Renascor Vertically Integrated Battery Anode Material Manufact..I have just been having a bit of a look around some of Australia's EV raw material type stocks and Renascor has been a bit of a monster over the last 12 months up around 1200%.

From their Facts Page: renascor.com.au

Renascor is developing a vertically integrated Battery Anode Material Manufacturing Operation in South Australia.

Renascor’s Siviour Graphite Deposit is the world’s second largest Proven Reserve of Graphite and the largest Graphite Reserve outside of Africa.

The favourable geology and location of the Siviour Graphite Deposit will allow Renascor to produce Graphite Concentrate at a cost that is amongst the lowest in the world.

Graphite Concentrates will be processed into Purified Spherical Graphite (“PSG”) in a 28ktpa, eco-friendly manufacturing facility in South Australia and shipped to lithium-ion battery anode manufacturers (currently located in Northeast Asia).

By leveraging off the low-cost Siviour resource, Renascor’s PSG production cost will be amongst the lowest in the world, competitive with current Chinese production and advantaged over other developments outside of China.

Looks interesting ...

Search in ideas for "zAngus"

Whitehaven Coal could be in for a bounce.At a reasonable support area and indicators look like it has been oversold. This used to be a $6 stock so plenty of potential upside if it does indeed recover. Around 35% to its recent high shown on the chart. Investors might have been recently spooked by the current Climate Change meetings happening with world leaders but coal will still be around for a while.

Worth a watch.

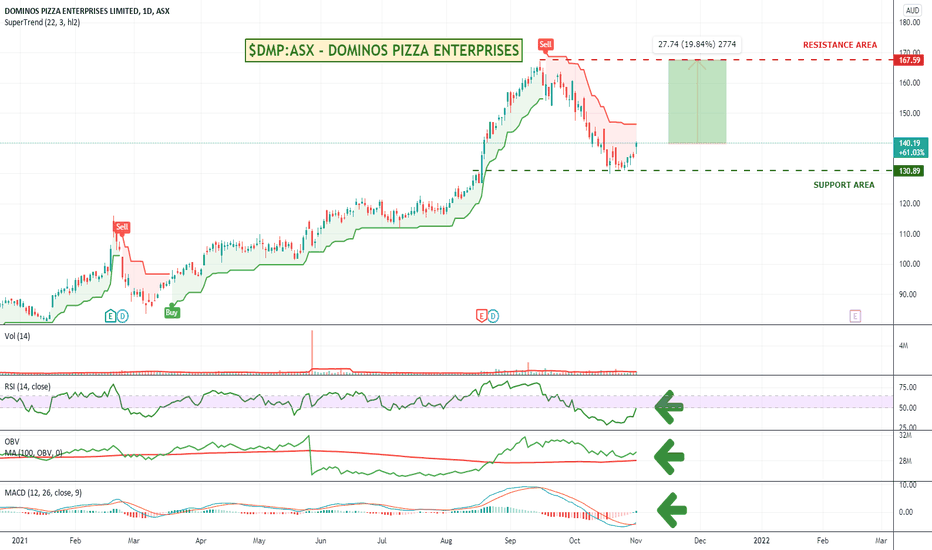

Dominos Australia looking interesting.Spotted this idea from @CompoundingCentral

Looks like it is recovering nicely after a recent pullback. The supporting indicators look like they might be starting to turn bullish as well.

I wonder though if now that a lot of Australia is opening back up including restaurants etc if that might take some of the attraction back off Dominos.

Could be worth a look.

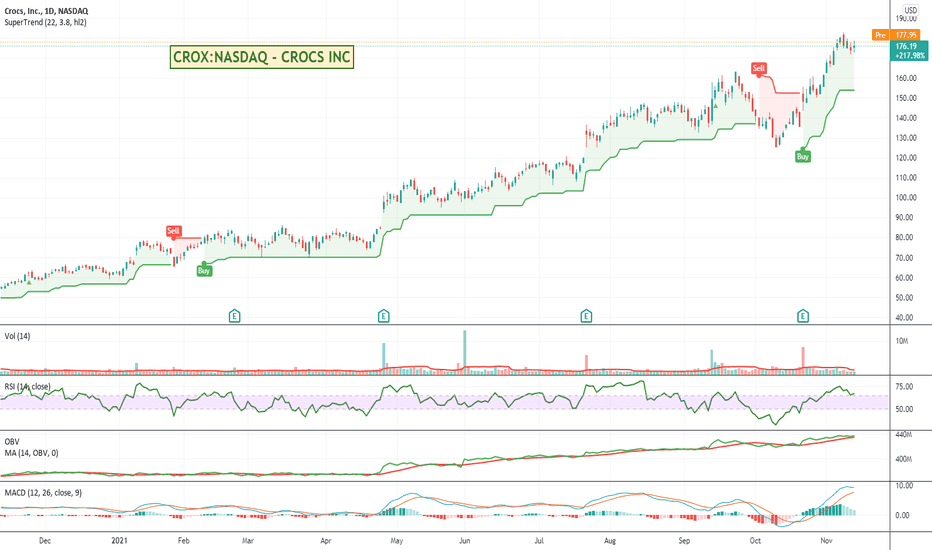

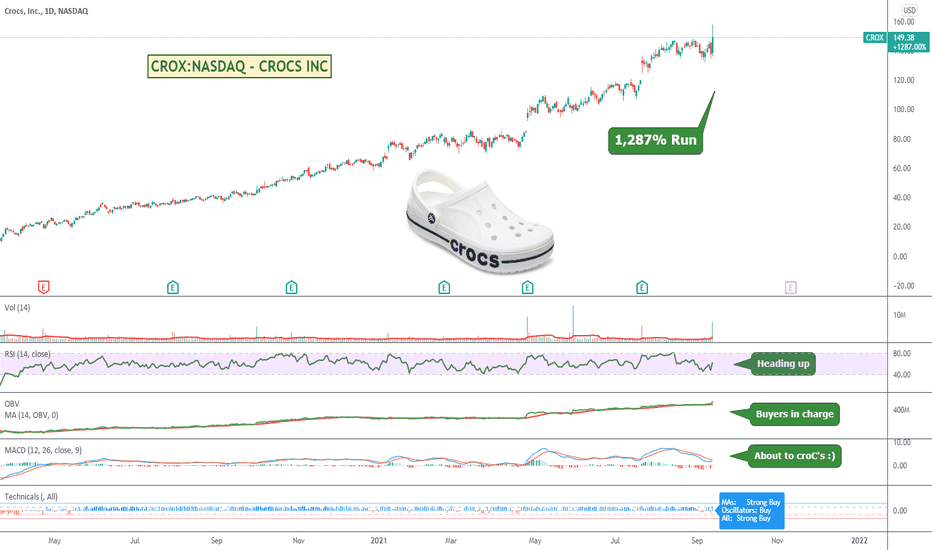

CROX has nudged over 200% for the last 12 monthsCrocs has been one of the pandemic success stories having gained nicely over the last couple of years as people at home sought out more casual footwear.

It might be a little expensive at the moment so don't be surprised if it pulls back a little, but a nice and steady consistent performer overall.

Worth a watch.

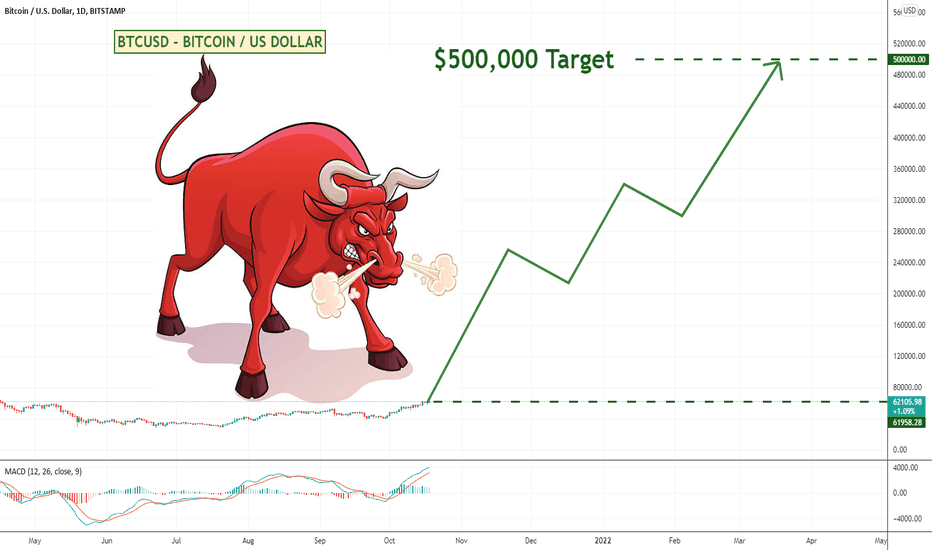

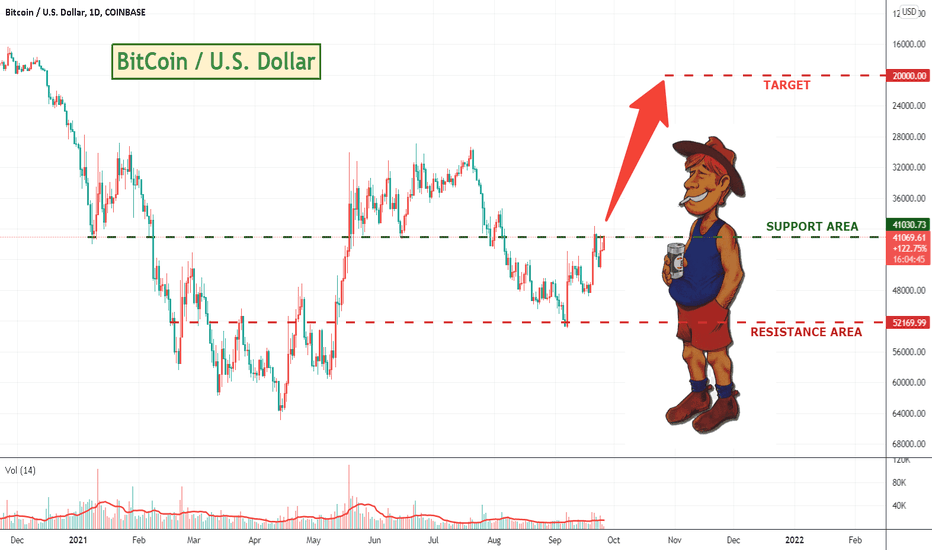

Well its official. Bitcoin to $500k !Cathy Wood in an interview came out today and declared that a Bitcoin valuation of around $500,000 might not be such a big stretch after all if institutions start to accumulate - especially with the likely imminent release of Crypto ETF's.

“If institutions around the world were to allocate 5 per cent of their portfolios to bitcoin, that allocation alone … would add roughly US$500,000 to bitcoin’s price today,” she said.

Is Cathy likely to be right - who knows. Will Bitcoin get to $500k a coin - who knows. Is it fun to speculate - probably :)

What do you think? $500k might not be a reality, but it might make $100k perhaps a little more likely than it might have been a few short weeks ago.

Not trading advice! But if it gets to $500k, here is my post for posterity :D Wonder if I will be alive...

Article: www.fintechbusiness.com

Australias Ethical Investment Fund (AEF) is running nicely.AEF has been having a good run over the last 12 months, up a bit over 150%.

AEF typically invests in a portfolio of industries, which includes clean energy, sustainable products, medical solutions, innovative technology, healthcare, recycling, energy efficiency, education, and aged care.

A win for the good guys.

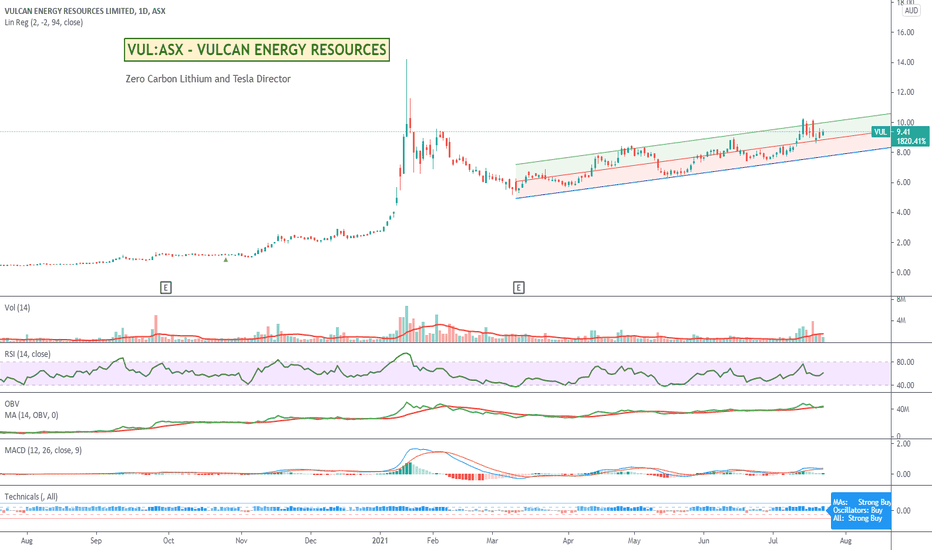

ASX's Vulcan Signs Deal To Sell Lithium to South Korea's LG ChemI've liked Vulcan for a long time as a Zero Carbon Lithium Provider with a strong European presence. This latest news with South Koreas LG Chemical would certainly seem to reduce some of the supply chain risk in the business in terms of long term high profile relationships. LG Chem is one of the biggest battery manufacturers - especially for Electric Vehicles - in the World.

Short version: "Australia-listed lithium miner Vulcan Energy Resources VUL said on Monday it had signed a long-term deal to sell lithium hydroxide from its German project to the battery unit of South Korea's LG Chem 051910".

You can see it has tried to break out and make some new highs but has failed each time, so worth keeping an eye on it.

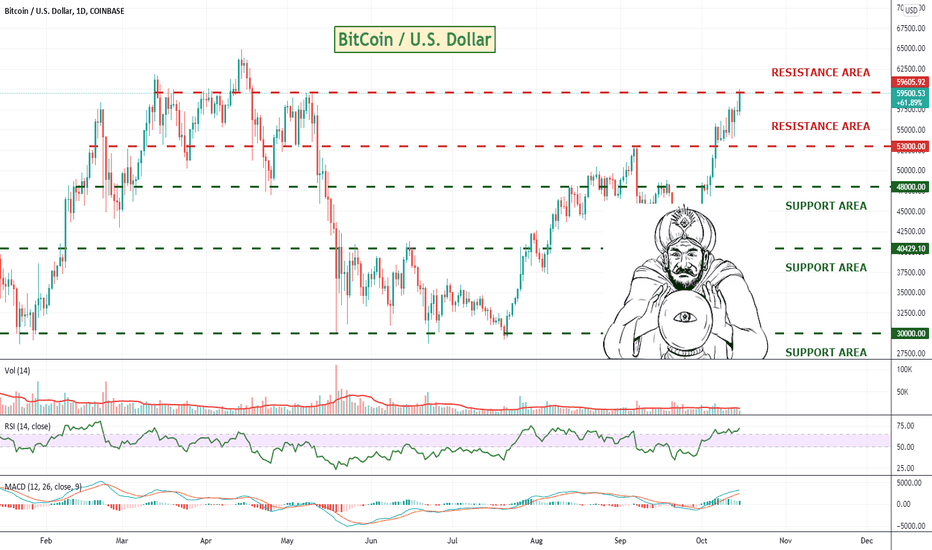

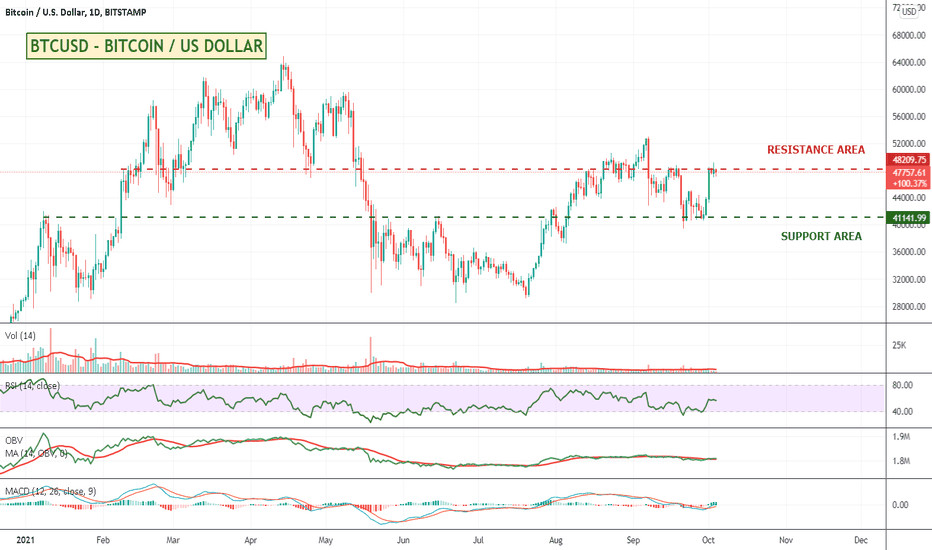

My magic lines think there will be a pullback. What do you thinkBTC looking good, but RSI getting into that pullback area with resistance at this point. Going to need some more volume to push through.

I'm going to guess a pullback before another run.

What do you think short term

1. Push through to new highs

2. Consolidate here

3. Pullback and then retest

4. Collapse and burn back to $53k

ASX Based Core Lithium SwingingSaw this a couple of days ago but didnt press the buy button as I was chasing some of US EV stocks, but its up 8% today and looking reasonably strong. Little bit of upside in the swing still left, but could of course reverse soon. Be interesting to follow it with a close trailing sell. Might be worth a look.

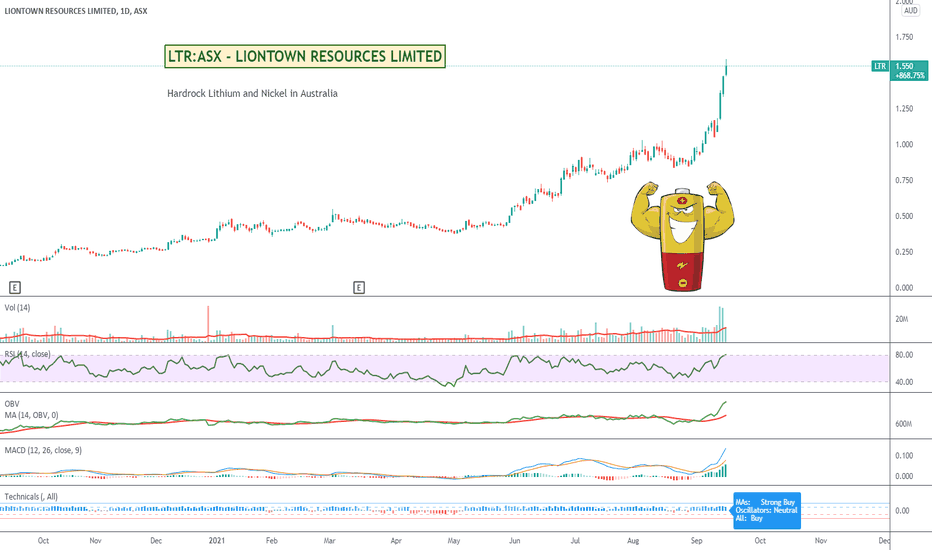

Lithium Running Hard On Shortages NewsAustralian Lithium miners like Liontown Resources are running really well at the moment with all the news around battery shortages.

Might be a bit too late to catch this one, but well worth looking around for other Lithium suppliers that might not have run as hard yet.

"Lithium hydroxide prices hit all-time highs of $20,000 per metric ton on Sept. 8, according to S&P Global. The primary reason is a surge in electric vehicle sales in China that has driven demand for lithium-ion batteries higher. Between January and August, sales of new electric vehicles (NEVs) in China jumped 194% year over year, according to data from the China Association of Automobile Manufacturers."

Source: www.fool.com

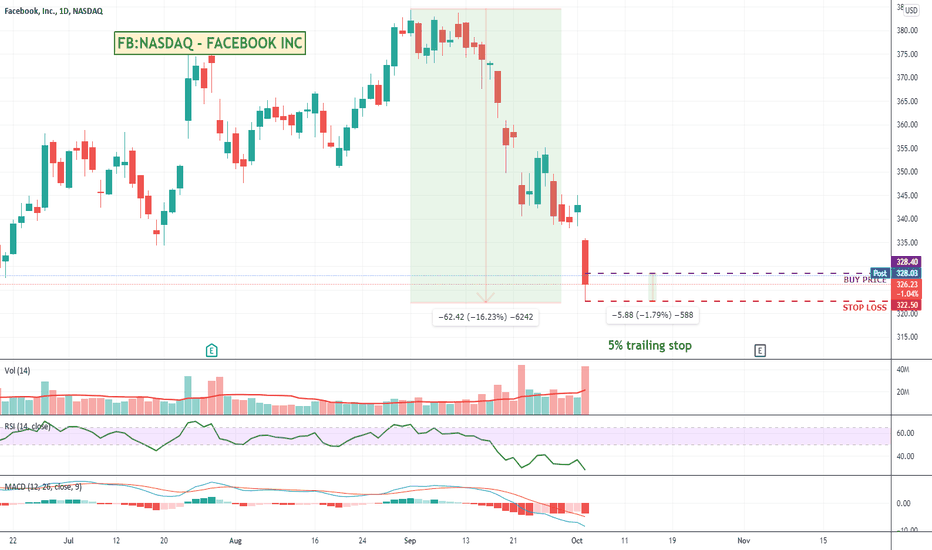

@Spreck talked me into buying FB - Good idea or Fail?@spreck talked me into buying some Facebook shares in the After Market hours.

It is definitely in the oversold area and down around 16% off its highs so a pretty good pull back and I can see it is up slightly in the After Market auction - hence my buy price a bit higher than the close of day.

It seems to be at a bit of a support area, so I'm hoping for perhaps a short term bounce, so have my stop at the bottom of todays low (so under 2% of my buy price), and a 5% trail to get me out quickly if it is some kind of technical bounce. I don't think it is going to be a long term buy and hold. Probably more downside in the short to medium term it seems.

Ironically the Facebook site is ALSO down at the moment.

What do you think - Good idea or Fail ? :)

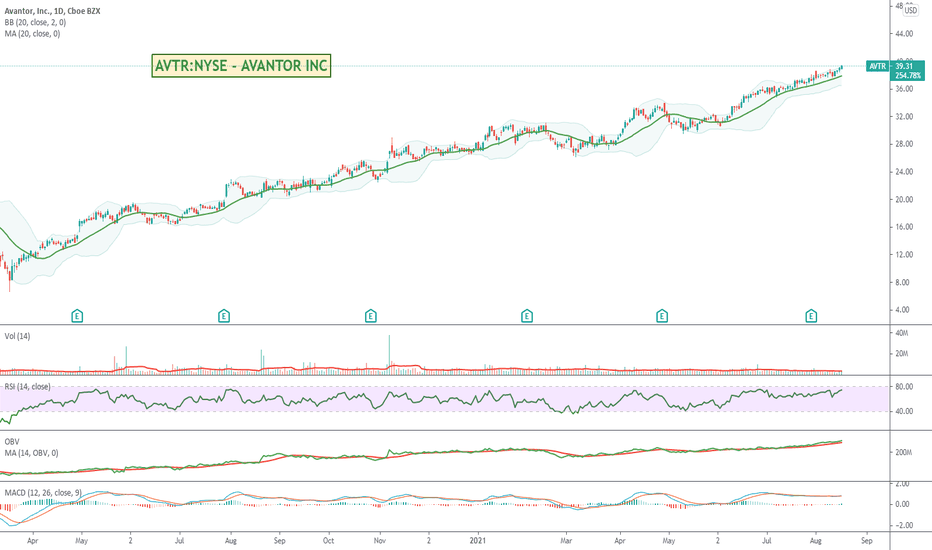

Avantor Named Best Company in Bioprocessing ExcellenceAvantor is having a nice steady run. Might be a bit overbought according to its RSI, but I do like that it is still a sub $40 stock. Will keep an eye on it.

From their website:

Avantor®, a Fortune 500 company, is a leading global provider of mission-critical products and services to customers in the biopharma, healthcare, education & government, and advanced technologies & applied materials industries. Our portfolio is used in virtually every stage of the most important research, development and production activities in the industries we serve. One of our greatest strengths comes from having a global infrastructure that is strategically located to support the needs of our customers. Our global footprint enables us to serve more than 225,000 customer locations and gives us extensive access to research laboratories and scientists in more than 180 countries. We set science in motion to create a better world.

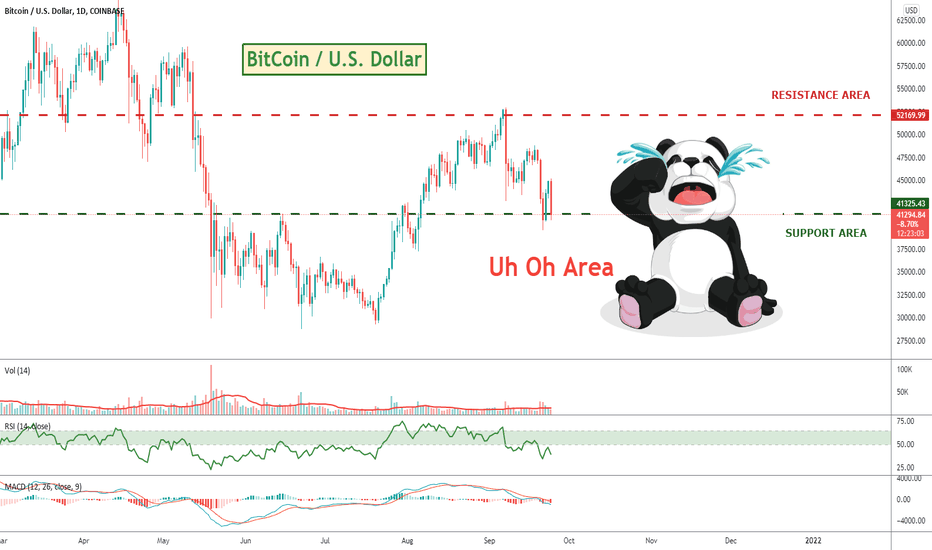

Bitcoin back at resistance. What do you think - Up or Down?BTC has been range trading a little. Has a great support base at that $41k mark, but is having trouble breaking back up into the $50ks.

I don't feel like there is enough momentum there right now - and it is indeed trading sideways.

Will be interesting to see what the stock market does over the next week. Many are tipping a stock market pullback / crash and recommending Gold, Silver and BTC as a bit of a flight to safety. China is creating nervousness around how they will deal with Evergrande further unsettling the market.

What do you think? BTC UP or DOWN?

Australia's Flight Centre - YAY or NAY ?Was just having a bit of a look through some Australian stocks on the ASX and notified that both Flight Centre and Webjet ( ASX:WEB ) were looking bullish on the charts.

Makes sense when you think that a lot of the travel restrictions we are under could soon be lifted.

Pricing looks a bit expensive at the moment. Until you zoom out ;)

Might be a bargain. What do you think - Yay or Nay ?

Crocs Starts Using Bio-Based Material in ShoesIs there anything these shoes can't do? One of the best runners ( walkers ? ) over the last 18 months Crocs continue to keep reinventing themselves with celebrity endorsers, designer Crocs, and now environmentally friendlier versions as well.

Had a good move up yesterday against the market and signs are looking bullish.

Some people might say they are embarrassed to wear them, but their share price says plenty of people have and like them :)

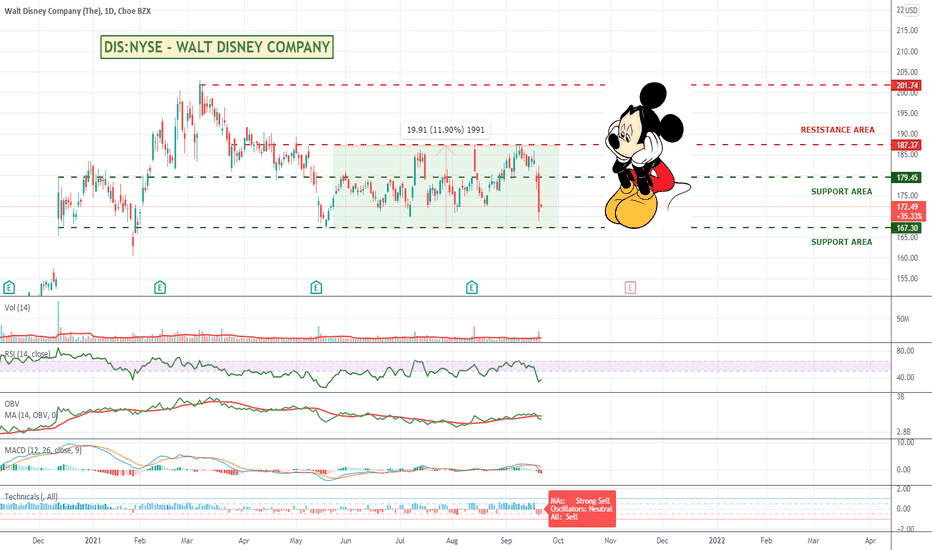

Disney back at the bottom of its trading range.Could be good for a swing trade back up to the top of its range if it moves back up again which I would think it should after being caught up in the market sell off.

Keep your stops close though in case it breaks through that support area and then again when it gets close to the top of the range and bumps up against resistance.

Worth a look.

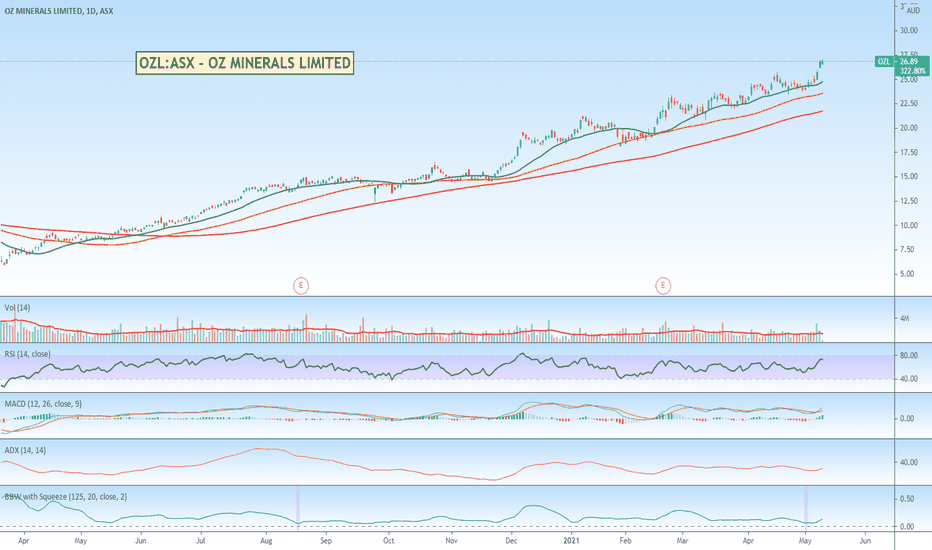

OZ Minerals - Australian Copper Miner. Was just having another read of some articles that indicate that copper demand from the transition to cleaner energy will grow somewhere between 600% and 900% over the next 5 to 10 years or so. Amongst other battery minerals copper is critical for solar panels, wind turbines, electric vehicles and battery storage and as we head towards net-zero emissions, increasingly large quantities of copper will be required. It is a resource that has been underinvested in over the last few decades so there is a shortfall in supply.

Thought I would have a look around and see what copper miners are about and this one continues to look good.

OZ Minerals is a copper focused miner in Australia and you can see from the chart has been having a great consistent run over the last 12 months. Thought I would have a look around and see what copper miners are about and this one looks good. Well worth keeping an eye on for a potential trade.

I posted about them a few months ago and they are continuing to head up.

March 30 2021 Post

August 4 2020 Post

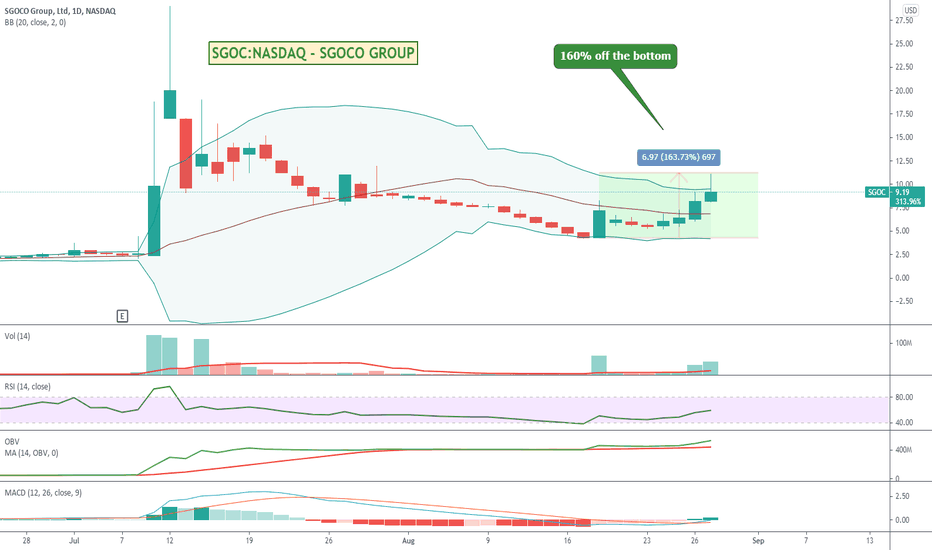

SGOC Back Up Above Its 20 Day MA on Strong VolumeStock is up around 180% over the last few days on strong volume so feeling more like a pump than anything newsworthy that I could see. Might be a short term play in it but I'd keep stops tight.

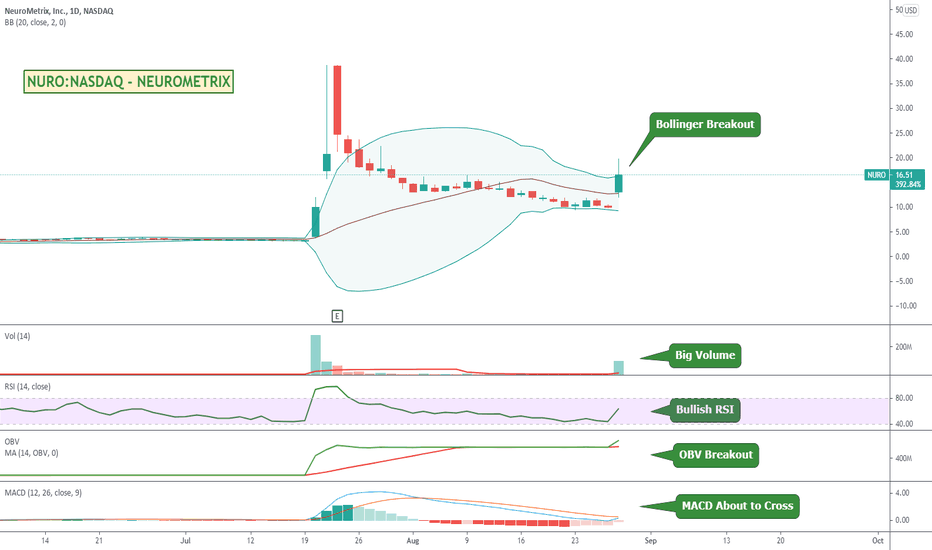

NURO looking bullish.NURO is all over social media and has had a big move up last week with significant volume. Be interesting to watch.

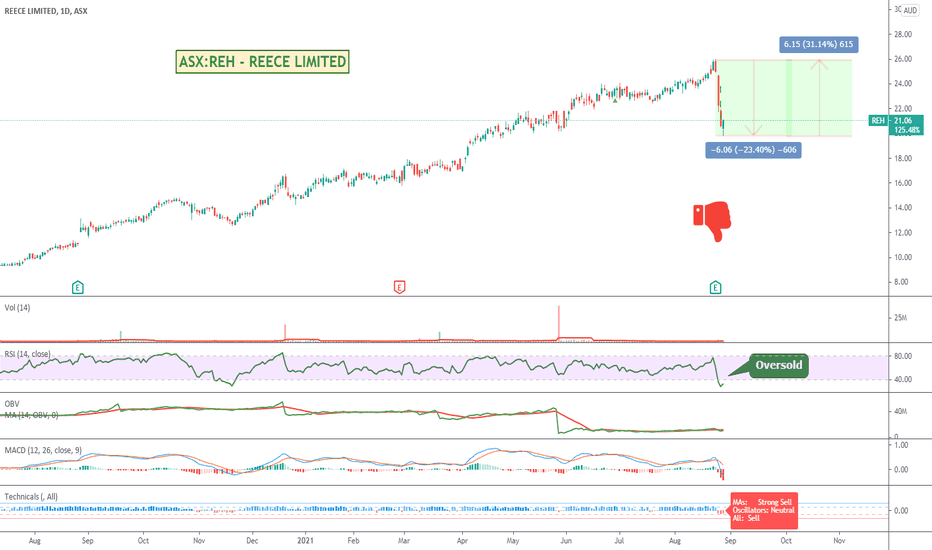

Australias Reece Oversold on Earnings.REH or Reece also took a big hit with earnings. Looks oversold down 20% off its highs so around 30% to recover if it resumes its upward trend.

Earnings headlines didn't look too bad. Analysts were looking for more...

Reece FY Revenue Rose 4% To A$ 6.271 Billion

* FY REVENUE ROSE 4 PERCENT TO A$ 6.271 BILLION

* FINAL DIVIDEND UP 100% TO 12 AU CENTS PER SHARE

* FY NPAT UP 25% TO A$286 MILLION