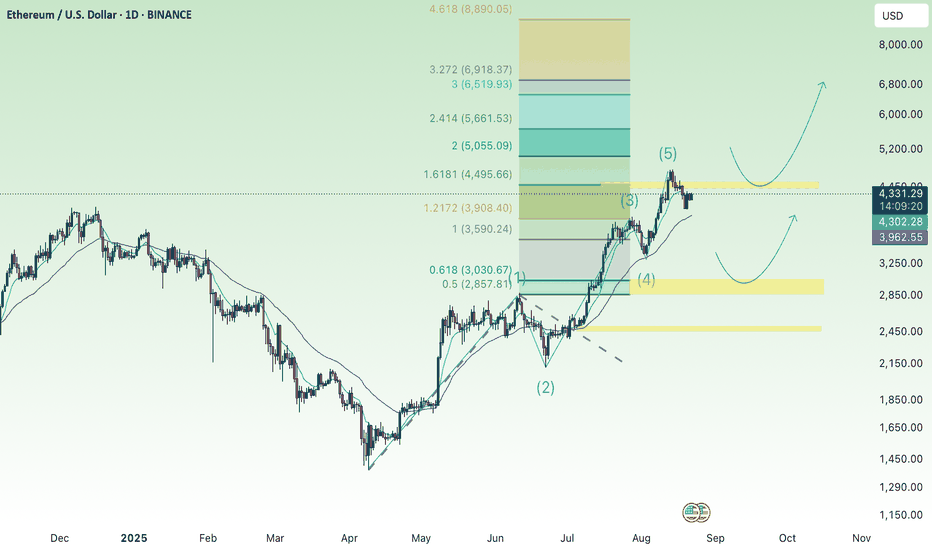

short term adjustment, accumulation for uptrend ETH💎 ETH WEEKEND PLAN UPDATE (August 22 , 2025 )

ETH is in a medium-term uptrend, having just completed wave (5) according to Elliott Wave, and is now undergoing a slight correction.

The current price zone around 4,200 – 4,300 USD is a key area to watch:

• If it holds, ETH may rebound higher.

• If it breaks down, it could retreat to deeper support levels.

Key Levels

Near Resistance:

• 4,500 – 4,600 USD: Strong resistance zone, aligning with wave (5) and Fibonacci 1.618.

• If this level is broken, the next target is 6,000 USD (Fibo 2.618).

Near Support:

• 3,800 – 3,900 USD: Confluence with EMA34 and an intermediate support zone.

• 3,200 – 3,250 USD: Strong support, intersecting EMA200 and key Fibonacci cluster.

• 2,500 – 2,600 USD: Final support, a solid base before the last strong rally.

Trend Outlook

• Short-term: ETH may continue correcting towards support to accumulate before forming a new rally.

• Medium-term: The main trend remains bullish as long as ETH holds above 3,200 USD.

• Long-term: If ETH breaks above 4,600 USD, it is highly likely to target 6,000 USD.

👉 Summary:

ETH is in a consolidation phase after a strong rally. Investors should watch the 3,800 – 3,900 USD zone closely. If it holds, the chance of retesting 4,600 USD and potentially 6,000 USD remains strong.