Gold Trading Strategy XAUUSD 20/8/2025Gold Trading Strategy XAUUSD 20/8/2025: Gold falls to lowest level since early this month, continues to be under pressure from potential talks, watching the FED minutes.

Fundamental news: Spot gold prices fell sharply, hitting their lowest intraday level since August 1. Gold prices fell as US President Donald Trump, Ukrainian President Zelensky and European leaders discussed potential talks with Russia. Safe-haven demand eased as security speculation in Kiev sparked optimism that the war could end.

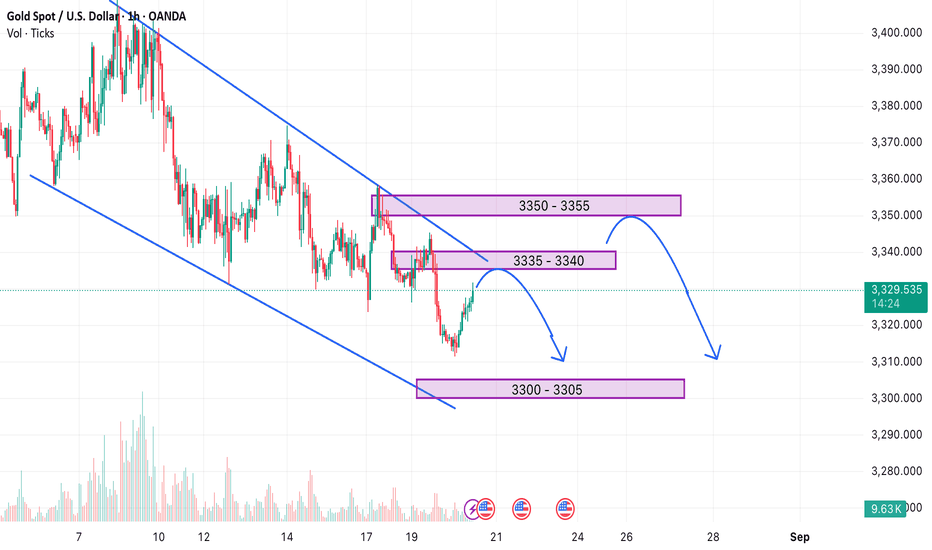

Technical analysis: Gold prices broke out of a bullish pattern and formed a bearish channel on the H1 timeframe. Currently, the MA lines combined with the liquidity zone are the resistance zones of gold prices. However, gold prices can recover strongly when approaching the support area of 3300, the fluctuation range of gold prices today will be 3300 - 3350.

Important price zones today: 3335 - 3340, 3350 - 3355 and 3300 - 3305.

Today's trading trend: SELL.

Recommended orders:

Plan 1: SELL XAUUSD zone 3338 - 3340

SL 3343

TP 3335 - 3325 - 3315 - 3300.

Plan 2: SELL XAUUSD zone 3350 - 3352

SL 3355

TP 3347 - 3337 - 3327 - 3300.

Plan 3: BUY XAUUSD zone 3300 - 3302

SL 3297

TP 3305 - 3315 - 3335 - 3350.

Wish you a safe, successful and profitable trading day.🥰🥰🥰🥰🥰

Sell-trend

XAUUSD Gold Trading Strategy August 12, 2025XAUUSD Gold Trading Strategy August 12, 2025:

Gold prices were under pressure on Monday (August 11) and recovered in the morning trading session today (August 12). US President Trump clearly stated that he would not impose import tariffs on gold, dispelling previous market concerns about disruptions to the global gold supply chain.

Fundamental news: Investors are paying attention to the Federal Reserve's interest rate outlook. Gold is entering a correction phase after tariff concerns are resolved, and price movements may be more influenced by Dollar and inflation data.

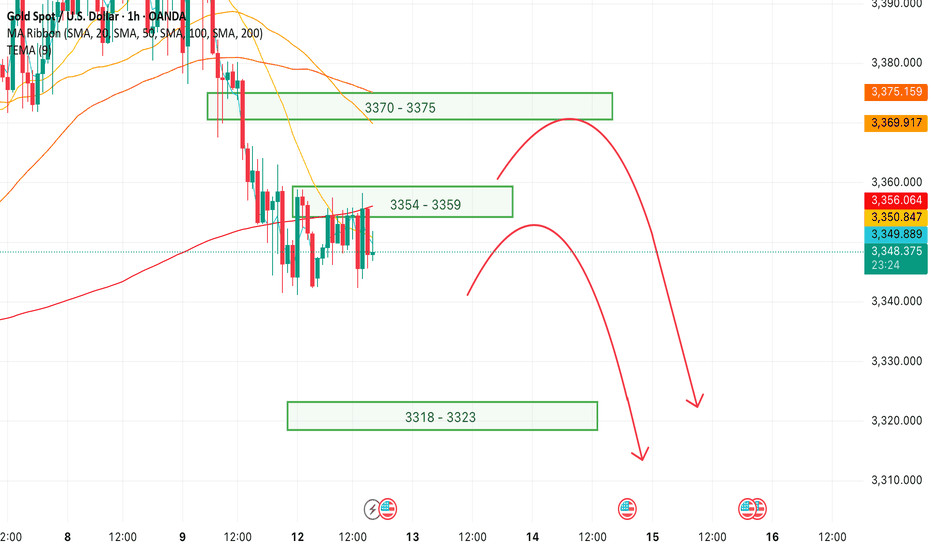

Technical analysis: Gold prices continue to correct downwards following the trend from last week, with MA lines still acting as resistance. Currently, the RSI H1 frame is approaching the oversold zone, and there is a high possibility that gold will recover this weekend. Resistance and high liquidity areas such as 3354 - 3359 and 3370 - 3375 will be very good trading areas.

Important price zones today: 3354 - 3359, 3370 - 3375 and 3318 - 3323.

Today's trading trend: SELL.

Recommended orders:

Plan 1: SELL XAUUSD zone 3357 - 3359

SL 3362

TP 3354 - 3344 - 3334 - 3324.

Plan 2: SELL XAUUSD zone 3373 - 3375

SL 3378

TP 3370 - 3360 - 3340 - 3320.

Plan 3: BUY XAUUSD zone 3318 - 3320

SL 3315

TP 3323 - 3333 - 3343 - 3363 (small vol).

Wish you a safe, successful and profitable trading day.🌟🌟🌟🌟🌟

XAUUSD Gold Trading Strategy August 5, 2025

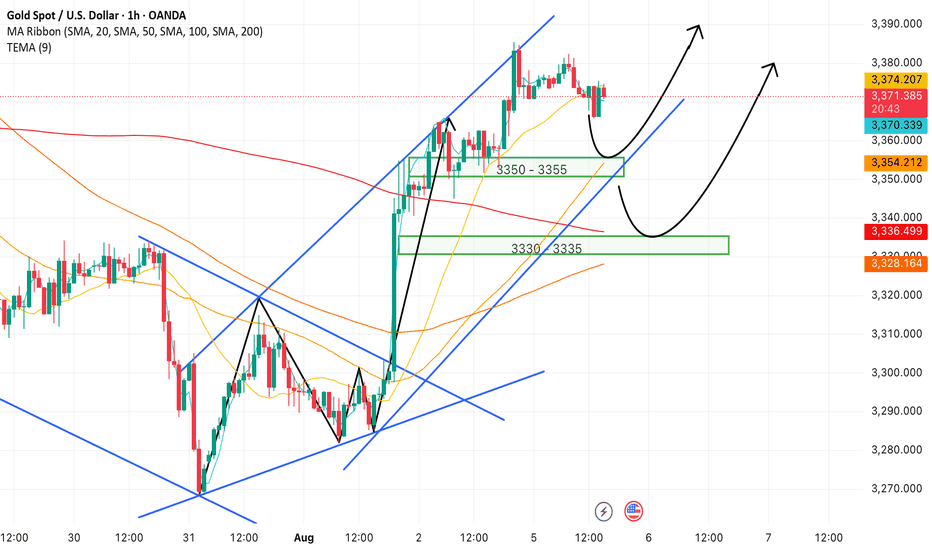

Yesterday's trading session, gold prices continued to increase sharply due to previous influences. However, the possibility of a short-term correction in gold prices at the end of the week will be very high.

Basic news: According to CME FEDWatch, the probability of the Fed cutting interest rates at its September meeting has now increased to about 84%, reflecting increasing concerns about economic weakness. The market is currently pricing in at least two 25 basis point cuts between now and the end of the year, showing a clear shift in investor sentiment after disappointing employment data.

Technical analysis: Gold's bullish momentum is currently showing signs of weakening. The peak area of 3383 - 3385 may create a double peak pattern on H1, but the possibility of gold prices correcting today is very low. Currently, gold prices are filling liquidity at support areas. The correction of gold prices may take place at the end of the week when buyers take profits.

Important price zones today: 3350 - 3355 and 3330 - 3335.

Today's trading trend: BUY.

Recommended orders:

Plan 1: BUY XAUUSD zone 3350 - 3352

SL 3347

TP 3355 - 3365 - 3375 - 3400.

Plan 2: BUY XAUUSD zone 3330 - 3332

SL 3327

TP 3335 - 3345 - 3365 - 3400.

Plan 3: SELL XAUUSD zone 3420 - 3422

SL 3425

TP 3417 - 3407 - 3387 - 3357 - OPEN (small volume).

Wish you a safe, successful and profitable trading day.🌟🌟🌟🌟🌟

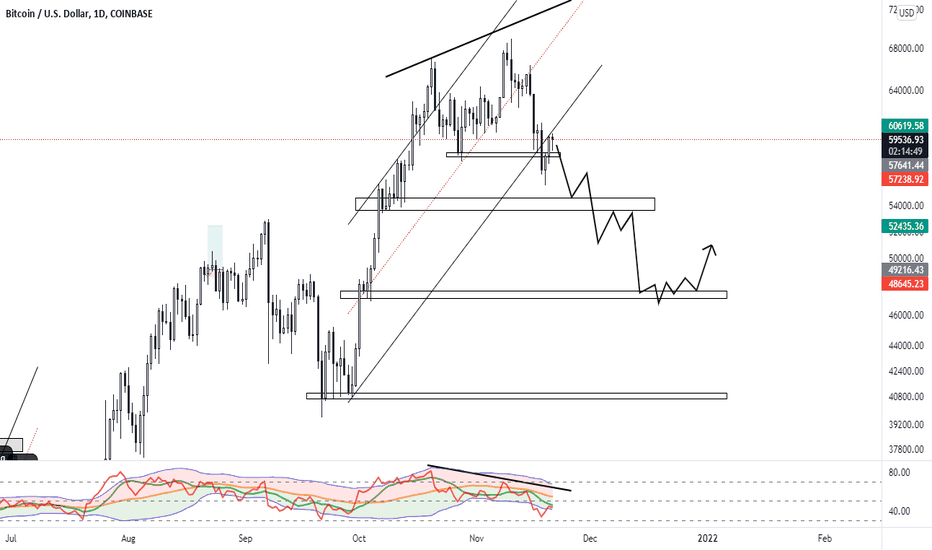

Gold Trading Strategy XAUUSD August 4, 2025

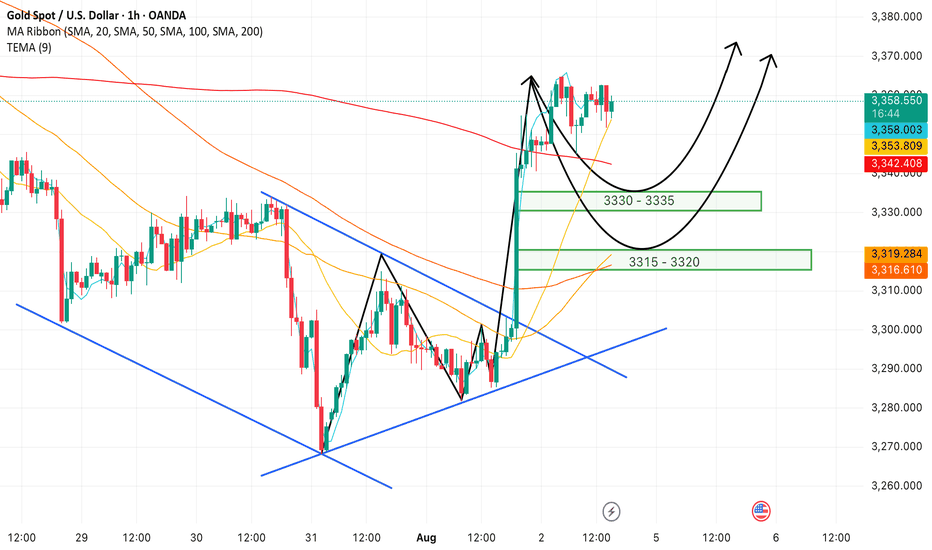

Gold prices rose more than 2% last Friday, hitting a one-week high, as weaker-than-expected US non-farm payrolls data boosted hopes for a Federal Reserve rate cut and the announcement of new tariffs fueled safe-haven demand for gold.

Fundamental news: The non-farm payrolls report showed only 73,000 jobs added in July, well below market expectations of 110,000. The unemployment rate rose to 4.2%, indicating a cooling labor market.

Technical Analysis: Gold prices are rising strongly after a strong candle in the 3285 - 3300 area as previously predicted. The bullish pattern on the H1 frame has shown that the buyers are returning very strongly. Currently, the price is showing signs of sideway at the 336x area, our strategy today will be to wait for trading at the support zones of the gold price. Important price zones today: 3315 - 3320 and 3330 - 3335.

Today's trading trend: BUY.

Recommended orders:

Plan 1: BUY XAUUSD zone 3330 - 3332

SL 3327

TP 3335 - 3345 - 3355 - 3370.

Plan 2: BUY XAUUSD zone 3318 - 3320

SL 3315

TP 3323 - 3333 - 3343 - 3363.

Plan 3: SELL XAUUSD zone 3370 - 3372

SL 3375

TP 3367 - 3357 - 3347 - 3337 (small volume).

Wishing you a safe, smooth and profitable trading week.💗💗💗💗💗

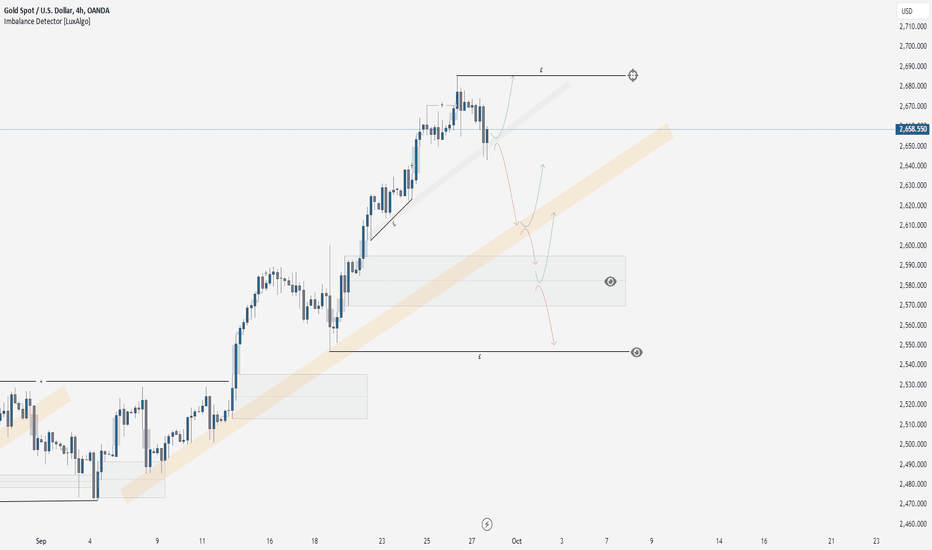

XAUUSD 29/09/24This week on gold, we maintain a similar overall outlook, with the price action expected to continue moving upward. Take note of the previous high. If a pullback occurs due to any fundamental factors, particularly the potential conflict in the Middle East, there may be opportunities to go long from the highlighted areas. However, if no pullback occurs, expect the price action to continue rising.

If we move higher from the current levels, the recent high will likely be taken out. Conversely, if we move lower from our current position, the probability of reaching the high remains strong. Be sure to note the liquid lows, which are in line with both the short-term trajectory and the longer-term trajectory, aligned with higher timeframe demand.

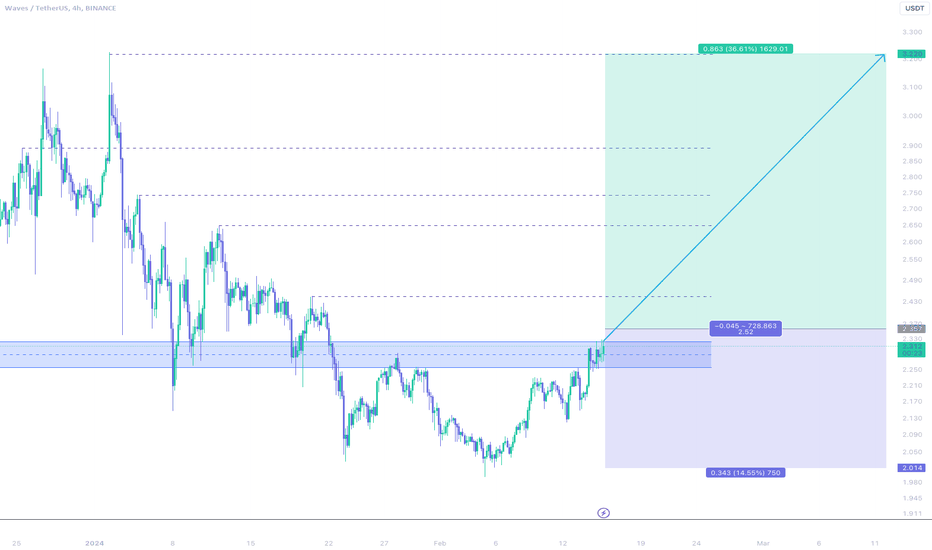

WAVES/USDT - Cool as cucumber | Dump and Pump #WAVES/USDT Analysis

Description

---------------------------------------------------------------

+ After gradual crash over the month, we are seeing a decent bounce back in the price

+ If this bounce back is really a next leg of the long trend then we are looking the price to reach next major resistance

+ If the bull trend we have multiple minor resistances and those resistances can be broken very easily if the trend is strong

+ Lets see how the price reacts and enter the trade only after the confirmed breakout

---------------------------------------------------------------

VectorAlgo Trade Details

------------------------------

Entry Price: 2.357

Stop Loss: 2.014

------------------------------

Targets 1: 2.430

Targets 2: 2.550

Targets 3: 2.750

Targets 4: 2.900

Targets 5: 3.075

Targets 6: 3.220

------------------------------

Timeframe: 4H

Capital: 1-2% of trading capital

Leverage: 5-10x

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Agree or Disagree with the ideas ? lets discuss in the comments.

Like and follow us for more ideas.

Regards

VectorAlgo

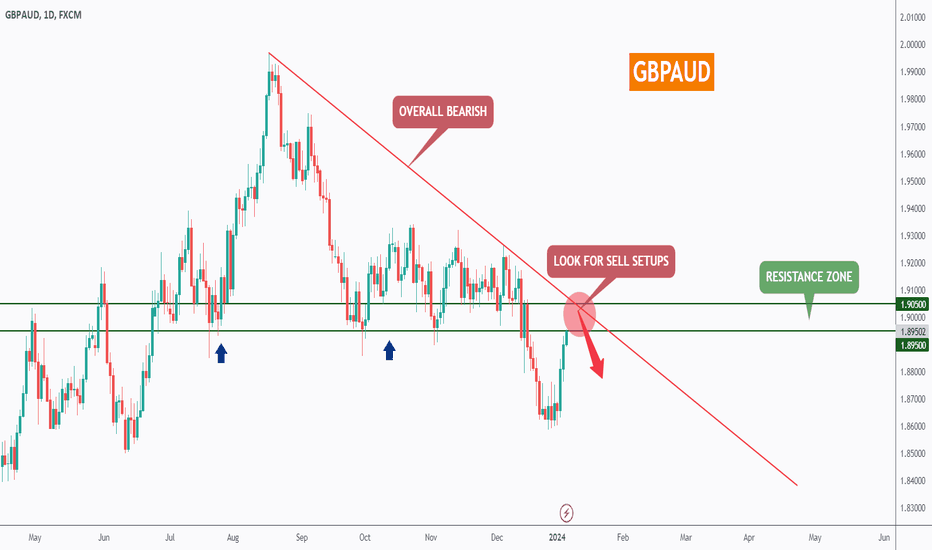

GBPAUD - Follow The Trend ↘️Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉 GBPAUD has been overall bearish trading below the red trendline, and it is currently retesting it.

Moreover, the zone 1.9 is a robust resistance.

🏹 So the highlighted red circle is a strong area to look for sell setups as it is the intersection of the resistance zone in green and red trendline acting as a non-horizontal resistance.

📚 As per my trading style:

As GBPAUD approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

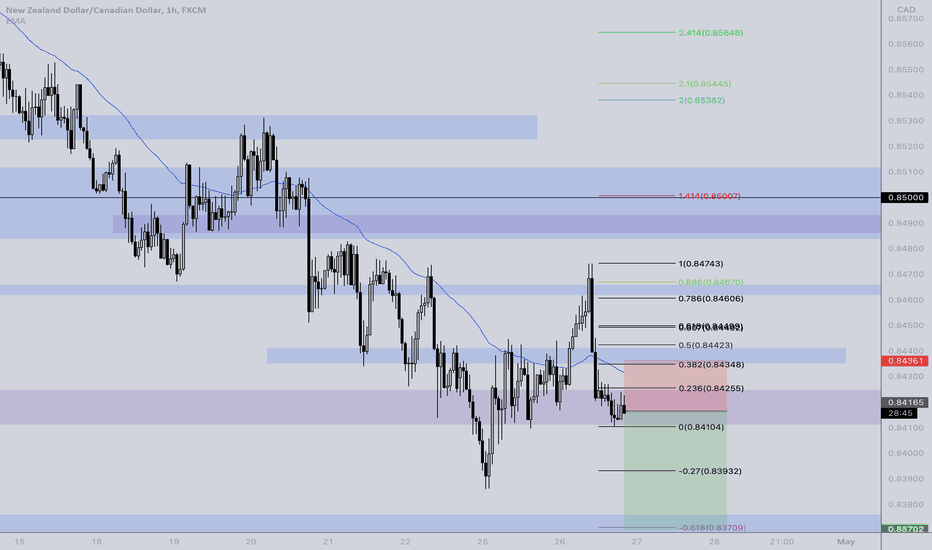

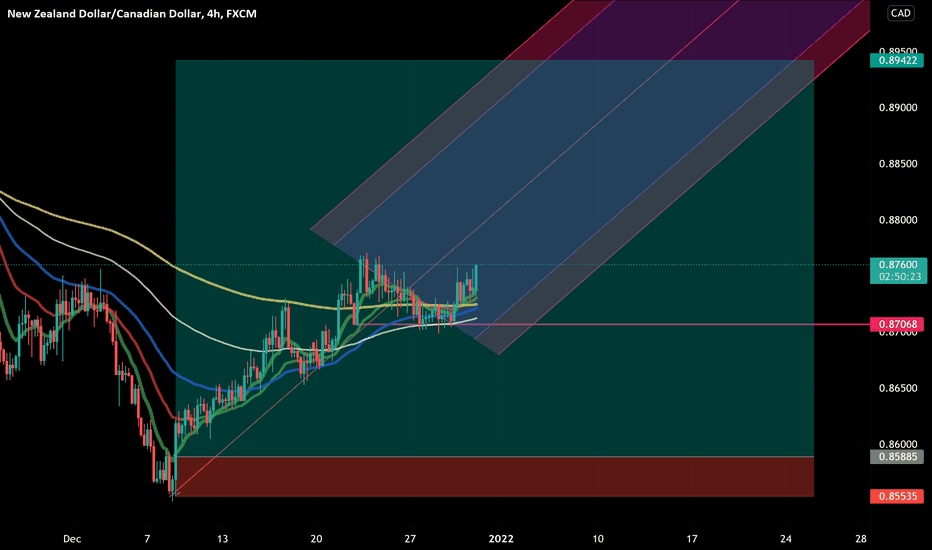

NZDCAD SELLEntry at 8:30 pm

Weekly: downtrend, last week closed extremely bearish under 0.085000 zone

Daily: downtrend, under 50 ma m yesterday closed super bearish below the last days close

4hr: Downtrend, just broke structure looking to sell the retracement

Under 50 MA

1hr: Downtrend, under 50 MA

30 min entry

NZD CAD-H4- Riding Trend Up toward 2022Happy New Year All!!! This New Year we are starting with a new strategy (G Money), new TP range and new targets.

NZD CAD H4 chart provided in the most simplistic way for your quick visual assessment and for a very easy reading by anyone.

We have some opened buy positions already with a target TP 3000 pips and estimated completion are time for this trades gonna be around one month. It is just an idea to be tested and the results of success or failure we gonna see in around 4 weeks time.

In the case of success, G Money makes some money! ;)

Strategy has been back tested until I did run out totally dry on historical trading data. Some minor human errors still happens due lack of concentration, tirednesses.

I do wish You all a very Successful trading in 2022!

PS:

Never trust 100% any TA, keep safeguards On, like as SL, TP , Alerts. In two words: Be smart!

TA analysis are not available for a public due testing, fine tuning & adjusting stage still in the progress.

It is not a financial guidance, advice or investment option. It is just an IDEA! ;)

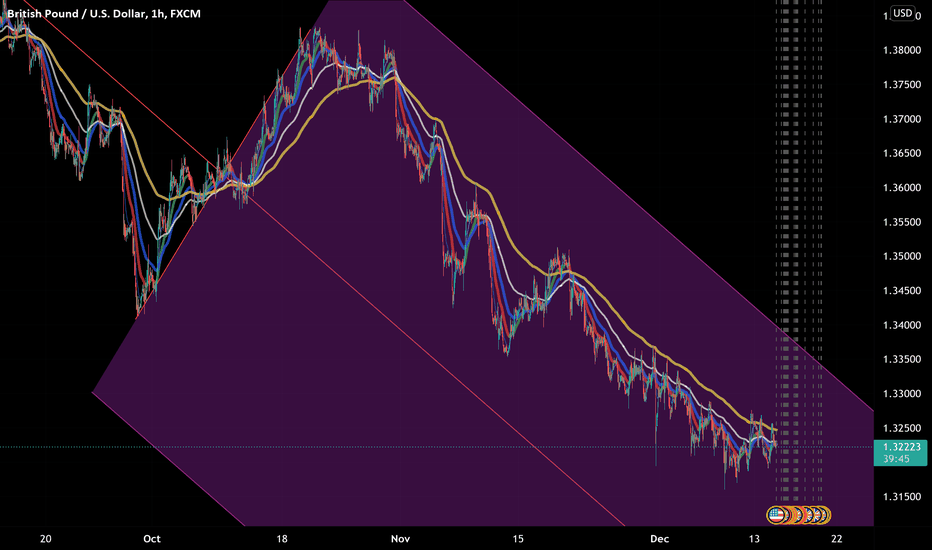

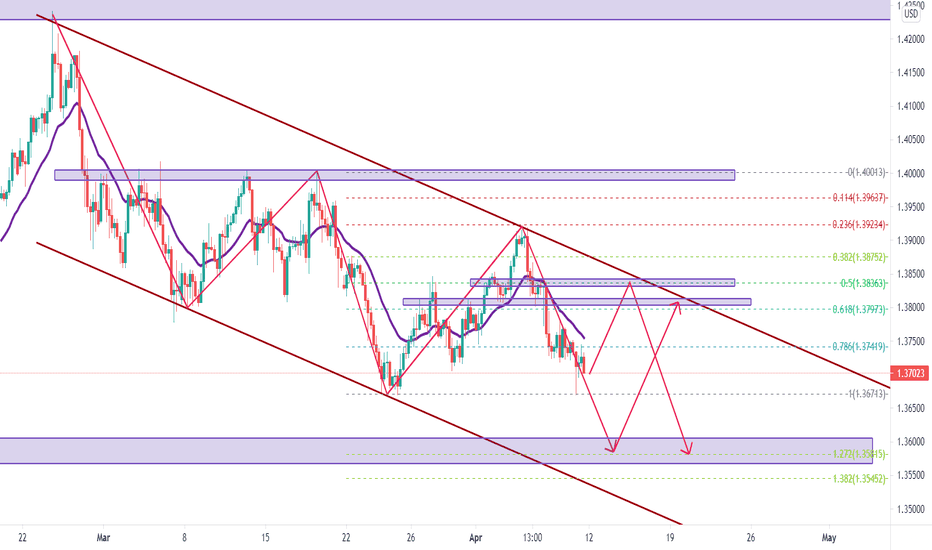

GBP - USD Deep TA - Final Part 4/4 -1HGBP USD TA final part 4 from the 4 parts. Overview of 1H chart and putting puzzle pieces all together. TA in 1 - 3 parts clearly pointing to continuous trend down. S/R levels, channel, pattern and trend direction . A Clasical trend down collecting pips within channel down and looks like has still got a bit way to go down. We’ve got some general picture over here for now.

Someone says time to buy and jumped to BUY. I did opposite, I did open sell position. I do believe, jumping is good for fitness or fun only. I do believe in extended TA and ENTERING trades with a well chosen entry point, SL and TP levels. I would like to do some “Jumping” after profit pips collection only. Even if you missed a perfect “entry” point, you still have a trend heading in the clear direction on the higher timeframes and easily guessed reverse levels. Please don’t forget about retracements. Please be patient, check first at all higher times frames ,do TA and just after only, look for a “perfect” entry on the smaller time frames of your liking.

It is not some financial advice, just my way of going through with TA and preparing for the “perfect” entry.

Share your TA, thoughts , likes as well please!

Long live and prosper to all traders!

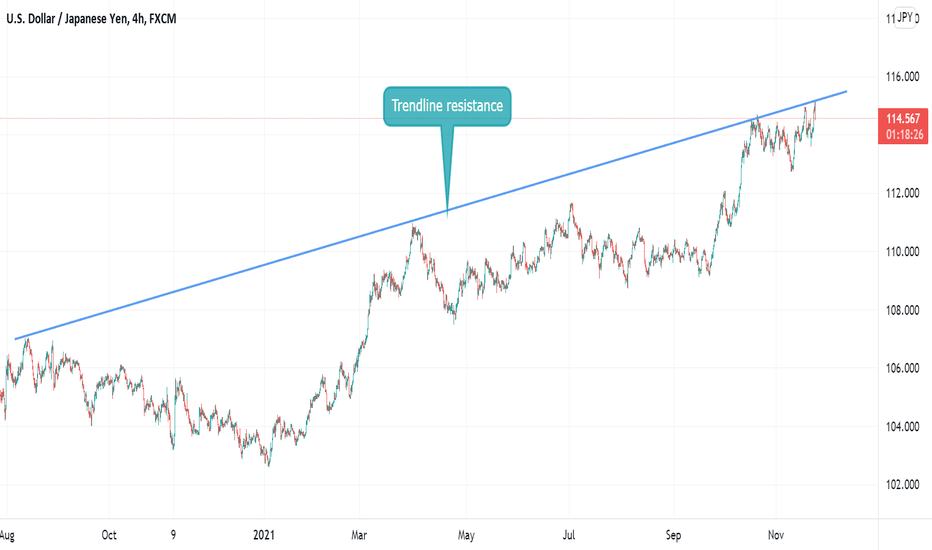

USDJPY on Trendline ResistanceHello, my fellow traders hope you all are making some profits. We are here with our new analysis so that we can increase those profits for you. Let’s get into it.

As we can see, the price is at its STRONGE TRENDLINE RESISTANCE.

Let us know your views on this in the comment section. Thank you all.

There is good news for our followers. We will be analyzing on-demand.

So let us know which pair you want our analysis on, and we will get it for you. Do like and follow us

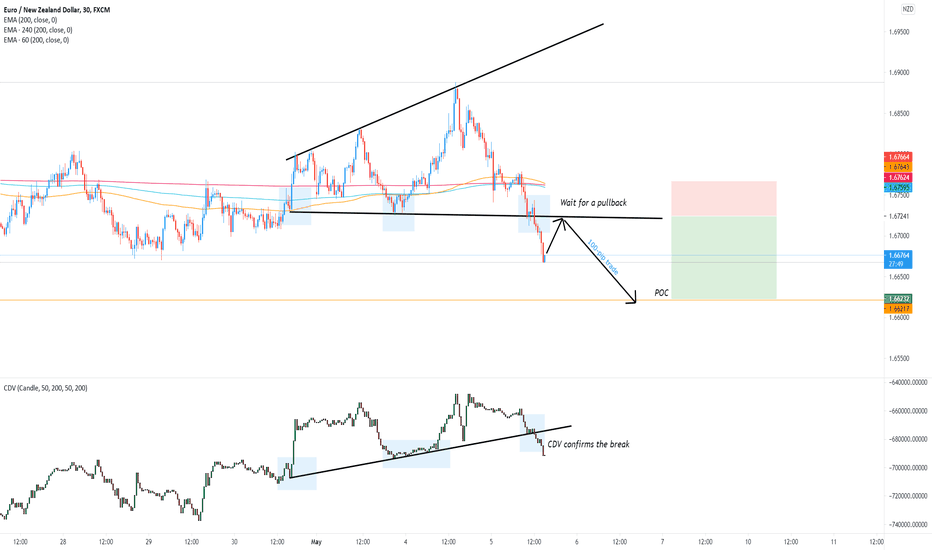

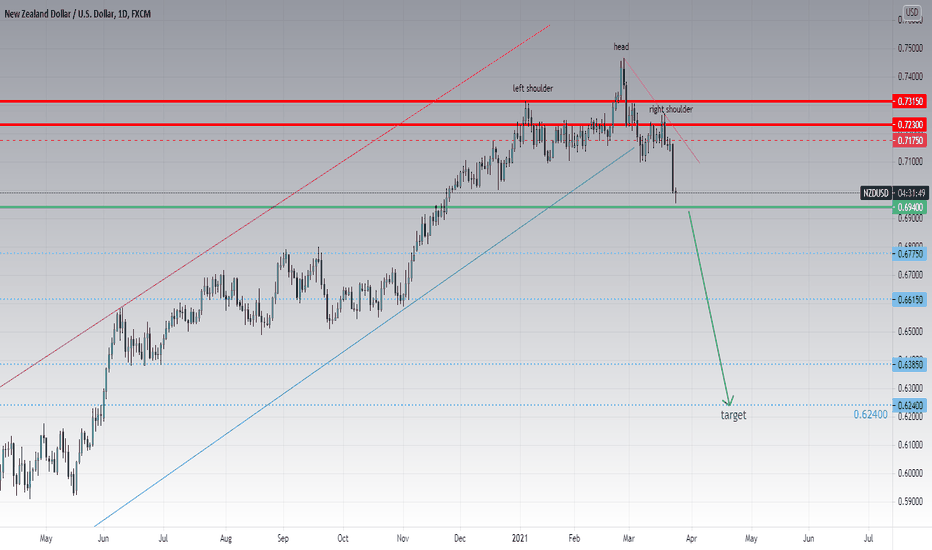

EUR/NZD: Don't miss this opportunity ! (100-pip trade) Hey guys,

Currently analyzing EUR/NZD which is in a bearish sequence.

If you check what is going on with cumulative delta volume (CDV), you will notice that it broke exactly at the same levels where price dropped (around 1.67230), thus creating a kind of Megaphone pattern.

The idea is to wait for a pullback in this area of previous support and short the pair.

I will be targeting the previous Point of Control (POC) which should act as a magnet on price.

As always, if price doesn't pullback, I don't take the trade

If you do like my ideas, please show some 💗.

Jesse

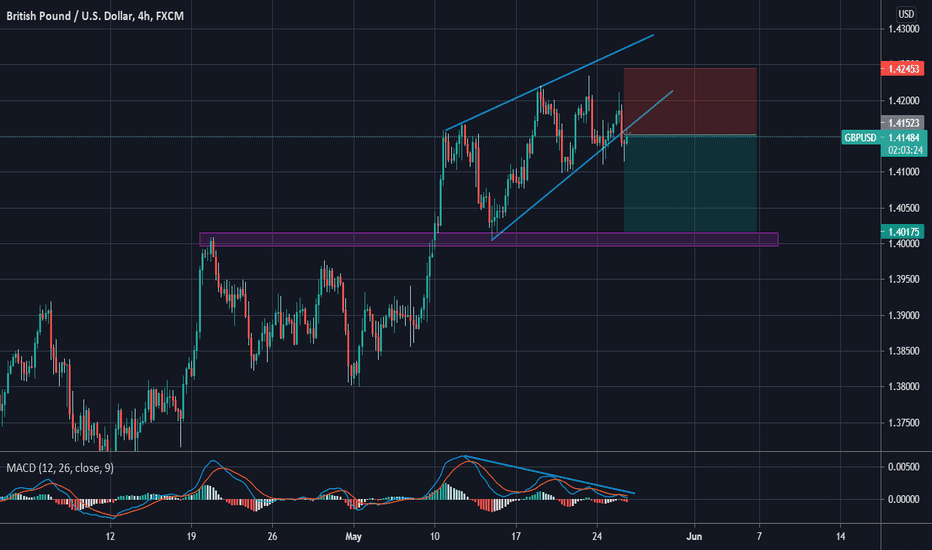

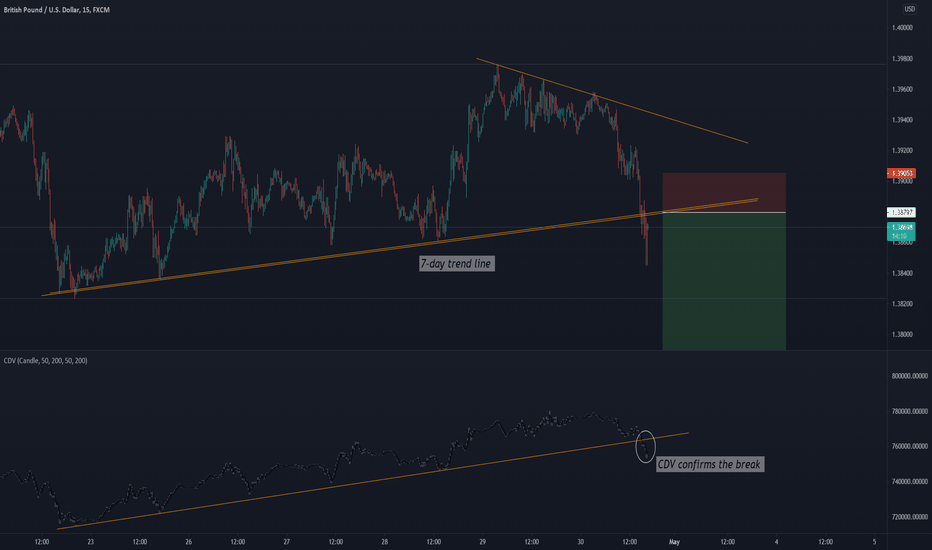

GBP/USD: Shorted for about 100 pips, check it out!Hey guys,

The current 7-day trendline on GBP/USD just broke a couple of minutes ago.

Cumulative Delta Volume (CDV) confirms this break to the downside which gave me an extra confirmation to short at these levels.

So I shorted at the break of the trendline and will exit the trade if price goes back above the trend line and starts moving the other way, so not taking a lot of risk in this trade.

The technical target is about 100 pips from the top to the bottom of the structure, as highlighted in my chart.

Trade with care and show some love!

Jesse

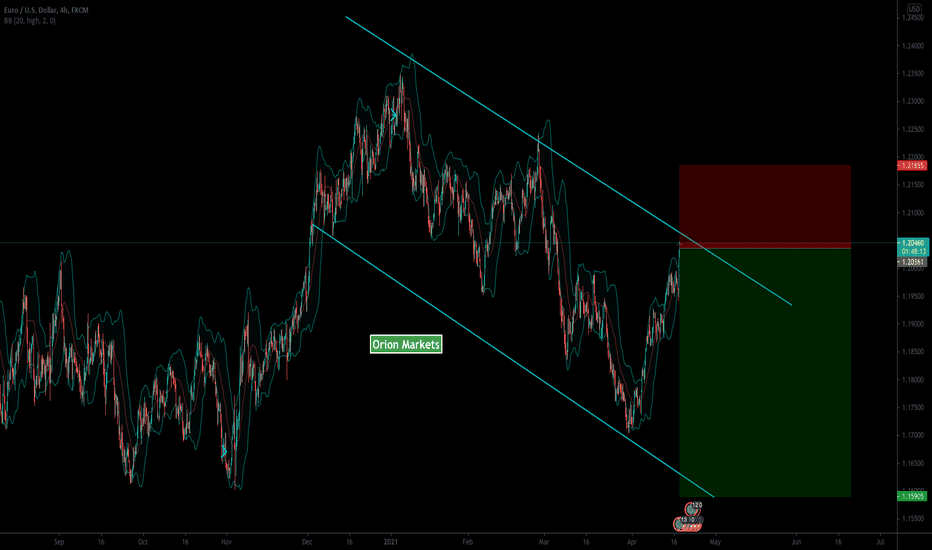

EUR/USD A strong SellWith the USD weakness over the weekend we have seen the Euro push back to the high of the trend. With a strong down trend in place we believe this area strong one to sell from.

The US dollar is breaking down again as we work deeper into the European session today, a development that comes after a week of very strong US data failing to excite renewed selling of US treasuries (and therefore higher yields), which was always the key support for the US dollar in its run higher since basing at the very beginning of this year. A very strong session for Chinese equities in Asia overnight after an ugly period of weak sentiment has also likely provided a bit of extra energy into the mix for renewed USD bears, as Chinese regulators have weighed in on what the market has perceive as support for the troubled Huarong Asset Management Company.

With this Sell of having taken place we believe the move is now over the correction in line with the trend will begin.

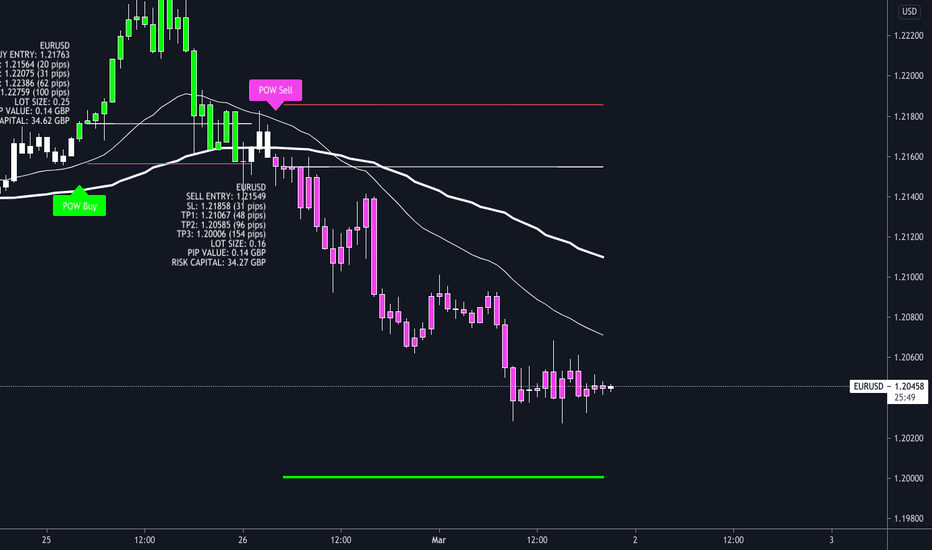

EURUSD - Sell approaching TP 🎯Entry details are shown on the chart.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out do they.

Also, see my 'related ideas' below to see more just like this.

Interested in access to my strategy so you can be in these trades the moment they're valid? Drop me a DM.

Thank you.

Darren