showing Range Expansion

- Wide Bands showing Range Expansion

- Upper Bollinger Band Touch showing Strength

- Crossed Above 20 DMA

OR TL;DR

Volume breakout at resistance

About Hot Chili

Hot Chili Limited is an Australia-based company that acquires and develops copper multi-commodity projects within Chile. The Company is principally engaged in mineral exploration. The Company's geographical regions include Australia and Chile. The Company's project include Productora copper project. The Productora copper project is located 15 kilometers south of the town of Vallenar, at low altitude, in Chile's Region III. The Company is focused on achieving growth and development at its Productora copper project, and in expanding the Company's project portfolio to ensure future copper production hub.

Disclaimer

I am guessing and the market lies.

$LVT - LIVETILES - Broken resistance $LVT - LIVETILES - Broken resistance

Has broken through a couple of resistance levels, done a retest and might be moving again. Long way off old time highs of 75 cents and has been recently admitted to the all ords so might pop up on more watch lists. Strategic alliance with Microsoft always helps. Good market depth on the buy side. Worth a watch.

LiveTiles Limited is an Australia-based company, which offers digital workplace platforms, including user experience-focused solutions to the enterprise, education and small and midsized business (SMB) markets. The Company is engaged in the development and sale of digital workplace software. The Company's product suite includes LiveTiles SharePoint, LiveTiles Cloud and LiveTiles Mosaic for K-12 schools. LiveTiles SharePoint organizes scattered business applications and designs dashboards and sites on Microsoft SharePoint and Office 365. LiveTiles Cloud organizes scattered business applications and designs dashboards and sites without needing to install software. LiveTiles Mosaic is a virtual classroom where teachers and students connect. The Company's customers represent a diverse range of sectors and are spread throughout North America, the United Kingdom, Europe, the Middle East and Asia-Pacific.

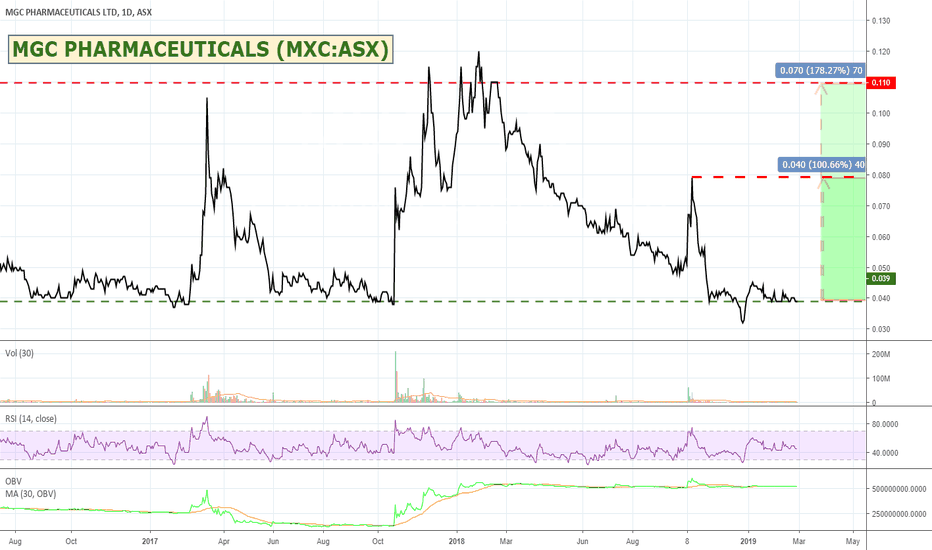

$MXC - MGC PHARMA - At very strong support level.$MXC - MGC PHARMA - At very strong support level.

Has a reputation for a pump and dump type stock, but that might be okay as its at the bottom of the pump area. Rising volume will be your friend here so keep an eye on the OBV. Id like to see RSI cross upwards through 50 to confirm interest. Has some very good market depth on the buy side so cant see it retracing too far. Id jam a stop a few pips down if I was going to trade it and let it run. Well worth a watch I think.

MGC Pharmaceuticals Limited, formerly Erin Resources Limited, is a medical and cosmetics cannabis company. The Company is engaged in the creating cannabidiol (CBD) and medical cannabis business that focuses on the CBD market in Europe. CBD is used for the treatment of a range of skin and health conditions, including acne, psoriasis, eczema and dry skin. The Company's business model involves in growing cannabis sativa plants from high CBD yielding seeds and extracting CBD resin from the plants grown. It sells the CBD resins as a wholesale product to cosmetic and therapeutic product manufacturers. The CBD is also used to produce the Company's line of cosmetic products in Slovenia under the Ananda Cosmetics Joint Venture. It grows, harvests, dries out, extracts and sells cannabis sativa crop to enterprise customers in bulk, individual consumers in delivery devices or other products. The Company subsidiaries include MGC Pharma (UK) Ltd and MGC Pharmaceuticals d.o.o.

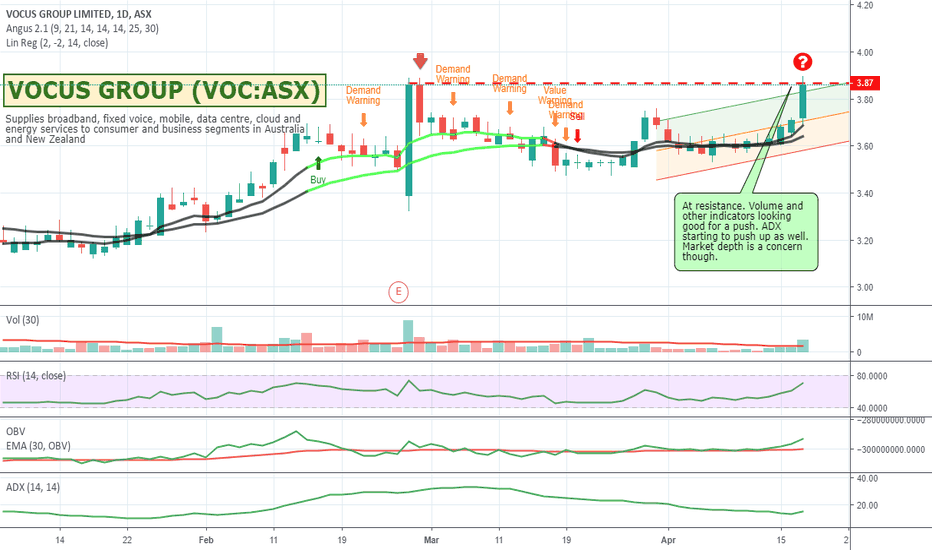

$VOC - VOCUS - Can it break resistance ?$VOC - VOCUS - Can it break resistance ?

Vocus is back up testing previous resistance. Indicators all look good for a push through, but ADX is still low showing that momentum hasn't arrived yet. This is confirmed when you look at the market depth on Commsec for example. It's a long way from its $9 highs in 2016 so lots of potential upside if it runs. Bit too early to trade but might be worth a watch.

About Vocus

Vocus Group Limited (ASX: VOC) is a specialist fibre network services provider operating Australia’s second largest inter-capital network as well as back haul fibre connecting most regional centres in Australia. Vocus also operates an extensive and modern network in New Zealand, connecting the country’s capitals and most regional centres. In total, the Vocus terrestrial network is c.30,000 route-km of high performance, high availability fibre-optic cable supported by 4,600km of submarine cable connecting Singapore, Indonesia and Australia and 2,100km of submarine cable between Port Hedland and Darwin and connecting offshore oil and gas facilities in the Timor Sea. Vocus owns a portfolio of brands catering to enterprise, government, wholesale, small business and residential customers across Australia and New Zealand.

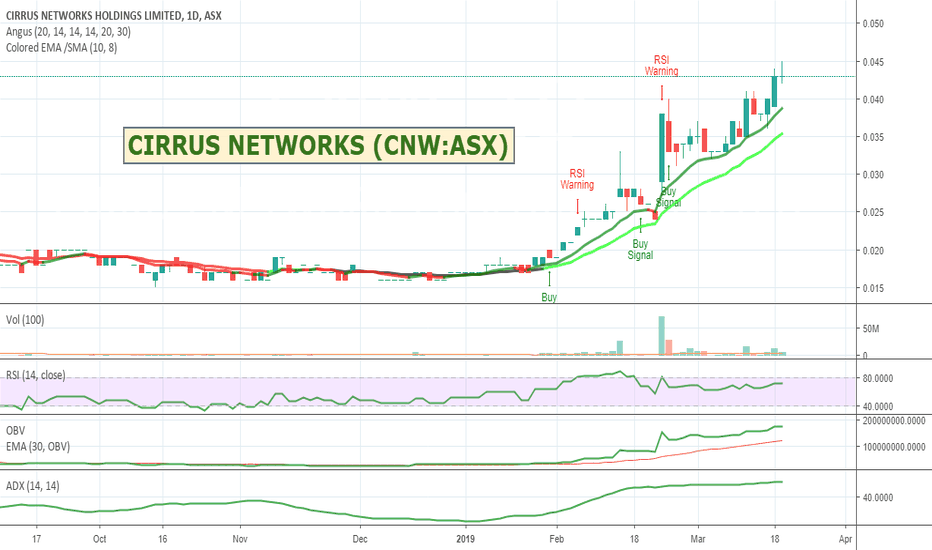

$CNW - CIRRUS NETWORKS - Having a breather.$CNW - CIRRUS NETWORKS - Having a breather.

===========================================

Stocks been having a really good run. Current candle shows a bit of a stalemate between buyers and sellers so the stock could go either way, but there is a lot of depth on the buy side so Im still bullish. Will keep an eye on it to see which way it heads on the open and decide on a play.

About Cirrus Networks

===========================================

Cirrus Networks Holdings Limited is engaged in the provision of information technology services and related third party products. The Company is a solutions integrator, which provides bespoke technology solutions to small and medium enterprises (SME) and government organizations. The Company's solutions include data center and cloud solutions; convergence; storage, big data and data management; network design and optimization; business continuity; end user computing; unified communications and Internet Protocol (IP) telephony; lifecycle management; information technology (IT) consulting and management, and project management. The Company's services include Nimbus level, which supports to sign up for a single offering, and Stratus, which is a bespoke mix and match of managed services and support agreements tailored for the business needs.