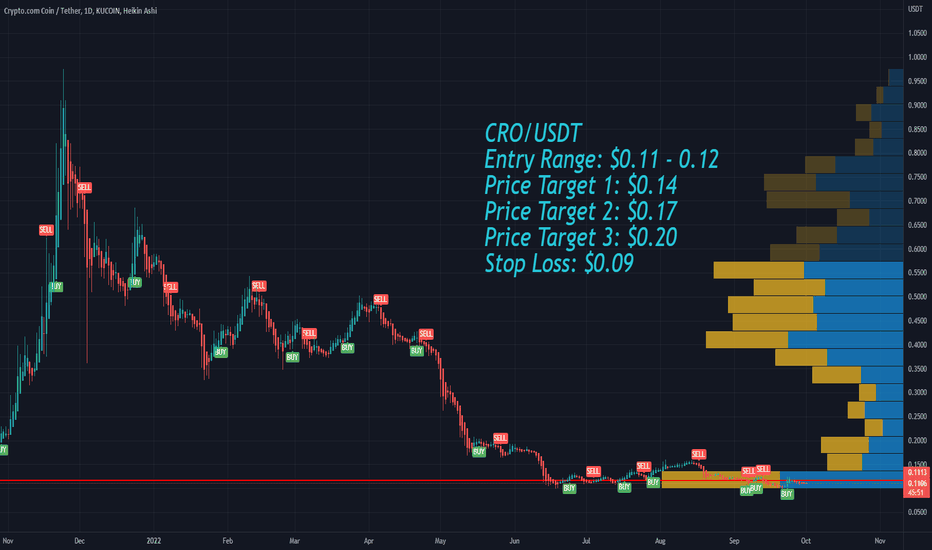

Cronos CRO Bear Market RallyFriday the S&P hit a new 52 week low, being oversold right now.

I expect a bounce in the stock market next week, which will determine a bear market rally in the crypto space too!

Cronos CRO is one of the cryptocurrencies that have a lot of potential for a bull run.

CRO/USDT

Entry Range: $0.11 - 0.12

Price Target 1: $0.14

Price Target 2: $0.17

Price Target 3: $0.20

Stop Loss: $0.09

Sell-buy

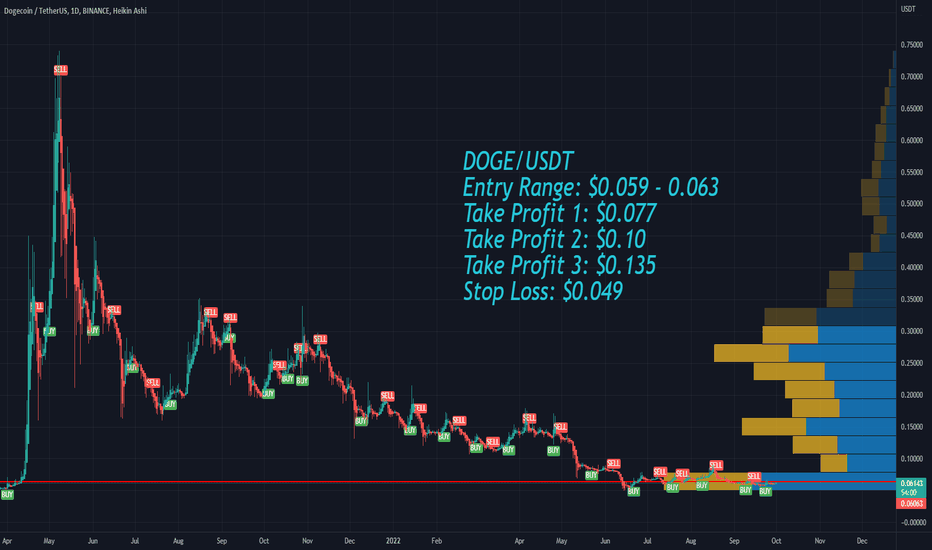

Dogecoin DOGE Bear Market RallyFriday the S&P hit a new 52 week low, being oversold right now.

I expect a bounce in the stock market next week, which will determine a bear market rally in the crypto space too!

Hedera HBAR is one of the cryptocurrencies that have a lot of potential for a bull run.

DOGE/USDT

Entry Range: $0.059 - 0.063

Take Profit 1: $0.077

Take Profit 2: $0.10

Take Profit 3: $0.135

Stop Loss: $0.049

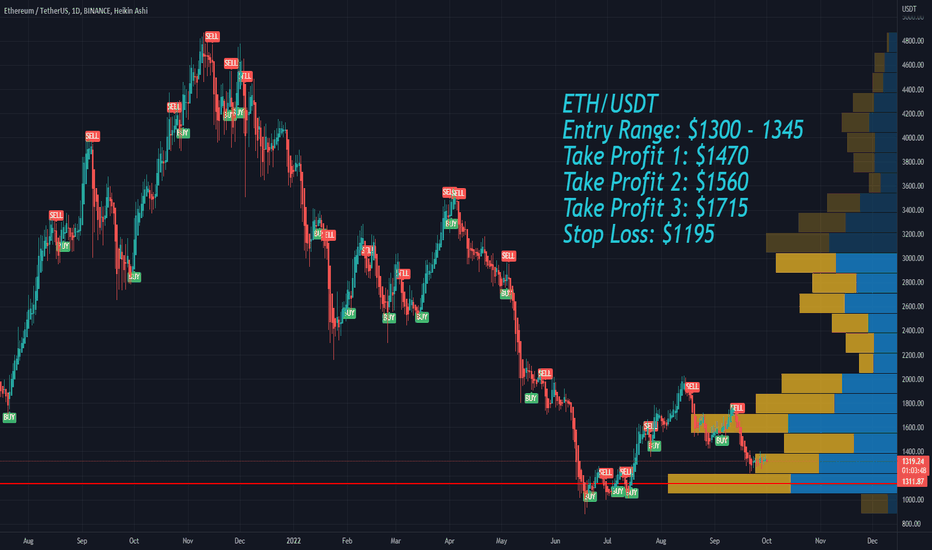

Ethereum ETH Bear Market RallyFriday the S&P hit a new 52 week low, being oversold right now.

I expect a bounce in the stock market next week, which will determine a bear market rally in the crypto space too!

Hedera HBAR is one of the cryptocurrencies that have a lot of potential for a bull run.

ETH/USDT

Entry Range: $1300 - 1345

Take Profit 1: $1470

Take Profit 2: $1560

Take Profit 3: $1715

Stop Loss: $1195

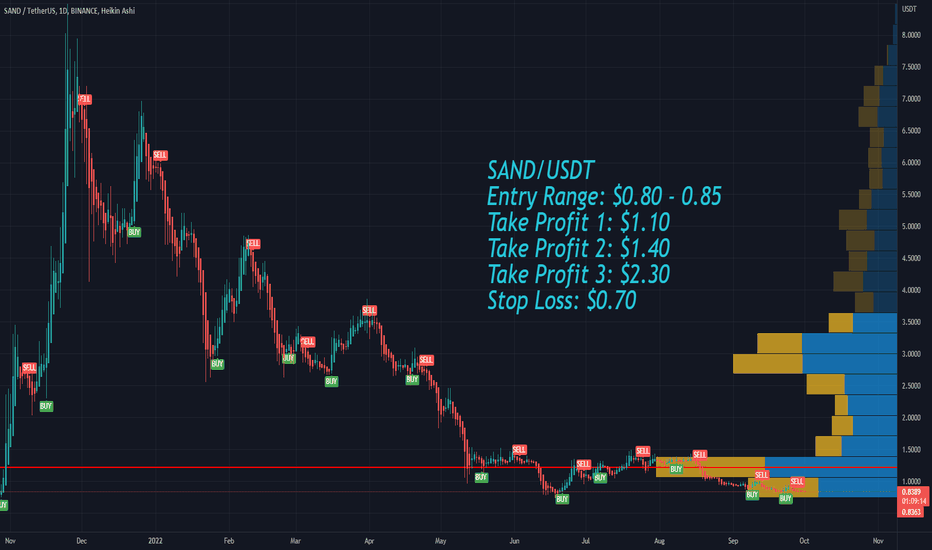

Sandbox SAND Bear Market RallyFriday the S&P hit a new 52 week low, being oversold right now.

I expect a bounce in the stock market next week, which will determine a bear market rally in the crypto space too!

Hedera HBAR is one of the cryptocurrencies that have a lot of potential for a bull run.

SAND/USDT

Entry Range: $0.80 - 0.85

Take Profit 1: $1.10

Take Profit 2: $1.40

Take Profit 3: $2.30

Stop Loss: $0.70

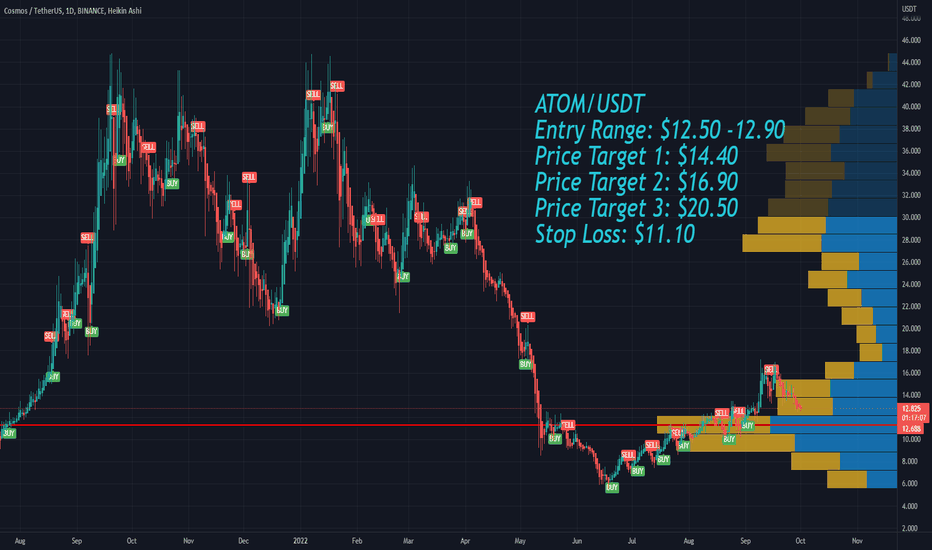

Cosmos ATOM Bear Market RallyFriday the S&P hit a new 52 week low, being oversold right now.

I expect a bounce in the stock market next week, which will determine a bear market rally in the crypto space too!

Cosmos ATOM is one of the cryptocurrencies that have a lot of potential for a bull run.

ATOM/USDT

Entry Range: $12.50 -12.90

Price Target 1: $14.40

Price Target 2: $16.90

Price Target 3: $20.50

Stop Loss: $11.10

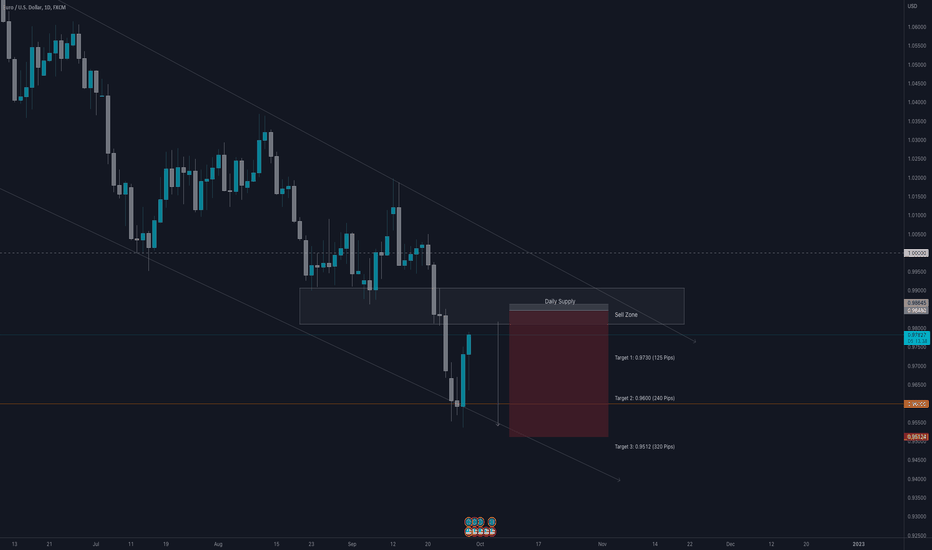

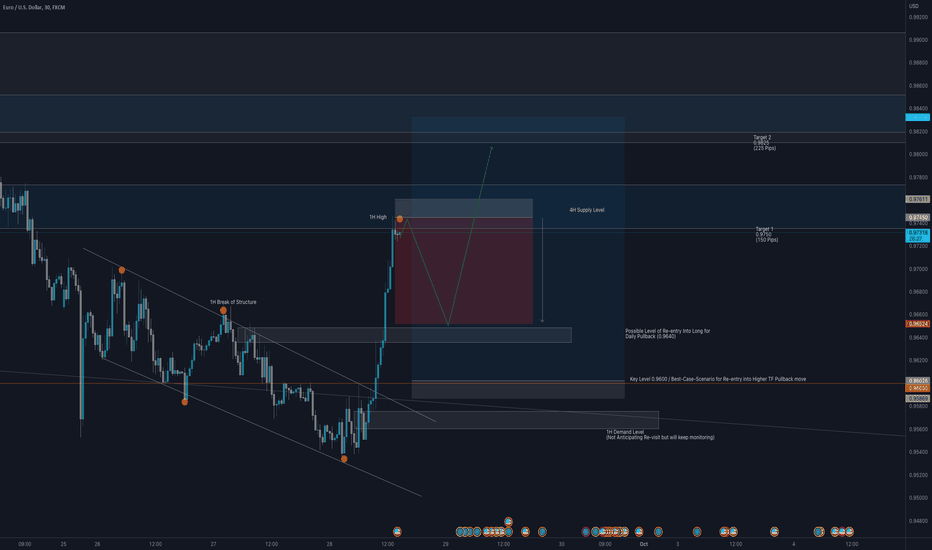

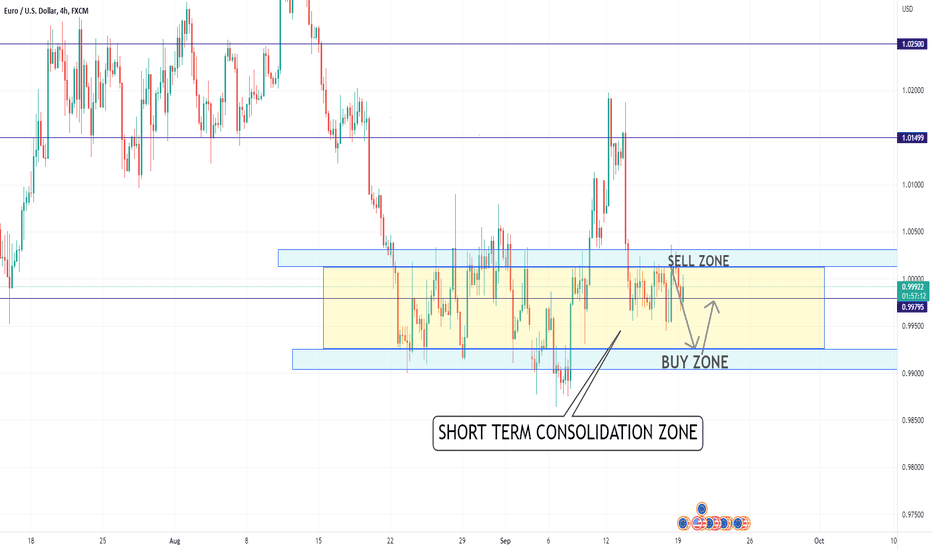

EURUSD Higher TF SELLEURUSD

EURUSD has made a strong push to the upside and closed well above the 0.9700 key level during NY Session (Sept 28). 1H made a clear break of structure to the upside and has been creating higher highs/lows since.

Price is reaching a strong Supply Level on the Daily Timeframe which I expect to see some reaction from. I will wait for Price Action confirmations before jumping into what I believe could be a long term Sell. I am overall Bearish on EURUSD and

would like to see the following scenario play out:

Price has made a strong push to the upside since trading around 0.9540s. I see this as the Daily Pullback and possible anticipation to a new Impulsive move to the downside.

I don't want to get caught into early SELL positions so I will wait to see how price reacts once it reaches my Supply Level at around 0.9850. From here I will like to see a clear price action confirmation and would enter into a SELL as follows:

Entry: 0.9850

0.9885

Stops : 15 pips above

Targets: 0.9730

0.9600

0.9512

*Again* I want to be very cautious with this SELL as I am aware of the bullish price action on the 4H, and Daily (last 2 candles), I would like to see a 30m and ideally 1H Break of Structure to the Downside to get into this SELL.

Note: This is not to be taken as trading advice and/or signals, please do your own analysis and manage your risk responsibly!

Best of luck in your trading

Let me know your thoughts on where you see EURUSD headed next!

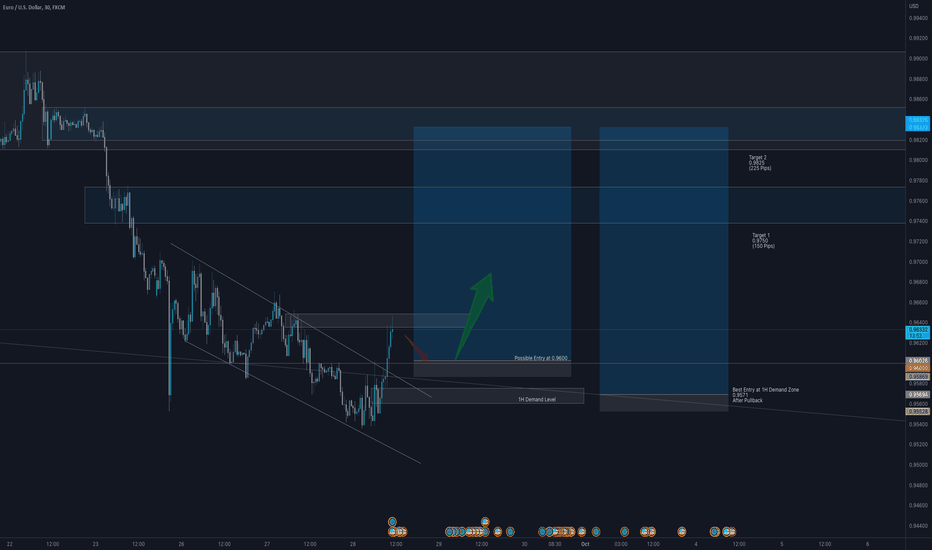

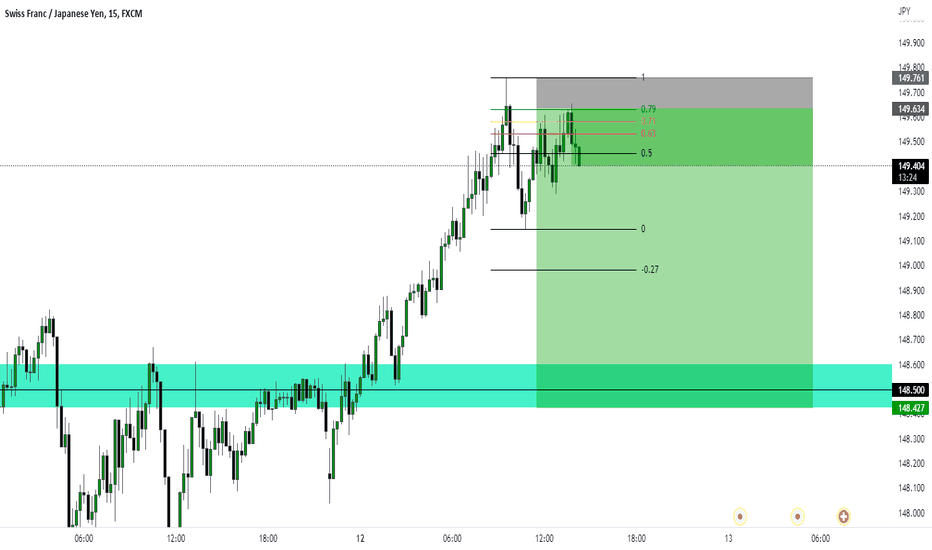

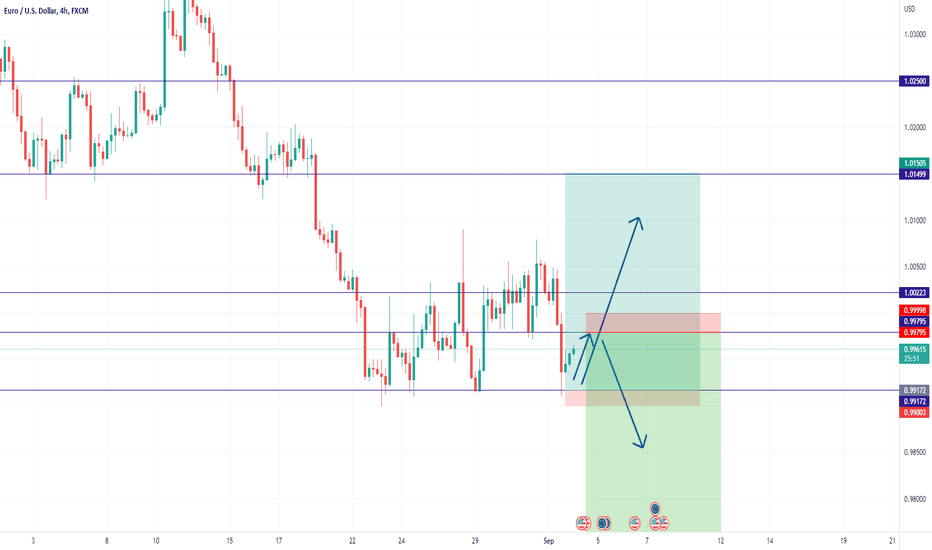

EURUSD Intraday Lower TF Pullback Move EURUSD:

Price Blasted through 0.9600 during the first part of NY Session officially breaking structure on the 1H TF. Initially I anticipated a reaction somewhere around 0.9630-40 and a lower TF Pullback allowing to re-enter the bullish push with ideal entry at 0.9600. However price went straight to my Target 1 of 0.9750 almost immediately not giving a clear opportunity to re-enter (at least for my style of trading). As it reached my First Target, this is a level I have 4H Supply Zone which hasn't been visited prior, and was anticipating a SELL move to take place from here.

I am currently on a SELL as I believe this to be the 1H Pullback I was waiting for this morning. Based on the Higher TF Price Action I could see the following scenario play out:

Lower TF Downtrend (as a 1H Pullback) possibly down to the 0.9650 Level where we have the 50% of the big Institutional 4H Candle of the 1st half of NY. I would love to see Price back at 0.9600 to re-enter the Higher TF Pullback move up, but know this might be a long shot

I know this could be a low probability setup based on how bullish price has been reacting today, however I accept and manage the risk.

Entry: SELL at 0.9745

Stop: 0.9761

Target 1: 0.9650

Target 2: 0.9590

Note: Please remember this is not trading advice or signals for your trading; Do your Own Analysis and manage your risk responsibly!

Best of luck on your trading.

Let me know your thoughts on what you see EURUSD doing next!

EURUSD Big Picture Pullback into Continuation ShortsEURUSD made a push to the mid 0.9530s during Asian Session (Sept 28,2022), recovering nicely again to just below previous NY Lows of 0.9580s during London. At this time the 1H Timeframe was in a beautiful downtrend but giving Price Action signals of a possible break.

From a Big Picture point of view, I wanted to see price make a recovery and break again above the 0.9600 (this has just been done during the NY Session (Sept 29). We have a clear break in structure from 1H down, and I am currently waiting on a Pullback to enter on a Long Position and ride the higher timeframe pullback as shown.

Possible Entries: 0.9600

0.9573

Stops between 10-15 pips below these entries

Targets:

Target 1: 0.9750

Target 2: 0.9825

Note: this is not trading advice and/or signals, do your own analysis and manage your risk accordingly.

Would love to hear your feedback. Best of luck in your trading.

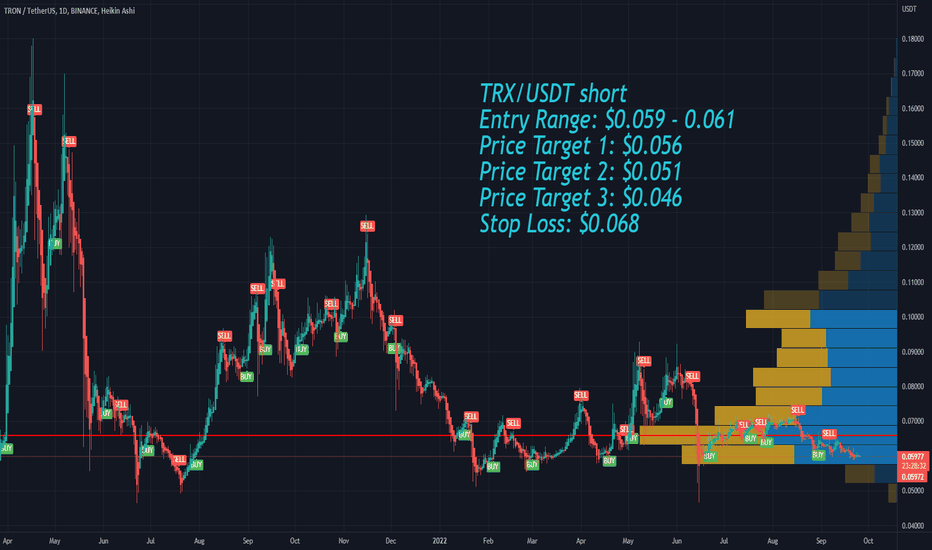

Tron TRX Bearish Sentiment Friday the S&P reached its 52 week low, $3636. There is a strong correlation between the S&P and the crypto world. Many stock investors diversified their portfolio into cryptos, especially in BTC Bitcoin and ETH Ethereum .

With a bearish stock market in the worst month for stocks and cryptos, i expect most of the cryptocurrencies to trade lower this week.

TRX/USDT short

Entry Range: $0.059 - 0.061

Price Target 1: $0.056

Price Target 2: $0.051

Price Target 3: $0.046

Stop Loss: $0.068

EURUSD INTRA-DAY SETUPS!!EURUSD looking like we may create a move to the upside as price is struggling to push lower even off the back of this USD strength. I'm holding shorts from my sell zone but wouldn't be surprised to see price return to this area and continue moving sideways around this consolidation range. Ill be keeping an eye for a break out of this region to give us a better idea of the next bigger directional move.

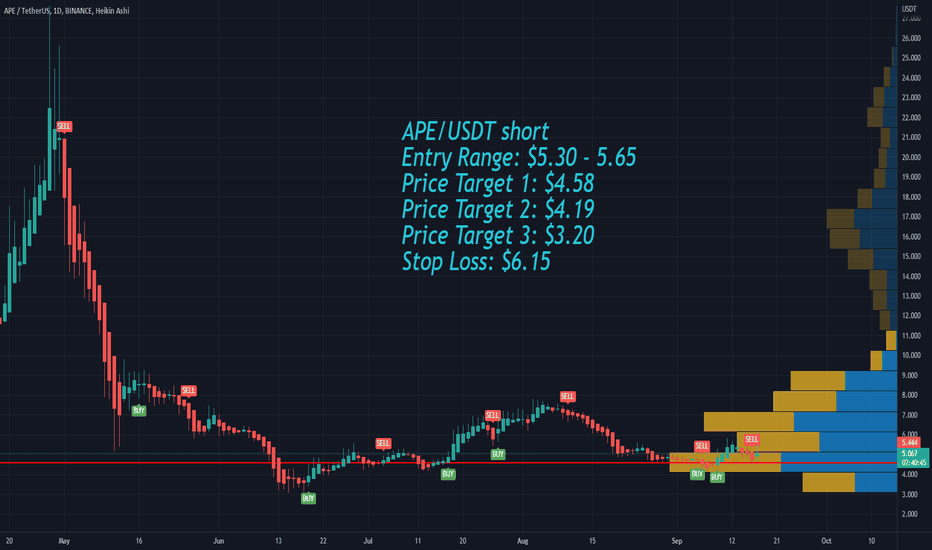

ApeCoin APE bearish sentimentNext week we have the FOMC meeting.

Most likely the Federal Reserve will raise rates by 75 basis points. In case of 100 basis points increase, i expect a sell-off in the markets.

Major cryptocurrencies have seen heavy coin inflow into exchanges recently.

I expect a strong sell pressure next week.

APE/USDT short

Entry Range: $5.30 - 5.65

Price Target 1: $4.58

Price Target 2: $4.19

Price Target 3: $3.20

Stop Loss: $6.15

Tron TRX Bearish SentimentNext week we have the FOMC meeting.

Most likely the Federal Reserve will raise rates by 75 basis points. In case of 100 basis points increase, i expect a sell-off in the markets.

Major cryptocurrencies have seen heavy coin inflow into exchanges recently.

I expect a strong sell pressure next week.

TRX/USDT short

Entry Range: $0.060 - 0.065

Price Target 1: $0.057

Price Target 2: $0.052

Price Target 3: $0.047

Stop Loss: $0.075

Dogecoin DOGE heavy coin inflow into exchangesNext week we have the FOMC meeting.

Most likely the Federal Reserve will raise rates by 75 basis points. In case of 100 basis points increase, i expect a sell-off in the markets.

Major cryptocurrencies have seen heavy coin inflow into exchanges recently.

I expect a strong sell pressure next week.

DOGE/USDT short

Entry Range: $0.059 - 0.063

Take Profit 1: $0.049

Take Profit 2: $0.041

Take Profit 3: $0.035

Stop Loss: $0.075

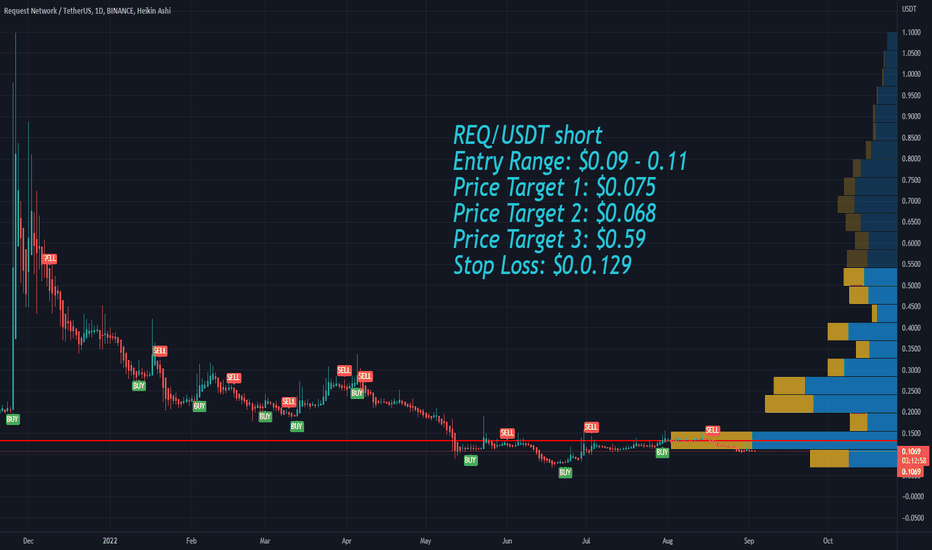

Request REQ bearish sentimentSeptember has major catalysts for the crypto market as well as for the stock market.

The Ethereum merge on September 6th, that will end on Sept 20, the inflation report on September 13 and the next FOMC meeting afterwards with the new interest rates hike.

That is reflected in the crypto space in general as a bearish outlook.

Request REQ has a negative overall sentiment recently.

I have the following price targets:

REQ/USDT short

Entry Range: $0.09 - 0.11

Price Target 1: $0.075

Price Target 2: $0.068

Price Target 3: $0.59

Stop Loss: $0.0.129

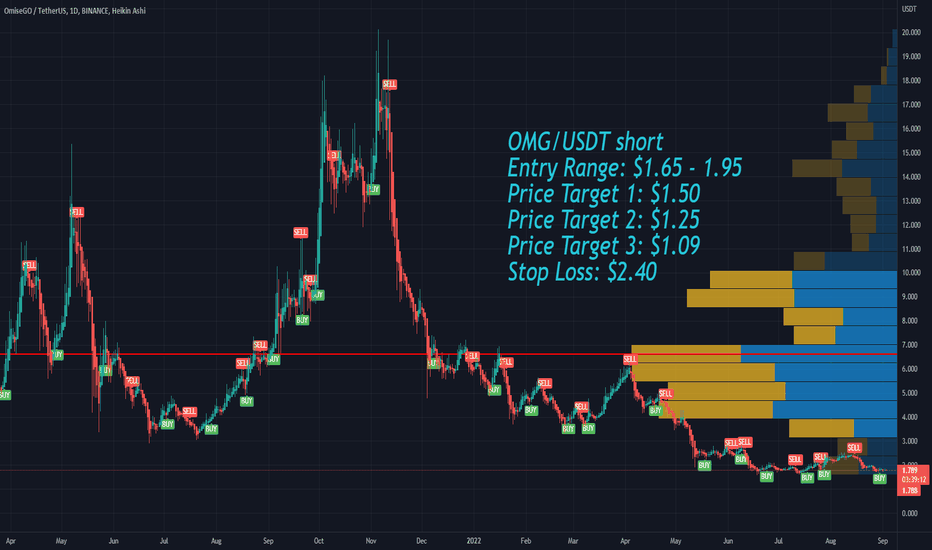

OMG Network bearish sentimentSeptember has major catalysts for the crypto market as well as for the stock market.

The Ethereum merge on September 6th, that will end on Sept 20, the inflation report on September 13 and the next FOMC meeting afterwards with the new interest rates hike.

That is reflected in the crypto space in general as a bearish outlook.

OMG Network has a negative overall sentiment recently.

I have the following price targets:

OMG/USDT short

Entry Range: $1.65 - 1.95

Price Target 1: $1.50

Price Target 2: $1.25

Price Target 3: $1.09

Stop Loss: $2.40

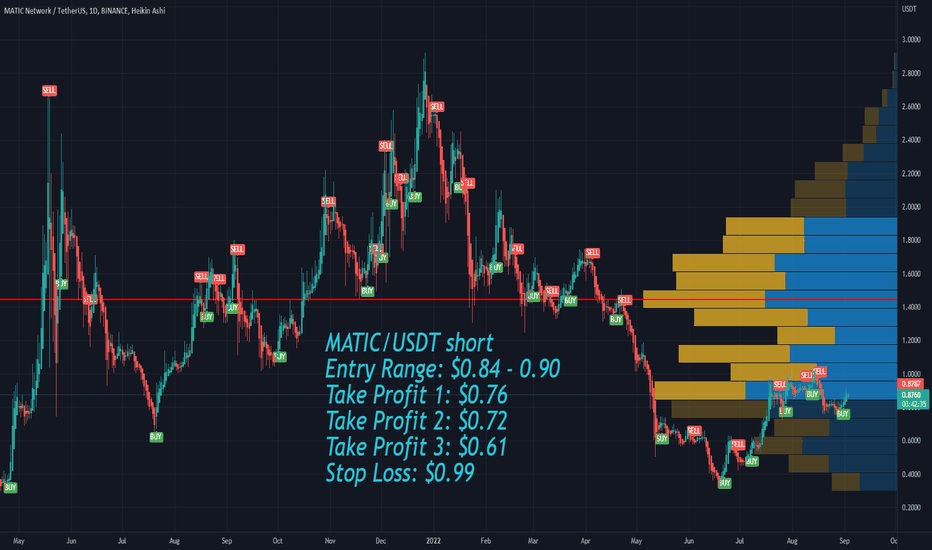

Polygon MATIC bearish sentimentSeptember has major catalysts for the crypto market as well as for the stock market.

The Ethereum merge on September 6th, that will end on Sept 20, the inflation report on September 13 and the next FOMC meeting afterwards with the new interest rates hike.

That is reflected in the crypto space in general as a bearish outlook.

Polygon MATIC has a negative overall sentiment recently.

I have the following price targets:

MATIC/USDT short

Entry Range: $0.84 - 0.90

Take Profit 1: $0.76

Take Profit 2: $0.72

Take Profit 3: $0.61

Stop Loss: $0.99

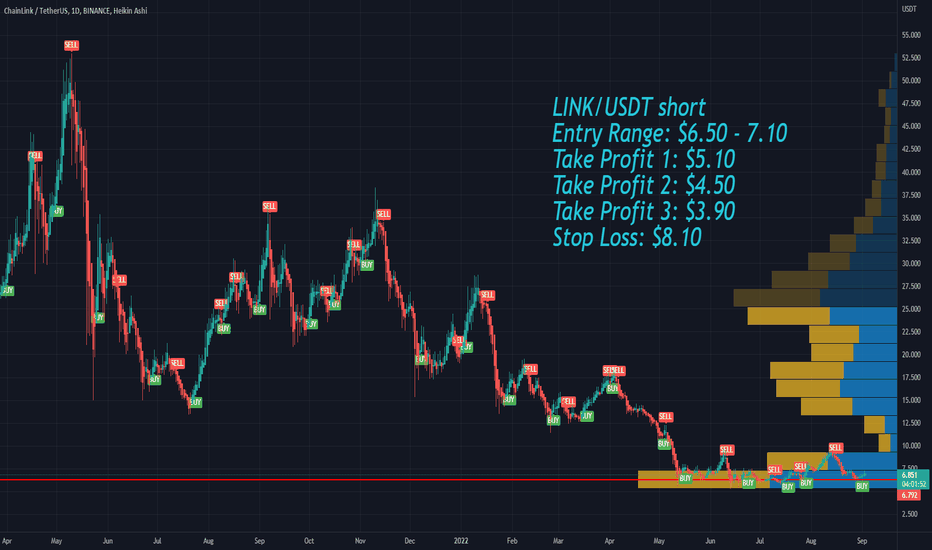

Chainlink LINK bearish sentimentSeptember has major catalysts for the crypto market as well as for the stock market.

The Ethereum merge on September 6th, that will end on Sept 20, the inflation report on September 13 and the next FOMC meeting afterwards with the new interest rates hike.

That is reflected in the crypto space in general as a bearish outlook.

Chainlink LINK has a negative overall sentiment recently.

I have the following price targets:

LINK/USDT short

Entry Range: $6.50 - 7.10

Take Profit 1: $5.10

Take Profit 2: $4.50

Take Profit 3: $3.90

Stop Loss: $8.10

EURUSD NEXT MOVES! Still have 50% of my short trade running risk free, but I'm looking at possible rejection off the supportive area of 0.99200. It may not be this week but Ill be looking for candle rejections and reversal patterns off that support to take a long trade.. the other option is price breaking through that support level and keeping the profit going on my short. Very import to always take some profit! hope everyone smashed it this week.

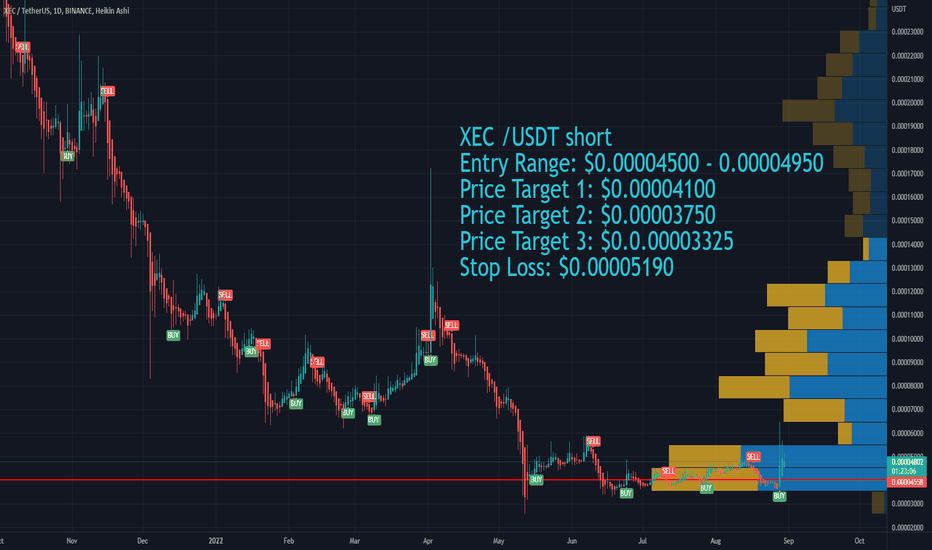

eCash XEC bearish sentiment September has major catalysts for the crypto market as well as for the stock market.

The Ethereum merge on September 6th, that will end on Sept 20, the inflation report on September 13 and the next FOMC meeting afterwards with the new interest rates hike.

That is reflected in the crypto space in general as a bearish outlook.

eCash XEC is a cypto with a negative overall sentiment recently.

I have the following price targets:

XEC /USDT short

Entry Range: $0.00004500 - 0.00004950

Price Target 1: $0.00004100

Price Target 2: $0.00003750

Price Target 3: $0.0.00003325

Stop Loss: $0.00005190