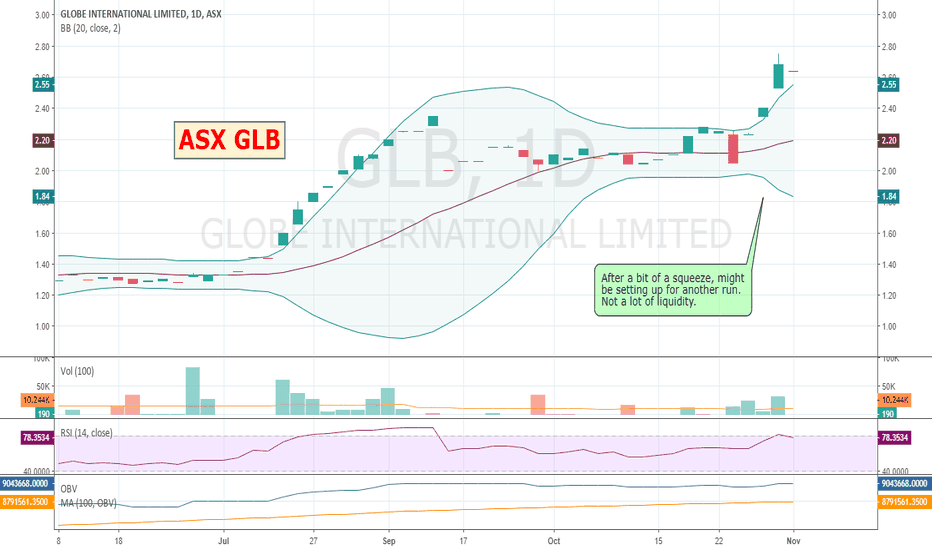

$GLB #ASX - Globe International about to run?Globe International Limited is engaged in the specialized production and distribution of purpose-built apparel, footwear and hardgoods for the board sports, street fashion and workwear markets globally. The Company's segments include Australasia, North America and Europe. The Company's divisions include Globe, Dwindle Distribution, Hardcore Distribution, 4Front and FXD. The Company's brands include Globe, Dwindle Distribution, Enjoi, Blind, Almost, Cliche, Darkstar, Tensor, Dusters, FXD and Sample. The Company also maintains diverse licensing and distribution of various third-party brands for the Australian and New Zealand markets through its Hardcore Distribution and 4Front divisions. The Company offers various products of third-party brands, such as Stussy, OBEY, KOMONO, Misfit Shapes, X-Large, Zero, Andale Bearings and Kryptonics Wheels. The Hardcore Distribution division is a distributor of over 30 skateboard brands, including Girl, Flip, Chocolate and Thrasher.

Not a heavily traded stock, but good consistent gains over the year supported by good financials. Might be worth a watch.

Search in ideas for "zAngus"

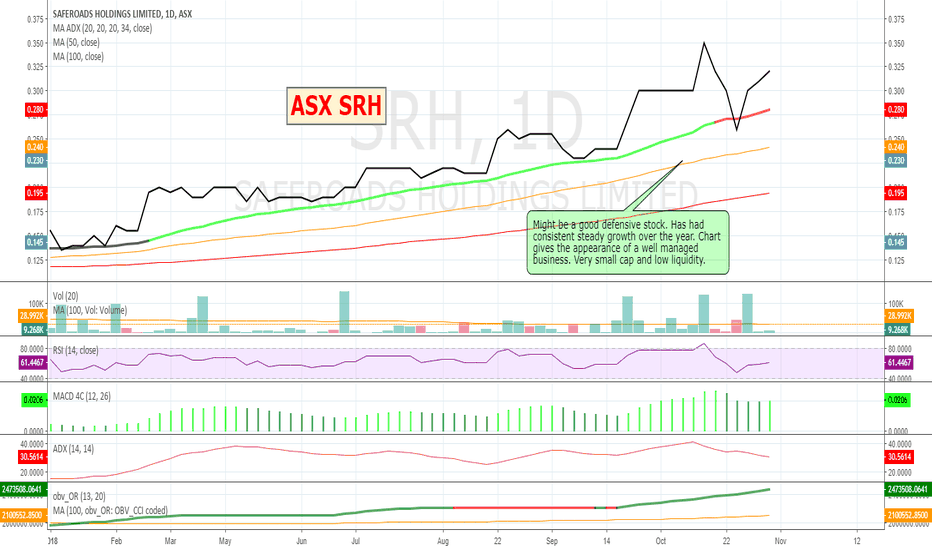

$SRH #ASX - Saferoads Holdings - Might be a good defensive stockJust been having a look around for potentially defensive stocks showing steady growth throughout the year. Very low cap stock, but has some good revenue coming through and in a space where effects of any economic downturns might be lessened. Not much liquidity though so entry and exit might take a bit longer to secure the price you want.

Saferoads Holdings Limited is engaged in the provision of road safety products and solutions primarily to end users. The Company provides products and services, including flexible guide posts and signage; rubber-based traffic calming products, including separation kerbing and wheel stops; variable messaging sign boards; decorative and standard street and major road light poles, and permanent and temporary crash cushions, including bollards and safety barriers. The Company provides safety products to the road users, such as motorists, road construction workers and pedestrians. The Company provides state government departments, local councils, road construction companies and equipment hire companies with a range of products and services designed to direct, protect, inform and illuminate for the public's safety. The Company offers solar lighting solution. It provides light duration of 23-30 hours without charge. It also offers Ironman Hybrid product.

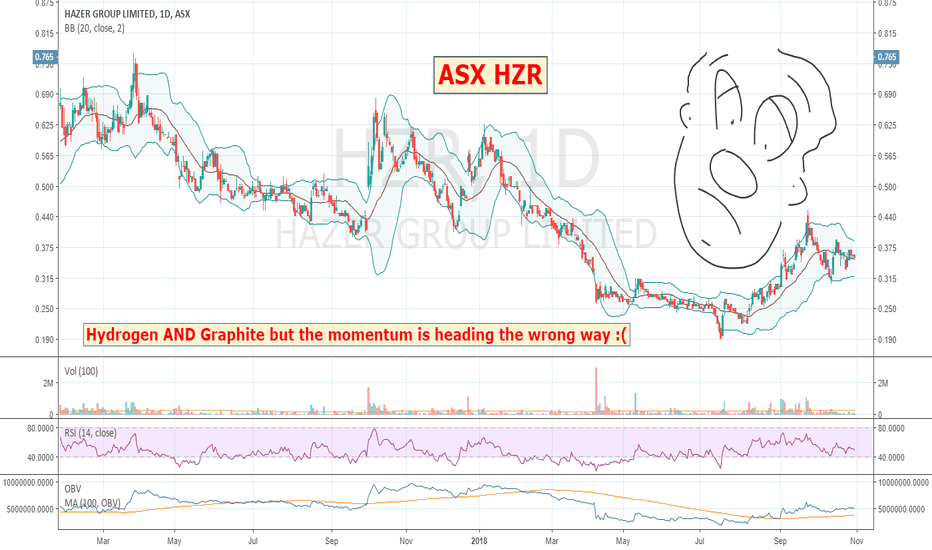

$HZR #ASX - Hazer Group potentially a favourite.Hazer Group Limited is a specialist commercialization company. The Company is engaged in research and development of graphite and hydrogen production technology. The Company utilizes the Hazer Process on unprocessed iron ore as a low cost catalyst to crack natural gas to produce hydrogen and graphite. The Hazer Process enables the conversion of natural gas, and similar feedstocks, into hydrogen and graphite. The graphite produced by the Hazer Process is (greater than 90% weight (wt)) crystalline synthetic graphite. The Hazer Process can be tailored to create a range of graphite morphologies, enabling the Company to target multiple specialized markets and end user applications. The Hazer Process is developed at the University of Western Australia (UWA).

I keep reading about more and more companies looking into Hydrogen as an alternate fuel source - especially for the longer distances here in Australia. Hazer has both hydrogen and graphite as their outputs of quite a clever process, and one of the very few traded Hydrogen stocks. Bit too early to buy and hold, but one to watch.

More of an emotive buy than a TA or FA one.

Someone talk me into or out of it :D

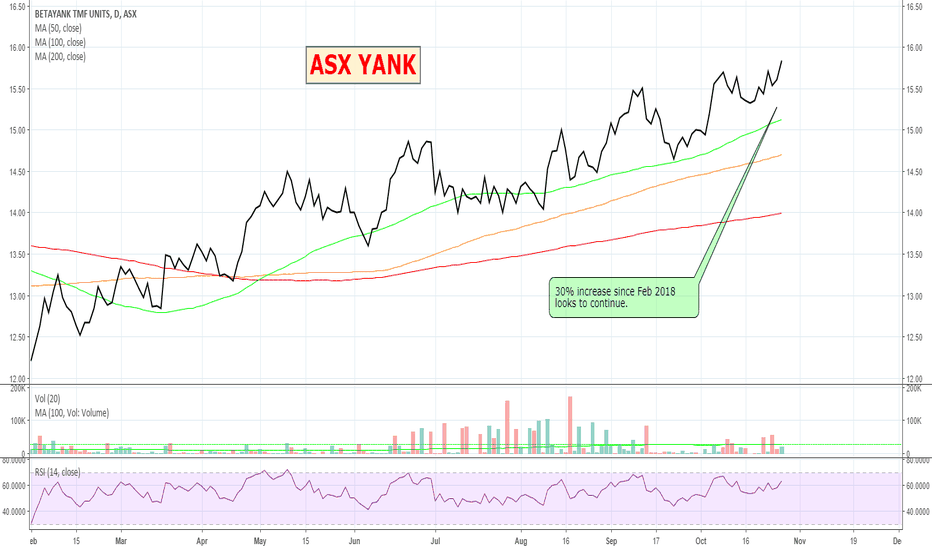

$YANK #ASX - Shorting the Aussie DollarWith the sharemarket in a pretty unpredictable state I have been looking around for some different options. Thought this could be interesting as I keep reading a lot of pundits suggesting that the Aussie dollar might be on its way to 60 cents. YANK is up 30% since Feb and that was during a pretty bullish period, so might be worth a look as an alternative to traditional shares. There is a non leveraged ETF called USD which does similar.

(Additionally BBUS, BBOZ, BEAR are also ASX traded ETF's that can help you more easily short the ASX and US if you think they are headed downwards. See my older post if interested in these.)

BetaShares Strong U.S. Dollar Fund (hedge fund)

OBJECTIVE

Provide investors with a simple way to obtain cost-effective geared exposure to the change in value of the U.S. Dollar relative to the Australian Dollar.

ABOUT

Gives investors a simple and accessible way to obtain magnified “long” exposure to the value of U.S. Dollar relative to the Australian Dollar

A 1% increase in the value of the U.S. Dollar relative to the Australian Dollar on a given day can generally be expected to deliver a 2.0% to 2.75% increase in the value of the Fund (and vice versa)

Profit from a view that the U.S. Dollar will strengthen relative to the Australian Dollar via an efficient use of capital

Hedge against USD currency risk – reduce exposure to movements in AUD/USD exchange rates

Diversify a portfolio – currencies have historically shown low correlation to equities, fixed income and most other asset classes

Alternative to CFDs or FX platforms

Gearing magnifies gains and losses and may not be a suitable strategy for all investors. Returns over longer periods will not necessarily be equivalent to 200% – 275% of the return of the U.S. Dollar relative to the Australian Dollar over that period.

Advantages

Access – obtain magnified exposure to the performance of the U.S. Dollar relative to the Australian Dollar as simply as buying any share

Convenience – investors avoid complications and costs of CFDs or other investments providing ‘geared’ currency exposure

No margin calls for investors – cannot lose more than initial investment

Liquidity – available to trade on ASX like any share

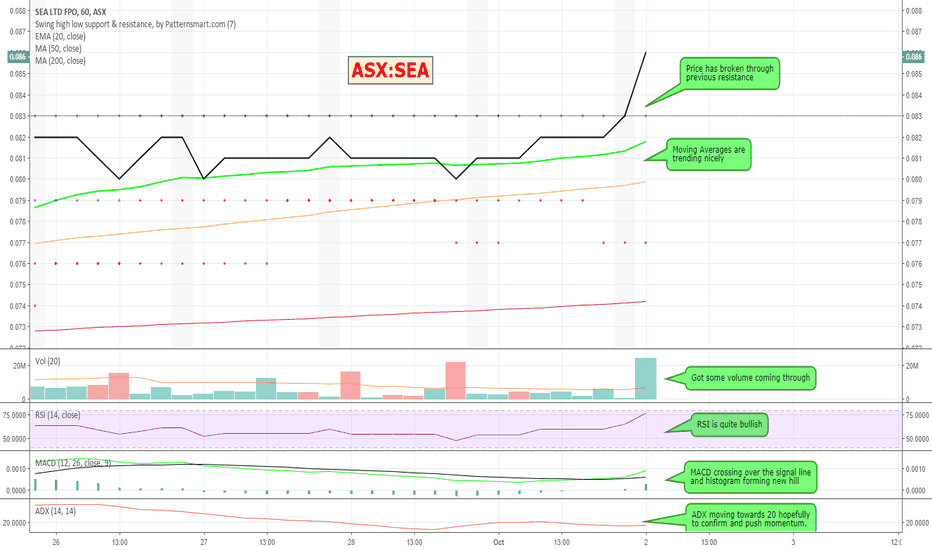

$CAG ASX - Cape Range going for a run?I haven't bought but thought it might be one to watch for a bit.

Had to go to their website to see what they do. Seems CAG bought out Biztrak which builds SAAS accounting and BI tools for SME's. Not a bad space to be in if the economy turns. Businesses cant as easily decide to cut back on their accounting software as easily as reducing headcount and other discretionary type costs such as travel etc.

From their website: Biztrak has performed with audited EBITDA of over $500K p/a for a number of consecutive years and Cape Range now holds 100% of the Company meaning its revenues and the existing customer base of 37,000 users from 18,000 SME’s in 18 countries.

BIZTRAK was founded in Malaysia in 1995 and is now an established and profitable software development company specialising in accounting and business intelligence software. Their software is used by over 18,000 SME’s in all types of industries, in 18 countires.

Biztrak developed their e-Bridge software solution to seamlessly integrate data from other systems and companies, in multiple countries and currencies, so they could integrate and centralise key business information in real time. e-Bridge complies with both Goods & Services Tax (GST) and Value-added Tax (VAT) regulations and the International Financial Reporting Standards (IFRS). Using electronic data exchange to centralise all this information, provides management with an extremely valuable tool that greatly improves business intelligence to support their decision making.

Biztrak currently have over 37,000 users from SME’s across all industries including retail, trading, logistics, healthcare, e-commerce, manufacturing, financial sectors, and higher education.

Biztrak customers are mainly in Asia, with the majority of current customers located in Malaysia, Brunei and Singapore. Biztrak sees the Australian and New Zealand markets as the logical next stage for the growth of its business with the launch of its SaaS offering.

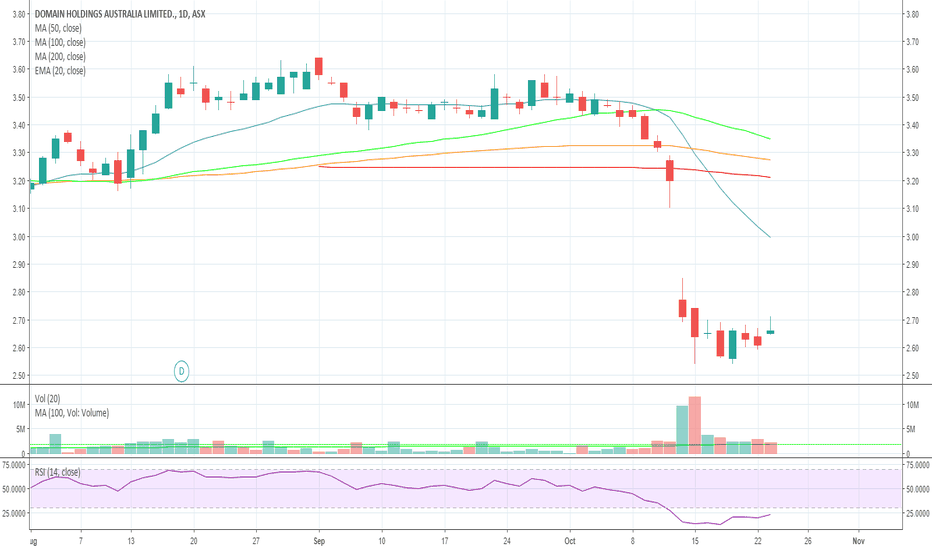

$DHG #ASX - DOMAIN HOLDINGS AUSTRALIA LIMITEDBig gap down, sell off on Domain. Hard to think there probably isnt some value here.

Domain Holdings Australia Limited is an Australia-based company. The Company is focused on offering an ecosystem of multi-platform property solutions. The Company delivers property marketing solutions for residential, new development and commercial properties, plus the latest market intel. The Company’s portfolios include Domain, Commercial Real Estate, Allhomes, The Weekly Review, MyDesktop, Pricefinder, and Homepass. The Company's agent center offers a range of solutions including agent news, domain complete solutions, domain digital solutions, and domain magazine solutions. Its Weekly Review is a free premium lifestyle and property magazine and can be accessed in print, online and social.

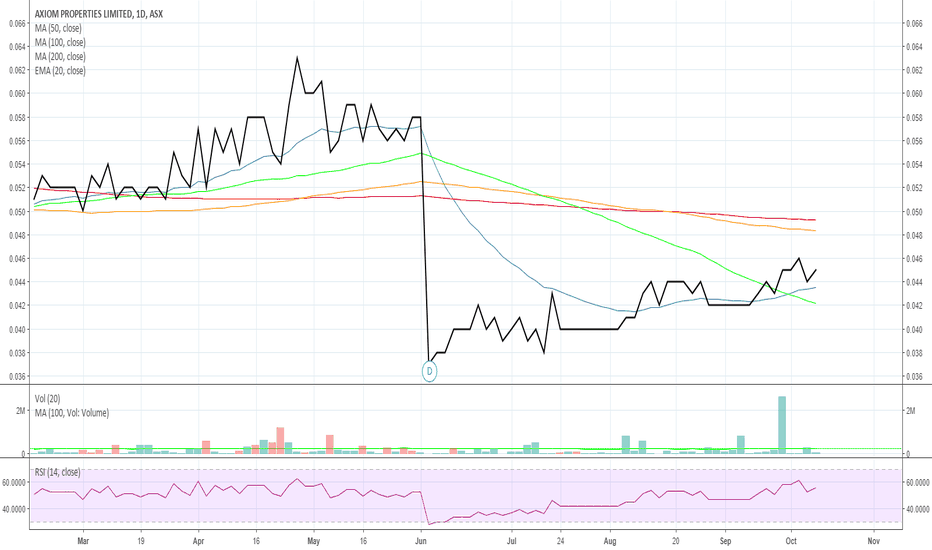

$AXI #ASX - Axiom Properties LimitedAxiom Properties Limited is engaged in property development and investment business. The Company is focused on developing and delivering property solutions. The Company's segments include investment property, development and corporate. The Churchill Centre project consists of over two separate tracts of land of approximately three hectares (South) and approximately 20 hectares (North) for a total of over 20 hectares, strategically located on Churchill Road, Kilburn in the inner northwest suburbs of Adelaide. The Churchill Centre North component of this project comprises Costco store, as well as a sub-regional shopping center, consisting of over 5,500 square meters Coles supermarket, an over 5,400 square meters Kmart discount department store, several other mini-major retailers and approximately 55 specialty shops. Its owns interest in Churchill Centre South, which comprises over 2,000 square meters of mixed use retail, as well as approximately 2,000 square meters pad site.

Might be worth watching if you like property developers.

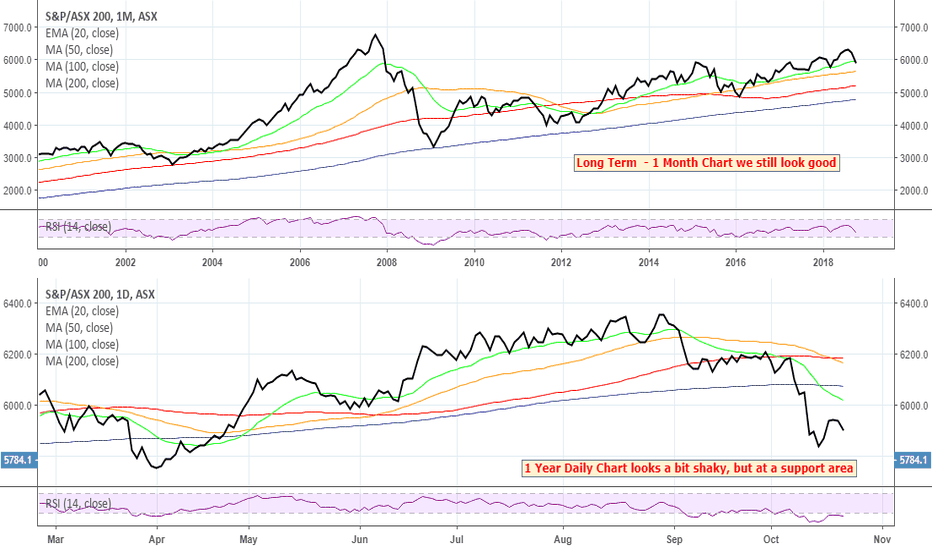

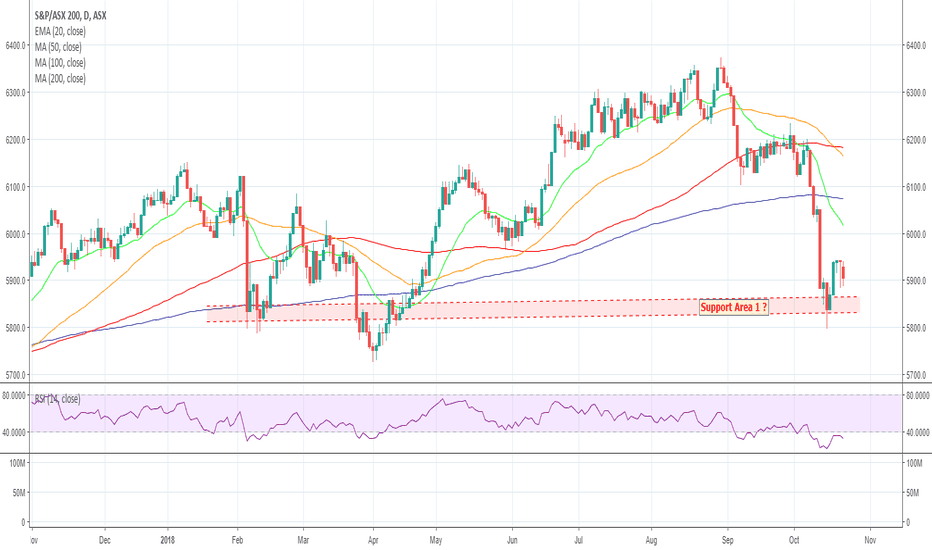

ASX / XJO Time Period ComparisonBit of nervousness around the market, but if you look at the longer term trend, if this was a stock and you were looking at a 1D type chart you would probably think now is a good time to buy as its at a support level representing value. Depends if it bounces off it over the next month, or breaks through it and keeps going down :)

$XJO ASX Looking Shaky.The S&P/ASX200 is an index that represents the 200 top stocks based on their weighted market capital in the Australian stock market "Australian Securities Exchange". The index represents 72% of the total market value of all the stocks traded in the Australian Securities Exchange. The trading hours for the ASX 200 index takes place from 10:00 a.m. to 4:00 p.m. Sydney time. This index was created back in 2000 and it started with a value of 3,133.3. The 2015 market capitalization of the index amounts to A$ 1.1 trillion, which sets it around the same market capitalization with some of the major indexes of Europe. The ASX200 is an indicator that gauges the performance of the Australian stock market and this indicator could be used as a guide by investors that want to understand how the biggest economy in Oceania is performing.

Dead cat bounce off support? Be interesting if it breaks down through that support area.

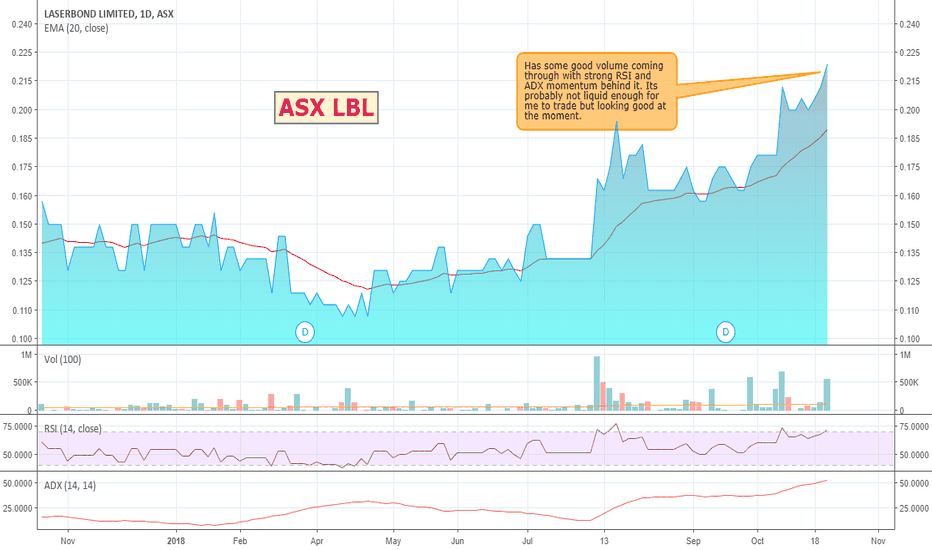

$LBL ASX - LASERBOND LIMITEDLaserbond Limited (LaserBond) specializes in developing technologies and implementing surface engineered solutions to provide service life for equipment used in a range of industries, including mining, drilling, minerals processing, manufacturing, construction, transport and power generation. The Company manufactures, repairs and reclaims wearing parts and assemblies incorporating surface engineering technologies. The Company operates in segments, which include NSW-Services Division and SA Services & Products Divisions. The Company offers drilling tools, which include hammer details and drill bits. The Company offers various services, which include laser cladding, thermal spary, welding, machining, heat treatment, metallurgy lab, surface coating and remanufacturing. LaserBond cladding and thermal spraying technologies, which are developed by the Company form core of its business. Its intellectual property is deployed within repair and remanufacture of customer equipment.

Its appeared on my screener for the last couple of days so I have been keeping an eye on it. Has some good volume coming through with RSI and ADX running the right way. Not sure it is liquid enough for me to trade so I dont have a position in it, but its in an interesting space leveraging a growth industry. Could be a grower.

$AOW ASX - American Patriot Oil and GasAmerican Patriot Oil and Gas (AOW) is an oil and natural gas exploration and development (E&P) group headquartered in Melbourne, Australia, with a U.S. office in Houston, Texas. The Company is focused on developing a significant conventional oil and gas production company focused on assets in the Texas and Gulf Coast region. The company has announced a number of recent acquisitions with a focus on acquiring conventional producing properties with low operating costs onshore USA with reserve reports and significant production upside via shut in wells, workover potential, behind pipe potential and infill drilling upside.

Looks like some nice volume coming through on the buyers side.

Bought in at .03.

Falling Sell Trigger at .027 to .025 sell

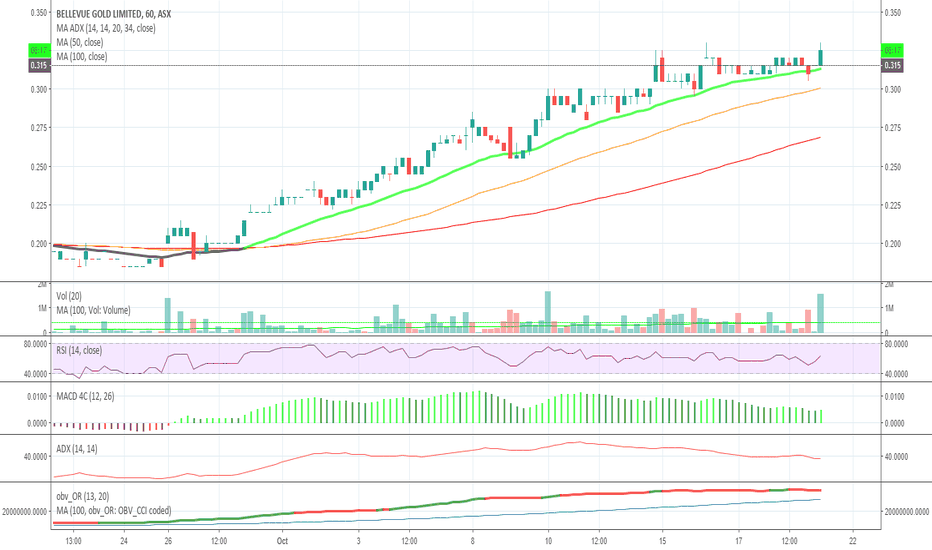

$BGL #ASX - BELLEVUE GOLD LIMITED - LONGBellevue-Gold Limited, formerly Draig Resources Limited, is an Australia-based gold-exploration company. The Company’s principal project is the Bellevue Gold Project, which is located approximately 157 kilometers north west of Laverton in Western Australia. The Bellevue Gold Project covers an area of approximately 27 square kilometres over three granted mining leases and one exploration license. The Company also holds interests in the Tribune Lode high grade discovery and the South Yandal Gold project.

Its been having a nice consistent run lately with some good momentum behind it. Moving averages all lined up with price respecting them nicely and some volume coming through. Other technical indicators looking good overall.

Bought in yesterday at .32

I have a wider Falling Stop Loss at .304

ASX $NTU - Rare Earth Metals.Pretty weak day on the ASX today but NTU was showing some signs of strength.

I like the idea that its one of the few games in town in this space. If US and China trade sanctions kick in further then NTU might become a good alternative for those not wishing to deal with China.

I like that they are now a producer with exports as opposed to simply wandering the desert poking holes in the ground.

From Stockhead:

Earlier this week Northern Minerals announced it had produced the very first export quality rare earth product from the Browns Range project in the East Kimberley region of Western Australia.

The company is the only ASX-listed heavy rare earths producer outside of China.

Rare earths — sometimes known as “magnet metals” — include minerals such as dysprosium, neodymium and praseodymium. They are lesser known compared to battery metals such as lithium and cobalt — but are attracting increased attention because of their use in electric car motors.

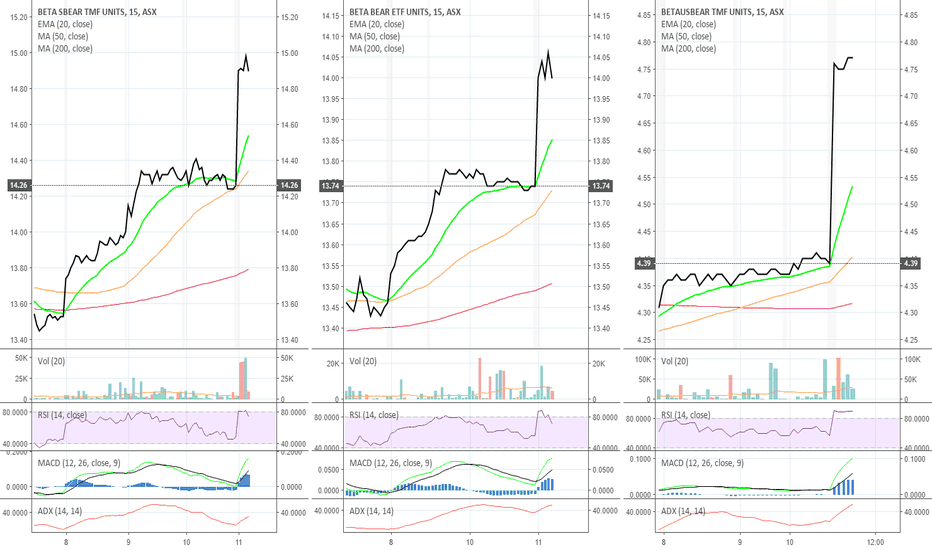

ASX $BBOZ $BBUS $BEAR - ETFs that short the ASX and US StocksI call this my PLAYSCHOOL strategy, because there is a bear in there...

Taking a complete punt on the ASX and US stocks continuing a bit of a downward run for a while so have taken a position on these ETFs that are a way of shorting the ASX and US markets without the complications. These work just like buying and selling normal shares.

From a user post on HotCopper

"BBOZ and BEAR are actually relatively simple strategies but as described above need to be carefully monitored as they do the opposite of what most investments do (i.e. they are specifically designed to go up when the market goes down). In order to achieve their investment strategies they essentially short SPI (ASX 200) futures, in the case of BEAR this is done on close to a 1:1 basis, in the case of BBOZ, this is done on a 2-3:1 basis.

I have used both funds extensively in my trading strategies to both hedge against or profit from market downturns. BBOZ requires far more careful monitoring due the leverage involved than BEAR but both do what they say. The BetaShares website shows you on a daily basis the "exposure" you should be expecting on the day vs. the ASX 200. e.g. at the time I write this BEAR is providing a -1.02x performance and BBOZ is providing a -2.17x exposure.

FYI, there is a similar product to BBOZ available for the US market, its called BBUS"

BEAR - BetaShares Australian Equities Bear Hedge Fund provides investors with a simple way to profit from, or protect against, a declining Australian sharemarket. It seeks to generate returns that are negatively correlated to the returns of the Australian sharemarket (as measured by the S&P/ASX 200 Accumulation index).

BBOZ - BetaShares Australian Equities Strong Bear Hedge Fund provides investors with a simple way to profit from, or protect against, a declining Australian sharemarket. It seeks to generate magnified returns that are negatively correlated to the returns of the Australian sharemarket (as measured by the S&P/ASX 200 Accumulation Index).

BBUS - BetaShares U.S. Equities Strong Bear Hedge Fund - Currency Hedged provides investors with a simple way to profit from, or protect against, a declining U.S sharemarket. It seeks to generate magnified returns that are negatively correlated to the returns of the U.S sharemarket (as measured by the S&P 500 Total Return Index).

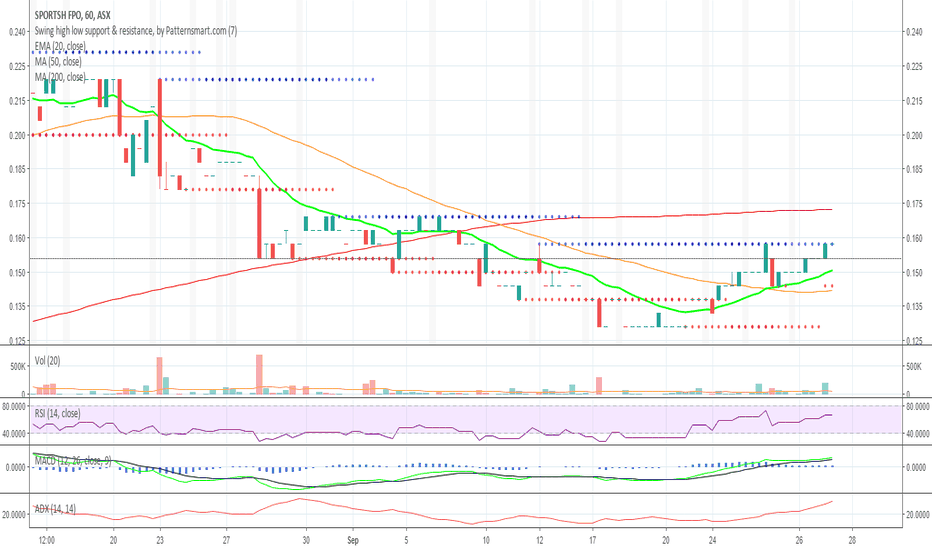

$SHO ASX - SportsHero Limited - MomentumSHO popped up on my scanner so have bought some at 16. See how it goes. Stops are in. DYOR :)

I see support at .145, so falling sell trigger set at .144 to limit .14

Sector: Technology

Industry: Internet Services

SportsHero Limited, formerly Nevada Iron Limited, is an Australia-based social media company. The Company is engaged in developing real-time sports social prediction platform. The Company's SportsHero application is a social network mobile application dedicated to sports prediction. The SportsHero application focuses on working with global brands to drive peer-to-peer commerce and user engagement, by providing a platform to reach sports fans around the world. The SportsHero application is available in over 160 markets across six continents. The SportsHero application allows users to compete with other users, predicting outcomes of games, matches and competitions that spans a range of sports, including football (soccer) and other sports. The SportsHero application also features in-application virtual currency, available through SportsHero Points and Golden Tickets, exchangeable for merchandise, event tickets and other items on the SportsHero.

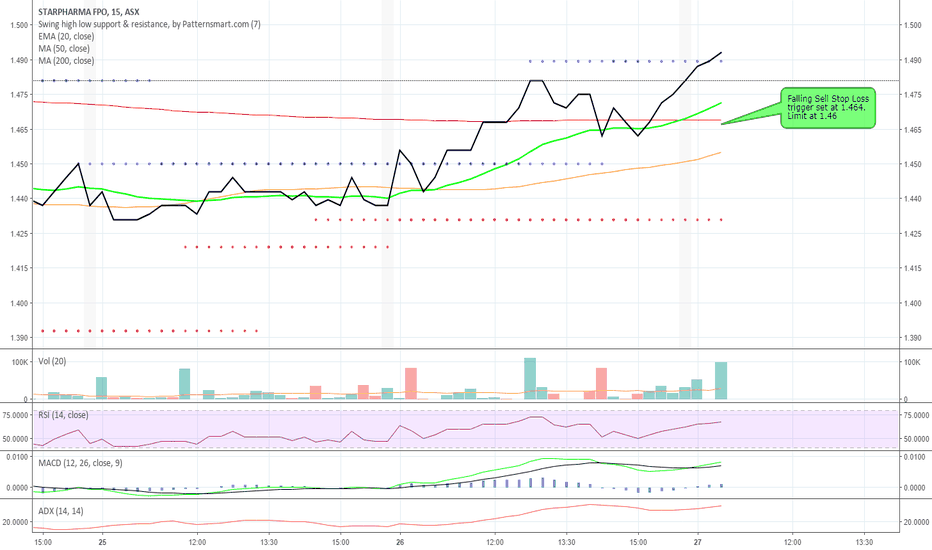

$SPL ASX - Starpharma Holdings might be a small playStarpharma Holdings Limited (SPL) is a biotechnology company that engages in the development of dendrimer products for pharmaceutical, life science and other applications. SPL's underlying technology is built around dendrimers, a type of synthetic nanoscale polymer that is highly regular in size and structure and well suited to pharmaceutical uses. SPL has three core development programs: VivaGel portfolio, drug delivery, and agrochemicals.

Looks like it has a bit of momentum at the moment. Stops in. DYOR.

$ELS ASX - Elsight Limited trending.Might be worth a look.

Elsight limited is engaged in providing ground-breaking hybrid (on-the-move or fixed) video/ data capturing, recording and transmission for various real- tactical security and surveillance purposes/applications. Its products include wearable and portable devices, vehicle mounted and fixed/wall mounted devices, including RiderM-04 mobile digital video recorder (DVR), command and control software, and multichannel-secure multi data link unit. RiderM-04 DVR offers encoding resolution (WD1) on all four channels (for transmission or recording), Wi-Fi automatic off load of recorded files, storage hard-disk shock vibration proof, two-way audio in between the command and control center and the vehicle where it is installed. Multichannel-secure multi data link unit is a technology, providing live video and audio transmission as well as recording capabilities through multiple 3G and 4G networks. Its solutions include first responders, intelligence, media and broadcast, telemedicine and transit.

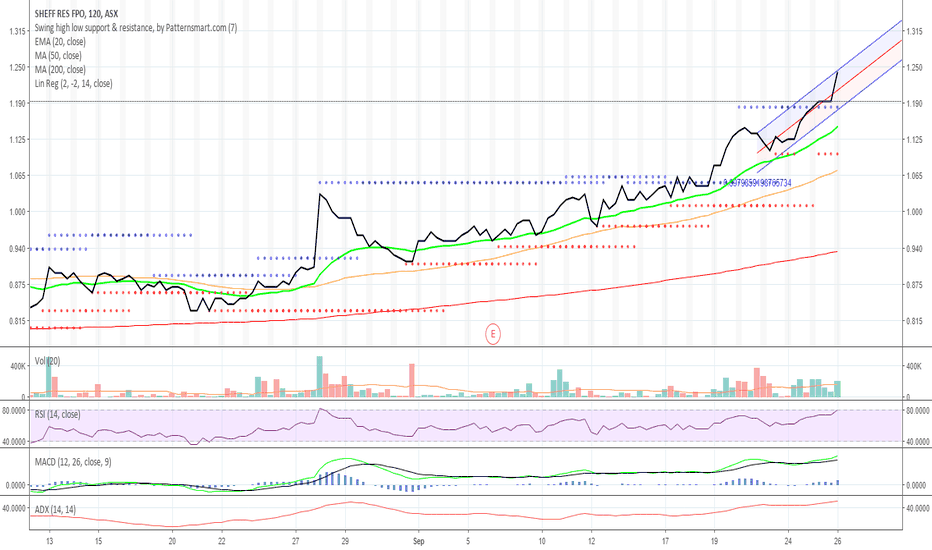

$SFX #ASX - Sheffield Resources going for a run? Bought this one as it broke $1 a couple of weeks ago. Might go for a bit of a run today on news of new mining lease approval. All the indicators I watch look pretty good at the moment. Has broken through resistance. Stops in. DYOR.

Sheffield Resources Limited is an exploration company. The Company is principally engaged in the exploration for mineral sands, including zircon and titanium minerals, and base metals within the state of Western Australia. The Company is focused on its Thunderbird Heavy Mineral Sands (HMS) project, which is located near Derby in Western Australia. The Company is also focused on exploring the Fraser Range project for nickel sulfide deposits and the Eneabba and McCalls projects north of Perth, Western Australia for mineral sands deposits. The Company's project includes Thunderbird Mineral Sands project, Derby East project, Oakover Copper-Manganese project and Eneabba project. The Thunderbird Mineral Sands project located in the Canning Basin in northern Western Australia. The Company's Derby East project consists of five granted tenements E04/2390, E04/2391, E04/2392, E04/2393 and E04/2394 with a total area of approximately 1,831 square kilometers.

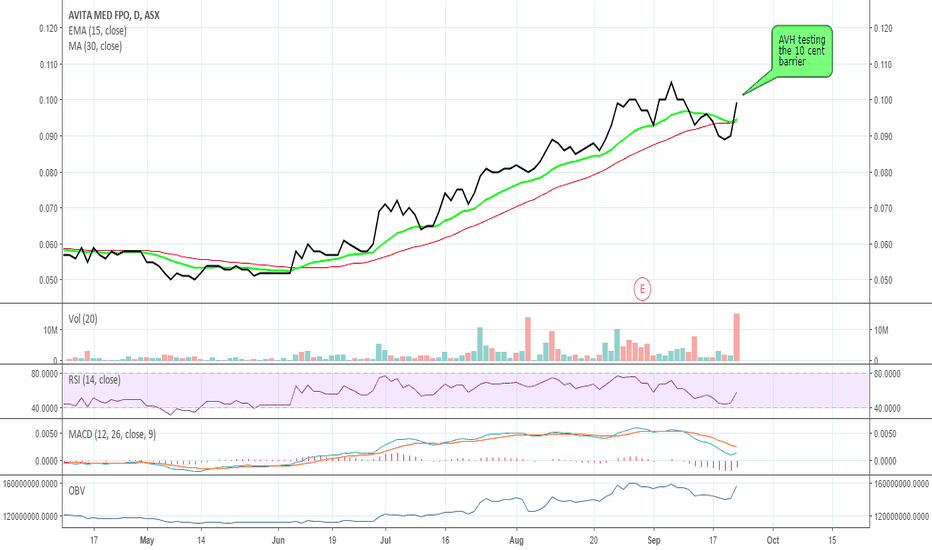

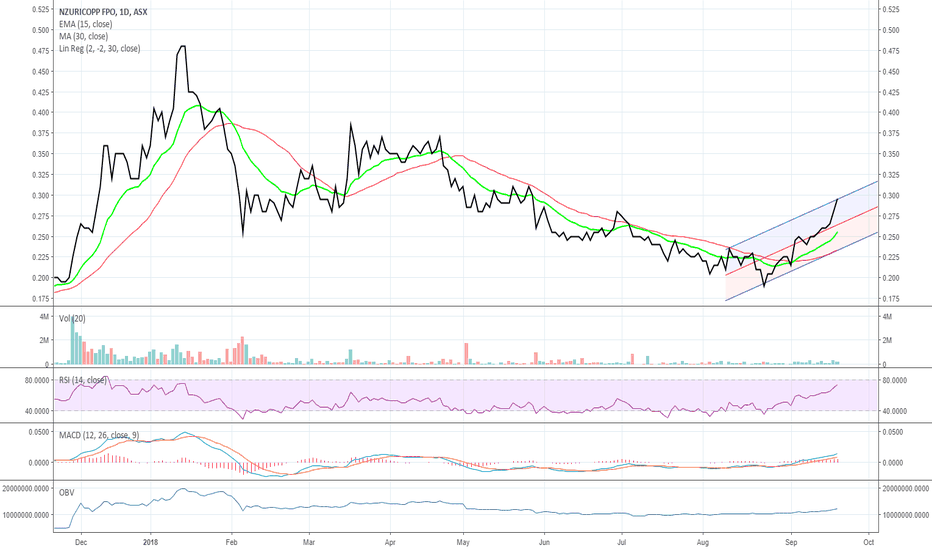

ASX NZCLooks to be making a recovery after a sell off. Has some good upside if it continues its upwards momentum. I bought in today. Stops in place. DYOR :)

Always appreciate hearing different views if you see something I don't.

Nzuri Copper Limited, formerly Regal Resources Limited, is an Australia-based minerals company. The Company is focused on the identification, acquisition, development and operation of high grade copper and cobalt projects in the Katangan Copperbelt of the Democratic Republic of the Congo (DRC). The Company's project is Kalongwe Copper-Cobalt deposit (Kalongwe project), which is located in the Lualaba Province of the DRC and is situated towards the western end of the Central African Copperbelt. Kalongwe hosts a near-surface Joint Ore Reserves Committee (JORC) resource of approximately 302,000 tons contained copper and over 42,000 tons contained cobalt as predominantly oxide ore. The Company manages the Fold and Thrust Belt Joint Venture (FTBJV), which covers an area of the western Lufilian Arc. FTBJV covers an area of approximately 350 square kilometers in a highly prospective part of the western Katangan Copperbelt. It hosts various targets on the prospective Mine Series rocks.