Gold prices continue their falling streakHello dear friends, it's great to meet you again for a discussion on gold today.

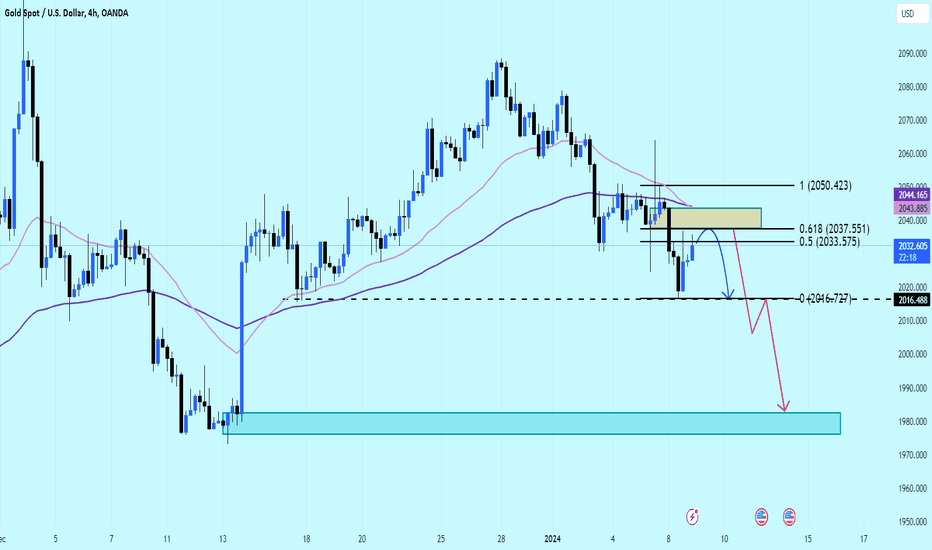

Currently, gold is trading around the level of $2032 in the early trading session and showing a slight recovery after a price correction following a drop to $2017 at the end of yesterday.

The precious metal has successfully broken out of the support level at $2033, and on the chart, the downward trend is clearly indicated with the convergence of the EMA 34 and 89 lines signaling a potential reversal.

It is expected that the current price correction will continue until reaching the 0.5 - 0.618 Fibonacci retracement level. We can anticipate further decline in gold after this consolidation phase. Selling is preferred, my friends!

What about you? Do you think gold will continue to decrease?

Sell-buy

XAUUSD - Trends and trading strategiesHello dear friends, let's delve into the gold price last week and discuss a new strategy with Karina!

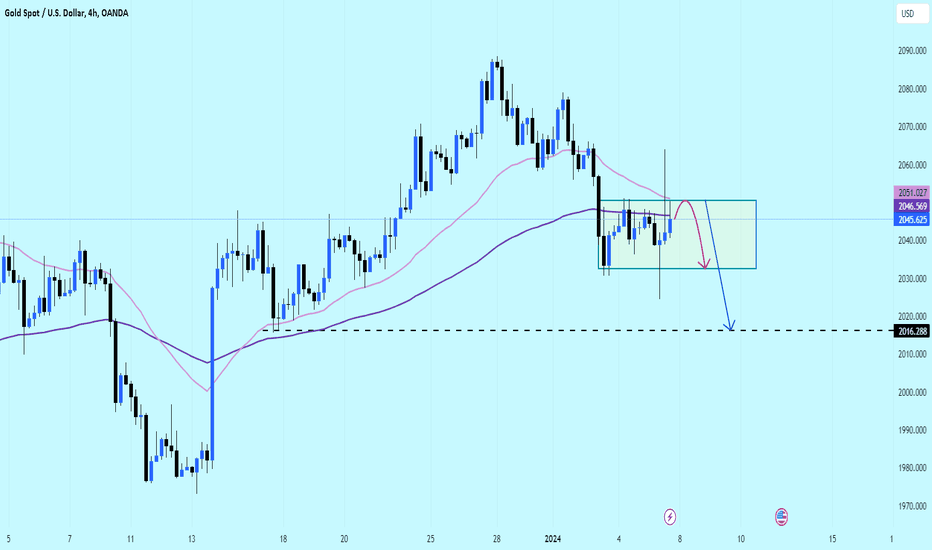

Last week, the gold price appeared to decline, losing more than 40 USD from 2088 USD to 2045 USD. Towards the end of the week, gold seemed to remain relatively stable, focusing on a sideways movement with a resistance level at 2050 USD and a support level at 2030 USD.

On Friday, when the Non Farm news was released, gold experienced significant fluctuations, reaching as high as 2065 USD and as low as 2024 USD. However, gold closed at 2045 USD without any major breakthroughs occurring.

Regarding the prospects and evaluation of future trends: Given the current situation where the USD is gradually recovering, gold is still inclined towards a further decline, indicated by the reversal from the EMA 34 line on shorter time frames and consolidation on the 4-hour chart.

A breakdown of the support level will push gold back to the 2015 USD mark.

What about you? What are you expecting from gold?

GOLD held his breath waiting for newsHello dear friends !

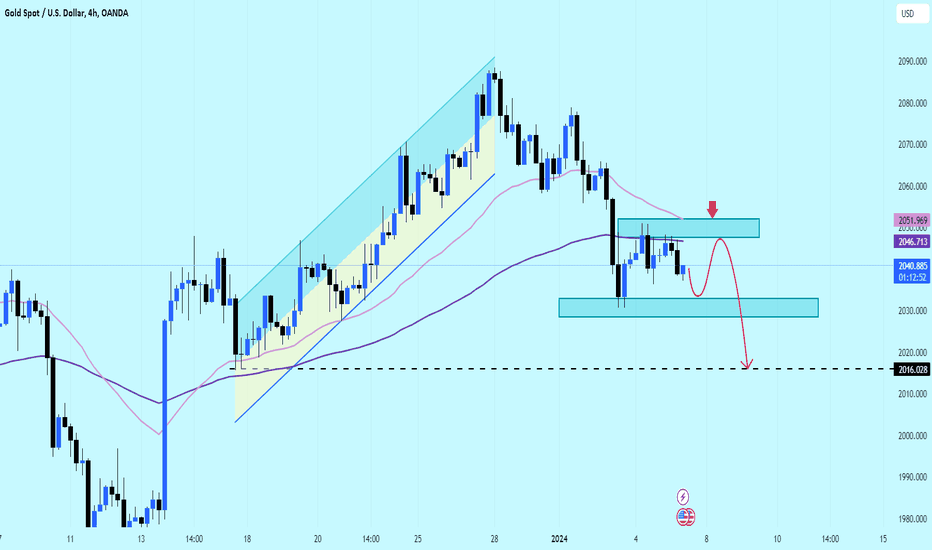

Gold price today is trading around 2040 USD and has not changed much compared to yesterday. Up to now, the main trend of gold is still down with sideways in the short and medium term with resistance level 2050 USD and support level 2030 USD.

At the end of the day when non-farm payrolls are announced, gold is likely to fluctuate more quickly like other weekends.

-In case the news continues to support the USD, gold will break the support level and drop quickly to 2015 USD.

- In the second case, the resistance level is broken by the buyers and gold will have a chance to reach the peak of 2065 USD.

And you, which direction do you think gold will move in? Let's wait with Karina!

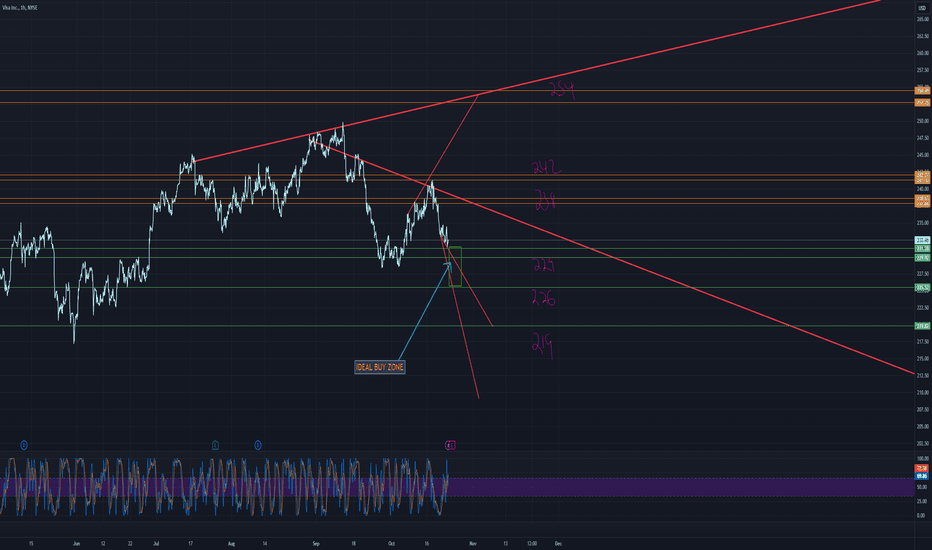

V EARNINGS CHART - BIG SUPPORT COMINGV has a really steep downtrend that is literally about to close out, probably tomorrow.

The movement from like 230-226 is pretty bullish.

Price targets and trends are marked.

Careful around that 242 mark, and look for possible support to coming back in around 236-238, which can easily take us up to that final rejection point.

With the trends and movement heading into earnings, it's hard to say that we should favor the bearish movement. IF we open super positive and run-up, I'd just wait to buy.

CHZ Chiliz Price TargetBinance, along with its CEO 'CZ,' has confessed to federal charges and committed to settling fines amounting to $4.3 billion.

The crypto exchange “admits it engaged in anti-money laundering, unlicensed money transmitting and sanctions violations"!

The question arises: from where will these substantial funds be derived?

One possible source is Binance's Proof-Of-Reserves, which reportedly exceeds 100%.

Among the tokens impacted is CHZ.

I've set a short-term price target for CHZ Chiliz at $0.055.

Looking forward to read your opinion about it!

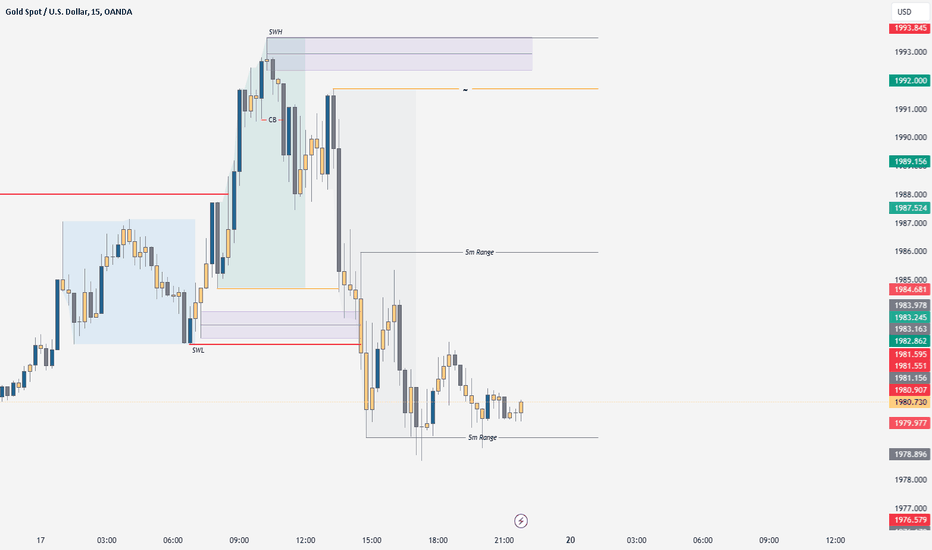

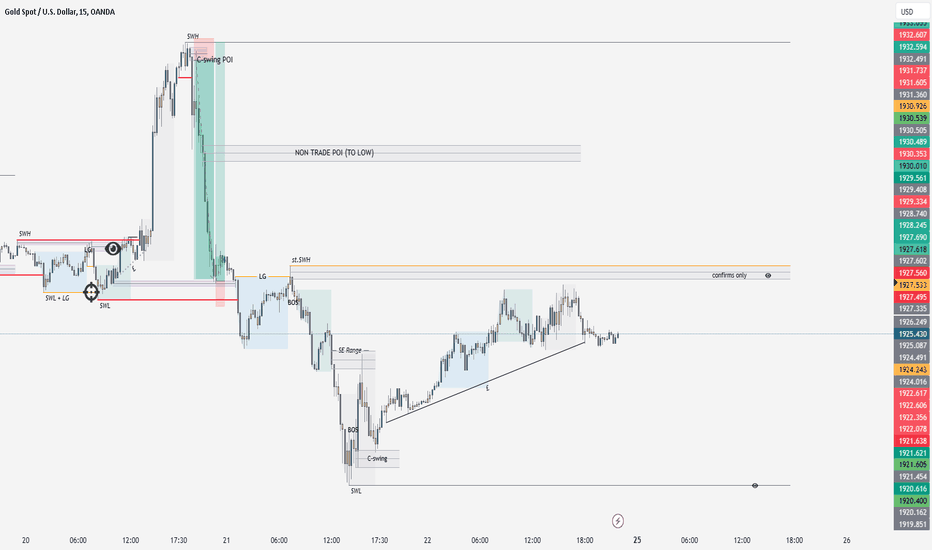

XAUUSD 19/11/23Gold sitting within a unconfirmed bearish range was still looking for a swinglow to be created for this range to be validated overall I am expecting price to shift bullish again as fundamentally gold is bullish and this is the first bearish range within an overall bullish delivery within market. Until we have a break of the swing high though we will continue to follow this structure to the downside.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

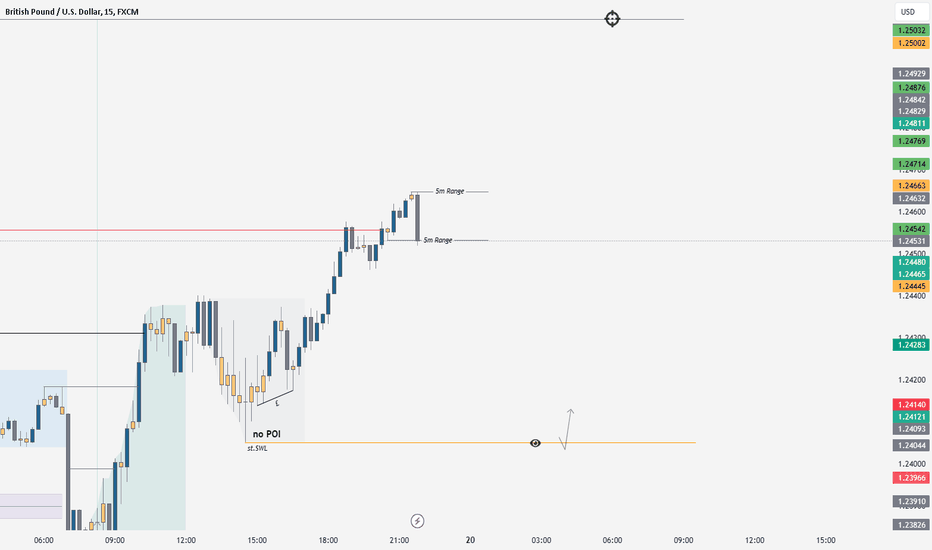

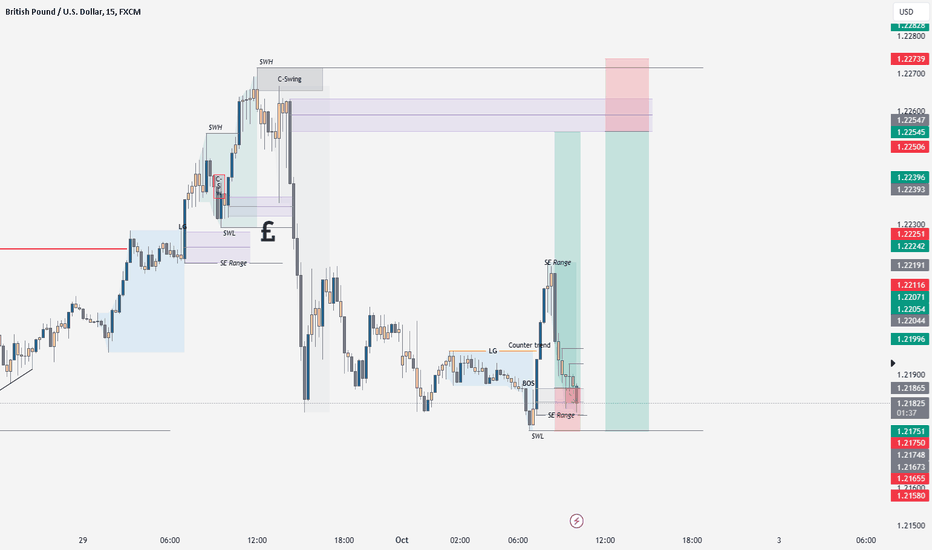

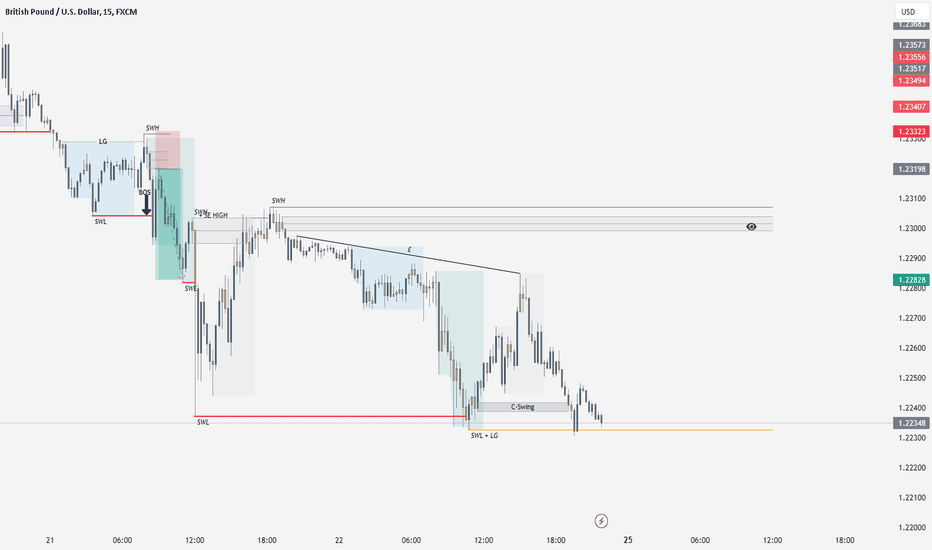

GBPUSD 19/11/23Starting this week off with GU From last Friday we've been playing within a large foolish range all of these structures that we have tracked from last week have been internal with some nice long moves lining up with our range bias we are looking for the range high to be taken and we are going to be looking for lungs into this week again if we break down the internal structure we may look for low risk counter trend sell entries but overall we are predominantly looking main target being 1.25060.

within our bullish range we are still waiting for a SWH to form.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

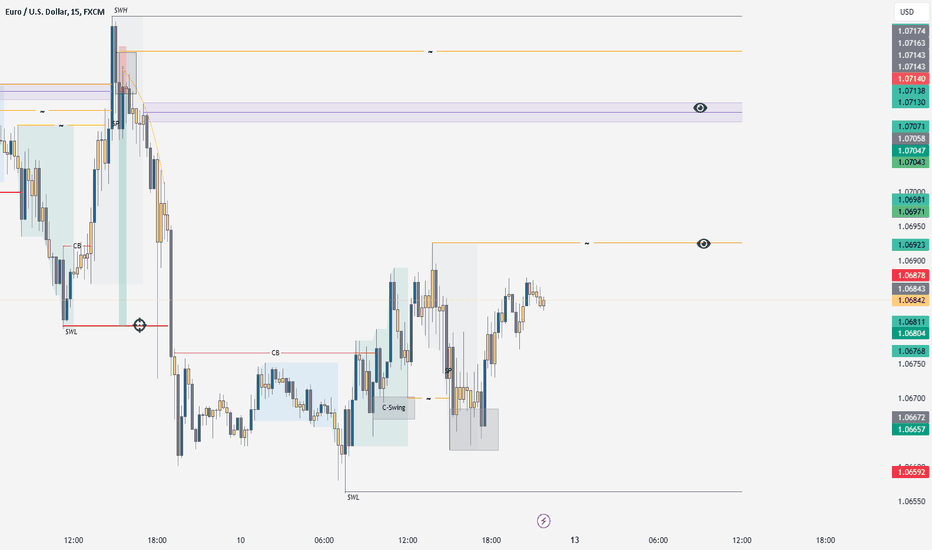

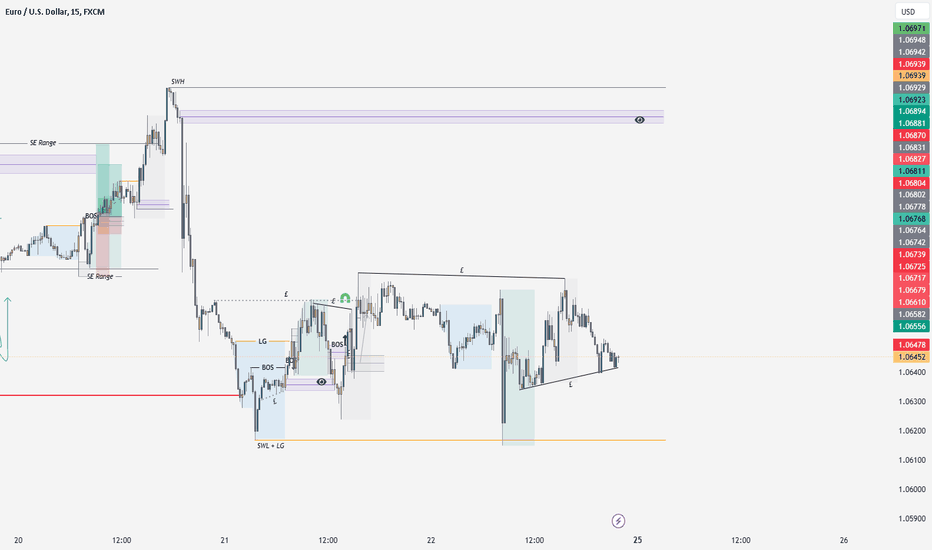

EURUSD 12/11/23With EUR usd this week we finished in the same range that we started Friday meaning there wasn't much to do when it came to adjustments in terms of this week's outlook and we know that gbp usd has gone bullish, so there is potential for euro to follow this movement overall structurally we have a barest range so we have to continue to follow that but we will be using caution coming into this week as possible bullish reversals are on the table.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

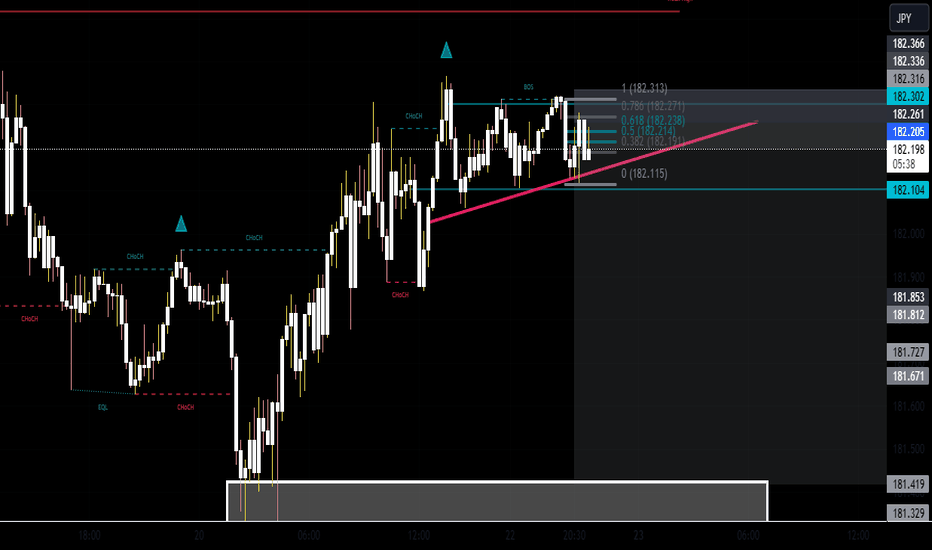

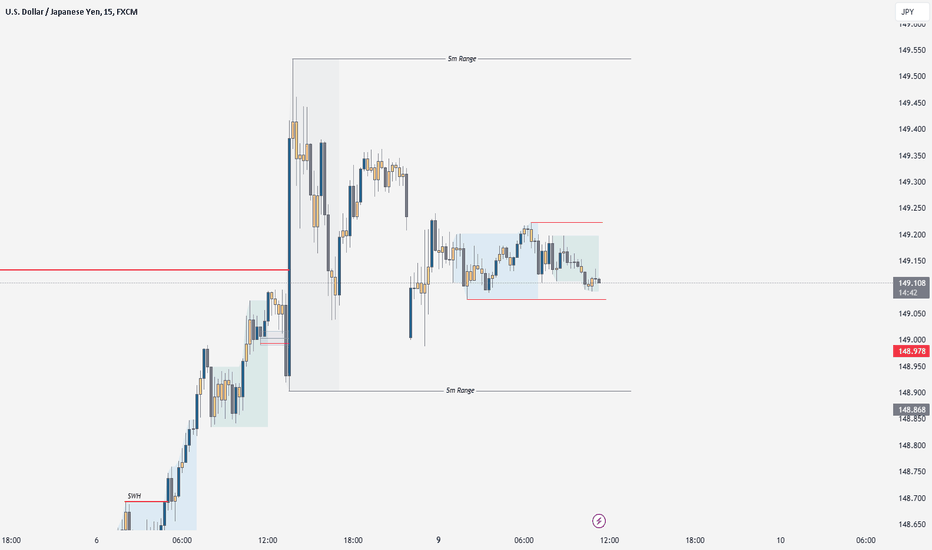

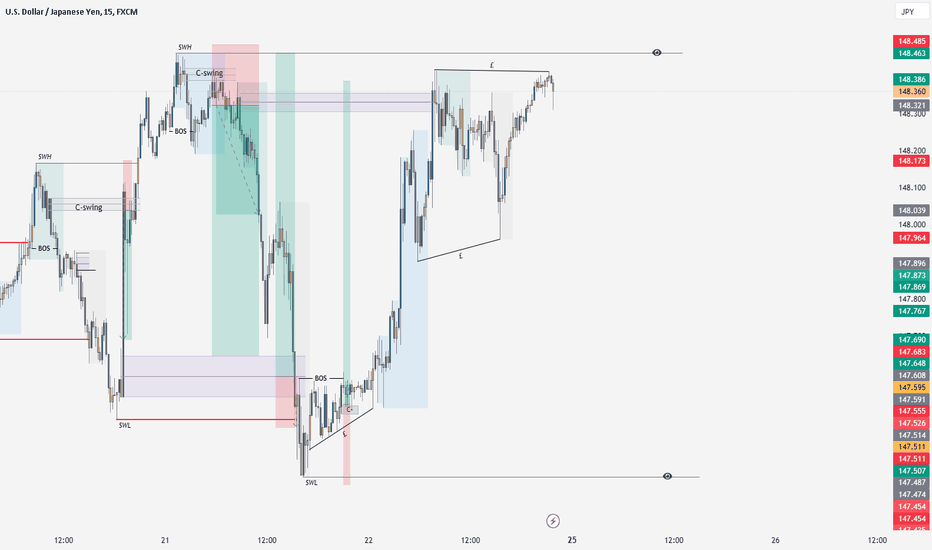

USDJPY 9/10/23US dollar to the Japanese yen showing us the same as most of our other US dollar correlated pairs which is a major gap at market open in this case we open low and we have stayed low since we have technically fulfilled the gap and fulfilled the low of the open itself so overall we should be set for some more true directional price action of course it is AUS bank holiday so we're not expecting anything huge as stated in our other markups we are going to be looking more towards Tuesday rather than Monday session, Collectively we are going to have a swing range high if we break this 5 minute range down if that happens we can then confirm a bullish bias for this pair but at the moment I am thinking that we may break lower and make internal price action which will eventually overrule the bullish swing narrative that we have until that happens we'll follow what price action shows us and we'll continue to read what price is telling us.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

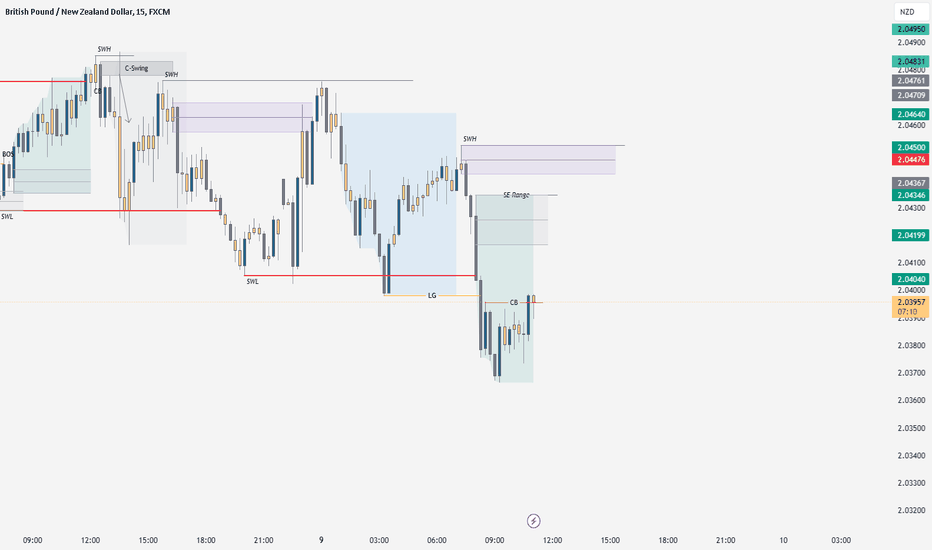

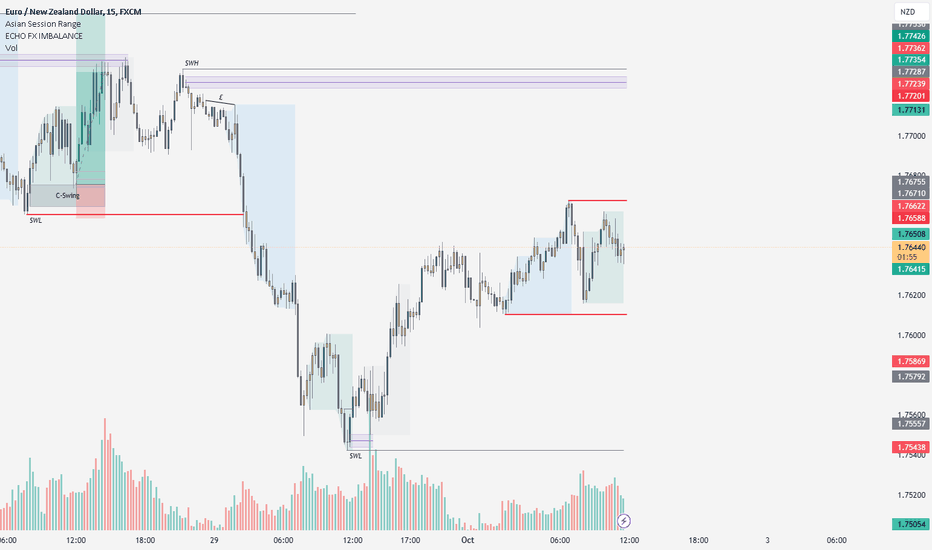

GBPNZD 9/10/23British pound to the New Zealand dollar showing us a consistent swing move to the downside which has played out around 4 to five times already before we got to the point we're at now we now have another clean push to the downside with a clear POI and a swing high to match we're now waiting for the formation of our swing low once this is formed we will have a valid range to look for short moves but as we stated at the beginning we have played out swing lows around five times now which means that we are building a significant amount of liquidity to the upside meaning the more we play lower the more likely an expansion to the upside could occur for either a short term or an overall longer term shift.

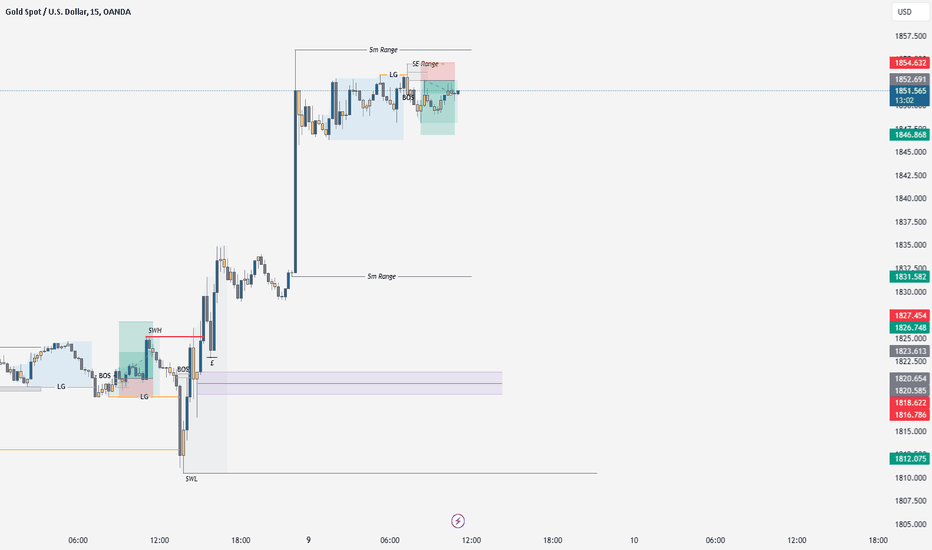

XAUUSD 9/10/23Gold showing us exactly what we want to see from our secondary US pairs a bullish range with a gap at the top now gold is slightly different to our other US secondary pairs as price action has stayed above the gap since creation rather than falling below the gap so in turn we have gapped higher with gold rather than gaping lower like the rest of our pairs now keeping in mind that we have AUS bank holiday today we aren't expecting to see any huge expansions from gold due to the lack of liquidity from New York session as you can see the price action that has occurred since the market open has actually been very sideways creating high level levels of liquidity higher and lower meaning that when we do shift there will be a significant amount of movement behind it overall I'm looking for price to come down and break the low of this massive 5 minute range that we have put in this would also feel our gap from market open and it would lead us into our unmitigated POI where we have a small amount of Inducement, until we get into our later sessions this week I am not expecting a fulfilment of this gap.

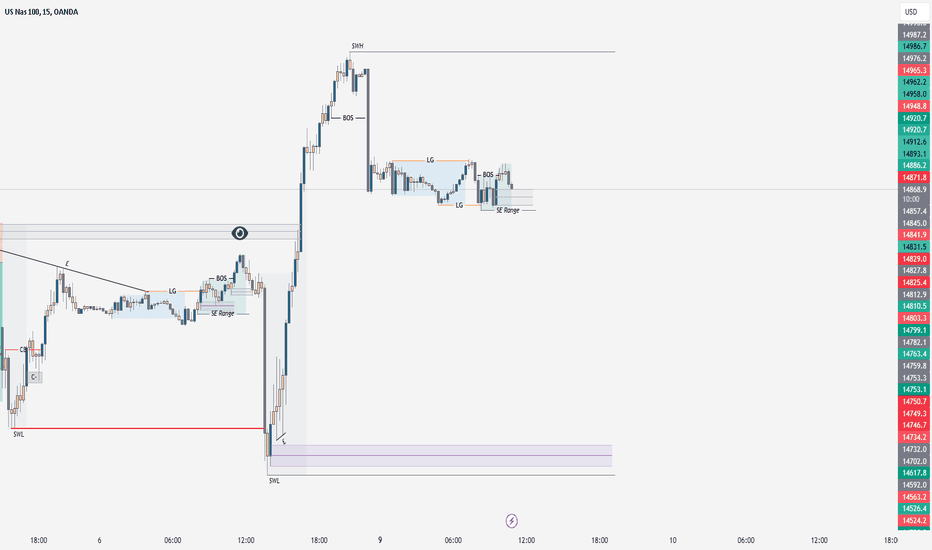

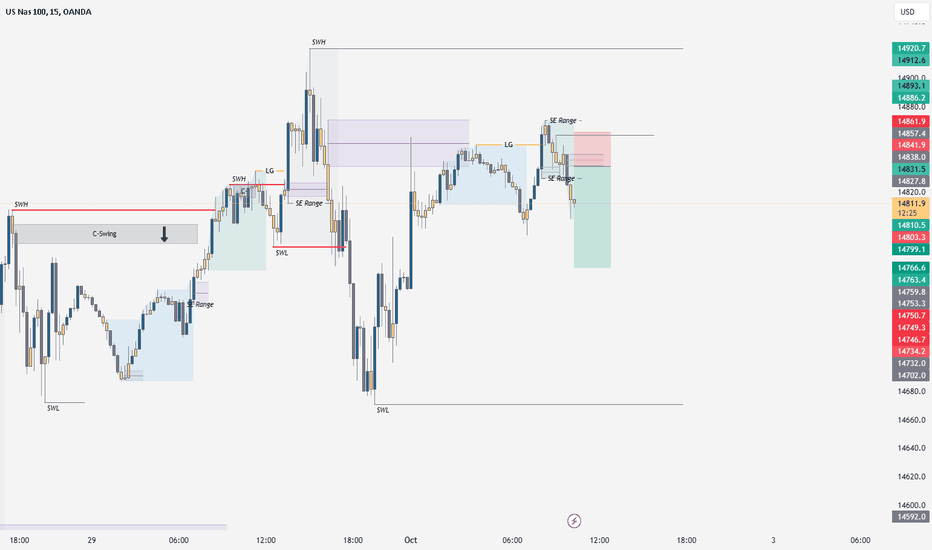

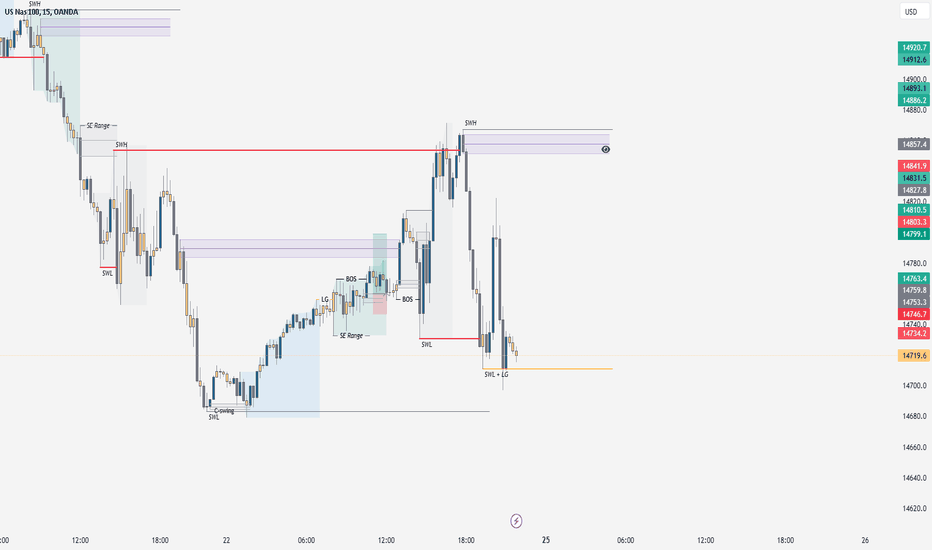

NAS100 9/10/23second pair up on our markups for today is NAS 100 otherwise known as the NASDAQ pretty similar looking setup here we have a bullish swing range with a swing higher and a swing low preformed the Main point we need to focus on here is the swing high technically has not been formed through to regular price action it's actually been formed from the gap that was created at market open meaning that this swing high may not be as clear and as clean as we would expect for a normal swing high this does not change the probability of the swing low holding orders as this was formed pre gap we have inducement at our lower POI and we also have internal price action which could lead us to sell this lower we would expect the gap to be filled even though it is represented as one large candle on this price chart.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

EURNZD 2/10/23EN Euro N has also given us a very clear bearish range lots of bearish range given from Friday session so we are going to look to see where this wants to travel remember if we do tap into the POI at the top we're going to look for bearish movements and if we do not get to that point we are going to expect price to continue down lower overall we would like to see a SE setup delivered at New York Open and from there we can maybe follow price to one of the external liquidity points either high or low but as it stands our main directional bias is bearish and we would look for the new investments to come in at market open for NY for London.

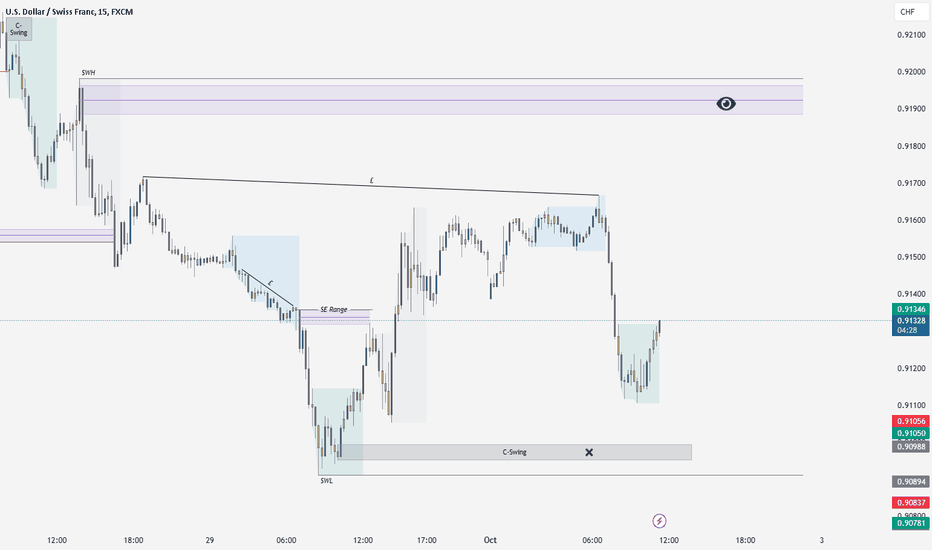

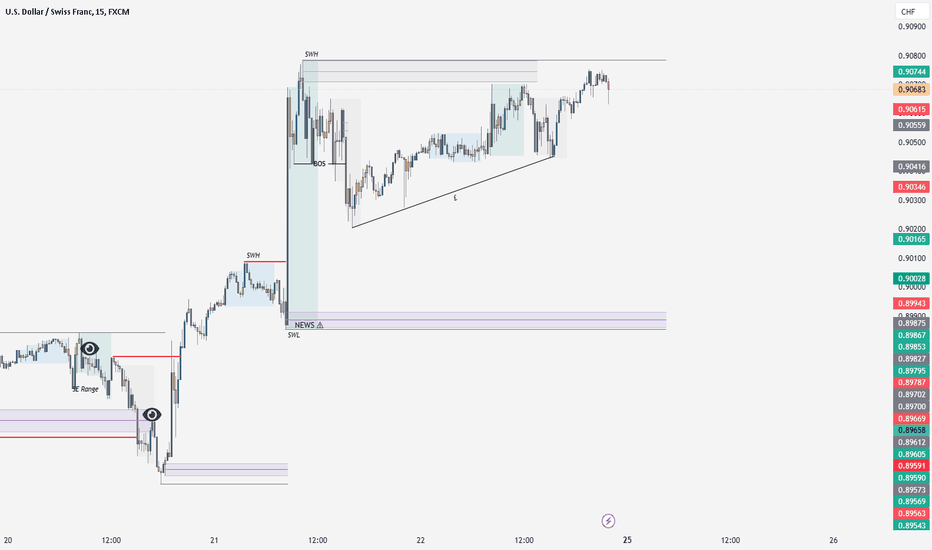

USDCHF 2/10/23UC US dollar chef giving us another clear bearish setup here with a non usable swing POI at the low and poi on the 5 minute time frame At our swing high which we are going to watch for more bearish momentum to the downside of course if we get there and we do not see any reaction at our point of interest it becomes less probable for this to play out we also have the S&P this afternoon as we mentioned in our previous two markups so until that news event has come we may see bias is shifting through this Monday session collectively we have had no entries yet on usdchf so we will keep you updated if we do have any this week.

NAS100 2/10/23That's NAS100 also gave us A bearish swing range following the price action Friday we have tapped into our only unmitigated POI during the Asia session and revisited it during London we also have an SE setup which is telling us that a bearish directional movement for this session is probable and collectively we are looking for price to go down now of course we do have a similar scenario with our other correlated pairs but as stated as well in the previous markup we do have the S&P This could change the narrative of the swing and it may shift our price action against our bias but as it stands we are looking for more bearish price action to follow.

GBPUSD 2/10/23Starting this Monday off with Gu we were left with a very clear bearish swing set up from Friday as we've come into the first session of the week we have been given a bullish impulse to the upside which has signalled to us that we now have a swing below therefore we have a confirmed bearish range we are looking for a low risk counter trend entry for then a bearish continuation to the downside if the bearish continuation does not occur we will hold the counter trend trade for a longer term position of course we have the S&P this afternoon so the narrative of price may change prior to that or during that event.

USDCHF 24/9/23UC is our last pair for this week, as it stands we have a clear bullish range but as we have said on nearly all of our pairs we do expect the current moves that have ran over the last few weeks, until we actually break out of this trend we will keep following it until it does then we will change our bias and follow price as it moves.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

EURUSD 24/9.23EU oh look another sell side swing range with a rather large space above, oh and liquid gathering above our highs almost as if we have seen this in nearly all our other USD related pairs this Sunday!

In short we are looking for a bearish move due to our range we sit in but of course we aren't expecting a run higher for then a full drop lower as our range is massively oversized. from what we have seen and what we know of these kind of range normally we see the short term price action take over the overall move but until this happens we stick to what we have!

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

GBPUSD 24/9/23GU if you haven't already noticed has been falling like a stone from last week, now of course you will see this is pretty much the same moves our other pairs have been making, giving us a nice uniform correlation and with this we are looking for it to line up if we do reverse with our other prediction.

Of course it is not something we actively seek to do which is trade against trend, but we are seeing more than just structure pointing to the upside including our liquid highs withing our current bearish range.

Overall bearish, so if we do drop deeper don't be shocked!

We are aiming for the lows but we are looking for a entry setup to long this if that's what she wants to do, of course lower trend and deeper moves may come, if so we will follow this to.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

XAUUSD 24/9/23XU is currently sitting in a monster range, we have tracked this thing bearish for the best part of last week, while we expect a bullish move we do have a few blocks stopping us from possibly shifting up into our upper 50% of this range.

firstly we have a minor SWH that will act as an internal protected high that could let us find an entry to go higher if we break it, we could also see it shift price deeper towards our low giving us a run of the lows overall iam looking for a break of this high leading us to the untradable POI we have marked.

open entries and watching out high is the key for an entry here on gold.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

NAS100 24/9/23N1 has been sweeping stops better than a cleaner over the last 2 sessions of the week, but you and i have seen these moves before, and a lot of the time we know it means a big shift is coming, iam personally not going to trade this yet until we get a nice clean entry more than likely around our NY session Monday, this is to do with the way ive traded nas in the past and also proven in back testing, when we sweep traders run like sheep. we chose to wait instead of run, this includes the first session of this week we are looking for a clean LDN OR NY open entry to follow a move out of this range, iam more inclined to say we are going up even those we are sitting in a sell range as of inclined to fridays session.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

USDJPY 24/9/23UJ giving some of the cleanest price action from Thursday and Friday leading us into what we have now which is a swing range to go lower, now we can clearly see we are sitting close to the SWH and have created liquid above the relatively equal highs BUT overall we do want to see some lower prices, if we don't take the high at open and we break down lower id be more inclined to look for sells, as always we will jut wait till its our time to trade then get in where we see fit!

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!