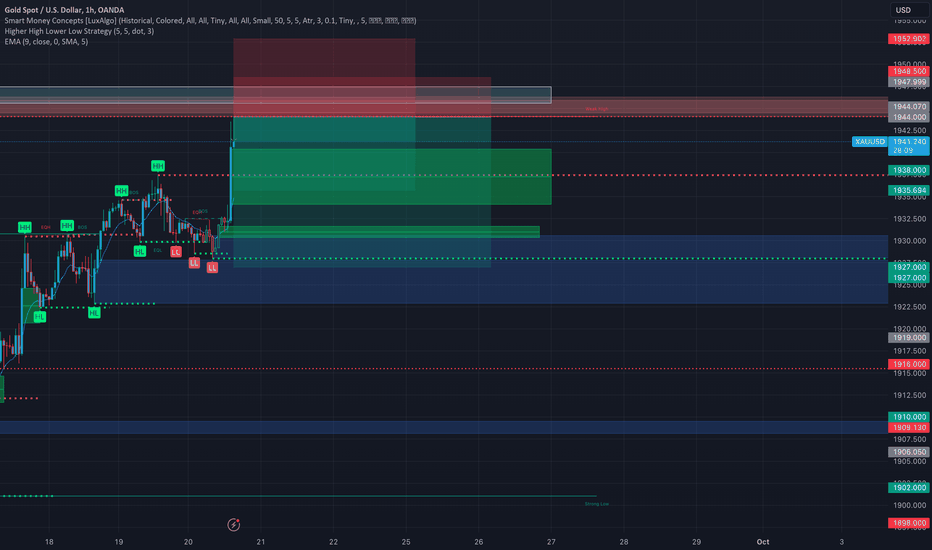

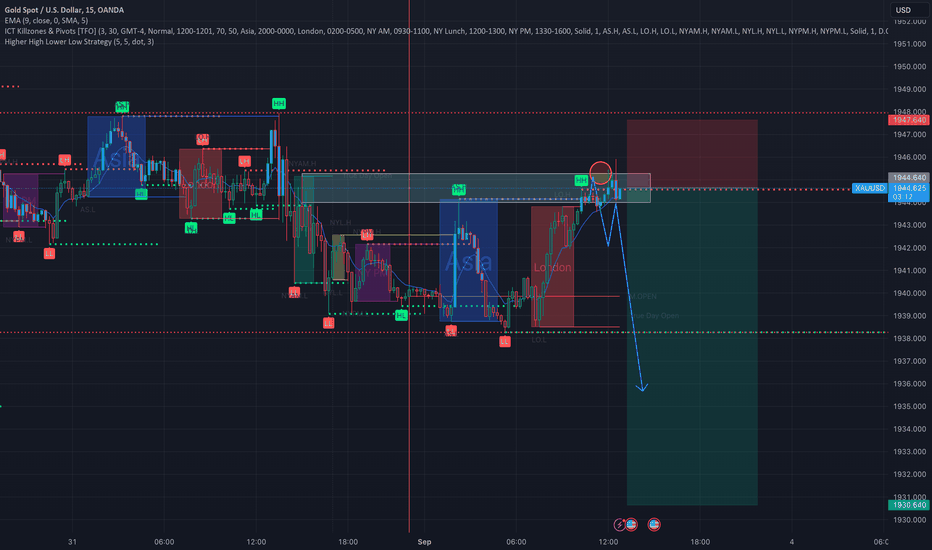

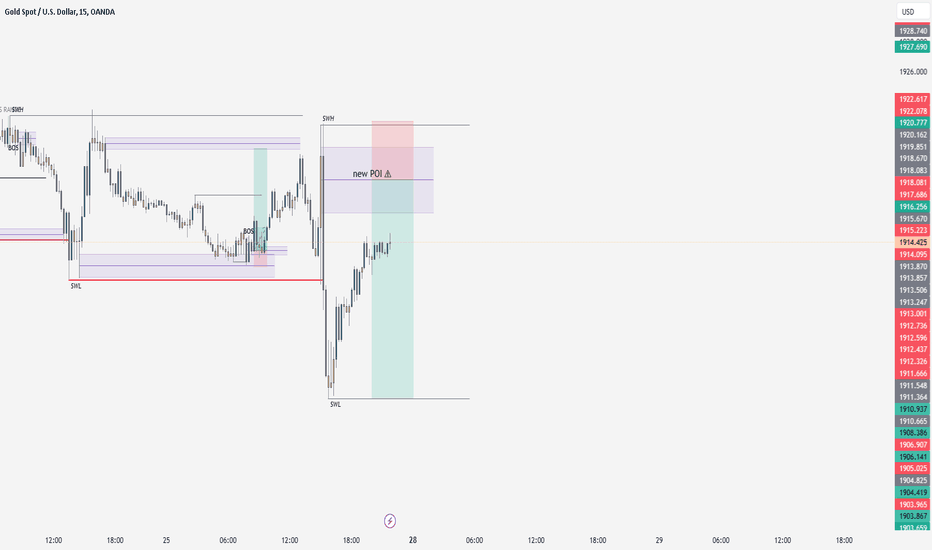

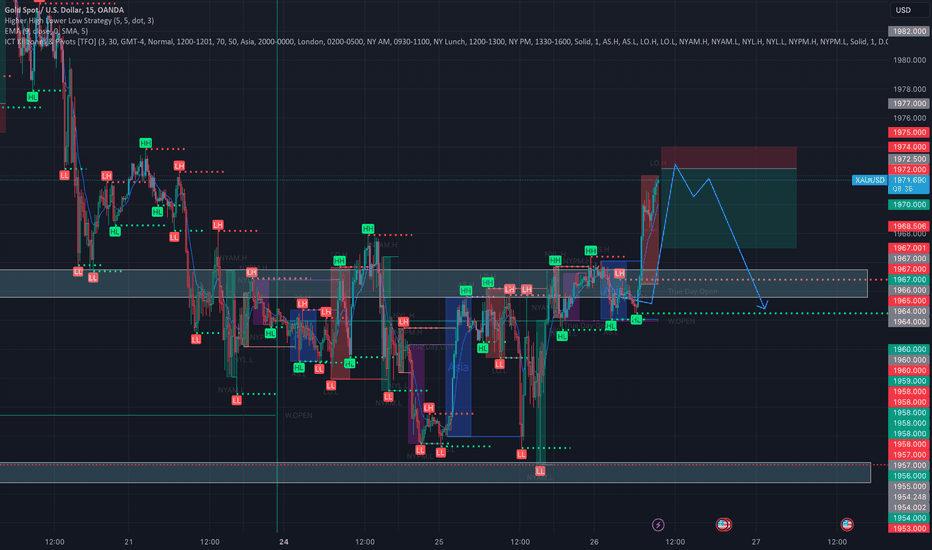

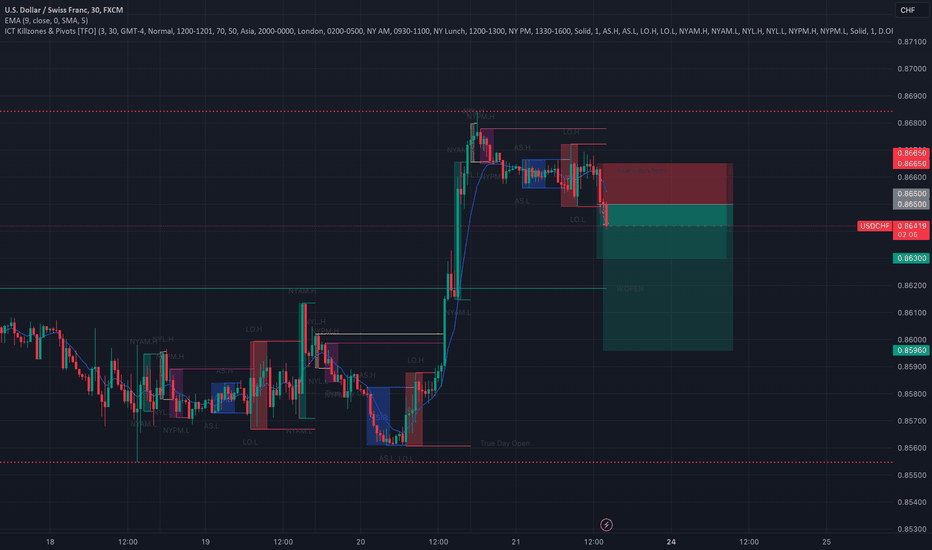

FOMC Order And PredictionTargeting sells from 1944-46 area. Golds sudden bullish movement to this price has caught my eye. I believe FOMC will not raise rates, thus I think it will have a huge impact on metals. There could be range up to that 1948, my stop is at 1948.5 with 2 targets 1940 and 1927 which was around the area of 25 key support.

Ive implemented the use of FVG, BOS and CHoCH, Im slightly adjusting the way I trade news, and trying to play it safer with setting orders rather than instant executions.

Overall this trade gives me a 1:1, 1:3.75 R/R. Orders set, lets see how my analysis goes.

Sell-buy

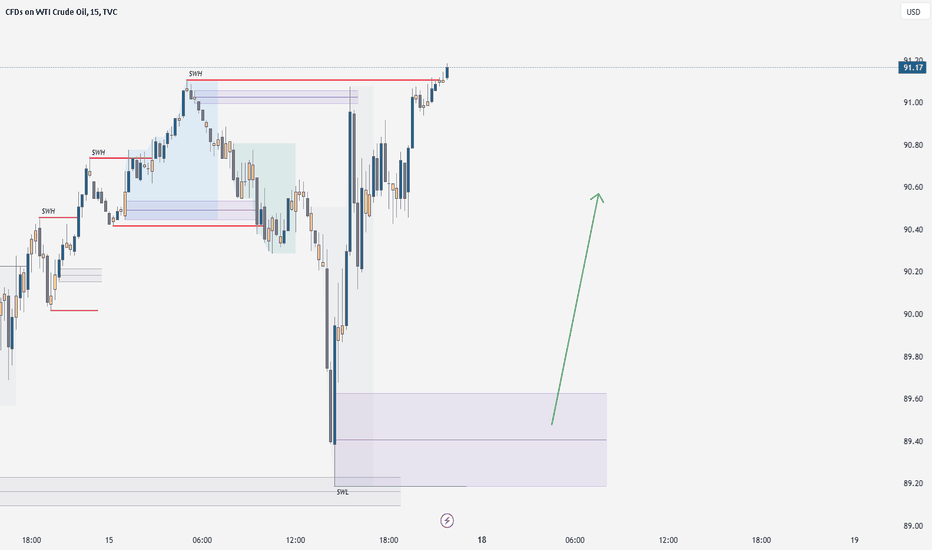

US-Oil 17/9/23US-Oil in a bullish range looking for tap into this area to shift us into the next bullish expansion.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

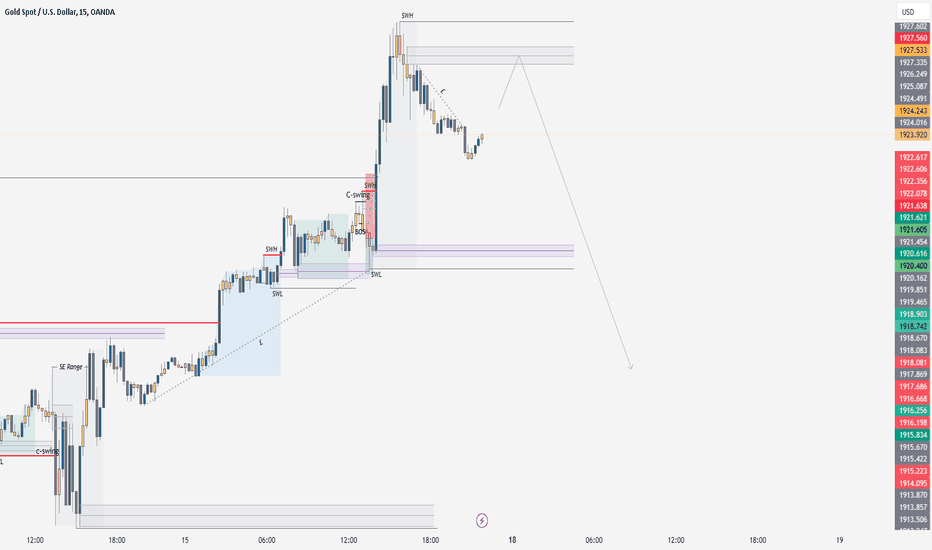

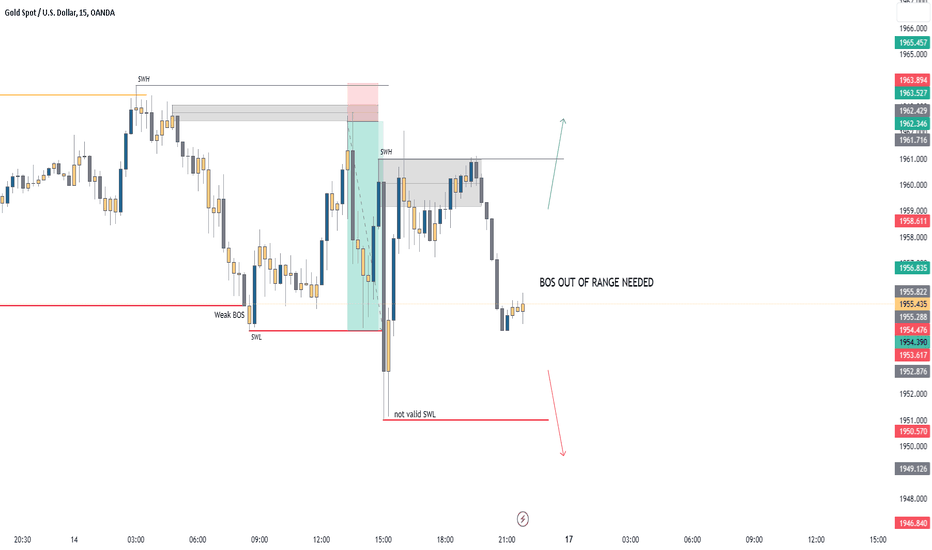

XAUUSD 17/9/23XU we have another clear example of a bullish swing range but overall, we know gold loves to take liquidity, so we could see the reversal from our unmitigated POI at our SWH but of course if we hit our swing low POI first then we go bullish it means most likely we are going higher.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

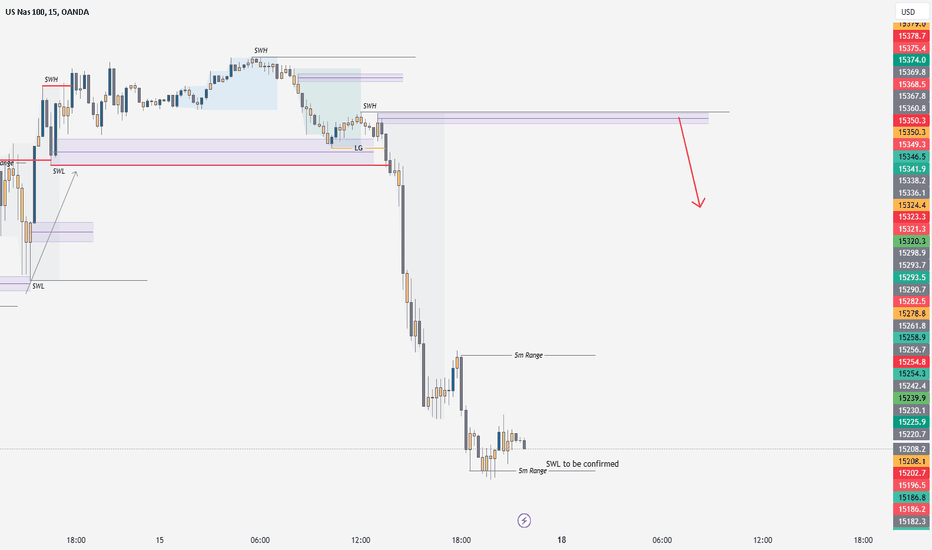

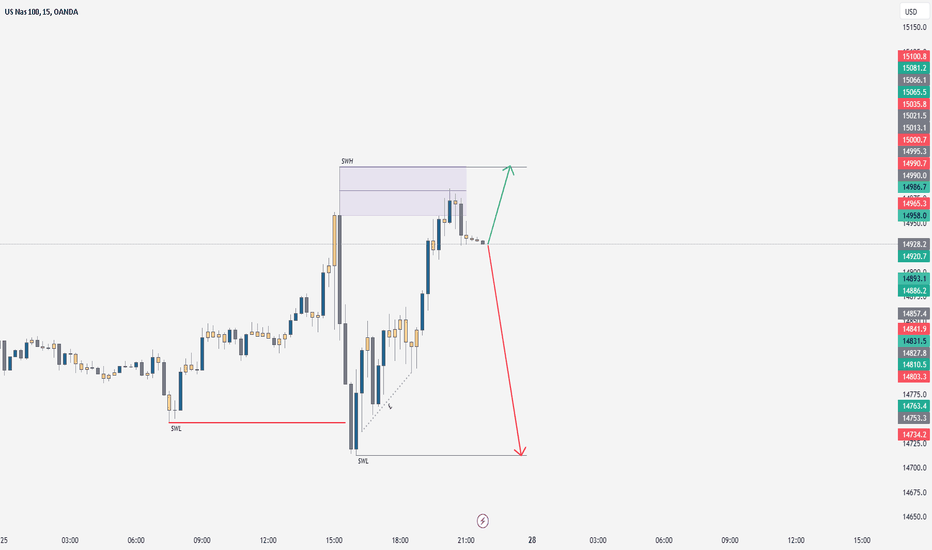

NAS100 17/9/23N1 has a huge expanded range here which tells us we are most likely to see some internal moves that we can trade before we see a pullback to our swing POI. we are still yet to put in a swing low so until that forms we cant exactly track our range.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

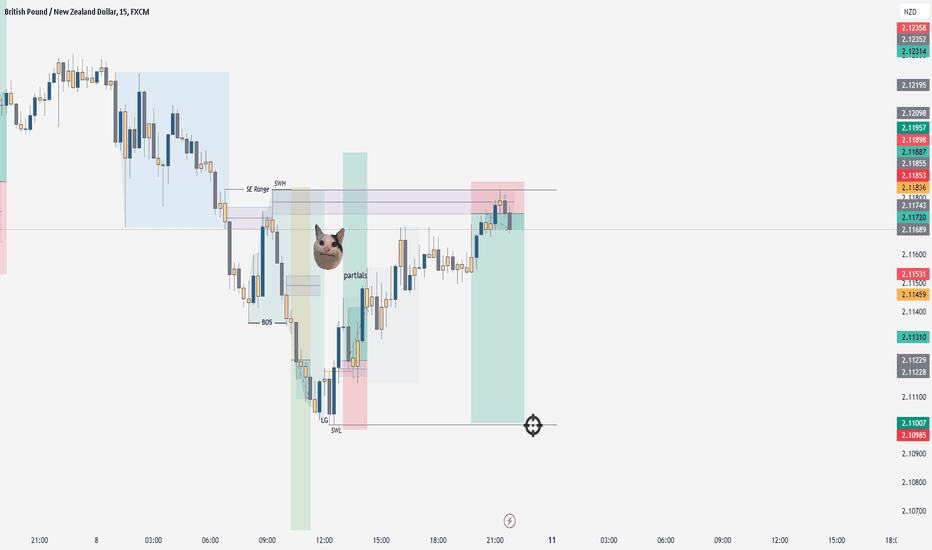

GBPNZD 10/9/23GN super simple and easy make up here, we are looking for the SWL to be taken out from our open moves, i think we will see this low taken within our Monday session now if we don't take this out it wouldn't be a surprised to run our highs above, now i say this because of the size of the range and the lower level of momentum, but still we have a clear lower range move. sell is our bias and until we have a breach of the range we will stick to this sell bias.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

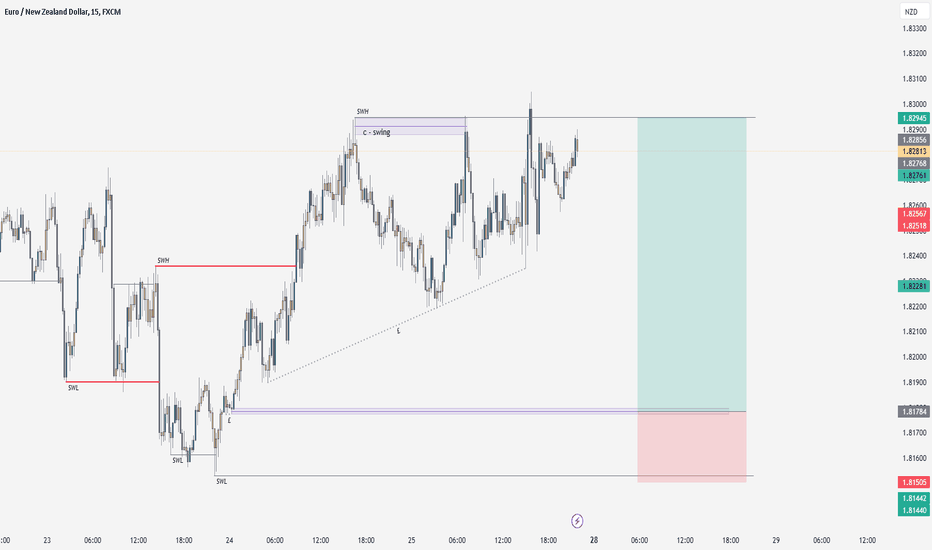

EURNZD 10/9/23EN is sitting within a huge range to the upside, this is overall a bullish range we did last week create a lot of sell side movement to towards our POI but we never broke out of our range and since have pushed up create a very clean trend liquid area which could give price a clear area to aim for, as it stands iam not really interested in trading the swing range as it has really over reached the POI we wanted to buy from so with this in mind il only be looking for SE moves to give us more of a cue as to what we will do next, we are looking to target our high but really we are a long way off as we stand.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

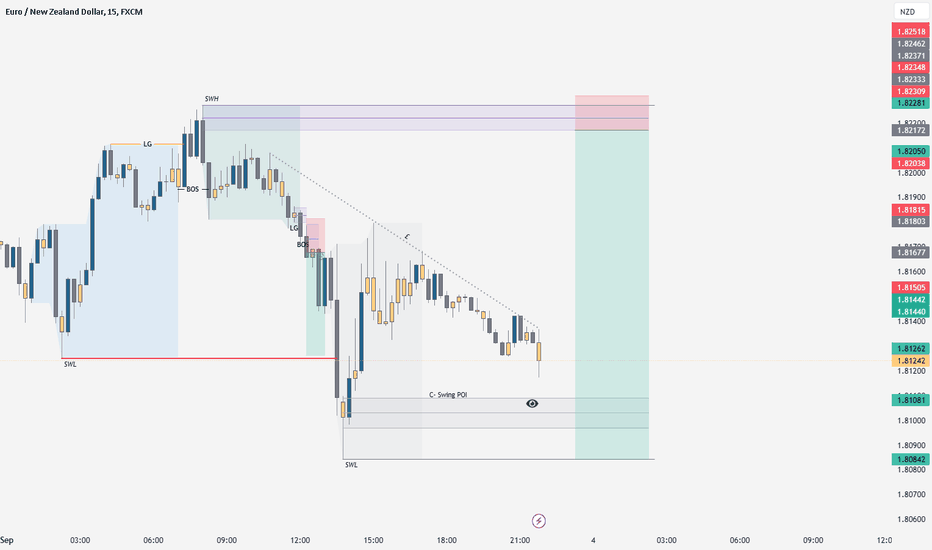

EURNZD 3/9/23Honestly a very clean sell side swing from EURNZD so looking forward to this possibly giving us a tap in, now mainly iam looking for a bullish run early on this week which could be given to us by the C-swing at our SWL base, its given us very clean POIs to work with along with heavy amounts of liquid to serve up for seller and buyer!

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

NFP PredictionXAUUSD has had a nice pump recently, looking at previous data, I can see that +12K is forecast for this months NFP. This should boost the Dollar. While dropping gold and other pairs. Ive entered Sells around NY opening, will hold through NFP with a bigger than usual SL. Time will tell, always use risk management, and extra caution when trading news. Its unpredictable and can be risky.

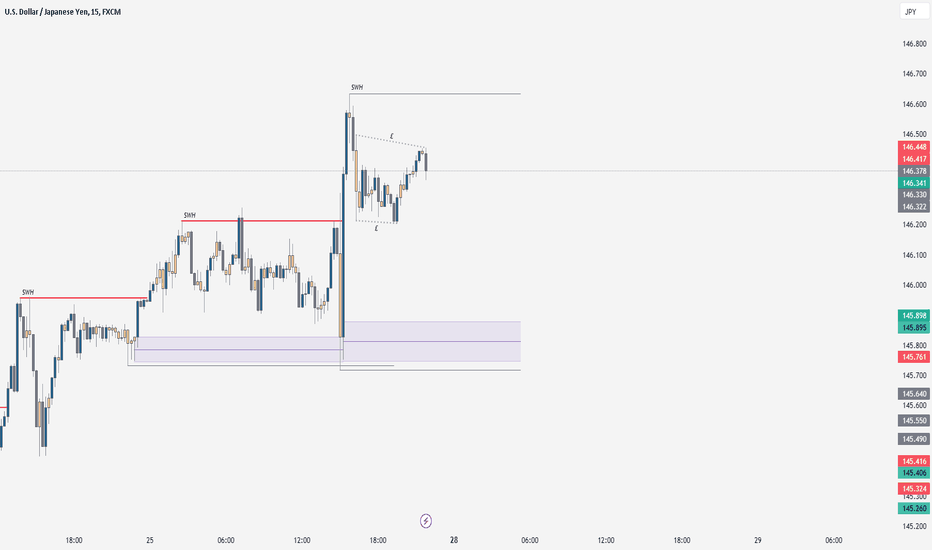

USDJPY 27/8/23UJ honestly i don't have a huge amount to say about this pair or about this range, if you have looked over our other USD related pairs you will know the story by now.

A news range with honestly a poor structure overall, liquid has built higher and lower meaning we may push up then shift lower, as you can see we have a reverse of our other USD pairs as in this case the USD is our primary.

so you guys know what we are looking for, either a shift higher to give us a new range or a confirm entry for our NEWS created POI, on the other end we may have a sweep of our low to give us a bias the is opposite to what we have currently.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

EURNZD 27/8/23EN one of our cleanest pairs from the low volume months is looking very clean again heading into a new week, we have a change from our USD pairs, no NEWS range and huge amounts of liquid below the lows in our range we sit in currently, a short term c-swing entry giving us a bearish shift but we met our demand and kept pushing into the SWH.

Coming into this new week iam seeing a low that we can head toward, and il be looking for a buy move from our highlighted zone, the only thing with this zone is that we don't have the highest amount of volume within that area, regardless we know his POI is aging by the day. so depending on our time to reach this POI will dictate how we enter it altogether.

would love to see LDN shift us lower into this POI and then a new bull range to start the week off would really kick of EN for us.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

NAS100 27/8/23N1 has again the same setup as all of the USD related pairs.

A news range with a break of the SWL, within this range we have tapped in to our POI and so far we have reacted slightly for lower prices, we are looking at our market open entries and some of our smaller timeframe ranges but overall we want to see a break down or up out of this swing range.

Liquid at our low tells us we could see the low taken but iam also thinking we are likely to fill some of our IMB range above the again we created but NEWS.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

GBPUSD 27/8/23GU as we stated in our GOLD markup we have a pretty similar setup on all USD pairs, we created this range with a news event so as per we are using confirm only to enter at this POI.

Mainly iam looking for this to play from our C-swing and then blast our high POI but of course, we wont hold our breath for this move, iam looking more into our open sweep entries for price action until we shift out of this range until then iam cautious to swing trade the news POI.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

XAUUSD 27/8/23XU is the first of our USD correlated pairs and from this you will see a very similar markup for all of the USD related pairs.

This setup is showing you we are looking for sell moves overall, BUT this range was created by a news events (Jackson hole) so we don't want to blindly follow the bias down when we know the news event ranges often prove many traders wrong, this is exactly why we don't jump in as we would with a normal trend move.

So as it stands we are looking at a news range that tells us we want to run the sw low, we will wait for price to tap into our POI if it is willing to deliver to it, once we get to the POI we are only entering if we see a clear confirm and breakdown in our favour.

Lets keep and open mind for this as we are fully aware of the probability of this playing out fully.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

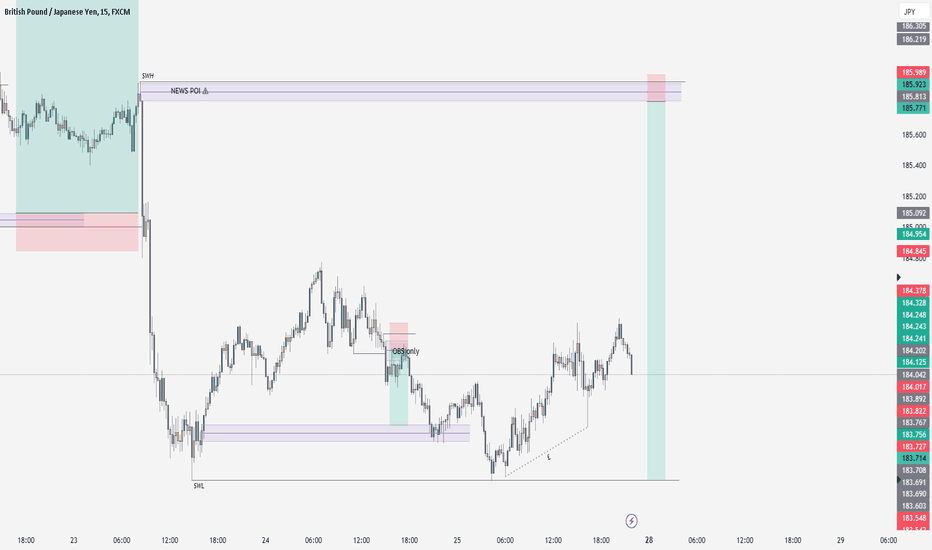

GBPJPY 27/8/23Starting off our week as per with GJ!

Now last week left the market in abit of an open space with very large ranges and lots of imbalance to fill, the main reasons for this is that we had the Jackson hole news event which has directly shifted a lot of our pairs directions and narrative.

Its important to not the time of the year we are in right now, we have just hit the final week of August which is widely know for being the worst time of the year to trade, we are now coming to the end of this period, so with this in mind i strongly believe the Jackson hole event has finally injected our high liquidity back into the markets for our final quarter.

Meaning the following, more efficient swings, faster and stronger moves with trend and a larger daily pip range, so all round good news for us!

Now as you can see we have a very large range here on GJ and as we head into this week we will only be looking for internal movements, leading us to look towards our LDN and NY opens, mainly focusing on our SE entry model.

we have seen price react from our C-swing low and mainly think we may shift higher from here but overall we are still bearish on this as it stands.

Our swing high is a news POI which means we can only really look for confirm entries on this we also have a lot less confirmations for shorts at the high as it becomes a very old POI.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

GBPCHF 🥷🏾 Waiting actions 2 Scenario's Hello Everyone,

GBPCHF 🥷🏾

We have here 2 scenario's

The First one and in my opinion the most possible scenario

↗️ The ascending Breakout ↗️

1️⃣ Buy after one ascending chart from the price 1.11285

🟢 TP 1.12240

🔴 SL 1.10880

2️⃣ Sell after one Descending chart from the price 1.10520

🟢 TP 1.09540

🔴 SL 1.10880

Good Luck and thank you

Give us your opinion in the comment 🤔

Follow And Like 💖

Xau/UsdHello traders!

In my opinion, the xau/usd pair is a buy because the price has broken the neckilne and we are waiting to enter trading if the price breaks the level of (1094.50) with a target of (1933.80) and 1961.00. Don't forget SL (1885.00)

Wait to enter the trade! Be careful!

Don`t forget to look at the economic calendar!

MAKE MONEY AND ENJOY LIFE 💰

THANK YOU!

GOOD LUCK!

🙏🏻🙏🏻🙏🏻

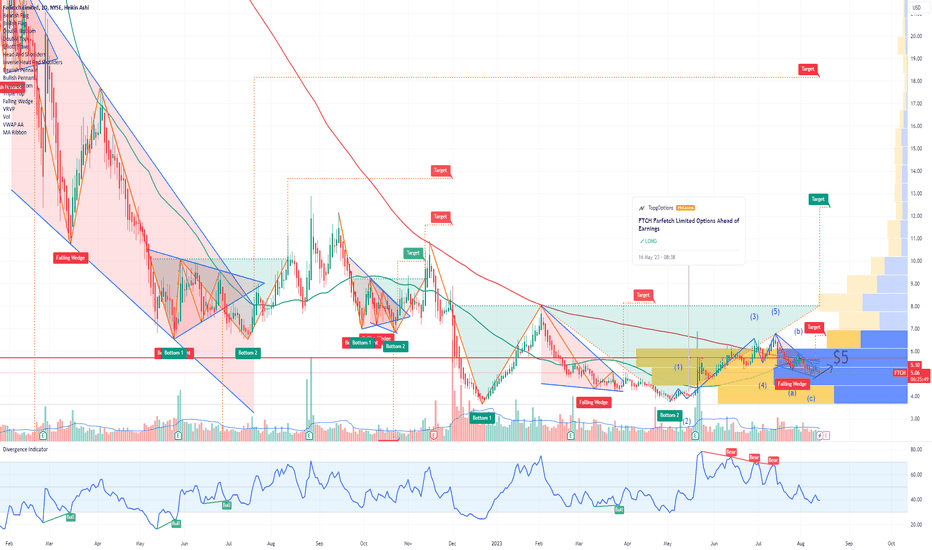

FTCH Farfetch Limited Options Ahead of EarningsIf you haven`t bought FTCH`s Double Bottom here:

Then analyzing the options chain and the chart patterns of FTCH Farfetch Limited prior to the earnings report this week,

I would consider purchasing the 5usd strike price at the money Calls with

an expiration date of 2024-1-19,

for a premium of approximately $1.06.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

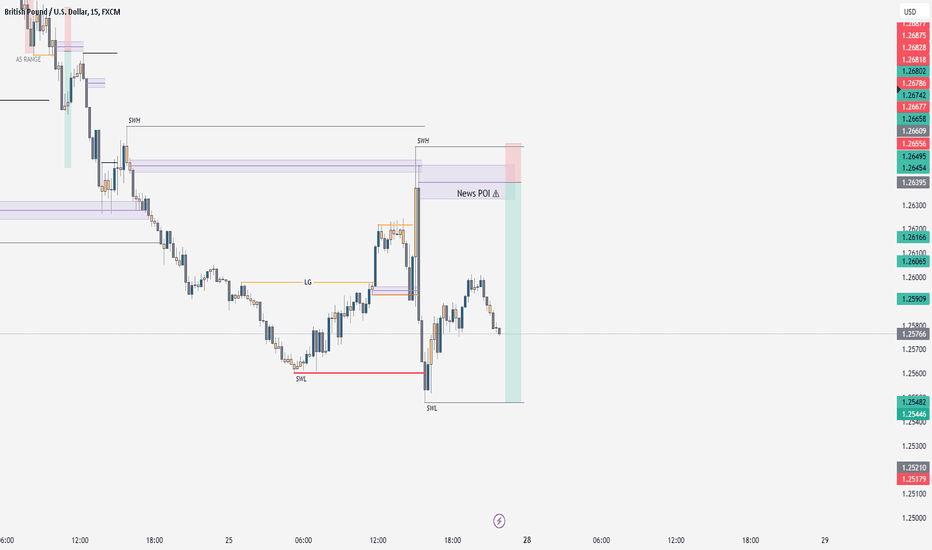

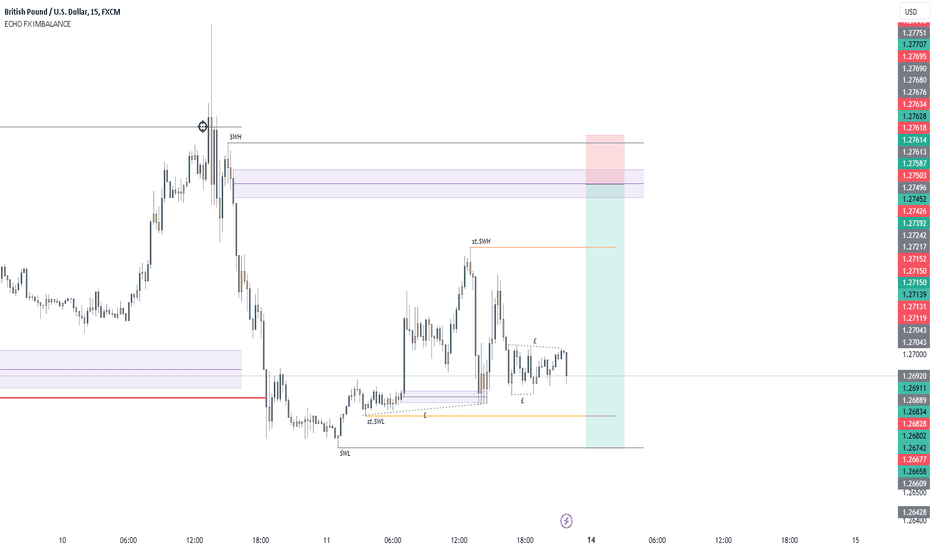

GBPUSD 13/8/23GU giving us a textbook markup here, we have a very clean internal price action move with a bullish short term swig higher, this is perfect to lead us into our overall swing range which we are expecting to sell lower, this will lead us nicely into what we expect for the USD pairs which is a sell off into a huge upside move.

We are looking for sells from our high of the range here as long as we don't clash with news or have any other external factors.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

XAUUSD 16th JulyGold has shown us its looking for lower prices after we shifted out of the buy range on Friday, this leads us into this week and what we can see is a range that's showing us lower moves but we don't have a valid low of this range meaning we have to wait for this range to fail or shift price lower again.

Remember to always read order flow and follow what price is showing you instead of trading based on your desired direction. And, as always, stick to your risk and your plan.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

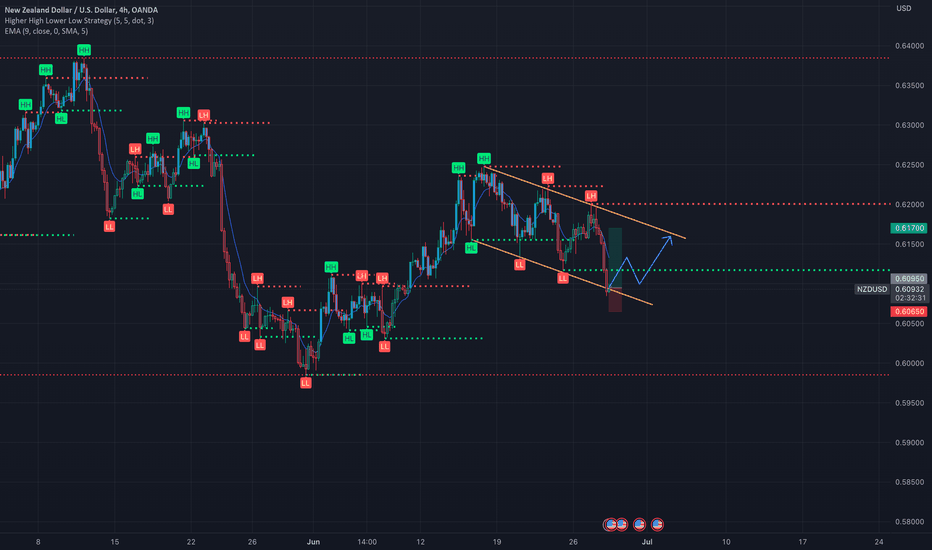

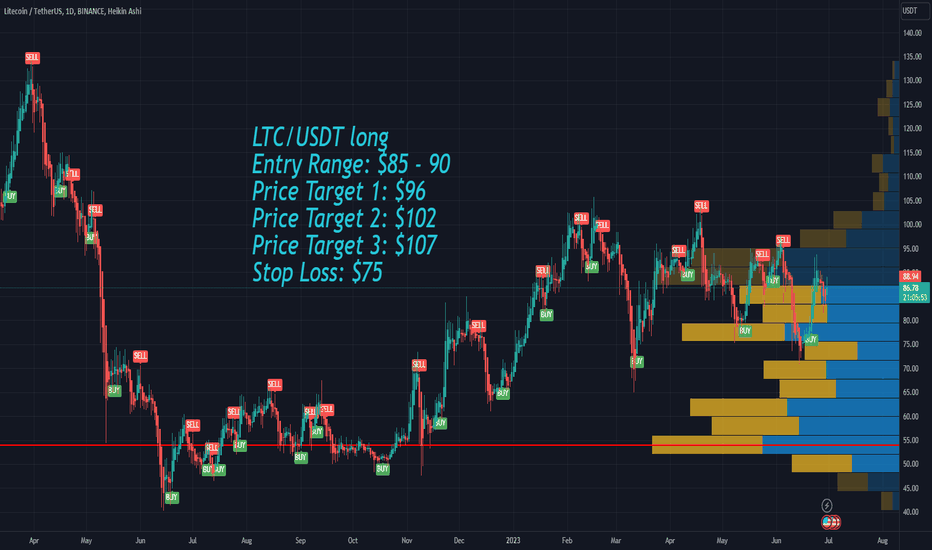

Litecoin LTC potential rally with the Stock MarketCryptocurrencies were left behind by the recent Stock Market rally.

With the arrival of new BTC Bitcoin ETFs, I expect the Crypto Market to follow!

LTC/USDT forecast

Entry Range: $85 - 90

Price Target 1: $96

Price Target 2: $102

Price Target 3: $107

Stop Loss: $75