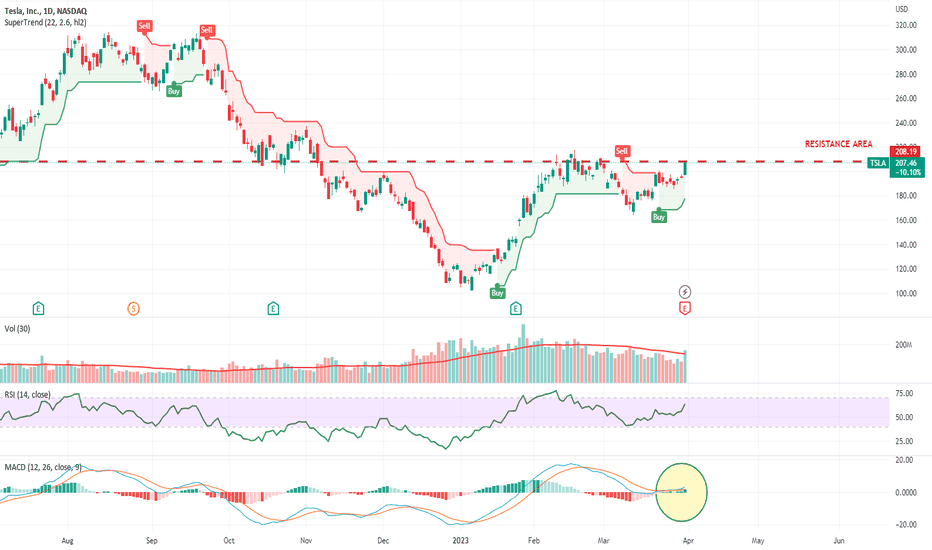

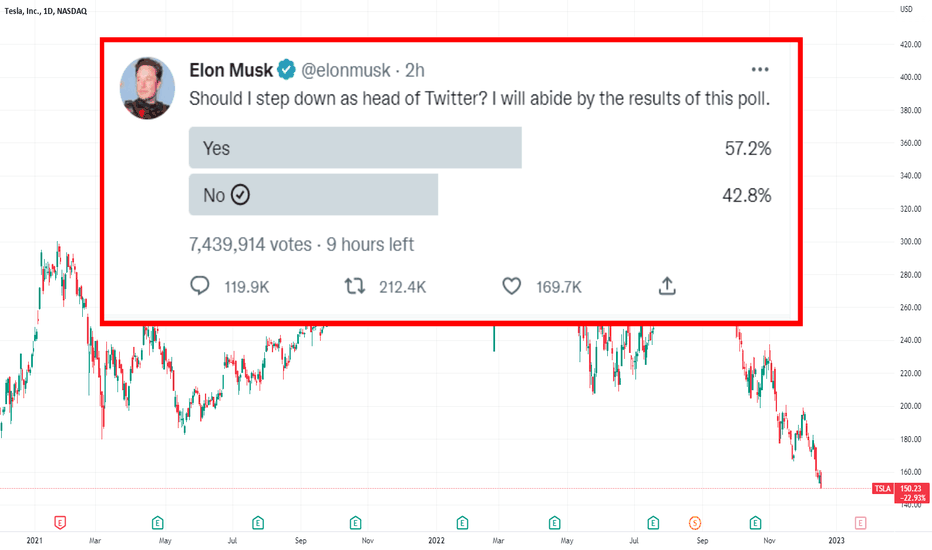

Tesla reports record Q1 deliveries as price cuts boost demand"Tesla (TSLA) on Sunday reported first quarter delivery and production numbers that topped estimates, indicating price cuts it initiated across the globe are boosting demand." ~ Yahoo News

Be interesting to see what it does for the price when the market open on Monday. The other good news in Teslas favour is the US EV car buying subsidies are increasingly being based on how much of the complete vehicle from batteries to body panels is being made locally in the USA. This will further boost Teslas attractiveness to buyers and give imported EVs less of a price advantage - ignoring any of their technical limitations.

From a technical perspective, I like the look of the MACD and where it is at the moment.

Worth a watch to see where it goes.

Search in ideas for "zAngus"

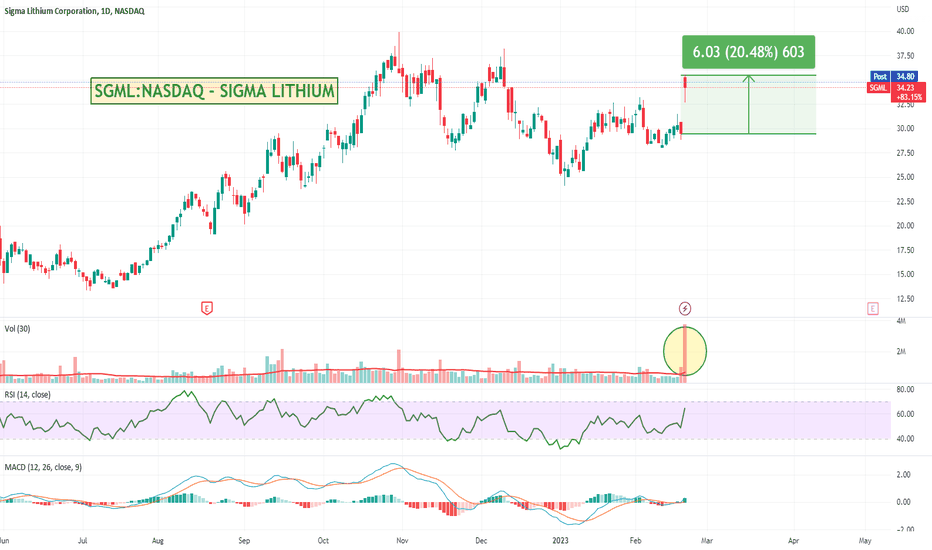

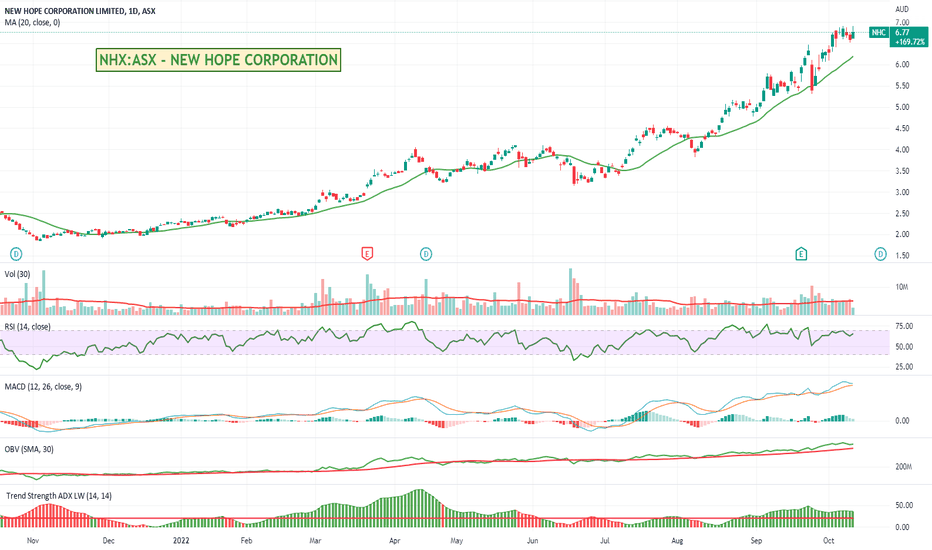

Australias Whitehaven Coal - Up 200% over 12 monthsWhitehaven Coal just keeps going up and up. I keep waiting for a pull back but it keeps going from strength to strength.

Not sure how long it will run for - but might be worth setting an alert for a pull back - OR - have a look around in the same sector for a copycat style trade - see who else is running.

See my post below for how to find copycat trade ideas.

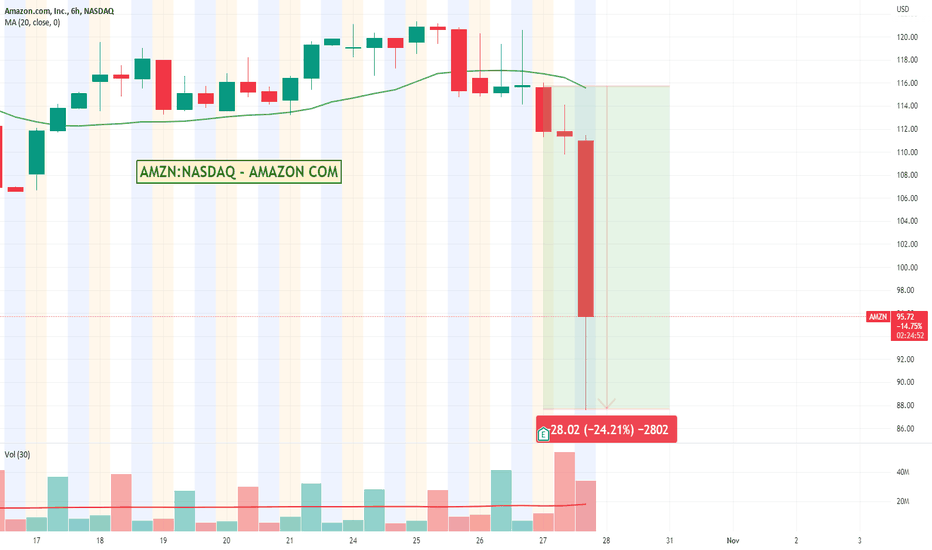

Will we get a 20% bounce out of Amazon?The cheap can always get cheaper, but the last couple of times Amazon has had a drop like this sending the RSI into lows we have ended up with a 20% or so bounce. Will be interesting to see if it happens again this time around or whether it continues its downward slide without the recovery rally.

One to watch.

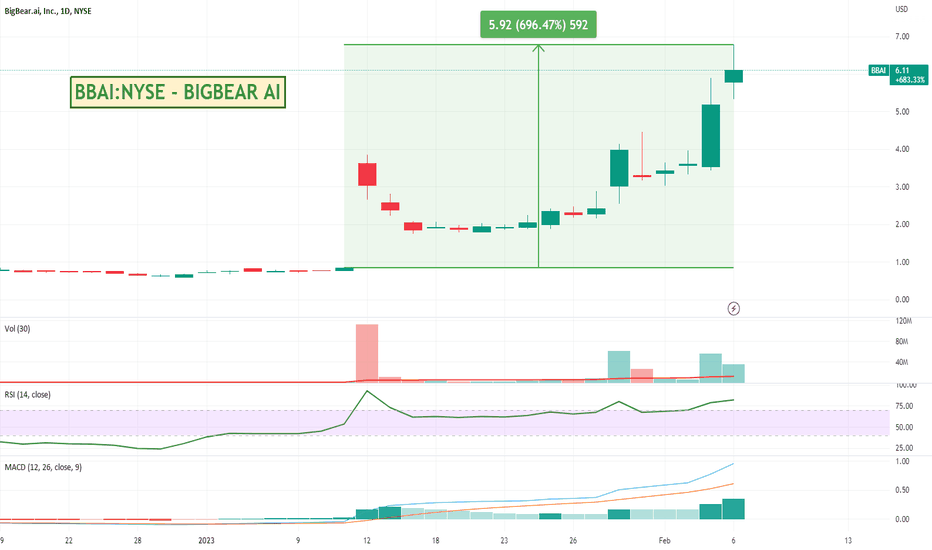

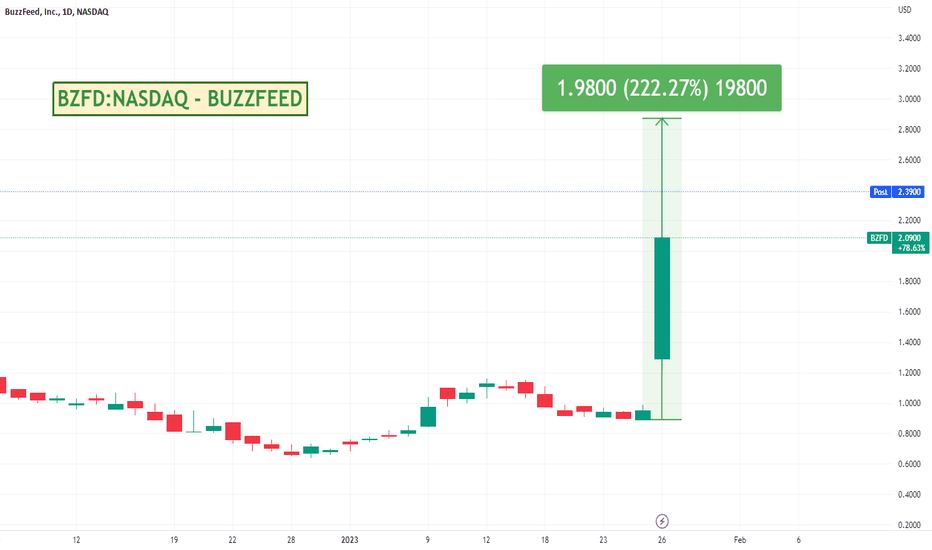

New Game. Mention AI. Win 200% + Stock IncreaseBuzzFeed announced yesterday that they were looking to use ChatGPT to help generate content.

Price rocketed before pulling back a little.

DEFINITELY NOT trading advice, but perhaps keep an eye out for any company announcements or general news where they talk about using ChatGPT.

I asked ChatGPT what it thought and it replied:

BuzzFeed now seeks our aid,

To help with content they have made,

Prices rocketed high in the sky,

But soon did pull back, oh me oh my!

ChatGPT's name now in the news,

Company announcements worthwhile to peruse,

Keep an eye out, but do take heed,

Trading advice this is not, but fun indeed.

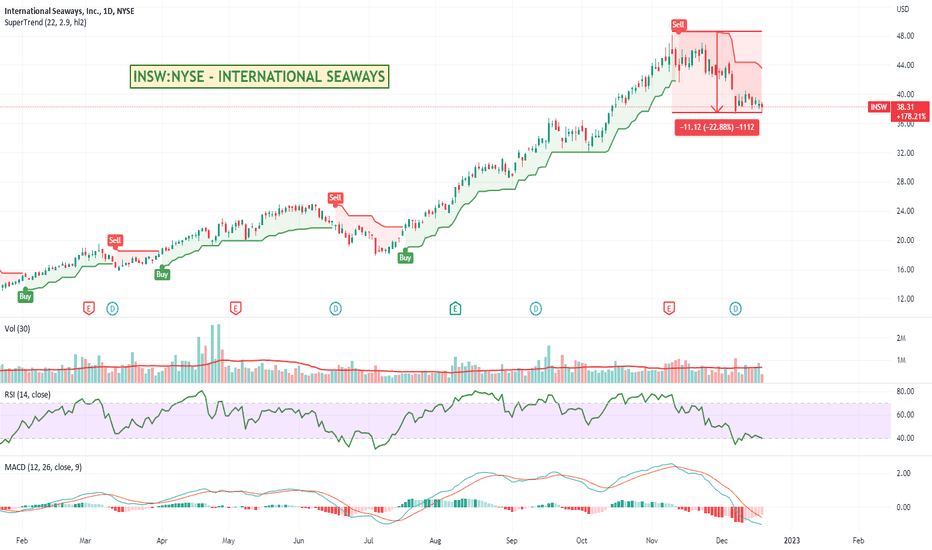

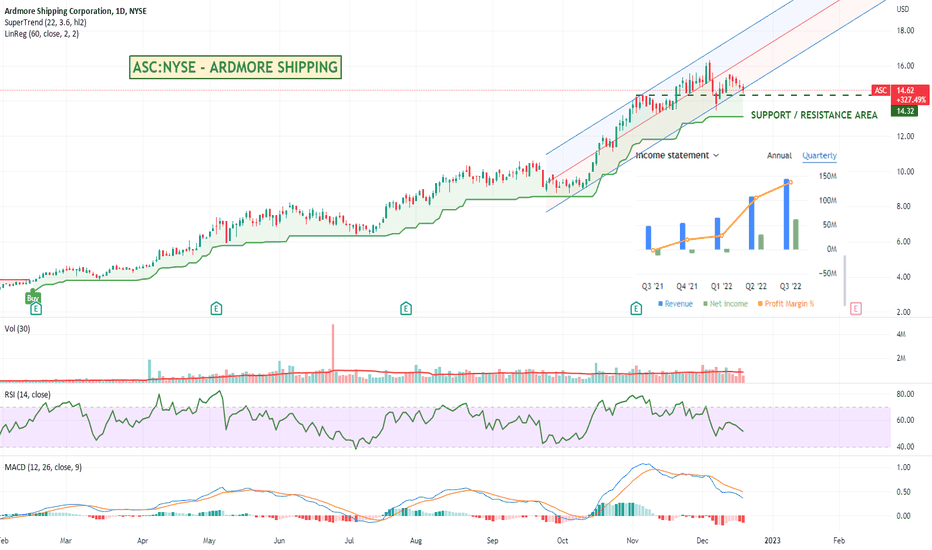

Ardmore Shipping - Up 300%Ardmore Shipping engages in the seaborne transportation of petroleum products and chemicals worldwide.

It is up a bit over 300% over the last 12 months and is going through a bit of a pull back to a better value area.

Could be worth a watch to see if it recovers and continues to run.

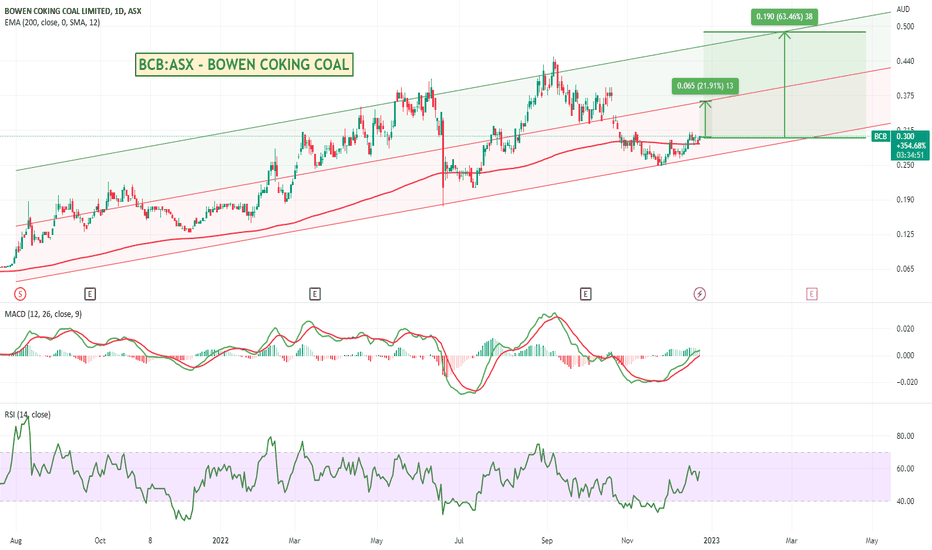

Bowen Coking Coal - Back above its 200 Moving AverageBowen is another one of those 300%+ runners over the last 12 months and has finally broken back up above its 200 day (exponential) moving average which could be a good bullish sign. Its also at the bottom of its long linear regression range / channel with some good potential upside if it trends like it has in the past.

Could be worth a watch.

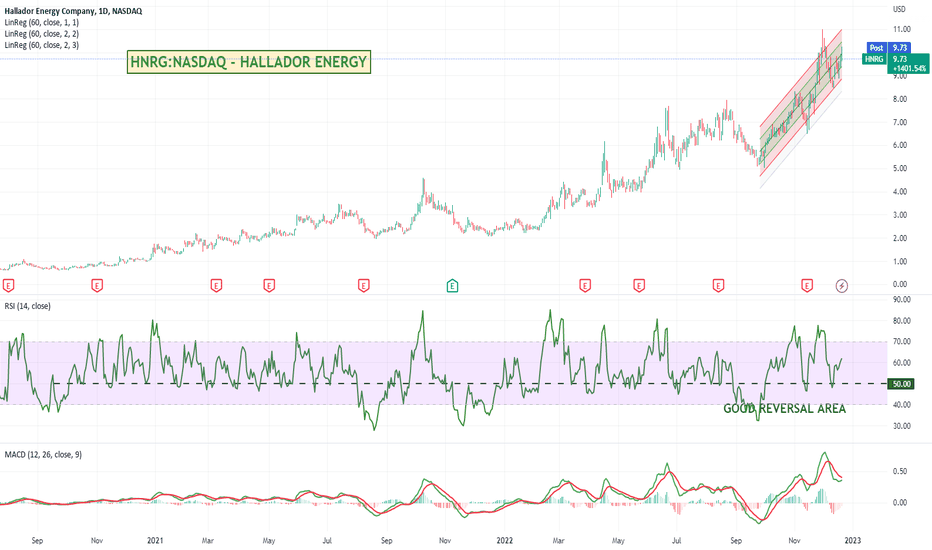

Hallador Energy - 1400% run.Hallador Energy engages in the production of steam coal in the Illinois basin for the electric power generation industry and is also involved in gas exploration activities in Indiana.

It has had a massive 1400% run since August 2021. Be interesting to see how long it will continue.

Seems to be a fairly strong pull back area around 50 on the RSI. You could set an alert at that area and have another look when it crosses down and then back up through it.

Might be worth a watch.

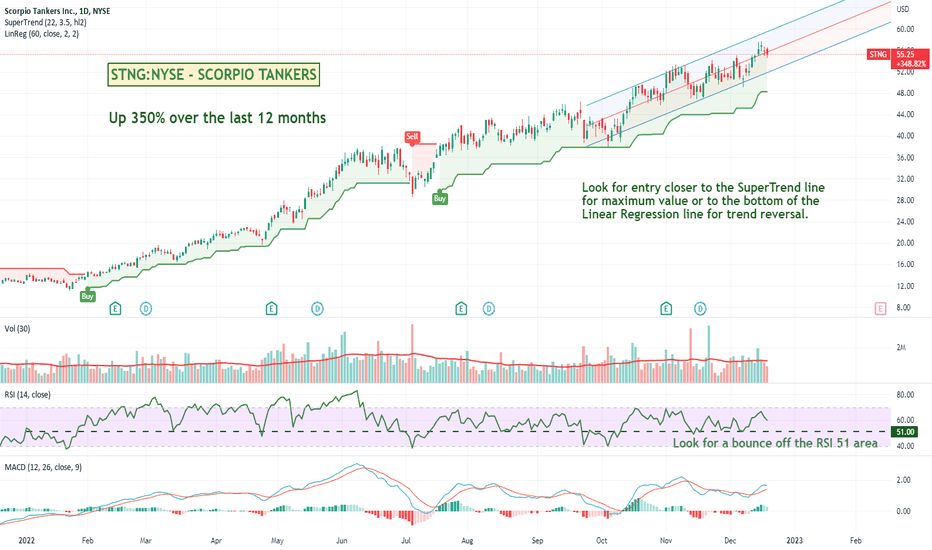

STNG - Scorpio Tankers - Up 350% over 12 monthsScorpio Tankers and its subsidiaries are involved in the seaborne transportation of refined petroleum products in global shipping markets.

Its stock price has had a 350% run so far over the last 12 months, and analysts are forecasting it could get to around $68 or so which is another 20% to go from its current price levels.

There are a couple of different pullback type areas where you might be able to get in for better value depending on your strategy that I have identified on the chart above.

Could be worth a look.

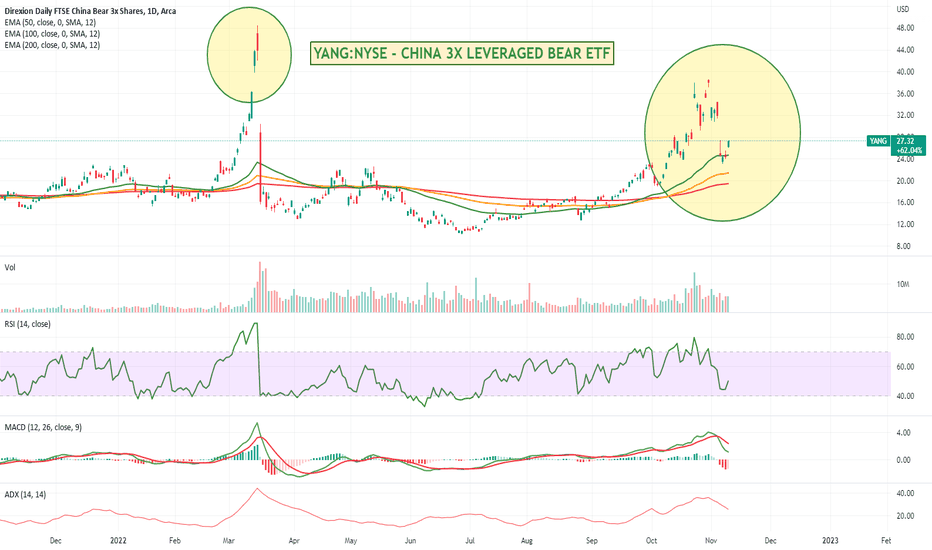

Guangzhou, world’s manufacturing hub, on brink of lockdown.After rumours last week of China about to announce plans for a recovery, we now have news about Guangzhou being locked down for Covid.

This is a BEAR ETF, meaning the worse things go for China, the more this ETFs price will increase. It is triple leveraged so can go down even more quickly than it rises, so any buyers beware.

More just to let people know that ETFs like this exist so you can effectively take a position against economies (in this case the FTSE China 50 Index) as opposed to individual stocks in a market.

It will be interesting timing just before Christmas. Already hard enough I would imagine getting goods shipped out of there in time for Christmas.

One that could be interesting to watch.

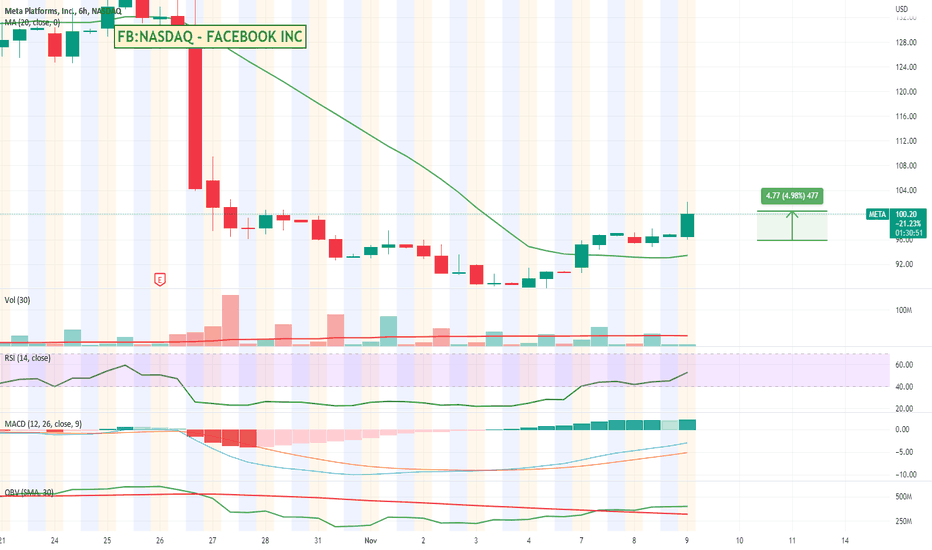

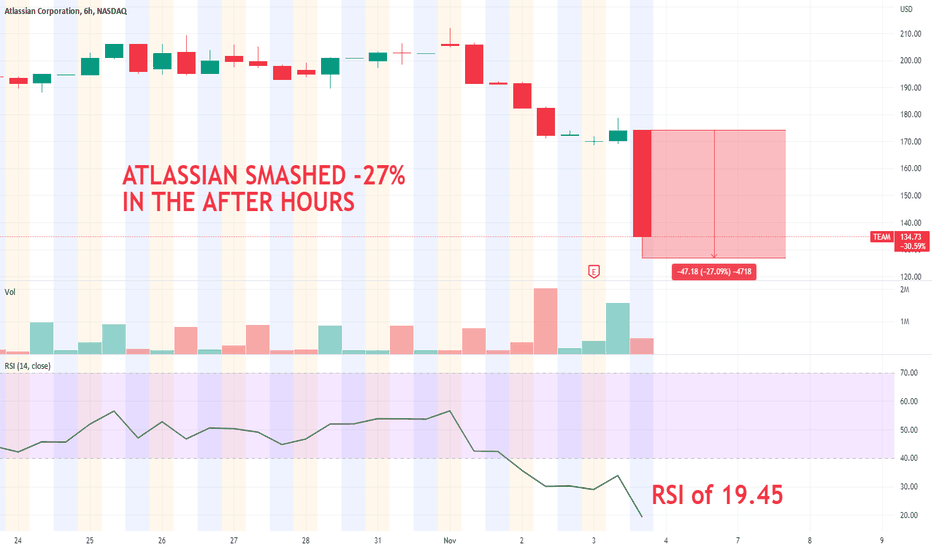

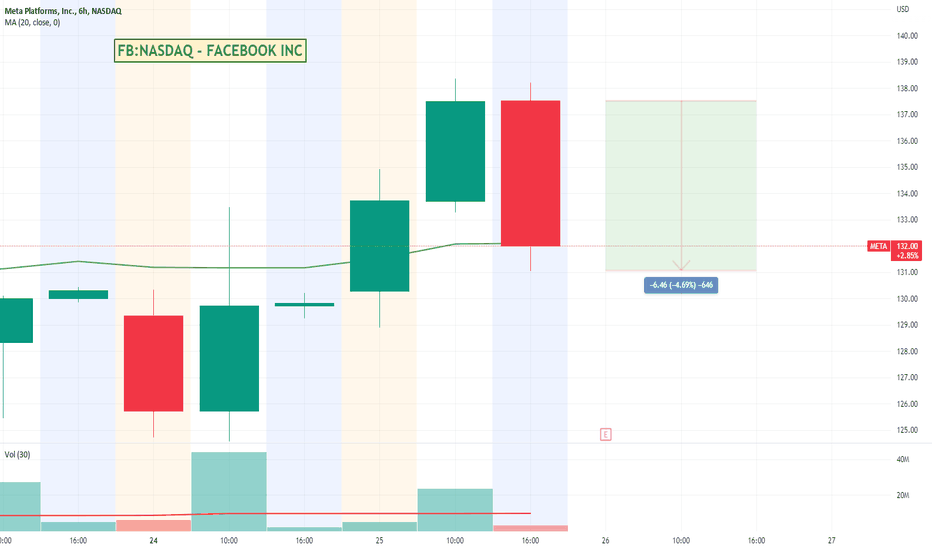

Facebook / Meta Caught Up In Googles After Hours DropGoogle dropped a bit over 7% in the market after hours after reporting poorer than expected earnings.

Facebook is due to report today but is already down by 4% or so on speculation they will suffer a similar performance drop as well.

Both are pretty big tech heavyweights that should give the overall Nasdaq some grief today.

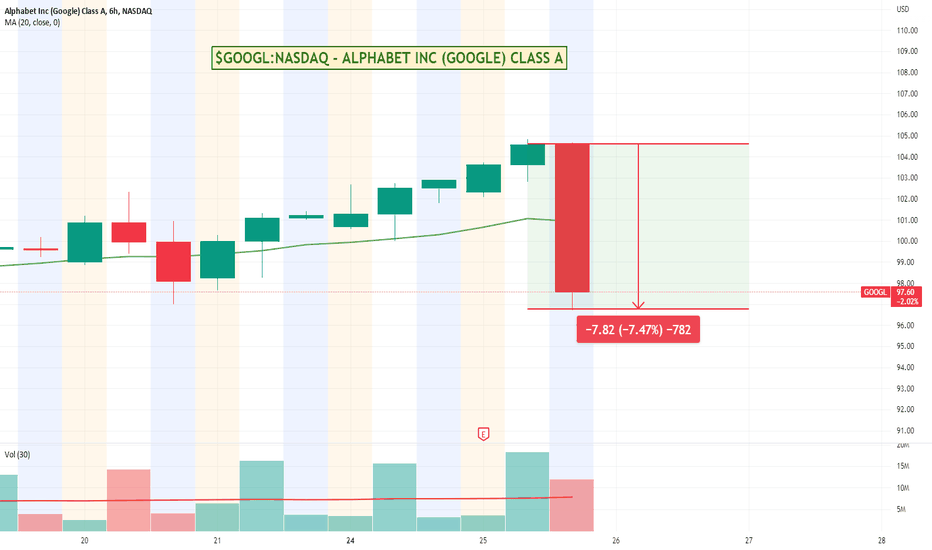

Google down over 7% in the after market. Ouch!Big dip on earnings after hours. Will probably drag the Nasdaq down a reasonable amount. Facebook is due to post their earnings soon so if Google got hit this bad, then there is a good chance Facebook will take a hit as well.

Could be a volatile next 24 to 48 hours heading into the weekend.

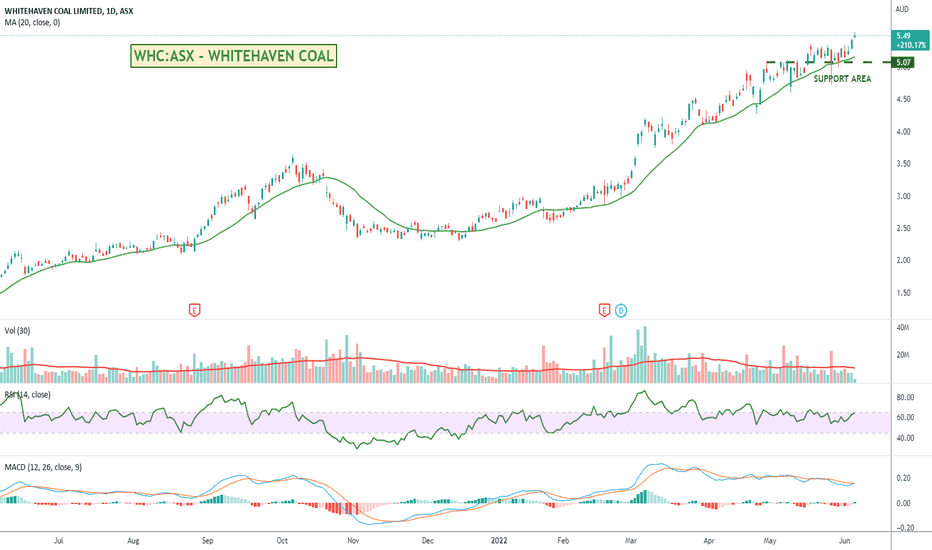

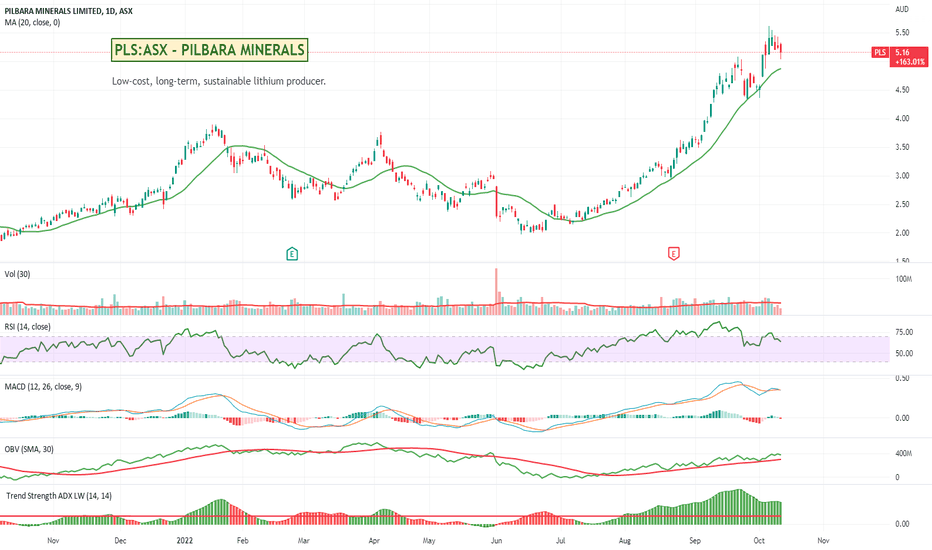

PLS. Australian Lithium Operation Trending Well.Pilbara Minerals is the world's largest independent hard-rock lithium operation and the leading ASX-listed pure-play lithium company. Their Pilgangoora Project, located in Western Australia's resource-rich Pilbara region, produces spodumene and tantalite concentrate and its significant scale and quality have drawn a consortium of high-quality global partners, including Ganfeng Lithium, General Lithium, Great Wall Motor Company, POSCO, CATL, and Yibin Tianyi.

The stock is up a bit over 160% over the last 12 months and with Elon and competitors around the world looking for Lithium hopefully their success and new price higher highs will continue for a while to come. Could be one to add to your watch list and do some more research around.

Terracom - Another Aussie Coal Company Making Higher HighsTerracom is another Australian mining stock I have been following along with ASX:WHC and ASX:NHC that has just been putting in consistently new higher highs over the last 12 months. It is now up a bit over 500% in a pretty tough market. Not sure what the next 12 will hold but could be worth a watch.

Cassava Rockets After SEC Reportedly Clears It Of TamperingSAVA:NASDAQ is one of those stocks that can get super spikey on news and after a 10 month investigation the SEC has apparently cleared them of any wrongdoing after having previously accused the company of manipulating research results of its experimental Alzheimers Disease drug.

Feels overbought at the moment looking at the RSI, but could be one to watch.