Sell-signals

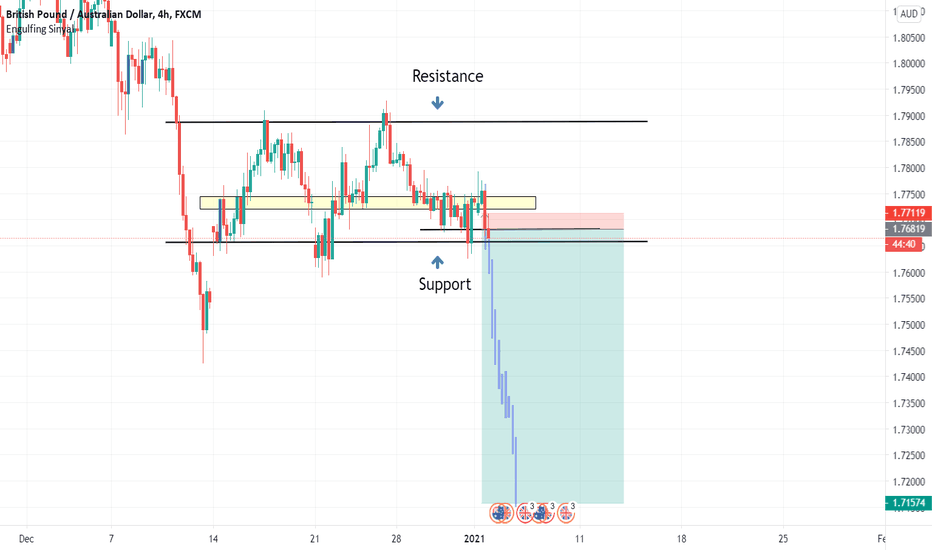

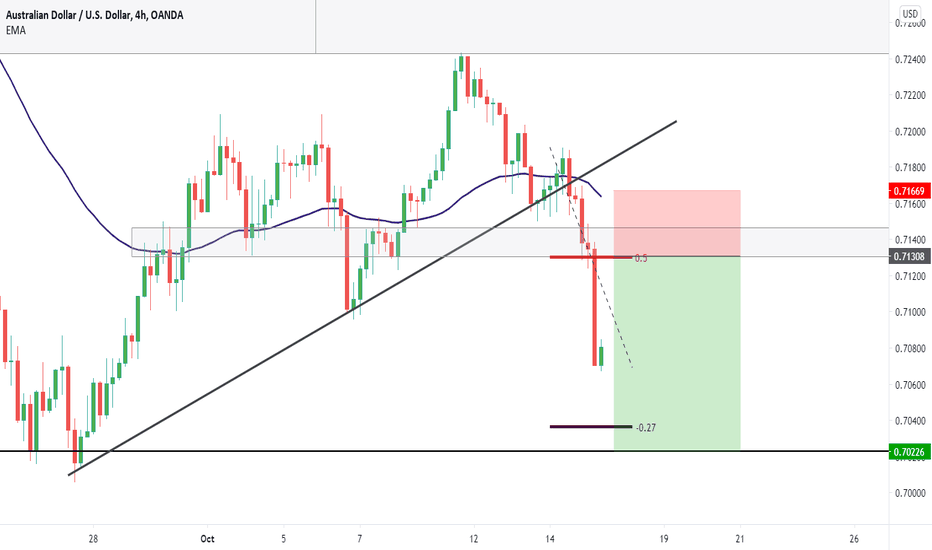

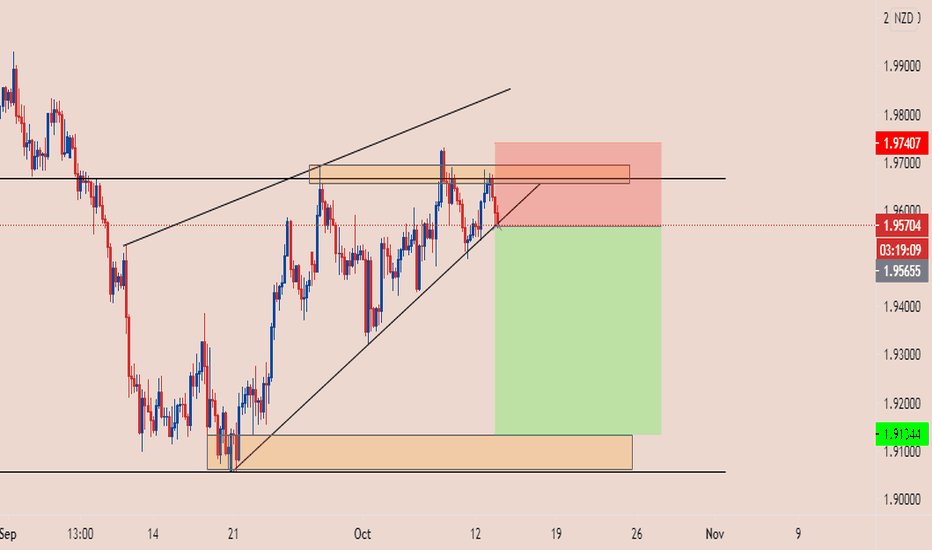

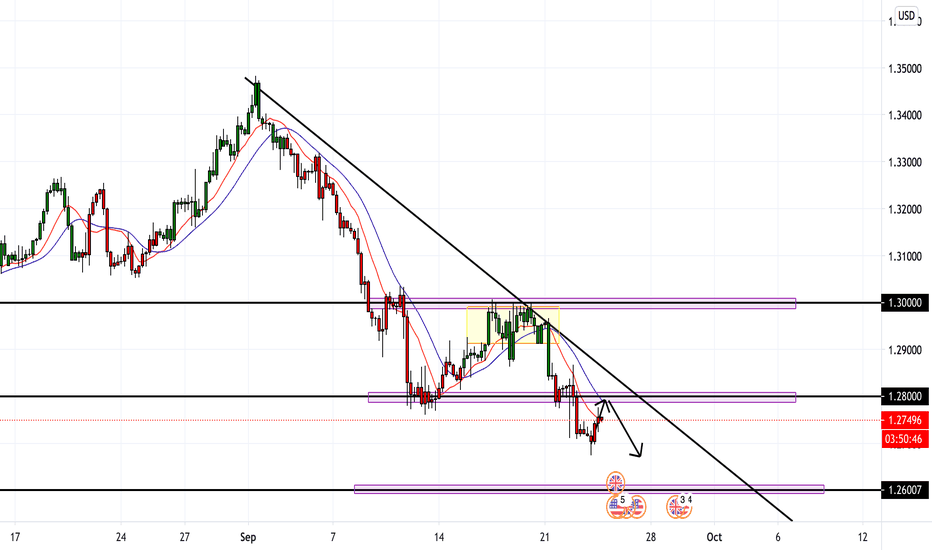

British Pound / Australian Dollar 4H ( Sell Setup )Hello Good Day to every traders around the world. Here is my analysis for GBPAUD in 4H chart. Previously, i predicted that this chart is valid for buy setup but unfortunately it fails. It creates a new turning point there and now we are more into sell mode. Due to GOLD rise, AUD will rise too. I've posted my targeted TP and SL with the long position box. Thank you for viewing my analysis on British Pound / Australian Dollar setup and do like if you think it's worth to view and follow.

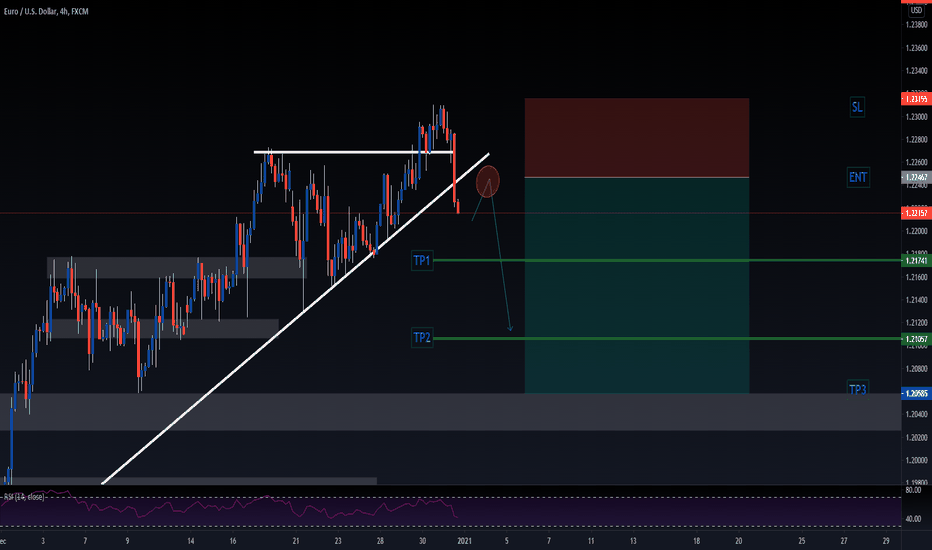

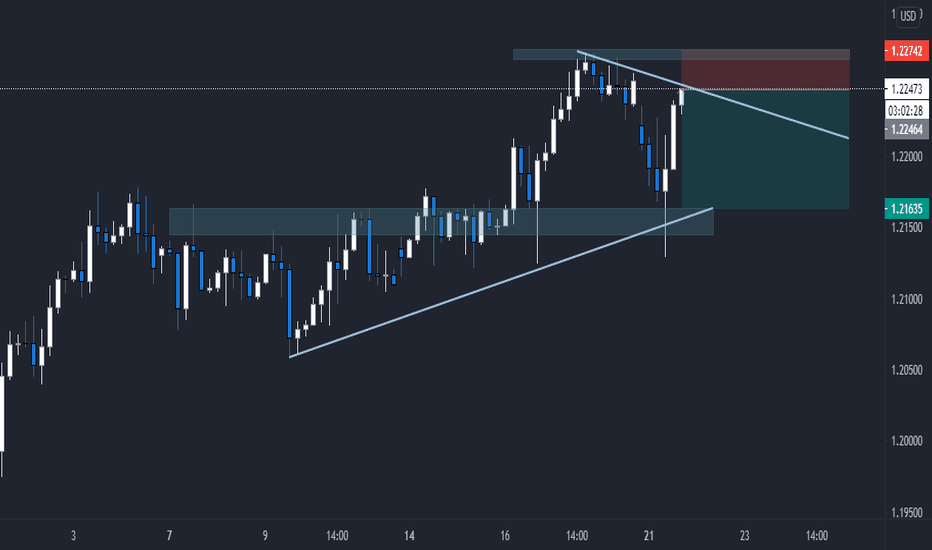

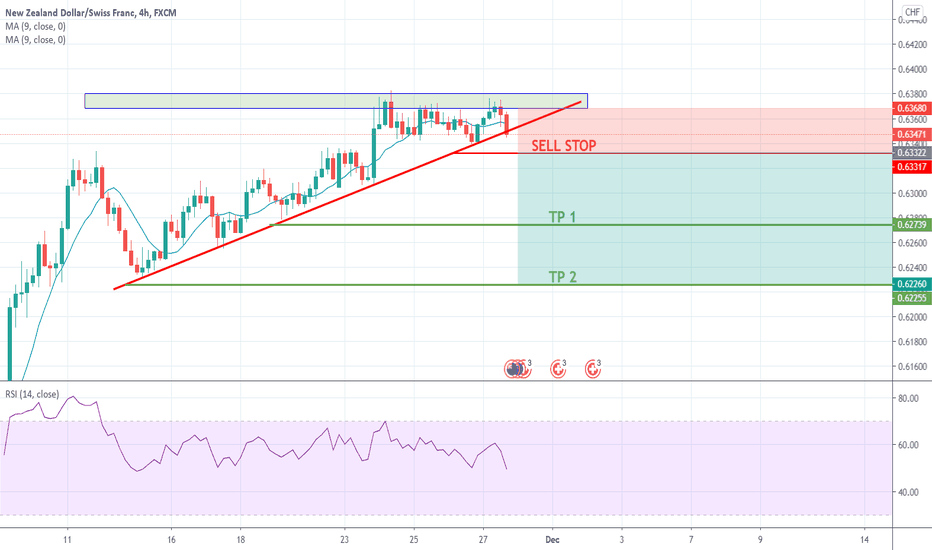

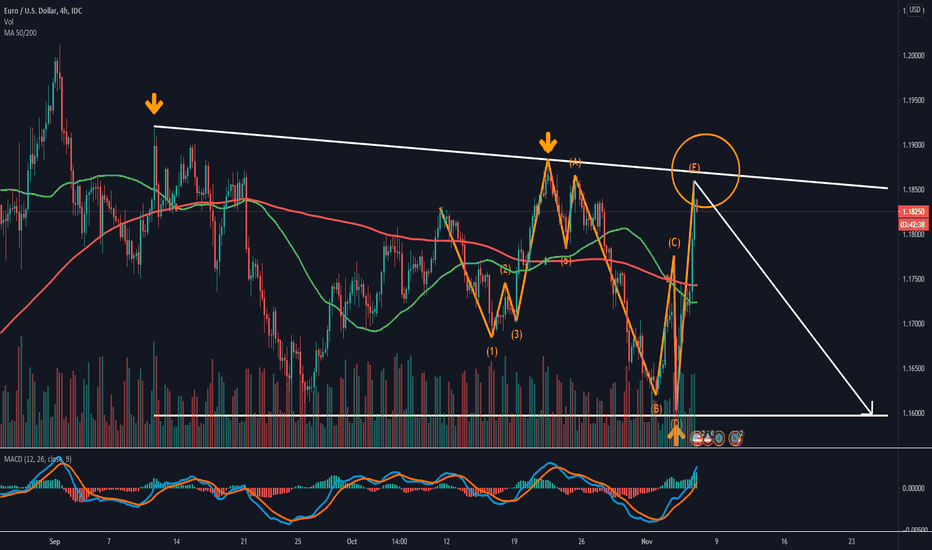

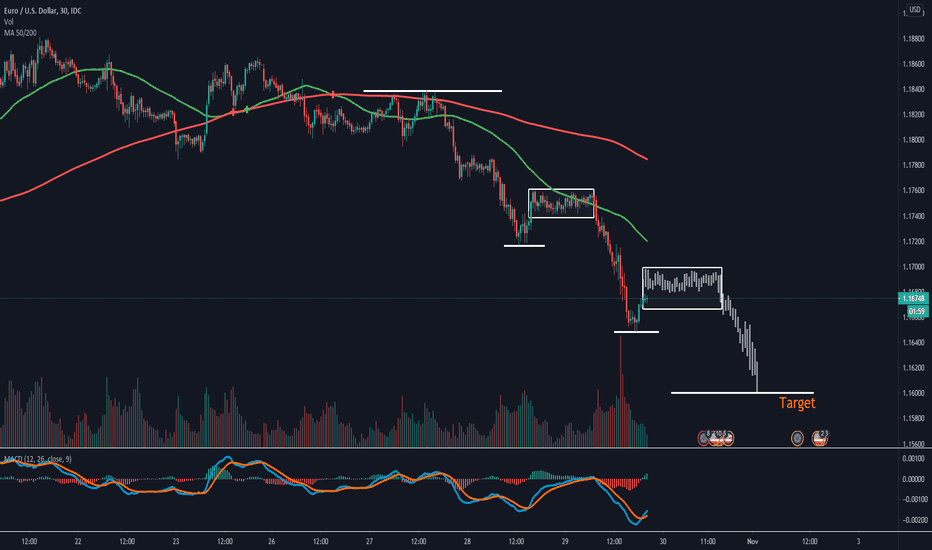

EUR/USD SIGNAL (Short term sell)TOPDOWN ANALYSIS: Shows bullish trend being broken (with large 4H candle break below trendline)

ACTION PLAN: 1.) Wait for pullback/ retracement to 1.22467 price level

2.) Look for a wick rejection and an bearish engulfing = enter with a 1:3 Risk reward

MAGIC IF: 1.) If price pulls back above trendline and consolidates = wait for another bearish break and retest

1.2) If price pulls back above trendline and shows large bullish momentum candles (large body but small wick) wait for a break and retest above previous structure highs (then look to enter a buy)

2.) If price continues down without retesting = Don't enter (because of possible entry at exhaustion) but wait for at least four bearish trend confirmation LL, LH, LL, LH

Reasons/ Confluences:

.Price has not yet reached monthly High and has broken bullish trendline structure

.USD News event strengthening the dollar

.Large 4H candle close below trendline

TIPS:

.Enter a sell position with a sell stop

.Once price has moved to 1:1 risk reward, move stop-loss to break even and possible exit (if candles show exhaustion)

.Never enter a trade hastily (there will always be more opportunities)

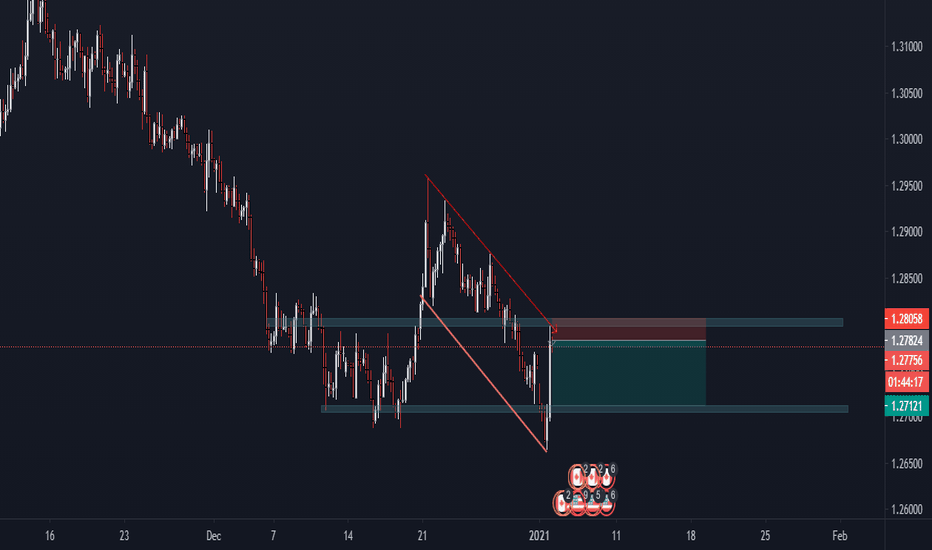

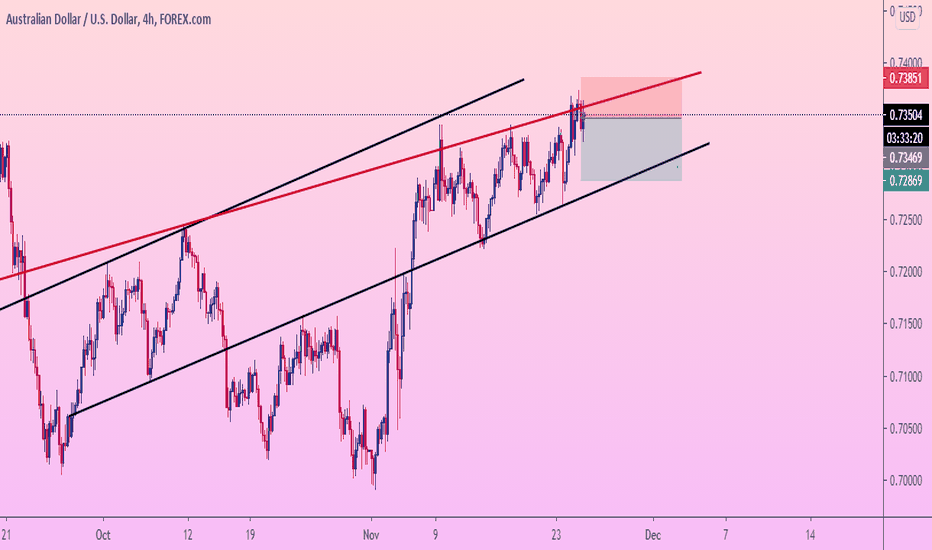

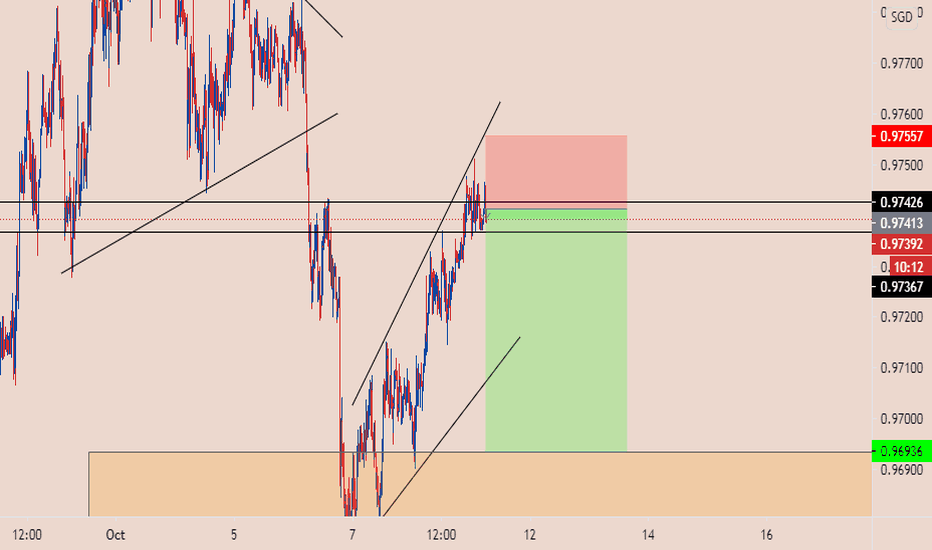

AUDUSD good time to SELLThe price moves in a stable uptrend despite pullbacks and corrections. Movement is regulated by the support line and the resistance line of September 2020.

Last time, the price just fell from resistance to support, having touched it with a candle shadow.

After that it rose, again failed to break through the resistance at 0.735 and began to fall again.

The resistance line is not the longest on the chart - it appeared in September this year. However, as you can see, the price came back even after a breakout.

Now I am waiting for the price to fall towards the support line. You can open a sell deal. I will never tire of reminding you of the importance of SL - set it above the resistance line in the area of - 0.738.

Traders, if you like this idea or have your own opinion about it, write in the comments. I will be glad👩💻

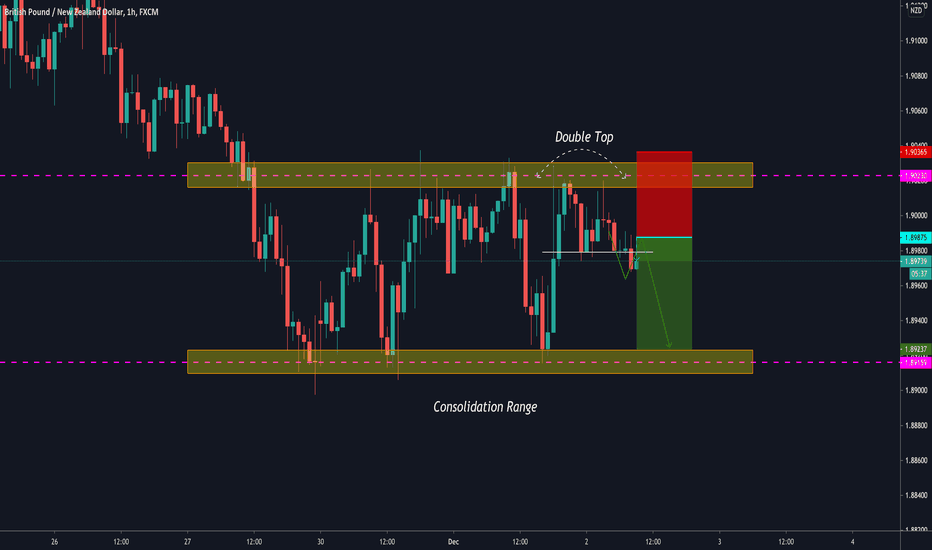

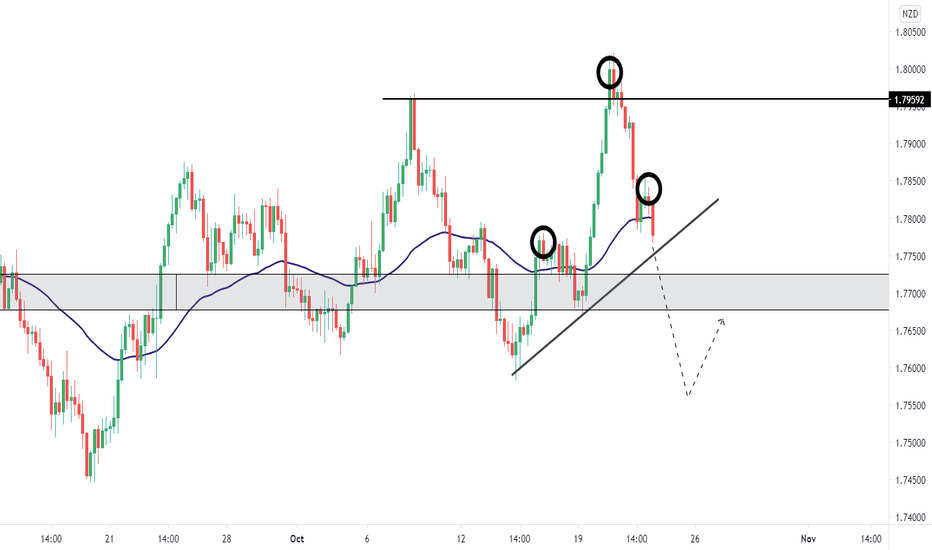

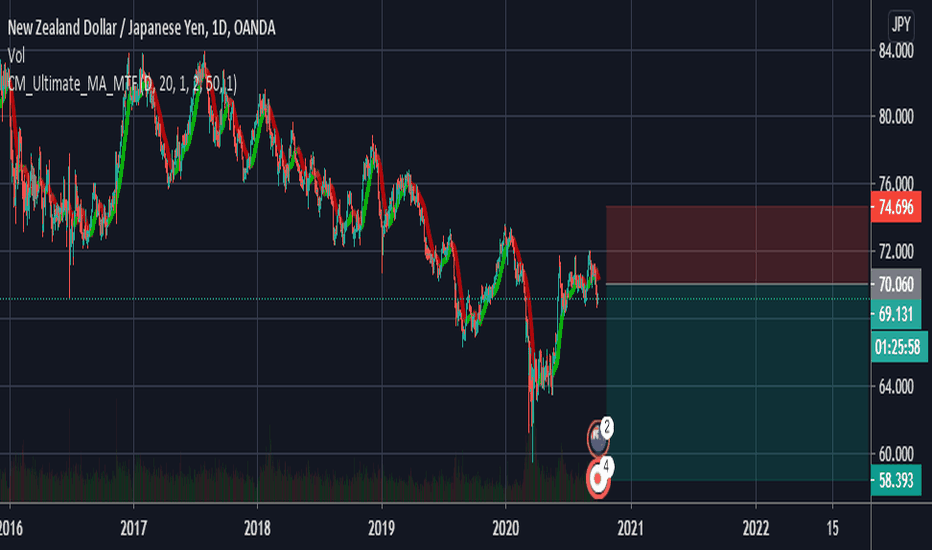

EURNZD- Shorts upon head and shoulders confirmationWe can see we have created a double top, but what also looks like a head an shoulders formation, although it is not the cleanest if we can break this neckline then it will confirm this head and shoulders pattern. However I will only be looking at taking shorts upon a confirmed lower low then on the retracement of a lower high.

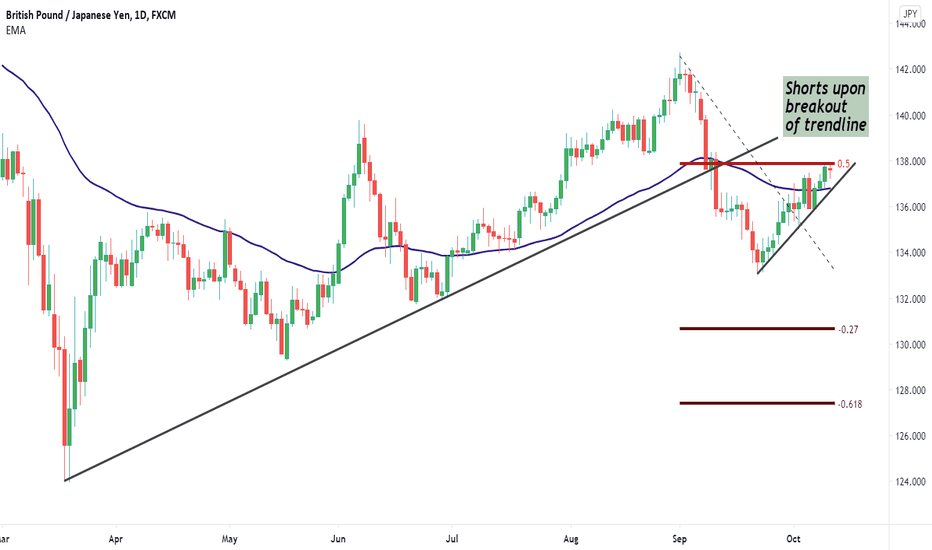

GBPJPY- Shorts setting up upon confirmationHere we have GBPJPY on the daily timeframe, a nice breakout of this longer term ascending trendline, creating a lower low, we also have a little correction happening where price is now interacting with the 50 fib level, If we can get a breakout of this short term ascending trendline I would look to short this pair.