Sell-buy

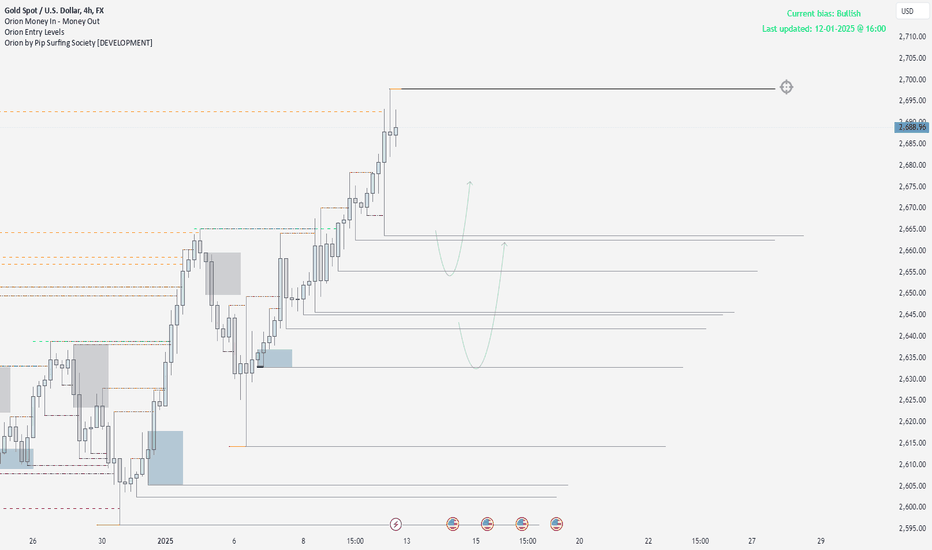

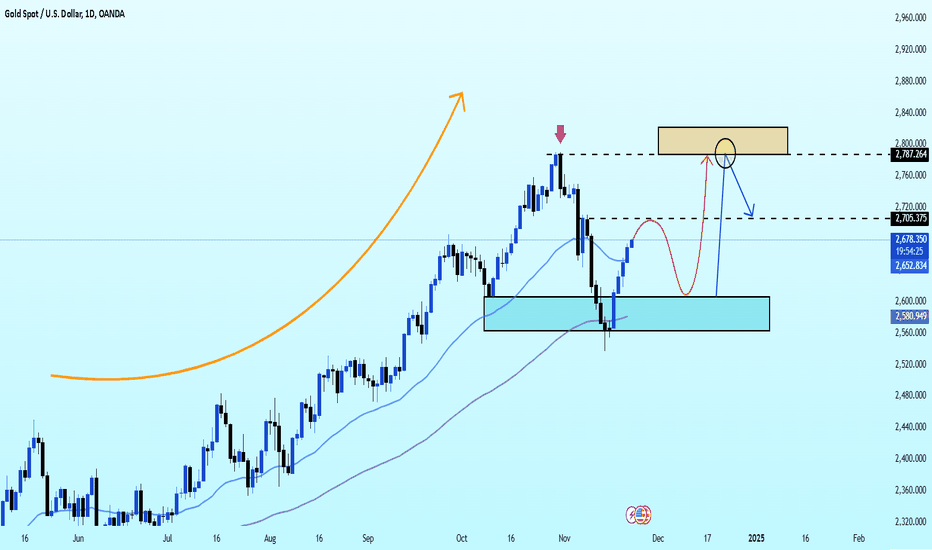

XAUUSD 12/1/24XAUUSD remains our second pair as usual. Orion is clear as always, giving us a bullish bias to target the highs. Similar to EU, we only have one high to aim for, so the options are the same as mentioned in that write-up. We could pull back from the current position, creating a new low in the process, which would lead us into the lows and present a long entry opportunity in line with the bias. Alternatively, we might take the high first and then drop down into the lows, which would also provide a potential long entry.

Overall, we are anticipating a higher shift and need to monitor the lows for this to materialize. Follow Orion, stick to your plan, and manage your risk properly.

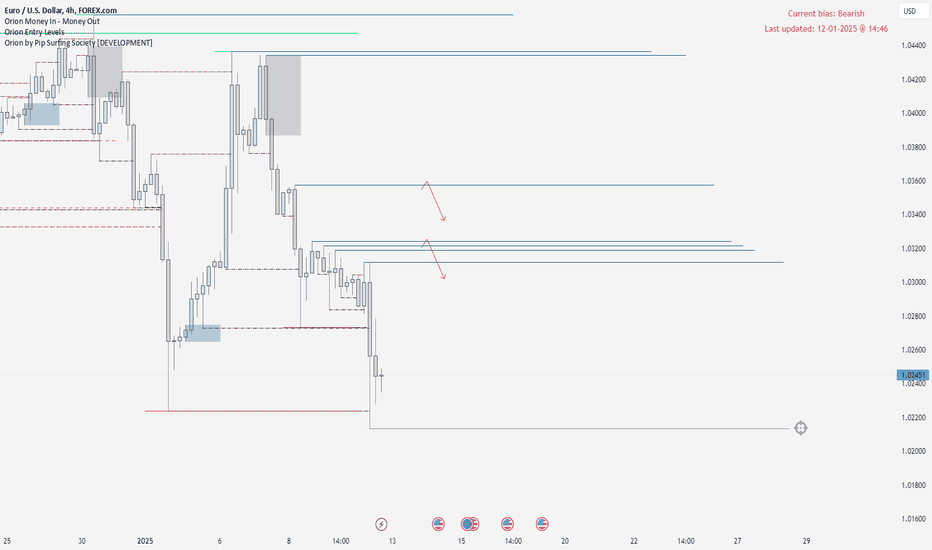

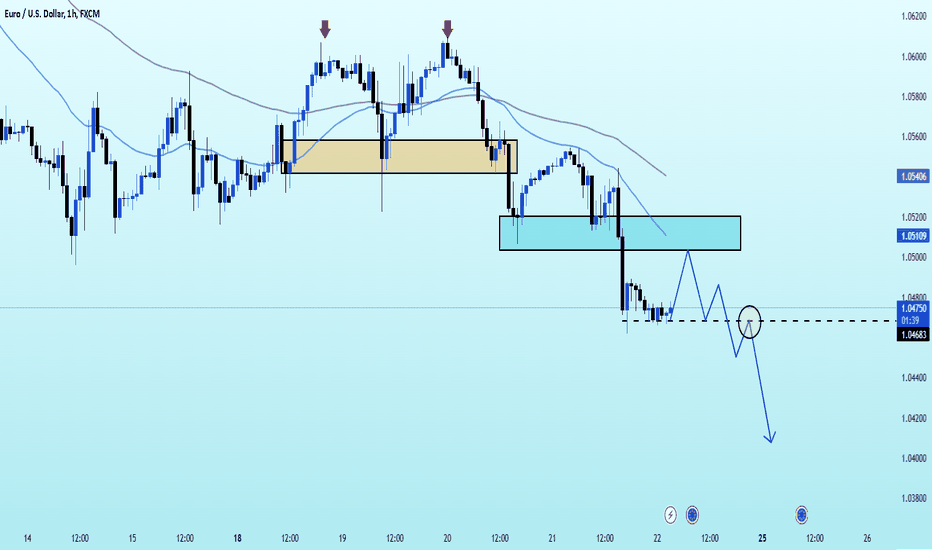

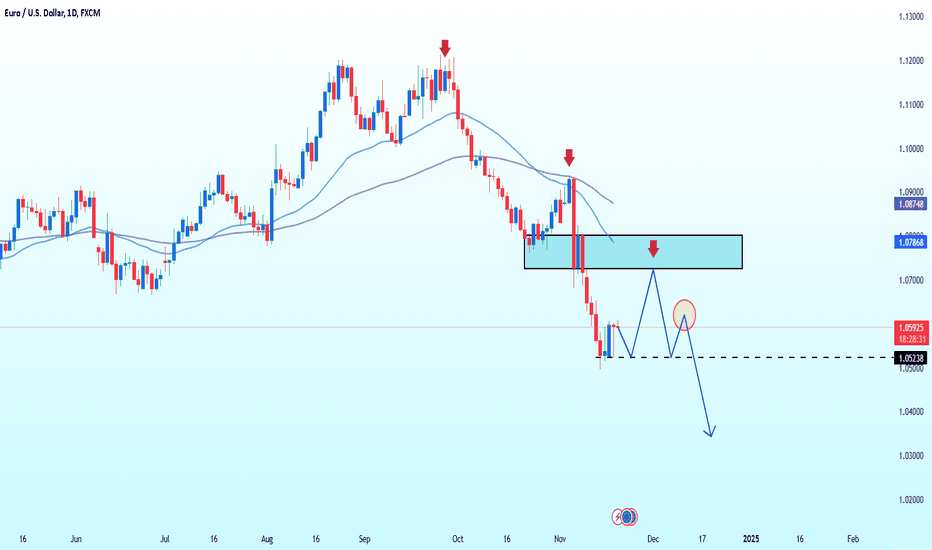

EURUSD 12/1/24Starting the week with our clear bias and understanding of what we aim to trade on EUR/USD. This bias and understanding are, as always, brought to us by Orion, providing precise bias, points of interest, and entry areas.

This week, we observe institutions once again driving the market downward, and we plan to follow this flow. Based on the current market conditions, we are presented with a target low and a major collection of highs, creating a strong area to watch for bearish momentum to return. The game plan is simple: look for a new low to form, giving us targets to aim for. If this happens, watch for the highs to be taken out, which will align us with our short bias. Alternatively, if our current target is reached first, we’ll shift our focus to the highs, providing opportunities to target new lows as the market retraces back to these areas, keeping us in line with the short bias.

Follow what price action shows you and, as always, trust Orion.

Stick to your plan, follow your rules.

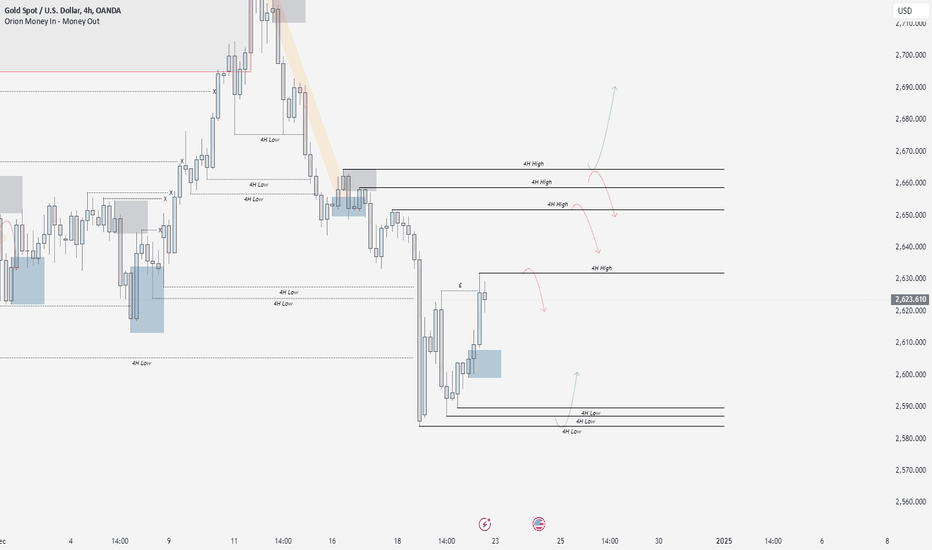

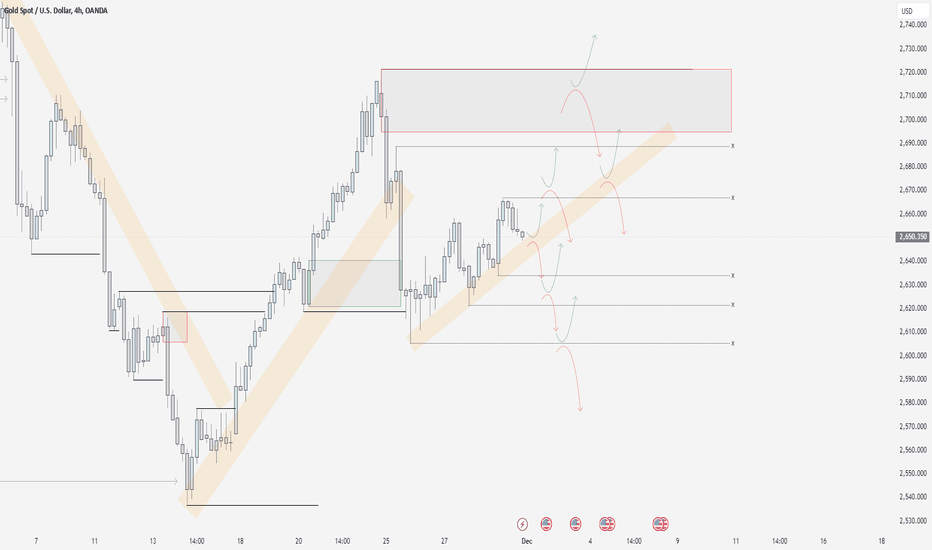

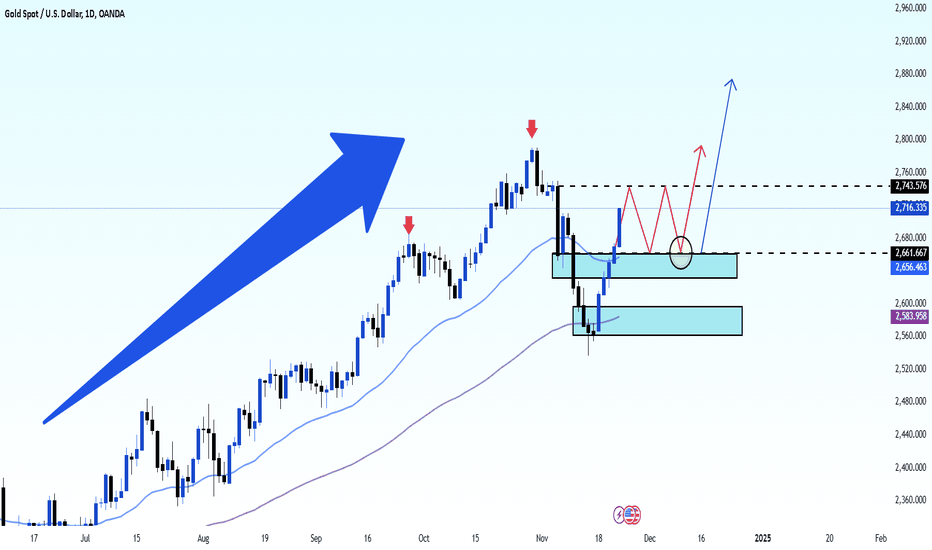

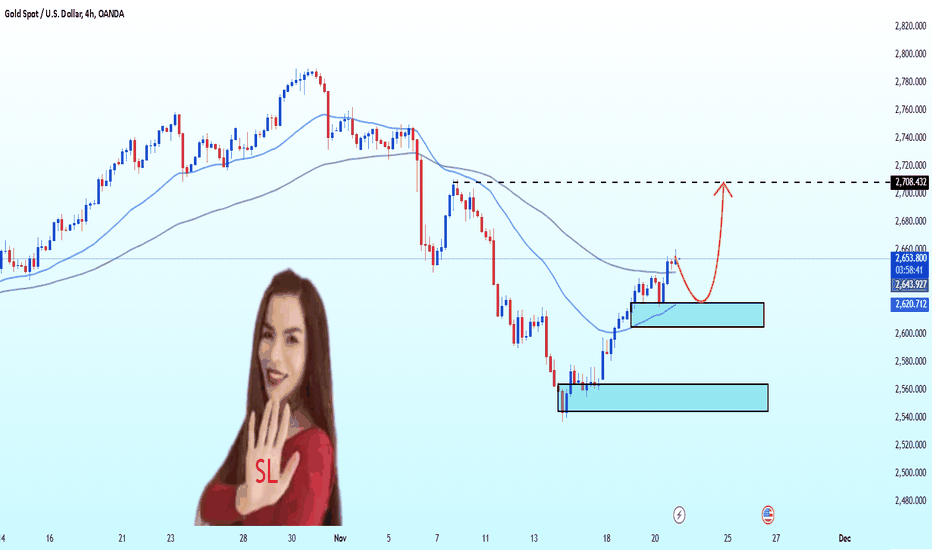

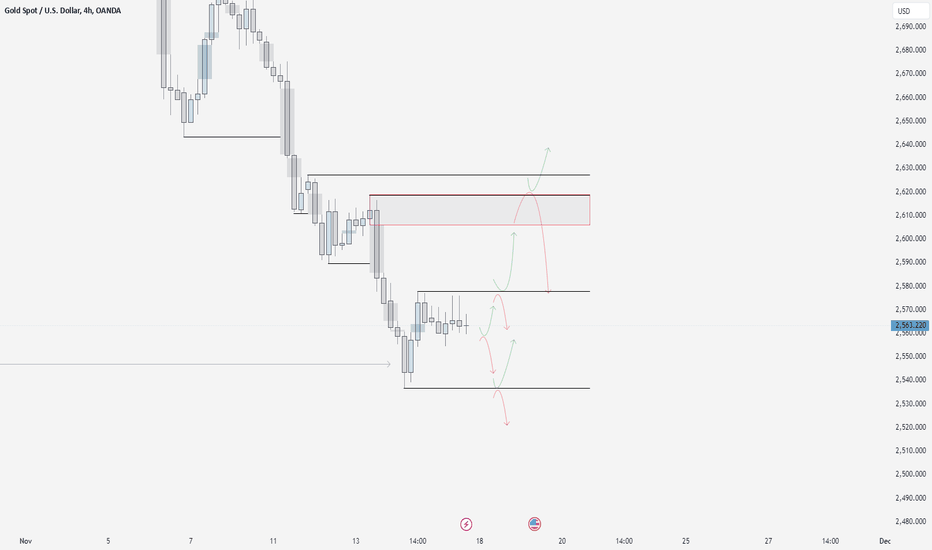

XAUUSD 22/12/25XAUUSD Analysis

Last week, we began with a bullish bias, but our outlook quickly shifted to bearish by Monday's close. This shift led to the significant downside movement observed during the latter half of the week, driven by fundamentals. We saw a substantial run targeting the lower levels, which brings us to today’s bias, which remains bearish.

Currently, we are focused on the three liquidity lows as our primary targets. As always, we look to the highs within the range to provide optimal entries for these targets. At the moment, there is a high in the middle of the range, but we are prioritizing the higher, more favorable highs for potential short positions. If an entry aligns with our plan, this could lead to the final sell-off of the week before the New Year approaches.

Trade safe and stick to your plan.

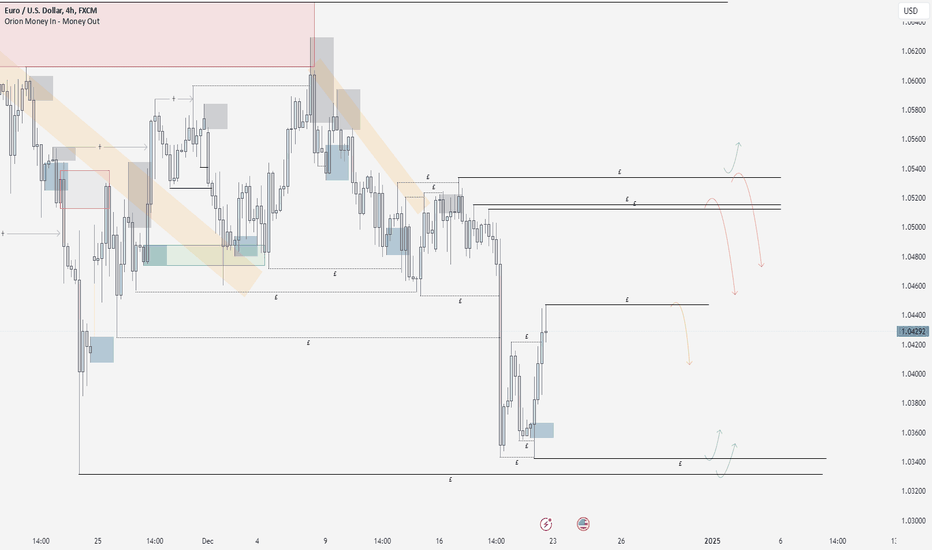

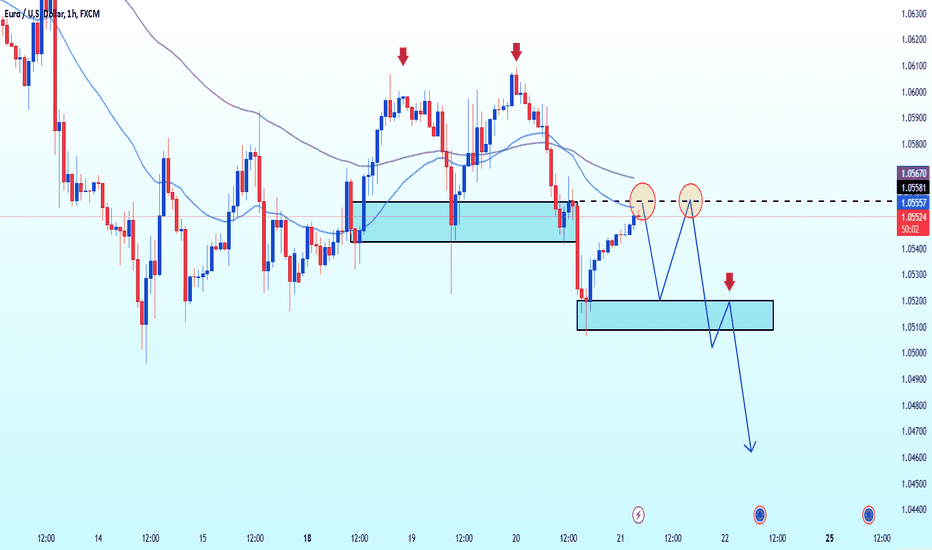

EURUSD 22/12/24EUR/USD Update: Final Week of Trading Before the New Year

As we head into the last week of trading before closing shop for the year, here’s a recap and outlook:

Last week, we called a short after identifying our "money out" level. With a daily bearish bias and liquidity sitting above the highs, we outlined a clear sell scenario. The market delivered exactly as expected.

Looking ahead to this week, our bias remains unchanged, and the principles stay the same. We are targeting deeper moves lower, focusing on the daily low at the base of the current range. Following the same approach, we anticipate the highs to be swept first, creating opportunities to enter and ride the price down to key lows.

Currently, we have a potential high forming near the center of the range, but this is unconfirmed for now and remains a possibility. Keep an eye on all the marked highs—we’re waiting for a sweep of these levels, which could trigger the final market move of the year. If an entry presents itself, we’ll look to trade lower.

Stay disciplined, trade your plan, and manage your risk.

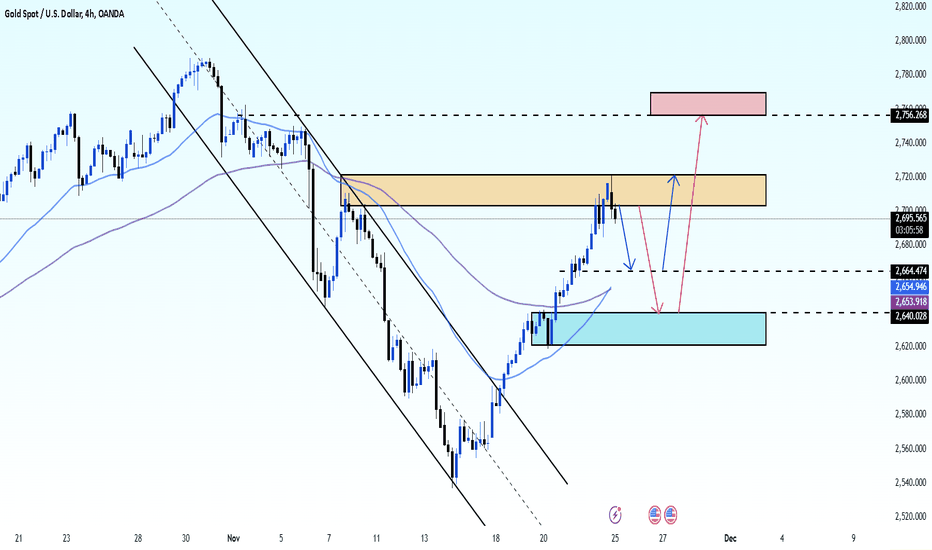

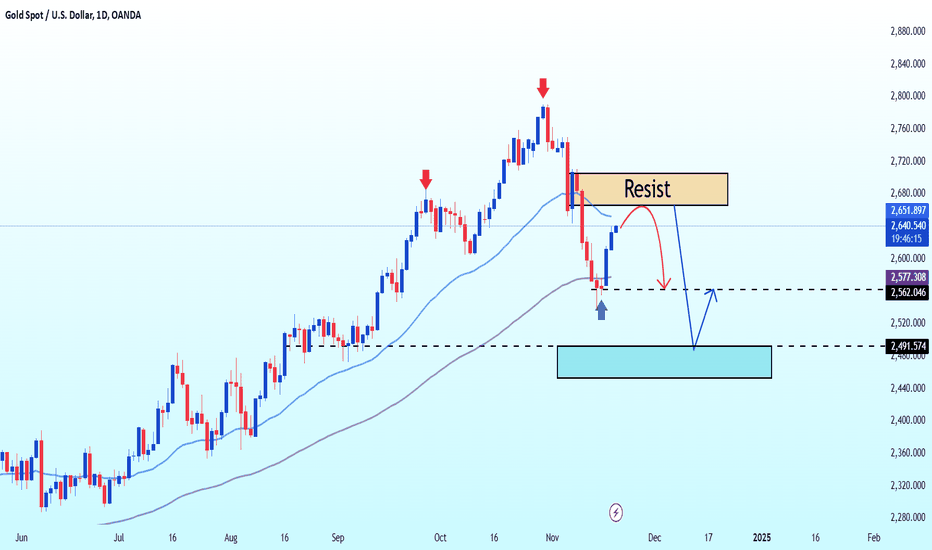

XAUUSD 1/12/24Heading into a new week with a fresh bias on gold, we maintain an overall short bias and aim to follow it. However, we are fully aware that the chances of gold moving long are relatively high. Because of this, we advise caution. Gold can be a challenging asset to trade due to its sensitivity to fundamentals and potential counter-bias movements.

Regardless, we stick to our data-proven ruleset. Currently, we are monitoring two key areas: the liquidity highs above the current price and the supply zone at the top of the last major high. These areas may offer good opportunities for a sell move. However, we are more inclined to see a sweep of a major high followed by a sell-off, aligning with our expected short bias.

Additionally, the upward-moving institutional average suggests that if gold begins to trade below this level, it could further support our anticipated downward move.

Trade safely, and stick to your plan and risk management strategy!

EURUSD 1/12/24As we enter the first week of December, our bias remains the same as last week—bearish. While the GBP/USD pair has shifted to a bullish bias, EUR/USD has yet to follow suit. As always, we track price based on our established bias.

From this chart, you can see several bearish targets in the form of liquidity lows. If we see a push higher, this may take price into the supply area above and toward the nearest liquidity high relative to the current price. At this stage, we will look for a clear sell setup to drive price back down toward the liquidity levels marked below.

If no pullback occurs and price moves lower, aligning with our bearish bias, we’ll look for liquidity highs to form and be taken out as we continue downward. Be aware of the demand zone sitting below the current price, as it may push the market back up if contacted.

For now, we remain bearish and focused on sell opportunities. Keep an eye on the daily bias, as it could shift if price holds higher within this range.

Trade safe and stick to your plan!

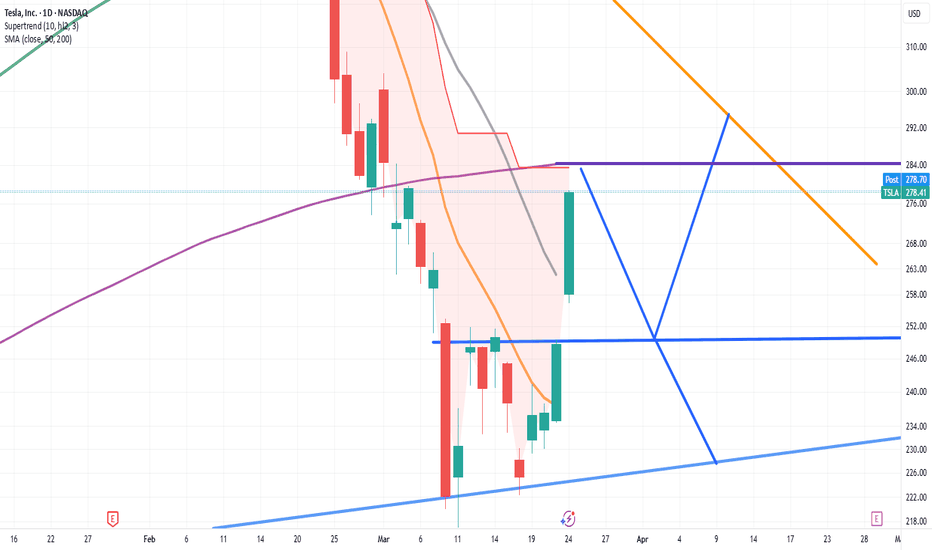

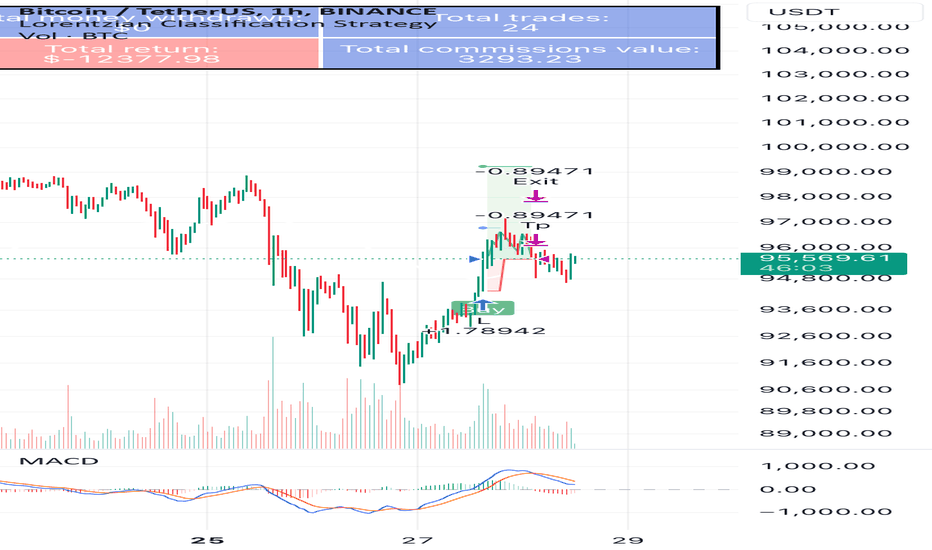

$BTC possible flip upward to new ATH? 1 hourSo I’m not an amazing trader and I don’t make your trades this isn’t advice as I am my own finacial adviser and that is how anyone trading should be so you can’t use this as a future prediction as I do not predict the future. Not finacial advice.

Please add any useful comments so we can grow and make money trading on the crypto markets!

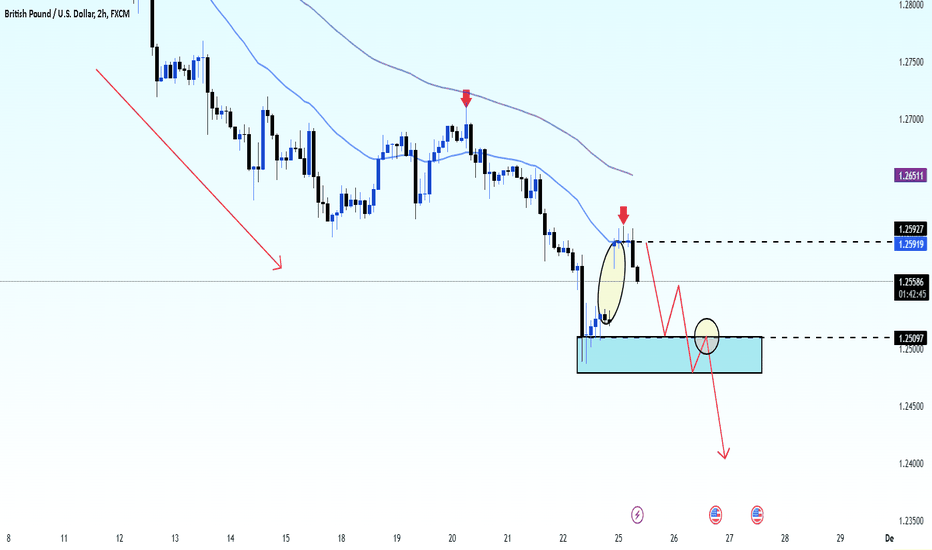

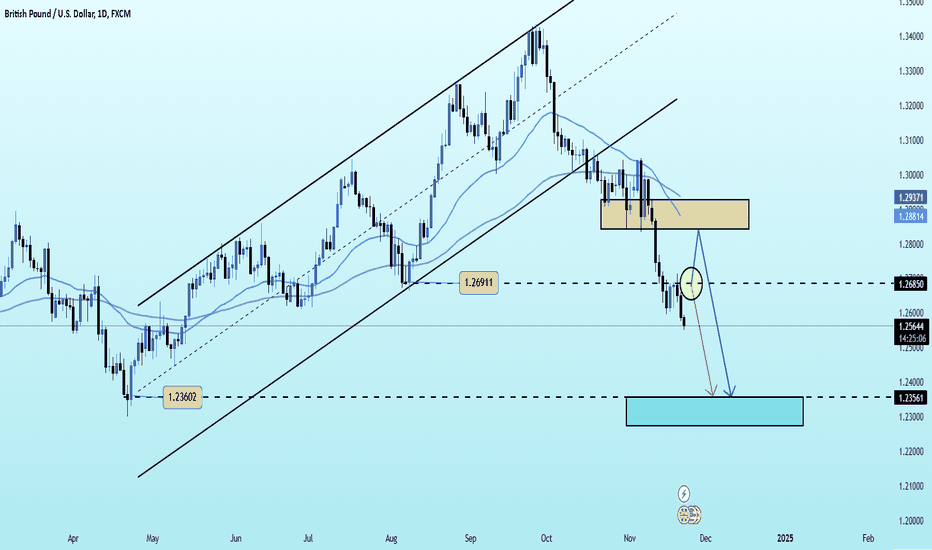

GBP/USD: Downtrend Holds Firm, Key Support in SightThe GBP/USD pair is trading around 1.2557, maintaining its downward trajectory as it fails to reclaim the resistance level at 1.2592. The pair continues to face selling pressure, with the prevailing downtrend keeping momentum in favor of the bears.

Immediate focus now shifts to the critical support zone near 1.2500, where some temporary buying interest may emerge. However, a break below this level could pave the way for further declines toward 1.2450, with the broader target potentially at 1.2400.

Any short-term pullbacks into the resistance range of 1.2592–1.2650 are expected to attract renewed selling pressure. The 50-period moving average also reinforces this zone as a significant barrier to any bullish attempts.

With bearish momentum firmly in control, GBP/USD presents opportunities for sellers to capitalize on short positions while monitoring for key breakouts below the 1.2500 support level.

Gold price continues to recoverLast week, gold posted an impressive gain of over $150 per ounce, recovering strongly across all trading sessions. This remarkable performance highlights the unwavering confidence of investors in the precious metal, particularly during times of economic and geopolitical turmoil.

From a personal perspective, gold's upward momentum is expected to remain supported by safe-haven demand as geopolitical tensions continue to escalate. Additionally, the "buy-the-dip" activity during minor corrections has helped sustain gold prices at elevated levels.

In the short term, if gold holds above the critical $2,700/ounce mark, the likelihood of it advancing to $2,800/ounce increases significantly. Moreover, optimistic forecasts suggest that gold could reach $3,000/ounce by next year, despite the challenges posed by a strong US Dollar and rising US bond yields.

Gold continues to solidify its role as a "safe harbor" during uncertain times. With its current upward trajectory, the precious metal remains a highly attractive asset, drawing robust interest from investors across the globe.

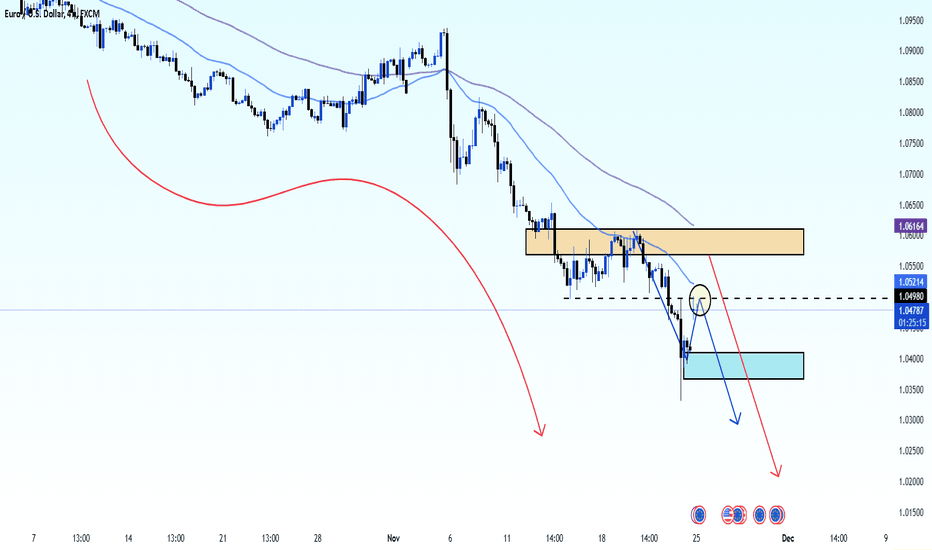

EUR/USD: Bearish Opportunities as Resistance HoldsEUR/USD remains under significant bearish pressure, currently trading around 1.0478. The pair's recovery attempts are capped by the key resistance zone at 1.0498–1.0521, providing a potential entry point for short positions.

The current structure favors a continuation of the downtrend. A rejection from the 1.0498–1.0521 zone could signal a move lower, targeting the immediate support at 1.0400. A decisive break below this level would likely accelerate the bearish momentum, pushing the pair toward the next support at 1.0300.

Traders focusing on short positions should consider entries near the resistance zone, with stops placed above 1.0521 to manage risk. Targets could range from 1.0400 in the short term to 1.0300 if selling pressure intensifies.

With the broader trend still bearish, EUR/USD offers a favorable setup for sellers, particularly if resistance levels continue to hold firm.

Gold Surges Past $2,700 Amid Safe-Haven DemandGlobal gold prices have rallied for the fifth consecutive session, surging by over $170 this week alone, driven by strong safe-haven demand.

By the close of trading on November 22, spot gold soared by $47, settling at $2,716/ounce. This marks the first time in two weeks that gold has climbed above the critical $2,700 level, as safe-haven flows outweighed the pressures of a strong US Dollar and the fading prospects of a Federal Reserve rate cut.

“Geopolitical tensions between Russia and Ukraine seem to be escalating into a Russia-U.S. confrontation. This development is undoubtedly fueling short-term demand for safe-haven assets,” analysts noted.

With mounting uncertainties on the global stage, gold continues to reaffirm its status as a reliable hedge against volatility, making it the standout asset of the week. As investors flock to safety, will gold sustain this momentum and head for new heights? Only time will tell.

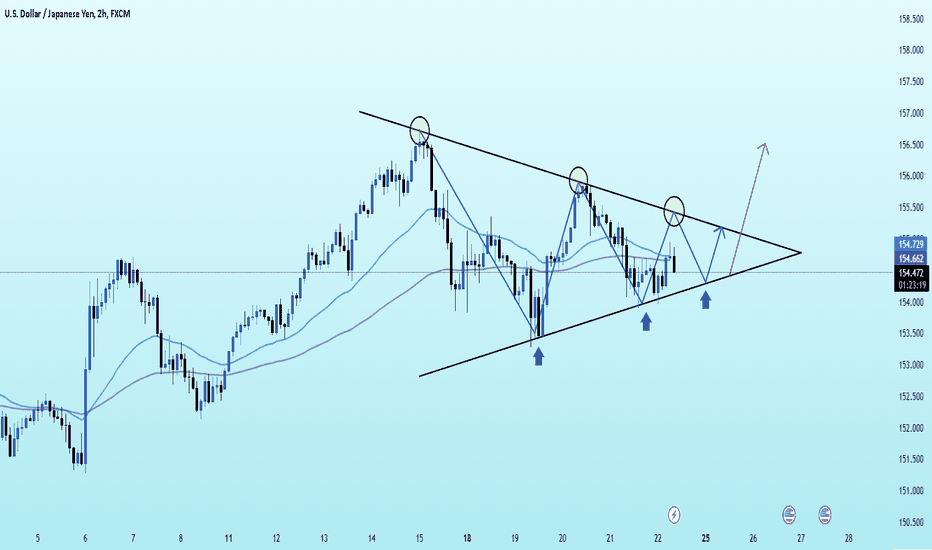

JPY Struggles Amid Rising US Dollar StrengthThe Japanese Yen is struggling to capitalize on the boost from rising domestic inflation. Uncertainty surrounding the Bank of Japan's (BoJ) interest rate hikes, combined with an optimistic market sentiment and soaring US Treasury yields, has kept JPY under pressure.

Meanwhile, the US Dollar continues its dominance, hitting a new yearly high and providing further support to the USD/JPY pair. The relentless strength of the USD has bolstered buyers, leaving the Yen with little room to recover in the near term.

GBP/USD: Bearish Trend Targets Lower LevelsGBP/USD is currently trading around 1.2564, extending its bearish trend after breaking below a long-term ascending channel. The price is consolidating below the resistance zone at 1.2685, which previously served as a support level, now turned resistance. This area is critical as it aligns with the recent breakdown structure.

If GBP/USD retests the 1.2685 level and fails to break above, the bearish trend is likely to continue. The next major support lies around 1.2360, where buyers may attempt to regain control. However, a sustained bearish move could push the pair even lower.

On the upside, a break above 1.2685 could lead to a short-term recovery toward the resistance zone near 1.2880, but this remains less likely given the prevailing downtrend. Traders should focus on selling opportunities near resistance levels, with targets around 1.2360 and stops placed above 1.2700 to manage risk effectively.

EUR/USD: Bearish Continuation in FocusEUR/USD is trading around 1.0469, r1.0510-1.0540, which

If the price retests the resistance zone but fails to break above, a bearish continuation could follow. Initial targets lie at *1.0440, wi1.0400 a

Traders should monitor price action closely at the resistance zone. Short positions could be considered near 1.0510-1.0540, with stop-loss levels set above 1.0550 to manage risk while targeting the next bearish leg.

Gold Rally Nears Key ResistanceSpot gold rose by $21.1 to $2,669.5/ounce, while gold futures climbed $23.5 to $2,672.5/ounce. This marks the fourth consecutive session of gains, reaching its highest level in over a week, driven by strong safe-haven demand.

Key drivers include Nvidia's gloomy revenue forecast, escalating tensions between Russia and Ukraine, and the U.S. veto of a UN Security Council resolution on a ceasefire in Gaza. These factors have shifted investor interest towards gold as a safe-haven asset amidst growing uncertainties.

Notably, gold prices have surged by 4% this week, the best weekly performance since April, rebounding from the sharpest drop in three years. Personally, I believe the next target is breaking the $2,700/ounce resistance level, potentially paving the way for further gains.

What about you? Do you think gold will conquer this critical milestone?

EUR/USD Pressured: Bears Eye Further DeclinesThe EUR/USD pair remains under selling pressure as it hovers near the 1.0550 level, unable to break free from its bearish trajectory. The chart reveals a clear head-and-shoulders pattern, indicating potential downward movement. The pair recently tested the support zone around 1.0530, and while minor recoveries have occurred, they have been capped by the resistance at 1.0567, aligning with the 50-period EMA.

With a failure to sustain above the resistance levels, sellers could push the price further downward. A break below 1.0530 might pave the way for a retest of the 1.0500 psychological mark, and potentially lower, as momentum indicators signal growing bearish sentiment.

For buyers to regain control, a decisive breakout above 1.0567 would be required, invalidating the current bearish structure. However, the dominant trend remains firmly in favor of the bears, suggesting further downside risks ahead.

Gold price continues to increaseGold prices continued their upward adjustment today, marking a three-day streak of gains as heightened risk aversion fueled demand for safe-haven assets. This impressive rally comes despite the strengthening U.S. dollar, showcasing the precious metal's resilience in uncertain market conditions.

So far this week, gold has surged over 3.40%, with bullish momentum driving prices closer to the key $2,700 mark. As investors seek refuge from mounting geopolitical tensions and economic risks, gold remains firmly in the spotlight, reinforcing its role as a reliable hedge against market volatility.

Gold Prices Rebound but Bearish Trend DominatesGold prices extended their recovery momentum on Wednesday, gaining over 70 pips during the early session and hovering around $2,639.

While the precious metal shows signs of short-term strength, the broader trend remains favorable for sellers. Gold’s recent rally stems from a weakening U.S. dollar, as investors took profits following last week’s sharp dollar gains. Since gold is dollar-denominated, a weaker dollar makes it more attractive to buyers using other currencies.

Geopolitical tensions also continue to provide support, with the next target set at the $2,665 resistance level. Should gold breach this level, further recovery may follow. However, if resistance holds, the primary bearish trend suggests prioritizing selling opportunities.

EURUSD today The EURUSD pair remains under significant bearish control, consolidating just above the critical support level near 1.0527. Despite a slight recovery, the overall trend continues to favor sellers, with the recent pullback likely to face resistance around the 1.0775–1.0868 zone.

Key Technical Insights:

Downward Momentum: The pair has been unable to sustain any significant upward movement, with each rally being met by selling pressure, maintaining the dominant bearish structure.

Resistance Levels: The 1.0775 and 1.0868 zones represent formidable barriers, with a rejection at these levels expected to reinforce the downward trend.

Target Levels: A breakdown below 1.0527 could open the path toward the psychological level of 1.0500 and further extend losses toward 1.0300.

Outlook:

Traders should monitor any attempts to retest the resistance zones for potential sell opportunities. As long as EURUSD remains below 1.0775, the pair is likely to stay on its bearish trajectory.

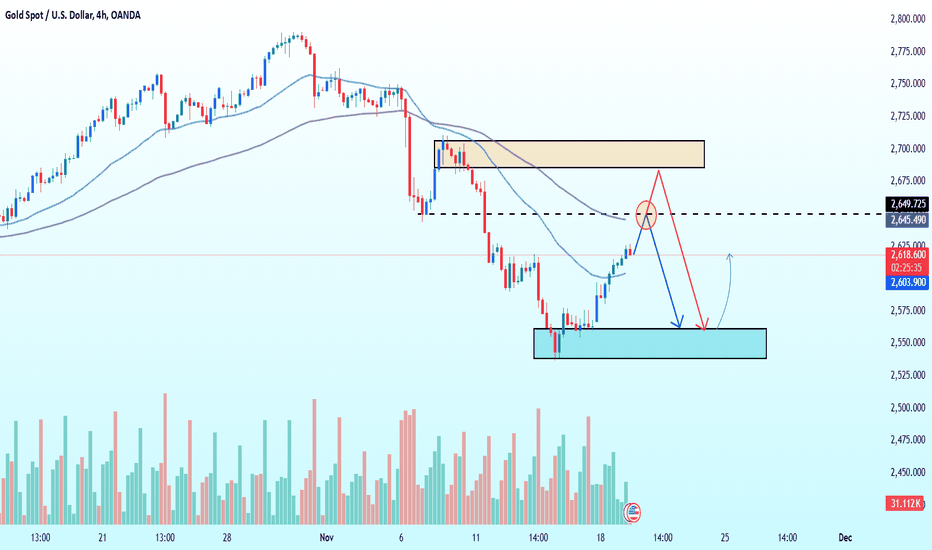

Gold Price Outlook: Testing Resistance and Potential DeclineThe gold market is displaying a recovery after recent losses, currently hovering near $2,645. However, the upward momentum is now approaching a critical resistance zone.

Market Highlights:

Resistance Zone: Gold faces significant resistance near $2,645-$2,650. A rejection at this level could trigger a downward retracement.

Support Levels: The support zone near $2,575-$2,550 remains key for the current trend's stability.

Volume Insight: Increased trading volume around the resistance level hints at a potential breakout or sharp reversal.

Trading Strategy:

Sell on Resistance Rejection: Monitor for bearish signs near $2,645, targeting $2,575 with a stop-loss above $2,650.

Buy on Retracement: If prices pull back to the $2,575-$2,550 support zone, look for long opportunities targeting $2,645, with a stop-loss below $2,540.

While the bullish recovery is encouraging, a clear break above resistance is needed to confirm further upside potential. Traders should stay vigilant as market sentiment evolves.

XAUUSD 17/11/24Following the previous weeks' analysis, we are once again adhering to the bearish narrative for this pair. Many traders have attempted to go long despite the pair showing strong bearish momentum. In my opinion, this is due to a couple of major factors. Firstly, gold is considered a safe haven, and as the market becomes more fluid, liquidity is being redirected to other assets that may carry slightly more risk. Secondly, the election of Donald Trump as president has bolstered confidence in the economy, further contributing to this liquidity shift. While gold remains a reliable safe haven, these factors have influenced its price movements.

It’s important to note that this view is based on my perspective. Over the past few months, gold prices have surged significantly, making a corrective move almost inevitable.

As mentioned in the EUR/USD market analysis, we are maintaining a bearish outlook here as well. After sweeping the daily low—indicated by the arrow on the left-hand side—the market experienced a short-term push to the upside. This move has swept liquidity, and we are now anticipating a reallocation higher within the short-term range that has been established.

Within this range, there is an unmitigated supply area similar to what was observed on the previous chart. We expect the price to run through the short-term highs located in the middle of the range before initiating a sell-off near the upper boundary. However, there is also a possibility that the sell-off could occur earlier, without pulling back into any of these areas. Should that happen, the chart will need to be updated accordingly.

Our overall targets are the liquid highs at the upper end of the range, followed by a continuation to the downside, with the price running the marked low and sustaining its bearish trend until the bias shifts.

Trade safe and stick to your plan.