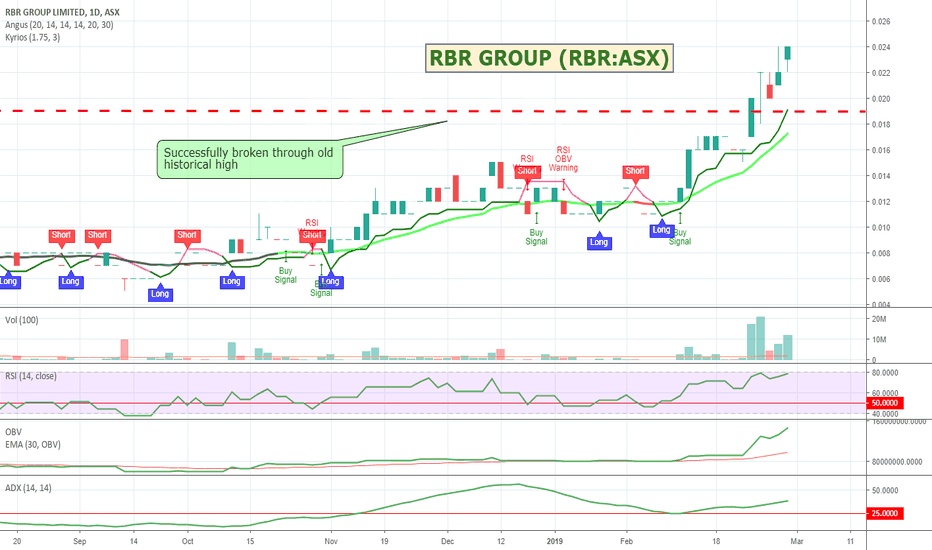

$RBR - RBR Group - Running well past old highs$RBR - RBR Group - Running well past old highs

Bought into RBR this morning. One of these pennies where the slightest move can result in fairly big returns - up and down - so have some tight stops in :)

They have had a please explain from the ASX for their rocketing price but no announcements at this stage so running somewhat on hype. The company believes it on the back of their attendance at the recent participation in the Resources Rising Stars (RRS) investor conferences held in Sydney and Melbourne on 12 and 14 February 2019 as well as some recent positive news regarding their Mozambique LNG project led by US company Anadarko.

Indicators and volume looks good. Would have been better with a slightly earlier entry but wanted to confirm the move past the old high. As always buyer beware, do your own research, but might be worth a watch for others with a higher risk profile.

RBR Group Limited, formerly Rubicon Resources Limited, focuses on the resources sector. The Company, through its subsidiaries, PacMoz, Lda and Futuro Skills, Lda, is engaged in the provision of labor and professional services in Mozambique. It also maintains mineral exploration and development assets, primarily in Western Australia. The Company's geographical segments include Australia and Mozambique. The Company controls approximately 423 square kilometers of prospective tenements in Western Australia. The Company has tenements in its Yindarlgooda gold project, which is located east of Kalgoorlie in Western Australia. It also holds interest in Peters Dam Joint Venture, which includes its tenements covering an area of approximately 50 square kilometers located in southern Yindarlgooda project. The Company, through its subsidiaries, focuses on operating transportable medical clinics, and offering broker service, and insurance and financial products, among others.

Search in ideas for "zAngus"

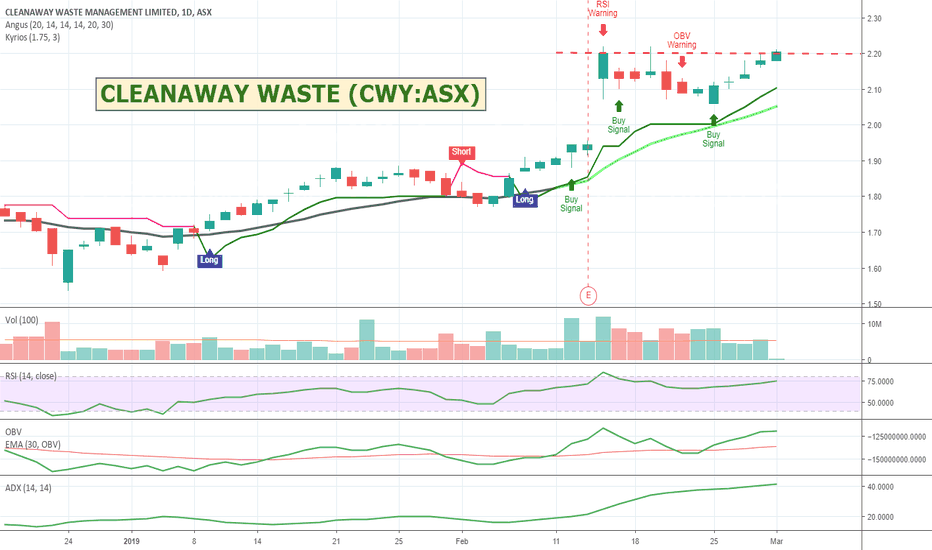

$CWY - CLEANAWAY WASTE - Moving up again after pullback.$CWY - CLEANAWAY WASTE - Moving up again after pullback.

Cleanaway has been in the news a little bit lately liked by quite a few of the FA pundits it seems. It's been up 3 days in a row so looks like it might challenge that $2.20 resistance mark again for a breakout. All my indicators are looking good for a push so have taken a position and will see what happens over the next couple of days :)

Cleanaway Waste Management Limited, formerly Transpacific Industries Group Ltd., is a waste management company. The Company's segments include Solids and Liquids & Industrial Services. Its principal activities include offering commercial and industrial, municipal and residential collection services for all types of solid waste streams, including general waste, recyclables, and medical and washroom services; ownership and management of waste transfer stations, resource recovery and recycling facilities, secure product destruction, quarantine treatment operations and landfills; sale of recovered paper, cardboard, metals and plastics to the domestic and international marketplace; collection, treatment, processing and recycling of liquid and hazardous waste, including industrial waste, grease trap waste and used mineral and cooking oils, and providing industrial solutions, including industrial cleaning, site remediation, sludge management, parts washing and emergency response services.

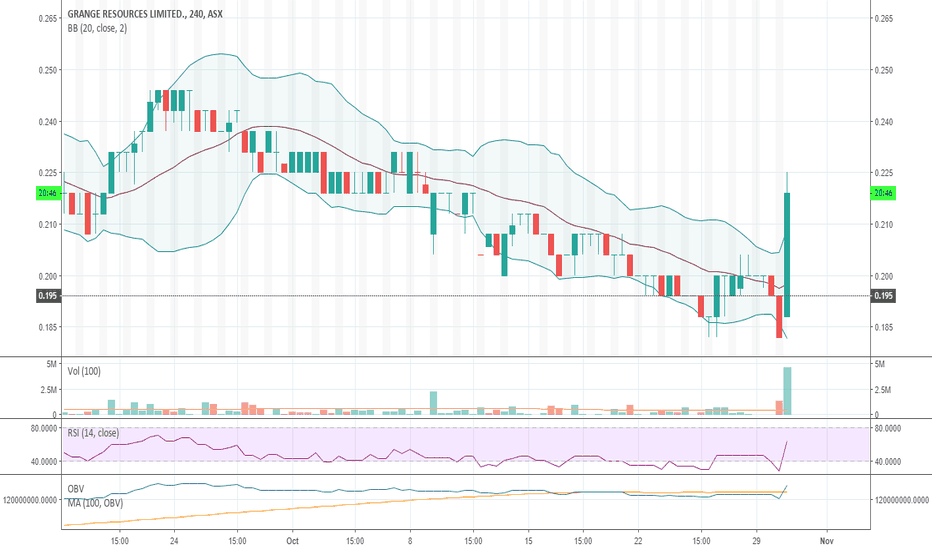

$GRR #ASX - Grange Resources has some unusual volumeGrange Resources Limited is an Australia-based company, which owns and operates iron ore mining and pellet production business located in the northwest region of Tasmania. The Company operates through the segment of exploration, evaluation and development of mineral resources and iron ore mining operations. The principal activities of the Company include the mining, processing and sale of iron ore, and the ongoing exploration, evaluation and development of mineral resources particularly, the Southdown Magnetite and associated Pellet Plant Projects. The Southdown Magnetite deposit is located approximately 90 kilometers (km) northeast of Albany on the South coast of Western Australia. Southdown Magnetite and Associated Pellet Project(s) is a joint venture between Grange Resources Limited and SRT Australia Pty Ltd. The joint venture proposes to mine and exports iron ore pellets and concentrates. Its Savage River magnetite iron ore mine is 100 km southwest of the city of Burnie.

Bit of unusual strong volume coming through on this one. Has some good fundamentals so hoping it stands up as a bit of a defensive stock during these more turbulent conditions.

Bought in at .21

Falling sell trigger at .194 to .19 worst case sell. Heres hoping I dont get stop hunted...

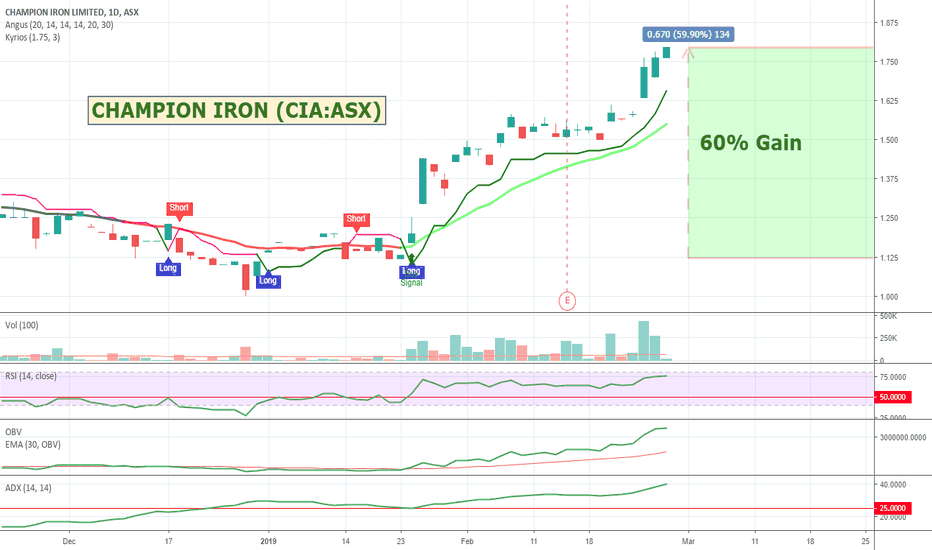

$CIA - CHAMPION IRON - Looking strong$CIA - CHAMPION IRON - Looking strong

Looking good on my indicators. Liquidity / market depth bit of a weakness, but if you can get in at the right amount it seems to be running well. Worth a watch.

Champion Iron Limited, formerly Mamba Minerals Limited, is engaged in the exploration and development of iron ore properties in Quebec, Canada. The Company's projects include Consolidated Fire Lake North Project, Snelgrove Lake Project, Powderhorn Lake Project and Gullbridge Property. The Company owns interest in over 12 properties covering approximately 847.5 square kilometers located in the Fermont Iron Ore District of northeastern Quebec. The Snelgrove Lake Project is located in western Labrador and is approximately 55 kilometers southeast of the community of Schefferville, Quebec and approximately 200 kilometers north of Labrador City, Labrador. Powderhorn Lake Project consists of approximately 148 claims covering an area of over 37 square kilometers situated in the Buchans-Robert's Arm Belt in Central Newfoundland. Gullbridge Property consists of approximately 179 claims covering over 45 square kilometers situated in the Buchans Robert's Arm Belt in Central Newfoundland.

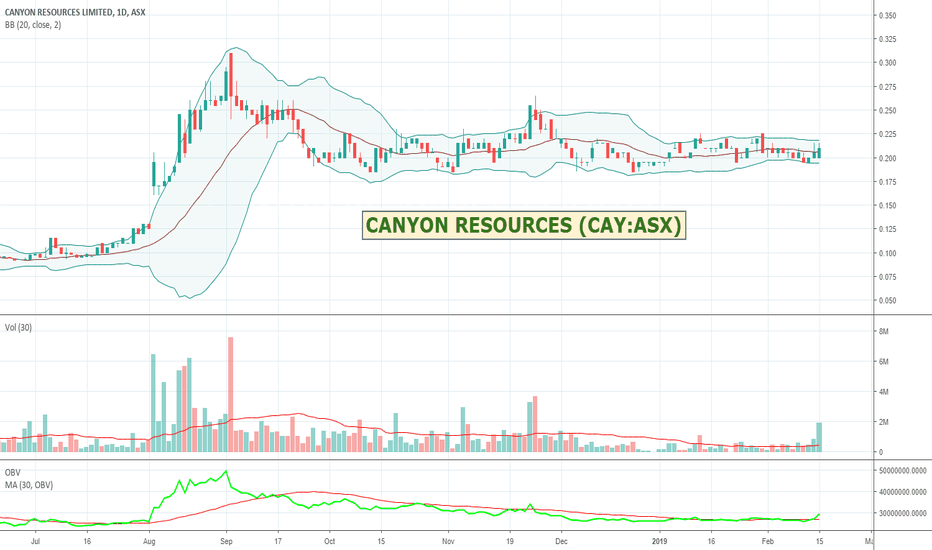

$CAY - CANYON RESOURCES - Bolly squeeze about to pop?$CAY - CANYON RESOURCES - Bolly squeeze about to pop?

Volumes up - might be about to make a move after tracking sideways and steadily contracting for quite a while. Its moved about its 20 and 50 day moving averages so showing some sign of life. Made a pretty good upward move last time it broke out so worth a watch over the next few days. Keep an eye on the Volume and more so the OBV for a bigger move. Good depth without many gaps on the buyers side so should give it a good base.

Canyon Resources Limited is engaged in bauxite and gold exploration. The Company is focused on development of Birsok Bauxite project in Cameroon. The Birsok project is located in central Cameroon and is contiguous to Minim Martap bauxite deposit. The Birsok project consists of over two permits covering an area of over 1,460 square kilometers and is located along raised plateaux. The Birsok project consists of two exploration licenses, the Birsok and Mandoum licenses, which are located in Adamawa bauxite province in central Cameroon. It has Taparko North project, Tao project, Derosa project and Pinarello project at Burkina Faso, West Africa. Its Tarparko North and Tao projects are along strike from operating gold mines Taparko and Essakane. Its Tao project lies in Gorouol Greenstone belt. The Taparko North project is located in Yalogo belt. The Pinarello and Konkolikan projects consist of over six exploration permits. The Derosa project consists of over six exploration permits.

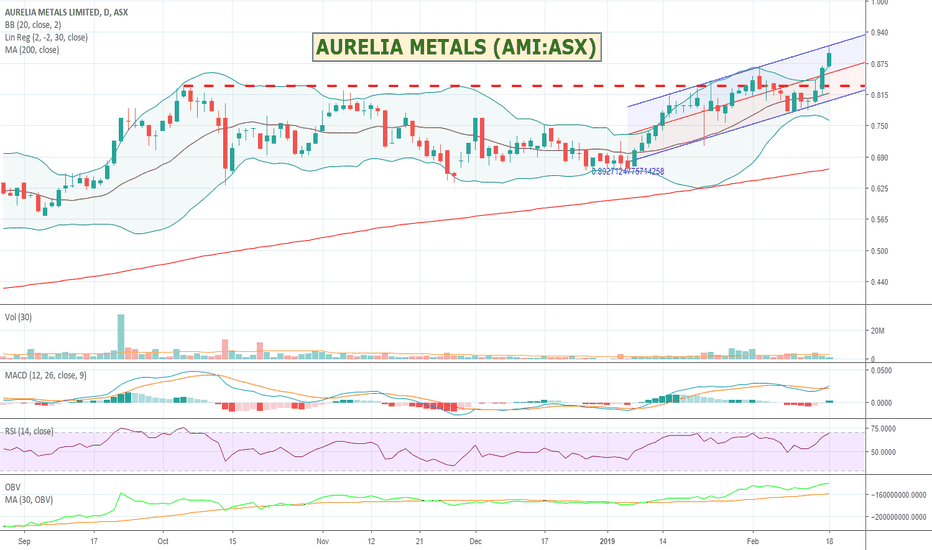

$AMI - AURELIA METALS - Nice breakout over old highsMight be worth a watch. Be nice to see a bit more volume and momentum behind it but looks good to run for a bit longer. Some good market depth on the buyers side. Decent financials which should maintain interest. The funnymentals bots also show AMI as significantly undervalued.

Aurelia Metals Limited is an exploration and mineral development company. The Company operates through segments, including Hera-Nymagee project and other exploration projects. The Hera-Nymagee project includes the gold and base metal Hera deposit, and the copper discovery at the Nymagee copper deposit. The Hera-Nymagee Project is located approximately 100 kilometers southeast of Cobar in western New South Wales (NSW). The Hera Project produces gold-silver dore and a bulk concentrate, which includes lead and zinc. The Doradilla project is a tin project. The Company is also engaged in exploration for copper, gold and tin on a number of tenements in the Lachlan Fold Belt of NSW. The Doradilla Project represents an exploration target for nickel, copper, silver, bismuth, zinc and indium. The Tallebung tin field is located over 70 kilometers north-west of Condoblin, NSW, and includes a series of alluvial and deep lead tin deposits, as well as tin-tungsten hard rock lodes.

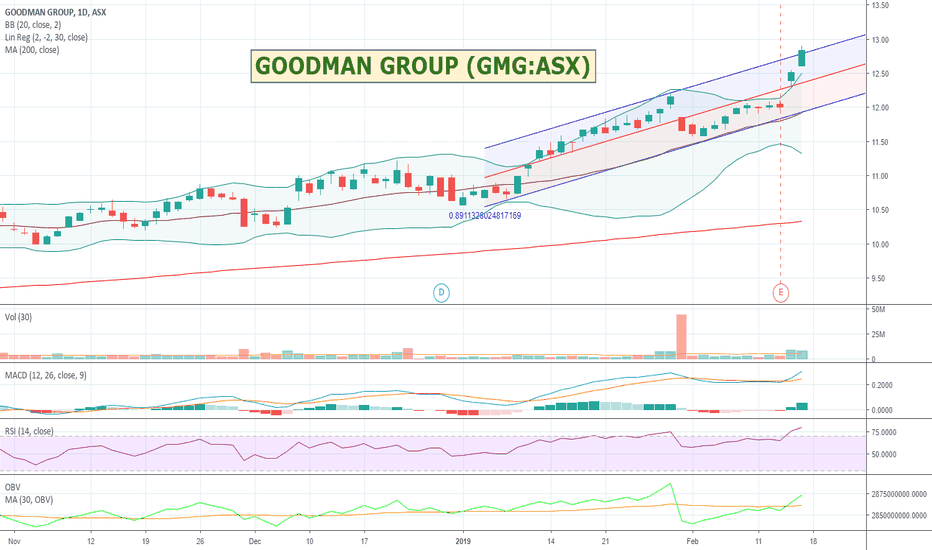

$GMG - GOODMAN GROUP - Great performer running again$GMG - GOODMAN GROUP - Great performer running again

Been a good performer this year and has some extra volume coming through giving it a further boost. Might be a short term correction or consolidation with the RSI so high. Trick is whether you can get someone to part with some of their shares.

Goodman Group is a global integrated property company. The Company is engaged in owning, developing and managing industrial property and business space in the markets across the world. The principal activities of the Company are investment in directly and indirectly held industrial property, property services, property development (including development management) and fund management. The Company's segments include Australia and New Zealand, Asia, Continental Europe, United Kingdom and Americas. The Company's stapled entities include Goodman Limited, Goodman Industrial Trust and Goodman Logistics (HK) Limited. The Company's portfolio consists of approximately 190 properties located in Sydney, Melbourne, Brisbane, Adelaide, Canberra and Perth. The Company is an investor in four property funds: Goodman Australia Industrial Partnership (GAIP), Goodman Australia Partnership (GAP), Goodman Australia Development Partnership (GADP) and KWASA-Goodman Industrial Partnership (KGIP).

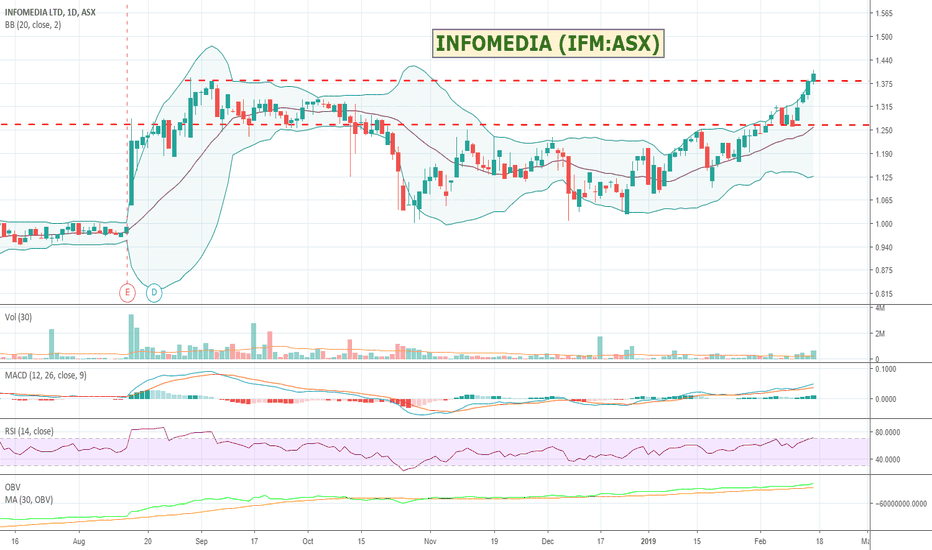

$IFM - INFOMEDIA - Running up before earnings$IFM - INFOMEDIA - Running up before earnings

Earnings are out on the 21st of Feb and in the past the share price has had a pretty good response in the days and weeks after. Bit of volume coming through. Very gappy marke depth on both buyers and sellers sides which I don't like. Added to the watch list to see if it moves much more before the announcement.

Infomedia Ltd is a technology company. The principal activities of the Company are development and supply of Software as a Service (SaaS) offerings, including electronic parts catalogues and service quoting software systems, for the parts and service sectors of the global automotive industry, and information management, analysis and data creation for the domestic automotive and oil industries. The Company's segments are Asia Pacific; Europe, Middle East and Africa (EMEA); and Americas, which represents the combined North America and Latin & South America segments. The Company offers various solutions, such as Parts and Service, Data Management and Future Motors. The Company's Parts and Service solutions include Microcat, Superservice Menus, Superservice Triage, Superservice Insight, Superservice Connect, Superservice Register, Auto PartsBridge and Microcat MARKET. Its Data Management solutions include Lubricants Recommendation, Lubrication and Tune-up Guide and Data Consulting.

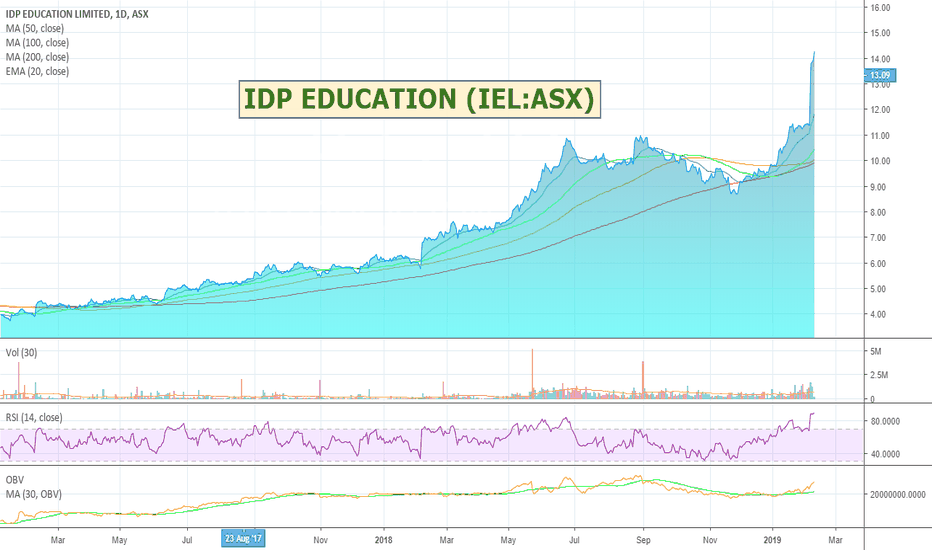

$IEL - EDP EDUCATION - Running Hard.$IEL - EDP EDUCATION - Running Hard.

Looks like a great business to be in. Nice profitable whale of an education dating service between overseas students and educators.

RSI has been too hot for a while so have this one on my watch list looking for an RSI under 70 to look for an entry. Closer to 60 the better.

IDP Education Limited is engaged in the placement of international students into education institutions in Australia, the United Kingdom, the United States, Canada and New Zealand; distribution and administration of International English Language Testing System (IELTS) tests, a globally recognized English language test for study, work and migration purposes, and operation of English language schools in Vietnam, Cambodia and Thailand. The Company's segments are Asia, which includes India, Malaysia, Indonesia, Mauritius, Bangladesh, Nepal, Sri Lanka, Singapore, Cambodia, Philippines, Vietnam, Thailand, Laos, China, Taiwan, Hong Kong and South Korea; Australasia, which includes Australia, New Zealand, Fiji and New Caledonia, and Rest of World, which includes Saudi Arabia, the United Arab Emirates (UAE), Turkey, Pakistan, Oman, Kuwait, Bahrain, Qatar, Egypt, Jordan, Libya, Azerbaijan, Iran, Canada, Russia, Germany, Mexico, Argentina, Columbia, Kazakhstan, Ukraine and South Africa.

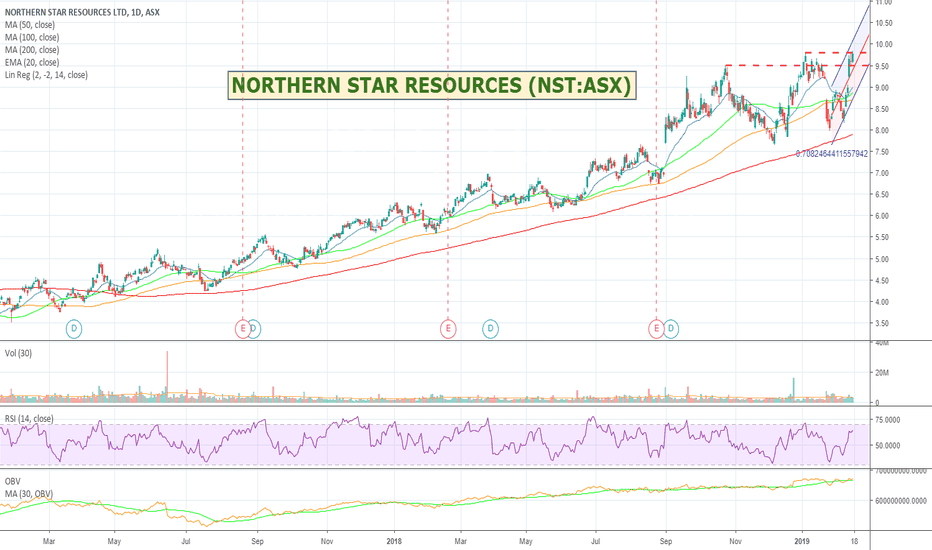

$NST - NORTHERN STAR RESOURCES - About to breakout?Northern Star has been having a great run and has recovered from its recent dip. Its broken through one resistance point and looks to be setting up to break its next high. Needs a bit more volume to support a new run but worth watching for now. Will keep an eye on the OBV to start to break away from the MA to confirm the setup. Big profitable company with good fundamentals.

Northern Star Resources Limited (Northern Star) is a gold (Au) production and exploration company. The Company's principal activities include mining of gold deposits at Jundee, Kundana, Kanowna Belle and Paulsens; construction and development of extensions to existing gold mining operations at all locations; exploration at Central Tanami Project in the Northern Territory, and exploration and development of gold deposits within Western Australia. The Company's segments include Paulsens, WA Australia, which is engaged in mining and processing of gold; Kundana, WA Australia, which is engaged in gold mining; Kanowna Belle, WA Australia, which is engaged in mining and processing of gold; Jundee, WA Australia, which is engaged in mining and processing of gold; Tanami NT Australia, and Exploration, which consists of the projects in exploration, evaluation and feasibility phase, such as Mt Olympus, Fortescue JV and Electric Dingo, as well as ongoing exploration programs.

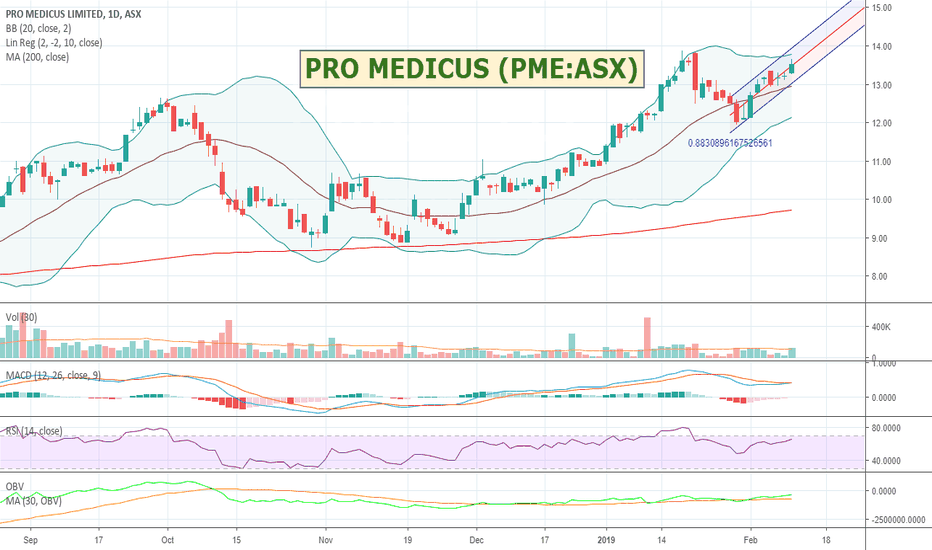

$PME - PRO MEDICUS - One to watch for breakout$PME - PRO MEDICUS - One to watch for breakout

Have held this one for a little while now and up a bit under 15% on it. It looks like it might be building towards a new breakout over its previous high. There isnt much volume behind the move at the moment, but one to keep en eye on.

Pro Medicus Limited produces integrated software applications for the healthcare industry. The Company's principal activities are the supply of healthcare imaging products and services to hospitals, diagnostic imaging groups and other health related entities in Australia, North America and Europe. The Company's segments include Australia, Europe and North America. Its products and services include Radiology Information Systems (RIS) and Visage 7.0. RIS offers medical software for practice management (RIS); training, installation and professional services; after sale support and service products; Promedicus.net secure e-mail, and digital radiology integration products. The Company's Visage 7.0 offers medical imaging software; picture archiving and communications system (PACS)/digital imaging software; training, installation and professional services, and service and support products. Its subsidiaries include Promed (USA) Pty Ltd, PME IP Australia Pty Ltd and Visage Imaging Inc.

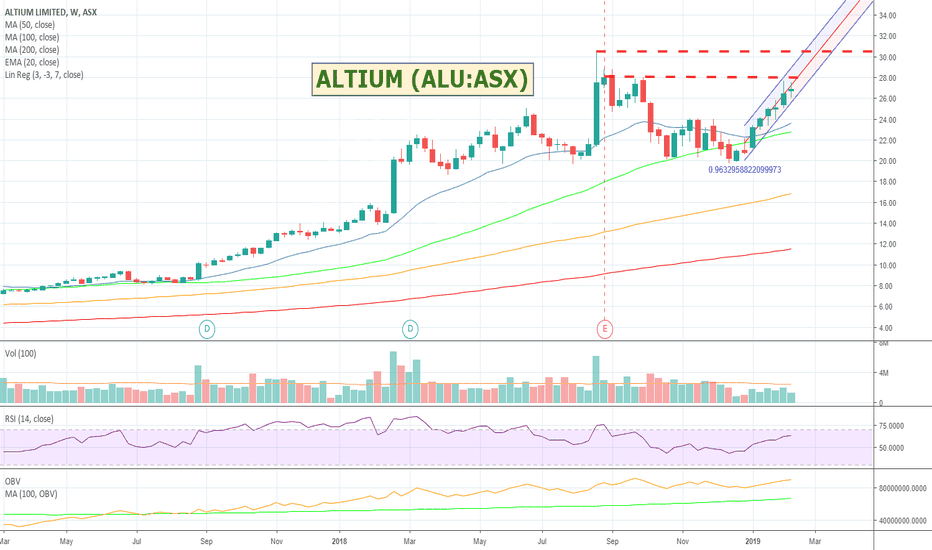

$ALU - ALTIUM - Good performer challenging resistance levelAltium has been a great runner for the last several years and is back testing previous resistance.

Worth a watch - especially if it can break through.

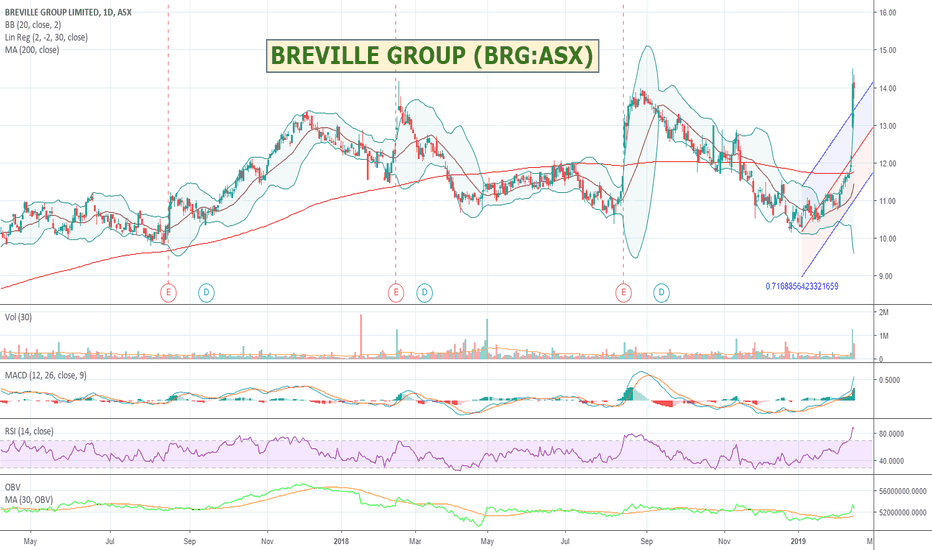

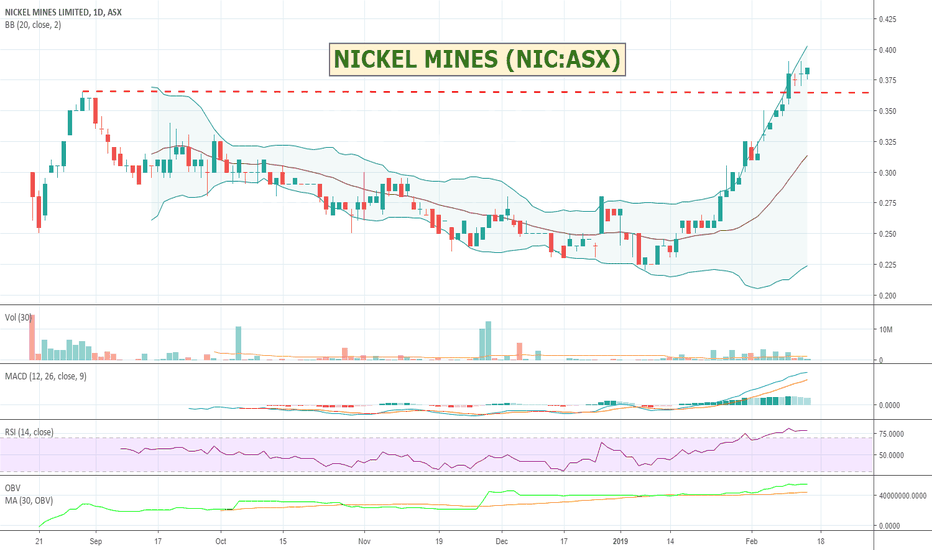

$NIC - NICKEL MINES - Calm after the storm range contractionNickel Mines has been having a great run as of late. On the 15 minute chart you can see it is consolidating before its next break - hopefully to the upside. I have set an alert to let me know when the OBV crosses above the 30(MA) to take another look and pick an entry.

Nickel Mines Ltd is an Australia-based company that is focused on producing nickel pig iron (NPI). The Company, through its subsidiary PT Hengjaya Mineralindo, owns the Hengjaya Mineralindo Nickel Mine (HM Mine). The HM Mine is located in the Morowali Regency of the east coast province of Central Sulawesi, Indonesia. The HM Mine covers an area of approximately 6,200 hectares.

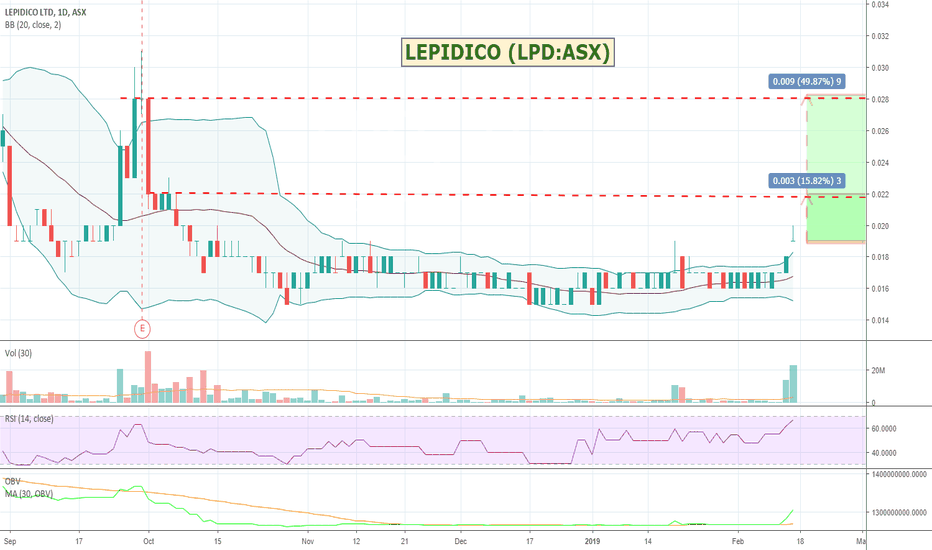

$LPD - LEPIDICO - Might be about to breakout of a sideways move$LPD - LEPIDICO - Might be about to breakout of a sideways move

Some good volume coming through. Not a share I'd be interested in holding long term, but could be good for a quick trade over the next few days. Some very good market depth and liquidity on the buyers side.

Platypus Minerals Ltd, formerly Ashburton Minerals Limited, is an Australia-based company. The Company is engaged in mineral exploration. The Company is focused on exploration and development of advanced gold and copper projects in Australia. Its Mt Webb Project is located wholly within Western Australia, 650 kilometers due west of Alice Springs. The 1,270 square kilometer project includes four exploration licenses. The Spring Valley Project is located near the towns of Goulburn and Canberra in New South Wales, some 20 kilometers north of the Woodlawn Zn-Pb mine. The Project consists of a single license, EL6941, 25 square kilometers in area. In October 2013, Ashburton Minerals Limited acquired Platypus Resources Pty Ltd.

$JIN - JUMBO INTERACTIVE - Broken strong resistance$JIN - JUMBO INTERACTIVE - Broken strong resistance

Has had a pretty good run over the last couple of years. Has broken through a traditional resistance level. Be worth a watch to see if it can continue its momentum. Has a bit of volume behind it.

Jumbo Interactive Limited is engaged in the retail of lottery tickets through the Internet and mobile devices sold both in Australia and eligible overseas jurisdictions. The Company operates in two segments: Internet Lotteries and All other segments. The Internet Lotteries segment consists of the retail of lottery tickets sold both in Australia and eligible international jurisdictions, and Internet database management/marketing. Internet Lotteries has two segments: Internet Lotteries Australia and Internet Lotteries Germany. All other segments include operating segments of non-lottery business activities. The Australian Charity Lottery business involves the sale of a number of charity-based lotteries to the established customer base in Australia. The Australian Charity Lottery business includes over four charities and the games are integrated into the OzLotteries.com Website and application. The Company offers German lottery sales online across desktop, tablet and mobile devices.

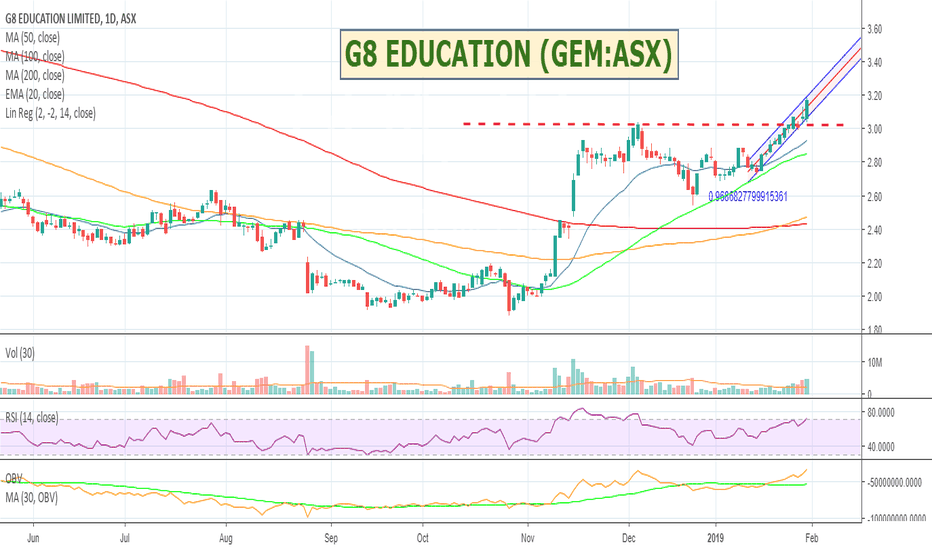

$GEM - G8 EDUCATION - Broken $3 resistance and growingGEM is looking interesting. Has successfully broken through and started to build support above the $3 ceiling. Nice big profitable company that had a $4.70 price tag in the past. One to watch.

Only word of warning is its a bit gappy on the buy side in the market depth queue. Would be nice to see more buyers lined up with a closer spread.

G8 Education Limited provides developmental and educational child care services. The Company's principal activities include the operation of early education centres owned by the Company and its subsidiaries, and the ownership of early education center franchises. It provides quality care and education facilities across Australia and Singapore through a range of brands. The Company's portfolio consists of approximately 490 in Australia and over 20 in Singapore. These centers provide a total combined licensed capacity of approximately 38,710 places. It offers brands, such as First Grammar, reative Garden, Kindy Patch Kids, buggles, Sandcastles, World of Learning, jellybeans, Kinder Haven, Pelican Childcare, Nurture One and Penguin Childcare. The Company's subsidiaries include Sydney Cove Children's Centre B Pty Ltd, Sydney Cove Property Holdings Pty Ltd, World Of Learning Licences Pty Ltd, Kindy Kids Operations Pty Ltd, Alfoom Investments Pty Ltd and Cherie Hearts Corporate Pte Ltd.

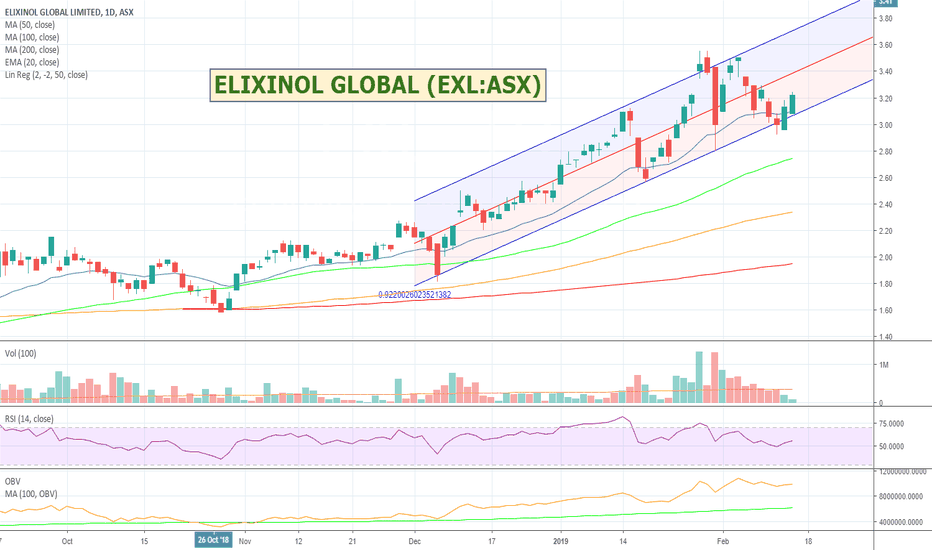

$EXL - ELIXINOL GLOBAL - Hemp company with a decent chart.$EXL - ELIXINOL GLOBAL - Cannabis company with a decent chart.

I've been following EXL for the last week or so after reading an article on them by an analyst who I quite like. ELIXINOL seems to have some good momentum in its business aggressively going after overseas markets. After a bit of a retrace entry conditions look good so have put in a bid. Would have liked to see more volume before entry but on the lower 15 minute chart there was a pretty good spike that broke out of its Bollinger Bands. RSI is around the mid 50's so looks like good value and a good time to take a punt for me.

ABOUT

=============

Elixinol Global Limited (“EXL”) (ASX:EXL; OTCQX:ELLXF) through its businesses has a global presence in the cannabis industry including hemp-derived CBD dietary supplements, hemp food and wellness products, as well as cultivation and manufacture of medicinal cannabis products. EXL’s businesses include:

- Elixinol (hemp-derived CBD dietary supplements), which was founded in 2014, is a manufacturer and global distributor of industrial hemp based dietary supplement and skincare products, with operations based out of Colorado, USA.

- Hemp Foods Australia (hemp-derived foods and skincare), which was founded in 1999, is a leading hemp food wholesaler, retailer, manufacturer and exporter of bulk and branded raw materials, and finished products.

- Nunyara (pharmaceutical medical cannabis), which was founded in 2014 to participate in the emerging Australian medicinal cannabis market has applications pending for cultivation and manufacturing licences.

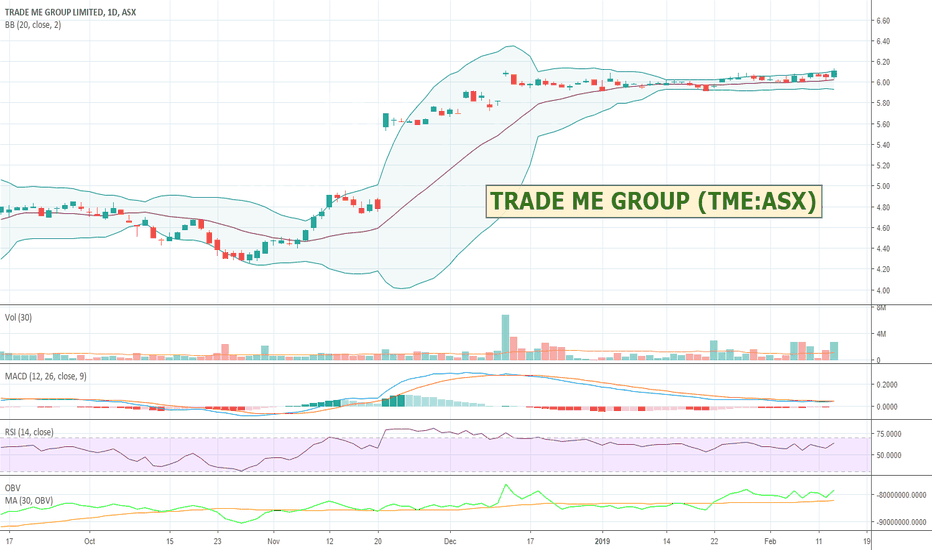

$TME - TRADE ME GROUP - Bolly squeeze opening up$TME - TRADE ME GROUP - Bolly squeeze opening up

For those who like Bollinger Band squeezes this one is looking interesting. Billion dollar market cap with pretty good financials. If you look at the bands on smaller time scales you can see it looks like its opening up to the upside.

Credit Suisse became a significant shareholder at the start of Feb and Trade Me Group Limited advises that it expects to release its results for the half year ended 31 December 2018, on Wednesday 27 February 2019 .

Might be worth a watch.

Trade Me Group Limited provides online marketplaces that connect people to undertake a transaction or form a relationship. The Company's businesses include providing a new and used goods marketplace, classified advertising for motor vehicles, real estate and employment, online advertising services and other ancillary online businesses. Its segments include General Items, Classifieds and Other. The General Items segment is its online marketplace business. The Classifieds segment represents advertising revenue from each of its three classified advertising sites: Motors, Property and Jobs. Its revenue is generated from basic and premium listing fees. The Other segment reflects all other businesses, including advertising, travel, dating, life and health insurance comparison and general insurance.

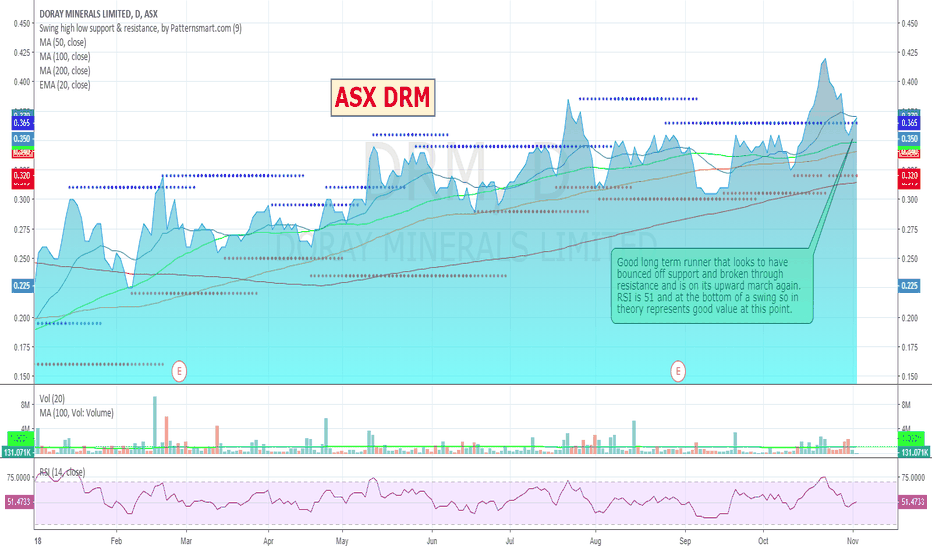

$DRM #ASX - Doray Minerals - Value breakout at bottom of swingWith recent market uncertainty I've been looking around a bit more at the Goldies.

Comments on chart. Looks to be heading in the right direction and seems to represent pretty good value at current pricing.

Doray Minerals Limited is a gold mining company. The Company's projects include Andy Well Gold Project, Deflector Gold Project (Deflector) and other exploration projects, such as Horse Well Gold Project. The Andy Well Gold Project is located approximately 50 kilometers north of Meekatharra, in the Murchison region of Western Australia (WA). Deflector is a gold-copper deposit located in the southern Murchison region of WA, approximately 450 kilometers north of Perth and over 160 kilometers east of the Western Australian regional city of Geraldton. Deflector's ore is located in approximately three separate lodes, including the West, Central and Contact lodes. It has an exploration tenement portfolio in both WA and South Australia (SA). The Deflector Project has a mine life of approximately six years. It is engaged in exploring gold mineralization at various WA regional projects, including the Gnaweeda Project. The Horse Well Gold Project is located near Wiluna.

(Oh and bring back Mountain / Area charts for the win.)

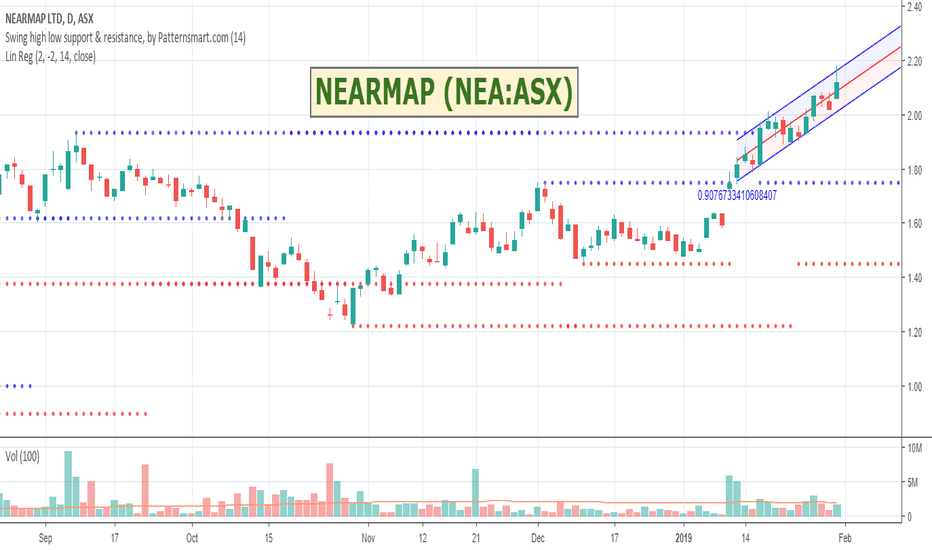

$NEA - NEARMAP - Broken through resistanceNearmap looking good to continue its run. Has broken through two previous resistance levels including a previous high. Might be a bit overbought so set a sensible stop to give it a little room in the short term.

Nearmap Ltd is an online PhotoMap content provider. The Company provides geospatial map technology for business, enterprises and government customers. Its segments include Australia, which is responsible for all sales and marketing efforts in Australia; United States, which is responsible for all sales and marketing efforts in the United States, and Corporate, which holds the intellectual property (IP) and product know-how that allows the Company to deliver its product offering, being online aerial photomapping. It offers solutions for various industries, such as architecture and engineering, construction, government, insurance, rail, property, roofing and solar. It provides site information, delivered to users' desktop through high-resolution PhotoMaps technology. Nearmap Insurance provides a desktop-based risk assessment solution. Nearmap Rail delivers visual analytics to mining, port and rail infrastructure. Its property solutions include Nearmap ART and Nearmap Property Tool.

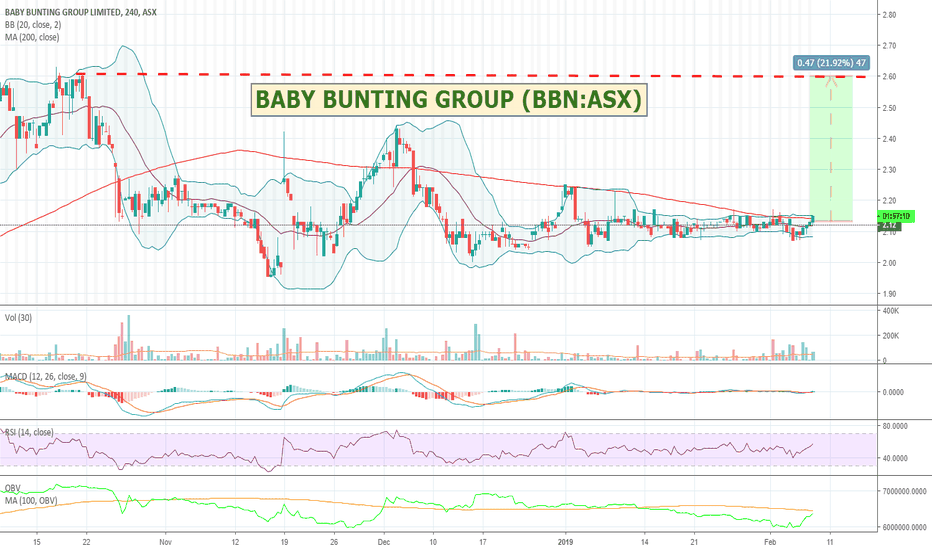

$BBN - BABY BUNTING - Bolly Squeeze is on... Baby Buntings price is undergoing quite a bit of compression in the lead up to its earnings announcement on the 15th of Feb. Several people have been somewhat bullish and if you look at the stock on the shorter time periods like 15m and 1h it does look like it might be setting up for an upward breakout. Buyers in the queue are pushing up as well. There is 20% or so room to move to get back to its previous highs so have taken a small punt to capture any significant upward movement. Stops are in of course.

1 HOUR VIEW

ABOUT BABY BUNTING

Baby Bunting Group Limited is a retailer of baby goods, primarily catering to parents with children from newborn to three years of age and parents-to-be. The Company is engaged in the operation of Baby Bunting retails stores and its online store, www.babybunting.com.au. The Company's product categories include prams, cots and nursery furniture, car safety, toys, babywear, feeding, nappies, manchester and associated accessories. The Company offers over 6,000 products. The Company sells private label and exclusive products. Private label products are sold by the Company under its own brand, 4Baby. The Company operates approximately 40 stores across all Australian states and territories, except Northern Territory and Tasmania. The Company offers additional services to its customers, including lay-by, car seat fitting, parenting rooms, which include baby weight scales, and an in-store/online gift registry.