How I look for quick second and third day wins off breakouts.Was going through looking for stocks I'll watch on Monday morning and thought I'd make a video to share how I do it.

These stocks might go up and they might go down so do your own due diligence.

I'm guessing and wont act until I see which way they are going.

Search in ideas for "zAngus"

$PNV - POLYNOVO - Broken out of resistance$PNV - POLYNOVO - Broken out of resistance

Good looking chart - especially when you take a look at its 5 year chart and consistent growth over time. Its just broken past a long term ceiling and making new highs so might be worth a watch.

PolyNovo Limited is a medical device company. The Company designs, develops and manufactures solutions for standalone and combination devices using its NovoSorb biodegradable polymer technology. The Company focuses on medical devices that are used in the treatment of burns, surgical wounds and negative pressure wound therapy (NPWT). It is involved in the development of NovoPore for use as a dressing in NPWT that involves a wound-contacting foam dressing, a sealing membrane, a suction pump, and a drainage tube from the dressing to a canister, and Biodegradable Temporising Matrix (BTM), a wound dressing focused on treatment of full-thickness wounds and burns where the dermal structure has been lost to trauma, or damaged requiring surgical removal, and requires a split-thickness skin graft for final closure. In addition, the Company is engaged in the development of breast sling prototypes for non-clinical and clinical trials, as well as new products for hernia and breast reconstructions.

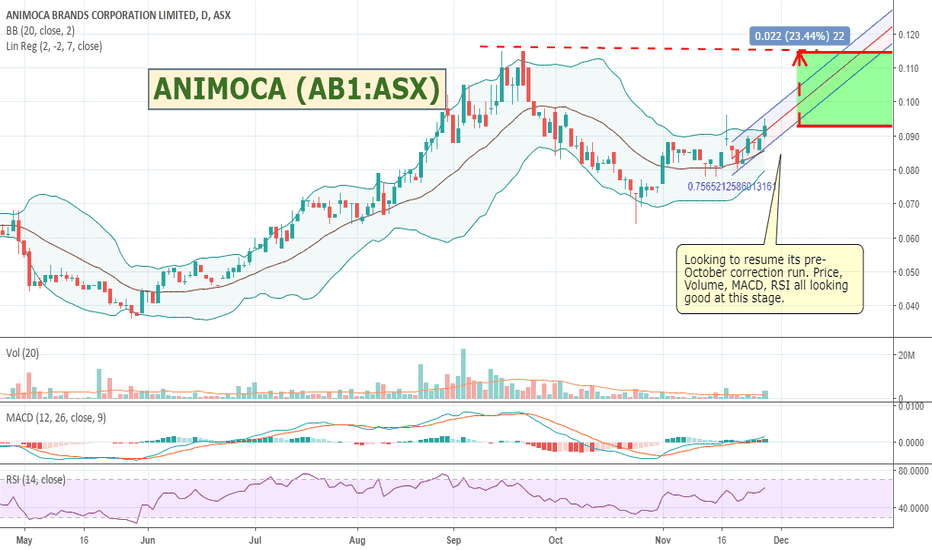

$AB1 - Animoca Brands - Resuming its pre-October runLooking to resume its pre-October correction run. Price, Volume, MACD, RSI all looking good at this stage especially if it can crack the 9 cents mark over the next few days and establish support before trying for the 10 cent previous highs. Hoping they can start to leverage some of the eSports hype building.

Animoca Brands Corporation Limited is engaged in the development and marketing a portfolio of mobile games and applications for smartphones and tablets. The Company's geographical segments include Europe and Asia. Its Europe segment consists of TicBits Oy's activities. Its Asia segment consists of Animoca Brands Limited's activities. Mobile games and applications developed and/or published are made available for customers on Application stores, including Apple App Store and Google Play. In addition to mobile games, the Company also provides additional products orientated to educational learning, including e-books and a book application. Its brands include Garfield, Ben10, Doraemon, Astro Boy, Norm of the North and Chocolate Rain. Its products include Garfield Games, Astro Boy Games, Doraemon Games, Ben 10 Games, Norm of the North's, Simulation Games, Robot Academy and Action Games.

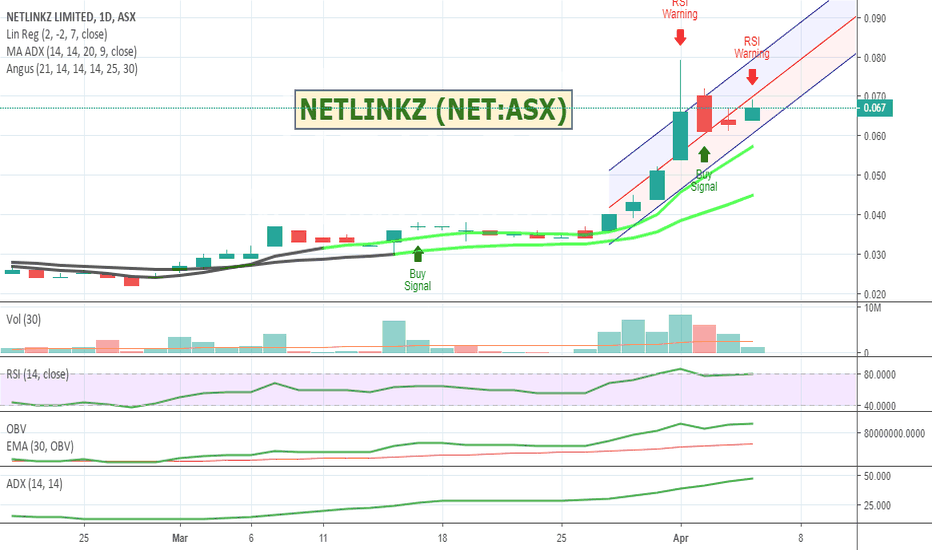

$NET - NETLINKZ - Running again after pullback?$NET - NETLINKZ - Running again after pullback?

Saw this one last week as it took off but was already fully invested elsewhere. It had a bit of a pullback but looks like it will run again supported by double the market depth on the buy vs the seller side.

The idea of a company being able to actively sell a VPN solution in China is quite interesting. Worth a watch.

"In February 2019 JAST (Netlinkz’s China Agent) was awarded a National IP - VPN Licence by the Ministry of Industry and Information Technology of the Chinese Government to distribute VPN replacement product throughout China"

About Netlinkz

NetLinkz Limited, formerly iWebGate Limited, is an Australia-based company, which offers NetLinkz, a technology that provides a Software-Defined Wide Area Network (SD-WAN) solution connecting any sites to any device, anywhere, on any network. Its segments include Australia, USA, Europe and Corporate. Its technology delivers the meshed peer-to-peer SD-WAN solution. SD-WAN offers a solution for information technology (IT) to extend or replace connectivity leveraging public Internet protocol links. Offering centralized wide area network management and near-zero touch edge software, which enables IT managers to connect cloud servers and mobile users to the enterprise network. It offers a range of products, which include LaunchPad and iWebGate Workspace Suit. Its LaunchPad acts as a single point of contact for various services, and is an integrated tool set and application program interface (API). Its iWebGate Workspace Suit includes Virtual Private Network LP, Desktop LP and Proxy LP.

$LCK - LEIGH CREEK - 60% Recovery Opportunity?$LCK - LEIGH CREEK - 60% Recovery Opportunity?

Big sell off over the last couple of days so will have a punt at the recovery. Bought in at .27 and stops are in place. Support at .25 so don't see too much short term risk and with Australia moving into Winter this gas company could regain some of its lost momentum. Worth a watch.

About Leigh Creek

Leigh Creek Energy Limited is a gas company. The Company focuses on the development of its Leigh Creek Energy Project (LCEP). The LCEP is located within PEL 650 at Leigh Creek in central South Australia, approximately 550 kilometers north of Adelaide. The Company focuses on producing electricity, methane and fertilizer from remnant coal resources at Leigh Creek utilizing in situ gasification (ISG) technologies. The LCEP intends to extract the energy in coal through ISG methods to produce methane for sale into the eastern Australian gas pipeline network. The LCEP will also utilize waste gasses through an adjacent fertilizer plant to provide supply to farmers across South Australia reliant on imports. The Company also holds a range of exploration license applications (mining and petroleum), however all of these tenements are at an early-stage of evaluation.

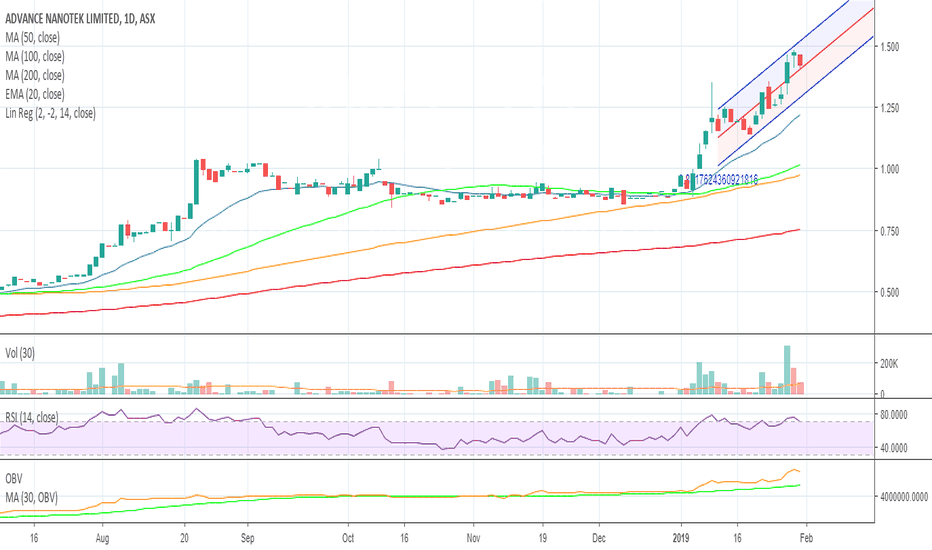

$ANO - ADVANCED NANOTEK - Bit more in it?After a long period of consolidation its been having a nice run of late. RSI is probably a bit high but has pulled back so might be a good time for an entry if it retests the previous high and runs again. Worth a watch.

Advance Nanotek Ltd, formerly Advanced Nano Technologies Limited, manufactures aluminum oxide powder, zinc oxide dispersions and zinc oxide powder for the personal care sector. The Company operates in the Personal Care segment, which produces and distributes dispersions of mineral-only ultra-violet (UV) filters in cosmetic emollients used for sunscreen, skincare and pharmaceutical formulations, as well as alumina plate-like powders used for cosmetic applications. Its geographical segments include Australia, United States of America, Europe and Rest of the world. It focuses on suncare and skincare sectors. The Company's products include ZinClear and Alusion. It offers a range of transparent zinc-based UV filters in dispersion and powder form under the ZinClear brand. ZinClear range includes ZinClear XP, ZinClear IM and ZinClear XP dispersions. Alusion is a soft focus cosmetic pigment and plate-like aluminum oxide that is used in various applications, such as cosmetics and coatings.

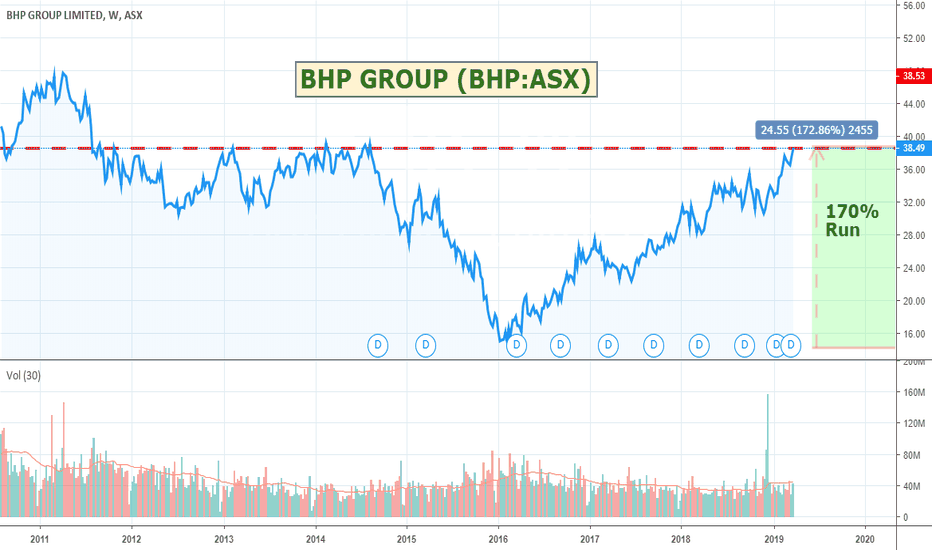

$BHP - BHP GROUP - Will it break through old resistance area ?BHP - Will it break through old resistance area ?

BHP has been having such a good run of late, I thought I would have a look at much longer time lines and you can see it is entering this really interesting resistance pocket. I would probably want to see it crack $40 before making a strong play at it, but might be worth a watch.

About BHP Group

BHP Group Ltd, formerly BHP Billiton Ltd, is a global resources company. The Company is a producer of various commodities, including iron ore, metallurgical coal, copper and uranium. Its segments include Petroleum, Copper, Iron Ore and Coal. The Petroleum segment is engaged in the exploration, development and production of oil and gas. The Copper segment is engaged in mining of copper, silver, lead, zinc, molybdenum, uranium and gold. The Iron Ore segment is engaged in mining of iron ore. The Coal segment is engaged in mining of metallurgical coal and thermal (energy) coal. Its businesses include Minerals Australia, Minerals Americas, Petroleum and Marketing. The Company extracts and processes minerals, oil and gas from its production operations located primarily in Australia and the Americas. The Company manages product distribution through its global logistics chain, including freight and pipeline transportation.

Conservative Stock Ideas 21st MarchJust some stock ideas for more conservative type portfolios. Always do your own research. I haven't looked at announcements, news, market depth etc which I would do before I spent any of my money on these. Like everyone else - I am simply guessing :)

Score 1 best, 2 good, 3 watch

BEST

AMI - 1 (might be over extended - be careful)

CHC - 1 (might be over extended - be careful)

GOOD

STO - 2 - Watch resistance area

DXS - 2 - Needs to break above resistance

GPT - 2 - Might have a bit more downside before turn around. Needs to break resistance.

NCM - 2 - Choppy but might be good short to medium term

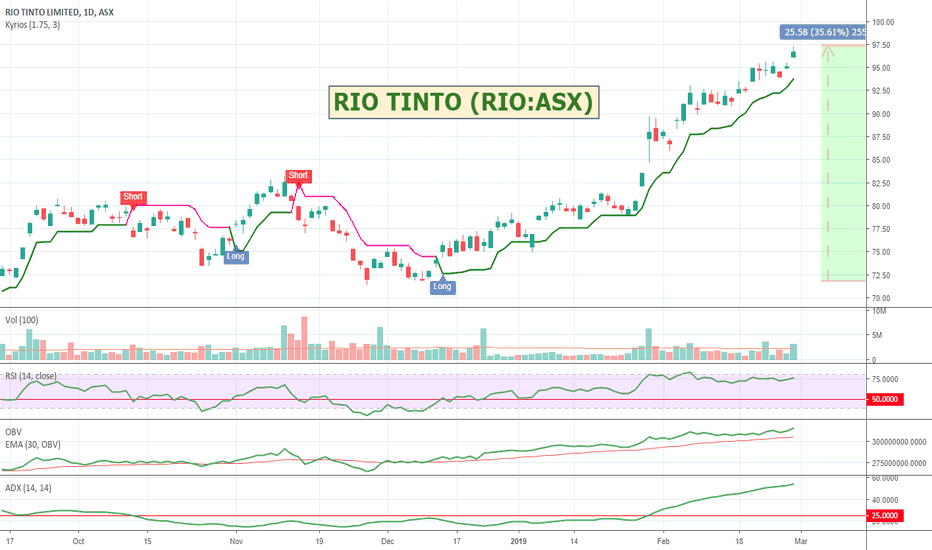

RIO - 2 - Like to see it break above 98

MGR - 2 - Like to see it close above 2.75

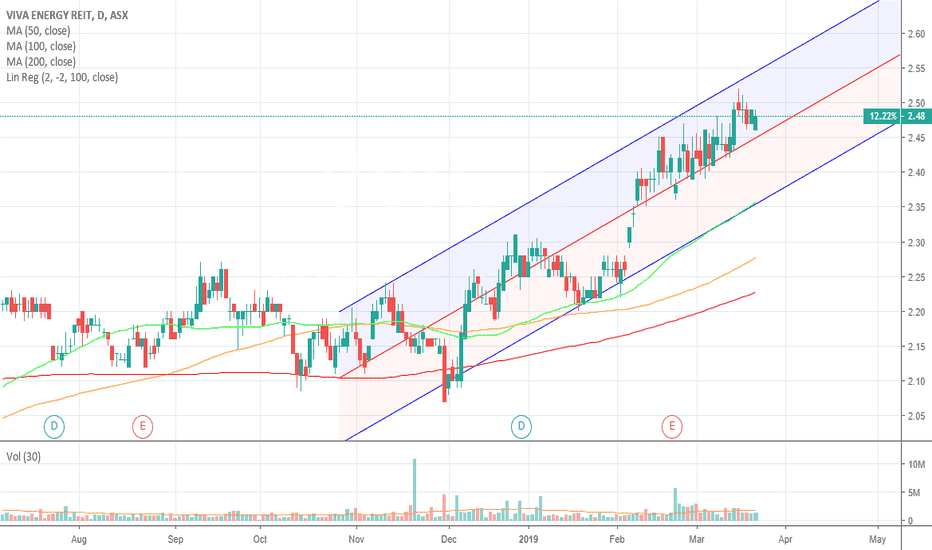

VVR - 2 - Bit choppy. Worth a look

WATCH

GMG - 3 - Good chart but rolling over. Need to watch for resumption of upward movement.

SAR - 3 - Might be recovering.

CWY - 3 - Watch

NST - 3 - Personally I think it might be at the bottom of a swing if it moves back up might be a great time to buy but the TA sites dont like it currently. Have a look on a 5 year chart.

BHP - 3 - Resistance area. Would like to see it above $38.50

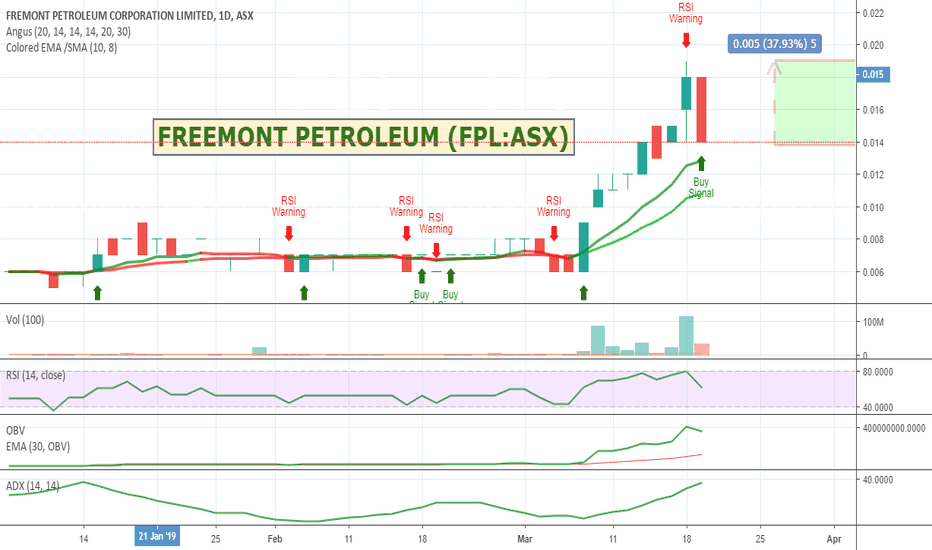

$FPL - FREEMONT PETROLEUM - Rebound on the sell off?$FPL - FREEMONT PETROLEUM - Rebound on the sell off?

Pretty good sell off today back down to a previous support / resistance level.

Be interesting if it moves back up tomorrow. There is LOTS of depth on the buyer and seller sides. I'm tempted. Will watch for which way it goes on the open.

About Freemont Petroleum

==================================

Fremont Petroleum Corporation, Ltd., formerly Austin Exploration Limited, is an oil and gas explorer and producer. The principal activities of the Company are the accumulation and operation of mineral prospective areas and the exploration for oil and gas in the United States. The Company's segments include Australia, US Sub and US JV. The Company has working interests and net revenue interests in three proven United States oil and gas provinces: Colorado, Kentucky and Texas. The Company operates its Colorado and Kentucky projects. The Company's Pathfinder Project is located in Fremont County, Colorado and consists of approximately 15,773 acres property in the DJ Basin. The Pathfinder Project's primary hydrocarbon targets are Pierre Shale and Niobrara Shale Formations and secondary targets are Codell, Greenhorn, Grenaros and Dakota Formations. The Pathfinder property has produced over 15 million barrels of oil from the Pierre formation.

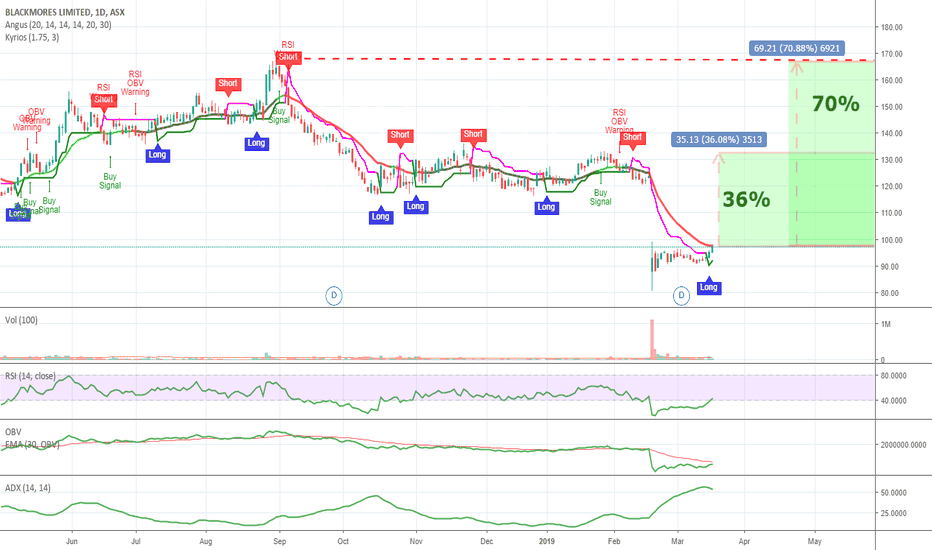

$BKL - BLACKMORES - Showing signs of recovery$BKL - BLACKMORES - Showing signs of recovery.

Might be one to add to your watch list. Nice big fat profitable company recovering after an earnings dump. Its finally crossed back above its 20 day moving average which is a good bullish sign if it can stay above it.

It's a company people are used to seeing trade in that $120 per share zone and it has been a $220 stock in its past so buyers wont be worried about seeing it back above that $100 mark.

As always do your own research.

About Blackmores

Blackmores Limited is engaged in the development, sales and marketing of health products for humans and animals, including vitamins, herbal and mineral nutritional supplements. The Company's segments include Australia, China (in-country), Other Asia, BioCeuticals and Other. The Company offers over 250 vitamins, minerals, herbal and nutritional supplements. BioCeuticals is a provider of healthcare practitioner nutritional and therapeutic supplements. Its product categories include pet health; infant formula; superfoods; arthritis, joint, bone and muscle; brain health; cold, flu and immunity; digestive health; energy and exercise; eye health; everyday health; fish and nutritional oils; heart and circulation; men's health; nails, hair and skin; pregnancy and pre-conception; stress relief, and weight management. Its products include Acidophilus Bifidus, Alive! Men's 50+ Multivitamin, Alive! Women's 50+ Multivitamin, Alive! Women's Multivitamin and Bilberry Eyestrain Relief.

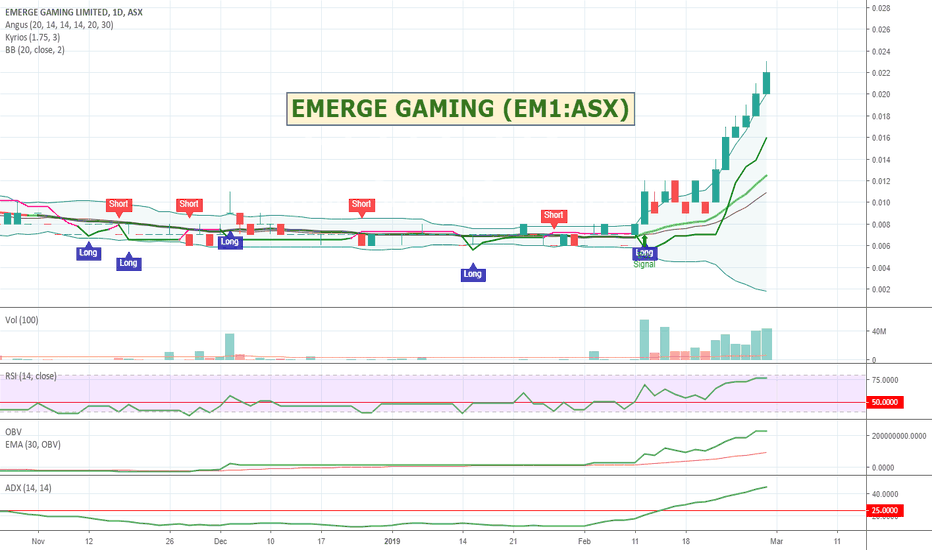

$EM1 - Emerge Gaming - Which way will the pullback go?I might be a bit late to the party on this one, but came up on my pullback scans tonight. I have put a bid on at 018 just to join the queue but am a bit 50/50 on it. Will be watching he queue before the market opens to see if I stay or flee. I like the whole esports space and these micro pennies only have to blip and the returns can be quite good. They can also hurt so lock in stops. Its a gamble.

This is what I saw on the 4 hour chart. If I was to play it properly I should probably put on a conditional order to buy if it goes to 019 cents with a falling sell at 016 cents.

Emerge Gaming Limited, formerly Arrowhead Resources Limited, is an eSports and casual gaming tournament company. The Company operates online eSports and casual gaming tournament platform and lifestyle hub, Arcade X. The Company's GamingBattleGround (GBG) platform focuses on skill-based tournaments and matches, where players compete to improve their user rankings or status in the virtual gaming world and for digital merchandise to improve their gaming experience. The Company has over 30,000 registered users and has operated over 10,000 gaming tournaments.

$SLX - SILEX SYSTEMS - Good momentum$SLX - SILEX SYSTEMS - Good momentum,

Worth a watch. So many good opportunities around at the moment. Has some good market depth on the buy side.

Quite an interesting business. Not sure how much upside there is if their product is licensed out.

Silex Systems Limited is a research and development company. The Company is focused on the development and commercialization of its primary asset, the Separation of Isotopes by Laser EXcitation (SILEX) laser uranium enrichment technology. It operates in the Silex Systems segment. It is focused on the delivery of the SILEX laser enrichment technology. The SILEX Technology is a laser-based process that has the potential to separate uranium isotopes, as well as other various elements. It has licensed SILEX technology exclusively to GE-Hitachi Global Laser Enrichment LLC in the United States. It has an interest in semiconductor technology known as Rare Earth Oxide (cREO) technology, which is exclusively licensed to IQE Plc. IQE Plc is progressing the cREO technology towards commercial deployment in various semiconductor products, such as power electronics and wireless radio frequency (RF) communications chips.

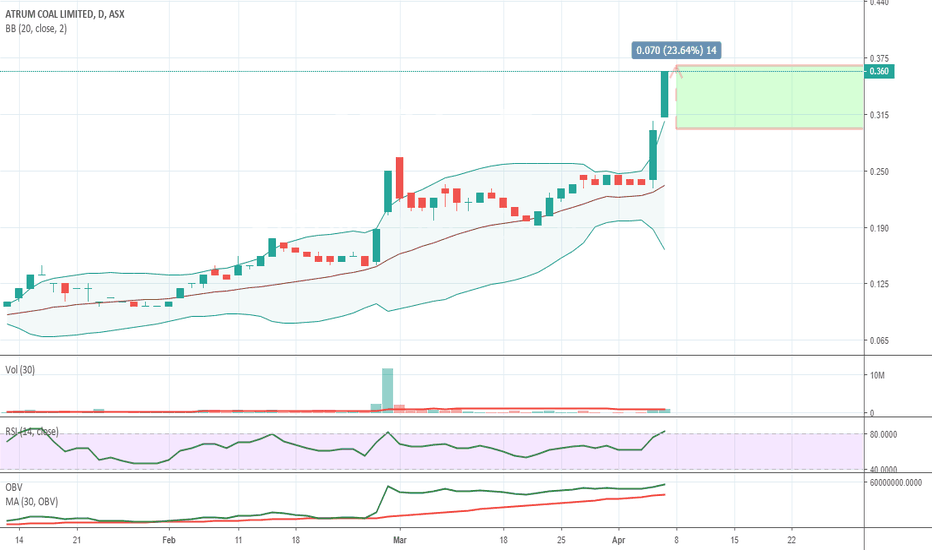

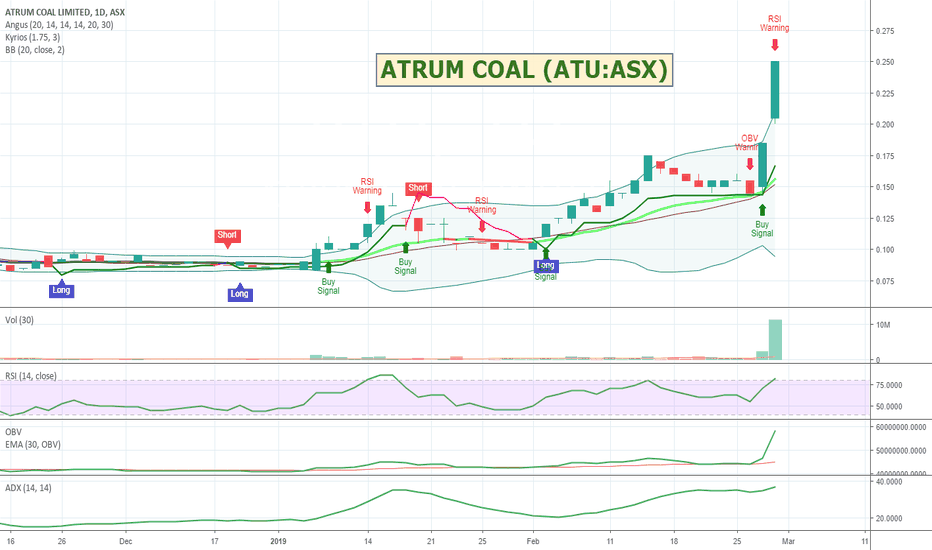

$ATU - ATRUM - Nearology takeover play?Nice spike on volume. On the watch list :)

This is what got me interested on the 15 min chart. Bit of room up after pullback.

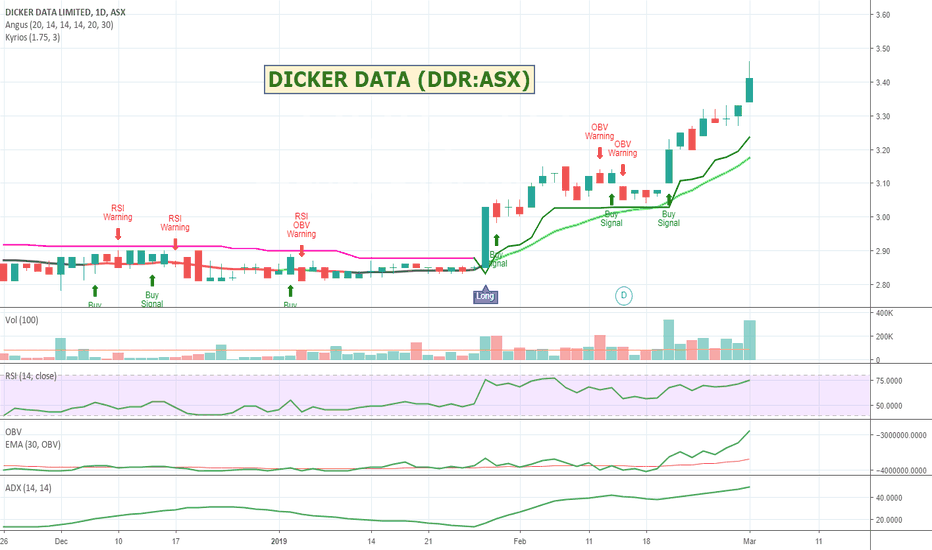

$DDR - DICKER DATA - Good momentum$DDR - DICKER DATA - Good momentum

Dicker Data has been having a good run of late. Main concern for me for an entry is its liquidity. Buyer depth is gappy but certainly worth a watch as its making new highs supported by volume.

Dicker Data Limited is engaged in the wholesale distribution of computer hardware, software and related products. The Company operates through two segments: Australian and New Zealand operations. The Company sells its products to over 3,000 resellers. The Company offers account management programs, which include drop ship delivery program; server and storage presales team, eclipse program for HP business opportunities; extended producer responsibility (EPR) Program for Toshiba notebooks for corporate accounts requiring volume pricing, and imaging and configuration. The Company offers a range of credit options, including direct transfer, credit card (VISA, Mastercard and American Express), and approximately 30 days from monthly statement credit account. The Company's subsidiaries include Express Data Holdings Pty Limited, Dicker Data New Zealand Ltd and Simms International Pty Ltd.

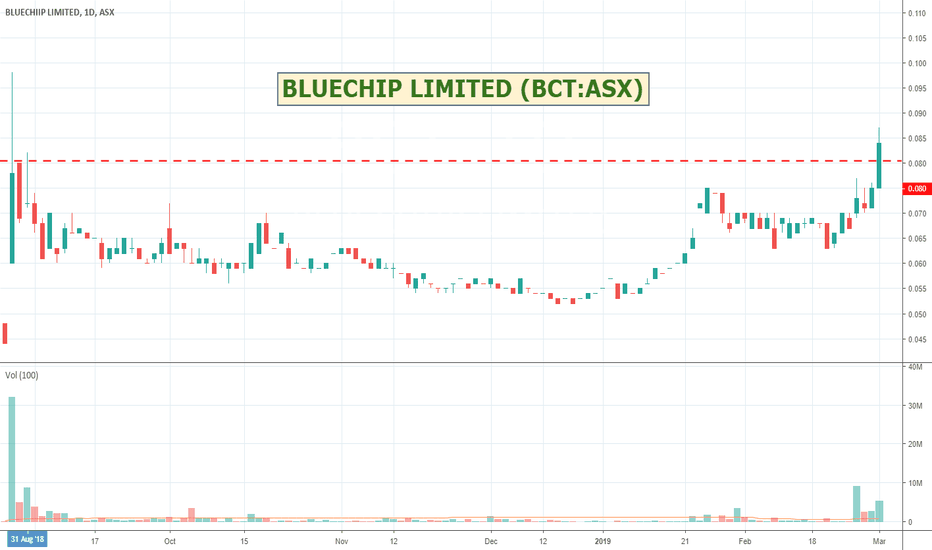

$BCT - BLUECHIP LIMITED - Might be having one of its crazy runsBought into Bluechip this morning on a tip from a forum friend. It was running today on some very good volume and it gets super spiky when that happens. Will give it a couple of days to play out and see how it goes. Its broken past its recent high resistance points and I do like that it has been a 20cent + stock in the past so plenty of room to grow into with some good news. Will run pretty tight stops below my buy price but all indicators look pretty good for now.

Indicators on the 15 min chart

I like the crazy spikes

Bluechiip Limited is engaged in the development and commercialization of a tracking system that offers technical capabilities over existing labels, barcode and radio frequency identification (RFID) technologies. The Company offers information technology (IT)-based temperature and identification tracking solution for biosamples in the health and life sciences industry. Its products include retrofit buttons, multi-vial reader, hand-held reader, smart chip, cryovials, cassettes, racks/frames and towers, cryotag, matchbox reader and retriever, and stream software and updates. The Multi-Vial Reader can scan ID and temperature of 81 (9x9) or 100 (10x10) vials in a box. It offers mobile reader for Vials, CryoTags, which includes a one dimensional/two dimensional (1D/2D) barcode scanner. The bluechiip cryovial is designed for the storage and transportation of biological material. bluechiip polycarbonate cassettes are designed to store blood bags containing platelet and plasma concentrates.

$RIO - RIO TINTO - Smooth run so farRIO might be worth a watch for anyone with a more conservative appetite. Has been running nicely since the start of the year.

Rio Tinto Limited is a mining company. The Company is focused on finding, mining and processing of mineral resources. The Company's operating segments include Iron Ore, Aluminum, Copper & Coal, Diamonds & Minerals, and Other Operations. Its products include aluminum, copper, diamonds, gold, industrial minerals (borates, titanium dioxide and salt), iron ore, thermal and metallurgical coal, and uranium. The Company's activities span across the world and are represented in Australia and North America, with businesses in Asia, Europe, Africa and South America. Its Copper product group comprises approximately four copper operating assets and over six coal operations, which includes Australia and South Africa, as well as development projects. The Diamonds & Minerals product group comprises a suite of businesses, including mining, refining and marketing operations across approximately five sectors. The Iron Ore product group operates iron ores, supplying the global seaborne iron ore trade.

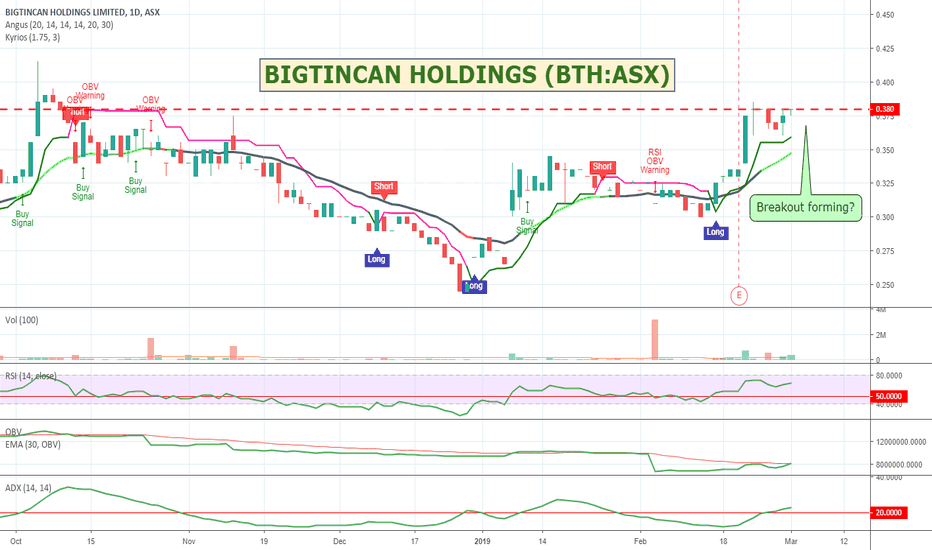

$BTH - BIGTINCAN HOLDINGS - About to make a break for it$BTH - BIGTINCAN HOLDINGS - About to make a break for it

Might be worth a watch and a small play next week if it can break resistance. The other indicators look like it will push through. Not overly excited by the company or its financials. Purely a chart play.

Bigtincan Holdings Limited is an Australia-based company, which provides enterprise mobility software. The Company provides software solutions as a service (SaaS) to customers accessing the software as needed. Its application suite comprises Bigtincan Hub and Bigtincan Forms. Bigtincan Hub is an integrated single-platform for sales and service organizations. Bigtincan Hub is powered by a machine learning and artificial intelligence (AI) system. It works on IPhone operating system (iOS), Android, Windows, and Blackberry, as well as Windows desktop, Mac desktop and Apple WatchOS. Bigtincan Forms enables organizations to reduce or in some cases eliminate manual paper-based forms, automate data capture and implement process improvements without requiring an infrastructure platform or stand-alone forms application. It operates in United States of America (USA), Europe, the Middle East and Africa (EMEA) and Asia Pacific/Japan.

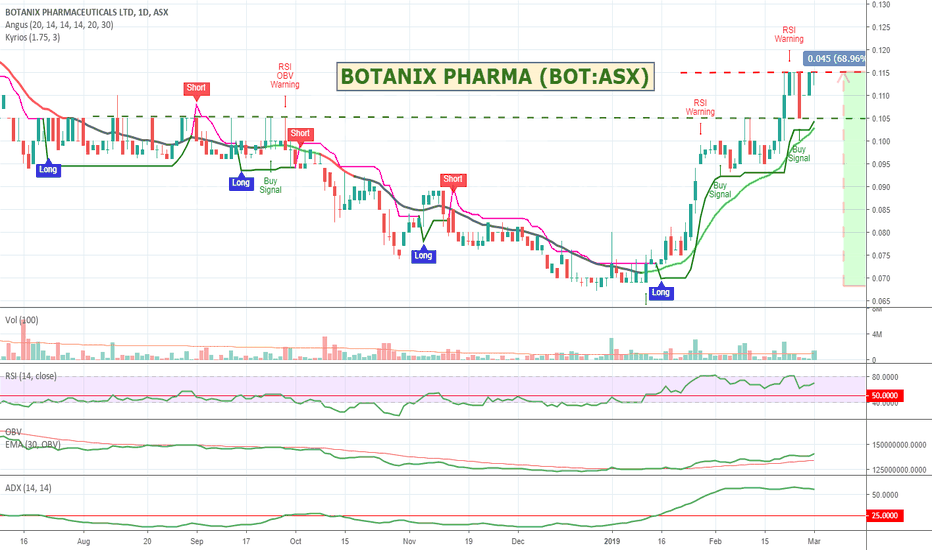

$BOT - BOTANIX PHARMA - Buyer and Sellers Showdown.BOT is starting to look interesting again but a big stand off between buyers and sellers both pretty evenly matched at current price points. Its broken past it end of last year flat patch and bounced off a retest of it. If it breaks up there is quite a bit of room it could run so will keep it on the watch list for now and watch for the break of resistance. Its financials etc are terrible so only looking to ride it while it runs.

Botanix Pharmaceuticals Limited, formerly Bone Medical Limited, is a pharmaceutical company. The Company focuses on developing medical dermatology products for dermatologists and their patients. Its segments include Research & Development and Corporate. The Company's products and pipeline products are all based on drug delivery technology known as Permetrex, which helps solve the challenge of delivering active pharmaceutical ingredients across the skin. The Company's products, which are under development, are focused on modulating the body's endocannabinoid system of receptors which regulates skin function, growth and renewal. Its product pipeline includes BTX1503, BTX1308 and BTX1204. Its BTX1503 is a transdermal gel formulation used for the treatment of serious acne in adults and teenagers. Its BTX1308 is a transdermal gel formulation used for the treatment of plaque psoriasis. Its BTX1204 is a transdermal gel formation used for the treatment of atopic dermititis.

$WKT - WALKABOUT RESOURCES - Worth a watch$WKT - WALKABOUT RESOURCES - Worth a watch

Have added an alert so that if my ADX turns above 20 and price gets to .115 and depth is still there on the buy side I will look for a entry. Lot of potential upside if it does decide to run.

Walkabout Resources Limited is an Australia-based mineral exploration company. The Company is principally engaged in the exploration and development of resources and energy assets located in Botswana, Tanzania and Namibia. The Company's operating segments include Graphite, Coal, Lithium and Copper. The Company's geographical segments include Australia, Botswana and Tanzania and Namibia. The Company's projects include Takatokwane Coal Project, Lindi Jumbo Graphite Project and Kigoma Copper Project. The Takatokwane Coal Project is located approximately 195 kilometers from the Botswana capital, Gaborone, in the southern belt of the Central Kalahari Sub-Basin. The Lindi Jumbo Graphite Project is located within the emerging graphite province in southeastern Tanzania approximately 200 kilometers by road from the port of Mtwara. The Kigoma Copper Project is located approximately 80 kilometers south of the town of Kigoma on the shores of Lake Tanganyika in western Tanzania.

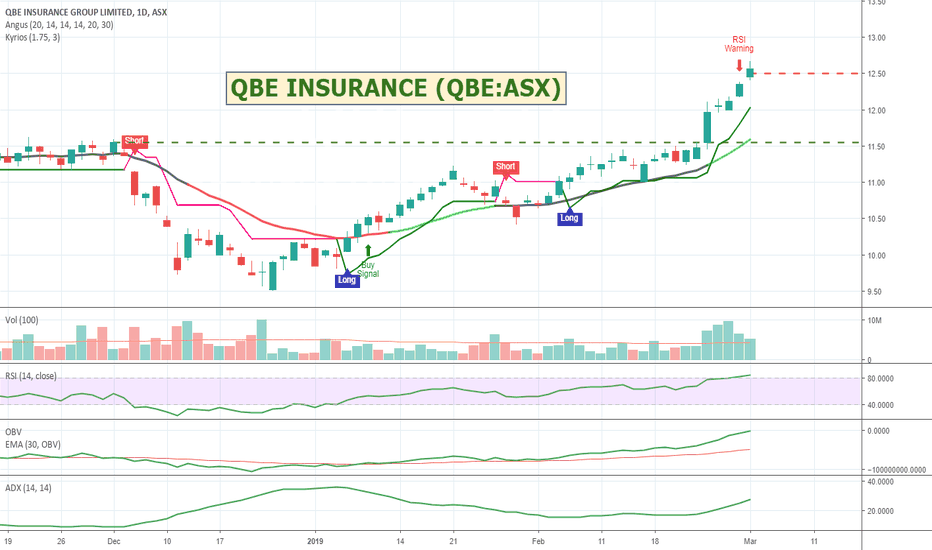

$QBE - QBE INSURANCE - Recovering nicely $QBE - QBE INSURANCE - Recovering nicely

New 52 week closing high shows good signs of continued recovery. On the lower 15 minute time scale I can see good support has formed above $12.50 - BUT - there is now a big gap between the bids and the asks which needs to close. There are more sellers than buyers in the queue so good chance that $12.50 support wont survive and a retrace may occur - which may give a better entry opportunity. One to sit out and watch for now.

$E2M - E2 METALS - New 52 Week Closing High$E2M - E2 METALS - New 52 Week Closing High

When I drop down to the 1H, 15M, 1M I still have strong buy signals above the 16 cent resistance line.

Doesn't have big volumes in the market depth but definitely a strong weighting on the buy side.

E2 Metals Limited is an Australia-based exploration and development company engaged in the development and exploration of gold and silver. The Company is focused on advancing its flagship asset known as the Neavesville Project. The Company’s projects are Neavesville epithermal gold and silver project, and Mount Hope gold project. The Neavesville epithermal gold and silver project is located in the Huaraki goldfield of New Zealand’s North Island, which is approximately 15 kilometers south-east of the Thames Mine. The Mount Hope gold project is located in the central west of South Wales in the Cobar Basin, which includes four prospects striking North-South namely Mount Solitary, Little Mount Solitary, Powerline Hill, and Mount Solar.