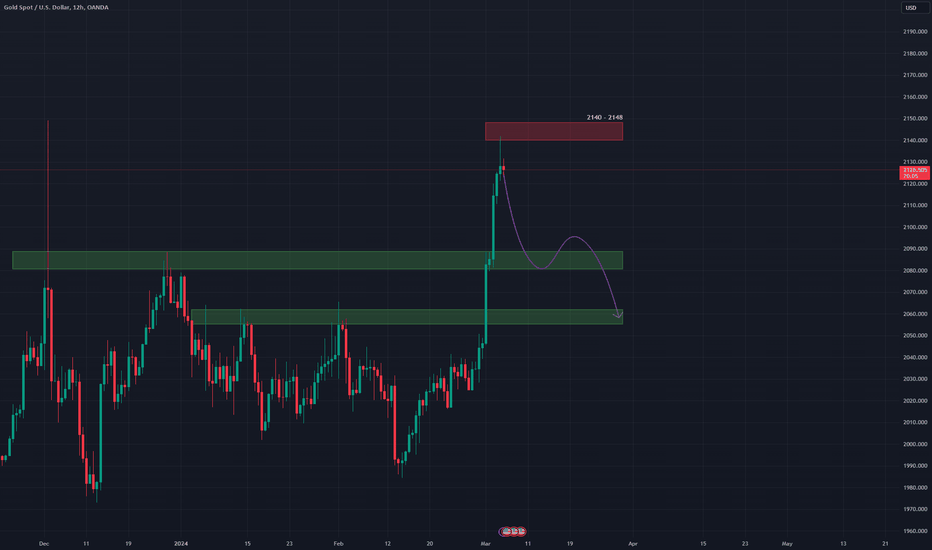

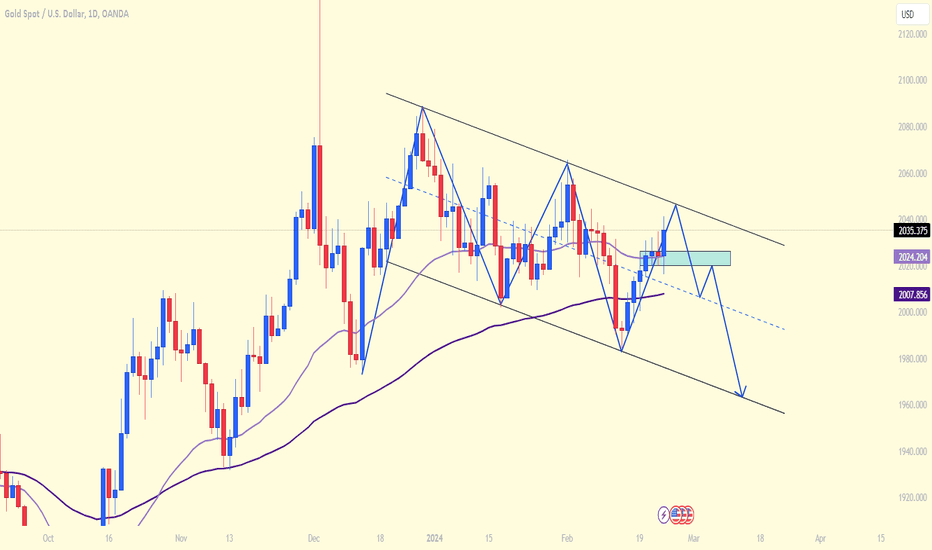

Analysis of Gold on the 12-hour Time FrameAfter a strong upward movement, gold has reached the resistance range of 2140 - 2148 significantly. It seems like it's time for a correction now.

If gold wants to correct due to today's news, we can set our target at 2090, which is an important support level for gold.

Gold Support: 2080.5 - 2088

Gold Resistance: 2140 - 2148

And the price of 2120 determines the market boundary.

Today-tomorrow there will be quite strong news, all focus on Fed Chair Powell. Discussions on interest rates, inflation, and other factors are likely. Given the overall situation in the US, there is a chance that the dollar will receive more support, potentially impacting gold negatively.

Gold might make another move upwards based on the news and touch the resistance zone before starting a downward movement.

Recommended Positions:

Sell: 2142 - 2148

No need for a stop-loss

Short-term Target: 2121 - 2090

Long-term Target: 2060 - 2033

Buy Short-term (Scalp): 2088 - 2085

Stop-loss: 2081

Target: 2094 - 2096 - 2100

Sell-buy

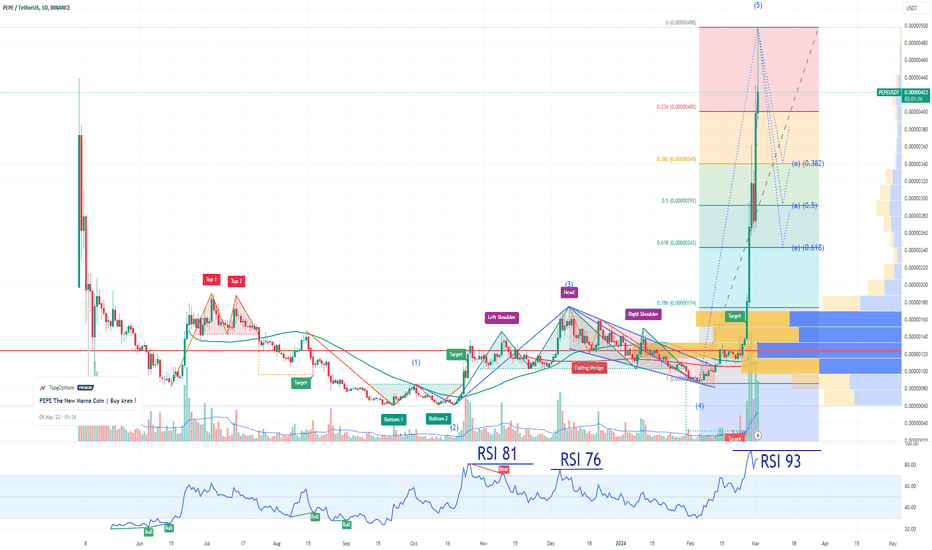

PEPE Potential Correction SoonIf you haven't entered PEPE in the buy area:

Now, at an RSI exceeding 93, it seems we are currently in a massive bubble.

The previous corrections following an RSI surpassing 76 were significant, as you can see in the chart!

Taking into account the Fibonacci retracement tool, my anticipated price target is $0.00000243, corresponding to the 0.618 level

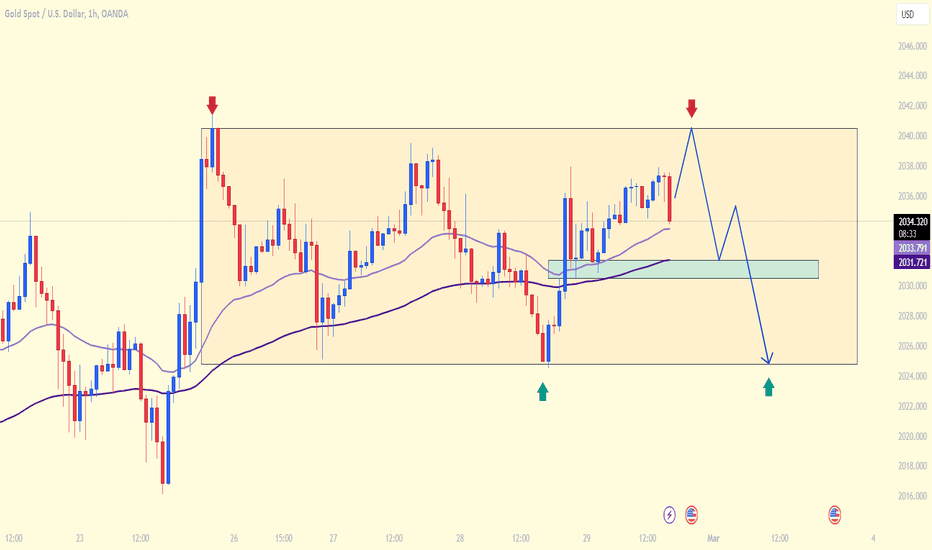

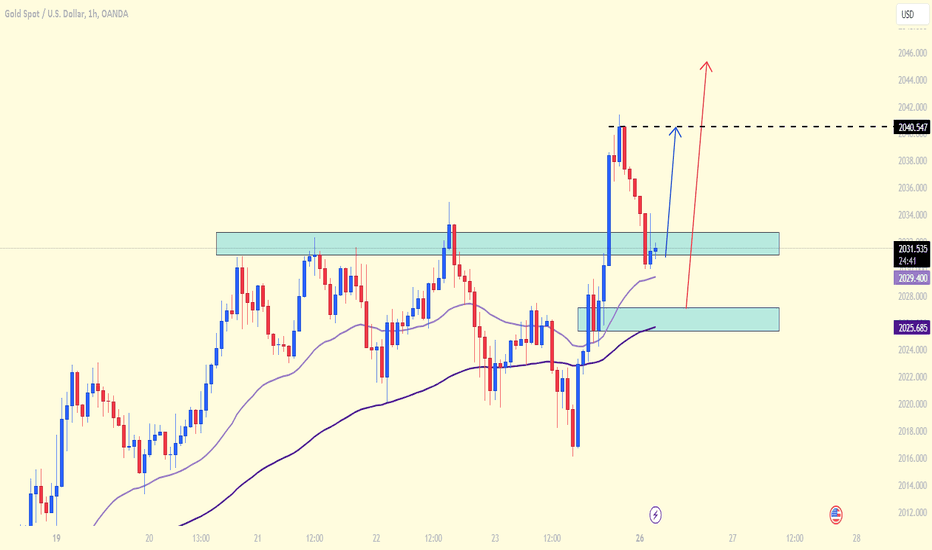

The trend is unknown, waiting for the decision from the Fed Gold prices are struggling to find meaningful momentum as the market awaits a new catalyst. The narrative of enduring higher interest rates by the Fed has curtailed the potential for XAU/USD's price increase.

From a technical standpoint, the ability to consistently break through the resistance at $2,041-$2,042 would serve as a fresh stimulus for bullish speculators, propelling gold further towards the next relevant barrier around the $2,065 zone. With oscillators on the daily chart just starting to gain positive traction, the momentum could extend further, reigniting the possibility for XAU/USD to revisit the notable $2,100 mark.

On the flip side, the weekly low around the $2,025-$2,024 area, recorded the day before, may continue to offer some support ahead of the 100-day SMA, currently near the $2,013-$2,012 zone. The next psychological milestone for gold could well be the significant $2,000 threshold.

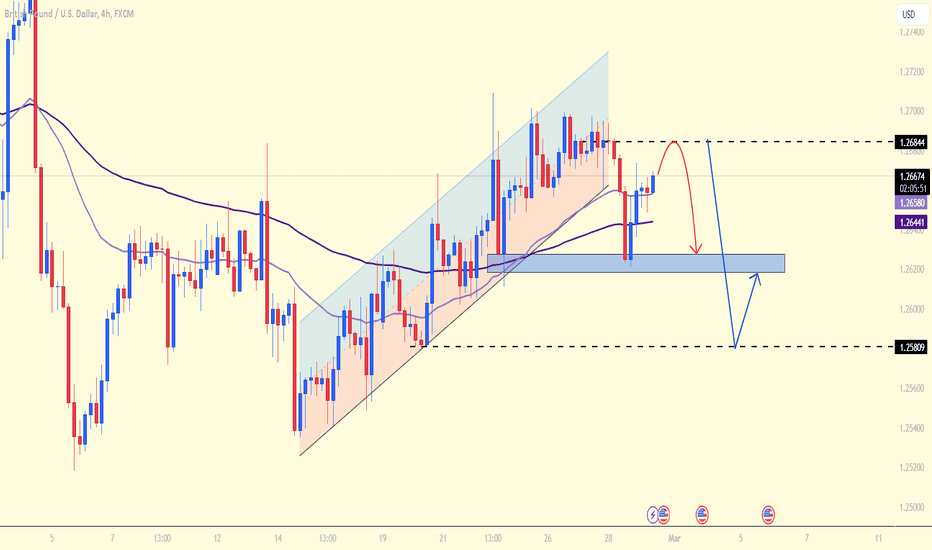

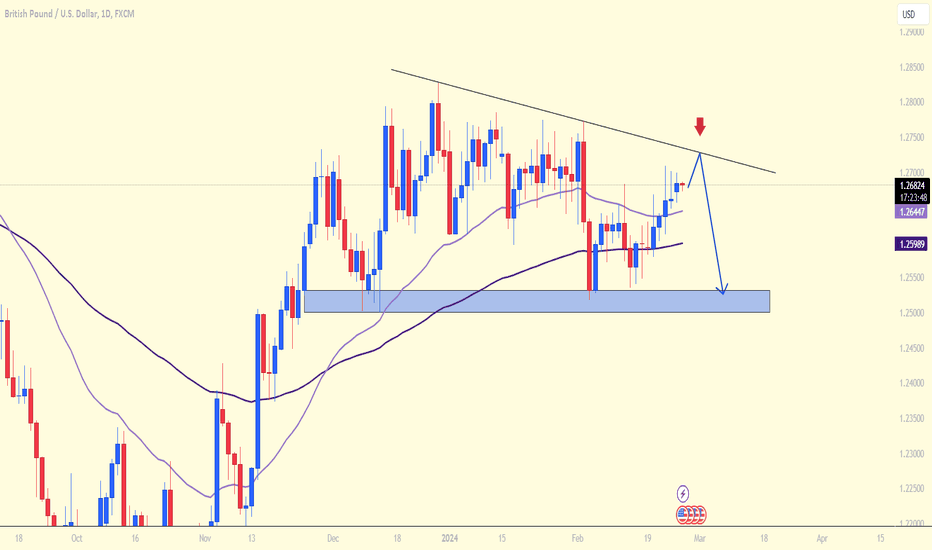

GBPUSD: Expected to fall ? Greetings, dear friends! Yesterday, the GBPUSD experienced a significant corrective decline, currently trading around 1.2666 and having broken free from its previous ascending channel.

With the US Dollar (USD) in high demand before a key US event, it's exerting pressure on this primary currency pair, and I'm anticipating a further decline for GBPUSD towards the end of the week, with primary targets set at 1.262 and subsequently at 1.258.

What are your expectations for this pair? Do you think it will make a comeback? Share your thoughts in the comments!

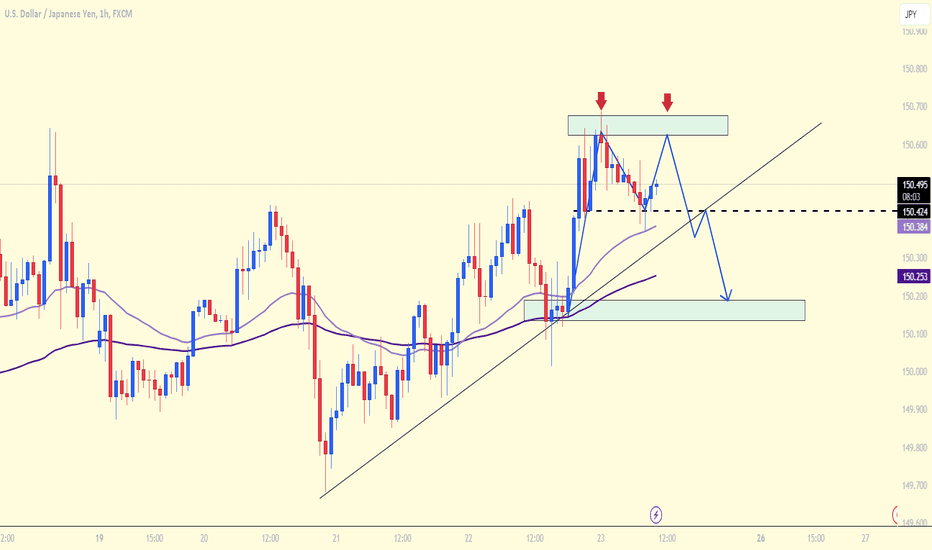

USDJPY today The Japanese Yen (JPY) found it challenging to leverage the uptick from hotter-than-expected domestic consumer inflation seen the previous day, facing a fresh influx of supply on Wednesday amidst the Bank of Japan's (BoJ) policy uncertainty.

This scenario, along with a recent surge in risk-on trading sentiment across global stock markets, has been pivotal in diminishing the safe-haven appeal of the JPY.

Conversely, the US Dollar (USD) gained support from the growing consensus that the Federal Reserve (Fed) might hold off on interest rate cuts until its June policy meeting. This support is expected to bolster the USD/JPY pair's growth overnight from the psychological benchmark of 150.00, sustaining modest gains into the European trading session on Wednesday.

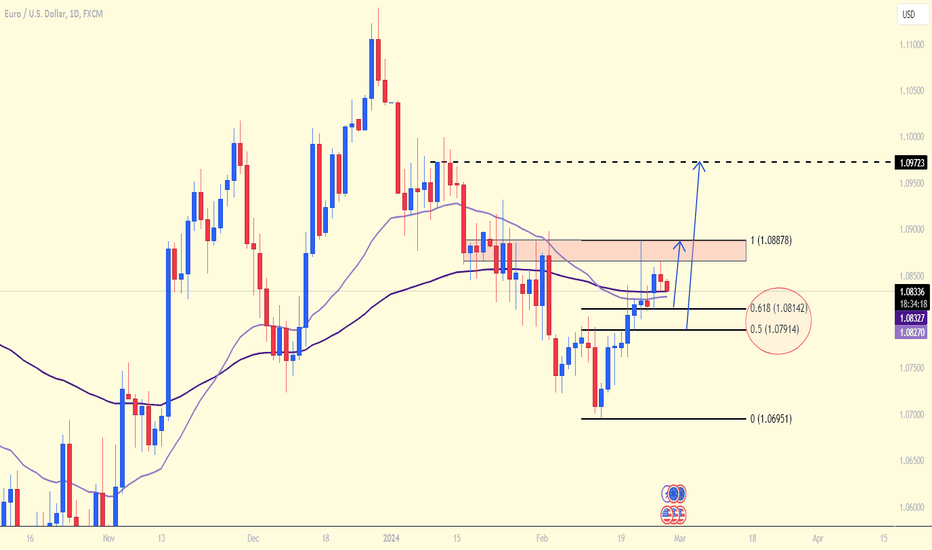

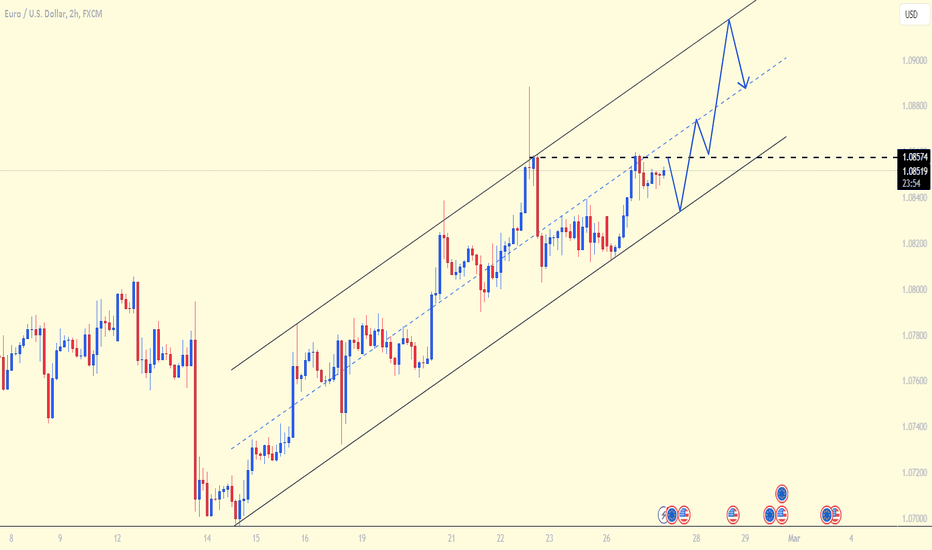

EURUSD : Attention to the defense level below 1,080Greetings, dear friends, today's EURUSD is trading around 1.083, but what's the next move?

EUR/USD remains stable, hovering close to 1.0850, especially after Tuesday's session, which saw minimal driving forces for the pair due to U.S. Durable Goods Orders in January falling more than expected. Now, all eyes are on the upcoming U.S. Gross Domestic Product (GDP) data set for release on Wednesday.

From the charts: EURUSD finds itself in a corrective phase, facing downward pressure from sellers as it approaches the resistance level at 1.0888. The current defensive stance is pegged at 1.079, with a notable chance for a price rebound in this zone. Positioned within the 0.5 - 0.618 range, buyers are keenly watching this area for opportunities to steer the pair back into the fray.

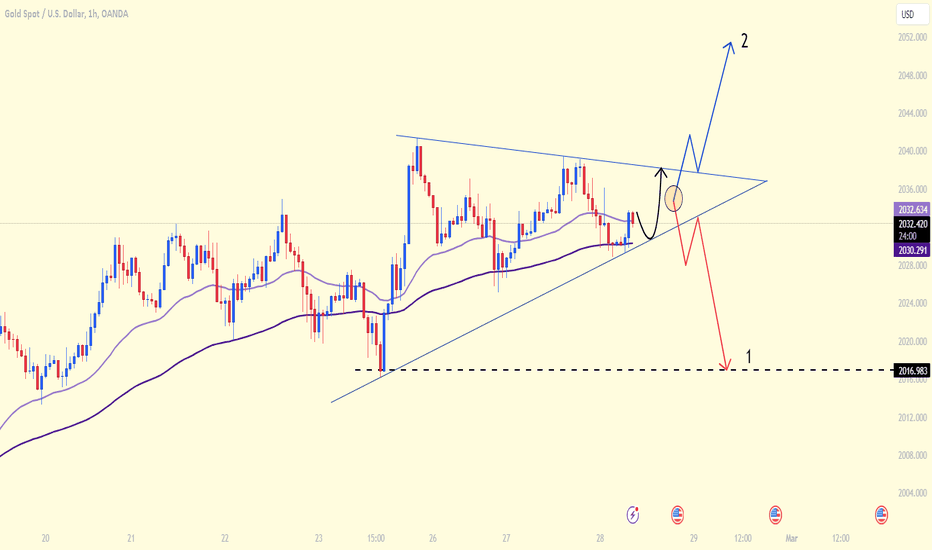

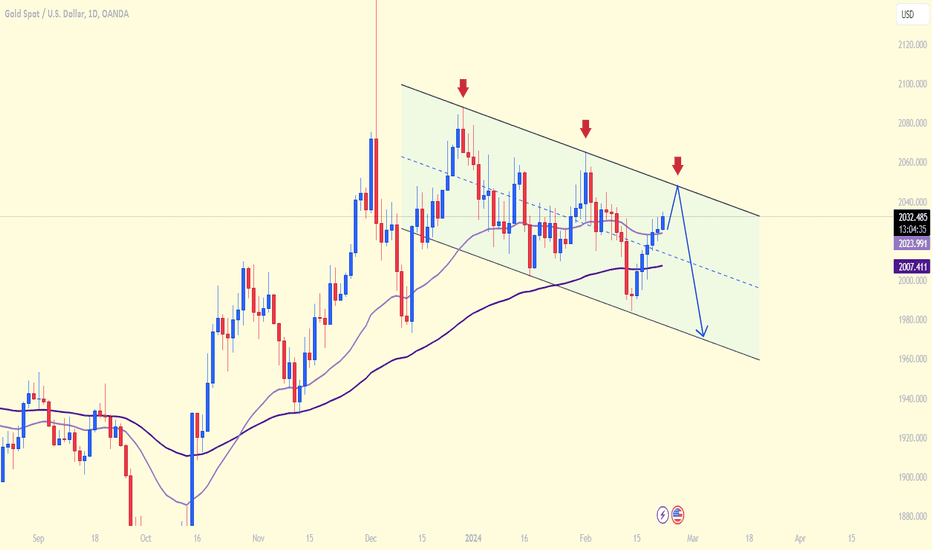

Gold will continue to increase or decrease sharply?Greetings, dear friends! Let's dive into today's gold price trends together!

As anticipated, gold continues its subdued trading, still unable to break through the resistance level of $2035. However, it's holding steady, elegantly navigating within a price wedge pattern. We stand at a crossroads, awaiting pivotal market news that could swing the pendulum in one of two directions:

Scenario one: Gold breaks free from the wedge, descending towards the support level at $2017.

Scenario two: Gold surmounts the $2035 resistance, aiming for the current bullish expectation at $2050.

I'm leaning towards scenario one with high anticipation. What about you? Drop your thoughts in the comments below!

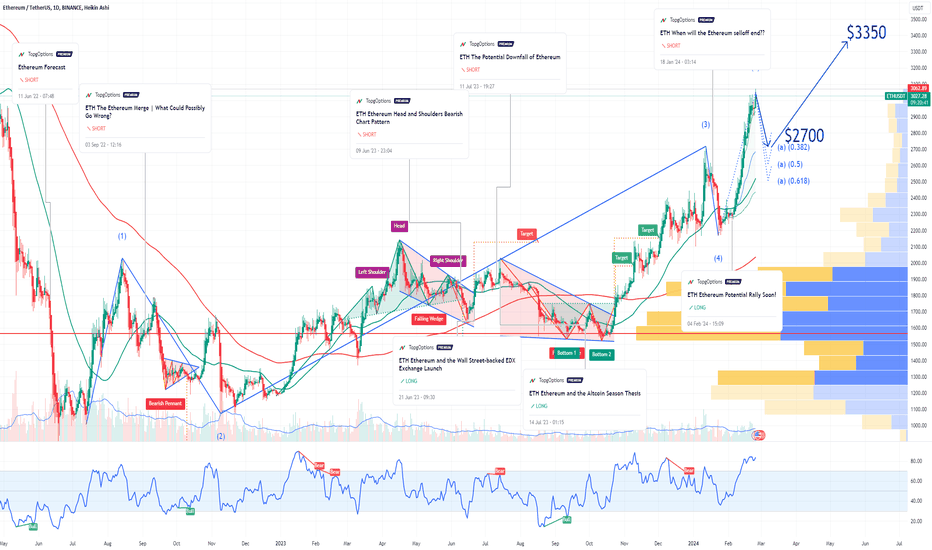

ETH Ethereum medium term Price TargetIf you haven`t bought ETH before the rally:

Then in alignment with the analysis derived from the Elliott Waves chart pattern, Ethereum is signaling a potential retracement, with one of the legs down anticipated around $2,700.

This correction is depicted in the chart pattern, suggesting a short-term bearish sentiment. However, in the broader market context, there's a noteworthy surge in optimistic calls for tech companies leading up to June 21 OPEX.

This surge might coincide with potential positive market catalysts, such as the prospect of an interest rate cut.

If Ethereum mirrors the trajectory of traditional market movements, there could be a renewed positive sentiment. In light of these factors, I speculate that Ethereum has the potential to experience an upside, reaching around $3,350 by mid-2024.

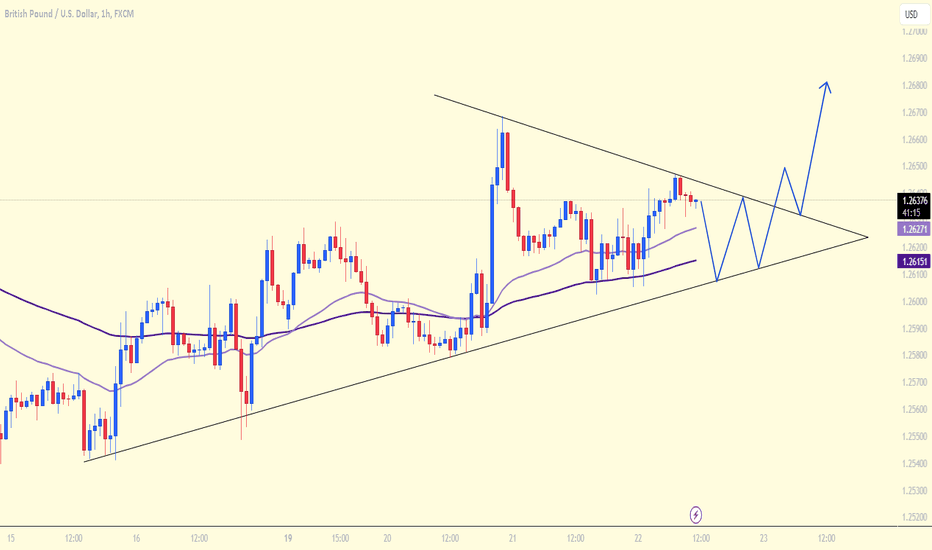

GBPUSD : Pay attention to important newsGBP/USD continues to rise, staying below the 1.2700 psychological barrier in early Tuesday's Asian session. FOMC minutes reveal the Fed's data-driven approach, softening the outlook and putting pressure on the USD, benefiting this currency pair. Currently, GBP/USD is at 1.2685, up 0.02%.

This week, the US Q4 GDP is expected to remain stable at 3.3%. Traders will watch Thursday's US Personal Consumption Expenditures (PCE) index closely for trading opportunities with GBP/USD.

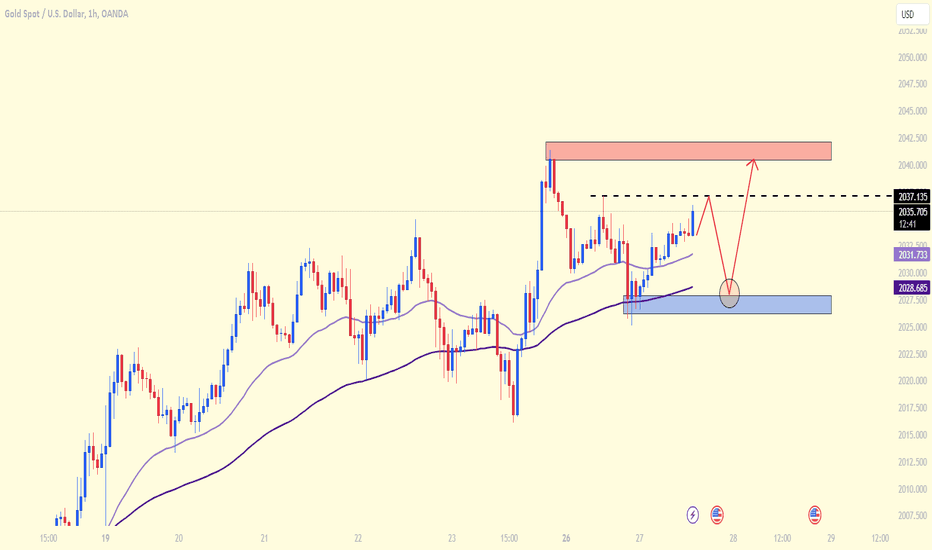

Gold strategy todayGreetings, cherished friends! How do you feel about today's gold prices? Let's delve into a lively discussion!

Recent developments have led to a slight downtrend in the USD, yet gold prices haven't soared as one might expect. Gold continues to hover around the $2032 to $2035 mark, with its future direction seemingly shrouded in uncertainty, heavily swayed by global market news.

Turning our gaze to today's gold price outlook and technical analysis:

Gold remains on an upward trajectory, buoyed above the 34 and 89 EMA lines. Immediate resistance levels are spotted at $2037 and $2041, suggesting a favorable buying strategy:

🌟 Consider entering a buy position in the gold zone of $2028 to $2031

🔹 Set your stop loss at $2025

🔹 Aim for take profits between $2036 and $2041

Dive into the glittering prospects of gold with us, and let's navigate the tides of the market together!

EURUSD: Maintain the parallel price increase channelThe EURUSD continues to maintain its position above the recent high, experiencing a significant rise at the start of the week on Monday.

Currently, the price of this currency pair remains well supported above the psychological level of 1.080, and the outlook for further appreciation remains positive as the established trendline shows no signs of breaking. Additionally, a weakening USD also serves to relieve some pressure off EURUSD!

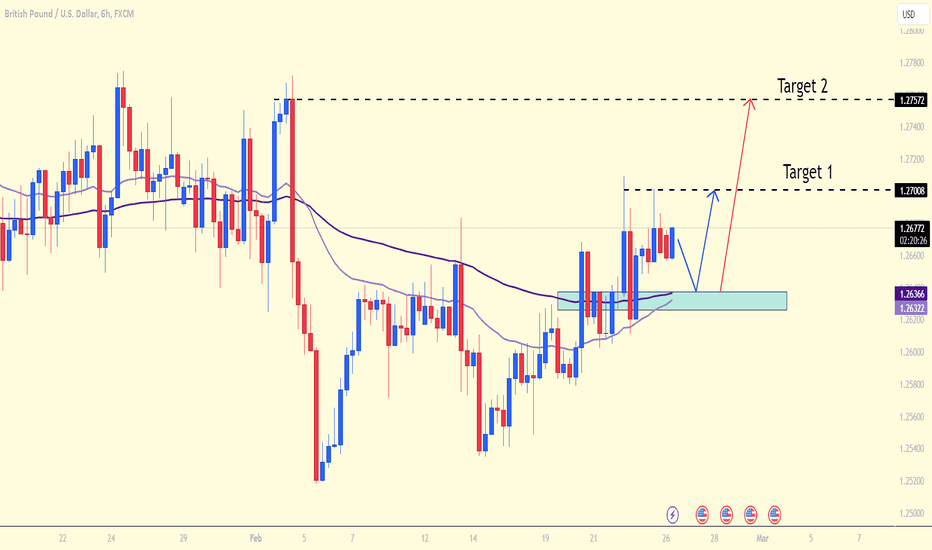

GBPUSD : Continue to increase in the future ? The GBP/USD pair made an effort to hold the 1.2650 level in early Monday trading in Europe, despite a rebound in the US Dollar driven by risk-averse market sentiment. Traders are now looking forward to a speech by BoE's Chief Economist Huw Pill and US housing data for fresh momentum.

From a technical standpoint: The convergence of the 34 and 89 EMA around the 1.264 support level suggests that we might expect an upward trajectory for GBPUSD in the near future, with two immediate targets highlighted in the analysis.

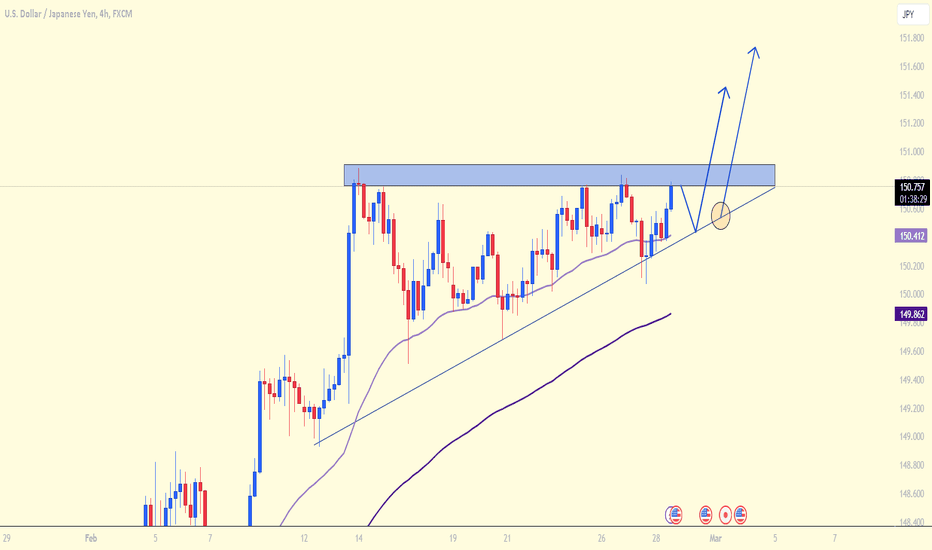

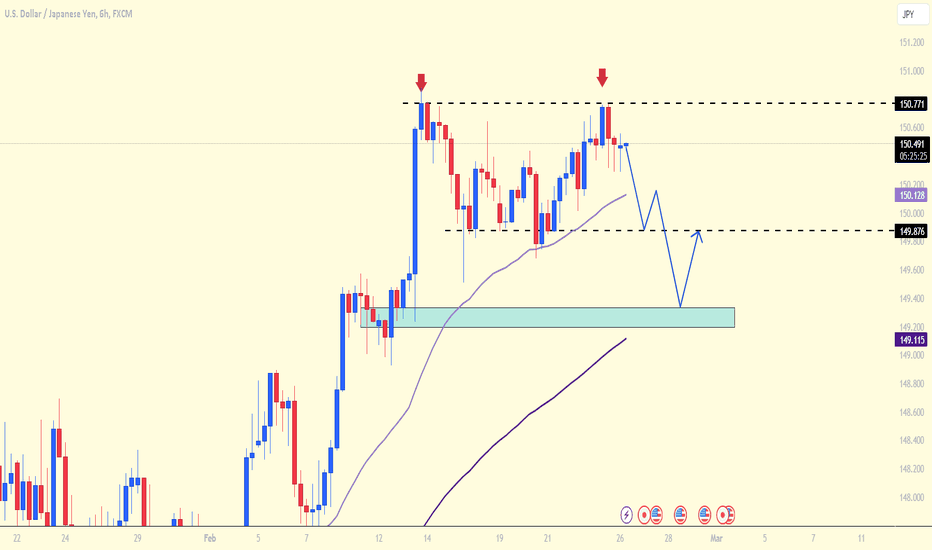

USDJPY : Stable transactions wait for a new breakthrough!Greetings, traders! What are your thoughts on USDJPY today and its future direction?

Looking at the chart, it's evident that USDJPY's recovery momentum is currently capped below a resistance level, as it appears to be forming a double top pattern.

The current support level stands at 149.888. Should this level be breached and the double top pattern fully materialize, the bearish target would be to drive this currency pair below the specified level, around 149.300.

Gold price today: Buy prospects!Warm greetings to all splendid friends, let's explore today's gold prices together!

Currently, gold is hovering around $2031, marking a slight decrease of nearly $4 from the last closing on Friday. It's evident that after a significant uptick, gold is undergoing a correction, moving towards approximately $2030—a new support level established after breaking through the prior resistance.

As for today's strategy and looking ahead: I'm optimistic about purchasing gold, observing that the correction phase seems to be concluding. In the short term, the EMA 34 and 89 lines continue to support an upward trend, making the strategy to buy highly favorable.

Wishing everyone a smooth trading week ahead!

XAUUSD - Increase prices but not sureHello, I'm delighted to discuss the XAUUSD market with you today!

As of the close of yesterday, the gold market experienced a notable uptick, soaring from $2016 to $2041—a $25 increase in just a few hours.

The current price stands at $2035, and technical analysis suggests that despite recent support for a price increase, the long-term trend seems to be on a downward trajectory within a descending channel. The $2045 resistance level, marking the upper boundary of this channel, could serve as a crucial point for bears to initiate the next price decline. In such a scenario, it's possible for gold to revisit the $19xx range once again.

What's your take? Do you foresee a decrease in gold prices, or do you believe it could break out of this trend?

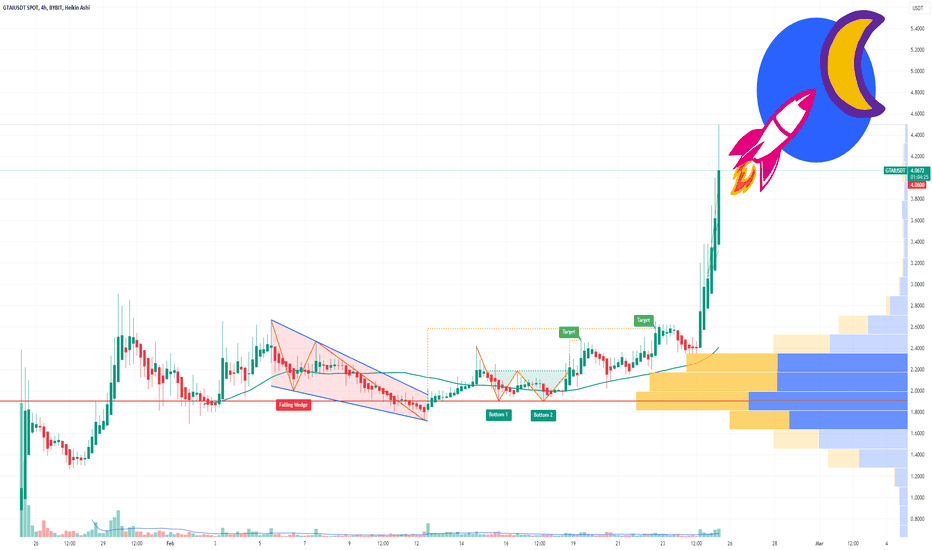

GTAI The Rise of the AI Cryptocurrencies !If you haven`t bought AGIX before the explosion:

Then I might have found another gem for you!

There is a recently launched cryptocurrency called GT Protocol, ticker GTAI, with a small market capitalization of $31 million and a circulating supply. It is a Web3 AI execution technology that provides access to CeFi, DeFi, and NFT crypto markets through an all-in-one conversational AI interface.

Although investing in a new coin related to AI could ride the wave of speculative investments, it is also risky to buy a newly launched cryptocurrency!

The target towards the psychological level of nearly 2050 usdTrading Strategy for XAUUSD:

Today, gold prices continue to receive bullish support, briefly recovering to near $2035 as they reach the boundary of a parallel channel.

The upward trend is expected to aim for higher levels around the psychological area of $2050 before a subsequent correction occurs after the metal touches the upper limit of the parallel price channel again.

What are your thoughts on the upcoming trend for gold?

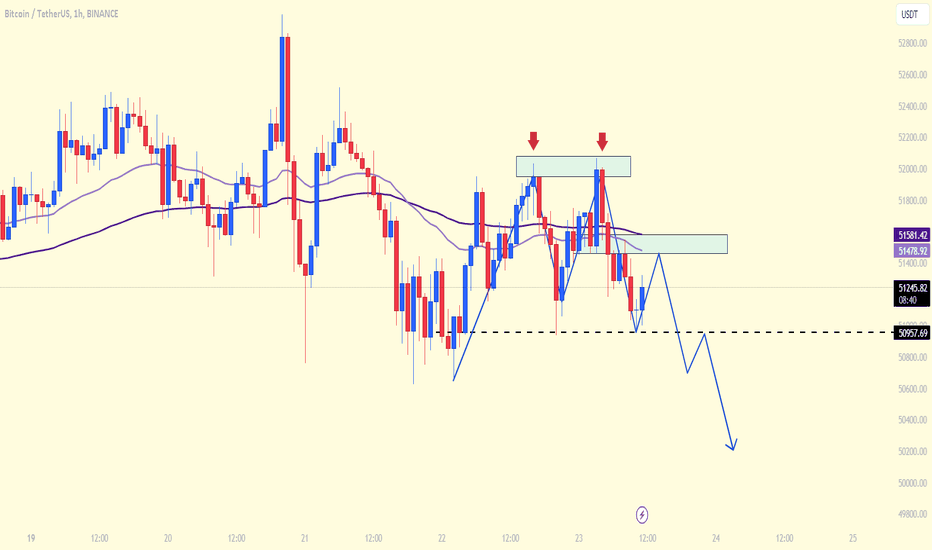

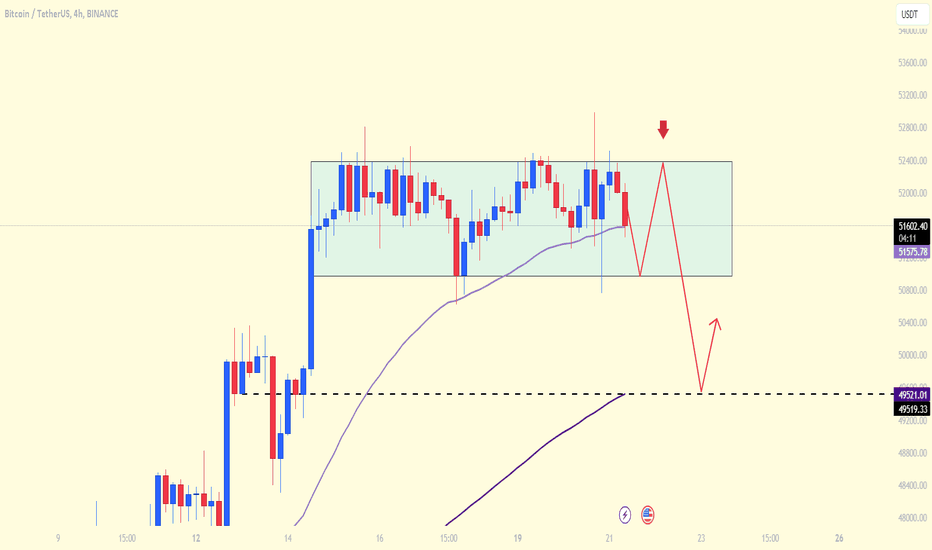

BTCUSDT today ( 23/02 )BTCUSDT has just completed a double top pattern on the 1-hour chart. The price is currently at the support level of 51,100 USD, and the technical outlook leans towards the bears, with the 34 EMA indicating a reversal.

The resistance level at 51,440 is forming a convergence zone with the EMA, and I am leaning towards a sell position for today's BTCUSDT trading. Do you agree with this assessment?

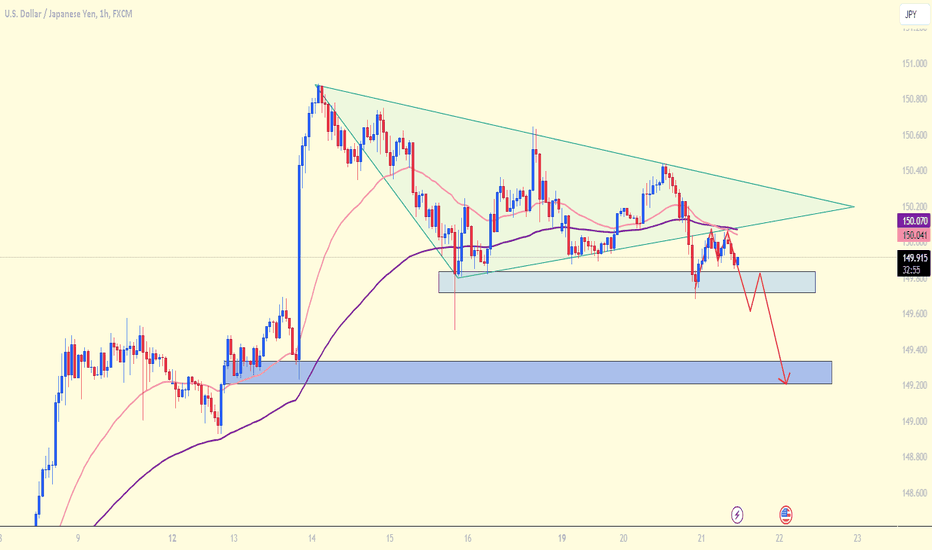

USDJPY : Strategic analysis today!Hello everyone, today the USDJPY has been trading around the 150.500 mark during the early trading hours of the weekend. This pair found support at 150.42 and retested the 34 EMA line.

Trend Forecast: USDJPY is expected to continue its upward momentum and is forming a double top pattern as indicated on the chart. We will consider a sell strategy if USDJPY reaches that level.

What about you? What are your thoughts on the trend and your next trading strategy for USDJPY? Drop a comment to let me know!

USDJPY: SupportedUSDJPY has continued its upward trend over the past few days, with prices fluctuating around the 150.23 mark and steadily advancing towards the 152 resistance level.

The US Dollar (USD) remains in a concerted effort to attract significant buying interest, contributing further to a daily decline of about 25 pips from the vicinity of the 150.00 level for the USD/JPY pair. Meanwhile, the increasingly firm expectation that the Federal Reserve (Fed) will maintain higher interest rates for an extended period, reinforced by the hawkish FOMC meeting minutes released on Wednesday, continues to support rising US Treasury yields.

This scenario benefits the USD's upward trajectory, indicating that the path of least resistance for this currency pair is upwards.

GBPUSD: Wait for a new price increaseToday, the GBPUSD pair maintains stability above the 1.2600 level, moving within a price wedge, indicating a potential upcoming breakout from its current trend.

Both the short and medium-term outlooks remain favorable for GBPUSD buyers, as evidenced by the current behavior of the two EMAs. The pair is expected to rise after reaching the boundary of the trendline.

USDJPY: Search for new support levelToday, the USD/JPY is trading around the 149.90 level, approaching a nearby support level with a predominant sideways movement, tilting the short-term outlook in favor of bearish momentum.

In the hourly timeframe, USD/JPY is exhibiting a Symmetrical Triangle pattern and has made a downward breakout. Should the current support be breached by a Double Top pattern, the bearish target is set at the 149.33 level, indicating a potential shift in the market's direction favoring sellers.

BTCUSDT : The price is still stable over $ 51,000Bitcoin is currently trading over 52,000 USD after an increase of nearly 100% in the past six months thanks to the excitement around the launch of Bitcoin exchange funds (ETF) delivered in the United States, along with the needs where funds This brings cryptocurrencies.