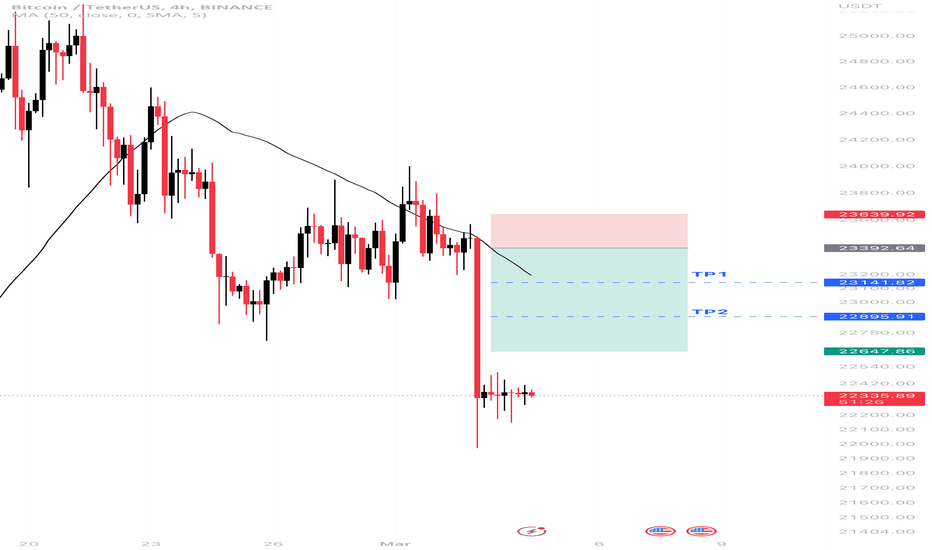

Sell-signal

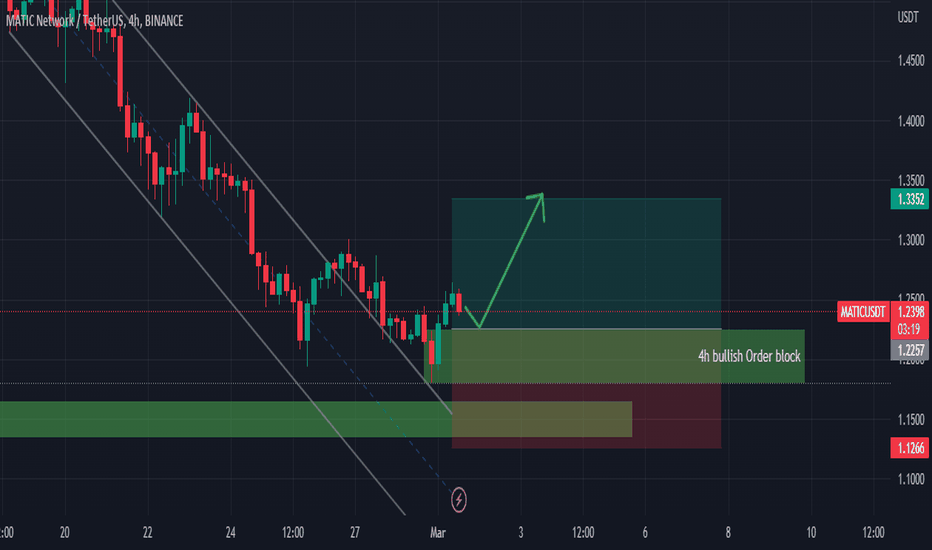

MATIC/USDT Buy setupthe price has broken the bearish channel after hitting the important 4-hour support area .

On the other hand, we have a bullish internal OB that we can enter into a safe buying trade after retesting it

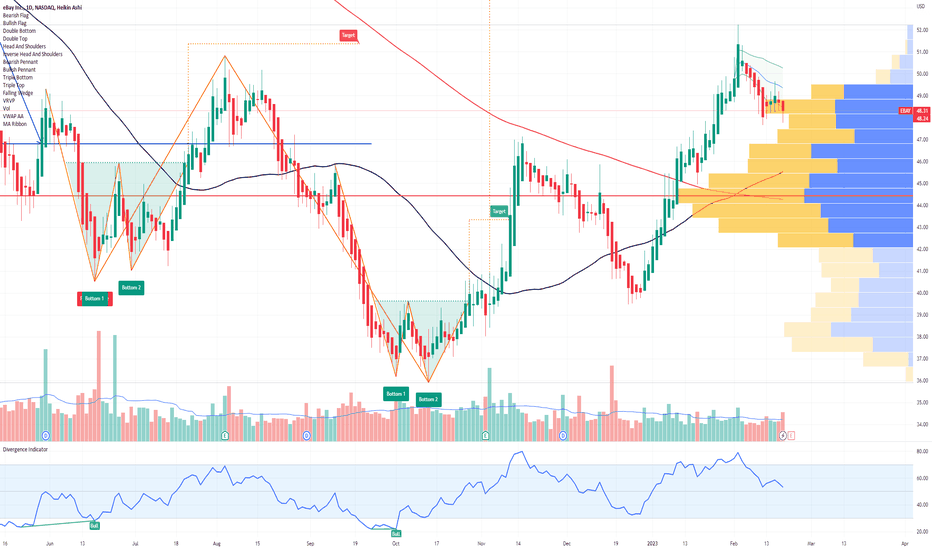

EBAY Options Ahead of EarningsI wonder who is still using Ebay?! I used to have a store there and close it because of their high fees.

If you haven`t sold EBAY here, on the active buyers decline:

Then you should know that looking at the EBAY options chain ahead of earnings , I would buy the $47.5 strike price Puts with

2023-7-21 expiration date for about

$3.70 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

I have chosen that expiration date to allow me to be wrong and not close the position and to have a bigger gain by the expiration date, if EBAY keeps going lower.

Looking forward to read your opinion about it.

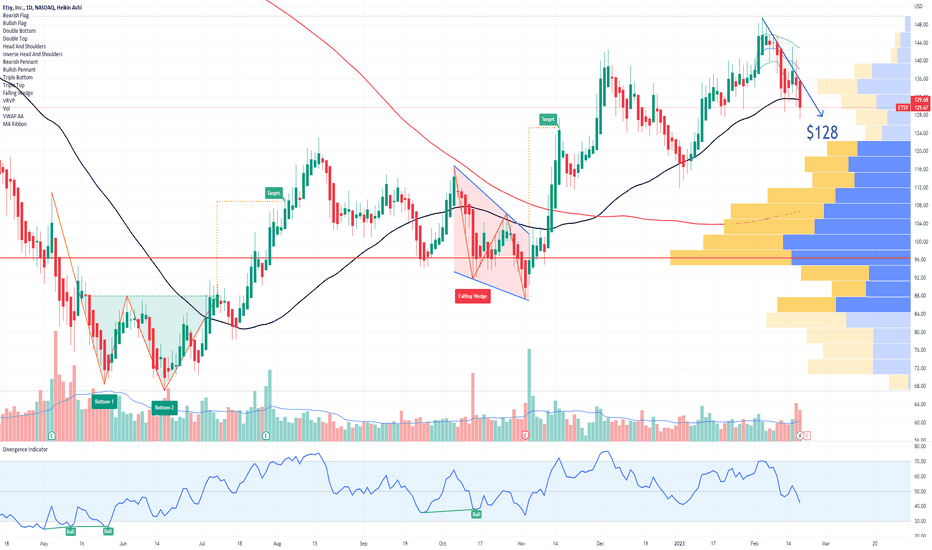

ETSY Options Ahead of Earnings If you haven`t sold ETSY after the disappointing forecast and bought the price target:

Then you should know that looking at the ETSY options chain ahead of earnings , I would buy the $128 strike price Puts with

2023-2-24 expiration date for about

$6.90 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.

PEP PepsiCo Options Ahead Of EarningsIf you haven`t bought PEP after my last call:

Then you should know that looking at the PEP PepsiCo options chain ahead of earnings , I would buy the $165 strike price Puts with

2023-2-17 expiration date for about

$1.83 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.

SNAP Snap Options Ahead Of Earnings | Who`s still using it?!If you haven`t bought puts with me here:

Then looking at the SNAP Snap options chain ahead of earnings , I would buy the $10.5 strike price Puts with

2023-2-3 expiration date for about

$0.84 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.

HOW TO BUY THE DIP- What is considered the bottom for a coin?

- How to identify the bottom?

- What technical analysis tools to use?

- What are the fundamental prerequisites for the bottom?

What is the bottom for a crypto asset?

The bottom is the lowest price level of a crypto asset, after which the price of this asset is expected to rise.

The bottom is not always an absolute measure for the entire history of the existence of an asset, but can be calculated for a certain period: a year, a quarter or a month.

How to identify the bottom

Each trader has his own set of tools to determine when to buy an asset.

Here are some of the most clearest signs to each of us:

There is a protracted flat with the upper border breakdowns

The movement occurs in a strong support zone and is accompanied by high volumes

The order book contains big bid checks

Good news on the market or the project

The price is lower than the sale price (ICO, IEO, IDO etc.)

The bottom we search for is not a new all-time bottom

Protracted flat with the upper border breakout

If you observe that for a long time: 2 weeks, 1 month, - the price is at the same level, while occasionally trying to “break out” up, that is, the resistance line is broken, then this is in 90% of cases - the impulse to the rapid growth of prices.

However, if the breakout is more often than just the support level, then get ready to test a new bottom.

Strong support zone and high side volumes

Determine that there is a strong support zone at this level, that is, it met more than 3 times on the chart for the period under study and is supported by good horizontal volumes (Volume indicator).

Display the VPVR (Volume Profile Visible Range) indicator on the same period on the screen and evaluate whether the maximum vertical volumes for the selected period are at this level.

Big average checks

If you observe volumes above average with a “small” candle body, then there are purchases at the same price for a large amount.

This may indicate "big checks" or high market density.

To confirm the existence of “big checks”, you can refer to the order book and make sure that there are real bid orders for large amounts.

Fundamental prerequisites

As an extra springboard from the bottom, news resources can:

Issue positive analytics from experts on this asset

Record the activity of major players - funds

Report new technologies that have been released or are about to be released by the project

Share the conditions for large investments in the project by large funds, etc.

Price analysis for IDO, ICO and Private Sale

If the project token or coin appeared on the market following one of the popular types of crowdfunding: ICO, IEO or IDO, the most popular one, then you need to compare the Public Sale price with the current price.

If the current price is below the Public Sale price of the IDO, then you can put this in another checkbox on your checklist as a sign of a potential bottom.

If the IDO price was lower, then this is not a bottom, there are still a large number of investors on the market who bought the coin at a lower price, which means they can sell it cheaper.

Our bottom is not a new all-time bottom

As we noted earlier, a support line is formed at the level of the potential bottom.

If the price has never dropped so low in the history of the asset, then we cannot build a support zone, which means that the price can go even lower and find many new bottoms.

How to auto-execute TradingView alerts on exchangeIf you have your own strategy in TradingView, you can set up opening trades on the exchange in a couple of clicks.

Next, you’ll see an example of how we set up alerts in 5 minutes, and how orders were opened and closed on the exchange. To do this, we will create alerts and a bot for alerts on our platform.

Step 1. Set the alert parameters.

Go to our terminal, select the Algotrading section → Trading Robots → Add strategy button.

You will see an interface for creating and customizing your bot, where you need to perform the Basic settings and proceed to setting the parameters for sending signals to the system.

To do this, go to the Sending signals block.

The TradingView signal source is already selected.

Copy the Request URL.

On the right side of the window, we see the code with the request parameters. You can add other parameters with checkboxes, we have added Stop Loss and Take Profit. Copy and save the code.

Step 2. Launch the bot.

Next, find the created bot in the All robots section and launch it in Work trading mode according to the manuals in the terminal.

Step 3. Set up an alert in TradingView.

Go to TradingView, open the Alerts section and set up an alert, for example, for opening an order (Buy) based on a simple indicator - in our case, Crossing.

Paste the code that we got in Step 1 in the Message field.

Paste the request URL we got in Step 1 in the Webhook URL field and Save.

The alert has been successfully created and is active on TradingView in the Alerts section.

Step 4. Monitor the orders.

The alert triggers and ... Go to the Alerts log, where we see a notification about executed alerts from TradingView.

We can check in the bot on our platform, open the Trades tab - we see open orders.

And we see that alert orders are open on the exchange.

Since we set Stop Loss and Take Profit, the orders were not only opened, but also closed. In the platform we can find deals, on the exchange we can find orders with the Sell parameter.

We hope that now trading with TradingView will become even easier. We will release new and more detailed articles for you on using webhooks so that the strategy created here works 24/7 without your participation.

BTC should recover from this levelThere is a possible pennant forming on H4.

The pennant formation is more accurate after bouncing between the converging trendlines a minimum of 5 times.

If the pennant formation holds, BTC should drop to the level shown after the breakdown.

For more accuracy the measured target should be moved to the area it breaks down.

(I've changed the resolution to H12 to show the recovery/measured target area.)

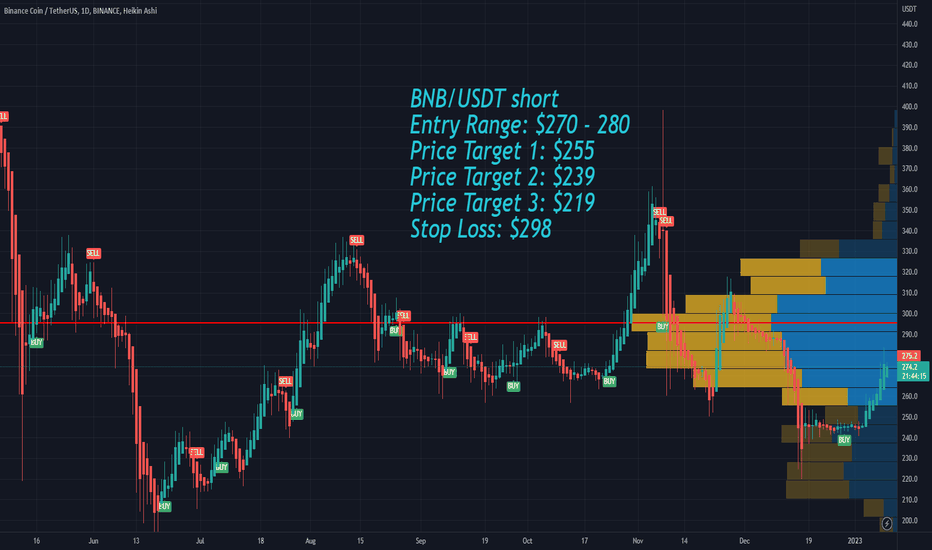

Binance Coin BNB Price Targets for this weekThis week I predict another selloff in the stock and crypto market after the CPI report on January 12.

My price targets for Binance Coin BNB are:

BNB/USDT short

Entry Range: $270 - 280

Price Target 1: $255

Price Target 2: $239

Price Target 3: $219

Stop Loss: $298

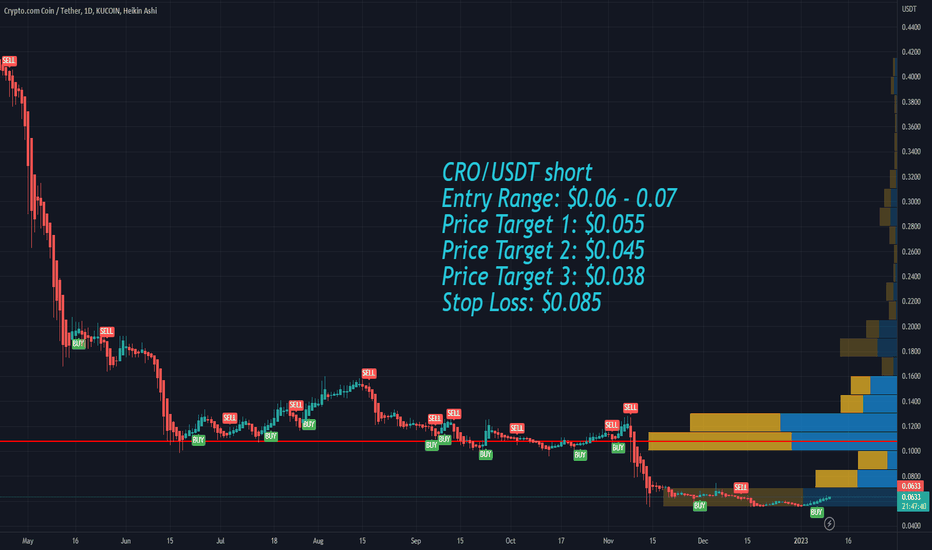

Cronos CRO Price Targets for this weekThis week I predict another selloff in the stock and crypto market after the CPI report on January 12.

My price targets for Bitcoin BTC are:

CRO/USDT short

Entry Range: $0.06 - 0.07

Price Target 1: $0.055

Price Target 2: $0.045

Price Target 3: $0.038

Stop Loss: $0.085

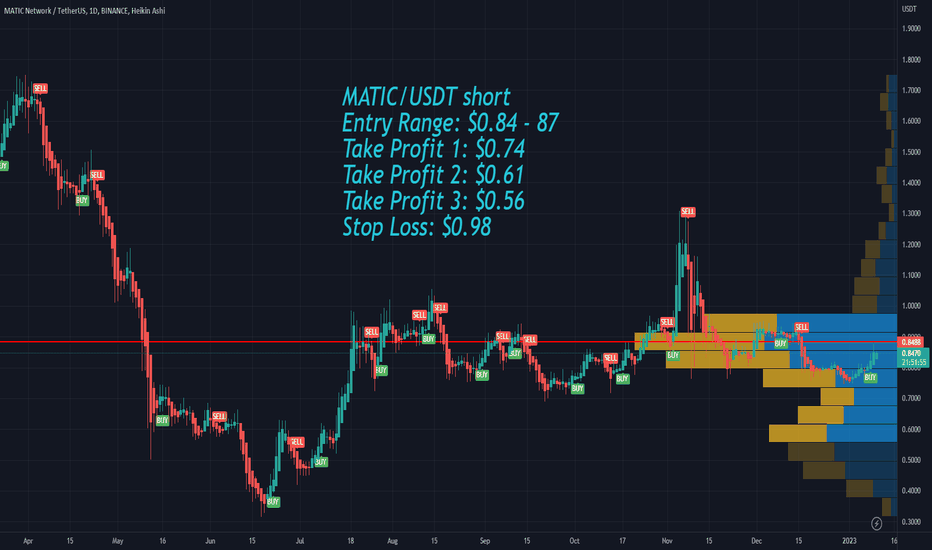

Polygon MATIC Price Targets for this weekThis week I predict another selloff in the stock and crypto market after the CPI report on January 12.

My price targets for Polygon MATIC are:

MATIC/USDT short

Entry Range: $0.84 - 87

Take Profit 1: $0.74

Take Profit 2: $0.61

Take Profit 3: $0.56

Stop Loss: $0.98

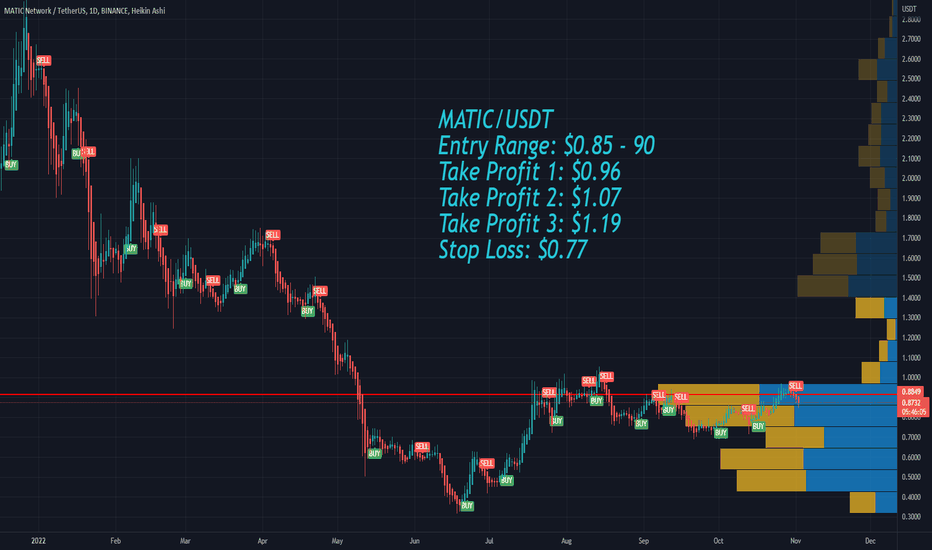

Polygon MATIC bullish ahead of the FOMC Press ConferenceI am bullish on Polygon MATIC ahead of the FOMC Press Conference.

Those are my price targets:

MATIC/USDT

Entry Range: $0.85 - 90

Take Profit 1: $0.96

Take Profit 2: $1.07

Take Profit 3: $1.19

Stop Loss: $0.77

AAVE most likely to go downAAVE, previously LEND, is one of the lending companies that are not down yet.

Most likely it will feel the contagion of FTX on others.

I have a short position in it since this post:

AAVE/USDT short

Entry Range: $57 - 59

Price Target 1: $50

Price Target 2: $37

Price Target 3: $20

Stop Loss: $69

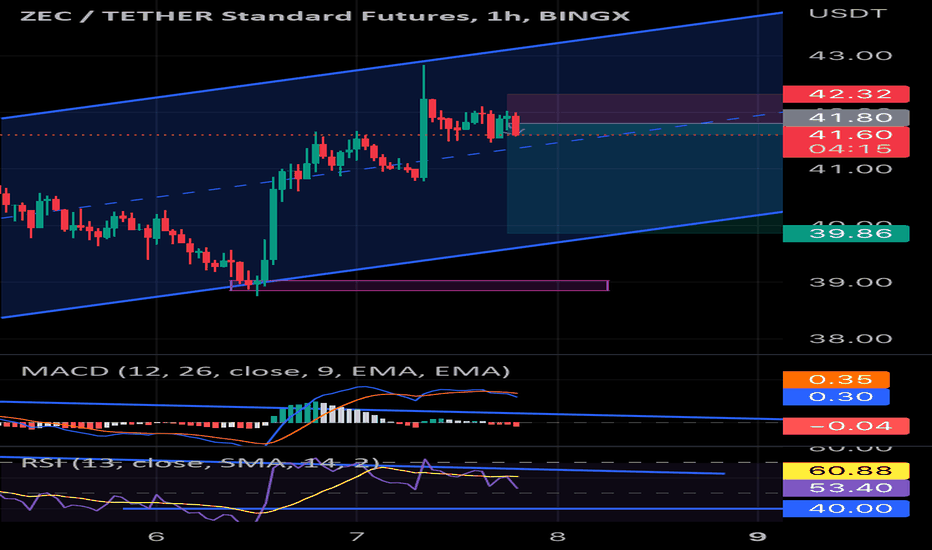

Zecusdt Zed could fall because of -RD in MACD and RSI indicators till 4h support line

—- This analis is not offer to buy or sell —-