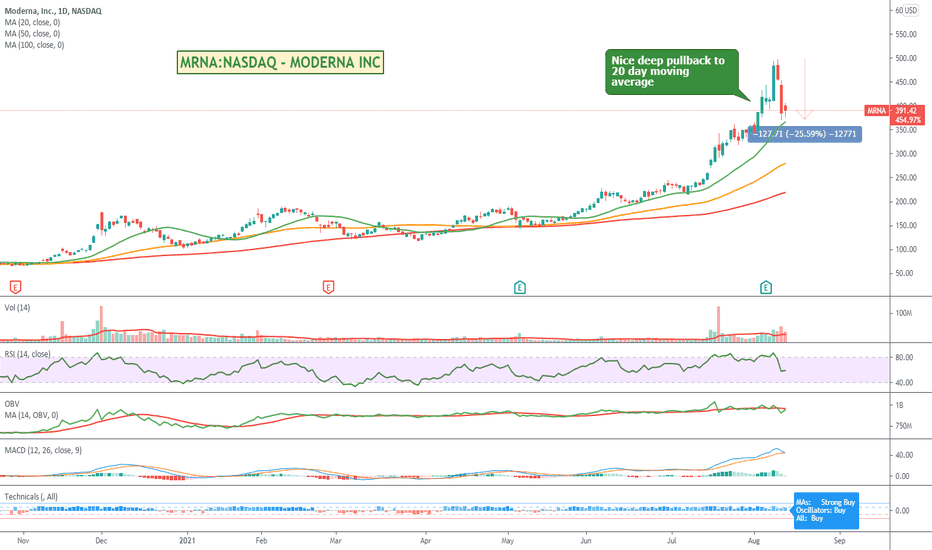

Moderna Back At Value Area After 25% PullbackI think Moderna and Pfizer will be making serious revenue off Corona initially but more importantly ongoing with "booster" type shots for years to come - GLOBALLY!

I've been waiting for a pullback as this stock was running so hot, and looks like we have it.

Worth investigating.

Search in ideas for "zAngus"

Bullish: Palantir Rises On Q2 Revenue Beat, Upbeat OutlookI took a punt on Palantir when it hit support recently and it is looking increasingly bullish especially after recent news with securing more and more government revenue.

Gets a lot of coverage from the various retail Youtubers which helps keep it in people minds. It's still a mid $20's stock so has that psychological "good value" feel.

Might be worth a look.

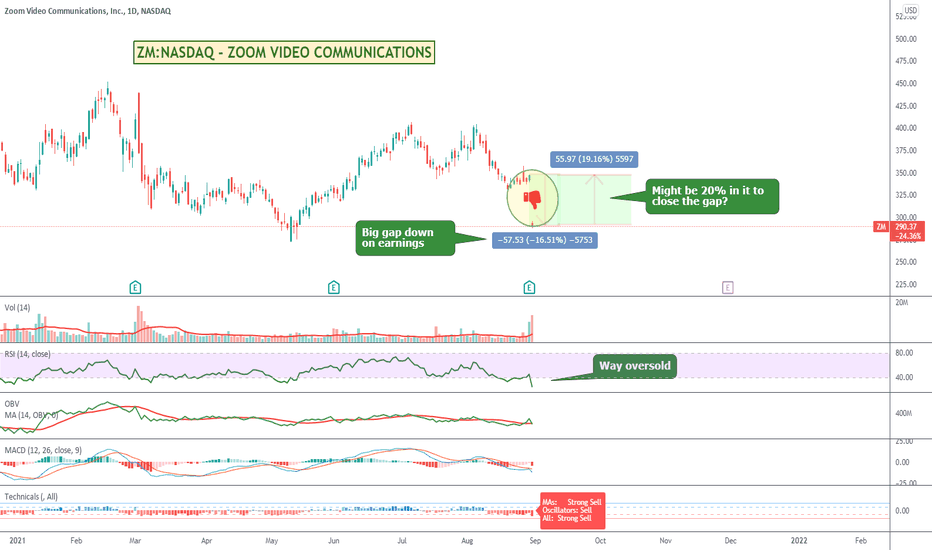

BIG over reaction on Zoom EarningsBig 16% gap down on Zoom on earnings that I would think will get filled. Zoom is still making money hand over first, but just at a declining rate.

I think this drop is an over reaction. Might be a good short play in it. Might be 20% in it to close the hole.

As always keep stops handy.

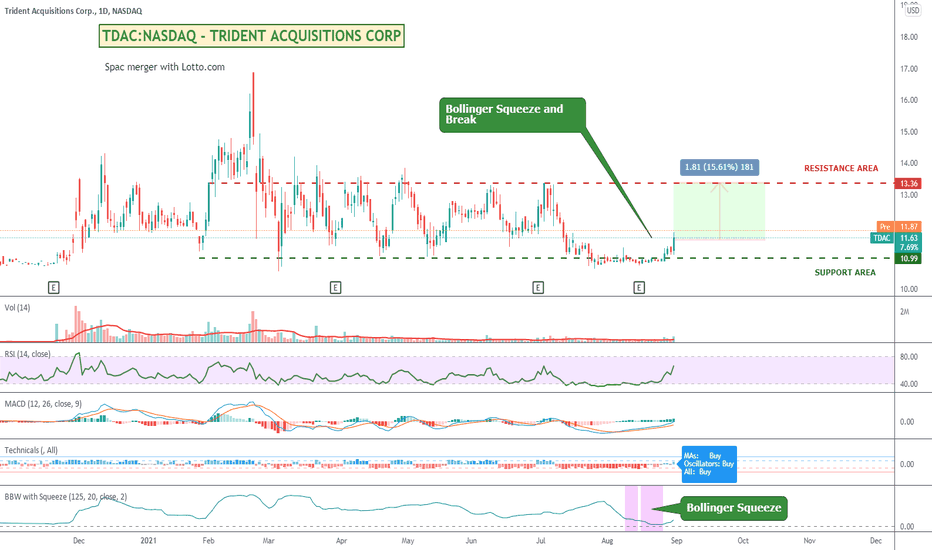

Trident Acquisitions Unveils Plan to Merge With Lottery.comThe merger is actually old news, I hadn't seen it before, but I found this looking for Bollinger Breakouts after a squeeze and this fits the bill.

Looks like it has also been steadily trading in a range until recently so could be good for a swing trade as well.

Close up of the Bollinger squeeze and break.

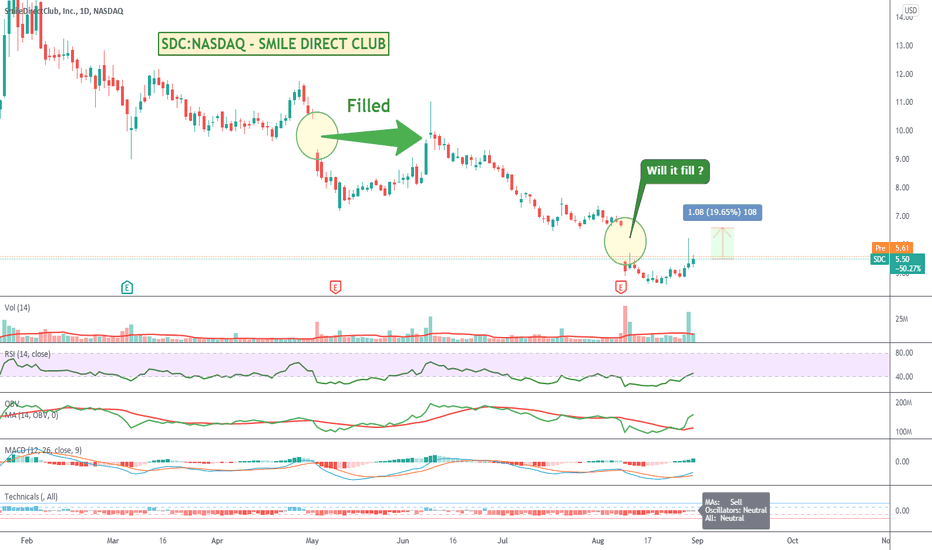

Smile Direct Gapped Down. Will It Fill ?Might be a short term trading opportunity to see if this fills like gaps tend to.

Stock is in a long term down trend so could be a quick hit and run type trade.

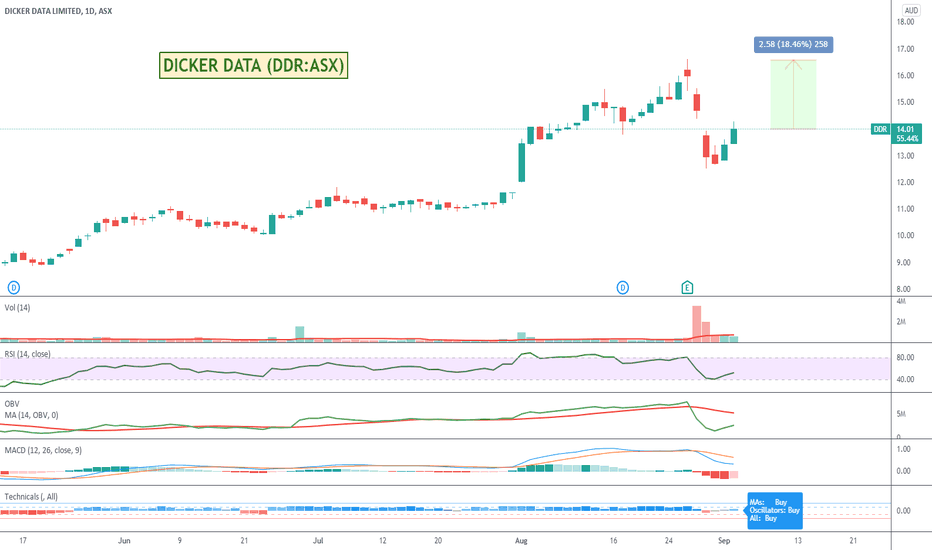

Australias Dicker Data oversold on founder selling his sharesDavid Dicker sold off a bunch of stocks which sent FUD waves through the stock - until - he told investors it was so he could buy a private jet, fund his self-made supercar project, and play the US stock markets. Legend.

Stock could be worth a look.

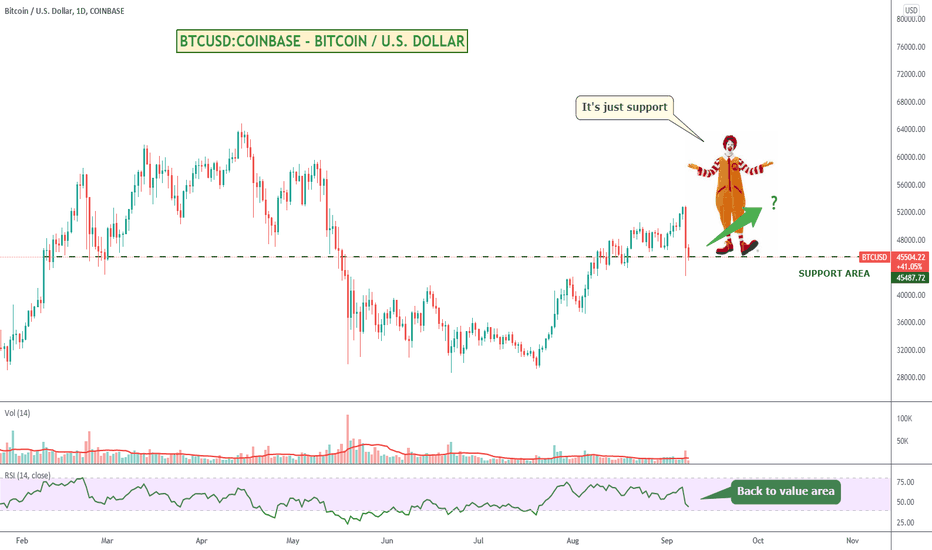

Crypto Crash - Probably Not - Ronalds Not Worried.Most crypto currencies and related stocks have simply followed Bitcoins lead and taken a bit of a breather and gone back to a safe area of support after its recent bullish moves.

Could be a great buying opportunity for those who like the coins if they bounce.

Buyer beware though and don't dive in too early. Wait for a bit of a recovery confirmation.

Good area to watch to see what happens next.

Apple Under Pressure After Adverse RulingApple has dropped around 5% from its recent highs along with a sell off in the broader market but perhaps also exacerbated by the recent ruling where "the U.S. District Court in Northern California found the tech icon in violation of the state’s Unfair Competition Law and issued an injunction that allows developers to place external links at the Apple store, enabling them to bypass the company’s formerly-exclusive payment system" (Source: finance.yahoo.com)

Apple is back at a pretty strong support area and has a new iPhone 13 launch coming up with week so that should help it rally, depending on what the overall market does.

Might be a buy if it goes up a little (stop order - or trailing buy order) or avoid if it goes down.

Worth a look.

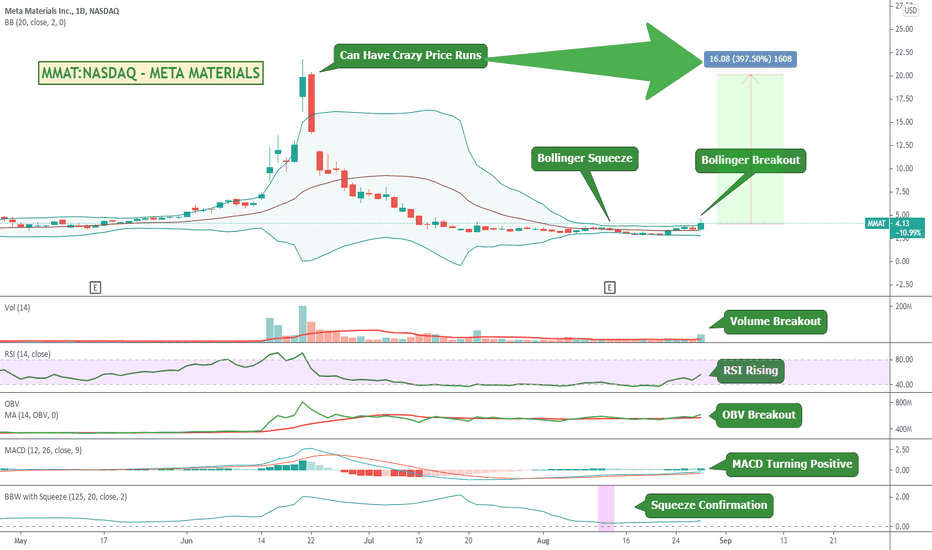

Meta Materials Bollinger Breakout SignalsPurely technical play. Various bullish signals described above in the chart put the odds of an upward move in our favour. Would be a shorter term play for me.

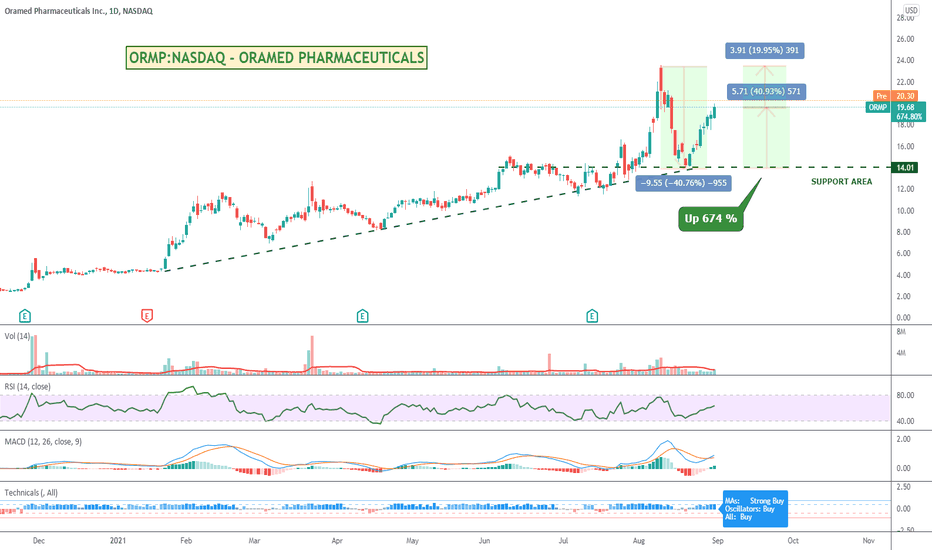

Preparing to conduct clinical trials for an ORAL Covid vaccineThis could be interesting. I am sure there are numerous companies racing to see if they can get an oral version of a Covid vaccine out into the market and especially booster tablets.

Oramed focuses on making oral delivery solutions for drugs typically delivered via injection. Its current focuses are an oral insulin capsule to be used for the treatment of individuals with diabetes, and the development of an oral COVID-19 vaccine for use both as a standalone vaccine and as a booster for people who have been previously vaccinated for COVID-19

The stock has run hard, up over 60% for this period. It had a deep 40% pull back and seems to be recovering nicely.

One to watch.

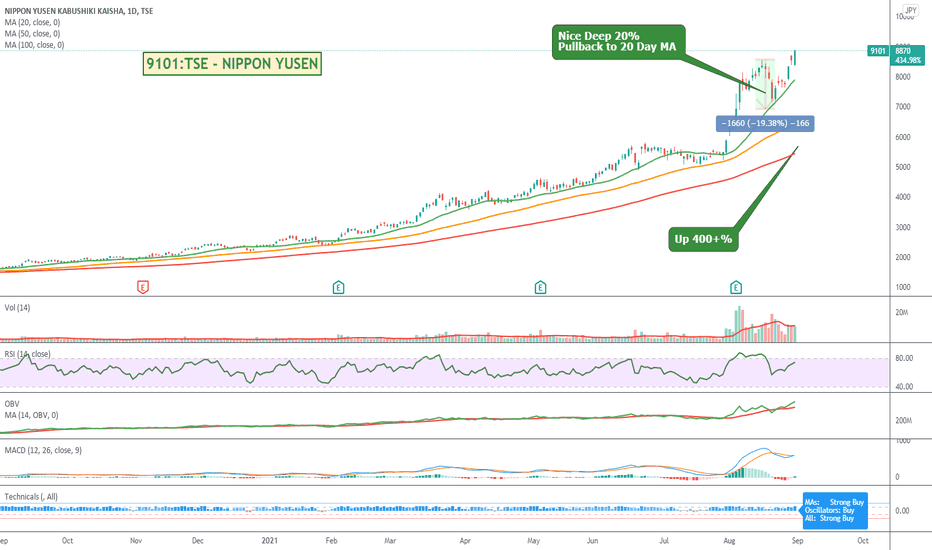

Japanese stocks have been enjoying an influx of foreign buyers.Japanese stocks have become increasingly sought after by foreign traders enjoying their bullish rises.

Nippon Yusen KK operates as a global logistics enterprise offering ocean, land, and air transport services and has been trending strongly over the last 12 months.

Trading technology allows us to trade the globe, so if you are still limited to your domestic market you might be missing out on some of these kinds of opportunities.

Worth a watch.

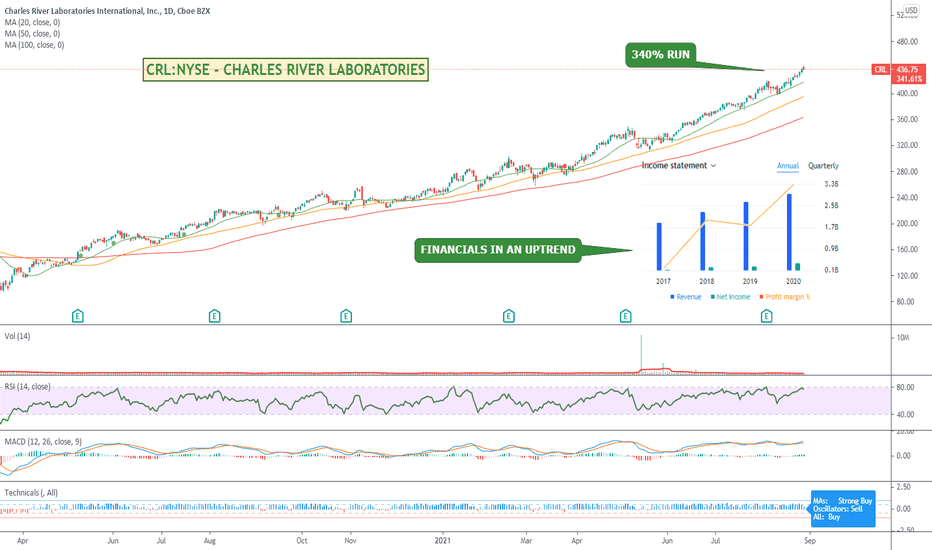

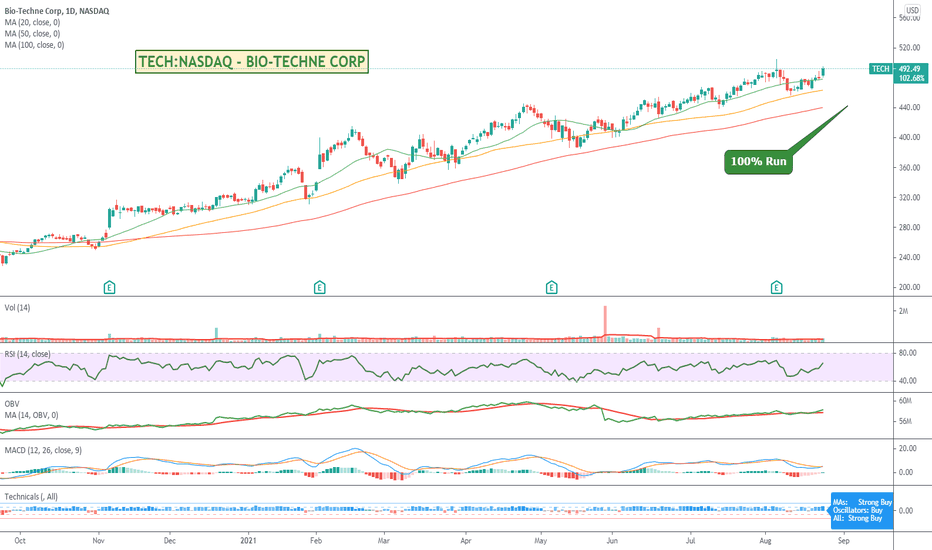

Charles River Laboratories Q2 Profit, Revenue RiseStock suggested by my dad as one to watch. Nice strong upward trend with financials also headed in the right way.

Might be a bit expensive at the moment looking at the RSI, so on the watch list waiting for a bit of a pullback prior to any entry decisions.

Worth a look.

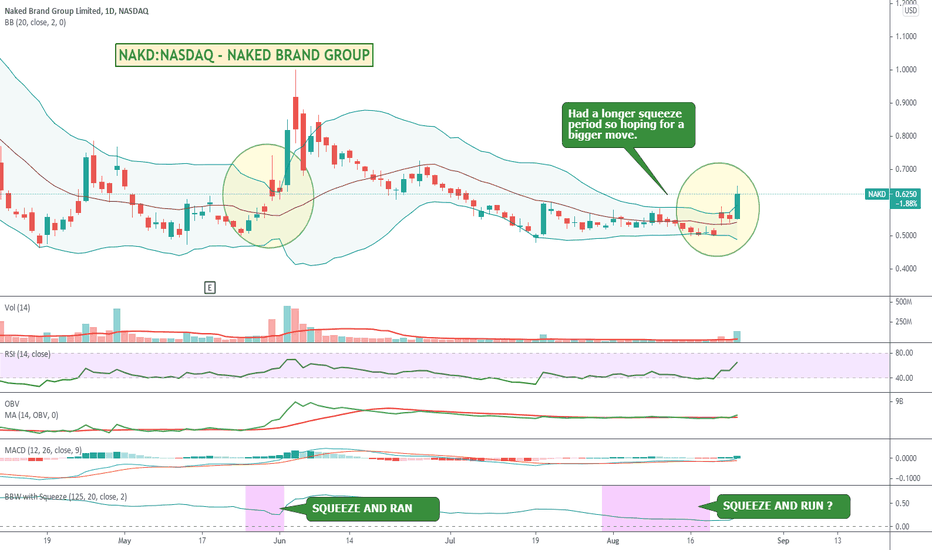

Is Naked Brand Setting Up A Breakout ? Bollinger has been squeezing for a longer period than last time and indicators looking like they are becoming more bullish especially with the upper band breakout on volume.

Sometimes these will have a day 2 or 3 pull back and then run hard.

On the watch list.

Acasti trading in a range. Might be good for a short swing tradeAs per title, looks like it might be heading back up in its range. Already up 20% off the bottom with possibly another 20% to go. Just crossed up over its 20 Day Moving Average which is often a good sign.

Buyer beware. Keep your stops tight especially as it nears the top.

BTCM Bullish as BIT Mining Swings to Profit as Revenue SurgesWith the price of BTC steadily going back up, some of the Bitcoin miners are seeing a nice rapid recovery in their prices as well.

There are quite a few out there, but my new crane indicator says this one looks petty good in terms of potential upside.

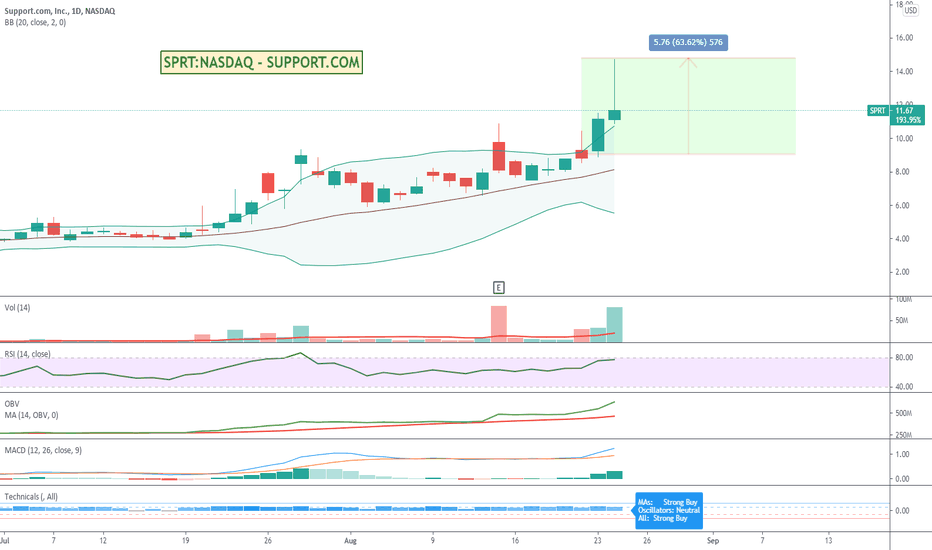

You ever buy a stock and forget why?I bought this a couple of days ago at $9.05 and have no memory of why. Wish I did because I'm up 40% on it after a couple of days. Really should have paid more attention.

I suspect it would have been because I was screening for stocks up > 200% over the last 12 months with a Bollinger Breakout.

Looks like its in oversold territory so keeping my stops close.