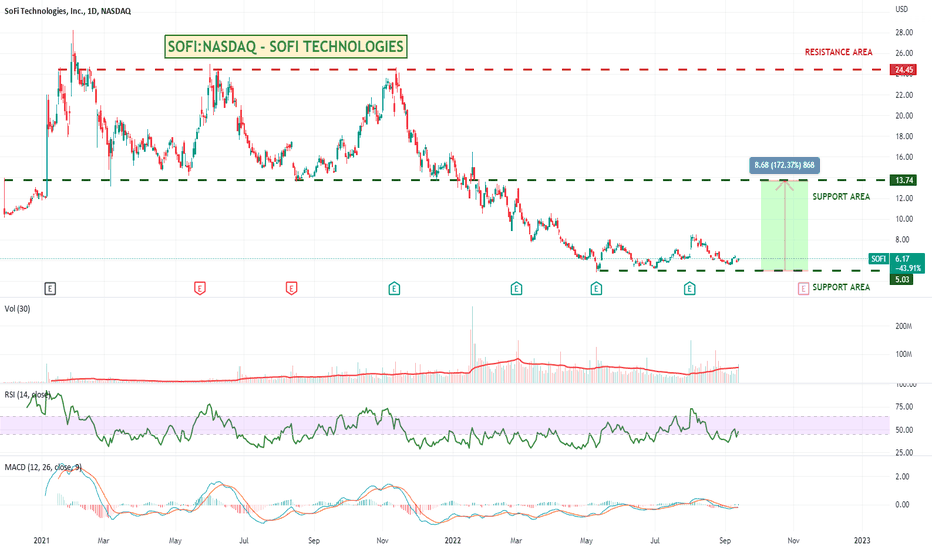

Bank of America have turned bullish on shares of SoFiBank of America analysts have become bullish on SoFi's stock with the student loan payment moratorium ending and its NFL partnership. The bank upgraded the company's stock to Buy from Neutral on Wednesday, raising their price target to $9 per share from $8 per share.

Could be one to watch.

Search in ideas for "zAngus"

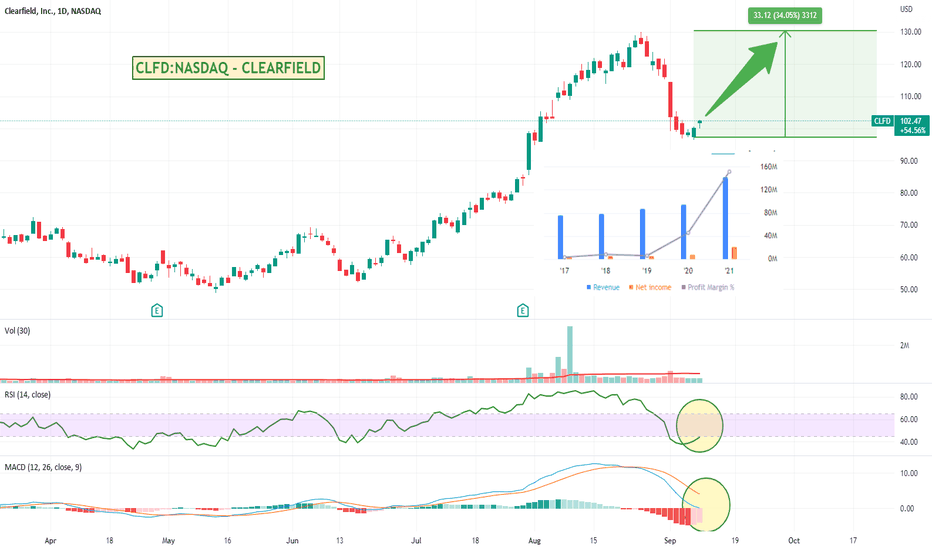

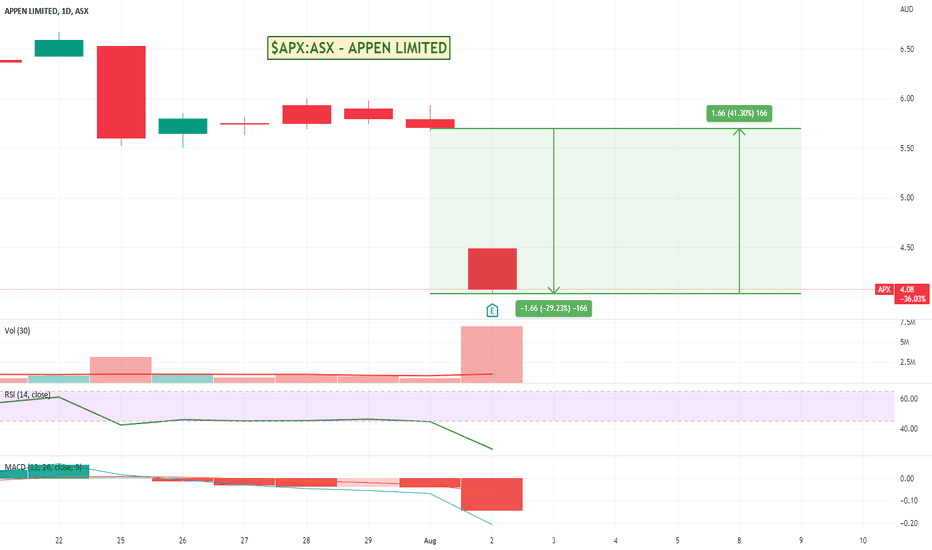

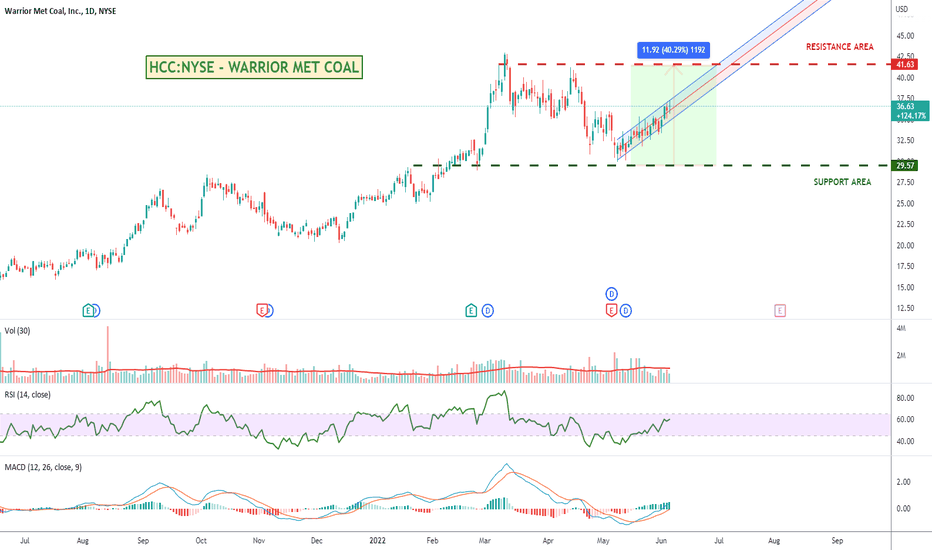

Big sell off on trial results. Oversold perhaps?Investors reacted strongly to the downside on news of the latest trial results, while the companies headline read more bullish.

Going to look at this one as potentially oversold - time will tell of course.

Could look at a stop limit buy order where if the stock recovers then you can enter the trade, but if it continues to head down then you stay out. Would also suggest of course a stop loss as well.

Might be one for the watch list to do more research around if you like this kind of potentially oversold on news type play.

Buyer beware :)

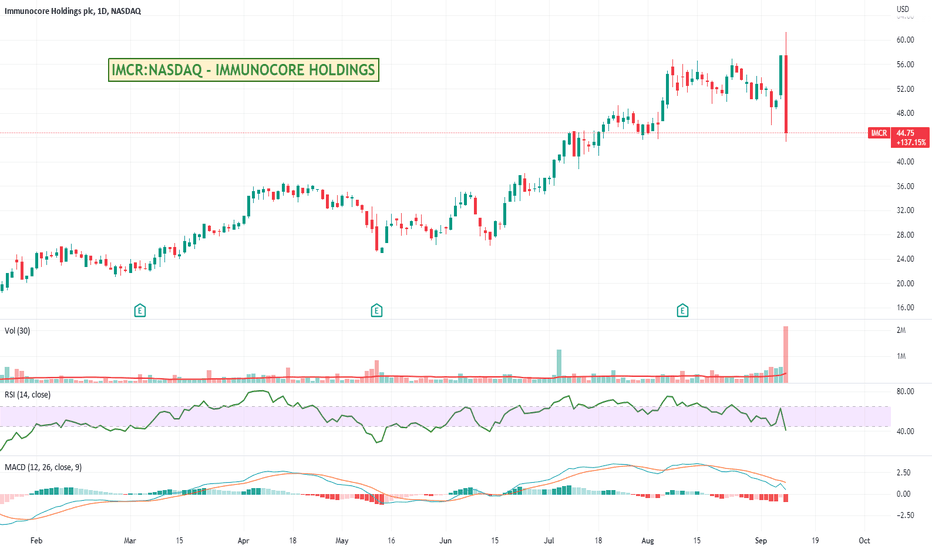

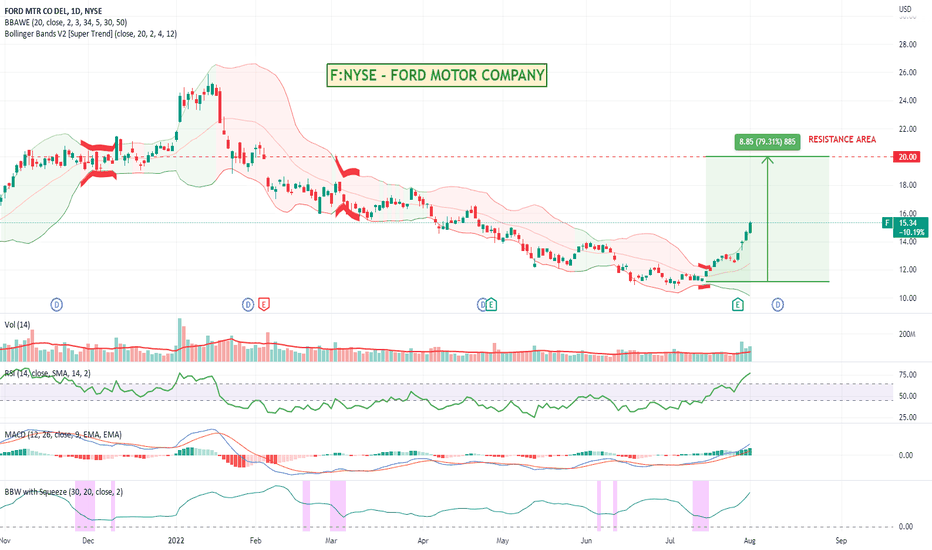

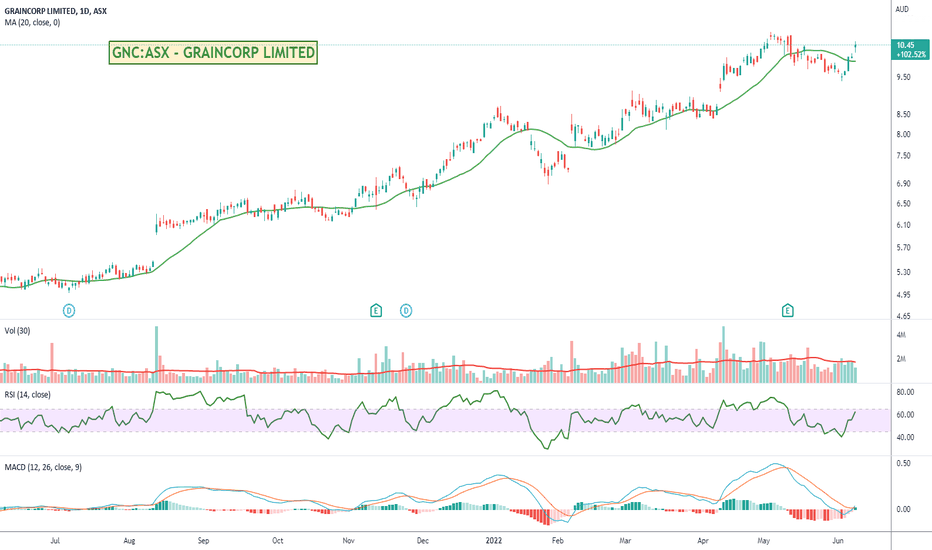

Warren Buffett Given Regulatory OK To Buy 50%Warren Buffett has been steadily buying this stock over the last few months and now owns 26.8%

With regulatory approval now allowing him to own up to 50% will be interesting to see where this stock ends up.

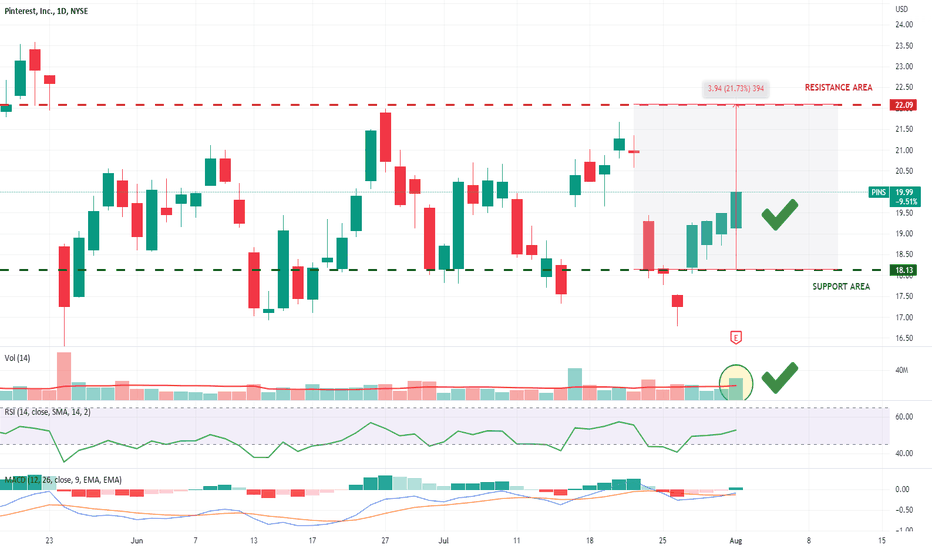

Indicators look good. Price at a support area, RSI showing good value, and MACD looks like momentum might be coming back into the stock after its recent pullback.

One way to buy this kind of stock could be with a stop or a stop limit order so if it does wiggle up on open then you enter the trade. If it does break through resistance and head downwards then your order wont trigger and you wont be in the trade.

Could be worth keeping an eye on and adding it to your watchlist to do more research.

Australias Anson Resources Targeting Increase in LithiumAnson has been range trading since the end of last year and with todays announcement of plans for a major increase in planned production capacity of its core asset, the Paradox Lithium Project in Utah, USA it would seem pretty bullish.

Could be worth further research.

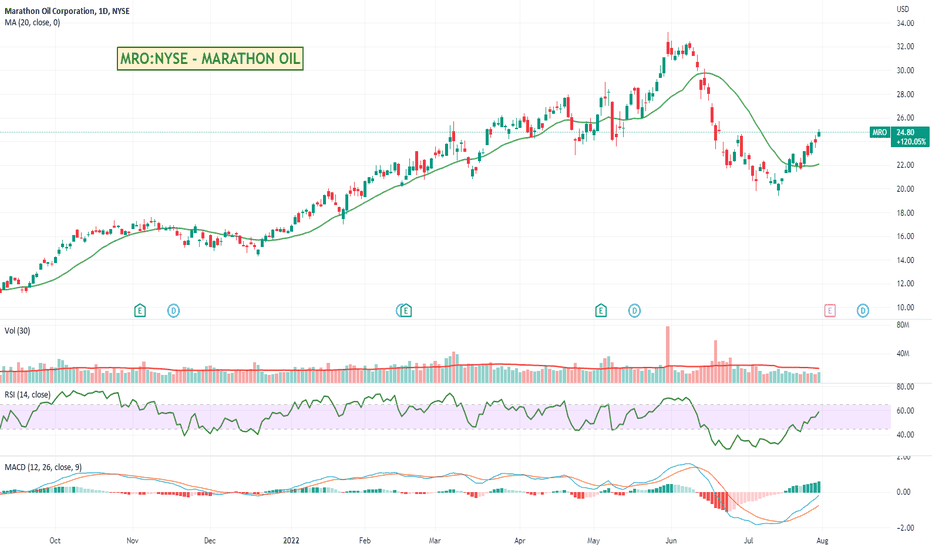

Marathon Oil Regaining Momentum.Marathon Oil was a nice steady runner throughout the last 12 months pre pullback with the wider market. It's back up above its 20 day moving average and showing signs of regaining some of its momentum.

Just keep an eye on earning due in the next couple of days and see which way the stock reacts depending on the news.

One to watch.

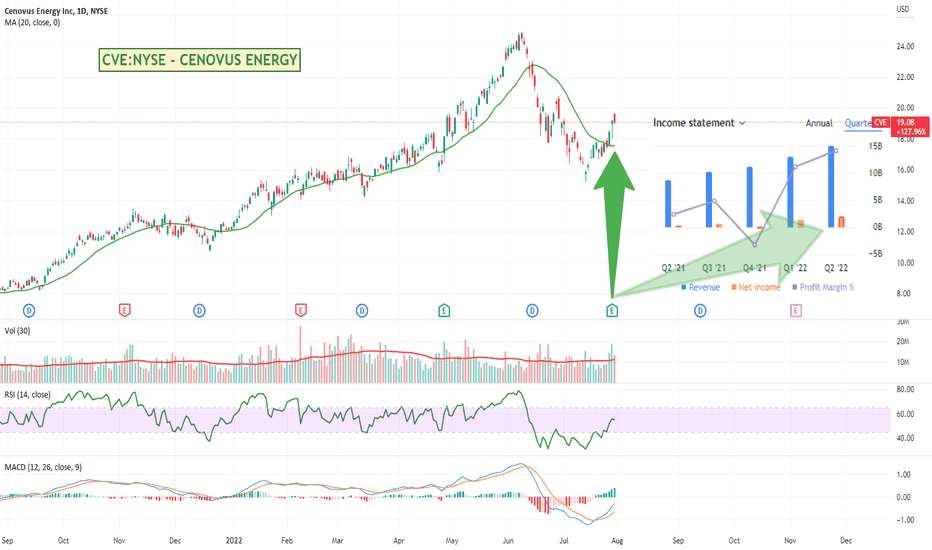

Cenovus Energy Moving Back UpCenovus Energy has had a bit of a run after reporting higher Q2 EPS year over year.

They are also potentially getting a bit of a bump pre next weeks OPEC meeting with crude oil closing higher on Friday even as recession concerns continue as traders see little prospect of a rise in supply coming from next week's OPEC+ meeting.

Might be worth a watch.

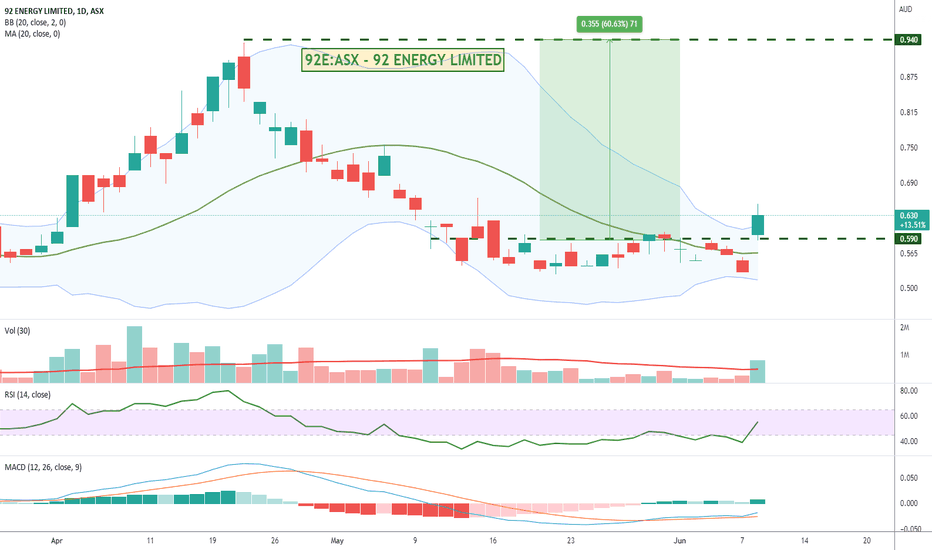

Uranium Stocks Running Hard on the ASX today.Must be news out there somewhere, but a lot of Australian Uranium stocks have broken out today.

92 Energy is exploring for Uranium in Canada which given its geographical proximity to the US is probably a good thing.

From a price perspective, it has broken out above its upper bollinger and above a previous resistance area with some upward room to get back to old highs.

Be interesting to see if it settles back tomorrow or continues to run.

Worth a bookmark.

Check out this link to see other Uranium stocks. Just sort by todays change to see which other stocks are jumping.

tradingview.sweetlogin.com

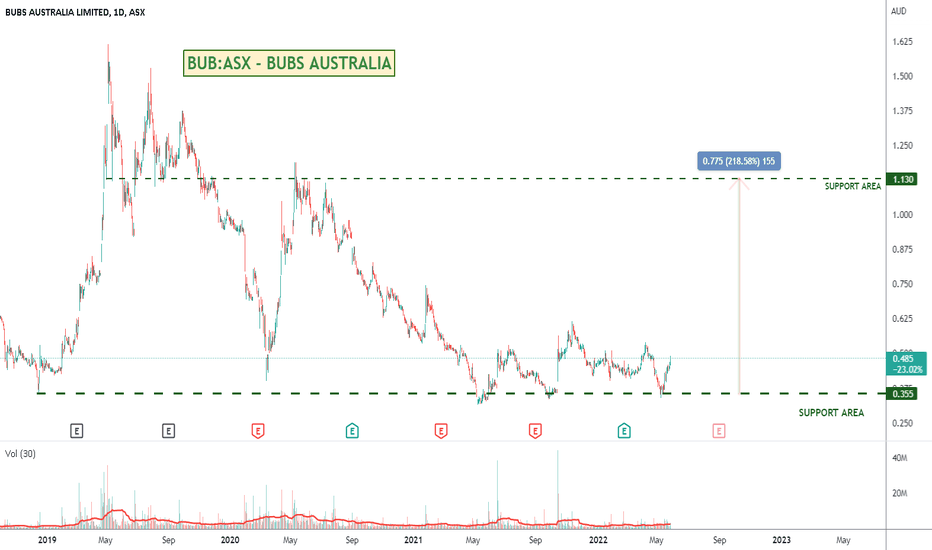

Massive BUBS Australia order Tweeted By Biden after FDA approvalFrom the Sydney Morning Herald, "An Australian baby formula company has sealed a mega deal to send more than a million tins to desperate parents in the United States, with President Joe Biden spruiking the deal on Twitter himself."

“I’ve got more good news: 27.5 million bottles of safe infant formula manufactured by Bubs Australia are coming to the United States,” Biden tweeted on Saturday local time.

"The company secured approval from the US Food and Drug Administration (FDA) on Saturday morning (AEST), allowing it to export six of its baby formula products to the US to help fill the country’s dwindling shelves."

Could be interesting to keep an eye on their stock price.

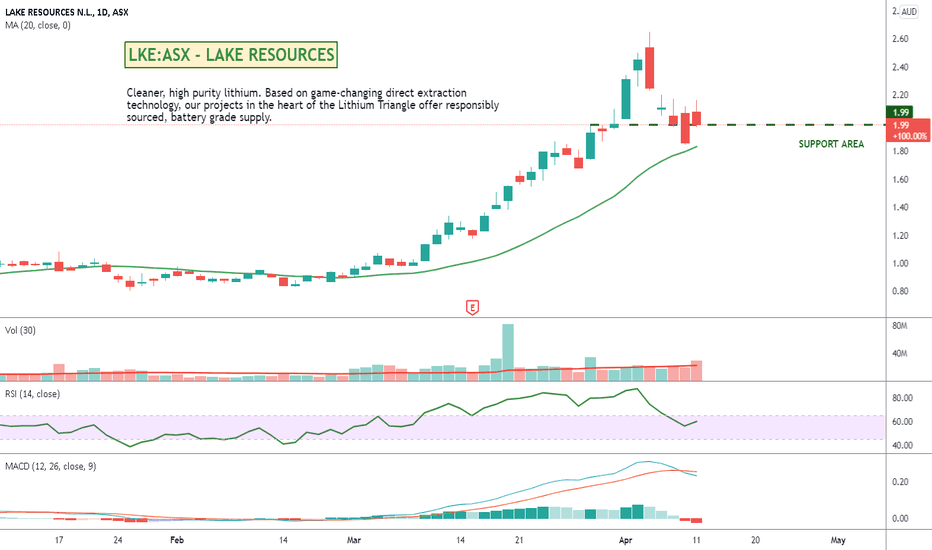

Australias Lake Resources Back Above Its MA 20Lake has had quite a pullback after its massive run in the earlier part of the year. Its crossed back up above its 20 Day Moving Average along with the MACD and RSI making upwards signs.

Commsec is currently showing 545 buyers for 4,847,335 units and only 294 sellers for 2,645,213 units, so fingers crossed it seems demand is on our side.

Could be one to add to your research list.

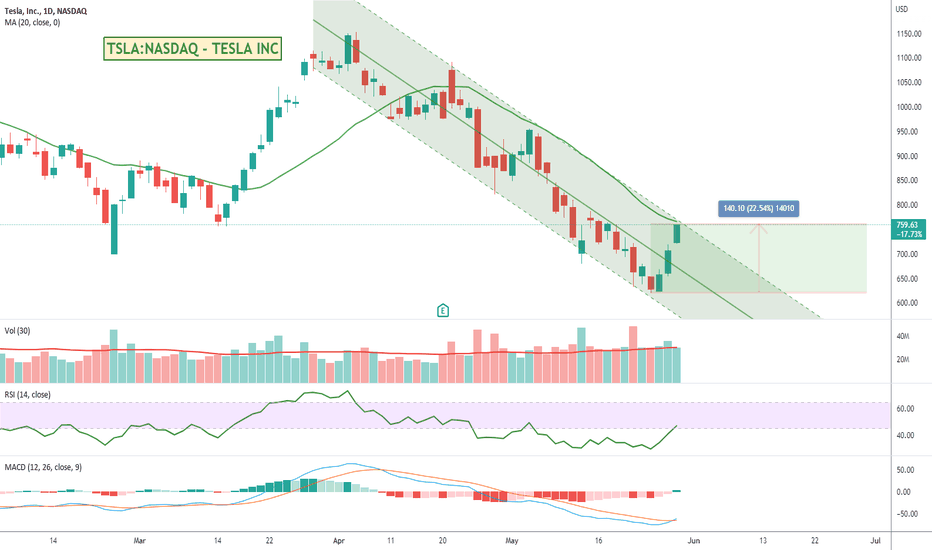

Teslas Back At The Top Of Its Channel - Run or Reject?Teslas been in a bit of a funk with Elon distracted by Twitter, but it is 20% up from its recent bottom and RSI starting to show some momentum again. Be interesting if it breaks out of this area and starts recovering. About to cross its 20 day moving average as well.

What do you think? Will it run or get rejected again?