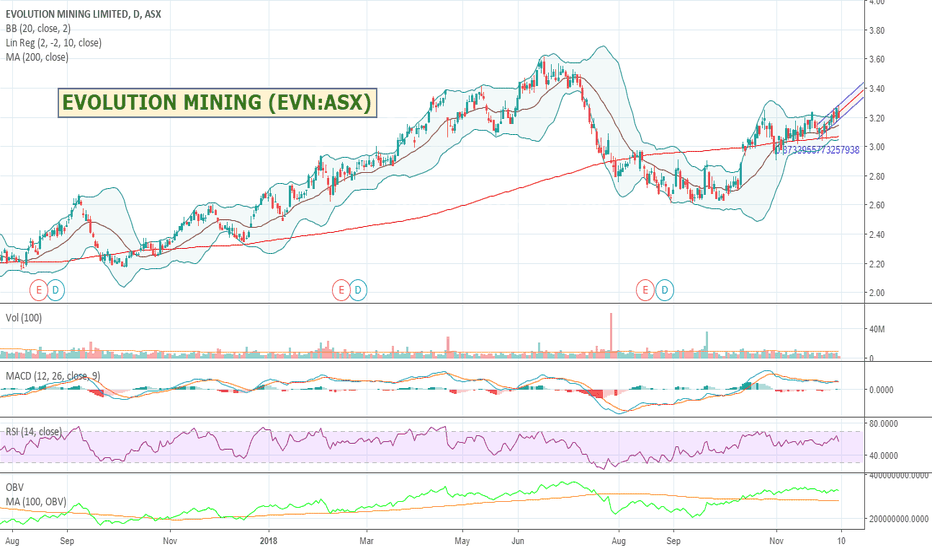

$EVN - EVOLUTION MINING - Looking like a new run setting upEVOLUTION MINING (EVN:ASX)

Nice big healthy miner looking to resume their run. I'd like to see them breakout past $3.25 cents for an entry, but headed in the right direction. Have an alert set.

$5B market cap with nice fat revenues always good to have in your portfolio when times might get a bit tough.

Evolution Mining Limited is a gold company. The Company is engaged in operating, identifying and developing gold related mining projects in Australia and New Zealand. Its segments are Cowal, Mungari, Mt Carlton, Mt Rawdon, Edna May, Cracow, Pajingo, Exploration and Corporate. It owns and operates approximately seven gold mines, including Cowal in New South Wales; Cracow, Pajingo, Mt Carlton and Mt Rawdon in Queensland, and Mungari and Edna May in Western Australia. The Cowal operation is an open pit mining operation with production from a range of different faces within the single pit. The Edna May gold mineralization consists of high-grade reef structures and associated stockwork veining hosted within approximately three en-echelon tonalitic gneiss intrusions (Edna May, Greenfinch and Golden Point). The Mt Carlton project is a high-sulfidation epithermal style deposit with mineralization occurring within felsic volcanic rocks on the northern margin of the Permian Bowen Basin.

Search in ideas for "zAngus"

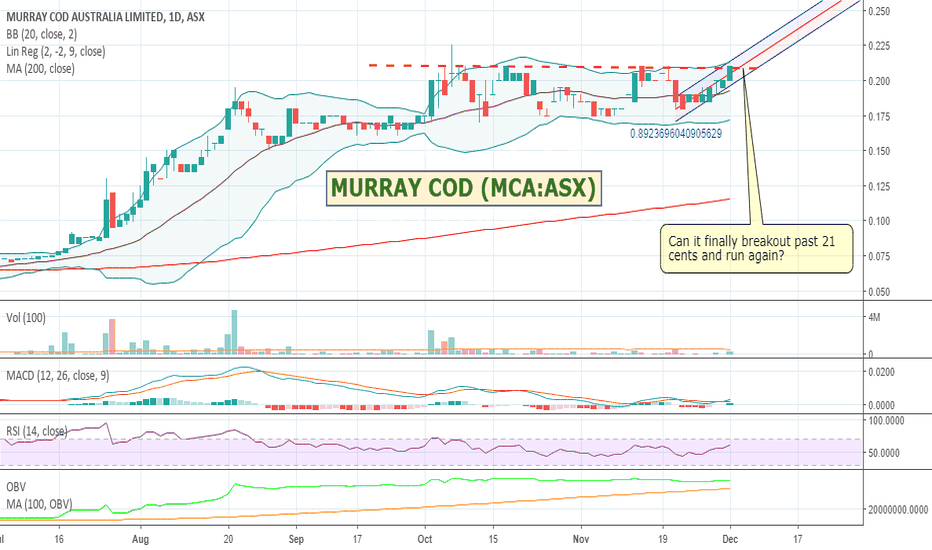

$MCA - MURRAY COD - About to breakout?$MCA - MURRAY COD - About to breakout?

Murray Cod is a stock I have always liked as I suspect businesses like this will be the future of seafood aquaculture and with demand from countries like China and India the industry is only going to get bigger.

MCA have been performing well and are about to supersize their operations with new facilities coming online in 2019.

Murray Cod Australia Limited, formerly Timpetra Resources Limited, is engaged in hatchery business, nursery business, fish farming and cage systems. The Company operates through the hatching, growing and selling of Australian native freshwater fish segment. Its hatchery business is engaged in Silverwater Native Fish breeds fry, including native species of Murray Cod, Silver Perch and Golden Perch, which are then grown into fingerlings in fry ponds and weaned inside the hatchery facilities. The nursery system includes a range of small and large tanks to allow for grading of fish by size. Fish farming includes over two ponds on the Ryan Farm, which are fitted with cage systems that are stocked with fish, with a capacity of approximately 20,000 fish for each pond, which enables an annual production capacity of Murray Cod of over 36,000 kilograms. The cage system allows monitoring of the fish stock for mortality and any signs of disease.

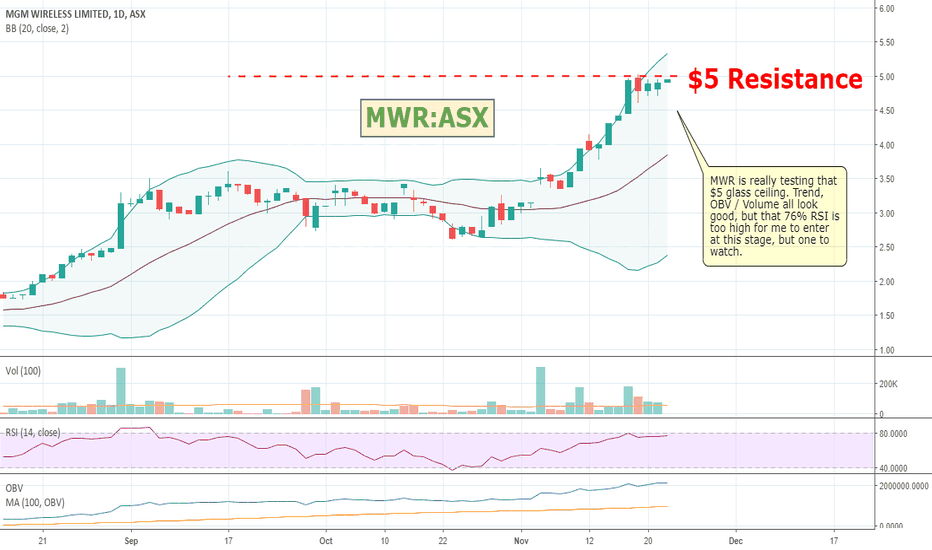

$MWR #ASX - MGM Wireless MWR has been a favourite of mine for a while and have bought and sold it several times. Looking good for another entry if it cracks the $5 mark. More notes on the chart.

MGM Wireless Limited provides mobile messaging solutions for business. The Company's segments include MGM Wireless Holdings and NZ MGM Wireless (NZ) Pty Ltd. Its products include messageyou, which is a student absence notification product that combines a student attendance management approach to short message service (SMS) with automation; MGM Watchlists, which automates the analysis of parent reply messages, message traffic and the status of attendance data to detect emerging patterns or trends and automatically alert school leaders responsible for follow-up action; Outreach, which is a school specific specialized Web-based SMS social communication solution; Smartsync, which automatically extracts parent contact data from student management systems; RollMarker, which manages student attendance, and AllMyTribe, a smartphone and Apple Watch application that keeps students safe by alerting parents whenever their child arrives or leaves a place, such as school, bus stop or sports venue.

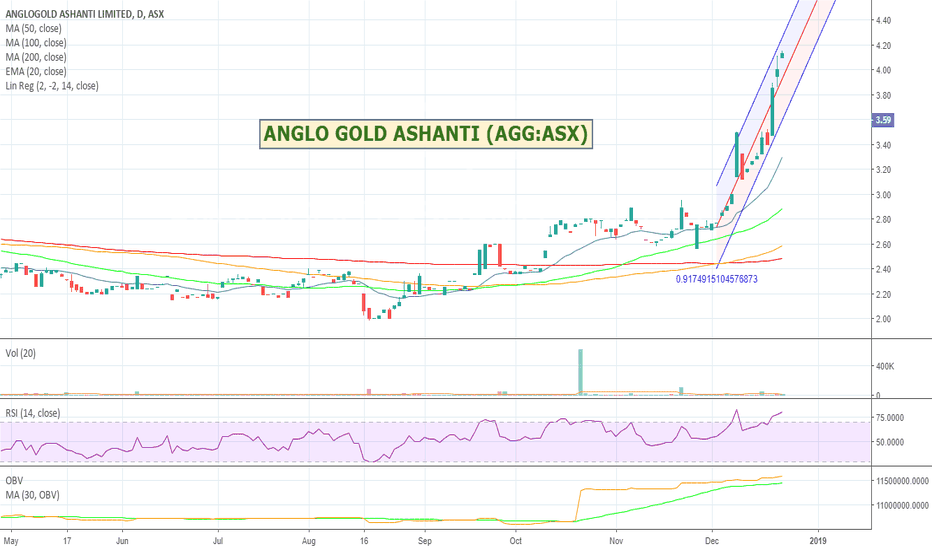

$AGG - AngloGold Ashanti having a whale of a time.$AGG - AngloGold Ashanti having a whale of a time.

Not much volume moving through the company but the share price is heading in the right direction on no announcements which is always quite interesting.

I not on it, but might be one to watch especially if the RSI comes down to the 60 type range and indicates better value buying. Have set an alert.

Looks like money is fleeing to Gold.

Bit fat killer whale of a company.

AngloGold Ashanti Limited (AngloGold Ashanti) is a gold mining company. The Company's business activities span the spectrum of the mining value chain. Its main product is gold. Its portfolio includes over 17 mines in approximately nine countries. It also produces silver, uranium and sulfuric acid as by-products. The Company operates through four segments: South Africa, Continental Africa, Australasia and Americas. Its South African operations comprise of the West Wits operations, including Mponeng and TauTona, and surface operations. It has operations in Continental Africa in locations, including Democratic Republic of the Congo, Ghana, Guinea, Mali and Tanzania. The Australasia segment includes the operations in Australia. It consists of Sunrise Dam and Tropicana. The Americas segment includes the operations in Argentina, Brazil and the United States.

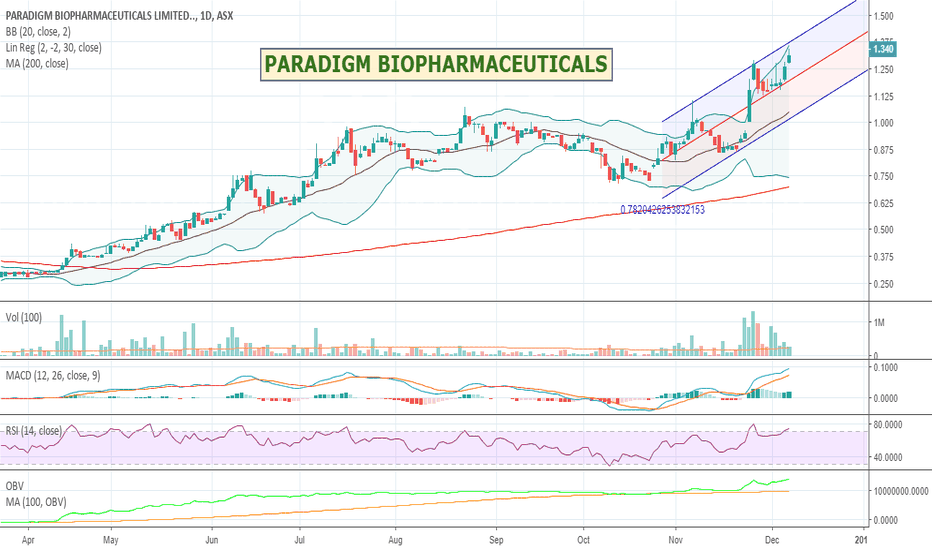

$PAR - PARADIGM BIOPHARMACEUTICALS - Steady riserPARADIGM BIOPHARMACEUTICALS (PAR:ASX)

Has been trending nicely for a while now. More good news today with their next announcement "PARADIGM REPORTS CONSISTENT >50% PAIN REDUCTION IN KNEE OSTEOARTHRITIS PATIENTS"

I like these kind of stocks in the medical space that are looking for alternative treatments to surgery. In the increasing world or obesity and ageing populations knee pain is massively increasing. How many people do you know of that have had some kind of knee surgery.

Paradigm Biopharmaceuticals Limited is a biopharmaceutical company focused on repurposing the drug pentosan polysulfate sodium (PPS) for the treatment of inflammation. The Company is engaged in researching and developing therapeutic products for human use. The Company is a drug repurposing company, which seeks to find new uses for old drugs. The Company has commenced the open labelled Phase II clinical trial, investigating the role of the drug PPS in treating traumatic Bone Marrow Lesions. The Company's Rhinosul has properties consisting of both histamine stabilizing and anti-inflammatory properties. The Company focuses on repurposing PPS under ZILOSUL name, as a treatment for bone marrow edema (BME) lesions following traumatic injury.

I hold.

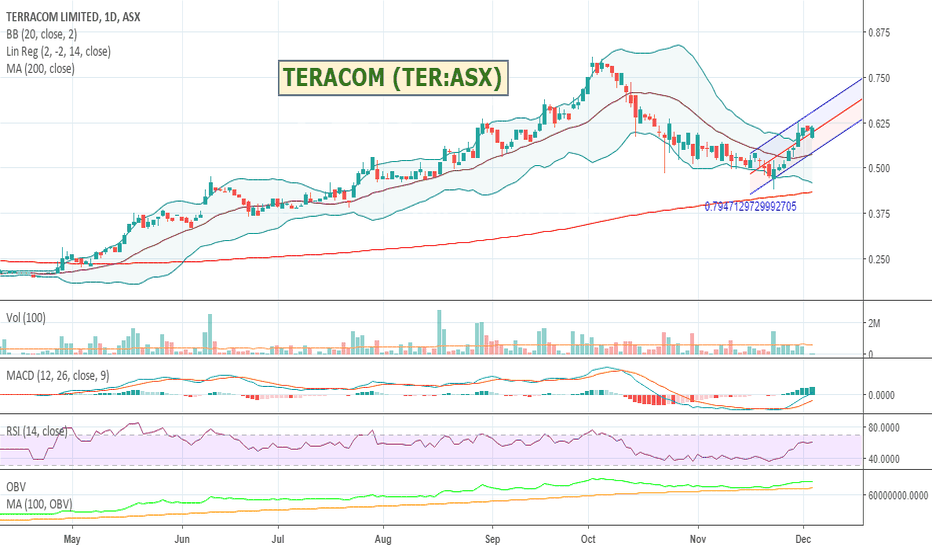

$TER - Terracom - Resuming its run.Nice little earner that looks like it is resuming its run.

From a recent statement "The 2018 Financial Year was a truly remarkable year for the Company, as it transformed itself from an Exploration company to an Export Mining company in Australia and Mongolia."

TerraCom Limited, formerly Guildford Coal Limited, is resource company with a portfolio of assets in Mongolia and Queensland. The Company is engaged in mineral exploration of mining tenements held across Australia. Its segments include Australia, which is engaged in coal exploration and development activities within Australia, and Mongolia, which is engaged in coal exploration and extraction activities within Mongolia, including the transition from developer to producer. The Company's tenements cover an area of approximately 11,100 square kilometers. Its projects include Northern Galilee Project, Springsure Project, Sierra Project, and Kolan Project (Maryborough Basin). The Company controls both thermal and coking control tenements located in the coal bearing basins of the South and Middle Gobi. It owns and operates the Baruun Noyon Uul (BNU) coking coal mine in Noyon Soum, South Gobi province. The Dund (Mid) Gobi Project consists of two exploration licenses: 12929X and 15466X.

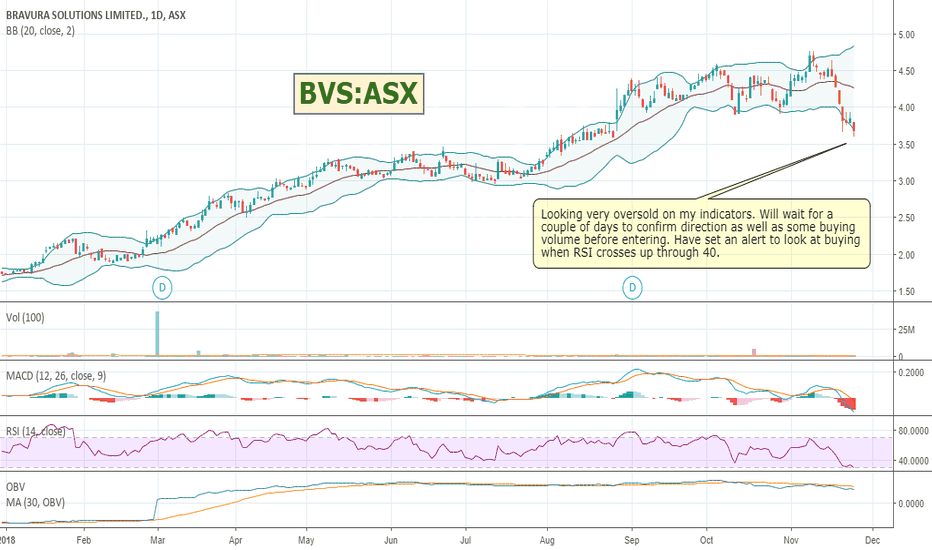

$BVS - Bravura Solutions - Looking oversold$BVS - Bravura Solutions - Looking oversold.

See which way it heads over the next couple of days but looks like it is in that oversold territory and should recover somewhat for a quick couple of percentage points gain.

Bravura Solutions Limited provides software products and services to clients operating in the wealth management and funds administration industries in the Asia-Pacific and Europe, Middle East and Africa regions. The Company's software products and services support the front-office, middle-office and back-office functions needed to manage and administer financial products across investment products and wrap platforms, superannuation, pension and retirement products, life insurance, private wealth and portfolio administration. It operates across two segments: Wealth Management, which provides software and services that support back-office functions relating to the management of investment products and wrap platforms, superannuation, pension and retirement products, and life insurance, and Funds Administration, which supports back-office administration requirements for a range of investment managers, custodians and third-party administrators for both retail and institutional customers.

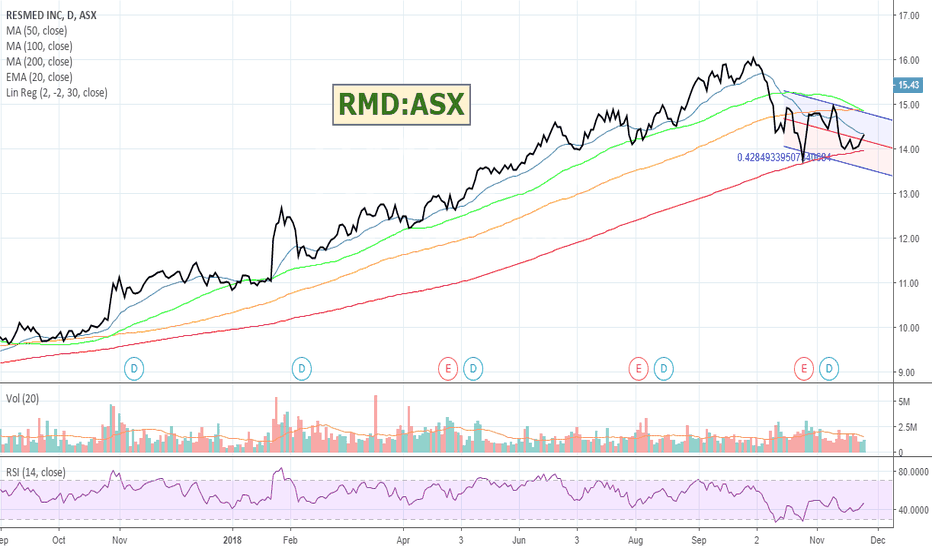

$RMD - Resmed making a comeback$RMD - Resmed making a comeback?

Increasing obesity and associated sleep apnea should further the demand for their products.

Might be a good one for longer term buy and hold like SMSF.

ResMed Inc. is a holding company. The Company is engaged in the development, manufacturing, distribution and marketing of medical devices and cloud-based software applications that diagnose, treat and manage respiratory disorders, including sleep disordered breathing (SDB), chronic obstructive pulmonary disease (COPD), neuromuscular disease and other diseases. SDB includes obstructive sleep apnea (OSA) and other respiratory disorders that occur during sleep. Its cloud-based software digital health applications, along with its devices, are designed to provide connected care to improve patient outcomes. The Company's portfolio of products includes devices, diagnostic products, mask systems, headgear and other accessories, dental devices, portable oxygen concentrators (POCs) and cloud-based software informatics solutions. The Company produces Continuous Positive Airway Pressure (CPAP), Variable Positive Airway Pressure (VPAP) and AutoSet systems for the titration and treatment of SDB.

$Z1P - Starting to run up on the Bunnings announcementDidn't spot this one as the market didn't react when the Bunnings announcement broke, but was reviewed on the YourMoney show and analysts are very bullish predicting mid to high $1.50+ type marks and believe it a better business model than AfterPay and less regulatory scrutiny.

From when I was in Retail we never liked to be first market mover on new tech, so always liked it when companies of a similar size did a deal and presumably all the due diligence. Always made the secondary sale a much easier decision to sign off on. Hopefully will open more doors for Z1P and drive more business and revenues.

I got in at .95. Lets see where it goes.

Zip Co Limited, formerly zipMoney Limited, offers point-of-sale credit and digital payment services to consumers and merchants. The Company provides a range of integrated Retail Finance solutions to small, medium and enterprise businesses across various industries, both online and in-store. The Company offers its services primarily to the retail, education, health and travel industries. Its products include zipMoney and zipPay. zipMoney is classified as a continuing line of credit and generally applied to various ticket purchases where a promotional interest-free period is applied, between 6 to 24 months. zipPay is a no interest ever digital shopping account and generally applied to various ticket purchases, such as fashion, accessories, food and hospitality. It supports prime, near prime and emerging prime borrowers by providing those customers with a revolving unsecured line of credit to finance their transactions.

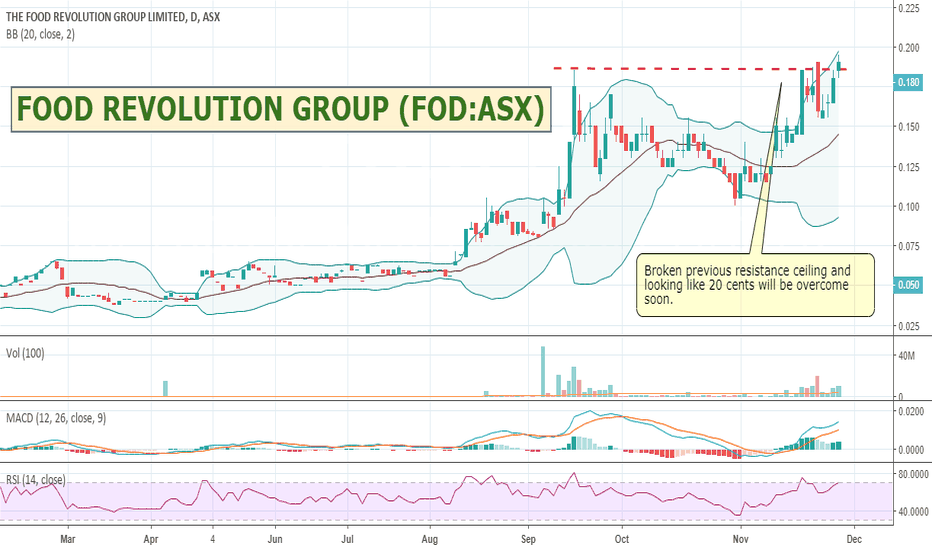

$FOD - FOOD REVOLUTION GROUP - Running on China deliveryLooking for it to punch through 20 cents and use it for support on the news.

FOD executes first juice supply contract to China

Highlights:

- FOD secures contract with JJ Global Fine Foods to supply its CIQ-approved Fruit Farm orange juice products through mainland China

- Given the high demand for Australian juice products in China, FOD will also supply its Fruit Farm apple juice as requested by JJ Global – CIQ for this product has been lodged and is expected within 10 days

- JJ Global works with the high-end hotel chains in China including the Marriott Group (300 hotels in China), Accor (160+ hotels in China), Peninsula, Mandarin Oriental, Hyatt,Shangri La and all major supermarkets, China Resources Vanguard, RT-Mart, ChinaWalmart, Lianhua and Carrefour

- Additionally, JJ Global’s parent company Conga recently acquired Metcash China

- With FOD products in these high-end retail outlets in China, the brand presence andstatus of FOD’s all-natural Australian Fruit Farm brand will be elevated throughout thecountry

- FOD is the only Australian company that has developed a propriety cold fill technology toincrease the shelf life of ambient fresh juice to nine months

- FOD is expected to ship the first orders once apple juice receives CIQ approval andexpects sales to grow strongly following this

- The deal builds on FOD’s distribution agreement with Sinopec for Australian canola oil.The Company expects to announce further deals as it rapidly expands its distributionfootprint in China

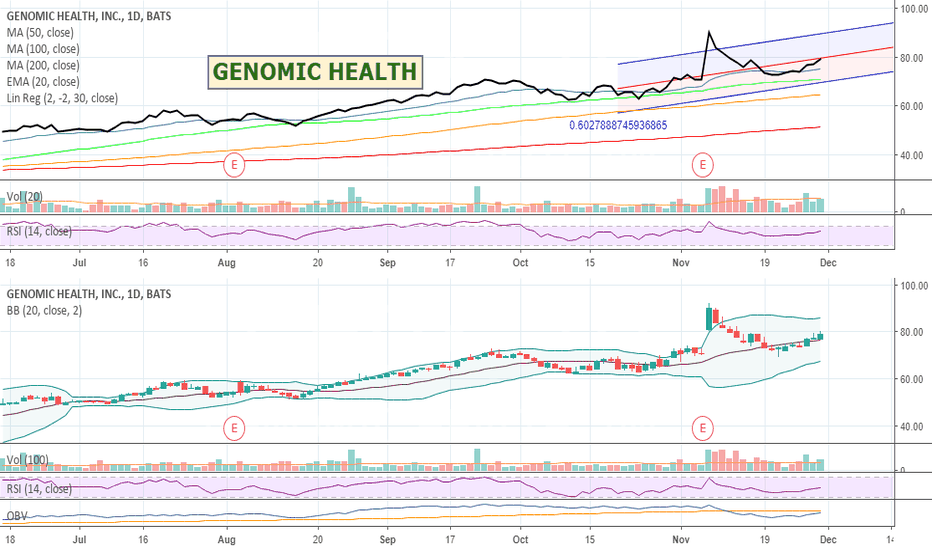

$GHDX - Genomic Health - The future of cancer treatmentsGood looking company in a (sadly) growth industry. Might have some short term volatility but all indicators looking good for the medium to long term.

Genomic Health, Inc. is a healthcare company that provides genomic-based diagnostic tests to personalize cancer treatment. The Company develops and commercializes genomic-based clinical laboratory services. The Company's Oncotype IQ Genomic Intelligence Platform is consisted of its flagship line of Oncotype DX gene expression tests, as well as its Oncotype SEQ Liquid Select test. Its research and development activities are focused on developing a pipeline of tests to optimize the treatment of various cancers including breast, colon, prostate and other cancers. It offers its Oncotype DX tests as a clinical laboratory service, where it analyzes the expression levels of genes in tumor tissue samples and provides physicians with a quantitative gene expression profile expressed as a single quantitative score, which it calls a Recurrence Score for invasive breast cancer and colon cancer, a DCIS Score for ductal carcinoma in situ (DCIS), and a Genomic Prostate Score, for prostate cancer.

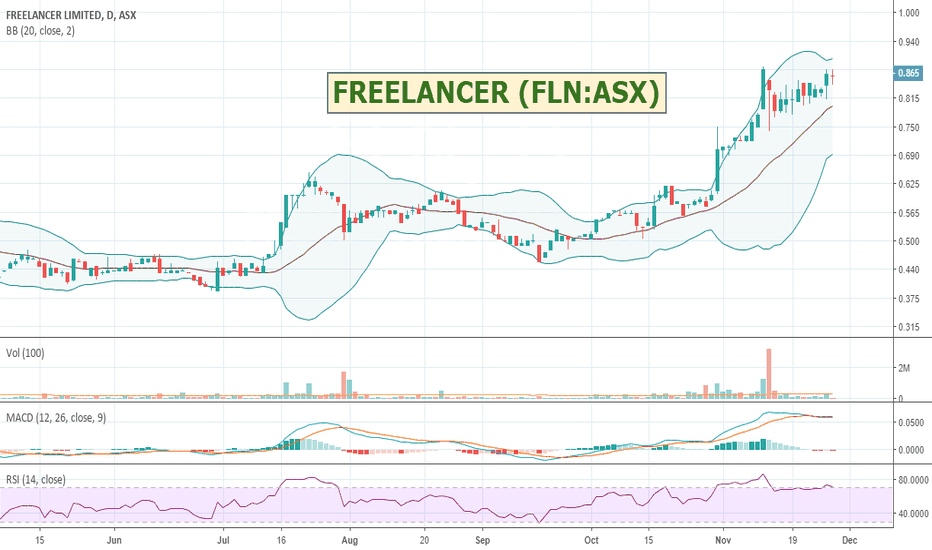

$FLN - Freelancer - Pushing resistance$FLN - Freelancer - Pushing resistance

Worth a watch. Has been having a great run and testing pushing through current resistance level. I like that they are starting to use their platform to push into and disrupt new areas such as freight. Gig economy only likely to get stronger over time as people look for ways to supplement existing incomes or work from home as cash pressure piles on.

Freelancer Limited is an Australia-based company, which is principally engaged in the provision of an online outsourcing marketplace and escrow payment services. The Company operates through two segments: online marketplace and online payment services. The Company's online payment services, which includes the business of Escrow.com, is a regulated entity that holds funds on behalf of its users in trust bank accounts. Escrow.com is a provider of secure online payments. Escrow.com offers a platform, which allows users to upload document and have their identity verified. Through its marketplace, employers can hire freelancers to do work in areas, such as software development, writing, data entry and design right through to engineering, the sciences, sales and marketing, accounting and legal services. The Company also operates Freightlancer.com, a global marketplace for freight, shipping and transportation spanning from enterprise haulage to consumer metro deliveries.

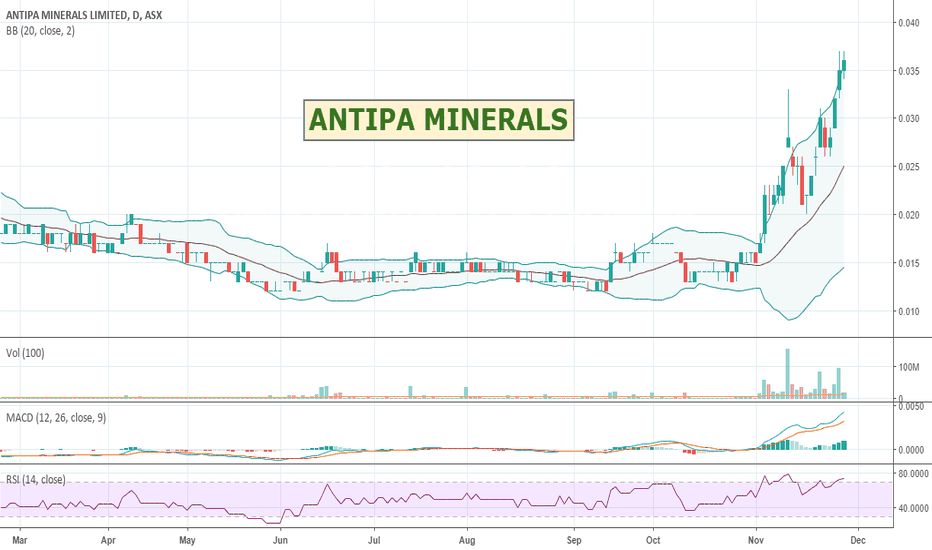

$AZY - Antipa Minerals - Running hard with depth$AZY - Antipa Minerals - Running hard with depth

Continuing to run hard with some big market depth and support on the buyers side.

Antipa Minerals Limited is engaged in mineral exploration. The Company's projects, including Citadel, North Telfer, Paterson and Telfer Dome, cover a combined area of approximately 4,420 square kilometers extending approximately 160 kilometers north to south, and located in the regions of the Proterozoic Paterson Province of Western Australia. Its Citadel Project consists of approximately seven exploration licenses and an area of over 1,430 square kilometers that includes Magnum gold-copper-silver-tungsten deposit; Calibre gold-copper-silver-tungsten deposit, and Corker poly metallic deposit. Its North Telfer Project consists of approximately four granted exploration licenses and an area of over 1,340 square kilometers that includes Minyari and gold-copper deposits. Its Paterson Project consists of approximately seven granted exploration licenses and covers an area of over 1,530 square kilometers. Its Telfer Dome tenements cover an area of over 130 square kilometers.

$SEK - SEEK - Recovering after recent sell off.Very dominant profitable brand looking like it is recovering after a significant sell off.

SEEK Limited is engaged in online matching of hirers and candidates with career opportunities and related services; investing in early-stage businesses and technologies, which are in or adjacent to the online employment marketplace, and distribution and provision of vocational training and higher education courses. The Company's segments include ANZ Employment, Zhaopin, SEEK Asia, Brasil Online, OCC, Education and Early Stage Ventures. Its ANZ Employment, Zhaopin, SEEK Asia, Brasil Online and OCC segments provide online employment marketplace services. Its Education segment is engaged in marketing, sale and distribution of education courses. Its Early Stage Ventures segment consists of a portfolio of Australian and international investments that either sit adjacent to the online employment and education marketplaces or provide its products or services in new geographical regions. Its operations include in Australia, New Zealand, China, South East Asia, Brazil and Mexico.

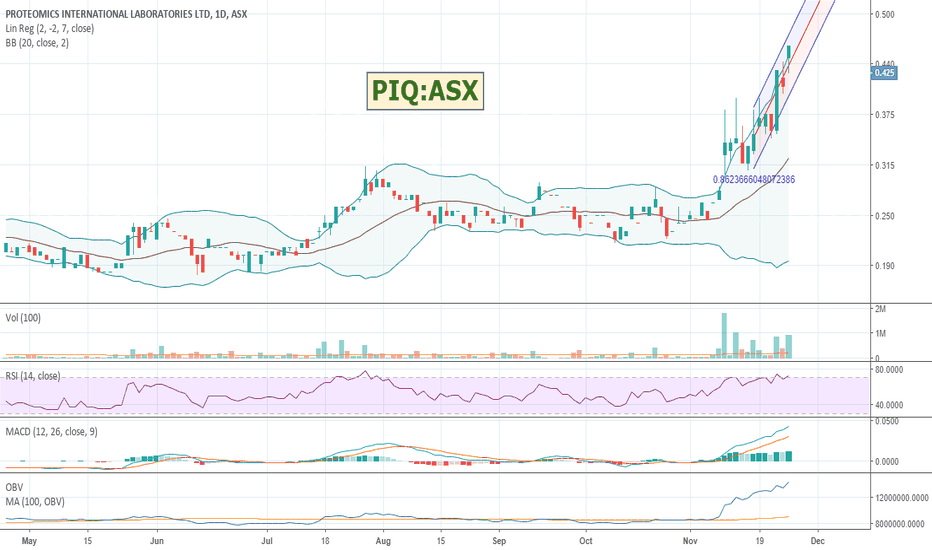

$PIQ - Proteomics International continuing its rapid climb$PIQ - Proteomics International continuing its rapid climb

Good little stock with lots of momentum. All my indicators are headed in the right direction - probably a bit expensive at the moment based on the RSI - but with diabetes being the next big global disease especially in the western world Ill take a punt and hold for the medium to long term unless a sudden significant reversal.

Todays announement was: "Proteomics signs collaboration agreement with US big pharma to accelerate diabetic kidney disease & heart disease drug discovery using PromarkerD"

Proteomics International Laboratories Limited is a biological research and drug discovery company. The Company operates in three business units unified by a technology platform: Analytical services, which includes specialist contract research, analytical testing and consultancy; Diagnostics, which includes biomarkers of disease and personalized medicine, and Therapeutics, which includes peptide drug discovery from venoms. The Company focuses on the PromarkerD, a proteomics-derived predictive and diagnostic test for diabetic kidney disease. The Company focuses on its diagnostics portfolio using the Promarker platform, and is investigating proteins associated with endometriosis, mesothelioma and other conditions. The Company has a therapeutic drug discovery program targeting new analgesic (painkilling) and antibiotic drug compounds. The Company also has a laboratory to analyze the make-up of biosimilar drugs as being like-for-like with the brand name drugs they seek to replace.

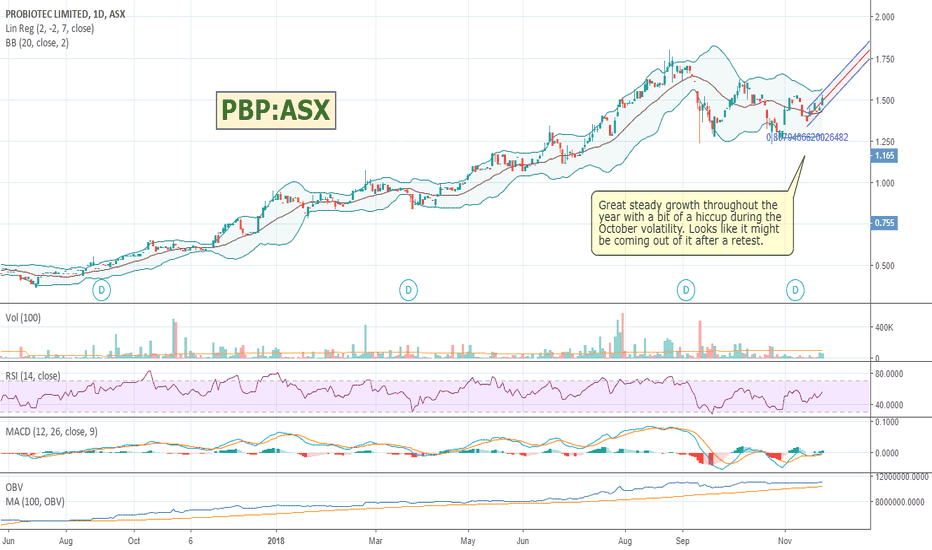

$PBP - Probiotec Limited starting a new run?Great steady growth throughout the year with a bit of a hiccup during the October volatility. Looks like it might be coming out of it after a retest of the lows.

Has better financials than most of the speculative stocks in the sector.

Probiotec Limited is engaged in the development, manufacture and sale of pharmaceuticals, consumer health and nutraceutical products in Australian and international markets. The Company's segments include Branded Pharmaceuticals, involving the sale of branded pharmaceutical products throughout Australia and also to selected South East Asian countries; Contract manufacture, involving the contract manufacturing of pharmaceutical, food and animal nutrition products on behalf of domestic and international pharmaceutical and food companies; Obesity and weight management, involving the manufacture and sale of a range of products across a number of channels, including fast moving consumer goods, pharmacy, health food stores and online; Europe, involving the manufacture and sale of products within Europe, and Specialty products, involving the sale of human and animal nutrition products, incorporating the sale of ingredients and additives for use in the pharmaceutical and food industries.

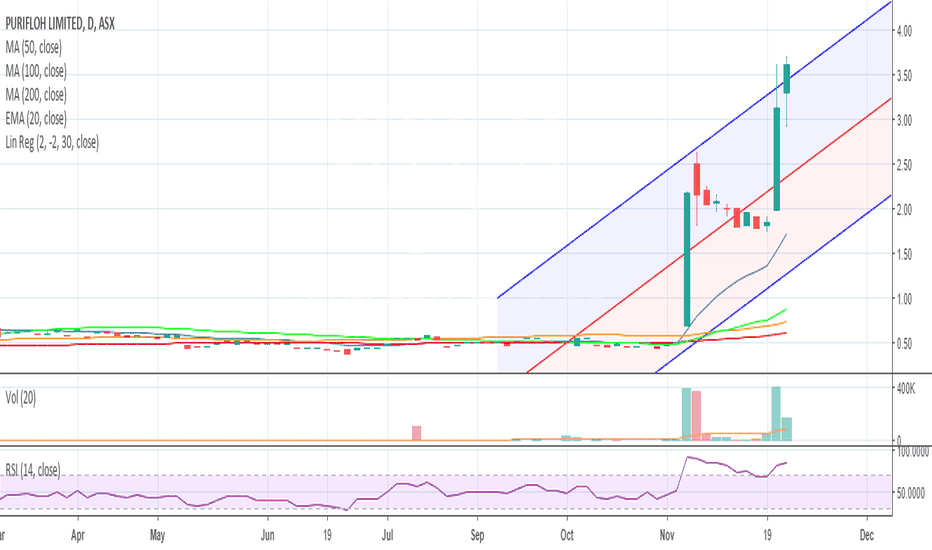

#ASX $PO3 PURIFLOH LIMITEDI dont hold, but I do like anything to do with water purification and this one seems to be getting some attention.

On the watch list. Maybe a small parcel to buy and see if it keeps running.

Purifloh Limited, formerly Water Resources Group Limited, is an Australia-based company focused on water treatment solutions within Australia, specifically using ozone within a water treatment facility. The Company is principally engaged in the ongoing analysis of the technical and economic viability of the AiR2O3 technology specific to its uses in water; seeking out and consideration alternative opportunities in the water sector, and consideration of alternative, non-water related opportunities utilizing the AiR2O3 generator. The Company is conducting research into various water treatment technologies and services, including ground water treatment, desalination and ozone production technology. The Company is also focused on the other uses of ozone within Australia.

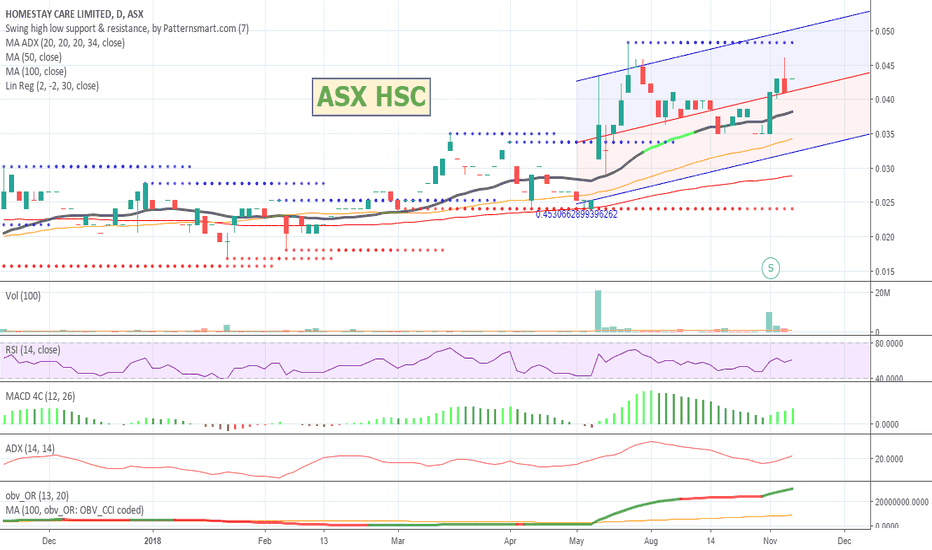

$HSC #ASX - HOMESTAY CARE LIMITEDQuadripple whammy of Health, Tech, Aged, and Home Based Care.

Someone like a Google, AMAZON, or Apple need to buy a company like this and integrate it into their various home control infrastructures. Massive pressure to keep elderly at home as long as possible and out of the hospital type systems.

I like it - early days - needs a few deals and announcements to boom. Bought in at .043 (at market) and will hold for a while. US companies in the home aged care type space are in the billions of market cap. I expect this will be a buy out opportunity by one of them if they can get enough attention.

Worth googling the company name and checking out their website to see what they do. The URL on Trading View is the old mining shell one.

Homestay Care Ltd, formerly Antilles Oil and Gas Ltd, is an Australia-based company that provides technology enabled care to the aged care industry. The Company, through its Internet of things (IoT) platform, assists seniors and the elderly to live independently in their homes. Its HomeStay IoT Platform is operated through an application available on both tablet and mobile on Android and iOS. Its application incorporates three offerings: Aged Care on Demand Services (HomeStay ODS), HealthCare Data Management and HomeStay Intelligent Home (Intelligent Home). HomeStay ODS is a market place for aged care services utilizing the HomeStay booking system through the HomeStay App. HealthCare Data Management permits users to monitor health information. Intelligent Home integrates various in-home artificial intelligence (AI) sensors, including activity monitoring, bed sensor, door/window sensors, hot water sensor, incontinence devices and wearable smart watches as a single modular package.

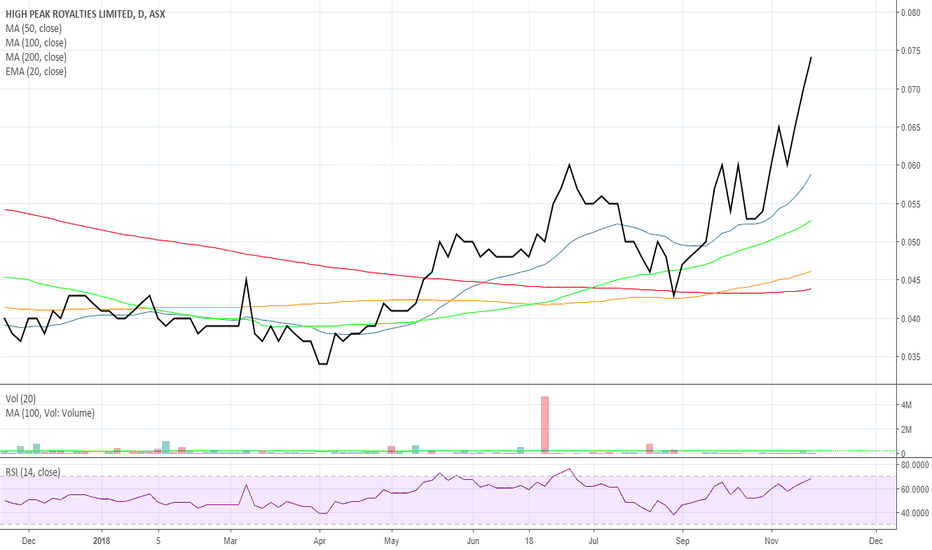

#ASX $HPR - High Peak RoyaltiesAlso been on a nice run for me despite market conditions. I like the business concept as well as the chart.

High Peak Royalties Limited is engaged in acquisition of royalty and exploration interests in oil and gas assets predominately in Australia and the United States. The Company has royalties on approximately 23 oil and gas projects, including two royalty areas that are in production, located in Australia and the United States. Its portfolio of royalty interests includes PL 171 and ATP 574P; ATP 299P, including the petroleum leases PL29, PL38, PL39, PL52, PL57, PL95, PL169, PL170, PL293, PL294, PL295 and PL298; Pet Gas Field (PL101); Surprise Oil Field (PL6); Longtom Gas Field (VIC/L29 and VIC/P54); WA-314P; WA-315P; EP115NM; PEL512; WA-482-P; EP156, and East Texas, Permian and Texas Gulf Coast Basins in the United States. Its royalty portfolio has access to projects in main oil and gas basins in Australia. Its portfolio spans producing royalties, potential development royalties and exploration royalties.

$JAT #ASX running hard on newsJATs running hard today on a trade deal announcement. Buyers overwhelming sellers. Might run for a bit longer.

Jatenergy Limited (Jat) is an Australia-based company engaged in undertaking trading activities with China, including the development of a JAT product range specifically for China, and marketing technology with TTG Mineral Processing and Coalplus conversion. The Company's product range includes milk powder, wine, cosmetics, skin/face creams, nutraceuticals, cereals, oats, biscuits, cleaning products and organic oils.

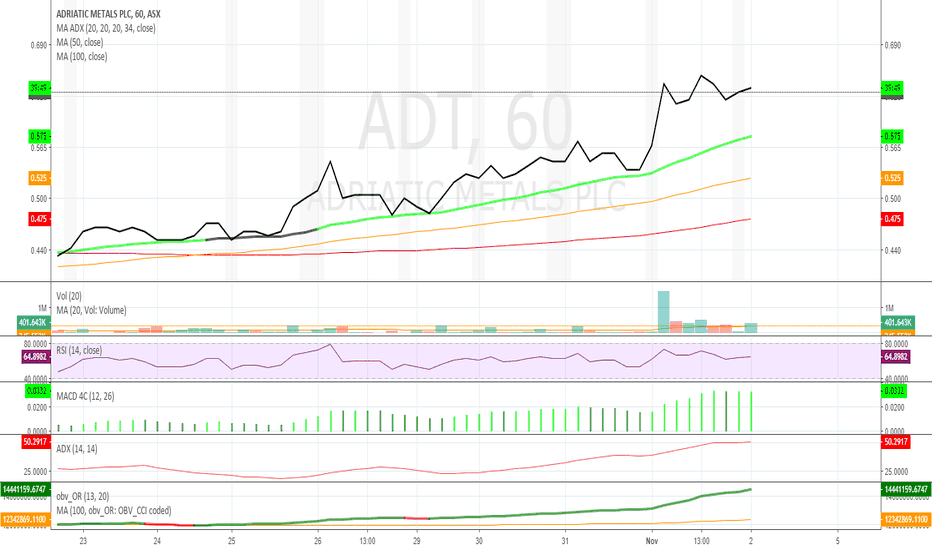

$ASX #ADT - Adriatic Metals - Gaining momentumAdriatic Metals PLC is a United Kingdom-based mineral exploration company. The Company operates through two Veovaca Project and Rupice Project. Veovaca Project has completed a 16 hole, 1,381 meters diamond drilling program. Rupice Project has completed an eight hole, 1,458 meters diamond drilling program. The Company's exploration concession covers two main advanced polymetallic projects located near the town of Vares, which is approximately 50 km north by sealed road from Sarajevo, the capital city of Bosnia and Herzegovina.

Picked up some ADT. Nicely trending chart with some momentum.