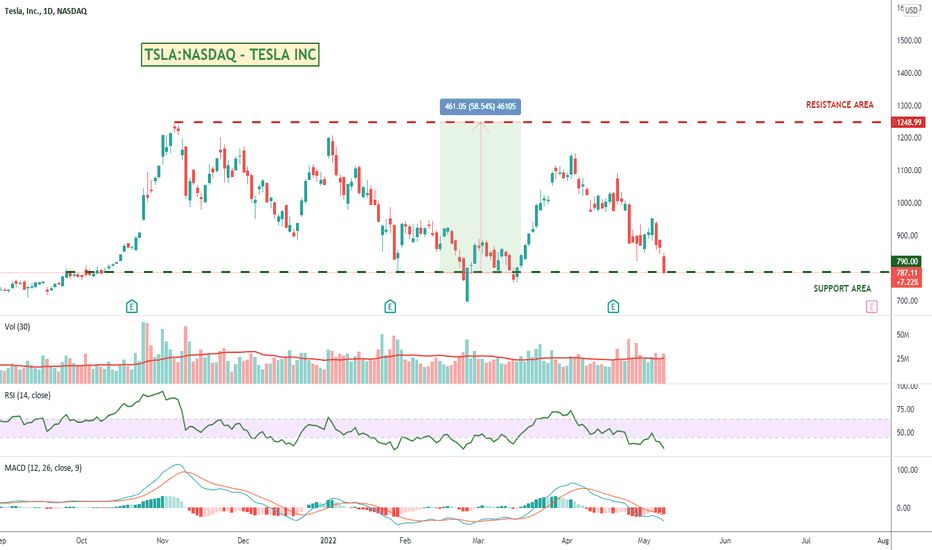

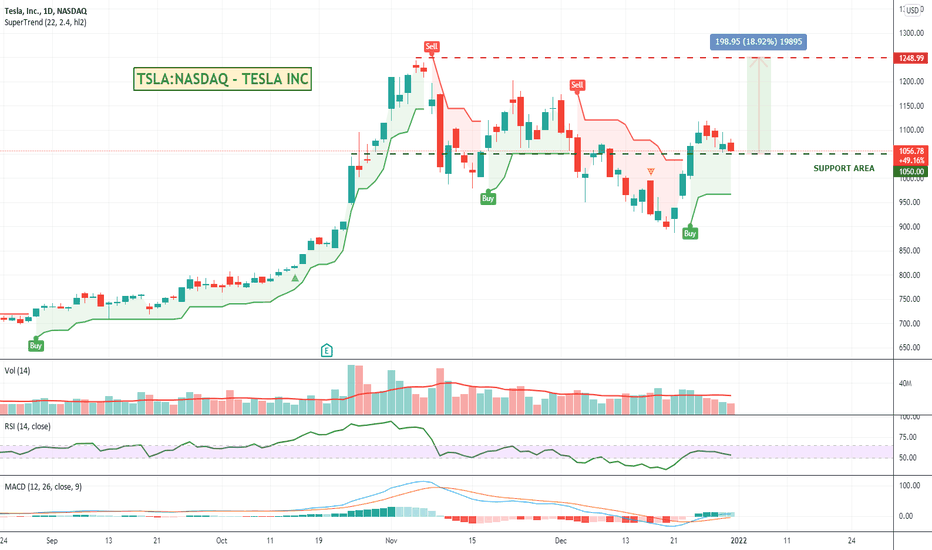

Tesla back at support and in oversold territoryTesla is back at a pretty strong historical support area but with so much going on with the overall market, Elons focus on Twitter, and ongoing supply issues, it will be interesting to see if we get a bounce from here (possibly with the overall market) or if it will break and move further into weakness.

Worth a watch.

Search in ideas for "zAngus"

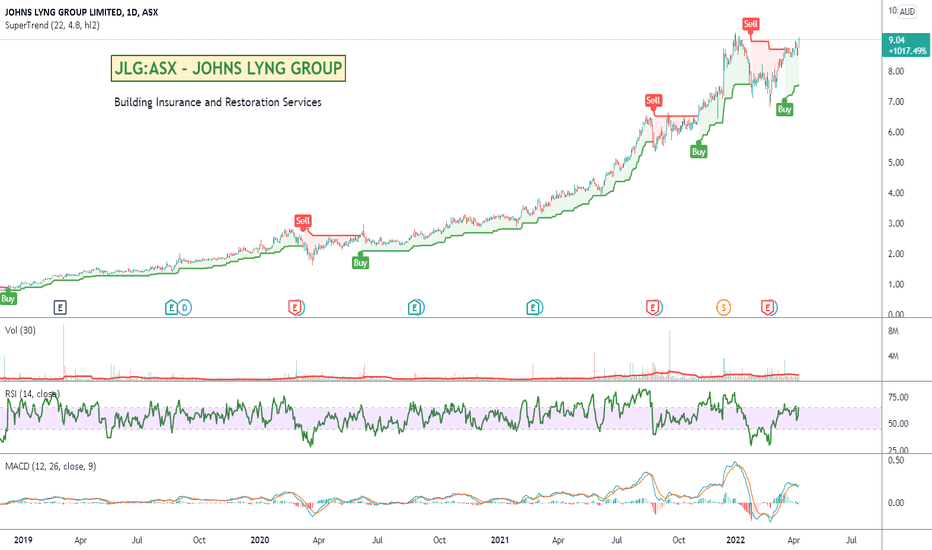

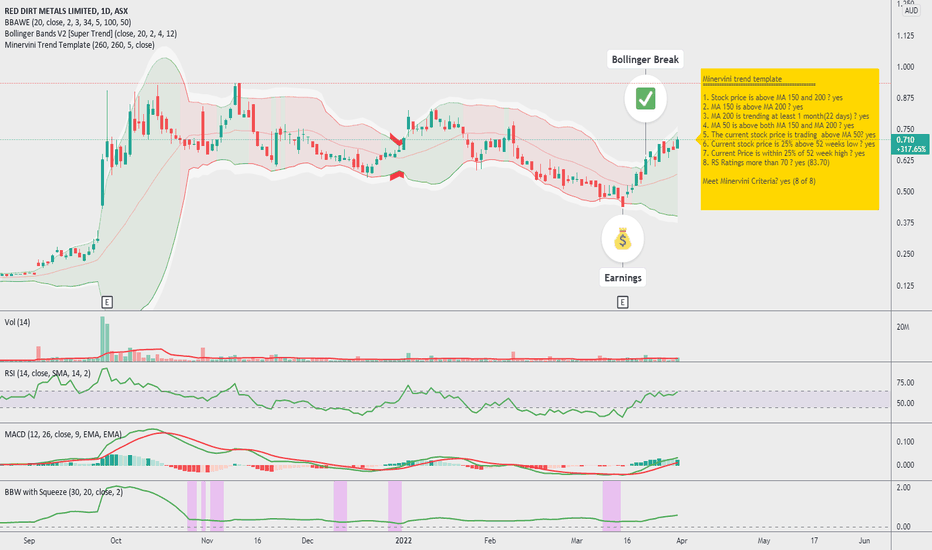

Australias Red Dirt MetalsSpotted this one a couple of days ago on a Bollinger breakout with good supporting volume and post earnings. Its around 30% below its 52 week high so might be some room to move.

Might be worth a watch.

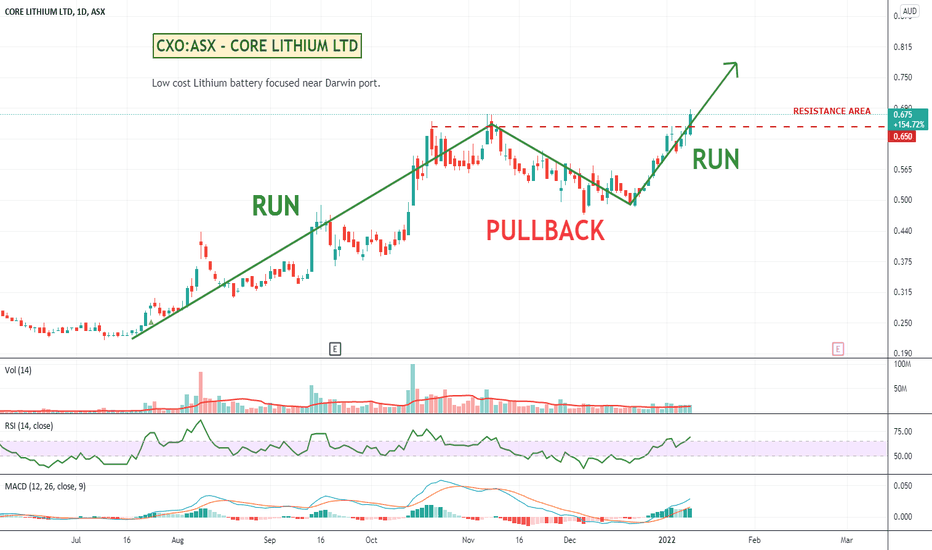

ASX's CXO has that nice Run, Pullback, Run pattern that I like.CXO has been running really well over the last 12 months and especially recently with the surge in demand for Lithium.

I like these kinds of patterns and will try and focus on them more in 2022 where the stock has been in a nice uptrend, had a pull back to a value area and then resumes its run.

I'll spend more time looking for these using the 20 day moving average as my filter in the screener to look for them.

CXO might be a bit expensive now if you don't already hold, but the easy way around that is to set an alert for when it crosses back below RSI 65 and start to keep an eye on it from there perhaps.

Lithium definitely having a good run and may for a while. Whole world is transitioning across to electric vehicles quicker than I think most expected.

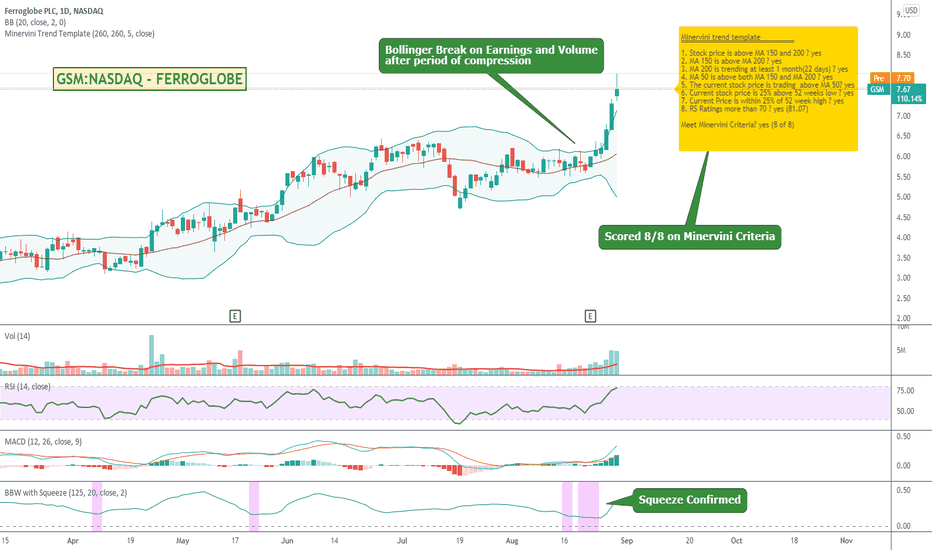

GSM up 1600% and scored 8/8 on the Minervini CriteriaBought this one at $5.75 on a Breakout on Earnings scan using the TradingView stock screener (video linked below).

This one ticked all the boxes for me. Sub $10. Breakout post earning, post squeeze on volume.

Nice trade running well.

The trick with these is once they get extended, where do you exit? :)

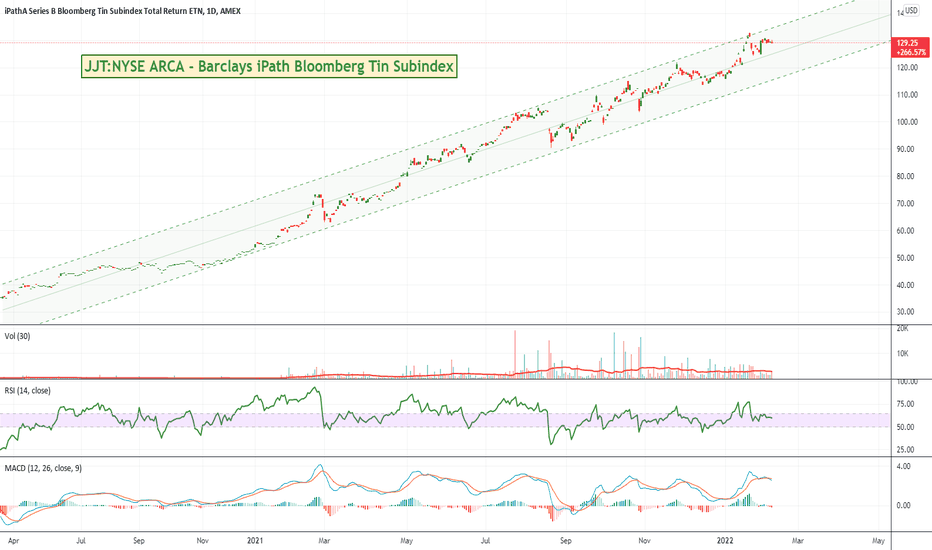

JJT:NYSE ARCA - Barclays iPath Bloomberg Tin Subindex - Up 260%Talk about a super steady "stock" so far.

Barclays iPath Bloomberg Tin Subindex has just been wiggling its way up the price scale relatively unnoticed.

Could be worth a look if you believe the trend is your friend and will continue to be :)

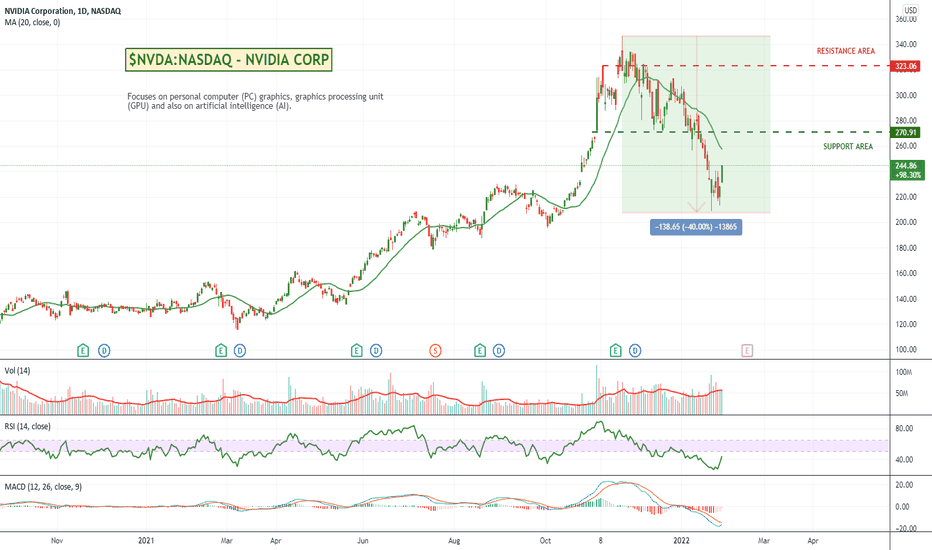

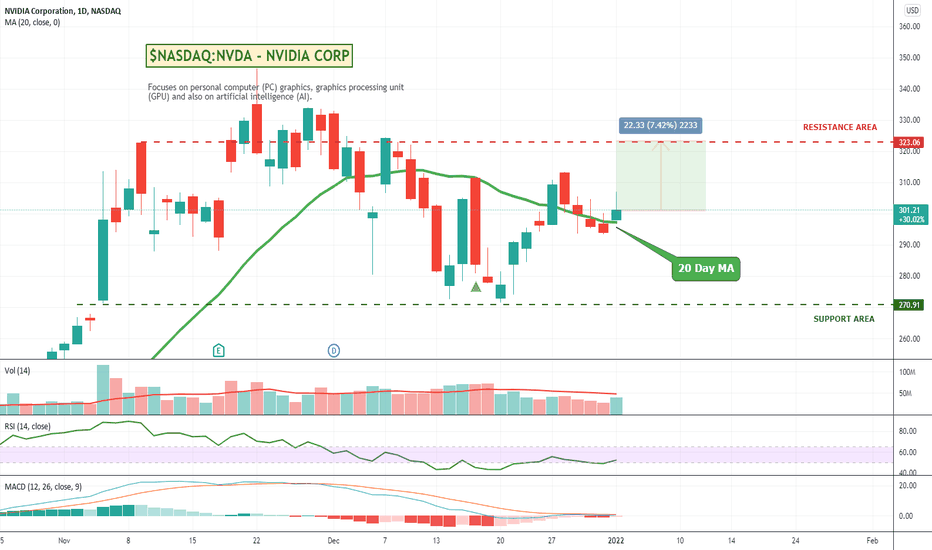

NVIDIA looking like a recovery is underway.Massive 40% sell off on NVDA between the acquisition they were looking to make compounded by the overall drop in higher profile tech stocks and across the NASDAQ sell off in general. RSI indicating oversold and pointing up. MACD well extended to the downside.

If the overall market is indeed recovering then there could be some relatively good upside on NVIDIA.

One to watch.

TSLA deliveries exceed the most optimistic Wall Street forecastsTesla smashed it yet again and delivered 308,600 vehicles in the fourth quarter, far higher than analysts' forecasts of 263,026 vehicles.

Hopefully we will see the share price head back up to those previous highs depending on what the wider market does.

TESLA doing well will likely have a flow on effect to other EVs like XPENG, NIO etc as well as Lithium and other battery minerals stocks

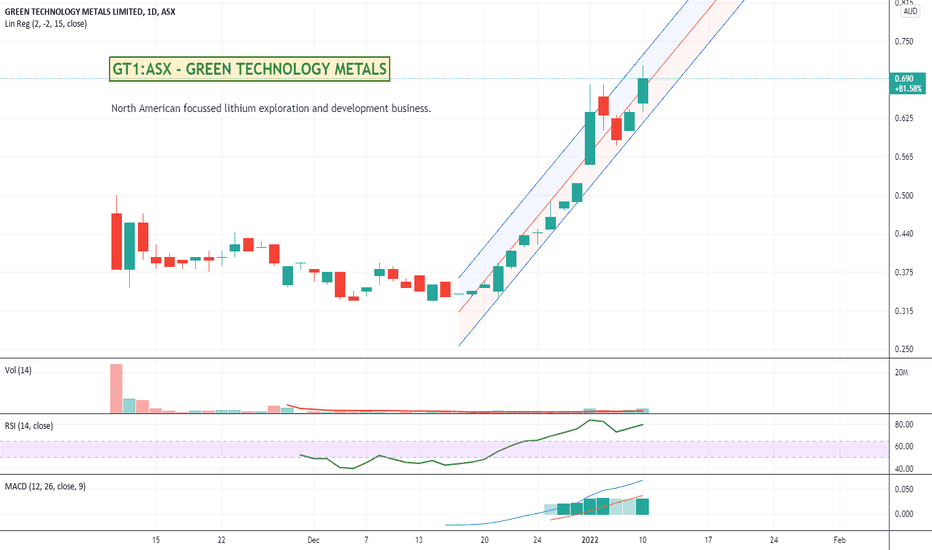

ASX stock GT1 off and Racing on the Lithium Pump.I took a very small position on this stock a couple of days ago after spotting it earlier and then seeing the pull back.

Definitely not a trade recommendation as I think it is probably well over cooked on its RSI, but might be one to keep on your radar longer term if you are interested in Lithium miners.

I like that they are newly listed and North American focused.

From their media releases:

Green Technology Metals is a North American focussed lithium exploration and development business. The Company’s Ontario Lithium Projects comprise three high-grade, hard rock spodumene assets (Seymour, Root and Wisa) covering 95km2 of highly prospective tenure north-west of Thunder Bay in Ontario, Canada. All sites are proximate to excellent existing infrastructure (including hydro power generation and transmission facilities), readily accessible by road, and with nearby rail delivering transport optionality.

They got hit with an ASX speeding ticket and in their please explain reply was:

The Company notes that it has begun its drilling campaign on the Seymour asset (announcement 6 December 2021) and that the Company has sent initial samples to Thunder Bay for expedited assay. The Company is not aware of when these results will become available and will release on the ASX platform once received and analysed.

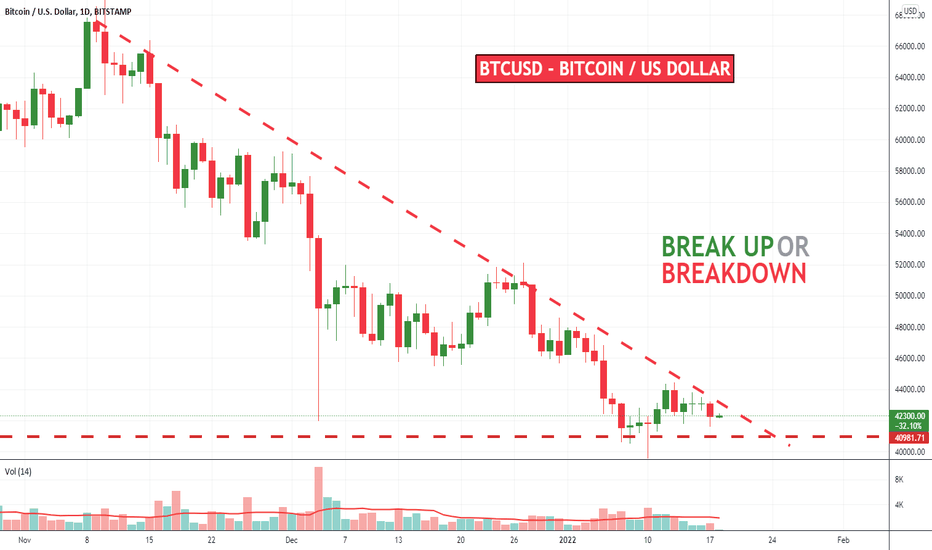

Bitcoin at its last major support level. Go big or go home?Will be interesting to see what happens from here.

Bitcoin is back at its last major support area so will we see a bounce or more doom and gloom ?

Might be time to check out this video again that I made earlier and see who is calling boom or bust and what the overall TradingView sentiment is.

Video: How To: Find Good Traders To Follow & Who Picked the BTC Crash !

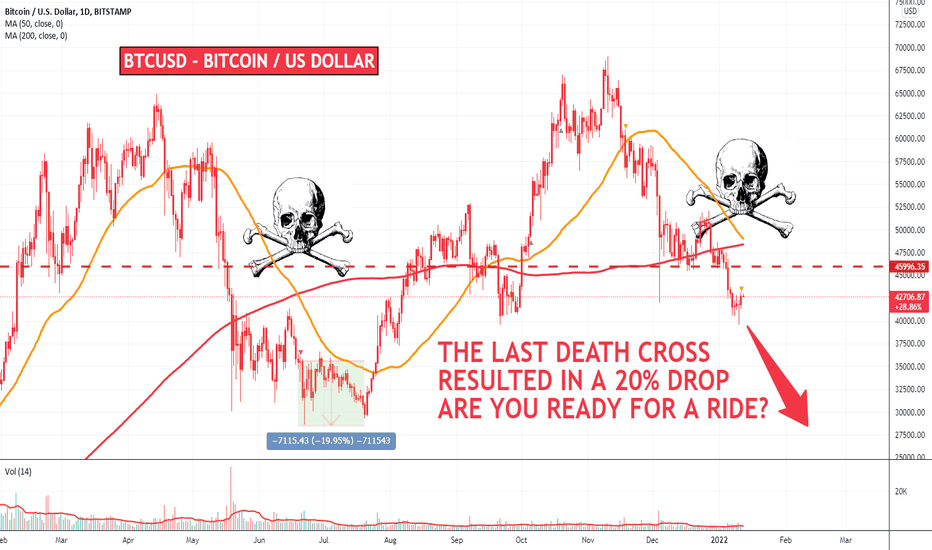

DEATH CROSS approaching. The last one hurt. Are you prepared ?More of a FUD post, but will be interesting to see what happens when we get the dreaded Death Cross which at this stage is inevitable.

You can see the slope of the 50 day was similar on the previous cross which led to a 20% drop followed by a bounce and then a slow capitulation before rallying again.

Will the pattern repeat?

Do you have stops in - or just going to close your eyes and come back in a month :)

Decisions decisions...

Here was my last BTC Death Cross post.

Press play to see what happened ;)

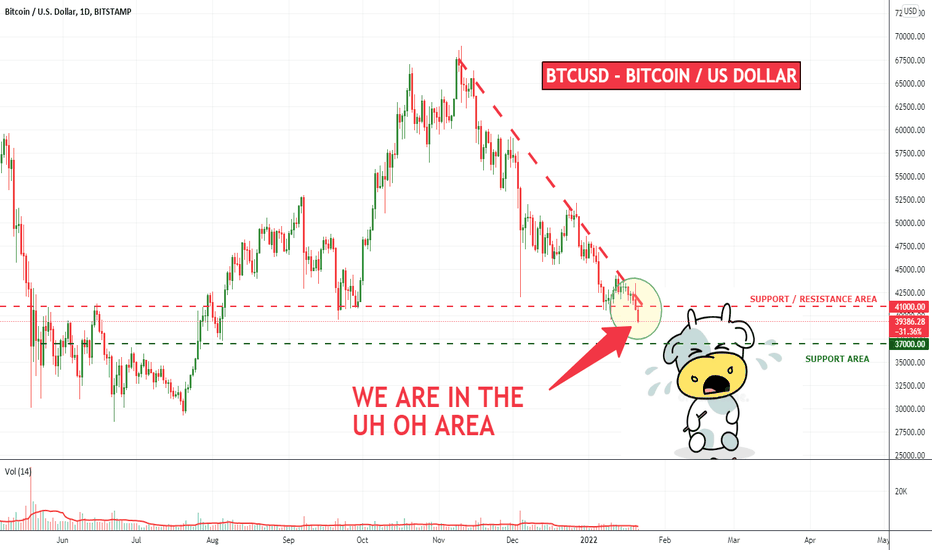

BTC in the UH OH Area. The FUD is real. 😭Broken below the $41k support area and right through below $40k with a big fat candle.

Will be interesting to see if their is a minor rally, or if we start to see peoples stops getting hit. If we get a waterfall of cascading stops that could build some downside momentum.

Next stop might be $37k and after that who knows.

You still bullish or bearish? Biggest question though - what is everyone else ;)

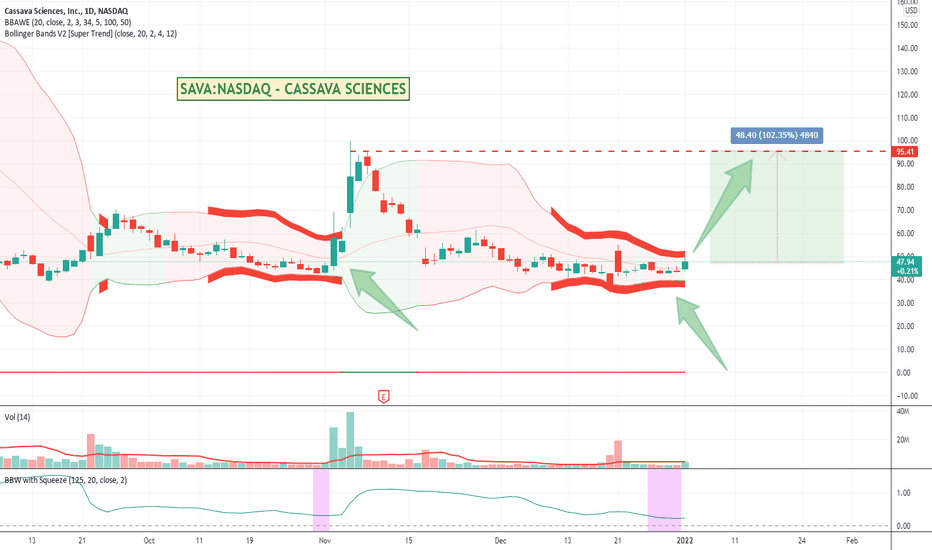

SAVA setting up for another technical breakout?Just having a play around with some Bollinger Squeeze indicators that are free in the library.

Wonder if SAVA will repeat the same pattern as last time and give us a bit of a breakout.

Last run was on news, but I haven't seen any catalyst for this one. I don't think it will run anywhere near the last breakout, but might get something out of it.

Will be interesting to watch and see what happens.

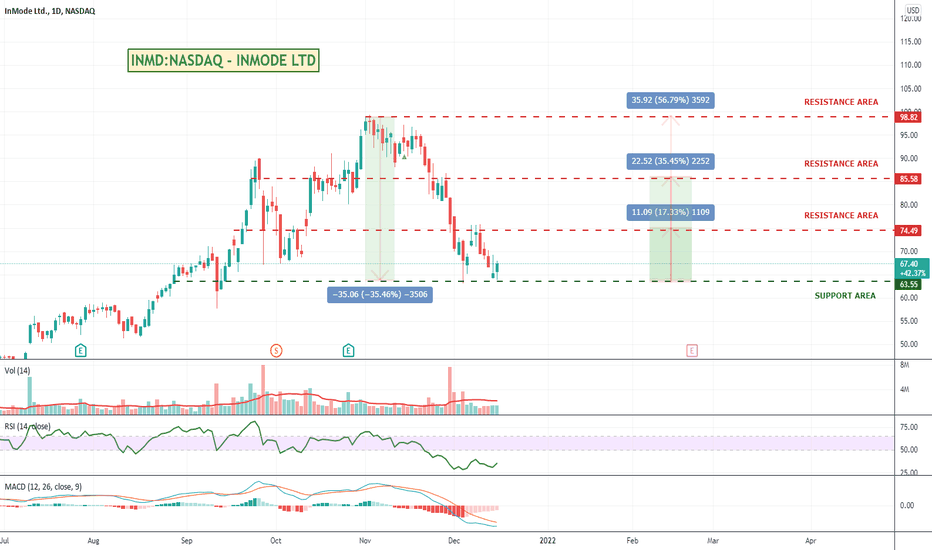

Inmode - Oversold with some upside to come?Inmode had a great momentum run over the last year and even with a recent 30% pullback is still up 190% for year.

I haven't really seen any news that might account for the drop and looking at Yahoo Finance their analysts are saying the current price should be closer to the $98.50 mark rather than where it is today at $67/40.

Fingers crossed for a bit of a run back to some of these resistance levels.

Worth some research.

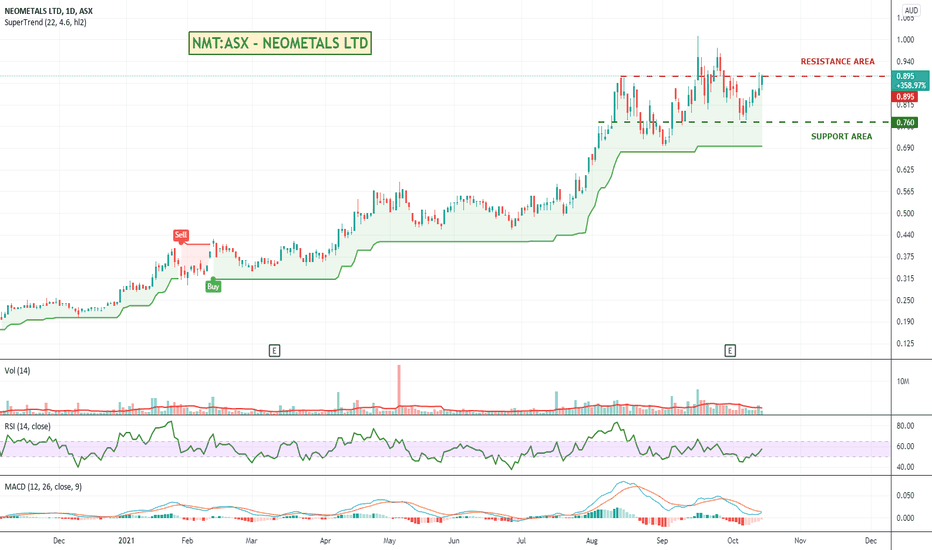

Australias Neometals Pursuing Lithium-ion Battery RecyclingASX listed Neometals has had a good run over the last 12 months up over some 358% over the last 12 months.

From their website their main focuses are on Lithium-ion Battery Recycling recovering cobalt and other valuable materials from spent and scrap lithium batteries as well as Vanadium exploration and recovery from slag.

Share price is still under $1 but back at a resistance area. Will be interesting to watch to see if it breaks through and continues to run.

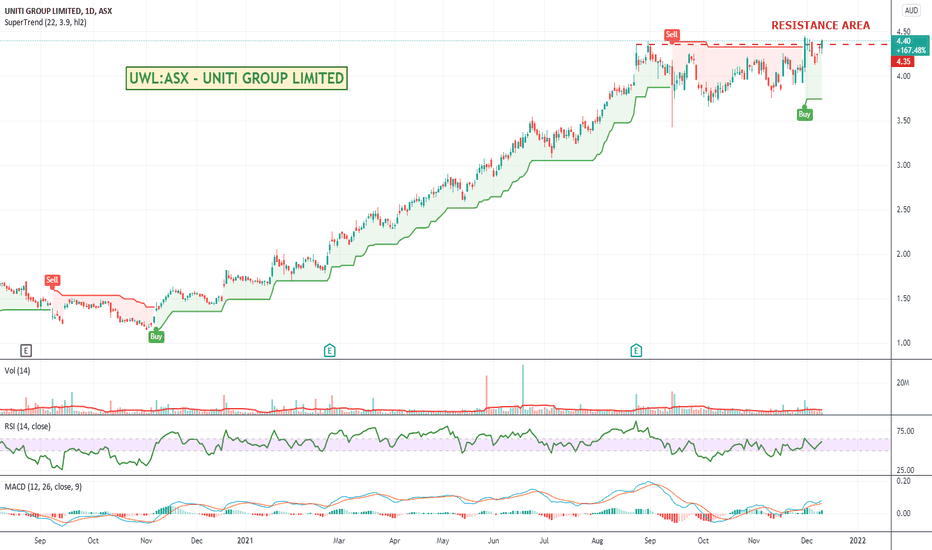

ASX's UNITI has been in a nice uptrend this year.UNITI is a broadband provider in Australia and has been trending nicely through the year.

A bit of a flat spot through September to December but it is back up against resistance again so will be worth keeping an eye on it to see if it breaks and runs.

Financials and technicals looking bullish .