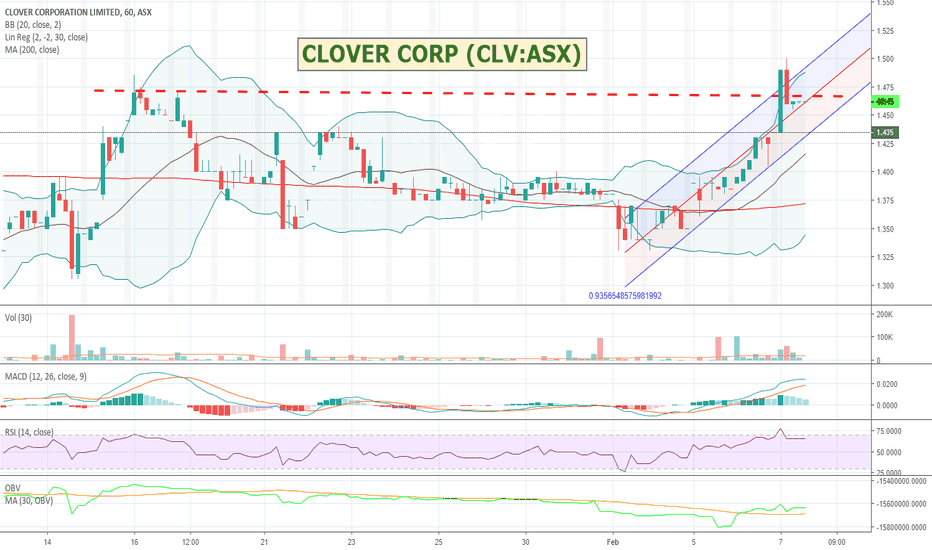

$CLV - CLOVER CORP - Feels like its setting up for a run.After a long sideways run it feels like it is starting to set up for another push.

Might be worth a watch.

Clover Corporation Limited is an Australia-based company, which is engaged in the refining and sale of natural oil. The Company is also engaged in the production of encapsulated powders, and the research and product development of functional food and infant nutrition ingredients. It focuses on developing nutrients for use in foods or as nutritional supplements. The Company provides lipid-based ingredients for the food industry. It focuses on the delivery of bioactive ingredients using encapsulation technology to produce ready-to-blend products containing tuna oil and other nutritional lipids. The Company offers an encapsulated oil and a food grade high docosahexaenoic acid (DHA) oil. It has a technology license for the encapsulation of marine and algal oils. The Company has a manufacturing plant for tuna oils and related products in Altona, Victoria. Its geographical segments include Australia/New Zealand, Asia, Europe and America.

Search in ideas for "zAngus"

$CYP - CYNATA - Up or Down ?Cynata has been having a good run of late, but is back up against its previous all time high. If it can push through I would take a punt on it to continue. It hit $1.65 in todays early trade but back down to $1.52 now. One to watch for now.

Cynata Therapeutics Limited is a stem cell and regenerative medicine company. The Company is engaged in the development and commercialization of a mesenchymal stem cell (MSC) technology for human therapeutic use, Cymerus. Its Cymerus technology facilitates manufacture of MSCs from a single donor and a single donation. The Company's Cymerus platform stem cell technology is based upon stem cells known as mesenchymoangioblasts (MCAs). The Company's technology utilizes induced pluripotent stem cells (iPSCs) originating from an adult donor as the starting material for generating MCAs and in turn for manufacturing the MSC therapeutic product. The Cymerus platform provides a source of MSCs that is independent of donor limitations and provides an off-the-shelf stem cell platform for therapeutic product use. The Company's MSCs produced using Cymerus technology, can be used to treat unrelated patients, without any need to match the recipient to the donor.

$MGX #ASX - Mount Gibson Iron - Trying for breakout.MGX has started to test support at 60 cents. Looking for a breakout!

Mount Gibson Iron Limited is a producer of iron ore products. The Company's principal activities include mining and shipment of hematite iron ore at Koolan Island in the Kimberley region of Western Australia; mining of hematite iron ore deposits at the Extension Hill mine site in the Mid-West region of Western Australia and haulage of the ore through road and rail for sale from the Geraldton Port, and exploration and development of hematite iron ore deposits at Koolan Island and in the Mid-West region of Western Australia. The Company operates through two segments: Extension Hill and Koolan Island. The Extension Hill segment includes the mining, crushing, transportation and sale of iron ore. The Extension Hill mine is located in the Mt Gibson Ranges. The Koolan Island segment includes the mining, crushing and sale of iron ore. The Company's Koolan Island hematite mining operation is located approximately 140 kilometers north of Derby in Yampi Sound, Western Australia.

$RHP - Rhipe - Good defensive stock at value price Need to wait for confirmation of direction but has been a good performer that looks oversold and might be about to rally.

rhipe Limited (rhipe), formerly FRR Corporation Limited, is engaged in the wholesale of subscription software licenses to various technology service provider resellers. In addition, the Company provides value added consulting and support to assist service provider resellers transition their own clients to cloud and subscription centric business environments. It provides cloud licensing and solutions for its software vendors across the Asia Pacific region. Its divisions are focused on cloud licensing (private, public and hybrid), cloud solutions (consulting services), and cloud operations (billing, provisioning, support, marketing). It offers Microsoft Indirect Cloud Solutions Program (CSP) program for Australia. Its program allows the Company to wholesale Microsoft's public cloud offerings, such as Office365, Azure and Enterprise Mobility Suite (EMS) to rhipe's reseller channel on a monthly subscription pay-as-you-use basis.

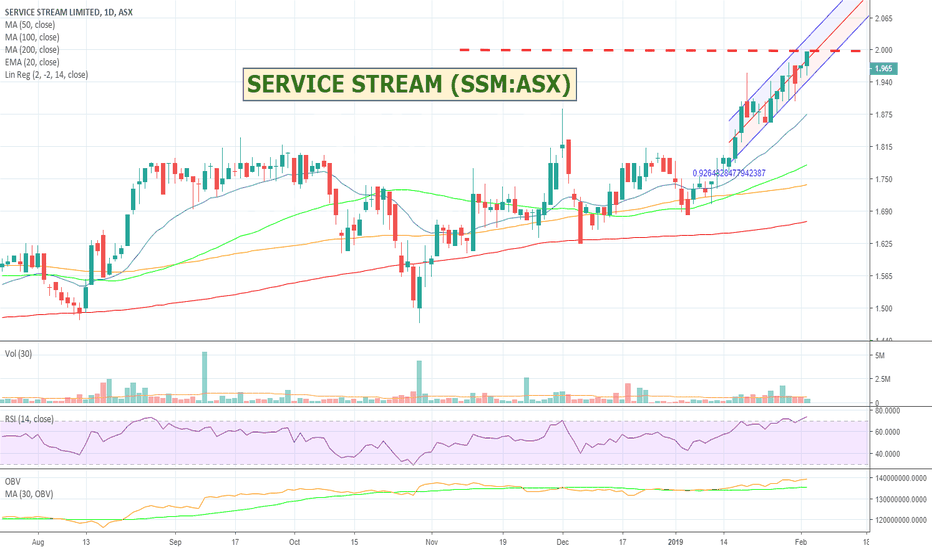

$SSM - SERVICE STREAM - Pushing up against the $2 mark. $SSM - SERVICE STREAM - Pushing up against the $2 mark.

Has a great looking 5 year consistent chart and starting to push that $2 ceiling. Looks like their acquisition of Comdain has gone smoothly allowing them to diversify and expand their solution offerings across the gas and water markets as well. Have added it to my watch list and added an alert for when it breaks the $2 mark and will look for an entry then.

Service Stream Limited is a provider of essential network services, including access, design, build, installation and maintenance across copper, fiber and wireless telecommunications networks, as well as to private and public energy, and water entities. The Company's segments include Fixed Communications, Mobile Communications, and Energy & Water. The Fixed Communications segment provides design, construction, maintenance and customer connection services to the owners of telecommunications network infrastructure in connection with the roll-out of the National Broadband Network in Australia. The Mobile Communications segment provides program management and turnkey services for infrastructure projects in the telecommunications sector. The Energy & Water segment provides a range of metering and energy services to electricity, gas and water networks, and through the Customer Care business provides contact centre services and workforce management support for contracts.

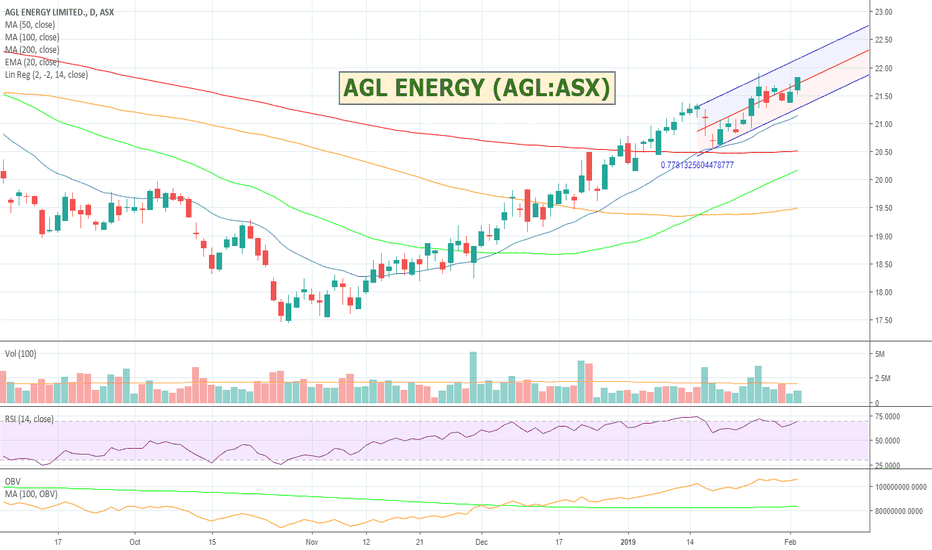

$AGL - AGL ENERGY - Enjoying a strong 3 month recovery. AGL has been looking good for a while. Showing a nice consistent recovery over the last 3 months that looks set to continue.

AGL Energy Limited is engaged in buying and selling of gas and electricity and related products and services; construction and/or operation of power generation and energy processing infrastructure; operation of natural gas storage facilities; extraction, production and sale of natural gas, and sale of distributed generation technologies, including solar, digital meters, storage and other business and residential energy services. Its segments include energy markets, which sells electricity, natural gas, and energy related products and services to consumer market, business and wholesale customers; group operations, which is a diverse power generation portfolio spread across thermal and renewable generation, including hydro, wind and solar; new energy, which includes new energy services, distributed energy services, as well as digital meter installation and data provider business, and investments, which include equity accounted investments in various energy related business.

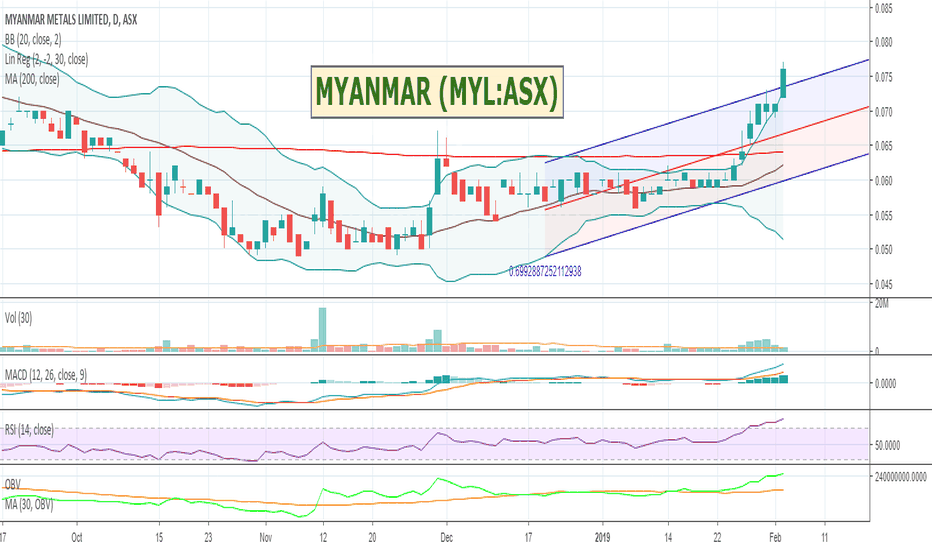

$MYL - MYANMAR - Has some momentum building$MYL - MYANMAR - Has some momentum building

Tempted by this one, but RSI too hot at the moment so have an alert set so that when the RSI drops below 65 Ill revisit.

Check out the 5 year chart. Nice.

Emerging Miner with a Tier 1 Project

51% Owner and JV Manager of the world’s best polymetallic project

Bawdwin is the most significant pre-production lead-silver project in the world, already boasting an 82 Mt high-grade JORC Resource, open in all directions and surrounded by exploration targets

- Re-development project with a fast track pathway to large scale, long life mining operation via existing Mining Concession & Production Sharing Agreement

- Attractive project economics from a high grade, low cost operation

- Highly strategic location <200km from Yunnan province, China, on the belt & road infrastructure corridor

- Board and Management team with proven experience operating large zinc and polymetallic projects and undertaking business in Myanmar

- Backed by leading local and international partners

- 100% of offtake unencumbered

- A unique project without parallel and held by an ASX-listed junior trading at a significant discount to any valuation metric

$KOV - Korvest enjoying a nice little run at the moment. Not the sort of stock for me as I more focus on the discovery type stocks but KOV is enjoying a nice little run at the moment and seems to be a pretty profitable business for a micro cap. Worth a look.

Korvest Ltd is engaged in hot dip galvanizing; sheet metal fabrication; manufacture of cable and pipe support systems and fittings; design and assembly of access systems for mobile equipment, and sale, repair and rental of high torque tools. The Company operates through two segments: Industrial Products and Production. The Industrial Products segment includes the manufacture of electrical and cable support systems, steel fabrication and access systems. It also includes the sale, hire and repair of high torque tools. It includes the businesses trading under the EzyStrut Pte. Ltd, Power Step (Australia) Pty Ltd, Power Step (Chile) SpA and Titan Technologies (SE Asia) Pty Ltd names. The Production segment represents the Korvest Galvanising business, which provides hot dip galvanizing services. Its businesses service a range of markets, including infrastructure, commercial, utilities, mining, food processing, oil and gas, power stations, health and industrial.

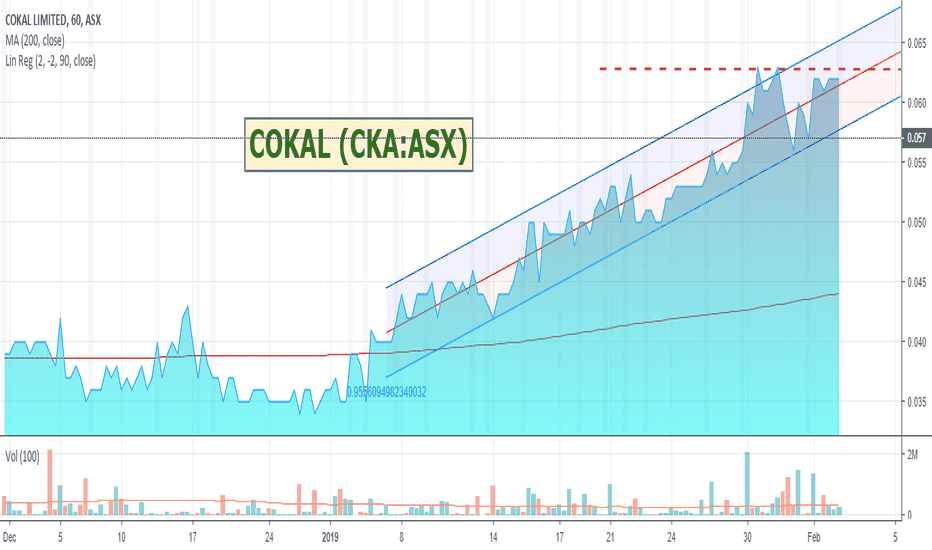

$CKA - COKAL - Running nicely but can it break resistance?COKAL (CKA:ASX)

Its had a good 3 month run including around 70%+ gains but is up against resistance around that 62-64 type mark. RSI has dropped back down to reasonable amounts so hopefully it can break through and continue its run. One to watch.

Cokal Limited is an Australia-based exploration and development stage company. The Company is engaged in identification and development of coal within the Central Kalimantan coking coal basin in Indonesia. The Company has joint arrangements to explore for coal in Tanzania. The Company's segments include exploration of coal in Indonesia, Tanzania and Australia. Its tenements in Central Kalimantan, Indonesia include Bumi Barito Mineral (BBM), which covers an area of approximately 15,000 hectares; Tambang Benua Alam Raya (TBAR), which covers an area of approximately 18,850 hectares; Borneo Bara Prima (BBP), which covers an area of approximately 13,000 hectares, and Anugerah Alam Katingan (AAK), which covers an area of approximately 5,000 hectares. Its tenements in West Kalimantan, Indonesia include Silangkop Nusa Raya (SNR), which holds over three exploration licenses in West Kalimantan close to the Malaysian border. The SNR Licenses cover an area of approximately 13,000 hectares.

$APX - APPEN - Breaking through resistance to new highs$APX - APPEN - Breaking through resistance to new highs

Appens looking good at the moment. Bit of volume coming through should keep it going. I'm currently up around 20% so far from first purchase. Might look to top up if it looks to continue with a bit of pressure taken off the RSI / retrace and rebuild.

Appen Limited is engaged in the provision of data solutions and services for global technology companies and government agencies. The Company operates through two segments: Content Relevance and Language Resources. The Content Relevance segment provides annotated data used in search technology (embedded in Web, e-commerce and social engagement) for managing relevance and accuracy of search results. The Language Resources segment provides data used in speech recognizers, machine translation, speech synthesizers and other machine-learning technologies for devices, including Internet-connected devices, in-car automotive systems and speech-enabled consumer electronics. Its solutions include search technology, such as whole-page evaluation and query categorization; language technology, such as phonetic transcription, sentiment analysis, speech-recognition training data, and conversational data; social technology; crowd sourcing, and project management for global deployments.

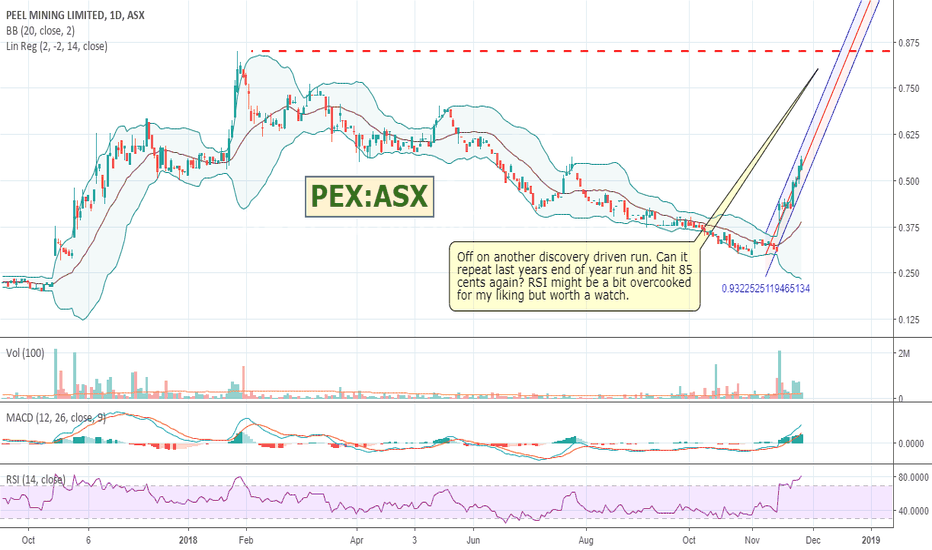

$PEX - Peel Mining - Running hard on discoveries again.$PEX - Peel Mining - Running hard on discoveries again.

Off on another discovery driven run. Can it repeat last years end of year run and hit 85 cents again? RSI might be a bit overcooked for my liking but worth a watch.

Peel Mining Limited is engaged in the exploration for economic deposits of minerals. The Company focuses on the base and precious metals. The Company operates through three segments: mineral exploration under its joint venture with CBH Resources Limited at its Mallee Bull prospect; mineral exploration under its farm-in agreement with Japan Oil, Gas and Metals National Corporation (JOGMEC), and other, including all other mineral exploration within Australia. It has approximately four main mineral projects comprising granted exploration licenses and licenses under application. It holds interest in Gilgunnia (EL7461 and ML1361); Cobar Superbasin Project, which is a package of granted tenements covering over 2,100 square kilometers within the Cobar Basin; Wagga Tank/Mount View Projects in Cobar Basin, and Apollo Hill Project, which includes Apollo Hill and the Ra Zone. Its Gilgunnia/Mallee Bull project is located approximately 100 kilometers south of Cobar in western New South Wales.

ASX: RMP - Red Emperor ResourcesJust my thoughts on RMP. Might be worth a look. As always see what your own charting says. I'm just guessing :)

If you see something different - please do comment.

Bought today at 0.063

I see support at: 0.061

I set a falling sell at: 0.06 to trigger down to a worst case 0.058 sell.

I'm long momentum trading so I don't set a profit target. I just wait until the trend / momentum looks like it is ending.

Will switch to a 15% trailing sell to ride the trend once its up around 5-10% or sell.

If it spikes > 10-20% in a single day then I tend to put a new falling sell up close at new support levels to keep any profit.

Red Emperor Resources NL is engaged in oil and gas exploration. The Company's principal activities are focused on identifying and exploring oil and gas in South East Asia and the Republic of Georgia. Its segments include Georgian Exploration & Evaluation; Philippines Exploration & Evaluation and Treasury. The Company has projects located in South East Asia and Georgia. The Company in South East Asia has entered into a Farmin Agreement with Otto Energy Philippines Inc. to farm into the prospective offshore Philippines Block, Service Contract 55 (SC55). Its SC55 is located in the southwest Palawan Basin and covers an area of approximately 9,880 square kilometers. Its Georgia project is located in the Republic of Georgia and covers an area of approximately 6,500 square kilometers. Its Philippines operations include Hawkeye-1 exploration well, which is drilled to the depth of approximately 2,920 meters with the reservoir intersected at approximately 2,710 meters.

$APC - AUSTRALIAN POTASH - Running nicelyMicrocap with weak fundamentals but its price action is performing well. It's not a buy for me, but might be worth a look depending on your level of risk. Id wait for the RSI to get back into the 60 type mark if you were looking to enter. Running pretty hot at the moment.

Its partnership with St Barbara (SBM:ASX also performing well) caught my attention.

Australian Potash Limited, formerly Goldphyre Resources Limited., is a minerals exploration company focused on advancing its project, the Lake Wells Potash Project. The Company is engaged in exploration of its tenements and applied for or acquired additional tenements. Its Lake Wells Potash Project is located approximately 400 kilometers northeast of the Eastern Goldfields centre of Kalgoorlie. The Lake Wells Potash Project is being explored for the fertilizer mineral sulfate of potash (SOP), contained within the lake brines. Its project portfolio includes the gold and base metals prospective Laverton Downs and Mailman Hill projects, and the Beretta project, located in base metals minerals province in the Albany Fraser Orogen. Its Laverton Downs Project is located over 15 kilometers north of the Laverton Township, lying in the Laverton Tectonic Zone. Its Great Central project occupies a portion of Lake Wells Station and Vacant Crown Land.

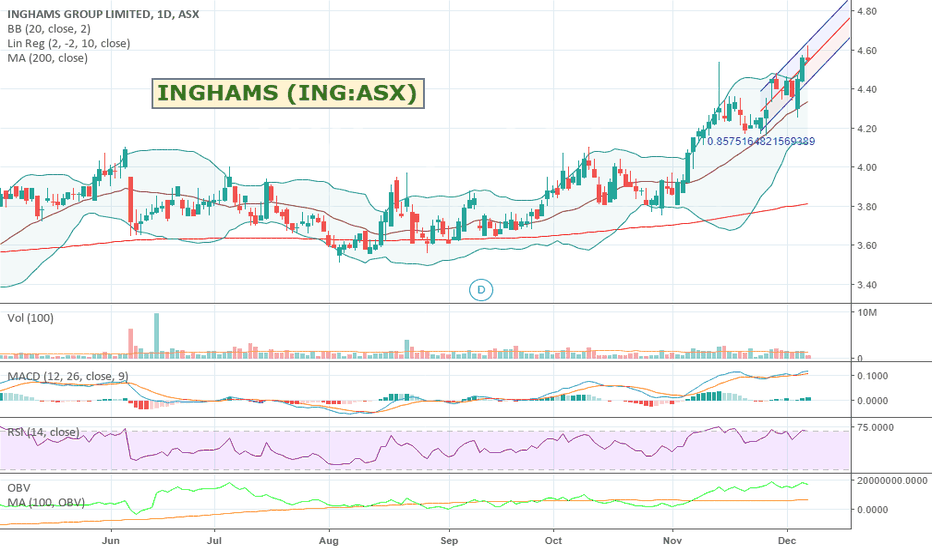

$ING - INGHAMS CHICKENS - Anticipating growth$ING - INGHAMS GROUP LIMITED

Nice steady performing share setting up for more growth.

ING have been buying back their own shares and the bots rate them a strong buy so who am I to argue. It is a pretty heavily shorted stock, but I'm happy to bet against them.

Might be a little pull back short term with the inflated RSI, but I like them because I think as the economy increasingly continues to turn sour I think more people will more regularly eat at home and turn to chicken as opposed to more expensive cuts of meat such as beef etc. Fast food chains such as KFC which Ingham supplies also tend to benefit as people switch to less expensive dining out options.

Ingham is also anticipating more growth based on their December 4th announcement below.

Ingham’s invests in infrastructure to support profitable growth

Inghams Group Limited is pleased to announce that it will build a new poultry hatchery in Victoria at a cost of $46 million. The new hatchery, which will replace an existing facility, will improve productivity and increase capacity to support anticipated growth in demand. Recently appointed Chief Executive, Jim Leighton, said “this significant investment demonstrates our commitment to all of our stakeholders in supporting infrastructure projects that deliver profitable growth”. The construction of the new hatchery is expected to be complete by the end of 2020, employing approximately 100 people during the construction phase and providing 20 ongoing jobs when fully operational.

Inghams Group Limited is an Australia-based integrated poultry producer. The Company has two operations: poultry, which is engaged in the production and sale of chicken and turkey products across various categories, such as primary, free range, value-enhanced, further processed and ingredients, and stockfeed, which is engaged in the production of stockfeed for use by the poultry, pig, dairy and equine industries. The Company operates through two geographic segments: Australia and New Zealand. The Company's operations include approximately one quarantine facility, over 10 feedmills, approximately 74 breeder farms, over 11 hatcheries, approximately 225 predominantly contracted broiler farms, as well as over seven primary processing plants, approximately seven further processing plants, over one protein conversion plant and approximately nine distribution centers across Australia and New Zealand. The Company's brands include Ingham's and Waitoa.

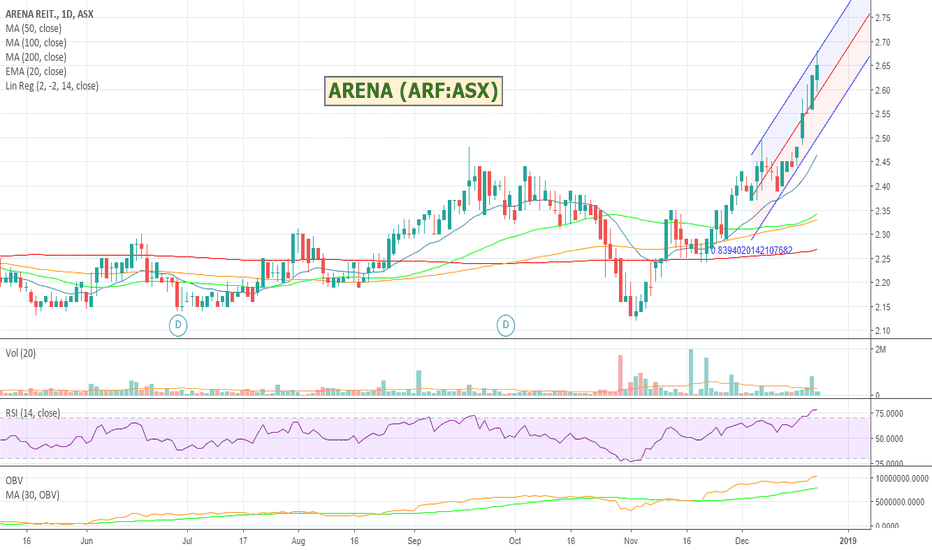

$ARF - Arena REIT booming alongSome of these REITs are powering along despite the economic downturn elsewhere. Might be a safe-haven worth investigating.

Arena REIT (ARF) is an internally managed stapled real estate group that owns, manages and develops specialised real estate assets across Australia. A security in ARF comprises one security in Arena REIT Limited; one security in Arena REIT No.1; and one security in Arena REIT No.2; stapled and traded together as one stapled ARF security.

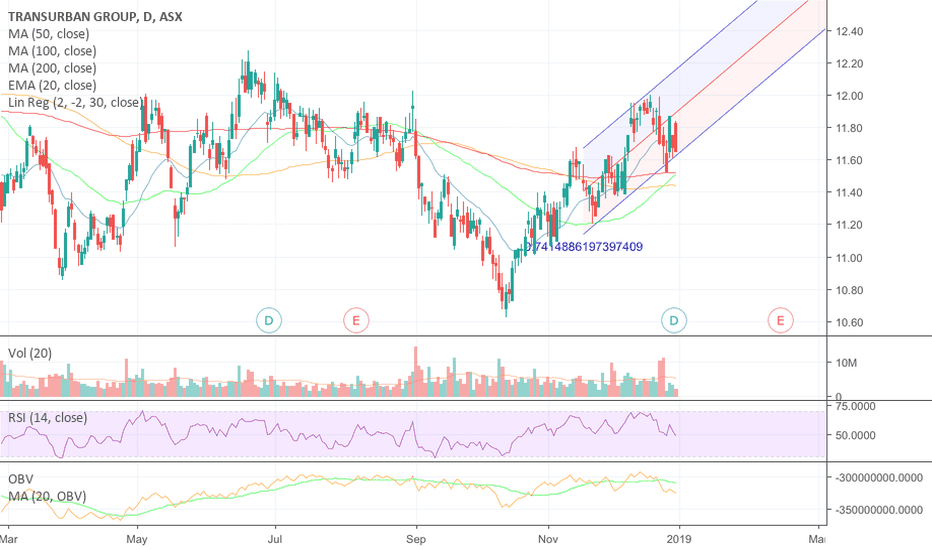

$TCL - Transurban increasing their pricing might bump itNot a share I’m excited by, but could be a bit of short term bump in the price with their announcing their increased pricing. I know that several brokers consider them quite a good defensive stock and the current chart would seem to indicate that they are in an upward trend and the value is probably fairly good at the moment. Depends of course on how the market reacts to the news. I typically wait until after 11 AM to see what the direction of the market is.

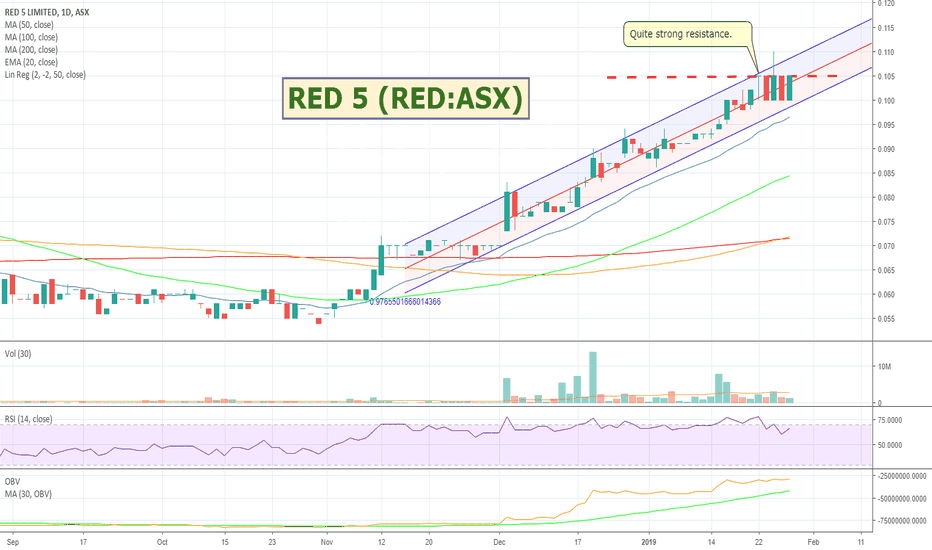

$RED - Will it break through resistance and keep climbing?I've been holding RED since the low .09s and its been trying to establish a base at 10 cents for a little while now. That 11 cent ceiling is proving troublesome and its become stuck in that 10-11 cent channel. Has had SUCH a good consistent run so hopefully it will breakout and continue. Gold sector is a little flat too at the moment with the US / China uncertainty but one to watch especially if it breaks that 11 cent mark.

Red 5 Limited is an Australia-based company, which is engaged in gold production and mineral exploration in the Philippines. The Company's principal asset is the Siana Gold Project. Its Siana Gold Project is situated on the island of Mindanao in the Philippines. The Company's principal asset also includes the Mapawa Project, which is located approximately 20 kilometers north of Siana Gold Project. Its Mapawa Project is a gold-copper porphyry prospect, which forms part of the Company's regional tenement portfolio in the prospective Surigao del Norte mining province in the Philippines. The Company's exploration targets across its tenements include Siana Gold Project-underground in-fill drilling, Dayano propect, Alegria propect and Madja propect. The Siana Gold Project produces a total of approximately 59,663 ounces of gold. Its Siana Gold Project processing plant processes a total of over 692,384 tons of ore per annum.

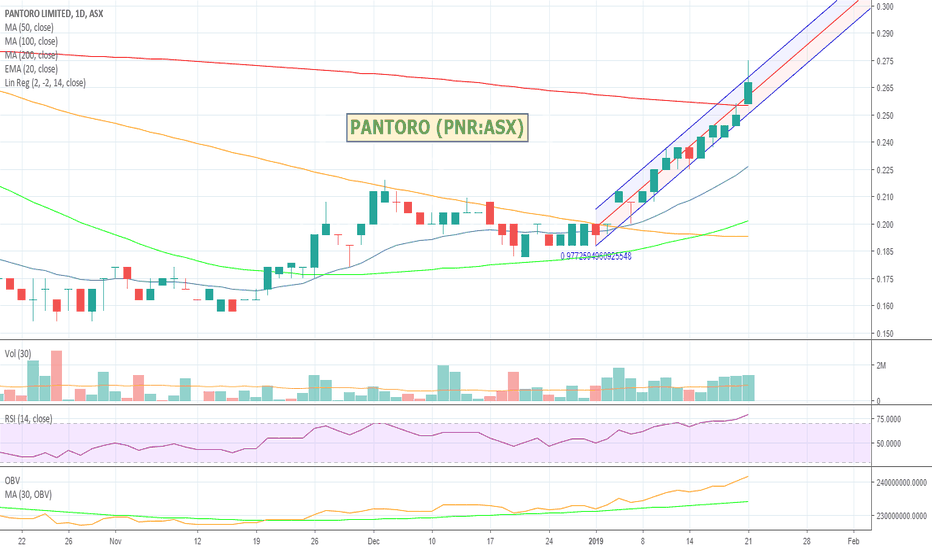

$PNR - PANTORO - Continuing to run on volumeBought this one at 22 and its still heading in the right direction. Some good volume coming through and the moving averages are nicely providing support and diverging as is the OBV. RSI is pretty high because of the momentum so perhaps some pull back could be expected before continuing its run. They have reasonably good financials for a small cap of this size. Looking good so far and lots of upside to get back to old highs.

Pantoro Limited, formerly Pacific Niugini Limited, is a gold producer engaged in development of the Halls Creek project and exploration of minerals in Papua New Guinea (PNG). The Company's segments include the Nicolsons Gold Project and PNG Exploration. The Nicolsons Gold Project segment includes mining, treatment, exploration and development of gold assets. The PNG Exploration segment includes the mineral exploration within PNG. The Halls Creek Project includes the Nicolsons Mine, and a pipeline of exploration and development prospects located east of Halls Creek in the Kimberley Region of Western Australia. The Halls Creek Project includes the Rowdies and Wagtail Deposits, which lie over 1.5 kilometers south of Nicolsons Mine. The Garaina Project is located over 100 kilometers southeast of the Hidden Valley Mine and Wau Town, in the Morobe province, covering an area of over 380 square kilometers and prospective for discovery of epithermal gold and porphyry copper-gold deposits.

$BGL #ASX - Bellevue Gold LimitedBellevue Gold Limited, formerly Draig Resources Limited, is an Australia-based gold exploration company. The Company’s principal project is the Bellevue Gold Project, which is located approximately 157 kilometers north west of Laverton in Western Australia. The Bellevue Gold Project covers an area of approximately 27 square kilometers over three granted mining leases and one exploration license. The Company also holds interests in the Tribune Lode high grade discovery and the South Yandal Gold project.

ASX BID===================================

ASX BID - Bid Energy

===================================

Looks like after a period of consolidation the BID bus is ready to resume its upward trend.

BidEnergy Limited, formerly Cove Resources Limited, is a technology company. The Company is principally engaged in the provision of cloud-based energy procurement system. Its cloud-based platform is used by multi-site organizations to manage their energy category, using robotic process automation to gather data on energy spend and usage. By automatically capturing and validating invoices meter data, its customers can update their accounting and payments processes, go to market at short notice to optimize their supply contracts and reduce on-bill chargers using analytics and reporting. It offers various solutions, such as data management and analytics; payment and budgeting, and procurement and contract management. Its integrated platform offers sourcing, contract management, spend analysis, budgeting, forecasting, payment automation, accounting, and supplier risk and performance management. The solution has an in-built interface and integrates with existing enterprise systems.

===================================

MY STRATEGY

===================================

I purely look at TA type indicators and like to find Penny Stocks having a good run over 3 months in speculative sectors and I will try and buy and hold them for 3 days to 3 weeks ish (or basically as long as they run) to get the best momentum. I use the Stock Screener to find them and then the intraday charts to look at buy positions and visually confirm the trend. On purchase I set a trailing sell stop loss at 15% to help ride out intraday noise, and then leave them alone until I can see the momentum is failing on say a 5 day chart. At that point I'll put in a falling sell at tight resistance points on the 1 minute chart to protect against any retrace. Goal is to keep entering stocks when they have the most upward momentum, exit when it slows. I try and find stocks where news will make them spike. If they do go up over 10% in a single day then I replace my trailing sell with a falling sell at close resistance points to capture profit if it retraces. If I pick wrong and it closes below my buy price (I try and ignore the first days up and downs) at any stage, then I use intraday 1 minute charts to set a tight falling sell at the second stop loss to give it one last chance and protect my cash. Most of my analysis happens in the Stock Screener, the charts are more to confirm direction and share ideas.

As always DYOR and please do post if you see something different to what I do - good or bad :)

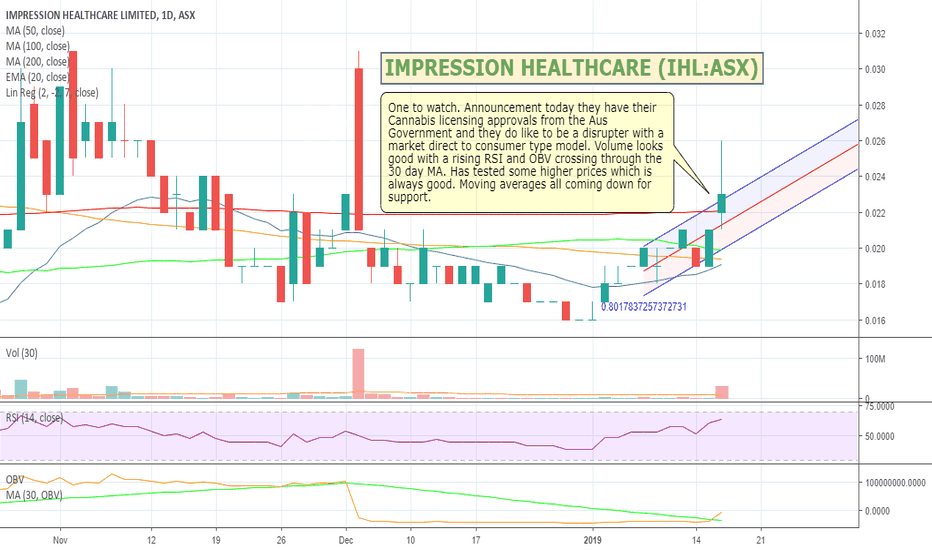

$IHL - Impression looking to disrupt the healthcare sector$IHL - Impression looking to disrupt the healthcare sector

Receipt of Medicinal Cannabis Licenses from the Department of Health

Impression Healthcare Limited (‘Impression, ‘IHL’ or the ‘Company’) is delighted to announce that it has received the relevant licenses from the Department of Health, Victoria to sell or supply, by wholesale, scheduled cannabinoid substances. Specifically, the licenses includes; Cannabis, Cannabidiol (CBD), Tetrahydrocannabinols (THC) and Dronabinol.

Interesting micro-cap with some sales. Might be one to watch. Announcement today they have their Cannabis licensing approvals from the Aus Government and they do like to be a disruptor with a market direct to consumer type model. Volume looks good with a rising RSI and OBV crossing through its 30 day MA. Has tested some higher prices which is always good. Moving averages all coming down for support.

Impression Healthcare Limited is Australia’s largest home dental impression company and is disrupting the dental devices market by providing consumers with an in-home method to consume laboratory-grade and personalised dental healthcare products at significantly lower prices than those offered by the traditional dental industry. Impression has significantly grown its distribution footprint and increased its revenues by 359% in the 2018 Financial Year. With its own dental laboratory in Victoria, Australia Impression offers best in class teeth protection and helps its customers combat bruxism, snoring, mild to moderate sleep apnoea and teeth discolouration with custom-fitted oral devices.

Impression has also broadened its commitment to disruption in the healthcare sector by pursuing multiple opportunities in the field of medicinal cannabis distribution and development including; a collaboaration agreement with leading US Cannabinoid therapeutics Company, AXIM Biotechnologies Inc; a license agreement for the production and distribution of Dronabinol in the USA, Canada, Australia and New Zealand with Resolution Chemicals Ltd; and an agreement for the distribution of medicinal cannabis oils with a major Canadian manufacturer. Impression will leverage its existing marketing activities to explore opportunities to distribute a range of cannabinoid therapeutic products throughout multiple jurisdicitions.

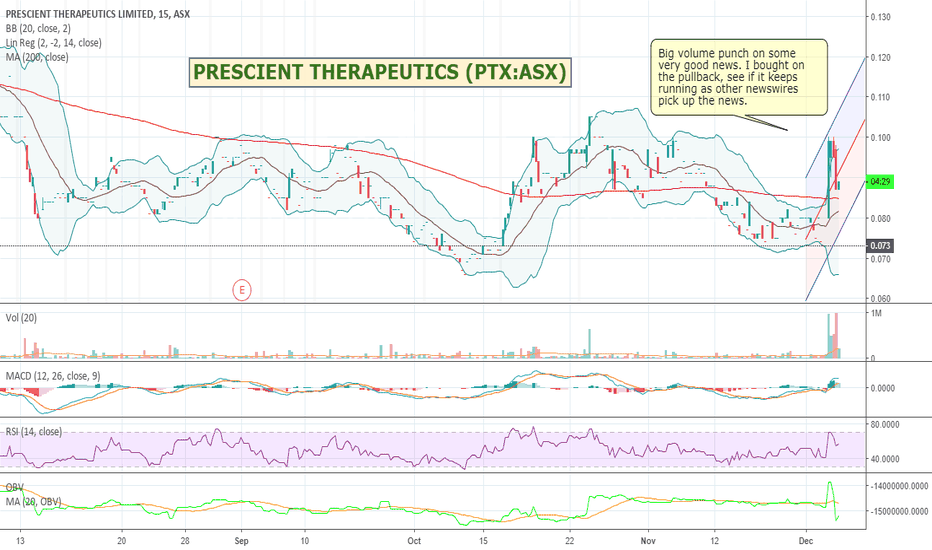

$PTX - Prescient Therapeutics - Strong news on cancer treatmentPopped up on my volume alerts and bought on the pullback. Went as high as 10 cents on some pretty strong news!

ANNOUNCEMENT:

================================

Melbourne, Australia (10 December 2018): Clinical-stage oncology company Prescient Therapeutics Limited (ASX: PTX; Prescient) is pleased to announce interim durability data on the PTX-200 study in HER2 negative, locally advanced breast cancer.

Follow-up studies have determined that none of the five responders in the Phase 2 component of the trial have had disease progression to date.

Progression Free Survival (PFS), which is the time from the start of treatment until disease recurrence or progression, ranges from 22.8 months to 30.4 months so far, with an average of 27 months. All patients remain progression free to date.

Overall survival (OS), which is the time from start of treatment until patient death, exhibits the same average duration of 27 months as none of the patients have passed away.

To date, not only did patients with pathological complete responses (pCR) remain free of disease progression, but interestingly all patients that had partial responses (PRs) also remain free of disease progression after over two years

ABOUT:

================================

Prescient Therapeutics Limited is a clinical-stage oncology company. The Company is engaged in the preparation for and conduct of clinical trials relating to the companies drugs; business development associated with the promotion of its technologies and products, and business development associated with developing collaborative, partnership relationships and corporate transactions. The Company is engaged in developing compounds to treat a range of solid and hematological cancers. It is pursuing the clinical and commercial development of two cancer compounds: PTX-200 and PTX-100. PTX-200 inhibits a tumor survival pathway, which plays a key role in the development of cancers. PTX-100 is a drug that kills cancer cells by blocking geranylgeranyl ransferase-1 (GGT-1). PTX-200 is in Phase Ib/IIa trials in breast and ovarian cancers, and focuses on an accruing patient for leukemia trials. PTX-100 is in Phase I of its clinical trials for breast cancer and multiple Myeloma.

$OGC - OceanaGold - Going long on the pullback.$OGC - OceanaGold - Going long on the pullback.

Momentum moving in the right way. All the moving averages starting to diverge nicely. RSI has come down a little off the heat of the previous days and there is still some good volume there. Might come back a little over the next few days but I'll buy now its pulled back and hold for a while. Nice profitable company so should ride out any short term volatility. Stop losses in though in case of a turnaround.

I also like that it has spent some time above the $5 resistance mark, so looking for it to cross that again and start to use it as a base to build.

If the China / US Trade conversations dont go well Gold might bounce, and if they do, can't hurt too much to hold until Trumps next Tweet :)

OceanaGold Corporation is a gold mining company. The Company is engaged in the exploration, development and operation of gold and other mineral mining activities. The Company's segments are New Zealand, the Philippines, the United States and All other segments. The Company's assets encompass its flagship operation, the Didipio Gold-Copper Mine located on the island of Luzon in the Philippines. On the north island of New Zealand, the Company operates the high-grade Waihi Gold Mine. On the south island of New Zealand, the Company operates the gold mine in the country at the Macraes Goldfield, which is made up of a series of open pit mines and the Frasers underground mine. In the United States, the Company is constructing the Haile Gold Mine, an asset located in South Carolina along the Carolina Slate Belt.