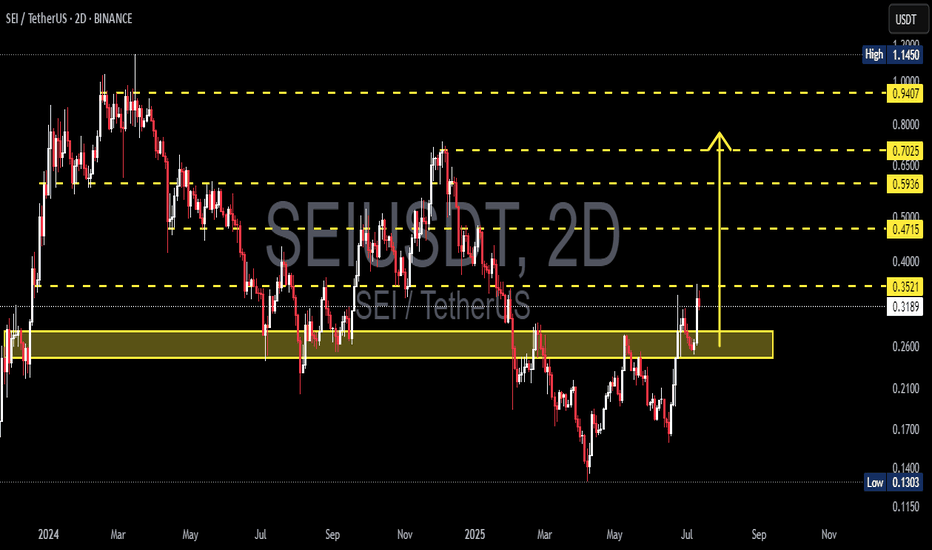

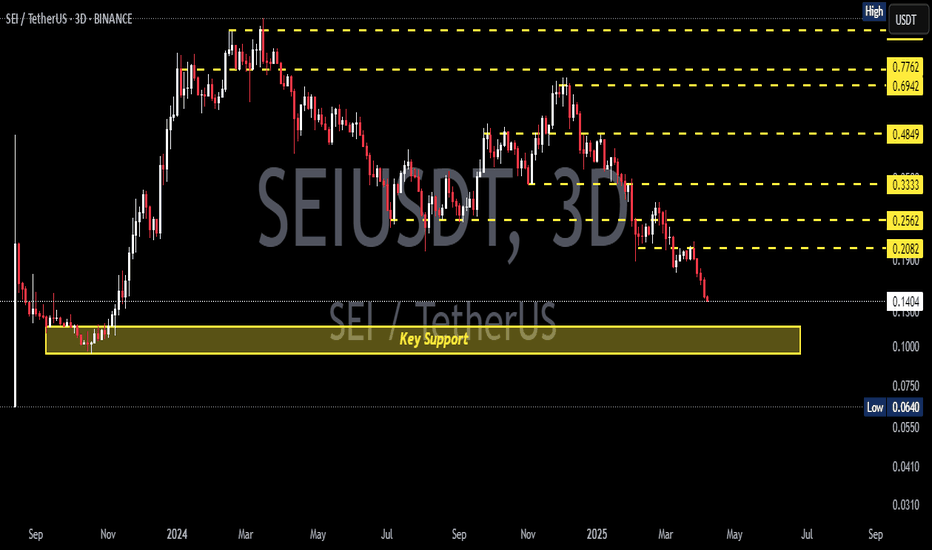

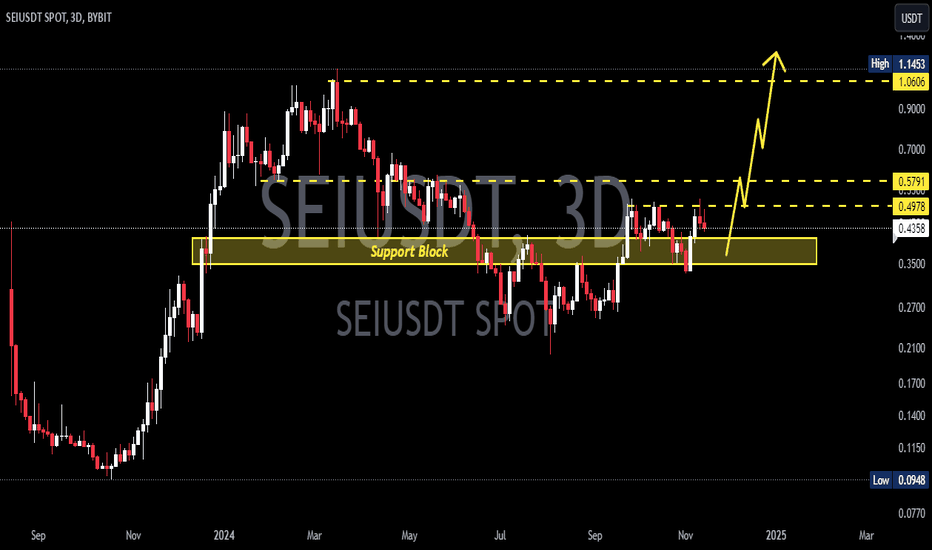

SEI/USDT Ready to Fly? Breakout from Accumulation Zone Signals🧠 Market Overview:

SEI/USDT has just delivered a powerful technical signal — a clean breakout from a major accumulation zone that has been holding price action for several months. With increasing volume and bullish price structure, this breakout could mark the beginning of a sustained upward trend.

The $0.24–$0.27 zone acted as a strong accumulation base. Now flipped into support, this area could serve as the launchpad for the next leg higher if price continues to hold above it.

📌 Pattern Breakdown:

🔸 Pattern: Accumulation Base Breakout

SEI traded sideways for nearly 6 months within a tight consolidation range.

This behavior is typical of institutional accumulation (smart money phase).

A strong bullish breakout above $0.27 has occurred.

Price has successfully retested the breakout level, confirming it as new support.

📈 Bullish Scenario (Primary Bias):

As long as SEI holds above the breakout zone ($0.26–$0.27), bullish continuation is likely.

🎯 Upside Targets:

$0.3521 → Minor resistance and key breakout validation.

$0.4715 → First major historical resistance.

$0.5900 → Strong price memory zone.

$0.5936 – $0.7025 → Key supply zone from previous market cycle.

$0.9407 up to $1.1450 → Long-term extension targets if bullish trend accelerates.

💡 Potential ROI from support to top target: Over 300%

📉 Bearish Scenario (Alternative View):

If price falls back below the breakout zone:

It could signal a false breakout (bull trap).

Price may re-enter the previous range and lose bullish momentum.

Downside levels to watch:

$0.21 (mid-range)

$0.17 (range low)

Failed breakout retest = bearish warning for long positions.

⚖️ Validation & Risk Strategy:

Breakout occurred with strong bullish volume → confirmation signal.

Ideal stop-loss: just below $0.25 to protect against invalidation.

Strategy: Buy on successful retest → Add if price breaks and holds above $0.35.

🧠 Pro Tip for Traders:

This setup is ideal for swing traders and mid-term investors.

The current breakout pattern is consistent with the Markup Phase in the Wyckoff Cycle.

Monitor market sentiment and volume to validate trend continuation.

If Bitcoin remains stable or bullish, altcoins like SEI may strongly outperform.

#SEI #SEIUSDT #BreakoutTrade #CryptoSignals #AltcoinAnalysis #ChartPattern #VolumeBreakout #TechnicalAnalysis #PriceAction #CryptoTraders

Seiusdlong

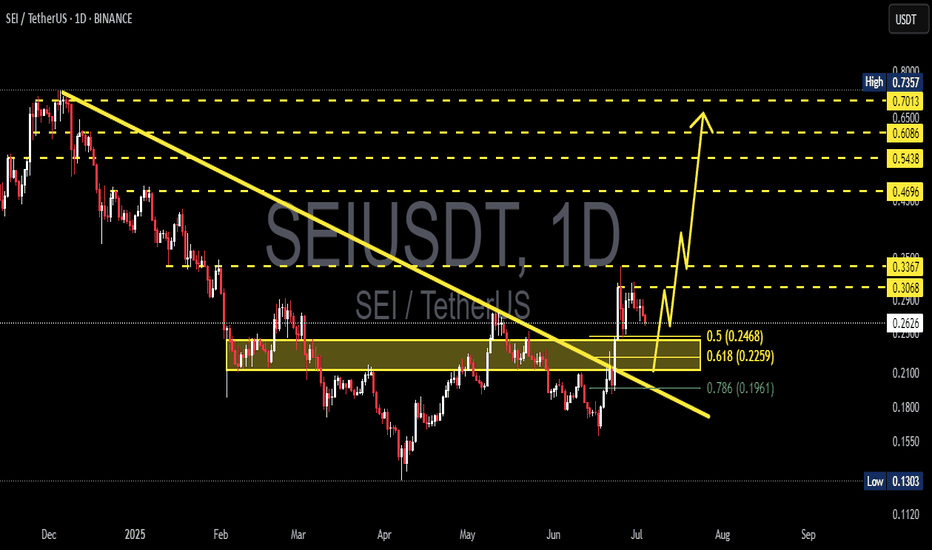

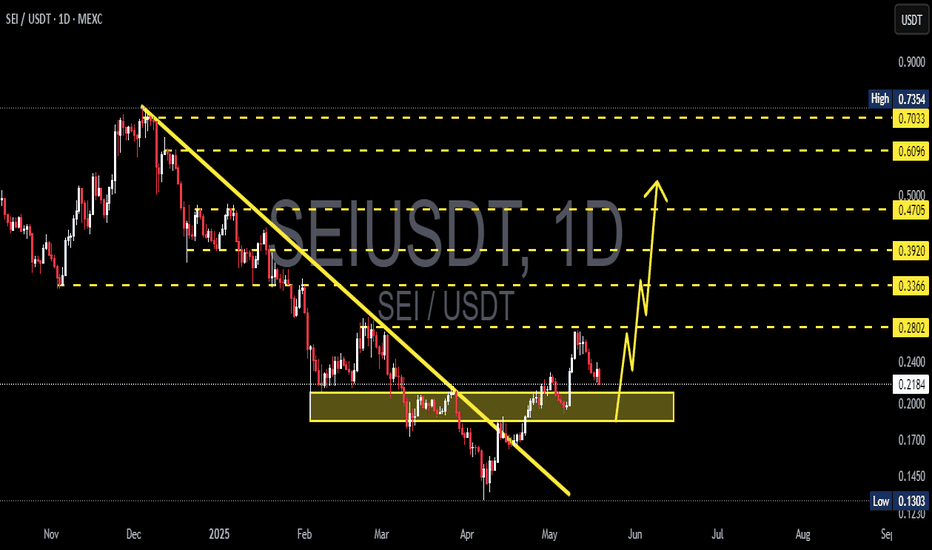

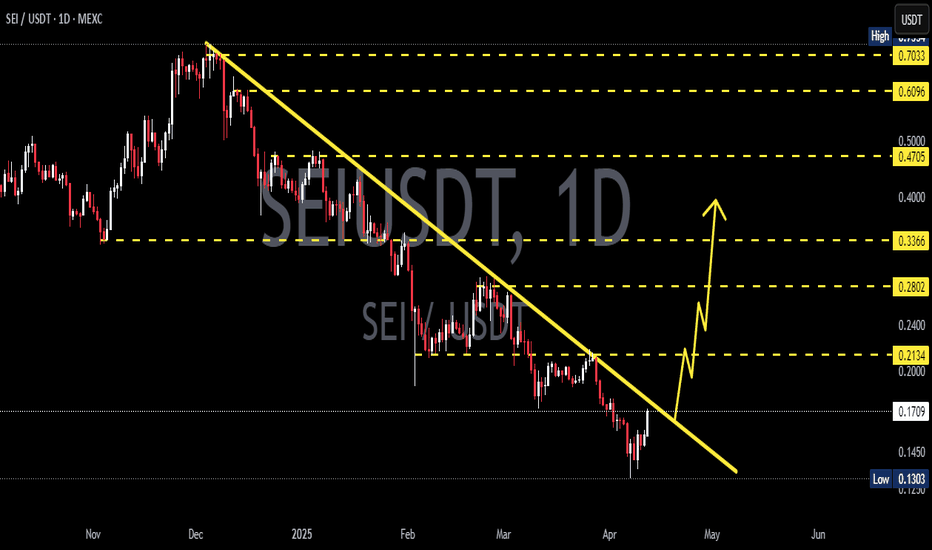

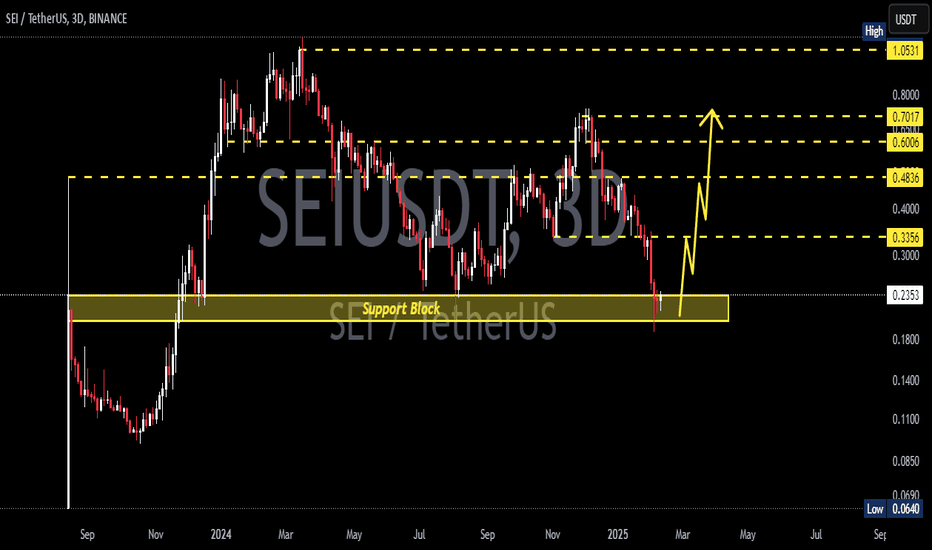

SEI/USDT Poised for a Major Breakout – Will It Surge Toward $0.7📊 Full Technical Analysis:

The SEI/USDT daily chart reveals a compelling setup with strong breakout potential. Here's a detailed breakdown:

🔍 Pattern & Key Structure:

Descending Trendline Breakout: SEI has successfully broken out of a long-term descending trendline that has suppressed price action since December 2024 — a strong early signal of a bullish reversal.

Bullish Retest in Progress: The price is currently retesting the breakout area, aligning with a historical demand zone and Fibonacci retracement levels of 0.5 ($0.2468) and 0.618 ($0.2259).

Previous Consolidation Zone: SEI previously moved sideways within a yellow box between $0.18 – $0.25. The breakout from this zone adds bullish confirmation.

🟢 Bullish Scenario:

If SEI holds above the key demand zone ($0.2259 – $0.2468), a strong rally could follow, targeting these Fibonacci resistance levels:

🔸 $0.3068

🔸 $0.3367

🔸 $0.4696

🔸 $0.5438

🔸 $0.6086

🔸 $0.6500

🔸 Final target: $0.7013 (major resistance)

This scenario is validated by a higher low formation and a continuation of the current uptrend, especially if backed by strong volume.

🔴 Bearish Scenario:

If the price breaks below the demand zone ($0.2259 – $0.2468), further downside may be expected, with potential support levels at:

🔻 0.786 Fibonacci at $0.1961

🔻 Historical support zones at $0.18 and $0.13

A bearish breakdown would invalidate the bullish structure and suggest sellers remain in control.

📐 Pattern Summary:

Pattern Type: Descending Trendline Breakout + Bullish Retest

Validation: Retest aligned with Fibonacci & prior consolidation

Bias: Bullish, as long as the price holds above $0.2259

📝 Conclusion:

SEI/USDT is showing early signs of a bullish reversal after a breakout from its long-term downtrend. A continuation toward higher Fibonacci levels is likely if the price holds the key demand zone. Traders should watch for bullish confirmation signals near support before entering.

#SEI #SEIUSDT #CryptoBreakout #BullishSetup #TechnicalAnalysis #FibonacciTrading #CryptoSignals #AltcoinSeason #ChartPattern #CryptoTA