SelectQuote | SLQT | Long at $2.18SelectQuote NYSE:SLQT is currently resting within my historical simple moving average zone. This often signals consolidation and a future move (in this case, let's hope up). Looking at the company's financials, NYSE:SLQT is currently profitable. For Q3 2025 (ended March 31, 2025), the company reported a net income of $26.0 million, up from $8.6 million in Q3 2024. This follows a strong Q2 2025 with a net income of $53.2 million. While like most companies there are likely headwinds in 2025 (earnings are projected at a loss of -$0.20 per share due to seasonal fluctuations and investments in 2025 (e.g., new Kansas facility)), profitability is likely to stabilize in 2026, with EPS forecasts of $0.05, supported by improved Medicare reimbursement rates and operational efficiencies. Ongoing Department of Justice allegations could pose risks... but SelectQuote’s recent $350M investment and cost management suggest profitability may continue if legal issues are resolved favorably.

Thus, at $2.18, NYSE:SLQT is in a personal buy zone. There is a potential for the price to dip to the bottom of the historical simple moving average channel (near $1.25) in the near-term, but time will tell.

Targets:

$2.64

$4.24

Selectquote

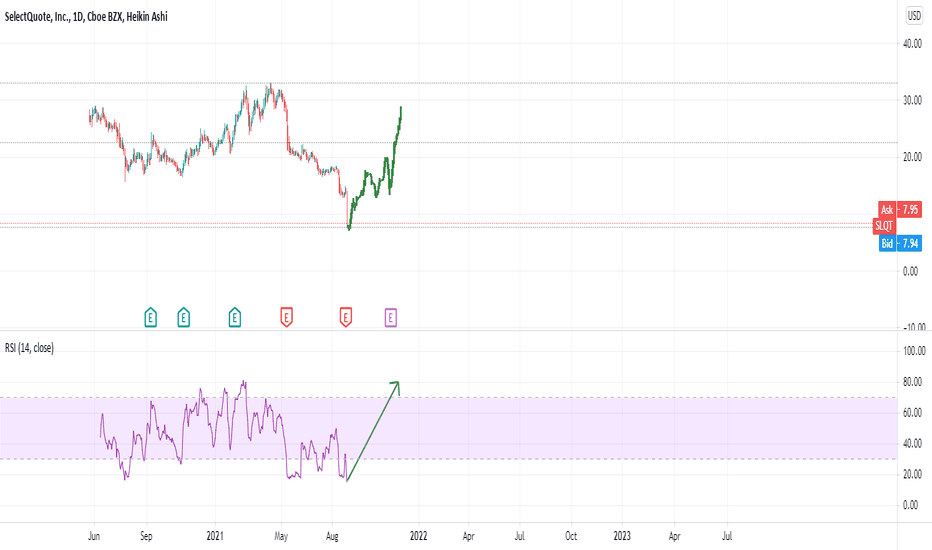

SelectQuote - Strong buy after -44%SelectQuote Stock Drops on Earnings Miss and Analyst Downgrades

SelectQuote shares drop after the insurance company misses earnings estimates, prompting rating downgrades and price cuts from analysts.

Shares of SelectQuote (SLQT) fell sharply Thursday after the insurance agency’s fiscal fourth-quarter earnings missed estimates, prompting rating downgrades and price target cuts from analysts at RBC and KBW.

Shares of the Overland Park, Kansas., fell 44.04% to $8.03.

---

The 44% is on our opinion way overdone. Daily RSI is around 15.